Bangladesh Corn Oil Market: Snapshot

Corn oil is used in edible as well as non-edible applications. Globally, Bangladesh is one of the major consumers as well as importers of edible oil. With the growing demand for edible oil in the domestic market, there is a surge in investment opportunities as far as the production of edible corn oil is concerned. The rising focus of the authorities on decreasing the country’s dependence on imports by increasing local production will prove to be immensely beneficial for the corn oil market in Bangladesh.

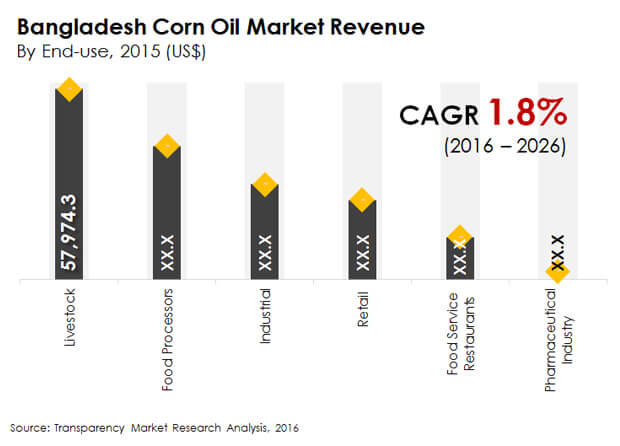

In terms of value, the Bangladesh corn oil market is expected to expand at a CAGR of 1.8% during the forecast period. The market was valued at US$167,073 in 2015 and is expected to reach US$202,072 by 2026.

Non-edible Corn Oil Enjoys Preference over Edible Variants

On the basis of type, the corn oil market is bifurcated into edible and non-edible. In terms of revenue, non-edible corn oil is expected to account for the leading share throughout the course of the forecast period. The segment is estimated to account for a 71.4% share in the Bangladesh corn oil market by the end of 2016. This is attributed to the increasing usage of corn oil for the production of biodiesel. The segment is expected to expand at a CAGR of 1.7% during the forecast period.

The edible oil segment is expected to show substantial growth in the near future. The segment is expected to expand at a CAGR of 2.1% during the forecast period, driven primarily by the changing dietary habits and improving living standards of the consumers. Moreover, growing consumer awareness regarding the high nutritive value of corn oil is expected to boost the growth of this segment over the duration of the forecast period.

Food Service Restaurants Restricting Usage of Corn Oil owing to Higher Prices

By end use, livestock accounted for the leading share of 34.7% in 2015 and is expected to expand at a modest CAGR of 2.0% during the forecast period. The segment is expected to retain its dominance through 2026. The revenue generated by the industrial segment is expected to report a 2.5% CAGR between 2015 and 2026 – the highest growth rate among other end-use segments. This is attributed to the growing application of corn oil in the manufacturing of biodiesel. The demand for corn oil in the industrial sector is also owing to the increased usage of corn oil in various applications such as rustproofing metal surfaces and in inks, textiles, and paints.

The segment of food service restaurants is expected to exhibit a comparatively slower growth rate over the forecast period and also accounts for a small share in the overall corn oil market. Prices of edible corn oil are comparatively higher than other edible oils in the country, which is projected to restrict the growth of this segment over the forecast period.

The retail segment, on the other hand, is expected to reflect sustainable growth in the near future. Growing consumer preference for healthy cooking and edible oils in order to lower the risk of heart diseases is expected to support this segment. Promotional campaigns by existing oil manufacturers have had a significant impact on consumers in the country and has created a sense of awareness among them regarding the consumption and benefits of heart-healthy products. Corn oil offers a number of advantages in this regard – lower cholesterol levels and controlled blood pressure levels.

Key players in the Bangladesh corn oil market include Adani Wilmar Ltd, Associated British Foods plc, American Vegetable Oils, Inc., and Olympic Oils Ltd.

Accelerating Demand from Food and Beverage Sector to Drive Corn Oil Market

Corn oil is utilized in eatable just as non-eatable applications. Universally, Bangladesh is one of the significant buyers just as merchants of consumable oil. With the developing interest for palatable oil in the homegrown market, there is a flood in venture openings to the extent the creation of eatable corn oil is concerned. The rising focal point of the experts on diminishing the country's reliance on imports by expanding nearby creation will end up being colossally gainful for the corn oil market.

Corn oil has both eatable and non-palatable applications universally while Bangladesh is one of the significant buyer and shipper of the consumable oil. Developing interest for palatable oil is setting out worthwhile open doors in the neighborhood market in Bangladesh for coil oil. These chances are pulling in players to contribute for improving their creation limit and dispersion channel. This neighborhood creation exercises are supported by government as these exercises makes the nation free and lessens the import which is hugely useful for the corn oil market in the country.

The availability of grains and corns at convenient rates, coupled with high net revenue for ranchers and food area is boosting development of the corn oil market. Notwithstanding of these development openings, factors like sloppy market, frail circulation channels, and offer of free pressing oil are hampering development of the corn oil market. Moreover, absence of appropriate information because of low marking and publicizing exercises are pleating development of the corn oil market. Inspite of this, the rising preference for corn oil for consumption purposes by the food and beverage industries as well as in households will further create lucrative growth opportunities for the market in the coming years.

The consumable oil portion is relied upon to show considerable development soon. This is driven basically by the changing dietary propensities and improving expectations for everyday comforts of the purchasers. Besides, developing buyer mindfulness with respect to the high nutritive estimation of corn oil is required to help the development of this section throughout the next few years.

