Analysts’ Viewpoint

Increase in outsourcing of automotive components is driving the global automotive logistics business. Automakers are increasingly adopting software-based systems to handle logistical processes. This is boosting operational efficiency and supply chain transparency in the market.

Expansion in the logistics sector is expected to augment the market statistics during the forecast period. Supply of an efficient and tailored logistic service has become a differentiating feature among logistic service providers. Logistic service companies are integrating disruptive technologies such as Big Data, Internet of Things (IoT), and linked ships to improve their supply chain management system. Vendors are establishing online marketplaces for containerized transportation to boost customer experience and increase their automotive logistics industry share.

Automotive logistics is a term used to describe the process of organizing and transporting resources, such as machinery, stock, and materials with finished cars and automotive parts, from one area to the intended location. It is management of the flow of commodities from the point of origin to the site of consumption. Logistics in the automobile industry is focused on the efficient and effective administration of everyday tasks related to the manufacture of finished products and services.

Logistics services are used in the e-commerce sector to manage and monitor the supply chain. E-commerce is a popular method for purchasing a wide range of goods, since it is simple to use, offers excellent shopping experiences, and provides various discounts. Rise in adoption of smartphones and increase in the penetration of Internet is propelling expansion in the e-commerce industry. The tech-savvy young population prefers using e-commerce to buy daily necessities, apparel, gadgets, and other important and non-essential things. Thus, growth in the e-commerce sector is likely to drive the automotive logistics market development during the forecast period.

Logistics service providers are focusing on improving automotive logistic operations owing to the rise in production of vehicles. They are introducing Finished Vehicle Logistics (FVL) services to effectively manage logistics operations. FVL offers real-time vehicle location data and analytics to vehicle logistic service providers, thereby facilitating total control over the movement of vehicles. It helps reduce costs and errors associated with older technologies such as manual scanning and radio frequency identification.

Improvement in operating efficiency can decrease the need for fleets in logistics. National Vehicle Distribution, an Ireland-based auto distributor, relies on advanced FVL technologies to streamline its operations. The company has quadrupled its production and cut customer lead times due to its ability to load eight to ten automobiles onto a truck in under 45 minutes. On the other hand, many Eastern European institutions require more than three hours for a similar process. Thus, increase in usage of FVL is likely to contribute to automotive logistics market growth during the forecast period.

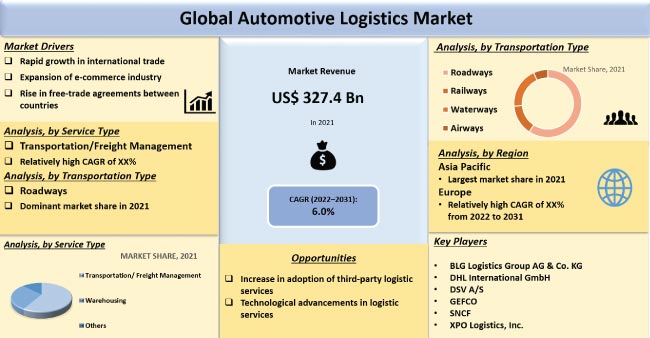

Based on service type, the transportation/freight management segment accounted for major share of 58.3% of the market in 2021. The segment is estimated to maintain its position and grow at a CAGR of more than 6.2% during the forecast period. Transportation is one of the most essential services in the production of automobiles, as automakers purchase numerous parts and elements from various businesses for vehicle assembly.

According to the latest automotive logistics market trends, the warehousing segment is likely to grow at a significant pace in the next few years. Rise in demand for storage facilities and expansion in the e-commerce sector are driving the segment.

According to the latest automotive logistics industry analysis, the roadways transportation type segment held significant share of 59.2% of the market in 2021. The segment is estimated to maintain its dominance and grow at a CAGR of more than 5.1% during the forecast period. Growth of the segment can be ascribed to the implementation of intelligent transportation networks in various regions. The transportation system in Europe permits platooning and automated driving.

The waterways segment is likely to grow at a fast pace in the next few years. Increase in availability of high-performing port services and high-quality infrastructure, which allows the elimination of additional expenses for transport operators, shippers, and consumers, is fueling the segment.

Regional analysis of the market is based on production trends, political reforms, regulation changes, and demand. Asia Pacific dominated the market in terms of revenue share in 2021. Expansion in the automotive sector, rise in demand for vehicles, and the availability of low-wage labor are driving the market progress in the region.

