Analysts’ Viewpoint on Multi-domain Controller Market Scenario

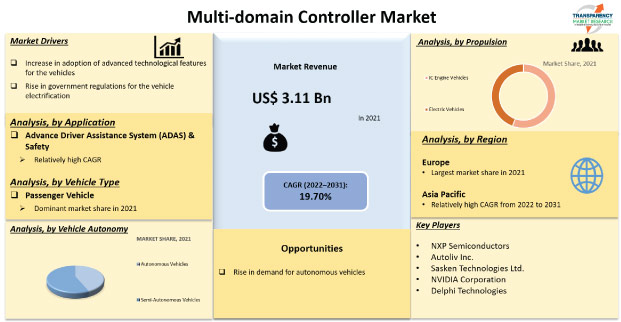

The global multi-domain controller market is being significantly driven by a rise in sales and production of vehicles across the globe. Moreover, increase in technology integration for the safety and comfort of vehicles; growing penetration of ADAS (advance driver assistance systems) features; and strategic partnerships and collaborative agreements among OEM and technology service providers are expected to augment the multi-domain controller market in the next few years. Furthermore, rise in infrastructure development activities across the globe is projected to drive the global market in the future. Several governments are providing funds for the adoption of electric vehicles in a form of incentives, subsidies, etc. This is expected to create growth opportunities for manufacturers operating in the global multi-domain controller market.

The multi-domain controller, or multi-domain control unit, is an integrated electronic control unit that improves the functionality and performance of vehicles by providing the vehicle system, i.e. IC engine or electric, with a large amount of data. However, this data further helps vehicles in several processes including automatic driving. This vehicle control unit deals with large data that is generated from integrated sub-electronic systems and connected vehicles for efficient and smooth vehicle operations. The multi-domain controller that is used in vehicles reduces the network space and density, which was previously caused by the process of multiple automotive electronic controller parts in a vehicle. Moreover, domain controller units offer improved user experience, active safety and security, and smart vehicle architecture. Domain controllers receive inputs from different radar sensors and cameras around the vehicle, which further creates a model of the surrounding by using the received data. The software application further decides what actions need to be taken based on the models. Rising electrification of vehicles has increased the need to manage complex vehicle electronics and its architecture. Similarly, increase in adoption of advanced technological features by consumers and auto manufacturers has further increased the electronic and control unit’s complexity in a vehicle, which is anticipated to increase the multi-domain controller market size in the near future.

The adoption of premium and luxury vehicles is increasing among consumers as these vehicles offer advanced safety features, autonomous-driving options, advanced connectivity solutions, and modern powertrain electrification. Integration of technologically advanced features in the vehicles offers convenience for handling advance driver assistance system, engine & powertrain, and chassis, body & cockpit control system. However, manufacturers integrate ADAS domain controller, chassis domain controller, and other controllers, which gather information in real-time and further take action accordingly. Moreover, these features enable the application of Internet of Things (IoT), artificial intelligence (AI), machine learning (ML), 5G network, and advance sensor solutions to improve safety and comfort in the vehicle. These advancements are enhancing the complexity in premium and luxury vehicles, which in turn boosts the requirement for multiple controllers. Therefore, technological upgrade of premium and luxury vehicles drives the growth of the automotive multi-domain controller market.

Demand for electric vehicles across the globe is rising due to rising emission norms, scarcity of IC engine fuels, and increase in adoption of green technology. Availability of advanced EV models, new critical battery technology initiatives, and support policies by governments for adoption of EVs also boost the electric vehicle market. Electric vehicles are more advanced and have complex electronic architecture, which requires many electronic control units such as multi-domain controllers. Various multi-domain controller types offer benefits including improved vehicle durability, reliability, efficiency, cost-effectiveness, and reduction in complexity and vehicle weight. Therefore, increase in vehicle electrification boosts the growth of the multi-domain controller market.

In terms of application, the multi-domain controller market has been classified into advance driver assistance system (ADAS) & safety, chassis & body control system, engine & powertrain, cockpit, and others. The advance driver assistance system (ADAS) & safety segment holds a dominant share of the multi-domain controller market in 2021. This is due to rapid urbanization, rise in disposable income of consumers, growth in traffic congestion, rise in investments in infrastructural development, and increasing government safety norms. ADAS & safety solutions require several controllers to collect information from different sensors and cameras in real-time and further offer data to vehicles in order to take certain actions as per the surroundings and also help in autonomous driving. Increase in use of chassis domain controller is expected to contribute to the multi-domain controller market share.

