Analysts’ Viewpoint on Market Scenario

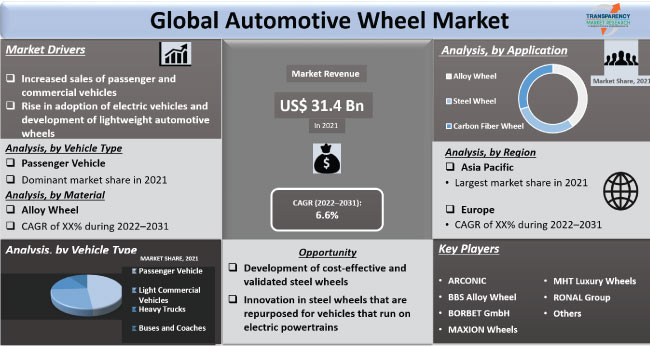

Increase in capital investment and R&D spending by OEMs, particularly on passenger cars, is boosting the global automotive market. The auto sector has released a series of updated policies that are aimed at its stakeholders and employees amid and after the COVID-19.

The global automobile industry has gained momentum as companies are strictly abiding by government guidelines to ensure the safety in their vehicles. These factors are projected to drive the automotive wheel market growth during the forecast period. Asia and Europe are expected to account for major automobile wheel market share in the next few years.

However, since businesses are implementing new design tools and production materials, steel wheels are giving aluminum wheels a tough fight. Therefore, manufacturers should work with the best research expertise, available worldwide, to enhance fuel efficiency using light aluminum alloy wheels.

Key market players are focusing on the introduction of new automotive wheels that all at once comply with rules, reduce carbon emissions, and boost production and efficiency.

The global adoption of strict pollution standards is expected to increase demand for electric vehicles, which will fuel the automotive wheel industry. Electric cars are becoming more and more popular around the world. In order to balance the weight of the battery, an electric vehicle must be lightweight. Therefore, it is anticipated that an increase in electric car sales will increase demand for alloy wheels.

The global automotive wheel market is projected to expand at a steady pace during the projected period owing to the rise in vehicle production and sales across the world, which has increased consumption and production of automobile wheels. Global demand for automobile wheels is anticipated to increase as vehicle manufacturers increase their investment in R&D to improve fuel-efficiency of their vehicles.

Developing nations including India, China, Brazil, and Mexico intend to enact emission standards that are comparable to Euro 6. It is projected that the implementation of such changes by developing nations, who are also witnessing a rise in car production, would propel the demand for automobile wheels around the world.

Alloy wheels were first used on SUVs because they provide superior off-road handling, better steering, and a reduction in the vehicle's unsprung weight. SUVs usually come with cast or forged alloy wheels instead of steel ones. Sport utility vehicles (SUVs) are currently in high demand worldwide and the demand is rising at a rapid pace. SUV sales have been increasing at a steady pace for the last few years, suggesting a potential market for alloy wheels.

Minimizing the vehicle weight has been the key imperative for automakers. Key players in the automobile wheel market are boosting their research spending in order develop innovative alloy wheels. For instance, the Canadian Arvida Research and Development Centre (ARDC) and Rio Tinto, a multinational metal firm with Anglo-Australian roots, collaborated to develop Revolution-AlTM, a novel high strength aluminum alloy designed to produce lightweight automobile wheels. Tougher alloys for die cast automotive wheels are gaining considerable traction in order to help minimize fuel consumption.

Based on vehicle type, passenger vehicle was the leading segment of the global automotive wheel market owing to rise in production of passenger vehicles across the globe. Demand for premium passenger vehicles and peak in SUV sales across the globe are key factors considerably boosting the passenger vehicle segment. Furthermore, the segment is also expanding due a rise in disposable income of people and an increase in purchasing power of people across the globe.

In terms of material, the alloy wheel segment accounted for major automotive wheel market share due to a rise in the demand for lightweight material to enhance fuel-efficiency of the vehicle. Major vehicle manufacturers are using alloy wheels to enhance vehicle dynamics, which has become popular not only in premium cars but also in economy cars. This is likely to positively boost the automotive wheel market forecast across the globe.

