Analysts’ Viewpoint on Bagasse Plates Market Scenario

Rise in demand for sustainable and cost-effective food serving solutions in the food & beverage sector is augmenting the bagasse plates market size. Bagasse plates have gained significant popularity across the globe due to their rigid structure and eco-friendliness. Development of recyclable and biodegradable bagasse plates is expected to bolster market statistics.

Bagasse plates are gaining widespread traction, especially in emerging countries that prioritize environmentally-friendly and recyclable food serving options. Bagasse, a readily available and cost-effective material, is revolutionizing the plates sector by offering an eco-friendly alternative. Key manufacturers are striving to introduce innovative and customized products in order to increase their bagasse plates market share.

Bagasse plates are thermal resistant plates that have the ability to hold hot food up to 95°C, which is relatively higher than paper plates. These plates are thick and densely made up of the maximum percentage of the fibrous material, which absorbs heat from the hot food. On the other hand, paper and plastic plates are highly susceptible to strong heat, thus leading to difficulty in handling of plates.

Single-use plastics, especially plastic plates, are subject to restrictions and prohibitions in several countries and regions. Bagasse plate is an environmentally-friendly substitute that enables food and beverage companies to follow these rules and help reduce plastic waste.

Bagasse plates are strong and can endure the weight and moisture of various foods, making them appropriate for a variety of culinary uses. These plates offer a safer option for food service, as they are free from potentially harmful chemicals present in certain plastic plates. They do not release harmful substances when exposed to heat or acidic foods, thus ensuring that the food served on bagasse plates remains safe and uncontaminated.

Bagasse plates are not only advanced with excellent physical properties, but also have an esthetic appeal. Therefore, most companies in the food sector and consumers prefer bagasse plates, owing to the ease & convenience in handling and esthetic appeal. Significant growth in the food & beverage sector, especially online food delivery services, after the onset of the COVID-19 pandemic, is augmenting the bagasse plates market value.

Adoption of bio-based products, such as bagasse plates, is a viable way to lessen the negative effects on the environment. Bagasse, a byproduct of sugarcane, is used to make bagasse plates. Bagasse plates have the potential to lessen dependency on fossil fuels and reduce carbon emissions brought on by the extraction and manufacture of conventional plastics derived from petroleum.

Usage of bagasse plates helps decrease the need for fossil fuels. The market for bagasse plates can lessen its reliance on limited and non-renewable fossil resources by switching from petroleum-based plastics to bio-based substitutes. This resource conservation facilitates the preservation of natural resources, lessens environmental damage brought on by the extraction of fossil fuels, and encourages sustainability over the long run.

Bagasse plates also help reduce plastic pollution in diverse settings such as oceans and landfills. These plates, which are compostable or biodegradable, can gradually decompose, thus lowering their negative impact on the environment.

Increase in innovation in food items, dishes, and recipes is boosting market progress. Companies are researching new ways to integrate sustainable materials and technologies into bagasse plate manufacturing processes. These include usage of plant-based colors or natural chemicals to promote biodegradability and composability of plates, as well as utilization of eco-friendly coatings or finishes to improve their performance and longevity.

Companies are skillfully incorporating attractive patterns, shapes, and textures into bagasse plates to enhance their visual appeal, thus making them suitable for various occasions and settings. Furthermore, the inclusion of multiple compartments tailored to hold different food items prevents the intermixing of foods and enables people to consume meals efficiently.

Bagasse plates can also be personalized and customized to meet branding and event requirements. These possibilities include the ability to print logos, pieces of art, or messages on the plates, thus making them ideal for social gatherings, parties, or business occasions.

Bagasse plates can be used to store food in the refrigerator until consumption. Therefore, firmness, durability, and excellent thermal insulation properties make bagasse plates an ideal choice for storage of food.

Plastic plates, when exposed to hot food items, often experience deformation, thus compromising their reusability and resulting in waste that adversely affects the environment. In contrast, bagasse plates can withstand a wide range of temperatures without deformation, making them a durable and environmentally-friendly alternative.

Paper plates, when used with oily food items, tend to undergo deformation and may end up completely damaged. Additionally, paper plates have limited compatibility. They are primarily suitable for dried food items within a specific temperature range. Inability to reuse paper plates further adds to the issue. In contrast, bagasse plates have emerged as ideal alternatives, as they help maintain structural integrity even when used with oily foods. Furthermore, they offer broader compatibility with a variety of food types and temperatures.

