Analysts’ Viewpoint on Automotive Telematics Market Scenario

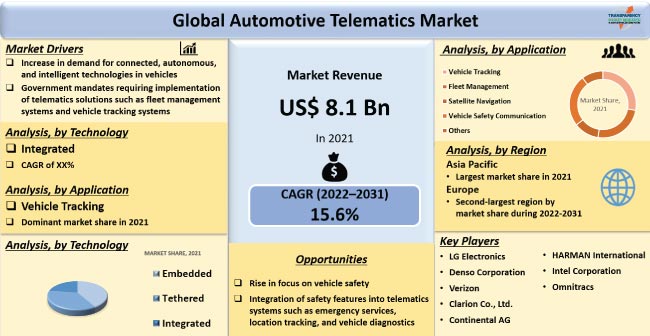

Increase in demand for connected, autonomous, and intelligent technologies in vehicles is driving the global automotive telematics market. Automotive telematics is primarily employed for fleet management and vehicular tracking. Adoption of telematics systems helps improve fleet safety and reduce operating costs. Commercial vehicles, such as forklifts, tractors, and heavy-duty trucks, rely on telematics to monitor operator behaviors such as speed and movement patterns. Governments across the globe are mandating the use of automotive telematics solutions to regulate the driving hours of commercial vehicles. Rise in focus on predictive maintenance, asset productivity, and fleet utilization is expected to augment the global market during the forecast period. Automotive telematics companies are developing new cloud technologies to securely manage vehicle data.

Automotive telematics is a vehicle communication technology that employs GPS technology, wireless connectivity, and telemetry to control wireless tracking, diagnostics, and communication to and from the vehicle. Telematics is a combination of two terminologies: ‘telecommunication’ and ‘informatics’. Wireless telematics devices collect, process, and transmit data for vehicle use, maintenance requirements, and automotive servicing. Automotive telematics boxes, smartphone-based telematics devices, Bluetooth-powered telematics devices, OBD-II port telematics devices, and OEM telematics devices are various types of connected car telematics solutions.

The automotive industry has always been witnessing a flurry of innovations. Automotive manufacturers are integrating IoT into vehicles to boost vehicle efficiency and safety. Telematics, once considered a niche feature, is gradually gaining traction in the automotive sector as consumers are increasingly preferring to buy vehicles with telematics capabilities. Significant developments in aftermarket car telematics technologies are paving the way for solutions offered by third-parties or aftermarket service providers. Commercial fleet operators are focused on reduction of operating costs and achieving their sustainability goals. This, in turn, is likely to boost demand for telematics solutions during the forecast period.

Emergence of Industry 4.0 has led to increase in adoption of automotive telematics systems such as vehicle tracking, satellite navigation, fleet management, and vehicle safety communication in the automotive sector. Expansion of 5G technology has enabled rapid and real-time data transmission across devices, thereby fueling the demand for autonomous technologies. OEMs are focused on transformation of the overall production process to become customer-centric, efficient in production, and flexible in business operations. Thus, surge in adoption of Industry 4.0. to boost product & process innovation and attain risk mitigation and cost optimization is expected to propel the automotive telematics market during the forecast period.

Increase in need for safety during fleet operations is expected to drive the demand for telematics systems in cars. Emergency warning systems, GPS navigation, autonomous driving assistance, sensors, radars, and other telematics solutions boost driver and cargo safety. Thus, rise in focus on safety and robust fleet management and expansion of the sensors market have led to the launch of new telematics solutions. In January 2020, Geotab, Inc., a privately held company that provides telematics hardware solutions, introduced an integrated telematics solution for General Motors. The solution has been primarily developed to enable fleet managers to gain access to vehicular data and improve the fleet management system.

Integration of telematics technology in cars can also help reduce road accident deaths. Road accidents are a leading cause of death for children and young adults. On-time medical assistance can help reduce death rates. Integration of emergency call systems (eCall) can help summon primary medical assistance at an accident location. Since April 2018, the eCall (RP2020) regulation is in force and requires all new M1 and N1 model types of vehicles to be equipped with eCall service.

Based on technology, the global automotive telematics market has been segmented into embedded, tethered, and integrated. The integrated segment is expected to hold major share of the automotive telematics market, owing to rise in adoption of telematics systems in Europe and North America. Most premium and mid-segment vehicle manufacturers are integrating automotive telematics systems in their vehicles. OEMs are increasingly preferring integrated technologies over their embedded counterparts.

