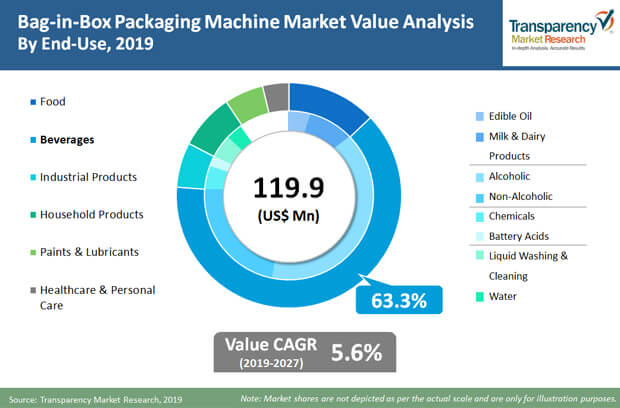

The global bag-in-box packaging machine market was valued at US$ 119.9 million in 2018. The market is forecast to expand at a CAGR of 5.4% during the forecast period, 2019-2027.

Bag-in-box packaging machines are capable of filling plastic pillow bags of capacity 1.5 liters to 25 liters or more. Automatic bag-in-box packaging machines are in high demand as they help increase the production quantity for any kind of beverage to aid the escalating demand. Bag-in-box is extensively used in the packaging of processed fruit juice and dairy products during the aseptic process. Pasteurized products packed in bag-in-box format are shelf stable and require no refrigeration. The low carbon foot print and extended shelf life of aseptic bag-in-box packaging machines offer more sustainable choices of packaging for various industries including dairy, juice, liquid eggs, and non-food items including certain chemicals and motor oil.

Asia Pacific is currently a prominent region in the global packaging machinery market, accounting for 38.4% of the global market share, and is further expected to expand with a CAGR of 7.8%, during 2019-2027, among all the regions. One of the major contributing factors for this, is the growth in demand for bag-in-box packaging machines in various applications such as food, pharmaceuticals, and consumer goods among others, especially in emerging economies.

In some of the largest wine drinking regions such as Europe and North America, bag-in-box containers are gaining foothold. U.S. is expected to be the largest consumer of bag-in-box containers in the world followed by France. Bag-in-box packaging machines will enjoy significant growth in the mature markets, while it will grow speedily in emerging markets. Bag-in-box are alternative packaging containers to traditional ones. Bag-in-box packaging has excellent environmental credentials as well. Bag-in-box is easier to transfer, store, and dispose off in regular waste collection. Bag-in-box provides various dispensing options for wine, juice, water, etc. Bag-in-box packaging uses 92% less plastic than pails. A bag-in-box container is around 88% corrugated box, which is totally recyclable.

Aseptic filling technology in bag-in-box packaging machine is mostly preferred than the non-aseptic filling technology. Aseptic filling technology increases the shelf life of the product packed inside and hence, is more popular than non-aseptic filling technology in bag-in-box packaging machine. Beverages will continue to represent over half of the global aseptic packaging market. Beverage aseptic packaging is expected to benefit from output growth along with increasing applications. This is due to cost effective and sustainability benefits of aseptic packaging. Aseptic packaging is also gaining traction in the food packaging market and is mostly driven by the availability of low particulate and pump-able food.

On the basis of beverage end use, the alcoholic segment is expected to witness lucrative growth and is valued at US$ 48 Mn by the end of 2018. Beverage end-use industries are progressively opting for customized bag-in-box packaging machine solutions for the packaging of wines to be able to stand out among other key players. As industries opt for automatic bag-in-box packaging machine solutions for improved efficiency in the bag-in-box packaging machine, it is expected that the automatic segment will witness an increased demand during the forecast period.

The beverages end-use segment is expected to be the most attractive segment during 2019-2027. Rapid industrialization is the key factor influencing the growth of the bag-in-box packaging machine market. The increasing demand for bag-in-box packaging machines in food and beverage end-use industries is expected to drive the bag-in-box packaging machine market. Some of the bag-in-box packaging machine manufacturers are looking for innovation and are investing in the packaging of the product while some are engaged in acquisitions and collaborations to expand their production business.

A bag-in-box container takes up only 5% of the space that a pail occupies when disposed of. The wine industry has witnessed a paradigm shift, since bag-in-box is introduced. Moreover, juice and other beverages to follow similar trend in the next half of the decade. Alcoholic beverages segment in bag-in-box market are expected to grow, owing to the wide range of practical benefits offered by the bag-in-box packaging machine technology.

On the basis of geography, India is expected to be the most attractive country followed by China in the bag-in-box packaging machine market. The US and Germany bag-in-box packaging machine markets being comparatively mature markets are expected to experience sluggish growth.

Key companies functioning in the global bag-in-box packaging machine market are Smurfit Kappa Group, DS Smith Packaging Ltd., Bosch Packaging Technology GmbH, Triangle Package Machinery Co., ABCO Automation, Inc, Rovema GmbH, IC Filling Systems, Sacmi Imola S.C, Voran Maschinen GmbH, TORR Industries, Kreuzmayr Maschinenbau GmbH, Flexifill Ltd, Terlet BV, and Gossamer Packaging Machinery.

