Analysts’ Viewpoint

Technological advancements in automotive lighting systems, such as the widespread adoption of LED and HID technologies, are driving innovation in the automotive headlight coatings aftermarket. Major players are concentrating on improving the efficiency of overall coating durability and performance to provide a product portfolio that offers cutting-edge benefits, is cost-effective, and safe.

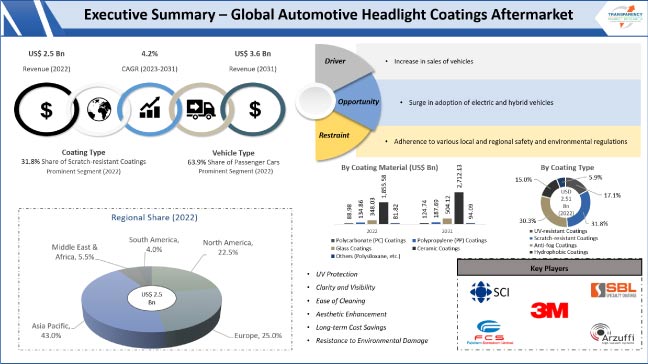

Stringent regulatory standards and environmental considerations are influencing the development of coatings that align with sustainability goals and safety regulations, further shaping the trajectory of the aftermarket. As the automotive industry continues to evolve with the surge in demand for passenger cars and rise in popularity of electric vehicles and autonomous driving technologies, the global automotive headlight coatings aftermarket is poised for sustained growth, offering a diverse range of solutions to meet the varied needs of consumers globally.

Automotive headlight coatings refer to specialized protective and functional layers applied to the surfaces of automotive headlights. These coatings enhance the durability of headlights, improve visibility, and contribute to the overall aesthetics of vehicles. Typically composed of materials designed to withstand environmental factors such as UV radiation, weathering, and abrasion, the coatings play a crucial role in maintaining the clarity and performance of headlights over time.

The global automotive headlight coatings aftermarket is dynamic and evolving, driven by the intersection of consumer demands, technological advancements, and regulatory influences. As vehicle ownership rises worldwide, consumers are increasingly turning to aftermarket solutions to enhance the performance and longevity of automotive headlights.

The automotive headlight coatings aftermarket size is poised to grow as consumers increasingly recognize the value of aftermarket solutions in preserving the clarity, functionality, and aesthetic appeal of their vehicle headlights in the ever-evolving automotive landscape.

As more vehicles hit the roads, there is a parallel increase in the need for reliable and high-performance headlight coatings that enhance visibility and ensure the safety of drivers and pedestrians. Consumers are increasingly conscious of the crucial role that headlights play in overall vehicle safety, prompting them to seek aftermarket solutions that offer superior protection against environmental elements, UV radiation, and general wear and tear.

Safety concerns are a key market catalyst, compelling vehicle owners to invest in upgraded headlight coatings that surpass the standard offerings. Whether driven by a desire for improved clarity during night driving or enhanced resistance to harsh weather conditions, aftermarket consumers are actively seeking coatings that provide an extra layer of safety for their vehicles. This trend is especially pronounced in regions with a high volume of vehicle sales, where consumers are willing to invest in aftermarket solutions to ensure optimal performance and longevity of their vehicle's headlights, augmenting the automotive headlight coatings aftermarket value.

Rapid adoption of advanced lighting technologies in the automotive industry is a key factor offering lucrative opportunities for market expansion. The widespread integration of advanced lighting systems such as LED (Light Emitting Diode) and HID (High-intensity Discharge) in modern vehicles, is leading to growth in need for specialized coatings that can complement and protect these sophisticated technologies. The advanced lighting systems not only offer improved visibility but also contribute to energy efficiency and overall vehicle aesthetics. Consequently, consumers are increasingly enhancing their vehicle's lighting capabilities by investing in coatings that cater specifically to the requirements of these cutting-edge technologies.

The coatings must provide durability, resist discoloration, and maintain optical clarity to ensure the continued effectiveness of these technologies over time. This trend is propelling the aftermarket sector as consumers recognize the importance of protecting and optimizing their investment in advanced lighting, further driving the demand for specialized headlight coatings in the automotive headlight coatings aftermarket.

The automotive headlight coatings aftermarket segmentation based on coating material includes polycarbonate (PC) coatings, polypropylene (PP) coatings, glass coatings, ceramic coatings, and others. Ceramic coatings have emerged as a dominant force in the global aftermarket, gaining popularity for their exceptional durability and protective qualities. Ceramic coatings have become a preferred choice as vehicle owners seek solutions that offer long-lasting defense against environmental factors, UV radiation, and abrasions. These coatings form a resilient, transparent layer on the headlight surface, providing robust resistance to scratches, chemical contaminants, and fading.

As consumers continue to prioritize the long-term protection and appearance of their vehicle headlights, ceramic coatings are expected to maintain their dominance in the global automotive headlight coatings aftermarket, reflecting the enduring appeal of their advanced protective capabilities.