Major Original Equipment Manufacturers (OEMs) of vehicles, including Toyota, Maruti Suzuki, Hyundai, and SAIC Motor Corporation Limited, are based in Asia Pacific. Logistics businesses are required to manage OEMs' purchasing, shipping, and storage activities, and effectively optimize supply chains.

Future demand for automotive logistics in Europe is driven by growth in the automotive spare parts logistics market, surge in demand for electric vehicles, and rise in focus of regional OEMs to rearrange supply chains in order to reduce the dependence on a single region.

The global automotive logistics market is consolidated, with a large number of service providers controlling the share. Major companies are adopting newer technologies to enhance their market share. Expansion of product portfolios and mergers & acquisitions are key strategies adopted by service providers.

Bolloré Transport & Logistics, BLG Logistics Group AG & Co. KG, CEVA Logistics, CJ Logistics Corporation, DACHSER Group SE & Co. KG, DB Schenker, DHL International GmbH, DSV A/S, Expeditors International of Washington, Inc., GEODIS, GEFCO, Hellmann Worldwide Logistics GmbH & Co. KG, Imperial Logistics, Kerry Logistics Network Limited, Kuehne + Nagel International AG, Nippon Express Co., Ltd., Panalpina World Transport (Holding) Ltd., Ryder System, Inc., Schnellecke Group AG & Co. KG, Sinotrans Limited, SNCF, United Parcel Service of America, Inc., and XPO Logistics, Inc. are major entities operating in the market.

These vendors are profiled in the automotive logistics market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 327.4 Bn |

|

Market Forecast Value in 2031 |

US$ 589.1 Bn |

|

Growth Rate (CAGR) |

6.0% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 327.4 Bn in 2021

It is expected to grow at a CAGR of 6.0% by 2031

It is likely to be valued at US$ 589.1 Bn by 2031

Rapid growth in international trade and expansion of e-commerce industry

The transportation/freight management segment accounted for 58.3% share in 2021

Asia Pacific is a highly lucrative region in the market

Bolloré Transport & Logistics, BLG Logistics Group AG & Co. KG, CEVA Logistics, CJ Logistics Corporation, DACHSER Group SE & Co. KG, DB Schenker, DHL International GmbH, DSV A/S, Expeditors International of Washington, Inc., GEODIS, GEFCO, Hellmann Worldwide Logistics GmbH & Co. KG, Imperial Logistics, Kerry Logistics Network Limited, Kuehne + Nagel International AG, Nippon Express Co., Ltd., Panalpina World Transport (Holding) Ltd., Ryder System, Inc., Schnellecke Group AG & Co. KG

