Analysts’ Viewpoint

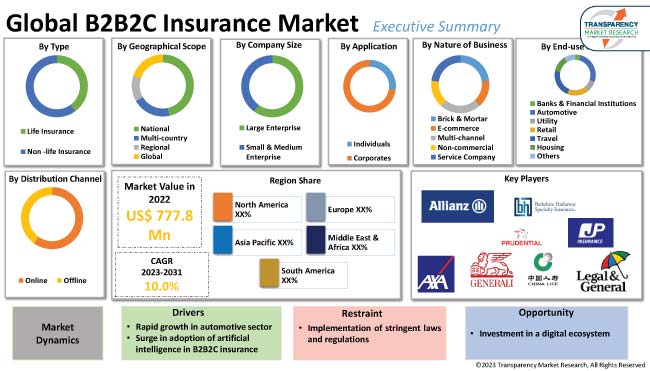

Rapid growth in the automotive sector and surge in adoption of Artificial Intelligence (AI) in insurance are expected to propel the B2B2C insurance market size in the near future. Investment in a digital ecosystem is likely to offer lucrative opportunities to players in the global B2B2C insurance industry.

B2B2C digital insurance and B2B2C insurance 2.0 are gaining traction in the sector. B2B2C insurers are investing in digital levers, such as e-commerce and mobile apps, to broaden their customer base. They are also adopting AI and advanced analytics to boost transparency in business activities.

B2B2C insurance is a new business model that leverages the existing relationships between insurers and businesses to expand insurance coverage to the end consumer. This model combines the traditional Business-to-Business (B2B) and Business-to-Consumer (B2C) models to create a more efficient and cost-effective solution for businesses and consumers alike. In this model, insurance companies collaborate with businesses to provide their customers with access to insurance products and services. This allows businesses to offer their customers a range of insurance products that are tailored to their specific needs, while the insurer provides a convenient platform for customers to purchase the insurance. This model also enables businesses to benefit from the insurer’s expertise in underwriting and pricing insurance products and customer service.

Several insurers are adopting the B2B2C model to offer insurance products through businesses that have a large customer base. This model also allows businesses to offer their customers a range of competitively priced insurance products. Additionally, businesses can leverage the insurer’s expertise to ensure that the products they are offering are of high quality and are tailored to meet the needs of their customers.

B2B2C insurance offers businesses and their customers a convenient and cost-effective way to access a range of insurance products. This model has the potential to revolutionize the way businesses and customers interact and purchase insurance products. B2B2C insurance companies are offering offline and online customer relationship management services to broaden their customer base. They are also tapping into business opportunities in material manufacturing and utilities industries to increase their B2B2C insurance market share.

Companies in the automotive sector are seeking to protect their investments from potential losses due to accidents, theft, or other unforeseen events. They are increasingly turning to insurance providers to protect their investments in the sector. B2B2C insurance provides a range of options such as comprehensive coverage for vehicles and product liability coverage. Rise in need for specialized coverage for the automotive sector is expected to spur the B2B2C insurance market growth in the near future.

B2B2C insurance companies are leveraging new technologies, such as telematics and AI, to provide more personalized and tailored insurance products. AI offers a variety of benefits such as increased efficiency, improved customer service, and enhanced risk management capabilities.

AI can be employed to analyze large amounts of data quickly and accurately in order to gain insights into customer behavior and risk profiles. This helps insurers to identify opportunities for cross-selling and up-selling as well as creating more personalized customer experiences. AI also aids in detecting fraud more quickly and accurately, resulting in fewer losses and improved customer service. Adoption of Al in the entire customer lifecycle helps boost revenue and reduce operational costs. It also aids in fraud management. B2B2C insurance providers are increasingly relying on Al to automate mundane tasks, such as claims processing, allowing them to focus their resources on other core tasks. Hence, rise in adoption of AI is driving the B2B2C insurance market value.

According to the latest B2B2C insurance market forecast, Asia Pacific is projected to hold largest share from 2023 to 2031. Rapid urbanization and industrialization in developing countries is fueling the market dynamics of the region.

The business in North America is anticipated to grow at the fastest rate during the forecast period. Technological advancements in the insurance sector, growth in the e-commerce sector, and a surge in government initiatives to promote the adoption of online insurance policies are boosting the B2B2C insurance market statistics in the region. Increase in number of digital insurance firms is also contributing to the market progress in North America.

The global landscape is highly competitive, with the presence of various global and regional players. Most companies are investing in product development and regional expansion to stay competitive in the sector. They are adopting partnership, collaboration, and M&A strategies to expand their customer base.

Allianz SE, Assicurazioni Generali S.p.A. Aviva Group, AXA SA, Berkshire Hathaway Inc. BNP Paribas S.A. China Life Insurance (Group) Company, Japan Post Holdings Co., Ltd, Munich Re Group, Prudential plc, UnitedHealth Group Inc. are key entities operating in this industry.