Analysis of the regional automotive wheel market trends reveal that Asia Pacific and Europe are expected to be highly lucrative markets. This is partly because China, Germany, Japan, and India all have sizable automobile industries and high urbanization rate coupled with rising spending power of citizens.

Rise in need for automobiles with better fuel-efficiency across Asia Pacific is projected to drive the automotive wheel industry growth in the region. The market in Europe is anticipated to grow in the next few years due to considerable presence of original equipment manufacturers and tier-1 suppliers in the region and the presence of cutting-edge facilities for material composition research and development.

Some of the key players identified in the automotive wheel market across the globe are: ARCONIC, BBS Alloy Wheel, BORBET GmbH, CITIC Dicastal Wheel Manufacturing Co., Enkei, Fuel Off Road Wheels, Foshan Nanhai Zhongnan Aluminum Wheel Co., Ltd, MAXION Wheels, MHT Luxury Wheels, RONAL Group, TSW Wheels, WHEELPROS LLC, Superior Industries International Inc., and Other Key Players.

Key players in the automotive wheel market report have been profiled on the basis of company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 31.4 Bn |

|

Market Forecast Value in 2031 |

US$ 59.3 Bn |

|

Growth Rate (CAGR) |

6.6% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value and Million Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The market was valued at US$ 31.4 Bn in 2021

The market is expected to expand at a CAGR of 6.6% by 2031

It is estimated to be worth US$ 59.3 Bn in 2031

Increased sales of passenger and commercial vehicles, rise in popularity of SUVs, and surge in adoption of electric vehicles

The passenger vehicles segment accounted for majority share in 2021

Asia Pacific is the most lucrative region in the global market

ARCONIC, BBS Alloy Wheel, BORBET GmbH, CITIC Dicastal Wheel Manufacturing Co., Enkei, Fuel Off Road Wheels, Foshan Nanhai Zhongnan Aluminum Wheel Co., Ltd, MAXION Wheels, MHT Luxury Wheels, RONAL Group, TSW Wheels, WHEELPROS LLC, and Superior Industries International Inc.

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Size in Million Units, Value US$ Bn, 2017-2031

1.2. TMR Analysis and Recommendations

1.3. Competitive Dashboard Analysis

2. Market Overview

2.1. Market Coverage / Taxonomy

2.2. Market Definition / Scope / Limitations

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunity

2.4. Market Factor Analysis

2.4.1. Porter’s Five Force Analysis

2.4.2. SWOT Analysis

2.5. Regulatory Scenario

2.6. Key Trend Analysis

2.7. Value Chain Analysis

2.8. Cost Structure Analysis

2.9. Profit Margin Analysis

3. COVID-19 Impact Analysis – Automotive Wheel Market

4. Global Automotive Wheel Market, by Material

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Automotive Wheel Market Volume (Million Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, by Material

4.2.1. Alloy Wheel

4.2.2. Steel Wheel

4.2.3. Carbon Fiber Wheel

5. Global Automotive Wheel Market, by Rim Size

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Automotive Wheel Market Volume (Million Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, by Rim Size

5.2.1. 12”-17”

5.2.2. 18”-21”

5.2.3. More than 21”

6. Global Automotive Wheel Market, by Vehicle Type

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Automotive Wheel Market Volume (Million Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, by Vehicle Type

6.2.1. Passenger Vehicle

6.2.1.1. Hatchback

6.2.1.2. Sedan

6.2.1.3. Utility Vehicles

6.2.2. Light Commercial Vehicles

6.2.3. Heavy Trucks

6.2.4. Buses and Coaches

7. Global Automotive Wheel Market, by Sales Channel

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Automotive Wheel Market Volume (Million Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, by Sales Channel

7.2.1. OEM

7.2.2. Aftermarket

8. Global Automotive Wheel Market, by Region

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Automotive Wheel Market Volume (Million Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, by Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Middle East & Africa