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Automotive Logistics Market

3.1. Global Automotive Logistics Market Size, US$ Bn, 2022-2031

4. Market Overview

4.1. Introduction

4.1.1. Automotive Logistics Market Definition

4.1.2. Key Industry Developments

4.2. Key Market Indicators

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunity

4.4. Porter’s Five Force Analysis

4.5. Value Chain Analysis

4.6. SWOT Analysis

4.7. Government Initiatives & Regulatory Scenario

5. Study of Economic Trends & Their Impact on Automotive Logistics Market

6. Automation & Digitalization in Automotive Logistics Supply Chain

6.1. Telematics, Mobile Apps & Platforms, Big Data, & Core Supply Chain Technologies in Use

6.2. Current Investment Scenario

6.3. Future Outlook

6.4. Roadblocks to automation

7. Opportunities in Additional Automotive Logistics Services

7.1. First & Last Mile Logistics

7.2. Reverse Logistics

7.3. Cross-border E-Commerce & Airfreight

8. Global Automotive Logistics Market: Potential Regional Analysis

9. Global Automotive Logistics Market: Cost Analysis

10. Global Automotive Logistics Market: Collaborations, Consolidations & Business Challenges

11. Global Automotive Logistics Market: Industry Initiatives

11.1. Automotive OEM support

11.2. Partnerships and Collaboration

12. Global Automotive Logistics Market Analysis and Forecast, Market Growth & Y-o-Y Analysis

13. Global Automotive Logistics Market Analysis and Forecast, By Industry Type

13.1. Introduction & Definition

13.2. Market Growth & Y-o-Y projection

13.3. Automotive Logistics Revenue (US$ Bn) Forecast By Industry Type, 2022-2031

13.3.1. Manufacturing

13.3.2. Retail & Consumer Products

13.3.3. Telecomm/Electronics

13.3.4. Healthcare & Pharmaceuticals

13.3.5. Food & Beverage

13.3.6. Others

14. Global Automotive Logistics Market Analysis and Forecast, By Service Type

14.1. Introduction & Definition

14.2. Market Growth & Y-o-Y projection

14.3. Automotive Logistics Revenue (US$ Bn) Forecast By Service Type, 2022-2031

14.3.1. Transportation/Freight Management

14.3.2. Warehousing

14.3.3. Others

15. Global Automotive Logistics Market Analysis and Forecast, By Distribution

15.1. Introduction & Definition

15.2. Market Growth & Y-o-Y projection

15.3. Automotive Logistics Revenue (US$ Bn) Forecast By Distribution, 2022-2031

15.3.1. Domestic

15.3.2. International

16. Global Automotive Logistics Market Analysis and Forecast, by Transportation Type

16.1. Introduction & Definition

16.2. Market Growth & Y-o-Y projection

16.3. Automotive Logistics Revenue (US$ Bn) Forecast by Transportation Type, 2022-2031

16.3.1. Roadways

16.3.2. Railways

16.3.3. Waterways

16.3.4. Airways

17. Global Automotive Logistics Market Analysis and Forecast, By Logistic Service

17.1. Introduction & Definition

17.2. Market Growth & Y-o-Y projection

17.3. Automotive Logistics Revenue (US$ Bn) Forecast By Logistic Service, 2022-2031

17.3.1. Inbound

17.3.2. Outbound

17.3.3. Reverse

17.3.4. Aftermarket

17.4. Automotive Logistics Market Attractiveness Analysis By Logistic Service Segment

18. Global Automotive Logistics Market Analysis and Forecast, by Region

18.1. Market Growth & Y-o-Y projection

18.2. Automotive Logistics Revenue (US$ Bn) Forecast by Region, 2022-2031

18.2.1. North America

18.2.2. Europe

18.2.3. Asia Pacific

18.2.4. Middle East & Africa

18.2.5. South America

19. North America Automotive Logistics Market Size and Forecast (US$ Bn), 2022-2031

19.1. Key Findings

19.2. Market Growth & Y-o-Y projection

19.3. North America Market, By Industry Type

19.3.1. Manufacturing

19.3.2. Retail & Consumer Products

19.3.3. Telecomm/Electronics

19.3.4. Healthcare & Pharmaceuticals

19.3.5. Food & Beverage

19.3.6. Others

19.4. North America Market, By Service Type

19.4.1. Transportation/Freight Management

19.4.2. Warehousing

19.4.3. Others

19.5. North America Market, By Distribution

19.5.1. Domestic

