Analysts’ Viewpoint

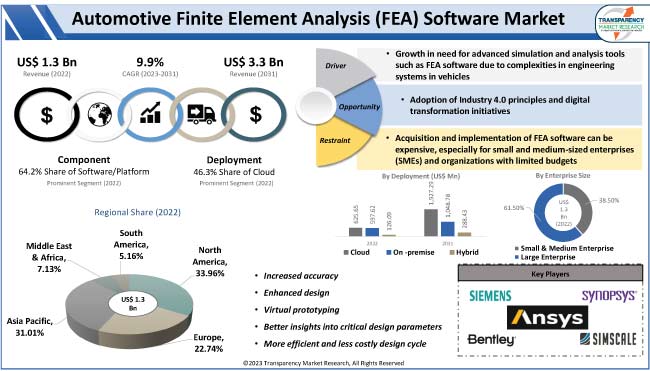

Growth in need for advanced simulation and analysis tools such as FEA software due to complexities involved in engineering systems in vehicles is augmenting the global automotive finite element analysis (FEA) software market size. Companies are increasingly integrating FEA into their digital workflows for automated and data-driven decision-making. Surge in demand for lightweight vehicles and rise in adoption of electric and hybrid vehicles are also augmenting market progress.

Key automotive finite element analysis (FEA) software market players are focusing on providing customers with cost-effective, safe, and cutting-edge product portfolio. In line with the latest automotive finite element analysis (FEA) software market trends, leading players are integrating artificial intelligence and machine learning capabilities in their software platforms to provide more efficient and scalable simulations. They are also harnessing big data for accurate modeling and predictive analytics.

Finite Element Analysis (FEA) software plays an important role in design and development of modern vehicles, enabling engineers to simulate and analyze complex structural and mechanical behaviors. Increase in demand for lightweight, fuel-efficient, and safe automobiles has made FEA software indispensable in optimizing vehicle designs, reducing development costs, and accelerating time-to-market.

Automotive FEA software helps assess crashworthiness, structural integrity, and various performance parameters, making it an essential tool for automakers and suppliers seeking to create cutting-edge vehicles that meet stringent regulatory standards and consumer expectations.

Advancements in materials, manufacturing processes, and vehicle design in the automotive sector are fueling the automotive finite element analysis (FEA) software market value. Manufacturers are increasingly relying on FEA tools to enhance the structural and functional aspects of vehicles, from electric cars to autonomous vehicles.

The FEA software is expected to play a vital role in addressing sustainability concerns by facilitating the development of eco-friendly vehicles and exploring innovative engineering solutions. Continuous demand for safer and fuel efficient vehicles is also fostering market expansion.

Weight reduction has become a critical objective to improve fuel efficiency, reduce emissions, and enhance overall vehicle performance. FEA software enables automakers to conduct comprehensive simulations and analysis of vehicle components and structure, allowing them to optimize designs by strategically reducing weight while maintaining safety and performance standards.

Light weighting is especially relevant in the context of electric and hybrid vehicles, where reducing weight directly contributes to extended battery range and improved efficiency. FEA software plays a vital role in assessing materials and structural designs for these advanced powertrains.

The automotive sector is undergoing a fundamental shift toward electrification. FEA software is instrumental in optimizing vehicle structure to accommodate large battery packs and electric propulsion systems. This dynamic aligns with the ongoing transition toward cleaner and more sustainable transportation. FEA software providers are well-positioned to cater to the evolving needs of automakers striving to develop lightweight and energy-efficient vehicles for the future.

Thus, increase in demand for lightweight vehicles is a significant factor fueling the global automotive finite element analysis (FEA) software market development.

Automakers are facing the unique challenge of designing and optimizing EHVs, as the automotive sector continues to shift toward electrification in order to meet environmental regulations and consumer demand for cleaner and more energy-efficient transportation. FEA software allows manufacturers to simulate and analyze the structural and mechanical behaviors of electric vehicle components, including battery systems and electric drivetrains.

EHVs often require substantial re-engineering of vehicle structure to accommodate batteries, electric motors, and related components. FEA software provides automakers with the tools needed to optimize vehicle architecture, ensuring that electric and hybrid vehicles meet safety, performance, and structural integrity standards. Thus, significant increase in adoption of electric and hybrid vehicles (EHVs) is augmenting market statistics.

According to the latest automotive finite element analysis (FEA) market segmentation, nonlinear software platforms lead the global industry in terms of component due to their ability to address intricate and complex challenges in the automotive sector.