1. Executive Summary

1.1. Market Overview

1.2. Market Analysis

1.3. TMR Analysis and Recommendations

1.4. Wheel of Opportunity

2. Market Introduction

2.1. Market Definition

2.2. Market Taxonomy

2.3. Bag-in-box Packaging Machine Installed Base, by Region

3. Market Viewpoint

3.1. Global Economic Outlook

3.2. Global Packaging Machinery Market Outlook

3.3. Global Packaging Market Outlook

3.4. Global Bag-in-box Container Market Outlook

3.5. Porters Five Forces Analysis

3.6. PESTLE Analysis for Key Countries

3.7. Macro-Economic Factors and Co-relation Analysis

3.8. Forecast Factors – Relevance and Impact

3.9. Value Chain Analysis

3.9.1. Profitability Margins

3.9.2. List of Active Participants

3.9.2.1. Component Suppliers

3.9.2.2. Bag-n-Box Manufacturers

3.9.2.3. Distributors/Suppliers

3.9.2.4. End-users

3.10. Market Dynamics

3.10.1. Drivers

3.10.1.1. Supply Side

3.10.1.2. Demand Side

3.10.2. Restraints

3.10.3. Opportunities

3.10.4. Trends

4. Bag-in-box Packaging Machine Market Analysis

4.1. Pricing Analysis

4.2. Market Value (US$ Mn) and Volume (Units) Analysis & Forecast

4.3. Y-o-Y Growth Projections

4.4. Absolute $ Opportunity Analysis

5. Global Bag-in-box Packaging Machine Market Analysis and Forecast, by Machine Type

5.1. Section Summary

5.2. Introduction

5.2.1. Market share and Basis Points (BPS) Analysis, by Machine Type

5.2.2. Y-o-Y Growth Projections, by Machine Type

5.3. Historical Market Value (US$ Mn) and Volume (Units) Analysis 2014-2018, by Machine Type

5.3.1. Integrated Systems

5.3.2. Standalone Units

5.3.2.1. Bag Making Machine

5.3.2.2. Bag Filler

5.3.2.3. Cartoning Machine

5.3.2.4. Bag Inserters

5.4. Market Value (US$ Mn) and Volume (Units) Forecast 2019-2027, by Machine Type

5.4.1. Integrated Systems

5.4.2. Standalone Units

5.4.2.1. Bag Making Machine

5.4.2.2. Bag Filler

5.4.2.3. Cartoning Machine

5.4.2.4. Bag Inserters

5.5. Market Attractiveness Analysis, by Machine Type

6. Global Bag-in-box Packaging Machine Market Analysis and Forecast, by Automation Type

6.1. Section Summary

6.2. Introduction

6.2.1. Market share and Basis Points (BPS) Analysis, by Automation Type

6.2.2. Y-o-Y Growth Projections, by Automation Type

6.3. Historical Market Value (US$ Mn) and Volume (Units) Analysis 2014-2018, by Automation Type

6.3.1. Automatic

6.3.2. Semi-Automatic

6.4. Market Value (US$ Mn) and Volume (Units) Forecast 2019-2027, by Automation Type

6.4.1. Automatic

6.4.2. Semi-Automatic

6.5. Market Attractiveness Analysis, by Automation Type

7. Global Bag-in-box Packaging Machine Market Analysis and Forecast, by Output Capacity

7.1. Section Summary

7.2. Introduction

7.2.1. Market share and Basis Points (BPS) Analysis, by Output Capacity

7.2.2. Y-o-Y Growth Projections, by Output Capacity

7.3. Historical Market Value (US$ Mn) and Volume (Units) Analysis 2014-2018, by Output Capacity

7.3.1. Up to 10 Bags/Min

7.3.2. 11 - 50 Bags/Min

7.3.3. 51 – 100 Bags/Min

7.3.4. Above 100 Bags/Min

7.4. Market Value (US$ Mn) and Volume (Units) Forecast 2019-2027, by Output Capacity

7.4.1. Up to 10 Bags/Min

7.4.2. 11 - 50 Bags/Min

7.4.3. 51 – 100 Bags/Min

7.4.4. Above 100 Bags/Min

7.5. Market Attractiveness Analysis, by Output Capacity

8. Global Bag-in-box Packaging Machine Market Analysis and Forecast, by Filling Technology

8.1. Section Summary

8.2. Introduction

8.2.1. Market share and Basis Points (BPS) Analysis, by Filling Technology

8.2.2. Y-o-Y Growth Projections, by Filling Technology

8.3. Historical Market Value (US$ Mn) and Volume (Units) Analysis 2014-2018, by Filling Technology

8.3.1. Aseptic Filling

8.3.2. Non-aseptic Filling

8.4. Market Value (US$ Mn) and Volume (Units) Forecast 2019-2027, by Filling Technology

8.4.1. Aseptic Filling

8.4.2. Non-aseptic Filling

8.5. Market Attractiveness Analysis, by Filling Technology

9. Global Bag-in-box Packaging Machine Market Analysis and Forecast, by End-use

9.1. Section Summary

9.2. Introduction

9.2.1. Market share and Basis Points (BPS) Analysis, by End-use

9.2.2. Y-o-Y Growth Projections, by End-use

9.3. Historical Market Value (US$ Mn) and Volume (Units) Analysis 2014-2018, by End-use

9.3.1. Food

9.3.1.1. Edible Oil

9.3.1.2. Milk & other Dairy Products

9.3.2. Beverages

9.3.2.1. Alcoholic Beverages

9.3.2.2. Non-Alcoholic Beverages

9.3.3. Industrial Products

9.3.3.1. Chemicals

9.3.3.2. Battery Acids

9.3.4. Household Products

9.3.4.1. Liquid Washing & Cleaning Products

9.3.4.2. Water

9.3.5. Paints & Lubricants

9.3.6. Healthcare & Personal Care

9.4. Market Value (US$ Mn) and Volume (Units) Forecast 2019-2027, by End-use

9.4.1. Food

9.4.1.1. Edible Oil

9.4.1.2. Milk & other Dairy Products

9.4.2. Beverages

9.4.2.1. Alcoholic Beverages

9.4.2.2. Non-Alcoholic Beverages

9.4.3. Industrial Products

9.4.3.1. Chemicals

9.4.3.2. Battery Acids

9.4.4. Household Products

9.4.4.1. Liquid Washing & Cleaning Products

9.4.4.2. Water

9.4.4.3. Cosmetics

9.4.5. Lubricants

9.4.6. Pharmaceutical & Healthcare

9.5. Market Attractiveness Analysis, by End-use

10. Global Bag-in-box Packaging Machine Market Analysis and Forecast, by Region

10.1. Section Summary

10.2. Introduction

10.2.1. Market share and Basis Points (BPS) Analysis, by Region

10.2.2. Y-o-Y Growth Projections, by Region

10.3. Historical Market Value (US$ Mn) and Volume (Units) Analysis 2014-2018, by Region

10.3.1. North America

10.3.2. Latin America

10.3.3. Europe

10.3.4. Asia Pacific (APAC)

10.3.5. Middle East and Africa (MEA)

10.4. Market Value (US$ Mn) and Volume (Units) Forecast 2019-2027 by Region

10.4.1. North America

10.4.2. Latin America

10.4.3. Europe

10.4.4. Asia Pacific (APAC)

10.4.5. Middle East and Africa (MEA)

10.5. Market Attractiveness Analysis, by Region

11. North America Bag-in-box Packaging Machine Market Analysis and Forecast

11.1. Section Summary

11.2. Introduction

