Clutch is a mechanical device that is used for engagement and disengagement of transmission from the driving shaft to the driven shaft. The primary function of the clutch is to transmit the torque from the engine side to the drivetrain. The clutch operates quietly and mitigates the drive-related vibration during its operation. Several friction materials are utilized to manufacture a clutch in order to ensure smooth engagement of gears, offer resistance, and providing strength. Organic friction materials are commonly used as friction material for clutch facing, as they offer a perfect combination of smooth engagement, wear resistance, and cost-effectiveness, as compared to others friction materials.

Dual clutch transmission and automated manual transmission are gaining popularity among car manufacturers as these systems offer all the convenience of the conventional automatic transmission, but at a lower price and without hampering fuel efficiency. These factors are likely to drive the demand for automotive clutch considerably during the forecast period.

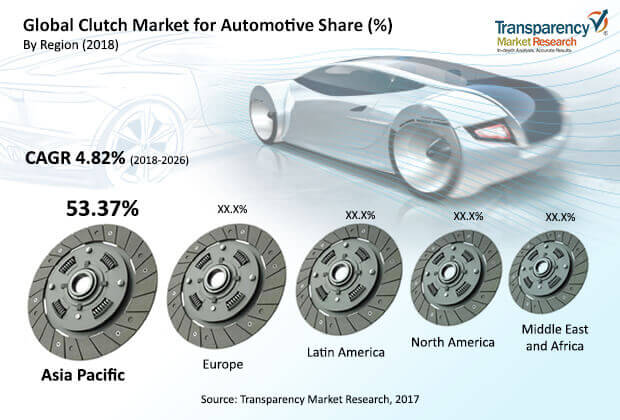

Increase in demand for SUVs, crossovers, compact SUVs, and premium cars across the globe, especially in countries in Asia is a primary factor that is estimated to drive the clutch market during the forecast period. Increase in industrialization, which is boosting the logistics industry, expansion of the IT industry, especially in metropolitan areas, increased population, and migration toward urban areas for better job opportunities, thereby augmenting daily commutation are all driving the production of commercial vehicles. Heavy commercial vehicles have been witnessing the adoption of automatic transmission owing to several advantages such as fuel economy and easier driving training for drivers. These factors are likely to boost the overall market during the forecast period. Increased disposable income and spending capacity of the public, primarily in developing countries, on account of significant revenue opportunities, have propelled the demand for vehicles that are forming the critical necessity for commutation. However, increase in automatic transmission vehicles and electric vehicles are likely to hamper the clutch market for automotive during the forecast period. The global clutch market for automotive is expected to expand at a CAGR of about 5% between 2018 and 2026.

Dry clutch type segment dominates the automotive clutch market presently, and it is expected to remain the same during the forecast period.

Dry clutch is the most used type of clutch in all vehicles due to its advantages over wet clutch such as high coefficient of friction, reduction in transmission power losses and ability to handle more power than the wet clutch. The clutch market can be split into manual transmission and automatic transmission segments. Expect North America penetration of manual transmission is largely present across the globe which is expected to drive the market of automotive clutch during forecast period. Growing dual clutch transmission and automated manual transmission owing its advantages such as competitive cost as compared to automatic transmission, higher fuel efficiency, and better driving experience are likely to boost the segment during forecast period. Rise in popularity of adventurous activities among the youth population has fueled the preference toward compact SUVs and vehicles with off-roading capabilities. This, in turn, has propelled the demand for clutch integration, thereby driving the market. Demand for SUVs and premium car vehicles is anticipated to drive the clutch market during the forecast period.

The dry clutch segment held a major share of the clutch market for automotive in 2017. Most vehicles are equipped with the dry clutch system, as it is inexpensive and provides better engagement on good condition roads. However, the dry clutch system has limitations such as it wears out faster than wet clutches and tends to generate considerable noise sometimes. The wet clutch is immersed in oil and hence, it offers smooth clutch engagement. The wet clutch is also utilized for higher torque application.

Ceramic material also used for clutch facing and it consists of copper, iron, tin bronze, and graphite. Ceramic materials can withstand considerable heat and hence, they are employed in continuous repeated engagement and disengagement applications. Ceramic clutches wear more rapidly than organic clutches, as they absorb more heat than organic material.

Crucial players in the clutch market are expected to benefit from the formation of strategic alliances with global players in the clutch market. The market witnesses the presence of key players that have strong global presence and firm establishments, which are equally coupled with diverse product portfolios. Prominent players operating in the global clutch market for automotive include ZF Friedrichshafen AG, BorgWarner Inc., Schaeffler Technologies AG & Co. KG, EXEDY Corporation, FTE Automotive, Aisin Seiki, F.C.C. Co., Ltd., and Valeo. Companies are focusing on mergers and acquisitions with regional automotive clutch manufacturers in order to expand their businesses globally. BorgWarner is a major manufacturer and has expertise in manufacturing of DualTronic clutch technology. BorgWarner holds a prominent position in the clutch market for automotive, as compared to other major manufacturers.

