Analysts’ Viewpoint

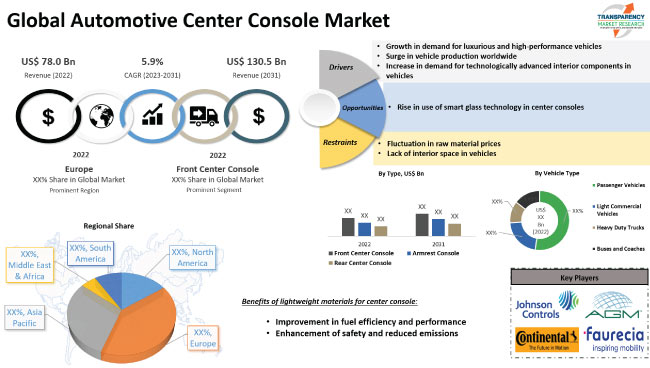

Rise in vehicle production, surge in popularity of luxurious and high-performance vehicles, and increase in demand for esthetically pleasing rental cars are fueling the global automotive center console market. Growth in demand for electric vehicles and rise in demand for technologically advanced interior components in vehicles are also augmenting the global automotive center console market share.

Increase in popularity of center consoles in online stores is further boosting market dynamics. Leading players are focusing on developing innovative center console systems to expand their customer base. However, absence of pre-installed armrests and lack of sufficient interior space in vehicles are likely to hamper market development during the forecast period.

The area of storage located between the driver's seat and the front passenger seat is known as center console. Besides storage space, center console may hold electrical devices and information about the vehicle's controls. It may additionally have cup holders, cigarette lighter or auxiliary power outlet, music controls, climate control/air conditioning system, and display screen.

Many high-end automobiles have lavishly decorated center consoles, which are made of leather, vinyl, varnished wood inserts, or aluminum. Demand for highly advanced center console for automobiles is increasing as a result of the rise in disposable income of consumers and growth in production of luxurious vehicles. Thus, the future market value of automotive center console appears promising.

Armrest console is an important automobile accessory that raises the level of comfort in a car. It is placed close to the handbrake location; therefore, it does not obstruct shifting of gears or application of the handbrake. Typically, soft foam is molded on top of the armrest to provide comfort to passengers. Armrests are reinforced with steel to ensure maximum stability and quality.

The armrest of the car has changed from its original use as a storage space into the form of the console that operates windows, air conditioning, and seat massaging features. It is ideal for mini-refrigerators and delicate electronics. Rise in demand for the latest technologies and comfort in armrests is likely to create lucrative business opportunities for the automotive center console industry during the forecast period.

Central console, which serves as an entry point for different cabin elements, has smart glass as a key component. It promotes the creation of smart surface technologies and expands the field of study for creative design utilizing Human-Machine Interface (HMI). It can be used as a cutting-edge material to improve the appearance of the vehicle.

Smart glass has actuators and sensors as well as a software framework that allows it to automatically understand user needs. Thus, development of smart glass technology is expected to fuel global market demand for automotive center console during the forecast period.

According to the global automotive center console industry report, the market segmentation, in terms of type, entails front center console, armrest console, and rear center console. The front center console segment accounted for 41.6% share in 2022. It is anticipated to dominate during the forecast period.

Demand for highly advanced elements in front center console is rising among end-users due to the increase in digitalization. Demand for touchscreen features is increasing. Manufacturers are striving to add smart features and advanced electronic components in front center console to improve consumer experience. The control framework used by car manufacturers places a strong emphasis on quality and functioning of the vehicle.

Based on vehicle type, the global market has been segmented into passenger vehicles, light commercial vehicles, heavy duty trucks, and buses and coaches. The passenger vehicles segment held 52.4% share in 2022. It is estimated to maintain its leading position and expand at a CAGR of more than 6.0% during the forecast period.

Passenger cars come with a variety of smart features. The need for automotive center consoles is increasing due to the rise in disposable income of consumers along with increase in young people's preferences for high-performance and luxurious vehicles. The global market is expected to grow in the near future, owing to the increase in electrification of automobiles, including passenger vehicles.

