Analysts’ Viewpoint on Market Scenario

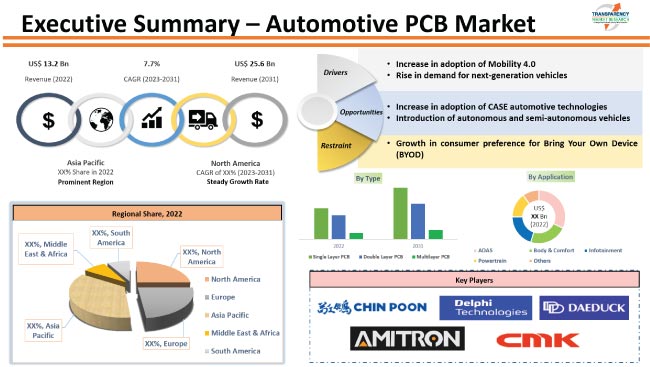

Increase in adoption of Mobility 4.0 and rise in demand for next-generation vehicles are expected to positively impact the automotive PCB market. Printed Circuit Boards (PCBs) provide a compact, cost-effective, and reliable solution for connecting electronic components in vehicles. Growth in utilization of CASE automotive technologies is anticipated to fuel market expansion in the near future.

Surge in consumer preference for Bring Your Own Device (BYOD) is projected to limit the demand for automotive PCBs. Introduction of autonomous and semi-autonomous vehicles is likely to offer lucrative opportunities for automotive PCB manufacturers. Key players are investing in R&D of new technologies and materials that improve the performance and reliability of automotive PCBs.

Printed Circuit Board (PCB) is a thin board made of insulating material (such as fiberglass or plastic) with conductive pathways (usually made of metal) printed on it. Transistors, resistors, and Integrated Circuits (ICs) are some of the components found on a PCB. Single layer PCBs, double layer PCBs, and multilayer PCBs are various types of automotive PCBs.

PCBs are widely used in the automotive industry for various functions such as controlling the engine, transmission, lighting systems, infotainment, and other electronic components. They provide a compact, cost-effective, and reliable solution for connecting electronic components in vehicles. Automotive circuit boards also have to withstand harsh conditions such as high vibration and temperature. Therefore, they require special design considerations and high-quality materials.

The automotive sector is experiencing a rapid transition into the new era of Mobility 4.0., which is characterized by the integration of advanced technologies such as artificial intelligence, Internet of Things (IoT), and autonomous vehicles. Mobility 4.0 aims to create smart and sustainable transportation systems that are safe, efficient, and environmentally friendly. Growth of Mobility 4.0 and integration of advanced technologies in the automotive industry are projected to spur automotive PCB market growth in the near future.

Fuel economy, safety, reliability, and quality play a key role during the purchase of vehicles. PCBs help ensure reliability and performance of advanced automotive systems, and are essential for the growth and success of the automotive industry.

Rise in demand for automotive electronic components is projected to augment the automotive PCB market value in the next few years. The passenger car market in the European Union contracted by 4.6% in the first half of 2022, primarily due to the impact of component shortages. However, the market improved consecutively for five months from August 2022 to December 2022 at a growth rate of 11.06%.

Consumers are seeking more sustainable, efficient, and technologically advanced modes of transportation. Thus, automakers are incorporating AI and IoT in their vehicles to improve safety and driving comfort. This is likely to boost the demand for next-generation vehicles.

Consumers are also preferring more personalized, efficient, and convenient transportation solutions. Next-generation vehicles offer these features. Governments of countries around the world are providing incentives and subsidies to encourage the adoption of electric and hybrid vehicles. These incentives aim to promote sustainability, reduce dependence on fossil fuels, and improve air quality. These factors are projected to fuel market development in the near future.

According to the latest automotive PCB market trends, the single layer type segment is estimated to hold the largest share during the forecast period. Single layer PCBs are cheaper than other types of PCBs. They are used in wipers and lighting and electronic throttle systems.

Surge in sale of passenger and commercial vehicles is projected to fuel the demand for single layer PCBs in the next few years.

The ADAS application segment is likely to dominate the industry during the forecast period. Implementation of various vehicle safety regulations is expected to drive the adoption of Advanced Driver Assistance Systems (ADAS) in vehicles.

PCBs play a critical role in the functioning of ADAS in vehicles. They are used to control and process data from sensors and cameras, and communicate with other electronic systems in the vehicle. For example, in autonomous emergency braking systems, PCBs process data from sensors and cameras to detect obstacles in the road and activate brakes in case of an emergency.

According to the latest automotive PCB market forecast, Asia Pacific is anticipated to account for the largest share from 2023 to 2031. Presence of major automakers and rise in sale of passenger vehicles are driving market progress in the region.

Automakers are incorporating several technologies, such as smart cabin monitoring, Human-machine Interface (HMI), and ADAS, in their vehicles. This is anticipated to drive the demand for automotive PCBs in the region in the near future. Surge in adoption of electric vehicles is also estimated to positively impact market statistics in Asia Pacific during the forecast period.

The automotive PCB market report profiles major vendors based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments. Amitron, Chin Poon Industrial Co., Ltd., CMK Corporation, Daeduck Electronics Co., Ltd., Delphi Technologies (BorgWarner Inc.), KCE Electronics, Meiko Electronics Co., Ltd., Nippon Mektron, Ltd., Samsung Electro-Mechanics, Tripod Technology Corporation, and Unimicron are key entities operating in the automotive PCB market.