In terms of vehicle autonomy, the global multi-domain controller market has been bifurcated into autonomous vehicles and semi-autonomous vehicles. The autonomous vehicles segment is expected to hold a major share of the global market in the future, as it does not require human intervention for its functioning. Several manufacturers are testing their vehicles for full automation. Increase in partnerships and collaborations for the development of autonomous vehicles and extensive R&D activities in vehicle autonomy are key factors contributing to the growth of sustainable and reliable autonomous vehicles. Autonomous vehicles are equipped with advanced technological solutions that require multiple control units. This is expected to drive the multi-domain controller market in the next few years.

Europe holds a dominant share of the multi-domain controller market. Increase in adoption of premium and luxury cars, lucrative presence of automotive manufacturers, and rise in number of OEMs who offer multi-domain controllers for vehicles are some of the notable factors driving market growth in Europe.

According to McKinsey Center for Future Mobility, individual mobility in Europe is estimated to account for a higher share, which would be around 90% as compared to the current share of 60% to 70%. Individual mobility includes vehicles for teenagers, senior citizens, and disabled people. Moreover, there would be a decrease in mobility costs to USD 0.11 per km, due to technological advancements, optimized shared-mobility services, and new powertrains. However, the integration of ADAS features is anticipated to boost the usage of individual mobility in younger and older age group population, as well as for partially disabled people. Additionally, vehicle electrification, awareness about the environment, and adoption of sustainable mobility are expected to boost the demand for several electronic control units, which in turn propels the market in Europe.

Asia Pacific is also anticipated to hold a notable share of the multi-domain controller market. This is due to an increase in production and sales of passenger cars and rise in adoption of ADAS features in vehicles in the region.

The global multi-domain controller market is consolidated with a small number of large-scale vendors that control a majority of the market share. Several firms are spending significantly on comprehensive R&D and integration of advanced solutions and technological features in multi-domain controllers. Expansion of product portfolios and mergers and acquisitions are major strategies adopted by key players. The global multi-domain controller market report includes various sections such as multi-domain controller market drivers, multi-domain controller market growth analysis, challenges, and opportunities in the multi-domain controller market. TATA ELXSI, Visteon Corporation, Robert Bosch GmbH, Continental AG, Sasken Technologies Ltd., Delphi Technologies, Mobileye, NVIDIA Corporation, Infineon Technologies AG, KRONO-SAFE, NXP Semiconductors, Autoliv Inc., ZF Friedrichshafen AG, and Texas Instruments Incorporated are some of the key multi-domain controller companies identified in the global market.

Each of these players has been profiled in the multi-domain controller market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 3.11 Bn |

|

Market Forecast Value in 2031 |

US$ 18.78 Bn |

|

Growth Rate (CAGR) |

19.70% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The multi-domain controller market was valued at US$ 3.11 Bn in 2021.

The multi-domain controller market is expected to advance at a CAGR of 19.70% by 2031.

The multi-domain controller market is expected to reach US$ 18.78 Bn in 2031.

Increase in sales and production of vehicles, growing automotive electrification across the globe, rise in adoption of advanced technological features.

The advance driver assistance systems (ADAS) & safety segment accounted for 34.8% share of the multi-domain controller market.

Europe is a highly lucrative region of the global multi-domain controller market.

TATA ELXSI, Visteon Corporation, Robert Bosch GmbH, Continental AG, Sasken Technologies Ltd., Delphi Technologies, Mobileye, NVIDIA Corporation, Infineon Technologies AG, KRONO-SAFE, NXP Semiconductors, Autoliv Inc., ZF Friedrichshafen AG, and Texas Instruments Incorporated.

1. Preface

1.1. About TMR

1.2. Market Coverage / Taxonomy

1.3. Assumptions and Research Methodology

2. Executive Summary

2.1. Global Market Outlook

2.1.1. Market Size, Units, US$ Bn, 2017-2031

2.2. Demand & Supply Side Trends

2.3. TMR Analysis and Recommendations

2.4. Competitive Dashboard Analysis

3. Market Overview

3.1. Macro-Economic Factors

3.2. Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunity

3.3. Market Factor Analysis

3.3.1. Porter’s Five Force Analysis

3.3.2. SWOT Analysis

3.4. Regulatory Scenario

3.5. Key Trend Analysis

3.6. Value Chain Analysis

3.7. Cost Structure Analysis

3.8. Profit Margin Analysis

4. COVID-19 Impact Analysis – Multi-domain Controller Market

5. Global Multi-domain Controller Market, by Application

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Multi-domain Controller Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, by Application