11.2.1. Market share and Basis Points (BPS) Analysis, by Country

11.2.2. Y-o-Y Growth Projections, by Country

11.3. Historical Market Value (US$ Mn) and Volume (Units) Analysis 2014-2018, by Country

11.3.1. U.S.

11.3.2. Canada

11.4. Market Value (US$ Mn) and Volume (Units) Forecast 2019-2027 by Country

11.4.1. U.S.

11.4.2. Canada

11.5. Historical Market Value (US$ Mn) and Volume (Units) Analysis 2014-2018, by Machine Type

11.5.1. Integrated Systems

11.5.2. Standalone Units

11.5.2.1. Bag Making Machine

11.5.2.2. Bag Filler

11.5.2.3. Cartoning Machine

11.5.2.4. Bag Inserters

11.6. Market Value (US$ Mn) and Volume (Units) Forecast 2019-2027, by Machine Type

11.6.1. Integrated Systems

11.6.2. Standalone Units

11.7. Historical Market Value (US$ Mn) and Volume (Units) Analysis 2014-2018, by Automation Type

11.7.1. Automatic

11.7.2. Semi-Automatic

11.8. Market Value (US$ Mn) and Volume (Units) Forecast 2019-2027, by Automation Type

11.8.1. Automatic

11.8.2. Semi-Automatic

11.8.2.1. Bag Making Machine

11.8.2.2. Bag Filler

11.8.2.3. Cartoning Machine

11.8.2.4. Bag Inserters

11.9. Historical Market Value (US$ Mn) and Volume (Units) Analysis 2014-2018, by Output Capacity

11.9.1. Up to 10 Bags/Min

11.9.2. 11 - 50 Bags/Min

11.9.3. 51 – 100 Bags/Min

11.9.4. Above 100 Bags/Min

11.10. Market Value (US$ Mn) and Volume (Units) Forecast 2019-2027, by Output Capacity

11.10.1. Up to 10 Bags/Min

11.10.2. 11 - 50 Bags/Min

11.10.3. 51 – 100 Bags/Min

11.10.4. Above 100 Bags/Min

11.11. Historical Market Value (US$ Mn) and Volume (Units) Analysis 2014-2018, by Filling Technology

11.11.1. Aseptic Filling

11.11.2. Non-aseptic Filling

11.12. Market Value (US$ Mn) and Volume (Units) Forecast 2019-2027, by Filling Technology

11.12.1. Aseptic Filling

11.12.2. Non-aseptic Filling

11.13. Historical Market Value (US$ Mn) and Volume (Units) Analysis 2014-2018, by End-use

11.13.1. Food

11.13.1.1. Edible Oil

11.13.1.2. Milk & other Dairy Products

11.13.2. Beverages

11.13.2.1. Alcoholic Beverages

11.13.2.2. Non-Alcoholic Beverages

11.13.3. Industrial Products

11.13.3.1. Chemicals

11.13.3.2. Battery Acids

11.13.4. Household Products

11.13.4.1. Liquid Washing & Cleaning Products

11.13.4.2. Water

11.13.5. Paints & Lubricants

11.13.6. Healthcare & Personal Care

11.14. Market Value (US$ Mn) and Volume (Units) Forecast 2019-2027, by End-use

11.14.1. Food

11.14.1.1. Edible Oil

11.14.1.2. Milk & other Dairy Products

11.14.2. Beverages

11.14.2.1. Alcoholic Beverages

11.14.2.2. Non-Alcoholic Beverages

11.14.3. Industrial Products

11.14.3.1. Chemicals

11.14.3.2. Battery Acids

11.14.4. Household Products

11.14.4.1. Liquid Washing & Cleaning Products

11.14.4.2. Water

11.14.5. Paints & Lubricants

11.14.6. Healthcare & Personal Care

11.15. Trends

11.16. Drivers and Restraints: Impact Analysis

11.17. Key Market Participants – Intensity Mapping

12. Latin America Bag-in-box Packaging Machine Market Analysis and Forecast

12.1. Section Summary

12.2. Introduction

12.2.1. Market share and Basis Points (BPS) Analysis, by Country

12.2.2. Y-o-Y Growth Projections, by Country

12.3. Historical Market Value (US$ Mn) and Volume (Units) Analysis 2014-2018, by Country

12.3.1. Brazil

12.3.2. Mexico

12.3.3. Argentina

12.3.4. Rest of Latin America

12.4. Market Value (US$ Mn) and Volume (Units) Forecast 2019-2027 by Country

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Argentina

12.4.4. Rest of Latin America

12.5. Historical Market Value (US$ Mn) and Volume (Units) Analysis 2014-2018, by Machine Type

12.5.1. Integrated Systems

12.5.2. Standalone Units

12.5.2.1. Bag Making Machine

12.5.2.2. Bag Filler

12.5.2.3. Cartoning Machine

12.5.2.4. Bag Inserters

12.6. Market Value (US$ Mn) and Volume (Units) Forecast 2019-2027, by Machine Type

12.6.1. Integrated Systems

12.6.2. Standalone Units

12.6.2.1. Bag Making Machine

12.6.2.2. Bag Filler

12.6.2.3. Cartoning Machine

12.6.2.4. Bag Inserters

12.7. Historical Market Value (US$ Mn) and Volume (Units) Analysis 2014-2018, by Automation Type

12.7.1. Automatic

12.7.2. Semi-Automatic

12.8. Market Value (US$ Mn) and Volume (Units) Forecast 2019-2027, by Automation Type

12.8.1. Automatic

12.8.2. Semi-Automatic

12.9. Historical Market Value (US$ Mn) and Volume (Units) Analysis 2014-2018, by Output Capacity

12.9.1. Up to 10 Bags/Min

12.9.2. 11 - 50 Bags/Min

12.9.3. 51 – 100 Bags/Min

12.9.4. Above 100 Bags/Min

12.10. Market Value (US$ Mn) and Volume (Units) Forecast 2019-2027, by Output Capacity

12.10.1. Up to 10 Bags/Min

12.10.2. 11 - 50 Bags/Min

12.10.3. 51 – 100 Bags/Min

12.10.4. Above 100 Bags/Min

12.11. Historical Market Value (US$ Mn) and Volume (Units) Analysis 2014-2018, by Filling Technology

12.11.1. Aseptic Filling

12.11.2. Non-aseptic Filling

12.12. Market Value (US$ Mn) and Volume (Units) Forecast 2019-2027, by Filling Technology

12.12.1. Aseptic Filling

12.12.2. Non-aseptic Filling

12.13. Historical Market Value (US$ Mn) and Volume (Units) Analysis 2014-2018, by End-use

12.13.1. Food

12.13.1.1. Edible Oil

12.13.1.2. Milk & other Dairy Products

12.13.2. Beverages

12.13.2.1. Alcoholic Beverages

12.13.2.2. Non-Alcoholic Beverages

12.13.3. Industrial Products

12.13.3.1. Chemicals

12.13.3.2. Battery Acids

12.13.4. Household Products

12.13.4.1. Liquid Washing & Cleaning Products

12.13.4.2. Water

12.13.5. Paints & Lubricants

12.13.6. Healthcare & Personal Care

12.14. Market Value (US$ Mn) and Volume (Units) Forecast 2019-2027, by End-use

12.14.1. Food

12.14.1.1. Edible Oil

12.14.1.2. Milk & other Dairy Products

12.14.2. Beverages

12.14.2.1. Alcoholic Beverages

12.14.2.2. Non-Alcoholic Beverages

12.14.3. Industrial Products

12.14.3.1. Chemicals

12.14.3.2. Battery Acids

12.14.4. Household Products

12.14.4.1. Liquid Washing & Cleaning Products

12.14.4.2. Water

12.14.5. Paints & Lubricants

