Analysts’ Viewpoint on Market Scenario

Key players, such as BorgWarner Inc., DENSO CORPORATION, FTE automotive, HUSCO Automotive, LLC, Johnson Electric, and Magna Powertrain, Inc., operating in the global automotive oil pump industry are focusing on the upgrade of performance of oil pumps in order to offer their customers with a product portfolio that is innovative, offers cutting-edge benefits, and is cost-effective and diverse. Automotive oil pump manufacturers are also emphasizing on highly efficient pumps that are not affected by the different weather conditions and the long running period in order to ensure safety and reduce the chances of any failure or breakdown.

Moreover, rise in demand for higher safety enabled fuel-efficient vehicles is also a key factor fueling the automotive oil pump market. Oil pumps ensure that pressurized lubrication oil circulates within the engine for smooth operation and minimizes the wear & tear of the moving components. Manufacturers are also tapping into incremental market opportunities to empower the efficiency of vehicles.

A lubrication system of an engine includes an oil pump that circulates pressurize oil or lubricant from the sump to the sliding pistons, revolving bearing, and camshaft of the engine. In addition to serving as a lubricant, the oil helps keep the engine and the systems employed cool.

When the oil pump is housed inside the engine's crankcase, it is powered by the crankshaft or a chain acting as an intermediate. For instance, the power steering pump is often belt-driven when the oil pump is being used to move actuators. In other words, the higher the engine speed, the greater the fluid displacement capacity. The oil pump is driven directly by the crankshaft of the engine. It is one of the crucial components of the engine's lubrication system, and therefore, it must not malfunction or break down for the smooth running of the engine.

In 2021, the production volume of light commercial vehicles (LCVs) increased 8% globally, while passenger car production increased 2% worldwide. Additionally, sales of all automobiles globally rose by roughly 5% in the same year. This considerably increased the use of automotive parts and components, which in turn is expected to drive the market for automotive oil pumps in the next few years.

Additionally, rapid pace of advancements and innovation in the automotive industry and the need to upgrade automobiles are boosting the demand for both passenger and commercial vehicles. This is estimated to offer significant market opportunities for automakers and manufacturers of automotive oil pumps.

Moreover, stringent emission standards in developed, populated areas with rigorous pollution laws; cheaper batteries; and more widely accessible charging infrastructure are projected to boost the adoption of electric vehicles (hybrid, plug-in, battery electric) and consequently, propel the boost demand for oil pumps and drive market expansion.

Each unit that uses an oil pump loses a significant amount of energy, which is a vital factor in increasing a vehicle's overall efficiency. Advancements in fuel efficiency of automobiles has led to an increase in demand for oil pumps that lose less energy. This is projected to drive growth of the global automotive oil pump market.

Improved fuel efficiency lowers operating costs and subsequently lowers maintenance costs, thereby extending the life of the engine. For instance, rise in prices of petrol or gasoline in India is anticipated to drastically propel the demand for fuel-efficient automobiles in the country. Inadvertently supporting in the decline of oil use are similar examples of increased fuel prices in other countries.

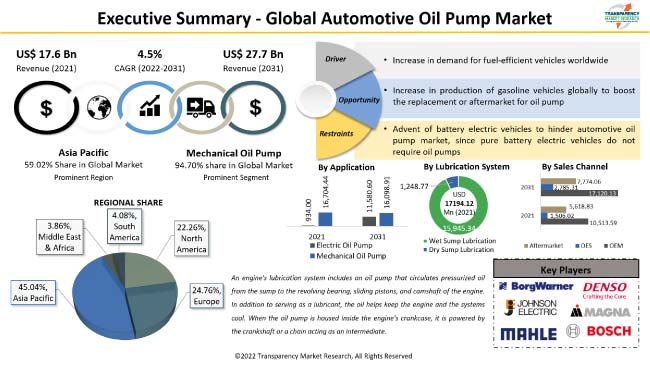

Based on application, the automotive oil pump market segmentation comprises electric oil pump and mechanical oil pump. The mechanical oil pump segment accounted for 94.70% share of total market demand in 2021. The mechanical oil pump is a traditional form of oil pump that is frequently utilized in automobiles.

Mechanical oil pumps are less expensive than electric oil pumps; they are straightforward, easy to make, and install. They are extensively employed in vehicles due to their cost-effectiveness over electric oil pumps. Consequently, these factors are estimated to contribute to the automobile oil pump market progress in the near future.

In terms of volume, and revenue, the wet sump lubrication segment dominated the worldwide market for automotive oil pump in 2021. The wet sump lubrication system works very well for smaller engines with lower power consumption and minimal need for extensive lubrication.

Wet sump lubrication systems have a simple design, are cost-effective, light, and require less maintenance. Therefore, they are widely utilized in commercial vehicles. These benefits are projected to contribute toward market development.

Asia Pacific dominated the global automotive oil pump demand in 2021 owing to the presence of nations such as China, India, Japan, Singapore, and South Korea. Asia Pacific is viewed as a leader in both technology and innovation. An overview of the automotive oil pump market reveals that the region is home to some of the fastest-growing vehicle manufacturers who are investing significantly in cutting-edge technologies to develop advanced and environment-friendly components to the market.

The market forecast for China is positive due to an increase in expenditure by renowned automakers to create sustainable production methods. For instance, in February 2022, Audi revealed plans to invest in clean energy for particular sites in China where it is having difficulty obtaining the necessary energy from renewable sources to manufacture hundreds of thousands of automobiles each year. Thus, rise in number of initiatives undertaken by various automakers across Asia Pacific is anticipated to propel automotive oil pump market development in the region.

An in-depth look at the global automotive oil pump business reveals that only a few manufacturers control major share of the global business. Prominent companies possess the potential to increase the pace of business growth by adopting newer technologies. One of the key trends witnessed in the automotive oil pump industry development is the adoption of mergers and acquisitions and expansion of product portfolios by key market players in order to consolidate their position in the automotive oil pump industry.

BorgWarner Inc., DENSO CORPORATION, FTE automotive, HUSCO Automotive, LLC, Johnson Electric, Magna Powertrain, Inc., MAHLE Group, Mikuni American Corporation, Mitsubishi Electric, Nidec Corporation, Rheinmetall Automotive AG, Robert Bosch GmbH, ZF Friedrichshafen AG, AISIN SEIKI, Hitachi Astemo, IXETIC, Jatco, KYB, NACHI-FUJIKOSHI, RBAS (PTS), SHW Germany, Stackpole, Wanliyang China, and ZF-TRW are some of the prominent players operating in the market.