Prominent players are implementing stringent quality control measures to ensure that the PCBs meet the required standards and specifications. They are also focusing on cost-effective manufacturing processes and reducing waste to offer competitive prices while maintaining quality. Overall, these strategies are projected to increase the automotive PCB market share in the near future.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 13.2 Bn |

|

Market Forecast Value in 2031 |

US$ 25.6 Bn |

|

Growth Rate (CAGR) |

7.7% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 13.2 Bn in 2022.

It is expected to grow at a CAGR of 7.7% from 2023 to 2031.

It is estimated to be worth US$ 25.6 Bn by the end of 2031.

Increase in adoption of Mobility 4.0 and rise in demand for next-generation vehicles.

The single layer PCB type segment is estimated to account for major share from 2023 to 2031.

Asia Pacific is the most lucrative region for vendors.

Amitron, Chin Poon Industrial Co., Ltd., CMK Corporation, Daeduck Electronics Co., Ltd., Delphi Technologies (BorgWarner Inc.), KCE Electronics, Meiko Electronics Co., Ltd., Nippon Mektron, Ltd., Samsung Electro-Mechanics, Tripod Technology Corporation, and Unimicron.

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Size in Units, Value US$ Bn, 2017-2031

1.2. TMR Analysis and Recommendations

1.3. Competitive Dashboard Analysis

2. Market Overview

2.1. Market Coverage/Taxonomy

2.2. Market Definition/Scope /Limitations

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunity

2.4. Market Factor Analysis

2.4.1. Porter’s Five Force Analysis

2.4.2. SWOT Analysis

2.5. Regulatory Scenario

2.6. Key Trend Analysis

2.7. Value Chain Analysis

2.8. Cost Structure Analysis

2.9. Profit Margin Analysis

2.10. COVID-19 Impact Analysis – Automotive PCB Market

3. Global Automotive PCB Market, By Type

3.1. Market Snapshot

3.1.1. Introduction, Definition, and Key Findings

3.1.2. Market Growth & Y-o-Y Projections

3.1.3. Base Point Share Analysis

3.2. Global Automotive PCB Market Size & Forecast, 2017-2031, By Type

3.2.1. Single Layer PCB

3.2.2. Double Layer PCB

3.2.3. Multilayer PCB

4. Global Automotive PCB Market, By Fuel Type

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Automotive PCB Market Size & Forecast, 2017-2031, By Fuel Type

4.2.1. IC Engine

4.2.1.1. Diesel

4.2.1.2. Gasoline

4.2.2. Electric

4.2.2.1. Battery Electric

4.2.2.2. Hybrid Electric

5. Global Automotive PCB Market, By Application

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Automotive PCB Market Size & Forecast, 2017-2031, By Application

5.2.1. ADAS

5.2.2. Body & Comfort

5.2.3. Infotainment

5.2.4. Powertrain

5.2.5. Others

6. Global Automotive PCB Market, By Vehicle Type

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Automotive PCB Market Size & Forecast, 2017-2031, By Vehicle Type

6.2.1. Minicompact

6.2.2. Supermini

6.2.3. Compact

6.2.4. Mid-size

6.2.5. Executive

6.2.6. Luxury

6.2.7. Utility Vehicle (Sport Utility Vehicle & Multi-purpose Vehicle)

7. Global Automotive PCB Market, By Level of Automation

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Automotive PCB Market Size & Forecast, 2017-2031, By Level of Automation

7.2.1. Level 1

7.2.2. Level 2

7.2.3. Level 3

7.2.4. Level 4

7.2.5. Level 5

8. Global Automotive PCB Market, By Substrate

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Automotive PCB Market Size & Forecast, 2017-2031, By Substrate

8.2.1. Rigid

8.2.2. Flexible

8.2.3. Rigid Flex

9. Global Automotive PCB Market, By Sales Channel

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global Automotive PCB Market Size & Forecast, 2017-2031, By Sales Channel