As per the automotive headlight coatings aftermarket analysis, based on vehicle type, the passenger cars segment holds a significant share of the aftermarket, driven by the extensive consumer base and the rise in demand for personalized aesthetics and enhanced safety features. Passenger car owners are increasingly recognizing the importance of aftermarket headlight coatings to not only protect their vehicle's headlights from environmental elements but also to customize the appearance of their cars. As personalization trends gain traction in the automotive industry, consumers seek coatings that offer both protective benefits and the ability to augment the overall visual appeal of their passenger vehicles.

The sheer volume of passenger cars on the road, coupled with the strong consumer inclination toward maintaining and upgrading their cars drives market statistics. Manufacturers and suppliers in the global automotive headlight coatings aftermarket are responding to this demand by offering a diverse range of coatings tailored to the specific needs and preferences of passenger car owners, solidifying the segment's major share in this dynamic market.

According to the latest automotive headlight coatings aftermarket forecast, Asia Pacific stands out as a dominant force in the global landscape. The growing automotive industry in countries such as China and India, coupled with the increasing affluence of consumers, has led to a surge in vehicle ownership. As a result, there is a heightened awareness among Asian consumers regarding the importance of aftermarket solutions for headlight protection and customization. Demand for advanced coatings that offer durability and aesthetic enhancements is on the rise, positioning Asia Pacific at the forefront of the global aftermarket.

Europe represents a substantial share of the aftermarket. The region has stringent regulations emphasizing vehicle safety and environmental standards, motivating consumers to invest in coatings that meet these criteria. The combination of regulatory drivers and consumer preferences has established Europe as a significant player in the aftermarket sector for automotive headlight coatings.

North America, comprising the United States and Canada, holds a notable position in the global automotive headlight coatings aftermarket. The region benefits from a mature automotive market with a large vehicle population.

The global automotive headlight coatings aftermarket is consolidated with a few manufacturers controlling the market share and major companies possessing the potential to increase the pace of growth by adopting newer technologies. Expansion of service offerings and mergers & acquisitions are major strategies adopted by key players.

3M, ARZUFFI SRL, AUTCA, ADSCO, Covestro AG, Fujichem Sonneborn Limited, Guangdong Veslee Chemical Science and Technology Co., Ltd., KISHO Corporation Co., Ltd., McKees37.com, Meguiar's, Momentive, Plasmatreat, SBL Coatings Private Limited., and SCI Engineered Materials are the prominent entities in this market.

Key players have been profiled in the global automotive headlight coatings aftermarket report based on pointers such as company overview, business strategies, financial overview, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Aftermarket Size in 2022 | US$ 2.5 Bn |

| Aftermarket Forecast Value in 2031 | US$ 3.6 Bn |

| Growth Rate (CAGR) | 4.2% |

| Forecast Period | 2023-2031 |

| Quantitative Units | Million Units for Volume US$ Bn for Value |

| Aftermarket Analysis | It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis, |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Aftermarket Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Company Profile |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 2.5 Bn in 2022

The CAGR is projected to be 4.2% from 2023 to 2031

It is expected to reach US$ 3.6 Bn by the end of 2031

Ceramic coatings is expected to dominate during the forecast period

Passenger cars segment accounted for 63.91% share in 2022

Asia Pacific is a highly lucrative region

3M, ARZUFFI SRL, AUTCA, ADSCO, Covestro AG, Fujichem Sonneborn Limited, Guangdong Veslee Chemical Science and Technology Co., Ltd., KISHO Corporation Co., Ltd., McKees37.com, Meguiar's, Momentive, Plasmatreat, SBL Coatings Private Limited., and SCI Engineered Materials

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Size, Million Units, US$ Bn, 2017-2031

1.2. Go to Market Strategy

1.2.1. Demand & Supply Side Trends

1.2.2. Identification of Potential Market Spaces

1.2.3. Understanding the Buying Process of Customers

1.3. TMR Analysis and Recommendations

1.4. Competitive Dashboard Analysis

2. Market Overview

2.1. Market Coverage / Taxonomy

2.2. Market Definition / Scope / Limitations

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunity

2.4. Market Factor Analysis

2.4.1. Porter’s Five Force Analysis

2.4.2. SWOT Analysis

2.5. Value Chain Analysis

2.6. Key Trend Analysis

2.7. Regulatory Scenario

3. Global Automotive Headlight Coatings Aftermarket, by Light Type

3.1. Market Snapshot

3.1.1. Introduction, Definition, and Key Findings

3.1.2. Market Growth & Y-o-Y Projections

3.1.3. Base Point Share Analysis

3.2. Global Automotive Headlight Coatings Aftermarket Volume (Million Units) and Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Light Type

3.2.1. Halogen

3.2.2. LED

3.2.3. Xenon/ HID

3.2.4. Laser

3.2.5. OLED

3.2.6. Others

4. Global Automotive Headlight Coatings Aftermarket, by Coating Type

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Automotive Headlight Coatings Aftermarket Volume (Million Units) and Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Coating Type

