Analysts’ Viewpoint on Market Scenario

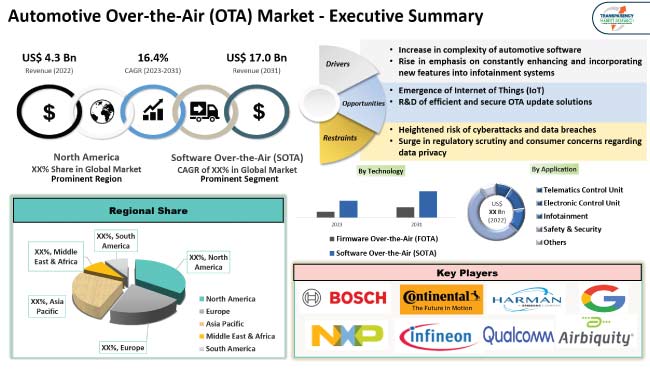

Increase in complexity of automotive software is expected to propel the automotive Over-the-Air (OTA) market size during the forecast period. Rise in emphasis on constantly enhancing and incorporating new features into infotainment systems is also projected to boost demand for automotive OTA in the next few years.

Emergence of Internet of Things (IoT) and R&D of efficient and secure OTA update solutions are likely to offer lucrative opportunities to vendors in the global automotive Over-the-Air (OTA) industry. However, heightened risk of cyberattacks and data breaches and surge in regulatory scrutiny and consumer concerns regarding data privacy are anticipated to limit the automotive Over-the-Air (OTA) market growth in the near future. Thus, manufacturers are implementing robust encryption, authentication, and cybersecurity measures to protect vehicle OTA upgrades and the connected vehicle ecosystem from cyber threats.

The automotive Over-the-Air (OTA) business refers to the rapidly growing segment within the automotive sector that focuses on delivering software updates and data exchanges to vehicles over wireless networks. OTA technology enables automakers to remotely update various aspects of a vehicle's software, including infotainment systems, Engine Control Units (ECUs), and safety features. This technology has gained prominence due to its ability to enhance vehicle functionality, improve security, and provide a better overall user experience.

Software updates and infotainment system upgrades are major applications of automotive Over-the-Air (OTA). There are various advantages of automotive Over-the-Air (OTA) updates including reduced costs associated with traditional recalls and service center visits for software-related issues and improved vehicle reliability and safety without requiring physical recalls.

Modern vehicles are becoming increasingly dependent on on-air automotive upgrades, making OTA updates crucial for keeping vehicles up-to-date and secure. OTA updates reduce the need for physical recalls and service center visits, saving automakers and consumers’ time and money. Firmware Over-the-Air (FOTA) is gaining traction for updating vehicle firmware. The rollout of 5G networks is expected to significantly improve OTA update speeds and reliability. Using OTA data for predictive maintenance can reduce vehicle downtime and maintenance costs.

Protecting OTA communication from cyber threats is a significant concern. Ensuring reliable network connectivity, even in remote areas, is crucial for successful vehicle firmware updates. OTA updates enable automakers to introduce new features and improvements, enhancing the user experience and customer satisfaction. Wireless vehicle updates help address cybersecurity vulnerabilities by allowing automakers to patch software vulnerabilities quickly.

Vehicles are becoming more sophisticated and highly reliant on software for a wide range of functions including engine management, safety features, infotainment systems, and autonomous driving capabilities. Automakers need a way to efficiently and securely update and maintain the software in their vehicles with this increased complexity. OTA updates provide a means to do so without requiring physical visits to service centers. Automakers are addressing performance issues, bugs, and security vulnerabilities by sending software updates directly to vehicles, improving overall reliability and functionality. Thus, rise in complexity of automotive software is propelling the automotive Over-the-Air (OTA) market value.