The automotive center console market demand is likely to increase during the forecast period, owing to the rise in sale of utility vehicles in the U.S. This is estimated to boost the passenger vehicles segment in the near future.

Europe is anticipated to hold major share of the global market during the forecast period, owing to the presence of renowned automotive manufacturing companies. Rapid adoption of modern technologies and rise in investment in manufacture of high-end premium cars are other factors contributing to automotive center console market development in Europe.

Demand for vehicle center consoles is high in Asia Pacific. Rise in disposable income of consumers, increase in auto sales, and growth in demand for high-performance and luxury vehicles are boosting market expansion in the region. Growth of the automotive sector in developing and developed countries such as India, China, and Japan is further augmenting market progress in Asia Pacific.

North America is anticipated to account for key share of the global automotive center console market size during the forecast period due to the rise in number of automakers in the region.

According to the automotive center console market research report, the industry for vehicle center console is fragmented, with the presence of large numbers of manufacturers. Major corporations possess the ability to accelerate growth through the usage of cutting-edge technologies. Key players usually employ product portfolio expansion and merger & acquisition as crucial strategies to increase their market share.

Some of the prominent players identified in the global automotive center console market are AGM Automotive, LLC, Continental AG, DRÄXLMAIER Group, Delphi Automotive plc, Emerson Electric Co., Grammer AG, Johnson Controls Inc., Faurecia, Lear Corporation, Magna International Inc., Novem Car Interior Design GmbH, Novares Group S.A., Yanfeng, and Valeo SA.

Prominent players have been summarized in the automotive center console market report based on parameters such as business segments, financial overview, product portfolio, company overview, recent developments, and business strategies.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 78.0 Bn |

|

Market Forecast Value in 2031 |

US$ 130.5 Bn |

|

Growth Rate (CAGR) |

5.9% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 78.0 Bn in 2022

It is anticipated to grow at a CAGR of 5.9% by 2031

It would be worth US$ 130.5 Bn in 2031

Rise in demand for luxurious and high-performance vehicles, surge in vehicle production worldwide, and increase in incorporation of electronics in automobiles

The front center console segment accounted for 41.6% share in 2022

Europe is a highly lucrative region for vendors

AGM Automotive, LLC, Continental AG, DRÄXLMAIER Group, Delphi Automotive plc, Emerson Electric Co., Grammer AG, Johnson Controls Inc., Faurecia, Lear Corporation, Magna International Inc, Novem Car Interior Design GmbH, Novares Group S.A., Yanfeng, and Valeo SA

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Value US$ Bn, 2017-2031

1.2. Competitive Dashboard Analysis

2. Market Overview

2.1. TMR Analysis and Recommendations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Opportunity

2.3. Market Factor Analysis

2.3.1. Porter’s Five Force Analysis

2.3.2. SWOT Analysis

2.3.3. Value Chain Analysis

2.4. Regulatory Scenario

2.5. Key Trend Analysis

2.6. Cost Structure Analysis

2.7. Profit Margin Analysis

3. COVID-19 Impact Analysis – Automotive Center Console Market

4. Global Automotive Center Console Market, By Type

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Automotive Center Console Market Size Analysis & Forecast, 2017-2031, By Type

4.2.1. Front Center Console

4.2.1.1. Air Conditioner Windows

4.2.1.2. Temperature Controls

4.2.1.3. Audio Controls

4.2.1.4. Control Units

4.2.2. Armrest Console

4.2.2.1. Storage Compartments

4.2.2.2. Cup Holders

4.2.2.3. Refrigerators

4.2.3. Rear Center Console

4.2.3.1. Entertainment Systems

4.2.3.2. Climate System Controls (Display Screens and Air Vents)

4.2.3.3. Auxiliary Power Outlets

4.2.3.4. Heater Vents

5. Global Automotive Center Console Market, By Vehicle Type

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Automotive Center Console Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