8.2.5. South America

9. North America Automotive Wheel Market

9.1. Market Snapshot

9.2. Automotive Wheel Market Volume (Million Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, by Material

9.2.1. Alloy Wheel

9.2.2. Steel Wheel

9.2.3. Carbon Fiber Wheel

9.3. Automotive Wheel Market Volume (Million Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, by Rim Size

9.3.1. 12”-17”

9.3.2. 18”-21”

9.3.3. More than 21”

9.4. Automotive Wheel Market Volume (Million Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, by Vehicle Type

9.4.1. Passenger Vehicle

9.4.1.1. Hatchback

9.4.1.2. Sedan

9.4.1.3. Utility Vehicles

9.4.2. Light Commercial Vehicles

9.4.3. Heavy Trucks

9.4.4. Buses and Coaches

9.5. Automotive Wheel Market Volume (Million Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, by Sales Channel

9.5.1. OEM

9.5.2. Aftermarket

9.6. Key Country Analysis – North America Automotive Wheel Market Volume (Million Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031

9.6.1. The U. S.

9.6.2. Canada

9.6.3. Mexico

10. Europe Automotive Wheel Market

10.1. Market Snapshot

10.2. Automotive Wheel Market Volume (Million Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, by Material

10.2.1. Alloy Wheel

10.2.2. Steel Wheel

10.2.3. Carbon Fiber Wheel

10.3. Automotive Wheel Market Volume (Million Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, by Rim Size

10.3.1. 12”-17”

10.3.2. 18”-21”

10.3.3. More than 21”

10.4. Automotive Wheel Market Volume (Million Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, by Vehicle Type

10.4.1. Passenger Vehicle

10.4.1.1. Hatchback

10.4.1.2. Sedan

10.4.1.3. Utility Vehicles

10.4.2. Light Commercial Vehicles

10.4.3. Heavy Trucks

10.4.4. Buses and Coaches

10.5. Automotive Wheel Market Volume (Million Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, by Sales Channel

10.5.1. OEM

10.5.2. Aftermarket

10.6. Key Country Analysis – Europe Automotive Wheel Market Volume (Million Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031

10.6.1. Germany

10.6.2. U. K.

10.6.3. France

10.6.4. Italy

10.6.5. Spain

10.6.6. Nordic Countries

10.6.7. Russia & CIS

10.6.8. Rest of Europe

11. Asia Pacific Automotive Wheel Market

11.1. Market Snapshot

11.2. Automotive Wheel Market Volume (Million Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, by Material

11.2.1. Alloy Wheel

11.2.2. Steel Wheel

11.2.3. Carbon Fiber Wheel

11.3. Automotive Wheel Market Volume (Million Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, by Rim Size

11.3.1. 12”-17”

11.3.2. 18”-21”

11.3.3. More than 21”

11.4. Automotive Wheel Market Volume (Million Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, by Vehicle Type

11.4.1. Passenger Vehicle

11.4.1.1. Hatchback

11.4.1.2. Sedan

11.4.1.3. Utility Vehicles

11.4.2. Light Commercial Vehicles

11.4.3. Heavy Trucks

11.4.4. Buses and Coaches

11.5. Automotive Wheel Market Volume (Million Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, by Sales Channel

11.5.1. OEM

11.5.2. Aftermarket

11.6. Key Country Analysis – Asia Pacific Automotive Wheel Market Volume (Million Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031

11.6.1. China

11.6.2. India

11.6.3. Japan

11.6.4. ASEAN Countries

11.6.5. South Korea

11.6.6. ANZ

11.6.7. Rest of Asia Pacific

12. Middle East & Africa Automotive Wheel Market

12.1. Market Snapshot

12.2. Automotive Wheel Market Volume (Million Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, by Material

12.2.1. Alloy Wheel

12.2.2. Steel Wheel

12.2.3. Carbon Fiber Wheel

12.3. Automotive Wheel Market Volume (Million Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, by Rim Size

12.3.1. 12”-17”

12.3.2. 18”-21”

