Analysts’ Viewpoint on Automotive Starter Motor and Alternator Market Scenario

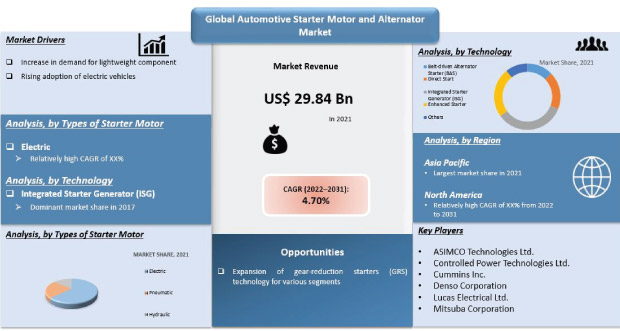

Automotive companies are leveraging the spur in international trade post the COVID-19 pandemic to revive market growth. An increase in production and sales of passenger & commercial vehicles, a rise in demand & sales of hybrid vehicles, and a surge in adoption of electric vehicles are contributing to market growth. Growing awareness about environmental concerns pertaining to car emissions around the globe are some of the key factors influencing the diversification of the automotive starter motor and alternator market into EVs. Moreover, a continuous increase in investments in research and development by manufacturers, coupled with acquisitions and mergers, is also anticipated to propel the global automotive starter motor and alternator market during the forecast period.

An automotive starter is used to turn on the internal combustion engine. The starter motor needs a considerable amount of current to start the engine. When the engine is cranked, the heavy draw of the starter motor temporarily pulls down the battery voltage. The starter motor uses electricity to crank the engine in order to start it. There are three types of automotive starters: electric, pneumatic, and hydraulic. An alternator is used to charge the battery and power the electrical systems in automobiles. It is a part of the car charging system that powers the engine. It consists of three main mechanisms: a voltage regulator, an alternator, and a battery. The alternator works with a battery to produce power for electrical parts of a vehicle, such as an instrument panel and exterior & interior lights. The alternator generates AC power with the help of an electromagnetism mechanism, which is produced through the position of the rotor and the starter.

The reduction in the size of engines has prompted manufacturers to develop starter motors and alternators that are in line with future trends. Different technologies, such as the belt-driven alternator, enhanced starter, integrated starter generators (ISG), and direct start have been introduced. These technologies are utilized in micro-hybrid and hybrid vehicles. The promotion of greener vehicles also boosts the demand for automotive starters and alternators around the world. The global automotive starter motor and alternator market is projected to advance at a decent growth rate throughout the assessment tenure, owing to an increase in the production of vehicles.

An increase in automotive production across the globe is estimated to fuel the global automotive starter motor and alternator market. Moreover, an increase in sales of two-wheelers as well as cars is likely to provide significant opportunities for the automotive starter motor and alternator market during the forecast period. A rise in urbanization and disposable income of people drives the automotive industry, which is further expected to boost the market.

For instance, Valeo SA introduced a hybrid4all system for automobiles. It combines a low-powered engine with a conventional combustion engine, reducing fuel consumption by up to 15%, cutting up the carbon dioxide cost per gram as compared to that of a hybrid in the market.

India and other developed and developing economies are expected to spend more on automobiles, due to advanced technologies, investment in research and development by manufacturers, and the creation of innovative automotive parts, which in turn is anticipated to further drive the automotive starter motor and alternator market across the globe. As such, automotive starter motors and alternators are being extensively used for both petrol and diesel engines.

The increasing adoption of electric vehicles (EV) due to environmental concerns, such as rising air pollution, is projected to boost the demand for automotive starter motors and alternators during the forecast period. Increasing preference for lightweight and fuel-efficient vehicles is also expected to fuel the demand for automotive starter motors and alternators across the globe.

Gear-reduction (GRS) technology is fast replacing direct drive technology starter motors across various segments. Gear-reduction (GRS) technology starter motors offer more advantages than direct-drive starter motors such as the lighter-in-weight feature and compactness. The GRS technology requires less space on any vehicle and enables high specific torque and its speed starts the engine at a faster rate. Furthermore, GRS starter motors enhance battery life as less current is drawn by the starter motor. These motors are easy to service and require low maintenance costs. All these factors are likely to propel the demand for automotive starter motors and alternators.

On the other hand, numerous manufacturers have developed alternators based on the current conventional designs with an external fan. These are classical and ventilated versions that are used in various segments such as tractors, farming equipment, and stationary engines. These alternators are built with utmost care to ensure the stability of output for continuous charging to the battery while operating under different working environments and applications. Also, the servo motor helps to support precise control of angular or linear position, velocity, and acceleration in different vehicles. Apart from these motors, manufacturers are increasing R&D to innovate in self starter motors.

In terms of technology, the global automotive starter motor and alternator market has been classified into belt-driven alternator starter (BAS), direct start, integrated starter generator (ISG), enhanced starter, and others. The integrated starter generator (ISG) segment held a significant share of 39.55% of the market in 2021. The segment is projected to maintain its position in the market and grow at a CAGR of 4.67% during the forecast period. These technologies help support the optimum performance of the automotive motor.

