Analyst Viewpoint

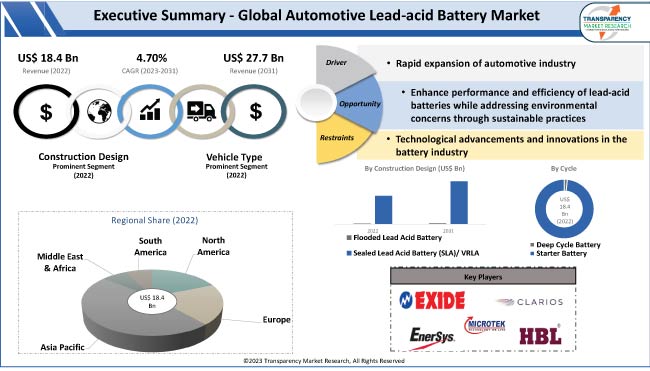

Rapid expansion of the automotive industry in both established and emerging economies is driving the global automotive lead-acid battery market. Despite increase in popularity of alternative energy storage technologies, lead-acid batteries continue to dominate the traditional internal combustion engine vehicles and find essential roles in new automotive technologies such as start-stop systems and hybrid vehicles. Affordability and cost-effectiveness are the other major factors driving market expansion. Furthermore, reliability and adaptability across a range of automotive applications are expected to bolster the global market during the forecast period.

Improving the efficiency of overall battery performance offers lucrative opportunities to market players. Manufacturers are focusing on innovation to enhance the performance and efficiency of lead-acid batteries while addressing environmental concerns through sustainable practices such as recycling initiatives.

A lead-acid battery is a rechargeable battery variant utilizing lead dioxide as the positive electrode, lead as the negative electrode, and sulfuric acid as the electrolyte. Among the oldest and most prevalent rechargeable battery types, it finds applications in various sectors, such as automotive, uninterruptible power supplies (UPS), and stationary backup power systems.

The global automotive lead-acid battery industry has witnessed significant growth and evolution over the years, establishing itself as a crucial component within the automotive industry. Lead-acid batteries have long been the preferred choice for starting, lighting, and ignition (SLI) applications in vehicles, owing to their reliability, cost-effectiveness, and well-established technology.

The market for automotive lead-acid batteries is characterized by a competitive landscape, with key players constantly striving for technological advancements to enhance performance, increase energy efficiency, and meet evolving environmental regulations.

Manufacturers are focusing on innovations such as enhanced battery designs, improved materials, and recycling initiatives to address sustainability concerns. Additionally, increase in demand for automobiles, especially in emerging economies, is fueling the global automotive lead-acid battery market growth, as these batteries remain integral to the automotive ecosystem, ensuring reliable and efficient power supply for a wide range of vehicles.

Expansion of the automotive industry on a global scale plays a pivotal role in driving demand for lead-acid batteries. As economies grow and urbanization increases, there is a parallel surge in demand for vehicles, ranging from conventional internal combustion engine cars to hybrid and electric vehicles.

Lead-acid batteries, with their proven reliability and cost-effectiveness, continue to be the preferred choice for a significant portion of these vehicles, especially in emerging markets where affordability is a critical factor in purchasing decisions.

The automotive industry's continuous innovation and development of new vehicle models contribute to the lead-acid battery market demand. As automakers introduce advanced features and technologies in vehicles, demand for reliable power sources, such as lead-acid batteries, remains strong.

Surge in popularity of electric vehicles, including hybrids, further amplifies the need for efficient energy storage solutions, with lead-acid batteries fulfilling auxiliary power requirements. In this context, expansion of the automotive industry acts as a catalyst for the sustained growth and evolution of the global automotive lead-acid battery market.

Affordability and cost-effectiveness of lead-acid batteries are crucial drivers propelling the global automotive lead-acid battery market. In a highly competitive automotive landscape, where cost considerations play a crucial role in purchasing decisions, lead-acid batteries offer a cost-effective solution without compromising on performance.

This economic advantage is particularly significant in emerging markets where consumers and businesses alike prioritize budget-friendly options, making lead-acid batteries the preferred choice for a range of vehicles, from entry-level cars to commercial fleets.

Cost-effectiveness of lead-acid batteries extends beyond the initial purchase, as these batteries boast a well-established and efficient recycling infrastructure. The ability to recycle lead-acid batteries contributes to sustainability efforts and helps manage the overall cost of ownership.

As environmental consciousness grows, and regulations emphasize the importance of responsible battery disposal, the cost-effectiveness and recyclability of lead-acid batteries position them strongly in the automotive industry.

In terms of vehicle type, the passenger vehicles battery segment accounted for the largest global automotive lead-acid battery market share in 2022. This is ascribed to significant demand for these batteries in conventional internal combustion engine cars.

Lead-acid batteries play a crucial role in providing the necessary power for starting engines, powering lighting systems, and supporting various electrical components in passenger vehicles. Continued growth of the global automotive industry, rise in urbanization, and increase in disposable income contribute to substantial demand for passenger vehicles across the world.

The passenger vehicle market includes a diverse range of automobiles, from compact cars to SUVs and luxury vehicles, all of which rely on lead-acid batteries for their essential electrical functions.