Each of these players has been profiled in the B2B2C insurance market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 | US$ 777.8 Mn |

| Market Forecast Value in 2031 | US$ 1.8 Bn |

| Growth Rate (CAGR) | 10.0% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2022 |

| Quantitative Units | US$ Mn/Bn for Value |

| Market Analysis | Includes cross segment analysis at regional as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Region Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 777.8 Mn in 2022

It is projected to advance at a CAGR of 10.0% from 2023 to 2031

Rapid growth in automotive sector and surge in adoption of artificial intelligence in B2B2C insurance

The life insurance type segment accounted for major share in 2022

Asia Pacific is projected to hold the largest share during the forecast period

Allianz SE, Assicurazioni Generali S.p.A. Aviva Group, AXA SA, Berkshire Hathaway Inc. BNP Paribas S.A. China Life Insurance (Group) Company, Japan Post Holdings Co., Ltd, Munich Re Group, Prudential plc, and UnitedHealth Group Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Key Market Indicators

5.5. Porter’s Five Forces Analysis

5.6. Industry SWOT Analysis

5.7. Value Chain Analysis

5.8. Key Regulatory Framework

5.9. Global B2B2C Insurance Market Analysis and Forecast, 2017 - 2031

5.9.1. Market Value Projection (US$ Mn)

6. Global B2B2C Insurance Market Analysis and Forecast, By Type

6.1. B2B2C Insurance Market Size (US$ Mn) Forecast, By Type, 2017 - 2031

6.1.1. Life Insurance

6.1.2. Non-life Insurance

6.1.2.1. Health Insurance

6.1.2.2. Home Insurance

6.1.2.3. Vehicle Insurance

6.1.2.4. Personal Insurance

6.1.2.5. Accident Insurance

6.1.2.6. Others (Transport, Credit Insurance, etc.)

6.2. Incremental Opportunity, By Type

7. Global B2B2C Insurance Market Analysis and Forecast, By Geographical Scope

7.1. B2B2C Insurance Market Size (US$ Mn) Forecast, By Geographical Scope, 2017 - 2031

7.1.1. National

7.1.2. Multi-country

7.1.3. Regional

7.1.4. Global

7.2. Incremental Opportunity, By Geographical Scope

8. Global B2B2C Insurance Market Analysis and Forecast, By Company Size

8.1. B2B2C Insurance Market Size (US$ Mn) Forecast, By Company Size, 2017 - 2031

8.1.1. Large Enterprise

8.1.2. Small & Medium Enterprise

8.2. Incremental Opportunity, By Company Size

9. Global B2B2C Insurance Market Analysis and Forecast, By Application

9.1. B2B2C Insurance Market Size (US$ Mn) Forecast, By Application, 2017 - 2031

9.1.1. Individuals

9.1.2. Corporates

9.2. Incremental Opportunity, By Application

10. Global B2B2C Insurance Market Analysis and Forecast, By Nature of Business

10.1. B2B2C Insurance Market Size (US$ Mn) Forecast, By Nature of Business, 2017 - 2031

10.1.1. Brick & Mortar

10.1.2. E-commerce

10.1.3. Multi-channel

10.1.4. Non-commercial

10.1.5. Service Company

10.2. Incremental Opportunity, By Nature of Business

11. Global B2B2C Insurance Market Analysis and Forecast, By End-use Industry

11.1. B2B2C Insurance Market Size (US$ Mn) Forecast, By End-use Industry, 2017 - 2031

11.1.1. Banks & Financial Institutions

11.1.2. Automotive

11.1.3. Utility

11.1.4. Retail

11.1.5. Travel

11.1.6. Housing

11.1.7. Others (Lifestyle, Telecom, etc.)

11.2. Incremental Opportunity, By End-use Industry

12. Global B2B2C Insurance Market Analysis and Forecast, By Distribution Channel

12.1. B2B2C Insurance Market Size (US$ Mn) Forecast, By Distribution Channel, 2017 - 2031

12.1.1. Online

12.1.2. Offline

12.2. Incremental Opportunity, By Distribution Channel

13. Global B2B2C Insurance Market Analysis and Forecast, By Region

13.1. B2B2C Insurance Market Size (US$ Mn) Forecast, By Region, 2017 - 2031

13.1.1. North America

13.1.2. Europe

13.1.3. Asia Pacific

13.1.4. Middle East & Africa

13.1.5. South America

13.2. Incremental Opportunity, By Region

14. North America B2B2C Insurance Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Macroeconomics Scenario

14.3. Key Supplier Analysis

14.4. Price Trend Analysis

14.4.1. Weighted Average Price (US$)

14.5. Key Trends Analysis

14.5.1. Demand Side

14.5.2. Supplier Side

