Analysts’ Viewpoint

Key players in the automotive shock absorber market, including Brinn Inc., BWI Group, Continental AG, Datsons Engineering Works Pvt. Ltd, DMA Sales, Inc., Duroshox, Endurance Technologies Limited, FCS Auto, Halla Holdings Corp., and KYB, are focusing on improving the quality of shock absorbers by upgrading the raw material used to manufacture them. Moreover, these players aim to provide their customers with a product portfolio that offers cutting-edge benefits, is cost-effective, and durable.

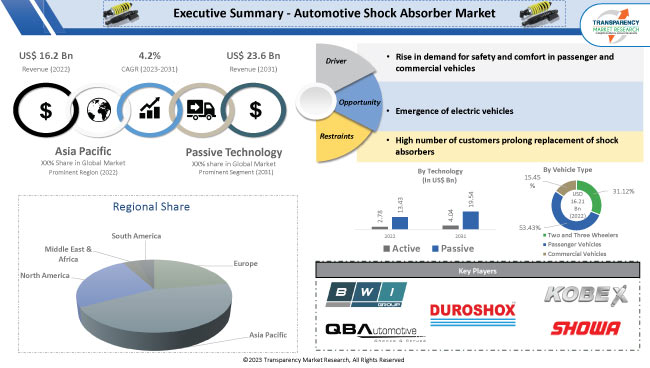

Preference for comfort and safety in vehicles, which enhance the overall performance of vehicles including fuel efficiency and reduce wear and tear of parts, is rising among vehicle users. Advancements in automotive technologies and emergence of electric vehicles are expected to create a lucrative demand for automotive parts and components and consequently, positively impact the future of the automotive shock absorber market. Manufacturers are also tapping into automotive shock absorber business opportunities to ensure the safety of driver, passengers, and vehicle.

A mechanical or hydraulic device used to dampen and absorb shock impulses is referred to as a shock absorber. To do this, the shock's kinetic energy is transformed into another kind of energy, usually heat, and then released as heat.

The most popular type is a rubber shock absorber because of its long lifespan, high flexibility, capacity to absorb shock and vibration, and ability to insulate sound. It can assume the desired shape and meet the demands for stiffness and strength. A specific dampening function of the rubber vibration absorber is its capacity to absorb mechanical energy, particularly high-frequency oscillation energy.

High demand for comfortable vehicles and rapid expansion of the automobile industry across the globe are estimated to fuel the automotive shock absorber industry growth during the forecast period.

Rapid increase in adoption of e-mobility in developed nations and the restructuring of the automotive industry in developing nations are likely to propel the demand for vehicle suspension systems globally. The forthcoming generation of electric vehicles with cutting-edge shock absorber technology is anticipated create significant future business opportunities in the automotive shock absorber market. Additionally, the shock absorber industry is expected to grow during the forecast period due to a rise in consumer preference for personal vehicles.

For instance, in June 2021, BMW unveiled the BMW i4 M50, their most recent electric vehicle. Model-specific adaptive M type suspension is a feature. Sales of electric cars have been increasing significantly for the last few years. For instance, according to the International Energy Agency (IEA), EV sales worldwide registered 10.5 million units in 2022 and surpassed the previous record year of 2021. In 2022, 12% of all new cars sold globally were electric vehicles, and this number has been increasing significantly in the last few years. Therefore, rapid increase in adoption of electric vehicles as future mobility alternatives is anticipated to impact technological developments in automotive shock absorber systems in the next few years.

The shock absorber system dampens vibration and shocks on uneven terrains to improve the rider’s comfort and safety while driving or riding. Growing concerns about comfort and safety in vehicles is driving innovation in motor vehicle shock absorbers. Furthermore, the inclination of end-users toward luxury vehicles with durable shock absorber systems is predicted to boost market demand in the next few years. Analysis of automotive shock absorber market trends reveal that rise in demand for small and lightweight components for new cars is anticipated to fuel the demand for shock absorbers.

Moreover, increased need for sophisticated and reliable shock absorbers is being driven by the rising adoption of SUVsand small SUVs among end-users in both developed and developing nations. Additionally, rising vehicle sales globally, owing to the rise in disposable income of an individual and living standards, is anticipated to have a favorable impact on the global shock absorber business during the forecast period.

In terms of technology, demand for passive shock absorbers was highest in 2022. Majority of passenger and mid-range cars are fitted with passive shock absorbers. The ease of maintenance and replacement task in terms of cost effectiveness is a key factor driving the automotive shock absorber market share held by the segment. This cost effectiveness of passive shock absorber makes it a top choice for low and mid-range automobiles.

