Analysts’ Viewpoint

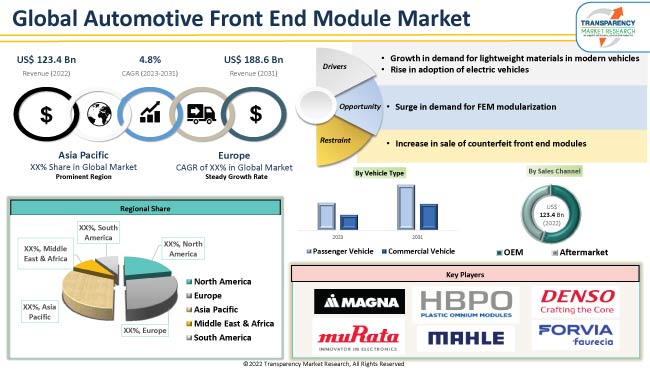

Growth in the automotive sector, increase in demand for commercial and passenger vehicles, and rise in demand for lightweight components in modern vehicles are significantly driving the automotive front end module industry growth. Moreover, increase in demand for electric vehicles and rise in focus on vehicle safety and efficiency are augmenting market expansion.

Manufacturers of automotive front end module are investing in R&D to gain incremental opportunities in the market. Technological advancement in automotive components and rise in application of efficient raw materials to meet safety and comfort requirements in vehicles are key factors fueling market growth. However, increase in sale of counterfeit front end modules is expected to hinder market growth in the near future.

Automotive front end modules are often multi-piece assemblies of numerous parts, including bumpers, crumple zones, air conditioning condensers, radiators, and cooling fans. Vehicle manufacturers outsource these modules to vendors after standardizing front end components such as radiators, headlights, crumple zones, and cooling fan assemblies. This has assisted in lowering the overall cost of manufacturing a vehicle by reducing the setup and maintenance cost of assembly lines.

A key driver of market growth is the rise in demand for FEM modularization and increase in need for original equipment manufacturers to modularize and outsource front end automotive modules in order to save time and money. Additionally, increase in government mandates and regulations relating to fuel economy and emissions are fueling automotive front end module market development in the near future.

Usage of lightweight composites as structural carriers for FEMs in place of steel and iron has been increasing for the last few years due to a greater emphasis on reducing the weight of vehicles. The need for lightweight materials from the automotive industry has significantly increased in the last ten years. Safety features of vehicles are gaining traction among consumers. Rise in sale of passenger and commercial vehicles is expected to drive the global market for automotive front end module during the forecast period.

Furthermore, rise in popularity of electric vehicles is the key factor influencing the demand for FEMs in vehicles. Increase in sale of electric components, such as advanced electronics and sensory equipment, is likely to fuel market dynamics in the near future.

Modularization is the process of producing the entire front end of a vehicle separately with the help of other vendors. Modularization helps vehicle manufacturers save money, time, and labor during the manufacturing process. In the past, OEMs used to manufacture every FEM component on an assembly line, which was laborious and time-consuming. However, the introduction of modularization has made it possible for OEMs to reduce these expenses and choose to outsource these tasks.

In comparison to the conventional front end techniques, modularization enables OEMs to save around 20% to 30% of costs. Material, color, and finish can all be used to differentiate models from one another. Additionally, FEMs can be incorporated late in the assembly process, which aids automakers in improving assembly line ergonomics by cutting down on the amount of time needed to build vehicle components.

Growth in sale of passenger vehicles worldwide is expected to drive the global market during the forecast period. Demand for SUVs is rising across the globe. This factor is also contributing to the growth of the passenger vehicle segment. Furthermore, the passenger vehicle segment is growing because of the rise in spending capacity of consumers in several regions.

The OEM sales channels segment is anticipated to dominate the global market during the forecast period. Increase in focus of OEMs toward modularization and reduction of vehicle curb weight in order to improve fuel efficiency is augmenting market expansion.