12.14.6. Healthcare & Personal Care

12.15. Trends

12.16. Drivers and Restraints: Impact Analysis

12.17. Key Market Participants – Intensity Mapping

13. Europe Bag-in-box Packaging Machine Market Analysis and Forecast

13.1. Section Summary

13.2. Introduction

13.2.1. Market share and Basis Points (BPS) Analysis, by Country

13.2.2. Y-o-Y Growth Projections, by Country

13.3. Historical Market Value (US$ Mn) and Volume (Units) Analysis 2014-2018, by Country

13.3.1. Germany

13.3.2. Spain

13.3.3. Italy

13.3.4. France

13.3.5. U.K.

13.3.6. BENELUX

13.3.7. Russia

13.3.8. Rest of Europe

13.4. Market Value (US$ Mn) and Volume (Units) Forecast 2019-2027 by Country

13.4.1. Germany

13.4.2. Spain

13.4.3. Italy

13.4.4. France

13.4.5. U.K.

13.4.6. BENELUX

13.4.7. Russia

13.4.8. Rest of Europe

13.5. Historical Market Value (US$ Mn) and Volume (Units) Analysis 2014-2018, by Machine Type

13.5.1. Integrated Systems

13.5.2. Standalone Units

13.5.2.1. Bag Making Machine

13.5.2.2. Bag Filler

13.5.2.3. Cartoning Machine

13.5.2.4. Bag Inserters

13.6. Market Value (US$ Mn) and Volume (Units) Forecast 2019-2027, by Machine Type

13.6.1. Integrated Systems

13.6.2. Standalone Units

13.6.2.1. Bag Making Machine

13.6.2.2. Bag Filler

13.6.2.3. Cartoning Machine

13.6.2.4. Bag Inserters

13.7. Historical Market Value (US$ Mn) and Volume (Units) Analysis 2014-2018, by Automation Type

13.7.1. Automatic

13.7.2. Semi-Automatic

13.8. Market Value (US$ Mn) and Volume (Units) Forecast 2019-2027, by Automation Type

13.8.1. Automatic

13.8.2. Semi-Automatic

13.9. Historical Market Value (US$ Mn) and Volume (Units) Analysis 2014-2018, by Output Capacity

13.9.1. Up to 10 Bags/Min

13.9.2. 11 - 50 Bags/Min

13.9.3. 51 – 100 Bags/Min

13.9.4. Above 100 Bags/Min

13.10. Market Value (US$ Mn) and Volume (Units) Forecast 2019-2027, by Output Capacity

13.10.1. Up to 10 Bags/Min

13.10.2. 11 - 50 Bags/Min

13.10.3. 51 – 100 Bags/Min

13.10.4. Above 100 Bags/Min

13.11. Historical Market Value (US$ Mn) and Volume (Units) Analysis 2014-2018, by Filling Technology

13.11.1. Aseptic Filling

13.11.2. Non-aseptic Filling

13.12. Market Value (US$ Mn) and Volume (Units) Forecast 2019-2027, by Filling Technology

13.12.1. Aseptic Filling

13.12.2. Non-aseptic Filling

13.13. Historical Market Value (US$ Mn) and Volume (Units) Analysis 2014-2018, by End-use

13.13.1. Food

13.13.1.1. Edible Oil

13.13.1.2. Milk & other Dairy Products

13.13.2. Beverages

13.13.2.1. Alcoholic Beverages

13.13.2.2. Non-Alcoholic Beverages

13.13.3. Industrial Products

13.13.3.1. Chemicals

13.13.3.2. Battery Acids

13.13.4. Household Products

13.13.4.1. Liquid Washing & Cleaning Products

13.13.4.2. Water

13.13.5. Paints & Lubricants

13.13.6. Healthcare & Personal Care

13.14. Market Value (US$ Mn) and Volume (Units) Forecast 2019-2027, by End-use

13.14.1. Food

13.14.1.1. Edible Oil

13.14.1.2. Milk & other Dairy Products

13.14.2. Beverages

13.14.2.1. Alcoholic Beverages

13.14.2.2. Non-Alcoholic Beverages

13.14.3. Industrial Products

13.14.3.1. Chemicals

13.14.3.2. Battery Acids

13.14.4. Household Products

13.14.4.1. Liquid Washing & Cleaning Products

13.14.4.2. Water

13.14.5. Paints & Lubricants

13.14.6. Healthcare & Personal Care

13.15. Trends

13.16. Drivers and Restraints: Impact Analysis

13.17. Key Market Participants – Intensity Mapping

14. Asia Pacific Bag-in-box Packaging Machine Market Analysis and Forecast

14.1. Section Summary

14.2. Introduction

14.2.1. Market share and Basis Points (BPS) Analysis, by Country

14.2.2. Y-o-Y Growth Projections, by Country

14.3. Historical Market Value (US$ Mn) and Volume (Units) Analysis 2014-2018, by Country

14.3.1. China

14.3.2. India

14.3.3. Japan

14.3.4. ASEAN

14.3.5. Australiva and New Zealand

14.3.6. Rest of APAC

14.4. Market Value (US$ Mn) and Volume (Units) Forecast 2019-2027 by Country

14.4.1. China

14.4.2. India

14.4.3. Japan

14.4.4. ASEAN

14.4.5. Australia and New Zealand

14.4.6. Rest of APAC

14.5. Historical Market Value (US$ Mn) and Volume (Units) Analysis 2014-2018, by Machine Type

14.5.1. Integrated Systems

14.5.2. Standalone Units

14.5.2.1. Bag Making Machine

14.5.2.2. Bag Filler

14.5.2.3. Cartoning Machine

14.5.2.4. Bag Inserters

14.6. Market Value (US$ Mn) and Volume (Units) Forecast 2019-2027, by Machine Type

14.6.1. Integrated Systems

14.6.2. Standalone Units

14.6.2.1. Bag Making Machine

14.6.2.2. Bag Filler

14.6.2.3. Cartoning Machine

14.6.2.4. Bag Inserters

14.7. Historical Market Value (US$ Mn) and Volume (Units) Analysis 2014-2018, by Automation Type

14.7.1. Automatic

14.7.2. Semi-Automatic

14.8. Market Value (US$ Mn) and Volume (Units) Forecast 2019-2027, by Automation Type

14.8.1. Automatic

14.8.2. Semi-Automatic

14.9. Historical Market Value (US$ Mn) and Volume (Units) Analysis 2014-2018, by Output Capacity

14.9.1. Up to 10 Bags/Min

14.9.2. 11 - 50 Bags/Min

14.9.3. 51 – 100 Bags/Min

14.9.4. Above 100 Bags/Min

14.10. Market Value (US$ Mn) and Volume (Units) Forecast 2019-2027, by Output Capacity

14.10.1. Up to 10 Bags/Min

14.10.2. 11 - 50 Bags/Min

14.10.3. 51 – 100 Bags/Min

14.10.4. Above 100 Bags/Min

14.11. Historical Market Value (US$ Mn) and Volume (Units) Analysis 2014-2018, by Filling Technology

14.11.1. Aseptic Filling

14.11.2. Non-aseptic Filling

14.12. Market Value (US$ Mn) and Volume (Units) Forecast 2019-2027, by Filling Technology

14.12.1. Aseptic Filling

14.12.2. Non-aseptic Filling

14.13. Historical Market Value (US$ Mn) and Volume (Units) Analysis 2014-2018, by End-use

14.13.1. Food

14.13.1.1. Edible Oil

14.13.1.2. Milk & other Dairy Products

14.13.2. Beverages

14.13.2.1. Alcoholic Beverages

14.13.2.2. Non-Alcoholic Beverages

14.13.3. Industrial Products

14.13.3.1. Chemicals

14.13.3.2. Battery Acids

14.13.4. Household Products

14.13.4.1. Liquid Washing & Cleaning Products