As automotive manufacturers introduce new models and incorporate advanced technologies into passenger vehicles, demand for high-performance lead-acid batteries persists. Whether in traditional vehicles or in modern hybrids with start-stop systems, lead-acid batteries remain a staple, ensuring the smooth operation and reliability of electrical systems in passenger vehicles.

As per automotive lead-acid battery market analysis, Asia Pacific is a powerhouse, dominating both production and consumption of automotive lead-acid batteries. Countries such as China, Japan, and India, with their robust automotive manufacturing industries and surge in demand for vehicles, play a pivotal role in driving the market. Rapid growth of electric vehicles, especially in China, is also increasing demand for lead-acid batteries in auxiliary power systems and hybrid applications.

Europe, known for its automotive innovation and environmental initiatives, plays a crucial role in shaping the automotive lead-acid battery market. Countries such as Germany, the U.K., and France host major automotive manufacturing facilities, driving demand for lead-acid batteries.

Rise in emphasis on sustainable transportation and adoption of electric vehicles are influencing market dynamics, as lead-acid batteries find applications in hybrid models and auxiliary power systems. The geographical outlook reflects a global market that responds to regional variations in automotive trends, economic development, and environmental considerations.

According to automotive lead-acid battery market research, North America, with its well-established automotive industry, is a significant player in the global industry. The U.S., in particular, is home to major automotive manufacturers, contributing to the steady demand for lead-acid batteries. Diverse fleet of vehicles, including traditional combustion engine cars and hybrid models, ensures a consistent need for reliable and cost-effective energy storage solutions.

The global automotive lead-acid battery market is consolidated, with small number of manufacturers accounting for large market share. Expansion of service offerings and merger & acquisition are the major strategies adopted by key players.

Exide Industries, Apex Battery, BAE Batteries USA, Bioenno Power, Briggs & Stratton, Chaowei Power, Clarios, Crown Battery, East Penn Manufacturing Co., EnerSys, Furukawa Electric, GS Yuasa Corporation, HBL Power Systems, Hitachi Chemical, JYC Battery, K2 Battery, Leoch International Technology, Lithion Battery, Luminous, Microtek, Northstar, Panasonic Corp., Su-KAM, The Sunlight Group, and V-Guard are the major players in the global automotive lead-acid battery market.

Each of these players has been profiled in the automotive lead-acid battery market report based on pointers such as company overview, business strategies, financial overview, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2022 | US$ 18.4 Bn |

| Forecast (Value) in 2031 | US$ 27.7 Bn |

| Growth Rate (CAGR) | 4.7% |

| Forecast Period | 2023-2031 |

| Quantitative Units | US$ Bn for Value and Million Units for Volume |

| Market Analysis | It includes cross-segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, and value chain analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Company Profile |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 18.4 Bn in 2022.

It is expected to expand at a CAGR of 4.7% by 2031.

It is projected to reach US$ 27.7 Bn in 2031.

The passenger vehicles battery segment accounted for 53.36% share in 2022

Asia Pacific was the highly lucrative region in 2022.

Exide Industries, Apex Battery, BAE Batteries USA, Bioenno Power, Briggs & Stratton, Chaowei Power, Clarios, Crown Battery, East Penn Manufacturing Co., EnerSys, Furukawa Electric, GS Yuasa Corporation, HBL Power Systems, Hitachi Chemical, JYC Battery, K2 Battery, Leoch International Technology, Lithion Battery, Luminous, Microtek, Northstar, Panasonic Corp., Su-KAM, The Sunlight Group, and V-Guard.

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Value US$ Bn, 2023-2031

1.2. Go to Market Strategy

1.2.1. Demand & Supply Side Trends

1.2.1.1. GAP Analysis

1.2.2. Identification of Potential Market Spaces

1.2.3. Understanding the Buying Process of the Customers

1.2.4. Preferred Sales & Marketing Strategy

2. Market Overview

2.1. TMR Analysis and Recommendations

2.2. Market Coverage / Taxonomy

2.3. Market Definition / Scope / Limitations

2.4. Market Dynamics

2.4.1. Drivers

2.4.2. Restraints

2.4.3. Opportunity

2.5. Market Factor Analysis

2.5.1. Porter’s Five Force Analysis

2.5.2. SWOT Analysis

2.6. Regulatory Scenario

2.7. Key Trend Analysis

2.8. Value Chain Analysis

2.9. Cost Structure Analysis

2.10. Profit Margin Analysis

3. Impact Factors: Automotive Lead-acid Battery

3.1. Electric Vehicle (EV) Trends

3.2. Replacement Market

3.3. Infrastructure Development

3.4. Government Incentives

4. Market Share Analysis of Regulated Vs Un-Regulated Market, by country, 2022

5. Global Automotive Lead-acid Battery Market, By Construction Design

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Automotive Lead-acid Battery Market Size Analysis & Forecast, 2023-2031, By Construction Design

5.2.1. Flooded Lead-acid Battery

5.2.2. Sealed Lead-acid Battery (SLA)/ Valve Regulated Lead-acid (VRLA)

5.2.2.1. AGM SLA

5.2.2.2. Gel SLA

6. Global Automotive Lead-acid Battery Market, By Cycle

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Automotive Lead-acid Battery Market Size Analysis & Forecast, 2023-2031, By Cycle