19.5.2. International

19.6. North America Market, By Transportation Type

19.6.1. Roadways

19.6.2. Railways

19.6.3. Waterways

19.6.4. Airways

19.7. North America Market, By Logistic Service

19.7.1. Inbound

19.7.2. Outbound

19.7.3. Reverse

19.7.4. Aftermarket

19.8. North America, By Country

19.8.1. U.S.

19.8.2. Canada

19.8.3. Mexico

19.9. North America Automotive Logistics Market: PEST Analysis

20. Europe Automotive Logistics Market Size and Forecast (US$ Bn), 2022-2031

20.1. Key Findings

20.2. Market Growth & Y-o-Y projection

20.3. Europe Market, By Industry Type

20.3.1. Manufacturing

20.3.2. Retail & Consumer Products

20.3.3. Telecomm/Electronics

20.3.4. Healthcare & Pharmaceuticals

20.3.5. Food & Beverage

20.3.6. Others

20.4. Europe Market, By Service Type

20.4.1. Transportation/Freight Management

20.4.2. Warehousing

20.4.3. Others

20.5. Europe Market, By Distribution

20.5.1. Domestic

20.5.2. International

20.6. Europe Market, By Transportation Type

20.6.1. Roadways

20.6.2. Railways

20.6.3. Waterways

20.6.4. Airways

20.7. Europe Market, By Logistic Service

20.7.1. Inbound

20.7.2. Outbound

20.7.3. Reverse

20.7.4. Aftermarket

20.8. Europe Market, By Country

20.8.1. Germany

20.8.2. U.K.

20.8.3. France

20.8.4. Italy

20.8.5. Spain

20.8.6. Rest of Europe

20.9. Europe Automotive Logistics Market: PEST Analysis

21. Asia Pacific Automotive Logistics Market Size and Forecast (US$ Bn), 2022-2031

21.1. Key Findings

21.2. Market Growth & Y-o-Y projection

21.3. Asia Pacific Market, By Industry Type

21.3.1. Manufacturing

21.3.2. Retail & Consumer Products

21.3.3. Telecomm/Electronics

21.3.4. Healthcare & Pharmaceuticals

21.3.5. Food & Beverage

21.3.6. Others

21.4. Asia Pacific Market, By Service Type

21.4.1. Transportation/Freight Management

21.4.2. Warehousing

21.4.3. Others

21.5. Asia Pacific Market, By Distribution

21.5.1. Domestic

21.5.2. International

21.6. Asia Pacific Market, By Transportation Type

21.6.1. Roadways

21.6.2. Railways

21.6.3. Waterways

21.6.4. Airways

21.7. Asia Pacific Market, By Logistic Service

21.7.1. Inbound

21.7.2. Outbound

21.7.3. Reverse

21.7.4. Aftermarket

21.8. Asia Pacific Market, By Country

21.8.1. China

21.8.2. India

21.8.3. Japan

21.8.4. ASEAN

21.8.5. Rest of Asia Pacific

21.9. Asia Pacific Automotive Logistics Market: PEST Analysis

22. Middle East & Africa Automotive Logistics Market Size and Forecast (US$ Bn), 2022-2031

22.1. Key Findings

22.2. Market Growth & Y-o-Y projection

22.3. Middle East & Africa Market, By Industry Type

22.3.1. Manufacturing

22.3.2. Retail & Consumer Products

22.3.3. Telecomm/Electronics

22.3.4. Healthcare & Pharmaceuticals

22.3.5. Food & Beverage

22.3.6. Others

22.4. Middle East & Africa Market, By Service Type

22.4.1. Transportation/Freight Management

22.4.2. Warehousing

22.4.3. Others

22.5. Middle East & Africa Market, By Distribution

22.5.1. Domestic

22.5.2. International

22.6. Middle East & Africa Market, By Transportation Type

22.6.1. Roadways

22.6.2. Railways

22.6.3. Waterways

22.6.4. Airways

22.7. Middle East & Africa Market, By Logistic Service

22.7.1. Inbound

22.7.2. Outbound

22.7.3. Reverse

22.7.4. Aftermarket

22.8. Middle East & Africa Market, By Country

22.8.1. GCC

22.8.2. South Africa

22.8.3. Rest of Middle East & Africa

22.9. Middle East & Africa Automotive Logistics Market: PEST Analysis

23. South America Automotive Logistics Market Size and Forecast (US$ Bn), 2022-2031

23.1. Key Findings

23.2. Market Growth & Y-o-Y projection

23.3. South America Market, By Industry Type

23.3.1. Manufacturing

23.3.2. Retail & Consumer Products

23.3.3. Telecomm/Electronics

23.3.4. Healthcare & Pharmaceuticals

23.3.5. Food & Beverage

23.3.6. Others

23.4. South America Market, By Service Type

23.4.1. Transportation/Freight Management

23.4.2. Warehousing

23.4.3. Others

23.5. South America Market, By Distribution

23.5.1. Domestic