1. Preface

1.1. Report Scope and Market Segmentation

1.2. Research Highlights

1.3. Research Objectives

1.4. Key Questions Answered

2. Assumptions and Research Methodology

2.1. Report Assumptions

2.2. Abbreviations Used

2.3. Research Methodology

3. Executive Summary

3.1. Global Clutch Market for Automotive Size, by Market Value (US$ Mn) and Market Volume (Million Units), by Region

4. Market Overview

4.1. Introduction

4.2. Market Indicator

4.3. Drivers and Restraints Snapshot Analysis

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.3.4. Porter’s Analysis

4.3.5. Value Chain Analysis

4.3.6. SWOT Analysis

4.3.7. Price Trend Analysis

5. Global Clutch Market for Automotive Analysis and Forecasts

5.1. North America

5.2. Europe

5.3. Asia Pacific

5.4. Middle East & Africa

5.5. Latin America

6. Global Clutch Market for Automotive Analysis and Forecasts, by Type

6.1. Introduction and Definition

6.2. Key Findings

6.3. Market Size (US$ Mn) Forecast, by Type

6.4. Clutch Market for Automotive Analysis, by Type

6.5. Clutch Market for Automotive Attractiveness Analysis, by Type

7. Global Clutch Market for Automotive Analysis and Forecasts, by Transmission Type

7.1. Introduction and Definition

7.2. Key Findings

7.3. Market Size (US$ Mn) Forecast, by Transmission Type

7.4. Clutch Market for Automotive Analysis, by Transmission Type

7.5. Clutch Market for Automotive Attractiveness Analysis, by Transmission Type

8. Global Clutch Market for Automotive Analysis and Forecasts, by Material Type

8.1. Introduction and Definition

8.2. Key Findings

8.3. Market Size (US$ Mn) Forecast, by Material Type

8.4. Clutch Market for Automotive Analysis, by Material Type

8.5. Clutch Market for Automotive Attractiveness Analysis, by Material type

9. Global Clutch Market for Automotive Analysis and Forecasts, by vehicle Type

9.1. Introduction and Definition

9.2. Key Findings

9.3. Market Size (US$ Mn) Forecast, by Vehicle Type

9.4. Clutch Market for Automotive Analysis, by Vehicle Type

9.5. Clutch Market for Automotive Attractiveness Analysis, by Vehicle type

10. Global Clutch Market for Automotive Analysis and Forecasts, by Sales Channel

10.1. Introduction and Definition

10.2. Key Findings

10.3. Market Size (US$ Mn) Forecast, by Sales Channel

10.4. Clutch Market for Automotive Analysis, by Sales Channel

10.5. Clutch Market for Automotive Attractiveness Analysis, by Sales Channel

11. Global Clutch Market for Automotive Analysis, by Region

11.1. Key Findings

11.2. Market Size (US$ Mn) Forecast, by Region

11.3. Clutch Market for Automotive Attractiveness Analysis, by Region

12. North America Clutch Market for Automotive Analysis

12.1. Key Findings

12.2. North America Clutch Market for Automotive Overview

12.3. North America Market Value Share Analysis, by Type

12.4. North America Market Forecast, by Type

12.4.1. Dry Clutch, 2018–2026

12.4.2. Wet Clutch, 2018–2026

12.5. North America Market Forecast, by Transmission Type

12.5.1. Manual Transmission , 2018–2026

12.5.2. Automatic Transmission, 2018–2026

12.5.2.1. Dual Clutch Transmission

12.5.2.2. Automated Manual Transmission

12.6. North America Market Value Share Analysis, by Material type

12.7. North America Market Forecast, by Material Type

12.7.1. Organic Material, 2018–2026

12.7.2. Ceramic Material, 2018–2026

12.7.3. Others ( Kevlar & Feramic ), 2018–2026

12.8. North America Market Value Share Analysis, by Vehicle Type

12.9. North America Market Forecast, by Vehicle Type

12.9.1. Passenger vehicle, 2018–2026

12.9.2. Commercial Vehicle, 2018–2026

12.10. North America Market Value Share Analysis, by Sales Channel

12.11. North America Market Forecast, by Sales Channel

12.11.1. OEM, 2018–2026

12.11.2. Aftermarket, 2018–2026

12.12. North America Market Value Share Analysis, by Country

12.13. North America Market Forecast, by Country

12.13.1. U.S., 2018–2026

12.13.2. Canada, 2018–2026

12.14. North America Market Analysis, by Country

12.15. U.S. Market Forecast, by Type

12.15.1. Dry Clutch, 2018–2026

12.15.2. Wet Clutch, 2018–2026

12.16. U.S. Market Forecast, by Transmission Type

12.16.1. Manual Transmission, 2018–2026

12.16.2. Automatic Transmission, 2018–2026

12.16.2.1. Dual Clutch Transmission 2018–2026

12.16.2.2. Automated Manual Transmission 2018–2026

12.17. U.S. Market Forecast, by Material Type

12.17.1. Organic Material, 2018–2026

12.17.2. Ceramic Material, 2018–2026

12.17.3. Others ( Kevlar & Feramic ), 2018–2026

12.18. U.S. Market Forecast, by Vehicle Type

12.18.1. Passenger Vehicle, 2018–2026

12.18.2. Commercial Vehicle, 2018–2026

12.19. Canada Market Forecast, by Type

12.19.1. Dry Clutch, 2018–2026

12.19.2. Wet Clutch, 2018–2026

12.20. Canada Market Forecast, by Transmission Type

12.20.1. Manual Transmission, 2018–2026

12.20.2. Automatic Transmission, 2018–2026

12.20.2.1. Dual Clutch Transmission 2018–2026

12.20.2.2. Automated Manual Transmission 2018–2026

12.21. Canada Market Forecast, by Material Type

12.21.1. Organic Material, 2018–2026

12.21.2. Ceramic Material, 2018–2026

12.21.3. Others ( Kevlar & Feramic ), 2018–2026

12.22. Canada Market Forecast, by Vehicle Type

12.22.1. Passenger Vehicle

12.22.2. Commercial Vehicle

12.23. PEST Analysis

13. Europe Clutch Market for Automotive Analysis

13.1. Key Findings

13.2. Europe Clutch Market for Automotive Overview

13.3. Europe Market Value Share Analysis, by Type

13.4. Europe Market Forecast, by Type

13.4.1. Dry Clutch, 2018–2026

13.4.2. Wet Clutch, 2018–2026

13.5. Europe Market Forecast, by Transmission Type

13.5.1. Manual Transmission, 2018–2026

13.5.2. Automatic Transmission, 2018–2026

13.5.2.1. Dual Clutch Transmission 2018–2026

13.5.2.2. Automated Manual Transmission 2018–2026

13.6. Europe Market Value Share Analysis, by Material Type

13.7. Europe Market Forecast, by Material

13.7.1. Organic Material, 2018–2026

13.7.2. Ceramic Material, 2018–2026

13.7.3. Others ( Kevlar & Feramic ), 2018–2026

13.8. Europe Market Value Share Analysis, by Vehicle Type

13.9. Europe Market Forecast, by Vehicle

13.9.1. Passenger Vehicle, 2018–2026

13.9.2. Commercial Vehicle, 2018–2026

13.10. Europe Market Value Share Analysis, by Sales Channel

13.11. Europe Market Forecast, by Sales Channel

13.11.1. OEM, 2018–2026

13.11.2. Aftermarket, 2018–2026

13.12. Europe Market Value Share Analysis, by Country/Sub-region

13.13. Europe Market Forecast, by Country/Sub-region

13.13.1. Germany, 2018–2026

13.13.2. U.K., 2018–2026

13.13.3. France, 2018–2026

13.13.4. Italy, 2018–2026

13.13.5. Spain, 2018–2026

13.13.6. Rest of Europe, 2018–2026

13.14. Europe Market Analysis, by Country/Sub-region

13.15. Germany Market Forecast, by Type

13.15.1. Dry Clutch, 2018–2026

13.15.2. Wet Clutch, 2018–2026

13.16. Germany Market Forecast, by Transmission Type

13.16.1. Manual Transmission, 2018–2026

13.16.2. Automatic Transmission, 2018–2026

13.16.2.1. Dual Clutch Transmission 2018–2026

13.16.2.2. Automated Manual Transmission 2018–2026

13.17. Germany Market Forecast, by Material

13.17.1. Organic Material, 2018–2026

13.17.2. Ceramic Material, 2018–2026

13.17.3. Others ( Kevlar & Feramic ), 2018–2026

13.18. Germany Market Forecast, by Vehicle

13.18.1. Passenger Vehicle, 2018–2026

13.18.2. Commercial Vehicle, 2018–2026

13.19. U.K. Market Forecast, by Type

13.19.1. Dry Clutch, 2018–2026

13.19.2. Wet Clutch, 2018–2026

13.20. U.K. Market Forecast, by Transmission Type

13.20.1. Manual Transmission, 2018–2026

13.20.2. Automatic Transmission, 2018–2026

13.21. U.K. Market Forecast, by Material

13.21.1. Organic Material, 2018–2026

13.21.2. Ceramic Material, 2018–2026

13.21.3. Others ( Kevlar & Feramic ), 2018–2026

13.22. U.K. Market Forecast, by Vehicle

13.22.1. Passenger Vehicle, 2018–2026

13.22.2. Commercial Vehicle, 2018–2026

13.23. France Market Forecast, by Type

13.23.1. Dry Clutch, 2018–2026

13.23.2. Wet Clutch, 2018–2026

13.24. France Market Forecast, by Transmission Type

13.24.1. Manual Transmission, 2018–2026

13.24.2. Automatic Transmission, 2018–2026

13.24.2.1. Dual Clutch Transmission 2018–2026

13.24.2.2. Automated Manual Transmission 2018–2026

13.25. France Market Forecast, by Material