The automotive sector is characterized by a wide range of nonlinear behaviors such as material deformation, contact interactions, and structural instability. Nonlinear FEA software excels at capturing these phenomena, enabling engineers to conduct more realistic simulations and analyses. This capability is vital for ensuring safety, durability, and optimal performance of vehicles, particularly in scenarios such as crash testing and dynamic load assessments, which demand a nonlinear approach.

Adoption of advanced materials, such as composites and high-strength alloys, in vehicle components has increased significantly. These materials often exhibit nonlinear properties. Nonlinear FEA software allows automakers to assess the behavior of these materials, leading to the development of lightweight, yet structurally sound, automotive structures.

In the era of electric and hybrid vehicles, where battery systems and electric powertrains introduce additional complexities, nonlinear FEA software is indispensable for modelling the behavior of these components under various operating conditions.

Cloud-based deployment dominates the global automotive finite element analysis (FEA) software market, as cloud-based FEA software offers the advantage of scalability. This enables automotive companies to flexibly adjust their computational resources according to project requirements. This is particularly advantageous for large-scale simulations and analyses, which often demand significant computational power.

Cloud deployment allows automotive firms to access these resources on-demand, thereby reducing infrastructure costs and ensuring that they can undertake complex FEA tasks efficiently and cost-effectively.

Cloud-based FEA software promotes collaboration and accessibility. Automotive design and engineering teams are often distributed across different locations and time zones. Cloud-based solutions provide a centralized platform accessible from anywhere with an internet connection, allowing teams to collaborate seamlessly on FEA projects. This leads to increased productivity, faster decision-making, and reduced project turnaround times. Furthermore, it facilitates access to the software for smaller automotive companies or start-ups that may not have the resources for on-premises infrastructure, thus democratizing access to advanced FEA capabilities.

North America is a prominent market for FEA software, owing to the presence of a robust automotive industry and strong emphasis on innovation and safety. The U.S., in particular, hosts several major automotive manufacturers and suppliers that rely on FEA software for product development and compliance with strict safety regulations. Growth in adoption of electric and autonomous vehicles in North America is also driving the demand for FEA software, as these technologies require thorough simulation and analysis.

Asia Pacific follows North America in terms of automotive finite element analysis (FEA) software market share. The automotive industry in China has experienced rapid growth and transformation over the years. Currently, the country is the largest automotive market in the world, with significant number of domestic automakers and manufacturers. As these companies expand and strive to meet global standards in vehicle safety and performance, they rely on advanced FEA software to facilitate the design and testing of their products. This surge in domestic demand for FEA software solutions has contributed significantly to China's dominant market position.

The automotive finite element analysis (FEA) software market demand is also high in Europe, primarily due to the region's focus on high-quality vehicle manufacturing and commitment to environmental standards.

Germany, home to some of the world's most renowned automotive manufacturers, plays a central role in the market in Europe. Automotive companies in the region rely on FEA software to optimize vehicle designs, improve crashworthiness, and meet strict emissions regulations.

The global automotive finite element analysis (FEA) software market is consolidated, with the presence of several manufacturers. Leading players possess the potential to increase the pace of growth through adoption of newer and advanced technologies.

Expansion of service offerings and mergers and acquisitions are key strategies adopted by the prominent companies. The global business is poised for further growth and technological advancements with continuous push for innovation and adoption of digital twin technologies. These advancements enhance performance, efficiency, and reliability, providing a competitive edge to market players.

Prominent automotive finite element analysis (FEA) software companies operating across the globe are Autodesk, Inc., ANSYS, Synopsys, Inc., COMSOL Multiphysics, Dassault Systèmes SE, Altair Engineering Inc., Aspen Technology, Murata Software Co., Ltd., Siemens PLM Software, Inc., PTC Inc., SimScale, MSC Software Corporation, BETA CAE Systems, and Vanderplaats R&D, Inc.

Each of these players has been profiled in the global automotive finite element analysis (FEA) software market report based on parameters such as company overview, business strategies, financial overview, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 | US$ 1.3 Bn |

| Market Forecast Value in 2031 | US$ 3.3 Bn |

| Growth Rate (CAGR) | 9.9% |

| Forecast Period | 2023-2031 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes cross-segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profile |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 1.3 Bn in 2022

It is anticipated to advance at a CAGR of 9.9% from 2023 to 2031

It would be worth US$ 3.3 Bn by 2031

The cloud segment is likely to account for significant share during the forecast period

North America is a highly lucrative region across the globe

Autodesk, Inc., ANSYS, Synopsys, Inc., COMSOL Multiphysics, Dassault Systèmes SE, Altair Engineering Inc., Aspen Technology, Murata Software Co., Ltd., Siemens PLM Software, Inc., PTC Inc., SimScale, MSC Software Corporation, BETA CAE Systems, and Vanderplaats R&D, Inc.