5.2.1. Advance Driver Assistance System (ADAS) & Safety

5.2.2. Engine & Powertrain

5.2.3. Chassis & Body Control System

5.2.4. Cockpit

5.2.5. Others

6. Global Multi-domain Controller Market, by Vehicle Autonomy

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Multi-domain Controller Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, by Vehicle Autonomy

6.2.1. Autonomous Vehicles

6.2.2. Semi-Autonomous Vehicles

7. Global Multi-domain Controller Market, by Vehicle Type

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Multi-domain Controller Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, by Vehicle Type

7.2.1. Passenger Cars

7.2.1.1. Hatchback

7.2.1.2. Sedan

7.2.1.3. Utility Vehicle

7.2.2. Commercial Vehicles

7.2.2.1. Light Commercial Vehicles

7.2.2.2. Heavy-duty Commercial Vehicles

8. Global Multi-domain Controller Market, by Propulsion

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Multi-domain Controller Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, by Propulsion

8.2.1. IC Engine Vehicles

8.2.1.1. Gasoline/Petrol Vehicles

8.2.1.2. Diesel Vehicles

8.2.2. Electric Vehicles

8.2.2.1. Battery Electric Vehicles

8.2.2.2. Plug-in Hybrid Electric Vehicles

9. Global Multi-domain Controller Market, by Region

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global Multi-domain Controller Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. South America

10. North America Multi-domain Controller Market

10.1. Market Snapshot

10.2. Multi-domain Controller Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, by Application

10.2.1. Advance Driver Assistance System (ADAS) & Safety

10.2.2. Engine & Powertrain

10.2.3. Chassis & Body Control System

10.2.4. Cockpit

10.2.5. Others

10.3. Multi-domain Controller Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, by Vehicle Autonomy

10.3.1. Autonomous Vehicles

10.3.2. Semi-Autonomous Vehicles

10.4. Multi-domain Controller Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, by Vehicle Type

10.4.1. Passenger Vehicle

10.4.1.1. Hatchback

10.4.1.2. Sedan

10.4.1.3. Utility Vehicle

10.4.2. Commercial Vehicles

10.4.2.1. Light Commercial Vehicles

10.4.2.2. Heavy-duty Commercial Vehicles

10.5. Multi-domain Controller Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, by Propulsion

10.5.1. IC Engine Vehicles

10.5.1.1. Gasoline/Petrol Vehicles

10.5.1.2. Diesel Vehicles

10.5.2. Electric Vehicles

10.5.2.1. Battery Electric Vehicles

10.5.2.2. Plug-in Hybrid Electric Vehicles

10.6. Key Country Analysis – North America Multi-domain Controller Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031