Surge in connectivity of vehicles has raised concerns about cybersecurity threats. OTA updates are a crucial tool for addressing security vulnerabilities promptly and ensuring that vehicles remain protected against cyberattacks. OTA technology allows automakers to patch software vulnerabilities and deploy security updates quickly, helping to safeguard vehicle systems and data.

OTA updates offer substantial cost savings for both automakers and vehicle owners. Instead of costly and time-consuming recall campaigns or service center visits, software-related issues can often be resolved through remote updates. For automakers, this means reduced warranty and recall costs, as well as the ability to introduce new features or fix problems without recalling vehicles. Vehicle owners benefit from the convenience of not having to visit a dealership for software updates, reducing downtime and inconvenience. These factors highlight the crucial role of OTA technology in addressing the evolving needs of the automotive sector by streamlining software management, improving vehicle performance, and enhancing the overall customer experience, thereby augmenting the automotive Over-the-Air (OTA) market expansion.

Consumers are expecting the same level of connectivity and software features in their cars as they do in their smartphones and other devices. Hence, automakers are using OTA updates to continuously improve and add new features to infotainment systems, navigation, and other in-car technologies. Improved user experiences can lead to higher customer satisfaction and brand loyalty.

According to the latest automotive Over-the-Air (OTA) market trends, the software Over-the-Air (SOTA) technology segment held major share in 2022. Automaker's priorities, the vehicle's systems, and the stage of technology adoption impact the demand for various types of automotive Over-the-Air (OTA).

SOTA is widely employed as it addresses software features and user-facing functions that directly impact the driving experience. Ultimately, the choice between firmware Over-the-Air (FOTA) and SOTA, or a combination of both, depends on the manufacturer's strategy, the type of vehicle, and the specific software and hardware components that require updates. Many modern vehicles incorporate both FOTA and SOTA capabilities to address various aspects of software and firmware management.

According to the latest automotive Over-the-Air (OTA) market analysis, the telematics control unit application segment is projected to dominate the industry during the forecast period. Growth of the segment can be ascribed to increase in demand from real-time data analytics.

OTA updates enable automakers to deliver new features, interface improvements, and compatibility enhancements to infotainment systems, keeping them up-to-date with the latest technology trends. OTA updates can include map data updates that help ensure navigation systems have the most up-to-date maps, routes, and points of interest. OTA updates aid in improving the functionality and safety of Advanced Driver-assistance System (ADAS) by delivering updated algorithms and performance enhancements.

According to the latest automotive Over-the-Air (OTA) market forecast, North America is expected to hold largest share from 2023 to 2031. The U.S. is a major market for OTA in the region. Expansion in the automotive sector and rise in focus of regulatory bodies on cybersecurity standards and regulations related to OTA updates are fueling the market dynamics of North America.

Presence of major automakers, including BMW, Mercedes-Benz, and Volkswagen, and surge in adoption of advanced vehicle connectivity features, are driving the automotive Over-the-Air (OTA) market statistics in Europe. Implementation of stringent cybersecurity regulations is also fueling the demand for OTA in the region.

The industry in Asia Pacific is anticipated to grow at a rapid pace during the forecast period due to increase in adoption of Electric Vehicles (EVs) and connected car technologies. China is a major market for OTA updates, with numerous EV manufacturers and tech companies offering advanced software solutions. Presence of companies, such as Hyundai and Toyota, that actively use OTA technology, is augmenting market progress in South Korea and Japan.

The global industry is dynamic and evolving, with different regions experiencing varying levels of adoption. Most companies are forming strategic alliances with other players to increase their automotive Over-the-Air (OTA) market share.

Robert Bosch GmbH, NXP Semiconductors N.V., Verizon Communications Inc., Continental AG, Infineon Technologies AG, Qualcomm Incorporated, Intel Corporation, Apple Inc., ATS Advanced Telematic Systems GmbH, Google Inc., NVIDIA Corporation, HARMAN International, Airbiquity Inc., and BlackBerry Limited are major manufacturers of automotive Over-the-Air (OTA).

