Analysts’ Viewpoint

Development of cutting-edge tire alignment systems and advancements in tire alignment technology have significantly increased the need for vehicle wheel alignment services in the last few years. This trend is anticipated to continue to during the next few years. Moreover, increased awareness about the effects of optimal wheel alignment on vehicle performance among consumers is anticipated to be one of the key growth factors of the automotive wheel alignment services market in the near future.

Additionally, rise in use of computerized wheel alignment systems is estimated to further boost the automotive wheel alignment services industry. Key players in the industry are expected to focus on adhering to the legal framework and make investments in new product development and emerging technologies in order to establish a solid foothold and grab business opportunities in the automobile wheel alignment services market.

Automotive wheel alignment services are significant in aligning all of the wheels of the vehicle during assembly as well as when the wheels become misaligned while being driven. The machine adjusts the angles of the wheels to the specifications suggested by the manufacturer; looks for any indications of improper alignment; and tests the toe, camber, and caster, which are the three main factors in determining how well the wheels are aligned and oriented.

Moreover, rising per capita wealth brought on by global economic growth is driving the demand for luxury goods and services including furniture, electronics, and transportation. An increase in purchasing power is expected to fuel consumer preference for buying cars, which in turn is anticipated to boost the demand for cars and consequently, for wheel alignment services globally.

Population growth that is driving rapid urbanization, infrastructure development, and the growth of the construction sector is also expected to propel the demand for transportation. Moreover, expansion of the e-commerce and logistics sectors at a rapid pace is likely to drive the demand for cargo transport and shipment, and the demand for heavy commercial vehicles. These factors are anticipated to boost the sale of passenger and commercial vehicles and consequently fuel the automotive alignment services market growth in the next few years.

According to the latest automobile wheel alignment services market trends, rising popularity of electric vehicles, particularly in developed nations; developments in electric power steering; and rising emphasis on enhancing driver comfort and safety are anticipated to fuel the demand for vehicle wheel alignment services. The introduction of new steering systems that use ABS/ESC systems is estimated to further boost the automotive wheel alignment services market demand during the forecast period.

Tire alignment has been identified by automotive manufacturers as one of the crucial factors that significantly improves a vehicle's efficiency and overall performance. Camber, caster, and toe are a few of the important parameters that are measured during an automotive wheel alignment procedure. Furthermore, frame angle, wheelbase variation, maximum turns, etc., are also checked during the procedure.

Additionally, growing awareness about maintenance, repair, and overhaul activities among vehicle owners is anticipated to significantly fuel the automotive wheel alignment services market value during the forecast period. Additionally, significant developments have been witnessed in automotive wheel alignment procedures, and this development is anticipated to continue in the next few years.

Based on vehicle type, the passenger vehicle segment dominated the global market due to a rise in production of passenger vehicles worldwide. Demand for luxury or premium passenger vehicles is increasing with the rise in disposable income of people and an increase in living standards of people across the globe.

In terms of service provider, the OEM segment held a notable automotive wheel alignment services market share, owing to increase in in-house testing facility where all vehicle tests are carried out, including wheel alignment, crash test, and NVH to enhance the vehicle performance. This is likely to boost the automotive wheel alignment service market revenue across the globe.

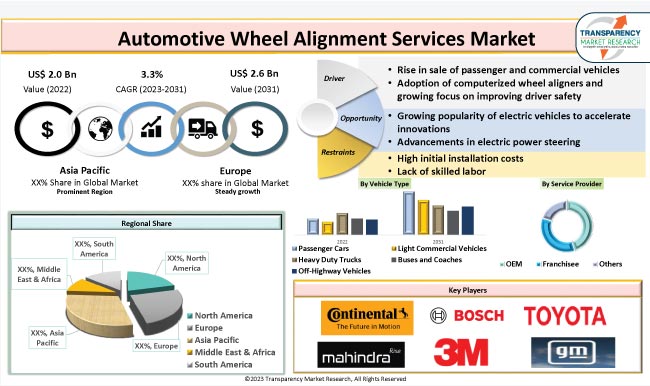

According to the latest regional automotive wheel alignment services market analysis, Asia Pacific and Europe are projected to be highly lucrative markets during the forecast period. This is primarily due to the presence of prominent automotive markets in China, Germany, Japan, and India.