4.2.1. UV-Resistant Coatings

4.2.2. Scratch- Resistant Coatings

4.2.3. Anti-Fog Coatings

4.2.4. Hydrophobic Coatings

4.2.5. Others

5. Global Automotive Headlight Coatings Aftermarket, By Coating Material

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Automotive Headlight Coatings Aftermarket Volume (Million Units) and Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Coating Material

5.2.1. Polycarbonate (PC) Coatings

5.2.2. Polypropylene (PP) Coatings

5.2.3. Glass Coatings

5.2.4. Ceramic Coatings

5.2.5. Others (Polysiloxane, etc.)

6. Global Automotive Headlight Coatings Aftermarket, by Vehicle Type

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Automotive Headlight Coatings Aftermarket Volume (Million Units) and Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Vehicle Type

6.2.1. Two/ Three Wheelers

6.2.2. Passenger Cars

6.2.2.1. Hatchback

6.2.2.2. Sedan

6.2.2.3. SUVs

6.2.3. Light Commercial Vehicles

6.2.4. Heavy Duty Trucks

6.2.5. Buses and Coaches

6.2.6. Off-road Vehicles

6.2.6.1. Agriculture Tractors & Equipment

6.2.6.2. Construction & Mining Equipment

6.2.6.3. Industrial Vehicles (Forklift, AGV, Etc.)

7. Global Automotive Headlight Coatings Aftermarket, by Region

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Automotive Headlight Coatings Aftermarket Volume (Million Units) and Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Region

7.2.1. North America

7.2.2. Europe

7.2.3. Asia Pacific

7.2.4. Middle East & Africa

7.2.5. South America

8. North America Automotive Headlight Coatings Aftermarket

8.1. Market Snapshot

8.2. North America Automotive Headlight Coatings Aftermarket Volume (Million Units) and Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Light Type

8.2.1. Halogen

8.2.2. LED

8.2.3. Xenon/ HID

8.2.4. Laser

8.2.5. OLED

8.2.6. Others

8.3. North America Automotive Headlight Coatings Aftermarket Volume (Million Units) and Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Coating Type

8.3.1. UV-Resistant Coatings

8.3.2. Scratch- Resistant Coatings

8.3.3. Anti-Fog Coatings

8.3.4. Hydrophobic Coatings

8.3.5. Others

8.4. North America Automotive Headlight Coatings Aftermarket Volume (Million Units) and Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Coating Material

8.4.1. Polycarbonate (PC) Coatings

8.4.2. Polypropylene (PP) Coatings

8.4.3. Glass Coatings

8.4.4. Ceramic Coatings

8.4.5. Others (Polysiloxane, etc.)

8.5. North America Automotive Headlight Coatings Aftermarket Volume (Million Units) and Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Vehicle Type

8.5.1. Two/ Three Wheelers

8.5.2. Passenger Cars

8.5.2.1. Hatchback

8.5.2.2. Sedan

8.5.2.3. SUVs

8.5.3. Light Commercial Vehicles

8.5.4. Heavy Duty Trucks

8.5.5. Buses and Coaches

8.5.6. Off-road Vehicles

8.5.6.1. Agriculture Tractors & Equipment

8.5.6.2. Construction & Mining Equipment

8.5.6.3. Industrial Vehicles (Forklift, AGV, Etc.)

8.6. Key Country Analysis – North America Automotive Headlight Coatings Aftermarket Volume (Million Units) and Revenue (US$ Bn) Analysis & Forecast, 2017-2031

8.6.1. U. S.

8.6.2. Canada

8.6.3. Mexico

9. Europe Automotive Headlight Coatings Aftermarket

9.1. Market Snapshot

9.2. Europe Automotive Headlight Coatings Aftermarket Volume (Million Units) and Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Light Type

9.2.1. Halogen

9.2.2. LED

9.2.3. Xenon/ HID

9.2.4. Laser

9.2.5. OLED

9.2.6. Others

9.3. Europe Automotive Headlight Coatings Aftermarket Volume (Million Units) and Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Coating Type

9.3.1. UV-Resistant Coatings

9.3.2. Scratch- Resistant Coatings

9.3.3. Anti-Fog Coatings

9.3.4. Hydrophobic Coatings

9.3.5. Others

9.4. Europe Automotive Headlight Coatings Aftermarket Volume (Million Units) and Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Coating Material

9.4.1. Polycarbonate (PC) Coatings

9.4.2. Polypropylene (PP) Coatings

9.4.3. Glass Coatings

9.4.4. Ceramic Coatings

9.4.5. Others (Polysiloxane, etc.)

9.5. Europe Automotive Headlight Coatings Aftermarket Volume (Million Units) and Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Vehicle Type

9.5.1. Two/ Three Wheelers

9.5.2. Passenger Cars

9.5.2.1. Hatchback

9.5.2.2. Sedan

9.5.2.3. SUVs

9.5.3. Light Commercial Vehicles

9.5.4. Heavy Duty Trucks

9.5.5. Buses and Coaches

9.5.6. Off-road Vehicles

9.5.6.1. Agriculture Tractors & Equipment

9.5.6.2. Construction & Mining Equipment

9.5.6.3. Industrial Vehicles (Forklift, AGV, Etc.)

9.6. Key Country Analysis – Europe Automotive Headlight Coatings Aftermarket Volume (Million Units) and Revenue (US$ Bn) Analysis & Forecast, 2017-2031