13.25.1. Organic Material, 2018–2026

13.25.2. Ceramic Material, 2018–2026

13.25.3. Others ( Kevlar & Feramic ), 2018–2026

13.26. France Market Forecast, by Vehicle

13.26.1. Passenger Vehicle, 2018–2026

13.26.2. Commercial Vehicle, 2018–2026

13.27. Italy Market Forecast, by Type

13.27.1. Dry Clutch, 2018–2026

13.27.2. Wet Clutch, 2018–2026

13.28. Italy Market Forecast, by Transmission Type

13.28.1. Manual Transmission, 2018–2026

13.28.2. Automatic Transmission, 2018–2026

13.28.2.1. Dual Clutch Transmission 2018–2026

13.28.2.2. Automated Manual Transmission 2018–2026

13.29. Italy Market Forecast, by Material

13.29.1. Organic Material, 2018–2026

13.29.2. Ceramic Material, 2018–2026

13.29.3. Others ( Kevlar & Feramic ), 2018–2026

13.30. Italy Market Forecast, by Vehicle

13.30.1. Passenger vehicle, 2018–2026

13.30.2. Commercial Vehicle, 2018–2026

13.31. Spain Market Forecast, by Type

13.31.1. Dry Clutch, 2018–2026

13.31.2. Wet Clutch, 2018–2026

13.32. Spain Market Forecast, by Transmission Type

13.32.1. Manual Transmission, 2018–2026

13.32.2. Automatic Transmission, 2018–2026

13.32.2.1. Dual Clutch Transmission 2018–2026

13.32.2.2. Automated Manual Transmission 2018–2026

13.33. Spain Market Forecast, by Material

13.33.1. Organic Material, 2018–2026

13.33.2. Ceramic Material, 2018–2026

13.33.3. Others ( Kevlar & Feramic ), 2018–2026

13.34. Spain Market Forecast, by Vehicle

13.34.1. Passenger vehicle, 2018–2026

13.34.2. Commercial Vehicle, 2018–2026

13.35. Rest Of Europe Market Forecast, by Type

13.35.1. Dry Clutch, 2018–2026

13.35.2. Wet Clutch, 2018–2026

13.36. Rest of Europe Market Forecast, by Transmission Type

13.36.1. Manual Transmission, 2018–2026

13.36.2. Automatic Transmission, 2018–2026

13.36.2.1. Dual Clutch Transmission 2018–2026

13.36.2.2. Automated Manual Transmission 2018–2026

13.37. Rest of Europe Market Forecast, by Material

13.37.1. Organic Material, 2018–2026

13.37.2. Ceramic Material

13.37.3. Others ( Kevlar & Feramic ), 2018–2026

13.38. Rest of Europe Market Forecast, by Vehicle

13.38.1. Passenger vehicle, 2018–2026

13.38.2. Commercial Vehicle, 2018–2026

13.39. PEST Analysis

14. Asia Pacific Clutch Market for Automotive Analysis

14.1. Key Findings

14.2. Asia Pacific Clutch Market for Automotive Overview

14.3. Asia Pacific Market Value Share Analysis, by Type

14.4. Asia Pacific Market Forecast, by Type

14.4.1. Dry Clutch, 2018–2026

14.4.2. Wet Clutch, 2018–2026

14.5. Asia Pacific Market Forecast, by Transmission Type

14.5.1. Manual Transmission, 2018–2026

14.5.2. Automatic Transmission, 2018–2026

14.5.2.1. Dual Clutch Transmission 2018–2026

14.5.2.2. Automated Manual Transmission 2018–2026

14.6. Asia Pacific Market Value Share Analysis, by Material

14.7. Asia Pacific Market Forecast, by Vehicle

14.7.1. Organic Material, 2018–2026

14.7.2. Ceramic Material, 2018–2026

14.7.3. Others ( Kevlar & Feramic ), 2018–2026

14.8. Asia Pacific Market Value Share Analysis, by Vehicle

14.9. Asia Pacific Market Forecast, by Vehicle

14.9.1. Passenger Vehicle 2018–2026

14.9.2. Commercial Vehicle, 2018–2026

14.10. Asia Pacific Market Value Share Analysis, by Sales Channel

14.11. Asia Pacific Market Forecast, by Sales Channel

14.11.1. OEM, 2017-2025

14.11.2. Aftermarket, 2017-2025

14.12. Asia Pacific Market Value Share Analysis, by Country/Sub-region

14.13. Asia Pacific Market Forecast, by Country/Sub-region

14.13.1. China, 2018–2026

14.13.2. India, 2018–2026

14.13.3. Japan, 2018–2026

14.13.4. ASEAN, 2018–2026

14.13.5. Rest of Asia Pacific, 2018–2026

14.14. Asia Pacific Market Analysis, by Country/Sub-region

14.15. China Market Forecast, by Type

14.15.1. Dry Clutch, 2018–2026

14.15.2. Wet Clutch, 2018–2026

14.16. China Market Forecast, by Transmission Type

14.16.1. Manual Transmission, 2018–2026

14.16.2. Automatic Transmission, 2018–2026

14.16.2.1. Dual Clutch Transmission 2018–2026

14.16.2.2. Automated Manual Transmission 2018–2026

14.17. China Market Forecast, by Material

14.17.1. Organic Material, 2018–2026

14.17.2. Ceramic Material, 2018–2026

14.17.3. Others ( Kevlar & Feramic ), 2018–2026

14.18. China Market Forecast, by Vehicle Type

14.18.1. Passenger Vehicle, 2018–2026

14.18.2. Commercial Vehicle, 2018–2026

14.19. India Market Forecast, by Type

14.19.1. Dry Clutch, 2018–2026

14.19.2. Wet Clutch, 2018–2026

14.20. India Market Forecast, by Transmission Type

14.20.1. Manual Transmission, 2018–2026

14.20.2. Automatic Transmission, 2018–2026

14.20.2.1. Dual Clutch Transmission 2018–2026

14.20.2.2. Automated Manual Transmission 2018–2026

14.21. India Market Forecast, by Material

14.21.1. Organic Material, 2018–2026

14.21.2. Ceramic Material, 2018–2026

14.21.3. Others ( Kevlar & Feramic ), 2018–2026

14.22. India Market Forecast, by Vehicle Type

14.22.1. Passenger Vehicle, 2018–2026

14.22.2. Commercial Vehicle, 2018–2026

14.23. Japan Market Forecast, by Type

14.23.1. Dry Clutch, 2018–2026

14.23.2. Wet Clutch, 2018–2026

14.24. Japan Market Forecast, by Transmission Type

14.24.1. Manual Transmission, 2018–2026

14.24.2. Automatic Transmission, 2018–2026

14.24.2.1. Dual Clutch Transmission 2018–2026

14.24.2.2. Automated Manual Transmission 2018–2026

14.25. Japan Market Forecast, by Material

14.25.1. Organic Material, 2018–2026

14.25.2. Ceramic Material, 2018–2026

14.25.3. Others ( Kevlar & Feramic ), 2018–2026

14.26. Japan Market Forecast, by Vehicle Type

14.26.1. Passenger Vehicle, 2018–2026

14.26.2. Commercial Vehicle, 2018–2026

14.27. ASEAN Market Forecast, by Type

14.27.1. Dry Clutch, 2018–2026

14.27.2. Wet Clutch, 2018–2026

14.28. ASEAN Market Forecast, by Transmission Type

14.28.1. Manual Transmission, 2018–2026

14.28.2. Automatic Transmission, 2018–2026

14.28.2.1. Dual Clutch Transmission 2018–2026

14.28.2.2. Automated Manual Transmission 2018–2026

14.29. ASEAN Market Forecast, by Material

14.29.1. Organic Material, 2018–2026

14.29.2. Ceramic Material, 2018–2026

14.29.3. Others ( Kevlar & Feramic ), 2018–2026

14.30. ASEAN Market Forecast, by Vehicle Type

14.30.1. Passenger Vehicle, 2018–2026

14.30.2. Commercial Vehicle, 2018–2026

14.31. Rest of Asia Pacific Market Forecast, by Type

14.31.1. Dry Clutch, 2018–2026

14.31.2. Wet Clutch, 2018–2026

14.32. Rest of Asia Pacific Market Forecast, by Transmission Type

14.32.1. Manual Transmission, 2018–2026

14.32.2. Automatic Transmission, 2018–2026

14.32.2.1. Dual Clutch Transmission 2018–2026

14.32.2.2. Automated Manual Transmission 2018–2026

14.33. Rest of Asia Pacific Market Forecast, by Material

14.33.1. Organic Material, 2018–2026

14.33.2. Ceramic Material, 2018–2026

14.33.3. Others ( Kevlar & Feramic ), 2018–2026

14.34. Rest of Asia Pacific Market Forecast, by Vehicle Type

14.34.1. Passenger Vehicle, 2018–2026

14.34.2. Commercial Vehicle, 2018–2026

14.35. PEST Analysis

15. Middle East & Africa Clutch Market for Automotive Analysis

15.1. Key Findings

15.2. Middle East & Africa Clutch Market for Automotive Overview

15.3. Middle East & Africa Market Value Share Analysis, by Type

15.4. Middle East & Africa Market Forecast, by Type

15.4.1. Dry Clutch, 2018–2026

15.4.2. Wet Clutch, 2018–2026

15.5. Middle East & Africa Market Forecast, by Transmission Type

15.5.1. Manual Transmission, 2018–2026

15.5.2. Automatic Transmission, 2018–2026

15.5.2.1. Dual Clutch Transmission 2018–2026

15.5.2.2. Automated Manual Transmission 2018–2026

15.6. Middle East & Africa Market Value Share Analysis, by Material

15.7. Middle East & Africa Market Forecast, by Material

15.7.1. Organic Material, 2018–2026

15.7.2. Ceramic Material, 2018–2026

15.7.3. Others ( Kevlar & Feramic ), 2018–2026

15.8. Middle East & Africa Market Value Share Analysis, by Vehicle

15.9. Middle East & Africa Market Forecast, by Vehicle Type

15.9.1. Passenger Vehicle, 2018–2026

15.9.2. Commercial Vehicle, 2018–2026

15.10. Middle East & Africa Market Value Share Analysis, by Sales Channel

15.11. Middle East & Africa Market Forecast, by Sales Channel

15.11.1. OEM, 2018–2026

15.11.2. Aftermarket, 2018–2026

15.12. Middle East & Africa Market Value Share Analysis, by Country/Sub-region