The automotive wheel alignment services market forecast for Asia Pacific is highly promising due to its large population and growing middle class in nations such as China and India,. Moreover, rise in demand for portable & wireless wheel alignment machines and surge in vehicle sales in Asia Pacific are expected to significantly augment market statistics in the region.

Major presence of original equipment manufacturers and tier- 1 suppliers across Europe who have advanced testing facilities for wheel alignment is anticipated to drive the demand for car alignment services in the region during the forecast period.

Prominent players in the automotive wheel alignment services industry are investing in new technology as well as providing attractive amenities and services to their customers in order to stay ahead in the market competition. Expansion of product portfolios, mergers and acquisitions are notable strategies adopted by prominent players. Some of the key players operating in the automotive wheel alignment services business include 3M, BMW AG, Bridgestone Corporation, Continental AG, DRiV Incrorporated, Ford Motor Company, General Motors, Mahindra & Mahindra Ltd., Mercedes Benz, MRF, Robert Bosch GmbH, TBC Corporation, The Goodyear Tire and Rubber Company, Tire Prose Francorp. Toyota Motor Corporation, and Volkswagen AG.

Key players in the automotive wheel alignment services market research report have been profiled based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Size Value in 2021 |

US$ 2.0 Bn |

|

Market Forecast Value in 2031 |

US$ 2.65 Bn |

|

Growth Rate (CAGR) |

3.3% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2022 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 2.0 Bn in 2022

It is expected to expand at a CAGR of 3.30 % by 2031

The global business is estimated to reach a value of US$ 2.65 Bn in 2031

Rise in sale of passenger and commercial vehicles, increase in adoption of EVs, surge in adoption of computerized wheel aligners, and growing focus on improving driver safety

Based on vehicle type, the passenger vehicle segment held largest share in 2022 due to rise in production of passenger vehicles worldwide

Asia Pacific was a highly lucrative region for automotive wheel alignment services

3M, BMW AG, Bridgestone Corporation, Continental AG, DRiV Incrorporated, Ford Motor Company, General Motors, Mahindra & Mahindra Ltd., Mercedes Benz, MRF, Robert Bosch GmbH, TBC Corporation, The Goodyear Tire and Rubber Company, Tire Prose Francorp. Toyota Motor Corporation, Volkswagen AG.

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Size, Value in US$ Bn, 2017-2031

1.2. TMR Analysis and Recommendations

1.3. Competitive Dashboard Analysis

2. Go to Market Strategy

2.1. Demand & Supply Side Trends

2.1.1. GAP Analysis

2.2. Identification of Potential Market Spaces

2.3. Understanding the Buying Process of the Customers

2.4. Preferred Sales & Marketing Strategy

3. Market Overview

3.1. Market Coverage / Taxonomy

3.2. Market Definition / Scope / Limitations

3.3. Market Dynamics

3.3.1. Drivers

3.3.2. Restraints

3.3.3. Opportunity

3.4. Market Factor Analysis

3.4.1. Porter’s Five Force Analysis

3.4.2. SWOT Analysis

3.5. Regulatory Scenario

3.6. Key Trend Analysis

3.7. Value Chain Analysis

3.7.1. List of Key Manufacturer

3.7.2. List of Customers

3.7.3. Level of Integration

4. Global Automotive Wheel Alignment Services Market, by Vehicle Type

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Automotive Wheel Alignment Services Market Size & Forecast, 2017-2031, by Vehicle Type

4.2.1. Passenger Cars

4.2.1.1. Hatchback

4.2.1.2. Sedan

4.2.1.3. Utility Vehicles (SUVs & MPVs)

4.2.2. Light Commercial Vehicles

4.2.3. Heavy Duty Trucks

4.2.4. Buses and Coaches

4.2.5. Off-Highway Vehicles

4.2.5.1. Agriculture Tractors & Equipment

4.2.5.2. Construction & Mining Equipment

4.2.5.3. Industrial Vehicles (Forklift, AGV, Etc.)

5. Global Automotive Wheel Alignment Services Market, by Service Provider

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Automotive Wheel Alignment Services Market Size & Forecast, 2017-2031, by Service Provider