9.2.1. OEM

9.2.2. Aftermarket

10. Global Automotive PCB Market, by Region

10.1. Market Snapshot

10.1.1. Introduction, Definition, and Key Findings

10.1.2. Market Growth & Y-o-Y Projections

10.1.3. Base Point Share Analysis

10.2. Global Automotive PCB Market Size & Forecast, 2017-2031, By Region

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Middle East & Africa

10.2.5. South America

11. North America Automotive PCB Market

11.1. Market Snapshot

11.2. North America Automotive PCB Market Size & Forecast, 2017-2031, By Type

11.2.1. Single Layer PCB

11.2.2. Double Layer PCB

11.2.3. Multilayer PCB

11.3. North America Automotive PCB Market Size & Forecast, 2017-2031, By Fuel Type

11.3.1. IC Engine

11.3.1.1. Diesel

11.3.1.2. Gasoline

11.3.2. Electric

11.3.2.1. Battery Electric

11.3.2.2. Hybrid Electric

11.4. North America Automotive PCB Market Size & Forecast, 2017-2031, By Application

11.4.1. ADAS

11.4.2. Body & Comfort

11.4.3. Infotainment

11.4.4. Powertrain

11.4.5. Others

11.5. North America Automotive PCB Market Size & Forecast, 2017-2031, By Vehicle Type

11.5.1. Minicompact

11.5.2. Supermini

11.5.3. Compact

11.5.4. Mid-size

11.5.5. Executive

11.5.6. Luxury

11.5.7. Utility Vehicle (Sport Utility Vehicle & Multi-purpose Vehicle)

11.6. North America Automotive PCB Market Size & Forecast, 2017-2031, By Level of Automation

11.6.1. Level 1

11.6.2. Level 2

11.6.3. Level 3

11.6.4. Level 4

11.6.5. Level 5

11.7. North America Automotive PCB Market Size & Forecast, 2017-2031, By Substrate

11.7.1. Rigid

11.7.2. Flexible

11.7.3. Rigid Flex

11.8. North America Automotive PCB Market Size & Forecast, 2017-2031, By Sales Channel

11.8.1. OEM

11.8.2. Aftermarket

11.9. North America Automotive PCB Market Size & Forecast, 2017-2031, By Country

11.9.1. U.S.

11.9.2. Canada

11.9.3. Mexico

12. Europe Automotive PCB Market

12.1. Market Snapshot

12.2. Europe Automotive PCB Market Size & Forecast, 2017-2031, By Type

12.2.1. Single Layer PCB

12.2.2. Double Layer PCB

12.2.3. Multilayer PCB

12.3. Europe Automotive PCB Market Size & Forecast, 2017-2031, By Fuel Type

12.3.1. IC Engine

12.3.1.1. Diesel

12.3.1.2. Gasoline

12.3.2. Electric

12.3.2.1. Battery Electric

12.3.2.2. Hybrid Electric

12.4. Europe Automotive PCB Market Size & Forecast, 2017-2031, By Application

12.4.1. ADAS

12.4.2. Body & Comfort

12.4.3. Infotainment

12.4.4. Powertrain

12.4.5. Others

12.5. Europe Automotive PCB Market Size & Forecast, 2017-2031, By Vehicle Type

12.5.1. Minicompact

12.5.2. Supermini

12.5.3. Compact

12.5.4. Mid-size

12.5.5. Executive

12.5.6. Luxury

12.5.7. Utility Vehicle (Sport Utility Vehicle & Multi-purpose Vehicle)

12.6. Europe Automotive PCB Market Size & Forecast, 2017-2031, By Level of Automation

12.6.1. Level 1

12.6.2. Level 2

12.6.3. Level 3

12.6.4. Level 4

12.6.5. Level 5

12.7. Europe Automotive PCB Market Size & Forecast, 2017-2031, By Substrate

12.7.1. Rigid

12.7.2. Flexible

12.7.3. Rigid Flex

12.8. Europe Automotive PCB Market Size & Forecast, 2017-2031, By Sales Channel

12.8.1. OEM

12.8.2. Aftermarket

12.9. Europe Automotive PCB Market Size & Forecast, 2017-2031, By Country

12.9.1. Germany

12.9.2. U.K.

12.9.3. France

12.9.4. Italy

12.9.5. Spain

12.9.6. Nordic Countries

12.9.7. Russia & CIS

12.9.8. Rest of Europe

13. Asia Pacific Automotive PCB Market

13.1. Market Snapshot

13.2. Asia Pacific Automotive PCB Market Size & Forecast, 2017-2031, By Type

13.2.1. Single Layer PCB

13.2.2. Double Layer PCB

13.2.3. Multilayer PCB

13.3. Asia Pacific Automotive PCB Market Size & Forecast, 2017-2031, By Fuel Type

13.3.1. IC Engine

13.3.1.1. Diesel

13.3.1.2. Gasoline

13.3.2. Electric

13.3.2.1. Battery Electric

13.3.2.2. Hybrid Electric

13.4. Asia Pacific Automotive PCB Market Size & Forecast, 2017-2031, By Application

13.4.1. ADAS

13.4.2. Body & Comfort

13.4.3. Infotainment

13.4.4. Powertrain

13.4.5. Others

13.5. Asia Pacific Automotive PCB Market Size & Forecast, 2017-2031, By Vehicle Type

13.5.1. Minicompact

13.5.2. Supermini

13.5.3. Compact

13.5.4. Mid-size

13.5.5. Executive

13.5.6. Luxury

13.5.7. Utility Vehicle (Sport Utility Vehicle & Multi-purpose Vehicle)

13.6. Asia Pacific Automotive PCB Market Size & Forecast, 2017-2031, By Level of Automation

13.6.1. Level 1

13.6.2. Level 2

13.6.3. Level 3

13.6.4. Level 4

13.6.5. Level 5

13.7. Asia Pacific Automotive PCB Market Size & Forecast, 2017-2031, By Substrate

13.7.1. Rigid

13.7.2. Flexible

13.7.3. Rigid Flex

13.8. Asia Pacific Automotive PCB Market Size & Forecast, 2017-2031, By Sales Channel

13.8.1. OEM

13.8.2. Aftermarket

13.9. Asia Pacific Automotive PCB Market Size & Forecast, 2017-2031, By Country

13.9.1. China

13.9.2. India

13.9.3. Japan

13.9.4. ASEAN Countries

13.9.5. South Korea

13.9.6. ANZ

13.9.7. Rest of Asia Pacific

14. Middle East & Africa Automotive PCB Market

14.1. Market Snapshot

14.2. Middle East & Africa Automotive PCB Market Size & Forecast, 2017-2031, By Type

14.2.1. Single Layer PCB

14.2.2. Double Layer PCB

14.2.3. Multilayer PCB