14.6. B2B2C Insurance Market Size (US$ Mn) Forecast, By Type, 2017 - 2031

14.6.1. Life Insurance

14.6.2. Non-life Insurance

14.6.2.1. Health Insurance

14.6.2.2. Home Insurance

14.6.2.3. Vehicle Insurance

14.6.2.4. Personal Insurance

14.6.2.5. Accident Insurance

14.6.2.6. Others (Transport, Credit Insurance, etc.)

14.7. B2B2C Insurance Market Size (US$ Mn) Forecast, By Geographical Scope, 2017 - 2031

14.7.1. National

14.7.2. Multi-country

14.7.3. Regional

14.7.4. Global

14.8. B2B2C Insurance Market Size (US$ Mn) Forecast, By Company Size, 2017 - 2031

14.8.1. Large Enterprise

14.8.2. Small & Medium Enterprise

14.9. B2B2C Insurance Market Size (US$ Mn) Forecast, By Application, 2017 - 2031

14.9.1. Individuals

14.9.2. Corporates

14.10. B2B2C Insurance Market Size (US$ Mn) Forecast, By Nature of Business, 2017 - 2031

14.10.1. Brick & Mortar

14.10.2. E-commerce

14.10.3. Multi-channel

14.10.4. Non-commercial

14.10.5. Service Company

14.11. B2B2C Insurance Market Size (US$ Mn) Forecast, By End-use Industry, 2017 - 2031

14.11.1. Banks & Financial Institutions

14.11.2. Automotive

14.11.3. Utility

14.11.4. Retail

14.11.5. Travel

14.11.6. Housing

14.11.7. Others (Lifestyle, Telecom, etc.)

14.12. B2B2C Insurance Market Size (US$ Mn) Forecast, By Distribution Channel, 2017 - 2031

14.12.1. Online

14.12.2. Offline

14.13. B2B2C Insurance Market Size (US$ Mn) Forecast, By Country, 2017 - 2031

14.13.1. U.S.

14.13.2. Canada

14.13.3. Rest of North America

14.14. Incremental Opportunity Analysis

15. Europe B2B2C Insurance Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Macroeconomics Scenario

15.3. Key Supplier Analysis

15.4. Price Trend Analysis

15.4.1. Weighted Average Price (US$)

15.5. Key Trends Analysis

15.5.1. Demand Side

15.5.2. Supplier Side

15.6. B2B2C Insurance Market Size (US$ Mn) Forecast, By Type, 2017 - 2031

15.6.1. Life Insurance

15.6.2. Non-life Insurance

15.6.2.1. Health Insurance

15.6.2.2. Home Insurance

15.6.2.3. Vehicle Insurance

15.6.2.4. Personal Insurance

15.6.2.5. Accident Insurance

15.6.2.6. Others (Transport, Credit Insurance, etc.)

15.7. B2B2C Insurance Market Size (US$ Mn) Forecast, By Geographical Scope, 2017 - 2031

15.7.1. National

15.7.2. Multi-country

15.7.3. Regional

15.7.4. Global

15.8. B2B2C Insurance Market Size (US$ Mn) Forecast, By Company Size, 2017 - 2031

15.8.1. Large Enterprise

15.8.2. Small & Medium Enterprise

15.9. B2B2C Insurance Market Size (US$ Mn) Forecast, By Application, 2017 - 2031

15.9.1. Individuals

15.9.2. Corporates

15.10. B2B2C Insurance Market Size (US$ Mn) Forecast, By Nature of Business, 2017 - 2031

15.10.1. Brick & Mortar

15.10.2. E-commerce

15.10.3. Multi-channel

15.10.4. Non-commercial

15.10.5. Service Company

15.11. B2B2C Insurance Market Size (US$ Mn) Forecast, By End-use Industry, 2017 - 2031

15.11.1. Banks & Financial Institutions

15.11.2. Automotive

15.11.3. Utility

15.11.4. Retail

15.11.5. Travel

15.11.6. Housing

15.11.7. Others (Lifestyle, Telecom, etc.)

15.12. B2B2C Insurance Market Size (US$ Mn) Forecast, By Distribution Channel, 2017 - 2031

15.12.1. Online

15.12.2. Offline

15.13. B2B2C Insurance Market Size (US$ Mn) Forecast, By Country, 2017 - 2031

15.13.1. U.K.

15.13.2. Germany

15.13.3. France

15.13.4. Rest of Europe

15.14. Incremental Opportunity Analysis

16. Asia Pacific B2B2C Insurance Market Analysis and Forecast

16.1. Regional Snapshot

16.2. Macroeconomics Scenario

16.3. Key Supplier Analysis

16.4. Key Trends Analysis

16.4.1. Demand Side

16.4.2. Supplier Side

16.5. B2B2C Insurance Market Size (US$ Mn) Forecast, By Type, 2017 - 2031

16.5.1. Life Insurance

16.5.2. Non-life Insurance

16.5.2.1. Health Insurance

16.5.2.2. Home Insurance

16.5.2.3. Vehicle Insurance

16.5.2.4. Personal Insurance

16.5.2.5. Accident Insurance

16.5.2.6. Others (Transport, Credit Insurance, etc.)

16.6. B2B2C Insurance Market Size (US$ Mn) Forecast, By Geographical Scope, 2017 - 2031

16.6.1. National

16.6.2. Multi-country

16.6.3. Regional

16.6.4. Global

16.7. B2B2C Insurance Market Size (US$ Mn) Forecast, By Company Size, 2017 - 2031

16.7.1. Large Enterprise