10.6.1. U. S.

10.6.2. Canada

10.6.3. Mexico

11. Europe Multi-domain Controller Market

11.1. Market Snapshot

11.2. Multi-domain Controller Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, by Application

11.2.1. Advance Driver Assistance System (ADAS) & Safety

11.2.2. Engine & Powertrain

11.2.3. Chassis & Body Control System

11.2.4. Cockpit

11.2.5. Others

11.3. Multi-domain Controller Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, by Vehicle Autonomy

11.3.1. Autonomous Vehicles

11.3.2. Semi-Autonomous Vehicles

11.4. Multi-domain Controller Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, by Vehicle Type

11.4.1. Passenger Vehicle

11.4.1.1. Hatchback

11.4.1.2. Sedan

11.4.1.3. Utility Vehicle

11.4.2. Commercial Vehicles

11.4.2.1. Light Commercial Vehicles

11.4.2.2. Heavy-duty Commercial Vehicles

11.5. Multi-domain Controller Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, by Propulsion

11.5.1. IC Engine Vehicles

11.5.1.1. Gasoline/Petrol Vehicles

11.5.1.2. Diesel Vehicles

11.5.2. Electric Vehicles

11.5.2.1. Battery Electric Vehicles

11.5.2.2. Plug-in Hybrid Electric Vehicles

11.6. Key Country Analysis – Europe Multi-domain Controller Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031

11.6.1. Germany

11.6.2. U. K.

11.6.3. France

11.6.4. Italy

11.6.5. Spain

11.6.6. Nordic Countries

11.6.7. Russia & CIS

11.6.8. Rest of Europe

12. Asia Pacific Multi-domain Controller Market

12.1. Market Snapshot

12.2. Multi-domain Controller Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, by Application

12.2.1. Advance Driver Assistance System (ADAS) & Safety

12.2.2. Engine & Powertrain

12.2.3. Chassis & Body Control System

12.2.4. Cockpit

12.2.5. Others

12.3. Multi-domain Controller Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, by Vehicle Autonomy

12.3.1. Autonomous Vehicles

12.3.2. Semi-Autonomous Vehicles

12.4. Multi-domain Controller Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, by Vehicle Type

12.4.1. Passenger Vehicle

12.4.1.1. Hatchback

12.4.1.2. Sedan

12.4.1.3. Utility Vehicle

12.4.2. Commercial Vehicles

12.4.2.1. Light Commercial Vehicles

12.4.2.2. Heavy-duty Commercial Vehicles

12.5. Multi-domain Controller Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, by Propulsion

12.5.1. IC Engine Vehicles

12.5.1.1. Gasoline/Petrol Vehicles

12.5.1.2. Diesel Vehicles

12.5.2. Electric Vehicles

12.5.2.1. Battery Electric Vehicles

12.5.2.2. Plug-in Hybrid Electric Vehicles

12.6. Key Country Analysis – Asia Pacific Multi-domain Controller Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031

12.6.1. China

12.6.2. India

12.6.3. Japan

12.6.4. ASEAN Countries

12.6.5. South Korea

12.6.6. ANZ

12.6.7. Rest of Asia Pacific

13. Middle East & Africa Multi-domain Controller Market

13.1. Market Snapshot

13.2. Multi-domain Controller Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, by Application

13.2.1. Advance Driver Assistance System (ADAS) & Safety

13.2.2. Engine & Powertrain

13.2.3. Chassis & Body Control System

13.2.4. Cockpit

13.2.5. Others

13.3. Multi-domain Controller Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, by Vehicle Autonomy

13.3.1. Autonomous Vehicles

13.3.2. Semi-Autonomous Vehicles

13.4. Multi-domain Controller Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, by Vehicle Type

13.4.1. Passenger Vehicle

13.4.1.1. Hatchback

13.4.1.2. Sedan

13.4.1.3. Utility Vehicle

13.4.2. Commercial Vehicles

13.4.2.1. Light Commercial Vehicles

13.4.2.2. Heavy-duty Commercial Vehicles

13.5. Multi-domain Controller Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, by Propulsion

13.5.1. IC Engine Vehicles

13.5.1.1. Gasoline/Petrol Vehicles

13.5.1.2. Diesel Vehicles

13.5.2. Electric Vehicles

13.5.2.1. Battery Electric Vehicles

13.5.2.2. Plug-in Hybrid Electric Vehicles

13.6. Key Country Analysis – Middle East & Africa Multi-domain Controller Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031

13.6.1. GCC

13.6.2. South Africa

13.6.3. Turkey

13.6.4. Rest of Middle East & Africa

14. South America Multi-domain Controller Market

14.1. Market Snapshot

14.2. Multi-domain Controller Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, by Application

14.2.1. Advance Driver Assistance System (ADAS) & Safety

14.2.2. Engine & Powertrain

14.2.3. Chassis & Body Control System

14.2.4. Cockpit

14.2.5. Others

14.3. Multi-domain Controller Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, by Vehicle Autonomy

14.3.1. Autonomous Vehicles

14.3.2. Semi-Autonomous Vehicles

14.4. Multi-domain Controller Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, by Vehicle Type

14.4.1. Passenger Vehicle

14.4.1.1. Hatchback

14.4.1.2. Sedan

14.4.1.3. Utility Vehicle

14.4.2. Commercial Vehicles

14.4.2.1. Light Commercial Vehicles

14.4.2.2. Heavy-duty Commercial Vehicles

14.5. Multi-domain Controller Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031, by Propulsion

14.5.1. IC Engine Vehicles

14.5.1.1. Gasoline/Petrol Vehicles

14.5.1.2. Diesel Vehicles

14.5.2. Electric Vehicles

14.5.2.1. Battery Electric Vehicles

14.5.2.2. Plug-in Hybrid Electric Vehicles

14.6. Key Country Analysis – South America Multi-domain Controller Market Value (US$ Bn) & Volume (Thousand Units) Analysis & Forecast, 2017-2031

14.6.1. Brazil

14.6.2. Argentina

14.6.3. Rest of South America

15. Competitive Landscape

15.1. Company Share Analysis/ Brand Share Analysis, 2020

15.2. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share, Executive Bios)