9.6.1. Germany

9.6.2. U. K.

9.6.3. France

9.6.4. Italy

9.6.5. Spain

9.6.6. Nordic Countries

9.6.7. Russia & CIS

9.6.8. Rest of Europe

10. Asia Pacific Automotive Headlight Coatings Aftermarket

10.1. Market Snapshot

10.2. Asia Pacific Automotive Headlight Coatings Aftermarket Volume (Million Units) and Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Light Type

10.2.1. Halogen

10.2.2. LED

10.2.3. Xenon/ HID

10.2.4. Laser

10.2.5. OLED

10.2.6. Others

10.3. Asia Pacific Automotive Headlight Coatings Aftermarket Volume (Million Units) and Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Coating Type

10.3.1. UV-Resistant Coatings

10.3.2. Scratch- Resistant Coatings

10.3.3. Anti-Fog Coatings

10.3.4. Hydrophobic Coatings

10.3.5. Others

10.4. Asia Pacific Automotive Headlight Coatings Aftermarket Volume (Million Units) and Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Coating Material

10.4.1. Polycarbonate (PC) Coatings

10.4.2. Polypropylene (PP) Coatings

10.4.3. Glass Coatings

10.4.4. Ceramic Coatings

10.4.5. Others (Polysiloxane, etc.)

10.5. Asia Pacific Automotive Headlight Coatings Aftermarket Volume (Million Units) and Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Vehicle Type

10.5.1. Two/ Three Wheelers

10.5.2. Passenger Cars

10.5.2.1. Hatchback

10.5.2.2. Sedan

10.5.2.3. SUVs

10.5.3. Light Commercial Vehicles

10.5.4. Heavy Duty Trucks

10.5.5. Buses and Coaches

10.5.6. Off-road Vehicles

10.5.6.1. Agriculture Tractors & Equipment

10.5.6.2. Construction & Mining Equipment

10.5.6.3. Industrial Vehicles (Forklift, AGV, Etc.)

10.6. Key Country Analysis – Asia Pacific Automotive Headlight Coatings Aftermarket Volume (Million Units) and Revenue (US$ Bn) Analysis & Forecast, 2017-2031

10.6.1. China

10.6.2. India

10.6.3. Japan

10.6.4. ASEAN Countries

10.6.5. South Korea

10.6.6. ANZ

10.6.7. Rest of Asia Pacific

11. Middle East & Africa Automotive Headlight Coatings Aftermarket

11.1. Market Snapshot

11.2. Middle East & Africa Automotive Headlight Coatings Aftermarket Volume (Million Units) and Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Light Type

11.2.1. Halogen

11.2.2. LED

11.2.3. Xenon/ HID

11.2.4. Laser

11.2.5. OLED

11.2.6. Others

11.3. Middle East & Africa Automotive Headlight Coatings Aftermarket Volume (Million Units) and Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Coating Type

11.3.1. UV-Resistant Coatings

11.3.2. Scratch- Resistant Coatings

11.3.3. Anti-Fog Coatings

11.3.4. Hydrophobic Coatings

11.3.5. Others

11.4. Middle East & Africa Automotive Headlight Coatings Aftermarket Volume (Million Units) and Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Coating Material

11.4.1. Polycarbonate (PC) Coatings

11.4.2. Polypropylene (PP) Coatings

11.4.3. Glass Coatings

11.4.4. Ceramic Coatings

11.4.5. Others (Polysiloxane, etc.)

11.5. Middle East & Africa Automotive Headlight Coatings Aftermarket Volume (Million Units) and Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Vehicle Type

11.5.1. Two/ Three Wheelers

11.5.2. Passenger Cars

11.5.2.1. Hatchback

11.5.2.2. Sedan

11.5.2.3. SUVs

11.5.3. Light Commercial Vehicles

11.5.4. Heavy Duty Trucks

11.5.5. Buses and Coaches

11.5.6. Off-road Vehicles

11.5.6.1. Agriculture Tractors & Equipment

11.5.6.2. Construction & Mining Equipment

11.5.6.3. Industrial Vehicles (Forklift, AGV, Etc.)

11.6. Key Country Analysis – Middle East & Africa Automotive Headlight Coatings Aftermarket Volume (Million Units) and Revenue (US$ Bn) Analysis & Forecast, 2017-2031

11.6.1. GCC

11.6.2. South Africa

11.6.3. Turkey

11.6.4. Rest of Middle East & Africa

12. South America Automotive Headlight Coatings Aftermarket

12.1. Market Snapshot

12.2. South America Automotive Headlight Coatings Aftermarket Volume (Million Units) and Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Light Type

12.2.1. Halogen

12.2.2. LED

12.2.3. Xenon/ HID

12.2.4. Laser

12.2.5. OLED

12.2.6. Others

12.3. South America Automotive Headlight Coatings Aftermarket Volume (Million Units) and Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Coating Type