The integrated starter generator (ISG) is just one of the solutions in the EV development timeline. Combining the integrated starter generator (ISG) with the ICE creates a mild hybrid electric vehicle (MHEV), and this hybrid power solution offers new opportunities for electronic modules and electric motors. The integrated starter generator (ISG) unit replaces the starter and alternator functional modules while augmenting the ICE functionality. In this assembly, there are two batteries, one traditional 12V battery, and another 48V lithium-ion battery. Such innovations are boosting the demand for robust vehicle starter motors.

The 48V lithium-ion battery supplies higher power loads, such as the inverter that powers the electric motor of the BSG/ISG. The 12V battery remains on MHEVs to power legacy electronic control modules in the vehicle and provides alternate low voltage electronics power to 48V systems if needed. The MHEV provides automotive original equipment manufacturers (OEMs) an intermediate step between traditional combustion engine propulsion and fully electric propulsion that is found in battery electric vehicles (BEVs).

The Asia Pacific held a notable share of 38.10% of the global automotive starter motor and alternator market in 2021. Developing economies and rapid industrial development in the Asia Pacific are prominent factors driving the automotive starter motor and alternator market in the region. Moreover, an increase in the production of vehicles, combined with continued investments and rising vehicle production in North America, is anticipated to increase the demand for alternators and starter motors for automobiles in the region. On the other hand, the starter motor market for 2 wheeler holds lucrative revenue opportunities for automotive companies in the Asia Pacific region.

The rise in demand for passenger vehicles due to increasing standards of living and refining of disposable incomes in the Asia Pacific and North America has also boosted the demand for these vehicle components in these regions. Thus, to meet the demand of automotive companies, OEMs are increasing the production of car starter motor & car alternators.

The global automotive starter motor and alternator market is fragmented with a higher number of manufacturers controlling the market. The market is also benefitting from the rising investments and mergers and acquisitions of several leading companies. These factors have helped companies improve their research activities, make value addition to their existing pipelines, and diversify their geographical reach. ASIMCO Technologies Ltd., Controlled Power Technologies Ltd., Cummins, Inc., Denso Corporation, Lucas Electrical Ltd., Mitsuba Corporation, Robert Bosch GmbH, Remy International Inc., and Valeo SA are the prominent entities operating in this market.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 29.84 Bn |

|

Market Forecast Value in 2031 |

US$ 47.23 Bn |

|

Growth Rate (CAGR) |

4.70% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value & Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The automotive starter motor and alternator market was valued at US$ 29.84 Bn by 2021.

The automotive starter motor and alternator market is estimated to grow at a CAGR of 4.70% during forecast period.

Increase in demand for lightweight & fuel-efficient vehicles and rise in production of vehicles are key factors driving the automotive starter motor and alternator market.

The passenger vehicles segment accounted for 36.15% share of the automotive starter motor and alternator market in 2021.

Asia Pacific is more attractive for suppliers in the automotive starter motor and alternator market.

Key players of automotive starter motor and alternator market include ASIMCO Technologies Ltd., Controlled Power Technologies Ltd., Cummins, Inc., Denso Corporation, Lucas Electrical Ltd., Mitsuba Corporation, Robert Bosch GmbH, Remy International Inc., and Valeo SA.

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Value US$ Bn, 2017‒2031

1.2. Competitive Dashboard Analysis

2. Market Overview

2.1. TMR Analysis and Recommendations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Opportunity

2.3. Market Factor Analysis

2.3.1. Porter’s Five Force Analysis

2.3.2. SWOT Analysis

2.3.3. Value Chain Analysis

2.3.3.1. Raw Material Supplier

2.3.3.2. Component Manufacturer

2.3.3.3. Sales Channel

2.3.3.4. End Users

2.4. Regulatory Scenario

2.5. Key Trend Analysis

3. COVID-19 Impact Analysis – Automotive Starter Motor and Alternator Market

4. Global Automotive Starter Motor and Alternator Market, by Types of Starter Motor

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Automotive Starter Motor and Alternator Market Size Analysis & Forecast, by Type of Starter Motor, 2017‒2031

4.2.1. Electric

4.2.2. Pneumatic

4.2.3. Hydraulic

5. Global Automotive Starter Motor and Alternator Market, by Alternator Type

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Automotive Starter Motor and Alternator Market Size Analysis & Forecast, by Alternator Type, 2017‒2031

5.2.1. Claw Pole Alternator

5.2.2. Cylindrical Alternator

6. Global Automotive Starter Motor and Alternator Market, By Technology

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Automotive Starter Motor and Alternator Market Size Analysis & Forecast, by Technology, 2017‒2031

6.2.1. Belt-driven Alternator Starter (BAS)

6.2.2. Direct Start

6.2.3. Integrated Starter Generator (ISG)

6.2.4. Enhanced Starter

6.2.5. Others

7. Global Automotive Starter Motor and Alternator Market, By Vehicle Type

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Automotive Starter Motor and Alternator Market Size Analysis & Forecast, by Vehicle Type, 2017‒2031