15.3. Company Profile/ Key Players – Multi-domain Controller Market

15.3.1. TATA ELXSI

15.3.1.1. Company Overview

15.3.1.2. Company Footprints

15.3.1.3. Production Locations

15.3.1.4. Product Portfolio

15.3.1.5. Competitors & Customers

15.3.1.6. Subsidiaries & Parent Organization

15.3.1.7. Recent Developments

15.3.1.8. Financial Analysis

15.3.1.9. Profitability

15.3.1.10. Revenue Share

15.3.1.11. Executive Bios

15.3.2. Visteon Corporation

15.3.2.1. Company Overview

15.3.2.2. Company Footprints

15.3.2.3. Production Locations

15.3.2.4. Product Portfolio

15.3.2.5. Competitors & Customers

15.3.2.6. Subsidiaries & Parent Organization

15.3.2.7. Recent Developments

15.3.2.8. Financial Analysis

15.3.2.9. Profitability

15.3.2.10. Revenue Share

15.3.2.11. Executive Bios

15.3.3. Robert Bosch GmbH

15.3.3.1. Company Overview

15.3.3.2. Company Footprints

15.3.3.3. Production Locations

15.3.3.4. Product Portfolio

15.3.3.5. Competitors & Customers

15.3.3.6. Subsidiaries & Parent Organization

15.3.3.7. Recent Developments

15.3.3.8. Financial Analysis

15.3.3.9. Profitability

15.3.3.10. Revenue Share

15.3.3.11. Executive Bios

15.3.4. Continental AG

15.3.4.1. Company Overview

15.3.4.2. Company Footprints

15.3.4.3. Production Locations

15.3.4.4. Product Portfolio

15.3.4.5. Competitors & Customers

15.3.4.6. Subsidiaries & Parent Organization

15.3.4.7. Recent Developments

15.3.4.8. Financial Analysis

15.3.4.9. Profitability

15.3.4.10. Revenue Share

15.3.4.11. Executive Bios

15.3.5. Sasken Technologies Ltd.

15.3.5.1. Company Overview

15.3.5.2. Company Footprints

15.3.5.3. Production Locations

15.3.5.4. Product Portfolio

15.3.5.5. Competitors & Customers

15.3.5.6. Subsidiaries & Parent Organization

15.3.5.7. Recent Developments

15.3.5.8. Financial Analysis

15.3.5.9. Profitability

15.3.5.10. Revenue Share

15.3.5.11. Executive Bios

15.3.6. Delphi Technologies

15.3.6.1. Company Overview

15.3.6.2. Company Footprints

15.3.6.3. Production Locations

15.3.6.4. Product Portfolio

15.3.6.5. Competitors & Customers

15.3.6.6. Subsidiaries & Parent Organization

15.3.6.7. Recent Developments

15.3.6.8. Financial Analysis

15.3.6.9. Profitability

15.3.6.10. Revenue Share

15.3.6.11. Executive Bios

15.3.7. Mobileye

15.3.7.1. Company Overview

15.3.7.2. Company Footprints

15.3.7.3. Production Locations

15.3.7.4. Product Portfolio

15.3.7.5. Competitors & Customers

15.3.7.6. Subsidiaries & Parent Organization

15.3.7.7. Recent Developments

15.3.7.8. Financial Analysis

15.3.7.9. Profitability

15.3.7.10. Revenue Share

15.3.7.11. Executive Bios

15.3.8. NVIDIA Corporation

15.3.8.1. Company Overview

15.3.8.2. Company Footprints

15.3.8.3. Production Locations

15.3.8.4. Product Portfolio

15.3.8.5. Competitors & Customers

15.3.8.6. Subsidiaries & Parent Organization

15.3.8.7. Recent Developments

15.3.8.8. Financial Analysis

15.3.8.9. Profitability

15.3.8.10. Revenue Share

15.3.8.11. Executive Bios

15.3.9. Infineon Technologies AG

15.3.9.1. Company Overview

15.3.9.2. Company Footprints

15.3.9.3. Production Locations

15.3.9.4. Product Portfolio

15.3.9.5. Competitors & Customers

15.3.9.6. Subsidiaries & Parent Organization

15.3.9.7. Recent Developments

15.3.9.8. Financial Analysis

15.3.9.9. Profitability

15.3.9.10. Revenue Share

15.3.9.11. Executive Bios

15.3.10. KRONO-SAFE

15.3.10.1. Company Overview

15.3.10.2. Company Footprints

15.3.10.3. Production Locations

15.3.10.4. Product Portfolio

15.3.10.5. Competitors & Customers

15.3.10.6. Subsidiaries & Parent Organization

15.3.10.7. Recent Developments

15.3.10.8. Financial Analysis

15.3.10.9. Profitability

15.3.10.10. Revenue Share

15.3.10.11. Executive Bios

15.3.11. NXP Semiconductors

15.3.11.1. Company Overview

15.3.11.2. Company Footprints

15.3.11.3. Production Locations

15.3.11.4. Product Portfolio

15.3.11.5. Competitors & Customers

15.3.11.6. Subsidiaries & Parent Organization

15.3.11.7. Recent Developments

15.3.11.8. Financial Analysis

15.3.11.9. Profitability

15.3.11.10. Revenue Share

15.3.11.11. Executive Bios

15.3.12. Autoliv Inc.

15.3.12.1. Company Overview

15.3.12.2. Company Footprints

15.3.12.3. Production Locations