Aluminum plates are a popular choice for serving food items due to their sustainability and compatibility. However, they suffer from drawbacks such as heavy weight, high cost, and heat conductivity. Bagasse plates, on the other hand, provide a superior alternative, as they are lightweight, cost-effective, and thermally stable. Their lightweight nature makes them convenient for consumers, while affordability and thermal stability further enhance their appeal as a preferred option over aluminum plates.

The Covid-19 pandemic led to a significant increase in online food services. Companies started providing consumers with more sustainable options to capture a larger market share during the peak of the pandemic. They began transitioning from aluminum and paper-based solutions to durable and recyclable bagasse-based plates. Bagasse offers high compatibility with food and can effectively replace other alternatives.

Of late, public transport services have been shifting toward the adoption of green tableware or green plates for utility during journeys. Catering services in public transport, such as trains, provide food to customers during their journey. Public transport companies have started using ‘green tableware,’ which is bagasse tableware, considering the increase in concerns toward environmental pollution. Bagasse tableware includes plates, bowls, spoons, forks, and other cutlery items, which are not only sustainable but also durable and easily compostable. Thus, they provide a sustainable option in catering services.

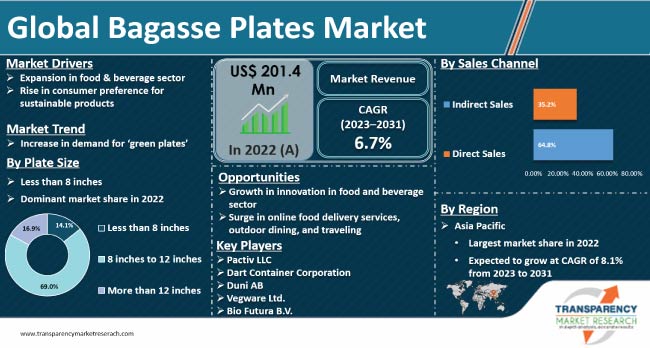

Asia Pacific held significant share of the global market in 2022. The market in the region is expected to expand substantially during the forecast period owing to the growth in agricultural practices, especially sugarcane pulping, rise in awareness about environmental conservation, and increase in adoption of sustainable packaging and sustainable living in the region.

Asia Pacific generates high amount of bagasse as waste during sugarcane pulping. Therefore, the region is estimated to record significant market expansion during the forecast period.

According to the bagasse plates market analysis, the global landscape is highly competitive owing to the presence of a large number of players.

The bagasse plates market report concludes with the company profiles section, which includes key information about major players such as Pactiv LLC, Bio Futura B.V., Dart Container Corporation, Genpak LLC, Duni AB, Vegware Ltd., Natural Tableware, Pappco Greenware, Greenvale Eco Products, AMS Compostable, GreenGood USA, DevEuro Paper Products LLP, Shanghai Youngpac Biotech Ltd., GREENWEIMO, and Shenzhen Zhiben Technology Group Co.

Each of these companies has been summarized in the bagasse plates market research report based on financial overview, business strategies, company overview, application portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 201.4 Mn |

|

Market Forecast Value in 2031 |

US$ 367.6 Mn |

|

Growth Rate (CAGR) |

6.7% |

|

Forecast Period |

2023-2031 |

|

Quantitative Units |

US$ Mn for Value and Units for Volume |

|

Market Analysis |

It includes cross-segment analysis at the global as well as regional level. Moreover, the qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 201.4 Mn in 2022

It is expected to grow at a CAGR of 6.7% from 2023 to 2031

It would be worth US$ 367.6 Mn by the end of 2031

Expansion in the food & beverage sector and rise in consumer preference for sustainable products

Plates measuring 8 inches to 12 inches are preferred by users

Asia Pacific is likely to record high demand for bagasse plates during the forecast period

Pactiv LLC, Bio Futura B.V., Dart Container Corporation, Genpak LLC, Duni AB, Vegware Ltd., Natural Tableware, Pappco Greenware, Greenvale Eco Products, AMS Compostable, GreenGood USA, DevEuro Paper Products LLP, Shanghai Youngpac Biotech Ltd., GREENWEIMO, and Shenzhen Zhiben Technology Group Co. Ltd.