5.2.1. OEM

5.2.1.1. Authorized Dealership

5.2.1.2. Tire Manufacturers

5.2.2. Franchisee

5.2.3. Others

6. Global Automotive Wheel Alignment Services Market, by Product Type

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Automotive Wheel Alignment Services Market Size & Forecast, 2017-2031, by Product Type

6.2.1. Imaging

6.2.2. Diagnostic

7. Global Automotive Wheel Alignment Services Market, by Technology

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Automotive Wheel Alignment Services Market Size & Forecast, 2017-2031, by Technology

7.2.1. CCD

7.2.2. 3D

8. Global Automotive Wheel Alignment Services Market, by Mobility

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Automotive Wheel Alignment Services Market Size & Forecast, 2017-2031, by Mobility

8.2.1. Fixed

8.2.2. Portable

9. Global Automotive Wheel Alignment Services Market, by Region

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global Automotive Wheel Alignment Services Market Size & Forecast, 2017-2031, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. South America

10. North America Automotive Wheel Alignment Services Market

10.1. Market Snapshot

10.2. Automotive Wheel Alignment Services Market Size & Forecast, 2017-2031, by Vehicle Type

10.2.1. Passenger Cars

10.2.1.1. Hatchback

10.2.1.2. Sedan

10.2.1.3. Utility Vehicles (SUVs & MPVs)

10.2.2. Light Commercial Vehicles

10.2.3. Heavy Duty Trucks

10.2.4. Buses and Coaches

10.2.5. Off-Highway Vehicles

10.2.5.1. Agriculture Tractors & Equipment

10.2.5.2. Construction & Mining Equipment

10.2.5.3. Industrial Vehicles (Forklift, AGV, Etc.)

10.3. Automotive Wheel Alignment Services Market Size & Forecast, 2017-2031, by Service Provider

10.3.1. OEM

10.3.1.1. Authorized Dealership

10.3.1.2. Tire Manufacturers

10.3.2. Franchisee

10.3.3. Others

10.4. Intra-city Automotive Wheel Alignment Services Market Size & Forecast, 2017-2031, by Product Type

10.4.1. Imaging

10.4.2. Diagnostic

10.5. Automotive Wheel Alignment Services Market Size & Forecast, 2017-2031, by Technology

10.5.1. CCD

10.5.2. 3D

10.6. Automotive Wheel Alignment Services Market Size & Forecast, 2017-2031, by Mobility

10.6.1. Fixed

10.6.2. Portable

10.7. Key Country Analysis – North America Automotive Wheel Alignment Services Market Size & Forecast, 2017-2031

10.7.1. U. S.

10.7.2. Canada

10.7.3. Mexico

11. Europe Automotive Wheel Alignment Services Market

11.1. Market Snapshot

11.2. Automotive Wheel Alignment Services Market Size & Forecast, 2017-2031, by Vehicle Type

11.2.1. Passenger Cars

11.2.1.1. Hatchback

11.2.1.2. Sedan

11.2.1.3. Utility Vehicles (SUVs & MPVs)

11.2.2. Light Commercial Vehicles

11.2.3. Heavy Duty Trucks

11.2.4. Buses and Coaches

11.2.5. Off-Highway Vehicles

11.2.5.1. Agriculture Tractors & Equipment

11.2.5.2. Construction & Mining Equipment

11.2.5.3. Industrial Vehicles (Forklift, AGV, Etc.)

11.3. Automotive Wheel Alignment Services Market Size & Forecast, 2017-2031, by Service Provider

11.3.1. OEM

11.3.1.1. Authorized Dealership

11.3.1.2. Tire Manufacturers

11.3.2. Franchisee

11.3.3. Others

11.4. Intra-city Automotive Wheel Alignment Services Market Size & Forecast, 2017-2031, by Product Type

