Analysts’ Viewpoint on Automotive Retrofit Electric Vehicle Powertrain Market Scenario

Companies in the automotive retrofit electric vehicle powertrain market are focusing on high-growth applications such as passenger vehicle and inclusive kits to keep their businesses growing post the COVID-19 pandemic. As such, the market is estimated to grow owing to numerous factors, including rising fuel prices that have propelled the demand for electric vehicles. However, not all automotive buyers can invest new electric vehicles due to their high purchasing prices. Automotive retrofit electric vehicle powertrain is an integrated electric powertrain, which is generally retrofitted to an old or classic vehicle in order to convert that vehicle into an electric vehicle to reduce its emissions. This way, conventional vehicle owners can complete their transition to electric mobility to lower their operating costs as well as cut down the emissions. Thus, all the companies should increase their R&D efforts in developing new types of automotive retrofit electric vehicle powertrains that help in smooth transition of conventional vehicles to electric vehicles in a cost-effective way.

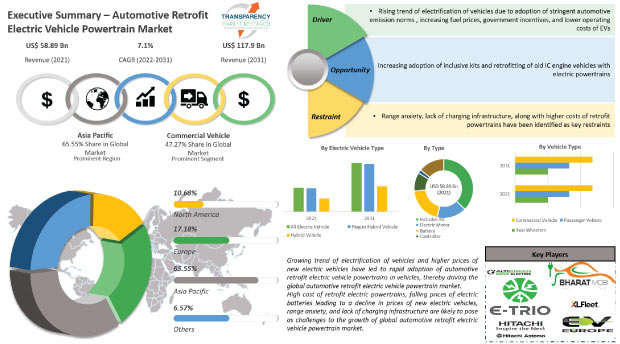

Rising implementation of strict emission norms, increasing fuel prices, and growing demand for cost effective solutions to switch to electric mobility are prominent factors driving the automotive retrofit electric vehicle powertrain market. Moreover, government incentives provided to electric vehicles to lower air pollution levels and announcements to ban the sales of new IC engine vehicles and usage of IC engine vehicles which are more than 15 years old in many countries of Europe and Asia Pacific are also driving the global market.

Electric retrofitting of a vehicle involves replacing the fossil fuel-powered engine, and the connected components such as axles by electric motors, batteries, and a slew of microelectronics including controllers and converters. Retrofitted vehicles are also provided with chargers to charge the vehicles at home as well as public grids.

Electric vehicle retrofitting is seen as a cost effective way and opportunity for a significant number of vehicle owners, who otherwise cannot afford to buy new electric vehicles, to own electric vehicles. Retrofitting is also now being increasingly considered as a way to extend an old vehicle’s life and usability, beyond the end of its lifecycle.

The global inclusive kit market is estimated to reach a valuation of US$ 23.7 Bn by end of 2022, attributed to the high demand from automobile owners who are keen to retrofit their existing conventional vehicles to electric vehicles instead of buying new electric vehicles to save on costs. Inclusive kit is a highly versatile product, since it contains all the essential components for retrofitting such as electric battery, charger, controllers, axles, and converters in one single kit.

Inclusive kits help save time, money, and efforts of vehicle owners that is needed in individually finding each and every component required for converting a vehicle into an electric vehicle. Furthermore, they are witnessing a high demand from the developed markets such as North America and Europe for retrofitting the classic vehicles from 70s, 80s, and 90s. All these factors are propelling their demand for their application as preferred type of automotive retrofit electric vehicle powertrains in the retrofitting of conventional vehicles.

In most cases, especially in developing countries, vehicle owners are increasingly looking to adopt electric mobility; however, prohibitive initial purchasing prices of electric vehicles even after factoring in the government subsidies prevents them from buying new electric vehicles. Thus, the sales of electric vehicle retrofit powertrains in markets such as Asia Pacific are continuously rising. Inclusive kits are widely used even in retrofitting of small cars. This is also proving to be a major factor in the rising demand for inclusive kits.

Inclusive kits are also used widely in retrofitting commercial vehicles. Hence, increasing retrofitting of commercial vehicles is also contributing to the growing demand for inclusive kits.

In addition, the growing demand for electrification of vehicles in developed as well as developing countries is a key factor boosting the demand and production for inclusive kits and therefore the automotive retrofit electric vehicle powertrain market.

Various government incentives are provided for the adoption of electric vehicles, worldwide. Some of these include free parking in central business areas of major cities, waving of road taxes and registration fees, free road usage by charging no road tolls and preferential road pricing, and direct subsidies and cashbacks provided during purchasing of electric vehicles. Many owners want to avail these benefits by switching to electric vehicles. Retrofitting is a very cost effective way for them to switch to electric mobility and enjoy these benefits. This is also boosting the global automotive retrofit electric vehicle powertrain market.

Consistent rise in fuel prices, which have significantly increased the operating costs of IC engine vehicles is propelling the automotive retrofit electric vehicle powertrain market. Furthermore, introduction of new retrofitting services such as converting the conventional vehicles to hybrid vehicles by retaining their IC engines to reduce the impact of factors including range anxiety in the minds of automobile buyers is expected to automotive retrofit electric vehicle powertrain industry.