Each of these players has been profiled in the automotive Over-the-Air (OTA) market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 | US$ 4.3 Bn |

| Market Forecast Value in 2031 | US$ 17.0 Bn |

| Growth Rate (CAGR) | 16.4% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2022 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profile |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 4.3 Bn in 2022

It is expected to advance at a CAGR of 16.4% from 2023 to 2031

It is estimated to reach US$ 17.0 Bn by the end of 2031

Increase in complexity of automotive software and rise in emphasis on constantly enhancing and incorporating new features into infotainment systems

The Software Over-the-Air (SOTA) technology segment is projected to hold largest share from 2023 to 2031

North America is anticipated to record the highest demand during the forecast period

Robert Bosch GmbH, NXP Semiconductors N.V., Verizon Communications Inc., Continental AG, Infineon Technologies AG, Qualcomm Incorporated, Intel Corporation, Apple Inc., ATS Advanced Telematic Systems GmbH, Google Inc., NVIDIA Corporation, HARMAN International, Airbiquity Inc., and BlackBerry Limited

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Size in Value US$ Bn, 2017-2031

1.2. TMR Analysis and Recommendations

1.3. Competitive Dashboard Analysis

2. Go to Market Strategy

2.1. Demand & Supply Side Trends

2.1.1. Gap Analysis

2.2. Identification of Potential Market Spaces

2.3. Understanding Buying Process of Customers

2.4. Preferred Sales & Marketing Strategy

3. Market Overview

3.1. Market Definition / Scope / Limitations

3.2. Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunity

3.3. Market Factor Analysis

3.3.1. Porter’s Five Force Analysis

3.3.2. SWOT Analysis

3.4. Regulatory Scenario

3.5. Key Trend Analysis

3.6. Value Chain Analysis

3.7. Cost Structure Analysis

3.8. Profit Margin Analysis

4. Global Automotive Over-the-Air (OTA) Market, By Technology

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Automotive Over-the-Air (OTA) Market Size & Forecast, 2017-2031, By Technology

4.2.1. Firmware Over-the-Air (FOTA)

4.2.2. Software Over-the-Air (SOTA)

5. Global Automotive Over-the-Air (OTA) Market, By Application

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Automotive Over-the-Air (OTA) Market Size & Forecast, 2017-2031, By Application

5.2.1. Telematics Control Unit

5.2.1.1. Telecommunication Applications

5.2.1.2. Real-time Data Analytics

5.2.2. Electronic Control Unit

5.2.3. Infotainment

5.2.4. Safety & Security

5.2.5. Others

6. Global Automotive Over-the-Air (OTA) Market, By Vehicle Type

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Automotive Over-the-Air (OTA) Market Size & Forecast, 2017-2031, By Vehicle Type

6.2.1. Passenger Cars

6.2.1.1. Hatchbacks

6.2.1.2. Sedans

6.2.1.3. Utility Vehicles

6.2.2. Light Commercial Vehicles

6.2.3. Heavy Duty Trucks

6.2.4. Buses and Coaches

6.2.5. Others

7. Global Automotive Over-the-Air (OTA) Market, By Electric Vehicle Type

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Automotive Over-the-Air (OTA) Market Size & Forecast, 2017-2031, By Electric Vehicle Type

7.2.1. Battery Electric Vehicles (BEVs)

7.2.2. Hybrid Electric Vehicles (HEVs)

7.2.3. Plug-in Hybrid Electric Vehicles (PHEVs)

8. Global Automotive Over-the-Air (OTA) Market, by Region

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Automotive Over-the-Air (OTA) Market Size & Forecast, 2017-2031, By Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Middle East & Africa