23.5.2. International

23.6. South America Market, By Transportation Type

23.6.1. Roadways

23.6.2. Railways

23.6.3. Waterways

23.6.4. Airways

23.7. South America Market, By Logistic Service

23.7.1. Inbound

23.7.2. Outbound

23.7.3. Reverse

23.7.4. Aftermarket

23.8. South America Market, By Country

23.8.1. Brazil

23.8.2. Argentina

23.8.3. Rest of South America

23.9. South America Automotive Logistics Market: PEST Analysis

24. Competition Landscape

24.1. Market Share Analysis By Company (2021)

24.2. Market Player – Competition Matrix (By Tier and Size of Companies)

24.3. Key Executive Bios

24.4. Company Financials

24.5. Key Market Players (Details – Overview, Overall Revenue, Recent Developments, Strategy)

24.5.1. Bolloré Transport & Logistics

24.5.1.1. Overview

24.5.1.2. Overall Revenue

24.5.1.3. Recent Developments

24.5.1.4. Strategy

24.5.2. BLG Logistics Group AG & Co. KG

24.5.2.1. Overview

24.5.2.2. Overall Revenue

24.5.2.3. Recent Developments

24.5.2.4. Strategy

24.5.3. CEVA Logistics

24.5.3.1. Overview

24.5.3.2. Overall Revenue

24.5.3.3. Recent Developments

24.5.3.4. Strategy

24.5.4. CJ Logistics Corporation

24.5.4.1. Overview

24.5.4.2. Overall Revenue

24.5.4.3. Recent Developments

24.5.4.4. Strategy

24.5.5. DACHSER Group SE & Co. KG

24.5.5.1. Overview

24.5.5.2. Overall Revenue

24.5.5.3. Recent Developments

24.5.5.4. Strategy

24.5.6. DB Schenker

24.5.6.1. Overview

24.5.6.2. Overall Revenue

24.5.6.3. Recent Developments

24.5.6.4. Strategy

24.5.7. DHL International GmbH

24.5.7.1. Overview

24.5.7.2. Overall Revenue

24.5.7.3. Recent Developments

24.5.7.4. Strategy

24.5.8. DSV A/S

24.5.8.1. Overview

24.5.8.2. Overall Revenue

24.5.8.3. Recent Developments

24.5.8.4. Strategy

24.5.9. Expeditors International of Washington, Inc.

24.5.9.1. Overview

24.5.9.2. Overall Revenue

24.5.9.3. Recent Developments

24.5.9.4. Strategy

24.5.10. GEODIS

24.5.10.1. Overview

24.5.10.2. Overall Revenue

24.5.10.3. Recent Developments

24.5.10.4. Strategy

24.5.11. GEFCO

24.5.11.1. Overview

24.5.11.2. Overall Revenue

24.5.11.3. Recent Developments

24.5.11.4. Strategy

24.5.12. Hellmann Worldwide Logistics GmbH & Co. KG

24.5.12.1. Overview

24.5.12.2. Overall Revenue

24.5.12.3. Recent Developments

24.5.12.4. Strategy

24.5.13. Imperial Logistics

24.5.13.1. Overview

24.5.13.2. Overall Revenue

24.5.13.3. Recent Developments

24.5.13.4. Strategy

24.5.14. Kerry Logistics Network Limited

24.5.14.1. Overview

24.5.14.2. Overall Revenue

24.5.14.3. Recent Developments

24.5.14.4. Strategy

24.5.15. Kuehne + Nagel International AG

24.5.15.1. Overview

24.5.15.2. Overall Revenue

24.5.15.3. Recent Developments

24.5.15.4. Strategy

24.5.16. Nippon Express Co., Ltd.

24.5.16.1. Overview

24.5.16.2. Overall Revenue

24.5.16.3. Recent Developments

24.5.16.4. Strategy

24.5.17. Panalpina World Transport (Holding) Ltd.

24.5.17.1. Overview

24.5.17.2. Overall Revenue

24.5.17.3. Recent Developments

24.5.17.4. Strategy

24.5.18. Ryder System, Inc.

24.5.18.1. Overview

24.5.18.2. Overall Revenue

24.5.18.3. Recent Developments

24.5.18.4. Strategy

24.5.19. Schnellecke Group AG & Co. KG

24.5.19.1. Overview

24.5.19.2. Overall Revenue

24.5.19.3. Recent Developments

24.5.19.4. Strategy

24.5.20. Sinotrans Limited

24.5.20.1. Overview

24.5.20.2. Overall Revenue

24.5.20.3. Recent Developments

24.5.20.4. Strategy

24.5.21. SNCF

24.5.21.1. Overview

24.5.21.2. Overall Revenue

24.5.21.3. Recent Developments

24.5.21.4. Strategy

24.5.22. United Parcel Service of America, Inc.

24.5.22.1. Overview

24.5.22.2. Overall Revenue

24.5.22.3. Recent Developments

24.5.22.4. Strategy

24.5.23. XPO Logistics, Inc.

24.5.23.1. Overview

24.5.23.2. Overall Revenue

24.5.23.3. Recent Developments

24.5.23.4. Strategy

25. Primary Research – Key Insights

List of Tables

Table 1: Global Automotive Logistics Market Revenue (US$ Bn) Forecast, by Industry Type, 2017‒2031