5.2.1. Passenger Vehicles

5.2.1.1. Hatchbacks

5.2.1.2. Sedans

5.2.1.3. Utility Vehicles

5.2.2. Light Commercial Vehicles

5.2.3. Heavy Duty Trucks

5.2.4. Buses and Coaches

6. Global Automotive Center Console Market, By Electric Vehicle Type

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Automotive Center Console Market Size Analysis & Forecast, 2017-2031, By Electric Vehicle Type

6.2.1. Battery Electric Vehicle (BEV)

6.2.2. Hybrid Electric Vehicle (HEV)

6.2.3. Plug-in Hybrid Electric Vehicle (PHEV)

6.2.4. Fuel Cell Electric Vehicle (FCEV)

7. Global Automotive Center Console Market, By Sales Channel

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Automotive Center Console Market Size Analysis & Forecast, 2017-2031, By Sales Channel

7.2.1. OEMs

7.2.2. Aftermarket

8. Global Automotive Center Console Market, by Region

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Automotive Center Console Market Size Analysis & Forecast, 2017-2031, By Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Middle East & Africa

8.2.5. South America

9. North America Automotive Center Console Market

9.1. Market Snapshot

9.2. Automotive Center Console Market Size Analysis & Forecast, 2017-2031, By Type

9.2.1. Front Center Console

9.2.1.1. Air Conditioner Windows

9.2.1.2. Temperature Controls

9.2.1.3. Audio Controls

9.2.1.4. Control Units

9.2.2. Armrest Console

9.2.2.1. Storage Compartments

9.2.2.2. Cup Holders

9.2.2.3. Refrigerators

9.2.3. Rear Center Console

9.2.3.1. Entertainment Systems

9.2.3.2. Climate System Controls (Display Screens and Air Vents)

9.2.3.3. Auxiliary Power Outlets

9.2.3.4. Heater Vents

9.3. Automotive Center Console Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

9.3.1. Passenger Vehicles

9.3.1.1. Hatchbacks

9.3.1.2. Sedans

9.3.1.3. Utility Vehicles

9.3.2. Light Commercial Vehicles

9.3.3. Heavy Duty Trucks

9.3.4. Buses and Coaches

9.4. Automotive Center Console Market Size Analysis & Forecast, 2017-2031, By Electric Vehicle Type

9.4.1. Battery Electric Vehicle (BEV)

9.4.2. Hybrid Electric Vehicle (HEV)

9.4.3. Plug-in Hybrid Electric Vehicle (PHEV)

9.4.4. Fuel Cell Electric Vehicle (FCEV)

9.5. Automotive Center Console Market Size Analysis & Forecast, 2017-2031, By Sales Channel

9.5.1. OEMs

9.5.2. Aftermarket

9.6. Key Country Analysis – North America Automotive Center Console Market Size Analysis & Forecast, 2017-2031

9.6.1. U.S.

9.6.2. Canada

9.6.3. Mexico

10. Europe Automotive Center Console Market

10.1. Market Snapshot

10.2. Automotive Center Console Market Size Analysis & Forecast, 2017-2031, By Type

10.2.1. Front Center Console

10.2.1.1. Air Conditioner Windows

10.2.1.2. Temperature Controls

10.2.1.3. Audio Controls

10.2.1.4. Control Units

10.2.2. Armrest Console

10.2.2.1. Storage Compartments

10.2.2.2. Cup Holders

10.2.2.3. Refrigerators

10.2.3. Rear Center Console

10.2.3.1. Entertainment Systems

10.2.3.2. Climate System Controls (Display Screens and Air Vents)

10.2.3.3. Auxiliary Power Outlets

10.2.3.4. Heater Vents

10.3. Automotive Center Console Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

10.3.1. Passenger Vehicles

10.3.1.1. Hatchbacks

10.3.1.2. Sedans

10.3.1.3. Utility Vehicles

10.3.2. Light Commercial Vehicles

10.3.3. Heavy Duty Trucks

10.3.4. Buses and Coaches

10.4. Automotive Center Console Market Size Analysis & Forecast, 2017-2031, By Electric Vehicle Type

10.4.1. Battery Electric Vehicle (BEV)

10.4.2. Hybrid Electric Vehicle (HEV)

10.4.3. Plug-in Hybrid Electric Vehicle (PHEV)

10.4.4. Fuel Cell Electric Vehicle (FCEV)

10.5. Automotive Center Console Market Size Analysis & Forecast, 2017-2031, By Sales Channel