6.2.1. Deep Cycle Battery

6.2.2. Starter Battery

7. Global Automotive Lead-acid Battery Market, By Vehicle Type

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Automotive Lead-acid Battery Market Size Analysis & Forecast, 2023-2031, By Vehicle Type

7.2.1. Two Wheeler Battery

7.2.2. Three Wheeler Battery

7.2.3. Passenger Vehicles Battery

7.2.4. Commercial Vehicles Battery

7.2.5. Buses & Coaches Battery

7.2.6. Off-road Vehicles Battery

7.2.7. E-Ride Battery

8. Global Automotive Lead-acid Battery Market, By Sales Channel

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Automotive Lead-acid Battery Market Size Analysis & Forecast, 2023-2031, By Sales Channel

8.2.1. OEM

8.2.2. Aftermarket

9. Global Automotive Lead-acid Battery Market, By Region

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global Automotive Lead-acid Battery Market Size Analysis & Forecast, 2023-2031, By Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. South America

10. North America Automotive Lead-acid Battery Market

10.1. Market Snapshot

10.2. North America Automotive Lead-acid Battery Market Size Analysis & Forecast, 2023-2031, By Construction Design

10.2.1. Flooded Lead-acid Battery

10.2.2. Sealed Lead-acid Battery (SLA)/ Valve Regulated Lead-acid (VRLA)

10.2.2.1. AGM SLA

10.2.2.2. Gel SLA

10.3. North America Automotive Lead-acid Battery Market Size Analysis & Forecast, 2023-2031, By Cycle

10.3.1. Deep Cycle Battery

10.3.2. Starter Battery

10.4. North America Automotive Lead-acid Battery Market Size Analysis & Forecast, 2023-2031, By Vehicle Type

10.4.1. Two Wheeler Battery

10.4.2. Three Wheeler Battery

10.4.3. Passenger Vehicles Battery

10.4.4. Commercial Vehicles Battery

10.4.5. Buses & Coaches Battery

10.4.6. Off-road Vehicles Battery

10.4.7. E-Ride Battery

10.5. North America Automotive Lead-acid Battery Market Size Analysis & Forecast, 2023-2031, By Sales Channel

10.5.1. OEM

10.5.2. Aftermarket

10.6. Key Country Analysis – North America Automotive Lead-acid Battery Market Size Analysis & Forecast, 2023-2031

10.6.1. U.S.

10.6.2. Canada

10.6.3. Mexico

11. Europe Automotive Lead-acid Battery Market

11.1. Market Snapshot

11.2. Europe Automotive Lead-acid Battery Market Size Analysis & Forecast, 2023-2031, By Construction Design

11.2.1. Flooded Lead-acid Battery

11.2.2. Sealed Lead-acid Battery (SLA)/ Valve Regulated Lead-acid (VRLA)

11.2.2.1. AGM SLA

11.2.2.2. Gel SLA

11.3. Europe Automotive Lead-acid Battery Market Size Analysis & Forecast, 2023-2031, By Cycle

11.3.1. Deep Cycle Battery

11.3.2. Starter Battery

11.4. Europe Automotive Lead-acid Battery Market Size Analysis & Forecast, 2023-2031, By Vehicle Type

11.4.1. Two Wheeler Battery

11.4.2. Three Wheeler Battery

11.4.3. Passenger Vehicles Battery

11.4.4. Commercial Vehicles Battery

11.4.5. Buses & Coaches Battery

11.4.6. Off-road Vehicles Battery

11.4.7. E-Ride Battery

11.5. Europe Automotive Lead-acid Battery Market Size Analysis & Forecast, 2023-2031, By Sales Channel

11.5.1. OEM

11.5.2. Aftermarket

11.6. Key Country Analysis – Europe Automotive Lead-acid Battery Market Size Analysis & Forecast, 2023-2031

11.6.1. Germany

11.6.2. U.K.

11.6.3. France

11.6.4. Italy

11.6.5. Spain

11.6.6. Nordic Countries

11.6.7. Russia & CIS

11.6.8. Rest of Europe

12. Asia Pacific Automotive Lead-acid Battery Market

12.1. Market Snapshot

12.2. Asia Pacific Automotive Lead-acid Battery Market Size Analysis & Forecast, 2023-2031, By Construction Design

12.2.1. Flooded Lead-acid Battery

12.2.2. Sealed Lead-acid Battery (SLA)/ Valve Regulated Lead-acid (VRLA)

12.2.2.1. AGM SLA

12.2.2.2. Gel SLA

12.3. Asia Pacific Automotive Lead-acid Battery Market Size Analysis & Forecast, 2023-2031, By Cycle

12.3.1. Deep Cycle Battery

12.3.2. Starter Battery

12.4. Asia Pacific Automotive Lead-acid Battery Market Size Analysis & Forecast, 2023-2031, By Vehicle Type

12.4.1. Two Wheeler Battery

12.4.2. Three Wheeler Battery

12.4.3. Passenger Vehicles Battery

12.4.4. Commercial Vehicles Battery

12.4.5. Buses & Coaches Battery

12.4.6. Off-road Vehicles Battery

12.4.7. E-Ride Battery

12.5. Asia Pacific Automotive Lead-acid Battery Market Size Analysis & Forecast, 2023-2031, By Sales Channel

12.5.1. OEM

12.5.2. Aftermarket

12.6. Key Country Analysis – Asia Pacific Automotive Lead-acid Battery Market Size Analysis & Forecast, 2023-2031

12.6.1. China

12.6.2. India

12.6.3. Japan

12.6.4. ASEAN Countries

12.6.5. South Korea

12.6.6. ANZ

12.6.7. Rest of Asia Pacific

13. Middle East & Africa Automotive Lead-acid Battery Market

13.1. Market Snapshot

13.2. Middle East & Africa Automotive Lead-acid Battery Market Size Analysis & Forecast, 2023-2031, By Construction Design