15.13. Middle East & Africa Market Forecast, by Country/Sub-region

15.13.1. GCC, 2018–2026

15.13.2. South Africa, 2018–2026

15.13.3. Rest of Middle East & Africa, 2018–2026

15.14. Middle East & Africa Market Analysis, by Country/Sub-region

15.15. GCC Market Forecast, by Type

15.15.1. Dry Clutch, 2018–2026

15.15.2. Wet Clutch, 2018–2026

15.16. GCC Market Forecast, by Transmission Type

15.16.1. Manual Transmission, 2018–2026

15.16.2. Automatic Transmission, 2018–2026

15.16.2.1. Dual Clutch Transmission 2018–2026

15.16.2.2. Automated Manual Transmission 2018–2026

15.17. GCC Market Forecast, by Material

15.17.1. Organic Material, 2018–2026

15.17.2. Ceramic Material, 2018–2026

15.17.3. Others ( Kevlar & Feramic ), 2018–2026

15.18. GCC Market Forecast, by Vehicle Type

15.18.1. Passenger Vehicle, 2018–2026

15.18.2. Commercial Vehicle, 2018–2026

15.19. South Africa Market Forecast, by Type

15.19.1. Dry Clutch, 2018–2026

15.19.2. Wet Clutch, 2018–2026

15.20. South Africa Market Forecast, by Transmission Type

15.20.1. Manual Transmission, 2018–2026

15.20.2. Automatic Transmission, 2018–2026

15.20.2.1. Dual Clutch Transmission 2018–2026

15.20.2.2. Automated Manual Transmission 2018–2026

15.21. South Africa Market Forecast, by Material

15.21.1. Organic Material, 2018–2026

15.21.2. Ceramic Material, 2018–2026

15.21.3. Others ( Kevlar & Feramic ), 2018–2026

15.22. South Africa Market Forecast, by Vehicle Type

15.22.1. Passenger Vehicle, 2018–2026

15.22.2. Commercial Vehicle, 2018–2026

15.23. Rest of Middle East & Africa Market Forecast, by Type

15.23.1. Dry Clutch, 2018–2026

15.23.2. Wet Clutch, 2018–2026

15.24. Rest of Middle East & Africa Market Forecast, by Transmission Type

15.24.1. Manual Transmission, 2018–2026

15.24.2. Automatic Transmission, 2018–2026

15.24.2.1. Dual Clutch Transmission 2018–2026

15.24.2.2. Automated Manual Transmission 2018–2026

15.25. Rest of Middle East & Africa Market Forecast, by Material

15.25.1. Organic Material, 2018–2026

15.25.2. Ceramic Material, 2018–2026

15.25.3. Others, 2017-2025

15.26. Rest of Middle East & Africa Market Forecast, by Vehicle Type

15.26.1. Passenger Vehicle, 2018–2026

15.26.2. Commercial Vehicle, 2018–2026

15.27. PEST Analysis

16. Latin America Clutch Market for Automotive Analysis

16.1. Key Findings

16.2. Latin America Clutch Market for Automotive Overview

16.3. Latin America Market Value Share Analysis, by Type

16.4. Latin America Market Forecast, by Type

16.4.1. Dry Clutch, 2018–2026

16.4.2. Wet Clutch, 2018–2026

16.5. Latin America Market Value Share Analysis, by Transmission Type

16.6. Latin America Market Forecast, by Transmission Type

16.6.1. Manual Transmission, 2018–2026

16.6.2. Automatic Transmission, 2018–2026

16.6.2.1. Dual Clutch Transmission 2018–2026

16.6.2.2. Automated Manual Transmission 2018–2026

16.7. Latin America Market Value Share Analysis, by Material

16.8. Latin America Market Forecast, by Material

16.8.1. Organic Material, 2018–2026

16.8.2. Ceramic Material, 2018–2026

16.8.3. Others ( Kevlar & Feramic ), 2018–2026

16.9. Latin America Market Value Share Analysis, by Vehicle Type

16.10. Latin America Market Forecast, by Vehicle Type

16.10.1. Passenger Vehicle 2017-2025

16.10.2. Commercial Vehicle 2017-2025

16.11. Latin America Market Value Share Analysis, by Sales Channel

16.12. Latin America Market Forecast, by Sales Channel

16.12.1. OEM, 2018–2026

16.12.2. Aftermarket, 2018–2026

16.13. Latin America Market Value Share Analysis, by Country/Sub-region

16.14. Latin America Market Forecast, by Country/Sub-region

16.14.1. Brazil, 2018–2026

16.14.2. Mexico, 2018–2026,

16.14.3. Rest of Latin America, 2018–2026

16.15. Latin America Market Analysis, by Country/Sub-region

16.16. Brazil Market Forecast, by Type

16.16.1. Dry Clutch, 2018–2026

16.16.2. Wet Clutch, 2018–2026

16.17. Brazil Market Forecast, by Transmission Type

16.17.1. Manual Transmission, 2018–2026

16.17.2. Automatic Transmission, 2018–2026

16.17.2.1. Dual Clutch Transmission 2018–2026

16.17.2.2. Automated Manual Transmission 2018–2026

16.18. Brazil Market Forecast, by Material

16.18.1. Organic Material, 2018–2026

16.18.2. Ceramic Material, 2018–2026

16.18.3. Others ( Kevlar & Feramic ), 2018–2026

16.19. Brazil Market Forecast, by Vehicle Type

16.19.1. Passenger Vehicle, 2018–2026

16.19.2. Commercial Vehicle, 2018–2026

16.20. Mexico Market Forecast, by Type

16.20.1. Dry Clutch, 2018–2026

16.20.2. Wet Clutch, 2018–2026

16.21. Mexico Market Forecast, by Transmission

16.21.1. Manual Transmission, 2018–2026

16.21.2. Automatic Transmission, 2018–2026

16.21.2.1. Dual Clutch Transmission 2018–2026

16.21.2.2. Automated Manual Transmission 2018–2026

16.22. Mexico Market Forecast, by Material

16.22.1. Organic Material, 2018–2026

16.22.2. Ceramic Material, 2018–2026

16.22.3. Others ( Kevlar & Feramic ), 2018–2026

16.23. Mexico Market Forecast, by Vehicle Type

16.23.1. Passenger Vehicle, 2018–2026

16.23.2. Commercial Vehicle, 2018–2026

16.24. Rest of Latin America Forecast, by Type

16.24.1. Dry Clutch, 2018–2026

16.24.2. Wet Clutch, 2018–2026

16.25. Rest of Latin America Forecast, by Transmission

16.25.1. Manual Transmission, 2018–2026

16.25.2. Automatic Transmission, 2018–2026

16.25.2.1. Dual Clutch Transmission 2018–2026

16.25.2.2. Automated Manual Transmission 2018–2026

16.26. Rest of Latin America Forecast, by Material

16.26.1. Organic Material, 2018–2026

16.26.2. Ceramic Material, 2018–2026

16.26.3. Others ( Kevlar & Feramic ), 2018–2026

16.27. Rest of Latin America Forecast, by Vehicle Type

16.27.1. Passenger Vehicle, 2018–2026

16.27.2. Commercial Vehicle, 2018–2026

16.28. PEST Analysis

17. Company Profiles

17.1. Market Share Analysis, by Company

17.2. Competition Matrix

17.3. Company Profiles: Key Players

17.3.1. Schaeffler AG

17.3.1.1. Company Overview

17.3.1.2. Financial Overview

17.3.1.3. Business Strategy

17.3.1.4. Recent Developments

17.3.2. BorgWarner Inc.

17.3.2.1. Company Overview

17.3.2.2. Financial Overview

17.3.2.3. Business Strategy

17.3.2.4. Recent Developments

17.3.3. ZF Friedrichshafen AG

17.3.3.1. Company Overview

17.3.3.2. Financial Overview

17.3.3.3. Business Strategy

17.3.3.4. Recent Developments

17.3.4. AISIN SEIKI

17.3.4.1. Company Overview

17.3.4.2. Financial Overview

17.3.4.3. Business Strategy

17.3.4.4. Recent Developments

17.3.5. EXEDY Corporation

17.3.5.1. Company Overview

17.3.5.2. Financial Overview

17.3.5.3. Business Strategy

17.3.5.4. Recent Developments

17.3.6. FTE automotive

17.3.6.1. Company Overview

17.3.6.2. Financial Overview

17.3.6.3. Business Strategy

17.3.6.4. Recent Developments

17.3.7. AMS Automotive

17.3.7.1. Company Overview

17.3.7.2. Financial Overview

17.3.7.3. Business Strategy

17.3.7.4. Recent Developments

17.3.8. F.C.C. Co., Ltd.

17.3.8.1. Company Overview

17.3.8.2. Financial Overview

17.3.8.3. Business Strategy

17.3.8.4. Recent Developments

17.3.9. Valeo

17.3.9.1. Company Overview

17.3.9.2. Financial Overview

17.3.9.3. Business Strategy

17.3.9.4. Recent Developments

17.3.10. Setco Automotive Ltd

17.3.10.1. Company Overview

17.3.10.2. Financial Overview

17.3.10.3. Business Strategy

17.3.10.4. Recent Developments

17.3.11. Robert Bosch GmbH

17.3.11.1. Company Overview

17.3.11.2. Financial Overview

17.3.11.3. Business Strategy

17.3.11.4. Recent Developments

18. Primary Key Insights

List of Tables

Table 1: Global Automotive Clutch Market Volume (Million Units) Forecast, by Transmission, 2017–2026

Table 2: Global Automotive Clutch Market Size (US$ Mn) Forecast, by Transmission, 2017–2026

Table 3: Global Automotive Clutch Market Volume (Million Units) Forecast, by Clutch Type, 2017–2026

Table 4: Global Automotive Clutch Market Size (US$ Mn) Forecast, by Clutch Type, 2017–2026

Table 5: Global Automotive Clutch Market Volume (Million Units) Forecast, by Material Type, 2017–2026

Table 6: Global Automotive Clutch Market Size (US$ Mn) Forecast, by Material Type, 2017–2026

Table 7: Global Automotive Clutch Market Volume (Million Units) and Forecast, by Vehicle Type, 2017–2026

Table 8: Global Automotive Clutch Market Size (USD Mn) and Forecast, by Vehicle Type, 2017–2026