7.2.1. Passenger Vehicle

7.2.1.1. Hatchback

7.2.1.2. Sedan

7.2.1.3. Utility Vehicles

7.2.2. Light Commercial Vehicles

7.2.3. Trucks

7.2.4. Buses & Coaches

7.2.5. Off-road Vehicle

7.2.5.1. Agriculture Tractors & Equipment

7.2.5.2. Construction & Mining Equipment

8. Global Automotive Starter Motor and Alternator Market, By Sales Channel

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Automotive Starter Motor and Alternator Market Size Analysis & Forecast, by Sales Channel, 2017‒2031

8.2.1. OEMs

8.2.2. Aftermarket

9. Global Automotive Starter Motor and Alternator Market, by Region

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global Automotive Starter Motor and Alternator Market Size Analysis & Forecast, by Region, 2017‒2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. South America

10. North America Automotive Starter Motor and Alternator Market

10.1. Market Snapshot

10.2. Automotive Starter Motor and Alternator Market Size Analysis & Forecast, by Types of Starter Motor, 2017‒2031

10.2.1. Electric

10.2.2. Pneumatic

10.2.3. Hydraulic

10.3. Automotive Starter Motor and Alternator Market Size Analysis & Forecast, by Alternator Type, 2017‒2031

10.3.1. Claw Pole Alternator

10.3.2. Cylindrical Alternator

10.4. Automotive Starter Motor and Alternator Market Size Analysis & Forecast, by Technology, 2017‒2031

10.4.1. Belt-driven Alternator Starter (BAS)

10.4.2. Direct Start

10.4.3. Integrated Starter Generator (ISG)

10.4.4. Enhanced Starter

10.4.5. Others

10.5. Automotive Starter Motor and Alternator Market Size Analysis & Forecast, by Vehicle Type, 2017‒2031

10.5.1. Passenger Vehicle

10.5.1.1. Hatchback

10.5.1.2. Sedan

10.5.1.3. Utility Vehicles

10.5.2. Light Commercial Vehicles

10.5.3. Trucks

10.5.4. Buses & Coaches

10.5.5. Off-road Vehicle

10.5.5.1. Agriculture Tractors & Equipment

10.5.5.2. Construction & Mining Equipment

10.6. Automotive Starter Motor and Alternator Market Size Analysis & Forecast, by Sales Channel, 2017‒2031

10.6.1. OEMs

10.6.2. Aftermarket

10.7. Key Country Analysis – North America Automotive Starter Motor and Alternator Market Size Analysis & Forecast, 2017‒2031