In terms of application, the global automotive telematics market has been classified into vehicle tracking, fleet management, satellite navigation, vehicle safety communication, and others. The vehicle tracking segment is anticipated to dominate the market during the forecast period. Telematics vehicle tracking is a basic feature in modern vehicles. Fleet operators and ride-sharing companies rely on vehicle tracking to execute operations. Expansion of the ride-sharing and car rental services market is expected to boost the segment in the next few years. Increase in cases of vehicle thefts is driving the demand for telematics in car insurance. According to Interpol, 4.2 million vehicles were reported to be stolen from 149 countries in 2008.

Asia Pacific is expected to dominate the global automotive telematics market during the forecast period. Rise in adoption of 5G services, expansion of the connected car devices market, and increase in investments in road infrastructure are driving the market worldwide. Major OEMs are adding infotainment systems and enhanced safety and security features to their mid-range vehicles, as consumers are increasingly aware about the safety of vehicles. China, India, and other countries in Asia Pacific are heavily investing in telecommunication and road infrastructure.

Europe and North America are highly developed regions in the market. However, the presence a smaller consumer base and low production of vehicles place these regions below Asia Pacific in terms of revenue generation. The market in Europe is driven by growth of the road safety market and the implantation of various road safety regulations in the region. New vehicles in the EU must be fitted with a ‘black box’ to record technical data. This mandate, effective from July 6, 2022, applies to all categories of cars including passenger cars and utility vehicles, but not yet to two-wheeled motor vehicles.

The global automotive telematics market is fragmented, with a large number of companies controlling the market share. R&D of new technologies is a prominent marketing strategy for automotive telematics market players. Expansion of product portfolios, collaborations, partnerships, and mergers & acquisitions are major strategies adopted by prominent players. Key players operating in the global automotive telematics market include Agero Inc., Clarion Co., Ltd., Continental AG, Delphi Technologies, Denso Corporation, Embitel Technologies, HARMAN International, Inseego Corp., Intel Corporation, LG Electronics, Luxoft, Magneti Marelli S.p.A., Masternaut Limited, Microlise Limited, NTT Docomo Inc., Omnitracs, LLC, Panasonic Corporation, Qualcomm Technologies, Inc., Robert Bosch GmbH, TomTom International B.V., Trimble Inc., Valeo, Verizon Communications Inc., and Vodafone Automotive SpA.

Key players have been profiled in the automotive telematics market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 8.1 Bn |

|

Market Forecast Value in 2031 |

US$ 34.52 Bn |

|

Growth Rate (CAGR) |

15.6% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The automotive telematics market was valued at US$ 8.1 Bn in 2021.

The automotive telematics market is expected to advance at a CAGR of 15.6% by 2031.

The automotive telematics market would be worth US$ 34.52 Bn in 2031.

Increase in demand for improved connectivity and intelligence in vehicles and rise in adoption of Industry 4.0 in automotive sector.

The integrated segment is expected account for major share of the automotive telematics market during the forecast period.

Asia Pacific is anticipated to be highly lucrative region of the global automotive telematics market.

Agero Inc., Clarion Co., Ltd., Continental AG, Delphi Technologies, Denso Corporation, Embitel Technologies, HARMAN International, Inseego Corp., Intel Corporation, LG Electronics, Luxoft, Magneti Marelli S.p.A., Masternaut Limited, Microlise Limited, NTT Docomo Inc., Omnitracs, LLC, Panasonic Corporation, Qualcomm Technologies, Inc., Robert Bosch GmbH, TomTom International B.V., Trimble Inc., Valeo, Verizon Communications Inc., and Vodafone Automotive SpA.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Automotive Telematics Market