In terms of electric vehicle type, the global automotive retrofit electric vehicle powertrain market has been segmented into all electric vehicle, plug-in hybrid vehicle, and hybrid vehicle. The all electric vehicle segment of the automotive retrofit electric vehicle powertrain market held a major share of 39.63% in 2021, and will maintain the status quo with a growth rate of more than 7% during the forecast period. The preference for all electric vehicles in automotive retrofit electric vehicle powertrain is mainly due to the inclination of vehicle buyers to opt for full electric conversions to reduce their operating costs, significantly. They also are eligible for incentives on electric vehicles. This has resulted into all electric vehicle being the dominant segment by electric vehicle type in automotive retrofit electric vehicle powertrain market.

Automotive retrofit electric vehicle powertrain market has been classified into two wheeler, passenger vehicle, and commercial vehicle, in terms of vehicle type. The commercial vehicle category dominated the global automotive retrofit electric vehicle powertrain market in 2021 with a market share of 47%. Furthermore, this segment is expected to register an impressive CAGR of 7.06% during the forecast period. Prices of new electric commercial vehicles are very high and fuel costs make up the largest share of the operating costs of fleet owners. Thus, there is a rising trend to retrofit old fleets with electric vehicle powertrains to control their ever increasing operating costs. This leads to commercial vehicle category being the largest one by vehicle type segment. Passenger vehicle was the fastest growing segment with a CAGR of 7.31% due to the growing trend of electrification of automobiles.

Asia Pacific held the largest volume share of 65.55% of the global automotive retrofit electric vehicle powertrain market in 2021. Growth was mainly attributed to key presence of developed countries that are home to advanced research and development as well as manufacturing facilities for automotive retrofit manufactures such as China, Japan, India, and South Korea. The region is home to global headquarters of major automotive retrofit electric powertrain manufacturers including Hitachi Astemo Ltd., Mitsubishi Electric Corporation, and Mando Corporation. Many new startups such as Altigreen, BharatMobi, Folks Motor, and Loop Moto are entering this market in countries including India.

China dominates the automotive retrofit electric vehicle powertrain market in Asia Pacific. India and China contributed 10.61% and 26.41% shares, respectively, to the overall Asia Pacific market. China accounts for almost one-third of the total automotive retrofit electric vehicle powertrain market in the Asia Pacific. The country is a key automotive hub across the globe.

In addition, government incentives on electric vehicles, announcements of baseline years to stop the sales of new IC engine vehicles, rising fuel prices, high taxation on automotive fuels, and growing environmental consciousness in Japan, South Korea, and China primarily propel the market in the region. The market is also driven by increasing conversion of old vehicles to electric vehicles in countries such as China, Japan, India, and South Korea, which is also estimated to boost the automotive retrofit electric vehicle powertrain market in Asia Pacific during the forecast period.

North America and Europe are also large markets for automotive retrofit electric vehicle powertrains, and held value shares of 10.69% and 17.19%, respectively, of the global market in 2021. These markets are primarily driven by retrofitting of old classic vehicles. Electric motors and chargers were the most demanded type of components for automotive retrofit electric vehicle powertrains in these regions.

The South America region is a larger market for automotive retrofit electric vehicle powertrains compared to the Middle East & Africa region; this market in South America is likely to grow at a faster rate compared to the Middle East & Africa region.

The global automotive retrofit electric vehicle powertrain market is fragmented with a number of startups as well as large vendors controlling the majority of the market share. Key firms are spending significant sums of money on comprehensive research and development, primarily to develop products such as inclusive kits. Expansion of product portfolios, joint ventures, and mergers and acquisitions are the key strategies adopted by the market players.

ALTIGREEN, BHARAT MOBI, Continental AG, Delphi Technologies, ETrio, EV Europe, Folks Motor, Hitachi Astemo Ltd., Johnson Electric Holdings Ltd, Loop Moto, Magna International Inc., Mando Corporation, Mitsubishi Electric, Rexnamo Electro Pvt Ltd., Robert Bosch GmbH, Transition One, VerdeMobility and XL Fleet are the prominent entities operating in this market.

|

Attribute |

Detail |

|

Market Size Value in 2021 (Base Year) |

US$ 58.89 Bn |

|

Market Forecast Value in 2031 |

US$ 117.9 Bn |

|

Growth Rate (CAGR) |

7.19% |

|

Forecast Period |

2022-2031 |

|

Quantitative Units |

US$ Bn for Value and Million Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porters Five Forces analysis, Value chain analysis, industry trend analysis, etc. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

The automotive retrofit electric vehicle powertrain market was valued at US$ 58.59 Bn

The automotive retrofit electric vehicle powertrain market is expected to grow with a CAGR of 7.1%, by 2031

The automotive retrofit electric vehicle powertrain market will be worth US$ 117.9 Bn in 2031

The prominent players operating in the automotive retrofit electric vehicle powertrain market are ALTIGREEN, BHARAT MOBI, Continental AG, Delphi Technologies, ETrio, EV Europe, Folks Motor, Hitachi Astemo Ltd., Johnson Electric Holdings Ltd, Loop Moto, Magna International Inc., Mando Corporation, Mitsubishi Electric, Rexnamo Electro Pvt Ltd., Robert Bosch GmbH, Transition One, VerdeMobility and XL Fleet