10.7.1. U.S.

10.7.2. Canada

10.7.3. Mexico

11. Europe Automotive Starter Motor and Alternator Market

11.1. Market Snapshot

11.2. Automotive Starter Motor and Alternator Market Size Analysis & Forecast, by Types of Starter Motor, 2017‒2031

11.2.1. Electric

11.2.2. Pneumatic

11.2.3. Hydraulic

11.3. Automotive Starter Motor and Alternator Market Size Analysis & Forecast, by Alternator, 2017‒2031 Type

11.3.1. Claw Pole Alternator

11.3.2. Cylindrical Alternator

11.4. Automotive Starter Motor and Alternator Market Size Analysis & Forecast, by Technology, 2017‒2031

11.4.1. Belt-driven Alternator Starter (BAS)

11.4.2. Direct Start

11.4.3. Integrated Starter Generator (ISG)

11.4.4. Enhanced Starter

11.4.5. Others

11.5. Automotive Starter Motor and Alternator Market Size Analysis & Forecast, by Vehicle Type, 2017‒2031

11.5.1. Passenger Vehicle

11.5.1.1. Hatchback

11.5.1.2. Sedan

11.5.1.3. Utility Vehicles

11.5.2. Light Commercial Vehicles

11.5.3. Trucks

11.5.4. Buses & Coaches

11.5.5. Off-road Vehicle

11.5.5.1. Agriculture Tractors & Equipment

11.5.5.2. Construction & Mining Equipment

11.6. Automotive Starter Motor and Alternator Market Size Analysis & Forecast, by Sales Channel, 2017‒2031

11.6.1. OEMs

11.6.2. Aftermarket

11.7. Key Country Analysis – Europe Automotive Starter Motor and Alternator Market Size Analysis & Forecast, 2017‒2031

11.7.1. Germany

11.7.2. U. K.

11.7.3. France

11.7.4. Italy

11.7.5. Spain

11.7.6. Nordic Countries

11.7.7. Russia & CIS

11.7.8. Rest of Europe

12. Asia Pacific Automotive Starter Motor and Alternator Market

12.1. Market Snapshot

12.2. Automotive Starter Motor and Alternator Market Size Analysis & Forecast, by Types of Starter Motor, 2017‒2031

12.2.1. Electric

12.2.2. Pneumatic

12.2.3. Hydraulic

12.3. Automotive Starter Motor and Alternator Market Size Analysis & Forecast, by Alternator Type, 2017‒2031

12.3.1. Claw Pole Alternator

12.3.2. Cylindrical Alternator

12.4. Automotive Starter Motor and Alternator Market Size Analysis & Forecast, by Technology, 2017‒2031

12.4.1. Belt-driven Alternator Starter (BAS)

12.4.2. Direct Start

12.4.3. Integrated Starter Generator (ISG)

12.4.4. Enhanced Starter

12.4.5. Others

12.5. Automotive Starter Motor and Alternator Market Size Analysis & Forecast, by Vehicle Type, 2017‒2031

12.5.1. Passenger Vehicle

12.5.1.1. Hatchback

12.5.1.2. Sedan

12.5.1.3. Utility Vehicles

12.5.2. Light Commercial Vehicles

12.5.3. Trucks

12.5.4. Buses & Coaches

12.5.5. Off-road Vehicle

12.5.5.1. Agriculture Tractors & Equipment

12.5.5.2. Construction & Mining Equipment

12.6. Automotive Starter Motor and Alternator Market Size Analysis & Forecast, by Sales Channel, 2017‒2031

12.6.1. OEMs

12.6.2. Aftermarket

12.7. Key Country Analysis – Asia Pacific Automotive Starter Motor and Alternator Market Size Analysis & Forecast, 2017‒2031

12.7.1. China

12.7.2. India

12.7.3. Japan

12.7.4. ASEAN Countries

12.7.5. South Korea

12.7.6. ANZ

12.7.7. Rest of Asia Pacific

13. Middle East & Africa Automotive Starter Motor and Alternator Market

13.1. Market Snapshot

13.2. Automotive Starter Motor and Alternator Market Size Analysis & Forecast, by Types of Starter Motor, 2017‒2031

13.2.1. Electric

13.2.2. Pneumatic

13.2.3. Hydraulic

13.3. Automotive Starter Motor and Alternator Market Size Analysis & Forecast, by Alternator Type, 2017‒2031

13.3.1. Claw Pole Alternator

13.3.2. Cylindrical Alternator

13.4. Automotive Starter Motor and Alternator Market Size Analysis & Forecast, by Technology, 2017‒2031

13.4.1. Belt-driven Alternator Starter (BAS)

13.4.2. Direct Start

13.4.3. Integrated Starter Generator (ISG)

13.4.4. Enhanced Starter

13.4.5. Others

13.5. Automotive Starter Motor and Alternator Market Size Analysis & Forecast, by Vehicle Type, 2017‒2031

13.5.1. Passenger Vehicle

13.5.1.1. Hatchback

13.5.1.2. Sedan

13.5.1.3. Utility Vehicles

13.5.2. Light Commercial Vehicles

13.5.3. Trucks

13.5.4. Buses & Coaches

13.5.5. Off-road Vehicle

13.5.5.1. Agriculture Tractors & Equipment

13.5.5.2. Construction & Mining Equipment

13.6. Automotive Starter Motor and Alternator Market Size Analysis & Forecast, by Sales Channel, 2017‒2031

13.6.1. OEMs

13.6.2. Aftermarket

13.7. Key Country Analysis – Middle East & Africa Automotive Starter Motor and Alternator Market Size Analysis & Forecast, 2017‒2031

13.7.1. GCC

13.7.2. South Africa

13.7.3. Turkey

13.7.4. Rest of Middle East & Africa

14. South America Automotive Starter Motor and Alternator Market

14.1. Market Snapshot

14.2. Automotive Starter Motor and Alternator Market Size Analysis & Forecast, by Types of Starter Motor, 2017‒2031

14.2.1. Electric

14.2.2. Pneumatic

14.2.3. Hydraulic

14.3. Automotive Starter Motor and Alternator Market Size Analysis & Forecast, by Alternator Type, 2017‒2031

14.3.1. Claw Pole Alternator

14.3.2. Cylindrical Alternator

14.4. Automotive Starter Motor and Alternator Market Size Analysis & Forecast, by Technology, 2017‒2031

14.4.1. Belt-driven Alternator Starter (BAS)

14.4.2. Direct Start

14.4.3. Integrated Starter Generator (ISG)

14.4.4. Enhanced Starter

14.4.5. Others

14.5. Automotive Starter Motor and Alternator Market Size Analysis & Forecast, by Vehicle Type, 2017‒2031

14.5.1. Passenger Vehicle

14.5.1.1. Hatchback

14.5.1.2. Sedan

14.5.1.3. Utility Vehicles

14.5.2. Light Commercial Vehicles

14.5.3. Trucks

14.5.4. Buses & Coaches

14.5.5. Off-road Vehicle

14.5.5.1. Agriculture Tractors & Equipment

14.5.5.2. Construction & Mining Equipment

14.6. Automotive Starter Motor and Alternator Market Size Analysis & Forecast, by Sales Channel, 2017‒2031

14.6.1. OEMs

14.6.2. Aftermarket

14.7. Key Country Analysis – South America Automotive Starter Motor and Alternator Market Size Analysis & Forecast, 2017‒2031