8.2.5. South America

9. North America Automotive Over-the-Air (OTA) Market

9.1. Market Snapshot

9.2. Automotive Over-the-Air (OTA) Market Size & Forecast, 2017-2031, By Technology

9.2.1. Firmware Over-the-Air (FOTA)

9.2.2. Software Over-the-Air (SOTA)

9.3. Automotive Over-the-Air (OTA) Market Size & Forecast, 2017-2031, By Application

9.3.1. Telematics Control Unit

9.3.1.1. Telecommunication Applications

9.3.1.2. Real-time Data Analytics

9.3.2. Electronic Control Unit

9.3.3. Infotainment

9.3.4. Safety & Security

9.3.5. Others

9.4. Automotive Over-the-Air (OTA) Market Size & Forecast, 2017-2031, By Vehicle Type

9.4.1. Passenger Cars

9.4.1.1. Hatchbacks

9.4.1.2. Sedans

9.4.1.3. Utility Vehicles

9.4.2. Light Commercial Vehicles

9.4.3. Heavy Duty Trucks

9.4.4. Buses and Coaches

9.4.5. Others

9.5. Automotive Over-the-Air (OTA) Market Size & Forecast, 2017-2031, By Electric Vehicle Type

9.5.1. Battery Electric Vehicles (BEVs)

9.5.2. Hybrid Electric Vehicles (HEVs)

9.5.3. Plug-in Hybrid Electric Vehicles (PHEVs)

9.6. Key Country Analysis - North America Automotive Over-the-Air (OTA) Market Size & Forecast, 2017-2031

9.6.1. U.S.

9.6.2. Canada

9.6.3. Mexico

10. Europe Automotive Over-the-Air (OTA) Market

10.1. Market Snapshot

10.2. Automotive Over-the-Air (OTA) Market Size & Forecast, 2017-2031, By Technology

10.2.1. Firmware Over-the-Air (FOTA)

10.2.2. Software Over-the-Air (SOTA)

10.3. Automotive Over-the-Air (OTA) Market Size & Forecast, 2017-2031, By Application

10.3.1. Telematics Control Unit

10.3.1.1. Telecommunication Applications

10.3.1.2. Real-time Data Analytics

10.3.2. Electronic Control Unit

10.3.3. Infotainment

10.3.4. Safety & Security

10.3.5. Others

10.4. Automotive Over-the-Air (OTA) Market Size & Forecast, 2017-2031, By Vehicle Type

10.4.1. Passenger Cars

10.4.1.1. Hatchbacks

10.4.1.2. Sedans

10.4.1.3. Utility Vehicles

10.4.2. Light Commercial Vehicles

10.4.3. Heavy Duty Trucks

10.4.4. Buses and Coaches

10.4.5. Others

10.5. Automotive Over-the-Air (OTA) Market Size & Forecast, 2017-2031, By Electric Vehicle Type

10.5.1. Battery Electric Vehicles (BEVs)

10.5.2. Hybrid Electric Vehicles (HEVs)

10.5.3. Plug-in Hybrid Electric Vehicles (PHEVs)

10.6. Key Country Analysis - Europe Automotive Over-the-Air (OTA) Market Size & Forecast, 2017-2031

10.6.1. Germany

10.6.2. U.K.

10.6.3. France

10.6.4. Italy

10.6.5. Spain

10.6.6. Nordic Countries

10.6.7. Russia & CIS

10.6.8. Rest of Europe

11. Asia Pacific Automotive Over-the-Air (OTA) Market

11.1. Market Snapshot

11.2. Automotive Over-the-Air (OTA) Market Size & Forecast, 2017-2031, By Technology

11.2.1. Firmware Over-the-Air (FOTA)

11.2.2. Software Over-the-Air (SOTA)

11.3. Automotive Over-the-Air (OTA) Market Size & Forecast, 2017-2031, By Application

11.3.1. Telematics Control Unit

11.3.1.1. Telecommunication Applications

11.3.1.2. Real-time Data Analytics

11.3.2. Electronic Control Unit

11.3.3. Infotainment

11.3.4. Safety & Security

11.3.5. Others

11.4. Automotive Over-the-Air (OTA) Market Size & Forecast, 2017-2031, By Vehicle Type

11.4.1. Passenger Cars

11.4.1.1. Hatchbacks

11.4.1.2. Sedans

11.4.1.3. Utility Vehicles

11.4.2. Light Commercial Vehicles

11.4.3. Heavy Duty Trucks

11.4.4. Buses and Coaches

11.4.5. Others

11.5. Automotive Over-the-Air (OTA) Market Size & Forecast, 2017-2031, By Electric Vehicle Type

11.5.1. Battery Electric Vehicles (BEVs)

11.5.2. Hybrid Electric Vehicles (HEVs)