The automotive oil pump market research report includes profiles of key players based on business strategies, company overview, product portfolio, financial overview, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 17.6 Bn |

|

Market Forecast Value in 2031 |

US$ 27.7 Bn |

|

Growth Rate (CAGR) |

4.5% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

Volume (Thousand Units) & US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, key trend analysis, automotive oil pump market size, and market forecast. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 17.6 Bn in 2021

It is expected to expand at a CAGR of 4.47 % by 2031

The automotive oil pump industry would be worth US$ 27.7 Bn in 2031

Increase in demand for fuel-efficient vehicles and rise in vehicle production globally

The wet sump lubrication segment accounted for 92.74 % share in 2021

Asia Pacific is a highly lucrative region of the global automotive oil pump industry

BorgWarner Inc., DENSO CORPORATION, FTE automotive, Johnson Electric, Magna International, Inc., MAHLE Group, Nidec Corporation, Rheinmetall Automotive AG, Robert Bosch GmbH, ZF Friedrichshafen AG, AISIN SEIKI, and Hitachi Astemo.

1. Preface

1.1. About TMR

1.2. Market Coverage / Taxonomy

1.3. Assumptions and Research Methodology

2. Executive Summary

2.1. Global Market Outlook

2.1.1. Market Size, Thousand Units, US$ Bn, 2017-2031

2.2. Demand & Supply Side Trends

2.3. TMR Analysis and Recommendations

2.4. Competitive Dashboard Analysis

3. Market Overview

3.1. Macro-Economic Factors

3.2. Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunity

3.3. Market Factor Analysis

3.3.1. Porter’s Five Force Analysis

3.3.2. SWOT Analysis

3.4. Regulatory Scenario

3.5. Key Trend Analysis

3.6. Value Chain Analysis

3.6.1. Who Supplies to Whom, by Country

3.6.1.1. Supplier of Automotive Oil Pump in a Country à Customer of in Country (OEMs)

3.6.2. Potential leads for Automotive Oil Pump

4. COVID-19 Impact Analysis – Automotive Oil Pump Market

5. Global Automotive Oil Pump Market, by Application

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Automotive Oil Pump Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, By Application

5.2.1. Electric Oil Pump

5.2.1.1. Transmission Oil Pump

5.2.1.2. Engine Oil Pump

5.2.1.3. Brake Oil Pump

5.2.2. Mechanical Oil Pump

5.2.2.1. Transmission Oil Pump

5.2.2.2. Engine Oil Pump

5.2.2.3. Brake Oil Pump

6. Global Automotive Oil Pump Market, by Lubrication System

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Automotive Oil Pump Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, By Lubrication System

6.2.1. Wet Sump Lubrication

6.2.2. Dry Sump Lubrication

7. Global Automotive Oil Pump Market, by Vehicle Type

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Automotive Oil Pump Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, By Vehicle Type

7.2.1. Passenger Vehicles

7.2.1.1. Hatchback

7.2.1.2. Sedan

7.2.1.3. Utility Vehicle

7.2.2. Light Commercial Vehicles

7.2.3. Heavy Commercial Vehicles

7.2.4. Buses & Coaches

7.2.5. Off-road Vehicles

8. Global Automotive Oil Pump Market, by Displacement Type

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Automotive Oil Pump Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, By Displacement Type

8.2.1. Fixed Displacement

8.2.2. Variable Displacement

9. Global Automotive Oil Pump Market, by Propulsion Type

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global Automotive Oil Pump Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, By Propulsion Type