11.4.1. Imaging

11.4.2. Diagnostic

11.5. Automotive Wheel Alignment Services Market Size & Forecast, 2017-2031, by Technology

11.5.1. CCD

11.5.2. 3D

11.6. Automotive Wheel Alignment Services Market Size & Forecast, 2017-2031, by Mobility

11.6.1. Fixed

11.6.2. Portable

11.7. Key Country Analysis - Europe Automotive Wheel Alignment Services Market Size & Forecast, 2017-2031

11.7.1. Germany

11.7.2. U. K.

11.7.3. France

11.7.4. Italy

11.7.5. Spain

11.7.6. Nordic Countries

11.7.7. Russia & CIS

11.7.8. Rest of Europe

12. Asia Pacific Automotive Wheel Alignment Services Market

12.1. Market Snapshot

12.2. Automotive Wheel Alignment Services Market Size & Forecast, 2017-2031, by Vehicle Type

12.2.1. Passenger Cars

12.2.1.1. Hatchback

12.2.1.2. Sedan

12.2.1.3. Utility Vehicles (SUVs & MPVs)

12.2.2. Light Commercial Vehicles

12.2.3. Heavy Duty Trucks

12.2.4. Buses and Coaches

12.2.5. Off-Highway Vehicles

12.2.5.1. Agriculture Tractors & Equipment

12.2.5.2. Construction & Mining Equipment

12.2.5.3. Industrial Vehicles (Forklift, AGV, Etc.)

12.3. Automotive Wheel Alignment Services Market Size & Forecast, 2017-2031, by Service Provider

12.3.1. OEM

12.3.1.1. Authorized Dealership

12.3.1.2. Tire Manufacturers

12.3.2. Franchisee

12.3.3. Others

12.4. Intra-city Automotive Wheel Alignment Services Market Size & Forecast, 2017-2031, by Product Type

12.4.1. Imaging

12.4.2. Diagnostic

12.5. Automotive Wheel Alignment Services Market Size & Forecast, 2017-2031, by Technology

12.5.1. CCD

12.5.2. 3D

12.6. Automotive Wheel Alignment Services Market Size & Forecast, 2017-2031, by Mobility

12.6.1. Fixed

12.6.2. Portable

12.7. Key Country Analysis - Asia Pacific Automotive Wheel Alignment Services Market Size & Forecast, 2017-2031, by Country

12.7.1. China

12.7.2. India

12.7.3. Japan

12.7.4. ASEAN Countries

12.7.5. South Korea

12.7.6. ANZ

12.7.7. Rest of Asia Pacific

13. Middle East & Africa Automotive Wheel Alignment Services Market

13.1. Market Snapshot

13.2. Automotive Wheel Alignment Services Market Size & Forecast, 2017-2031, by Vehicle Type

13.2.1. Passenger Cars

13.2.1.1. Hatchback

13.2.1.2. Sedan

13.2.1.3. Utility Vehicles (SUVs & MPVs)

13.2.2. Light Commercial Vehicles

13.2.3. Heavy Duty Trucks

13.2.4. Buses and Coaches

13.2.5. Off-Highway Vehicles

13.2.5.1. Agriculture Tractors & Equipment

13.2.5.2. Construction & Mining Equipment

13.2.5.3. Industrial Vehicles (Forklift, AGV, Etc.)

13.3. Automotive Wheel Alignment Services Market Size & Forecast, 2017-2031, by Service Provider

13.3.1. OEM

13.3.1.1. Authorized Dealership

13.3.1.2. Tire Manufacturers

13.3.2. Franchisee

13.3.3. Others

13.4. Intra-city Automotive Wheel Alignment Services Market Size & Forecast, 2017-2031, by Product Type

13.4.1. Imaging

13.4.2. Diagnostic

13.5. Automotive Wheel Alignment Services Market Size & Forecast, 2017-2031, by Technology

13.5.1. CCD

13.5.2. 3D

13.6. Automotive Wheel Alignment Services Market Size & Forecast, 2017-2031, by Mobility

13.6.1. Fixed

13.6.2. Portable

13.7. Key Country Analysis - Middle East & Africa Automotive Wheel Alignment Services Market Size & Forecast, 2017-2031, by Country