According to the latest automotive front end module market research analysis, Asia Pacific is estimated to lead the global industry during the forecast period. The automotive front end module market demand in Asia Pacific is expected to increase in the near future, owing to growth in the automobile industry and rapid expansion of the manufacturing sector in the region.

Moreover, rise in production of electric vehicles in the region is also fueling the automotive front end module market growth in the region. Demand for FEMs is increasing significantly in China and India. Furthermore, increase in disposable income and surge in demand for safety features in vehicles are contributing to the market progress in Asia Pacific.

The automotive front end module market size in Europe is anticipated to increase in the near future, owing to the rise in demand for electric vehicles in the region. Strong presence of several OEMs in the region is also fueling market statistics.

Vehicle manufacturers strive consistently to stay ahead of the competition and to acquire major automotive front end module market share. They are focusing on new product development and investing in R&D. As per the latest automotive front end module market forecast, key players are implementing strategies including expansion of product portfolios, mergers, partnerships, and acquisitions.

Some of the major players identified in the automotive front end module market across the globe are Magna International, MAHLE GmbH, Murata Manufacturing Co., Ltd., Faurecia SA, Denso Corporation, Calsonic Kansei Corporation, HBPO Group, Plastic Omnium, Hyundai Mobis, Samvardhana Motherson Group, Valeo, Flex-N-Gate Corporation, RTP Company, and SL Corporation. These players are following the automotive front end module market trends to gain revenue opportunities.

Key players have been profiled in the automotive front end module market report based on parameters such as financial overview, company overview, business strategies, product portfolio, latest developments, and business segments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 123.4 Bn |

|

Market Forecast Value in 2031 |

US$ 188.6 Bn |

|

Growth Rate (CAGR) |

4.8% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2022 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 123.4 Bn in 2022.

It is expected to grow at a CAGR of 4.8% by 2031.

It would be worth US$ 188.6 Bn in 2031

Growth in demand for lightweight materials in modern vehicles and rise in sale of electric vehicles.

Based on vehicle type, the passenger vehicle segment accounted for major share in 2022.

Asia Pacific was the most lucrative region in 2022.

Magna International, MAHLE GmbH, Murata Manufacturing Co., Ltd., Faurecia SA, Denso Corporation, Calsonic Kansei Corporation, HBPO Group, Plastic Omnium, Hyundai Mobis, Samvardhana Motherson Group, Valeo, Flex-N-Gate Corporation, RTP Company, and SL Corporation.

1. Global Automotive Front End Module Market - Executive Summary

1.1. Market Volume Thousand Units, Size, US$ Bn, 2017-2031

1.2. Market Analysis and Key Segment Analysis

1.3. Key Facts & Figures

1.4. TMR Analysis and Recommendations

2. Go to Market Strategy

2.1. Demand & Supply Side Trends

2.1.1. GAP Analysis

2.2. Identification of Potential Market Spaces

2.3. Understanding the Buying Process of the Customers

2.4. Preferred Sales & Marketing Strategy

3. Market Overview

3.1. Macro-economic Factors

3.2. Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunity

3.2.4. Impact Analysis of Drivers and Restraints

3.3. Market Factor Analysis

3.3.1. Porter’s Five Force Analysis

3.3.2. PESTEL Analysis

3.3.3. Value Chain Analysis

3.3.3.1. List of Key Manufacturers

3.3.3.2. List of Customers

3.3.3.3. Level of Integration

3.3.4. SWOT Analysis

3.4. Impact Factors

3.4.1. Rise in demand for light weight vehicles

3.4.2. Rise in production of vehicle

3.4.3. Enactment of stringent emission norms across the globe

3.5. Key Trend Analysis

3.5.1. Technology/ Product Trend

4. Global Automotive Front End Module Market, by Type

4.1. Market Snapshot

4.1.1. Introduction & Definition

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Automotive Front End Module Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Type

