Analysts’ Viewpoint on Market Scenario

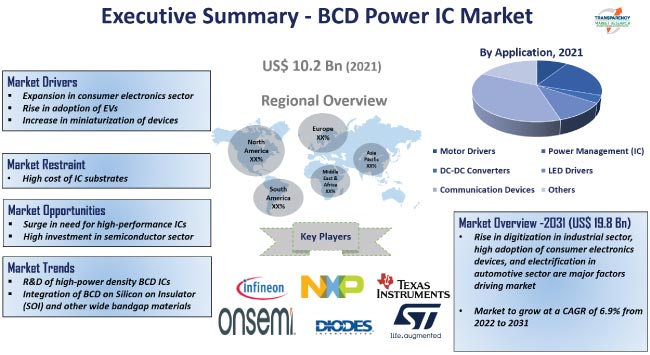

Expansion in the consumer electronics sector and rise in adoption of EVs are augmenting the global BCD power IC market size. Bipolar-CMOS-DMOS (BCD) technology is widely used in power management circuits. It offers various advantages such as improved reliability, reduced electromagnetic interference, and smaller chip area.

Increase in miniaturization of devices is expected to augment market progress during the forecast period. Surge in need for high-performance ICs and growth in investment in the semiconductor sector are likely to offer lucrative opportunities for vendors in the industry. Market players are investing significantly in the development of new generation of BCD power ICs and expansion of their production capabilities.

BCD technology is employed in power management of electronic devices. It combines bipolar and Complementary Metal-Oxide-Semiconductor (CMOS) technologies to produce high-performance, low-power ICs. BCD technology is used in various end-use industries such as consumer electronics, automotive, and aerospace.

Different process nodes of BCD are employed in various applications and voltage ranges. For instance, a 40/28nm process node is preferred in smartphone AMOLED driver ICs. BCD-based PMIC technology is widely employed in modern electronic devices with diverse functions such as DC-DC converters, LED drivers, battery management, and motor drivers.

The consumer electronics sector has been witnessing rapid growth in demand for electronic products post the peak of the COVID-19 pandemic. Rise in penetration of 5G and related network technologies is expected to further boost the adoption of electronic gadgets and mobile devices.

Shipment volume of 5G smartphones is surging worldwide. A typical 5G smartphone can hold as many as eight power-management chips compared with two to three in a 4G phone. Thus, rise in demand for consumer electronics is anticipated to boost BCD power IC market development during the forecast period.

Expansion in the IT & telecommunications sector has led to high usage of ICs. Demand for connectivity solutions and microcontrollers is likely to remain strong in the next few years. High adoption of wearables and smart home appliances is anticipated to further fuel the production of microcontrollers. This, in turn, is estimated to propel market revenue in the near future.

EVs and autonomous vehicles are generally integrated with Advanced Driver-assistance System (ADAS) and Graphics Processing Units (GPUs). Therefore, demand for power management solutions is high in the automotive sector.

Electrification in the automotive sector has prompted significant investment in the silicon wafer technology. The goal of electrification is to reduce reliance on fossil fuels, decrease carbon emissions, and improve the efficiency and performance of vehicles. Electrification of vehicles is gaining traction in the automotive sector; governments of several countries across the globe have implemented stringent emissions regulations regarding vehicle electrification. Key automakers are investing significantly in the development and production of EVs. This is projected to fuel market expansion in the near future.

BCD technology facilitates high power density in smaller spaces. This can be ascribed to the ability of BCD ICs to handle higher levels of current and voltage compared to those made with other manufacturing processes such as CMOS or NMOS. This makes BCD ICs well-suited for applications such as portable electronics and automotive systems, which require a high level of power efficiency.

BCD technology provides other benefits such as low cost and excellent performance at high temperatures. However, the technology has certain limitations such as relatively low yield and complexity compared to other processes.

Vendors in the BCD power IC market are focusing on the development of BCD power ICs that are more reliable and robust. These ICs are likely to offer improved performance under harsh operating conditions such as high temperatures and high voltage transients.

According to the latest BCD power IC market forecast, Asia Pacific is expected to dominate the industry during the forecast period. The region held the largest share in 2021. Presence of key vendors and expansion in the consumer electronics sector are driving market statistics in Asia Pacific.