11.5.3. Plug-in Hybrid Electric Vehicles (PHEVs)

11.6. Key Country Analysis - Asia Pacific Automotive Over-the-Air (OTA) Market Size & Forecast, 2017-2031

11.6.1. China

11.6.2. India

11.6.3. Japan

11.6.4. ASEAN Countries

11.6.5. South Korea

11.6.6. Australia & New Zealand

11.6.7. Rest of Asia Pacific

12. Middle East & Africa Automotive Over-the-Air (OTA) Market

12.1. Market Snapshot

12.2. Automotive Over-the-Air (OTA) Market Size & Forecast, 2017-2031, By Technology

12.2.1. Firmware Over-the-Air (FOTA)

12.2.2. Software Over-the-Air (SOTA)

12.3. Automotive Over-the-Air (OTA) Market Size & Forecast, 2017-2031, By Application

12.3.1. Telematics Control Unit

12.3.1.1. Telecommunication Applications

12.3.1.2. Real-time Data Analytics

12.3.2. Electronic Control Unit

12.3.3. Infotainment

12.3.4. Safety & Security

12.3.5. Others

12.4. Automotive Over-the-Air (OTA) Market Size & Forecast, 2017-2031, By Vehicle Type

12.4.1. Passenger Cars

12.4.1.1. Hatchbacks

12.4.1.2. Sedans

12.4.1.3. Utility Vehicles

12.4.2. Light Commercial Vehicles

12.4.3. Heavy Duty Trucks

12.4.4. Buses and Coaches

12.4.5. Others

12.5. Automotive Over-the-Air (OTA) Market Size & Forecast, 2017-2031, By Electric Vehicle Type

12.5.1. Battery Electric Vehicles (BEVs)

12.5.2. Hybrid Electric Vehicles (HEVs)

12.5.3. Plug-in Hybrid Electric Vehicles (PHEVs)

12.6. Key Country Analysis - Middle East & Africa Automotive Over-the-Air (OTA) Market Size & Forecast, 2017-2031

12.6.1. GCC

12.6.2. South Africa

12.6.3. Turkey

12.6.4. Rest of Middle East & Africa

13. South America Automotive Over-the-Air (OTA) Market

13.1. Market Snapshot

13.2. Automotive Over-the-Air (OTA) Market Size & Forecast, 2017-2031, By Technology

13.2.1. Firmware Over-the-Air (FOTA)

13.2.2. Software Over-the-Air (SOTA)

13.3. Automotive Over-the-Air (OTA) Market Size & Forecast, 2017-2031, By Application

13.3.1. Telematics Control Unit

13.3.1.1. Telecommunication Applications

13.3.1.2. Real-time Data Analytics

13.3.2. Electronic Control Unit

13.3.3. Infotainment

13.3.4. Safety & Security

13.3.5. Others

13.4. Automotive Over-the-Air (OTA) Market Size & Forecast, 2017-2031, By Vehicle Type

13.4.1. Passenger Cars

13.4.1.1. Hatchbacks

13.4.1.2. Sedans

13.4.1.3. Utility Vehicles

13.4.2. Light Commercial Vehicles

13.4.3. Heavy Duty Trucks

13.4.4. Buses and Coaches

13.4.5. Others

13.5. Automotive Over-the-Air (OTA) Market Size & Forecast, 2017-2031, By Electric Vehicle Type

13.5.1. Battery Electric Vehicles (BEVs)

13.5.2. Hybrid Electric Vehicles (HEVs)

13.5.3. Plug-in Hybrid Electric Vehicles (PHEVs)

13.6. Key Country Analysis - South America Automotive Over-the-Air (OTA) Market Size & Forecast, 2017-2031

13.6.1. Brazil

13.6.2. Argentina

13.6.3. Rest of South America

14. Competitive Landscape

14.1. Company Share Analysis/ Brand Share Analysis, 2022

14.2. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

15. Company Profiles/ Key Players

15.1. Robert Bosch GmbH

15.1.1. Company Overview

15.1.2. Company Footprints

15.1.3. Production Locations

15.1.4. Product Portfolio

15.1.5. Competitors & Customers

15.1.6. Subsidiaries & Parent Organization

15.1.7. Recent Developments

15.1.8. Financial Analysis

15.1.9. Profitability

15.1.10. Revenue Share

15.2. NXP Semiconductors N.V.

15.2.1. Company Overview

15.2.2. Company Footprints

15.2.3. Production Locations

15.2.4. Product Portfolio

15.2.5. Competitors & Customers

15.2.6. Subsidiaries & Parent Organization