12.3.1. UV-Resistant Coatings

12.3.2. Scratch- Resistant Coatings

12.3.3. Anti-Fog Coatings

12.3.4. Hydrophobic Coatings

12.3.5. Others

12.4. South America Automotive Headlight Coatings Aftermarket Volume (Million Units) and Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Coating Material

12.4.1. Polycarbonate (PC) Coatings

12.4.2. Polypropylene (PP) Coatings

12.4.3. Glass Coatings

12.4.4. Ceramic Coatings

12.4.5. Others (Polysiloxane, etc.)

12.5. South America Automotive Headlight Coatings Aftermarket Volume (Million Units) and Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Vehicle Type

12.5.1. Two/ Three Wheelers

12.5.2. Passenger Cars

12.5.2.1. Hatchback

12.5.2.2. Sedan

12.5.2.3. SUVs

12.5.3. Light Commercial Vehicles

12.5.4. Heavy Duty Trucks

12.5.5. Buses and Coaches

12.5.6. Off-road Vehicles

12.5.6.1. Agriculture Tractors & Equipment

12.5.6.2. Construction & Mining Equipment

12.5.6.3. Industrial Vehicles (Forklift, AGV, Etc.)

12.6. Key Country Analysis – South America Automotive Headlight Coatings Aftermarket Volume (Million Units) and Revenue (US$ Bn) Analysis & Forecast, 2017-2031

12.6.1. Brazil

12.6.2. Argentina

12.6.3. Rest of South America

13. Competitive Landscape

13.1. Company Share Analysis/ Brand Share Analysis, 2022

13.2. Company Analysis for each player

Company Overview, Company Footprints, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis

