Products in the global automotive power electronics market, such as modules, discrete, and power ICs have various applications in the automotive industry. These include body electronics, security electronics, powertrain, and safety electronics. Used in both passenger as well as commercial vehicles, products in the global automotive power electronics market can be applied in both, electric vehicles as well as internal combustion or IC engine operated vehicles. Increasing need for compliance with emerging vehicle emission as well as vehicle safety standards along with rising demand for vehicle infotainment, powertrain electrification, and connectivity are two major factors driving the growth in the global automotive power electronics market within the next few years.

On the other hand, the COVID-19 pandemic and subsequent lockdowns adversely impacted the automotive industry across the world. This trend can be attributed to the disruptions in large scale manufacturing, interruptions in supply chain activities, restrictions on travelling, and diminishing sales of automotive vehicles on 2020. These factors have also restricted the growth in the global automotive power electronics market as a result. Furthermore, halt in export of raw materials from China as well as China-U.S. trade war had also negatively impacted the revenue generation in the global automotive power electronics market in late 2020. However, the global automotive power electronics market is anticipated to regain its momentum over the next few years.

Increasing demand for electric vehicles is expected to positively influence the growth in the global automotive power electronics market in coming years. Furthermore, rising demand for fuel efficient technologies as well as high performance safety systems in passenger vehicles may also favor the expansion of the global automotive power electronics market within the next few years. Furthermore, rising demand for various vehicle management features and increased safety is also positively influencing the demand dynamics in the global automotive power electronics market. Players and manufacturers operating within the global automotive power electronics market are engaged in portfolio expansion as well as increasing their investments aimed at research and development activities in order to design and produce technologically advanced products.

The global automotive power electronics market is gaining from the rising sales of electric vehicles for environmental considerations. Several governments in the world are encouraging the adoption of electric vehicles as they do not emit harmful emissions that are detrimental to the environment. For instance, in the U.K, the sale of petrol and diesel cars is anticipated to be banned by 2040 as the government is undertaking consistent efforts to improve the air quality.

Apart from this, thrust to equip vehicles with advanced power solutions is stoking growth of automotive power electronics market. This includes advanced driver assistance systems and convenience systems to enhance vehicular safety and to track vehicle in real-time.

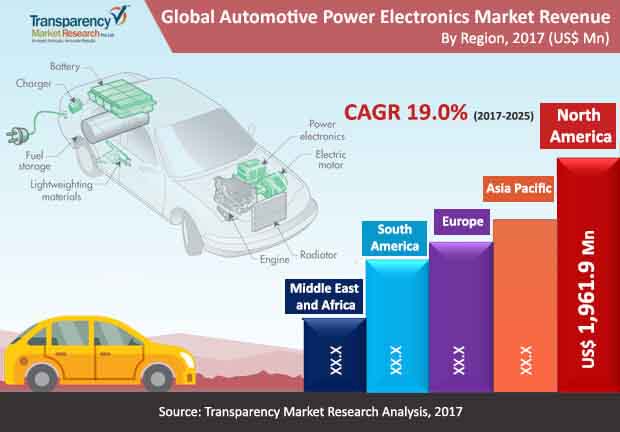

A report by Transparency Market Research (TMR) projects the global automotive power electronics market to clock an impressive 19.0% CAGR between 2017 and 2025, for the market to reach a valuation of US$22,658.4 mn by the end of 2025.

The global automotive power electronics market is segmented on the basis of electric vehicle, vehicle type, application, and geography. On the basis of electric vehicle, the segments of the market include battery electric vehicles, hybrid electric vehicles, and plug-in hybrid electric vehicles. Amongst them, in 2016, the hybrid electric vehicles (HEV) segment held the leading share of the market as it plays a key role in decarbonizing the transport sector and in reducing dependence on fossil fuels. Going forward, the hybrid electric vehicles segment is likely to hold a key share in the global automotive power electronics market over the forecast period. However, plug-in hybrid electric vehicles (PHEV) is projected to expand at a relatively significant growth rate in the automotive power electronics market over the forecast period.

On the basis of vehicle type, the global automotive power electronics market is categorized into passenger cars (PC) and commercial vehicle (CV). Of the two, the passenger car segment is anticipated to account for the leading revenue contribution expanding at a significant CAGR during the forecast period between 2017 and 2025. The growth of the passenger car segment is mainly because of government initiatives for equipping advanced electronics in passenger cars to minimize environmental pollution. Further, upcoming safety rules are anticipated to mandate installation of automotive safety technologies and security features in passenger cars. The emergence of advanced driving assistance technologies is leading original equipment manufacturers (OEMs) to equip passenger cars with efficient power electronic components.

The global automotive power electronics market is segmented into powertrain and chassis, body electronics, safety & security systems, infotainment & telematics, and others based on application. Amongst them, the body electronics segment is anticipated to account for the leading share in the overall market vis-à-vis value and volume. On the other hand, the safety and security systems is anticipated to witness significant growth during the forecast period on the back of government initiatives for safety and security norms in the transportation sector.