Table 2: Global Automotive Logistics Market Revenue (US$ Bn) Forecast, by Service Type, 2017‒2031

Table 3: Global Automotive Logistics Market Revenue (US$ Bn) Forecast, by Transportation Type, 2017‒2031

Table 4: Global Automotive Logistics Market Revenue (US$ Bn) Forecast, by Distribution, 2017‒2031

Table 5: Global Automotive Logistics Market Revenue (US$ Bn) Forecast, by Logistic Service, 2017‒2031

Table 6: Global Automotive Logistics Market Revenue (US$ Bn) Forecast, by Region, 2017‒2031

Table 7: North America Automotive Logistics Market Revenue (US$ Bn) Forecast, by Industry Type, 2017‒2031

Table 8: North America Automotive Logistics Market Revenue (US$ Bn) Forecast, by Service Type, 2017‒2031

Table 9: North America Automotive Logistics Market Revenue (US$ Bn) Forecast, by Transportation Type, 2017‒2031

Table 10: North America Automotive Logistics Market Revenue (US$ Bn) Forecast, by Distribution, 2017‒2031

Table 11: North America Automotive Logistics Market Revenue (US$ Bn) Forecast, by Logistic Service, 2017‒2031

Table 12: North America Automotive Logistics Market Revenue (US$ Bn) Forecast, by Country, 2017‒2031

Table 13: Europe Automotive Logistics Market Revenue (US$ Bn) Forecast, by Industry Type, 2017‒2031

Table 14: Europe Automotive Logistics Market Revenue (US$ Bn) Forecast, by Service Type, 2017‒2031

Table 15: Europe Automotive Logistics Market Revenue (US$ Bn) Forecast, by Transportation Type, 2017‒2031

Table 16: Europe Automotive Logistics Market Revenue (US$ Bn) Forecast, by Distribution, 2017‒2031

Table 17: Europe Automotive Logistics Market Revenue (US$ Bn) Forecast, by Logistic Service, 2017‒2031

Table 18: Europe Automotive Logistics Market Revenue (US$ Bn) Forecast, by Country, 2017‒2031

Table 19: Asia Pacific Automotive Logistics Market Revenue (US$ Bn) Forecast, by Industry Type, 2017‒2031

Table 20: Asia Pacific Automotive Logistics Market Revenue (US$ Bn) Forecast, by Service Type, 2017‒2031

Table 21: Asia Pacific Automotive Logistics Market Revenue (US$ Bn) Forecast, by Transportation Type, 2017‒2031

Table 22: Asia Pacific Automotive Logistics Market Revenue (US$ Bn) Forecast, by Distribution, 2017‒2031

Table 23: Asia Pacific Automotive Logistics Market Revenue (US$ Bn) Forecast, by Logistic Service, 2017‒2031

Table 24: Asia Pacific Automotive Logistics Market Revenue (US$ Bn) Forecast, by Country, 2017‒2031

Table 25: Middle East & Africa Automotive Logistics Market Revenue (US$ Bn) Forecast, by Industry Type, 2017‒2031

Table 26: Middle East & Africa Automotive Logistics Market Revenue (US$ Bn) Forecast, by Service Type, 2017‒2031

Table 27: Middle East & Africa Automotive Logistics Market Revenue (US$ Bn) Forecast, by Transportation Type, 2017‒2031

Table 28: Middle East & Africa Automotive Logistics Market Revenue (US$ Bn) Forecast, by Distribution, 2017‒2031

Table 29: Middle East & Africa Automotive Logistics Market Revenue (US$ Bn) Forecast, by Logistic Service, 2017‒2031

Table 30: Middle East & Africa Automotive Logistics Market Revenue (US$ Bn) Forecast, by Country, 2017‒2031

Table 31: South America Automotive Logistics Market Revenue (US$ Bn) Forecast, by Industry Type, 2017‒2031

Table 32: South America Automotive Logistics Market Revenue (US$ Bn) Forecast, by Service Type, 2017‒2031

Table 33: South America Automotive Logistics Market Revenue (US$ Bn) Forecast, by Transportation Type, 2017‒2031

Table 34: South America Automotive Logistics Market Revenue (US$ Bn) Forecast, by Distribution, 2017‒2031

Table 35: South America Automotive Logistics Market Revenue (US$ Bn) Forecast, by Logistic Service, 2017‒2031