The industry in North America and Europe is likely to grow at a significant pace during 2022 to 2031 due to the presence of key integrated device manufacturers in these regions. Growth in automotive and industrial sectors, surge in focus on energy-efficient devices, and implementation of stringent energy regulations are propelling BCD power IC market share in Europe.

Large well-established companies and smaller specialized manufacturers operate in the sector. The BCD power IC market report profiles vendors based on parameters such as company overview, business strategies, product portfolio, financial overview, business segments, and recent developments. The competition among vendors is intense.

Diodes Incorporated, Dialog Semiconductor Plc (Renesas Electronics Corporation), Infineon Technologies AG, Magnachip, NXP Semiconductors, Semiconductor Components Industries, LLC, Rohm Co., Ltd., STMicroelectronics, Texas Instruments Incorporated, Vishay Intertechnology, Inc., and Toshiba Electronic Devices & Storage Corporation are prominent entities operating in the market.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 10.2 Bn |

|

Market Forecast Value in 2031 |

US$ 19.8 Bn |

|

Growth Rate (CAGR) |

6.9% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It stood at US$ 10.2 Bn in 2021

It is expected to grow at a CAGR of 6.9% by 2031

It is anticipated to reach US$ 19.8 Bn in 2031

China accounted for 21.0% share in 2021

R&D of high-power density BCD ICs and integration of BCD on Silicon on Insulator (SOI) and other wide bandgap materials

Asia Pacific is a more lucrative region for vendors

Diodes Incorporated, Dialog Semiconductor Plc (Renesas Electronics Corporation), Infineon Technologies AG, Magnachip, NXP Semiconductors, Semiconductor Components Industries, LLC, Rohm Co., Ltd., STMicroelectronics, Texas Instruments Incorporated, Vishay Intertechnology, Inc., and Toshiba Electronic Devices & Storage Corporation

1. Preface

1.1. Research Scope

1.2. BCD Power IC Market Overview

1.3. Market and Segments Definition

1.4. Market Taxonomy

1.5. Research Methodology

1.6. Assumptions and Acronyms

2. Executive Summary

2.1. Global BCD Power IC Market Analysis and Forecast

2.2. Regional Outline

2.3. Market Dynamics Snapshot

2.4. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Key Market Indicators

3.3. Drivers

3.4. Restraints

3.5. Opportunities

3.6. Trends

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Global Power ICs Industry Overview

