Despite the impact of COVID-19, the demand for medium truck tire retreads dropped only slightly from previous-year levels in the U.S. However, the lack of enough truck drivers and workforce is causing a slowdown in the business activities. The India retreaded tire market, on the other hand, is facing poor market sentiments due to the ongoing pandemic. This has taken a toll on India’s GDP, since the automotive industry accounts for a large share of the GDP. As such, mass vaccination programs are anticipated to revive market growth in India.

The emerging COVID-19 scare due to the ever-evolving infection in Peru and European countries has compelled manufacturers in the retreaded tire market to adopt contingency planning. Retreaders are collaborating with fleet operators to keep economies running during the pandemic. Plymouth’s Bandvulc Tyres Ltd.— a seller of recycled and retreaded tires for commercial trucks & lorries, is being publicized for administering sales growth during the pandemic.

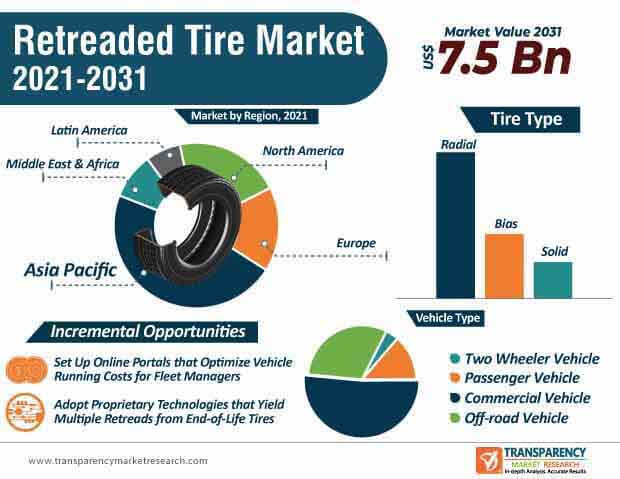

Though retreaded tires offer advantages of environment conservation, the influx of budget tires is leading to a paradigm shift in the market landscape. This explains why the retreaded tire market is slated to clock a CAGR of 0.26% during the assessment period. Budget tires are less expensive than retreaded tires and freshly made tires that offer better quality than retreaded tires. Thus, apart from retreading, stakeholders must diversify their business capabilities in budget tires to stay relevant in the market and supply retreaded tires for customers that place special requirements.

Manufacturers are establishing robust on-site mixing facilities where manufacturers can work with suppliers to procure new types of oils, polymers, and other materials.

In order to revive growth in the retreaded tire market, owing to a sluggish CAGR, companies are going the extra mile to offer technical support, quality control, and visibility. Marangoni— a worldwide recognized brand in retreading systems is increasing the focus on B2B online ordering systems and technical support on machinery and casings in order to improve finished product quality. Technological innovations are at the forefront for stakeholders in the retreaded tire market. Commercial and managerial tools & courses are being implemented to optimize resources and achieve better results.

Manufacturers are increasing their R&D muscle to develop tires without joints and weak structural points to guarantee perfect adhesion and new-tire-level performance. They are gaining proficiency in tire retreading systems that use spliceless pre-cured rings, which fits perfectly to the casing.

With professional management aimed at meeting business needs of customers, Michelin— a France-based multinational tire manufacturing company, is publicizing its MICHELIN Remix® retreaded tires that deliver same performance levels as per safety, robustness, and mileage of new MICHELIN tires. Since commercial vehicles are expected to dictate the highest revenue share compared to all vehicle types in the retreaded tire market, manufacturers are mainly focusing on set up online portals that help to optimize the running costs for fleet managers.

Companies in the retreaded tire market are carrying out retreading as per recommendations from manufacturers and service providers. The decline in raw material consumption is one of the major advantages of retreaded tires. This signals less waste to recycle for a retreaded tire. Retreading is being linked with saving on natural resources.

Apart from trucks, manufacturers in the retreaded tire market are unlocking incremental opportunities by extending supply for civil airliners, since more than 70% of these airliners are fitted with retreaded tires. The U.K. buses are gaining popularity for using retreaded tires. This is evident as an increasing number of end-of-life truck tires is rising in the U.K. every year.

Europe is estimated to dominate the highest revenue share among all regions in the retreaded tire market during the forecast period. More than 90% of the truck tire retreads used in the U.K. are manufactured in the nation. Such findings are grabbing the attention of stakeholders in the market. Moreover, the U.K. retreading industry supports the job of several thousand workers. These jobs are located in deprived areas of the country.

Retreading technologies are emerging as an environment-friendly way to protect bottom lines. This technique helps to reduce the tire total cost of ownership (TCO). Manufacturers in the retreaded tire market are taking advantage of saving on million gallons of oil annually throughout the world. Since end-of-life tires end up in landfills, manufacturers can use them to deploy in trucks and civil airliners.

The low rolling resistance with retreaded tires helps to ensure maximum fuel efficiency. Manufacturers in the retreaded tire market are adopting proprietary technologies that yield multiple retreads. Carefully monitored and audited multi-step manufacturing processes help to deliver uniform results in end products. On-site digital apps are ensuring better manufacturer, supplier, and customer relationships and accountability. There is a demand for consistent and nationwide retread warranty for tires.