However, demand for active shock absorber systems is estimated to increase at a rapid pace during forecast period. Active systems can increase comfort and safety by minimizing body vibrations that are conveyed to the driver and passenger. In contrast to passive systems, active shock absorbers are more pleasant and secure. Therefore, they are extensively integrated in high-end and upper-mid-range vehicles.

Changes in the road surface must be continuously monitored or sensed by the system to work effectively. This information is subsequently transmitted to other components by an electronic control unit. The high price and accessibility of active shock absorber systems have led to extensive usage of these systems in industrialized and developed regions such as North America and Europe.

In terms of vehicle type, the passenger car segment accounted for the prominent market share in 2022, and it is projected to maintain its dominant share during the forecast period. Sales of two-wheelers and commercial vehicles are expanding more slowly than those of passenger cars. For instance, according to predictions from the International Association of Motor Vehicle Manufacturers (OICA), 26 million commercial vehicles and 56 million passenger cars were sold globally in 2021.

The two-wheeler market is anticipated to expand at a notable CAGR during the forecast period. Increased popularity of sports such as dirt riding and motorcycle racing, among others, is expected to boost the adventure sports market. Consequently, demand for shock absorbers is estimated to rise during the forecast period. Moreover, developing and underdeveloped countries, notably in Asia Pacific, are likely to witness an increase in demand for affordable transportation.

Asia Pacific dominated the global shock absorber market in 2022. The business in Asia Pacific is projected expand at a notable CAGR in the next few years. The industry in the region is expanding as a result of increasing automobile sales in China. For instance, according to the International Motor Vehicle Manufacturers Association (OICA), China sold more vehicles than any other country in 2021, more than 26 million. Rising sales and manufacturing of electric vehicles in China and India during the forecast period would further aid in market development in the region. Moreover, the market in the region is expanding due to the easy availability of raw materials, a booming automobile industry, an escalating population, and low manufacturing costs.

Europe was the second-largest market for vehicle shock absorbers worldwide. The shock absorber industry in Europe is likely to be fueled by the superior automotive industries of Germany, France, the U.K., Italy, and other nations in the region. The presence of significant players such as Continental AG, ThyssenKrupp AG, and ZF Friedrichshafen, as well as luxury automakers such as BMW and Audi, is another factor contributing to market progress.

Widespread use of electric vehicles in Europe is a key factor boosting the demand for automotive shock absorbers. For instance, according to data from the International Council on Sustainable Transportation, the number of electric vehicle registrations in Europe topped 2.2 million units in 2022, and it is expected to continue to grow in the next few years.

The market for automotive shock absorbers has become more concentrated, with a few number of manufacturers accounting for major share with large corporations having the potential to accelerate expansion through the adoption of cutting-edge technologies. Key players frequently use acquisitions, mergers of companies, and the expansion of product portfolios as essential business strategy.

Some of the key players operating in the automotive shock absorber business across the globe are Brinn Inc., Continental AG, BWI Group, DMA Sales, Inc., Endurance Technologies Limited, FCS Auto, Halla Holdings Corp., Kobe Suspensions, KYB, LEACREE Company, Magneti Marelli S.p.A., OSC Automotive Inc., QBAutomotive, Hitachi Automotive Systems, Ltd. (TOKICO), Robert Bosch GmbH, SHOWA Corporation, Tenneco Inc., and ZF Friedrichshafen AG.

Key players in the automotive shock absorber market report have been profiled based on vital pointers such as company overview, business strategies, financial overview, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 16.2 Bn |

|

Market Forecast Value in 2031 |

US$ 23.6 Bn |

|

Growth Rate (CAGR) |

4.2% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2022 |

|

Quantitative Units |

Volume (Thousand Units) & US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, key trend analysis, automotive shock absorber market size, automotive shock absorber market share, and forecast of automotive shock absorber market. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 16.2 Bn in 2022

It is expected to expand at a CAGR of 4.2% by 2031

The global business is estimated to reach a value of US$ 23.6 Bn in 2031

Increase in adoption of e-mobility and rise in demand for comfort and safety in vehicles

The passenger vehicle segment accounted for largest share in 2022

Asia Pacific was a highly lucrative region for vendors in 2022

Brinn Inc., BWI Group, Continental AG, Datsons Engineering Works Pvt. Ltd, DMA Sales, Inc., Duroshox, Endurance Technologies Limited, FCS Auto, Halla Holdings Corp., Kobe Suspensions, KYB, LEACREE Company, Magneti Marelli S.p.A., OSC Automotive Inc., QBAutomotive, Hitachi Automotive Systems, Ltd. (TOKICO), Robert Bosch GmbH, Samvardhana Motherson Group, SHOWA Corporation, Tenneco Inc., and ZF Friedrichshafen AG.