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Size, Value in US$ Mn, 2017-2031

1.2. TMR Analysis and Recommendations

1.3. Competitive Dashboard Analysis

2. Go to Market Strategy

2.1. Demand & Supply Side Trends

2.2. Identification of Potential Market Spaces

2.3. Understanding Buying Process of Customers

2.4. Preferred Sales & Marketing Strategy

3. Market Overview

3.1. Market Coverage / Taxonomy

3.2. Market Definition / Scope / Limitations

3.3. Market Dynamics

3.3.1. Drivers

3.3.2. Restraints

3.3.3. Opportunities

3.4. Market Factor Analysis

3.4.1. Porter’s Five Force Analysis

3.4.2. SWOT Analysis

3.5. Value Chain Analysis

3.6. Key Trend Analysis

3.7. End-use Industry Sentiment Analysis

3.7.1. Increase in Spending

3.7.2. Decrease in Spending

3.8. Short-term and Long-term impact on Automotive Finite Element Analysis [FEA] Software Market

3.9. Competitive Scenario

3.9.1. List of Emerging, Prominent, and Leading Players

3.9.2. Major Mergers & Acquisitions, Expansions, Partnerships, Contracts, Deals, Etc.

4. Global Automotive Finite Element Analysis [FEA] Software Market, By Component

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projection

4.1.3. Base Point Share Analysis

4.2. Global Automotive Finite Element Analysis [FEA] Software Market Size & Forecast, 2017-2031, By Component

4.2.1. Software/Platform

4.2.1.1. Nonlinear

4.2.1.2. Complex

4.2.2. Service

4.2.2.1. Professional Service

4.2.2.1.1. Installation & Integration

4.2.2.1.2. Design & Consulting

4.2.2.1.3. Support & Maintenance

4.2.2.2. Managed Service

5. Global Automotive Finite Element Analysis [FEA] Software Market, By Deployment

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projection

5.1.3. Base Point Share Analysis

5.2. Global Automotive Finite Element Analysis [FEA] Software Market Size & Forecast, 2017-2031, By Deployment

5.2.1. Cloud

5.2.2. On-premise

5.2.3. Hybrid

6. Global Automotive Finite Element Analysis [FEA] Software Market, By Enterprise Size

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projection

6.1.3. Base Point Share Analysis

6.2. Global Automotive Finite Element Analysis [FEA] Software Market Size & Forecast, 2017-2031, By Enterprise Size

6.2.1. Small & Medium Enterprise

6.2.2. Large Enterprise

7. Global Automotive Finite Element Analysis [FEA] Software Market, by Region

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projection

7.1.3. Base Point Share Analysis

7.2. Global Automotive Finite Element Analysis [FEA] Software Market Size & Forecast, 2017-2031, By Region

7.2.1. North America

7.2.2. Europe

7.2.3. Asia Pacific

7.2.4. Middle East & Africa

7.2.5. South America

8. North America Automotive Finite Element Analysis [FEA] Software Market

8.1. Market Snapshot

8.2. Automotive Finite Element Analysis [FEA] Software Market Size & Forecast, 2017-2031, By Component

8.2.1. Software/Platform

8.2.1.1. Nonlinear

8.2.1.2. Complex

8.2.2. Service

8.2.2.1. Professional Service

8.2.2.1.1. Installation & Integration

8.2.2.1.2. Design & Consulting

8.2.2.1.3. Support & Maintenance

8.2.2.2. Managed Service

8.3. Automotive Finite Element Analysis [FEA] Software Market Size & Forecast, 2017-2031, By Deployment

8.3.1. Cloud

8.3.2. On-premise

8.3.3. Hybrid

8.4. Automotive Finite Element Analysis [FEA] Software Market Size & Forecast, 2017-2031, By Enterprise Size

8.4.1. Small & Medium Enterprise

8.4.2. Large Enterprise

8.5. Automotive Finite Element Analysis [FEA] Software Market Size & Forecast, 2017-2031, By Country

8.5.1. U. S.

8.5.2. Canada

8.5.3. Mexico

9. Europe Automotive Finite Element Analysis [FEA] Software Market

9.1. Market Snapshot

9.2. Automotive Finite Element Analysis [FEA] Software Market Size & Forecast, 2017-2031, By Component

9.2.1. Software/Platform

9.2.1.1. Nonlinear

9.2.1.2. Complex

9.2.2. Service

9.2.2.1. Professional Service