Geography-wise, the global automotive power electronics market is bifurcated into North America, Asia Pacific, Europe, the Middle East and Africa, and South America. Asia Pacific, amongst all, is anticipated to display the leading growth rate of 20.3% between 2017 and 2025. Europe, on the other hand, is anticipated to display second-leading growth rate owing to government initiatives that encourage adoption of smart transportation solutions.

Prominent participants in the global automotive power electronics market include Infineon Technologies AG, Texas Instruments Inc., ON Semiconductor Corp., Renessa Electronics Corp., Mitsubishi Heavy Industries Ltd., Maxim Products Inc., NXP Semiconductors N.V., Qualcomm Ins., Robert Bosch GmbH, and Vishay Intertechnology Inc.

Automotive Power Electronics Market Predicted to 19.09% CAGR During the Forecast Period.

Automotive Power Electronics Market Forecast Till 2031

The Players Involved in the Automotive Power Electronics Market are Texas Instruments, Inc., ON Semiconductor Corp., Maxim Integrated Products Inc., NXP Semiconductors N.V., Qualcomm, Ins., others.

North America Takes Lead in the Automotive Power Electronics Market.

The Automotive Power Electronics Market Would Be of Significant US$22,658.4 mn.

Chapter 1 Preface

1.1 Research Scope

1.2 Market Segmentation

1.3 Research Objectives

1.4 Key Questions Answered

Chapter 2 Assumptions and Research Methodology

2.1 Report Assumptions

2.2 Acronyms Used

2.3 Research Methodology

Chapter 3 Executive Summary

3.1 Automotive Power Electronic Market Snapshot

Chapter 4 Market Dynamics

4.1 Market Taxonomy

4.2 Product Overview

4.3 Drivers and Restraints Snapshot Analysis

4.4 Drivers

4.5 Restraints

4.6 Opportunity

4.7 Opportunity Analysis

4.8 Global Automotive Power Electronic Market Analysis and Forecast, 2015 - 2025

4.9 Global Automotive Power Electronics Market Price Trend Analysis

Chapter 5 Automotive Power Electronic Market Analysis, By Electric Vehicle

5.1 Key Trends

5.2 Introduction

5.3 Global Automotive Power Electronic Market Revenue Share Analysis, By Electric Vehicle

5.4 Global Automotive Power Electronic Market Volume Share Analysis, By Electric Vehicle

5.5 Global Automotive Power Electronic Market Analysis, By Electric Vehicle

5.5.1 Battery Electric Vehicles (BEV)

5.5.2 Hybrid Electric Vehicles (HEV)

5.5.3 Plug-in Hybrid Electric Vehicles (PHEV)

5.6 Market Attractiveness

Chapter 6 Automotive Power Electronic Market Analysis, By Vehicle Type

6.1 Key Trends

6.2 Introduction

6.3 Global Automotive Power Electronic Market Revenue Share Analysis, By Vehicle Type

6.4 Global Automotive Power Electronic Market Volume Share Analysis, By Vehicle Type

6.5 Global Automotive Power Electronic Market Analysis, By Electric Vehicle

6.5.1 Passenger Cars (PC)

6.5.1 Commercial Vehicles (CV)

6.6 Market Attractiveness

Chapter 7 Automotive Power Electronic Market Analysis, By Application

7.1 Key Trends

7.2 Introduction

7.3 Global Automotive Power Electronic Market Revenue Share Analysis, By Application

7.4 Global Automotive Power Electronic Market Volume Share Analysis, By Application

7.5 Global Automotive Power Electronic Market Analysis, By Application

7.5.1 Powertrain and Chassis

7.5.2 Body Electronics

7.5.3 Safety & Security Systems

7.5.4 Infotainment & Telematics

7.5.5 Others

7.6 Market Attractiveness

Chapter 8 Global Automotive Power Electronic Market Analysis, By Region

8.1 Global Regulatory Scenario

8.2 Introduction

8.3 Global Automotive Power Electronic Market Revenue Share Analysis, By Region

8.4 Global Automotive Power Electronic Market Volume Share Analysis, By Region