The concept of circular economy is becoming a fast growing phenomena in the Europe retreaded tire market. Laura D'Aprile, Director General for the Circular Economy at the Ministry of the Environment, has stressed on the role played by retreaded tires as products resulting from recovery and restoration of end-of-life tires. Manufacturers are taking advantage of such opportunities since repair, reuse, and eco-design are forming the basis of the European plan for establishing a circular economy.

Advanced tire design technology, proven tread designs, and new tire manufacturing standards are contributing to the growth of the retreaded tire market. Technological innovations are delivering reliable retreads that are designed to meet end-use applications and help maximize tire assets. Manufacturers are focusing on important manufacturing processes such as initial inspection, bussing, and casing integrity analysis (CIA), among others, to increase the availability of high quality products.

Analysts’ Viewpoint

Even though profits are increasing for certain companies, poor market sentiments and economic downturn are compelling manufacturers in the retreaded tire market in various countries to diversify their business streams such as in buses, trucks, and civil airliners. The market is expected to reach US$ 7.44 Bn by 2031. However, budget tires and quality compromise with retreaded tires as compared to new tires are emerging as challenges for stakeholders. Hence, companies in the market should adopt proprietary technologies, new tire designs, and multi-step manufacturing processes to ensure uniformity and quality in retreaded tires.

Retreaded Tire Market is projected to reach US$ 7.44 Bn by 2031

Retreaded Tire Market is expected to grow at a CAGR of 0.26% during 2021-2031

Retreaded Tire Market is studied from 2021-2031

Key vendors in the Retreaded Tire Market are Akarmak, Apollo, Bridgestone Corporation, Continental AG, Kal Tire, Marangoni S.p.A., MELION INDUSTRY CO., LTD., MICHELIN, MRF Limited, Parrish Tire and Automotive, RDH Tire & Retread Co., Service Tire Truck Centers, The Goodyear Tire & Rubber Company, THE YOKOHAMA RUBBER CO., LTD., Tyresoles, and West End Tire.

Asia Pacific region Takes Lead in the Retreaded Tire Market

1. Preface

1.1. About TMR

1.2. Market Coverage / Taxonomy

1.3. Market Definition / Scope / Limitations

1.4. Assumptions and Research Methodology

2. Executive Summary

2.1. Global Market Outlook

2.1.1. Market Size, Units, US$ Mn, 2017-2031

2.2. Demand & Supply Side Trends

2.3. TMR Analysis and Recommendations

2.4. Competitive Dashboard Analysis

3. Market Overview

3.1. Market Coverage / Taxonomy

3.2. Market Definition / Scope / Limitations

3.3. Macro-Economic Factors

3.3.1. GDP & GDP Growth Rate

3.3.2. Per Capita Income

3.4. Market Dynamics

3.4.1. Drivers

3.4.2. Restraints

3.4.3. Opportunity

3.5. Market Factor Analysis

3.5.1. Porter’s Five Force Analysis

3.5.2. SWOT Analysis

3.6. Regulatory Scenario

4. Key Trend Analysis

5. Industry Ecosystem Analysis

5.1. Value Chain Analysis

5.1.1. Tier Manufacturer

5.1.2. End Use/OEMs/Aftermarket

5.1.3. Retreaded Tire Companies

5.1.4. End Use/Aftermarket

5.2. Vendor Matrix

5.3. Gross Margin Analysis

6. Global Retreaded Tire Market Volume (Thousand Units) & Value (US$ Mn) Analysis and Forecast, 2017-2031

6.1. Current and Future Market Value (US$ Mn) Projections, 2017-2031

7. Pricing Analysis

7.1. Regional Retreaded TireSales Pricing (US$), 2017-2031

7.2. Cost Structure Analysis

7.3. Profit Margin Analysis

8. COVID-19 Impact Analysis – Retreaded Tire

9. Impact Factors

9.1. Growing road infrastructure

9.2. Rise in trade activities

9.3. Advancements in additive manufacturing technology

10. Global Retreaded Tire Market Analysis and Forecast, by Process

10.1. Market Snapshot

10.1.1. Introduction, Definition, and Key Findings

10.1.2. Market Growth & Y-o-Y Projections

10.1.3. Base Point Share Analysis

10.2. Global Retreaded Tire Market Volume (Thousand Units) & Value (US$ Mn) Analysis & Forecast, by Process, 2017-2031

10.2.1. Pre-Cure (Cold Treading)

10.2.2. Mold-cure (Hot Treading)

11. Global Retreaded Tire Market Analysis and Forecast, by Vehicle Type

11.1. Market Snapshot

11.1.1. Introduction, Definition, and Key Findings

11.1.2. Market Growth & Y-o-Y Projections

11.1.3. Base Point Share Analysis

11.2. Global Retreaded Tire Market Volume (Thousand Units) & Value (US$ Mn) Analysis & Forecast, by Vehicle Type, 2017-2031