12.3.3. More than 21”

12.4. Automotive Wheel Market Volume (Million Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, by Vehicle Type

12.4.1. Passenger Vehicle

12.4.1.1. Hatchback

12.4.1.2. Sedan

12.4.1.3. Utility Vehicles

12.4.2. Light Commercial Vehicles

12.4.3. Heavy Trucks

12.4.4. Buses and Coaches

12.5. Automotive Wheel Market Volume (Million Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, by Sales Channel

12.5.1. OEM

12.5.2. Aftermarket

12.6. Key Country Analysis – Middle East & Africa Automotive Wheel Market Volume (Million Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031

12.6.1. GCC

12.6.2. South Africa

12.6.3. Turkey

12.6.4. Rest of Middle East & Africa

13. South America Automotive Wheel Market

13.1. Market Snapshot

13.2. Automotive Wheel Market Volume (Million Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, by Material

13.2.1. Alloy Wheel

13.2.2. Steel Wheel

13.2.3. Carbon Fiber Wheel

13.3. Automotive Wheel Market Volume (Million Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, by Rim Size

13.3.1. 12”-17”

13.3.2. 18”-21”

13.3.3. More than 21”

13.4. Automotive Wheel Market Volume (Million Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, by Vehicle Type

13.4.1. Passenger Vehicle

13.4.1.1. Hatchback

13.4.1.2. Sedan

13.4.1.3. Utility Vehicles

13.4.2. Light Commercial Vehicles

13.4.3. Heavy Trucks

13.4.4. Buses and Coaches

13.5. Automotive Wheel Market Volume (Million Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, by Sales Channel

13.5.1. OEM

13.5.2. Aftermarket

13.6. Key Country Analysis – South America Automotive Wheel Market Volume (Million Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031