8.5 Global Automotive Power Electronic Market Revenue and Volume Forecast, By Region

8.6 Market Attractiveness

Chapter 9 North America Automotive Power Electronic Market Analysis, By Region

9.1 Key Trend Analysis

9.2 North America Automotive Power Electronic Market Overview

9.3 North America Automotive Power Electronic Market Analysis, By Electric Vehicle

9.3.1 Battery Electric Vehicles (BEV)

9.3.2 Hybrid Electric Vehicles (HEV)

9.3.3 Plug-in Hybrid Electric Vehicles (PHEV)

9.4 North America Automotive Power Electronic Market Analysis, By Vehicle Type

9.4.1 Passenger Cars (PC)

9.4.2 Commercial Vehicles (CV)

9.5 North America Automotive Power Electronic Market Analysis, By Application

9.5.1 Powertrain and Chassis

9.5.2 Body Electronics

9.5.3 Safety & Security Systems

9.5.4 Infotainment & Telematics

9.5.5 Others

9.6 North America Automotive Power Electronics Market Share Analysis, by Country, 2016–2025

9.7 North America Automotive Power Electronics Market Revenue and Volume Forecast, by Country, 2015–2025

9.7.1 U.S.

9.7.2 Canada

9.7.3 Mexico

9.8 North America Automotive Power Electronics Market Attractiveness Analysis, by Market Segmentation

9.8.1 Electric Vehicle

9.8.2 Vehicle Type

9.8.3 Application

Chapter 10 Europe Automotive Power Electronic Market Analysis, By Region

10.1 Key Trend Analysis

10.2 Europe Automotive Power Electronic Market Overview

10.3 Europe Automotive Power Electronic Market Analysis, By Electric Vehicle

10.3.1 Battery Electric Vehicles (BEV)

10.3.2 Hybrid Electric Vehicles (HEV)

10.3.3 Plug-in Hybrid Electric Vehicles (PHEV)

10.4 Europe Automotive Power Electronic Market Analysis, By Vehicle Type

10.4.1 Passenger Cars (PC)

10.4.2 Commercial Vehicles (CV)

10.5 Europe Automotive Power Electronic Market Analysis, By Application

10.5.1 Powertrain and Chassis

10.5.2 Body Electronics

10.5.3 Safety & Security Systems

10.5.4 Infotainment & Telematics

10.5.5 Others

10.6 Europe Automotive Power Electronics Market Share Analysis, by Country, 2016–2025

10.7 Europe Automotive Power Electronics Market Revenue and Volume Forecast, by Country, 2015–2025

10.7.1 U.K.

10.7.2 Germany

10.7.3 France

10.7.4 Norway

10.7.5 Rest of Europe

10.8 Europe Automotive Power Electronics Market Attractiveness Analysis, by Market Segmentation

10.8.1 Electric Vehicle

10.8.2 Vehicle Type

10.8.3 Application

Chapter 11 Asia Pacific Automotive Power Electronic Market Analysis, By Region

11.1 Key Trend Analysis

11.2 Asia Pacific Automotive Power Electronic Market Overview

11.3 Asia Pacific Automotive Power Electronic Market Analysis, By Electric Vehicle

11.3.1 Battery Electric Vehicles (BEV)

11.3.2 Hybrid Electric Vehicles (HEV)

11.3.3 Plug-in Hybrid Electric Vehicles (PHEV)

11.4 Asia Pacific Automotive Power Electronic Market Analysis, By Vehicle Type

11.4.1 Passenger Cars (PC)

11.4.2 Commercial Vehicles (CV)

11.5 Asia Pacific Automotive Power Electronic Market Analysis, By Application

11.5.1 Powertrain and Chassis

11.5.2 Body Electronics

11.5.3 Safety & Security Systems

11.5.4 Infotainment & Telematics

11.5.5 Others

11.6 Asia Pacific Automotive Power Electronics Market Share Analysis, by Country, 2016–2025

11.7 Asia Pacific Automotive Power Electronics Market Revenue and Volume Forecast, by Country, 2015–2025

11.7.1 India

11.7.2 China

11.7.3 Japan

11.7.4 Rest of Asia Pacific

11.8 Asia Pacific Automotive Power Electronics Market Attractiveness Analysis, by Market Segmentation

11.8.1 Electric Vehicle

11.8.2 Vehicle Type

11.8.3 Application

Chapter 12 Middle East and Africa (MEA) Automotive Power Electronic Market Analysis, By Region