16.7.2. Small & Medium Enterprise

16.8. B2B2C Insurance Market Size (US$ Mn) Forecast, By Application, 2017 - 2031

16.8.1. Individuals

16.8.2. Corporates

16.9. B2B2C Insurance Market Size (US$ Mn) Forecast, By Nature of Business, 2017 - 2031

16.9.1. Brick & Mortar

16.9.2. E-commerce

16.9.3. Multi-channel

16.9.4. Non-commercial

16.9.5. Service Company

16.10. B2B2C Insurance Market Size (US$ Mn) Forecast, By End-use Industry, 2017 - 2031

16.10.1. Banks & Financial Institutions

16.10.2. Automotive

16.10.3. Utility

16.10.4. Retail

16.10.5. Travel

16.10.6. Housing

16.10.7. Others (Lifestyle, Telecom, etc.)

16.11. B2B2C Insurance Market Size (US$ Mn) Forecast, By Distribution Channel, 2017 - 2031

16.11.1. Online

16.11.2. Offline

16.12. B2B2C Insurance Market Size (US$ Mn) Forecast, By Country, 2017 - 2031

16.12.1. India

16.12.2. China

16.12.3. Japan

16.12.4. Rest of Asia Pacific

16.13. Incremental Opportunity Analysis

17. Middle East & Africa B2B2C Insurance Market Analysis and Forecast

17.1. Regional Snapshot

17.2. Macroeconomics Scenario

17.3. Key Supplier Analysis

17.4. Price Trend Analysis

17.4.1. Weighted Average Price (US$)

17.5. Key Trends Analysis

17.5.1. Demand Side

17.5.2. Supplier Side

17.6. B2B2C Insurance Market Size (US$ Mn) Forecast, By Type, 2017 - 2031

17.6.1. Life Insurance

17.6.2. Non-life Insurance

17.6.2.1. Health Insurance

17.6.2.2. Home Insurance

17.6.2.3. Vehicle Insurance

17.6.2.4. Personal Insurance

17.6.2.5. Accident Insurance

17.6.2.6. Others (Transport, Credit Insurance, etc.)

17.7. B2B2C Insurance Market Size (US$ Mn) Forecast, By Geographical Scope, 2017 - 2031

17.7.1. National

17.7.2. Multi-country

17.7.3. Regional

17.7.4. Global

17.8. B2B2C Insurance Market Size (US$ Mn) Forecast, By Company Size, 2017 - 2031

17.8.1. Large Enterprise

17.8.2. Small & Medium Enterprise

17.9. B2B2C Insurance Market Size (US$ Mn) Forecast, By Application, 2017 - 2031

17.9.1. Individuals

17.9.2. Corporates

17.10. B2B2C Insurance Market Size (US$ Mn) Forecast, By Nature of Business, 2017 - 2031

17.10.1. Brick & Mortar

17.10.2. E-commerce

17.10.3. Multi-channel

17.10.4. Non-commercial

17.10.5. Service Company

17.11. B2B2C Insurance Market Size (US$ Mn) Forecast, By End-use Industry, 2017 - 2031

17.11.1. Banks & Financial Institutions

17.11.2. Automotive

17.11.3. Utility

17.11.4. Retail

17.11.5. Travel

17.11.6. Housing

17.11.7. Others (Lifestyle, Telecom, etc.)

17.12. B2B2C Insurance Market Size (US$ Mn) Forecast, By Distribution Channel, 2017 - 2031

17.12.1. Online

17.12.2. Offline

17.13. B2B2C Insurance Market Size (US$ Mn) Forecast, By Country, 2017 - 2031

17.13.1. GCC

17.13.2. Rest of Middle East & Africa

17.14. Incremental Opportunity Analysis

18. South America B2B2C Insurance Market Analysis and Forecast

18.1. Regional Snapshot

18.2. Macroeconomics Scenario

18.3. Key Supplier Analysis

18.4. Price Trend Analysis

18.4.1. Weighted Average Price (US$)

18.5. Key Trends Analysis

18.5.1. Demand Side

18.5.2. Supplier Side

18.6. B2B2C Insurance Market Size (US$ Mn) Forecast, By Type, 2017 - 2031

18.6.1. Life Insurance

18.6.2. Non-life Insurance

18.6.2.1. Health Insurance

18.6.2.2. Home Insurance

18.6.2.3. Vehicle Insurance

18.6.2.4. Personal Insurance

18.6.2.5. Accident Insurance

18.6.2.6. Others (Transport, Credit Insurance, etc.)

18.7. B2B2C Insurance Market Size (US$ Mn) Forecast, By Geographical Scope, 2017 - 2031

18.7.1. National

18.7.2. Multi-country

18.7.3. Regional

18.7.4. Global

18.8. B2B2C Insurance Market Size (US$ Mn) Forecast, By Company Size, 2017 - 2031

18.8.1. Large Enterprise

18.8.2. Small & Medium Enterprise

18.9. B2B2C Insurance Market Size (US$ Mn) Forecast, By Application, 2017 - 2031

18.9.1. Individuals

18.9.2. Corporates

18.10. B2B2C Insurance Market Size (US$ Mn) Forecast, By Nature of Business, 2017 - 2031

18.10.1. Brick & Mortar

18.10.2. E-commerce

18.10.3. Multi-channel

18.10.4. Non-commercial

18.10.5. Service Company

18.11. B2B2C Insurance Market Size (US$ Mn) Forecast, By End-use Industry, 2017 - 2031

18.11.1. Banks & Financial Institutions

18.11.2. Automotive

