Automotive Lubricants Aftermarket : Snapshot

A lubricant is a substance that is used to reduce friction and control wear between surfaces that are in contact with a relative motion. Automotive lubricants sold in the aftermarket are required for maintenance and smooth operation of vehicles after their purchase. Typically, a lubricant consists of approximately 80% to 90% base oil, and the rest is additives. However, these percentages vary according to application. Characteristics of a good lubricant include high boiling point, high viscosity index, corrosion retardation, thermal stability, low freezing point, and resistance to oxidation. Lubricants are used for their ability to increase the operating lifespan of mechanical parts. They can also eliminate any residue deposited over mechanical parts. Additives are added to the base oil to impart various properties to the lubricant and improve its performance. Lubricant additives are inorganic and organic compounds that are dissolved or suspended as solids in lubricants or base oils. in terms of type, the automotive lubricants aftermarket can be classified into engine oil, gear oil, transmission fluid, and others (including brake oil, greases, coolants, etc.). Aftermarket customers require lubricant suppliers to help them reduce their total operating cost. For instance, extended oil drain intervals help fleet owners to reduce their operating and maintenance cost, primarily by keeping cars and trucks on road for a longer duration of time. The type and quality of the lubricants used has a significant bearing on engine performance, fuel economy, and vehicle life. For instance, European cars and trucks have smaller, more fuel efficient and higher performance engines than vehicles in North America and Asia. Better fuel economy in cars can be achieved by reduced engine and gearbox friction, which is achieved by using lower viscosity and friction-modified lubricants.

World Vehicle Usage

Increase in automotive vehicle fleet has been the main driver of the automotive lubricant aftermarket. The vehicles in operation all over the world require lubricants at frequent time intervals for smoother engine operation and fuel economy. The total global vehicle fleet, including passenger cars and commercial vehicles, stood at 1.28 billion in 2015 and is projected to cross the 2 billion mark by 2035 and 2.5 billion by 2050. Increasing vehicle fleet around the globe is a key indicator of increasing demand for aftermarket automotive lubricants in the near future.

Increasing Sales of New Vehicles

The total number of new vehicle sales stood at 96,804,390 units (including passenger cars and commercial vehicles) in 2017. The rapid increase in sales of vehicle in developing countries and development of infrastructure have created a strong demand for aftermarket automotive lubricants. Increase in manufacturing of vehicles is one of the major factors contributing to the expansion of the global automotive lubricants aftermarket. Rise in demand for low viscosity fluids in the automotive sector is expected to boost the automotive lubricants aftermarket during the forecast period. The engine oil segment dominated the market in 2017 and is expected to expand at a significant rate during the forecast period due to increasing number of vehicles. Engine oil has to be changed frequently after every 5,000 miles to 15,000 miles of vehicle usage depending upon the engine and base oil used. This is expected to boost demand for engine oil. A unique feature of the global automotive aftermarket lubricant industry is that there is no significant slowdown in the consumption of aftermarket lubricants during economic downturns or market slowdowns. For instance, when vehicle sales go up, there is more consumption of lubricants, whereas even if new vehicle sales go down, the running vehicle fleet requires lubricants at frequent time intervals for smoother operation. Oil changes in vehicles become more frequent as they grow old. Therefore, even during unfavorable market conditions, customers have to purchase lubricants in order to maintain the current fleet of vehicles.

Impact of Electric Vehicles on Lubricant Demand

In 2015, there were about 1.1 billion light passenger vehicles, of which 0.9% (9.9 million) vehicles were electric, while the rest were internal combustion engine (ICE) vehicles. Out of the total number of light electric vehicles (9.9 million), 0.1% were battery electric vehicles (BEV) and the rest were hybrid electric vehicles (HEV/PHEV). Despite the marginal penetration of electric vehicles, the move toward electrification of automotive vehicles is likely to gain further impetus as electric vehicles help reduce emissions to meet the CAFÉ norms and various emissions norms set across the world. Since battery electric vehicles do not have internal combustion engines, they do not require engine oil. They only consume small amounts of greases and other products. This is expected to hamper demand for light vehicle lubricants in the near future.

Synthetic and Semi-synthetic Oil Paving the Way for Future Automotive Lubricants

Currently, mineral engine oil dominates the global automotive lubricants aftermarket due to its reasonable price. However, the market share of semi-synthetic and synthetic engine oils is likely to increase in near future, due to increased product knowledge and higher awareness among consumers. As modern lightweight vehicle engines are put under enormous stress, automakers worldwide are shifting toward lubricant grades with less viscosity to support achieving higher mandated fuel economy standards and emission requirements. This has led to increasing consumption of synthetic and semi-synthetic lubricants in newer cars, and it presents a significant market opportunity for all the aftermarket service providers. Synthetic engine oils are made with a variety of performance additives and synthetic base oils. Unlike mineral base oils, synthetic base oils are engineered with molecules of uniform shape and size and are optimized to consistently perform better than mineral base oils. Synthetic oils offer many advantages for newer and advanced engines. They don’t break down as easily as mineral oils, which means they protect the engine longer from excessive metal-to-metal contact that causes wear. Synthetic engine oils also function better in extreme hot and cold temperature conditions. They are paving the way for next-generation engine technology. The inclination toward use of lower viscosity oils to achieve newer grades such as 0W-20, 0W-30, and still to come 0W-16 requires the use of synthetics. Automakers are demanding even lower viscosity grade lubricants, for example 0W-8, which is possible only with synthetic formulations.