11.2.1. Two Wheeler Vehicle

11.2.2. Passenger Vehicle

11.2.2.1. Hatchback

11.2.2.2. Sedan

11.2.2.3. Utility Vehicle

11.2.3. Commercial Vehicle

11.2.3.1. Light Commercial Vehicle

11.2.3.2. Heavy Commercial Vehicle

11.2.3.3. Buses & Coaches

11.2.4. Off-road Vehicle

11.2.4.1. Agriculture Equipment

11.2.4.1.1. Tractors

11.2.4.1.2. Harvesters

11.2.4.1.3. Trailers

11.2.4.1.4. Loaders

11.2.4.1.5. Others

11.2.4.2. Construction and Mining Equipment

11.2.4.2.1. Excavators

11.2.4.2.2. Bulldozers

11.2.4.2.3. Graders

11.2.4.2.4. Crane Trucks

11.2.4.2.5. Dump Trucks

11.2.4.2.6. Others

11.2.4.3. Industrial Vehicle

11.2.4.4. All-terrain Vehicle (ATV) & Utility Task Vehicle (UTV)

12. Global Retreaded Tire Market Analysis and Forecast, by Tire Type

12.1. Market Snapshot

12.1.1. Introduction, Definition, and Key Findings

12.1.2. Market Growth & Y-o-Y Projections

12.1.3. Base Point Share Analysis

12.2. Global Retreaded Tire Market Volume (Thousand Units) & Value (US$ Mn) Analysis & Forecast, by Tire Type, 2017-2031

12.2.1. Radial

12.2.2. Bias

12.2.3. Solid

13. Global Retreaded Tire Market Analysis and Forecast, by Region

13.1. Market Snapshot

13.1.1. Introduction, Definition, and Key Findings

13.1.2. Market Growth & Y-o-Y Projections

13.1.3. Base Point Share Analysis

13.2. Global Retreaded Tire Market Volume (Thousand Units) & Value (US$ Mn) Analysis & Forecast, by Region, 2017-2031

13.2.1. North America

13.2.2. Europe

13.2.3. Asia Pacific

13.2.4. Middle East & Africa

13.2.5. Latin America

14. North America Retreaded Tire Market

14.1. Market Snapshot

14.2. North America Retreaded Tire Market Volume (Thousand Units) & Value (US$ Mn) Analysis & Forecast, by Process, 2017-2031

14.2.1. Pre-Cure (Cold Treading)

14.2.2. Mold-cure (Hot Treading)

14.3. North America Retreaded Tire Market Volume (Thousand Units) & Value (US$ Mn) Analysis & Forecast, by Vehicle Type, 2017-2031

14.3.1. Two Wheeler Vehicle

14.3.2. Passenger Vehicle

14.3.2.1. Hatchback

14.3.2.2. Sedan

14.3.2.3. Utility Vehicle

14.3.3. Commercial Vehicle

14.3.3.1. Light Commercial Vehicle

14.3.3.2. Heavy Commercial Vehicle

14.3.3.3. Buses & Coaches

14.3.4. Off-road Vehicle

14.3.4.1. Agriculture Equipment

14.3.4.1.1. Tractors

14.3.4.1.2. Harvesters

14.3.4.1.3. Trailers

14.3.4.1.4. Loaders

14.3.4.1.5. Others

14.3.4.2. Construction and Mining Equipment

14.3.4.2.1. Excavators

14.3.4.2.2. Bulldozers

14.3.4.2.3. Graders

14.3.4.2.4. Crane Trucks

14.3.4.2.5. Dump Trucks

14.3.4.2.6. Others

14.3.4.3. Industrial Vehicle

14.3.4.4. All-terrain Vehicle (ATV) & Utility Task Vehicle (UTV)

14.4. North America Retreaded Tire Market Volume (Thousand Units) & Value (US$ Mn) Analysis & Forecast, by Tire Type, 2017-2031

14.4.1. Radial

14.4.2. Bias

14.4.3. Solid

14.5. North America Retreaded Tire Market Volume (Thousand Units) & Value (US$ Mn) Analysis & Forecast, by Country, 2017-2031

14.5.1. The U. S.

14.5.2. Canada

14.5.3. Mexico

15. Europe Retreaded Tire Market

15.1. Market Snapshot

15.2. Europe Retreaded Tire Market Volume (Thousand Units) & Value (US$ Mn) Analysis & Forecast, by Process, 2017-2031

15.2.1. Pre-Cure (Cold Treading)

15.2.2. Mold-cure (Hot Treading)

15.3. Europe Retreaded Tire Market Volume (Thousand Units) & Value (US$ Mn) Analysis & Forecast, by Vehicle Type, 2017-2031

15.3.1. Two Wheeler Vehicle

15.3.2. Passenger Vehicle

15.3.2.1. Hatchback

15.3.2.2. Sedan

15.3.2.3. Utility Vehicle

15.3.3. Commercial Vehicle

15.3.3.1. Light Commercial Vehicle

15.3.3.2. Heavy Commercial Vehicle

15.3.3.3. Buses & Coaches

15.3.4. Off-road Vehicle

15.3.4.1. Agriculture Equipment

15.3.4.1.1. Tractors

15.3.4.1.2. Harvesters

15.3.4.1.3. Trailers

15.3.4.1.4. Loaders

15.3.4.1.5. Others

15.3.4.2. Construction and Mining Equipment

15.3.4.2.1. Excavators

15.3.4.2.2. Bulldozers

15.3.4.2.3. Graders

15.3.4.2.4. Crane Trucks

15.3.4.2.5. Dump Trucks

15.3.4.2.6. Others

15.3.4.3. Industrial Vehicle

15.3.4.4. All-terrain Vehicle (ATV) & Utility Task Vehicle (UTV)

15.4. Europe Retreaded Tire Market Volume (Thousand Units) & Value (US$ Mn) Analysis & Forecast, by Tire Type, 2017-2031

15.4.1. Radial

15.4.2. Bias

15.4.3. Solid

15.5. Europe Retreaded Tire Market Volume (Thousand Units) & Value (US$ Mn) Analysis & Forecast, by Country & Sub-region, 2017-2031