4.2. Supply Chain Analysis

4.3. Industry SWOT Analysis

4.4. Porter Five Forces Analysis

4.5. COVID-19 Impact Analysis

5. Global BCD Power IC Market Analysis, by Process Node

5.1. Global BCD Power IC Market Size (US$ Mn) Analysis & Forecast, by Process Node, 2017‒2031

5.1.1. Below 40 nm

5.1.2. 40 nm

5.1.3. 90 nm

5.1.4. 0.13 µm

5.1.5. 0.16 µm

5.1.6. 0.18 µm

5.1.7. 0.30 µm

5.1.8. Above 0.30 µm

5.2. Global BCD Power IC Market Attractiveness Analysis, by Process Node

6. Global BCD Power IC Market Analysis, by Process

6.1. Global BCD Power IC Market Size (US$ Mn) Analysis & Forecast, by Process, 2017‒2031

6.1.1. High-voltage BCD

6.1.2. High-density BCD

6.2. Global BCD Power IC Market Attractiveness Analysis, by Process

7. Global BCD Power IC Market Analysis, by Application

7.1. Global BCD Power IC Market Size (US$ Mn) Analysis & Forecast, by Application, 2017‒2031

7.1.1. Motor Drivers

7.1.2. Power Management (IC)

7.1.3. DC-DC Converters

7.1.4. LED Drivers

7.1.5. Communication Devices

7.1.6. Others

7.2. Global BCD Power IC Market Attractiveness Analysis, by Application

8. Global BCD Power IC Market Analysis, by End-use Industry

8.1. Global BCD Power IC Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017‒2031

8.1.1. Automotive

8.1.2. Consumer Electronics

8.1.3. IT & Telecommunications

8.1.4. Media & Entertainment

8.1.5. Aerospace & Defense

8.1.6. Power & Utilities

8.1.7. Others

8.2. Global BCD Power IC Market Attractiveness Analysis, by End-use Industry

9. Global BCD Power IC Market Analysis and Forecast, by Region

9.1. Global BCD Power IC Market Size (US$ Mn) Analysis & Forecast, by Region, 2017 – 2031

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Middle East & Africa

9.1.5. South America

9.2. Global BCD Power IC Market Attractiveness Analysis, by Region

10. North America BCD Power IC Market Analysis and Forecast

10.1. Market Snapshot

10.2. North America BCD Power IC Market Size (US$ Mn) Analysis & Forecast, by Process Node, 2017‒2031

10.2.1. Below 40 nm

10.2.2. 40 nm

10.2.3. 90 nm

10.2.4. 0.13 µm

10.2.5. 0.16 µm

10.2.6. 0.18 µm

10.2.7. 0.30 µm

10.2.8. Above 0.30 µm

10.3. North America BCD Power IC Market Size (US$ Mn) Analysis & Forecast, by Process, 2017‒2031

10.3.1. High-voltage BCD

10.3.2. High-density BCD

10.4. North America BCD Power IC Market Size (US$ Mn) Analysis & Forecast, by Application, 2017‒2031

10.4.1. Motor Drivers

10.4.2. Power Management (IC)

10.4.3. DC-DC Converters

10.4.4. LED Drivers

10.4.5. Communication Devices

10.4.6. Others

10.5. North America BCD Power IC Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017‒2031

10.5.1. Automotive

10.5.2. Consumer Electronics

10.5.3. IT & Telecommunications

10.5.4. Media & Entertainment

10.5.5. Aerospace & Defense

10.5.6. Power & Utilities

10.5.7. Others

10.6. North America BCD Power IC Market Size (US$ Mn) Analysis & Forecast, by Country & Sub-region, 2017 – 2031

10.6.1. U.S.

10.6.2. Canada

10.6.3. Rest of North America

10.7. North America BCD Power IC Market Attractiveness Analysis

10.7.1. By Process Node

10.7.2. By Process

10.7.3. By Application

10.7.4. By End-use Industry

10.7.5. By Country & Sub-region

11. Europe BCD Power IC Market Analysis and Forecast

11.1. Market Snapshot

11.2. Europe BCD Power IC Market Size (US$ Mn) Analysis & Forecast, by Process Node, 2017‒2031

11.2.1. Below 40 nm

11.2.2. 40 nm

11.2.3. 90 nm

11.2.4. 0.13 µm

11.2.5. 0.16 µm

11.2.6. 0.18 µm

11.2.7. 0.30 µm

11.2.8. Above 0.30 µm

11.3. Europe BCD Power IC Market Size (US$ Mn) Analysis & Forecast, by Process, 2017‒2031

11.3.1. High-voltage BCD

11.3.2. High-density BCD

11.4. Europe BCD Power IC Market Size (US$ Mn) Analysis & Forecast, by Application, 2017‒2031

11.4.1. Motor Drivers

11.4.2. Power Management (IC)

11.4.3. DC-DC Converters

11.4.4. LED Drivers

11.4.5. Communication Devices