12.1 Key Trend Analysis

12.2 MEA Automotive Power Electronic Market Overview

12.3 MEA Automotive Power Electronic Market Analysis, By Electric Vehicle

12.3.1 Battery Electric Vehicles (BEV)

12.3.2 Hybrid Electric Vehicles (HEV)

12.3.3 Plug-in Hybrid Electric Vehicles (PHEV)

12.4 MEA Automotive Power Electronic Market Analysis, By Vehicle Type

12.4.1 Passenger Cars (PC)

12.4.2 Commercial Vehicles (CV)

12.5 MEA Automotive Power Electronic Market Analysis, By Application

12.5.1 Powertrain and Chassis

12.5.2 Body Electronics

12.5.3 Safety & Security Systems

12.5.4 Infotainment & Telematics

12.5.5 Others

12.6 MEA Automotive Power Electronics Market Share Analysis, by Country, 2016–2025

12.7 MEA Automotive Power Electronics Market Revenue and Volume Forecast, by Country, 2015–2025

12.7.1 GCC

12.7.2 South Africa

12.7.3 Rest of MEA

12.8 MEA Automotive Power Electronics Market Attractiveness Analysis, by Market Segmentation

12.8.1 Electric Vehicle

12.8.2 Vehicle Type

12.8.3 Application

Chapter 13 South America Automotive Power Electronic Market Analysis, By Region

13.1 Key Trend Analysis

13.2 South America Automotive Power Electronic Market Overview

13.3 South America Automotive Power Electronic Market Analysis, By Electric Vehicle

13.3.1 Battery Electric Vehicles (BEV)

13.3.2 Hybrid Electric Vehicles (HEV)

13.3.3 Plug-in Hybrid Electric Vehicles (PHEV)

13.4 South America Automotive Power Electronic Market Analysis, By Vehicle Type

13.4.1 Passenger Cars (PC)

13.4.2 Commercial Vehicles (CV)

13.5 South America Automotive Power Electronic Market Analysis, By Application

13.5.1 Powertrain and Chassis

13.5.2 Body Electronics

13.5.3 Safety & Security Systems

13.5.4 Infotainment & Telematics

13.5.5 Others

13.6 South America Automotive Power Electronics Market Share Analysis, by Country, 2016–2025

13.7 South America Automotive Power Electronics Market Revenue and Volume Forecast, by Country, 2015–2025

13.7.1 Brazil

13.7.2 Rest of South America

13.8 South America Automotive Power Electronics Market Attractiveness Analysis, by Market Segmentation

13.8.1 Electric Vehicle

13.8.2 Vehicle Type

13.8.3 Application

Chapter 14 Company Profiles

14.1 Competition Matrix

14.2 Heat Map Analysis, by Key Players, 2016

14.3 Qualcomm Incorporated

14.3.1 Company Details (HQ, Foundation Year, Employee Strength)

14.3.2 Market Presence, By Segment and Geography

14.3.3 Strategic Overview

14.3.4 SWOT analysis

14.3.5 Historical Revenue

14.4 Infineon Technologies AG

14.4.1 Company Details (HQ, Foundation Year, Employee Strength)

14.4.2 Market Presence, By Segment and Geography

14.4.3 Strategic Overview

14.4.4 SWOT analysis

14.4.5 Historical Revenue

14.5 Texas Instruments Inc.

14.5.1 Company Details (HQ, Foundation Year, Employee Strength)

14.5.2 Market Presence, By Segment and Geography

14.5.3 Strategic Overview

14.5.4 SWOT analysis

14.5.5 Historical Revenue

14.6 Maxim Integrated Products Inc.

14.6.1 Company Details (HQ, Foundation Year, Employee Strength)

14.6.2 Market Presence, By Segment and Geography

14.6.3 Strategic Overview

14.6.4 SWOT analysis

14.6.5 Historical Revenue

14.7 NXP Semiconductors N.V.

14.7.1 Company Details (HQ, Foundation Year, Employee Strength)

14.7.2 Market Presence, By Segment and Geography

14.7.3 Strategic Overview

14.7.4 SWOT analysis

14.7.5 Historical Revenue

14.8 ON Semiconductor

14.8.1 Company Details (HQ, Foundation Year, Employee Strength)

14.8.2 Market Presence, By Segment and Geography

14.8.3 Strategic Overview

14.8.4 SWOT analysis

14.8.5 Historical Revenue

14.9 Renesas Electronics Corporation

14.9.1 Company Details (HQ, Foundation Year, Employee Strength)

14.9.2 Market Presence, By Segment and Geography

14.9.3 Strategic Overview

14.9.4 SWOT analysis

14.9.5 Historical Revenue

14.10 Mitsubishi Heavy Industries Ltd.

14.10.1 Company Details (HQ, Foundation Year, Employee Strength)

14.10.2 Market Presence, By Segment and Geography

14.10.3 Strategic Overview

14.10.4 SWOT analysis

14.10.5 Historical Revenue

14.11 Robert Bosch GmbH

14.11.1 Company Details (HQ, Foundation Year, Employee Strength)

14.11.2 Market Presence, By Segment and Geography

14.11.3 Strategic Overview

14.11.4 SWOT analysis

14.11.5 Historical Revenue

14.12 Vishay Intertechnology, Inc.

14.12.1 Company Details (HQ, Foundation Year, Employee Strength)

14.12.2 Market Presence, By Segment and Geography

14.12.3 Strategic Overview

14.12.4 SWOT analysis

14.12.5 Historical Revenue

List Of Table

Table 1: Global Automotive Power Electronics Market Revenue (US$ Mn) and Volume (Thousand Units) Forecast, by Electric Vehicle, 2015–2025

Table 2: Global Automotive Power Electronics Market Revenue (US$ Mn) and Volume (Thousand Units) Forecast, by Battery Electric Vehicles (BEV), By Region, 2015–2025