15.5.1. Germany

15.5.2. U. K.

15.5.3. France

15.5.4. Italy

15.5.5. Spain

15.5.6. Nordic Countries

15.5.7. Russia & CIS

15.5.8. Rest of Europe

16. Asia Pacific Retreaded Tire Market

16.1. Market Snapshot

16.2. Asia Pacific Retreaded Tire Market Volume (Thousand Units) & Value (US$ Mn) Analysis & Forecast, by Process, 2017-2031

16.2.1. Pre-Cure (Cold Treading)

16.2.2. Mold-cure (Hot Treading)

16.3. Asia Pacific Retreaded Tire Market Volume (Thousand Units) & Value (US$ Mn) Analysis & Forecast, by Vehicle Type, 2017-2031

16.3.1. Two Wheeler Vehicle

16.3.2. Passenger Vehicle

16.3.2.1. Hatchback

16.3.2.2. Sedan

16.3.2.3. Utility Vehicle

16.3.3. Commercial Vehicle

16.3.3.1. Light Commercial Vehicle

16.3.3.2. Heavy Commercial Vehicle

16.3.3.3. Buses & Coaches

16.3.4. Off-road Vehicle

16.3.4.1. Agriculture Equipment

16.3.4.1.1. Tractors

16.3.4.1.2. Harvesters

16.3.4.1.3. Trailers

16.3.4.1.4. Loaders

16.3.4.1.5. Others

16.3.4.2. Construction and Mining Equipment

16.3.4.2.1. Excavators

16.3.4.2.2. Bulldozers

16.3.4.2.3. Graders

16.3.4.2.4. Crane Trucks

16.3.4.2.5. Dump Trucks

16.3.4.2.6. Others

16.3.4.3. Industrial Vehicle

16.3.4.4. All-terrain Vehicle (ATV) & Utility Task Vehicle (UTV)

16.4. Asia Pacific Retreaded Tire Market Volume (Thousand Units) & Value (US$ Mn) Analysis & Forecast, by Tire Type, 2017-2031

16.4.1. Radial

16.4.2. Bias

16.4.3. Solid

16.5. Asia Pacific Retreaded Tire Market Volume (Thousand Units) & Value (US$ Mn) Analysis & Forecast, by Country & Sub-region, 2017-2031

16.5.1. China

16.5.2. India

16.5.3. Japan

16.5.4. ASEAN Countries

16.5.5. South Korea

16.5.6. ANZ

16.5.7. Rest of Asia Pacific

17. Middle East & Africa Retreaded Tire Market

17.1. Market Snapshot

17.2. Middle East & Africa Retreaded Tire Market Volume (Thousand Units) & Value (US$ Mn) Analysis & Forecast, by Process, 2017-2031

17.2.1. Pre-Cure (Cold Treading)

17.2.2. Mold-cure (Hot Treading)

17.3. Middle East & Africa Retreaded Tire Market Volume (Thousand Units) & Value (US$ Mn) Analysis & Forecast, by Vehicle Type, 2017-2031

17.3.1. Two Wheeler Vehicle

17.3.2. Passenger Vehicle

17.3.2.1. Hatchback

17.3.2.2. Sedan

17.3.2.3. Utility Vehicle

17.3.3. Commercial Vehicle

17.3.3.1. Light Commercial Vehicle

17.3.3.2. Heavy Commercial Vehicle

17.3.3.3. Buses & Coaches

17.3.4. Off-road Vehicle

17.3.4.1. Agriculture Equipment

17.3.4.1.1. Tractors

17.3.4.1.2. Harvesters

17.3.4.1.3. Trailers

17.3.4.1.4. Loaders

17.3.4.1.5. Others

17.3.4.2. Construction and Mining Equipment

17.3.4.2.1. Excavators

17.3.4.2.2. Bulldozers

17.3.4.2.3. Graders

17.3.4.2.4. Crane Trucks

17.3.4.2.5. Dump Trucks

17.3.4.2.6. Others

17.3.4.3. Industrial Vehicle

17.3.4.4. All-terrain Vehicle (ATV) & Utility Task Vehicle (UTV)

17.4. Middle East & Africa Retreaded Tire Market Volume (Thousand Units) & Value (US$ Mn) Analysis & Forecast, by Tire Type, 2017-2031

17.4.1. Radial

17.4.2. Bias

17.4.3. Solid

17.5. Middle East & Africa Retreaded Tire Market Volume (Thousand Units) & Value (US$ Mn) Analysis & Forecast, by Country & Sub-region, 2017-2031