15.3.12.4. Product Portfolio

15.3.12.5. Competitors & Customers

15.3.12.6. Subsidiaries & Parent Organization

15.3.12.7. Recent Developments

15.3.12.8. Financial Analysis

15.3.12.9. Profitability

15.3.12.10. Revenue Share

15.3.12.11. Executive Bios

15.3.13. ZF Friedrichshafen AG

15.3.13.1. Company Overview

15.3.13.2. Company Footprints

15.3.13.3. Production Locations

15.3.13.4. Product Portfolio

15.3.13.5. Competitors & Customers

15.3.13.6. Subsidiaries & Parent Organization

15.3.13.7. Recent Developments

15.3.13.8. Financial Analysis

15.3.13.9. Profitability

15.3.13.10. Revenue Share

15.3.13.11. Executive Bios

15.3.14. Texas Instruments Incorporated

15.3.14.1. Company Overview

15.3.14.2. Company Footprints

15.3.14.3. Production Locations

15.3.14.4. Product Portfolio

15.3.14.5. Competitors & Customers

15.3.14.6. Subsidiaries & Parent Organization

15.3.14.7. Recent Developments

15.3.14.8. Financial Analysis

15.3.14.9. Profitability

15.3.14.10. Revenue Share

15.3.14.11. Executive Bios

15.3.15. Other Key Players

15.3.15.1. Company Overview

15.3.15.2. Company Footprints

15.3.15.3. Production Locations

15.3.15.4. Product Portfolio

15.3.15.5. Competitors & Customers

15.3.15.6. Subsidiaries & Parent Organization

15.3.15.7. Recent Developments

15.3.15.8. Financial Analysis

15.3.15.9. Profitability

15.3.15.10. Revenue Share

15.3.15.11. Executive Bios

List of Tables

Table 1: Global Multi-domain Controller Market Size & Forecast, Volume (Thousand Units), by Application, 2017-2031

Table 2: Global Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Application, 2017-2031

Table 3: Global Multi-domain Controller Market Size & Forecast, Volume (Thousand Units), by Vehicle Autonomy, 2017-2031

Table 4: Global Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Vehicle Autonomy, 2017-2031

Table 5: Global Multi-domain Controller Market Size & Forecast, Volume (Thousand Units), by Vehicle Type, 2017-2031

Table 6: Global Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Vehicle Type, 2017-2031

Table 7: Global Multi-domain Controller Market Size & Forecast, Volume (Thousand Units), by Propulsion, 2017-2031

Table 8: Global Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Propulsion, 2017-2031

Table 9: Global Multi-domain Controller Market Size & Forecast, Volume (Thousand Units), by Region, 2017-2031

Table 10: Global Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Region, 2017-2031

Table 11: North America Multi-domain Controller Market Size & Forecast, Volume (Thousand Units), by Application, 2017-2031

Table 12: North America Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Application, 2017-2031

Table 13: North America Multi-domain Controller Market Size & Forecast, Volume (Thousand Units), by Vehicle Autonomy, 2017-2031

Table 14: North America Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Vehicle Autonomy, 2017-2031

Table 15: North America Multi-domain Controller Market Size & Forecast, Volume (Thousand Units), by Vehicle Type, 2017-2031

Table 16: North America Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Vehicle Type, 2017-2031

Table 17: North America Multi-domain Controller Market Size & Forecast, Volume (Thousand Units), by Propulsion, 2017-2031

Table 18: North America Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Propulsion, 2017-2031

Table 19: North America Multi-domain Controller Market Size & Forecast, Volume (Thousand Units), by Country, 2017-2031

Table 20: North America Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Country, 2017-2031

Table 21: Europe Multi-domain Controller Market Size & Forecast, Volume (Thousand Units), by Application, 2017-2031

Table 22: Europe Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Application, 2017-2031

Table 23: Europe Multi-domain Controller Market Size & Forecast, Volume (Thousand Units), by Vehicle Autonomy, 2017-2031

Table 24: Europe Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Vehicle Autonomy, 2017-2031

Table 25: Europe Multi-domain Controller Market Size & Forecast, Volume (Thousand Units), by Vehicle Type, 2017-2031

Table 26: Europe Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Vehicle Type, 2017-2031