13.6.1. Brazil

13.6.2. Argentina

13.6.3. Rest of South America

14. Competitive Landscape

14.1. Company Share Analysis/ Brand Share Analysis, 2021

14.2. Key Strategy Analysis

14.2.1. Strategic Overview - Expansion, M&A, Partnership

14.2.2. Product & Marketing Strategy

14.3. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

15. Company Profile/ Key Players

15.1. ARCONIC

15.1.1. Company Overview

15.1.2. Company Footprints

15.1.3. Production Locations

15.1.4. Product Portfolio

15.1.5. Competitors & Customers

15.1.6. Subsidiaries & Parent Organization

15.1.7. Recent Developments

15.1.8. Financial Analysis

15.1.9. Profitability

15.1.10. Revenue Share

15.2. BBS Alloy Wheel

15.2.1. Company Overview

15.2.2. Company Footprints

15.2.3. Production Locations

15.2.4. Product Portfolio

15.2.5. Competitors & Customers

15.2.6. Subsidiaries & Parent Organization

15.2.7. Recent Developments

15.2.8. Financial Analysis

15.2.9. Profitability

15.2.10. Revenue Share

15.3. BORBET GmbH.

15.3.1. Company Overview

15.3.2. Company Footprints

15.3.3. Production Locations

15.3.4. Product Portfolio

15.3.5. Competitors & Customers

15.3.6. Subsidiaries & Parent Organization

15.3.7. Recent Developments

15.3.8. Financial Analysis

15.3.9. Profitability

15.3.10. Revenue Share

15.4. CITIC Dicastal Wheel Manufacturing Co.

15.4.1. Company Overview

15.4.2. Company Footprints

15.4.3. Production Locations

15.4.4. Product Portfolio

15.4.5. Competitors & Customers

15.4.6. Subsidiaries & Parent Organization

15.4.7. Recent Developments

15.4.8. Financial Analysis

15.4.9. Profitability

15.4.10. Revenue Share

15.5. Enkei

15.5.1. Company Overview

15.5.2. Company Footprints

15.5.3. Production Locations

15.5.4. Product Portfolio

15.5.5. Competitors & Customers

15.5.6. Subsidiaries & Parent Organization

15.5.7. Recent Developments

15.5.8. Financial Analysis

15.5.9. Profitability

15.5.10. Revenue Share

15.6. Fuel Off Road Wheels

15.6.1. Company Overview

15.6.2. Company Footprints

15.6.3. Production Locations

15.6.4. Product Portfolio

15.6.5. Competitors & Customers

15.6.6. Subsidiaries & Parent Organization

15.6.7. Recent Developments

15.6.8. Financial Analysis

15.6.9. Profitability

15.6.10. Revenue Share

15.7. Foshan Nanhai Zhongnan Aluminum Wheel Co., Ltd

15.7.1. Company Overview

15.7.2. Company Footprints

15.7.3. Production Locations

15.7.4. Product Portfolio

15.7.5. Competitors & Customers

15.7.6. Subsidiaries & Parent Organization

15.7.7. Recent Developments

15.7.8. Financial Analysis

15.7.9. Profitability

15.7.10. Revenue Share

15.8. MAXION Wheels

15.8.1. Company Overview

15.8.2. Company Footprints

15.8.3. Production Locations

15.8.4. Product Portfolio

15.8.5. Competitors & Customers

15.8.6. Subsidiaries & Parent Organization

15.8.7. Recent Developments

15.8.8. Financial Analysis

15.8.9. Profitability

15.8.10. Revenue Share

15.9. MHT Luxury Wheels.

15.9.1. Company Overview

15.9.2. Company Footprints

15.9.3. Production Locations

15.9.4. Product Portfolio

15.9.5. Competitors & Customers

15.9.6. Subsidiaries & Parent Organization

15.9.7. Recent Developments

15.9.8. Financial Analysis

15.9.9. Profitability

15.9.10. Revenue Share

15.10. RONAL Group

15.10.1. Company Overview

15.10.2. Company Footprints

15.10.3. Production Locations

15.10.4. Product Portfolio

15.10.5. Competitors & Customers

15.10.6. Subsidiaries & Parent Organization

15.10.7. Recent Developments

15.10.8. Financial Analysis

15.10.9. Profitability

15.10.10. Revenue Share

15.11. TSW Wheels

15.11.1. Company Overview

15.11.2. Company Footprints

15.11.3. Production Locations

15.11.4. Product Portfolio

15.11.5. Competitors & Customers

15.11.6. Subsidiaries & Parent Organization

15.11.7. Recent Developments

15.11.8. Financial Analysis

15.11.9. Profitability

15.11.10. Revenue Share

15.12. WHEELPROS LLC

15.12.1. Company Overview

15.12.2. Company Footprints

15.12.3. Production Locations

15.12.4. Product Portfolio

15.12.5. Competitors & Customers

15.12.6. Subsidiaries & Parent Organization

15.12.7. Recent Developments

15.12.8. Financial Analysis

15.12.9. Profitability

15.12.10. Revenue Share

15.13. Superior Industries International Inc.

15.13.1. Company Overview

15.13.2. Company Footprints

15.13.3. Production Locations

15.13.4. Product Portfolio

15.13.5. Competitors & Customers

15.13.6. Subsidiaries & Parent Organization

15.13.7. Recent Developments

15.13.8. Financial Analysis

15.13.9. Profitability

15.13.10. Revenue Share

15.14. Others

15.14.1. Company Overview

15.14.2. Company Footprints

15.14.3. Production Locations

15.14.4. Product Portfolio

15.14.5. Competitors & Customers

15.14.6. Subsidiaries & Parent Organization

15.14.7. Recent Developments

15.14.8. Financial Analysis

15.14.9. Profitability

15.14.10. Revenue Share

List of Tables

Table 1: Global Automotive Wheel Market Volume (Million Units) Forecast, by Material, 2017-2031

Table 2: Global Automotive Wheel Market Value (US$ Bn) Forecast, by Material, 2017-2031

Table 3: Global Automotive Wheel Market Volume (Million Units) Forecast, by Rim Size, 2017-2031

Table 4: Global Automotive Wheel Market Value (US$ Bn) Forecast, by Rim Size, 2017-2031

Table 5: Global Automotive Wheel Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Table 6: Global Automotive Wheel Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 7: Global Automotive Wheel Market Volume (Million Units) Forecast, by Sales Channel, 2017-2031

Table 8: Global Automotive Wheel Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 9: Global Automotive Wheel Market Volume (Million Units) Forecast, by Region, 2017-2031

Table 10: Global Automotive Wheel Market Value (US$ Bn) Forecast, by Region, 2017-2031