17.5.1. GCC

17.5.2. South Africa

17.5.3. Turkey

17.5.4. Rest of Middle East & Africa

18. Latin America Retreaded Tire Market

18.1. Market Snapshot

18.2. Latin America Retreaded Tire Market Volume (Thousand Units) & Value (US$ Mn) Analysis & Forecast, by Process, 2017-2031

18.2.1. Pre-Cure (Cold Treading)

18.2.2. Mold-cure (Hot Treading)

18.3. Latin America Retreaded Tire Market Volume (Thousand Units) & Value (US$ Mn) Analysis & Forecast, by Vehicle Type, 2017-2031

18.3.1. Two Wheeler Vehicle

18.3.2. Passenger Vehicle

18.3.2.1. Hatchback

18.3.2.2. Sedan

18.3.2.3. Utility Vehicle

18.3.3. Commercial Vehicle

18.3.3.1. Light Commercial Vehicle

18.3.3.2. Heavy Commercial Vehicle

18.3.3.3. Buses & Coaches

18.3.4. Off-road Vehicle

18.3.4.1. Agriculture Equipment

18.3.4.1.1. Tractors

18.3.4.1.2. Harvesters

18.3.4.1.3. Trailers

18.3.4.1.4. Loaders

18.3.4.1.5. Others

18.3.4.2. Construction and Mining Equipment

18.3.4.2.1. Excavators

18.3.4.2.2. Bulldozers

18.3.4.2.3. Graders

18.3.4.2.4. Crane Trucks

18.3.4.2.5. Dump Trucks

18.3.4.2.6. Others

18.3.4.3. Industrial Vehicle

18.3.4.4. All-terrain Vehicle (ATV) & Utility Task Vehicle (UTV)

18.4. Latin America Retreaded Tire Market Volume (Thousand Units) & Value (US$ Mn) Analysis & Forecast, by Tire Type, 2017-2031

18.4.1. Radial

18.4.2. Bias

18.4.3. Solid

18.5. Latin America Retreaded Tire Market Volume (Thousand Units) & Value (US$ Mn) Analysis & Forecast, by Country & Sub-region, 2017-2031

18.5.1. Brazil

18.5.2. Argentina

18.5.3. Rest of Latin America

19. Competitive Landscape

19.1. Company Share Analysis/ Brand Share Analysis, 2020

19.2. Key Strategy Analysis

19.2.1. Strategic Overview - Expansion, M&A, Partnership

19.2.2. Product & Marketing Strategy

19.3. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share, Executive Bios)