18.11.3. Utility

18.11.4. Retail

18.11.5. Travel

18.11.6. Housing

18.11.7. Others (Lifestyle, Telecom, etc.)

18.12. B2B2C Insurance Market Size (US$ Mn) Forecast, By Distribution Channel, 2017 - 2031

18.12.1. Online

18.12.2. Offline

18.13. B2B2C Insurance Market Size (US$ Mn) Forecast, By Country, 2017 - 2031

18.13.1. Brazil

18.13.2. Rest of South America

18.14. Incremental Opportunity Analysis

19. Competition Landscape

19.1. Market Player - Competition Dashboard

19.2. Market Revenue Share Analysis (%), (2022)

19.3. Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

19.3.1. Allianz SE

19.3.1.1. Company Overview

19.3.1.2. Sales Area/Geographical Presence

19.3.1.3. Revenue

19.3.1.4. Strategy & Business Overview

19.3.2. Assicurazioni Generali S.p.A.

19.3.2.1. Company Overview

19.3.2.2. Sales Area/Geographical Presence

19.3.2.3. Revenue

19.3.2.4. Strategy & Business Overview

19.3.3. Aviva plc

19.3.3.1. Company Overview

19.3.3.2. Sales Area/Geographical Presence

19.3.3.3. Revenue

19.3.3.4. Strategy & Business Overview

19.3.4. AXA S.A.

19.3.4.1. Company Overview

19.3.4.2. Sales Area/Geographical Presence

19.3.4.3. Revenue

19.3.4.4. Strategy & Business Overview

19.3.5. Berkshire Hathaway Inc.

19.3.5.1. Company Overview

19.3.5.2. Sales Area/Geographical Presence

19.3.5.3. Revenue

19.3.5.4. Strategy & Business Overview

19.3.6. BNP Paribas S.A.

19.3.6.1. Company Overview

19.3.6.2. Sales Area/Geographical Presence

19.3.6.3. Revenue

19.3.6.4. Strategy & Business Overview

19.3.7. China Life Insurance Group

19.3.7.1. Company Overview

19.3.7.2. Sales Area/Geographical Presence

19.3.7.3. Revenue

19.3.7.4. Strategy & Business Overview

19.3.8. Japan Post Holdings Co., Ltd.

19.3.8.1. Company Overview

19.3.8.2. Sales Area/Geographical Presence

19.3.8.3. Revenue

19.3.8.4. Strategy & Business Overview

19.3.9. Munich Re Group

19.3.9.1. Company Overview

19.3.9.2. Sales Area/Geographical Presence

19.3.9.3. Revenue

19.3.9.4. Strategy & Business Overview

19.3.10. Prudential plc

19.3.10.1. Company Overview

19.3.10.2. Sales Area/Geographical Presence

19.3.10.3. Revenue

19.3.10.4. Strategy & Business Overview

19.3.11. UnitedHealth Group Inc.

19.3.11.1. Company Overview

19.3.11.2. Sales Area/Geographical Presence

19.3.11.3. Revenue

19.3.11.4. Strategy & Business Overview

19.3.12. Other Key Players

19.3.12.1. Company Overview

19.3.12.2. Sales Area/Geographical Presence

19.3.12.3. Revenue

19.3.12.4. Strategy & Business Overview

20. Go to Market Strategy

20.1. Identification of Potential Market Spaces

20.1.1. By Type

20.1.2. By Geographical Scope

20.1.3. By Company Size

20.1.4. By Application

20.1.5. By Nature of Business

20.1.6. By End-use Industry

20.1.7. By Distribution Channel

20.1.8. By Region

20.2. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global B2B2C Insurance Market Value (US$ Mn), by Type, 2017-2031

Table 2: Global B2B2C Insurance Market Value (US$ Mn), by Geographical Scope, 2017-2031

Table 3: Global B2B2C Insurance Market Value (US$ Mn), by Company Size, 2017-2031

Table 4: Global B2B2C Insurance Market Value (US$ Mn), by Application, 2017-2031

Table 5: Global B2B2C Insurance Market Value (US$ Mn), by Nature of Business, 2017-2031

Table 6: Global B2B2C Insurance Market Value (US$ Mn), by End-use Industry, 2017-2031

Table 7: Global B2B2C Insurance Market Value (US$ Mn), by Distribution Channel, 2017-2031

Table 8: Global B2B2C Insurance Market Value (US$ Mn), by Region, 2017-2031

Table 9: North America B2B2C Insurance Market Value (US$ Mn), by Type, 2017-2031

Table 10: North America B2B2C Insurance Market Value (US$ Mn), by Geographical Scope, 2017-2031

Table 11: North America B2B2C Insurance Market Value (US$ Mn), by Company Size, 2017-2031

Table 12: North America B2B2C Insurance Market Value (US$ Mn), by Application, 2017-2031

Table 13: North America B2B2C Insurance Market Value (US$ Mn), by Nature of Business, 2017-2031

Table 14: North America B2B2C Insurance Market Value (US$ Mn), by End-use Industry, 2017-2031

Table 15: North America B2B2C Insurance Market Value (US$ Mn), by Distribution Channel, 2017-2031