13.7.1. GCC

13.7.2. South Africa

13.7.3. Turkey

13.7.4. Rest of Middle East & Africa

14. South America Automotive Wheel Alignment Services Market

14.1. Market Snapshot

14.2. Automotive Wheel Alignment Services Market Size & Forecast, 2017-2031, by Vehicle Type

14.2.1. Passenger Cars

14.2.1.1. Hatchback

14.2.1.2. Sedan

14.2.1.3. Utility Vehicles (SUVs & MPVs)

14.2.2. Light Commercial Vehicles

14.2.3. Heavy Duty Trucks

14.2.4. Buses and Coaches

14.2.5. Off-Highway Vehicles

14.2.5.1. Agriculture Tractors & Equipment

14.2.5.2. Construction & Mining Equipment

14.2.5.3. Industrial Vehicles (Forklift, AGV, Etc.)

14.3. Automotive Wheel Alignment Services Market Size & Forecast, 2017-2031, by Service Provider

14.3.1. OEM

14.3.1.1. Authorized Dealership

14.3.1.2. Tire Manufacturers

14.3.2. Franchisee

14.3.3. Others

14.4. Intra-city Automotive Wheel Alignment Services Market Size & Forecast, 2017-2031, by Product Type

14.4.1. Imaging

14.4.2. Diagnostic

14.5. Automotive Wheel Alignment Services Market Size & Forecast, 2017-2031, by Technology

14.5.1. CCD

14.5.2. 3D

14.6. Automotive Wheel Alignment Services Market Size & Forecast, 2017-2031, by Mobility

14.6.1. Fixed

14.6.2. Portable

14.7. Key Country Analysis - South America Automotive Wheel Alignment Services Market Size & Forecast, 2017-2031

14.7.1. Brazil

14.7.2. Argentina

14.7.3. Rest of South America

15. Competitive Landscape

15.1. Company Share Analysis/ Brand Share Analysis, 2022

15.2. Key Strategy Analysis

15.2.1. Strategic Overview - Expansion, M&A, Partnership

15.2.2. Product & Marketing Strategy

15.3. Pricing comparison among key players

15.4. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

16. Company Profile/ Key Players

16.1. 3M

16.1.1. Company Overview

16.1.2. Company Footprints

16.1.3. Production Locations

16.1.4. Product Portfolio

16.1.5. Competitors & Customers

16.1.6. Subsidiaries & Parent Organization

16.1.7. Recent Developments

16.1.8. Financial Analysis

16.1.9. Profitability

16.1.10. Revenue Share

16.2. BMW AG

16.2.1. Company Overview

16.2.2. Company Footprints

16.2.3. Production Locations

16.2.4. Product Portfolio

16.2.5. Competitors & Customers

16.2.6. Subsidiaries & Parent Organization

16.2.7. Recent Developments

16.2.8. Financial Analysis

16.2.9. Profitability

16.2.10. Revenue Share

16.3. Bridgestone Corporation

16.3.1. Company Overview

16.3.2. Company Footprints

16.3.3. Production Locations

16.3.4. Product Portfolio

16.3.5. Competitors & Customers

16.3.6. Subsidiaries & Parent Organization

16.3.7. Recent Developments

16.3.8. Financial Analysis

16.3.9. Profitability

16.3.10. Revenue Share

16.4. Continental AG

16.4.1. Company Overview

16.4.2. Company Footprints

16.4.3. Production Locations

16.4.4. Product Portfolio

16.4.5. Competitors & Customers

16.4.6. Subsidiaries & Parent Organization

16.4.7. Recent Developments

16.4.8. Financial Analysis

16.4.9. Profitability

16.4.10. Revenue Share

16.5. DRiV Incrorporated

16.5.1. Company Overview

16.5.2. Company Footprints

16.5.3. Production Locations

16.5.4. Product Portfolio

16.5.5. Competitors & Customers

16.5.6. Subsidiaries & Parent Organization

16.5.7. Recent Developments

16.5.8. Financial Analysis

16.5.9. Profitability

16.5.10. Revenue Share

16.6. Ford Motor Company

16.6.1. Company Overview

16.6.2. Company Footprints

16.6.3. Production Locations

16.6.4. Product Portfolio

16.6.5. Competitors & Customers

16.6.6. Subsidiaries & Parent Organization

16.6.7. Recent Developments

16.6.8. Financial Analysis

16.6.9. Profitability

16.6.10. Revenue Share

16.7. General Motors

16.7.1. Company Overview

16.7.2. Company Footprints

16.7.3. Production Locations

16.7.4. Product Portfolio

16.7.5. Competitors & Customers

16.7.6. Subsidiaries & Parent Organization

16.7.7. Recent Developments

16.7.8. Financial Analysis

16.7.9. Profitability

16.7.10. Revenue Share

16.8. Mahindra & Mahindra Ltd

16.8.1. Company Overview

16.8.2. Company Footprints

16.8.3. Production Locations

16.8.4. Product Portfolio

16.8.5. Competitors & Customers

16.8.6. Subsidiaries & Parent Organization

16.8.7. Recent Developments

16.8.8. Financial Analysis

16.8.9. Profitability

16.8.10. Revenue Share