Japanese cars have used 0W-20 grade lubricants for several years, and their U.S. and European counterparts are now following in their footsteps. When the new ILSAC GF-6 specification becomes active in near future, synthetics are expected to play a more prominent role.

Market Bound by Emerging Economies in the Aftermath of Global Recession

Consumers in developed and developing regions have different mobility needs. Continued urbanization is likely to lead them toward car ownership. The global lubricants industry has seen a dramatic rebound since the global economic recession of 2008–2009. One of the key drivers of this rebound is higher demand for lubricants from developing economies. This can be ascribed to the surge in new vehicle sales and rise in number of onroad vehicles in Asia Pacific, Latin America, and Middle East & Africa. Economies of rapidly expanding countries of the market such as China, India, and Brazil are expected to achieve significant growth rates in the near future. This is anticipated to drive the global automotive lubricants aftermarket.

Consolidated market with the top few players accounting for more than 60% of the market share

The global automotive lubricants aftermarket is a highly organized market with top players accounting for majority of market share. Key players operating in the Automotive Lubricants Aftermarket are Royal Dutch Shell plc, ExxonMobil Corporation, BP p.l.c., Chevron Corporation, Total S.A., Sinopec Corporation, Fuchs Lubricants Co., LUKOIL Oil Company, Valvoline, Phillips 66, Bharat Petroleum Corporation Limited, JX Nippon Oil & Energy Corporation, Repsol S.A., Petrobras, Petronas, and Indian Oil Corporation Limited.