Table 16: North America B2B2C Insurance Market Value (US$ Mn), by Region, 2017-2031

Table 17: Europe B2B2C Insurance Market Value (US$ Mn), by Type, 2017-2031

Table 18: Europe B2B2C Insurance Market Value (US$ Mn), by Geographical Scope, 2017-2031

Table 19: Europe B2B2C Insurance Market Value (US$ Mn), by Company Size, 2017-2031

Table 20: Europe B2B2C Insurance Market Value (US$ Mn), by Application, 2017-2031

Table 21: Europe B2B2C Insurance Market Value (US$ Mn), by Nature of Business, 2017-2031

Table 22: Europe B2B2C Insurance Market Value (US$ Mn), by End-use Industry, 2017-2031

Table 23: Europe B2B2C Insurance Market Value (US$ Mn), by Distribution Channel, 2017-2031

Table 24: Europe B2B2C Insurance Market Value (US$ Mn), by Region, 2017-2031

Table 25: Asia Pacific B2B2C Insurance Market Value (US$ Mn), by Type, 2017-2031

Table 26: Asia Pacific B2B2C Insurance Market Value (US$ Mn), by Geographical Scope, 2017-2031

Table 27: Asia Pacific B2B2C Insurance Market Value (US$ Mn), by Company Size, 2017-2031

Table 28: Asia Pacific B2B2C Insurance Market Value (US$ Mn), by Application, 2017-2031

Table 29: Asia Pacific B2B2C Insurance Market Value (US$ Mn), by Nature of Business, 2017-2031

Table 30: Asia Pacific B2B2C Insurance Market Value (US$ Mn), by End-use Industry, 2017-2031

Table 31: Asia Pacific B2B2C Insurance Market Value (US$ Mn), by Distribution Channel, 2017-2031

Table 32: Asia Pacific B2B2C Insurance Market Value (US$ Mn), by Region, 2017-2031

Table 33: Middle East & Africa B2B2C Insurance Market Value (US$ Mn), by Type, 2017-2031

Table 34: Middle East & Africa B2B2C Insurance Market Value (US$ Mn), by Geographical Scope, 2017-2031

Table 35: Middle East & Africa B2B2C Insurance Market Value (US$ Mn), by Company Size, 2017-2031

Table 36: Middle East & Africa B2B2C Insurance Market Value (US$ Mn), by Application, 2017-2031

Table 37: Middle East & Africa B2B2C Insurance Market Value (US$ Mn), by Nature of Business, 2017-2031

Table 38: Middle East & Africa B2B2C Insurance Market Value (US$ Mn), by End-use Industry, 2017-2031

Table 39: Middle East & Africa B2B2C Insurance Market Value (US$ Mn), by Distribution Channel, 2017-2031

Table 40: Middle East & Africa B2B2C Insurance Market Value (US$ Mn), by Region, 2017-2031

Table 41: South America B2B2C Insurance Market Value (US$ Mn), by Type, 2017-2031

Table 42: South America B2B2C Insurance Market Value (US$ Mn), by Geographical Scope, 2017-2031

Table 43: South America B2B2C Insurance Market Value (US$ Mn), by Company Size, 2017-2031

Table 44: South America B2B2C Insurance Market Value (US$ Mn), by Application, 2017-2031

Table 45: South America B2B2C Insurance Market Value (US$ Mn), by Nature of Business, 2017-2031

Table 46: South America B2B2C Insurance Market Value (US$ Mn), by End-use Industry, 2017-2031

Table 47: South America B2B2C Insurance Market Value (US$ Mn), by Distribution Channel, 2017-2031

Table 48: South America B2B2C Insurance Market Value (US$ Mn), by Region, 2017-2031

List of Figures

Figure 1: Global B2B2C Insurance Market Value (US$ Mn), by Type, 2017-2031

Figure 2: Global B2B2C Insurance Market Incremental Opportunity (US$ Mn), Forecast, by Type, 2023-2031

Figure 3: Global B2B2C Insurance Market Value (US$ Mn), by Geographical Scope, 2017-2031

Figure 4: Global B2B2C Insurance Market Incremental Opportunity (US$ Mn), Forecast, by Geographical Scope, 2023-2031

Figure 5: Global B2B2C Insurance Market Value (US$ Mn), by Company Size, 2017-2031

Figure 6: Global B2B2C Insurance Market Incremental Opportunity (US$ Mn), Forecast, by Company Size, 2023-2031

Figure 7: Global B2B2C Insurance Market Value (US$ Mn), by Application, 2017-2031

Figure 8: Global B2B2C Insurance Market Incremental Opportunity (US$ Mn), Forecast, by Application, 2023-2031

Figure 9: Global B2B2C Insurance Market Value (US$ Mn), by Nature of Business, 2017-2031

Figure 10: Global B2B2C Insurance Market Incremental Opportunity (US$ Mn), Forecast, by Nature of Business, 2023-2031

Figure 11: Global B2B2C Insurance Market Value (US$ Mn), by End-use Industry, 2017-2031

Figure 12: Global B2B2C Insurance Market Incremental Opportunity (US$ Mn), Forecast, by End-use Industry, 2023-2031