The automotive retrofit electric vehicle powertrain market in the U.S. is significantly big due to retrofitting of old classic vehicles with electric powertrains

The inclusive kit segment in automotive retrofit electric vehicle powertrain market holds a significant market share

Rising adoption of inclusive kits for the convenience of retrofitting old vehicles and retrofitting commercial vehicles with electric powertrains are some of the prominent trends in the automotive retrofit electric vehicle powertrain market

Asia Pacific is the most lucrative region in the automotive retrofit electric vehicle powertrain market with the highest market share

1. Preface

1.1. About TMR

1.2. Market Coverage / Taxonomy

1.3. Assumptions and Research Methodology

2. Executive Summary

2.1. Global Market Outlook

2.1.1. Market Size, Units, US$ Mn, 2017-2031

2.2. Demand & Supply Side Trends

2.3. TMR Analysis and Recommendations

2.4. Competitive Dashboard Analysis

3. Market Overview

3.1. Market Definition / Scope / Limitations

3.2. Macro-Economic Factors

3.3. Forecast Factors - Relevance & Impact

3.3.1. Global Automotive Retrofit Electric Vehicle Powertrain Market Growth

3.4. Market Dynamics

3.4.1. Drivers

3.4.2. Restraints

3.4.3. Opportunity

3.5. Market Factor Analysis

3.5.1. Porter’s Five Force Analysis

3.5.2. SWOT Analysis

3.6. Regulatory Scenario

4. Key Trend Analysis

5. Industry Ecosystem Analysis

5.1. Value Chain Analysis (Global & India)

5.1.1. Raw Material Supplier

5.1.2. Component Manufacturer

5.1.3. System Suppliers

5.1.4. Tier 1 Players

5.1.5. Tier Players/ Technology Providers

5.1.6. OEMs/ End-users

5.2. Vendor Matrix

6. Pricing Analysis

6.1. Regional Automotive Retrofit Electric Vehicle Powertrain Sales Pricing (US$), 2017-2031

6.2. Component Pricing and Trend

6.3. Battery Prices

6.4. Regional Cost Advantages

6.5. Cost Structure Analysis

6.6. Profit Margin Analysis

7. COVID-19 Impact Analysis – Automotive Retrofit Electric Vehicle Powertrain Market

8. Impact Factors

8.1. Emergence of new electric vehicle technologies

8.2. On-going regulatory transformations

9. Global Automotive Retrofit Electric Vehicle Powertrain Market, by Vehicle Type

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global Automotive Retrofit Electric Vehicle Powertrain Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031, By Vehicle Type

9.2.1. Two-Wheelers

9.2.2. Passenger Vehicle

9.2.2.1. Hatchback

9.2.2.2. Sedan

9.2.2.3. Utility Vehicles

9.2.3. Commercial vehicle

9.2.3.1. Light Commercial Vehicle

9.2.3.2. Heavy Commercial Vehicle

10. Global Automotive Retrofit Electric Vehicle Powertrain Market, by Component

10.1. Market Snapshot

10.1.1. Introduction, Definition, and Key Findings

10.1.2. Market Growth & Y-o-Y Projections

10.1.3. Base Point Share Analysis

10.2. Global Automotive Retrofit Electric Vehicle Powertrain Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031, By Component

10.2.1. Inclusive Kit

10.2.2. Electric Motor

10.2.3. Battery

10.2.4. Controller

10.2.5. Charger

10.2.6. Others (Axle, Converter, etc.)

11. Global Automotive Retrofit Electric Vehicle Powertrain Market, by Electric Vehicle Type

11.1. Market Snapshot

11.1.1. Introduction, Definition, and Key Findings

11.1.2. Market Growth & Y-o-Y Projections

11.1.3. Base Point Share Analysis

11.2. Global Automotive Retrofit Electric Vehicle Powertrain Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031, By Electric Vehicle Type

11.2.1. All Electric Vehicle

11.2.2. Plug-in Hybrid Vehicle

11.2.3. Hybrid Electric Vehicle

12. Global Automotive Retrofit Electric Vehicle Powertrain Market, by Region

12.1. Market Snapshot

12.1.1. Introduction, Definition, and Key Findings

12.1.2. Market Growth & Y-o-Y Projections

12.1.3. Base Point Share Analysis

12.2. Global Automotive Retrofit Electric Vehicle Powertrain Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031, By Region

12.2.1. North America

12.2.2. Europe

12.2.3. Asia Pacific

12.2.4. Middle East & Africa

12.2.5. South America

13. North America Automotive Retrofit Electric Vehicle Powertrain Market

13.1. Market Snapshot

13.2. Automotive Retrofit Electric Vehicle Powertrain Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031, By Vehicle Type

13.2.1. Two-Wheelers

13.2.2. Passenger Vehicle

13.2.2.1. Hatchback

13.2.2.2. Sedan

13.2.2.3. Utility Vehicles

13.2.3. Commercial vehicle

13.2.3.1. Light Commercial Vehicle

13.2.3.2. Heavy Commercial Vehicle

13.3. Automotive Retrofit Electric Vehicle Powertrain Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031, By Component