20. Company Profile/ Key Players – Retreaded Tire

20.1. Akarmak

20.1.1. Company Overview

20.1.2. Company Footprints

20.1.3. Production Locations

20.1.4. Product Portfolio

20.1.5. Competitors & Customers

20.1.6. Subsidiaries & Parent Organization

20.1.7. Recent Developments

20.1.8. Financial Analysis

20.1.9. Profitability

20.1.10. Revenue Share

20.1.11. Executive Bios

20.2. Apollo

20.2.1. Company Overview

20.2.2. Company Footprints

20.2.3. Production Locations

20.2.4. Product Portfolio

20.2.5. Competitors & Customers

20.2.6. Subsidiaries & Parent Organization

20.2.7. Recent Developments

20.2.8. Financial Analysis

20.2.9. Profitability

20.2.10. Revenue Share

20.2.11. Executive Bios

20.3. Bridgestone Corporation

20.3.1. Company Overview

20.3.2. Company Footprints

20.3.3. Production Locations

20.3.4. Product Portfolio

20.3.5. Competitors & Customers

20.3.6. Subsidiaries & Parent Organization

20.3.7. Recent Developments

20.3.8. Financial Analysis

20.3.9. Profitability

20.3.10. Revenue Share

20.3.11. Executive Bios

20.4. Continental AG

20.4.1. Company Overview

20.4.2. Company Footprints

20.4.3. Production Locations

20.4.4. Product Portfolio

20.4.5. Competitors & Customers

20.4.6. Subsidiaries & Parent Organization

20.4.7. Recent Developments

20.4.8. Financial Analysis

20.4.9. Profitability

20.4.10. Revenue Share

20.4.11. Executive Bios

20.5. Kal Tire

20.5.1. Company Overview

20.5.2. Company Footprints

20.5.3. Production Locations

20.5.4. Product Portfolio

20.5.5. Competitors & Customers

20.5.6. Subsidiaries & Parent Organization

20.5.7. Recent Developments

20.5.8. Financial Analysis

20.5.9. Profitability

20.5.10. Revenue Share

20.5.11. Executive Bios

20.6. Marangoni S.p.A.

20.6.1. Company Overview

20.6.2. Company Footprints

20.6.3. Production Locations

20.6.4. Product Portfolio

20.6.5. Competitors & Customers

20.6.6. Subsidiaries & Parent Organization

20.6.7. Recent Developments

20.6.8. Financial Analysis

20.6.9. Profitability

20.6.10. Revenue Share

20.6.11. Executive Bios

20.7. MELION INDUSTRY CO., LTD.

20.7.1. Company Overview

20.7.2. Company Footprints

20.7.3. Production Locations

20.7.4. Product Portfolio

20.7.5. Competitors & Customers

20.7.6. Subsidiaries & Parent Organization

20.7.7. Recent Developments

20.7.8. Financial Analysis

20.7.9. Profitability

20.7.10. Revenue Share

20.7.11. Executive Bios

20.8. MICHELIN

20.8.1. Company Overview

20.8.2. Company Footprints

20.8.3. Production Locations

20.8.4. Product Portfolio

20.8.5. Competitors & Customers

20.8.6. Subsidiaries & Parent Organization

20.8.7. Recent Developments

20.8.8. Financial Analysis

20.8.9. Profitability

20.8.10. Revenue Share

20.8.11. Executive Bios

20.9. MRF Limited

20.9.1. Company Overview

20.9.2. Company Footprints

20.9.3. Production Locations

20.9.4. Product Portfolio

20.9.5. Competitors & Customers

20.9.6. Subsidiaries & Parent Organization

20.9.7. Recent Developments

20.9.8. Financial Analysis

20.9.9. Profitability

20.9.10. Revenue Share

20.9.11. Executive Bios

20.10. Parrish Tire and Automotive

20.10.1. Company Overview

20.10.2. Company Footprints

20.10.3. Production Locations

20.10.4. Product Portfolio

20.10.5. Competitors & Customers

20.10.6. Subsidiaries & Parent Organization

20.10.7. Recent Developments

20.10.8. Financial Analysis

20.10.9. Profitability

20.10.10. Revenue Share

20.10.11. Executive Bios

20.11. RDH Tire & Retread Co.

20.11.1. Company Overview

20.11.2. Company Footprints

20.11.3. Production Locations

20.11.4. Product Portfolio

20.11.5. Competitors & Customers

20.11.6. Subsidiaries & Parent Organization

20.11.7. Recent Developments

20.11.8. Financial Analysis

20.11.9. Profitability

20.11.10. Revenue Share

20.11.11. Executive Bios

20.12. Service Tire Truck Centers

20.12.1. Company Overview

20.12.2. Company Footprints

20.12.3. Production Locations

20.12.4. Product Portfolio

20.12.5. Competitors & Customers

20.12.6. Subsidiaries & Parent Organization

20.12.7. Recent Developments

20.12.8. Financial Analysis

20.12.9. Profitability

20.12.10. Revenue Share

20.12.11. Executive Bios

20.13. The Goodyear Tire & Rubber Company

20.13.1. Company Overview

20.13.2. Company Footprints

20.13.3. Production Locations

20.13.4. Product Portfolio

20.13.5. Competitors & Customers

20.13.6. Subsidiaries & Parent Organization

20.13.7. Recent Developments

20.13.8. Financial Analysis

20.13.9. Profitability

20.13.10. Revenue Share

20.13.11. Executive Bios

20.14. THE YOKOHAMA RUBBER CO., LTD.

20.14.1. Company Overview

20.14.2. Company Footprints

20.14.3. Production Locations

20.14.4. Product Portfolio

20.14.5. Competitors & Customers

20.14.6. Subsidiaries & Parent Organization

20.14.7. Recent Developments

20.14.8. Financial Analysis

20.14.9. Profitability

20.14.10. Revenue Share

20.14.11. Executive Bios

20.15. Tyresoles

20.15.1. Company Overview

20.15.2. Company Footprints

20.15.3. Production Locations

20.15.4. Product Portfolio

20.15.5. Competitors & Customers

20.15.6. Subsidiaries & Parent Organization

20.15.7. Recent Developments

20.15.8. Financial Analysis

20.15.9. Profitability

20.15.10. Revenue Share

20.15.11. Executive Bios

20.16. West End Tire

20.16.1. Company Overview

20.16.2. Company Footprints

20.16.3. Production Locations

20.16.4. Product Portfolio

20.16.5. Competitors & Customers

20.16.6. Subsidiaries & Parent Organization

20.16.7. Recent Developments

20.16.8. Financial Analysis

20.16.9. Profitability

20.16.10. Revenue Share

20.16.11. Executive Bios

List of Tables

Table 1: Global Retreaded Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017-2031

Table 2: Global Retreaded Tire Market Value (US$ Mn) Forecast, by Tire Type, 2017-2031

Table 3: Global Retreaded Tire Market Volume (Thousand Units) Forecast, by Process, 2017-2031

Table 4: Global Retreaded Tire Market Value (US$ Mn) Forecast, by Process, 2017-2031

Table 5: Global Retreaded Tire Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 6: Global Retreaded Tire Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Table 7: Global Retreaded Tire Market Volume (Thousand Units) Forecast, by Region , 2017-2031

Table 8: Global Retreaded Tire Market Value (US$ Mn) Forecast, by Region , 2017-2031

Table 9: North America Retreaded Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017-2031

Table 10: North America Retreaded Tire Market Value (US$ Mn) Forecast, by Tire Type, 2017-2031

Table 11: North America Retreaded Tire Market Volume (Thousand Units) Forecast, by Process, 2017-2031

Table 12: North America Retreaded Tire Market Value (US$ Mn) Forecast, by Process, 2017-2031

Table 13: North America Retreaded Tire Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 14: North America Retreaded Tire Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Table 15: North America Retreaded Tire Market Volume (Thousand Units) Forecast, by Country , 2017-2031