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Value US$ Mn, 2017-2031

1.2. Competitive Dashboard Analysis

2. Market Overview

2.1. TMR Analysis and Recommendations

2.2. Market Coverage / Taxonomy

2.3. Market Definition / Scope / Limitations

2.4. Macro-Economic Factors

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunity

2.6. Market Factor Analysis

2.6.1. Porter’s Five Force Analysis

2.6.2. SWOT Analysis

2.7. Regulatory Scenario

2.8. Key Trend Analysis

3. Industry Ecosystem Analysis

3.1. Value Chain Analysis

4. COVID-19 Impact Analysis – Automotive Shock Absorber Market

5. Pricing Analysis

5.1. Cost Structure Analysis

5.2. Profit Margin Analysis

6. Impact Factors: Automotive Shock Absorber

6.1. Emergence of Autonomous Vehicles

6.2. Scarcity of Semiconductors (Chips)

6.3. Regulatory Norms

7. Global Automotive Shock Absorber Market, by Mechanism

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Automotive Shock Absorber Market Size Analysis & Forecast, 2017-2031, by Mechanism

7.2.1. Gas Charged

7.2.2. Hydraulic

8. Global Automotive Shock Absorber Market, by Product Type

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Automotive Shock Absorber Market Size Analysis & Forecast, 2017-2031, by Product Type

8.2.1. Conventional Shock Absorber

8.2.2. Regenerative Shock Absorber

9. Global Automotive Shock Absorber Market, by Technology

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global Automotive Shock Absorber Market Size Analysis & Forecast, 2017-2031, by Technology