13.3.1. Inclusive Kit

13.3.2. Electric Motor

13.3.3. Battery

13.3.4. Controller

13.3.5. Charger

13.3.6. Others (Axle, Converter, etc.)

13.4. Automotive Retrofit Electric Vehicle Powertrain Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031, By Electric Vehicle Type

13.4.1. All Electric Vehicle

13.4.2. Plug-in Hybrid Vehicle

13.4.3. Hybrid Electric Vehicle

13.5. Key Country Analysis – North America Automotive Retrofit Electric Vehicle Powertrain Market Size (Units), Revenue (US$ Mn) Analysis & Forecast, 2017-2031

13.5.1. The U. S.

13.5.2. Canada

13.5.3. Mexico

14. Europe Automotive Retrofit Electric Vehicle Powertrain Market

14.1. Market Snapshot

14.2. Automotive Retrofit Electric Vehicle Powertrain Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031, By Vehicle Type

14.2.1. Two-Wheelers

14.2.2. Passenger Vehicle

14.2.2.1. Hatchback

14.2.2.2. Sedan

14.2.2.3. Utility Vehicles

14.2.3. Commercial vehicle

14.2.3.1. Light Commercial Vehicle

14.2.3.2. Heavy Commercial Vehicle

14.3. Automotive Retrofit Electric Vehicle Powertrain Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031, By Component

14.3.1. Inclusive Kit

14.3.2. Electric Motor

14.3.3. Battery

14.3.4. Controller

14.3.5. Charger

14.3.6. Others (Axle, Converter, etc.)

14.4. Automotive Retrofit Electric Vehicle Powertrain Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031, By Electric Vehicle Type

14.4.1. All Electric Vehicle

14.4.2. Plug-in Hybrid Vehicle

14.4.3. Hybrid Electric Vehicle

14.5. Key Country Analysis – Europe Automotive Retrofit Electric Vehicle Powertrain Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031

14.5.1. Germany

14.5.2. U. K.

14.5.3. France

14.5.4. Italy

14.5.5. Spain

14.5.6. Nordic Countries

14.5.7. Russia & CIS

14.5.8. Rest of Europe

15. Asia Pacific Automotive Retrofit Electric Vehicle Powertrain Market

15.1. Market Snapshot

15.2. Automotive Retrofit Electric Vehicle Powertrain Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031, By Vehicle Type

15.2.1. Two-Wheelers

15.2.2. Passenger Vehicle

15.2.2.1. Hatchback

15.2.2.2. Sedan

15.2.2.3. Utility Vehicles

15.2.3. Commercial vehicle

15.2.3.1. Light Commercial Vehicle

15.2.3.2. Heavy Commercial Vehicle

15.3. Automotive Retrofit Electric Vehicle Powertrain Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031, By Component

15.3.1. Inclusive Kit

15.3.2. Electric Motor

15.3.3. Battery

15.3.4. Controller

15.3.5. Charger

15.3.6. Others (Axle, Converter, etc.)

15.4. Automotive Retrofit Electric Vehicle Powertrain Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031, By Electric Vehicle Type

15.4.1. All Electric Vehicle

15.4.2. Plug-in Hybrid Vehicle

15.4.3. Hybrid Electric Vehicle

15.5. Key Country Analysis – Asia Pacific Automotive Retrofit Electric Vehicle Powertrain Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031

15.5.1. China

15.5.2. India

15.5.3. Japan

15.5.4. ASEAN Countries

15.5.5. South Korea

15.5.6. ANZ

15.5.7. Rest of Asia Pacific

16. Middle East & Africa Automotive Retrofit Electric Vehicle Powertrain Market

16.1. Market Snapshot

16.2. Automotive Retrofit Electric Vehicle Powertrain Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031, By Vehicle Type

16.2.1. Two-Wheelers

16.2.2. Passenger Vehicle

16.2.2.1. Hatchback

16.2.2.2. Sedan

16.2.2.3. Utility Vehicles

16.2.3. Commercial vehicle

16.2.3.1. Light Commercial Vehicle

16.2.3.2. Heavy Commercial Vehicle

16.3. Automotive Retrofit Electric Vehicle Powertrain Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031, By Component

16.3.1. Inclusive Kit

16.3.2. Electric Motor

16.3.3. Battery

16.3.4. Controller

16.3.5. Charger

16.3.6. Others (Axle, Converter, etc.)

16.4. Automotive Retrofit Electric Vehicle Powertrain Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031, By Electric Vehicle Type

16.4.1. All Electric Vehicle

16.4.2. Plug-in Hybrid Vehicle

16.4.3. Hybrid Electric Vehicle

16.5. Key Country Analysis – Middle East & Africa Automotive Retrofit Electric Vehicle Powertrain Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031

16.5.1. GCC

16.5.2. South Africa

16.5.3. Turkey

16.5.4. Rest of Middle East & Africa

17. South America Automotive Retrofit Electric Vehicle Powertrain Market

17.1. Market Snapshot

17.2. Automotive Retrofit Electric Vehicle Powertrain Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031, By Vehicle Type