Table 11: North America Automotive Wheel Market Volume (Million Units) Forecast, by Material, 2017-2031

Table 12: North America Automotive Wheel Market Value (US$ Bn) Forecast, by Material, 2017-2031

Table 13: North America Automotive Wheel Market Volume (Million Units) Forecast, by Rim Size, 2017-2031

Table 14: North America Automotive Wheel Market Value (US$ Bn) Forecast, by Rim Size, 2017-2031

Table 15: North America Automotive Wheel Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Table 16: North America Automotive Wheel Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 17: North America Automotive Wheel Market Volume (Million Units) Forecast, by Sales Channel, 2017-2031

Table 18: North America Automotive Wheel Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 19: North America Automotive Wheel Market Volume (Million Units) Forecast, by Country, 2017-2031

Table 20: North America Automotive Wheel Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 21: Europe Automotive Wheel Market Volume (Million Units) Forecast, by Material, 2017-2031

Table 22: Europe Automotive Wheel Market Value (US$ Bn) Forecast, by Material, 2017-2031

Table 23: Europe Automotive Wheel Market Volume (Million Units) Forecast, by Rim Size, 2017-2031

Table 24: Europe Automotive Wheel Market Value (US$ Bn) Forecast, by Rim Size, 2017-2031

Table 25: Europe Automotive Wheel Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Table 26: Europe Automotive Wheel Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 27: Europe Automotive Wheel Market Volume (Million Units) Forecast, by Sales Channel, 2017-2031

Table 28: Europe Automotive Wheel Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 29: Europe Automotive Wheel Market Volume (Million Units) Forecast, by Country, 2017-2031

Table 30: Europe Automotive Wheel Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 31: Asia Pacific Automotive Wheel Market Volume (Million Units) Forecast, by Material, 2017-2031

Table 32: Asia Pacific Automotive Wheel Market Value (US$ Bn) Forecast, by Material, 2017-2031

Table 33: Asia Pacific Automotive Wheel Market Volume (Million Units) Forecast, by Rim Size, 2017-2031

Table 34: Asia Pacific Automotive Wheel Market Value (US$ Bn) Forecast, by Rim Size, 2017-2031

Table 35: Asia Pacific Automotive Wheel Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Table 36: Asia Pacific Automotive Wheel Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 37: Asia Pacific Automotive Wheel Market Volume (Million Units) Forecast, by Sales Channel, 2017-2031

Table 38: Asia Pacific Automotive Wheel Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 39: Asia Pacific Automotive Wheel Market Volume (Million Units) Forecast, by Country, 2017-2031

Table 40: Asia Pacific Automotive Wheel Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 41: Middle East & Africa Automotive Wheel Market Volume (Million Units) Forecast, by Material, 2017-2031

Table 42: Middle East & Africa Automotive Wheel Market Value (US$ Bn) Forecast, by Material, 2017-2031

Table 43: Middle East & Africa Automotive Wheel Market Volume (Million Units) Forecast, by Rim Size, 2017-2031

Table 44: Middle East & Africa Automotive Wheel Market Value (US$ Bn) Forecast, by Rim Size, 2017-2031

Table 45: Middle East & Africa Automotive Wheel Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Table 46: Middle East & Africa Automotive Wheel Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 47: Middle East & Africa Automotive Wheel Market Volume (Million Units) Forecast, by Sales Channel, 2017-2031

Table 48: Middle East & Africa Automotive Wheel Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 49: Middle East & Africa Automotive Wheel Market Volume (Million Units) Forecast, by Country, 2017-2031

Table 50: Middle East & Africa Automotive Wheel Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 51: South America Automotive Wheel Market Volume (Million Units) Forecast, by Material, 2017-2031

Table 52: South America Automotive Wheel Market Value (US$ Bn) Forecast, by Material, 2017-2031

Table 53: South America Automotive Wheel Market Volume (Million Units) Forecast, by Rim Size, 2017-2031

Table 54: South America Automotive Wheel Market Value (US$ Bn) Forecast, by Rim Size, 2017-2031