1. Executive Summary

1.1. Market Overview

1.2. Market Analysis

1.3. Analysis and Recommendations

2. Market Introduction

2.1. Market Taxonomy

2.2. Market Definition

3. Bagasse Plates Market Overview

3.1. Introduction

3.2. Global Packaging Market Overview

3.3. Macroeconomic Factors - Correlation Analysis

3.4. Forecast Factors - Relevance & Impact

3.5. Bagasse Plates Market Value Chain Analysis

3.5.1. Exhaustive List of Active Participants

3.5.1.1. Manufacturers

3.5.1.2. Distributors & Suppliers

3.5.1.3. End-users

3.5.2. Profitability Margins

3.6. Market Dynamics

3.6.1. Drivers

3.6.2. Restraints

3.6.3. Trends

3.6.4. Opportunities

4. Global Bagasse Plates Market Analysis

4.1. Pricing Analysis

4.1.1. Pricing Assumption

4.1.2. Price Projection By Region

4.2. Market Size (US$ Mn) and Forecast

4.2.1. Market Size and Y-o-Y Growth

4.2.2. Absolute $ Opportunity

5. Global Bagasse Plates Market Analysis and Forecast, By Plate Size

5.1. Introduction

5.1.1. Market Share and Basis Points (BPS) Analysis, By Plate Size

5.1.2. Y-o-Y Growth Projections, By Plate Size

5.2. Historical Market Value (US$ Mn) and Volume (Units), 2015-2022, By Plate Size

5.2.1. Less than 8 inches

5.2.2. 8 inches to 12 inches

5.2.3. More than 12 inches

5.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2023-2031, By Plate Size

5.3.1. Less than 8 inches

5.3.2. 8 inches to 12 inches

5.3.3. More than 12 inches

5.4. Market Attractiveness Analysis, By Plate Size

6. Global Bagasse Plates Market Analysis and Forecast, By Sales Channel

6.1. Introduction

6.1.1. Market Share and Basis Points (BPS) Analysis, By Sales Channel

6.1.2. Y-o-Y Growth Projections, By Sales Channel

6.2. Historical Market Value (US$ Mn) and Volume (Units), 2015-2022, By Sales Channel

6.2.1. Indirect Sales

6.2.1.1. Departmental & Discount Stores

6.2.1.2. Hypermarkets/Supermarkets

6.2.1.3. Specialty Stores

6.2.1.4. Online Sales

6.2.2. Direct Sales

6.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2023-2031, By Sales Channel