17.2.1. Two-Wheelers

17.2.2. Passenger Vehicle

17.2.2.1. Hatchback

17.2.2.2. Sedan

17.2.2.3. Utility Vehicles

17.2.3. Commercial vehicle

17.2.3.1. Light Commercial Vehicle

17.2.3.2. Heavy Commercial Vehicle

17.3. Automotive Retrofit Electric Vehicle Powertrain Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031, By Component

17.3.1. Inclusive Kit

17.3.2. Electric Motor

17.3.3. Battery

17.3.4. Controller

17.3.5. Charger

17.3.6. Others (Axle, Converter, etc.)

17.4. Automotive Retrofit Electric Vehicle Powertrain Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031, By Electric Vehicle Type

17.4.1. All Electric Vehicle

17.4.2. Plug-in Hybrid Vehicle

17.4.3. Hybrid Electric Vehicle

17.5. Key Country Analysis – South America Automotive Retrofit Electric Vehicle Powertrain Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031

17.5.1. Brazil

17.5.2. Argentina

17.5.3. Rest of South America

18. Competitive Landscape

18.1. Company Share Analysis/ Brand Share Analysis, 2020

18.2. Key Strategy Analysis

18.2.1. Strategic Overview - Expansion, M&A, Partnership

18.2.2. Product & Marketing Strategy

18.3. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share, Executive Bios)