Table 27: Europe Multi-domain Controller Market Size & Forecast, Volume (Thousand Units), by Propulsion, 2017-2031

Table 28: Europe Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Propulsion, 2017-2031

Table 29: Europe Multi-domain Controller Market Size & Forecast, Volume (Thousand Units), by Country and Sub-region, 2017-2031

Table 30: Europe Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Country and Sub-region, 2017-2031

Table 31: Asia Pacific Multi-domain Controller Market Size & Forecast, Volume (Thousand Units), by Application, 2017-2031

Table 32: Asia Pacific Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Application, 2017-2031

Table 33: Asia Pacific Multi-domain Controller Market Size & Forecast, Volume (Thousand Units), by Vehicle Autonomy, 2017-2031

Table 34: Asia Pacific Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Vehicle Autonomy, 2017-2031

Table 35: Asia Pacific Multi-domain Controller Market Size & Forecast, Volume (Thousand Units), by Vehicle Type, 2017-2031

Table 36: Asia Pacific Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Vehicle Type, 2017-2031

Table 37: Asia Pacific Multi-domain Controller Market Size & Forecast, Volume (Thousand Units), by Propulsion, 2017-2031

Table 38: Asia Pacific Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Propulsion, 2017-2031

Table 39: Asia Pacific Multi-domain Controller Market Size & Forecast, Volume (Thousand Units), by Country and Sub-region, 2017-2031

Table 40: Asia Pacific Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Country and Sub-region, 2017-2031

Table 41: Middle East & Africa Multi-domain Controller Market Size & Forecast, Volume (Thousand Units), by Application, 2017-2031

Table 42: Middle East & Africa Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Application, 2017-2031

Table 43: Middle East & Africa Multi-domain Controller Market Size & Forecast, Volume (Thousand Units), by Vehicle Autonomy, 2017-2031

Table 44: Middle East & Africa Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Vehicle Autonomy, 2017-2031

Table 45: Middle East & Africa Multi-domain Controller Market Size & Forecast, Volume (Thousand Units), by Vehicle Type, 2017-2031

Table 46: Middle East & Africa Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Vehicle Type, 2017-2031

Table 47: Middle East & Africa Multi-domain Controller Market Size & Forecast, Volume (Thousand Units), by Propulsion, 2017-2031

Table 48: Middle East & Africa Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Propulsion, 2017-2031

Table 49: Middle East & Africa Multi-domain Controller Market Size & Forecast, Volume (Thousand Units), by Country and Sub-region, 2017-2031

Table 50: Middle East & Africa Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Country and Sub-region, 2017-2031

Table 51: South America Multi-domain Controller Market Size & Forecast, Volume (Thousand Units), by Application, 2017-2031

Table 52: South America Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Application, 2017-2031

Table 53: South America Multi-domain Controller Market Size & Forecast, Volume (Thousand Units), by Vehicle Autonomy, 2017-2031

Table 54: South America Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Vehicle Autonomy, 2017-2031

Table 55: South America Multi-domain Controller Market Size & Forecast, Volume (Thousand Units), by Vehicle Type, 2017-2031

Table 56: South America Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Vehicle Type, 2017-2031

Table 57: South America Multi-domain Controller Market Size & Forecast, Volume (Thousand Units), by Propulsion, 2017-2031

Table 58: South America Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Propulsion, 2017-2031

Table 59: South America Multi-domain Controller Market Size & Forecast, Volume (Thousand Units), by Country and Sub-region, 2017-2031

Table 60: South America Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Country and Sub-region, 2017-2031

List of Figures

Figure 1: Global Multi-domain Controller Market Volume (Thousand Units) Forecast, 2017–2031

Figure 2: Global Multi-domain Controller Market Value (US$ Bn) Forecast, 2017–2031

Figure 3: Key Segment Analysis for Global

Figure 4: Global Multi-domain Controller Market Size & Forecast, Value (US$ Bn), 2017-2031

Figure 5: Global Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Application, 2017-2031

Figure 6: Global Market Attractiveness, Value (US$ Bn), by Application, 2022-2031

Figure 7: Global Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Vehicle Autonomy, 2017-2031

Figure 8: Global Market Attractiveness, Value (US$ Bn), by Vehicle Autonomy, 2022-2031

Figure 9: Global Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Vehicle Type, 2017-2031

Figure 10: Global Market Attractiveness, Value (US$ Bn), by Vehicle Type, 2022-2031

Figure 11: Global Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Propulsion, 2017-2031

Figure 12: Global Market Attractiveness, Value (US$ Bn), by Propulsion, 2022-2031

Figure 13: Global Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Region, 2017-2031