14.13.4.2. Water

14.13.5. Paints & Lubricants

14.13.6. Healthcare & Personal Care

14.14. Market Value (US$ Mn) and Volume (Units) Forecast 2019-2027, by End-use

14.14.1. Food

14.14.1.1. Edible Oil

14.14.1.2. Milk & other Dairy Products

14.14.2. Beverages

14.14.2.1. Alcoholic Beverages

14.14.2.2. Non-Alcoholic Beverages

14.14.3. Industrial Products

14.14.3.1. Chemicals

14.14.3.2. Battery Acids

14.14.4. Household Products

14.14.4.1. Liquid Washing & Cleaning Products

14.14.4.2. Water

14.14.5. Paints & Lubricants

14.14.6. Healthcare & Personal Care

14.15. Trends

14.16. Drivers and Restraints: Impact Analysis

14.17. Key Market Participants – Intensity Mapping

15. Middle East and Africa Bag-in-box Packaging Machine Market Analysis and Forecast

15.1. Section Summary

15.2. Introduction

15.2.1. Market share and Basis Points (BPS) Analysis, by Country

15.2.2. Y-o-Y Growth Projections, by Country

15.3. Historical Market Value (US$ Mn) and Volume (Units) Analysis 2014-2018, by Country

15.3.1. GCC countries

15.3.2. Northern Africa

15.3.3. South Africa

15.3.4. Rest of MEA

15.4. Market Value (US$ Mn) and Volume (Units) Forecast 2019-2027 by Country

15.4.1. GCC countries

15.4.2. Northern Africa

15.4.3. South Africa

15.4.4. Rest of MEA

15.5. Historical Market Value (US$ Mn) and Volume (Units) Analysis 2014-2018, by Machine Type

15.5.1. Integrated Systems

15.5.2. Standalone Units

15.5.2.1. Bag Making Machine

15.5.2.2. Bag Filler

15.5.2.3. Cartoning Machine

15.5.2.4. Bag Inserters

15.6. Market Value (US$ Mn) and Volume (Units) Forecast 2019-2027, by Machine Type

15.6.1. Integrated Systems

15.6.2. Standalone Units

15.6.2.1. Bag Making Machine

15.6.2.2. Bag Filler

15.6.2.3. Cartoning Machine

15.6.2.4. Bag Inserters

15.7. Historical Market Value (US$ Mn) and Volume (Units) Analysis 2014-2018, by Automation Type

15.7.1. Automatic

15.7.2. Semi-Automatic

15.8. Market Value (US$ Mn) and Volume (Units) Forecast 2019-2027, by Automation Type

15.8.1. Automatic

15.8.2. Semi-Automatic

15.9. Historical Market Value (US$ Mn) and Volume (Units) Analysis 2014-2018, by Output Capacity

15.9.1. Up to 10 Bags/Min

15.9.2. 11 - 50 Bags/Min

15.9.3. 51 – 100 Bags/Min

15.9.4. Above 100 Bags/Min

15.10. Market Value (US$ Mn) and Volume (Units) Forecast 2019-2027, by Output Capacity

15.10.1. Up to 10 Bags/Min

15.10.2. 11 - 50 Bags/Min

15.10.3. 51 – 100 Bags/Min

15.10.4. Above 100 Bags/Min

15.11. Historical Market Value (US$ Mn) and Volume (Units) Analysis 2014-2018, by Filling Technology

15.11.1. Aseptic Filling

15.11.2. Non-aseptic Filling

15.12. Market Value (US$ Mn) and Volume (Units) Forecast 2019-2027, by Filling Technology

15.12.1. Aseptic Filling

15.12.2. Non-aseptic Filling

15.13. Historical Market Value (US$ Mn) and Volume (Units) Analysis 2014-2018, by End-use

15.13.1. Food

15.13.1.1. Edible Oil

15.13.1.2. Milk & other Dairy Products

15.13.2. Beverages

15.13.2.1. Alcoholic Beverages

15.13.2.2. Non-Alcoholic Beverages

15.13.3. Industrial Products

15.13.3.1. Chemicals

15.13.3.2. Battery Acids

15.13.4. Household Products

15.13.4.1. Liquid Washing & Cleaning Products

15.13.4.2. Water

15.13.5. Paints & Lubricants

15.13.6. Healthcare & Personal Care

15.14. Market Value (US$ Mn) and Volume (Units) Forecast 2019-2027, by End-use

15.14.1. Food

15.14.1.1. Edible Oil

15.14.1.2. Milk & other Dairy Products

15.14.2. Beverages

15.14.2.1. Alcoholic Beverages

15.14.2.2. Non-Alcoholic Beverages

15.14.3. Industrial Products

15.14.3.1. Chemicals

15.14.3.2. Battery Acids

15.14.4. Household Products

15.14.4.1. Liquid Washing & Cleaning Products

15.14.4.2. Water

15.14.5. Paints & Lubricants

15.14.6. Healthcare & Personal Care

15.15. Trends

15.16. Drivers and Restraints: Impact Analysis

15.17. Key Market Participants – Intensity Mapping

16. Market Structure Analysis

16.1. Market Analysis, by Tier of Companies

16.1.1. by Large, Medium and Small

16.2. Market Concentration

16.2.1. by Top 5 and by Top 10

16.3. Production Machine Type Share Analysis

16.3.1. by Large, Medium and Small

16.3.2. by Top 5 and Top 10

16.4. Market Share Analysis of Top 10 Players

16.4.1. The Americas Market Share Analysis, by Top Players

16.4.2. EMEA Market Share Analysis, by Top Players

16.4.3. Asia Pacific Market Share Analysis, by Top Players

16.5. Market Presence Analysis

16.5.1. By Regional footprint of Players

16.5.2. Channel footprint by Players

17. Competitive Landscape

17.1. Competition Dashboard

17.2. Company Market Share Analysis

17.3. Market Tier Structure Analysis

17.4. Company Profiles (Details – Overview, Financials, Strategy, Recent Developments, SWOT analysis)

17.5. Competition Deep Dive

17.5.1. DS Smith Plc

17.5.1.1. Overview

17.5.1.2. Product Portfolio

17.5.1.3. Profitability

17.5.1.4. Production Footprint

17.5.1.5. Sales Footprint

17.5.1.6. Channel Footprint

17.5.1.7. Competition Benchmarking

17.5.1.8. Strategy

17.5.1.8.1. Marketing Strategy

17.5.1.8.2. Product Strategy

17.5.1.8.3. Channel Strategy

17.5.2. Triangle Package Machinery Co

17.5.3. Smurfit Kappa Group plc

17.5.4. IC Filling Systems

17.5.5. ABCO Automation, Inc.

17.5.6. Alfa Laval

17.5.7. Sacmi Group

17.5.8. Voran Maschinen GmbH

17.5.9. ROVEMA GmbH

17.5.10. TORR Industries

17.5.11. Bosch Packaging Technology, Inc.

17.5.12. Kreuzmayr Maschinenbau GmbH

17.5.13. Flexifill Ltd.

17.5.14. Terlet BV

17.5.15. Gosammer Packaging

18. Assumptions and Acronyms

19. Research Methodology

List of Tables

Table 01: Global Bag-in-box Packaging Machine Market Value (US$ Mn) and Volume (Units) Forecast, by Machine Type, 2014 – 2027

Table 02: Global Bag-in-box Packaging Machine Market Value (US$ Mn) and Volume (Units) Forecast, by Automation Type, 2014 – 2027

Table 03: Global Bag-in-box Packaging Machines Market Value (US$ Mn) and Volume (Units) Forecast, by Output Capacity, 2014 – 2027