16.9. Mercedes Benz

16.9.1. Company Overview

16.9.2. Company Footprints

16.9.3. Production Locations

16.9.4. Product Portfolio

16.9.5. Competitors & Customers

16.9.6. Subsidiaries & Parent Organization

16.9.7. Recent Developments

16.9.8. Financial Analysis

16.9.9. Profitability

16.9.10. Revenue Share

16.10. MRF

16.10.1. Company Overview

16.10.2. Company Footprints

16.10.3. Production Locations

16.10.4. Product Portfolio

16.10.5. Competitors & Customers

16.10.6. Subsidiaries & Parent Organization

16.10.7. Recent Developments

16.10.8. Financial Analysis

16.10.9. Profitability

16.10.10. Revenue Share

16.11. Robert Bosch GmbH

16.11.1. Company Overview

16.11.2. Company Footprints

16.11.3. Production Locations

16.11.4. Product Portfolio

16.11.5. Competitors & Customers

16.11.6. Subsidiaries & Parent Organization

16.11.7. Recent Developments

16.11.8. Financial Analysis

16.11.9. Profitability

16.11.10. Revenue Share

16.12. TBC Corporation

16.12.1. Company Overview

16.12.2. Company Footprints

16.12.3. Production Locations

16.12.4. Product Portfolio

16.12.5. Competitors & Customers

16.12.6. Subsidiaries & Parent Organization

16.12.7. Recent Developments

16.12.8. Financial Analysis

16.12.9. Profitability

16.12.10. Revenue Share

16.13. The Goodyear Tire and Rubber Company

16.13.1. Company Overview

16.13.2. Company Footprints

16.13.3. Production Locations

16.13.4. Product Portfolio

16.13.5. Competitors & Customers

16.13.6. Subsidiaries & Parent Organization

16.13.7. Recent Developments

16.13.8. Financial Analysis

16.13.9. Profitability

16.13.10. Revenue Share

16.14. Tire Prose Francorp

16.14.1. Company Overview

16.14.2. Company Footprints

16.14.3. Production Locations

16.14.4. Product Portfolio

16.14.5. Competitors & Customers

16.14.6. Subsidiaries & Parent Organization

16.14.7. Recent Developments

16.14.8. Financial Analysis

16.14.9. Profitability

16.14.10. Revenue Share

16.15. Toyota Motor Corporation

16.15.1. Company Overview

16.15.2. Company Footprints

16.15.3. Production Locations

16.15.4. Product Portfolio

16.15.5. Competitors & Customers

16.15.6. Subsidiaries & Parent Organization

16.15.7. Recent Developments

16.15.8. Financial Analysis

16.15.9. Profitability

16.15.10. Revenue Share

16.16. Volkswagen AG

16.16.1. Company Overview

16.16.2. Company Footprints

16.16.3. Production Locations

16.16.4. Product Portfolio

16.16.5. Competitors & Customers

16.16.6. Subsidiaries & Parent Organization

16.16.7. Recent Developments

16.16.8. Financial Analysis

16.16.9. Profitability

16.16.10. Revenue Share

16.17. Others

16.17.1. Company Overview

16.17.2. Company Footprints

16.17.3. Production Locations

16.17.4. Product Portfolio

16.17.5. Competitors & Customers

16.17.6. Subsidiaries & Parent Organization

16.17.7. Recent Developments

16.17.8. Financial Analysis

16.17.9. Profitability

16.17.10. Revenue Share

List of Tables

Table 1: Global Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 2: Global Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Service Provider, 2017-2031

Table 3: Global Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Product Type, 2017-2031

Table 4: Global Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Technology, 2017-2031

Table 5: Global Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Mobility, 2017-2031

Table 7: Global Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Region, 2017-2031

Table 8: North America Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 9: North America Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Service Provider, 2017-2031

Table 10: North America Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Product Type, 2017-2031

Table 11: North America Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Technology, 2017-2031

Table 12: North America Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Mobility, 2017-2031

Table 14: North America Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Country, 2017-2031

Table 15: Europe Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 16: Europe Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Service Provider, 2017-2031

Table 17: Europe Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Product Type, 2017-2031