10.5.1. OEMs

10.5.2. Aftermarket

10.6. Key Country Analysis – Europe Automotive Center Console Market Size Analysis & Forecast, 2017-2031

10.6.1. Germany

10.6.2. U. K.

10.6.3. France

10.6.4. Italy

10.6.5. Spain

10.6.6. Nordic Countries

10.6.7. Russia & CIS

10.6.8. Rest of Europe

11. Asia Pacific Automotive Center Console Market

11.1. Market Snapshot

11.2. Automotive Center Console Market Size Analysis & Forecast, 2017-2031, By Type

11.2.1. Front Center Console

11.2.1.1. Air Conditioner Windows

11.2.1.2. Temperature Controls

11.2.1.3. Audio Controls

11.2.1.4. Control Units

11.2.2. Armrest Console

11.2.2.1. Storage Compartments

11.2.2.2. Cup Holders

11.2.2.3. Refrigerators

11.2.3. Rear Center Console

11.2.3.1. Entertainment Systems

11.2.3.2. Climate System Controls (Display Screens and Air Vents)

11.2.3.3. Auxiliary Power Outlets

11.2.3.4. Heater Vents

11.3. Automotive Center Console Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

11.3.1. Passenger Vehicles

11.3.1.1. Hatchbacks

11.3.1.2. Sedans

11.3.1.3. Utility Vehicles

11.3.2. Light Commercial Vehicles

11.3.3. Heavy Duty Trucks

11.3.4. Buses and Coaches

11.4. Automotive Center Console Market Size Analysis & Forecast, 2017-2031, By Electric Vehicle Type

11.4.1. Battery Electric Vehicle (BEV)

11.4.2. Hybrid Electric Vehicle (HEV)

11.4.3. Plug-in Hybrid Electric Vehicle (PHEV)

11.4.4. Fuel Cell Electric Vehicle (FCEV)

11.5. Automotive Center Console Market Size Analysis & Forecast, 2017-2031, By Sales Channel

11.5.1. OEMs

11.5.2. Aftermarket

11.6. Key Country Analysis – Asia Pacific Automotive Center Console Market Size Analysis & Forecast, 2017-2031

11.6.1. China

11.6.2. India

11.6.3. Japan

11.6.4. ASEAN Countries

11.6.5. South Korea

11.6.6. ANZ

11.6.7. Rest of Asia Pacific

12. Middle East & Africa Automotive Center Console Market

12.1. Market Snapshot

12.2. Automotive Center Console Market Size Analysis & Forecast, 2017-2031, By Type

12.2.1. Front Center Console

12.2.1.1. Air Conditioner Windows

12.2.1.2. Temperature Controls

12.2.1.3. Audio Controls

12.2.1.4. Control Units

12.2.2. Armrest Console

12.2.2.1. Storage Compartments

12.2.2.2. Cup Holders

12.2.2.3. Refrigerators

12.2.3. Rear Center Console

12.2.3.1. Entertainment Systems

12.2.3.2. Climate System Controls (Display Screens and Air Vents)

12.2.3.3. Auxiliary Power Outlets

12.2.3.4. Heater Vents

12.3. Automotive Center Console Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

12.3.1. Passenger Vehicles

12.3.1.1. Hatchbacks

12.3.1.2. Sedans

12.3.1.3. Utility Vehicles

12.3.2. Light Commercial Vehicles

12.3.3. Heavy Duty Trucks

12.3.4. Buses and Coaches

12.4. Automotive Center Console Market Size Analysis & Forecast, 2017-2031, By Electric Vehicle Type

12.4.1. Battery Electric Vehicle (BEV)

12.4.2. Hybrid Electric Vehicle (HEV)

12.4.3. Plug-in Hybrid Electric Vehicle (PHEV)

12.4.4. Fuel Cell Electric Vehicle (FCEV)

12.5. Automotive Center Console Market Size Analysis & Forecast, 2017-2031, By Sales Channel

12.5.1. OEMs

12.5.2. Aftermarket

12.6. Key Country Analysis – Middle East & Africa Automotive Center Console Market Size Analysis & Forecast, 2017-2031

12.6.1. GCC

12.6.2. South Africa

12.6.3. Turkey

12.6.4. Rest of Middle East & Africa

13. South America Automotive Center Console Market

13.1. Market Snapshot

13.2. Automotive Center Console Market Size Analysis & Forecast, 2017-2031, By Type

13.2.1. Front Center Console

13.2.1.1. Air Conditioner Windows

13.2.1.2. Temperature Controls

13.2.1.3. Audio Controls

13.2.1.4. Control Units

13.2.2. Armrest Console

13.2.2.1. Storage Compartments