9.2.1. Active

9.2.2. Passive

10. Global Automotive Shock Absorber Market, by Vehicle Type

10.1. Market Snapshot

10.1.1. Introduction, Definition, and Key Findings

10.1.2. Market Growth & Y-o-Y Projections

10.1.3. Base Point Share Analysis

10.2. Global Automotive Shock Absorber Market Size Analysis & Forecast, 2017-2031, by Vehicle Type

10.2.1. Two and Three Wheelers

10.2.2. Passenger Vehicles

10.2.2.1. Hatchback

10.2.2.2. Sedan

10.2.2.3. Utility Vehicle

10.2.3. Commercial Vehicles

11. Global Automotive Shock Absorber Market, by Sales Channel

11.1. Market Snapshot

11.1.1. Introduction, Definition, and Key Findings

11.1.2. Market Growth & Y-o-Y Projections

11.1.3. Base Point Share Analysis

11.2. Global Automotive Shock Absorber Market Size Analysis & Forecast, 2017-2031, by Sales Channel

11.2.1. OEM

11.2.2. Aftermarket

12. Global Automotive Shock Absorber Market, by Region

12.1. Market Snapshot

12.1.1. Introduction, Definition, and Key Findings

12.1.2. Market Growth & Y-o-Y Projections

12.1.3. Base Point Share Analysis

12.2. Global Automotive Shock Absorber Market Size Analysis & Forecast, 2017-2031, by Region

12.2.1. North America

12.2.2. Europe

12.2.3. Asia Pacific

12.2.4. Middle East & Africa

12.2.5. South America

13. North America Automotive Shock Absorber Market

13.1. Market Snapshot

13.2. North America Automotive Shock Absorber Market Size Analysis & Forecast, 2017-2031, by Mechanism

13.2.1. Gas Charged

13.2.2. Hydraulic

13.3. North America Automotive Shock Absorber Market Size Analysis & Forecast, 2017-2031, by Product Type

13.3.1. Conventional Shock Absorber

13.3.2. Regenerative Shock Absorber

13.4. North America Automotive Shock Absorber Market Size Analysis & Forecast, 2017-2031, by Technology

13.4.1. Active

13.4.2. Passive

13.5. North America Automotive Shock Absorber Market Size Analysis & Forecast, 2017-2031, by Vehicle Type

13.5.1. Two and Three Wheelers

13.5.2. Passenger Vehicles

13.5.2.1. Hatchback

13.5.2.2. Sedan

13.5.2.3. Utility Vehicle

13.5.3. Commercial Vehicles

13.6. North America Automotive Shock Absorber Market Size Analysis & Forecast, 2017-2031, by Sales Channel

13.6.1. OEM

13.6.2. Aftermarket

13.7. Key Country Analysis – North America Automotive Shock Absorber Market Size Analysis & Forecast, 2017-2031

13.7.1. U.S.

13.7.2. Canada

13.7.3. Mexico

14. Europe Automotive Shock Absorber Market

14.1. Market Snapshot

14.2. Europe Automotive Shock Absorber Market Size Analysis & Forecast, 2017-2031, by Mechanism

14.2.1. Gas Charged

14.2.2. Hydraulic

14.3. Europe Automotive Shock Absorber Market Size Analysis & Forecast, 2017-2031, by Product Type

14.3.1. Conventional Shock Absorber

14.3.2. Regenerative Shock Absorber

14.4. Europe Automotive Shock Absorber Market Size Analysis & Forecast, 2017-2031, by Technology

14.4.1. Active

14.4.2. Passive

14.5. Europe Automotive Shock Absorber Market Size Analysis & Forecast, 2017-2031, by Vehicle Type

14.5.1. Two and Three Wheelers

14.5.2. Passenger Vehicles

14.5.2.1. Hatchback

14.5.2.2. Sedan

14.5.2.3. Utility Vehicle

14.5.3. Commercial Vehicles

14.6. Europe Automotive Shock Absorber Market Size Analysis & Forecast, 2017-2031, by Sales Channel

14.6.1. OEM

14.6.2. Aftermarket

14.7. Key Country Analysis – Europe Automotive Shock Absorber Market Size Analysis & Forecast, 2017-2031

14.7.1. Germany

14.7.2. U. K.

14.7.3. France

14.7.4. Italy

14.7.5. Spain

14.7.6. Nordic Countries

14.7.7. Russia & CIS

14.7.8. Rest of Europe

15. Asia Pacific Automotive Shock Absorber Market

15.1. Market Snapshot

15.2. Asia Pacific Automotive Shock Absorber Market Size Analysis & Forecast, 2017-2031, by Mechanism

15.2.1. Gas Charged

15.2.2. Hydraulic

15.3. Asia Pacific Automotive Shock Absorber Market Size Analysis & Forecast, 2017-2031, by Product Type

15.3.1. Conventional Shock Absorber

15.3.2. Regenerative Shock Absorber

15.4. Asia Pacific Automotive Shock Absorber Market Size Analysis & Forecast, 2017-2031, by Technology

15.4.1. Active

15.4.2. Passive

15.5. Asia Pacific Automotive Shock Absorber Market Size Analysis & Forecast, 2017-2031, by Vehicle Type

15.5.1. Two and Three Wheelers

15.5.2. Passenger Vehicles

15.5.2.1. Hatchback

15.5.2.2. Sedan

15.5.2.3. Utility Vehicle

15.5.3. Commercial Vehicles

15.6. Asia Pacific Automotive Shock Absorber Market Size Analysis & Forecast, 2017-2031, by Sales Channel

15.6.1. OEM

15.6.2. Aftermarket

15.7. Key Country Analysis – Asia Pacific Automotive Shock Absorber Market Size Analysis & Forecast, 2017-2031

15.7.1. China

15.7.2. India

15.7.3. Japan

15.7.4. ASEAN Countries

15.7.5. South Korea

15.7.6. ANZ

15.7.7. Rest of Asia Pacific

16. Middle East & Africa Automotive Shock Absorber Market

16.1. Market Snapshot

16.2. Middle East & Africa Automotive Shock Absorber Market Size Analysis & Forecast, 2017-2031, by Mechanism

16.2.1. Gas Charged