15.2.7. Recent Developments

15.2.8. Financial Analysis

15.2.9. Profitability

15.2.10. Revenue Share

15.3. Verizon Communications Inc.

15.3.1. Company Overview

15.3.2. Company Footprints

15.3.3. Production Locations

15.3.4. Product Portfolio

15.3.5. Competitors & Customers

15.3.6. Subsidiaries & Parent Organization

15.3.7. Recent Developments

15.3.8. Financial Analysis

15.3.9. Profitability

15.3.10. Revenue Share

15.4. Continental AG

15.4.1. Company Overview

15.4.2. Company Footprints

15.4.3. Production Locations

15.4.4. Product Portfolio

15.4.5. Competitors & Customers

15.4.6. Subsidiaries & Parent Organization

15.4.7. Recent Developments

15.4.8. Financial Analysis

15.4.9. Profitability

15.4.10. Revenue Share

15.5. Infineon Technologies AG

15.5.1. Company Overview

15.5.2. Company Footprints

15.5.3. Production Locations

15.5.4. Product Portfolio

15.5.5. Competitors & Customers

15.5.6. Subsidiaries & Parent Organization

15.5.7. Recent Developments

15.5.8. Financial Analysis

15.5.9. Profitability

15.5.10. Revenue Share

15.6. Qualcomm Incorporated

15.6.1. Company Overview

15.6.2. Company Footprints

15.6.3. Production Locations

15.6.4. Product Portfolio

15.6.5. Competitors & Customers

15.6.6. Subsidiaries & Parent Organization

15.6.7. Recent Developments

15.6.8. Financial Analysis

15.6.9. Profitability

15.6.10. Revenue Share

15.7. Intel Corporation

15.7.1. Company Overview

15.7.2. Company Footprints

15.7.3. Production Locations

15.7.4. Product Portfolio

15.7.5. Competitors & Customers

15.7.6. Subsidiaries & Parent Organization

15.7.7. Recent Developments

15.7.8. Financial Analysis

15.7.9. Profitability

15.7.10. Revenue Share

15.8. Apple Inc.

15.8.1. Company Overview

15.8.2. Company Footprints

15.8.3. Production Locations

15.8.4. Product Portfolio

15.8.5. Competitors & Customers

15.8.6. Subsidiaries & Parent Organization

15.8.7. Recent Developments

15.8.8. Financial Analysis

15.8.9. Profitability

15.8.10. Revenue Share

15.9. ATS Advanced Telematic Systems GmbH

15.9.1. Company Overview

15.9.2. Company Footprints

15.9.3. Production Locations

15.9.4. Product Portfolio

15.9.5. Competitors & Customers

15.9.6. Subsidiaries & Parent Organization

15.9.7. Recent Developments

15.9.8. Financial Analysis

15.9.9. Profitability

15.9.10. Revenue Share

15.10. Google Inc.

15.10.1. Company Overview

15.10.2. Company Footprints

15.10.3. Production Locations

15.10.4. Product Portfolio

15.10.5. Competitors & Customers

15.10.6. Subsidiaries & Parent Organization

15.10.7. Recent Developments

15.10.8. Financial Analysis

15.10.9. Profitability

15.10.10. Revenue Share

15.11. NVIDIA Corporation

15.11.1. Company Overview

15.11.2. Company Footprints

15.11.3. Production Locations

15.11.4. Product Portfolio

15.11.5. Competitors & Customers

15.11.6. Subsidiaries & Parent Organization

15.11.7. Recent Developments

15.11.8. Financial Analysis

15.11.9. Profitability

15.11.10. Revenue Share

15.12. HARMAN International

15.12.1. Company Overview

15.12.2. Company Footprints

15.12.3. Production Locations

15.12.4. Product Portfolio

15.12.5. Competitors & Customers

15.12.6. Subsidiaries & Parent Organization

15.12.7. Recent Developments

15.12.8. Financial Analysis

15.12.9. Profitability

15.12.10. Revenue Share

15.13. Airbiquity Inc.

15.13.1. Company Overview

15.13.2. Company Footprints

15.13.3. Production Locations

15.13.4. Product Portfolio