Table 3: Global Automotive Power Electronics Market Revenue (US$ Mn) and Volume (Thousand Units) Forecast, by Hybrid Electric Vehicle (HEV), By Region, 2015–2025

Table 4: Global Automotive Power Electronics Market Revenue (US$ Mn) and Volume (Thousand Units) Forecast, by Plug-in Hybrid Electric Vehicles (PHEV), By Region, 2015–2025

Table 5: Global Automotive Power Electronics Market Revenue (US$ Mn) and Volume (Thousand Units) Forecast, by Vehicle Type, 2015–2025

Table 6: Global Automotive Power Electronics Market Revenue (US$ Mn) and Volume (Thousand Units) Forecast, by Passenger Cars (PC), By Region, 2015–2025

Table 7: Global Automotive Power Electronics Market Revenue (US$ Mn) and Volume (Thousand Units) Forecast, by Commercial Vehicles (CV), By Region, 2015–2025

Table 8: Global Automotive Power Electronics Market Revenue (US$ Mn) and Volume (Thousand Units) Forecast, by Application, 2015–2025

Table 9: Global Automotive Power Electronics Market Revenue (US$ Mn) and Volume (Thousand Units) Forecast, by Powertrain and Chassis, By Region, 2015–2025

Table 10: Global Automotive Power Electronics Market Revenue (US$ Mn) and Volume (Thousand Units) Forecast, by Body Electronics, By Region, 2015–2025

Table 11: Global Automotive Power Electronics Market Revenue (US$ Mn) and Volume (Thousand Units) Forecast, by Safety & Security Systems, By Region, 2015–2025

Table 12: Global Automotive Power Electronics Market Revenue (US$ Mn) and Volume (Thousand Units) Forecast, By Infotainment & Telematics, By Region, 2015–2025

Table 13: Global Automotive Power Electronics Market Revenue (US$ Mn) and Volume (Thousand Units) Forecast, by Others, By Region, 2015–2025

Table 14: Global Automotive Power Electronics Market Revenue (US$ Mn) and Volume (Thousand Units) Forecast, By Region Type, 2015–2024

Table 15: North America Automotive Power Electronics Market Revenue (US$ Mn) and Volume (Thousand Units) Forecast, By Country, 2015–2025

Table 16: Europe Automotive Power Electronics Market Revenue (US$ Mn) and Volume (Thousand Units) Forecast, By Country, 2015–2025

Table 17: Asia Pacific Automotive Power Electronics Market Revenue (US$ Mn) and Volume (Thousand Units) Forecast, By Country, 2015–2025

Table 18: Middle East and Africa (MEA) Automotive Power Electronics Market Revenue (US$ Mn) and Volume (Thousand Units) Forecast, By Country, 2015–2025

Table 19: South America Automotive Power Electronics Market Revenue (US$ Mn) and Volume (Thousand Units) Forecast, By Country, 2015–2025

List Of Figures

Fig 1: Research Methodology

Fig 2: Market Snapshot (US$ Bn)

Fig 3: Global Automotive Power Electronics Market Size (US$ Mn) and Volume (Thousand Units) Forecast, 2015–2025

Fig 4: Global Automotive Power Electronics Average Price (US$/ Unit) 2015–2025

Fig 5: Global Automotive Power Electronics Market Revenue Share Analysis By Electric Vehicle, 2016 and 2025

Fig 6: Global Automotive Power Electronics Market Volume Share Analysis By Electric Vehicle, 2016 and 2025

Fig 7: Global Automotive Power Electronics Market for Battery Electric Vehicles (BEV), Revenue and Volume (US$ Mn and Thousand Units) Forecast, 2015–2025

Fig 8: Global Automotive Power Electronics Market for Hybrid Electric Vehicles (HEV), Revenue and Volume (US$ Mn and Thousand Units) Forecast, 2015–2025

Fig 9: Global Automotive Power Electronics Market for Plug-in Hybrid Electric Vehicles (PHEV), Revenue and Volume (US$ Mn and Thousand Units) Forecast, 2015–2025

Fig 10: Global Automotive Power Electronics Market Attractive Analysis, By Electric Vehicle, 2016-2025

Fig 11: Global Automotive Power Electronics Market Revenue Share Analysis, by Vehicle Type, 2016 and 2025

Fig 12: Global Automotive Power Electronics Market Volume Share Analysis, by Vehicle Type, 2016 and 2025

Fig 13: Global Automotive Power Electronics Market for Passenger Cars (PC), Revenue and Volume (US$ Mn and Thousand Units) Forecast, 2016–2025

Fig 14: Global Automotive Power Electronics Market for Commercial Vehicles (CV), Revenue and Volume (US$ Mn and Thousand Units) Forecast, 2016–2025

Fig 15: Automotive Power Electronics Market Attractiveness Analysis, by Vehicle Type