6.3.1. Indirect Sales

6.3.1.1. Departmental & Discount Stores

6.3.1.2. Hypermarkets/Supermarkets

6.3.1.3. Specialty Stores

6.3.1.4. Online Sales

6.3.2. Direct Sales

6.4. Market Attractiveness Analysis, By Sales Channel

7. Global Bagasse Plates Market Analysis and Forecast, By End-use

7.1. Introduction

7.1.1. Market Share and Basis Points (BPS) Analysis, By End-use

7.1.2. Y-o-Y Growth Projections, By End-use

7.2. Historical Market Value (US$ Mn) and Volume (Units), 2015-2022, By End-use

7.2.1. Commercial

7.2.1.1. Hotels & Cafes

7.2.1.2. Full Service Restaurants

7.2.1.3. Quick Service Restaurants

7.2.1.4. Venues & Catering Services

7.2.2. Household

7.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2023-2031, By End-use

7.3.1. Commercial

7.3.1.1. Hotels & Cafes

7.3.1.2. Full Service Restaurants

7.3.1.3. Quick Service Restaurants

7.3.1.4. Venues & Catering Services

7.3.2. Household

7.4. Market Attractiveness Analysis, By End-use

8. Global Bagasse Plates Market Analysis, by Region

8.1. Introduction

8.1.1. Market Share and Basis Points (BPS) Analysis By Region

8.1.2. Y-o-Y Growth Projections By Region

8.2. Historical Market Value (US$ Mn) and Volume (Units), 2015-2022, By Region

8.2.1. North America

8.2.2. Latin America

8.2.3. Europe

8.2.4. Asia Pacific (ASIA PACIFIC)

8.2.5. Middle East & Africa (MIDDLE EAST & AFRICA)

8.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2023-2031 By Region

8.3.1. North America

8.3.2. Latin America

8.3.3. Europe

8.3.4. Asia Pacific (ASIA PACIFIC)

8.3.5. Middle East & Africa (MIDDLE EAST & AFRICA)

8.4. Market Attractiveness Analysis By Region

9. North America Bagasse Plates Market Analysis and Forecast

9.1. Introduction

9.1.1. Market Share and Basis Points (BPS) Analysis, By Country

9.1.2. Y-o-Y Growth Projections, By Country

9.2. Historical Market Value (US$ Mn) and Volume (Units), 2015-2022, By Country

9.2.1. U.S.

9.2.2. Canada

9.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2023-2031, By Country

9.3.1. U.S.

9.3.2. Canada

9.4. Historical Market Value (US$ Mn) and Volume (Units), 2015-2022, By Plate Size

9.4.1. Less than 8 inches

9.4.2. 8 inches to 12 inches

9.4.3. More than 12 inches

9.5. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2023-2031, By Plate Size

9.5.1. Less than 8 inches

9.5.2. 8 inches to 12 inches

9.5.3. More than 12 inches

9.6. Historical Market Value (US$ Mn) and Volume (Units), 2015-2022, By Sales Channel

9.6.1. Indirect Sales

9.6.1.1. Departmental & Discount Stores

9.6.1.2. Hypermarkets/Supermarkets

9.6.1.3. Specialty Stores

9.6.1.4. Online Sales

9.6.2. Direct Sales

9.7. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2023-2031, By Sales Channel

9.7.1. Indirect Sales

9.7.1.1. Departmental & Discount Stores

9.7.1.2. Hypermarkets/Supermarkets

9.7.1.3. Specialty Stores

9.7.1.4. Online Sales

9.7.2. Direct Sales

9.8. Historical Market Value (US$ Mn) and Volume (Units), 2015-2022, By End-use

9.8.1. Commercial

9.8.1.1. Hotels & Cafes

9.8.1.2. Full Service Restaurants

9.8.1.3. Quick Service Restaurants

9.8.1.4. Venues & Catering Services

9.8.2. Household

9.9. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2023-2031, By End-use

9.9.1. Commercial

9.9.1.1. Hotels & Cafes

9.9.1.2. Full Service Restaurants

9.9.1.3. Quick Service Restaurants

9.9.1.4. Venues & Catering Services

9.9.2. Household

9.10. Market Attractiveness Analysis

9.10.1. By Plate Size

9.10.2. By Sales Channel

9.10.3. By End-use

10. Latin America Bagasse Plates Market Analysis and Forecast

10.1. Introduction

10.1.1. Market share and Basis Points (BPS) Analysis, By Country

10.1.2. Y-o-Y Growth Projections, By Country

10.2. Historical Market Value (US$ Mn) and Volume (Units), 2015-2022, By Country

10.2.1. Brazil

10.2.2. Mexico

10.2.3. Argentina

10.2.4. Rest of Latin America

10.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2023-2031 By Country

10.3.1. Brazil

10.3.2. Mexico

10.3.3. Argentina

10.3.4. Rest of Latin America

10.4. Historical Market Value (US$ Mn) and Volume (Units), 2015-2022, By Plate Size

10.4.1. Less than 8 inches

10.4.2. 8 inches to 12 inches

10.4.3. More than 12 inches

10.5. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2023-2031, By Plate Size

10.5.1. Less than 8 inches

10.5.2. 8 inches to 12 inches

10.5.3. More than 12 inches

10.6. Historical Market Value (US$ Mn) and Volume (Units), 2015-2022, By Sales Channel

10.6.1. Indirect Sales

10.6.1.1. Departmental & Discount Stores

10.6.1.2. Hypermarkets/Supermarkets

10.6.1.3. Specialty Stores

10.6.1.4. Online Sales

10.6.2. Direct Sales

10.7. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2023-2031, By Sales Channel