9.2.1. IC Engine

9.2.1.1. Diesel

9.2.1.2. Gasoline

9.2.2. Electric

9.2.2.1. Battery Electric Vehicle (BEV)

9.2.2.2. Hybrid and Plug-in Electric Vehicle (HEV)

10. Global Automotive Oil Pump Market, by Discharge Type

10.1. Market Snapshot

10.1.1. Introduction, Definition, and Key Findings

10.1.2. Market Growth & Y-o-Y Projections

10.1.3. Base Point Share Analysis

10.2. Global Automotive Oil Pump Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, By Discharge Type

10.2.1. Gear Pump

10.2.2. Gerotor

10.2.3. Vane Pump

10.2.4. Others

11. Global Automotive Oil Pump Market, by Sales Channel

11.1. Market Snapshot

11.1.1. Introduction, Definition, and Key Findings

11.1.2. Market Growth & Y-o-Y Projections

11.1.3. Base Point Share Analysis

11.2. Global Automotive Oil Pump Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, By Sales Channel

11.2.1. OEM

11.2.2. OES

11.2.3. Aftermarket

12. Global Automotive Oil Pump Market, by Region

12.1. Market Snapshot

12.1.1. Introduction, Definition, and Key Findings

12.1.2. Market Growth & Y-o-Y Projections

12.1.3. Base Point Share Analysis

12.2. Global Automotive Oil Pump Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, By Region

12.2.1. North America

12.2.2. Europe

12.2.3. Asia Pacific

12.2.4. Middle East & Africa

12.2.5. South America

13. North America Automotive Oil Pump Market

13.1. Market Snapshot

13.2. Automotive Oil Pump Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, By Application

13.2.1. Electric Oil Pump

13.2.1.1. Transmission Oil Pump

13.2.1.2. Engine Oil Pump

13.2.1.3. Brake Oil Pump

13.2.2. Mechanical Oil Pump

13.2.2.1. Transmission Oil Pump

13.2.2.2. Engine Oil Pump

13.2.2.3. Brake Oil Pump

13.3. Automotive Oil Pump Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, By Lubrication System

13.3.1. Wet Sump Lubrication

13.3.2. Dry Sump Lubrication

13.4. Automotive Oil Pump Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, By Vehicle Type

13.4.1. Passenger Vehicles

13.4.1.1. Hatchback

13.4.1.2. Sedan

13.4.1.3. Utility Vehicle

13.4.2. Light Commercial Vehicles

13.4.3. Heavy Commercial Vehicles

13.4.4. Buses & Coaches

13.4.5. Off-road Vehicles

13.5. Automotive Oil Pump Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, By Displacement Type

13.5.1. Fixed Displacement

13.5.2. Variable Displacement

13.6. Automotive Oil Pump Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, By Propulsion Type

13.6.1. IC Engine

13.6.1.1. Diesel

13.6.1.2. Gasoline

13.6.2. Electric

13.6.2.1. Battery Electric Vehicle (BEV)

13.6.2.2. Hybrid and Plug-in Electric Vehicle (HEV)

13.7. Automotive Oil Pump Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, By Discharge Type

13.7.1. Gear Pump

13.7.2. Gerotor

13.7.3. Vane Pump

13.7.4. Others

13.8. Automotive Oil Pump Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, By Sales Channel

13.8.1. OEM

13.8.2. OES

13.8.3. Aftermarket

13.9. Key Country Analysis – North America Automotive Oil Pump Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031

13.9.1. U. S.

13.9.2. Canada

13.9.3. Mexico

14. Europe Automotive Oil Pump Market

14.1. Market Snapshot

14.2. Automotive Oil Pump Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, By Application

14.2.1. Electric Oil Pump

14.2.1.1. Transmission Oil Pump

14.2.1.2. Engine Oil Pump

14.2.1.3. Brake Oil Pump

14.2.2. Mechanical Oil Pump

14.2.2.1. Transmission Oil Pump

14.2.2.2. Engine Oil Pump

14.2.2.3. Brake Oil Pump

14.3. Automotive Oil Pump Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, By Lubrication System

14.3.1. Wet Sump Lubrication

14.3.2. Dry Sump Lubrication

14.4. Automotive Oil Pump Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, By Vehicle Type

14.4.1. Passenger Vehicles

14.4.1.1. Hatchback

14.4.1.2. Sedan

14.4.1.3. Utility Vehicle

14.4.2. Light Commercial Vehicles

14.4.3. Heavy Commercial Vehicles

14.4.4. Buses & Coaches

14.4.5. Off-road Vehicles

14.5. Automotive Oil Pump Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, By Displacement Type

14.5.1. Fixed Displacement

14.5.2. Variable Displacement

14.6. Automotive Oil Pump Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, By Propulsion Type

14.6.1. IC Engine

14.6.1.1. Diesel

14.6.1.2. Gasoline

14.6.2. Electric

14.6.2.1. Battery Electric Vehicle (BEV)

14.6.2.2. Hybrid and Plug-in Electric Vehicle (HEV)

14.7. Automotive Oil Pump Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, By Discharge Type

14.7.1. Gear Pump

14.7.2. Gerotor

14.7.3. Vane Pump

14.7.4. Others

14.8. Automotive Oil Pump Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, By Sales Channel

14.8.1. OEM

14.8.2. OES

14.8.3. Aftermarket

14.9. Key Country Analysis – Europe Automotive Oil Pump Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031

14.9.1. Germany

14.9.2. U. K.

14.9.3. France

14.9.4. Italy

14.9.5. Spain

14.9.6. Nordic Countries

14.9.7. Russia & CIS

14.9.8. Rest of Europe

15. Asia Pacific Automotive Oil Pump Market

15.1. Market Snapshot

15.2. Automotive Oil Pump Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, By Application

15.2.1. Electric Oil Pump

15.2.1.1. Transmission Oil Pump

15.2.1.2. Engine Oil Pump

15.2.1.3. Brake Oil Pump

15.2.2. Mechanical Oil Pump

15.2.2.1. Transmission Oil Pump

15.2.2.2. Engine Oil Pump

15.2.2.3. Brake Oil Pump

15.3. Automotive Oil Pump Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, By Lubrication System

15.3.1. Wet Sump Lubrication

15.3.2. Dry Sump Lubrication

15.4. Automotive Oil Pump Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, By Vehicle Type

15.4.1. Passenger Vehicles

15.4.1.1. Hatchback

15.4.1.2. Sedan

15.4.1.3. Utility Vehicle

15.4.2. Light Commercial Vehicles

15.4.3. Heavy Commercial Vehicles

15.4.4. Buses & Coaches

15.4.5. Off-road Vehicles

15.5. Automotive Oil Pump Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, By Displacement Type

15.5.1. Fixed Displacement

15.5.2. Variable Displacement

15.6. Automotive Oil Pump Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, By Propulsion Type

15.6.1. IC Engine

15.6.1.1. Diesel

15.6.1.2. Gasoline

15.6.2. Electric

15.6.2.1. Battery Electric Vehicle (BEV)

15.6.2.2. Hybrid and Plug-in Electric Vehicle (HEV)

15.7. Automotive Oil Pump Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, By Discharge Type

15.7.1. Gear Pump

15.7.2. Gerotor

15.7.3. Vane Pump

15.7.4. Others

15.8. Automotive Oil Pump Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, By Sales Channel

15.8.1. OEM

15.8.2. OES

15.8.3. Aftermarket

15.9. Key Country Analysis – Asia Pacific Automotive Oil Pump Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031

15.9.1. China

15.9.2. India

15.9.3. Japan

15.9.4. ASEAN Countries

15.9.5. South Korea

15.9.6. ANZ

15.9.7. Rest of Asia Pacific

16. Middle East & Africa Automotive Oil Pump Market

16.1. Market Snapshot

16.2. Automotive Oil Pump Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, By Application

16.2.1. Electric Oil Pump

16.2.1.1. Transmission Oil Pump

16.2.1.2. Engine Oil Pump

16.2.1.3. Brake Oil Pump

16.2.2. Mechanical Oil Pump

16.2.2.1. Transmission Oil Pump

16.2.2.2. Engine Oil Pump

16.2.2.3. Brake Oil Pump

16.3. Automotive Oil Pump Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, By Lubrication System

16.3.1. Wet Sump Lubrication

16.3.2. Dry Sump Lubrication

16.4. Automotive Oil Pump Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, By Vehicle Type

16.4.1. Passenger Vehicles

16.4.1.1. Hatchback

16.4.1.2. Sedan

16.4.1.3. Utility Vehicle

16.4.2. Light Commercial Vehicles

16.4.3. Heavy Commercial Vehicles

16.4.4. Buses & Coaches

16.4.5. Off-road Vehicles

16.5. Automotive Oil Pump Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, By Displacement Type

16.5.1. Fixed Displacement

16.5.2. Variable Displacement

16.6. Automotive Oil Pump Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, By Propulsion Type

16.6.1. IC Engine

16.6.1.1. Diesel

16.6.1.2. Gasoline

16.6.2. Electric

16.6.2.1. Battery Electric Vehicle (BEV)

16.6.2.2. Hybrid and Plug-in Electric Vehicle (HEV)

16.7. Automotive Oil Pump Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, By Discharge Type

16.7.1. Gear Pump

16.7.2. Gerotor

16.7.3. Vane Pump

16.7.4. Others

16.8. Automotive Oil Pump Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, By Sales Channel

16.8.1. OEM

16.8.2. OES

16.8.3. Aftermarket

16.9. Key Country Analysis – Middle East & Africa Automotive Oil Pump Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031