15.13.5. Competitors & Customers

15.13.6. Subsidiaries & Parent Organization

15.13.7. Recent Developments

15.13.8. Financial Analysis

15.13.9. Profitability

15.13.10. Revenue Share

15.14. BlackBerry Limited

15.14.1. Company Overview

15.14.2. Company Footprints

15.14.3. Production Locations

15.14.4. Product Portfolio

15.14.5. Competitors & Customers

15.14.6. Subsidiaries & Parent Organization

15.14.7. Recent Developments

15.14.8. Financial Analysis

15.14.9. Profitability

15.14.10. Revenue Share

15.15. Other Key Players

15.15.1. Company Overview

15.15.2. Company Footprints

15.15.3. Production Locations

15.15.4. Product Portfolio

15.15.5. Competitors & Customers

15.15.6. Subsidiaries & Parent Organization

15.15.7. Recent Developments

15.15.8. Financial Analysis

15.15.9. Profitability

15.15.10. Revenue Share

List of Tables

Table 1: Global Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Technology, 2017-2031

Table 2: Global Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Table 3: Global Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 4: Global Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Electric Vehicle Type, 2017-2031

Table 5: Global Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Region, 2017-2031

Table 6: North America Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Technology, 2017-2031

Table 7: North America Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Table 8: North America Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 9: North America Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Electric Vehicle Type, 2017-2031

Table 10: North America Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 11: Europe Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Technology, 2017-2031

Table 12: Europe Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Table 13: Europe Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 14: Europe Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Electric Vehicle Type, 2017-2031

Table 15: Europe Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 16: Asia Pacific Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Technology, 2017-2031

Table 17: Asia Pacific Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Table 18: Asia Pacific Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 19: Asia Pacific Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Electric Vehicle Type, 2017-2031

Table 20: Asia Pacific Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 21: Middle East & Africa Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Technology, 2017-2031

Table 22: Middle East & Africa Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Table 23: Middle East & Africa Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 24: Middle East & Africa Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Electric Vehicle Type, 2017-2031

Table 25: Middle East & Africa Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 26: South America Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Technology, 2017-2031

Table 27: South America Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Table 28: South America Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 29: South America Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Electric Vehicle Type, 2017-2031

Table 30: South America Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

List of Figures

Figure 1: Global Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Technology, 2017-2031