Table 04: Global Bag-in-box Packaging Machine Market Value (US$ Mn) and Volume (Units) Forecast, by Filling Technology, 2014 – 2027

Table 05: Global Bag-in-box Packaging Machines Market Value (US$ Mn) and Volume (Units) Forecast, by End-Use, 2014 – 2027

Table 06: Global Bag-in-box Packaging Machines Market Value (US$ Mn) and Volume (Units) Forecast, by End-Use, 2014 – 2027

Table 07: Global Bag-in-box Packaging Machines Market Value (US$ Mn) and Volume (Units) Forecast, by End-Use, 2014 – 2027

Table 08: North America Bag-in-box Packaging Machine Market Value (US$ Mn) and Volume (Units) Forecast, by Country, 2014 – 2027

Table 09: North America Bag-in-box Packaging Machine Market Value (US$ Mn) and Volume (Units) Forecast, by Machine Type, 2014 – 2027

Table 10: North America Bag-in-box Packaging Machine Market Value (US$ Mn) and Volume (Units) Forecast, by Automation Type, 2014 – 2027

Table 11: North America Bag-in-box Packaging Machines Market Value (US$ Mn) and Volume (Units) Forecast, by Output Capacity, 2014 – 2027

Table 12: North America Bag-in-box Packaging Machine Market Value (US$ Mn) and Volume (Units) Forecast, by Filling Technology, 2014 – 2027

Table 13: North America Bag-in-box Packaging Machines Market Value (US$ Mn) and Volume (Units) Forecast, by End-Use, 2014 – 2027

Table 14: North America Bag-in-box Packaging Machines Market Value (US$ Mn) and Volume (Units) Forecast, by End-Use, 2014 – 2027

Table 15: North America Bag-in-box Packaging Machines Market Value (US$ Mn) and Volume (Units) Forecast, by End-Use, 2014 – 2027

Table 16: Latin America Bag-in-box Packaging Machine Market Value (US$ Mn) and Volume (Units) Forecast, by Country, 2014 – 2027

Table 17: Latin America Bag-in-box Packaging Machine Market Value (US$ Mn) and Volume (Units) Forecast, by Machine Type, 2014 – 2027

Table 18: Latin America Bag-in-box Packaging Machine Market Value (US$ Mn) and Volume (Units) Forecast, by Automation Type, 2014 – 2027

Table 19: Latin America Bag-in-box Packaging Machines Market Value (US$ Mn) and Volume (Units) Forecast, by Output Capacity, 2014 – 2027

Table 20: Latin America Bag-in-box Packaging Machine Market Value (US$ Mn) and Volume (Units) Forecast, by Filling Technology, 2014 – 2027

Table 21: Latin America Bag-in-box Packaging Machines Market Value (US$ Mn) and Volume (Units) Forecast, by End-Use, 2014 – 2027

Table 22: Latin America Bag-in-box Packaging Machines Market Value (US$ Mn) and Volume (Units) Forecast, by End-Use, 2014 – 2027

Table 23: Latin America Bag-in-box Packaging Machines Market Value (US$ Mn) and Volume (Units) Forecast, by End-Use, 2014 – 2027

Table 24: Europe Bag-in-box Packaging Machine Market Value (US$ Mn) and Volume (Units) Forecast, by Country, 2014 – 2027

Table 25: Europe Bag-in-box Packaging Machine Market Value (US$ Mn) and Volume (Units) Forecast, by Machine Type, 2014 – 2027

Table 26: Europe Bag-in-box Packaging Machine Market Value (US$ Mn) and Volume (Units) Forecast, by Automation Type, 2014 – 2027

Table 27: Europe Bag-in-box Packaging Machines Market Value (US$ Mn) and Volume (Units) Forecast, by Output Capacity, 2014 – 2027

Table 28: Europe Bag-in-box Packaging Machine Market Value (US$ Mn) and Volume (Units) Forecast, by Filling Technology, 2014 – 2027

Table 29: Europe Bag-in-box Packaging Machines Market Value (US$ Mn) and Volume (Units) Forecast, by End-Use, 2014 – 2027

Table 30: Europe Bag-in-box Packaging Machines Market Value (US$ Mn) and Volume (Units) Forecast, by End-Use, 2014 – 2027

Table 31: Europe Bag-in-box Packaging Machines Market Value (US$ Mn) and Volume (Units) Forecast, by End-Use, 2014 – 2027

Table 32: APAC Bag-in-box Packaging Machine Market Value (US$ Mn) and Volume (Units) Forecast, by Country, 2014 – 2027

Table 33: APAC Bag-in-box Packaging Machine Market Value (US$ Mn) and Volume (Units) Forecast, by Machine Type, 2014 – 2027

Table 34: APAC Bag-in-box Packaging Machine Market Value (US$ Mn) and Volume (Units) Forecast, by Automation Type, 2014 – 2027

Table 35: APAC Bag-in-box Packaging Machines Market Value (US$ Mn) and Volume (Units) Forecast, by Output Capacity, 2014 – 2027

Table 36: APAC Bag-in-box Packaging Machine Market Value (US$ Mn) and Volume (Units) Forecast, by Filling Technology, 2014 – 2027

Table 37: APAC Bag-in-box Packaging Machines Market Value (US$ Mn) and Volume (Units) Forecast, by End-Use, 2014 – 2027

Table 38: APAC Bag-in-box Packaging Machines Market Value (US$ Mn) and Volume (Units) Forecast, by End-Use, 2014 – 2027

Table 39: APAC Bag-in-box Packaging Machines Market Value (US$ Mn) and Volume (Units) Forecast, by End-Use, 2014 – 2027

Table 40: MEA Bag-in-box Packaging Machine Market Value (US$ Mn) and Volume (Units) Forecast, by Country, 2014 – 2027

Table 41: MEA Bag-in-box Packaging Machine Market Value (US$ Mn) and Volume (Units) Forecast, by Machine Type, 2014 – 2027

Table 42: MEA Bag-in-box Packaging Machine Market Value (US$ Mn) and Volume (Units) Forecast, by Automation Type, 2014 – 2027

Table 43: MEA Bag-in-box Packaging Machines Market Value (US$ Mn) and Volume (Units) Forecast, by Output Capacity, 2014 – 2027

Table 44: MEA Bag-in-box Packaging Machine Market Value (US$ Mn) and Volume (Units) Forecast, by Filling Technology, 2014 – 2027

Table 45: MEA Bag-in-box Packaging Machines Market Value (US$ Mn) and Volume (Units) Forecast, by End-Use, 2014 – 2027

Table 46: MEA Bag-in-box Packaging Machines Market Value (US$ Mn) and Volume (Units) Forecast, by End-Use, 2014 – 2027

Table 47: MEA Bag-in-box Packaging Machines Market Value (US$ Mn) and Volume (Units) Forecast, by End-Use, 2014 – 2027

List of Figures

Figure 01: Global Bag-in-box Packaging Machine Market Share Analysis, by Machine Type, 2014(H), 2019(E) & 2027(F)

Figure 02: Global Bag-in-box Packaging Machine Market Y-o-Y Growth, by Machine Type, 2015(A)-2027(F)