13.2.2.2. Cup Holders

13.2.2.3. Refrigerators

13.2.3. Rear Center Console

13.2.3.1. Entertainment Systems

13.2.3.2. Climate System Controls (Display Screens and Air Vents)

13.2.3.3. Auxiliary Power Outlets

13.2.3.4. Heater Vents

13.3. Automotive Center Console Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

13.3.1. Passenger Vehicles

13.3.1.1. Hatchbacks

13.3.1.2. Sedans

13.3.1.3. Utility Vehicles

13.3.2. Light Commercial Vehicles

13.3.3. Heavy Duty Trucks

13.3.4. Buses and Coaches

13.4. Automotive Center Console Market Size Analysis & Forecast, 2017-2031, By Electric Vehicle Type

13.4.1. Battery Electric Vehicle (BEV)

13.4.2. Hybrid Electric Vehicle (HEV)

13.4.3. Plug-in Hybrid Electric Vehicle (PHEV)

13.4.4. Fuel Cell Electric Vehicle (FCEV)

13.5. Automotive Center Console Market Size Analysis & Forecast, 2017-2031, By Sales Channel

13.5.1. OEMs

13.5.2. Aftermarket

13.6. Key Country Analysis – South America Automotive Center Console Market Size Analysis & Forecast, 2017-2031

13.6.1. Brazil

13.6.2. Argentina

13.6.3. Rest of South America

14. Competitive Landscape

14.1. Company Share Analysis/ Brand Share Analysis, 2022

14.2. Pricing comparison among key players

14.3. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

14.4. Company Profile/ Key Players

14.4.1. AGM Automotive, LLC

14.4.1.1. Company Overview

14.4.1.2. Company Footprints

14.4.1.3. Production Locations

14.4.1.4. Product Portfolio

14.4.1.5. Competitors & Customers

14.4.1.6. Subsidiaries & Parent Organization

14.4.1.7. Recent Developments

14.4.1.8. Financial Analysis

14.4.1.9. Profitability

14.4.1.10. Revenue Share

14.4.2. Continental AG

14.4.2.1. Company Overview

14.4.2.2. Company Footprints

14.4.2.3. Production Locations

14.4.2.4. Product Portfolio

14.4.2.5. Competitors & Customers

14.4.2.6. Subsidiaries & Parent Organization

14.4.2.7. Recent Developments

14.4.2.8. Financial Analysis

14.4.2.9. Profitability

14.4.2.10. Revenue Share

14.4.3. DRÄXLMAIER Group

14.4.3.1. Company Overview

14.4.3.2. Company Footprints

14.4.3.3. Production Locations

14.4.3.4. Product Portfolio

14.4.3.5. Competitors & Customers

14.4.3.6. Subsidiaries & Parent Organization

14.4.3.7. Recent Developments

14.4.3.8. Financial Analysis

14.4.3.9. Profitability

14.4.3.10. Revenue Share

14.4.4. Delphi Automotive plc

14.4.4.1. Company Overview

14.4.4.2. Company Footprints

14.4.4.3. Production Locations

14.4.4.4. Product Portfolio

14.4.4.5. Competitors & Customers

14.4.4.6. Subsidiaries & Parent Organization

14.4.4.7. Recent Developments

14.4.4.8. Financial Analysis

14.4.4.9. Profitability

14.4.4.10. Revenue Share

14.4.5. Emerson Electric Co.

14.4.5.1. Company Overview

14.4.5.2. Company Footprints

14.4.5.3. Production Locations

14.4.5.4. Product Portfolio

14.4.5.5. Competitors & Customers

14.4.5.6. Subsidiaries & Parent Organization

14.4.5.7. Recent Developments

14.4.5.8. Financial Analysis

14.4.5.9. Profitability

14.4.5.10. Revenue Share

14.4.6. Grammer AG

14.4.6.1. Company Overview

14.4.6.2. Company Footprints

14.4.6.3. Production Locations

14.4.6.4. Product Portfolio

14.4.6.5. Competitors & Customers

14.4.6.6. Subsidiaries & Parent Organization

14.4.6.7. Recent Developments

14.4.6.8. Financial Analysis

14.4.6.9. Profitability

14.4.6.10. Revenue Share

14.4.7. Johnson Controls Inc.

14.4.7.1. Company Overview

14.4.7.2. Company Footprints

14.4.7.3. Production Locations

14.4.7.4. Product Portfolio

14.4.7.5. Competitors & Customers

14.4.7.6. Subsidiaries & Parent Organization

14.4.7.7. Recent Developments

14.4.7.8. Financial Analysis

14.4.7.9. Profitability