19. Company Profile/ Key Players – Automotive Retrofit Electric Vehicle Powertrain Market

19.1. ALTIGREEN

19.1.1. Company Overview

19.1.2. Company Footprints

19.1.3. Production Locations

19.1.4. Product Portfolio

19.1.5. Competitors & Customers

19.1.6. Subsidiaries & Parent Organization

19.1.7. Recent Developments

19.1.8. Financial Analysis

19.1.9. Profitability

19.1.10. Revenue Share

19.1.11. Executive Bios

19.2. BHARAT MOBI

19.2.1. Company Overview

19.2.2. Company Footprints

19.2.3. Production Locations

19.2.4. Product Portfolio

19.2.5. Competitors & Customers

19.2.6. Subsidiaries & Parent Organization

19.2.7. Recent Developments

19.2.8. Financial Analysis

19.2.9. Profitability

19.2.10. Revenue Share

19.2.11. Executive Bios

19.3. Continental AG

19.3.1. Company Overview

19.3.2. Company Footprints

19.3.3. Production Locations

19.3.4. Product Portfolio

19.3.5. Competitors & Customers

19.3.6. Subsidiaries & Parent Organization

19.3.7. Recent Developments

19.3.8. Financial Analysis

19.3.9. Profitability

19.3.10. Revenue Share

19.3.11. Executive Bios

19.4. Delphi Technologies

19.4.1. Company Overview

19.4.2. Company Footprints

19.4.3. Production Locations

19.4.4. Product Portfolio

19.4.5. Competitors & Customers

19.4.6. Subsidiaries & Parent Organization

19.4.7. Recent Developments

19.4.8. Financial Analysis

19.4.9. Profitability

19.4.10. Revenue Share

19.4.11. Executive Bios

19.5. ETrio

19.5.1. Company Overview

19.5.2. Company Footprints

19.5.3. Production Locations

19.5.4. Product Portfolio

19.5.5. Competitors & Customers

19.5.6. Subsidiaries & Parent Organization

19.5.7. Recent Developments

19.5.8. Financial Analysis

19.5.9. Profitability

19.5.10. Revenue Share

19.5.11. Executive Bios

19.6. EV Europe

19.6.1. Company Overview

19.6.2. Company Footprints

19.6.3. Production Locations

19.6.4. Product Portfolio

19.6.5. Competitors & Customers

19.6.6. Subsidiaries & Parent Organization

19.6.7. Recent Developments

19.6.8. Financial Analysis

19.6.9. Profitability

19.6.10. Revenue Share

19.6.11. Executive Bios

19.7. Folks Motor

19.7.1. Company Overview

19.7.2. Company Footprints

19.7.3. Production Locations

19.7.4. Product Portfolio

19.7.5. Competitors & Customers

19.7.6. Subsidiaries & Parent Organization

19.7.7. Recent Developments

19.7.8. Financial Analysis

19.7.9. Profitability

19.7.10. Revenue Share

19.7.11. Executive Bios

19.8. Hitachi Astemo Ltd.

19.8.1. Company Overview

19.8.2. Company Footprints

19.8.3. Production Locations

19.8.4. Product Portfolio

19.8.5. Competitors & Customers

19.8.6. Subsidiaries & Parent Organization

19.8.7. Recent Developments

19.8.8. Financial Analysis

19.8.9. Profitability

19.8.10. Revenue Share

19.8.11. Executive Bios

19.9. Johnson Electric Holdings Ltd

19.9.1. Company Overview

19.9.2. Company Footprints

19.9.3. Production Locations

19.9.4. Product Portfolio

19.9.5. Competitors & Customers

19.9.6. Subsidiaries & Parent Organization

19.9.7. Recent Developments

19.9.8. Financial Analysis

19.9.9. Profitability

19.9.10. Revenue Share

19.9.11. Executive Bios

19.10. Loop Moto

19.10.1. Company Overview

19.10.2. Company Footprints

19.10.3. Production Locations

19.10.4. Product Portfolio

19.10.5. Competitors & Customers

19.10.6. Subsidiaries & Parent Organization

19.10.7. Recent Developments

19.10.8. Financial Analysis

19.10.9. Profitability

19.10.10. Revenue Share

19.10.11. Executive Bios

19.11. Magna International Inc.

19.11.1. Company Overview

19.11.2. Company Footprints

19.11.3. Production Locations

19.11.4. Product Portfolio

19.11.5. Competitors & Customers

19.11.6. Subsidiaries & Parent Organization

19.11.7. Recent Developments

19.11.8. Financial Analysis

19.11.9. Profitability

19.11.10. Revenue Share

19.11.11. Executive Bios

19.12. Mando Corporation

19.12.1. Company Overview

19.12.2. Company Footprints

19.12.3. Production Locations

19.12.4. Product Portfolio

19.12.5. Competitors & Customers

19.12.6. Subsidiaries & Parent Organization

19.12.7. Recent Developments

19.12.8. Financial Analysis

19.12.9. Profitability

19.12.10. Revenue Share

19.12.11. Executive Bios

19.13. Mitsubishi Electric

19.13.1. Company Overview

19.13.2. Company Footprints

19.13.3. Production Locations

19.13.4. Product Portfolio

19.13.5. Competitors & Customers

19.13.6. Subsidiaries & Parent Organization

19.13.7. Recent Developments

19.13.8. Financial Analysis

19.13.9. Profitability

19.13.10. Revenue Share

19.13.11. Executive Bios

19.14. Rexnamo Electro Pvt Ltd.

19.14.1. Company Overview

19.14.2. Company Footprints

19.14.3. Production Locations

19.14.4. Product Portfolio

19.14.5. Competitors & Customers

19.14.6. Subsidiaries & Parent Organization

19.14.7. Recent Developments

19.14.8. Financial Analysis

19.14.9. Profitability

19.14.10. Revenue Share

19.14.11. Executive Bios

19.15. Robert Bosch GmbH

19.15.1. Company Overview

19.15.2. Company Footprints

19.15.3. Production Locations

19.15.4. Product Portfolio

19.15.5. Competitors & Customers

19.15.6. Subsidiaries & Parent Organization

19.15.7. Recent Developments

19.15.8. Financial Analysis

19.15.9. Profitability

19.15.10. Revenue Share

19.15.11. Executive Bios

19.16. Transition One

19.16.1. Company Overview

19.16.2. Company Footprints

19.16.3. Production Locations

19.16.4. Product Portfolio

19.16.5. Competitors & Customers

19.16.6. Subsidiaries & Parent Organization

19.16.7. Recent Developments

19.16.8. Financial Analysis

19.16.9. Profitability

19.16.10. Revenue Share

19.16.11. Executive Bios

19.17. VerdeMobility

19.17.1. Company Overview

19.17.2. Company Footprints

19.17.3. Production Locations

19.17.4. Product Portfolio

19.17.5. Competitors & Customers

19.17.6. Subsidiaries & Parent Organization

19.17.7. Recent Developments

19.17.8. Financial Analysis

19.17.9. Profitability

19.17.10. Revenue Share

19.17.11. Executive Bios

19.18. XL Fleet

19.18.1. Company Overview

19.18.2. Company Footprints

19.18.3. Production Locations

19.18.4. Product Portfolio

19.18.5. Competitors & Customers

19.18.6. Subsidiaries & Parent Organization

19.18.7. Recent Developments

19.18.8. Financial Analysis

19.18.9. Profitability

19.18.10. Revenue Share

19.18.11. Executive Bios

List of Tables

Table 1: Global Automotive Retrofit Electric Vehicle Powertrain Market Volume (Million Units) Forecast, by Type, 2017-2031

Table 2: Global Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Bn) Forecast, by Type, 2017‒2031

Table 3: Global Automotive Retrofit Electric Vehicle Powertrain Market Volume (Million Units) Forecast, by Electric Vehicle Type, 2017-2031

Table 4: Global Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Bn) Forecast, by Electric Vehicle Type, 2017‒2031

Table 5: Global Automotive Retrofit Electric Vehicle Powertrain Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Table 6: Global Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 7: Global Automotive Retrofit Electric Vehicle Powertrain Market Volume (Million Units) Forecast, by Region, 2017-2031

Table 8: Global Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Bn) Forecast, by Region, 2017‒2031

Table 9: North America Automotive Retrofit Electric Vehicle Powertrain Market Volume (Million Units) Forecast, by Type, 2017-2031

Table 10: North America Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Bn) Forecast, by Type, 2017‒2031

Table 11: North America Automotive Retrofit Electric Vehicle Powertrain Market Volume (Million Units) Forecast, by Electric Vehicle Type, 2017-2031

Table 12: North America Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Bn) Forecast, by Electric Vehicle Type, 2017‒2031

Table 13: North America Automotive Retrofit Electric Vehicle Powertrain Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Table 14: North America Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 15: North America Automotive Retrofit Electric Vehicle Powertrain Market Volume (Million Units) Forecast, by Country, 2017-2031

Table 16: North America Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 17: Europe Automotive Retrofit Electric Vehicle Powertrain Market Volume (Million Units) Forecast, by Type, 2017-2031