Fig 16: Global Automotive Power Electronics Market Revenue Share Analysis, by Application Type, 2016 and 2024

Fig 17: Global Automotive Power Electronics Market Volume Share Analysis, by Application, 2016 and 2024

Fig 18: Global Automotive Power Electronics Market for Powertrain and Chassis, Revenue and Volume (US$ Mn and Thousand Units) Forecast, 2016–2025

Fig 19: Global Automotive Power Electronics Market for Body Electronics, Revenue and Volume (US$ Mn and Thousand Units) Forecast, 2016–2025

Fig 20: Global Automotive Power Electronics Market for Safety & Security Systems, Revenue and Volume (US$ Mn and Thousand Units) Forecast, 2016–2025

Fig 21: Global Automotive Power Electronics Market for Infotainment & Telematics, Revenue and Volume (US$ Mn and Thousand Units) Forecast, 2016–2025

Fig 22: Global Automotive Power Electronics Market for Others Application, Revenue and Volume (US$ Mn and Thousand Units) Forecast, 2016–2025

Fig 23: Automotive Power Electronics Market Attractiveness Analysis, by Application

Fig 24: Global Automotive Power Electronics Market Revenue Share Analysis By Region Type, 2016 and 2025

Fig 25: Global Automotive Power Electronics Market Volume Share Analysis By Region Type, 2016 and 2025

Fig 26: Automotive Power Electronics Market Attractiveness Analysis, By Region

Fig 27: North America Automotive Power Electronics Market Revenue (US$ Mn) and Volume (Thousand Units) Forecast, 2015–2024

Fig 28: North America Automotive Power Electronics Market Revenue and Volume Y-o-Y Growth Projections, 2015–2025

Fig 29: North America Market Attractiveness Analysis By Country

Fig 30: North America Automotive Power Electronics Market Revenue and Volume (US$ Mn and Thousand Units) Forecast for BEV, 2015–2025

Fig 31: North America Automotive Power Electronics Market Revenue and Volume (US$ Mn and Thousand Units) Forecast for HEV, 2015–2025

Fig 32: North America Automotive Power Electronics Market Revenue and Volume (US$ Mn and Thousand Units) Forecast for PHEV, 2015–2025

Fig 33: North America Automotive Power Electronics Market Revenue and Volume (US$ Mn and Thousand Units) Forecast for Passenger Cars (PC), 2015–2025

Fig 34: North America Automotive Power Electronics Market Revenue and Volume (US$ Mn and Thousand Units) Forecast for Commercial Vehicles (CV), 2015–2025

Fig 35: North America Automotive Power Electronics Market Revenue and Volume (US$ Mn and Thousand Units) Forecast for Powertrain and Chassis, 2015–2025

Fig 36: North America Automotive Power Electronics Market Revenue and Volume (US$ Mn and Thousand Units) Forecast for Body Electronics, 2015–2025

Fig 37: North America Automotive Power Electronics Market Revenue and Volume (US$ Mn and Thousand Units) Forecast for Safety & Security Systems, 2015–2025

Fig 38: North America Automotive Power Electronics Market Revenue and Volume (US$ Mn and Thousand Units) Forecast for infotainment & Telematics, 2015–2025

Fig 39: North America Automotive Power Electronics Market Revenue and Volume (US$ Mn and Thousand Units) Forecast for Others, 2015–2025

Fig 40: North America Automotive Power Electronics Market, Revenue Share Analysis, by Country, 2016 & 2025

Fig 41: North America Automotive Power Electronics Market, Volume Share Analysis, by Country, 2016 & 2025

Fig 42: North America Automotive Power Electronics Market Attractiveness, by Electric Vehicle, 2016-2025

Fig 43: North America Automotive Power Electronics Market Attractiveness, by Vehicle Type, 2016-2025

Fig 44: North America Automotive Power Electronics Market Attractiveness, by Application, 2016-2025

Fig 45: Europe Automotive Power Electronics Market Revenue (US$ Mn) and Volume (Thousand Units) Forecast, 2015–2024

Fig 46: Europe Automotive Power Electronics Market Revenue and Volume Y-o-Y Growth Projections, 2015–2025

Fig 47: Europe Market Attractiveness Analysis By Country

Fig 48: Europe Automotive Power Electronics Market Revenue and Volume (US$ Mn and Thousand Units) Forecast for BEV, 2015–2025

Fig 49: Europe Automotive Power Electronics Market Revenue and Volume (US$ Mn and Thousand Units) Forecast for HEV, 2015–2025

Fig 50: Europe Automotive Power Electronics Market Revenue and Volume (US$ Mn and Thousand Units) Forecast for PHEV, 2015–2025

Fig 51: Europe Automotive Power Electronics Market Revenue and Volume (US$ Mn and Thousand Units) Forecast for Passenger Cars (PC), 2015–2025