Table 18: Europe Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Technology, 2017-2031

Table 19: Europe Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Mobility, 2017-2031

Table 21: Europe Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Country, 2017-2031

Table 22: Asia Pacific Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 23: Asia Pacific Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Service Provider, 2017-2031

Table 24: Asia Pacific Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Product Type, 2017-2031

Table 25: Asia Pacific Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Technology, 2017-2031

Table 26: Asia Pacific Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Mobility, 2017-2031

Table 28: Asia Pacific Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Country, 2017-2031

Table 29: Middle East & Africa Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 30: Middle East & Africa Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Service Provider, 2017-2031

Table 31: Middle East & Africa Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Product Type, 2017-2031

Table 32: Middle East & Africa Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Technology, 2017-2031

Table 33: Middle East & Africa Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Mobility, 2017-2031

Table 35: Middle East & Africa Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Country, 2017-2031

Table 36: South America Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 37: South America Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Service Provider, 2017-2031

Table 38: South America Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Product Type, 2017-2031

Table 39: South America Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Technology, 2017-2031

Table 40: South America Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Mobility, 2017-2031

Table 42: South America Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Country, 2017-2031

List of Figures

Figure 1: Global Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 2: Global Automotive Wheel Alignment Services Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 3: Global Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Service Provider, 2017-2031

Figure 4: Global Automotive Wheel Alignment Services Market, Incremental Opportunity, by Service Provider, Value (US$ Bn), 2023-2031

Figure 5: Global Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Product Type, 2017-2031

Figure 6: Global Automotive Wheel Alignment Services Market, Incremental Opportunity, by Product Type, Value (US$ Bn), 2023-2031

Figure 7: Global Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Technology, 2017-2031

Figure 8: Global Automotive Wheel Alignment Services Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2023-2031

Figure 9: Global Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Mobility, 2017-2031

Figure 10: Global Automotive Wheel Alignment Services Market, Incremental Opportunity, by Mobility, Value (US$ Bn), 2023-2031

Figure 13: Global Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 14: Global Automotive Wheel Alignment Services Market, Incremental Opportunity, by Region, Value (US$ Bn), 2023-2031

Figure 15: North America Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 16: North America Automotive Wheel Alignment Services Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 17: North America Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Service Provider, 2017-2031

Figure 18: North America Automotive Wheel Alignment Services Market, Incremental Opportunity, by Service Provider, Value (US$ Bn), 2023-2031

Figure 19: North America Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Product Type, 2017-2031

Figure 20: North America Automotive Wheel Alignment Services Market, Incremental Opportunity, by Product Type, Value (US$ Bn), 2023-2031

Figure 21: North America Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Technology, 2017-2031

Figure 22: North America Automotive Wheel Alignment Services Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2023-2031

Figure 23: North America Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Mobility, 2017-2031