4.2.1. Forward Lighting

4.2.2. Radiator and Cooling Fan

4.2.3. Condenser

4.2.4. Grill Opening Panel

4.2.5. Bumper

4.2.6. Fender

4.2.7. Horn Assembly

4.2.8. Others

5. Global Automotive Front End Module Market, by Material

5.1. Market Snapshot

5.1.1. Introduction & Definition

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Automotive Front End Module Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Material

5.2.1. Steel

5.2.2. Pelletized Long Fiber Polypropylene

5.2.3. Plastic

5.2.4. Glass Mat Thermoplastic (GMT)

5.2.5. Others

6. Global Automotive Front End Module Market, by Vehicle Type

6.1. Market Snapshot

6.1.1. Introduction & Definition

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Automotive Front End Module Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Vehicle Type

6.2.1. Passenger Vehicle

6.2.1.1. Hatchback

6.2.1.2. Sedan

6.2.1.3. Utility Vehicle

6.2.2. Commercial Vehicle

6.2.2.1. Light Commercial Vehicle

6.2.2.2. Heavy Commercial Vehicle

7. Global Automotive Front End Module Market, by Sales Channel

7.1. Market Snapshot

7.1.1. Introduction & Definition

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Automotive Front End Module Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Sales Channel

7.2.1. OEM

7.2.2. Aftermarket

8. Global Automotive Front End Module Market, by Region

8.1. Market Snapshot

8.1.1. Introduction & Definition

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Automotive Front End Module Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Region