Figure 13: Global B2B2C Insurance Market Value (US$ Mn), by Distribution Channel, 2017-2031

Figure 14: Global B2B2C Insurance Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel, 2023-2031

Figure 15: Global B2B2C Insurance Market Value (US$ Mn), by Region, 2017-2031

Figure 16: Global B2B2C Insurance Market Incremental Opportunity (US$ Mn), Forecast, by Region, 2023-2031

Figure 17: North America B2B2C Insurance Market Value (US$ Mn), by Type, 2017-2031

Figure 18: North America B2B2C Insurance Market Incremental Opportunity (US$ Mn), Forecast, by Type, 2023-2031

Figure 19: North America B2B2C Insurance Market Value (US$ Mn), by Geographical Scope, 2017-2031

Figure 20: North America B2B2C Insurance Market Incremental Opportunity (US$ Mn), Forecast, by Geographical Scope, 2023-2031

Figure 21: North America B2B2C Insurance Market Value (US$ Mn), by Company Size, 2017-2031

Figure 22: North America B2B2C Insurance Market Incremental Opportunity (US$ Mn), Forecast, by Company Size, 2023-2031

Figure 23: North America B2B2C Insurance Market Value (US$ Mn), by Application, 2017-2031

Figure 24: North America B2B2C Insurance Market Incremental Opportunity (US$ Mn), Forecast, by Application, 2023-2031

Figure 25: North America B2B2C Insurance Market Value (US$ Mn), by Nature of Business, 2017-2031

Figure 26: North America B2B2C Insurance Market Incremental Opportunity (US$ Mn), Forecast, by Nature of Business, 2023-2031

Figure 27: North America B2B2C Insurance Market Value (US$ Mn), by End-use Industry, 2017-2031

Figure 28: North America B2B2C Insurance Market Incremental Opportunity (US$ Mn), Forecast, by End-use Industry, 2023-2031

Figure 29: North America B2B2C Insurance Market Value (US$ Mn), by Distribution Channel, 2017-2031

Figure 30: North America B2B2C Insurance Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel, 2023-2031

Figure 31: North America B2B2C Insurance Market Value (US$ Mn), by Region, 2017-2031

Figure 32: North America B2B2C Insurance Market Incremental Opportunity (US$ Mn), Forecast, by Region, 2023-2031

Figure 33: Europe B2B2C Insurance Market Value (US$ Mn), by Type, 2017-2031

Figure 34: Europe B2B2C Insurance Market Incremental Opportunity (US$ Mn), Forecast, by Type, 2023-2031

Figure 35: Europe B2B2C Insurance Market Value (US$ Mn), by Geographical Scope, 2017-2031

Figure 36: Europe B2B2C Insurance Market Incremental Opportunity (US$ Mn), Forecast, by Geographical Scope, 2023-2031

Figure 37: Europe B2B2C Insurance Market Value (US$ Mn), by Company Size, 2017-2031

Figure 38: Europe B2B2C Insurance Market Incremental Opportunity (US$ Mn), Forecast, by Company Size, 2023-2031

Figure 39: Europe B2B2C Insurance Market Value (US$ Mn), by Application, 2017-2031

Figure 40: Europe B2B2C Insurance Market Incremental Opportunity (US$ Mn), Forecast, by Application, 2023-2031

Figure 41: Europe B2B2C Insurance Market Value (US$ Mn), by Nature of Business, 2017-2031

Figure 42: Europe B2B2C Insurance Market Incremental Opportunity (US$ Mn), Forecast, by Nature of Business, 2023-2031

Figure 43: Europe B2B2C Insurance Market Value (US$ Mn), by End-use Industry, 2017-2031

Figure 44: Europe B2B2C Insurance Market Incremental Opportunity (US$ Mn), Forecast, by End-use Industry, 2023-2031

Figure 45: Europe B2B2C Insurance Market Value (US$ Mn), by Distribution Channel, 2017-2031

Figure 46: Europe B2B2C Insurance Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel, 2023-2031

Figure 47: Europe B2B2C Insurance Market Value (US$ Mn), by Region, 2017-2031

Figure 48: Europe B2B2C Insurance Market Incremental Opportunity (US$ Mn), Forecast, by Region, 2023-2031

Figure 49: Asia Pacific B2B2C Insurance Market Value (US$ Mn), by Type, 2017-2031

Figure 50: Asia Pacific B2B2C Insurance Market Incremental Opportunity (US$ Mn), Forecast, by Type, 2023-2031

Figure 51: Asia Pacific B2B2C Insurance Market Value (US$ Mn), by Geographical Scope, 2017-2031

Figure 52: Asia Pacific B2B2C Insurance Market Incremental Opportunity (US$ Mn), Forecast, by Geographical Scope, 2023-2031

Figure 53: Asia Pacific B2B2C Insurance Market Value (US$ Mn), by Company Size, 2017-2031

Figure 54: Asia Pacific B2B2C Insurance Market Incremental Opportunity (US$ Mn), Forecast, by Company Size, 2023-2031

Figure 55: Asia Pacific B2B2C Insurance Market Value (US$ Mn), by Application, 2017-2031