3.1. Global Automotive Telematics Market Size, US$ Bn, 2017-2031

4. Market Overview

4.1. Overview

4.2. Key Trend Analysis

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.4. Opportunity

4.5. Porter’s Five Force Analysis

4.6. Value Chain Analysis

4.6.1. List of Key Manufacturers

4.6.2. List of Customers

4.6.3. Level of Integration

4.7. Regulatory Scenario

4.8. SWOT Analysis

5. Technology Roadmap for Automotive Telematics Technology

6. Automotive Telematics Application

6.1. eCall and Roadside Assistance

6.2. Stolen Vehicle Tracking

6.3. Motor Insurance Telematics

6.4. Vehicle Diagnostics and Maintenance

6.5. Over-the-air Updates

6.6. Leasing and Rental Fleet Management

6.7. Electronic Toll Collection and Congestion Charging

6.8. Remote Control and Convenience Services

6.9. Connected Navigation and Infotainment

6.10. Connected in-vehicle Payments

6.11. Wi-Fi Hotspot

7. Vehicle Manufacturers (OEM) Telematics Propositions

7.1. BMW

7.1.1. BMW ConnectedDrive

7.1.2. BMW CarData

7.2. Changan Motors

7.2.1. Changan Motors InCall

7.3. Daimler Group

7.3.1. Mercedes-Benz telematics services

7.3.2. COMAND

7.3.3. MBUX

7.3.4. Mercedes Me Services in Europe and Asia Pacific

7.3.5. Mbrace

7.4. Fiat Chrysler Automobiles

7.4.1. The Uconnect

7.4.2. Mopar Connect in Europe

7.5. Ford Motor Company

7.5.1. Ford SYNC

7.6. Geely

7.6.1. Geely G-Link, Geely G-Netlink 3.0 and GKUI

7.7. General Motors

7.7.1. GM OnStar

7.8. Great Wall Motors

7.8.1. GWM

7.9. Honda Motor Company

7.9.1. HondaLink

7.9.2. AcuraLink

7.10. Hyundai Motor Group

7.10.1. Hyundai Blue Link

7.10.2. Kia UVO

7.11. Jaguar Land Rover Automotive

7.11.1. InControl Telematics Services

7.12. Mazda Motor Corporation

7.12.1. Connect Infotainment System

7.12.2. Mazda Mobile Start

7.13. Nissan Motor Company

7.13.1. NissanConnect Services

7.13.2. Infiniti Connection

7.13.3. NissanConnect and Infiniti InTouch Infotainment Systems

7.14. PSA Group

7.14.1. Telematics Services

7.15. Renault Group

7.15.1. Renault R-Link

7.15.2. Renault Easy Connect

7.16. SAIC Motors

7.16.1. SAIC Connected Car Programs

7.17. Subaru

7.17.1. STARLINK

7.17.2. G-BOOK Telematics Services in Japan

7.18. Tesla

7.18.1. Telematics and Infotainment Services

7.19. Toyota Motor Corporation

7.19.1. T-Connect and G-LINK

7.19.2. Entune/Enform and Safety Connect

7.19.3. Toyota T-Connect Telematics Services

7.19.4. Connected Infotainment Systems

7.20. Volkswagen Group

7.20.1. Audi Connect telematics service

7.20.2. Porsche Car Connect telematics service

7.20.3. Volkswagen Car-Net telematics services

7.21. Volvo Car Group

7.21.1. On-call Telematics Services

7.21.2. Sensus Connect Infotainment System

7.21.3. In-car Delivery, Concierge Services and Car Sharing

8. Value Proposition of Smart City

9. Prospect for Multi-National Organizations in Smart Cities/ Smart Transportation using Telematics

9.1. Proliferation of Automotive Telematics in Developing Smart Cities (Use Case Analysis)

10. Roadmap of Smart Transportation through Telematics Usage

11. Smart City Market Analysis

11.1. Smart Parking

11.2. Emergency Service Network

12. Smart Mobility

12.1. ITS

12.2. Vehicle Telematics

12.3. Connected Cars

13. Global Automotive Telematics Market Analysis and Forecast, by Technology

13.1. Introduction & Definition

13.2. Automotive Telematics Market Value (US$ Bn) Forecast, by Technology, 2017-2031

13.2.1. Embedded

13.2.2. Tethered

13.2.3. Integrated

13.3. Automotive Telematics Market Attractiveness Analysis, by Technology

14. Global Automotive Telematics Market Analysis and Forecast, by Application

14.1. Introduction & Definition

14.2. Automotive Telematics Market Value (US$ Bn) Forecast, by Application, 2017-2031

14.2.1. Vehicle Tracking