1. Preface

1.1. Report Description

1.2. Research Scope

1.3. Market Segmentation

2. Assumptions & Research Methodology

2.1. Assumptions

2.2. Research Methodology

3. Executive Summary

3.1. Global Automotive Lubricants Aftermarket, Revenue (US$ Mn), 2016–2025

3.2. Market Snapshot

4. Market Overview

4.1. Product Overview

4.2. Key Industry Developments

4.3. Market Indicators

4.4. Driver 1-Increase in demand for Automotive Lubricants Aftermarket in Wood & Coil Coatings

4.5. Driver 2-Demand for Automotive Lubricants Aftermarket in Industrial and Architectural Coatings

4.6. Restraints

4.7. Opportunity

4.8. Porter’s Five Forces Analysis

4.9. Value Chain Analysis

4.10. SWOT Analysis

5. Market Segmentation- Product Type Segment Analysis

5.1. Introduction

5.2. Global Automotive Lubricants Aftermarket– Product Type Analysis

5.2.1. Silica, Volume (Tons) & Revenue (US$ Mn), 2016-2025

5.2.2. Wax-based, Volume (Tons) & Revenue (US$ Mn), 2016-2025

5.2.3. Thermoplastic based, Volume (Tons) & Revenue (US$ Mn), 2016-2025

5.3. Market Attractiveness Analysis, by Product Type

6. Market Segmentation- Technology Segment Analysis

6.1. Introduction

6.2. Global Automotive Lubricants Aftermarket– Technology Segment Analysis

6.2.1. Water-based, Volume ( Tons) & Revenue (US$ Mn), 2016-2025

6.2.2. Solvent-based Volume (Tons) & Revenue (US$ Mn), 2016-2025

6.2.3. Others , Volume (Tons) & Revenue (US$ Mn), 2016-2025

6.3. Market Attractiveness Analysis, by Technology Segment

7. Market Segmentation- Application Segment Analysis

7.1. Introduction

7.2. Global Automotive Lubricants Aftermarket– Application Analysis

7.2.1. Industrial , Volume (Tons) & Revenue (US$ Mn), 2016-2025

7.2.1.1. Metal, Volume (Tons) & Revenue (US$ Mn), 2016-2025

7.2.1.2. Paper, Volume (Tons) & Revenue (US$ Mn), 2016-2025

7.2.1.3. Plastics, Volume (Tons) & Revenue (US$ Mn), 2016-2025

7.2.1.4. Printing Ink, Volume (Tons) & Revenue (US$ Mn), 2016-2025

7.2.1.5. Others, Volume (Tons) & Revenue (US$ Mn), 2016-2025

7.2.2. Wood Coatings, Volume (Tons) & Revenue (US$ Mn), 2016-2025

7.2.3. Leather Coatings, Volume (Tons) & Revenue (US$ Mn), 2016-2025

7.2.4. Architectural Coatings, Volume (Tons) & Revenue (US$ Mn), 2016-2025

7.2.5. Others, Volume (Tons) & Revenue (US$ Mn), 2016-2025

7.3. Market Attractiveness Analysis, by Application

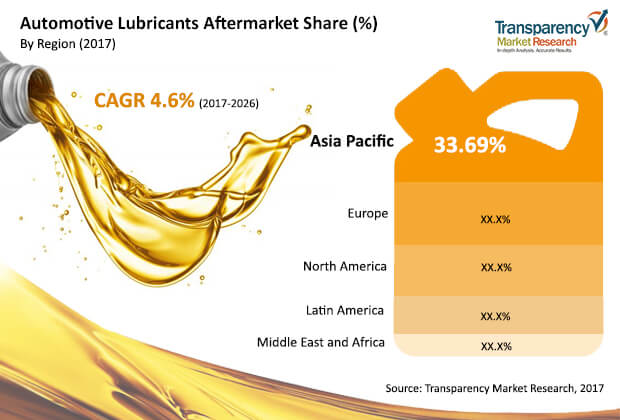

8. Global Automotive Lubricants Aftermarket– Regional Analysis

8.1. Global Automotive Lubricants Aftermarket Regional Scenario

8.2. Global Automotive Lubricants Aftermarket– Regional Analysis

8.2.1. North America, Volume (Tons) & Revenue (US$ Mn), 2016-2025

8.2.2. Europe, Volume (Tons) & Revenue (US$ Mn), 2016-2025

8.2.3. Asia Pacific, Volume (Tons) & Revenue (US$ Mn), 2016-2025

8.2.4. Latin America, Volume (Tons) & Revenue (US$ Mn), 2016-2025

8.2.5. Middle East & Africa, Volume (Tons) & Revenue (US$ Mn), 2016-2025

8.3. Market Attractiveness Analysis, by Application

9. North America Automotive Lubricants Aftermarket Snapshot

9.1. Key Findings

9.2. North America Automotive Lubricants Aftermarket Overview

9.3. North America Automotive Lubricants Aftermarket– Product Type Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

9.4. North America Automotive Lubricants Aftermarket– Technology segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

9.5. North America Automotive Lubricants Aftermarket– Application Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

9.6. North America Automotive Lubricants Aftermarket– Country/Sub-region Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

9.7. U.S. Automotive Lubricants Aftermarket– Product Type Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

9.8. U.S. Automotive Lubricants Aftermarket– Technology Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

9.9. U.S. Automotive Lubricants Aftermarket– Application Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

9.10. Canada Automotive Lubricants Aftermarket– Product Type Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

9.11. Canada Automotive Lubricants Aftermarket– Technology Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

9.12. Canada Automotive Lubricants Aftermarket– Application Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

9.13. North America Automotive Lubricants Aftermarket Attractiveness

9.14. PEST Analysis-North America

10. Europe Automotive Lubricants Aftermarket Snapshot

10.1. Key Findings

10.2. Europe Automotive Lubricants Aftermarket Overview

10.3. Europe Automotive Lubricants Aftermarket– Product Type Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

10.4. Europe Automotive Lubricants Aftermarket– Technology Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

10.5. Europe Automotive Lubricants Aftermarket– Application Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

10.6. Europe Automotive Lubricants Aftermarket– Country/Sub-region Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

10.7. Germany Automotive Lubricants Aftermarket– Product Type Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

10.8. Germany Automotive Lubricants Aftermarket– Technology Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

10.9. Germany Automotive Lubricants Aftermarket– Application Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

10.10. U.K. Automotive Lubricants Aftermarket– Product Type Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

10.11. U.K. Automotive Lubricants Aftermarket– Technology Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

10.12. U.K. Automotive Lubricants Aftermarket– Application Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

10.13. France Automotive Lubricants Aftermarket– Product Type Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

10.14. France Automotive Lubricants Aftermarket– Technology Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

10.15. Italy Automotive Lubricants Aftermarket– Technology Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

10.16. Italy Automotive Lubricants Aftermarket– Application Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

10.17. Rest of Europe Automotive Lubricants Aftermarket– Product Type Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

10.18. Rest of Europe Automotive Lubricants Aftermarket– Technology Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

10.19. Rest of Europe Automotive Lubricants Aftermarket– Application Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

10.20. Europe Automotive Lubricants Aftermarket Attractiveness

10.21. PEST Analysis-EUROPE

11. Asia Pacific Automotive Lubricants Aftermarket Snapshot

11.1. Key Findings

11.2. Asia Pacific Automotive Lubricants Aftermarket Overview

11.3. Asia Pacific Automotive Lubricants Aftermarket– Product Type Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

11.4. Asia Pacific Automotive Lubricants Aftermarket– Technology Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

11.5. Asia Pacific Automotive Lubricants Aftermarket– Application Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

11.6. Asia Pacific Automotive Lubricants Aftermarket– Country/Sub-region Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