Table 9: Global Automotive Clutch Market Volume (Million Units) and Forecast, by Sales Channel, 2018–2026

Table 10: Global Automotive Clutch Market Size (USD Mn) and Forecast, by Sales Channel, 2017–2026

Table 11: Global Automotive Clutch Market Size (US$ Mn) Forecast, by Region, 2017–2026

Table 12: Global Automotive Clutch Market Volume (Mn Units) Forecast, by Region, 2017–2026

Table 13: North America Automotive Clutch Market Size (US$ Mn) Forecast, by Transmission, 2017–2026

Table 14: North America Automotive Clutch Market Volume (Million Units) Forecast, by Transmission, 2017–2026

Table 15: North America Automotive Clutch Market Size (US$ Mn) Forecast, by Clutch Type, 2017–2026

Table 16: North America Automotive Clutch Market Volume (Mn Units) Forecast, by Clutch Type, 2017–2026

Table 17: North America Automotive Clutch Market Size (US$ Mn) Forecast, by Material Type, 2017–2026

Table 18: North America Automotive Clutch Market Volume (Mn Units) Forecast, by Material Type, 2017–2026

Table 19: North America Automotive Clutch Market Size (US$ Mn) Forecast, by Sales Channel, 2017–2026

Table 20: North America Automotive Clutch Market Volume (Mn Units) Forecast, by Sales Channel, 2017–2026

Table 21: North America Automotive Clutch Market Size (US$ Mn) Forecast, by Vehicle Type, 2017–2026

Table 22: North America Automotive Clutch Market Volume (Million Units) Forecast, by Vehicle Type, 2017–2026

Table 23: North America Automotive Clutch Market Size (US$ Mn) Forecast, by Country, 2017–2026

Table 24: North America Automotive Clutch Market Volume (Million Units) Forecast, by Country, 2017–2026

Table 25: U.S. Automotive Clutch Market Size (US$ Mn) Forecast, by Transmission, 2017–2026

Table 26: U.S. Automotive Clutch Market Volume (Million Units) Forecast, by Transmission, 2017–2026

Table 27: U.S. Automotive Clutch Market Size (US$ Mn) Forecast, by Clutch Type, 2017–2026

Table 28: U.S. Automotive Clutch Market Volume (Million Units) Forecast, by Clutch Type, 2017–2026

Table 29: U.S. Automotive Clutch Market Size (US$ Mn) Forecast, by Material Type, 2017–2026

Table 30: U.S. Automotive Clutch Market Volume (Million Units) Forecast, by Material Type, 2017–2026

Table 31: U.S. Automotive Clutch Market Size (US$ Mn) Forecast, by Vehicle Type, 2017–2026

Table 32: U.S. Automotive Clutch Market Volume (Million Units) Forecast, by Vehicle Type, 2017–2026

Table 33: Canada Automotive Clutch Market Size (US$ Mn) Forecast, by Transmission, 2017–2026

Table 34: Canada Automotive Clutch Market Volume (Mn Units) Forecast, by Transmission, 2017–2026

Table 35: Canada Automotive Clutch Market Size (US$ Mn) Forecast, by Clutch Type, 2017–2026

Table 36: Canada Automotive Clutch Market Volume (Units) Forecast, by Clutch Type, 2017–2026

Table 37: Canada Automotive Clutch Market Size (US$ Mn) Forecast, by Material Type, 2017–2026

Table 38: Canada Automotive Clutch Market Volume (Units) Forecast, by Material Type, 2017–2026

Table 39: Canada Automotive Clutch Market Size (US$ Mn) Forecast, by Vehicle Type, 2017–2026

Table 40: Canada Automotive Clutch Market Volume (Million Units) Forecast, by Vehicle Type, 2017–2026

Table 41: Europe Automotive Clutch Market Size (US$ Mn) Forecast, by Transmission, 2017–2026

Table 42: Europe Automotive Clutch Market Volume (Million Units) Forecast, by Transmission, 2017–2026

Table 43: Europe Automotive Clutch Market Size (US$ Mn) Forecast, by Clutch Type, 2017–2026

Table 44: Europe Automotive Clutch Market Volume (Million Units) Forecast, by Clutch Type, 2017–2026

Table 45: Europe Automotive Clutch Market Size (US$ Mn) Forecast, by Material Type, 2017–2026

Table 46: Europe Automotive Clutch Market Volume (Million Units) Forecast, by Material Type, 2017–2026

Table 47: Europe Automotive Clutch Market Size (US$ Mn) Forecast, by Sales Channel, 2017–2026

Table 48: Europe Automotive Clutch Market Volume (Million Units) Forecast, by Sales Channel, 2017–2026

Table 49: Europe Automotive Clutch Market Size (US$ Mn) Forecast, by Vehicle Type, 2017–2026

Table 50: Europe Automotive Clutch Market Volume (Million Units) Forecast, by Vehicle Type, 2017–2026

Table 51: Europe Automotive Clutch Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2026

Table 52: Europe Automotive Clutch Market Volume (Million Units) Forecast, by Country/Sub-region, 2017–2026

Table 53: Germany Automotive Clutch Market Size (US$ Mn) Forecast, by Transmission, 2017–2026

Table 54: Germany Automotive Clutch Market Volume (Million Units) Forecast, by Transmission, 2017–2026

Table 55: Germany Automotive Clutch Market Size (US$ Mn) Forecast, by Clutch Type, 2017–2026

Table 56: Germany Automotive Clutch Market Volume (Million Units) Forecast, by Clutch Type, 2017–2026

Table 57: Germany Automotive Clutch Market Size (US$ Mn) Forecast, by Material Type, 2017–2026

Table 58: Germany Automotive Clutch Market Volume (Million Units) Forecast by Material Type, 2017–2026

Table 59: Germany Automotive Clutch Market Size (US$ Mn) Forecast, by Vehicle Type, 2017–2026

Table 60: Germany Automotive Clutch Market Volume (Million Units) Forecast, by Vehicle Type, 2017–2026

Table 61: U.K. Automotive Clutch Market Size (US$ Mn) Forecast, by Transmission, 2017–2026

Table 62: U.K. Automotive Clutch Market Volume (Million Units) Forecast, by Transmission, 2017–2026

Table 63: U.K. Automotive Clutch Market Size (US$ Mn) Forecast, by Clutch Type, 2017–2026

Table 64: U.K. Automotive Clutch Market Volume (Million Units) Forecast, by Clutch Type, 2017–2026

Table 65: U.K. Automotive Clutch Market Size (US$ Mn) Forecast, by Material Type, 2017–2026

Table 66: U.K. Automotive Clutch Market Volume (Million Units) Forecast, by Material Type, 2017–2026

Table 67: U.K. Automotive Clutch Market Size (US$ Mn) Forecast, by Vehicle Type, 2017–2026

Table 68: U.K. Automotive Clutch Market Volume (Million Units) Forecast, by Vehicle Type, 2017–2026

Table 69: France Automotive Clutch Market Size (US$ Mn) Forecast, by Transmission, 2017–2026

Table 70: France Automotive Clutch Market Volume (Million Units) Forecast, by Transmission, 2017–2026

Table 71: France Automotive Clutch Market Size (US$ Mn) Forecast, by Clutch Type, 2017–2026

Table 72: France Automotive Clutch Market Volume (Million Units) Forecast, by Clutch Type, 2017–2026

Table 73: France Automotive Clutch Market Size (US$ Mn) Forecast, by Material Type, 2017–2026

Table 74: France Automotive Clutch Market Volume (Million Units) Forecast, by Material Type, 2017–2026

Table 75: France Automotive Clutch Market Size (US$ Mn) Forecast, by Vehicle Type, 2017–2026

Table 76: France Automotive Clutch Market Volume (Million Units) Forecast, by Vehicle Type, 2017–2026

Table 77: Italy Automotive Clutch Market Size (US$ Mn) Forecast, by Transmission, 2017–2026

Table 78: Italy Automotive Clutch Market Volume (Million Units) Forecast, by Transmission, 2017–2026

Table 79: Italy Automotive Clutch Market Size (US$ Mn) Forecast, by Clutch Type, 2017–2026

Table 80: Italy Automotive Clutch Market Volume (Million Units) Forecast, by Clutch Type, 2017–2026

Table 81: Italy Automotive Clutch Market Size (US$ Mn) Forecast, by Material Type, 2017–2026

Table 82: Italy Automotive Clutch Market Volume (Million Units) Forecast, by Material Type, 2017–2026

Table 83: Italy Automotive Clutch Market Size (US$ Mn) Forecast, by Vehicle Type, 2017–2026

Table 84: Italy Automotive Clutch Market Volume (Millions Units) Forecast, by Vehicle Type, 2017–2026

Table 85: Spain Automotive Clutch Market Size (US$ Mn) Forecast, by Transmission, 2017–2026