Figure 03: Global Bag-in-box Packaging Machine Market Attractiveness Index, by Machine Type, 2019(E) – 2027(F)

Figure 04: Global Bag-in-box Packaging Machine Market Share Analysis, by Automation Type, 2014(H), 2019(E) & 2027(F)

Figure 05: Global Bag-in-box Packaging Machine Market Y-o-Y Growth, by Automation Type, 2015(A)-2027(F)

Figure 06: Global Bag-in-box Packaging Machine Market Attractiveness Index, by Automation Type, 2019(E) – 2027(F)

Figure 07: Global Bag-in-box Packaging Machine Market Share Analysis, by Output Capacity, 2014(H), 2019(E) & 2027(F)

Figure 08: Global Bag-in-box Packaging Machine Market Y-o-Y Growth, by Output Capacity, 2015(A)-2027(F)

Figure 09: Global Bag-in-box Packaging Machine Market Attractiveness Index, by Output Capacity, 2019(E) – 2027(F)

Figure 10: Global Bag-in-box Packaging Machine Market Share Analysis, by Filling Technology, 2014(H), 2019(E) & 2027(F)

Figure 11: Global Bag-in-box Packaging Machine Market Y-o-Y Growth, by Filling Technology, 2015(A)-2027(F)

Figure 12: Global Bag-in-box Packaging Machine Market Attractiveness Index, by Filling Technology, 2019(E) – 2027(F)

Figure 13: Global Bag-in-box Packaging Machine Market Share Analysis, by End-Use, 2014(H), 2019(E) & 2027(F)

Figure 14: Global Bag-in-box Packaging Machine Market Y-o-Y Growth, by End-Use, 2015(A)-2027(F)

Figure 15: Global Bag-in-box Packaging Machine Market Attractiveness Index, by End-Use, 2019(E) – 2027(F)

Figure 16: North America Bag-in-box Packaging Machine Market Share Analysis, by Country, 2014(H), 2019(E) & 2027(F)

Figure 17: North America Bag-in-box Packaging Machine Market Y-o-Y Growth, by Country, 2015(A)-2027(F)

Figure 18: North America Bag-in-box Packaging Machine Market Attractiveness Index, by Country, 2019(E) – 2027(F)

Figure 19: North America Bag-in-box Packaging Machine Market Share Analysis, by Machine Type, 2014(H), 2019(E) & 2027(F)

Figure 20: North America Bag-in-box Packaging Machine Market Y-o-Y Growth, by Machine Type, 2015(A)-2027(F)

Figure 21: North America Bag-in-box Packaging Machine Market Attractiveness Index, by Machine Type, 2019(E) – 2027(F)

Figure 22: North America Bag-in-box Packaging Machine Market Share Analysis, by Automation Type, 2014(H), 2019(E) & 2027(F)

Figure 23: North America Bag-in-box Packaging Machine Market Y-o-Y Growth, by Automation Type, 2015(A)-2027(F)

Figure 24: North America Bag-in-box Packaging Machine Market Attractiveness Index, by Automation Type, 2019(E) – 2027(F)

Figure 25: North America Bag-in-box Packaging Machine Market Share Analysis, by Output Capacity, 2014(H), 2019(E) & 2027(F)

Figure 26: North America Bag-in-box Packaging Machine Market Y-o-Y Growth, by Output Capacity, 2015(A)-2027(F)

Figure 27: North America Bag-in-box Packaging Machine Market Attractiveness Index, by Output Capacity, 2019(E) – 2027(F)

Figure 28: North America Bag-in-box Packaging Machine Market Share Analysis, by Filling Technology, 2014(H), 2019(E) & 2027(F)

Figure 29: North America Bag-in-box Packaging Machine Market Y-o-Y Growth, by Filling Technology, 2015(A)-2027(F)

Figure 30: North America Bag-in-box Packaging Machine Market Attractiveness Index, by Filling Technology, 2019(E) – 2027(F)

Figure 31: North America Bag-in-box Packaging Machine Market Share Analysis, by End-Use, 2014(H), 2019(E) & 2027(F)

Figure 32: North America Bag-in-box Packaging Machine Market Y-o-Y Growth, by End-Use, 2015(A)-2027(F)

Figure 33: North America Bag-in-box Packaging Machine Market Attractiveness Index, by End-Use, 2019(E) – 2027(F)

Figure 34: Latin America Bag-in-box Packaging Machine Market Share Analysis, by Country, 2014(H), 2019(E) & 2027(F)

Figure 35: Latin America Bag-in-box Packaging Machine Market Y-o-Y Growth, by Country, 2015(A)-2027(F)

Figure 36: Latin America Bag-in-box Packaging Machine Market Attractiveness Index, by Country, 2019(E) – 2027(F)

Figure 37: Latin America Bag-in-box Packaging Machine Market Share Analysis, by Machine Type, 2014(H), 2019(E) & 2027(F)

Figure 38: Latin America Bag-in-box Packaging Machine Market Y-o-Y Growth, by Machine Type, 2015(A)-2027(F)

Figure 39: Latin America Bag-in-box Packaging Machine Market Attractiveness Index, by Machine Type, 2019(E) – 2027(F)

Figure 40: Latin America Bag-in-box Packaging Machine Market Share Analysis, by Automation Type, 2014(H), 2019(E) & 2027(F)

Figure 41: Latin America Bag-in-box Packaging Machine Market Y-o-Y Growth, by Automation Type, 2015(A)-2027(F)

Figure 42: Latin America Bag-in-box Packaging Machine Market Attractiveness Index, by Automation Type, 2019(E) – 2027(F)

Figure 43 Latin America Bag-in-box Packaging Machine Market Share Analysis, by Output Capacity, 2014(H), 2019(E) & 2027(F)

Figure 44: Latin America Bag-in-box Packaging Machine Market Y-o-Y Growth, by Output Capacity, 2015(A)-2027(F)

Figure 45: Latin America Bag-in-box Packaging Machine Market Attractiveness Index, by Output Capacity, 2019(E) – 2027(F)

Figure 46: Latin America Bag-in-box Packaging Machine Market Share Analysis, by Filling Technology, 2014(H), 2019(E) & 2027(F)

Figure 47: Latin America Bag-in-box Packaging Machine Market Y-o-Y Growth, by Filling Technology, 2015(A)-2027(F)

Figure 48: Latin America Bag-in-box Packaging Machine Market Attractiveness Index, by Filling Technology, 2019(E) – 2027(F)

Figure 49: Latin America Bag-in-box Packaging Machine Market Share Analysis, by End-Use, 2014(H), 2019(E) & 2027(F)

Figure 50: Latin America Bag-in-box Packaging Machine Market Y-o-Y Growth, by End-Use, 2015(A)-2027(F)

Figure 51: Latin America Bag-in-box Packaging Machine Market Attractiveness Index, by End-Use, 2019(E) – 2027(F)

Figure 52: Europe Bag-in-box Packaging Machine Market Share Analysis, by Country, 2014(H), 2019(E) & 2027(F)

Figure 53: Europe Bag-in-box Packaging Machine Market Y-o-Y Growth, by Country, 2015(A)-2027(F)

Figure 54: Europe Bag-in-box Packaging Machine Market Attractiveness Index, by Country, 2019(E) – 2027(F)