13.2.1. Flooded Lead-acid Battery

13.2.2. Sealed Lead-acid Battery (SLA)/ Valve Regulated Lead-acid (VRLA)

13.2.2.1. AGM SLA

13.2.2.2. Gel SLA

13.3. Middle East & Africa Automotive Lead-acid Battery Market Size Analysis & Forecast, 2023-2031, By Cycle

13.3.1. Deep Cycle Battery

13.3.2. Starter Battery

13.4. Middle East & Africa Automotive Lead-acid Battery Market Size Analysis & Forecast, 2023-2031, By Vehicle Type

13.4.1. Two Wheeler Battery

13.4.2. Three Wheeler Battery

13.4.3. Passenger Vehicles Battery

13.4.4. Commercial Vehicles Battery

13.4.5. Buses & Coaches Battery

13.4.6. Off-road Vehicles Battery

13.4.7. E-Ride Battery

13.5. Middle East & Africa Automotive Lead-acid Battery Market Size Analysis & Forecast, 2023-2031, By Sales Channel

13.5.1. OEM

13.5.2. Aftermarket

13.6. Key Country Analysis – Middle East & Africa Automotive Lead-acid Battery Market Size Analysis & Forecast, 2023-2031

13.6.1. GCC

13.6.2. South Africa

13.6.3. Turkey

13.6.4. Rest of Middle East & Africa

14. South America Automotive Lead-acid Battery Market

14.1. Market Snapshot

14.2. South America Automotive Lead-acid Battery Market Size Analysis & Forecast, 2023-2031, By Construction Design

14.2.1. Flooded Lead-acid Battery

14.2.2. Sealed Lead-acid Battery (SLA)/ Valve Regulated Lead-acid (VRLA)

14.2.2.1. AGM SLA

14.2.2.2. Gel SLA

14.3. South America Automotive Lead-acid Battery Market Size Analysis & Forecast, 2023-2031, By Cycle

14.3.1. Deep Cycle Battery

14.3.2. Starter Battery

14.4. South America Automotive Lead-acid Battery Market Size Analysis & Forecast, 2023-2031, By Vehicle Type

14.4.1. Two Wheeler Battery

14.4.2. Three Wheeler Battery

14.4.3. Passenger Vehicles Battery

14.4.4. Commercial Vehicles Battery

14.4.5. Buses & Coaches Battery

14.4.6. Off-road Vehicles Battery

14.4.7. E-Ride Battery

14.5. South America Automotive Lead-acid Battery Market Size Analysis & Forecast, 2023-2031, By Sales Channel

14.5.1. OEM

14.5.2. Aftermarket

14.6. Key Country Analysis – South America Automotive Lead-acid Battery Market Size Analysis & Forecast, 2023-2031

14.6.1. Brazil

14.6.2. Argentina

14.6.3. Rest of South America

15. Competitive Landscape

15.1. Company Share Analysis/ Brand Share Analysis, 2022

15.2. Company Analysis for each player

15.3. Company Overview, Company Footprints, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share

16. Company Profile/ Key Players

16.1. Exide Industries

16.1.1. Company Overview

16.1.2. Company Footprints

16.1.3. Product Portfolio

16.1.4. Competitors & Customers

16.1.5. Subsidiaries & Parent Organization

16.1.6. Recent Developments

16.1.7. Financial Analysis

16.1.8. Profitability

16.1.9. Revenue Share

16.2. Apex Battery

16.2.1. Company Overview

16.2.2. Company Footprints

16.2.3. Product Portfolio

16.2.4. Competitors & Customers

16.2.5. Subsidiaries & Parent Organization

16.2.6. Recent Developments

16.2.7. Financial Analysis

16.2.8. Profitability

16.2.9. Revenue Share

16.3. BAE Batteries USA

16.3.1. Company Overview

16.3.2. Company Footprints

16.3.3. Product Portfolio

16.3.4. Competitors & Customers

16.3.5. Subsidiaries & Parent Organization

16.3.6. Recent Developments

16.3.7. Financial Analysis

16.3.8. Profitability

16.3.9. Revenue Share

16.4. Bioenno Power

16.4.1. Company Overview

16.4.2. Company Footprints

16.4.3. Product Portfolio

16.4.4. Competitors & Customers

16.4.5. Subsidiaries & Parent Organization

16.4.6. Recent Developments

16.4.7. Financial Analysis

16.4.8. Profitability

16.4.9. Revenue Share

16.5. Briggs & Stratton

16.5.1. Company Overview

16.5.2. Company Footprints

16.5.3. Product Portfolio

16.5.4. Competitors & Customers

16.5.5. Subsidiaries & Parent Organization

16.5.6. Recent Developments

16.5.7. Financial Analysis

16.5.8. Profitability

16.5.9. Revenue Share

16.6. Chaowei Power

16.6.1. Company Overview

16.6.2. Company Footprints

16.6.3. Product Portfolio

16.6.4. Competitors & Customers

16.6.5. Subsidiaries & Parent Organization

16.6.6. Recent Developments

16.6.7. Financial Analysis

16.6.8. Profitability

16.6.9. Revenue Share

16.7. Clarios

16.7.1. Company Overview

16.7.2. Company Footprints

16.7.3. Product Portfolio

16.7.4. Competitors & Customers

16.7.5. Subsidiaries & Parent Organization

16.7.6. Recent Developments

16.7.7. Financial Analysis

16.7.8. Profitability

16.7.9. Revenue Share

16.8. Crown Battery

16.8.1. Company Overview

16.8.2. Company Footprints

16.8.3. Product Portfolio

16.8.4. Competitors & Customers

16.8.5. Subsidiaries & Parent Organization

16.8.6. Recent Developments

16.8.7. Financial Analysis