Table 86: Spain Automotive Clutch Market Volume (Million Units) Forecast, by Transmission, 2017–2026

Table 87: Spain Automotive Clutch Market Size (US$ Mn) Forecast, by Clutch Type, 2017–2026

Table 88: Spain Automotive Clutch Market Volume (Million Units) Forecast, by Clutch Type, 2017–2026

Table 89: Spain Automotive Clutch Market Size (US$ Mn) Forecast, by Material Type, 2017–2026

Table 90: Spain Automotive Clutch Market Volume (Million Units) Forecast, by Material Type, 2017–2026

Table 91: Spain Automotive Clutch Market Size (US$ Mn) Forecast, by Vehicle Type, 2017–2026

Table 92: Spain Automotive Clutch Market Volume (Million Units) Forecast, by Vehicle Type, 2017–2026

Table 93: Rest of Europe Automotive Clutch Market Size (US$ Mn) Forecast, by Transmission, 2017–2026

Table 94: Rest of Europe Automotive Clutch Market Volume (Millions Units) Forecast, by Transmission, 2017–2026

Table 95: Rest of Europe Automotive Clutch Market Size (US$ Mn) Forecast, by Clutch, 2017–2026

Table 96: Rest of Europe Automotive Clutch Market Volume (Millions Units) Forecast, by Clutch Type, 2017–2026

Table 97: Rest of Europe Automotive Clutch Market Size (US$ Mn) Forecast, by Material Type, 2017–2026

Table 98: Rest of Europe Automotive Clutch Market Volume (Millions Units) Forecast, by Material Type, 2017–2026

Table 99: Rest of Europe Automotive Clutch Market Size (US$ Mn) Forecast, by Vehicle Type, 2017–2026

Table 100: Rest of Europe Automotive Clutch Market Volume (Million Units) Forecast, by Vehicle Type, 2017–2026

Table 101: Asia Pacific Automotive Clutch Market Size (US$ Mn) Forecast, by Transmission, 2017–2026

Table 102: Asia Pacific Automotive Clutch Market Volume (Million Units) Forecast, by Transmission, 2017–2026

Table 103: Asia Pacific Automotive Clutch Market Size (US$ Mn) Forecast, by Clutch Type, 2017–2026

Table 104: Asia Pacific Automotive Clutch Market Volume (Million Units) Forecast, by Clutch Type, 2017–2026

Table 105: Asia Pacific Automotive Clutch Market Size (US$ Mn) Forecast, by Material Type, 2017–2026

Table 106: Asia Pacific Automotive Clutch Market Volume (Million Units) Forecast, by Material Type, 2017–2026

Table 107: Asia Pacific Automotive Clutch Market Size (US$ Mn) Forecast, by Sales Channel Type, 2017–2026

Table 108: Asia Pacific Automotive Clutch Market Volume (Million Units) Forecast, by Sales Channel, 2017–2026

Table 109: Asia Pacific Automotive Clutch Market Size (US$ Mn) Forecast, by Vehicle Type, 2017–2026

Table 110: Asia Pacific Automotive Clutch Market Volume (Million Units) Forecast, by Vehicle Type, 2017–2026

Table 111: Asia Pacific Automotive Clutch Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2026

Table 112: Asia Pacific Automotive Clutch Market, by Volume (Million Units) Forecast, by Country/Sub-region, 2017–2026

Table 113: China Automotive Clutch Market Size (US$ Mn) Forecast, by Transmission, 2017–2026

Table 114: China Automotive Clutch Market Volume (Million Units) Forecast, by Transmission, 2017–2026

Table 115: China Automotive Clutch Market Size (US$ Mn) Forecast, by Clutch Type, 2017–2026

Table 116: China Automotive Clutch Market Volume (Million Units) Forecast, by Clutch Type, 2017–2026

Table 117: China Automotive Clutch Market Size (US$ Mn) Forecast, by Material Type, 2017–2026

Table 118: China Automotive Clutch Market Volume (Million Units) Forecast, by Material Type, 2017–2026

Table 119: China Automotive Clutch Market Size (US$ Mn) Forecast, by Vehicle Type, 2017–2026

Table 120: China Automotive Clutch Market Volume (Million Units) Forecast, by Vehicle Type, 2017–2026

Table 121: India Automotive Clutch Market Size (US$ Mn) Forecast, by Transmission, 2017–2026

Table 122: India Automotive Clutch Market Volume (Million Units) Forecast, by Transmission, 2017–2026

Table 123: India Automotive Clutch Market Size (US$ Mn) Forecast, by Clutch Type, 2017–2026

Table 124: India Automotive Clutch Market Volume (Million Units) Forecast, by Clutch Type, 2017–2026

Table 125: India Automotive Clutch Market Size (US$ Mn) Forecast, by Material Type, 2017–2026

Table 126: India Automotive Clutch Market Volume (Million Units) Forecast, by Material Type, 2017–2026

Table 127: India Automotive Clutch Market Size (US$ Mn) Forecast, by Vehicle Type, 2017–2026

Table 128: India Automotive Clutch Market Volume (Million Units) Forecast, by Vehicle Type, 2017–2026

Table 129: Japan Automotive Clutch Market Size (US$ Mn) Forecast, by Transmission, 2017–2026

Table 130: Japan Automotive Clutch Market Volume (Million Units) Forecast, by Transmission, 2017–2026

Table 131: Japan Automotive Clutch Market Size (US$ Mn) Forecast, by Clutch Type, 2017–2026

Table 132: Japan Automotive Clutch Market Volume (Million Units) Forecast, by Clutch Type, 2017–2026

Table 133: Japan Automotive Clutch Market Size (US$ Mn) Forecast, by Material Type, 2017–2026

Table 134: Japan Automotive Clutch Market Volume (Million Units) Forecast, by Material Type, 2017–2026

Table 135: Japan Automotive Clutch Market Size (US$ Mn) Forecast, by Vehicle Type, 2017–2026

Table 136: Japan Automotive Clutch Market Volume (Million Units) Forecast, by Vehicle Type, 2017–2026

Table 137: ASEAN Automotive Clutch Market Size (US$ Mn) Forecast, by Transmission, 2017–2026

Table 138: ASEAN Automotive Clutch Market Volume (Million Units) Forecast, by Transmission, 2017–2026

Table 139: ASEAN Automotive Clutch Market Size (US$ Mn) Forecast, by Clutch Type, 2017–2026

Table 140: ASEAN Automotive Clutch Market Volume (Million Units) Forecast, by Clutch Type, 2017–2026

Table 141: ASEAN Automotive Clutch Market Size (US$ Mn) Forecast, by Material Type, 2017–2026

Table 142: ASEAN Automotive Clutch Market Volume (Million Units) Forecast, by Material Type, 2017–2026

Table 143: ASEAN Automotive Clutch Market Size (US$ Mn) Forecast, by Vehicle Type, 2017–2026

Table 144: ASEAN Automotive Clutch Market Volume (Million Units) Forecast, by Vehicle Type, 2017–2026

Table 145: Rest of Asia Pacific Automotive Clutch Market Size (US$ Mn) Forecast, by Transmission, 2017–2026

Table 146: Rest of Asia Pacific Automotive Clutch Market Volume (Million Units) Forecast, by Transmission, 2017–2026

Table 147: Rest of Asia Pacific Automotive Clutch Market Size (US$ Mn) Forecast, by Clutch Type, 2017–2026

Table 148: Rest of Asia Pacific Automotive Clutch Market Volume (Million Units) Forecast, by Clutch Type, 2017–2026

Table 149: Rest of Asia Pacific Automotive Clutch Market Size (US$ Mn) Forecast, by Material Type, 2017–2026

Table 150: Rest of Asia Pacific Automotive Clutch Market Volume (Million Units) Forecast, by Material Type, 2017–2026

Table 151: Rest of Asia Pacific Automotive Clutch Market Size (US$ Mn) Forecast, by Vehicle Type, 2017–2026

Table 152: Rest of Asia Pacific Automotive Clutch Market Volume (Million Units) Forecast, by Vehicle Type, 2017–2026

Table 111: Middle East & Africa Automotive Clutch Market Size (US$ Mn) Forecast, by Transmission, 2017–2026

Table 112: Middle East & Africa Automotive Clutch Market Volume (Million Units) Forecast, by Transmission, 2017–2026

Table 153: Middle East & Africa Automotive Clutch Market Size (US$ Mn) Forecast, by Clutch Type, 2017–2026

Table 154: Middle East & Africa Automotive Clutch Market Volume (Million Units) Forecast, by Clutch Type, 2017–2026

Table 155: Middle East & Africa Automotive Clutch Market Size (US$ Mn) Forecast, by Clutch Type, 2017–2026

Table 156: Middle East & Africa Automotive Clutch Market Volume (Million Units) Forecast, by Clutch Type, 2017–2026

Table 157: Middle East & Africa Automotive Clutch Market Size (US$ Mn) Forecast, by Sales Channel, 2017–2026