14.3. Middle East & Africa Automotive PCB Market Size & Forecast, 2017-2031, By Fuel Type

14.3.1. IC Engine

14.3.1.1. Diesel

14.3.1.2. Gasoline

14.3.2. Electric

14.3.2.1. Battery Electric

14.3.2.2. Hybrid Electric

14.4. Middle East & Africa Automotive PCB Market Size & Forecast, 2017-2031, By Application

14.4.1. ADAS

14.4.2. Body & Comfort

14.4.3. Infotainment

14.4.4. Powertrain

14.4.5. Others

14.5. Middle East & Africa Automotive PCB Market Size & Forecast, 2017-2031, By Vehicle Type

14.5.1. Minicompact

14.5.2. Supermini

14.5.3. Compact

14.5.4. Mid-size

14.5.5. Executive

14.5.6. Luxury

14.5.7. Utility Vehicle (Sport Utility Vehicle & Multi-purpose Vehicle)

14.6. Middle East & Africa Automotive PCB Market Size & Forecast, 2017-2031, By Level of Automation

14.6.1. Level 1

14.6.2. Level 2

14.6.3. Level 3

14.6.4. Level 4

14.6.5. Level 5

14.7. Middle East & Africa Automotive PCB Market Size & Forecast, 2017-2031, By Substrate

14.7.1. Rigid

14.7.2. Flexible

14.7.3. Rigid Flex

14.8. Middle East & Africa Automotive PCB Market Size & Forecast, 2017-2031, By Sales Channel

14.8.1. OEM

14.8.2. Aftermarket

14.9. Middle East & Africa Automotive PCB Market Size & Forecast, 2017-2031, By Country

14.9.1. GCC

14.9.2. South Africa

14.9.3. Turkey

14.9.4. Rest of Middle East & Africa

15. South America Automotive PCB Market

15.1. Market Snapshot

15.2. South America Automotive PCB Market Size & Forecast, 2017-2031, By Type

15.2.1. Single Layer PCB

15.2.2. Double Layer PCB

15.2.3. Multilayer PCB

15.3. South America Automotive PCB Market Size & Forecast, 2017-2031, By Fuel Type

15.3.1. IC Engine

15.3.1.1. Diesel

15.3.1.2. Gasoline

15.3.2. Electric

15.3.2.1. Battery Electric

15.3.2.2. Hybrid Electric

15.4. South America Automotive PCB Market Size & Forecast, 2017-2031, By Application

15.4.1. ADAS

15.4.2. Body & Comfort

15.4.3. Infotainment

15.4.4. Powertrain

15.4.5. Others

15.5. South America Automotive PCB Market Size & Forecast, 2017-2031, By Vehicle Type

15.5.1. Minicompact

15.5.2. Supermini

15.5.3. Compact

15.5.4. Mid-size

15.5.5. Executive

15.5.6. Luxury

15.5.7. Utility Vehicle (Sport Utility Vehicle & Multi-purpose Vehicle)

15.6. South America Automotive PCB Market Size & Forecast, 2017-2031, By Level of Automation

15.6.1. Level 1

15.6.2. Level 2

15.6.3. Level 3

15.6.4. Level 4

15.6.5. Level 5

15.7. South America Automotive PCB Market Size & Forecast, 2017-2031, By Substrate

15.7.1. Rigid

15.7.2. Flexible

15.7.3. Rigid Flex

15.8. South America Automotive PCB Market Size & Forecast, 2017-2031, By Sales Channel

15.8.1. OEM

15.8.2. Aftermarket

15.9. South America Automotive PCB Market Size & Forecast, 2017-2031, By Country

15.9.1. Brazil

15.9.2. Argentina

15.9.3. Rest of South America

16. Competitive Landscape

16.1. Company Share Analysis/ Brand Share Analysis, 2021

16.2. Company Analysis for Each Player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

17. Company Profile/Key Players

17.1. Amitron

17.1.1. Company Overview

17.1.2. Company Footprints

17.1.3. Production Locations

17.1.4. Product Portfolio

17.1.5. Competitors & Customers

17.1.6. Subsidiaries & Parent Organization

17.1.7. Recent Developments

17.1.8. Financial Analysis

17.1.9. Profitability

17.1.10. Revenue Share

17.2. Chin Poon Industrial Co., Ltd.

17.2.1. Company Overview

17.2.2. Company Footprints

17.2.3. Production Locations

17.2.4. Product Portfolio

17.2.5. Competitors & Customers

17.2.6. Subsidiaries & Parent Organization

17.2.7. Recent Developments

17.2.8. Financial Analysis

17.2.9. Profitability

17.2.10. Revenue Share

17.3. CMK Corporation

17.3.1. Company Overview

17.3.2. Company Footprints

17.3.3. Production Locations

17.3.4. Product Portfolio

17.3.5. Competitors & Customers

17.3.6. Subsidiaries & Parent Organization

17.3.7. Recent Developments

17.3.8. Financial Analysis

17.3.9. Profitability

17.3.10. Revenue Share

17.4. Daeduck Electronics Co., Ltd.

17.4.1. Company Overview

17.4.2. Company Footprints

17.4.3. Production Locations

17.4.4. Product Portfolio

17.4.5. Competitors & Customers

17.4.6. Subsidiaries & Parent Organization

17.4.7. Recent Developments

17.4.8. Financial Analysis

17.4.9. Profitability

17.4.10. Revenue Share

17.5. Delphi Technologies (BorgWarner Inc.)

17.5.1. Company Overview

17.5.2. Company Footprints

17.5.3. Production Locations

17.5.4. Product Portfolio

17.5.5. Competitors & Customers

17.5.6. Subsidiaries & Parent Organization

17.5.7. Recent Developments

17.5.8. Financial Analysis

17.5.9. Profitability

17.5.10. Revenue Share

17.6. KCE Electronics

17.6.1. Company Overview

17.6.2. Company Footprints

17.6.3. Production Locations

17.6.4. Product Portfolio

17.6.5. Competitors & Customers

17.6.6. Subsidiaries & Parent Organization

17.6.7. Recent Developments

17.6.8. Financial Analysis

17.6.9. Profitability

17.6.10. Revenue Share

17.7. Meiko Electronics Co., Ltd.

17.7.1. Company Overview

17.7.2. Company Footprints

17.7.3. Production Locations

17.7.4. Product Portfolio