11.4.6. Others

11.5. Europe BCD Power IC Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017‒2031

11.5.1. Automotive

11.5.2. Consumer Electronics

11.5.3. IT & Telecommunications

11.5.4. Media & Entertainment

11.5.5. Aerospace & Defense

11.5.6. Power & Utilities

11.5.7. Others

11.6. Europe BCD Power IC Market Size (US$ Mn) Analysis & Forecast, by Country & Sub-region, 2017‒2031

11.6.1. U.K.

11.6.2. Germany

11.6.3. France

11.6.4. Rest of Europe

11.7. Europe BCD Power IC Market Attractiveness Analysis

11.7.1. By Process Node

11.7.2. By Process

11.7.3. By Application

11.7.4. By End-use Industry

11.7.5. By Country & Sub-region

12. Asia Pacific BCD Power IC Market Analysis and Forecast

12.1. Market Snapshot

12.2. Asia Pacific BCD Power IC Market Size (US$ Mn) Analysis & Forecast, by Process Node, 2017‒2031

12.2.1. Below 40 nm

12.2.2. 40 nm

12.2.3. 90 nm

12.2.4. 0.13 µm

12.2.5. 0.16 µm

12.2.6. 0.18 µm

12.2.7. 0.30 µm

12.2.8. Above 0.30 µm

12.3. Asia Pacific BCD Power IC Market Size (US$ Mn) Analysis & Forecast, by Process, 2017‒2031

12.3.1. High-voltage BCD

12.3.2. High-density BCD

12.4. Asia Pacific BCD Power IC Market Size (US$ Mn) Analysis & Forecast, by Application, 2017‒2031

12.4.1. Motor Drivers

12.4.2. Power Management (IC)

12.4.3. DC-DC Converters

12.4.4. LED Drivers

12.4.5. Communication Devices

12.4.6. Others

12.5. Asia Pacific BCD Power IC Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017‒2031

12.5.1. Automotive

12.5.2. Consumer Electronics

12.5.3. IT & Telecommunications

12.5.4. Media & Entertainment

12.5.5. Aerospace & Defense

12.5.6. Power & Utilities

12.5.7. Others

12.6. Asia Pacific BCD Power IC Market Size (US$ Mn) Analysis & Forecast, by Country & Sub-region, 2017‒2031

12.6.1. China

12.6.2. India

12.6.3. Japan

12.6.4. South Korea

12.6.5. ASEAN

12.6.6. Rest of Asia Pacific

12.7. Asia Pacific BCD Power IC Market Attractiveness Analysis

12.7.1. By Process Node

12.7.2. By Process

12.7.3. By Application

12.7.4. By End-use Industry

12.7.5. By Country & Sub-region

13. Middle East & Africa BCD Power IC Market Analysis and Forecast

13.1. Market Snapshot

13.2. Middle East & Africa BCD Power IC Market Size (US$ Mn) Analysis & Forecast, by Process Node, 2017‒2031

13.2.1. Below 40 nm

13.2.2. 40 nm

13.2.3. 90 nm

13.2.4. 0.13 µm

13.2.5. 0.16 µm

13.2.6. 0.18 µm

13.2.7. 0.30 µm

13.2.8. Above 0.30 µm

13.3. Middle East & Africa BCD Power IC Market Size (US$ Mn) Analysis & Forecast, by Process, 2017‒2031

13.3.1. High-voltage BCD

13.3.2. High-density BCD

13.4. Middle East & Africa BCD Power IC Market Size (US$ Mn) Analysis & Forecast, by Application, 2017‒2031

13.4.1. Motor Drivers

13.4.2. Power Management (IC)

13.4.3. DC-DC Converters

13.4.4. LED Drivers

13.4.5. Communication Devices

13.4.6. Others

13.5. Middle East & Africa BCD Power IC Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017‒2031

13.5.1. Automotive

13.5.2. Consumer Electronics

13.5.3. IT & Telecommunications

13.5.4. Media & Entertainment

13.5.5. Aerospace & Defense

13.5.6. Power & Utilities

13.5.7. Others

13.6. Middle East & Africa BCD Power IC Market Size (US$ Mn) Analysis & Forecast, by Country & Sub-region, 2017‒2031

13.6.1. GCC

13.6.2. South Africa

13.6.3. Rest of Middle East & Africa

13.7. Middle East & Africa BCD Power IC Market Attractiveness Analysis

13.7.1. By Process Node

13.7.2. By Process

13.7.3. By Application

13.7.4. By End-use Industry

13.7.5. By Country & Sub-region

14. South America BCD Power IC Market Analysis and Forecast

14.1. Market Snapshot

14.2. South America BCD Power IC Market Size (US$ Mn) Analysis & Forecast, by Process Node, 2017‒2031

14.2.1. Below 40 nm

14.2.2. 40 nm

14.2.3. 90 nm

14.2.4. 0.13 µm

14.2.5. 0.16 µm

14.2.6. 0.18 µm

14.2.7. 0.30 µm

14.2.8. Above 0.30 µm

14.3. South America BCD Power IC Market Size (US$ Mn) Analysis & Forecast, by Process, 2017‒2031