14.4.7.10. Revenue Share

14.4.8. Faurecia

14.4.8.1. Company Overview

14.4.8.2. Company Footprints

14.4.8.3. Production Locations

14.4.8.4. Product Portfolio

14.4.8.5. Competitors & Customers

14.4.8.6. Subsidiaries & Parent Organization

14.4.8.7. Recent Developments

14.4.8.8. Financial Analysis

14.4.8.9. Profitability

14.4.8.10. Revenue Share

14.4.9. Lear Corporation

14.4.9.1. Company Overview

14.4.9.2. Company Footprints

14.4.9.3. Production Locations

14.4.9.4. Product Portfolio

14.4.9.5. Competitors & Customers

14.4.9.6. Subsidiaries & Parent Organization

14.4.9.7. Recent Developments

14.4.9.8. Financial Analysis

14.4.9.9. Profitability

14.4.9.10. Revenue Share

14.4.10. Magna International Inc

14.4.10.1. Company Overview

14.4.10.2. Company Footprints

14.4.10.3. Production Locations

14.4.10.4. Product Portfolio

14.4.10.5. Competitors & Customers

14.4.10.6. Subsidiaries & Parent Organization

14.4.10.7. Recent Developments

14.4.10.8. Financial Analysis

14.4.10.9. Profitability

14.4.10.10. Revenue Share

14.4.11. Novem Car Interior Design GmbH

14.4.11.1. Company Overview

14.4.11.2. Company Footprints

14.4.11.3. Production Locations

14.4.11.4. Product Portfolio

14.4.11.5. Competitors & Customers

14.4.11.6. Subsidiaries & Parent Organization

14.4.11.7. Recent Developments

14.4.11.8. Financial Analysis

14.4.11.9. Profitability

14.4.11.10. Revenue Share

14.4.12. Novares Group S.A.

14.4.12.1. Company Overview

14.4.12.2. Company Footprints

14.4.12.3. Production Locations

14.4.12.4. Product Portfolio

14.4.12.5. Competitors & Customers

14.4.12.6. Subsidiaries & Parent Organization

14.4.12.7. Recent Developments

14.4.12.8. Financial Analysis

14.4.12.9. Profitability

14.4.12.10. Revenue Share

14.4.13. Yanfeng

14.4.13.1. Company Overview

14.4.13.2. Company Footprints

14.4.13.3. Production Locations

14.4.13.4. Product Portfolio

14.4.13.5. Competitors & Customers

14.4.13.6. Subsidiaries & Parent Organization

14.4.13.7. Recent Developments

14.4.13.8. Financial Analysis

14.4.13.9. Profitability

14.4.13.10. Revenue Share

14.4.14. Valeo SA

14.4.14.1. Company Overview

14.4.14.2. Company Footprints

14.4.14.3. Production Locations

14.4.14.4. Product Portfolio

14.4.14.5. Competitors & Customers

14.4.14.6. Subsidiaries & Parent Organization

14.4.14.7. Recent Developments

14.4.14.8. Financial Analysis

14.4.14.9. Profitability

14.4.14.10. Revenue Share

14.4.15. Other Key Players

14.4.15.1. Company Overview

14.4.15.2. Company Footprints

14.4.15.3. Production Locations

14.4.15.4. Product Portfolio

14.4.15.5. Competitors & Customers

14.4.15.6. Subsidiaries & Parent Organization

14.4.15.7. Recent Developments

14.4.15.8. Financial Analysis

14.4.15.9. Profitability

14.4.15.10. Revenue Share

List of Tables

Table 1: Global Automotive Center Console Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Table 2: Global Automotive Center Console Market Value (US$ Bn) Forecast, by Type, 2017‒2031

Table 3: Global Automotive Center Console Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 4: Global Automotive Center Console Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 5: Global Automotive Center Console Market Volume (Thousand Units) Forecast, by Electric Vehicle Type, 2017-2031

Table 6: Global Automotive Center Console Market Value (US$ Bn) Forecast, by Electric Vehicle Type, 2017‒2031

Table 7: Global Automotive Center Console Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 8: Global Automotive Center Console Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 9: Global Automotive Center Console Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Table 10: Global Automotive Center Console Market Value (US$ Bn) Forecast, by Region, 2017‒2031