17.7.5. Competitors & Customers

17.7.6. Subsidiaries & Parent Organization

17.7.7. Recent Developments

17.7.8. Financial Analysis

17.7.9. Profitability

17.7.10. Revenue Share

17.8. Nippon Mektron, Ltd.

17.8.1. Company Overview

17.8.2. Company Footprints

17.8.3. Production Locations

17.8.4. Product Portfolio

17.8.5. Competitors & Customers

17.8.6. Subsidiaries & Parent Organization

17.8.7. Recent Developments

17.8.8. Financial Analysis

17.8.9. Profitability

17.8.10. Revenue Share

17.9. Samsung Electro-Mechanics

17.9.1. Company Overview

17.9.2. Company Footprints

17.9.3. Production Locations

17.9.4. Product Portfolio

17.9.5. Competitors & Customers

17.9.6. Subsidiaries & Parent Organization

17.9.7. Recent Developments

17.9.8. Financial Analysis

17.9.9. Profitability

17.9.10. Revenue Share

17.10. Tripod Technology Corporation

17.10.1. Company Overview

17.10.2. Company Footprints

17.10.3. Production Locations

17.10.4. Product Portfolio

17.10.5. Competitors & Customers

17.10.6. Subsidiaries & Parent Organization

17.10.7. Recent Developments

17.10.8. Financial Analysis

17.10.9. Profitability

17.10.10. Revenue Share

17.11. Unimicron

17.11.1. Company Overview

17.11.2. Company Footprints

17.11.3. Production Locations

17.11.4. Product Portfolio

17.11.5. Competitors & Customers

17.11.6. Subsidiaries & Parent Organization

17.11.7. Recent Developments

17.11.8. Financial Analysis

17.11.9. Profitability

17.11.10. Revenue Share

17.12. Others

17.12.1. Company Overview

17.12.2. Company Footprints

17.12.3. Production Locations

17.12.4. Product Portfolio

17.12.5. Competitors & Customers

17.12.6. Subsidiaries & Parent Organization

17.12.7. Recent Developments

17.12.8. Financial Analysis

17.12.9. Profitability

17.12.10. Revenue Share

List of Tables

Table 1: Global Automotive PCB Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Table 2: Global Automotive PCB Market Revenue (US$ Bn) Forecast, by Type, 2017-2031

Table 3: Global Automotive PCB Market Volume (Thousand Units) Forecast, by Fuel Type, 2017-2031

Table 4: Global Automotive PCB Market Revenue (US$ Bn) Forecast, by Fuel Type, 2017-2031

Table 5: Global Automotive PCB Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 6: Global Automotive PCB Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Table 7: Global Automotive PCB Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 8: Global Automotive PCB Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 9: Global Automotive PCB Market Volume (Thousand Units) Forecast, by Level of Automation, 2017-2031

Table 10: Global Automotive PCB Market Revenue (US$ Bn) Forecast, by Level of Automation, 2017-2031

Table 11: Global Automotive PCB Market Volume (Thousand Units) Forecast, by Substrate, 2017-2031

Table 12: Global Automotive PCB Market Revenue (US$ Bn) Forecast, by Substrate, 2017-2031

Table 13: Global Automotive PCB Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 14: Global Automotive PCB Market Revenue (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 15: Global Automotive PCB Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Table 16: Global Automotive PCB Market Revenue (US$ Bn) Forecast, by Region, 2017-2031

Table 17: North America Automotive PCB Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Table 18: North America Automotive PCB Market Revenue (US$ Bn) Forecast, by Type, 2017-2031

Table 19: North America Automotive PCB Market Volume (Thousand Units) Forecast, by Fuel Type, 2017-2031

Table 20: North America Automotive PCB Market Revenue (US$ Bn) Forecast, by Fuel Type, 2017-2031

Table 21: North America Automotive PCB Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 22: North America Automotive PCB Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Table 23: North America Automotive PCB Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 24: North America Automotive PCB Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 25: North America Automotive PCB Market Volume (Thousand Units) Forecast, by Level of Automation, 2017-2031

Table 26: North America Automotive PCB Market Revenue (US$ Bn) Forecast, by Level of Automation, 2017-2031

Table 27: North America Automotive PCB Market Volume (Thousand Units) Forecast, by Substrate, 2017-2031

Table 28: North America Automotive PCB Market Revenue (US$ Bn) Forecast, by Substrate, 2017-2031

Table 29: North America Automotive PCB Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 30: North America Automotive PCB Market Revenue (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 31: North America Automotive PCB Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 32: North America Automotive PCB Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 33: Europe Automotive PCB Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Table 34: Europe Automotive PCB Market Revenue (US$ Bn) Forecast, by Type, 2017-2031

Table 35: Europe Automotive PCB Market Volume (Thousand Units) Forecast, by Fuel Type, 2017-2031

Table 36: Europe Automotive PCB Market Revenue (US$ Bn) Forecast, by Fuel Type, 2017-2031