8.2.1. North America

8.2.2. Latin America

8.2.3. Europe

8.2.4. Asia Pacific

8.2.5. Middle East & Africa

9. North America Automotive Front End Module Market

9.1. Market Snapshot

9.2. Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Type

9.2.1. Forward Lighting

9.2.2. Radiator and Cooling Fan

9.2.3. Condenser

9.2.4. Grill Opening Panel

9.2.5. Bumper

9.2.6. Fender

9.2.7. Horn Assembly

9.2.8. Others

9.3. Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Material

9.3.1. Steel

9.3.2. Pelletized Long Fiber Polypropylene

9.3.3. Plastic

9.3.4. Glass Mat Thermoplastic (GMT)

9.3.5. Others

9.4. Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Vehicle Type

9.4.1. Passenger Vehicle

9.4.1.1. Hatchback

9.4.1.2. Sedan

9.4.1.3. Utility Vehicle

9.4.2. Commercial Vehicle

9.4.2.1. Light Commercial Vehicle

9.4.2.2. Heavy Commercial Vehicle

9.5. Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Sales Channel

9.5.1. OEM

9.5.2. Aftermarket

9.6. Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Country

9.6.1. U. S.

9.6.2. Canada

10. Europe Automotive Front End Module Market

10.1. Market Snapshot

10.2. Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Type

10.2.1. Forward Lighting

10.2.2. Radiator and Cooling Fan

10.2.3. Condenser

10.2.4. Grill Opening Panel

10.2.5. Bumper

10.2.6. Fender

10.2.7. Horn Assembly

10.2.8. Others

10.3. Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Material

10.3.1. Steel

10.3.2. Pelletized Long Fiber Polypropylene

10.3.3. Plastic

10.3.4. Glass Mat Thermoplastic (GMT)

10.3.5. Others

10.4. Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Vehicle Type

10.4.1. Passenger Vehicle

10.4.1.1. Hatchback

10.4.1.2. Sedan

10.4.1.3. Utility Vehicle

10.4.2. Commercial Vehicle

10.4.2.1. Light Commercial Vehicle

10.4.2.2. Heavy Commercial Vehicle

10.5. Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Sales Channel

10.5.1. OEM

10.5.2. Aftermarket

10.6. Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Country

10.6.1. Germany

10.6.2. U. K.

10.6.3. France

10.6.4. Italy

10.6.5. Spain

10.6.6. East Europe

10.6.7. Rest of Europe

11. Asia Pacific Automotive Front End Module Market

11.1. Market Snapshot

11.2. Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Type

11.2.1. Forward Lighting

11.2.2. Radiator and Cooling Fan

11.2.3. Condenser

11.2.4. Grill Opening Panel

11.2.5. Bumper

11.2.6. Fender

11.2.7. Horn Assembly

11.2.8. Others

11.3. Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Material

11.3.1. Steel

11.3.2. Pelletized Long Fiber Polypropylene

11.3.3. Plastic

11.3.4. Glass Mat Thermoplastic (GMT)

11.3.5. Others

11.4. Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Vehicle Type

11.4.1. Passenger Vehicle

11.4.1.1. Hatchback

11.4.1.2. Sedan

11.4.1.3. Utility Vehicle

11.4.2. Commercial Vehicle

11.4.2.1. Light Commercial Vehicle

11.4.2.2. Heavy Commercial Vehicle

11.5. Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Sales Channel

11.5.1. OEM

11.5.2. Aftermarket

11.6. Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Country

11.6.1. China

11.6.2. India

11.6.3. Japan

11.6.4. South Korea

11.6.5. ASEAN

11.6.6. Rest of Asia Pacific

12. Middle East & Africa Automotive Front End Module Market

12.1. Market Snapshot

12.2. Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Type

12.2.1. Forward Lighting

12.2.2. Radiator and Cooling Fan

12.2.3. Condenser

12.2.4. Grill Opening Panel

12.2.5. Bumper

12.2.6. Fender

12.2.7. Horn Assembly

12.2.8. Others

12.3. Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Material

12.3.1. Steel

12.3.2. Pelletized Long Fiber Polypropylene

12.3.3. Plastic

12.3.4. Glass Mat Thermoplastic (GMT)

12.3.5. Others

12.4. Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Vehicle Type

12.4.1. Passenger Vehicle

12.4.1.1. Hatchback

12.4.1.2. Sedan

12.4.1.3. Utility Vehicle

12.4.2. Commercial Vehicle

12.4.2.1. Light Commercial Vehicle

12.4.2.2. Heavy Commercial Vehicle

12.5. Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Sales Channel

12.5.1. OEM

12.5.2. Aftermarket

12.6. Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Country

12.6.1. GCC

12.6.2. Turkey

12.6.3. South Africa

12.6.4. Rest of Middle East & Africa

13. Latin America Automotive Front End Module Market

13.1. Market Snapshot

13.2. Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Type

13.2.1. Forward Lighting

13.2.2. Radiator and Cooling Fan

13.2.3. Condenser

13.2.4. Grill Opening Panel

13.2.5. Bumper

13.2.6. Fender

13.2.7. Horn Assembly