14.2.2. Fleet Management

14.2.3. Satellite Navigation

14.2.4. Vehicle Safety Communication

14.2.5. Others

14.3. Automotive Telematics Market Attractiveness Analysis, by Application

15. Global Automotive Telematics Market Analysis and Forecast, by Vehicle Type

15.1. Introduction & Definition

15.2. Automotive Telematics Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

15.2.1. Passenger Vehicle

15.2.2. Light Commercial Vehicle

15.2.3. Heavy Commercial Vehicle

15.3. Automotive Telematics Market Attractiveness Analysis, by Vehicle Type

16. Global Automotive Telematics Market Analysis and Forecast, by Sales Channel

16.1. Introduction & Definition

16.2. Automotive Telematics Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

16.2.1. OEM

16.2.2. Aftermarket

16.3. Automotive Telematics Market Attractiveness Analysis, by Sales Channel

17. Global Automotive Telematics Market Analysis and Forecast, by Region

17.1. Key Findings

17.2. Automotive Telematics Market Value (US$ Bn) Forecast, by Region, 2017-2031

17.2.1. North America

17.2.2. South America

17.2.3. Europe

17.2.4. Asia Pacific

17.2.5. Middle East & Africa

17.3. Automotive Telematics Market Attractiveness Analysis, by Region

18. North America Automotive Telematics Market Value (US$ Bn) Forecast, 2017-2031

18.1. Key Findings

18.2. North America Automotive Telematics Market, by Technology

18.2.1. Embedded

18.2.2. Tethered

18.2.3. Integrated

18.3. North America Automotive Telematics Market, by Application

18.3.1. Vehicle Tracking

18.3.2. Fleet Management

18.3.3. Satellite Navigation

18.3.4. Vehicle Safety Communication

18.3.5. Others

18.4. North America Automotive Telematics Market, by Vehicle Type

18.4.1. Passenger Vehicle

18.4.2. Light Commercial Vehicle

18.4.3. Heavy Commercial Vehicle

18.5. North America Automotive Telematics Market, by Sales Channel

18.5.1. OEM

18.5.2. Aftermarket

18.6. North America Automotive Telematics Market, by Country

18.6.1. U.S.

18.6.2. Canada

18.6.3. Mexico

19. Europe Automotive Telematics Market Value (US$ Bn) Forecast, 2017-2031

19.1. Key Findings

19.2. Europe Automotive Telematics Market, by Technology

19.2.1. Embedded

19.2.2. Tethered

19.2.3. Integrated

19.3. Europe Automotive Telematics Market, by Application

19.3.1. Vehicle Tracking

19.3.2. Fleet Management

19.3.3. Satellite Navigation

19.3.4. Vehicle Safety Communication

19.3.5. Others

19.4. Europe Automotive Telematics Market, by Vehicle Type

19.4.1. Passenger Vehicle

19.4.2. Light Commercial Vehicle

19.4.3. Heavy Commercial Vehicle

19.5. Europe Automotive Telematics Market, by Sales Channel

19.5.1. OEM

19.5.2. Aftermarket

19.6. Europe Automotive Telematics Market, by Country and Sub-region

19.6.1. Germany

19.6.2. U.K.

19.6.3. France

19.6.4. Italy

19.6.5. Spain

19.6.6. Rest of Europe

20. Asia Pacific Automotive Telematics Market Value (US$ Bn) Forecast, 2017-2031

20.1. Key Findings

20.2. Asia Pacific Automotive Telematics Market, by Technology

20.2.1. Embedded

20.2.2. Tethered

20.2.3. Integrated

20.3. Asia Pacific Automotive Telematics Market, by Application

20.3.1. Vehicle Tracking

20.3.2. Fleet Management

20.3.3. Satellite Navigation

20.3.4. Vehicle Safety Communication

20.3.5. Others

20.4. Asia Pacific Automotive Telematics Market, by Vehicle Type

20.4.1. Passenger Vehicle

20.4.2. Light Commercial Vehicle

20.4.3. Heavy Commercial Vehicle

20.5. Asia Pacific Automotive Telematics Market, by Sales Channel

20.5.1. OEM

20.5.2. Aftermarket

20.6. Asia Pacific Automotive Telematics Market, by Country and Sub-region

20.6.1. China

20.6.2. India

20.6.3. Japan

20.6.4. ASEAN

20.6.5. Rest of Asia Pacific

21. Middle East & Africa Automotive Telematics Market Value (US$ Bn) Forecast, 2017-2031