11.7. China Automotive Lubricants Aftermarket– Product Type Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

11.8. China Automotive Lubricants Aftermarket– Technology Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

11.9. China Automotive Lubricants Aftermarket– Application Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

11.10. Japan Automotive Lubricants Aftermarket– Product Type Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

11.11. Japan Automotive Lubricants Aftermarket– Technology Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

11.12. Japan Automotive Lubricants Aftermarket– Application Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

11.13. India Automotive Lubricants Aftermarket– Product Type Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

11.14. India Automotive Lubricants Aftermarket– Technology Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

11.15. India Automotive Lubricants Aftermarket– Application Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

11.16. ASEAN Automotive Lubricants Aftermarket– Product Type Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

11.17. Rest of Asia Pacific Automotive Lubricants Aftermarket– Application Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

11.18. Asia Pacific Automotive Lubricants Aftermarket Attractiveness

11.19. PEST Analysis-Asia Pacific

12. Latin America Automotive Lubricants Aftermarket Snapshot

12.1. Key Findings

12.2. Latin America Automotive Lubricants Aftermarket Overview

12.3. Latin America Automotive Lubricants Aftermarket– Product Type Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

12.4. Latin America Automotive Lubricants Aftermarket– Technology Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

12.5. Latin America Automotive Lubricants Aftermarket– Application Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

12.6. Latin America Automotive Lubricants Aftermarket– Country/Sub-region Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

12.7. Brazil Automotive Lubricants Aftermarket– Product Type Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

12.8. Mexico Automotive Lubricants Aftermarket– Product Type Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

12.9. Mexico Automotive Lubricants Aftermarket– Technology Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

12.10. Mexico Automotive Lubricants Aftermarket– Application Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

12.11. Rest of Latin America Automotive Lubricants Aftermarket– Product Type Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

12.12. Rest of Latin America Automotive Lubricants Aftermarket– Technology Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

12.13. Rest of Latin America Automotive Lubricants Aftermarket– Application Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

12.14. Latin America Automotive Lubricants Aftermarket Attractiveness

12.15. PEST Analysis-Latin America

13. Middle East & Africa Automotive Lubricants Aftermarket Snapshot

13.1. Key Findings

13.2. Middle East & Africa Automotive Lubricants Aftermarket Overview

13.3. Middle East & Africa Automotive Lubricants Aftermarket– Application Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

13.4.Middle East & Africa Automotive Lubricants Aftermarket– Country/Sub-region Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

13.5. Turkey Automotive Lubricants Aftermarket– Product Type Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

13.6. Turkey Automotive Lubricants Aftermarket– Technology Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

13.7. Turkey Automotive Lubricants Aftermarket– Application Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

13.8. South Africa Automotive Lubricants Aftermarket– Product Type Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

13.9. South Africa Automotive Lubricants Aftermarket– Technology Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

13.10. South Africa Automotive Lubricants Aftermarket– Application Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

13.11.Rest of MEA Automotive Lubricants Aftermarket– Product Type Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

13.12. Rest of MEA Automotive Lubricants Aftermarket– Technology Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

13.13. Rest of Middle East & Africa Automotive Lubricants Aftermarket– Application Segment Analysis, Volume (Tons) & Revenue (US$ Mn), 2016-2025

13.14. Middle East & Africa Automotive Lubricants Aftermarket Attractiveness

13.15. PEST Analysis-Middle East & Africa

14. Competitive Landscape

14.1. Competition Matrix

14.2. Product Mapping

14.3. Company Profiles

14.3.1. Evonik Industries AG

14.3.1.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

14.3.1.2. Business Overview

14.3.1.3. Strategic Overview

14.3.2. PPG Industries, Inc.

14.3.2.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

14.3.2.2. Business Overview

14.3.2.3. Strategic Overview

14.3.3. Huntsman International

14.3.3.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

14.3.3.2. Business Overview

14.3.4. W. R. Grace & Co.-Conn.

14.3.4.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

14.3.4.2. Business Overview

14.3.4.3. Strategic Overview

14.3.5. J.M. Huber Corporation

14.3.5.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

14.3.5.2. Business Overview

14.3.6. Imerys

14.3.6.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

14.3.6.2. Business Overview

14.3.6.3. Strategic Overview

14.3.7. Allnex Group

14.3.7.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

14.3.7.2. Business Overview

14.3.8. Arkema Group

14.3.8.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

14.3.8.2. Business Overview

14.3.8.3. Strategic Overview

14.3.9. Akzo Nobel N.V.

14.3.9.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

14.3.9.2. Business Overview

14.3.9.3. Strategic Overview

14.3.10. The Lubrizol Corporation

14.3.10.1.Company Details (HQ, Foundation Year, Revenue, Employee Strength)

14.3.10.2. Business Overview

14.3.10.3. Strategic Overview

14.3.11. PQ Corporation

14.3.11.1. Company Details (HQ, Foundation Year, Revenue, Employee Strength)

14.3.11.2. Business Overview

14.3.12. Axalta Coating Systems Ltd.

14.3.12.1.Company Details (HQ, Foundation Year)

14.3.12.2.Business Overview

14.3.12.3.Strategic Overview

14.3.13. michelman, inc.