13.2.8. Others

13.3. Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Material

13.3.1. Steel

13.3.2. Pelletized Long Fiber Polypropylene

13.3.3. Plastic

13.3.4. Glass Mat Thermoplastic (GMT)

13.3.5. Others

13.4. Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Vehicle Type

13.4.1. Passenger Vehicle

13.4.1.1. Hatchback

13.4.1.2. Sedan

13.4.1.3. Utility Vehicle

13.4.2. Commercial Vehicle

13.4.2.1. Light Commercial Vehicle

13.4.2.2. Heavy Commercial Vehicle

13.5. Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Sales Channel

13.5.1. OEM

13.5.2. Aftermarket

13.6. Market Volume (Thousand Units), Value (US$ Bn) Analysis & Forecast, 2017-2031, by Country

13.6.1. Brazil

13.6.2. Mexico

13.6.3. Rest of Latin America

14. Competition Assessment

14.1. Global Target Market Competition - a Dashboard View

14.2. Global Target Market Structure Analysis

14.3. Global Target Market Company Share Analysis

14.3.1. For Tier 1 Market Players, 2022

15. Company Profile

15.1. Competition Landscape

15.1.1. Company Overview

15.1.2. Company Footprints

15.1.3. Product Portfolio

15.1.4. Strategy Overview

15.1.5. Recent Developments

15.1.6. Financial Analysis

15.1.7. Revenue Share

15.1.8. Executive Bios

15.2. Company Profile

15.2.1. Magna International

15.2.1.1. Company Overview

15.2.1.2. Company Footprints

15.2.1.3. Product Portfolio

15.2.1.4. Strategy Overview

15.2.1.5. Recent Developments

15.2.1.6. Financial Analysis

15.2.1.7. Revenue Share

15.2.1.8. Executive Bios

15.2.2. MAHLE GmbH

15.2.2.1. Company Overview

15.2.2.2. Company Footprints

15.2.2.3. Product Portfolio

15.2.2.4. Strategy Overview

15.2.2.5. Recent Developments

15.2.2.6. Financial Analysis

15.2.2.7. Revenue Share

15.2.2.8. Executive Bios

15.2.3. Murata Manufacturing Co., Ltd

15.2.3.1. Company Overview

15.2.3.2. Company Footprints

15.2.3.3. Product Portfolio

15.2.3.4. Strategy Overview

15.2.3.5. Recent Developments

15.2.3.6. Financial Analysis

15.2.3.7. Revenue Share

15.2.3.8. Executive Bios

15.2.4. Faurecia SA

15.2.4.1. Company Overview

15.2.4.2. Company Footprints

15.2.4.3. Product Portfolio

15.2.4.4. Strategy Overview

15.2.4.5. Recent Developments

15.2.4.6. Financial Analysis

15.2.4.7. Revenue Share

15.2.4.8. Executive Bios

15.2.5. Denso Corporation

15.2.5.1. Company Overview

15.2.5.2. Company Footprints

15.2.5.3. Product Portfolio

15.2.5.4. Strategy Overview

15.2.5.5. Recent Developments

15.2.5.6. Financial Analysis

15.2.5.7. Revenue Share

15.2.5.8. Executive Bios

15.2.6. Calsonic Kansei Corporation

15.2.6.1. Company Overview

15.2.6.2. Company Footprints

15.2.6.3. Product Portfolio

15.2.6.4. Strategy Overview

15.2.6.5. Recent Developments

15.2.6.6. Financial Analysis

15.2.6.7. Revenue Share

15.2.6.8. Executive Bios

15.2.7. HBPO Group

15.2.7.1. Company Overview

15.2.7.2. Company Footprints

15.2.7.3. Product Portfolio

15.2.7.4. Strategy Overview

15.2.7.5. Recent Developments

15.2.7.6. Financial Analysis

15.2.7.7. Revenue Share

15.2.7.8. Executive Bios

15.2.8. Plastic Omnium

15.2.8.1. Company Overview

15.2.8.2. Company Footprints

15.2.8.3. Product Portfolio

15.2.8.4. Strategy Overview

15.2.8.5. Recent Developments

15.2.8.6. Financial Analysis

15.2.8.7. Revenue Share

15.2.8.8. Executive Bios

15.2.9. Hyundai Mobis

15.2.9.1. Company Overview

15.2.9.2. Company Footprints

15.2.9.3. Product Portfolio

15.2.9.4. Strategy Overview

15.2.9.5. Recent Developments

15.2.9.6. Financial Analysis

15.2.9.7. Revenue Share

15.2.9.8. Executive Bios

15.2.10. Samvardhana Motherson Group

15.2.10.1. Company Overview

15.2.10.2. Company Footprints

15.2.10.3. Product Portfolio

15.2.10.4. Strategy Overview

15.2.10.5. Recent Developments

15.2.10.6. Financial Analysis

15.2.10.7. Revenue Share

15.2.10.8. Executive Bios

15.2.11. Valeo

15.2.11.1. Company Overview

15.2.11.2. Company Footprints

15.2.11.3. Product Portfolio

15.2.11.4. Strategy Overview

15.2.11.5. Recent Developments

15.2.11.6. Financial Analysis

15.2.11.7. Revenue Share

15.2.11.8. Executive Bios

15.2.12. Flex-N-Gate Corporation

15.2.12.1. Company Overview

15.2.12.2. Company Footprints

15.2.12.3. Product Portfolio

15.2.12.4. Strategy Overview

15.2.12.5. Recent Developments

15.2.12.6. Financial Analysis

15.2.12.7. Revenue Share

15.2.12.8. Executive Bios

15.2.13. RTP Company

15.2.13.1. Company Overview

15.2.13.2. Company Footprints

15.2.13.3. Product Portfolio

15.2.13.4. Strategy Overview

15.2.13.5. Recent Developments

15.2.13.6. Financial Analysis

15.2.13.7. Revenue Share