21.1. Key Findings

21.2. Middle East & Africa Automotive Telematics Market, by Technology

21.2.1. Embedded

21.2.2. Tethered

21.2.3. Integrated

21.3. Middle East & Africa Automotive Telematics Market, by Application

21.3.1. Vehicle Tracking

21.3.2. Fleet Management

21.3.3. Satellite Navigation

21.3.4. Vehicle Safety Communication

21.3.5. Others

21.4. Middle East & Africa Automotive Telematics Market, by Vehicle Type

21.4.1. Passenger Vehicle

21.4.2. Light Commercial Vehicle

21.4.3. Heavy Commercial Vehicle

21.5. Middle East & Africa Automotive Telematics Market, by Sales Channel

21.5.1. OEM

21.5.2. Aftermarket

21.6. Middle East & Africa Automotive Telematics Market, by Country and Sub-region

21.6.1. GCC

21.6.2. South Africa

21.6.3. Rest of Middle East & Africa

22. South America Automotive Telematics Market Value (US$ Bn) Forecast, 2017-2031

22.1. Key Findings

22.2. South America Automotive Telematics Market, by Technology

22.2.1. Embedded

22.2.2. Tethered

22.2.3. Integrated

22.3. South America Automotive Telematics Market, by Application

22.3.1. Vehicle Tracking

22.3.2. Fleet Management

22.3.3. Satellite Navigation

22.3.4. Vehicle Safety Communication

22.3.5. Others

22.4. South America Automotive Telematics Market, by Vehicle Type

22.4.1. Passenger Vehicle

22.4.2. Light Commercial Vehicle

22.4.3. Heavy Commercial Vehicle

22.5. South America Automotive Telematics Market, by Sales Channel

22.5.1. OEM

22.5.2. Aftermarket

22.6. South America Automotive Telematics Market, by Country and Sub-region

22.6.1. Brazil

22.6.2. Argentina

22.6.3. Rest of South America

23. Competition Landscape

23.1. Market Share Analysis, by Company (2021)

23.2. Market Player – Competition Matrix (By Tier and Size of companies)

23.3. Company Financials

23.4. Executive Bios/ Key Executive Changes

23.5. Key Market Players (Details – Overview, Overall Revenue, Recent Developments, Strategy)

23.5.1. Agero Inc.

23.5.1.1. Overview

23.5.1.2. Overall Revenue

23.5.1.3. Recent Developments

23.5.1.4. Strategy

23.5.2. Clarion Co., Ltd.

23.5.2.1. Overview

23.5.2.2. Overall Revenue

23.5.2.3. Recent Developments

23.5.2.4. Strategy

23.5.3. Continental AG

23.5.3.1. Overview

23.5.3.2. Overall Revenue

23.5.3.3. Recent Developments

23.5.3.4. Strategy

23.5.4. Delphi Technologies

23.5.4.1. Overview

23.5.4.2. Overall Revenue

23.5.4.3. Recent Developments

23.5.4.4. Strategy

23.5.5. DENSO Corporation

23.5.5.1. Overview

23.5.5.2. Overall Revenue

23.5.5.3. Recent Developments

23.5.5.4. Strategy

23.5.6. Embitel Technologies

23.5.6.1. Overview

23.5.6.2. Overall Revenue

23.5.6.3. Recent Developments

23.5.6.4. Strategy

23.5.7. HARMAN International

23.5.7.1. Overview

23.5.7.2. Overall Revenue

23.5.7.3. Recent Developments

23.5.7.4. Strategy

23.5.8. Inseego Corp

23.5.8.1. Overview

23.5.8.2. Overall Revenue

23.5.8.3. Recent Developments

23.5.8.4. Strategy

23.5.9. Intel Corporation

23.5.9.1. Overview

23.5.9.2. Overall Revenue

23.5.9.3. Recent Developments

23.5.9.4. Strategy

23.5.10. LG Electronics

23.5.10.1. Overview

23.5.10.2. Overall Revenue

23.5.10.3. Recent Developments

23.5.10.4. Strategy

23.5.11. Luxoft

23.5.11.1. Overview

23.5.11.2. Overall Revenue

23.5.11.3. Recent Developments

23.5.11.4. Strategy

23.5.12. Magneti Marelli S.p.A.

23.5.12.1. Overview

23.5.12.2. Overall Revenue

23.5.12.3. Recent Developments

23.5.12.4. Strategy

23.5.13. Masternaut Limited

23.5.13.1. Overview

23.5.13.2. Overall Revenue

23.5.13.3. Recent Developments

23.5.13.4. Strategy

23.5.14. Microlise Limited

23.5.14.1. Overview

23.5.14.2. Overall Revenue

23.5.14.3. Recent Developments

23.5.14.4. Strategy

23.5.15. NTT Docomo Inc.

23.5.15.1. Overview

23.5.15.2. Overall Revenue