Table 11: North America Automotive Center Console Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Table 12: North America Automotive Center Console Market Value (US$ Bn) Forecast, by Type, 2017‒2031

Table 13: North America Automotive Center Console Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 14: North America Automotive Center Console Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 15: North America Automotive Center Console Market Volume (Thousand Units) Forecast, by Electric Vehicle Type, 2017-2031

Table 16: North America Automotive Center Console Market Value (US$ Bn) Forecast, by Electric Vehicle Type, 2017‒2031

Table 17: North America Automotive Center Console Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 18: North America Automotive Center Console Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 19: North America Automotive Center Console Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 20: North America Automotive Center Console Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 21: Europe Automotive Center Console Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Table 22: Europe Automotive Center Console Market Value (US$ Bn) Forecast, by Type, 2017‒2031

Table 23: Europe Automotive Center Console Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 24: Europe Automotive Center Console Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 25: Europe Automotive Center Console Market Volume (Thousand Units) Forecast, by Electric Vehicle Type, 2017-2031

Table 26: Europe Automotive Center Console Market Value (US$ Bn) Forecast, by Electric Vehicle Type, 2017‒2031

Table 27: Europe Automotive Center Console Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 28: Europe Automotive Center Console Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 29: Europe Automotive Center Console Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 30: Europe Automotive Center Console Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 31: Asia Pacific Automotive Center Console Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Table 32: Asia Pacific Automotive Center Console Market Value (US$ Bn) Forecast, by Type, 2017‒2031

Table 33: Asia Pacific Automotive Center Console Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 34: Asia Pacific Automotive Center Console Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 35: Asia Pacific Automotive Center Console Market Volume (Thousand Units) Forecast, by Electric Vehicle Type, 2017-2031

Table 36: Asia Pacific Automotive Center Console Market Value (US$ Bn) Forecast, by Electric Vehicle Type, 2017‒2031

Table 37: Asia Pacific Automotive Center Console Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 38: Asia Pacific Automotive Center Console Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 39: Asia Pacific Automotive Center Console Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 40: Asia Pacific Automotive Center Console Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 41: Middle East & Africa Automotive Center Console Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Table 42: Middle East & Africa Automotive Center Console Market Value (US$ Bn) Forecast, by Type, 2017‒2031

Table 43: Middle East & Africa Automotive Center Console Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 44: Middle East & Africa Automotive Center Console Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 45: Middle East & Africa Automotive Center Console Market Volume (Thousand Units) Forecast, by Electric Vehicle Type, 2017-2031