15.2.13.8. Executive Bios

15.2.14. SL Corporation

15.2.14.1. Company Overview

15.2.14.2. Company Footprints

15.2.14.3. Product Portfolio

15.2.14.4. Strategy Overview

15.2.14.5. Recent Developments

15.2.14.6. Financial Analysis

15.2.14.7. Revenue Share

15.2.14.8. Executive Bios

16. Key Takeaways

16.1. Market Attractiveness Opportunity

16.2. Manufacturer’s Perspective

List of Tables

Table 1: Global Automotive Front End Module Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Table 2: Global Automotive Front End Module Market Value (US$ Bn) Forecast, by Type, 2017-2031

Table 3: Global Automotive Front End Module Market Volume (Thousand Units) Forecast, by Material, 2017-2031

Table 4: Global Automotive Front End Module Market Value (US$ Bn) Forecast, by Material, 2017-2031

Table 5: Global Automotive Front End Module Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 6: Global Automotive Front End Module Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 7: Global Automotive Front End Module Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 8: Global Automotive Front End Module Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 9: Global Automotive Front End Module Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Table 10: Global Automotive Front End Module Market Value (US$ Bn) Forecast, by Region, 2017-2031

Table 11: North America Automotive Front End Module Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Table 12: North America Automotive Front End Module Market Value (US$ Bn) Forecast, by Type, 2017-2031

Table 13: North America Automotive Front End Module Market Volume (Thousand Units) Forecast, by Material, 2017-2031

Table 14: North America Automotive Front End Module Market Value (US$ Bn) Forecast, by Material, 2017-2031

Table 15: North America Automotive Front End Module Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 16: North America Automotive Front End Module Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 17: North America Automotive Front End Module Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 18: North America Automotive Front End Module Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 19: North America Automotive Front End Module Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 20: North America Automotive Front End Module Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 21: Europe Automotive Front End Module Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Table 22: Europe Automotive Front End Module Market Value (US$ Bn) Forecast, by Type, 2017-2031

Table 23: Europe Automotive Front End Module Market Volume (Thousand Units) Forecast, by Material, 2017-2031

Table 24: Europe Automotive Front End Module Market Value (US$ Bn) Forecast, by Material, 2017-2031

Table 25: Europe Automotive Front End Module Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 26: Europe Automotive Front End Module Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 27: Europe Automotive Front End Module Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 28: Europe Automotive Front End Module Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 29: Europe Automotive Front End Module Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 30: Europe Automotive Front End Module Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 31: Asia Pacific Automotive Front End Module Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Table 32: Asia Pacific Automotive Front End Module Market Value (US$ Bn) Forecast, by Type, 2017-2031

Table 33: Asia Pacific Automotive Front End Module Market Volume (Thousand Units) Forecast, by Material, 2017-2031

Table 34: Asia Pacific Automotive Front End Module Market Value (US$ Bn) Forecast, by Material, 2017-2031

Table 35: Asia Pacific Automotive Front End Module Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 36: Asia Pacific Automotive Front End Module Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 37: Asia Pacific Automotive Front End Module Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 38: Asia Pacific Automotive Front End Module Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 39: Asia Pacific Automotive Front End Module Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 40: Asia Pacific Automotive Front End Module Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 41: Middle East & Africa Automotive Front End Module Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Table 42: Middle East & Africa Automotive Front End Module Market Value (US$ Bn) Forecast, by Type, 2017-2031