10.7.1. Indirect Sales

10.7.1.1. Departmental & Discount Stores

10.7.1.2. Hypermarkets/Supermarkets

10.7.1.3. Specialty Stores

10.7.1.4. Online Sales

10.7.2. Direct Sales

10.8. Historical Market Value (US$ Mn) and Volume (Units), 2015-2022, By End-use

10.8.1. Commercial

10.8.1.1. Hotels & Cafes

10.8.1.2. Full Service Restaurants

10.8.1.3. Quick Service Restaurants

10.8.1.4. Venues & Catering Services

10.8.2. Household

10.9. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2023-2031, By End-use

10.9.1. Commercial

10.9.1.1. Hotels & Cafes

10.9.1.2. Full Service Restaurants

10.9.1.3. Quick Service Restaurants

10.9.1.4. Venues & Catering Services

10.9.2. Household

10.10. Market Attractiveness Analysis

10.10.1. By Plate Size

10.10.2. By Sales Channel

10.10.3. By End-use

11. Europe Bagasse Plates Market Analysis and Forecast

11.1. Introduction

11.1.1. Market share and Basis Points (BPS) Analysis, By Country

11.1.2. Y-o-Y Growth Projections, By Country

11.2. Historical Market Value (US$ Mn) and Volume (Units), 2015-2022, By Country

11.2.1. Germany

11.2.2. Spain

11.2.3. Italy

11.2.4. France

11.2.5. U.K.

11.2.6. BENELUX

11.2.7. Nordic

11.2.8. Russia

11.2.9. Poland

11.2.10. Rest of Europe

11.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2023-2031 By Country

11.3.1. Germany

11.3.2. Spain

11.3.3. Italy

11.3.4. France

11.3.5. U.K.

11.3.6. BENELUX

11.3.7. Nordic

11.3.8. Russia

11.3.9. Poland

11.3.10. Rest of Europe

11.4. Historical Market Value (US$ Mn) and Volume (Units), 2015-2022, By Plate Size

11.4.1. Less than 8 inches

11.4.2. 8 inches to 12 inches

11.4.3. More than 12 inches

11.4.4. Above 8ml

11.5. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2023-2031, By Plate Size

11.5.1. Less than 8 inches

11.5.2. 8 inches to 12 inches

11.5.3. More than 12 inches

11.5.4. Above 8ml

11.6. Historical Market Value (US$ Mn) and Volume (Units), 2015-2022, By Sales Channel

11.6.1. Indirect Sales

11.6.1.1. Departmental & Discount Stores

11.6.1.2. Hypermarkets/Supermarkets

11.6.1.3. Specialty Stores

11.6.1.4. Online Sales

11.6.2. Direct Sales

11.7. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2023-2031, By Sales Channel

11.7.1. Indirect Sales

11.7.1.1. Departmental & Discount Stores

11.7.1.2. Hypermarkets/Supermarkets

11.7.1.3. Specialty Stores

11.7.1.4. Online Sales

11.7.2. Direct Sales

11.8. Historical Market Value (US$ Mn) and Volume (Units), 2015-2022, By End-use

11.8.1. Commercial

11.8.1.1. Hotels & Cafes

11.8.1.2. Full Service Restaurants

11.8.1.3. Quick Service Restaurants

11.8.1.4. Venues & Catering Services

11.8.2. Household

11.9. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2023-2031, By End-use

11.9.1. Commercial

11.9.1.1. Hotels & Cafes

11.9.1.2. Full Service Restaurants

11.9.1.3. Quick Service Restaurants

11.9.1.4. Venues & Catering Services

11.9.2. Household

11.10. Market Attractiveness Analysis

11.10.1. By Plate Size

11.10.2. By Sales Channel

11.10.3. By End-use

12. Asia Pacific Bagasse Plates Market Analysis and Forecast

12.1. Introduction

12.1.1. Market share and Basis Points (BPS) Analysis, By Country

12.1.2. Y-o-Y Growth Projections, By Country

12.2. Historical Market Value (US$ Mn) and Volume (Units), 2015-2022, By Country

12.2.1. China

12.2.2. India

12.2.3. Japan

12.2.4. ASEAN

12.2.5. Australia and New Zealand

12.2.6. Rest of ASIA PACIFIC

12.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2023-2031 By Country

12.3.1. China

12.3.2. India

12.3.3. Japan

12.3.4. ASEAN

12.3.5. Australia and New Zealand

12.3.6. Rest of ASIA PACIFIC

12.4. Historical Market Value (US$ Mn) and Volume (Units), 2015-2022, By Plate Size

12.4.1. Less than 8 inches

12.4.2. 8 inches to 12 inches

12.4.3. More than 12 inches

12.4.4. Above 8ml

12.5. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2023-2031, By Plate Size