16.8.8. Profitability

16.8.9. Revenue Share

16.9. East Penn Manufacturing Co.

16.9.1. Company Overview

16.9.2. Company Footprints

16.9.3. Product Portfolio

16.9.4. Competitors & Customers

16.9.5. Subsidiaries & Parent Organization

16.9.6. Recent Developments

16.9.7. Financial Analysis

16.9.8. Profitability

16.9.9. Revenue Share

16.10. EnerSys

16.10.1. Company Overview

16.10.2. Company Footprints

16.10.3. Product Portfolio

16.10.4. Competitors & Customers

16.10.5. Subsidiaries & Parent Organization

16.10.6. Recent Developments

16.10.7. Financial Analysis

16.10.8. Profitability

16.10.9. Revenue Share

16.11. Furukawa Electric

16.11.1. Company Overview

16.11.2. Company Footprints

16.11.3. Product Portfolio

16.11.4. Competitors & Customers

16.11.5. Subsidiaries & Parent Organization

16.11.6. Recent Developments

16.11.7. Financial Analysis

16.11.8. Profitability

16.11.9. Revenue Share

16.12. GS Yuasa Corporation

16.12.1. Company Overview

16.12.2. Company Footprints

16.12.3. Product Portfolio

16.12.4. Competitors & Customers

16.12.5. Subsidiaries & Parent Organization

16.12.6. Recent Developments

16.12.7. Financial Analysis

16.12.8. Profitability

16.12.9. Revenue Share

16.13. HBL Power Systems

16.13.1. Company Overview

16.13.2. Company Footprints

16.13.3. Product Portfolio

16.13.4. Competitors & Customers

16.13.5. Subsidiaries & Parent Organization

16.13.6. Recent Developments

16.13.7. Financial Analysis

16.13.8. Profitability

16.13.9. Revenue Share

16.14. Hitachi Chemical

16.14.1. Company Overview

16.14.2. Company Footprints

16.14.3. Product Portfolio

16.14.4. Competitors & Customers

16.14.5. Subsidiaries & Parent Organization

16.14.6. Recent Developments

16.14.7. Financial Analysis

16.14.8. Profitability

16.14.9. Revenue Share

16.15. JYC Battery

16.15.1. Company Overview

16.15.2. Company Footprints

16.15.3. Product Portfolio

16.15.4. Competitors & Customers

16.15.5. Subsidiaries & Parent Organization

16.15.6. Recent Developments

16.15.7. Financial Analysis

16.15.8. Profitability

16.15.9. Revenue Share

16.16. K2 Battery

16.16.1. Company Overview

16.16.2. Company Footprints

16.16.3. Product Portfolio

16.16.4. Competitors & Customers

16.16.5. Subsidiaries & Parent Organization

16.16.6. Recent Developments

16.16.7. Financial Analysis

16.16.8. Profitability

16.16.9. Revenue Share

16.17. Leoch International Technology

16.17.1. Company Overview

16.17.2. Company Footprints

16.17.3. Product Portfolio

16.17.4. Competitors & Customers

16.17.5. Subsidiaries & Parent Organization

16.17.6. Recent Developments

16.17.7. Financial Analysis

16.17.8. Profitability

16.17.9. Revenue Share

16.18. Lithion Battery

16.18.1. Company Overview

16.18.2. Company Footprints

16.18.3. Product Portfolio

16.18.4. Competitors & Customers

16.18.5. Subsidiaries & Parent Organization

16.18.6. Recent Developments

16.18.7. Financial Analysis

16.18.8. Profitability

16.18.9. Revenue Share

16.19. Luminous

16.19.1. Company Overview

16.19.2. Company Footprints

16.19.3. Product Portfolio

16.19.4. Competitors & Customers

16.19.5. Subsidiaries & Parent Organization

16.19.6. Recent Developments

16.19.7. Financial Analysis

16.19.8. Profitability

16.19.9. Revenue Share

16.20. Microtek

16.20.1. Company Overview

16.20.2. Company Footprints

16.20.3. Product Portfolio

16.20.4. Competitors & Customers

16.20.5. Subsidiaries & Parent Organization

16.20.6. Recent Developments

16.20.7. Financial Analysis

16.20.8. Profitability

16.20.9. Revenue Share

16.21. Northstar

16.21.1. Company Overview

16.21.2. Company Footprints

16.21.3. Product Portfolio

16.21.4. Competitors & Customers

16.21.5. Subsidiaries & Parent Organization

16.21.6. Recent Developments

16.21.7. Financial Analysis

16.21.8. Profitability

16.21.9. Revenue Share

16.22. Panasonic Corp.

16.22.1. Company Overview

16.22.2. Company Footprints

16.22.3. Product Portfolio

16.22.4. Competitors & Customers

16.22.5. Subsidiaries & Parent Organization

16.22.6. Recent Developments

16.22.7. Financial Analysis

16.22.8. Profitability

16.22.9. Revenue Share

16.23. Su-KAM

16.23.1. Company Overview

16.23.2. Company Footprints

16.23.3. Product Portfolio

16.23.4. Competitors & Customers

16.23.5. Subsidiaries & Parent Organization

16.23.6. Recent Developments

16.23.7. Financial Analysis

16.23.8. Profitability

16.23.9. Revenue Share

16.24. The Sunlight Group

16.24.1. Company Overview

16.24.2. Company Footprints

16.24.3. Product Portfolio

16.24.4. Competitors & Customers

16.24.5. Subsidiaries & Parent Organization