Table 37: Europe Automotive PCB Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 38: Europe Automotive PCB Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Table 39: Europe Automotive PCB Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 40: Europe Automotive PCB Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 41: Europe Automotive PCB Market Volume (Thousand Units) Forecast, by Level of Automation, 2017-2031

Table 42: Europe Automotive PCB Market Revenue (US$ Bn) Forecast, by Level of Automation, 2017-2031

Table 43: Europe Automotive PCB Market Volume (Thousand Units) Forecast, by Substrate, 2017-2031

Table 44: Europe Automotive PCB Market Revenue (US$ Bn) Forecast, by Substrate, 2017-2031

Table 45: Europe Automotive PCB Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 46: Europe Automotive PCB Market Revenue (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 47: Europe Automotive PCB Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 48: Europe Automotive PCB Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 49: Asia Pacific Automotive PCB Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Table 50: Asia Pacific Automotive PCB Market Revenue (US$ Bn) Forecast, by Type, 2017-2031

Table 51: Asia Pacific Automotive PCB Market Volume (Thousand Units) Forecast, by Fuel Type, 2017-2031

Table 52: Asia Pacific Automotive PCB Market Revenue (US$ Bn) Forecast, by Fuel Type, 2017-2031

Table 53: Asia Pacific Automotive PCB Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 54: Asia Pacific Automotive PCB Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Table 55: Asia Pacific Automotive PCB Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 56: Asia Pacific Automotive PCB Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 57: Asia Pacific Automotive PCB Market Volume (Thousand Units) Forecast, by Level of Automation, 2017-2031

Table 58: Asia Pacific Automotive PCB Market Revenue (US$ Bn) Forecast, by Level of Automation, 2017-2031

Table 59: Asia Pacific Automotive PCB Market Volume (Thousand Units) Forecast, by Substrate, 2017-2031

Table 60: Asia Pacific Automotive PCB Market Revenue (US$ Bn) Forecast, by Substrate, 2017-2031

Table 61: Asia Pacific Automotive PCB Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 62: Asia Pacific Automotive PCB Market Revenue (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 63: Asia Pacific Automotive PCB Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 64: Asia Pacific Automotive PCB Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 65: Middle East & Africa Automotive PCB Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Table 66: Middle East & Africa Automotive PCB Market Revenue (US$ Bn) Forecast, by Type, 2017-2031

Table 67: Middle East & Africa Automotive PCB Market Volume (Thousand Units) Forecast, by Fuel Type, 2017-2031

Table 68: Middle East & Africa Automotive PCB Market Revenue (US$ Bn) Forecast, by Fuel Type, 2017-2031

Table 69: Middle East & Africa Automotive PCB Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 70: Middle East & Africa Automotive PCB Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Table 71: Middle East & Africa Automotive PCB Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 72: Middle East & Africa Automotive PCB Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 73: Middle East & Africa Automotive PCB Market Volume (Thousand Units) Forecast, by Level of Automation, 2017-2031

Table 74: Middle East & Africa Automotive PCB Market Revenue (US$ Bn) Forecast, by Level of Automation, 2017-2031

Table 75: Middle East & Africa Automotive PCB Market Volume (Thousand Units) Forecast, by Substrate, 2017-2031

Table 76: Middle East & Africa Automotive PCB Market Revenue (US$ Bn) Forecast, by Substrate, 2017-2031

Table 77: Middle East & Africa Automotive PCB Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 78: Middle East & Africa Automotive PCB Market Revenue (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 79: Middle East & Africa Automotive PCB Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 80: Middle East & Africa Automotive PCB Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 81: South America Automotive PCB Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Table 82: South America Automotive PCB Market Revenue (US$ Bn) Forecast, by Type, 2017-2031

Table 83: South America Automotive PCB Market Volume (Thousand Units) Forecast, by Fuel Type, 2017-2031

Table 84: South America Automotive PCB Market Revenue (US$ Bn) Forecast, by Fuel Type, 2017-2031

Table 85: South America Automotive PCB Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 86: South America Automotive PCB Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Table 87: South America Automotive PCB Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 88: South America Automotive PCB Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 89: South America Automotive PCB Market Volume (Thousand Units) Forecast, by Level of Automation, 2017-2031

Table 90: South America Automotive PCB Market Revenue (US$ Bn) Forecast, by Level of Automation, 2017-2031

Table 91: South America Automotive PCB Market Volume (Thousand Units) Forecast, by Substrate, 2017-2031

Table 92: South America Automotive PCB Market Revenue (US$ Bn) Forecast, by Substrate, 2017-2031

Table 93: South America Automotive PCB Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 94: South America Automotive PCB Market Revenue (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 95: South America Automotive PCB Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 96: South America Automotive PCB Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

List of Figures

Figure 1: Global Automotive PCB Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Figure 2: Global Automotive PCB Market Revenue (US$ Bn) Forecast, by Type, 2017-2031

Figure 3: Global Automotive PCB Market, Incremental Opportunity, by Type, Value (US$ Bn), 2023-2031

Figure 4: Global Automotive PCB Market Volume (Thousand Units) Forecast, by Fuel Type, 2017-2031

Figure 5: Global Automotive PCB Market Revenue (US$ Bn) Forecast, by Fuel Type, 2017-2031

Figure 6: Global Automotive PCB Market, Incremental Opportunity, by Fuel Type, Value (US$ Bn), 2023-2031