9.2.2.1.1. Installation & Integration

9.2.2.1.2. Design & Consulting

9.2.2.1.3. Support & Maintenance

9.2.2.2. Managed Service

9.3. Automotive Finite Element Analysis [FEA] Software Market Size & Forecast, 2017-2031, By Deployment

9.3.1. Cloud

9.3.2. On-premise

9.3.3. Hybrid

9.4. Automotive Finite Element Analysis [FEA] Software Market Size & Forecast, 2017-2031, By Enterprise Size

9.4.1. Small & Medium Enterprise

9.4.2. Large Enterprise

9.5. Automotive Finite Element Analysis [FEA] Software Market Size & Forecast, 2017-2031, By Country

9.5.1. Germany

9.5.2. U. K.

9.5.3. France

9.5.4. Italy

9.5.5. Spain

9.5.6. Nordic Countries

9.5.7. Russia & CIS

9.5.8. Rest of Europe

10. Asia Pacific Automotive Finite Element Analysis [FEA] Software Market

10.1. Market Snapshot

10.2. Automotive Finite Element Analysis [FEA] Software Market Size & Forecast, 2017-2031, By Component

10.2.1. Software/Platform

10.2.1.1. Nonlinear

10.2.1.2. Complex

10.2.2. Service

10.2.2.1. Professional Service

10.2.2.1.1. Installation & Integration

10.2.2.1.2. Design & Consulting

10.2.2.1.3. Support & Maintenance

10.2.2.2. Managed Service

10.3. Automotive Finite Element Analysis [FEA] Software Market Size & Forecast, 2017-2031, By Deployment

10.3.1. Cloud

10.3.2. On-premise

10.3.3. Hybrid

10.4. Automotive Finite Element Analysis [FEA] Software Market Size & Forecast, 2017-2031, By Enterprise Size

10.4.1. Small & Medium Enterprise

10.4.2. Large Enterprise

10.5. Automotive Finite Element Analysis [FEA] Software Market Size & Forecast, 2017-2031, By Country

10.5.1. China

10.5.2. India

10.5.3. Japan

10.5.4. ASEAN Countries

10.5.5. South Korea

10.5.6. ANZ

10.5.7. Rest of Asia Pacific

11. Middle East & Africa Automotive Finite Element Analysis [FEA] Software Market

11.1. Market Snapshot

11.2. Automotive Finite Element Analysis [FEA] Software Market Size & Forecast, 2017-2031, By Component

11.2.1. Software/Platform

11.2.1.1. Nonlinear

11.2.1.2. Complex

11.2.2. Service

11.2.2.1. Professional Service

11.2.2.1.1. Installation & Integration

11.2.2.1.2. Design & Consulting

11.2.2.1.3. Support & Maintenance

11.2.2.2. Managed Service

11.3. Automotive Finite Element Analysis [FEA] Software Market Size & Forecast, 2017-2031, By Deployment

11.3.1. Cloud

11.3.2. On-premise

11.3.3. Hybrid

11.4. Automotive Finite Element Analysis [FEA] Software Market Size & Forecast, 2017-2031, By Enterprise Size

11.4.1. Small & Medium Enterprise

11.4.2. Large Enterprise

11.5. Automotive Finite Element Analysis [FEA] Software Market Size & Forecast, 2017-2031, By Country

11.5.1. GCC

11.5.2. South Africa

11.5.3. Turkey

11.5.4. Rest of Middle East & Africa

12. South America Automotive Finite Element Analysis [FEA] Software Market

12.1. Market Snapshot

12.2. Automotive Finite Element Analysis [FEA] Software Market Size & Forecast, 2017-2031, By Component

12.2.1. Software/Platform

12.2.1.1. Nonlinear

12.2.1.2. Complex

12.2.2. Service

12.2.2.1. Professional Service

12.2.2.1.1. Installation & Integration

12.2.2.1.2. Design & Consulting

12.2.2.1.3. Support & Maintenance

12.2.2.2. Managed Service

12.3. Automotive Finite Element Analysis [FEA] Software Market Size & Forecast, 2017-2031, By Deployment

12.3.1. Cloud

12.3.2. On-premise

12.3.3. Hybrid

12.4. Automotive Finite Element Analysis [FEA] Software Market Size & Forecast, 2017-2031, By Enterprise Size

12.4.1. Small & Medium Enterprise

12.4.2. Large Enterprise

12.5. Automotive Finite Element Analysis [FEA] Software Market Size & Forecast, 2017-2031, By Country

12.5.1. Brazil

12.5.2. Argentina

12.5.3. Rest of South America

13. Competitive Landscape

13.1. Company Share Analysis/ Brand Share Analysis, 2022

13.2. Company Analysis for Each Player

Company Overview, Company Footprint, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis

14. Company Profile/Key Players

14.1. ANSYS

14.1.1. Company Overview

14.1.2. Company Footprint

14.1.3. Product Portfolio

14.1.4. Competitors & Customers

14.1.5. Subsidiaries & Parent Organization

14.1.6. Recent Developments

14.1.7. Financial Analysis

14.2. Synopsys, Inc.

14.2.1. Company Overview

14.2.2. Company Footprint

14.2.3. Product Portfolio

14.2.4. Competitors & Customers

14.2.5. Subsidiaries & Parent Organization

14.2.6. Recent Developments

14.2.7. Financial Analysis

14.3. Autodesk, Inc.

14.3.1. Company Overview

14.3.2. Company Footprint

14.3.3. Product Portfolio

14.3.4. Competitors & Customers

14.3.5. Subsidiaries & Parent Organization

14.3.6. Recent Developments

14.3.7. Financial Analysis

14.4. Dassault Systèmes SE

14.4.1. Company Overview

14.4.2. Company Footprint

14.4.3. Product Portfolio

14.4.4. Competitors & Customers

14.4.5. Subsidiaries & Parent Organization

14.4.6. Recent Developments

14.4.7. Financial Analysis

14.5. IBM Corporation

14.5.1. Company Overview

14.5.2. Company Footprint

14.5.3. Product Portfolio

14.5.4. Competitors & Customers

14.5.5. Subsidiaries & Parent Organization

14.5.6. Recent Developments

14.5.7. Financial Analysis

14.6. Altair Engineering Inc.

14.6.1. Company Overview

14.6.2. Company Footprint

14.6.3. Product Portfolio

14.6.4. Competitors & Customers

14.6.5. Subsidiaries & Parent Organization

14.6.6. Recent Developments

14.6.7. Financial Analysis

14.7. Aspen Technology

14.7.1. Company Overview

14.7.2. Company Footprint

14.7.3. Product Portfolio

14.7.4. Competitors & Customers

14.7.5. Subsidiaries & Parent Organization

14.7.6. Recent Developments

14.7.7. Financial Analysis

14.8. Siemens PLM Software, Inc.

14.8.1. Company Overview

14.8.2. Company Footprint

14.8.3. Product Portfolio

14.8.4. Competitors & Customers

14.8.5. Subsidiaries & Parent Organization

14.8.6. Recent Developments

14.8.7. Financial Analysis

14.9. PTC Inc.

14.9.1. Company Overview

14.9.2. Company Footprint

14.9.3. Product Portfolio

14.9.4. Competitors & Customers

14.9.5. Subsidiaries & Parent Organization

14.9.6. Recent Developments

14.9.7. Financial Analysis

14.10. Bentley Systems, Inc.

14.10.1. Company Overview

14.10.2. Company Footprint

14.10.3. Product Portfolio

14.10.4. Competitors & Customers

14.10.5. Subsidiaries & Parent Organization

14.10.6. Recent Developments

14.10.7. Financial Analysis

14.11. ADINA R&D, Inc.

14.11.1. Company Overview

14.11.2. Company Footprint

14.11.3. Product Portfolio

14.11.4. Competitors & Customers

14.11.5. Subsidiaries & Parent Organization

14.11.6. Recent Developments

14.11.7. Financial Analysis

14.12. ESI Group

14.12.1. Company Overview

14.12.2. Company Footprint

14.12.3. Product Portfolio

14.12.4. Competitors & Customers

14.12.5. Subsidiaries & Parent Organization

14.12.6. Recent Developments

14.12.7. Financial Analysis

14.13. Computers and Structures, Inc.

14.13.1. Company Overview

14.13.2. Company Footprint

14.13.3. Product Portfolio

14.13.4. Competitors & Customers

14.13.5. Subsidiaries & Parent Organization

14.13.6. Recent Developments

14.13.7. Financial Analysis

14.14. Dlubal Software GmbH

14.14.1. Company Overview

14.14.2. Company Footprint

14.14.3. Product Portfolio

14.14.4. Competitors & Customers

14.14.5. Subsidiaries & Parent Organization

14.14.6. Recent Developments

14.14.7. Financial Analysis

14.15. SimScale

14.15.1. Company Overview

14.15.2. Company Footprint

14.15.3. Product Portfolio