16.2.2. Hydraulic

16.3. Middle East & Africa Automotive Shock Absorber Market Size Analysis & Forecast, 2017-2031, by Product Type

16.3.1. Conventional Shock Absorber

16.3.2. Regenerative Shock Absorber

16.4. Middle East & Africa Automotive Shock Absorber Market Size Analysis & Forecast, 2017-2031, by Technology

16.4.1. Active

16.4.2. Passive

16.5. Middle East & Africa Automotive Shock Absorber Market Size Analysis & Forecast, 2017-2031, by Vehicle Type

16.5.1. Two and Three Wheelers

16.5.2. Passenger Vehicles

16.5.2.1. Hatchback

16.5.2.2. Sedan

16.5.2.3. Utility Vehicle

16.5.3. Commercial Vehicles

16.6. Middle East & Africa Automotive Shock Absorber Market Size Analysis & Forecast, 2017-2031, by Sales Channel

16.6.1. OEM

16.6.2. Aftermarket

16.7. Key Country Analysis – Middle East & Africa Automotive Shock Absorber Market Size Analysis & Forecast, 2017-2031

16.7.1. GCC

16.7.2. South Africa

16.7.3. Turkey

16.7.4. Rest of Middle East & Africa

17. South America Automotive Shock Absorber Market

17.1. Market Snapshot

17.2. South America Automotive Shock Absorber Market Size Analysis & Forecast, 2017-2031, by Mechanism

17.2.1. Gas Charged

17.2.2. Hydraulic

17.3. South America Automotive Shock Absorber Market Size Analysis & Forecast, 2017-2031, by Product Type

17.3.1. Conventional Shock Absorber

17.3.2. Regenerative Shock Absorber

17.4. South America Automotive Shock Absorber Market Size Analysis & Forecast, 2017-2031, by Technology

17.4.1. Active

17.4.2. Passive

17.5. South America Automotive Shock Absorber Market Size Analysis & Forecast, 2017-2031, by Vehicle Type

17.5.1. Two and Three Wheelers

17.5.2. Passenger Vehicles

17.5.2.1. Hatchback

17.5.2.2. Sedan

17.5.2.3. Utility Vehicle

17.5.3. Commercial Vehicles

17.6. South America Automotive Shock Absorber Market Size Analysis & Forecast, 2017-2031, by Sales Channel

17.6.1. OEM

17.6.2. Aftermarket

17.7. Key Country Analysis – South America Automotive Shock Absorber Market Size Analysis & Forecast, 2017-2031

17.7.1. Brazil

17.7.2. Argentina

17.7.3. Rest of South America

18. Competitive Landscape

18.1. Company Share Analysis/ Brand Share Analysis, 2022

18.2. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

19. Company Profile/ Key Players

19.1. Brinn Inc.

19.1.1. Company Overview

19.1.2. Company Footprints

19.1.3. Production Locations

19.1.4. Product Portfolio

19.1.5. Competitors & Customers

19.1.6. Subsidiaries & Parent Organization

19.1.7. Recent Developments

19.1.8. Financial Analysis

19.1.9. Profitability

19.1.10. Revenue Share

19.2. BWI Group

19.2.1. Company Overview

19.2.2. Company Footprints

19.2.3. Production Locations

19.2.4. Product Portfolio

19.2.5. Competitors & Customers

19.2.6. Subsidiaries & Parent Organization

19.2.7. Recent Developments

19.2.8. Financial Analysis

19.2.9. Profitability

19.2.10. Revenue Share

19.3. Continental AG

19.3.1. Company Overview

19.3.2. Company Footprints

19.3.3. Production Locations

19.3.4. Product Portfolio

19.3.5. Competitors & Customers

19.3.6. Subsidiaries & Parent Organization

19.3.7. Recent Developments

19.3.8. Financial Analysis

19.3.9. Profitability

19.3.10. Revenue Share

19.4. Datsons Engineering Works Pvt. Ltd

19.4.1. Company Overview

19.4.2. Company Footprints

19.4.3. Production Locations

19.4.4. Product Portfolio

19.4.5. Competitors & Customers

19.4.6. Subsidiaries & Parent Organization

19.4.7. Recent Developments

19.4.8. Financial Analysis

19.4.9. Profitability

19.4.10. Revenue Share

19.5. DMA Sales, Inc.

19.5.1. Company Overview

19.5.2. Company Footprints

19.5.3. Production Locations

19.5.4. Product Portfolio

19.5.5. Competitors & Customers

19.5.6. Subsidiaries & Parent Organization

19.5.7. Recent Developments

19.5.8. Financial Analysis

19.5.9. Profitability

19.5.10. Revenue Share

19.6. Duroshox

19.6.1. Company Overview

19.6.2. Company Footprints

19.6.3. Production Locations

19.6.4. Product Portfolio

19.6.5. Competitors & Customers

19.6.6. Subsidiaries & Parent Organization

19.6.7. Recent Developments

19.6.8. Financial Analysis

19.6.9. Profitability

19.6.10. Revenue Share

19.7. Endurance Technologies Limited

19.7.1. Company Overview

19.7.2. Company Footprints

19.7.3. Production Locations

19.7.4. Product Portfolio

19.7.5. Competitors & Customers

19.7.6. Subsidiaries & Parent Organization

19.7.7. Recent Developments

19.7.8. Financial Analysis

19.7.9. Profitability

19.7.10. Revenue Share

19.8. FCS Auto

19.8.1. Company Overview

19.8.2. Company Footprints

19.8.3. Production Locations

19.8.4. Product Portfolio

19.8.5. Competitors & Customers

19.8.6. Subsidiaries & Parent Organization

19.8.7. Recent Developments

19.8.8. Financial Analysis

19.8.9. Profitability

19.8.10. Revenue Share

19.9. Halla Holdings Corp.

19.9.1. Company Overview

19.9.2. Company Footprints

19.9.3. Production Locations