Table 18: Europe Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Bn) Forecast, by Type, 2017‒2031

Table 19: Europe Automotive Retrofit Electric Vehicle Powertrain Market Volume (Million Units) Forecast, by Electric Vehicle Type, 2017-2031

Table 20: Europe Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Bn) Forecast, by Electric Vehicle Type, 2017‒2031

Table 21: Europe Automotive Retrofit Electric Vehicle Powertrain Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Table 22: Europe Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 23: Europe Automotive Retrofit Electric Vehicle Powertrain Market Volume (Million Units) Forecast, by Country, 2017-2031

Table 24: Europe Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 25: Asia Pacific Automotive Retrofit Electric Vehicle Powertrain Market Volume (Million Units) Forecast, by Type, 2017-2031

Table 26: Asia Pacific Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Bn) Forecast, by Type, 2017‒2031

Table 27: Asia Pacific Automotive Retrofit Electric Vehicle Powertrain Market Volume (Million Units) Forecast, by Electric Vehicle Type, 2017-2031

Table 28: Asia Pacific Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Bn) Forecast, by Electric Vehicle Type, 2017‒2031

Table 29: Asia Pacific Automotive Retrofit Electric Vehicle Powertrain Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Table 30: Asia Pacific Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 31: Asia Pacific Automotive Retrofit Electric Vehicle Powertrain Market Volume (Million Units) Forecast, by Country, 2017-2031

Table 32: Asia Pacific Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 33: Middle East and Africa Automotive Retrofit Electric Vehicle Powertrain Market Volume (Million Units) Forecast, by Type, 2017-2031

Table 34: Middle East and Africa Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Bn) Forecast, by Type, 2017‒2031

Table 35: Middle East and Africa Automotive Retrofit Electric Vehicle Powertrain Market Volume (Million Units) Forecast, by Electric Vehicle Type, 2017-2031

Table 36: Middle East and Africa Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Bn) Forecast, by Electric Vehicle Type, 2017‒2031

Table 37: Middle East and Africa Automotive Retrofit Electric Vehicle Powertrain Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Table 38: Middle East and Africa Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 39: Middle East and Africa Automotive Retrofit Electric Vehicle Powertrain Market Volume (Million Units) Forecast, by Country, 2017-2031

Table 40: Middle East and Africa Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 41: South America Automotive Retrofit Electric Vehicle Powertrain Market Volume (Million Units) Forecast, by Type, 2017-2031

Table 42: South America Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Bn) Forecast, by Type, 2017‒2031

Table 43: South America Automotive Retrofit Electric Vehicle Powertrain Market Volume (Million Units) Forecast, by Electric Vehicle Type, 2017-2031

Table 44: South America Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Bn) Forecast, by Electric Vehicle Type, 2017‒2031

Table 45: South America Automotive Retrofit Electric Vehicle Powertrain Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Table 46: South America Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 47: South America Automotive Retrofit Electric Vehicle Powertrain Market Volume (Million Units) Forecast, by Country, 2017-2031

Table 48: South America Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Bn) Forecast, by Country, 2017‒2031

List of Figures

Figure 1: Global Automotive Retrofit Electric Vehicle Powertrain Market Volume (Million Units) Forecast, by Component, 2017-2031

Figure 2: Global Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 3: Global Automotive Retrofit Electric Vehicle Powertrain Market, Incremental Opportunity, by Component, Value (US$ Bn), 2022-2031

Figure 4: Global Automotive Retrofit Electric Vehicle Powertrain Market Volume (Million Units) Forecast, by Electric Vehicle Type, 2017-2031

Figure 5: Global Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Bn) Forecast, by Electric Vehicle Type, 2017-2031

Figure 6: Global Automotive Retrofit Electric Vehicle Powertrain Market, Incremental Opportunity, by Electric Vehicle Type, Value (US$ Bn), 2022-2031

Figure 7: Global Automotive Retrofit Electric Vehicle Powertrain Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Figure 8: Global Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 9: Global Automotive Retrofit Electric Vehicle Powertrain Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 10: Global Automotive Retrofit Electric Vehicle Powertrain Market Volume (Million Units) Forecast, by Region, 2017-2031

Figure 11: Global Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 12: Global Automotive Retrofit Electric Vehicle Powertrain Market, Incremental Opportunity, by Region, Value (US$ Bn), 2022-2031

Figure 13: North America Automotive Retrofit Electric Vehicle Powertrain Market Volume (Million Units) Forecast, by Component, 2017-2031

Figure 14: North America Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 15: North America Automotive Retrofit Electric Vehicle Powertrain Market, Incremental Opportunity, by Component, Value (US$ Bn), 2022-2031

Figure 16: North America Automotive Retrofit Electric Vehicle Powertrain Market Volume (Million Units) Forecast, by Electric Vehicle Type, 2017-2031

Figure 17: North America Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Bn) Forecast, by Electric Vehicle Type, 2017-2031

Figure 18: North America Automotive Retrofit Electric Vehicle Powertrain Market, Incremental Opportunity, by Electric Vehicle Type, Value (US$ Bn), 2022-2031

Figure 19: North America Automotive Retrofit Electric Vehicle Powertrain Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Figure 20: North America Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 21: North America Automotive Retrofit Electric Vehicle Powertrain Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 22: North America Automotive Retrofit Electric Vehicle Powertrain Market Volume (Million Units) Forecast, by Country, 2017-2031