14.15.4. Competitors & Customers

14.15.5. Subsidiaries & Parent Organization

14.15.6. Recent Developments

14.15.7. Financial Analysis

14.16. MSC Software Corporation

14.16.1. Company Overview

14.16.2. Company Footprint

14.16.3. Product Portfolio

14.16.4. Competitors & Customers

14.16.5. Subsidiaries & Parent Organization

14.16.6. Recent Developments

14.16.7. Financial Analysis

14.17. SimuTech Group

14.17.1. Company Overview

14.17.2. Company Footprint

14.17.3. Product Portfolio

14.17.4. Competitors & Customers

14.17.5. Subsidiaries & Parent Organization

14.17.6. Recent Developments

14.17.7. Financial Analysis

14.18. Murata Software Co., Ltd.

14.18.1. Company Overview

14.18.2. Company Footprint

14.18.3. Product Portfolio

14.18.4. Competitors & Customers

14.18.5. Subsidiaries & Parent Organization

14.18.6. Recent Developments

14.18.7. Financial Analysis

14.19. COMSOL Multiphysics

14.19.1. Company Overview

14.19.2. Company Footprint

14.19.3. Product Portfolio

14.19.4. Competitors & Customers

14.19.5. Subsidiaries & Parent Organization

14.19.6. Recent Developments

14.19.7. Financial Analysis

14.20. BETA CAE Systems

14.20.1. Company Overview

14.20.2. Company Footprint

14.20.3. Product Portfolio

14.20.4. Competitors & Customers

14.20.5. Subsidiaries & Parent Organization

14.20.6. Recent Developments

14.20.7. Financial Analysis

14.21. Vanderplaats R&D, Inc.

14.21.1. Company Overview

14.21.2. Company Footprint

14.21.3. Product Portfolio

14.21.4. Competitors & Customers

14.21.5. Subsidiaries & Parent Organization

14.21.6. Recent Developments

14.21.7. Financial Analysis

14.22. Flownex

14.22.1. Company Overview

14.22.2. Company Footprint

14.22.3. Product Portfolio

14.22.4. Competitors & Customers

14.22.5. Subsidiaries & Parent Organization

14.22.6. Recent Developments

14.22.7. Financial Analysis

14.23. Other Key Players

14.23.1. Company Overview

14.23.2. Company Footprint

14.23.3. Product Portfolio

14.23.4. Competitors & Customers

14.23.5. Subsidiaries & Parent Organization

14.23.6. Recent Developments

14.23.7. Financial Analysis

List of Tables

Table 1: Global Automotive Finite Element Analysis (FEA) Software Market Value (US$ Mn) Forecast, by Component, 2017‒2031

Table 2: Global Automotive Finite Element Analysis (FEA) Software Market Value (US$ Mn) Forecast, by Deployment, 2017‒2031

Table 3: Global Automotive Finite Element Analysis (FEA) Software Market Value (US$ Mn) Forecast, by Enterprise Size, 2017‒2031

Table 4: Global Automotive Finite Element Analysis (FEA) Software Market Value (US$ Mn) Forecast, by Region, 2017‒2031

Table 5: North America Automotive Finite Element Analysis (FEA) Software Market Value (US$ Mn) Forecast, by Component, 2017‒2031

Table 6: North America Automotive Finite Element Analysis (FEA) Software Market Value (US$ Mn) Forecast, by Deployment, 2017‒2031

Table 7: North America Automotive Finite Element Analysis (FEA) Software Market Value (US$ Mn) Forecast, by Enterprise Size, 2017‒2031

Table 8: North America Automotive Finite Element Analysis (FEA) Software Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Table 9: Europe Automotive Finite Element Analysis (FEA) Software Market Value (US$ Mn) Forecast, by Component, 2017‒2031

Table 10: Europe Automotive Finite Element Analysis (FEA) Software Market Value (US$ Mn) Forecast, by Deployment, 2017‒2031

Table 11: Europe Automotive Finite Element Analysis (FEA) Software Market Value (US$ Mn) Forecast, by Enterprise Size, 2017‒2031