13.3. Company Profile/ Service Providers – Automotive Headlight Coatings Aftermarket

13.3.1. 3M

13.3.1.1. Company Overview

13.3.1.2. Company Footprints

13.3.1.3. Product Portfolio

13.3.1.4. Competitors & Customers

13.3.1.5. Subsidiaries & Parent Organization

13.3.1.6. Recent Developments

13.3.1.7. Financial Analysis

13.3.2. ARZUFFI SRL

13.3.2.1. Company Overview

13.3.2.2. Company Footprints

13.3.2.3. Product Portfolio

13.3.2.4. Competitors & Customers

13.3.2.5. Subsidiaries & Parent Organization

13.3.2.6. Recent Developments

13.3.2.7. Financial Analysis

13.3.3. AUTCA

13.3.3.1. Company Overview

13.3.3.2. Company Footprints

13.3.3.3. Product Portfolio

13.3.3.4. Competitors & Customers

13.3.3.5. Subsidiaries & Parent Organization

13.3.3.6. Recent Developments

13.3.3.7. Financial Analysis

13.3.4. ADSCO

13.3.4.1. Company Overview

13.3.4.2. Company Footprints

13.3.4.3. Product Portfolio

13.3.4.4. Competitors & Customers

13.3.4.5. Subsidiaries & Parent Organization

13.3.4.6. Recent Developments

13.3.4.7. Financial Analysis

13.3.5. Covestro AG

13.3.5.1. Company Overview

13.3.5.2. Company Footprints

13.3.5.3. Product Portfolio

13.3.5.4. Competitors & Customers

13.3.5.5. Subsidiaries & Parent Organization

13.3.5.6. Recent Developments

13.3.5.7. Financial Analysis

13.3.6. Fujichem Sonneborn Limited

13.3.6.1. Company Overview

13.3.6.2. Company Footprints

13.3.6.3. Product Portfolio

13.3.6.4. Competitors & Customers

13.3.6.5. Subsidiaries & Parent Organization

13.3.6.6. Recent Developments

13.3.6.7. Financial Analysis

13.3.7. Guangdong

13.3.7.1. Company Overview

13.3.7.2. Company Footprints

13.3.7.3. Product Portfolio

13.3.7.4. Competitors & Customers

13.3.7.5. Subsidiaries & Parent Organization

13.3.7.6. Recent Developments

13.3.7.7. Financial Analysis

13.3.8. KISHO Corporation Co., Ltd.

13.3.8.1. Company Overview

13.3.8.2. Company Footprints

13.3.8.3. Product Portfolio

13.3.8.4. Competitors & Customers

13.3.8.5. Subsidiaries & Parent Organization

13.3.8.6. Recent Developments

13.3.8.7. Financial Analysis

13.3.9. McKees37.com

13.3.9.1. Company Overview

13.3.9.2. Company Footprints

13.3.9.3. Product Portfolio

13.3.9.4. Competitors & Customers

13.3.9.5. Subsidiaries & Parent Organization

13.3.9.6. Recent Developments

13.3.9.7. Financial Analysis

13.3.10. Meguiar's

13.3.10.1. Company Overview

13.3.10.2. Company Footprints

13.3.10.3. Product Portfolio

13.3.10.4. Competitors & Customers

13.3.10.5. Subsidiaries & Parent Organization

13.3.10.6. Recent Developments

13.3.10.7. Financial Analysis

13.3.11. Momentive

13.3.11.1. Company Overview

13.3.11.2. Company Footprints

13.3.11.3. Product Portfolio

13.3.11.4. Competitors & Customers

13.3.11.5. Subsidiaries & Parent Organization

13.3.11.6. Recent Developments

13.3.11.7. Financial Analysis

13.3.12. Plasmatreat

13.3.12.1. Company Overview

13.3.12.2. Company Footprints

13.3.12.3. Product Portfolio

13.3.12.4. Competitors & Customers

13.3.12.5. Subsidiaries & Parent Organization

13.3.12.6. Recent Developments

13.3.12.7. Financial Analysis

13.3.13. SBL Coatings Private Limited.

13.3.13.1. Company Overview

13.3.13.2. Company Footprints

13.3.13.3. Product Portfolio

13.3.13.4. Competitors & Customers

13.3.13.5. Subsidiaries & Parent Organization

13.3.13.6. Recent Developments

13.3.13.7. Financial Analysis

13.3.14. SCI Engineered Materials

13.3.14.1. Company Overview

13.3.14.2. Company Footprints

13.3.14.3. Product Portfolio

13.3.14.4. Competitors & Customers

13.3.14.5. Subsidiaries & Parent Organization

13.3.14.6. Recent Developments

13.3.14.7. Financial Analysis

13.3.15. Other Key Players

13.3.15.1. Company Overview

13.3.15.2. Company Footprints

13.3.15.3. Product Portfolio

13.3.15.4. Competitors & Customers

13.3.15.5. Subsidiaries & Parent Organization

13.3.15.6. Recent Developments

13.3.15.7. Financial Analysis

List of Tables

Table 1: Global Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Light Type, 2017-2031

Table 2: Global Automotive Headlight Coatings Aftermarket Revenue (US$ Bn) Forecast, by Light Type, 2017-2031

Table 3: Global Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Coating Type, 2017-2031

Table 4: Global Automotive Headlight Coatings Aftermarket Revenue (US$ Bn) Forecast, by Coating Type, 2017-2031

Table 5: Global Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Coating Material, 2017-2031

Table 6: Global Automotive Headlight Coatings Aftermarket Revenue (US$ Bn) Forecast, by Coating Material, 2017-2031

Table 7: Global Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Table 8: Global Automotive Headlight Coatings Aftermarket Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 9: Global Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Region 2017-2031

Table 10: Global Automotive Headlight Coatings Aftermarket Revenue (US$ Bn) Forecast, by Region, 2017-2031

Table 11: North America Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Light Type, 2017-2031

Table 12: North America Automotive Headlight Coatings Aftermarket Revenue (US$ Bn) Forecast, by Light Type, 2017-2031

Table 13: North America Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Coating Type, 2017-2031

Table 14: North America Automotive Headlight Coatings Aftermarket Revenue (US$ Bn) Forecast, by Coating Type, 2017-2031

Table 15: North America Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Coating Material, 2017-2031

Table 16: North America Automotive Headlight Coatings Aftermarket Revenue (US$ Bn) Forecast, by Coating Material, 2017-2031

Table 17: North America Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Table 18: North America Automotive Headlight Coatings Aftermarket Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 19: North America Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Country 2017-2031

Table 20: North America Automotive Headlight Coatings Aftermarket Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 21: Europe Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Light Type, 2017-2031

Table 22: Europe Automotive Headlight Coatings Aftermarket Revenue (US$ Bn) Forecast, by Light Type, 2017-2031

Table 23: Europe Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Coating Type, 2017-2031

Table 24: Europe Automotive Headlight Coatings Aftermarket Revenue (US$ Bn) Forecast, by Coating Type, 2017-2031

Table 25: Europe Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Coating Material, 2017-2031

Table 26: Europe Automotive Headlight Coatings Aftermarket Revenue (US$ Bn) Forecast, by Coating Material, 2017-2031

Table 27: Europe Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Table 28: Europe Automotive Headlight Coatings Aftermarket Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 29: Europe Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Country 2017-2031

Table 30: Europe Automotive Headlight Coatings Aftermarket Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 31: Asia Pacific Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Light Type, 2017-2031

Table 32: Asia Pacific Automotive Headlight Coatings Aftermarket Revenue (US$ Bn) Forecast, by Light Type, 2017-2031

Table 33: Asia Pacific Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Coating Type, 2017-2031

Table 34: Asia Pacific Automotive Headlight Coatings Aftermarket Revenue (US$ Bn) Forecast, by Coating Type, 2017-2031

Table 35: Asia Pacific Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Coating Material, 2017-2031

Table 36: Asia Pacific Automotive Headlight Coatings Aftermarket Revenue (US$ Bn) Forecast, by Coating Material, 2017-2031

Table 37: Asia Pacific Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Table 38: Asia Pacific Automotive Headlight Coatings Aftermarket Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 39: Asia Pacific Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Country 2017-2031

Table 40: Asia Pacific Automotive Headlight Coatings Aftermarket Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 41: Middle East & Africa Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Light Type, 2017-2031

Table 42: Middle East & Africa Automotive Headlight Coatings Aftermarket Revenue (US$ Bn) Forecast, by Light Type, 2017-2031

Table 43: Middle East & Africa Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Coating Type, 2017-2031