19.9.4. Product Portfolio

19.9.5. Competitors & Customers

19.9.6. Subsidiaries & Parent Organization

19.9.7. Recent Developments

19.9.8. Financial Analysis

19.9.9. Profitability

19.9.10. Revenue Share

19.10. Kobe Suspensions

19.10.1. Company Overview

19.10.2. Company Footprints

19.10.3. Production Locations

19.10.4. Product Portfolio

19.10.5. Competitors & Customers

19.10.6. Subsidiaries & Parent Organization

19.10.7. Recent Developments

19.10.8. Financial Analysis

19.10.9. Profitability

19.10.10. Revenue Share

19.11. KYB

19.11.1. Company Overview

19.11.2. Company Footprints

19.11.3. Production Locations

19.11.4. Product Portfolio

19.11.5. Competitors & Customers

19.11.6. Subsidiaries & Parent Organization

19.11.7. Recent Developments

19.11.8. Financial Analysis

19.11.9. Profitability

19.11.10. Revenue Share

19.12. LEACREE Company

19.12.1. Company Overview

19.12.2. Company Footprints

19.12.3. Production Locations

19.12.4. Product Portfolio

19.12.5. Competitors & Customers

19.12.6. Subsidiaries & Parent Organization

19.12.7. Recent Developments

19.12.8. Financial Analysis

19.12.9. Profitability

19.12.10. Revenue Share

19.13. Magneti Marelli S.p.A.

19.13.1. Company Overview

19.13.2. Company Footprints

19.13.3. Production Locations

19.13.4. Product Portfolio

19.13.5. Competitors & Customers

19.13.6. Subsidiaries & Parent Organization

19.13.7. Recent Developments

19.13.8. Financial Analysis

19.13.9. Profitability

19.13.10. Revenue Share

19.14. OSC Automotive Inc.

19.14.1. Company Overview

19.14.2. Company Footprints

19.14.3. Production Locations

19.14.4. Product Portfolio

19.14.5. Competitors & Customers

19.14.6. Subsidiaries & Parent Organization

19.14.7. Recent Developments

19.14.8. Financial Analysis

19.14.9. Profitability

19.14.10. Revenue Share

19.15. QBAutomotive

19.15.1. Company Overview

19.15.2. Company Footprints

19.15.3. Production Locations

19.15.4. Product Portfolio

19.15.5. Competitors & Customers

19.15.6. Subsidiaries & Parent Organization

19.15.7. Recent Developments

19.15.8. Financial Analysis

19.15.9. Profitability

19.15.10. Revenue Share

19.16. Ride Control, LLC

19.16.1. Company Overview

19.16.2. Company Footprints

19.16.3. Production Locations

19.16.4. Product Portfolio

19.16.5. Competitors & Customers

19.16.6. Subsidiaries & Parent Organization

19.16.7. Recent Developments

19.16.8. Financial Analysis

19.16.9. Profitability

19.16.10. Revenue Share

19.17. Hitachi Automotive Systems, Ltd. (TOKICO)

19.17.1. Company Overview

19.17.2. Company Footprints

19.17.3. Production Locations

19.17.4. Product Portfolio

19.17.5. Competitors & Customers

19.17.6. Subsidiaries & Parent Organization

19.17.7. Recent Developments

19.17.8. Financial Analysis

19.17.9. Profitability

19.17.10. Revenue Share

19.18. Robert Bosch GmbH

19.18.1. Company Overview

19.18.2. Company Footprints

19.18.3. Production Locations

19.18.4. Product Portfolio

19.18.5. Competitors & Customers

19.18.6. Subsidiaries & Parent Organization

19.18.7. Recent Developments

19.18.8. Financial Analysis

19.18.9. Profitability

19.18.10. Revenue Share

19.19. Samvardhana Motherson Group

19.19.1. Company Overview

19.19.2. Company Footprints

19.19.3. Production Locations

19.19.4. Product Portfolio

19.19.5. Competitors & Customers

19.19.6. Subsidiaries & Parent Organization

19.19.7. Recent Developments

19.19.8. Financial Analysis

19.19.9. Profitability

19.19.10. Revenue Share

19.20. SHOWA Corporation

19.20.1. Company Overview

19.20.2. Company Footprints

19.20.3. Production Locations

19.20.4. Product Portfolio

19.20.5. Competitors & Customers

19.20.6. Subsidiaries & Parent Organization

19.20.7. Recent Developments

19.20.8. Financial Analysis

19.20.9. Profitability

19.20.10. Revenue Share

19.21. Tenneco Inc.

19.21.1. Company Overview

19.21.2. Company Footprints

19.21.3. Production Locations

19.21.4. Product Portfolio

19.21.5. Competitors & Customers

19.21.6. Subsidiaries & Parent Organization

19.21.7. Recent Developments

19.21.8. Financial Analysis

19.21.9. Profitability

19.21.10. Revenue Share

19.22. ZF Friedrichshafen AG

19.22.1. Company Overview

19.22.2. Company Footprints

19.22.3. Production Locations

19.22.4. Product Portfolio

19.22.5. Competitors & Customers

19.22.6. Subsidiaries & Parent Organization

19.22.7. Recent Developments

19.22.8. Financial Analysis

19.22.9. Profitability

19.22.10. Revenue Share

19.23. Other Key Players

19.23.1. Company Overview

19.23.2. Company Footprints

19.23.3. Production Locations

19.23.4. Product Portfolio

19.23.5. Competitors & Customers

19.23.6. Subsidiaries & Parent Organization

19.23.7. Recent Developments

19.23.8. Financial Analysis

19.23.9. Profitability

19.23.10. Revenue Share

List of Tables

Table 1: Global Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Mechanism, 2017-2031