Figure 14: Global Market Attractiveness, Value (US$ Bn), by Region, 2022-2031

Figure 15: North America Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Application, 2017-2031

Figure 16: North America Market Attractiveness, Value (US$ Bn), by Application, 2022-2031

Figure 17: North America Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Vehicle Autonomy, 2017-2031

Figure 18: North America Market Attractiveness, Value (US$ Bn), by Vehicle Autonomy, 2022-2031

Figure 19: North America Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Vehicle Type, 2017-2031

Figure 20: North America Market Attractiveness, Value (US$ Bn), by Vehicle Type, 2022-2031

Figure 21: North America Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Propulsion, 2017-2031

Figure 22: North America Market Attractiveness, Value (US$ Bn), by Propulsion, 2022-2031

Figure 23: North America Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Country, 2017-2031

Figure 24: North America Market Attractiveness, Value (US$ Bn), by Country, 2022-2031

Figure 25: Europe Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Application, 2017-2031

Figure 26: Europe Market Attractiveness, Value (US$ Bn), by Application, 2022-2031

Figure 27: Europe Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Vehicle Autonomy, 2017-2031

Figure 28: Europe Market Attractiveness, Value (US$ Bn), by Vehicle Autonomy, 2022-2031

Figure 29: Europe Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Vehicle Type, 2017-2031

Figure 30: Europe Market Attractiveness, Value (US$ Bn), by Vehicle Type, 2022-2031

Figure 31: Europe Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Propulsion, 2017-2031

Figure 32: Europe Market Attractiveness, Value (US$ Bn), by Propulsion, 2022-2031

Figure 33: Europe Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Country and Sub-region, 2017-2031

Figure 34: Europe Market Attractiveness, Value (US$ Bn), by Country and Sub-region, 2022-2031

Figure 35: Asia Pacific Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Application, 2017-2031

Figure 36: Asia Pacific Market Attractiveness, Value (US$ Bn), by Application, 2022-2031

Figure 37: Asia Pacific Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Vehicle Autonomy, 2017-2031

Figure 38: Asia Pacific Market Attractiveness, Value (US$ Bn), by Vehicle Autonomy, 2022-2031

Figure 39: Asia Pacific Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Vehicle Type, 2017-2031

Figure 40: Asia Pacific Market Attractiveness, Value (US$ Bn), by Vehicle Type, 2022-2031

Figure 41: Asia Pacific Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Propulsion, 2017-2031

Figure 42: Asia Pacific Market Attractiveness, Value (US$ Bn), by Propulsion, 2022-2031

Figure 43: Asia Pacific Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Country and Sub-region, 2017-2031

Figure 44: Asia Pacific Market Attractiveness, Value (US$ Bn), by Country and Sub-region, 2022-2031

Figure 45: Middle East & Africa Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Application, 2017-2031

Figure 46: Middle East & Africa Market Attractiveness, Value (US$ Bn), by Application, 2022-2031

Figure 47: Middle East & Africa Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Vehicle Autonomy, 2017-2031

Figure 48: Middle East & Africa Market Attractiveness, Value (US$ Bn), by Vehicle Autonomy, 2022-2031

Figure 49: Middle East & Africa Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Vehicle Type, 2017-2031

Figure 50: Middle East & Africa Market Attractiveness, Value (US$ Bn), by Vehicle Type, 2022-2031

Figure 51: Middle East & Africa Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Propulsion, 2017-2031

Figure 52: Middle East & Africa Market Attractiveness, Value (US$ Bn), by Propulsion, 2022-2031

Figure 53: Middle East & Africa Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Country and Sub-region, 2017-2031

Figure 54: Middle East & Africa Market Attractiveness, Value (US$ Bn), by Country and Sub-region, 2022-2031

Figure 55: South America Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Application, 2017-2031

Figure 56: South America Market Attractiveness, Value (US$ Bn), by Application, 2022-2031

Figure 57: South America Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Vehicle Autonomy, 2017-2031

Figure 58: South America Market Attractiveness, Value (US$ Bn), by Vehicle Autonomy, 2022-2031

Figure 59: South America Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Vehicle Type, 2017-2031

Figure 60: South America Market Attractiveness, Value (US$ Bn), by Vehicle Type, 2022-2031

Figure 61: South America Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Propulsion, 2017-2031

Figure 62: South America Market Attractiveness, Value (US$ Bn), by Propulsion, 2022-2031

Figure 63: South America Multi-domain Controller Market Size & Forecast, Value (US$ Bn), by Country and Sub-region, 2017-2031

Figure 64: South America Market Attractiveness, Value (US$ Bn), by Country and Sub-region, 2022-2031