Table 44: Middle East & Africa Automotive Headlight Coatings Aftermarket Revenue (US$ Bn) Forecast, by Coating Type, 2017-2031

Table 45: Middle East & Africa Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Coating Material, 2017-2031

Table 46: Middle East & Africa Automotive Headlight Coatings Aftermarket Revenue (US$ Bn) Forecast, by Coating Material, 2017-2031

Table 47: Middle East & Africa Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Table 48: Middle East & Africa Automotive Headlight Coatings Aftermarket Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 49: Middle East & Africa Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Country 2017-2031

Table 50: Middle East & Africa Automotive Headlight Coatings Aftermarket Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 51: South America Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Light Type, 2017-2031

Table 52: South America Automotive Headlight Coatings Aftermarket Revenue (US$ Bn) Forecast, by Light Type, 2017-2031

Table 53: South America Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Coating Type, 2017-2031

Table 54: South America Automotive Headlight Coatings Aftermarket Revenue (US$ Bn) Forecast, by Coating Type, 2017-2031

Table 55: South America Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Coating Material, 2017-2031

Table 56: South America Automotive Headlight Coatings Aftermarket Revenue (US$ Bn) Forecast, by Coating Material, 2017-2031

Table 57: South America Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Table 58: South America Automotive Headlight Coatings Aftermarket Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 59: South America Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Country 2017-2031

Table 60: South America Automotive Headlight Coatings Aftermarket Revenue (US$ Bn) Forecast, by Country, 2017-2031

List of Figures

Figure 1: Global Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Light Type, 2017-2031

Figure 2: Global Automotive Headlight Coatings Aftermarket Value (US$ Bn) Forecast, by Light Type, 2017-2031

Figure 3: Global Automotive Headlight Coatings Aftermarket, Incremental Opportunity, by Light Type, Value (US$ Bn), 2023-2031

Figure 4: Global Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Coating Type, 2017-2031

Figure 5: Global Automotive Headlight Coatings Aftermarket Value (US$ Bn) Forecast, by Coating Type, 2017-2031

Figure 6: Global Automotive Headlight Coatings Aftermarket, Incremental Opportunity, by Coating Type, Value (US$ Bn), 2023-2031

Figure 7: Global Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Coating Material, 2017-2031

Figure 8: Global Automotive Headlight Coatings Aftermarket Value (US$ Bn) Forecast, by Coating Material, 2017-2031

Figure 9: Global Automotive Headlight Coatings Aftermarket, Incremental Opportunity, by Coating Material, Value (US$ Bn), 2023-2031

Figure 10: Global Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Figure 11: Global Automotive Headlight Coatings Aftermarket Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 12: Global Automotive Headlight Coatings Aftermarket, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 13: Global Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Region, 2017-2031

Figure 14: Global Automotive Headlight Coatings Aftermarket Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 15: Global Automotive Headlight Coatings Aftermarket, Incremental Opportunity, by Region, Value (US$ Bn), 2023-2031

Figure 16: North America Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Light Type, 2017-2031

Figure 17: North America Automotive Headlight Coatings Aftermarket Value (US$ Bn) Forecast, by Light Type, 2017-2031

Figure 18: North America Automotive Headlight Coatings Aftermarket, Incremental Opportunity, by Light Type, Value (US$ Bn), 2023-2031

Figure 19: North America Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Coating Type, 2017-2031

Figure 20: North America Automotive Headlight Coatings Aftermarket Value (US$ Bn) Forecast, by Coating Type, 2017-2031

Figure 21: North America Automotive Headlight Coatings Aftermarket, Incremental Opportunity, by Coating Type, Value (US$ Bn), 2023-2031

Figure 22: North America Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Coating Material, 2017-2031

Figure 23: North America Automotive Headlight Coatings Aftermarket Value (US$ Bn) Forecast, by Coating Material, 2017-2031

Figure 24: North America Automotive Headlight Coatings Aftermarket, Incremental Opportunity, by Coating Material, Value (US$ Bn), 2023-2031

Figure 25: North America Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Figure 26: North America Automotive Headlight Coatings Aftermarket Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 27: North America Automotive Headlight Coatings Aftermarket, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 28: North America Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Country, 2017-2031

Figure 29: North America Automotive Headlight Coatings Aftermarket Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 30: North America Automotive Headlight Coatings Aftermarket, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 31: Europe Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Light Type, 2017-2031

Figure 32: Europe Automotive Headlight Coatings Aftermarket Value (US$ Bn) Forecast, by Light Type, 2017-2031

Figure 33: Europe Automotive Headlight Coatings Aftermarket, Incremental Opportunity, by Light Type, Value (US$ Bn), 2023-2031

Figure 34: Europe Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Coating Type, 2017-2031

Figure 35: Europe Automotive Headlight Coatings Aftermarket Value (US$ Bn) Forecast, by Coating Type, 2017-2031

Figure 36: Europe Automotive Headlight Coatings Aftermarket, Incremental Opportunity, by Coating Type, Value (US$ Bn), 2023-2031

Figure 37: Europe Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Coating Material, 2017-2031

Figure 38: Europe Automotive Headlight Coatings Aftermarket Value (US$ Bn) Forecast, by Coating Material, 2017-2031