16.9.1. GCC

16.9.2. South Africa

16.9.3. Turkey

16.9.4. Rest of Middle East & Africa

17. South America Automotive Oil Pump Market

17.1. Market Snapshot

17.2. Automotive Oil Pump Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, By Application

17.2.1. Electric Oil Pump

17.2.1.1. Transmission Oil Pump

17.2.1.2. Engine Oil Pump

17.2.1.3. Brake Oil Pump

17.2.2. Mechanical Oil Pump

17.2.2.1. Transmission Oil Pump

17.2.2.2. Engine Oil Pump

17.2.2.3. Brake Oil Pump

17.3. Automotive Oil Pump Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, By Lubrication System

17.3.1. Wet Sump Lubrication

17.3.2. Dry Sump Lubrication

17.4. Automotive Oil Pump Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, By Vehicle Type

17.4.1. Passenger Vehicles

17.4.1.1. Hatchback

17.4.1.2. Sedan

17.4.1.3. Utility Vehicle

17.4.2. Light Commercial Vehicles

17.4.3. Heavy Commercial Vehicles

17.4.4. Buses & Coaches

17.4.5. Off-road Vehicles

17.5. Automotive Oil Pump Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, By Displacement Type

17.5.1. Fixed Displacement

17.5.2. Variable Displacement

17.6. Automotive Oil Pump Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, By Propulsion Type

17.6.1. IC Engine

17.6.1.1. Diesel

17.6.1.2. Gasoline

17.6.2. Electric

17.6.2.1. Battery Electric Vehicle (BEV)

17.6.2.2. Hybrid and Plug-in Electric Vehicle (HEV)

17.7. Automotive Oil Pump Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, By Sales Channel

17.7.1. OEM

17.7.2. OES

17.7.3. Aftermarket

17.8. Automotive Oil Pump Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, By Discharge Type

17.8.1. Gear Pump

17.8.2. Gerotor

17.8.3. Vane Pump

17.8.4. Others

17.9. Key Country Analysis – South America Automotive Oil Pump Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031

17.9.1. Brazil

17.9.2. Argentina

17.9.3. Rest of South America

18. Competitive Landscape

18.1. Company Share Analysis/ Brand Share Analysis, 2021

18.2. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share, Executive Bios)