Figure 23: North America Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 24: North America Automotive Retrofit Electric Vehicle Powertrain Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 25: Europe Automotive Retrofit Electric Vehicle Powertrain Market Volume (Million Units) Forecast, by Component, 2017-2031

Figure 26: Europe Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 27: Europe Automotive Retrofit Electric Vehicle Powertrain Market, Incremental Opportunity, by Component, Value (US$ Bn), 2022-2031

Figure 28: Europe Automotive Retrofit Electric Vehicle Powertrain Market Volume (Million Units) Forecast, by Electric Vehicle Type, 2017-2031

Figure 29: Europe Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Bn) Forecast, by Electric Vehicle Type, 2017-2031

Figure 30: Europe Automotive Retrofit Electric Vehicle Powertrain Market, Incremental Opportunity, by Electric Vehicle Type, Value (US$ Bn), 2022-2031

Figure 31: Europe Automotive Retrofit Electric Vehicle Powertrain Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Figure 32: Europe Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 33: Europe Automotive Retrofit Electric Vehicle Powertrain Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 34: Europe Automotive Retrofit Electric Vehicle Powertrain Market Volume (Million Units) Forecast, by Country, 2017-2031

Figure 35: Europe Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 36: Europe Automotive Retrofit Electric Vehicle Powertrain Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 37: Asia Pacific Automotive Retrofit Electric Vehicle Powertrain Market Volume (Million Units) Forecast, by Component, 2017-2031

Figure 38: Asia Pacific Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 39: Asia Pacific Automotive Retrofit Electric Vehicle Powertrain Market, Incremental Opportunity, by Component, Value (US$ Bn), 2022-2031

Figure 40: Asia Pacific Automotive Retrofit Electric Vehicle Powertrain Market Volume (Million Units) Forecast, by Electric Vehicle Type, 2017-2031

Figure 41: Asia Pacific Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Bn) Forecast, by Electric Vehicle Type, 2017-2031

Figure 42: Asia Pacific Automotive Retrofit Electric Vehicle Powertrain Market, Incremental Opportunity, by Electric Vehicle Type, Value (US$ Bn), 2022-2031

Figure 43: Asia Pacific Automotive Retrofit Electric Vehicle Powertrain Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Figure 44: Asia Pacific Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 45: Asia Pacific Automotive Retrofit Electric Vehicle Powertrain Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 46: Asia Pacific Automotive Retrofit Electric Vehicle Powertrain Market Volume (Million Units) Forecast, by Country, 2017-2031

Figure 47: Asia Pacific Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 48: Asia Pacific Automotive Retrofit Electric Vehicle Powertrain Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 49: Middle East and Africa Automotive Retrofit Electric Vehicle Powertrain Market Volume (Million Units) Forecast, by Component, 2017-2031

Figure 50: Middle East and Africa Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 51: Middle East and Africa Automotive Retrofit Electric Vehicle Powertrain Market, Incremental Opportunity, by Component, Value (US$ Bn), 2022-2031

Figure 52: Middle East and Africa Automotive Retrofit Electric Vehicle Powertrain Market Volume (Million Units) Forecast, by Electric Vehicle Type, 2017-2031

Figure 53: Middle East and Africa Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Bn) Forecast, by Electric Vehicle Type, 2017-2031

Figure 54: Middle East and Africa Automotive Retrofit Electric Vehicle Powertrain Market, Incremental Opportunity, by Electric Vehicle Type, Value (US$ Bn), 2022-2031

Figure 55: Middle East and Africa Automotive Retrofit Electric Vehicle Powertrain Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Figure 56: Middle East and Africa Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 57: Middle East and Africa Automotive Retrofit Electric Vehicle Powertrain Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 58: Middle East and Africa Automotive Retrofit Electric Vehicle Powertrain Market Volume (Million Units) Forecast, by Country, 2017-2031

Figure 59: Middle East and Africa Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 60: Middle East and Africa Automotive Retrofit Electric Vehicle Powertrain Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 61: South America Automotive Retrofit Electric Vehicle Powertrain Market Volume (Million Units) Forecast, by Component, 2017-2031

Figure 62: South America Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 63: South America Automotive Retrofit Electric Vehicle Powertrain Market, Incremental Opportunity, by Component, Value (US$ Bn), 2022-2031

Figure 64: South America Automotive Retrofit Electric Vehicle Powertrain Market Volume (Million Units) Forecast, by Electric Vehicle Type, 2017-2031

Figure 65: South America Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Bn) Forecast, by Electric Vehicle Type, 2017-2031

Figure 66: South America Automotive Retrofit Electric Vehicle Powertrain Market, Incremental Opportunity, by Electric Vehicle Type, Value (US$ Bn), 2022-2031

Figure 67: South America Automotive Retrofit Electric Vehicle Powertrain Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Figure 68: South America Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 69: South America Automotive Retrofit Electric Vehicle Powertrain Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 70: South America Automotive Retrofit Electric Vehicle Powertrain Market Volume (Million Units) Forecast, by Country, 2017-2031

Figure 71: South America Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 72: South America Automotive Retrofit Electric Vehicle Powertrain Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031