Figure 7: Global Automotive PCB Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 8: Global Automotive PCB Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Figure 9: Global Automotive PCB Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 10: Global Automotive PCB Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 11: Global Automotive PCB Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 12: Global Automotive PCB Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 13: Global Automotive PCB Market Volume (Thousand Units) Forecast, by Level of Automation, 2017-2031

Figure 14: Global Automotive PCB Market Revenue (US$ Bn) Forecast, by Level of Automation, 2017-2031

Figure 15: Global Automotive PCB Market, Incremental Opportunity, by Level of Automation, Value (US$ Bn), 2023-2031

Figure 16: Global Automotive PCB Market Volume (Thousand Units) Forecast, by Substrate, 2017-2031

Figure 17: Global Automotive PCB Market Revenue (US$ Bn) Forecast, by Substrate, 2017-2031

Figure 18: Global Automotive PCB Market, Incremental Opportunity, by Substrate, Value (US$ Bn), 2023-2031

Figure 19: Global Automotive PCB Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 20: Global Automotive PCB Market Revenue (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 21: Global Automotive PCB Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 22: Global Automotive PCB Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Figure 23: Global Automotive PCB Market Revenue (US$ Bn) Forecast, by Region, 2017-2031

Figure 24: Global Automotive PCB Market, Incremental Opportunity, by Region, Value (US$ Bn), 2023-2031

Figure 25: North America Automotive PCB Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Figure 26: North America Automotive PCB Market Revenue (US$ Bn) Forecast, by Type, 2017-2031

Figure 27: North America Automotive PCB Market, Incremental Opportunity, by Type, Value (US$ Bn), 2023-2031

Figure 28: North America Automotive PCB Market Volume (Thousand Units) Forecast, by Fuel Type, 2017-2031

Figure 29: North America Automotive PCB Market Revenue (US$ Bn) Forecast, by Fuel Type, 2017-2031

Figure 30: North America Automotive PCB Market, Incremental Opportunity, by Fuel Type, Value (US$ Bn), 2023-2031

Figure 31: North America Automotive PCB Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 32: North America Automotive PCB Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Figure 33: North America Automotive PCB Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 34: North America Automotive PCB Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 35: North America Automotive PCB Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 36: North America Automotive PCB Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 37: North America Automotive PCB Market Volume (Thousand Units) Forecast, by Level of Automation, 2017-2031

Figure 38: North America Automotive PCB Market Revenue (US$ Bn) Forecast, by Level of Automation, 2017-2031

Figure 39: North America Automotive PCB Market, Incremental Opportunity, by Level of Automation, Value (US$ Bn), 2023-2031

Figure 40: North America Automotive PCB Market Volume (Thousand Units) Forecast, by Substrate, 2017-2031

Figure 41: North America Automotive PCB Market Revenue (US$ Bn) Forecast, by Substrate, 2017-2031

Figure 42: North America Automotive PCB Market, Incremental Opportunity, by Substrate, Value (US$ Bn), 2023-2031

Figure 43: North America Automotive PCB Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 44: North America Automotive PCB Market Revenue (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 45: North America Automotive PCB Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 46: North America Automotive PCB Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 47: North America Automotive PCB Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 48: North America Automotive PCB Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 49: Europe Automotive PCB Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Figure 50: Europe Automotive PCB Market Revenue (US$ Bn) Forecast, by Type, 2017-2031

Figure 51: Europe Automotive PCB Market, Incremental Opportunity, by Type, Value (US$ Bn), 2023-2031

Figure 52: Europe Automotive PCB Market Volume (Thousand Units) Forecast, by Fuel Type, 2017-2031

Figure 53: Europe Automotive PCB Market Revenue (US$ Bn) Forecast, by Fuel Type, 2017-2031

Figure 54: Europe Automotive PCB Market, Incremental Opportunity, by Fuel Type, Value (US$ Bn), 2023-2031

Figure 55: Europe Automotive PCB Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 56: Europe Automotive PCB Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Figure 57: Europe Automotive PCB Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 58: Europe Automotive PCB Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 59: Europe Automotive PCB Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 60: Europe Automotive PCB Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 61: Europe Automotive PCB Market Volume (Thousand Units) Forecast, by Level of Automation, 2017-2031

Figure 62: Europe Automotive PCB Market Revenue (US$ Bn) Forecast, by Level of Automation, 2017-2031

Figure 63: Europe Automotive PCB Market, Incremental Opportunity, by Level of Automation, Value (US$ Bn), 2023-2031

Figure 64: Europe Automotive PCB Market Volume (Thousand Units) Forecast, by Substrate, 2017-2031

Figure 65: Europe Automotive PCB Market Revenue (US$ Bn) Forecast, by Substrate, 2017-2031

Figure 66: Europe Automotive PCB Market, Incremental Opportunity, by Substrate, Value (US$ Bn), 2023-2031

Figure 67: Europe Automotive PCB Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 68: Europe Automotive PCB Market Revenue (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 69: Europe Automotive PCB Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 70: Europe Automotive PCB Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 71: Europe Automotive PCB Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 72: Europe Automotive PCB Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 73: Asia Pacific Automotive PCB Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Figure 74: Asia Pacific Automotive PCB Market Revenue (US$ Bn) Forecast, by Type, 2017-2031

Figure 75: Asia Pacific Automotive PCB Market, Incremental Opportunity, by Type, Value (US$ Bn), 2023-2031

Figure 76: Asia Pacific Automotive PCB Market Volume (Thousand Units) Forecast, by Fuel Type, 2017-2031

Figure 77: Asia Pacific Automotive PCB Market Revenue (US$ Bn) Forecast, by Fuel Type, 2017-2031