18.3. Company Profile/ Key Players – Automotive Oil Pump Market

18.3.1. BorgWarner Inc.

18.3.1.1. Company Overview

18.3.1.2. Company Footprints

18.3.1.3. Production Locations

18.3.1.4. Product Portfolio

18.3.1.5. Competitors & Customers

18.3.1.6. Subsidiaries & Parent Organization

18.3.1.7. Recent Developments

18.3.1.8. Financial Analysis

18.3.1.9. Profitability

18.3.1.10. Revenue Share

18.3.1.11. Executive Bios

18.3.2. DENSO CORPORATION

18.3.2.1. Company Overview

18.3.2.2. Company Footprints

18.3.2.3. Production Locations

18.3.2.4. Product Portfolio

18.3.2.5. Competitors & Customers

18.3.2.6. Subsidiaries & Parent Organization

18.3.2.7. Recent Developments

18.3.2.8. Financial Analysis

18.3.2.9. Profitability

18.3.2.10. Revenue Share

18.3.2.11. Executive Bios

18.3.3. FTE automotive

18.3.3.1. Company Overview

18.3.3.2. Company Footprints

18.3.3.3. Production Locations

18.3.3.4. Product Portfolio

18.3.3.5. Competitors & Customers

18.3.3.6. Subsidiaries & Parent Organization

18.3.3.7. Recent Developments

18.3.3.8. Financial Analysis

18.3.3.9. Profitability

18.3.3.10. Revenue Share

18.3.3.11. Executive Bios

18.3.4. HUSCO Automotive, LLC

18.3.4.1. Company Overview

18.3.4.2. Company Footprints

18.3.4.3. Production Locations

18.3.4.4. Product Portfolio

18.3.4.5. Competitors & Customers

18.3.4.6. Subsidiaries & Parent Organization

18.3.4.7. Recent Developments

18.3.4.8. Financial Analysis

18.3.4.9. Profitability

18.3.4.10. Revenue Share

18.3.4.11. Executive Bios

18.3.5. Johnson Electric

18.3.5.1. Company Overview

18.3.5.2. Company Footprints

18.3.5.3. Production Locations

18.3.5.4. Product Portfolio

18.3.5.5. Competitors & Customers

18.3.5.6. Subsidiaries & Parent Organization

18.3.5.7. Recent Developments

18.3.5.8. Financial Analysis

18.3.5.9. Profitability

18.3.5.10. Revenue Share

18.3.5.11. Executive Bios

18.3.6. Magna Powertrain, Inc.

18.3.6.1. Company Overview

18.3.6.2. Company Footprints

18.3.6.3. Production Locations

18.3.6.4. Product Portfolio

18.3.6.5. Competitors & Customers

18.3.6.6. Subsidiaries & Parent Organization

18.3.6.7. Recent Developments

18.3.6.8. Financial Analysis

18.3.6.9. Profitability

18.3.6.10. Revenue Share

18.3.6.11. Executive Bios

18.3.7. MAHLE Group

18.3.7.1. Company Overview

18.3.7.2. Company Footprints

18.3.7.3. Production Locations

18.3.7.4. Product Portfolio

18.3.7.5. Competitors & Customers

18.3.7.6. Subsidiaries & Parent Organization

18.3.7.7. Recent Developments

18.3.7.8. Financial Analysis

18.3.7.9. Profitability

18.3.7.10. Revenue Share

18.3.7.11. Executive Bios

18.3.8. Mikuni American Corporation

18.3.8.1. Company Overview

18.3.8.2. Company Footprints

18.3.8.3. Production Locations

18.3.8.4. Product Portfolio

18.3.8.5. Competitors & Customers

18.3.8.6. Subsidiaries & Parent Organization

18.3.8.7. Recent Developments

18.3.8.8. Financial Analysis

18.3.8.9. Profitability

18.3.8.10. Revenue Share

18.3.8.11. Executive Bios

18.3.9. Mitsubishi Electric

18.3.9.1. Company Overview

18.3.9.2. Company Footprints

18.3.9.3. Production Locations

18.3.9.4. Product Portfolio

18.3.9.5. Competitors & Customers

18.3.9.6. Subsidiaries & Parent Organization

18.3.9.7. Recent Developments

18.3.9.8. Financial Analysis

18.3.9.9. Profitability

18.3.9.10. Revenue Share

18.3.9.11. Executive Bios

18.3.10. Nidec Corporation

18.3.10.1. Company Overview

18.3.10.2. Company Footprints

18.3.10.3. Production Locations

18.3.10.4. Product Portfolio

18.3.10.5. Competitors & Customers

18.3.10.6. Subsidiaries & Parent Organization

18.3.10.7. Recent Developments

18.3.10.8. Financial Analysis

18.3.10.9. Profitability

18.3.10.10. Revenue Share

18.3.10.11. Executive Bios

18.3.11. Rheinmetall Automotive AG

18.3.11.1. Company Overview

18.3.11.2. Company Footprints

18.3.11.3. Production Locations

18.3.11.4. Product Portfolio

18.3.11.5. Competitors & Customers

18.3.11.6. Subsidiaries & Parent Organization

18.3.11.7. Recent Developments

18.3.11.8. Financial Analysis

18.3.11.9. Profitability

18.3.11.10. Revenue Share

18.3.11.11. Executive Bios

18.3.12. Robert Bosch GmbH

18.3.12.1. Company Overview

18.3.12.2. Company Footprints

18.3.12.3. Production Locations

18.3.12.4. Product Portfolio

18.3.12.5. Competitors & Customers

18.3.12.6. Subsidiaries & Parent Organization

18.3.12.7. Recent Developments

18.3.12.8. Financial Analysis

18.3.12.9. Profitability

18.3.12.10. Revenue Share

18.3.12.11. Executive Bios

18.3.13. ZF Friedrichshafen AG

18.3.13.1. Company Overview

18.3.13.2. Company Footprints

18.3.13.3. Production Locations

18.3.13.4. Product Portfolio

18.3.13.5. Competitors & Customers

18.3.13.6. Subsidiaries & Parent Organization

18.3.13.7. Recent Developments

18.3.13.8. Financial Analysis

18.3.13.9. Profitability

18.3.13.10. Revenue Share

18.3.13.11. Executive Bios

18.3.14. AISIN SEIKI

18.3.14.1. Company Overview

18.3.14.2. Company Footprints

18.3.14.3. Production Locations

18.3.14.4. Product Portfolio

18.3.14.5. Competitors & Customers

18.3.14.6. Subsidiaries & Parent Organization

18.3.14.7. Recent Developments

18.3.14.8. Financial Analysis

18.3.14.9. Profitability

18.3.14.10. Revenue Share

18.3.14.11. Executive Bios

18.3.15. Hitachi Astemo

18.3.15.1. Company Overview

18.3.15.2. Company Footprints

18.3.15.3. Production Locations

18.3.15.4. Product Portfolio

18.3.15.5. Competitors & Customers

18.3.15.6. Subsidiaries & Parent Organization

18.3.15.7. Recent Developments

18.3.15.8. Financial Analysis

18.3.15.9. Profitability

18.3.15.10. Revenue Share

18.3.15.11. Executive Bios

18.3.16. IXETIC

18.3.16.1. Company Overview

18.3.16.2. Company Footprints

18.3.16.3. Production Locations

18.3.16.4. Product Portfolio

18.3.16.5. Competitors & Customers

18.3.16.6. Subsidiaries & Parent Organization

18.3.16.7. Recent Developments

18.3.16.8. Financial Analysis

18.3.16.9. Profitability

18.3.16.10. Revenue Share

18.3.16.11. Executive Bios

18.3.17. Jatco

18.3.17.1. Company Overview

18.3.17.2. Company Footprints

18.3.17.3. Production Locations

18.3.17.4. Product Portfolio

18.3.17.5. Competitors & Customers

18.3.17.6. Subsidiaries & Parent Organization

18.3.17.7. Recent Developments

18.3.17.8. Financial Analysis

18.3.17.9. Profitability

18.3.17.10. Revenue Share

18.3.17.11. Executive Bios

18.3.18. KYB

18.3.18.1. Company Overview

18.3.18.2. Company Footprints

18.3.18.3. Production Locations

18.3.18.4. Product Portfolio

18.3.18.5. Competitors & Customers

18.3.18.6. Subsidiaries & Parent Organization

18.3.18.7. Recent Developments

18.3.18.8. Financial Analysis

18.3.18.9. Profitability

18.3.18.10. Revenue Share

18.3.18.11. Executive Bios

18.3.19. NACHI-FUJIKOSHI

18.3.19.1. Company Overview

18.3.19.2. Company Footprints

18.3.19.3. Production Locations

18.3.19.4. Product Portfolio

18.3.19.5. Competitors & Customers

18.3.19.6. Subsidiaries & Parent Organization

18.3.19.7. Recent Developments

18.3.19.8. Financial Analysis

18.3.19.9. Profitability

18.3.19.10. Revenue Share

18.3.19.11. Executive Bios

18.3.20. RBAS (PTS)

18.3.20.1. Company Overview

18.3.20.2. Company Footprints

18.3.20.3. Production Locations

18.3.20.4. Product Portfolio

18.3.20.5. Competitors & Customers

18.3.20.6. Subsidiaries & Parent Organization

18.3.20.7. Recent Developments

18.3.20.8. Financial Analysis

18.3.20.9. Profitability

18.3.20.10. Revenue Share

18.3.20.11. Executive Bios

18.3.21. SHW Germany

18.3.21.1. Company Overview

18.3.21.2. Company Footprints

18.3.21.3. Production Locations

18.3.21.4. Product Portfolio

18.3.21.5. Competitors & Customers

18.3.21.6. Subsidiaries & Parent Organization

18.3.21.7. Recent Developments

18.3.21.8. Financial Analysis

18.3.21.9. Profitability