12.5.1. Less than 8 inches

12.5.2. 8 inches to 12 inches

12.5.3. More than 12 inches

12.5.4. Above 8ml

12.6. Historical Market Value (US$ Mn) and Volume (Units), 2015-2022, By Sales Channel

12.6.1. Indirect Sales

12.6.1.1. Departmental & Discount Stores

12.6.1.2. Hypermarkets/Supermarkets

12.6.1.3. Specialty Stores

12.6.1.4. Online Sales

12.6.2. Direct Sales

12.7. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2023-2031, By Sales Channel

12.7.1. Indirect Sales

12.7.1.1. Departmental & Discount Stores

12.7.1.2. Hypermarkets/Supermarkets

12.7.1.3. Specialty Stores

12.7.1.4. Online Sales

12.7.2. Direct Sales

12.8. Historical Market Value (US$ Mn) and Volume (Units), 2015-2022, By End-use

12.8.1. Commercial

12.8.1.1. Hotels & Cafes

12.8.1.2. Full Service Restaurants

12.8.1.3. Quick Service Restaurants

12.8.1.4. Venues & Catering Services

12.8.2. Household

12.9. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2023-2031, By End-use

12.9.1. Commercial

12.9.1.1. Hotels & Cafes

12.9.1.2. Full Service Restaurants

12.9.1.3. Quick Service Restaurants

12.9.1.4. Venues & Catering Services

12.9.2. Household

12.10. Market Attractiveness Analysis

12.10.1. By Plate Size

12.10.2. By Sales Channel

12.10.3. By End-use

13. Middle East & Africa Bagasse Plates Market Analysis and Forecast

13.1. Introduction

13.1.1. Market share and Basis Points (BPS) Analysis, By Country

13.1.2. Y-o-Y Growth Projections, By Country

13.2. Historical Market Value (US$ Mn) and Volume (Units), 2015-2022, By Country

13.2.1. North Africa

13.2.2. GCC Countries

13.2.3. South Africa

13.2.4. Turkey

13.2.5. Rest of MIDDLE EAST & AFRICA

13.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2023-2031, By Country

13.3.1. North Africa

13.3.2. GCC countries

13.3.3. South Africa

13.3.4. Turkey

13.3.5. Rest of MIDDLE EAST & AFRICA

13.4. Historical Market Value (US$ Mn) and Volume (Units), 2015-2022, By Plate Size

13.4.1. Less than 8 inches

13.4.2. 8 inches to 12 inches

13.4.3. More than 12 inches

13.4.4. Above 8ml

13.5. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2023-2031, By Plate Size

13.5.1. Less than 8 inches

13.5.2. 8 inches to 12 inches

13.5.3. More than 12 inches

13.5.4. Above 8ml

13.6. Historical Market Value (US$ Mn) and Volume (Units), 2015-2022, By Sales Channel

13.6.1. Indirect Sales

13.6.1.1. Departmental & Discount Stores

13.6.1.2. Hypermarkets/Supermarkets

13.6.1.3. Specialty Stores

13.6.1.4. Online Sales

13.6.2. Direct Sales

13.7. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2023-2031, By Sales Channel