23.5.15.3. Recent Developments

23.5.15.4. Strategy

23.5.16. Omnitracs, LLC

23.5.16.1. Overview

23.5.16.2. Overall Revenue

23.5.16.3. Recent Developments

23.5.16.4. Strategy

23.5.17. Panasonic Corporation

23.5.17.1. Overview

23.5.17.2. Overall Revenue

23.5.17.3. Recent Developments

23.5.17.4. Strategy

23.5.18. Qualcomm Technologies, Inc.

23.5.18.1. Overview

23.5.18.2. Overall Revenue

23.5.18.3. Recent Developments

23.5.18.4. Strategy

23.5.19. Robert Bosch GmbH

23.5.19.1. Overview

23.5.19.2. Overall Revenue

23.5.19.3. Recent Developments

23.5.19.4. Strategy

23.5.20. TomTom International B.V.

23.5.20.1. Overview

23.5.20.2. Overall Revenue

23.5.20.3. Recent Developments

23.5.20.4. Strategy

23.5.21. Trimble Inc.

23.5.21.1. Overview

23.5.21.2. Overall Revenue

23.5.21.3. Recent Developments

23.5.21.4. Strategy

23.5.22. Valeo

23.5.22.1. Overview

23.5.22.2. Overall Revenue

23.5.22.3. Recent Developments

23.5.22.4. Strategy

23.5.23. Verizon Communications Inc.

23.5.23.1. Overview

23.5.23.2. Overall Revenue

23.5.23.3. Recent Developments

23.5.23.4. Strategy

23.5.24. Vodafone Automotive SpA

23.5.24.1. Overview

23.5.24.2. Overall Revenue

23.5.24.3. Recent Developments

23.5.24.4. Strategy

List of Tables

Table 1: Global Automotive Telematics Market Value (US$ Bn) Forecast, by Technology, 2017-2031

Table 2: Global Automotive Telematics Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 3: Global Automotive Telematics Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 4: Global Automotive Telematics Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 5: Global Automotive Telematics Market Value (US$ Bn) Forecast, by Region, 2017-2031

Table 6: North America Automotive Telematics Market Value (US$ Bn) Forecast, by Technology, 2017-2031

Table 7: North America Automotive Telematics Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 8: North America Automotive Telematics Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 9: North America Automotive Telematics Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 10: North America Automotive Telematics Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 11: Europe Automotive Telematics Market Value (US$ Bn) Forecast, by Technology, 2017-2031

Table 12: Europe Automotive Telematics Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 13: Europe Automotive Telematics Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 14: Europe Automotive Telematics Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 15: Europe Automotive Telematics Market Value (US$ Bn) Forecast, by Country and Sub-region, 2017-2031

Table 16: Asia Pacific Automotive Telematics Market Value (US$ Bn) Forecast, by Technology, 2017-2031

Table 17: Asia Pacific Automotive Telematics Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 18: Asia Pacific Automotive Telematics Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 19: Asia Pacific Automotive Telematics Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 20: Asia Pacific Automotive Telematics Market Value (US$ Bn) Forecast, by Country and Sub-region, 2017-2031

Table 21: Middle East & Africa Automotive Telematics Market Value (US$ Bn) Forecast, by Technology, 2017-2031

Table 22: Middle East & Africa Automotive Telematics Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 23: Middle East & Africa Automotive Telematics Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 24: Middle East & Africa Automotive Telematics Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 25: Middle East & Africa Automotive Telematics Market Value (US$ Bn) Forecast, by Country and Sub-region, 2017-2031

Table 26: South America Automotive Telematics Market Value (US$ Bn) Forecast, by Technology, 2017-2031