Figure 24: North America Automotive Wheel Alignment Services Market, Incremental Opportunity, by Mobility, Value (US$ Bn), 2023-2031

Figure 27: North America Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 28: North America Automotive Wheel Alignment Services Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 29: Europe Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 30: Europe Automotive Wheel Alignment Services Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 31: Europe Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Service Provider, 2017-2031

Figure 32: Europe Automotive Wheel Alignment Services Market, Incremental Opportunity, by Service Provider, Value (US$ Bn), 2023-2031

Figure 33: Europe Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Product Type, 2017-2031

Figure 34: Europe Automotive Wheel Alignment Services Market, Incremental Opportunity, by Product Type, Value (US$ Bn), 2023-2031

Figure 35: Europe Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Technology, 2017-2031

Figure 36: Europe Automotive Wheel Alignment Services Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2023-2031

Figure 37: Europe Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Mobility, 2017-2031

Figure 38: Europe Automotive Wheel Alignment Services Market, Incremental Opportunity, by Mobility, Value (US$ Bn), 2023-2031

Figure 41: Europe Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 42: Europe Automotive Wheel Alignment Services Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 43: Asia Pacific Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 44: Asia Pacific Automotive Wheel Alignment Services Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 45: Asia Pacific Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Service Provider, 2017-2031

Figure 46: Asia Pacific Automotive Wheel Alignment Services Market, Incremental Opportunity, by Service Provider, Value (US$ Bn), 2023-2031

Figure 47: Asia Pacific Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Product Type, 2017-2031

Figure 48: Asia Pacific Automotive Wheel Alignment Services Market, Incremental Opportunity, by Product Type, Value (US$ Bn), 2023-2031

Figure 49: Asia Pacific Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Technology, 2017-2031

Figure 50: Asia Pacific Automotive Wheel Alignment Services Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2023-2031

Figure 51: Asia Pacific Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Mobility, 2017-2031

Figure 52: Asia Pacific Automotive Wheel Alignment Services Market, Incremental Opportunity, by Mobility, Value (US$ Bn), 2023-2031

Figure 55: Asia Pacific Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 56: Asia Pacific Automotive Wheel Alignment Services Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 57: Middle East & Africa Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 58: Middle East & Africa Automotive Wheel Alignment Services Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 59: Middle East & Africa Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Service Provider, 2017-2031

Figure 60: Middle East & Africa Automotive Wheel Alignment Services Market, Incremental Opportunity, by Service Provider, Value (US$ Bn), 2023-2031

Figure 61: Middle East & Africa Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Product Type, 2017-2031

Figure 62: Middle East & Africa Automotive Wheel Alignment Services Market, Incremental Opportunity, by Product Type, Value (US$ Bn), 2023-2031

Figure 63: Middle East & Africa Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Technology, 2017-2031

Figure 64: Middle East & Africa Automotive Wheel Alignment Services Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2023-2031

Figure 65: Middle East & Africa Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Mobility, 2017-2031

Figure 66: Middle East & Africa Automotive Wheel Alignment Services Market, Incremental Opportunity, by Mobility, Value (US$ Bn), 2023-2031

Figure 69: Middle East & Africa Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 70: Middle East & Africa Automotive Wheel Alignment Services Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 71: South America Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 72: South America Automotive Wheel Alignment Services Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 73: South America Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Service Provider, 2017-2031

Figure 74: South America Automotive Wheel Alignment Services Market, Incremental Opportunity, by Service Provider, Value (US$ Bn), 2023-2031

Figure 75: South America Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Product Type, 2017-2031

Figure 76: South America Automotive Wheel Alignment Services Market, Incremental Opportunity, by Product Type, Value (US$ Bn), 2023-2031

Figure 77: South America Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Technology, 2017-2031

Figure 78: South America Automotive Wheel Alignment Services Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2023-2031

Figure 79: South America Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Mobility, 2017-2031

Figure 80: South America Automotive Wheel Alignment Services Market, Incremental Opportunity, by Mobility, Value (US$ Bn), 2023-2031

Figure 83: South America Automotive Wheel Alignment Services Market, Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 84: South America Automotive Wheel Alignment Services Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031