Table 12: Europe Automotive Finite Element Analysis (FEA) Software Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Table 13: Asia Pacific Automotive Finite Element Analysis (FEA) Software Market Value (US$ Mn) Forecast, by Component, 2017‒2031

Table 14: Asia Pacific Automotive Finite Element Analysis (FEA) Software Market Value (US$ Mn) Forecast, by Deployment, 2017‒2031

Table 15: Asia Pacific Automotive Finite Element Analysis (FEA) Software Market Value (US$ Mn) Forecast, by Enterprise Size, 2017‒2031

Table 16: Asia Pacific Automotive Finite Element Analysis (FEA) Software Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Table 17: Middle East & Africa Automotive Finite Element Analysis (FEA) Software Market Value (US$ Mn) Forecast, by Component, 2017‒2031

Table 18: Middle East & Africa Automotive Finite Element Analysis (FEA) Software Market Value (US$ Mn) Forecast, by Deployment, 2017‒2031

Table 19: Middle East & Africa Automotive Finite Element Analysis (FEA) Software Market Value (US$ Mn) Forecast, by Enterprise Size, 2017‒2031

Table 20: Middle East & Africa Automotive Finite Element Analysis (FEA) Software Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Table 21: South America Automotive Finite Element Analysis (FEA) Software Market Value (US$ Mn) Forecast, by Component, 2017‒2031

Table 22: South America Automotive Finite Element Analysis (FEA) Software Market Value (US$ Mn) Forecast, by Deployment, 2017‒2031

Table 23: South America Automotive Finite Element Analysis (FEA) Software Market Value (US$ Mn) Forecast, by Enterprise Size, 2017‒2031

Table 24: South America Automotive Finite Element Analysis (FEA) Software Market Value (US$ Mn) Forecast, by Country, 2017‒2031

List of Figures

Figure 1: Global Automotive Finite Element Analysis (FEA) Software Market Value (US$ Mn) Forecast, by Component, 2017-2031

Figure 2: Global Automotive Finite Element Analysis (FEA) Software Market, Incremental Opportunity, by Component, Value (US$ Mn), 2023-2031

Figure 3: Global Automotive Finite Element Analysis (FEA) Software Market Value (US$ Mn) Forecast, by Deployment, 2017-2031

Figure 4: Global Automotive Finite Element Analysis (FEA) Software Market, Incremental Opportunity, by Deployment, Value (US$ Mn), 2023-2031

Figure 5: Global Automotive Finite Element Analysis (FEA) Software Market Value (US$ Mn) Forecast, by Enterprise Size, 2017-2031

Figure 6: Global Automotive Finite Element Analysis (FEA) Software Market, Incremental Opportunity, by Enterprise Size, Value (US$ Mn), 2023-2031

Figure 7: Global Automotive Finite Element Analysis (FEA) Software Market Value (US$ Mn) Forecast, by Region, 2017-2031

Figure 8: Global Automotive Finite Element Analysis (FEA) Software Market, Incremental Opportunity, by Region, Value (US$ Mn), 2023-2031

Figure 9: North America Automotive Finite Element Analysis (FEA) Software Market Value (US$ Mn) Forecast, by Component, 2017-2031

Figure 10: North America Automotive Finite Element Analysis (FEA) Software Market, Incremental Opportunity, by Component, Value (US$ Mn), 2023-2031

Figure 11: North America Automotive Finite Element Analysis (FEA) Software Market Value (US$ Mn) Forecast, by Deployment, 2017-2031

Figure 12: North America Automotive Finite Element Analysis (FEA) Software Market, Incremental Opportunity, by Deployment, Value (US$ Mn), 2023-2031

Figure 13: North America Automotive Finite Element Analysis (FEA) Software Market Value (US$ Mn) Forecast, by Enterprise Size, 2017-2031

Figure 14: North America Automotive Finite Element Analysis (FEA) Software Market, Incremental Opportunity, by Enterprise Size, Value (US$ Mn), 2023-2031

Figure 15: North America Automotive Finite Element Analysis (FEA) Software Market Value (US$ Mn) Forecast, by Country, 2017-2031

Figure 16: North America Automotive Finite Element Analysis (FEA) Software Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023-2031

Figure 17: Europe Automotive Finite Element Analysis (FEA) Software Market Value (US$ Mn) Forecast, by Component, 2017-2031

Figure 18: Europe Automotive Finite Element Analysis (FEA) Software Market, Incremental Opportunity, by Component, Value (US$ Mn), 2023-2031