16.24.6. Recent Developments

16.24.7. Financial Analysis

16.24.8. Profitability

16.24.9. Revenue Share

16.25. V-Guard

16.25.1. Company Overview

16.25.2. Company Footprints

16.25.3. Product Portfolio

16.25.4. Competitors & Customers

16.25.5. Subsidiaries & Parent Organization

16.25.6. Recent Developments

16.25.7. Financial Analysis

16.25.8. Profitability

16.25.9. Revenue Share

List of Tables

Table 1: Global Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Construction Design, 2023-2031

Table 2: Global Automotive Lead-acid Battery Market Revenue (US$ Bn) Forecast, by Construction Design, 2023-2031

Table 3: Global Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Cycle, 2023-2031

Table 4: Global Automotive Lead-acid Battery Market Revenue (US$ Bn) Forecast, by Cycle, 2023-2031

Table 5: Global Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Vehicle Type, 2023-2031

Table 6: Global Automotive Lead-acid Battery Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2023-2031

Table 7: Global Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Sales Channel, 2023-2031

Table 8: Global Automotive Lead-acid Battery Market Revenue (US$ Bn) Forecast, by Sales Channel, 2023-2031

Table 9: Global Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Region 2023-2031

Table 10: Global Automotive Lead-acid Battery Market Revenue (US$ Bn) Forecast, by Region, 2023-2031

Table 11: North America Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Construction Design, 2023-2031

Table 12: North America Automotive Lead-acid Battery Market Revenue (US$ Bn) Forecast, by Construction Design, 2023-2031

Table 13: North America Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Cycle, 2023-2031

Table 14: North America Automotive Lead-acid Battery Market Revenue (US$ Bn) Forecast, by Cycle, 2023-2031

Table 15: North America Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Vehicle Type, 2023-2031

Table 16: North America Automotive Lead-acid Battery Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2023-2031

Table 17: North America Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Sales Channel, 2023-2031

Table 18: North America Automotive Lead-acid Battery Market Revenue (US$ Bn) Forecast, by Sales Channel, 2023-2031

Table 19: North America Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Country 2023-2031

Table 20: North America Automotive Lead-acid Battery Market Revenue (US$ Bn) Forecast, by Country, 2023-2031

Table 21: Europe Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Construction Design, 2023-2031

Table 22: Europe Automotive Lead-acid Battery Market Revenue (US$ Bn) Forecast, by Construction Design, 2023-2031

Table 23: Europe Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Cycle, 2023-2031

Table 24: Europe Automotive Lead-acid Battery Market Revenue (US$ Bn) Forecast, by Cycle, 2023-2031

Table 25: Europe Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Vehicle Type, 2023-2031

Table 26: Europe Automotive Lead-acid Battery Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2023-2031

Table 27: Europe Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Sales Channel, 2023-2031

Table 28: Europe Automotive Lead-acid Battery Market Revenue (US$ Bn) Forecast, by Sales Channel, 2023-2031

Table 29: Europe Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Country 2023-2031

Table 30: Europe Automotive Lead-acid Battery Market Revenue (US$ Bn) Forecast, by Country, 2023-2031

Table 31: Asia Pacific Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Construction Design, 2023-2031

Table 32: Asia Pacific Automotive Lead-acid Battery Market Revenue (US$ Bn) Forecast, by Construction Design, 2023-2031

Table 33: Asia Pacific Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Cycle, 2023-2031

Table 34: Asia Pacific Automotive Lead-acid Battery Market Revenue (US$ Bn) Forecast, by Cycle, 2023-2031

Table 35: Asia Pacific Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Vehicle Type, 2023-2031

Table 36: Asia Pacific Automotive Lead-acid Battery Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2023-2031

Table 37: Asia Pacific Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Sales Channel, 2023-2031

Table 38: Asia Pacific Automotive Lead-acid Battery Market Revenue (US$ Bn) Forecast, by Sales Channel, 2023-2031

Table 39: Asia Pacific Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Country 2023-2031

Table 40: Asia Pacific Automotive Lead-acid Battery Market Revenue (US$ Bn) Forecast, by Country, 2023-2031

Table 41: Middle East & Africa Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Construction Design, 2023-2031