Table 36: South America Automotive Logistics Market Revenue (US$ Bn) Forecast, by Country, 2017‒2031

List of Figures

Figure 1: Global Automotive Logistics Market Revenue (US$ Bn) Forecast, by Industry Type, 2017-2031

Figure 2: Global Automotive Logistics Market, Incremental Opportunity, by Industry Type, Value (US$ Bn), 2022-2031

Figure 3: Global Automotive Logistics Market Revenue (US$ Bn) Forecast, by Service Type, 2017-2031

Figure 4: Global Automotive Logistics Market, Incremental Opportunity, by Service Type, Value (US$ Bn), 2022-2031

Figure 5: Global Automotive Logistics Market Revenue (US$ Bn) Forecast, by Transportation Type, 2017-2031

Figure 6: Global Automotive Logistics Market, Incremental Opportunity, by Transportation Type Value (US$ Bn), 2022-2031

Figure 7: Global Automotive Logistics Market Revenue (US$ Bn) Forecast, by Distribution, 2017-2031

Figure 8: Global Automotive Logistics Market, Incremental Opportunity, by Distributions Value (US$ Bn), 2022-2031

Figure 9: Global Automotive Logistics Market Revenue (US$ Bn) Forecast, by Logistic Service, 2017-2031

Figure 10: Global Automotive Logistics Market, Incremental Opportunity, by Logistic Service, Value (US$ Bn), 2022-2031

Figure 11: Global Automotive Logistics Market Revenue (US$ Bn) Forecast, by Region, 2017-2031

Figure 12: Global Automotive Logistics Market, Incremental Opportunity, by Region, Value (US$ Bn), 2022-2031

Figure 13: North America Automotive Logistics Market Revenue (US$ Bn) Forecast, by Industry Type, 2017-2031

Figure 14: North America Automotive Logistics Market, Incremental Opportunity, by Industry Type, Value (US$ Bn), 2022-2031

Figure 15: North America Automotive Logistics Market Revenue (US$ Bn) Forecast, by Service Type, 2017-2031

Figure 16: North America Automotive Logistics Market, Incremental Opportunity, by Service Type, Value (US$ Bn), 2022-2031

Figure 17: North America Automotive Logistics Market Revenue (US$ Bn) Forecast, by Transportation Type, 2017-2031

Figure 18: North America Automotive Logistics Market, Incremental Opportunity, by Transportation Type Value (US$ Bn), 2022-2031

Figure 19: North America Automotive Logistics Market Revenue (US$ Bn) Forecast, by Distribution, 2017-2031

Figure 20: North America Automotive Logistics Market, Incremental Opportunity, by Distributions Value (US$ Bn), 2022-2031

Figure 21: North America Automotive Logistics Market Revenue (US$ Bn) Forecast, by Logistic Service, 2017-2031

Figure 22: North America Automotive Logistics Market, Incremental Opportunity, by Logistic Service, Value (US$ Bn), 2022-2031

Figure 23: North America Automotive Logistics Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 24: North America Automotive Logistics Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 25: Europe Automotive Logistics Market Revenue (US$ Bn) Forecast, by Industry Type, 2017-2031

Figure 26: Europe Automotive Logistics Market, Incremental Opportunity, by Industry Type, Value (US$ Bn), 2022-2031

Figure 27: Europe Automotive Logistics Market Revenue (US$ Bn) Forecast, by Service Type, 2017-2031

Figure 28: Europe Automotive Logistics Market, Incremental Opportunity, by Service Type, Value (US$ Bn), 2022-2031

Figure 29: Europe Automotive Logistics Market Revenue (US$ Bn) Forecast, by Transportation Type, 2017-2031

Figure 30: Europe Automotive Logistics Market, Incremental Opportunity, by Transportation Type Value (US$ Bn), 2022-2031

Figure 31: Europe Automotive Logistics Market Revenue (US$ Bn) Forecast, by Distribution, 2017-2031

Figure 32: Europe Automotive Logistics Market, Incremental Opportunity, by Distributions Value (US$ Bn), 2022-2031

Figure 33: Europe Automotive Logistics Market Revenue (US$ Bn) Forecast, by Logistic Service, 2017-2031

Figure 34: Europe Automotive Logistics Market, Incremental Opportunity, by Logistic Service, Value (US$ Bn), 2022-2031

Figure 35: Europe Automotive Logistics Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 36: Europe Automotive Logistics Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 37: Asia Pacific Automotive Logistics Market Revenue (US$ Bn) Forecast, by Industry Type, 2017-2031