Figure 39: Europe Automotive Headlight Coatings Aftermarket, Incremental Opportunity, by Coating Material, Value (US$ Bn), 2023-2031

Figure 40: Europe Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Figure 41: Europe Automotive Headlight Coatings Aftermarket Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 42: Europe Automotive Headlight Coatings Aftermarket, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 43: Europe Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Country, 2017-2031

Figure 44: Europe Automotive Headlight Coatings Aftermarket Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 45: Europe Automotive Headlight Coatings Aftermarket, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 46: Asia Pacific Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Light Type, 2017-2031

Figure 47: Asia Pacific Automotive Headlight Coatings Aftermarket Value (US$ Bn) Forecast, by Light Type, 2017-2031

Figure 48: Asia Pacific Automotive Headlight Coatings Aftermarket, Incremental Opportunity, by Light Type, Value (US$ Bn), 2023-2031

Figure 49: Asia Pacific Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Coating Type, 2017-2031

Figure 50: Asia Pacific Automotive Headlight Coatings Aftermarket Value (US$ Bn) Forecast, by Coating Type, 2017-2031

Figure 51: Asia Pacific Automotive Headlight Coatings Aftermarket, Incremental Opportunity, by Coating Type, Value (US$ Bn), 2023-2031

Figure 52: Asia Pacific Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Coating Material, 2017-2031

Figure 53: Asia Pacific Automotive Headlight Coatings Aftermarket Value (US$ Bn) Forecast, by Coating Material, 2017-2031

Figure 54: Asia Pacific Automotive Headlight Coatings Aftermarket, Incremental Opportunity, by Coating Material, Value (US$ Bn), 2023-2031

Figure 55: Asia Pacific Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Figure 56: Asia Pacific Automotive Headlight Coatings Aftermarket Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 57: Asia Pacific Automotive Headlight Coatings Aftermarket, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 58: Asia Pacific Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Country, 2017-2031

Figure 59: Asia Pacific Automotive Headlight Coatings Aftermarket Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 60: Asia Pacific Automotive Headlight Coatings Aftermarket, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 61: Middle East & Africa Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Light Type, 2017-2031

Figure 62: Middle East & Africa Automotive Headlight Coatings Aftermarket Value (US$ Bn) Forecast, by Light Type, 2017-2031

Figure 63: Middle East & Africa Automotive Headlight Coatings Aftermarket, Incremental Opportunity, by Light Type, Value (US$ Bn), 2023-2031

Figure 64: Middle East & Africa Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Coating Type, 2017-2031

Figure 65: Middle East & Africa Automotive Headlight Coatings Aftermarket Value (US$ Bn) Forecast, by Coating Type, 2017-2031

Figure 66: Middle East & Africa Automotive Headlight Coatings Aftermarket, Incremental Opportunity, by Coating Type, Value (US$ Bn), 2023-2031

Figure 67: Middle East & Africa Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Coating Material, 2017-2031

Figure 68: Middle East & Africa Automotive Headlight Coatings Aftermarket Value (US$ Bn) Forecast, by Coating Material, 2017-2031

Figure 69: Middle East & Africa Automotive Headlight Coatings Aftermarket, Incremental Opportunity, by Coating Material, Value (US$ Bn), 2023-2031

Figure 70: Middle East & Africa Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Figure 71: Middle East & Africa Automotive Headlight Coatings Aftermarket Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 72: Middle East & Africa Automotive Headlight Coatings Aftermarket, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 73: Middle East & Africa Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Country, 2017-2031

Figure 74: Middle East & Africa Automotive Headlight Coatings Aftermarket Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 75: Middle East & Africa Automotive Headlight Coatings Aftermarket, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 76: South America Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Light Type, 2017-2031

Figure 77: South America Automotive Headlight Coatings Aftermarket Value (US$ Bn) Forecast, by Light Type, 2017-2031

Figure 78: South America Automotive Headlight Coatings Aftermarket, Incremental Opportunity, by Light Type, Value (US$ Bn), 2023-2031

Figure 79: South America Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Coating Type, 2017-2031

Figure 80: South America Automotive Headlight Coatings Aftermarket Value (US$ Bn) Forecast, by Coating Type, 2017-2031

Figure 81: South America Automotive Headlight Coatings Aftermarket, Incremental Opportunity, by Coating Type, Value (US$ Bn), 2023-2031

Figure 82: South America Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Coating Material, 2017-2031

Figure 83: South America Automotive Headlight Coatings Aftermarket Value (US$ Bn) Forecast, by Coating Material, 2017-2031

Figure 84: South America Automotive Headlight Coatings Aftermarket, Incremental Opportunity, by Coating Material, Value (US$ Bn), 2023-2031

Figure 85: South America Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Figure 86: South America Automotive Headlight Coatings Aftermarket Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 87: South America Automotive Headlight Coatings Aftermarket, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 88: South America Automotive Headlight Coatings Aftermarket Volume (Million Units) Forecast, by Country, 2017-2031

Figure 89: South America Automotive Headlight Coatings Aftermarket Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 90: South America Automotive Headlight Coatings Aftermarket, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031