14.3.13.1. Company Details (HQ, Foundation Year)

14.3.13.2. Business Overview

14.3.14. Quantum Silicones, LLC

14.3.14.1.Company Details (HQ, Foundation Year)

14.3.14.2. Business Overview

14.3.15. Toyobo Co., Ltd

14.3.15.1.Company Details (HQ, Foundation Year, Revenue, Employee Strength)

14.3.15.2. Business Overview

14.3.15.3. Strategic Overview

List of Tables

Table 01: Global Automotive Lubricants Aftermarket Size (US$ Mn) and Volume (Tons) Forecast, by Product, 2016–2025

Table 02: Global Automotive Lubricants Aftermarket Size (US$ Mn) and Volume (Tons) Forecast, by Technology, 2016–2025

Table 03: Global Automotive Lubricants Aftermarket Size (US$ Mn) and Volume (Tons) Forecast, by Application, 2016–2025

Table 04: Global Automotive Lubricants Aftermarket Size (US$ Mn) and Volume (Tons) Forecast, by Region, 2016–2025

Table 05: North America Automotive Lubricants Aftermarket Size (US$ Mn) and Market Volume (Tons) Forecast, by Product, 2016–2025

Table 06: North America Automotive Lubricants Aftermarket Size (US$ Mn) and Market Volume (Tons) Forecast, by Technology, 2016–2025

Table 07: North America Automotive Lubricants Aftermarket Size (US$ Mn) and Volume (Tons) Forecast, by Application, 2016–2025

Table 08: North America Automotive Lubricants Aftermarket Size (US$ Mn) and Market Volume (Tons) Forecast, by Country, 2016–2025

Table 09: U.S. Automotive Lubricants Aftermarket Size (US$ Mn) and Market Volume (Tons) Forecast, by Product, 2016–2025

Table 10: U.S. Automotive Lubricants Aftermarket Size (US$ Mn) and Market Volume (Tons) Forecast, by Technology, 2016–2025

Table 11: U.S. Automotive Lubricants Aftermarket Size (US$ Mn) and Volume (Tons) Forecast, by Application, 2016–2025

Table 12:Canada Automotive Lubricants Aftermarket Size (US$ Mn) and Market Volume (Tons) Forecast, by Product, 2016–2025

Table 13: Canada Automotive Lubricants Aftermarket Size (US$ Mn) and Market Volume (Tons) Forecast, by Technology, 2016–2025

Table 14: Canada Automotive Lubricants Aftermarket Size (US$ Mn) and Volume (Tons) Forecast, by Application, 2016–2025

Table 15: Europe Automotive Lubricants Aftermarket Size (US$ Mn) and Market Volume (Tons) Forecast, by Product, 2016–2025

Table 16: Europe Automotive Lubricants Aftermarket Size (US$ Mn) and Market Volume (Tons) Forecast, by Technology, 2016–2025

Table 17: Europe Automotive Lubricants Aftermarket Size (US$ Mn) and Volume (Tons) Forecast, by Application, 2016–2025

Table 18: Europe Automotive Lubricants Aftermarket Size (US$ Mn) and Market Volume (Tons) Forecast, by Country, 2016–2025

Table 19: Germany Automotive Lubricants Aftermarket Size (US$ Mn) and Market Volume (Tons) Forecast, by Product, 2016–2025

Table 20: Germany Automotive Lubricants Aftermarket Size (US$ Mn) and Market Volume (Tons) Forecast, by Technology, 2016–2025

Table 21: Germany Automotive Lubricants Aftermarket Size (US$ Mn) and Volume (Tons) Forecast, by Application, 2016–2025

Table 22:U.K. Automotive Lubricants Aftermarket Size (US$ Mn) and Market Volume (Tons) Forecast, by Product, 2016–2025

Table 23: U.K. Automotive Lubricants Aftermarket Size (US$ Mn) and Market Volume (Tons) Forecast, by Technology, 2016–2025

Table 24: U.K. Automotive Lubricants Aftermarket Size (US$ Mn) and Volume (Tons) Forecast, by Application, 2016–2025

Table 25:France Automotive Lubricants Aftermarket Size (US$ Mn) and Market Volume (Tons) Forecast, by Product, 2016–2025

Table 26: France Automotive Lubricants Aftermarket Size (US$ Mn) and Market Volume (Tons) Forecast, by Technology, 2016–2025

Table 27: France Automotive Lubricants Aftermarket Size (US$ Mn) and Volume (Tons) Forecast, by Application, 2016–2025

Table 28:Italy Automotive Lubricants Aftermarket Size (US$ Mn) and Market Volume (Tons) Forecast, by Product, 2016–2025

Table 29: Italy Automotive Lubricants Aftermarket Size (US$ Mn) and Market Volume (Tons) Forecast, by Technology, 2016–2025