Figure 56: Asia Pacific B2B2C Insurance Market Incremental Opportunity (US$ Mn), Forecast, by Application, 2023-2031

Figure 57: Asia Pacific B2B2C Insurance Market Value (US$ Mn), by Nature of Business, 2017-2031

Figure 58: Asia Pacific B2B2C Insurance Market Incremental Opportunity (US$ Mn), Forecast, by Nature of Business, 2023-2031

Figure 59: Asia Pacific B2B2C Insurance Market Value (US$ Mn), by End-use Industry, 2017-2031

Figure 60: Asia Pacific B2B2C Insurance Market Incremental Opportunity (US$ Mn), Forecast, by End-use Industry, 2023-2031

Figure 61: Asia Pacific B2B2C Insurance Market Value (US$ Mn), by Distribution Channel, 2017-2031

Figure 62: Asia Pacific B2B2C Insurance Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel, 2023-2031

Figure 63: Asia Pacific B2B2C Insurance Market Value (US$ Mn), by Region, 2017-2031

Figure 64: Asia Pacific B2B2C Insurance Market Incremental Opportunity (US$ Mn), Forecast, by Region, 2023-2031

Figure 65: Middle East & Africa B2B2C Insurance Market Value (US$ Mn), by Type, 2017-2031

Figure 66: Middle East & Africa B2B2C Insurance Market Incremental Opportunity (US$ Mn), Forecast, by Type, 2023-2031

Figure 67: Middle East & Africa B2B2C Insurance Market Value (US$ Mn), by Geographical Scope, 2017-2031

Figure 68: Middle East & Africa B2B2C Insurance Market Incremental Opportunity (US$ Mn), Forecast, by Geographical Scope, 2023-2031

Figure 69: Middle East & Africa B2B2C Insurance Market Value (US$ Mn), by Company Size, 2017-2031

Figure 70: Middle East & Africa B2B2C Insurance Market Incremental Opportunity (US$ Mn), Forecast, by Company Size, 2023-2031

Figure 71: Middle East & Africa B2B2C Insurance Market Value (US$ Mn), by Application, 2017-2031

Figure 72: Middle East & Africa B2B2C Insurance Market Incremental Opportunity (US$ Mn), Forecast, by Application, 2023-2031

Figure 73: Middle East & Africa B2B2C Insurance Market Value (US$ Mn), by Nature of Business, 2017-2031

Figure 74: Middle East & Africa B2B2C Insurance Market Incremental Opportunity (US$ Mn), Forecast, by Nature of Business, 2023-2031

Figure 75: Middle East & Africa B2B2C Insurance Market Value (US$ Mn), by End-use Industry, 2017-2031

Figure 76: Middle East & Africa B2B2C Insurance Market Incremental Opportunity (US$ Mn), Forecast, by End-user Industry, 2023-2031

Figure 77: Middle East & Africa B2B2C Insurance Market Value (US$ Mn), by Distribution Channel, 2017-2031

Figure 78: Middle East & Africa B2B2C Insurance Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel, 2023-2031

Figure 79: Middle East & Africa B2B2C Insurance Market Value (US$ Mn), by Region, 2017-2031

Figure 80: Middle East & Africa B2B2C Insurance Market Incremental Opportunity (US$ Mn), Forecast, by Region, 2023-2031

Figure 81: South America B2B2C Insurance Market Value (US$ Mn), by Type, 2017-2031

Figure 82: South America B2B2C Insurance Market Incremental Opportunity (US$ Mn), Forecast, by Type, 2023-2031

Figure 83: South America B2B2C Insurance Market Value (US$ Mn), by Geographical Scope, 2017-2031

Figure 84: South America B2B2C Insurance Market Incremental Opportunity (US$ Mn), Forecast, by Geographical Scope, 2023-2031

Figure 85: South America B2B2C Insurance Market Value (US$ Mn), by Company Size, 2017-2031

Figure 86: South America B2B2C Insurance Market Incremental Opportunity (US$ Mn), Forecast, by Company Size, 2023-2031

Figure 87: South America B2B2C Insurance Market Value (US$ Mn), by Application, 2017-2031

Figure 88: South America B2B2C Insurance Market Incremental Opportunity (US$ Mn), Forecast, by Application, 2023-2031

Figure 89: South America B2B2C Insurance Market Value (US$ Mn), by Nature of Business, 2017-2031

Figure 90: South America B2B2C Insurance Market Incremental Opportunity (US$ Mn), Forecast, by Nature of Business, 2023-2031

Figure 91: South America B2B2C Insurance Market Value (US$ Mn), by End-use Industry, 2017-2031

Figure 92: South America B2B2C Insurance Market Incremental Opportunity (US$ Mn), Forecast, by End-use Industry, 2023-2031

Figure 93: South America B2B2C Insurance Market Value (US$ Mn), by Distribution Channel, 2017-2031

Figure 94: South America B2B2C Insurance Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel, 2023-2031

Figure 95: South America B2B2C Insurance Market Value (US$ Mn), by Region, 2017-2031

Figure 96: South America B2B2C Insurance Market Incremental Opportunity (US$ Mn), Forecast, by Region, 2023-2031