14.7.1. Brazil

14.7.2. Argentina

14.7.3. Rest of South America

15. Competitive Landscape

15.1. Company Share Analysis/ Brand Share Analysis, 2020

15.2. Pricing comparison among key players

15.3. Company Analysis for each player

pany Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

16. Company Profile/ Key Players

16.1.1. ASIMCO Technologies Ltd.

16.1.1.1. Company Overview

16.1.1.2. Company Footprints

16.1.1.3. Production Locations

16.1.1.4. Product Portfolio

16.1.1.5. Competitors & Customers

16.1.1.6. Subsidiaries & Parent Organization

16.1.1.7. Recent Developments

16.1.1.8. Financial Analysis

16.1.1.9. Profitability

16.1.1.10. Revenue Share

16.1.2. BBB Industries

16.1.2.1. Company Overview

16.1.2.2. Company Footprints

16.1.2.3. Production Locations

16.1.2.4. Product Portfolio

16.1.2.5. Competitors & Customers

16.1.2.6. Subsidiaries & Parent Organization

16.1.2.7. Recent Developments

16.1.2.8. Financial Analysis

16.1.2.9. Profitability

16.1.2.10. Revenue Share

16.1.3. Controlled Power Technologies Ltd.

16.1.3.1. Company Overview

16.1.3.2. Company Footprints

16.1.3.3. Production Locations

16.1.3.4. Product Portfolio

16.1.3.5. Competitors & Customers

16.1.3.6. Subsidiaries & Parent Organization

16.1.3.7. Recent Developments

16.1.3.8. Financial Analysis

16.1.3.9. Profitability

16.1.3.10. Revenue Share

16.1.4. Cummins, Inc.

16.1.4.1. Company Overview

16.1.4.2. Company Footprints

16.1.4.3. Production Locations

16.1.4.4. Product Portfolio

16.1.4.5. Competitors & Customers

16.1.4.6. Subsidiaries & Parent Organization

16.1.4.7. Recent Developments

16.1.4.8. Financial Analysis

16.1.4.9. Profitability

16.1.4.10. Revenue Share

16.1.5. Denso Corporation

16.1.5.1. Company Overview

16.1.5.2. Company Footprints

16.1.5.3. Production Locations

16.1.5.4. Product Portfolio

16.1.5.5. Competitors & Customers

16.1.5.6. Subsidiaries & Parent Organization

16.1.5.7. Recent Developments

16.1.5.8. Financial Analysis

16.1.5.9. Profitability

16.1.5.10. Revenue Share

16.1.6. Hitachi Automotive Systems, Ltd.

16.1.6.1. Company Overview

16.1.6.2. Company Footprints

16.1.6.3. Production Locations

16.1.6.4. Product Portfolio

16.1.6.5. Competitors & Customers

16.1.6.6. Subsidiaries & Parent Organization

16.1.6.7. Recent Developments

16.1.6.8. Financial Analysis

16.1.6.9. Profitability

16.1.6.10. Revenue Share

16.1.7. Hella KGAA Hueck & Co.

16.1.7.1. Company Overview

16.1.7.2. Company Footprints

16.1.7.3. Production Locations

16.1.7.4. Product Portfolio

16.1.7.5. Competitors & Customers

16.1.7.6. Subsidiaries & Parent Organization

16.1.7.7. Recent Developments

16.1.7.8. Financial Analysis

16.1.7.9. Profitability

16.1.7.10. Revenue Share

16.1.8. Lucas Electrical Ltd.

16.1.8.1. Company Overview

16.1.8.2. Company Footprints

16.1.8.3. Production Locations

16.1.8.4. Product Portfolio

16.1.8.5. Competitors & Customers

16.1.8.6. Subsidiaries & Parent Organization

16.1.8.7. Recent Developments

16.1.8.8. Financial Analysis

16.1.8.9. Profitability

16.1.8.10. Revenue Share

16.1.9. Mitsubishi Electric Corporation

16.1.9.1. Company Overview

16.1.9.2. Company Footprints

16.1.9.3. Production Locations

16.1.9.4. Product Portfolio

16.1.9.5. Competitors & Customers

16.1.9.6. Subsidiaries & Parent Organization

16.1.9.7. Recent Developments

16.1.9.8. Financial Analysis

16.1.9.9. Profitability

16.1.9.10. Revenue Share

16.1.10. Mitsuba Corporation

16.1.10.1. Company Overview

16.1.10.2. Company Footprints

16.1.10.3. Production Locations

16.1.10.4. Product Portfolio

16.1.10.5. Competitors & Customers

16.1.10.6. Subsidiaries & Parent Organization

16.1.10.7. Recent Developments

16.1.10.8. Financial Analysis

16.1.10.9. Profitability

16.1.10.10. Revenue Share

16.1.11. Ningbo zhongwang auto fittings Co., LTD.

16.1.11.1. Company Overview

16.1.11.2. Company Footprints

16.1.11.3. Production Locations

16.1.11.4. Product Portfolio

16.1.11.5. Competitors & Customers

16.1.11.6. Subsidiaries & Parent Organization

16.1.11.7. Recent Developments

16.1.11.8. Financial Analysis

16.1.11.9. Profitability

16.1.11.10. Revenue Share

16.1.12. Robert Bosch GmbH

16.1.12.1. Company Overview

16.1.12.2. Company Footprints

16.1.12.3. Production Locations

16.1.12.4. Product Portfolio

16.1.12.5. Competitors & Customers

16.1.12.6. Subsidiaries & Parent Organization

16.1.12.7. Recent Developments

16.1.12.8. Financial Analysis

16.1.12.9. Profitability

16.1.12.10. Revenue Share

16.1.13. Remy International, Inc.

16.1.13.1. Company Overview

16.1.13.2. Company Footprints

16.1.13.3. Production Locations

16.1.13.4. Product Portfolio

16.1.13.5. Competitors & Customers

16.1.13.6. Subsidiaries & Parent Organization

16.1.13.7. Recent Developments

16.1.13.8. Financial Analysis

16.1.13.9. Profitability

16.1.13.10. Revenue Share

16.1.14. RFL Alternators

16.1.14.1. Company Overview

16.1.14.2. Company Footprints

16.1.14.3. Production Locations

16.1.14.4. Product Portfolio

16.1.14.5. Competitors & Customers

16.1.14.6. Subsidiaries & Parent Organization

16.1.14.7. Recent Developments

16.1.14.8. Financial Analysis

16.1.14.9. Profitability

16.1.14.10. Revenue Share

16.1.15. Unipoint Electric MFG Co., Ltd.

16.1.15.1. Company Overview

16.1.15.2. Company Footprints

16.1.15.3. Production Locations

16.1.15.4. Product Portfolio