Table 30: Italy Automotive Lubricants Aftermarket Size (US$ Mn) and Volume (Tons) Forecast, by Application, 2016–2025

Table 31:Rest of Europe Automotive Lubricants Aftermarket Size (US$ Mn) and Market Volume (Tons) Forecast, by Product, 2016–2025

Table 32: Rest of Europe Automotive Lubricants Aftermarket Size (US$ Mn) and Market Volume (Tons) Forecast, by Technology, 2016–2025

Table 33: Rest of Europe Automotive Lubricants Aftermarket Size (US$ Mn) and Volume (Tons) Forecast, by Application, 2016–2025

Table 34: Asia Pacific Automotive Lubricants Aftermarket Size (US$ Mn) and Market Volume (Tons) Forecast, by Product, 2016–2025

Table 35: Asia Pacific Automotive Lubricants Aftermarket Size (US$ Mn) and Market Volume (Tons) Forecast, by Technology, 2016–2025

Table 36: Asia Pacific Automotive Lubricants Aftermarket Size (US$ Mn) and Volume (Tons) Forecast, by Application, 2016–2025

Table 37: Asia Pacific Automotive Lubricants Aftermarket Size (US$ Mn) and Market Volume (Tons) Forecast, by Country, 2016–2025

Table 38: China Automotive Lubricants Aftermarket Size (US$ Mn) and Market Volume (Tons) Forecast, by Product, 2016–2025

Table 39: China Automotive Lubricants Aftermarket Size (US$ Mn) and Market Volume (Tons) Forecast, by Technology, 2016–2025

Table 40: China Automotive Lubricants Aftermarket Size (US$ Mn) and Volume (Tons) Forecast, by Application, 2016–2025

Table 41:Japan Automotive Lubricants Aftermarket Size (US$ Mn) and Market Volume (Tons) Forecast, by Product, 2016–2025

Table 42: Japan Automotive Lubricants Aftermarket Size (US$ Mn) and Market Volume (Tons) Forecast, by Technology, 2016–2025

Table 43: Japan Automotive Lubricants Aftermarket Size (US$ Mn) and Volume (Tons) Forecast, by Application, 2016–2025

Table 44:India Automotive Lubricants Aftermarket Size (US$ Mn) and Market Volume (Tons) Forecast, by Product, 2016–2025

Table 45: India Automotive Lubricants Aftermarket Size (US$ Mn) and Market Volume (Tons) Forecast, by Technology, 2016–2025

Table 46: India Automotive Lubricants Aftermarket Size (US$ Mn) and Volume (Tons) Forecast, by Application, 2016–2025

Table 47:ASEAN Automotive Lubricants Aftermarket Size (US$ Mn) and Market Volume (Tons) Forecast, by Product, 2016–2025

Table 48: ASEAN Automotive Lubricants Aftermarket Size (US$ Mn) and Market Volume (Tons) Forecast, by Technology, 2016–2025

Table 49: ASEAN Automotive Lubricants Aftermarket Size (US$ Mn) and Volume (Tons) Forecast, by Application, 2016–2025

Table 50:Rest of Asia Pacific Automotive Lubricants Aftermarket Size (US$ Mn) and Market Volume (Tons) Forecast, by Product, 2016–2025

Table 51: Rest of Asia Pacific Automotive Lubricants Aftermarket Size (US$ Mn) and Market Volume (Tons) Forecast, by Technology, 2016–2025

Table 52: Rest of Asia Pacific Automotive Lubricants Aftermarket Size (US$ Mn) and Volume (Tons) Forecast, by Application, 2016–2025

Table 53: Latin America Automotive Lubricants Aftermarket Size (US$ Mn) and Market Volume (Tons) Forecast, by Product, 2016–2025

Table 54: Latin America Automotive Lubricants Aftermarket Size (US$ Mn) and Market Volume (Tons) Forecast, by Technology, 2016–2025

Table 55: Latin America Automotive Lubricants Aftermarket Size (US$ Mn) and Volume (Tons) Forecast, by Application, 2016–2025

Table 56: Latin America Automotive Lubricants Aftermarket Size (US$ Mn) and Market Volume (Tons) Forecast, by Country, 2016–2025

Table 57: Brazil Automotive Lubricants Aftermarket Size (US$ Mn) and Market Volume (Tons) Forecast, by Product, 2016–2025

Table 58: Brazil Automotive Lubricants Aftermarket Size (US$ Mn) and Market Volume (Tons) Forecast, by Technology, 2016–2025

Table 59: Brazil Automotive Lubricants Aftermarket Size (US$ Mn) and Volume (Tons) Forecast, by Application, 2016–2025

Table 60:Mexico Automotive Lubricants Aftermarket Size (US$ Mn) and Market Volume (Tons) Forecast, by Product, 2016–2025

Table 61: Mexico Automotive Lubricants Aftermarket Size (US$ Mn) and Market Volume (Tons) Forecast, by Technology, 2016–2025