Figure 2: Global Automotive Over-the-Air (OTA) Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2017-2031

Figure 3: Global Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Figure 4: Global Automotive Over-the-Air (OTA) Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 5: Global Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 6: Global Automotive Over-the-Air (OTA) Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 7: Global Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Electric Vehicle Type, 2017-2031

Figure 8: Global Automotive Over-the-Air (OTA) Market, Incremental Opportunity, by Electric Vehicle Type, Value (US$ Bn), 2023-2031

Figure 9: Global Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Region, 2017-2031

Figure 10: Global Automotive Over-the-Air (OTA) Market, Incremental Opportunity, by Region, Value (US$ Bn), 2023-2031

Figure 11: North America Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Technology, 2017-2031

Figure 12: North America Automotive Over-the-Air (OTA) Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2017-2031

Figure 13: North America Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Figure 14: North America Automotive Over-the-Air (OTA) Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 15: North America Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 16: North America Automotive Over-the-Air (OTA) Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 17: North America Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Electric Vehicle Type, 2017-2031

Figure 18: North America Automotive Over-the-Air (OTA) Market, Incremental Opportunity, by Electric Vehicle Type, Value (US$ Bn), 2023-2031

Figure 19: North America Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 20: North America Automotive Over-the-Air (OTA) Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 21: Europe Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Technology, 2017-2031

Figure 22: Europe Automotive Over-the-Air (OTA) Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2017-2031

Figure 23: Europe Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Figure 24: Europe Automotive Over-the-Air (OTA) Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 25: Europe Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 26: Europe Automotive Over-the-Air (OTA) Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 27: Europe Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Electric Vehicle Type, 2017-2031

Figure 28: Europe Automotive Over-the-Air (OTA) Market, Incremental Opportunity, by Electric Vehicle Type, Value (US$ Bn), 2023-2031

Figure 29: Europe Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 30: Europe Automotive Over-the-Air (OTA) Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 31: Asia Pacific Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Technology, 2017-2031

Figure 32: Asia Pacific Automotive Over-the-Air (OTA) Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2017-2031

Figure 33: Asia Pacific Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Figure 34: Asia Pacific Automotive Over-the-Air (OTA) Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 35: Asia Pacific Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 36: Asia Pacific Automotive Over-the-Air (OTA) Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 37: Asia Pacific Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Electric Vehicle Type, 2017-2031

Figure 38: Asia Pacific Automotive Over-the-Air (OTA) Market, Incremental Opportunity, by Electric Vehicle Type, Value (US$ Bn), 2023-2031

Figure 39: Asia Pacific Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 40: Asia Pacific Automotive Over-the-Air (OTA) Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 41: Middle East & Africa Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Technology, 2017-2031

Figure 42: Middle East & Africa Automotive Over-the-Air (OTA) Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2017-2031

Figure 43: Middle East & Africa Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Figure 44: Middle East & Africa Automotive Over-the-Air (OTA) Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 45: Middle East & Africa Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 46: Middle East & Africa Automotive Over-the-Air (OTA) Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 47: Middle East & Africa Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Electric Vehicle Type, 2017-2031

Figure 48: Middle East & Africa Automotive Over-the-Air (OTA) Market, Incremental Opportunity, by Electric Vehicle Type, Value (US$ Bn), 2023-2031

Figure 49: Middle East & Africa Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 50: Middle East & Africa Automotive Over-the-Air (OTA) Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 51: South America Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Technology, 2017-2031

Figure 52: South America Automotive Over-the-Air (OTA) Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2017-2031

Figure 53: South America Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Figure 54: South America Automotive Over-the-Air (OTA) Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 55: South America Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 56: South America Automotive Over-the-Air (OTA) Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 57: South America Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Electric Vehicle Type, 2017-2031

Figure 58: South America Automotive Over-the-Air (OTA) Market, Incremental Opportunity, by Electric Vehicle Type, Value (US$ Bn), 2023-2031

Figure 59: South America Automotive Over-the-Air (OTA) Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 60: South America Automotive Over-the-Air (OTA) Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031