Table 42: Middle East & Africa Automotive Lead-acid Battery Market Revenue (US$ Bn) Forecast, by Construction Design, 2023-2031

Table 43: Middle East & Africa Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Cycle, 2023-2031

Table 44: Middle East & Africa Automotive Lead-acid Battery Market Revenue (US$ Bn) Forecast, by Cycle, 2023-2031

Table 45: Middle East & Africa Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Vehicle Type, 2023-2031

Table 46: Middle East & Africa Automotive Lead-acid Battery Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2023-2031

Table 47: Middle East & Africa Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Sales Channel, 2023-2031

Table 48: Middle East & Africa Automotive Lead-acid Battery Market Revenue (US$ Bn) Forecast, by Sales Channel, 2023-2031

Table 49: Middle East & Africa Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Country 2023-2031

Table 50: Middle East & Africa Automotive Lead-acid Battery Market Revenue (US$ Bn) Forecast, by Country, 2023-2031

Table 51: South America Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Construction Design, 2023-2031

Table 52: South America Automotive Lead-acid Battery Market Revenue (US$ Bn) Forecast, by Construction Design, 2023-2031

Table 53: South America Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Cycle, 2023-2031

Table 54: South America Automotive Lead-acid Battery Market Revenue (US$ Bn) Forecast, by Cycle, 2023-2031

Table 55: South America Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Vehicle Type, 2023-2031

Table 56: South America Automotive Lead-acid Battery Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2023-2031

Table 57: South America Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Sales Channel, 2023-2031

Table 58: South America Automotive Lead-acid Battery Market Revenue (US$ Bn) Forecast, by Sales Channel, 2023-2031

Table 59: South America Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Country 2023-2031

Table 60: South America Automotive Lead-acid Battery Market Revenue (US$ Bn) Forecast, by Country, 2023-2031

List of Figures

Figure 1: Global Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Construction Design, 2023-2031

Figure 2: Global Automotive Lead-acid Battery Market Value (US$ Bn) Forecast, by Construction Design, 2023-2031

Figure 3: Global Automotive Lead-acid Battery Market, Incremental Opportunity, by Construction Design, Value (US$ Bn), 2023-2031

Figure 4: Global Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Cycle, 2023-2031

Figure 5: Global Automotive Lead-acid Battery Market Value (US$ Bn) Forecast, by Cycle, 2023-2031

Figure 6: Global Automotive Lead-acid Battery Market, Incremental Opportunity, by Cycle, Value (US$ Bn), 2023-2031

Figure 7: Global Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Vehicle Type, 2023-2031

Figure 8: Global Automotive Lead-acid Battery Market Value (US$ Bn) Forecast, by Vehicle Type, 2023-2031

Figure 9: Global Automotive Lead-acid Battery Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 10: Global Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Sales Channel, 2023-2031

Figure 11: Global Automotive Lead-acid Battery Market Value (US$ Bn) Forecast, by Sales Channel, 2023-2031

Figure 12: Global Automotive Lead-acid Battery Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 13: Global Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Region, 2023-2031

Figure 14: Global Automotive Lead-acid Battery Market Value (US$ Bn) Forecast, by Region, 2023-2031

Figure 15: Global Automotive Lead-acid Battery Market, Incremental Opportunity, by Region, Value (US$ Bn), 2023-2031

Figure 16: North America Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Construction Design, 2023-2031

Figure 17: North America Automotive Lead-acid Battery Market Value (US$ Bn) Forecast, by Construction Design, 2023-2031

Figure 18: North America Automotive Lead-acid Battery Market, Incremental Opportunity, by Construction Design, Value (US$ Bn), 2023-2031

Figure 19: North America Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Cycle, 2023-2031

Figure 20: North America Automotive Lead-acid Battery Market Value (US$ Bn) Forecast, by Cycle, 2023-2031

Figure 21: North America Automotive Lead-acid Battery Market, Incremental Opportunity, by Cycle, Value (US$ Bn), 2023-2031

Figure 22: North America Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Vehicle Type, 2023-2031

Figure 23: North America Automotive Lead-acid Battery Market Value (US$ Bn) Forecast, by Vehicle Type, 2023-2031

Figure 24: North America Automotive Lead-acid Battery Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 25: North America Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Sales Channel, 2023-2031

Figure 26: North America Automotive Lead-acid Battery Market Value (US$ Bn) Forecast, by Sales Channel, 2023-2031

Figure 27: North America Automotive Lead-acid Battery Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 28: North America Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Country, 2023-2031

Figure 29: North America Automotive Lead-acid Battery Market Value (US$ Bn) Forecast, by Country, 2023-2031

Figure 30: North America Automotive Lead-acid Battery Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 31: Europe Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Construction Design, 2023-2031

Figure 32: Europe Automotive Lead-acid Battery Market Value (US$ Bn) Forecast, by Construction Design, 2023-2031

Figure 33: Europe Automotive Lead-acid Battery Market, Incremental Opportunity, by Construction Design, Value (US$ Bn), 2023-2031

Figure 34: Europe Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Cycle, 2023-2031

Figure 35: Europe Automotive Lead-acid Battery Market Value (US$ Bn) Forecast, by Cycle, 2023-2031

Figure 36: Europe Automotive Lead-acid Battery Market, Incremental Opportunity, by Cycle, Value (US$ Bn), 2023-2031