Table 16: North America Retreaded Tire Market Value (US$ Mn) Forecast, by Country , 2017-2031

Table 17: Europe Retreaded Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017-2031

Table 18: Europe Retreaded Tire Market Value (US$ Mn) Forecast, by Tire Type, 2017-2031

Table 19: Europe Retreaded Tire Market Volume (Thousand Units) Forecast, by Process, 2017-2031

Table 20: Europe Retreaded Tire Market Value (US$ Mn) Forecast, by Process, 2017-2031

Table 21: Europe Retreaded Tire Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 22: Europe Retreaded Tire Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Table 23: Europe Retreaded Tire Market Volume (Thousand Units) Forecast, by Country & Sub-region , 2017-2031

Table 24: Europe Retreaded Tire Market Value (US$ Mn) Forecast, by Country & Sub-region , 2017-2031

Table 25: Asia Pacific Retreaded Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017-2031

Table 26: Asia Pacific Retreaded Tire Market Value (US$ Mn) Forecast, by Tire Type, 2017-2031

Table 27: Asia Pacific Retreaded Tire Market Volume (Thousand Units) Forecast, by Process, 2017-2031

Table 28: Asia Pacific Retreaded Tire Market Value (US$ Mn) Forecast, by Process, 2017-2031

Table 29: Asia Pacific Retreaded Tire Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 30: Asia Pacific Retreaded Tire Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Table 31: Asia Pacific Retreaded Tire Market Volume (Thousand Units) Forecast, by Country & Sub-region , 2017-2031

Table 32: Asia Pacific Retreaded Tire Market Value (US$ Mn) Forecast, by Country & Sub-region , 2017-2031

Table 33: Middle East & Africa Retreaded Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017-2031

Table 34: Middle East & Africa Retreaded Tire Market Value (US$ Mn) Forecast, by Tire Type, 2017-2031

Table 35: Middle East & Africa Retreaded Tire Market Volume (Thousand Units) Forecast, by Process, 2017-2031

Table 36: Middle East & Africa Retreaded Tire Market Value (US$ Mn) Forecast, by Process, 2017-2031

Table 37: Middle East & Africa Retreaded Tire Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 38: Middle East & Africa Retreaded Tire Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Table 39: Middle East & Africa Retreaded Tire Market Volume (Thousand Units) Forecast, by Country & Sub-region , 2017-2031

Table 40: Middle East & Africa Retreaded Tire Market Value (US$ Mn) Forecast, by Country & Sub-region , 2017-2031

Table 41: Latin America Retreaded Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017-2031

Table 42: Latin America Retreaded Tire Market Value (US$ Mn) Forecast, by Tire Type, 2017-2031

Table 43: Latin America Retreaded Tire Market Volume (Thousand Units) Forecast, by Process, 2017-2031

Table 44: Latin America Retreaded Tire Market Value (US$ Mn) Forecast, by Process, 2017-2031

Table 45: Latin America Retreaded Tire Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 46: Latin America Retreaded Tire Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Table 47: Latin America Retreaded Tire Market Volume (Thousand Units) Forecast, by Country & Sub-region , 2017-2031

Table 48: Latin America Retreaded Tire Market Value (US$ Mn) Forecast, by Country & Sub-region , 2017-2031

List of Figures

Figure 1: Global Retreaded Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017-2031

Figure 2: Global Retreaded Tire Market Value (US$ Mn) Forecast, by Tire Type, 2017-2031

Figure 3: Global Retreaded Tire Market, Incremental Opportunity, by Tire Type, Value (US$ Mn), 2021-2031

Figure 4: Global Retreaded Tire Market Volume (Thousand Units) Forecast, by Process, 2017-2031

Figure 5: Global Retreaded Tire Market Value (US$ Mn) Forecast, by Process, 2017-2031

Figure 6: Global Retreaded Tire Market, Incremental Opportunity, by Process, Value (US$ Mn), 2021-2031

Figure 7: Global Retreaded Tire Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 8: Global Retreaded Tire Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 9: Global Retreaded Tire Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2021-2031

Figure 10: Global Retreaded Tire Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Figure 11: Global Retreaded Tire Market Value (US$ Mn) Forecast, by Region, 2017-2031

Figure 12: Global Retreaded Tire Market, Incremental Opportunity, by Region, Value (US$ Mn), 2021-2031

Figure 13: North America Retreaded Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017-2031

Figure 14: North America Retreaded Tire Market Value (US$ Mn) Forecast, by Tire Type, 2017-2031

Figure 15: North America Retreaded Tire Market, Incremental Opportunity, by Tire Type, Value (US$ Mn), 2021-2031

Figure 16: North America Retreaded Tire Market Volume (Thousand Units) Forecast, by Process, 2017-2031

Figure 17: North America Retreaded Tire Market Value (US$ Mn) Forecast, by Process, 2017-2031

Figure 18: North America Retreaded Tire Market, Incremental Opportunity, by Process, Value (US$ Mn), 2021-2031

Figure 19: North America Retreaded Tire Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 20: North America Retreaded Tire Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 21: North America Retreaded Tire Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2021-2031

Figure 22: North America Retreaded Tire Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 23: North America Retreaded Tire Market Value (US$ Mn) Forecast, by Country, 2017-2031

Figure 24: North America Retreaded Tire Market, Incremental Opportunity, by Country, Value (US$ Mn), 2021-2031