14.3.1. High-voltage BCD

14.3.2. High-density BCD

14.4. South America BCD Power IC Market Size (US$ Mn) Analysis & Forecast, by Application, 2017‒2031

14.4.1. Motor Drivers

14.4.2. Power Management (IC)

14.4.3. DC-DC Converters

14.4.4. LED Drivers

14.4.5. Communication Devices

14.4.6. Others

14.5. South America BCD Power IC Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017‒2031

14.5.1. Automotive

14.5.2. Consumer Electronics

14.5.3. IT & Telecommunications

14.5.4. Media & Entertainment

14.5.5. Aerospace & Defense

14.5.6. Power & Utilities

14.5.7. Others

14.6. South America BCD Power IC Market Size (US$ Mn) Analysis & Forecast, by Country & Sub-region, 2017‒2031

14.6.1. Brazil

14.6.2. Rest of South America

14.7. South America BCD Power IC Market Attractiveness Analysis

14.7.1. By Process Node

14.7.2. By Process

14.7.3. By Application

14.7.4. By End-use Industry

14.7.5. By Country & Sub-region

15. Competition Assessment

15.1. Global BCD Power IC Market Competition Matrix - a Dashboard View

15.2. Global BCD Power IC Market Company Share Analysis, by Value (2020)

15.3. Technological Differentiator

16. Company Profiles (Manufacturers/Suppliers)

16.1. Diodes Incorporated

16.1.1. Overview

16.1.2. Product Portfolio

16.1.3. Sales Footprint

16.1.4. Key Subsidiaries or Distributors

16.1.5. Strategy and Recent Developments

16.1.6. Key Financials

16.2. Dialog Semiconductor Plc (Renesas Electronics Corporation)

16.2.1. Overview

16.2.2. Product Portfolio

16.2.3. Sales Footprint

16.2.4. Key Subsidiaries or Distributors

16.2.5. Strategy and Recent Developments

16.2.6. Key Financials

16.3. Infineon Technologies AG

16.3.1. Overview

16.3.2. Product Portfolio

16.3.3. Sales Footprint

16.3.4. Key Subsidiaries or Distributors

16.3.5. Strategy and Recent Developments

16.3.6. Key Financials

16.4. Magnachip

16.4.1. Overview

16.4.2. Product Portfolio

16.4.3. Sales Footprint

16.4.4. Key Subsidiaries or Distributors

16.4.5. Strategy and Recent Developments

16.4.6. Key Financials

16.5. NXP Semiconductors

16.5.1. Overview

16.5.2. Product Portfolio

16.5.3. Sales Footprint

16.5.4. Key Subsidiaries or Distributors

16.5.5. Strategy and Recent Developments

16.5.6. Key Financials

16.6. Semiconductor Components Industries, LLC

16.6.1. Overview

16.6.2. Product Portfolio

16.6.3. Sales Footprint

16.6.4. Key Subsidiaries or Distributors

16.6.5. Strategy and Recent Developments

16.6.6. Key Financials

16.7. Rohm Co., Ltd.

16.7.1. Overview

16.7.2. Product Portfolio

16.7.3. Sales Footprint

16.7.4. Key Subsidiaries or Distributors

16.7.5. Strategy and Recent Developments

16.7.6. Key Financials

16.8. STMicroelectronics

16.8.1. Overview

16.8.2. Product Portfolio

16.8.3. Sales Footprint

16.8.4. Key Subsidiaries or Distributors

16.8.5. Strategy and Recent Developments

16.8.6. Key Financials

16.9. Texas Instruments Incorporated

16.9.1. Overview

16.9.2. Product Portfolio

16.9.3. Sales Footprint

16.9.4. Key Subsidiaries or Distributors

16.9.5. Strategy and Recent Developments

16.9.6. Key Financials

16.10. Vishay Intertechnology, Inc.

16.10.1. Overview

16.10.2. Product Portfolio

16.10.3. Sales Footprint

16.10.4. Key Subsidiaries or Distributors

16.10.5. Strategy and Recent Developments

16.10.6. Key Financials

16.11. Toshiba Electronic Devices & Storage Corporation

16.11.1. Overview

16.11.2. Product Portfolio

16.11.3. Sales Footprint

16.11.4. Key Subsidiaries or Distributors

16.11.5. Strategy and Recent Developments

16.11.6. Key Financials

17. Recommendation

17.1. Opportunity Assessment

17.1.1. By Process Node

17.1.2. By Process

17.1.3. By Application

17.1.4. By End-use Industry

17.1.5. By Country & Sub-region

List of Tables

Table 1: Global BCD Power IC Market Value (US$ Mn) & Forecast, by Process Node, 2017‒2031