13.7.1. Indirect Sales

13.7.1.1. Departmental & Discount Stores

13.7.1.2. Hypermarkets/Supermarkets

13.7.1.3. Specialty Stores

13.7.1.4. Online Sales

13.7.2. Direct Sales

13.8. Historical Market Value (US$ Mn) and Volume (Units), 2015-2022, By End-use

13.8.1. Commercial

13.8.1.1. Hotels & Cafes

13.8.1.2. Full Service Restaurants

13.8.1.3. Quick Service Restaurants

13.8.1.4. Venues & Catering Services

13.8.2. Household

13.9. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2023-2031, By End-use

13.9.1. Commercial

13.9.1.1. Hotels & Cafes

13.9.1.2. Full Service Restaurants

13.9.1.3. Quick Service Restaurants

13.9.1.4. Venues & Catering Services

13.9.2. Household

13.10. Market Attractiveness Analysis

13.10.1. By Plate Size

13.10.2. By Sales Channel

13.10.3. By End-use

14. Competition Landscape

14.1. Competition Dashboard

14.2. Company Market Share Analysis

14.3. Company Profiles (Details - Overview, Financials, Strategy, Recent Developments, SWOT analysis)

14.4. Competition Deep Dive

14.4.1. Pactiv LLC

14.4.1.1. Financials

14.4.1.2. Strategy

14.4.1.3. Recent Developments

14.4.1.4. SWOT Analysis

14.4.2. Bio Futura B.V.

14.4.2.1. Financials

14.4.2.2. Strategy

14.4.2.3. Recent Developments

14.4.2.4. SWOT Analysis

14.4.3. Dart Container Corporation

14.4.3.1. Financials

14.4.3.2. Strategy

14.4.3.3. Recent Developments

14.4.3.4. SWOT Analysis

14.4.4. Genpak, LLC

14.4.4.1. Financials

14.4.4.2. Strategy

14.4.4.3. Recent Developments

14.4.4.4. SWOT Analysis

14.4.5. Duni AB

14.4.5.1. Financials

14.4.5.2. Strategy

14.4.5.3. Recent Developments

14.4.5.4. SWOT Analysis

14.4.6. Vegware Ltd.

14.4.6.1. Financials

14.4.6.2. Strategy

14.4.6.3. Recent Developments

14.4.6.4. SWOT Analysis

14.4.7. Natural Tableware

14.4.7.1. Financials

14.4.7.2. Strategy

14.4.7.3. Recent Developments

14.4.7.4. SWOT Analysis

14.4.8. Pappco Greenware

14.4.8.1. Financials

14.4.8.2. Strategy

14.4.8.3. Recent Developments

14.4.8.4. SWOT Analysis

14.4.9. Greenvale Eco Products

14.4.9.1. Financials

14.4.9.2. Strategy

14.4.9.3. Recent Developments

14.4.9.4. SWOT Analysis

14.4.10. AMS Corporation

14.4.10.1. Financials

14.4.10.2. Strategy

14.4.10.3. Recent Developments

14.4.10.4. SWOT Analysis

14.4.11. GreenGood USA

14.4.11.1. Financials

14.4.11.2. Strategy

14.4.11.3. Recent Developments

14.4.11.4. SWOT Analysis

14.4.12. DevEuro Paper Products LLP

14.4.12.1. Financials

14.4.12.2. Strategy

14.4.12.3. Recent Developments

14.4.12.4. SWOT Analysis

14.4.13. Shanghai Youngpac Biotech Ltd.

14.4.13.1. Financials

14.4.13.2. Strategy

14.4.13.3. Recent Developments

14.4.13.4. SWOT Analysis

14.4.14. GREENWEIMO

14.4.14.1. Financials

14.4.14.2. Strategy

14.4.14.3. Recent Developments

14.4.14.4. SWOT Analysis

14.4.15. Shenzhen Zhiben Technology Group Co.Ltd.

14.4.15.1. Financials

14.4.15.2. Strategy

14.4.15.3. Recent Developments

14.4.15.4. SWOT Analysis

15. Assumptions and Acronyms Used

16. Research Methodology

List of Tables

Table 01: Global Bagasse Plates Market Value (US$ Mn) and Volume (Units) 2015-2031, by Plate Size

Table 02: Global Bagasse Plates Market Value (US$ Mn) and Volume (Units) 2015-2031, by Sales Channel

Table 03: Global Bagasse Plates Market Value (US$ Mn) and Volume (Units) 2015-2031, by End-use

Table 04: Global Bagasse Plates Market Value (US$ Mn) and Volume (Units) 2015-2031, by Region

Table 05: North America Bagasse Plates Market Value (US$ Mn) and Volume (Units) 2015-2031, by Plate Size

Table 06: North America Bagasse Plates Market Value (US$ Mn) and Volume (Units) 2015-2031, by Sales Channel

Table 07: North America Bagasse Plates Market Value (US$ Mn) and Volume (Units) 2015-2031, by End-use