Figure 38: Asia Pacific Automotive Logistics Market, Incremental Opportunity, by Industry Type, Value (US$ Bn), 2022-2031

Figure 39: Asia Pacific Automotive Logistics Market Revenue (US$ Bn) Forecast, by Service Type, 2017-2031

Figure 40: Asia Pacific Automotive Logistics Market, Incremental Opportunity, by Service Type, Value (US$ Bn), 2022-2031

Figure 41: Asia Pacific Automotive Logistics Market Revenue (US$ Bn) Forecast, by Transportation Type, 2017-2031

Figure 42: Asia Pacific Automotive Logistics Market, Incremental Opportunity, by Transportation Type Value (US$ Bn), 2022-2031

Figure 43: Asia Pacific Automotive Logistics Market Revenue (US$ Bn) Forecast, by Distribution, 2017-2031

Figure 44: Asia Pacific Automotive Logistics Market, Incremental Opportunity, by Distributions Value (US$ Bn), 2022-2031

Figure 45: Asia Pacific Automotive Logistics Market Revenue (US$ Bn) Forecast, by Logistic Service, 2017-2031

Figure 46: Asia Pacific Automotive Logistics Market, Incremental Opportunity, by Logistic Service, Value (US$ Bn), 2022-2031

Figure 47: Asia Pacific Automotive Logistics Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 48: Asia Pacific Automotive Logistics Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 49: Middle East & Africa Automotive Logistics Market Revenue (US$ Bn) Forecast, by Industry Type, 2017-2031

Figure 50: Middle East & Africa Automotive Logistics Market, Incremental Opportunity, by Industry Type, Value (US$ Bn), 2022-2031

Figure 51: Middle East & Africa Automotive Logistics Market Revenue (US$ Bn) Forecast, by Service Type, 2017-2031

Figure 52: Middle East & Africa Automotive Logistics Market, Incremental Opportunity, by Service Type, Value (US$ Bn), 2022-2031

Figure 53: Middle East & Africa Automotive Logistics Market Revenue (US$ Bn) Forecast, by Transportation Type, 2017-2031

Figure 54: Middle East & Africa Automotive Logistics Market, Incremental Opportunity, by Transportation Type Value (US$ Bn), 2022-2031

Figure 55: Middle East & Africa Automotive Logistics Market Revenue (US$ Bn) Forecast, by Distribution, 2017-2031

Figure 56: Middle East & Africa Automotive Logistics Market, Incremental Opportunity, by Distributions Value (US$ Bn), 2022-2031

Figure 57: Middle East & Africa Automotive Logistics Market Revenue (US$ Bn) Forecast, by Logistic Service, 2017-2031

Figure 58: Middle East & Africa Automotive Logistics Market, Incremental Opportunity, by Logistic Service, Value (US$ Bn), 2022-2031

Figure 59: Middle East & Africa Automotive Logistics Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 60: Middle East & Africa Automotive Logistics Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 61: South America Automotive Logistics Market Revenue (US$ Bn) Forecast, by Industry Type, 2017-2031

Figure 62: South America Automotive Logistics Market, Incremental Opportunity, by Industry Type, Value (US$ Bn), 2022-2031

Figure 63: South America Automotive Logistics Market Revenue (US$ Bn) Forecast, by Service Type, 2017-2031

Figure 64: South America Automotive Logistics Market, Incremental Opportunity, by Service Type, Value (US$ Bn), 2022-2031

Figure 65: South America Automotive Logistics Market Revenue (US$ Bn) Forecast, by Transportation Type, 2017-2031

Figure 66: South America Automotive Logistics Market, Incremental Opportunity, by Transportation Type Value (US$ Bn), 2022-2031

Figure 67: South America Automotive Logistics Market Revenue (US$ Bn) Forecast, by Distribution, 2017-2031

Figure 68: South America Automotive Logistics Market, Incremental Opportunity, by Distributions Value (US$ Bn), 2022-2031

Figure 69: South America Automotive Logistics Market Revenue (US$ Bn) Forecast, by Logistic Service, 2017-2031

Figure 70: South America Automotive Logistics Market, Incremental Opportunity, by Logistic Service, Value (US$ Bn), 2022-2031

Figure 71: South America Automotive Logistics Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 72: South America Automotive Logistics Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031