Figure 55: Europe Bag-in-box Packaging Machine Market Share Analysis, by Machine Type, 2014(H), 2019(E) & 2027(F)

Figure 56: Europe Bag-in-box Packaging Machine Market Y-o-Y Growth, by Machine Type, 2015(A)-2027(F)

Figure 57: Europe Bag-in-box Packaging Machine Market Attractiveness Index, by Machine Type, 2019(E) – 2027(F)

Figure 58: Europe Bag-in-box Packaging Machine Market Share Analysis, by Automation Type, 2014(H), 2019(E) & 2027(F)

Figure 59: Europe Bag-in-box Packaging Machine Market Y-o-Y Growth, by Automation Type, 2015(A)-2027(F)

Figure 60: Europe Bag-in-box Packaging Machine Market Attractiveness Index, by Automation Type, 2019(E) – 2027(F)

Figure 61: Europe Bag-in-box Packaging Machine Market Share Analysis, by Output Capacity, 2014(H), 2019(E) & 2027(F)

Figure 62: Europe Bag-in-box Packaging Machine Market Y-o-Y Growth, by Output Capacity, 2015(A)-2027(F)

Figure 63: Europe Bag-in-box Packaging Machine Market Attractiveness Index, by Output Capacity, 2019(E) – 2027(F)

Figure 64: Europe Bag-in-box Packaging Machine Market Share Analysis, by Filling Technology, 2014(H), 2019(E) & 2027(F)

Figure 65: Europe Bag-in-box Packaging Machine Market Y-o-Y Growth, by Filling Technology, 2015(A)-2027(F)

Figure 66: Europe Bag-in-box Packaging Machine Market Attractiveness Index, by Filling Technology, 2019(E) – 2027(F)

Figure 67: Europe Bag-in-box Packaging Machine Market Share Analysis, by End-Use, 2014(H), 2019(E) & 2027(F)

Figure 68: Europe Bag-in-box Packaging Machine Market Y-o-Y Growth, by End-Use, 2015(A)-2027(F)

Figure 69: Europe Bag-in-box Packaging Machine Market Attractiveness Index, by End-Use, 2019(E) – 2027(F)

Figure 70: APAC Bag-in-box Packaging Machine Market Share Analysis, by Country, 2014(H), 2019(E) & 2027(F)

Figure 71: APAC Bag-in-box Packaging Machine Market Y-o-Y Growth, by Country, 2015(A)-2027(F)

Figure 72: APAC Bag-in-box Packaging Machine Market Attractiveness Index, by Country, 2019(E) – 2027(F)

Figure 73: APAC Bag-in-box Packaging Machine Market Share Analysis, by Machine Type, 2014(H), 2019(E) & 2027(F)

Figure 74: APAC Bag-in-box Packaging Machine Market Y-o-Y Growth, by Machine Type, 2015(A)-2027(F)

Figure 75: APAC Bag-in-box Packaging Machine Market Attractiveness Index, by Machine Type, 2019(E) – 2027(F)

Figure 76: APAC Bag-in-box Packaging Machine Market Share Analysis, by Automation Type, 2014(H), 2019(E) & 2027(F)

Figure 77: APAC Bag-in-box Packaging Machine Market Y-o-Y Growth, by Automation Type, 2015(A)-2027(F)

Figure 78: APAC Bag-in-box Packaging Machine Market Attractiveness Index, by Automation Type, 2019(E) – 2027(F)

Figure 79: APAC Bag-in-box Packaging Machine Market Share Analysis, by Output Capacity, 2014(H), 2019(E) & 2027(F)

Figure 80: APAC Bag-in-box Packaging Machine Market Y-o-Y Growth, by Output Capacity, 2015(A)-2027(F)

Figure 81: APAC Bag-in-box Packaging Machine Market Attractiveness Index, by Output Capacity, 2019(E) – 2027(F)

Figure 82: APAC Bag-in-box Packaging Machine Market Share Analysis, by Filling Technology, 2014(H), 2019(E) & 2027(F)

Figure 83: APAC Bag-in-box Packaging Machine Market Y-o-Y Growth, by Filling Technology, 2015(A)-2027(F)

Figure 84: APAC Bag-in-box Packaging Machine Market Attractiveness Index, by Filling Technology, 2019(E) – 2027(F)

Figure 85: APAC Bag-in-box Packaging Machine Market Share Analysis, by End-Use, 2014(H), 2019(E) & 2027(F)

Figure 86: APAC Bag-in-box Packaging Machine Market Y-o-Y Growth, by End-Use, 2015(A)-2027(F)

Figure 87: APAC Bag-in-box Packaging Machine Market Attractiveness Index, by End-Use, 2019(E) – 2027(F)

Figure 88: MEA Bag-in-box Packaging Machine Market Share Analysis, by Country, 2014(H), 2019(E) & 2027(F)

Figure 89: MEA Bag-in-box Packaging Machine Market Y-o-Y Growth, by Country, 2015(A)-2027(F)

Figure 90: MEA Bag-in-box Packaging Machine Market Attractiveness Index, by Country, 2019(E) – 2027(F)

Figure 91: MEA Bag-in-box Packaging Machine Market Share Analysis, by Machine Type, 2014(H), 2019(E) & 2027(F)

Figure 92: MEA Bag-in-box Packaging Machine Market Y-o-Y Growth, by Machine Type, 2015(A)-2027(F)

Figure 93: MEA Bag-in-box Packaging Machine Market Attractiveness Index, by Machine Type, 2019(E) – 2027(F)

Figure 94: MEA Bag-in-box Packaging Machine Market Share Analysis, by Automation Type, 2014(H), 2019(E) & 2027(F)

Figure 95: MEA Bag-in-box Packaging Machine Market Y-o-Y Growth, by Automation Type, 2015(A)-2027(F)

Figure 96: MEA Bag-in-box Packaging Machine Market Attractiveness Index, by Automation Type, 2019(E) – 2027(F)

Figure 97: MEA Bag-in-box Packaging Machine Market Share Analysis, by Output Capacity, 2014(H), 2019(E) & 2027(F)

Figure 98: MEA Bag-in-box Packaging Machine Market Y-o-Y Growth, by Output Capacity, 2015(A)-2027(F)

Figure 99: MEA Bag-in-box Packaging Machine Market Attractiveness Index, by Output Capacity, 2019(E) – 2027(F)

Figure 100: MEA Bag-in-box Packaging Machine Market Share Analysis, by Filling Technology, 2014(H), 2019(E) & 2027(F)

Figure 101: MEA Bag-in-box Packaging Machine Market Y-o-Y Growth, by Filling Technology, 2015(A)-2027(F)

Figure 102: MEA Bag-in-box Packaging Machine Market Attractiveness Index, by Filling Technology, 2019(E) – 2027(F)

Figure 103: MEA Bag-in-box Packaging Machine Market Share Analysis, by End-Use, 2014(H), 2019(E) & 2027(F)

Figure 104: MEA Bag-in-box Packaging Machine Market Y-o-Y Growth, by End-Use, 2015(A)-2027(F)

Figure 105: MEA Bag-in-box Packaging Machine Market Attractiveness Index, by End-Use, 2019(E) – 2027(F)