Table 43: Middle East & Africa Automotive Front End Module Market Volume (Thousand Units) Forecast, by Material, 2017-2031

Table 44: Middle East & Africa Automotive Front End Module Market Value (US$ Bn) Forecast, by Material, 2017-2031

Table 45: Middle East & Africa Automotive Front End Module Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 46: Middle East & Africa Automotive Front End Module Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 47: Middle East & Africa Automotive Front End Module Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 48: Middle East & Africa Automotive Front End Module Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 49: Middle East & Africa Automotive Front End Module Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 50: Middle East & Africa Automotive Front End Module Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 51: Latin America Automotive Front End Module Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Table 52: Latin America Automotive Front End Module Market Value (US$ Bn) Forecast, by Type, 2017-2031

Table 53: Latin America Automotive Front End Module Market Volume (Thousand Units) Forecast, by Material, 2017-2031

Table 54: Latin America Automotive Front End Module Market Value (US$ Bn) Forecast, by Material, 2017-2031

Table 55: Latin America Automotive Front End Module Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 56: Latin America Automotive Front End Module Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 57: Latin America Automotive Front End Module Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 58: Latin America Automotive Front End Module Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 59: Latin America Automotive Front End Module Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 60: Latin America Automotive Front End Module Market Value (US$ Bn) Forecast, by Country, 2017-2031

List of Figures

Figure 1: Global Automotive Front End Module Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Figure 2: Global Automotive Front End Module Market Value (US$ Bn) Forecast, by Type, 2017-2031

Figure 3: Global Automotive Front End Module Market, Incremental Opportunity, by Type, Value (US$ Bn), 2022-2031

Figure 4: Global Automotive Front End Module Market Volume (Thousand Units) Forecast, by Material, 2017-2031

Figure 5: Global Automotive Front End Module Market Value (US$ Bn) Forecast, by Material, 2017-2031

Figure 6: Global Automotive Front End Module Market, Incremental Opportunity, by Material, Value (US$ Bn), 2022-2031

Figure 7: Global Automotive Front End Module Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 8: Global Automotive Front End Module Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 9: Global Automotive Front End Module Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 10: Global Automotive Front End Module Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 11: Global Automotive Front End Module Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 12: Global Automotive Front End Module Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 13: Global Automotive Front End Module Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Figure 14: Global Automotive Front End Module Market Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 15: Global Automotive Front End Module Market, Incremental Opportunity, by Region, Value (US$ Bn), 2022-2031

Figure 16: North America Automotive Front End Module Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Figure 17: North America Automotive Front End Module Market Value (US$ Bn) Forecast, by Type, 2017-2031

Figure 18: North America Automotive Front End Module Market, Incremental Opportunity, by Type, Value (US$ Bn), 2022-2031

Figure 19: North America Automotive Front End Module Market Volume (Thousand Units) Forecast, by Material, 2017-2031

Figure 20: North America Automotive Front End Module Market Value (US$ Bn) Forecast, by Material, 2017-2031

Figure 21: North America Automotive Front End Module Market, Incremental Opportunity, by Material, Value (US$ Bn), 2022-2031

Figure 22: North America Automotive Front End Module Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 23: North America Automotive Front End Module Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 24: North America Automotive Front End Module Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 25: North America Automotive Front End Module Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 26: North America Automotive Front End Module Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 27: North America Automotive Front End Module Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 28: North America Automotive Front End Module Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 29: North America Automotive Front End Module Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 30: North America Automotive Front End Module Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 31: Europe Automotive Front End Module Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Figure 32: Europe Automotive Front End Module Market Value (US$ Bn) Forecast, by Type, 2017-2031

Figure 33: Europe Automotive Front End Module Market, Incremental Opportunity, by Type, Value (US$ Bn), 2022-2031

Figure 34: Europe Automotive Front End Module Market Volume (Thousand Units) Forecast, by Material, 2017-2031

Figure 35: Europe Automotive Front End Module Market Value (US$ Bn) Forecast, by Material, 2017-2031