Table 158: Middle East & Africa Automotive Clutch Market Volume (Million Units) Forecast, by Sales Channel, 2017–2026

Table 159: Middle East & Africa Automotive Clutch Market Size (US$ Mn) Forecast, by Vehicle Type, 2017–2026

Table 160: Middle East & Africa Automotive Clutch Market Volume (Million Units) Forecast, by Vehicle Type, 2017–2026

Table 161: Middle East & Africa Automotive Clutch Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2026

Table 162: Middle East & Africa Automotive Clutch Market Volume (Million Units) Forecast, by Country/Sub-region, 2017–2026

Table 163: GCC Automotive Clutch Market Size (US$ Mn) Forecast, by Transmission, 2017–2026

Table 164: GCC Automotive Clutch Market Volume (Million Units) Forecast, by Transmission, 2017–2026

Table 165: GCC Automotive Clutch Market Size (US$ Mn) Forecast, by Clutch Type, 2017–2026

Table 166: GCC Automotive Clutch Market Volume (Million Units) Forecast, by Clutch Type, 2017–2026

Table 167: GCC Automotive Clutch Market Size (US$ Mn) Forecast, by Material Type, 2017–2026

Table 168: GCC Automotive Clutch Market Volume (Million Units) Forecast, by Material Type, 2017–2026

Table 169: GCC Automotive Clutch Market Size (US$ Mn) Forecast, by Vehicle Type, 2017–2026

Table 170: GCC Automotive Clutch Market Volume (Million Units) Forecast, by Vehicle Type, 2017–2026

Table 171: South Africa Automotive Clutch Market Size (US$ Mn) Forecast, by Transmission, 2017–2026

Table 172: South Africa Automotive Clutch Market Volume (Million Units) Forecast, by Transmission, 2017–2026

Table 173: South Africa Automotive Clutch Market Size (US$ Mn) Forecast, by Clutch Type, 2017–2026

Table 174: South Africa Automotive Clutch Market Volume (Million Units) Forecast, by Clutch Type, 2017–2026

Table 175: South Africa Automotive Clutch Market Size (US$ Mn) Forecast, by Material Type, 2017–2026

Table 176: South Africa Automotive Clutch Market Volume (Million Units) Forecast, by Material Type, 2017–2026

Table 177: South Africa Automotive Clutch Market Size (US$ Mn) Forecast, by Vehicle Type, 2017–2026

Table 178: South Africa Automotive Clutch Market Volume (Million Units) Forecast, by Vehicle Type, 2017–2026

Table 179: Rest of MEA Automotive Clutch Market Size (US$ Mn) Forecast, by Transmission, 2017–2026

Table 180: Rest of MEA Automotive Clutch Market Volume (Million Units) Forecast, by Transmission, 2017–2026

Table 181: Rest of MEA Automotive Clutch Market Size (US$ Mn) Forecast, by Clutch Type, 2017–2026

Table 182: Rest of MEA Automotive Clutch Market Volume (Million Units) Forecast, by Clutch Type, 2017–2026

Table 183: Rest of MEA Automotive Clutch Market Size (US$ Mn) Forecast, by Material Type, 2017–2026

Table 184: Rest of MEA Automotive Clutch Market Volume (Million Units) Forecast, by Material Type, 2017–2026

Table 185: Rest of MEA Automotive Clutch Market Size (US$ Mn) Forecast, by Vehicle Type, 2017–2026

Table 186: Rest of MEA Automotive Clutch Market Volume (Million Units) Forecast, by Vehicle Type, 2017–2026

Table 187: Latin America Automotive Clutch Market Size (US$ Mn) Forecast, by Transmission, 2017–2026

Table 188: Latin America Automotive Clutch Market Volume (Million Units) Forecast, by Transmission, 2017–2026

Table 189: Latin America Automotive Clutch Market Size (US$ Mn) Forecast, by Clutch Type, 2017–2026

Table 190: Latin America Automotive Clutch Market Volume (Million Units) Forecast, by Clutch Type, 2017–2026

Table 191: Latin America Automotive Clutch Market Size (US$ Mn) Forecast, by Material Type, 2017–2026

Table 192: Latin America Automotive Clutch Market Volume (Million Units) Forecast, by Material Type, 2017–2026

Table 193: Latin America Automotive Clutch Market Size (US$ Mn) Forecast, by Sales Channel, 2017–2026

Table 194: Latin America Automotive Clutch Market Volume (Million Units) Forecast, by Sales Channel, 2017–2026

Table 195: Latin America Automotive Clutch Market Size (US$ Mn) Forecast, by Vehicle Type, 2017–2026

Table 196: Latin America Automotive Clutch Market Volume (Million Units) Forecast, by Vehicle Type, 2017–2026

Table 197: Latin America Automotive Clutch Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2026

Table 198: Latin America Automotive Clutch Market Volume (Million Units) Forecast, by Country and Sub-Regions, 2017–2026

Table 199: Mexico Automotive Clutch Market Size (US$ Mn) Forecast, by Transmission, 2017–2026

Table 200: Mexico Automotive Clutch Market Volume (Million Units) Forecast, by Transmission, 2017–2026

Table 201: Mexico Automotive Clutch Market Size (US$ Mn) Forecast, by Clutch, 2017–2026

Table 202: Mexico Automotive Clutch Market Volume (Million Units) Forecast, by Clutch, 2017–2026

Table 203: Mexico Automotive Clutch Market Size (US$ Mn) Forecast, by Material, 2017–2026

Table 204: Mexico Automotive Clutch Market Volume (Million Units) Forecast, by Material, 2017–2026

Table 205: Mexico Automotive Clutch Market Size (US$ Mn) Forecast, by Vehicle Type, 2017–2026

Table 206: Mexico Automotive Clutch Market Volume (Million Units) Forecast, by Vehicle Type, 2017–2026

Table 207: Brazil Automotive Clutch Market Size (US$ Mn) Forecast, by Transmission, 2017–2026

Table 208: Brazil Automotive Clutch Market Volume (Million Units) Forecast, by Transmission, 2017–2026

Table 209: Brazil Automotive Clutch Market Size (US$ Mn) Forecast, by Clutch Type, 2017–2026

Table 210: Brazil Automotive Clutch Market Volume (Million Units) Forecast, by Clutch Type, 2017–2026

Table 211: Brazil Automotive Clutch Market Size (US$ Mn) Forecast, by Material Type, 2017–2026

Table 212: Brazil Automotive Clutch Market Volume (Million Units) Forecast, by Material Type, 2017–2026

Table 213: Brazil Automotive Clutch Market Size (US$ Mn) Forecast, by Vehicle Type, 2017–2026

Table 214: Brazil Automotive Clutch Market Volume (Million Units) Forecast, by Vehicle Type, 2017–2026

Table 215: Rest of Latin America Automotive Clutch Market Size (US$ Mn) Forecast, by Transmission, 2017–2026

Table 216: Rest of Latin America Automotive Clutch Market Volume (Million Units) Forecast, by Transmission, 2017–2026

Table 217: Rest of Latin America Automotive Clutch Market Size (US$ Mn) Forecast, by Clutch Type, 2017–2026

Table 218: Rest of Latin America Automotive Clutch Market Volume (Million Units) Forecast, by Clutch Type, 2017–2026

Table 219: Rest of Latin America Automotive Clutch Market Size (US$ Mn) Forecast, by Material Type, 2017–2026

Table 220: Rest of Latin America Automotive Clutch Market Volume (Million Units) Forecast, by Material Type, 2017–2026

Table 221: Rest of Latin America Automotive Clutch Market Size (US$ Mn) Forecast, by Vehicle Type, 2017–2026

Table 222: Rest of Latin America Automotive Clutch Market Volume (Million Units) Forecast, by Vehicle Type, 2017–2026

List of Figures

Figure 1: Global Automotive Clutch Market Snapshot

Figure 2: Global Automotive Clutch Market Size (US$ Mn) and (Million Units) Forecast, 2017–2026

Figure 3: Global Automotive Clutch Market, Y-o-Y Growth (%), 2017–2026

Figure 4: Global Automotive Clutch Market Value Share Analysis (US$ Mn), by Transmission, 2017 and 2026

Figure 5: Global Manual Transmission Segment Volume (Million Units) Value (US$ Mn) Forecast, 2017–2026

Figure 6: Global Automatic Transmission Segment Volume (Million Units) Value (US$ Mn) Forecast, 2017–2026

Figure 7: Global Dual Clutch Transmission Segment Volume (Million Units) Value (US$ Mn) Forecast, 2017–2026

Figure 8: Global Automated Manual Transmission Segment Volume (Million Units) Value (US$ Mn) Forecast, 2017–2026

Figure 9: Global Transmission Others Segment, by Volume (Million Units) & Value (US$ Mn) Forecast 2017–2026

Figure 10: Global Automotive Clutch Market Attractiveness Analysis, by Transmission