Figure 78: Asia Pacific Automotive PCB Market, Incremental Opportunity, by Fuel Type, Value (US$ Bn), 2023-2031

Figure 79: Asia Pacific Automotive PCB Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 80: Asia Pacific Automotive PCB Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Figure 81: Asia Pacific Automotive PCB Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 82: Asia Pacific Automotive PCB Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 83: Asia Pacific Automotive PCB Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 84: Asia Pacific Automotive PCB Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 85: Asia Pacific Automotive PCB Market Volume (Thousand Units) Forecast, by Level of Automation, 2017-2031

Figure 86: Asia Pacific Automotive PCB Market Revenue (US$ Bn) Forecast, by Level of Automation, 2017-2031

Figure 87: Asia Pacific Automotive PCB Market, Incremental Opportunity, by Level of Automation, Value (US$ Bn), 2023-2031

Figure 88: Asia Pacific Automotive PCB Market Volume (Thousand Units) Forecast, by Substrate, 2017-2031

Figure 89: Asia Pacific Automotive PCB Market Revenue (US$ Bn) Forecast, by Substrate, 2017-2031

Figure 90: Asia Pacific Automotive PCB Market, Incremental Opportunity, by Substrate, Value (US$ Bn), 2023-2031

Figure 91: Asia Pacific Automotive PCB Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 92: Asia Pacific Automotive PCB Market Revenue (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 93: Asia Pacific Automotive PCB Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 94: Asia Pacific Automotive PCB Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 95: Asia Pacific Automotive PCB Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 96: Asia Pacific Automotive PCB Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 97: Middle East & Africa Automotive PCB Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Figure 98: Middle East & Africa Automotive PCB Market Revenue (US$ Bn) Forecast, by Type, 2017-2031

Figure 99: Middle East & Africa Automotive PCB Market, Incremental Opportunity, by Type, Value (US$ Bn), 2023-2031

Figure 100: Middle East & Africa Automotive PCB Market Volume (Thousand Units) Forecast, by Fuel Type, 2017-2031

Figure 101: Middle East & Africa Automotive PCB Market Revenue (US$ Bn) Forecast, by Fuel Type, 2017-2031

Figure 102: Middle East & Africa Automotive PCB Market, Incremental Opportunity, by Fuel Type, Value (US$ Bn), 2023-2031

Figure 103: Middle East & Africa Automotive PCB Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 104: Middle East & Africa Automotive PCB Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Figure 105: Middle East & Africa Automotive PCB Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 106: Middle East & Africa Automotive PCB Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 107: Middle East & Africa Automotive PCB Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 108: Middle East & Africa Automotive PCB Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 109: Middle East & Africa Automotive PCB Market Volume (Thousand Units) Forecast, by Level of Automation, 2017-2031

Figure 110: Middle East & Africa Automotive PCB Market Revenue (US$ Bn) Forecast, by Level of Automation, 2017-2031

Figure 111: Middle East & Africa Automotive PCB Market, Incremental Opportunity, by Level of Automation, Value (US$ Bn), 2023-2031

Figure 112: Middle East & Africa Automotive PCB Market Volume (Thousand Units) Forecast, by Substrate, 2017-2031

Figure 113: Middle East & Africa Automotive PCB Market Revenue (US$ Bn) Forecast, by Substrate, 2017-2031

Figure 114: Middle East & Africa Automotive PCB Market, Incremental Opportunity, by Substrate, Value (US$ Bn), 2023-2031

Figure 115: Middle East & Africa Automotive PCB Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 116: Middle East & Africa Automotive PCB Market Revenue (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 117: Middle East & Africa Automotive PCB Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 118: Middle East & Africa Automotive PCB Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 119: Middle East & Africa Automotive PCB Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 120: Middle East & Africa Automotive PCB Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 121: South America Automotive PCB Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Figure 122: South America Automotive PCB Market Revenue (US$ Bn) Forecast, by Type, 2017-2031

Figure 123: South America Automotive PCB Market, Incremental Opportunity, by Type, Value (US$ Bn), 2023-2031

Figure 124: South America Automotive PCB Market Volume (Thousand Units) Forecast, by Fuel Type, 2017-2031

Figure 125: South America Automotive PCB Market Revenue (US$ Bn) Forecast, by Fuel Type, 2017-2031

Figure 126: South America Automotive PCB Market, Incremental Opportunity, by Fuel Type, Value (US$ Bn), 2023-2031

Figure 127: South America Automotive PCB Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 128: South America Automotive PCB Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Figure 129: South America Automotive PCB Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 130: South America Automotive PCB Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 131: South America Automotive PCB Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 132: South America Automotive PCB Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 133: South America Automotive PCB Market Volume (Thousand Units) Forecast, by Level of Automation, 2017-2031

Figure 134: South America Automotive PCB Market Revenue (US$ Bn) Forecast, by Level of Automation, 2017-2031

Figure 135: South America Automotive PCB Market, Incremental Opportunity, by Level of Automation, Value (US$ Bn), 2023-2031

Figure 136: South America Automotive PCB Market Volume (Thousand Units) Forecast, by Substrate, 2017-2031

Figure 137: South America Automotive PCB Market Revenue (US$ Bn) Forecast, by Substrate, 2017-2031

Figure 138: South America Automotive PCB Market, Incremental Opportunity, by Substrate, Value (US$ Bn), 2023-2031

Figure 139: South America Automotive PCB Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 140: South America Automotive PCB Market Revenue (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 141: South America Automotive PCB Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 142: South America Automotive PCB Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 143: South America Automotive PCB Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 144: South America Automotive PCB Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031