Table 62: Mexico Automotive Lubricants Aftermarket Size (US$ Mn) and Volume (Tons) Forecast, by Application, 2016–2025

Table 63:Rest of Latin America Automotive Lubricants Aftermarket Size (US$ Mn) and Market Volume (Tons) Forecast, by Product, 2016–2025

Table 64: Rest of Latin America Automotive Lubricants Aftermarket Size (US$ Mn) and Market Volume (Tons) Forecast, by Technology, 2016–2025

Table 65: Rest of Latin America Automotive Lubricants Aftermarket Size (US$ Mn) and Volume (Tons) Forecast, by Application, 2016–2025

Table 66: Middle East & Africa Automotive Lubricants Aftermarket Size (US$ Mn) and Market Volume (Tons) Forecast, by Product, 2016–2025

Table 67: Middle East & Africa Automotive Lubricants Aftermarket Size (US$ Mn) and Market Volume (Tons) Forecast, by Technology, 2016–2025

Table 68: Middle East & Africa Automotive Lubricants Aftermarket Size (US$ Mn) and Volume (Tons) Forecast, by Application, 2016–2025

Table 69: Middle East & Africa Automotive Lubricants Aftermarket Size (US$ Mn) and Market Volume (Tons) Forecast, by Country, 2016–2025

Table 70: GCC Automotive Lubricants Aftermarket Size (US$ Mn) and Market Volume (Tons) Forecast, by Product, 2016–2025

Table 71: GCC Automotive Lubricants Aftermarket Size (US$ Mn) and Market Volume (Tons) Forecast, by Technology, 2016–2025

Table 72: GCC Automotive Lubricants Aftermarket Size (US$ Mn) and Volume (Tons) Forecast, by Application, 2016–2025

Table 73:South Africa Automotive Lubricants Aftermarket Size (US$ Mn) and Market Volume (Tons) Forecast, by Product, 2016–2025

Table 74: South Africa Automotive Lubricants Aftermarket Size (US$ Mn) and Market Volume (Tons) Forecast, by Technology, 2016–2025

Table 75: South Africa Automotive Lubricants Aftermarket Size (US$ Mn) and Volume (Tons) Forecast, by Application, 2016–2025

Table 76:Rest of Middle East & Africa Automotive Lubricants Aftermarket Size (US$ Mn) and Market Volume (Tons) Forecast, by Product, 2016–2025

Table 77: Rest of Middle East & Africa Automotive Lubricants Aftermarket Size (US$ Mn) and Market Volume (Tons) Forecast, by Technology, 2016–2025

Table 78: Rest of Middle East & Africa Automotive Lubricants Aftermarket Size (US$ Mn) and Volume (Tons) Forecast, by Application, 2016–2025

List of Figures

Figure 01: Global Automotive Lubricants Aftermarket Size (US$ Mn) Forecast, 2016–2025

Figure 02: Global Automotive Lubricants Aftermarket Volume (Tons) Forecast, 2016–2025

Figure 03: Global Automotive Lubricants Aftermarket Value Share, by Product (2016)

Figure 04: Global Automotive Lubricants Aftermarket, by Technology (2016)

Figure 05: Global Automotive Lubricants Aftermarket, by Application (2016)

Figure 06: Global Automotive Lubricants Aftermarket, Value Share Analysis, by Product, 2016 and 2025

Figure 07: Global Automotive Lubricants Aftermarket Attractiveness Analysis, by Product, 2016

Figure 08: Global Automotive Lubricants Aftermarket, Value Share Analysis, by Technology, 2016 and 2025

Figure 09: Global Automotive Lubricants Aftermarket Attractiveness Analysis, by Technology, 2016

Figure 10: Global Automotive Lubricants Aftermarket, Value Share Analysis, by Application, 2016 and 2025

Figure 11: Global Automotive Lubricants Aftermarket Attractiveness Analysis, by Application, 2016

Figure 12: Global Automotive Lubricants Aftermarket Value Share Analysis, by Region, 2016 and 2025

Figure 13: Global Automotive Lubricants Aftermarket Attractiveness Analysis, by Region

Figure 14: North America Automotive Lubricants Aftermarket Size (US$ Mn) and Volume (Tons) Forecast, 2016–2025

Figure 15: North America Automotive Lubricants Aftermarket Size and Volume Y-o-Y Growth Projections, 2016–2025

Figure 16: North America Automotive Lubricants Aftermarket Value Share Analysis, by Product, 2016 and 2025

Figure 17: North America Automotive Lubricants Aftermarket, Market Value Share Analysis, by Technology, 2016 and 2025

Figure 18: North America Automotive Lubricants Aftermarket, Market Value Share Analysis, by Application, 2016 and 2025

Figure 19: North America Automotive Lubricants Aftermarket Value Share Analysis, by Country, 2016 and 2025

Figure 20: North America Automotive Lubricants Aftermarket Attractiveness, by Product

Figure 21: North America Automotive Lubricants Aftermarket Attractiveness, by Technology