18.3.21.10. Revenue Share

18.3.21.11. Executive Bios

18.3.22. Stackpole

18.3.22.1. Company Overview

18.3.22.2. Company Footprints

18.3.22.3. Production Locations

18.3.22.4. Product Portfolio

18.3.22.5. Competitors & Customers

18.3.22.6. Subsidiaries & Parent Organization

18.3.22.7. Recent Developments

18.3.22.8. Financial Analysis

18.3.22.9. Profitability

18.3.22.10. Revenue Share

18.3.22.11. Executive Bios

18.3.23. Wanliyang China

18.3.23.1. Company Overview

18.3.23.2. Company Footprints

18.3.23.3. Production Locations

18.3.23.4. Product Portfolio

18.3.23.5. Competitors & Customers

18.3.23.6. Subsidiaries & Parent Organization

18.3.23.7. Recent Developments

18.3.23.8. Financial Analysis

18.3.23.9. Profitability

18.3.23.10. Revenue Share

18.3.23.11. Executive Bios

18.3.24. ZF-TRW

18.3.24.1. Company Overview

18.3.24.2. Company Footprints

18.3.24.3. Production Locations

18.3.24.4. Product Portfolio

18.3.24.5. Competitors & Customers

18.3.24.6. Subsidiaries & Parent Organization

18.3.24.7. Recent Developments

18.3.24.8. Financial Analysis

18.3.24.9. Profitability

18.3.24.10. Revenue Share

18.3.24.11. Executive Bios

18.3.25. Other Key Players

List of Tables

Table 1: Global Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 2: Global Automotive Oil Pump Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 3: Global Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Lubrication System, 2017-2031

Table 4: Global Automotive Oil Pump Market Value (US$ Bn) Forecast, by Lubrication System, 2017‒2031

Table 5: Global Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 6: Global Automotive Oil Pump Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 7: Global Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Displacement Type, 2017-2031

Table 8: Global Automotive Oil Pump Market Value (US$ Bn) Forecast, by Displacement Type, 2017‒2031

Table 9: Global Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Propulsion Type, 2017-2031

Table 10: Global Automotive Oil Pump Market Value (US$ Bn) Forecast, by Propulsion Type, 2017‒2031

Table 11: Global Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Discharge Type, 2017-2031

Table 12: Global Automotive Oil Pump Market Value (US$ Bn) Forecast, by Discharge Type, 2017‒2031

Table 13: Global Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 14: Global Automotive Oil Pump Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 15: Global Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Table 16: Global Automotive Oil Pump Market Value (US$ Bn) Forecast, by Region, 2017‒2031

Table 17: North America Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 18: North America Automotive Oil Pump Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 19: North America Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Lubrication System, 2017-2031

Table 20: North America Automotive Oil Pump Market Value (US$ Bn) Forecast, by Lubrication System, 2017‒2031

Table 21: North America Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 22: North America Automotive Oil Pump Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 23: North America Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Displacement Type, 2017-2031

Table 24: North America Automotive Oil Pump Market Value (US$ Bn) Forecast, by Displacement Type, 2017‒2031

Table 25: North America Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Propulsion Type, 2017-2031

Table 26: North America Automotive Oil Pump Market Value (US$ Bn) Forecast, by Propulsion Type, 2017‒2031

Table 27: North America Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Discharge Type, 2017-2031

Table 28: North America Automotive Oil Pump Market Value (US$ Bn) Forecast, by Discharge Type, 2017‒2031

Table 29: North America Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 30: North America Automotive Oil Pump Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 31: North America Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 32: North America Automotive Oil Pump Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 33: Europe Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 34: Europe Automotive Oil Pump Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 35: Europe Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Lubrication System, 2017-2031

Table 36: Europe Automotive Oil Pump Market Value (US$ Bn) Forecast, by Lubrication System, 2017‒2031

Table 37: Europe Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 38: Europe Automotive Oil Pump Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 39: Europe Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Displacement Type, 2017-2031

Table 40: Europe Automotive Oil Pump Market Value (US$ Bn) Forecast, by Displacement Type, 2017‒2031

Table 41: Europe Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Propulsion Type, 2017-2031

Table 42: Europe Automotive Oil Pump Market Value (US$ Bn) Forecast, by Propulsion Type, 2017‒2031

Table 43: Europe Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Discharge Type, 2017-2031

Table 44: Europe Automotive Oil Pump Market Value (US$ Bn) Forecast, by Discharge Type, 2017‒2031

Table 45: Europe Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 46: Europe Automotive Oil Pump Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 47: Europe Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 48: Europe Automotive Oil Pump Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 49: Asia Pacific Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 50: Asia Pacific Automotive Oil Pump Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 51: Asia Pacific Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Lubrication System, 2017-2031

Table 52: Asia Pacific Automotive Oil Pump Market Value (US$ Bn) Forecast, by Lubrication System, 2017‒2031

Table 53: Asia Pacific Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 54: Asia Pacific Automotive Oil Pump Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 55: Asia Pacific Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Displacement Type, 2017-2031

Table 56: Asia Pacific Automotive Oil Pump Market Value (US$ Bn) Forecast, by Displacement Type, 2017‒2031

Table 57: Asia Pacific Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Propulsion Type, 2017-2031

Table 58: Asia Pacific Automotive Oil Pump Market Value (US$ Bn) Forecast, by Propulsion Type, 2017‒2031

Table 59: Asia Pacific Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Discharge Type, 2017-2031

Table 60: Asia Pacific Automotive Oil Pump Market Value (US$ Bn) Forecast, by Discharge Type, 2017‒2031

Table 61: Asia Pacific Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 62: Asia Pacific Automotive Oil Pump Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 63: Asia Pacific Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 64: Asia Pacific Automotive Oil Pump Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 65: Middle East & Africa Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 66: Middle East & Africa Automotive Oil Pump Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 67: Middle East & Africa Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Lubrication System, 2017-2031

Table 68: Middle East & Africa Automotive Oil Pump Market Value (US$ Bn) Forecast, by Lubrication System, 2017‒2031

Table 69: Middle East & Africa Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 70: Middle East & Africa Automotive Oil Pump Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 71: Middle East & Africa Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Displacement Type, 2017-2031

Table 72: Middle East & Africa Automotive Oil Pump Market Value (US$ Bn) Forecast, by Displacement Type, 2017‒2031