Fig 52: Europe Automotive Power Electronics Market Revenue and Volume (US$ Mn and Thousand Units) Forecast for Commercial Vehicles (CV), 2015–2025

Fig 53: Europe Automotive Power Electronics Market Revenue and Volume (US$ Mn and Thousand Units) Forecast for Powertrain and Chassis, 2015–2025

Fig 54: Europe Automotive Power Electronics Market Revenue and Volume (US$ Mn and Thousand Units) Forecast for Body Electronics, 2015–2025

Fig 55: Europe Automotive Power Electronics Market Revenue and Volume (US$ Mn and Thousand Units) Forecast for Safety & Security Systems, 2015–2025

Fig 56: Europe Automotive Power Electronics Market Revenue and Volume (US$ Mn and Thousand Units) Forecast for infotainment & Telematics, 2015–2025

Fig 57: Europe Automotive Power Electronics Market Revenue and Volume (US$ Mn and Thousand Units) Forecast for Others, 2015–2025

Fig 58: Europe Automotive Power Electronics Market, Revenue Share Analysis, by Country, 2016 & 2025

Fig 59: Europe Automotive Power Electronics Market, Volume Share Analysis, by Country, 2016 & 2025

Fig 60: Europe Automotive Power Electronics Market Attractiveness, by Electric Vehicle, 2016-2025

Fig 61: Europe Automotive Power Electronics Market Attractiveness, by Vehicle Type, 2016-2025

Fig 62: Europe Automotive Power Electronics Market Attractiveness, by Application, 2016-2025

Fig 63: Asia Pacific Automotive Power Electronics Market Revenue (US$ Mn) and Volume (Thousand Units) Forecast, 2015–2024

Fig 64: Asia Pacific Automotive Power Electronics Market Revenue and Volume Y-o-Y Growth Projections, 2015–2025

Fig 65: Asia Pacific Market Attractiveness Analysis By Country

Fig 66: Asia Pacific Automotive Power Electronics Market Revenue and Volume (US$ Mn and Thousand Units) Forecast for BEV, 2015–2025

Fig 67: Asia Pacific Automotive Power Electronics Market Revenue and Volume (US$ Mn and Thousand Units) Forecast for HEV, 2015–2025

Fig 68: Asia Pacific Automotive Power Electronics Market Revenue and Volume (US$ Mn and Thousand Units) Forecast for PHEV, 2015–2025

Fig 69: Asia Pacific Automotive Power Electronics Market Revenue and Volume (US$ Mn and Thousand Units) Forecast for Passenger Cars (PC), 2015–2025

Fig 70: Asia Pacific Automotive Power Electronics Market Revenue and Volume (US$ Mn and Thousand Units) Forecast for Commercial Vehicles (CV), 2015–2025

Fig 71: Asia Pacific Automotive Power Electronics Market Revenue and Volume (US$ Mn and Thousand Units) Forecast for Powertrain and Chassis, 2015–2025

Fig 72: Asia Pacific Automotive Power Electronics Market Revenue and Volume (US$ Mn and Thousand Units) Forecast for Body Electronics, 2015–2025

Fig 73: Asia Pacific Automotive Power Electronics Market Revenue and Volume (US$ Mn and Thousand Units) Forecast for Safety & Security Systems, 2015–2025

Fig 74: Asia Pacific Automotive Power Electronics Market Revenue and Volume (US$ Mn and Thousand Units) Forecast for infotainment & Telematics, 2015–2025

Fig 75: Asia Pacific Automotive Power Electronics Market Revenue and Volume (US$ Mn and Thousand Units) Forecast for Others, 2015–2025

Fig 76: Asia Pacific Automotive Power Electronics Market, Revenue Share Analysis, by Country, 2016 & 2025

Fig 77: Asia Pacific Automotive Power Electronics Market, Volume Share Analysis, by Country, 2016 & 2025

Fig 78: Asia Pacific Automotive Power Electronics Market Attractiveness, by Electric Vehicle, 2016-2025

Fig 79: Asia Pacific Automotive Power Electronics Market Attractiveness, by Vehicle Type, 2016-2025

Fig 80: Asia Pacific Automotive Power Electronics Market Attractiveness, by Application, 2016-2025

Fig 81: MEA Automotive Power Electronics Market Revenue (US$ Mn) and Volume (Thousand Units) Forecast, 2015–2024

Fig 82: MEA Automotive Power Electronics Market Revenue and Volume Y-o-Y Growth Projections, 2015–2025

Fig 83: MEA Market Attractiveness Analysis by Country

Fig 84: MEA Automotive Power Electronics Market Revenue and Volume (US$ Mn and Thousand Units) Forecast for BEV, 2015–2025

Fig 85: MEA Automotive Power Electronics Market Revenue and Volume (US$ Mn and Thousand Units) Forecast for HEV, 2015–2025

Fig 86: MEA Automotive Power Electronics Market Revenue and Volume (US$ Mn and Thousand Units) Forecast for PHEV, 2015–2025