16.1.15.5. Competitors & Customers

16.1.15.6. Subsidiaries & Parent Organization

16.1.15.7. Recent Developments

16.1.15.8. Financial Analysis

16.1.15.9. Profitability

16.1.15.10. Revenue Share

16.1.16. Valeo SA

16.1.16.1. Company Overview

16.1.16.2. Company Footprints

16.1.16.3. Production Locations

16.1.16.4. Product Portfolio

16.1.16.5. Competitors & Customers

16.1.16.6. Subsidiaries & Parent Organization

16.1.16.7. Recent Developments

16.1.16.8. Financial Analysis

16.1.16.9. Profitability

16.1.16.10. Revenue Share

16.1.17. Other Key Players

16.1.17.1. Company Overview

16.1.17.2. Company Footprints

16.1.17.3. Production Locations

16.1.17.4. Product Portfolio

16.1.17.5. Competitors & Customers

16.1.17.6. Subsidiaries & Parent Organization

16.1.17.7. Recent Developments

16.1.17.8. Financial Analysis

16.1.17.9. Profitability

16.1.17.10. Revenue Share

List of Tables

Table 1: Global Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Types of Starter Motor, 2017‒2031

Table 2: Global Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Types of Starter Motor, 2017‒2031

Table 3: Global Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Alternator Type, 2017‒2031

Table 4: Global Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Alternator Type, 2017‒2031

Table 5: Global Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Technology, 2017‒2031

Table 6: Global Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Technology, 2017‒2031

Table 7: Global Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Vehicle Type, 2017‒2031

Table 8: Global Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 9: Global Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Sales Channel, 2017‒2031

Table 10: Global Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 11: Global Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Region, 2017‒2031

Table 12: Global Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Region, 2017‒2031

Table 13: North America Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Types of Starter Motor, 2017‒2031

Table 14: North America Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Types of Starter Motor, 2017‒2031

Table 15: North America Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Alternator Type, 2017‒2031

Table 16: North America Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Alternator Type, 2017‒2031

Table 17: North America Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Technology, 2017‒2031

Table 18: North America Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Technology, 2017‒2031

Table 19: North America Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Vehicle Type, 2017‒2031

Table 20: North America Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 21: North America Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Sales Channel, 2017‒2031

Table 22: North America Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 23: North America Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Country, 2017‒2031

Table 24: North America Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 25: Europe Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Types of Starter Motor, 2017‒2031

Table 26: Europe Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Types of Starter Motor, 2017‒2031

Table 27: Europe Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Alternator Type, 2017‒2031

Table 28: Europe Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Alternator Type, 2017‒2031

Table 29: Europe Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Technology, 2017‒2031

Table 30: Europe Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Technology, 2017‒2031

Table 31: Europe Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Vehicle Type, 2017‒2031

Table 32: Europe Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 33: Europe Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Sales Channel, 2017‒2031

Table 34: Europe Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 35: Europe Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Country & Sub-region, 2017‒2031

Table 36: Europe Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Country & Sub-region, 2017‒2031

Table 37: Asia Pacific Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Types of Starter Motor, 2017‒2031

Table 38: Asia Pacific Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Types of Starter Motor, 2017‒2031

Table 39: Asia Pacific Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Alternator Type, 2017‒2031

Table 40: Asia Pacific Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Alternator Type, 2017‒2031

Table 41: Asia Pacific Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Technology, 2017‒2031

Table 42: Asia Pacific Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Technology, 2017‒2031

Table 43: Asia Pacific Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Vehicle Type, 2017‒2031

Table 44: Asia Pacific Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 45: Asia Pacific Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Sales Channel, 2017‒2031

Table 46: Asia Pacific Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 47: Asia Pacific Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Country & Sub-region, 2017‒2031

Table 48: Asia Pacific Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Country & Sub-region, 2017‒2031