Table 73: Middle East & Africa Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Propulsion Type, 2017-2031

Table 74: Middle East & Africa Automotive Oil Pump Market Value (US$ Bn) Forecast, by Propulsion Type, 2017‒2031

Table 75: Middle East & Africa Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Discharge Type, 2017-2031

Table 76: Middle East & Africa Automotive Oil Pump Market Value (US$ Bn) Forecast, by Discharge Type, 2017‒2031

Table 77: Middle East & Africa Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 78: Middle East & Africa Automotive Oil Pump Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 79: Middle East & Africa Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 80: Middle East & Africa Automotive Oil Pump Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 81: South America Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 82: South America Automotive Oil Pump Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 83: South America Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Lubrication System, 2017-2031

Table 84: South America Automotive Oil Pump Market Value (US$ Bn) Forecast, by Lubrication System, 2017‒2031

Table 85: South America Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 86: South America Automotive Oil Pump Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 87: South America Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Displacement Type, 2017-2031

Table 88: South America Automotive Oil Pump Market Value (US$ Bn) Forecast, by Displacement Type, 2017‒2031

Table 89: South America Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Propulsion Type, 2017-2031

Table 90: South America Automotive Oil Pump Market Value (US$ Bn) Forecast, by Propulsion Type, 2017‒2031

Table 91: South America Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Discharge Type, 2017-2031

Table 92: South America Automotive Oil Pump Market Value (US$ Bn) Forecast, by Discharge Type, 2017‒2031

Table 93: South America Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 94: South America Automotive Oil Pump Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 95: South America Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 96: South America Automotive Oil Pump Market Value (US$ Bn) Forecast, by Country, 2017‒2031

List of Figures

Figure 1: Global Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 2: Global Automotive Oil Pump Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 3: Global Automotive Oil Pump Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022-2031

Figure 4: Global Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Lubrication System, 2017-2031

Figure 5: Global Automotive Oil Pump Market Value (US$ Bn) Forecast, by Lubrication System, 2017-2031

Figure 6: Global Automotive Oil Pump Market, Incremental Opportunity, by Lubrication System, Value (US$ Bn), 2022-2031

Figure 7: Global Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 8: Global Automotive Oil Pump Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 9: Global Automotive Oil Pump Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 10: Global Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Displacement Type, 2017-2031

Figure 11: Global Automotive Oil Pump Market Value (US$ Bn) Forecast, by Displacement Type, 2017-2031

Figure 12: Global Automotive Oil Pump Market, Incremental Opportunity, by Displacement Type, Value (US$ Bn), 2022-2031

Figure 13: Global Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Propulsion Type, 2017-2031

Figure 14: Global Automotive Oil Pump Market Value (US$ Bn) Forecast, by Propulsion Type, 2017-2031

Figure 15: Global Automotive Oil Pump Market, Incremental Opportunity, by Propulsion Type, Value (US$ Bn), 2022-2031

Figure 16: Global Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Discharge Type, 2017-2031

Figure 17: Global Automotive Oil Pump Market Value (US$ Bn) Forecast, by Discharge Type, 2017-2031

Figure 18: Global Automotive Oil Pump Market, Incremental Opportunity, by Discharge Type, Value (US$ Bn), 2022-2031

Figure 19: Global Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 20: Global Automotive Oil Pump Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 21: Global Automotive Oil Pump Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 22: Global Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Figure 23: Global Automotive Oil Pump Market Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 24: Global Automotive Oil Pump Market, Incremental Opportunity, by Region, Value (US$ Bn), 2022-2031

Figure 25: North America Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 26: North America Automotive Oil Pump Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 27: North America Automotive Oil Pump Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022-2031

Figure 28: North America Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Lubrication System, 2017-2031

Figure 29: North America Automotive Oil Pump Market Value (US$ Bn) Forecast, by Lubrication System, 2017-2031

Figure 30: North America Automotive Oil Pump Market, Incremental Opportunity, by Lubrication System, Value (US$ Bn), 2022-2031

Figure 31: North America Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 32: North America Automotive Oil Pump Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 33: North America Automotive Oil Pump Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 34: North America Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Displacement Type, 2017-2031

Figure 35: North America Automotive Oil Pump Market Value (US$ Bn) Forecast, by Displacement Type, 2017-2031

Figure 36: North America Automotive Oil Pump Market, Incremental Opportunity, by Displacement Type, Value (US$ Bn), 2022-2031

Figure 37: North America Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Propulsion Type, 2017-2031

Figure 38: North America Automotive Oil Pump Market Value (US$ Bn) Forecast, by Propulsion Type, 2017-2031

Figure 39: North America Automotive Oil Pump Market, Incremental Opportunity, by Propulsion Type, Value (US$ Bn), 2022-2031

Figure 40: North America Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Discharge Type, 2017-2031

Figure 41: North America Automotive Oil Pump Market Value (US$ Bn) Forecast, by Discharge Type, 2017-2031

Figure 42: North America Automotive Oil Pump Market, Incremental Opportunity, by Discharge Type, Value (US$ Bn), 2022-2031

Figure 43: North America Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 44: North America Automotive Oil Pump Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 45: North America Automotive Oil Pump Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 46: North America Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 47: North America Automotive Oil Pump Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 48: North America Automotive Oil Pump Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 49: Europe Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 50: Europe Automotive Oil Pump Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 51: Europe Automotive Oil Pump Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022-2031

Figure 52: Europe Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Lubrication System, 2017-2031

Figure 53: Europe Automotive Oil Pump Market Value (US$ Bn) Forecast, by Lubrication System, 2017-2031

Figure 54: Europe Automotive Oil Pump Market, Incremental Opportunity, by Lubrication System, Value (US$ Bn), 2022-2031

Figure 55: Europe Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 56: Europe Automotive Oil Pump Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 57: Europe Automotive Oil Pump Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 58: Europe Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Displacement Type, 2017-2031

Figure 59: Europe Automotive Oil Pump Market Value (US$ Bn) Forecast, by Displacement Type, 2017-2031

Figure 60: Europe Automotive Oil Pump Market, Incremental Opportunity, by Displacement Type, Value (US$ Bn), 2022-2031

Figure 61: Europe Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Propulsion Type, 2017-2031

Figure 62: Europe Automotive Oil Pump Market Value (US$ Bn) Forecast, by Propulsion Type, 2017-2031

Figure 63: Europe Automotive Oil Pump Market, Incremental Opportunity, by Propulsion Type, Value (US$ Bn), 2022-2031