Figure 25: Europe Retreaded Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017-2031

Figure 26: Europe Retreaded Tire Market Value (US$ Mn) Forecast, by Tire Type, 2017-2031

Figure 27: Europe Retreaded Tire Market, Incremental Opportunity, by Tire Type, Value (US$ Mn), 2021-2031

Figure 28: Europe Retreaded Tire Market Volume (Thousand Units) Forecast, by Process, 2017-2031

Figure 29: Europe Retreaded Tire Market Value (US$ Mn) Forecast, by Process, 2017-2031

Figure 30: Europe Retreaded Tire Market, Incremental Opportunity, by Process, Value (US$ Mn), 2021-2031

Figure 31: Europe Retreaded Tire Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 32: Europe Retreaded Tire Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 33: Europe Retreaded Tire Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2021-2031

Figure 34: Europe Retreaded Tire Market Volume (Thousand Units) Forecast, by Country & Sub-region, 2017-2031

Figure 35: Europe Retreaded Tire Market Value (US$ Mn) Forecast, by Country & Sub-region, 2017-2031

Figure 36: Europe Retreaded Tire Market, Incremental Opportunity, by Country & Sub-region, Value (US$ Mn), 2021-2031

Figure 37: Asia Pacific Retreaded Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017-2031

Figure 38: Asia Pacific Retreaded Tire Market Value (US$ Mn) Forecast, by Tire Type, 2017-2031

Figure 39: Asia Pacific Retreaded Tire Market, Incremental Opportunity, by Tire Type, Value (US$ Mn), 2021-2031

Figure 40: Asia Pacific Retreaded Tire Market Volume (Thousand Units) Forecast, by Process, 2017-2031

Figure 41: Asia Pacific Retreaded Tire Market Value (US$ Mn) Forecast, by Process, 2017-2031

Figure 42: Asia Pacific Retreaded Tire Market, Incremental Opportunity, by Process, Value (US$ Mn), 2021-2031

Figure 43: Asia Pacific Retreaded Tire Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 44: Asia Pacific Retreaded Tire Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 45: Asia Pacific Retreaded Tire Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2021-2031

Figure 46: Asia Pacific Retreaded Tire Market Volume (Thousand Units) Forecast, by Country & Sub-region, 2017-2031

Figure 47: Asia Pacific Retreaded Tire Market Value (US$ Mn) Forecast, by Country & Sub-region, 2017-2031

Figure 48: Asia Pacific Retreaded Tire Market, Incremental Opportunity, by Country & Sub-region, Value (US$ Mn), 2021-2031

Figure 49: Middle East & Africa Retreaded Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017-2031

Figure 50: Middle East & Africa Retreaded Tire Market Value (US$ Mn) Forecast, by Tire Type, 2017-2031

Figure 51: Middle East & Africa Retreaded Tire Market, Incremental Opportunity, by Tire Type, Value (US$ Mn), 2021-2031

Figure 52: Middle East & Africa Retreaded Tire Market Volume (Thousand Units) Forecast, by Process, 2017-2031

Figure 53: Middle East & Africa Retreaded Tire Market Value (US$ Mn) Forecast, by Process, 2017-2031

Figure 54: Middle East & Africa Retreaded Tire Market, Incremental Opportunity, by Process, Value (US$ Mn), 2021-2031

Figure 55: Middle East & Africa Retreaded Tire Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 56: Middle East & Africa Retreaded Tire Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 57: Middle East & Africa Retreaded Tire Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2021-2031

Figure 58: Middle East & Africa Retreaded Tire Market Volume (Thousand Units) Forecast, by Country & Sub-region, 2017-2031

Figure 59: Middle East & Africa Retreaded Tire Market Value (US$ Mn) Forecast, by Country & Sub-region, 2017-2031

Figure 60: Middle East & Africa Retreaded Tire Market, Incremental Opportunity, by Country & Sub-region, Value (US$ Mn), 2021-2031

Figure 61: Latin America Retreaded Tire Market Volume (Thousand Units) Forecast, by Tire Type, 2017-2031

Figure 62: Latin America Retreaded Tire Market Value (US$ Mn) Forecast, by Tire Type, 2017-2031

Figure 63: Latin America Retreaded Tire Market, Incremental Opportunity, by Tire Type, Value (US$ Mn), 2021-2031

Figure 64: Latin America Retreaded Tire Market Volume (Thousand Units) Forecast, by Process, 2017-2031

Figure 65: Latin America Retreaded Tire Market Value (US$ Mn) Forecast, by Process, 2017-2031

Figure 66: Latin America Retreaded Tire Market, Incremental Opportunity, by Process, Value (US$ Mn), 2021-2031

Figure 67: Latin America Retreaded Tire Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 68: Latin America Retreaded Tire Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 69: Latin America Retreaded Tire Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2021-2031

Figure 70: Latin America Retreaded Tire Market Volume (Thousand Units) Forecast, by Country & Sub-region, 2017-2031

Figure 71: Latin America Retreaded Tire Market Value (US$ Mn) Forecast, by Country & Sub-region, 2017-2031

Figure 72: Latin America Retreaded Tire Market, Incremental Opportunity, by Country & Sub-region, Value (US$ Mn), 2021-2031