Figure 37: Europe Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Vehicle Type, 2023-2031

Figure 38: Europe Automotive Lead-acid Battery Market Value (US$ Bn) Forecast, by Vehicle Type, 2023-2031

Figure 39: Europe Automotive Lead-acid Battery Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 40: Europe Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Sales Channel, 2023-2031

Figure 41: Europe Automotive Lead-acid Battery Market Value (US$ Bn) Forecast, by Sales Channel, 2023-2031

Figure 42: Europe Automotive Lead-acid Battery Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 43: Europe Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Country, 2023-2031

Figure 44: Europe Automotive Lead-acid Battery Market Value (US$ Bn) Forecast, by Country, 2023-2031

Figure 45: Europe Automotive Lead-acid Battery Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 46: Asia Pacific Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Construction Design, 2023-2031

Figure 47: Asia Pacific Automotive Lead-acid Battery Market Value (US$ Bn) Forecast, by Construction Design, 2023-2031

Figure 48: Asia Pacific Automotive Lead-acid Battery Market, Incremental Opportunity, by Construction Design, Value (US$ Bn), 2023-2031

Figure 49: Asia Pacific Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Cycle, 2023-2031

Figure 50: Asia Pacific Automotive Lead-acid Battery Market Value (US$ Bn) Forecast, by Cycle, 2023-2031

Figure 51: Asia Pacific Automotive Lead-acid Battery Market, Incremental Opportunity, by Cycle, Value (US$ Bn), 2023-2031

Figure 52: Asia Pacific Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Vehicle Type, 2023-2031

Figure 53: Asia Pacific Automotive Lead-acid Battery Market Value (US$ Bn) Forecast, by Vehicle Type, 2023-2031

Figure 54: Asia Pacific Automotive Lead-acid Battery Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 55: Asia Pacific Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Sales Channel, 2023-2031

Figure 56: Asia Pacific Automotive Lead-acid Battery Market Value (US$ Bn) Forecast, by Sales Channel, 2023-2031

Figure 57: Asia Pacific Automotive Lead-acid Battery Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 58: Asia Pacific Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Country, 2023-2031

Figure 59: Asia Pacific Automotive Lead-acid Battery Market Value (US$ Bn) Forecast, by Country, 2023-2031

Figure 60: Asia Pacific Automotive Lead-acid Battery Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 61: Middle East & Africa Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Construction Design, 2023-2031

Figure 62: Middle East & Africa Automotive Lead-acid Battery Market Value (US$ Bn) Forecast, by Construction Design, 2023-2031

Figure 63: Middle East & Africa Automotive Lead-acid Battery Market, Incremental Opportunity, by Construction Design, Value (US$ Bn), 2023-2031

Figure 64: Middle East & Africa Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Cycle, 2023-2031

Figure 65: Middle East & Africa Automotive Lead-acid Battery Market Value (US$ Bn) Forecast, by Cycle, 2023-2031

Figure 66: Middle East & Africa Automotive Lead-acid Battery Market, Incremental Opportunity, by Cycle, Value (US$ Bn), 2023-2031

Figure 67: Middle East & Africa Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Vehicle Type, 2023-2031

Figure 68: Middle East & Africa Automotive Lead-acid Battery Market Value (US$ Bn) Forecast, by Vehicle Type, 2023-2031

Figure 69: Middle East & Africa Automotive Lead-acid Battery Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 70: Middle East & Africa Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Sales Channel, 2023-2031

Figure 71: Middle East & Africa Automotive Lead-acid Battery Market Value (US$ Bn) Forecast, by Sales Channel, 2023-2031

Figure 72: Middle East & Africa Automotive Lead-acid Battery Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 73: Middle East & Africa Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Country, 2023-2031

Figure 74: Middle East & Africa Automotive Lead-acid Battery Market Value (US$ Bn) Forecast, by Country, 2023-2031

Figure 75: Middle East & Africa Automotive Lead-acid Battery Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 76: South America Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Construction Design, 2023-2031

Figure 77: South America Automotive Lead-acid Battery Market Value (US$ Bn) Forecast, by Construction Design, 2023-2031

Figure 78: South America Automotive Lead-acid Battery Market, Incremental Opportunity, by Construction Design, Value (US$ Bn), 2023-2031

Figure 79: South America Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Cycle, 2023-2031

Figure 80: South America Automotive Lead-acid Battery Market Value (US$ Bn) Forecast, by Cycle, 2023-2031

Figure 81: South America Automotive Lead-acid Battery Market, Incremental Opportunity, by Cycle, Value (US$ Bn), 2023-2031

Figure 82: South America Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Vehicle Type, 2023-2031

Figure 83: South America Automotive Lead-acid Battery Market Value (US$ Bn) Forecast, by Vehicle Type, 2023-2031

Figure 84: South America Automotive Lead-acid Battery Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 85: South America Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Sales Channel, 2023-2031

Figure 86: South America Automotive Lead-acid Battery Market Value (US$ Bn) Forecast, by Sales Channel, 2023-2031

Figure 87: South America Automotive Lead-acid Battery Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 88: South America Automotive Lead-acid Battery Market Volume (Million Units) Forecast, by Country, 2023-2031

Figure 89: South America Automotive Lead-acid Battery Market Value (US$ Bn) Forecast, by Country, 2023-2031

Figure 90: South America Automotive Lead-acid Battery Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031