Figure 64: Europe Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Discharge Type, 2017-2031

Figure 65: Europe Automotive Oil Pump Market Value (US$ Bn) Forecast, by Discharge Type, 2017-2031

Figure 66: Europe Automotive Oil Pump Market, Incremental Opportunity, by Discharge Type, Value (US$ Bn), 2022-2031

Figure 67: Europe Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 68: Europe Automotive Oil Pump Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 69: Europe Automotive Oil Pump Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 70: Europe Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 71: Europe Automotive Oil Pump Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 72: Europe Automotive Oil Pump Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 73: Asia Pacific Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 74: Asia Pacific Automotive Oil Pump Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 75: Asia Pacific Automotive Oil Pump Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022-2031

Figure 76: Asia Pacific Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Lubrication System, 2017-2031

Figure 77: Asia Pacific Automotive Oil Pump Market Value (US$ Bn) Forecast, by Lubrication System, 2017-2031

Figure 78: Asia Pacific Automotive Oil Pump Market, Incremental Opportunity, by Lubrication System, Value (US$ Bn), 2022-2031

Figure 79: Asia Pacific Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 80: Asia Pacific Automotive Oil Pump Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 81: Asia Pacific Automotive Oil Pump Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 82: Asia Pacific Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Displacement Type, 2017-2031

Figure 83: Asia Pacific Automotive Oil Pump Market Value (US$ Bn) Forecast, by Displacement Type, 2017-2031

Figure 84: Asia Pacific Automotive Oil Pump Market, Incremental Opportunity, by Displacement Type, Value (US$ Bn), 2022-2031

Figure 85: Asia Pacific Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Propulsion Type, 2017-2031

Figure 86: Asia Pacific Automotive Oil Pump Market Value (US$ Bn) Forecast, by Propulsion Type, 2017-2031

Figure 87: Asia Pacific Automotive Oil Pump Market, Incremental Opportunity, by Propulsion Type, Value (US$ Bn), 2022-2031

Figure 88: Asia Pacific Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Discharge Type, 2017-2031

Figure 89: Asia Pacific Automotive Oil Pump Market Value (US$ Bn) Forecast, by Discharge Type, 2017-2031

Figure 90: Asia Pacific Automotive Oil Pump Market, Incremental Opportunity, by Discharge Type, Value (US$ Bn), 2022-2031

Figure 91: Asia Pacific Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 92: Asia Pacific Automotive Oil Pump Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 93: Asia Pacific Automotive Oil Pump Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 94: Asia Pacific Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 95: Asia Pacific Automotive Oil Pump Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 96: Asia Pacific Automotive Oil Pump Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 97: Middle East & Africa Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 98: Middle East & Africa Automotive Oil Pump Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 99: Middle East & Africa Automotive Oil Pump Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022-2031

Figure 100: Middle East & Africa Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Lubrication System, 2017-2031

Figure 101: Middle East & Africa Automotive Oil Pump Market Value (US$ Bn) Forecast, by Lubrication System, 2017-2031

Figure 102: Middle East & Africa Automotive Oil Pump Market, Incremental Opportunity, by Lubrication System, Value (US$ Bn), 2022-2031

Figure 103: Middle East & Africa Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 104: Middle East & Africa Automotive Oil Pump Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 105: Middle East & Africa Automotive Oil Pump Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 106: Middle East & Africa Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Displacement Type, 2017-2031

Figure 107: Middle East & Africa Automotive Oil Pump Market Value (US$ Bn) Forecast, by Displacement Type, 2017-2031

Figure 108: Middle East & Africa Automotive Oil Pump Market, Incremental Opportunity, by Displacement Type, Value (US$ Bn), 2022-2031

Figure 109: Middle East & Africa Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Propulsion Type, 2017-2031

Figure 110: Middle East & Africa Automotive Oil Pump Market Value (US$ Bn) Forecast, by Propulsion Type, 2017-2031

Figure 111: Middle East & Africa Automotive Oil Pump Market, Incremental Opportunity, by Propulsion Type, Value (US$ Bn), 2022-2031

Figure 112: Middle East & Africa Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Discharge Type, 2017-2031

Figure 113: Middle East & Africa Automotive Oil Pump Market Value (US$ Bn) Forecast, by Discharge Type, 2017-2031

Figure 114: Middle East & Africa Automotive Oil Pump Market, Incremental Opportunity, by Discharge Type, Value (US$ Bn), 2022-2031

Figure 115: Middle East & Africa Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 116: Middle East & Africa Automotive Oil Pump Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 117: Middle East & Africa Automotive Oil Pump Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 118: Middle East & Africa Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 119: Middle East & Africa Automotive Oil Pump Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 120: Middle East & Africa Automotive Oil Pump Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 121: South America Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 122: South America Automotive Oil Pump Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 123: South America Automotive Oil Pump Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022-2031

Figure 124: South America Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Lubrication System, 2017-2031

Figure 125: South America Automotive Oil Pump Market Value (US$ Bn) Forecast, by Lubrication System, 2017-2031

Figure 126: South America Automotive Oil Pump Market, Incremental Opportunity, by Lubrication System, Value (US$ Bn), 2022-2031

Figure 127: South America Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 128: South America Automotive Oil Pump Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 129: South America Automotive Oil Pump Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 130: South America Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Displacement Type, 2017-2031

Figure 131: South America Automotive Oil Pump Market Value (US$ Bn) Forecast, by Displacement Type, 2017-2031

Figure 132: South America Automotive Oil Pump Market, Incremental Opportunity, by Displacement Type, Value (US$ Bn), 2022-2031

Figure 133: South America Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Propulsion Type, 2017-2031

Figure 134: South America Automotive Oil Pump Market Value (US$ Bn) Forecast, by Propulsion Type, 2017-2031

Figure 135: South America Automotive Oil Pump Market, Incremental Opportunity, by Propulsion Type, Value (US$ Bn), 2022-2031

Figure 136: South America Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Discharge Type, 2017-2031

Figure 137: South America Automotive Oil Pump Market Value (US$ Bn) Forecast, by Discharge Type, 2017-2031

Figure 138: South America Automotive Oil Pump Market, Incremental Opportunity, by Discharge Type, Value (US$ Bn), 2022-2031

Figure 139: South America Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 140: South America Automotive Oil Pump Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 141: South America Automotive Oil Pump Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 142: South America Automotive Oil Pump Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 143: South America Automotive Oil Pump Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 144: South America Automotive Oil Pump Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031