Table 55: South America Automotive Wheel Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Table 56: South America Automotive Wheel Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 57: South America Automotive Wheel Market Volume (Million Units) Forecast, by Sales Channel, 2017-2031

Table 58: South America Automotive Wheel Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 59: South America Automotive Wheel Market Volume (Million Units) Forecast, by Country, 2017-2031

Table 60: South America Automotive Wheel Market Value (US$ Bn) Forecast, by Country, 2017-2031

List of Figures

Figure 1: Global Automotive Wheel Market Volume (Million Units) Forecast, by Material, 2017-2031

Figure 2: Global Automotive Wheel Market Value (US$ Bn) Forecast, by Material, 2017-2031

Figure 3: Global Automotive Wheel Market, Incremental Opportunity, by Material, Value (US$ Bn), 2022-2031

Figure 4: Global Automotive Wheel Market Volume (Million Units) Forecast, by Rim Size, 2017-2031

Figure 5: Global Automotive Wheel Market Value (US$ Bn) Forecast, by Rim Size, 2017-2031

Figure 6: Global Automotive Wheel Market, Incremental Opportunity, by Rim Size, Value (US$ Bn), 2022-2031

Figure 7: Global Automotive Wheel Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Figure 8: Global Automotive Wheel Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 9: Global Automotive Wheel Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 10: Global Automotive Wheel Market Volume (Million Units) Forecast, by Sales Channel, 2017-2031

Figure 11: Global Automotive Wheel Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 12: Global Automotive Wheel Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 13: Global Automotive Wheel Market Volume (Million Units) Forecast, by Region, 2017-2031

Figure 14: Global Automotive Wheel Market Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 15: Global Automotive Wheel Market, Incremental Opportunity, by Region, Value (US$ Bn), 2022-2031

Figure 16: North America Automotive Wheel Market Volume (Million Units) Forecast, by Material, 2017-2031

Figure 17: North America Automotive Wheel Market Value (US$ Bn) Forecast, by Material, 2017-2031

Figure 18: North America Automotive Wheel Market, Incremental Opportunity, by Material, Value (US$ Bn), 2022-2031

Figure 19: North America Automotive Wheel Market Volume (Million Units) Forecast, by Rim Size, 2017-2031

Figure 20: North America Automotive Wheel Market Value (US$ Bn) Forecast, by Rim Size, 2017-2031

Figure 21: North America Automotive Wheel Market, Incremental Opportunity, by Rim Size, Value (US$ Bn), 2022-2031

Figure 22: North America Automotive Wheel Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Figure 23: North America Automotive Wheel Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 24: North America Automotive Wheel Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 25: North America Automotive Wheel Market Volume (Million Units) Forecast, by Sales Channel, 2017-2031

Figure 26: North America Automotive Wheel Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 27: North America Automotive Wheel Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 28: North America Automotive Wheel Market Volume (Million Units) Forecast, by Country, 2017-2031

Figure 29: North America Automotive Wheel Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 30: North America Automotive Wheel Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 31: Europe Automotive Wheel Market Volume (Million Units) Forecast, by Material, 2017-2031

Figure 32: Europe Automotive Wheel Market Value (US$ Bn) Forecast, by Material, 2017-2031

Figure 33: Europe Automotive Wheel Market, Incremental Opportunity, by Material, Value (US$ Bn), 2022-2031

Figure 34: Europe Automotive Wheel Market Volume (Million Units) Forecast, by Rim Size, 2017-2031

Figure 35: Europe Automotive Wheel Market Value (US$ Bn) Forecast, by Rim Size, 2017-2031

Figure 36: Europe Automotive Wheel Market, Incremental Opportunity, by Rim Size, Value (US$ Bn), 2022-2031

Figure 37: Europe Automotive Wheel Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Figure 38: Europe Automotive Wheel Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 39: Europe Automotive Wheel Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 40: Europe Automotive Wheel Market Volume (Million Units) Forecast, by Sales Channel, 2017-2031

Figure 41: Europe Automotive Wheel Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 42: Europe Automotive Wheel Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 43: Europe Automotive Wheel Market Volume (Million Units) Forecast, by Country, 2017-2031