Table 2: Global Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Mechanism, 2017‒2031

Table 3: Global Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Product Type, 2017-2031

Table 4: Global Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Product Type, 2017‒2031

Table 5: Global Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Technology, 2017-2031

Table 6: Global Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Technology, 2017‒2031

Table 7: Global Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 8: Global Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 9: Global Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 10: Global Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 11: Global Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Table 12: Global Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Region, 2017‒2031

Table 13: North America Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Mechanism, 2017-2031

Table 14: North America Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Mechanism, 2017‒2031

Table 15: North America Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Product Type, 2017-2031

Table 16: North America Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Product Type, 2017‒2031

Table 17: North America Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Technology, 2017-2031

Table 18: North America Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Technology, 2017‒2031

Table 19: North America Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 20: North America Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 21: North America Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 22: North America Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 23: North America Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 24: North America Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 25: Europe Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Mechanism, 2017-2031

Table 26: Europe Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Mechanism, 2017‒2031

Table 27: Europe Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Product Type, 2017-2031

Table 28: Europe Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Product Type, 2017‒2031

Table 29: Europe Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Technology, 2017-2031

Table 30: Europe Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Technology, 2017‒2031

Table 31: Europe Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 32: Europe Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 33: Europe Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 34: Europe Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 35: Europe Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 36: Europe Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 37: Asia Pacific Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Mechanism, 2017-2031

Table 38: Asia Pacific Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Mechanism, 2017‒2031

Table 39: Asia Pacific Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Product Type, 2017-2031

Table 40: Asia Pacific Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Product Type, 2017‒2031

Table 41: Asia Pacific Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Technology, 2017-2031

Table 42: Asia Pacific Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Technology, 2017‒2031

Table 43: Asia Pacific Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 44: Asia Pacific Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 45: Asia Pacific Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 46: Asia Pacific Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 47: Asia Pacific Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 48: Asia Pacific Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 49: Middle East & Africa Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Mechanism, 2017-2031

Table 50: Middle East & Africa Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Mechanism, 2017‒2031

Table 51: Middle East & Africa Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Product Type, 2017-2031

Table 52: Middle East & Africa Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Product Type, 2017‒2031

Table 53: Middle East & Africa Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Technology, 2017-2031

Table 54: Middle East & Africa Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Technology, 2017‒2031

Table 55: Middle East & Africa Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 56: Middle East & Africa Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 57: Middle East & Africa Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 58: Middle East & Africa Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 59: Middle East & Africa Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 60: Middle East & Africa Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 61: South America Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Mechanism, 2017-2031

Table 62: South America Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Mechanism, 2017‒2031

Table 63: South America Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Product Type, 2017-2031

Table 64: South America Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Product Type, 2017‒2031

Table 65: South America Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Technology, 2017-2031

Table 66: South America Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Technology, 2017‒2031

Table 67: South America Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 68: South America Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 69: South America Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 70: South America Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 71: South America Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 72: South America Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Country, 2017‒2031

List of Figures

Figure 1: Global Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Mechanism, 2017-2031

Figure 2: Global Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Mechanism, 2017-2031

Figure 3: Global Automotive Shock Absorber Market, Incremental Opportunity, by Mechanism, Value (US$ Bn), 2023-2031

Figure 4: Global Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Product Type, 2017-2031

Figure 5: Global Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Product Type, 2017-2031

Figure 6: Global Automotive Shock Absorber Market, Incremental Opportunity, by Product Type, Value (US$ Bn), 2023-2031

Figure 7: Global Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Technology, 2017-2031

Figure 8: Global Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Technology, 2017-2031

Figure 9: Global Automotive Shock Absorber Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2023-2031

Figure 10: Global Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 11: Global Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 12: Global Automotive Shock Absorber Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 13: Global Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 14: Global Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 15: Global Automotive Shock Absorber Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 16: Global Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Figure 17: Global Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 18: Global Automotive Shock Absorber Market, Incremental Opportunity, by Region, Value (US$ Bn), 2023-2031

Figure 19: North America Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Mechanism, 2017-2031

Figure 20: North America Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Mechanism, 2017-2031

Figure 21: North America Automotive Shock Absorber Market, Incremental Opportunity, by Mechanism, Value (US$ Bn), 2023-2031

Figure 22: North America Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Product Type, 2017-2031