Table 27: South America Automotive Telematics Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 28: South America Automotive Telematics Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 29: South America Automotive Telematics Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 30: South America Automotive Telematics Market Value (US$ Bn) Forecast, by Country and Sub-region, 2017-2031

List of Figures

Figure 1: Global Automotive Telematics Market Value (US$ Bn) Forecast, by Technology, 2017-2031

Figure 2: Global Automotive Telematics Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2022-2031

Figure 3: Global Automotive Telematics Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 4: Global Automotive Telematics Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022-2031

Figure 5: Global Automotive Telematics Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 6: Global Automotive Telematics Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 7: Global Automotive Telematics Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 8: Global Automotive Telematics Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 9: Global Automotive Telematics Market Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 10: Global Automotive Telematics Market, Incremental Opportunity, by Region, Value (US$ Bn), 2022-2031

Figure 11: North America Automotive Telematics Market Value (US$ Bn) Forecast, by Technology, 2017-2031

Figure 12: North America Automotive Telematics Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2022-2031

Figure 13: North America Automotive Telematics Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 14: North America Automotive Telematics Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022-2031

Figure 15: North America Automotive Telematics Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 16: North America Automotive Telematics Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 17: North America Automotive Telematics Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 18: North America Automotive Telematics Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 19: North America Automotive Telematics Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 20: North America Automotive Telematics Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 21: Europe Automotive Telematics Market Value (US$ Bn) Forecast, by Technology, 2017-2031

Figure 22: Europe Automotive Telematics Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2022-2031

Figure 23: Europe Automotive Telematics Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 24: Europe Automotive Telematics Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022-2031

Figure 25: Europe Automotive Telematics Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 26: Europe Automotive Telematics Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 27: Europe Automotive Telematics Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 28: Europe Automotive Telematics Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 29: Europe Automotive Telematics Market Value (US$ Bn) Forecast, by Country and Sub-region, 2017-2031

Figure 30: Europe Automotive Telematics Market, Incremental Opportunity, by Country and Sub-region, Value (US$ Bn), 2022-2031

Figure 31: Asia Pacific Automotive Telematics Market Value (US$ Bn) Forecast, by Technology, 2017-2031

Figure 32: Asia Pacific Automotive Telematics Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2022-2031

Figure 33: Asia Pacific Automotive Telematics Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 34: Asia Pacific Automotive Telematics Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022-2031

Figure 35: Asia Pacific Automotive Telematics Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 36: Asia Pacific Automotive Telematics Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 37: Asia Pacific Automotive Telematics Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 38: Asia Pacific Automotive Telematics Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 39: Asia Pacific Automotive Telematics Market Value (US$ Bn) Forecast, by Country and Sub-region, 2017-2031

Figure 40: Asia Pacific Automotive Telematics Market, Incremental Opportunity, by Country and Sub-region, Value (US$ Bn), 2022-2031

Figure 41: Middle East & Africa Automotive Telematics Market Value (US$ Bn) Forecast, by Technology, 2017-2031

Figure 42: Middle East & Africa Automotive Telematics Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2022-2031

Figure 43: Middle East & Africa Automotive Telematics Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 44: Middle East & Africa Automotive Telematics Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022-2031

Figure 45: Middle East & Africa Automotive Telematics Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 46: Middle East & Africa Automotive Telematics Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 47: Middle East & Africa Automotive Telematics Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 48: Middle East & Africa Automotive Telematics Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 49: Middle East & Africa Automotive Telematics Market Value (US$ Bn) Forecast, by Country and Sub-region, 2017-2031

Figure 50: Middle East & Africa Automotive Telematics Market, Incremental Opportunity, by Country and Sub-region, Value (US$ Bn), 2022-2031

Figure 51: South America Automotive Telematics Market Value (US$ Bn) Forecast, by Technology, 2017-2031

Figure 52: South America Automotive Telematics Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2022-2031

Figure 53: South America Automotive Telematics Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 54: South America Automotive Telematics Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022-2031

Figure 55: South America Automotive Telematics Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 56: South America Automotive Telematics Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 57: South America Automotive Telematics Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 58: South America Automotive Telematics Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 59: South America Automotive Telematics Market Value (US$ Bn) Forecast, by Country and Sub-region, 2017-2031

Figure 60: South America Automotive Telematics Market, Incremental Opportunity, by Country and Sub-region, Value (US$ Bn), 2022-2031