Figure 44: Europe Automotive Wheel Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 45: Europe Automotive Wheel Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 46: Asia Pacific Automotive Wheel Market Volume (Million Units) Forecast, by Material, 2017-2031

Figure 47: Asia Pacific Automotive Wheel Market Value (US$ Bn) Forecast, by Material, 2017-2031

Figure 48: Asia Pacific Automotive Wheel Market, Incremental Opportunity, by Material, Value (US$ Bn), 2022-2031

Figure 49: Asia Pacific Automotive Wheel Market Volume (Million Units) Forecast, by Rim Size, 2017-2031

Figure 50: Asia Pacific Automotive Wheel Market Value (US$ Bn) Forecast, by Rim Size, 2017-2031

Figure 51: Asia Pacific Automotive Wheel Market, Incremental Opportunity, by Rim Size, Value (US$ Bn), 2022-2031

Figure 52: Asia Pacific Automotive Wheel Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Figure 53: Asia Pacific Automotive Wheel Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 54: Asia Pacific Automotive Wheel Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 55: Asia Pacific Automotive Wheel Market Volume (Million Units) Forecast, by Sales Channel, 2017-2031

Figure 56: Asia Pacific Automotive Wheel Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 57: Asia Pacific Automotive Wheel Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 58: Asia Pacific Automotive Wheel Market Volume (Million Units) Forecast, by Country, 2017-2031

Figure 59: Asia Pacific Automotive Wheel Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 60: Asia Pacific Automotive Wheel Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 61: Middle East & Africa Automotive Wheel Market Volume (Million Units) Forecast, by Material, 2017-2031

Figure 62: Middle East & Africa Automotive Wheel Market Value (US$ Bn) Forecast, by Material, 2017-2031

Figure 63: Middle East & Africa Automotive Wheel Market, Incremental Opportunity, by Material, Value (US$ Bn), 2022-2031

Figure 64: Middle East & Africa Automotive Wheel Market Volume (Million Units) Forecast, by Rim Size, 2017-2031

Figure 65: Middle East & Africa Automotive Wheel Market Value (US$ Bn) Forecast, by Rim Size, 2017-2031

Figure 66: Middle East & Africa Automotive Wheel Market, Incremental Opportunity, by Rim Size, Value (US$ Bn), 2022-2031

Figure 67: Middle East & Africa Automotive Wheel Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Figure 68: Middle East & Africa Automotive Wheel Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 69: Middle East & Africa Automotive Wheel Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 70: Middle East & Africa Automotive Wheel Market Volume (Million Units) Forecast, by Sales Channel, 2017-2031

Figure 71: Middle East & Africa Automotive Wheel Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 72: Middle East & Africa Automotive Wheel Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 73: Middle East & Africa Automotive Wheel Market Volume (Million Units) Forecast, by Country, 2017-2031

Figure 74: Middle East & Africa Automotive Wheel Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 75: Middle East & Africa Automotive Wheel Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 76: South America Automotive Wheel Market Volume (Million Units) Forecast, by Material, 2017-2031

Figure 77: South America Automotive Wheel Market Value (US$ Bn) Forecast, by Material, 2017-2031

Figure 78: South America Automotive Wheel Market, Incremental Opportunity, by Material, Value (US$ Bn), 2022-2031

Figure 79: South America Automotive Wheel Market Volume (Million Units) Forecast, by Rim Size, 2017-2031

Figure 80: South America Automotive Wheel Market Value (US$ Bn) Forecast, by Rim Size, 2017-2031

Figure 81: South America Automotive Wheel Market, Incremental Opportunity, by Rim Size, Value (US$ Bn), 2022-2031

Figure 82: South America Automotive Wheel Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Figure 83: South America Automotive Wheel Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 84: South America Automotive Wheel Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 85: South America Automotive Wheel Market Volume (Million Units) Forecast, by Sales Channel, 2017-2031

Figure 86: South America Automotive Wheel Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 87: South America Automotive Wheel Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 88: South America Automotive Wheel Market Volume (Million Units) Forecast, by Country, 2017-2031

Figure 89: South America Automotive Wheel Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 90: South America Automotive Wheel Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031