Figure 23: North America Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Product Type, 2017-2031

Figure 24: North America Automotive Shock Absorber Market, Incremental Opportunity, by Product Type, Value (US$ Bn), 2023-2031

Figure 25: North America Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Technology, 2017-2031

Figure 26: North America Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Technology, 2017-2031

Figure 27: North America Automotive Shock Absorber Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2023-2031

Figure 28: North America Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 29: North America Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 30: North America Automotive Shock Absorber Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 31: North America Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 32: North America Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 33: North America Automotive Shock Absorber Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 34: North America Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 35: North America Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 36: North America Automotive Shock Absorber Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 37: Europe Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Mechanism, 2017-2031

Figure 38: Europe Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Mechanism, 2017-2031

Figure 39: Europe Automotive Shock Absorber Market, Incremental Opportunity, by Mechanism, Value (US$ Bn), 2023-2031

Figure 40: Europe Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Product Type, 2017-2031

Figure 41: Europe Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Product Type, 2017-2031

Figure 42: Europe Automotive Shock Absorber Market, Incremental Opportunity, by Product Type, Value (US$ Bn), 2023-2031

Figure 43: Europe Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Technology, 2017-2031

Figure 44: Europe Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Technology, 2017-2031

Figure 45: Europe Automotive Shock Absorber Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2023-2031

Figure 46: Europe Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 47: Europe Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 48: Europe Automotive Shock Absorber Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 49: Europe Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 50: Europe Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 51: Europe Automotive Shock Absorber Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 52: Europe Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 53: Europe Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 54: Europe Automotive Shock Absorber Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 55: Asia Pacific Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Mechanism, 2017-2031

Figure 56: Asia Pacific Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Mechanism, 2017-2031

Figure 57: Asia Pacific Automotive Shock Absorber Market, Incremental Opportunity, by Mechanism, Value (US$ Bn), 2023-2031

Figure 58: Asia Pacific Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Product Type, 2017-2031

Figure 59: Asia Pacific Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Product Type, 2017-2031

Figure 60: Asia Pacific Automotive Shock Absorber Market, Incremental Opportunity, by Product Type, Value (US$ Bn), 2023-2031

Figure 61: Asia Pacific Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Technology, 2017-2031

Figure 62: Asia Pacific Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Technology, 2017-2031

Figure 63: Asia Pacific Automotive Shock Absorber Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2023-2031

Figure 64: Asia Pacific Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 65: Asia Pacific Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 66: Asia Pacific Automotive Shock Absorber Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 67: Asia Pacific Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 68: Asia Pacific Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 69: Asia Pacific Automotive Shock Absorber Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 70: Asia Pacific Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 71: Asia Pacific Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 72: Asia Pacific Automotive Shock Absorber Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 73: Middle East & Africa Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Mechanism, 2017-2031

Figure 74: Middle East & Africa Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Mechanism, 2017-2031

Figure 75: Middle East & Africa Automotive Shock Absorber Market, Incremental Opportunity, by Mechanism, Value (US$ Bn), 2023-2031

Figure 76: Middle East & Africa Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Product Type, 2017-2031

Figure 77: Middle East & Africa Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Product Type, 2017-2031

Figure 78: Middle East & Africa Automotive Shock Absorber Market, Incremental Opportunity, by Product Type, Value (US$ Bn), 2023-2031

Figure 79: Middle East & Africa Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Technology, 2017-2031

Figure 80: Middle East & Africa Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Technology, 2017-2031

Figure 81: Middle East & Africa Automotive Shock Absorber Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2023-2031

Figure 82: Middle East & Africa Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 83: Middle East & Africa Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 84: Middle East & Africa Automotive Shock Absorber Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 85: Middle East & Africa Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 86: Middle East & Africa Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 87: Middle East & Africa Automotive Shock Absorber Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 88: Middle East & Africa Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 89: Middle East & Africa Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 90: Middle East & Africa Automotive Shock Absorber Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 91: South America Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Mechanism, 2017-2031

Figure 92: South America Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Mechanism, 2017-2031

Figure 93: South America Automotive Shock Absorber Market, Incremental Opportunity, by Mechanism, Value (US$ Bn), 2023-2031

Figure 94: South America Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Product Type, 2017-2031

Figure 95: South America Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Product Type, 2017-2031

Figure 96: South America Automotive Shock Absorber Market, Incremental Opportunity, by Product Type, Value (US$ Bn), 2023-2031

Figure 97: South America Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Technology, 2017-2031

Figure 98: South America Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Technology, 2017-2031

Figure 99: South America Automotive Shock Absorber Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2023-2031

Figure 100: South America Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 101: South America Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 102: South America Automotive Shock Absorber Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 103: South America Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 104: South America Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 105: South America Automotive Shock Absorber Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 106: South America Automotive Shock Absorber Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 107: South America Automotive Shock Absorber Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 108: South America Automotive Shock Absorber Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031