Figure 22: North America Automotive Lubricants Aftermarket Attractiveness, by Application

Figure 23: North America Automotive Lubricants Aftermarket Attractiveness, by Country

Figure 24: Europe Automotive Lubricants Aftermarket Size (US$ Mn) and Volume (Tons) Forecast, 2016–2025

Figure 25: Europe Automotive Lubricants Aftermarket Size and Volume, Y-o-Y Growth Projection, 2016–2025

Figure 26: Europe Automotive Lubricants Aftermarket, Market Value Share Analysis, by Product, 2016 and 2025

Figure 27: Europe Automotive Lubricants Aftermarket, Market Value Share Analysis, by Technology, 2016 and 2025

Figure 28: Europe Automotive Lubricants Aftermarket, Market Value Share Analysis, by Application, 2016 and 2025

Figure 29: Europe Automotive Lubricants Aftermarket Value Share Analysis, by Country, 2016 and 2025

Figure 30: Europe Automotive Lubricants Aftermarket Attractiveness, by Product

Figure 31: Europe Automotive Lubricants Aftermarket Attractiveness, by Technology

Figure 32: Europe Automotive Lubricants Aftermarket Attractiveness, by Application

Figure 33: Europe Automotive Lubricants Aftermarket Attractiveness, by Country

Figure 34: Asia Pacific Automotive Lubricants Aftermarket Size (US$ Mn) and Volume (Tons) Forecast, 2016–2025

Figure 35: Asia Pacific Automotive Lubricants Aftermarket Size and Volume, Y-o-Y Growth Projection, 2016–2025

Figure 36: Asia Pacific Automotive Lubricants Aftermarket, Market Value Share Analysis, by Product, 2016 and 2025

Figure 37: Asia Pacific Automotive Lubricants Aftermarket, Market Value Share Analysis, by Technology, 2016 and 2025

Figure 38: Asia Pacific Automotive Lubricants Aftermarket, Market Value Share Analysis, by Application, 2016 and 2025

Figure 39: Asia Pacific Automotive Lubricants Aftermarket Value Share Analysis, by Country and Sub-region, 2016 and 2025

Figure 40: Asia Pacific Automotive Lubricants Aftermarket Attractiveness, by Product

Figure 41: Asia Pacific Automotive Lubricants Aftermarket Attractiveness, by Technology

Figure 42: Asia Pacific Automotive Lubricants Aftermarket Attractiveness, by Application

Figure 43: Asia Pacific Automotive Lubricants Aftermarket Attractiveness, by Country

Figure 44: Latin America Automotive Lubricants Aftermarket Size (US$ Mn) and Volume (Tons) Forecast, 2016–2025

Figure 45: Latin America Automotive Lubricants Aftermarket Size and Volume Y-o-Y Growth Projections, 2016–2025

Figure 46: Latin America Automotive Lubricants Aftermarket Value Share Analysis, by Product, 2016 and 2025

Figure 47: Latin America Automotive Lubricants Aftermarket Value Share Analysis, by Technology, 2016 and 2025

Figure 48: Latin America Automotive Lubricants Aftermarket Value Share Analysis, by Application, 2016 and 2025

Figure 49: Latin America Automotive Lubricants Aftermarket Value Share Analysis by Country, 2016 and 2025

Figure 50: Latin America Automotive Lubricants Aftermarket Attractiveness, by Product

Figure 51: Latin America Automotive Lubricants Aftermarket Attractiveness, by Technology

Figure 52: Latin America Automotive Lubricants Aftermarket Attractiveness, by Application

Figure 53: Latin America Automotive Lubricants Aftermarket Attractiveness, by Country

Figure 54: Middle East & Africa Automotive Lubricants Aftermarket Size (US$ Mn) and Volume (Tons) Forecast, 2016–2025

Figure 55: Middle East & Africa Automotive Lubricants Aftermarket Size and Volume Y-o-Y Growth Projections, 2016–2025

Figure 56: Middle East & Africa Automotive Lubricants Aftermarket Value Share Analysis, by Product, 2016 and 2025

Figure 57: Middle East & Africa Automotive Lubricants Aftermarket Value Share Analysis, by Technology, 2016 and 2025

Figure 58: Middle East & Africa Automotive Lubricants Aftermarket Value Share Analysis, by Application, 2016 and 2025

Figure 59: Middle East & Africa Automotive Lubricants Aftermarket Value Share Analysis, by Country, 2016 and 2025

Figure 60: Middle East & Africa Automotive Lubricants Aftermarket Attractiveness, by Product

Figure 61: Middle East & Africa Automotive Lubricants Aftermarket Attractiveness, by Technology

Figure 62: Middle East & Africa Automotive Lubricants Aftermarket Attractiveness, by Application

Figure 63: Middle East & Africa Automotive Lubricants Aftermarket Attractiveness, by Country

Figure 64: Automotive Lubricants Aftermarket Share Analysis, by Company (2016)