Table 49: Middle East & Africa Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Types of Starter Motor, 2017‒2031

Table 50: Middle East & Africa Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Types of Starter Motor, 2017‒2031

Table 51: Middle East & Africa Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Alternator Type, 2017‒2031

Table 52: Middle East & Africa Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Alternator Type, 2017‒2031

Table 53: Middle East & Africa Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Technology, 2017‒2031

Table 54: Middle East & Africa Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Technology, 2017‒2031

Table 55: Middle East & Africa Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Vehicle Type, 2017‒2031

Table 56: Middle East & Africa Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 57: Middle East & Africa Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Sales Channel, 2017‒2031

Table 58: Middle East & Africa Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 59: Middle East & Africa Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Country & Sub-region, 2017‒2031

Table 60: Middle East & Africa Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Country & Sub-region, 2017‒2031

Table 61: South America Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Types of Starter Motor, 2017‒2031

Table 62: South America Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Types of Starter Motor, 2017‒2031

Table 63: South America Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Alternator Type, 2017‒2031

Table 64: South America Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Alternator Type, 2017‒2031

Table 65: South America Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Technology, 2017‒2031

Table 66: South America Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Technology, 2017‒2031

Table 67: South America Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Vehicle Type, 2017‒2031

Table 68: South America Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 69: South America Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Sales Channel, 2017‒2031

Table 70: South America Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 71: South America Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Country & Sub-region, 2017‒2031

Table 72: South America Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Country & Sub-region, 2017‒2031

List of Figures

Figure 1: Global Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Types of Starter Motor, 2017‒2031

Figure 2: Global Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Types of Starter Motor, 2017‒2031

Figure 3: Global Automotive Starter Motor and Alternator Market, Incremental Opportunity, by Types of Starter Motor, Value (US$ Bn), 2022‒2031

Figure 4: Global Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Alternator Type, 2017‒2031

Figure 5: Global Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Alternator Type, 2017‒2031

Figure 6: Global Automotive Starter Motor and Alternator Market, Incremental Opportunity, by Alternator Type, Value (US$ Bn), 2022‒2031

Figure 7: Global Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Technology, 2017‒2031

Figure 8: Global Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Technology, 2017‒2031

Figure 9: Global Automotive Starter Motor and Alternator Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2022‒2031

Figure 10: Global Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Vehicle Type, 2017‒2031

Figure 11: Global Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Figure 12: Global Automotive Starter Motor and Alternator Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022‒2031

Figure 13: Global Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Sales Channel, 2017‒2031

Figure 14: Global Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Figure 15: Global Automotive Starter Motor and Alternator Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022‒2031

Figure 16: Global Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Region, 2017‒2031

Figure 17: Global Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Region, 2017‒2031

Figure 18: Global Automotive Starter Motor and Alternator Market, Incremental Opportunity, by Region, Value (US$ Bn), 2022‒2031

Figure 19: North America Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Types of Starter Motor, 2017‒2031

Figure 20: North America Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Types of Starter Motor, 2017‒2031

Figure 21: North America Automotive Starter Motor and Alternator Market, Incremental Opportunity, by Types of Starter Motor, Value (US$ Bn), 2022‒2031

Figure 22: North America Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Alternator Type, 2017‒2031

Figure 23: North America Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Alternator Type, 2017‒2031

Figure 24: North America Automotive Starter Motor and Alternator Market, Incremental Opportunity, by Alternator Type, Value (US$ Bn), 2022‒2031

Figure 25: North America Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Technology, 2017‒2031

Figure 26: North America Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Technology, 2017‒2031

Figure 27: North America Automotive Starter Motor and Alternator Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2022‒2031

Figure 28: North America Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Vehicle Type, 2017‒2031

Figure 29: North America Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Figure 30: North America Automotive Starter Motor and Alternator Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022‒2031

Figure 31: North America Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Sales Channel, 2017‒2031

Figure 32: North America Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Figure 33: North America Automotive Starter Motor and Alternator Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022‒2031

Figure 34: North America Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Country, 2017‒2031

Figure 35: North America Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Figure 36: North America Automotive Starter Motor and Alternator Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022‒2031

Figure 37: Europe Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Types of Starter Motor, 2017‒2031

Figure 38: Europe Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Types of Starter Motor, 2017‒2031

Figure 39: Europe Automotive Starter Motor and Alternator Market, Incremental Opportunity, by Types of Starter Motor, Value (US$ Bn), 2022‒2031

Figure 40: Europe Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Alternator Type, 2017‒2031

Figure 41: Europe Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Alternator Type, 2017‒2031

Figure 42: Europe Automotive Starter Motor and Alternator Market, Incremental Opportunity, by Alternator Type, Value (US$ Bn), 2022‒2031

Figure 43: Europe Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Technology, 2017‒2031

Figure 44: Europe Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Technology, 2017‒2031

Figure 45: Europe Automotive Starter Motor and Alternator Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2022‒2031

Figure 46: Europe Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Vehicle Type, 2017‒2031

Figure 47: Europe Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Figure 48: Europe Automotive Starter Motor and Alternator Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022‒2031

Figure 49: Europe Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Sales Channel, 2017‒2031

Figure 50: Europe Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Figure 51: Europe Automotive Starter Motor and Alternator Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022‒2031