Table 2: Global BCD Power IC Market Value (US$ Mn) & Forecast, by Process, 2017‒2031

Table 3: Global BCD Power IC Market Value (US$ Mn) & Forecast, by Application, 2017‒2031

Table 4: Global BCD Power IC Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2033

Table 5: Global BCD Power IC Market Value (US$ Mn) & Forecast, by Region, 2017‒2031

Table 6: North America BCD Power IC Market Value (US$ Mn) & Forecast, by Process Node, 2017‒2031

Table 7: North America BCD Power IC Market Value (US$ Mn) & Forecast, by Process, 2017‒2031

Table 8: North America BCD Power IC Market Value (US$ Mn) & Forecast, by Application, 2017‒2031

Table 9: North America BCD Power IC Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2033

Table 10: North America BCD Power IC Market Value (US$ Mn) & Forecast, by Region, 2017‒2031

Table 11: Europe BCD Power IC Market Value (US$ Mn) & Forecast, by Process Node, 2017‒2031

Table 12: Europe BCD Power IC Market Value (US$ Mn) & Forecast, by Process, 2017‒2031

Table 13: Europe BCD Power IC Market Value (US$ Mn) & Forecast, by Application, 2017‒2031

Table 14: Europe BCD Power IC Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2033

Table 15: Europe BCD Power IC Market Value (US$ Mn) & Forecast, by Region, 2017‒2031

Table 16: Asia Pacific BCD Power IC Market Value (US$ Mn) & Forecast, by Process Node, 2017‒2031

Table 17: Asia Pacific BCD Power IC Market Value (US$ Mn) & Forecast, by Process, 2017‒2031

Table 18: Asia Pacific BCD Power IC Market Value (US$ Mn) & Forecast, by Application 2017‒2031

Table 19: Asia Pacific BCD Power IC Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2033

Table 20: Asia Pacific BCD Power IC Market Value (US$ Mn) & Forecast, by Region, 2017‒2031

Table 21: Middle East & Africa BCD Power IC Market Value (US$ Mn) & Forecast, by Process Node, 2017‒2031

Table 22: Middle East & Africa BCD Power IC Market Value (US$ Mn) & Forecast, by Process, 2017‒2031

Table 23: Middle East & Africa BCD Power IC Market Value (US$ Mn) & Forecast, by Application 2017‒2031

Table 24: Middle East & Africa BCD Power IC Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2033

Table 25: Middle East & Africa BCD Power IC Market Value (US$ Mn) & Forecast, by Region, 2017‒2031

Table 26: South America BCD Power IC Market Value (US$ Mn) & Forecast, by Process Node, 2017‒2031

Table 27: South America BCD Power IC Market Value (US$ Mn) & Forecast, by Process, 2017‒2031

Table 28: South America BCD Power IC Market Value (US$ Mn) & Forecast, by Application, 2017‒2031

Table 29: South America BCD Power IC Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2033

Table 30: South America BCD Power IC Market Value (US$ Mn) & Forecast, by Region, 2017‒2031

List of Figures

Figure 01: Global BCD Power IC Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 02: Global BCD Power IC Market Size & Forecast, Y-o-Y, Value (US$ Mn), 2017‒2031

Figure 03: Global BCD Power IC Market Projections by Process Node, Value (US$ Mn), 2017‒2031

Figure 04: Global BCD Power IC Market Share Analysis, by Process Node, 2021 and 2031

Figure 05: Global BCD Power IC Market, Incremental Opportunity, by Process Node, 2021‒2031

Figure 06: Global BCD Power IC Market Projections by Process, Value (US$ Mn), 2017‒2031

Figure 07: Global BCD Power IC Market Share Analysis, by Process, 2021 and 2031

Figure 08: Global BCD Power IC Market, Incremental Opportunity, by Process, 2021‒2031

Figure 09: Global BCD Power IC Market Projections by Application, Value (US$ Mn), 2017‒2031

Figure 10: Global BCD Power IC Market Share Analysis, by Application, 2021 and 2031

Figure 11: Global BCD Power IC Market, Incremental Opportunity, by Application, 2021‒2031