Table 08: Latin America Bagasse Plates Market Value (US$ Mn) and Volume (Units) 2015-2031, by Plate Size

Table 09: Latin America Bagasse Plates Market Value (US$ Mn) and Volume (Units) 2015-2031, by Sales Channel

Table 10: Latin America Bagasse Plates Market Value (US$ Mn) and Volume (Units) 2015-2031, by End-use

Table 11: Europe Bagasse Plates Market Value (US$ Mn) and Volume (Units) 2015-2031, by Plate Size

Table 12: Europe Bagasse Plates Market Value (US$ Mn) and Volume (Units) 2015-2031, by Sales Channel

Table 13: Europe Bagasse Plates Market Value (US$ Mn) and Volume (Units) 2015-2031, by End-use

Table 14: Asia Pacific Bagasse Plates Market Value (US$ Mn) and Volume (Units) 2015-2031, by Plate Size

Table 15: Asia Pacific Bagasse Plates Market Value (US$ Mn) and Volume (Units) 2015-2031, by Sales Channel

Table 16: Asia Pacific Bagasse Plates Market Value (US$ Mn) and Volume (Units) 2015-2031, by End-use

Table 17: Middle East & Africa Bagasse Plates Market Value (US$ Mn) and Volume (Units) 2015-2031, by Plate Size

Table 18: Middle East & Africa Bagasse Plates Market Value (US$ Mn) and Volume (Units) 2015-2031, by Sales Channel

Table 19: Middle East & Africa Bagasse Plates Market Value (US$ Mn) and Volume (Units) 2015-2031, by End-use

List of Figures

Figure 01: Global Bagasse Plates Market Value Share Analysis, 2023 & 2031, by Plate Size

Figure 02: Global Bagasse Plates Market Attractiveness Analysis 2023 & 2031, by Plate Size

Figure 03: Global Bagasse Plates Market Value Share Analysis, 2023 & 2031, by Sales Channel

Figure 04: Global Bagasse Plates Market Attractiveness Analysis 2023 & 2031, by Sales Channel

Figure 05: Global Bagasse Plates Market Value Share Analysis, 2023 & 2031, by End-use

Figure 06: Global Bagasse Plates Market Attractiveness Analysis 2023 & 2031, by End-use

Figure 07: Global Bagasse Plates Market Value Share Analysis, 2023 & 2031, by Region

Figure 08: Global Bagasse Plates Market Attractiveness Analysis 2023 & 2031, by Region

Figure 09: North America Bagasse Plates Market Attractiveness Analysis 2023 & 2031, by Plate Size

Figure 10: North America Bagasse Plates Market Attractiveness Analysis 2023 & 2031, by Sales Channel

Figure 11: North America Bagasse Plates Market Attractiveness Analysis 2023 & 2031, by End-use

Figure 12: Latin America Bagasse Plates Market Attractiveness Analysis 2023 & 2031, by Plate Size

Figure 13: Latin America Bagasse Plates Market Attractiveness Analysis 2023 & 2031, by Sales Channel

Figure 14: Latin America Bagasse Plates Market Attractiveness Analysis 2023 & 2031, by End-use

Figure 15: Europe Bagasse Plates Market Attractiveness Analysis 2023 & 2031, by Plate Size

Figure 16: Europe Bagasse Plates Market Attractiveness Analysis 2023 & 2031, by Sales Channel

Figure 17: Europe Bagasse Plates Market Attractiveness Analysis 2023 & 2031, by End-use

Figure 18: Asia Pacific Bagasse Plates Market Attractiveness Analysis 2023 & 2031, by Plate Size

Figure 19: Asia Pacific Bagasse Plates Market Attractiveness Analysis 2023 & 2031, by Sales Channel

Figure 20: Asia Pacific Bagasse Plates Market Attractiveness Analysis 2023 & 2031, by End-use

Figure 21: Middle East & Africa Bagasse Plates Market Attractiveness Analysis 2023 & 2031, by Plate Size

Figure 22: Middle East & Africa Bagasse Plates Market Attractiveness Analysis 2023 & 2031, by Sales Channel

Figure 23: Middle East & Africa Bagasse Plates Market Attractiveness Analysis 2023 & 2031, by End-use