Figure 36: Europe Automotive Front End Module Market, Incremental Opportunity, by Material, Value (US$ Bn), 2022-2031

Figure 37: Europe Automotive Front End Module Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 38: Europe Automotive Front End Module Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 39: Europe Automotive Front End Module Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 40: Europe Automotive Front End Module Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 41: Europe Automotive Front End Module Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 42: Europe Automotive Front End Module Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 43: Europe Automotive Front End Module Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 44: Europe Automotive Front End Module Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 45: Europe Automotive Front End Module Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 46: Asia Pacific Automotive Front End Module Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Figure 47: Asia Pacific Automotive Front End Module Market Value (US$ Bn) Forecast, by Type, 2017-2031

Figure 48: Asia Pacific Automotive Front End Module Market, Incremental Opportunity, by Type, Value (US$ Bn), 2022-2031

Figure 49: Asia Pacific Automotive Front End Module Market Volume (Thousand Units) Forecast, by Material, 2017-2031

Figure 50: Asia Pacific Automotive Front End Module Market Value (US$ Bn) Forecast, by Material, 2017-2031

Figure 51: Asia Pacific Automotive Front End Module Market, Incremental Opportunity, by Material, Value (US$ Bn), 2022-2031

Figure 52: Asia Pacific Automotive Front End Module Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 53: Asia Pacific Automotive Front End Module Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 54: Asia Pacific Automotive Front End Module Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 55: Asia Pacific Automotive Front End Module Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 56: Asia Pacific Automotive Front End Module Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 57: Asia Pacific Automotive Front End Module Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 58: Asia Pacific Automotive Front End Module Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 59: Asia Pacific Automotive Front End Module Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 60: Asia Pacific Automotive Front End Module Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 61: Middle East & Africa Automotive Front End Module Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Figure 62: Middle East & Africa Automotive Front End Module Market Value (US$ Bn) Forecast, by Type, 2017-2031

Figure 63: Middle East & Africa Automotive Front End Module Market, Incremental Opportunity, by Type, Value (US$ Bn), 2022-2031

Figure 64: Middle East & Africa Automotive Front End Module Market Volume (Thousand Units) Forecast, by Material, 2017-2031

Figure 65: Middle East & Africa Automotive Front End Module Market Value (US$ Bn) Forecast, by Material, 2017-2031

Figure 66: Middle East & Africa Automotive Front End Module Market, Incremental Opportunity, by Material, Value (US$ Bn), 2022-2031

Figure 67: Middle East & Africa Automotive Front End Module Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 68: Middle East & Africa Automotive Front End Module Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 69: Middle East & Africa Automotive Front End Module Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 70: Middle East & Africa Automotive Front End Module Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 71: Middle East & Africa Automotive Front End Module Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 72: Middle East & Africa Automotive Front End Module Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 73: Middle East & Africa Automotive Front End Module Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 74: Middle East & Africa Automotive Front End Module Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 75: Middle East & Africa Automotive Front End Module Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 76: Latin America Automotive Front End Module Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Figure 77: Latin America Automotive Front End Module Market Value (US$ Bn) Forecast, by Type, 2017-2031

Figure 78: Latin America Automotive Front End Module Market, Incremental Opportunity, by Type, Value (US$ Bn), 2022-2031

Figure 79: Latin America Automotive Front End Module Market Volume (Thousand Units) Forecast, by Material, 2017-2031

Figure 80: Latin America Automotive Front End Module Market Value (US$ Bn) Forecast, by Material, 2017-2031

Figure 81: Latin America Automotive Front End Module Market, Incremental Opportunity, by Material, Value (US$ Bn), 2022-2031

Figure 82: Latin America Automotive Front End Module Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 83: Latin America Automotive Front End Module Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 84: Latin America Automotive Front End Module Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 85: Latin America Automotive Front End Module Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 86: Latin America Automotive Front End Module Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 87: Latin America Automotive Front End Module Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 88: Latin America Automotive Front End Module Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 89: Latin America Automotive Front End Module Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 90: Latin America Automotive Front End Module Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031