1. Executive Summary

2. Assumptions & Acronyms Used

3. Research Methodology

4. Market Introduction

4.1. Market Definition

4.2. Market Taxonomy

5. Bangladesh Corn Oil Market Analysis Scenario

5.1. Market size & Forecast

5.1.1. Market Size & Y-o-Y Growth

5.1.2. Absolute $ Opportunity

5.2. Bangladesh Corn Oil Market Trends

6. Bangladesh Corn Oil Market Overview

6.1. Global Maize Production Analysis - Volume Perspective

6.2. Major Country Wise Corn Oil Production (tons) Scenario

6.3. Edible oil Consumption and Import Scenario In Bangladesh

6.4. Corn Oil Extraction Process & Its Other By-products

6.5. Bangladesh Corn Oil Market: Manufacturing Plant Cost Structure for Edible Corn Oil

6.6. Bangladesh Corn Oil Market: Value Chain and Profitability Margins

7. Bangladesh Corn Oil Market Dynamics

7.1. Drivers

7.2. Restraints

7.3. Opportunities

8. Bangladesh Corn Oil Market Analysis and Forecast, By Type

8.1. Bangladesh Corn Oil Market: Snapshot By Type

8.2. Bangladesh Corn Oil Market BPS Analysis By Type

8.3. Bangladesh Corn Oil Market Analysis & Forecast By Type

8.4. Global Edible Oil Market Scenario

8.5. Bangladesh Corn Oil Market Analysis by Type

8.5.1. Edible Corn Oil

8.5.2. Non Edible Corn Oil

8.6. Bangladesh Corn Oil Market Attractiveness Analysis by Type

9. Bangladesh Corn Oil Market Analysis and Forecast, By End-use

9.1. Bangladesh Corn Oil Market: Snapshot By End Use

9.2. Bangladesh Corn Oil Market BPS Analysis By End-use

9.3. Bangladesh Corn Oil Market Analysis & Forecast By End-use

9.4. Bangladesh Corn Oil Market Analysis by End-use

9.4.1. Food Service Restaurants

9.4.2. Food Processors

9.4.3. Retails

9.4.4. Livestock

9.4.5. Industrial

9.4.6. Pharmaceutical Industry

9.5. Bangladesh Corn Oil Market Attractiveness Analysis by End-use

10. Bangladesh Corn Oil Market: Competitive Landscape

10.1. Global Edible Oils : Recent Developments

10.2. Bangladesh Corn Oil Market: Company Profiles

10.2.1. Adani Wilmar

10.2.1.1. Company Overview

10.2.1.2. Product Offerings

10.2.1.3. SWOT Analysis

10.2.1.4. Geographical Presence

10.2.1.5. Strategic Overview

10.2.2. Associated British Foods plc

10.2.2.1. Company Overview

10.2.2.2. Product Offerings

10.2.2.3. SWOT Analysis

10.2.2.4. Geographical Presence

10.2.2.5. Strategic Overview

10.2.3. American Vegetable Oils, Inc.

10.2.3.1. Company Overview

10.2.3.2. Product Offerings

10.2.3.3. SWOT Analysis

10.2.3.4. Geographical Presence

10.2.3.5. Strategic Overview

10.2.4. Olympic Oils Limited

10.2.4.1. Company Overview

10.2.4.2. Product Offerings

10.2.4.3. SWOT Analysis

10.2.4.4. Geographical Presence

10.2.4.5. Strategic Overview

List of Tables

Table 1: Bangladesh Corn Oil Market Value (US$) Forecast By Type, 2015–2026

Table 2: Bangladesh Corn Oil Market Value (US$) Forecast By End-use, 2015–2026

List of Figures

Figure 1: Bangladesh Corn Oil Market Value (US$) and Y-o-Y Forecast, 2015–2026

Figure 2: Bangladesh Corn Oil Market Value Absolute $ Opportunity, 2015–2026

Figure 3: Bangladesh Corn Oil Market Value Share and BPS Analysis By Type, 2016 & 2026

Figure 4: Bangladesh Corn Oil Market Absolute $ Opportunity (US$), by Edible Corn Oil Segment, 2015?2026

Figure 5: Bangladesh Corn Oil Market Absolute $ Opportunity (US$), by Non Edible Corn Oil Segment, 2015?2026

Figure 6: Bangladesh Corn Oil Market Attractiveness by Type, 2016–2026

Figure 7: Bangladesh Corn Oil Market Value Share and BPS Analysis By End-use, 2016 & 2026

Figure 8: Bangladesh Corn Oil Market Absolute $ Opportunity (US$), by Food Service Restaurants Segment, 2015?2026

Figure 9: Bangladesh Corn Oil Market Absolute $ Opportunity (US$), by Food Processors Segment, 2015?2026

Figure 10: Bangladesh Corn Oil Market Absolute $ Opportunity (US$), by Retails Segment, 2015?2026

Figure 11: Bangladesh Corn Oil Market Absolute $ Opportunity (US$), by Livestock Segment, 2015?2026

Figure 12: Bangladesh Corn Oil Market Absolute $ Opportunity (US$), by Industrial Segment, 2015?2026

Figure 13: Bangladesh Corn Oil Market Absolute $ Opportunity (US$), by Pharmaceutical Industry Segment, 2015?2026

Figure 14: Bangladesh Corn Oil Market Attractiveness by End-use, 2016–2026