Fig 86: MEA Automotive Power Electronics Market Revenue and Volume (US$ Mn and Thousand Units) Forecast for Passenger Cars (PC), 2015–2025

Fig 88: MEA Automotive Power Electronics Market Revenue and Volume (US$ Mn and Thousand Units) Forecast for Commercial Vehicles (CV), 2015–2025

Fig 89: MEA Automotive Power Electronics Market Revenue and Volume (US$ Mn and Thousand Units) Forecast for Powertrain and Chassis, 2015–2025

Fig 90: MEA Automotive Power Electronics Market Revenue and Volume (US$ Mn and Thousand Units) Forecast for Body Electronics, 2015–2025

Fig 91: MEA Automotive Power Electronics Market Revenue and Volume (US$ Mn and Thousand Units) Forecast for Powertrain and Chassis, 2015–2025

Fig 92: MEA Automotive Power Electronics Market Revenue and Volume (US$ Mn and Thousand Units) Forecast for Body Electronics, 2015–2025

Fig 93: MEA Automotive Power Electronics Market Revenue and Volume (US$ Mn and Thousand Units) Forecast for Safety & Security Systems, 2015–2025

Fig 94: MEA Automotive Power Electronics Market Revenue and Volume (US$ Mn and Thousand Units) Forecast for infotainment & Telematics, 2015–2025

Fig 95: MEA Automotive Power Electronics Market Revenue and Volume (US$ Mn and Thousand Units) Forecast for Others, 2015–2025

Fig 96: MEA Automotive Power Electronics Market, Revenue Share Analysis, by Country, 2016 & 2025

Fig 97: MEA Automotive Power Electronics Market, Volume Share Analysis, by Country, 2016 & 2025

Fig 98: MEA Automotive Power Electronics Market Attractiveness, by Electric Vehicle, 2016-2025

Fig 99: MEA Automotive Power Electronics Market Attractiveness, by Vehicle Type, 2016-2025

Fig 100: MEA Automotive Power Electronics Market Attractiveness, by Application, 2016-2025

Fig 101: South America Automotive Power Electronics Market Revenue (US$ Mn) and Volume (Thousand Units) Forecast, 2015–2024

Fig 102: South America Automotive Power Electronics Market Revenue and Volume Y-o-Y Growth Projections, 2015–2025

Fig 103: South America Market Attractiveness Analysis by Country

Fig 104: South America Automotive Power Electronics Market Revenue and Volume (US$ Mn and Thousand Units) Forecast for BEV, 2015–2025

Fig 105: South America Automotive Power Electronics Market Revenue and Volume (US$ Mn and Thousand Units) Forecast for HEV, 2015–2025

Fig 106: South America Automotive Power Electronics Market Revenue and Volume (US$ Mn and Thousand Units) Forecast for PHEV, 2015–2025

Fig 107: South America Automotive Power Electronics Market Revenue and Volume (US$ Mn and Thousand Units) Forecast for Passenger Cars (PC), 2015–2025

Fig 108: South America Automotive Power Electronics Market Revenue and Volume (US$ Mn and Thousand Units) Forecast for Commercial Vehicles (CV), 2015–2025

Fig 109: South America Automotive Power Electronics Market Revenue and Volume (US$ Mn and Thousand Units) Forecast for Powertrain and Chassis, 2015–2025

Fig 110: South America Automotive Power Electronics Market Revenue and Volume (US$ Mn and Thousand Units) Forecast for Body Electronics, 2015–2025

Fig 111: South America Automotive Power Electronics Market Revenue and Volume (US$ Mn and Thousand Units) Forecast for Powertrain and Chassis, 2015–2025

Fig 112: South America Automotive Power Electronics Market Revenue and Volume (US$ Mn and Thousand Units) Forecast for Body Electronics, 2015–2025

Fig 113: South America Automotive Power Electronics Market Revenue and Volume (US$ Mn and Thousand Units) Forecast for Safety & Security Systems, 2015–2025

Fig 114: South America Automotive Power Electronics Market Revenue and Volume (US$ Mn and Thousand Units) Forecast for infotainment & Telematics, 2015–2025

Fig 115: South America Automotive Power Electronics Market Revenue and Volume (US$ Mn and Thousand Units) Forecast for Others, 2015–2025

Fig 116: South America Automotive Power Electronics Market, Revenue Share Analysis, by Country, 2016 & 2025

Fig 117: South America Automotive Power Electronics Market, Volume Share Analysis, by Country, 2016 & 2025

Fig 118: South America Automotive Power Electronics Market Attractiveness, by Electric Vehicle, 2016-2025

Fig 119: South America Automotive Power Electronics Market Attractiveness, by Vehicle Type, 2016-2025

Fig 120: South America Automotive Power Electronics Market Attractiveness, by Application, 2016-2025