Figure 11: Global Automotive Clutch Market Value Share Analysis, by Clutch Type, 2017 and 2026

Figure 12: Global Dry clutch Segment Volume (Million Units) Value (US$ Mn) Forecast, 2017–2026

Figure 13: Global Wet Clutch Segment Volume (Million Units) Value (US$ Mn) Forecast, 2017–2026

Figure 14: Global Automotive Clutch Market Attractiveness Analysis, by Clutch Type

Figure 15: Global Automotive Clutch Market Value Share Analysis (US$ Mn), by Material Type, 2017 and 2026

Figure 16: Global Organic Material Segment Volume (Million Units) Value (US$ Mn) Forecast, 2017–2026

Figure 17: Global Ceramic Material Segment Volume (Million Units) Value (US$ Mn) Forecast, 2017–2026

Figure 18: Global Transmission Segment, by Volume (Million Units) & Value (US$ Mn) Forecast 2017–2026

Figure 19: Global Automotive Clutch Market Attractiveness Analysis, by Material Type

Figure 20: Global Automotive Clutch Market Value Share Analysis, by Vehicle Type, 2017 and 2026

Figure 21: Global Passenger Vehicle Segment, by Volume (Million Units) & Value (US$ Mn) Forecast 2017–2026

Figure 22: Global Commercial Vehicle Segment, by Volume (Million Units) & Value (US$ Mn) Forecast 2017–2026

Figure 23: Global Automotive Clutch Market Attractiveness Analysis, by Vehicle Type

Figure 24: Global Automotive Clutch Market Value Share Analysis, by Sales Channel Type, 2017 and 2026

Figure 25: Global OEM Segment, by Volume (Million Units) & Value (US$ Mn) Forecast 2017–2026

Figure 26: Global Aftermarket Segment, by Volume (Million Units) & Value (US$ Mn) Forecast 2017–2026

Figure 27: Global Automotive Clutch Market Attractiveness Analysis, by Sales Channel

Figure 28: Global Automotive Clutch Market Value Share Analysis, by Region, 2017 and 2026

Figure 29: Global Automotive Clutch Market Attractiveness Analysis, by Region

Figure 30: North America Automotive Clutch Market Size (US$ Mn) and Volume (Million Units) Forecast, 2017–2026

Figure 31: North America Automotive Clutch Market Attractiveness Analysis, by Country

Figure 32: North America Automotive Clutch Market Value Share Analysis, by Transmission, 2017 and 2026

Figure 33: North America Automotive Clutch Market Value Share Analysis, by Clutch Type, 2017 and 2026

Figure 34: North America Automotive Clutch Market Value Share Analysis, by Material Type, 2017 and 2026

Figure 35: North America Automotive Clutch Market Value Share Analysis, by Sales Channel, 2017 and 2026

Figure 36: North America Automotive Clutch Market Value Share Analysis, by Vehicle Type, 2017 and 2026

Figure 37: North America Automotive Clutch Market Value Share Analysis, by Country, 2017 and 2026

Figure 38: North America Market Attractiveness Analysis, by Transmission

Figure 39: North America Market Attractiveness Analysis, by Vehicle Type

Figure 40: North America Automotive Clutch Market Attractiveness Analysis, by Clutch Type

Figure 41: North America Automotive Clutch Market Attractiveness Analysis, by Material Type

Figure 42: North America Automotive Clutch Market Attractiveness Analysis, by sales Channel

Figure 43: Europe Automotive Clutch Market Size (US$ Mn) and Volume (Million Units) Forecast, 2017–2026

Figure 44: Europe Automotive Clutch Market Attractiveness Analysis, by Country/Sub-region

Figure 45: Europe Automotive Clutch Market Value Share Analysis, by Transmission, 2017 and 2026

Figure 46: Europe Automotive Clutch Market Value Share Analysis, by Clutch Type, 2017 and 2026

Figure 47: Europe Automotive Clutch Market Value Share Analysis, by Material Type, 2017 and 2026

Figure 48: Europe Automotive Clutch Market Value Share Analysis, by Sales Channel, 2017 and 2026

Figure 49: Europe Automotive Clutch Market Value Share Analysis, by Vehicle Type, 2017 and 2026

Figure 50: Europe Automotive Clutch Market Value Share Analysis, by Country/Sub-region, 2017 and 2026

Figure 51: Europe Automotive Clutch Market Attractiveness Analysis, by Transmission

Figure 52: Europe Automotive Clutch Market Attractiveness Analysis, by Clutch Type

Figure 53: Europe Automotive Clutch Market Attractiveness Analysis, by Material Type

Figure 54: Europe Automotive Clutch Market Attractiveness Analysis, by Vehicle Type

Figure 55: Asia Pacific Automotive Clutch Market Size (US$ Mn) and Volume (Million Units) Forecast, 2017–2026

Figure 56: Asia Pacific Automotive Clutch Market Attractiveness Analysis, by Country/Sub-region

Figure 57: Asia Pacific Automotive Clutch Market Value Share Analysis, by Transmission, 2017 and 2026

Figure 58: Asia Pacific Automotive Clutch Market Value Share Analysis, by Clutch Type, 2017 and 2026

Figure 59: Asia Pacific Automotive Clutch Market Value Share Analysis, by Material Type, 2017 and 2026

Figure 60: Asia Pacific Automotive Clutch Market Value Share Analysis, by Sales Channel, 2017 and 2026

Figure 61: Asia Pacific Automotive Clutch Market Value Share Analysis, by Vehicle Type, 2017 and 2026

Figure 62: Asia Pacific Automotive Clutch Market Value Share Analysis, by Country/Sub-region, 2017 and 2026

Figure 63: Asia Pacific Automotive Clutch Market Attractiveness Analysis, by Transmission

Figure 64: Asia Pacific Automotive Clutch Market Attractiveness Analysis, by Clutch Type

Figure 65: Asia Pacific Automotive Clutch Market Attractiveness Analysis, by Material Type

Figure 66: Asia Pacific Automotive Clutch Market Attractiveness Analysis, by Vehicle Type

Figure 67: Middle East & Africa Automotive Clutch Market Size (US$ Mn) and Volume (Million Units) Forecast, 2017–2026

Figure 68: Middle East & Africa Automotive Clutch Market Attractiveness Analysis, by Country/Sub-region

Figure 69: Middle East & Africa Automotive Clutch Market Value Share Analysis, by Transmission, 2017 and 2026

Figure 70: Middle East & Africa Automotive Clutch Market Value Share Analysis, by Clutch Type, 2017 and 2026

Figure 71: Middle East & Africa Automotive Clutch Market Value Share Analysis, by Material Type, 2017 and 2026

Figure 72: Middle East & Africa Automotive Clutch Market Value Share Analysis, by Sales Channel, 2017 and 2026

Figure 73: Middle East & Africa Automotive Clutch Market Value Share Analysis, by Vehicle Type, 2017 and 2026

Figure 74: Middle East & Africa Automotive Clutch Market Value Share Analysis, by Country/Sub-region, 2017 and 2026

Figure 75: Middle East and Africa Automotive Clutch Market Attractiveness Analysis, by Transmission

Figure 76: Middle East and Africa Automotive Clutch Market Attractiveness Analysis, by Clutch Type

Figure 77: Middle East and Africa Automotive Clutch Market Attractiveness Analysis, by Material Type

Figure 78: Middle East and Africa Automotive Clutch Market Attractiveness Analysis, by Sales Channel

Figure 79: Middle East & Africa Automotive Clutch Market Attractiveness Analysis, by Vehicle Type

Figure 80: Latin America Automotive Clutch Market Size (US$ Mn) and Volume (Million Units) Forecast, 2017–2026

Figure 81: Latin America Automotive Clutch Market Attractiveness Analysis, by Country/Sub-region

Figure 82: Latin America Automotive Clutch Market Value Share Analysis, by Transmission, 2017 and 2026

Figure 83: Latin America Automotive Clutch Market Value Share Analysis, by Clutch Type, 2017 and 2026

Figure 84: Latin America Automotive Clutch Market Value Share Analysis, by Material Type, 2017 and 2026

Figure 85: Latin America Automotive Clutch Market Value Share Analysis, by Sales Channel, 2017 and 2026

Figure 86: Latin America Automotive Clutch Market Value Share Analysis, by Vehicle Type, 2017 and 2026

Figure 87: Latin America Automotive Clutch Market Value Share Analysis, by Country/Sub-region, 2017 and 2026

Figure 88: Latin America Automotive Clutch Market Attractiveness Analysis, by Vehicle Types

Figure 89: Latin America Automotive Clutch Market Attractiveness Analysis, by Transmission

Figure 90: Latin America Automotive Clutch Market Attractiveness Analysis, by Material Type

Figure 91: Latin America Automotive Clutch Market Attractiveness Analysis, by Clutch Type

Figure 92: Latin America Automotive Clutch Market Attractiveness Analysis, by Sales Channel