Figure 12: Global BCD Power IC Market Projections by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 13: Global BCD Power IC Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 14: Global BCD Power IC Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 15: Global BCD Power IC Market Projections by Country and sub-region, Value (US$ Mn), 2017‒2031

Figure 16: Global BCD Power IC Market Share Analysis, by Country and sub-region 2021 and 2031

Figure 17: Global BCD Power IC Market, Incremental Opportunity, by Country and sub-region, 2021‒2031

Figure 18: North America BCD Power IC Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 19: North America BCD Power IC Market Size & Forecast, Y-o-Y, Value (US$ Mn), 2017‒2031

Figure 20: North America BCD Power IC Market Projections by Process Node, Value (US$ Mn), 2017‒2031

Figure 21: North America BCD Power IC Market Share Analysis, by Process Node, 2021 and 2031

Figure 22: North America BCD Power IC Market, Incremental Opportunity, by Process Node, 2021‒2031

Figure 23: North America BCD Power IC Market Projections by Process, Value (US$ Mn), 2017‒2031

Figure 24: North America BCD Power IC Market Share Analysis, by Process, 2021 and 2031

Figure 25: North America BCD Power IC Market, Incremental Opportunity, by Process, 2021‒2031

Figure 26: North America BCD Power IC Market Projections by Application, Value (US$ Mn), 2017‒2031

Figure 27: North America BCD Power IC Market Share Analysis, by Application, 2021 and 2031

Figure 28: North America BCD Power IC Market, Incremental Opportunity, by Application, 2021‒2031

Figure 29: North America BCD Power IC Market Projections by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 30: North America BCD Power IC Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 31: North America BCD Power IC Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 32: North America BCD Power IC Market Projections by Country and sub-region, Value (US$ Mn), 2017‒2031

Figure 33: North America BCD Power IC Market Share Analysis, by Country and sub-region 2021 and 2031

Figure 34: North America BCD Power IC Market, Incremental Opportunity, by Country and sub-region, 2021‒2031

Figure 35: Europe BCD Power IC Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 36: Europe BCD Power IC Market Size & Forecast, Y-o-Y, Value (US$ Mn), 2017‒2031

Figure 37: Europe BCD Power IC Market Projections by Process Node, Value (US$ Mn), 2017‒2031

Figure 38: Europe BCD Power IC Market Share Analysis, by Process Node, 2021 and 2031

Figure 39: Europe BCD Power IC Market, Incremental Opportunity, by Process Node, 2021‒2031

Figure 40: Europe BCD Power IC Market Projections by Process, Value (US$ Mn), 2017‒2031

Figure 41: Europe BCD Power IC Market Share Analysis, by Process, 2021 and 2031

Figure 42: Europe BCD Power IC Market, Incremental Opportunity, by Process, 2021‒2031

Figure 43: Europe BCD Power IC Market Projections by Application, Value (US$ Mn), 2017‒2031

Figure 44: Europe BCD Power IC Market Share Analysis, by Application, 2021 and 2031

Figure 45: Europe BCD Power IC Market, Incremental Opportunity, by Printing Type, 2021‒2031

Figure 46: Europe BCD Power IC Market Projections by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 47: Europe BCD Power IC Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 48: Europe BCD Power IC Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 49: Europe BCD Power IC Market Projections by Country and sub-region, Value (US$ Mn), 2017‒2031

Figure 50: Europe BCD Power IC Market Share Analysis, by Country and sub-region 2021 and 2031

Figure 51: Europe BCD Power IC Market, Incremental Opportunity, by Country and sub-region, 2021‒2031

Figure 52: Asia Pacific BCD Power IC Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 53: Asia Pacific BCD Power IC Market Size & Forecast, Y-o-Y, Value (US$ Mn), 2017‒2031

Figure 54: Asia Pacific BCD Power IC Market Projections by Process Node, Value (US$ Mn), 2017‒2031

Figure 55: Asia Pacific BCD Power IC Market Share Analysis, by Process Node, 2021 and 2031

Figure 56: Asia Pacific BCD Power IC Market, Incremental Opportunity, by Process Node, 2021‒2031

Figure 57: Asia Pacific BCD Power IC Market Projections by Process, Value (US$ Mn), 2017‒2031

Figure 58: Asia Pacific BCD Power IC Market Share Analysis, by Process, 2021 and 2031