Figure 52: Europe Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Country & Sub-region, 2017‒2031

Figure 53: Europe Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Country & Sub-region, 2017‒2031

Figure 54: Europe Automotive Starter Motor and Alternator Market, Incremental Opportunity, by Country & Sub-region, Value (US$ Bn), 2022‒2031

Figure 55: Asia Pacific Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Types of Starter Motor, 2017‒2031

Figure 56: Asia Pacific Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Types of Starter Motor, 2017‒2031

Figure 57: Asia Pacific Automotive Starter Motor and Alternator Market, Incremental Opportunity, by Types of Starter Motor, Value (US$ Bn), 2022‒2031

Figure 58: Asia Pacific Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Alternator Type, 2017‒2031

Figure 59: Asia Pacific Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Alternator Type, 2017‒2031

Figure 60: Asia Pacific Automotive Starter Motor and Alternator Market, Incremental Opportunity, by Alternator Type, Value (US$ Bn), 2022‒2031

Figure 61: Asia Pacific Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Technology, 2017‒2031

Figure 62: Asia Pacific Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Technology, 2017‒2031

Figure 63: Asia Pacific Automotive Starter Motor and Alternator Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2022‒2031

Figure 64: Asia Pacific Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Vehicle Type, 2017‒2031

Figure 65: Asia Pacific Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Figure 66: Asia Pacific Automotive Starter Motor and Alternator Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022‒2031

Figure 67: Asia Pacific Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Sales Channel, 2017‒2031

Figure 68: Asia Pacific Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Figure 69: Asia Pacific Automotive Starter Motor and Alternator Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022‒2031

Figure 70: Asia Pacific Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Country & Sub-region, 2017‒2031

Figure 71: Asia Pacific Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Country & Sub-region, 2017‒2031

Figure 72: Asia Pacific Automotive Starter Motor and Alternator Market, Incremental Opportunity, by Country & Sub-region, Value (US$ Bn), 2022‒2031

Figure 73: Middle East & Africa Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Types of Starter Motor, 2017‒2031

Figure 74: Middle East & Africa Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Types of Starter Motor, 2017‒2031

Figure 75: Middle East & Africa Automotive Starter Motor and Alternator Market, Incremental Opportunity, by Types of Starter Motor, Value (US$ Bn), 2022‒2031

Figure 76: Middle East & Africa Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Alternator Type, 2017‒2031

Figure 77: Middle East & Africa Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Alternator Type, 2017‒2031

Figure 78: Middle East & Africa Automotive Starter Motor and Alternator Market, Incremental Opportunity, by Alternator Type, Value (US$ Bn), 2022‒2031

Figure 79: Middle East & Africa Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Technology, 2017‒2031

Figure 80: Middle East & Africa Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Technology, 2017‒2031

Figure 81: Middle East & Africa Automotive Starter Motor and Alternator Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2022‒2031

Figure 82: Middle East & Africa Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Vehicle Type, 2017‒2031

Figure 83: Middle East & Africa Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Figure 84: Middle East & Africa Automotive Starter Motor and Alternator Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022‒2031

Figure 85: Middle East & Africa Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Sales Channel, 2017‒2031

Figure 86: Middle East & Africa Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Figure 87: Middle East & Africa Automotive Starter Motor and Alternator Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022‒2031

Figure 88: Middle East & Africa Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Country & Sub-region, 2017‒2031

Figure 89: Middle East & Africa Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Country & Sub-region, 2017‒2031

Figure 90: Middle East & Africa Automotive Starter Motor and Alternator Market, Incremental Opportunity, by Country & Sub-region, Value (US$ Bn), 2022‒2031

Figure 91: South America Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Types of Starter Motor, 2017‒2031

Figure 92: South America Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Types of Starter Motor, 2017‒2031

Figure 93: South America Automotive Starter Motor and Alternator Market, Incremental Opportunity, by Types of Starter Motor, Value (US$ Bn), 2022‒2031

Figure 94: South America Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Alternator Type, 2017‒2031

Figure 95: South America Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Alternator Type, 2017‒2031

Figure 96: South America Automotive Starter Motor and Alternator Market, Incremental Opportunity, by Alternator Type, Value (US$ Bn), 2022‒2031

Figure 97: South America Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Technology, 2017‒2031

Figure 98: South America Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Technology, 2017‒2031

Figure 99: South America Automotive Starter Motor and Alternator Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2022‒2031

Figure 100: South America Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Vehicle Type, 2017‒2031

Figure 101: South America Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Figure 102: South America Automotive Starter Motor and Alternator Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022‒2031

Figure 103: South America Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Sales Channel, 2017‒2031

Figure 104: South America Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Figure 105: South America Automotive Starter Motor and Alternator Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022‒2031

Figure 106: South America Automotive Starter Motor and Alternator Market Volume (Million Units) Forecast, by Country & Sub-region, 2017‒2031

Figure 107: South America Automotive Starter Motor and Alternator Market Value (US$ Bn) Forecast, by Country & Sub-region, 2017‒2031

Figure 108: South America Automotive Starter Motor and Alternator Market, Incremental Opportunity, by Country & Sub-region, Value (US$ Bn), 2022‒2031