Figure 19: Europe Automotive Finite Element Analysis (FEA) Software Market Value (US$ Mn) Forecast, by Deployment, 2017-2031

Figure 20: Europe Automotive Finite Element Analysis (FEA) Software Market, Incremental Opportunity, by Deployment, Value (US$ Mn), 2023-2031

Figure 21: Europe Automotive Finite Element Analysis (FEA) Software Market Value (US$ Mn) Forecast, by Enterprise Size, 2017-2031

Figure 22: Europe Automotive Finite Element Analysis (FEA) Software Market, Incremental Opportunity, by Enterprise Size, Value (US$ Mn), 2023-2031

Figure 23: Europe Automotive Finite Element Analysis (FEA) Software Market Value (US$ Mn) Forecast, by Country, 2017-2031

Figure 24: Europe Automotive Finite Element Analysis (FEA) Software Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023-2031

Figure 25: Asia Pacific Automotive Finite Element Analysis (FEA) Software Market Value (US$ Mn) Forecast, by Component, 2017-2031

Figure 26: Asia Pacific Automotive Finite Element Analysis (FEA) Software Market, Incremental Opportunity, by Component, Value (US$ Mn), 2023-2031

Figure 27: Asia Pacific Automotive Finite Element Analysis (FEA) Software Market Value (US$ Mn) Forecast, by Deployment, 2017-2031

Figure 28: Asia Pacific Automotive Finite Element Analysis (FEA) Software Market, Incremental Opportunity, by Deployment, Value (US$ Mn), 2023-2031

Figure 29: Asia Pacific Automotive Finite Element Analysis (FEA) Software Market Value (US$ Mn) Forecast, by Enterprise Size, 2017-2031

Figure 30: Asia Pacific Automotive Finite Element Analysis (FEA) Software Market, Incremental Opportunity, by Enterprise Size, Value (US$ Mn), 2023-2031

Figure 31: Asia Pacific Automotive Finite Element Analysis (FEA) Software Market Value (US$ Mn) Forecast, by Country, 2017-2031

Figure 32: Asia Pacific Automotive Finite Element Analysis (FEA) Software Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023-2031

Figure 33: Middle East & Africa Automotive Finite Element Analysis (FEA) Software Market Value (US$ Mn) Forecast, by Component, 2017-2031

Figure 34: Middle East & Africa Automotive Finite Element Analysis (FEA) Software Market, Incremental Opportunity, by Component, Value (US$ Mn), 2023-2031

Figure 35: Middle East & Africa Automotive Finite Element Analysis (FEA) Software Market Value (US$ Mn) Forecast, by Deployment, 2017-2031

Figure 36: Middle East & Africa Automotive Finite Element Analysis (FEA) Software Market, Incremental Opportunity, by Deployment, Value (US$ Mn), 2023-2031

Figure 37: Middle East & Africa Automotive Finite Element Analysis (FEA) Software Market Value (US$ Mn) Forecast, by Enterprise Size, 2017-2031

Figure 38: Middle East & Africa Automotive Finite Element Analysis (FEA) Software Market, Incremental Opportunity, by Enterprise Size, Value (US$ Mn), 2023-2031

Figure 39: Middle East & Africa Automotive Finite Element Analysis (FEA) Software Market Value (US$ Mn) Forecast, by Country, 2017-2031

Figure 40: Middle East & Africa Automotive Finite Element Analysis (FEA) Software Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023-2031

Figure 41: South America Automotive Finite Element Analysis (FEA) Software Market Value (US$ Mn) Forecast, by Component, 2017-2031

Figure 42: South America Automotive Finite Element Analysis (FEA) Software Market, Incremental Opportunity, by Component, Value (US$ Mn), 2023-2031

Figure 43: South America Automotive Finite Element Analysis (FEA) Software Market Value (US$ Mn) Forecast, by Deployment, 2017-2031

Figure 44: South America Automotive Finite Element Analysis (FEA) Software Market, Incremental Opportunity, by Deployment, Value (US$ Mn), 2023-2031

Figure 45: South America Automotive Finite Element Analysis (FEA) Software Market Value (US$ Mn) Forecast, by Enterprise Size, 2017-2031

Figure 46: South America Automotive Finite Element Analysis (FEA) Software Market, Incremental Opportunity, by Enterprise Size, Value (US$ Mn), 2023-2031

Figure 47: South America Automotive Finite Element Analysis (FEA) Software Market Value (US$ Mn) Forecast, by Country, 2017-2031

Figure 48: South America Automotive Finite Element Analysis (FEA) Software Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023-2031