Figure 59: Asia Pacific BCD Power IC Market, Incremental Opportunity, by Process, 2021‒2031

Figure 60: Asia Pacific BCD Power IC Market Projections by Application, Value (US$ Mn), 2017‒2031

Figure 61: Asia Pacific BCD Power IC Market Share Analysis, by Application, 2021 and 2031

Figure 62: Asia Pacific BCD Power IC Market, Incremental Opportunity, by Application, 2021‒2031

Figure 63: Asia Pacific BCD Power IC Market Projections by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 64: Asia Pacific BCD Power IC Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 65: Asia Pacific BCD Power IC Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 66: Asia Pacific BCD Power IC Market Projections by Country and sub-region, Value (US$ Mn), 2017‒2031

Figure 67: Asia Pacific BCD Power IC Market Share Analysis, by Country and sub-region 2021 and 2031

Figure 68: Asia Pacific BCD Power IC Market, Incremental Opportunity, by Country and sub-region, 2021‒2031

Figure 69: Middle East & Africa BCD Power IC Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 70: Middle East & Africa BCD Power IC Market Size & Forecast, Y-o-Y, Value (US$ Mn), 2017‒2031

Figure 71: Middle East & Africa BCD Power IC Market Projections by Process Node, Value (US$ Mn), 2017‒2031

Figure 72: Middle East & Africa BCD Power IC Market Share Analysis, by Process Node, 2021 and 2031

Figure 73: Middle East & Africa BCD Power IC Market, Incremental Opportunity, by Process Node, 2021‒2031

Figure 74: Middle East & Africa BCD Power IC Market Projections by Process, Value (US$ Mn), 2017‒2031

Figure 75: Middle East & Africa BCD Power IC Market Share Analysis, by Process, 2021 and 2031

Figure 76: Middle East & Africa BCD Power IC Market, Incremental Opportunity, by Process, 2021‒2031

Figure 77: Middle East & Africa BCD Power IC Market Projections by Application, Value (US$ Mn), 2017‒2031

Figure 78: Middle East & Africa BCD Power IC Market Share Analysis, by Application, 2021 and 2031

Figure 79: Middle East & Africa BCD Power IC Market, Incremental Opportunity, by Application, 2021‒2031

Figure 80: Middle East & Africa BCD Power IC Market Projections by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 81: Middle East & Africa BCD Power IC Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 82: Middle East & Africa BCD Power IC Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 83: Middle East & Africa BCD Power IC Market Projections by Country and sub-region, Value (US$ Mn), 2017‒2031

Figure 84: Middle East & Africa BCD Power IC Market Share Analysis, by Country and sub-region 2021 and 2031

Figure 85: Middle East & Africa BCD Power IC Market, Incremental Opportunity, by Country and sub-region, 2021‒2031

Figure 86: South America BCD Power IC Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 87: South America BCD Power IC Market Size & Forecast, Y-o-Y, Value (US$ Mn), 2017‒2031

Figure 88: South America BCD Power IC Market Projections by Process Node, Value (US$ Mn), 2017‒2031

Figure 89: South America BCD Power IC Market Share Analysis, by Process Node, 2021 and 2031

Figure 90: South America BCD Power IC Market, Incremental Opportunity, by Process Node, 2021‒2031

Figure 91: South America BCD Power IC Market Projections by Process, Value (US$ Mn), 2017‒2031

Figure 92: South America BCD Power IC Market Share Analysis, by Process, 2021 and 2031

Figure 93: South America BCD Power IC Market, Incremental Opportunity, by Process, 2021‒2031

Figure 94: South America BCD Power IC Market Projections by Application, Value (US$ Mn), 2017‒2031

Figure 95: South America BCD Power IC Market Share Analysis, by Application, 2021 and 2031

Figure 96: South America BCD Power IC Market, Incremental Opportunity, by Application, 2021‒2031

Figure 97: South America BCD Power IC Market Projections by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 98: South America BCD Power IC Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 99: South America BCD Power IC Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 100: South America BCD Power IC Market Projections by Country and sub-region, Value (US$ Mn), 2017‒2031

Figure 101: South America BCD Power IC Market Share Analysis, by Country and sub-region 2021 and 2031

Figure 102: South America BCD Power IC Market, Incremental Opportunity, by Country and sub-region, 2021‒2031