Table 46: Middle East & Africa Automotive Center Console Market Value (US$ Bn) Forecast, by Electric Vehicle Type, 2017‒2031

Table 47: Middle East & Africa Automotive Center Console Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 48: Middle East & Africa Automotive Center Console Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 49: Middle East & Africa Automotive Center Console Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 50: Middle East & Africa Automotive Center Console Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 51: South America Automotive Center Console Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Table 52: South America Automotive Center Console Market Value (US$ Bn) Forecast, by Type, 2017‒2031

Table 53: South America Automotive Center Console Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 54: South America Automotive Center Console Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 55: South America Automotive Center Console Market Volume (Thousand Units) Forecast, by Electric Vehicle Type, 2017-2031

Table 56: South America Automotive Center Console Market Value (US$ Bn) Forecast, by Electric Vehicle Type, 2017‒2031

Table 57: South America Automotive Center Console Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 58: South America Automotive Center Console Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 59: South America Automotive Center Console Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 60: South America Automotive Center Console Market Value (US$ Bn) Forecast, by Country, 2017‒2031

List of Figures

Figure 1: Global Automotive Center Console Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Figure 2: Global Automotive Center Console Market Value (US$ Bn) Forecast, by Type, 2017-2031

Figure 3: Global Automotive Center Console Market, Incremental Opportunity, by Type, Value (US$ Bn), 2023-2031

Figure 4: Global Automotive Center Console Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 5: Global Automotive Center Console Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 6: Global Automotive Center Console Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 7: Global Automotive Center Console Market Volume (Thousand Units) Forecast, by Electric Vehicle Type, 2017-2031

Figure 8: Global Automotive Center Console Market Value (US$ Bn) Forecast, by Electric Vehicle Type, 2017-2031

Figure 9: Global Automotive Center Console Market, Incremental Opportunity, by Electric Vehicle Type, Value (US$ Bn), 2023-2031

Figure 10: Global Automotive Center Console Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 11: Global Automotive Center Console Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 12: Global Automotive Center Console Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 13: Global Automotive Center Console Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Figure 14: Global Automotive Center Console Market Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 15: Global Automotive Center Console Market, Incremental Opportunity, by Region, Value (US$ Bn), 2023-2031

Figure 16: North America Automotive Center Console Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Figure 17: North America Automotive Center Console Market Value (US$ Bn) Forecast, by Type, 2017-2031

Figure 18: North America Automotive Center Console Market, Incremental Opportunity, by Type, Value (US$ Bn), 2023-2031

Figure 19: North America Automotive Center Console Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 20: North America Automotive Center Console Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 21: North America Automotive Center Console Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 22: North America Automotive Center Console Market Volume (Thousand Units) Forecast, by Electric Vehicle Type, 2017-2031

Figure 23: North America Automotive Center Console Market Value (US$ Bn) Forecast, by Electric Vehicle Type, 2017-2031

Figure 24: North America Automotive Center Console Market, Incremental Opportunity, by Electric Vehicle Type, Value (US$ Bn), 2023-2031

Figure 25: North America Automotive Center Console Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 26: North America Automotive Center Console Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 27: North America Automotive Center Console Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 28: North America Automotive Center Console Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 29: North America Automotive Center Console Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 30: North America Automotive Center Console Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 31: Europe Automotive Center Console Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Figure 32: Europe Automotive Center Console Market Value (US$ Bn) Forecast, by Type, 2017-2031

Figure 33: Europe Automotive Center Console Market, Incremental Opportunity, by Type, Value (US$ Bn), 2023-2031

Figure 34: Europe Automotive Center Console Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 35: Europe Automotive Center Console Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 36: Europe Automotive Center Console Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 37: Europe Automotive Center Console Market Volume (Thousand Units) Forecast, by Electric Vehicle Type, 2017-2031

Figure 38: Europe Automotive Center Console Market Value (US$ Bn) Forecast, by Electric Vehicle Type, 2017-2031

Figure 39: Europe Automotive Center Console Market, Incremental Opportunity, by Electric Vehicle Type, Value (US$ Bn), 2023-2031

Figure 40: Europe Automotive Center Console Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 41: Europe Automotive Center Console Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 42: Europe Automotive Center Console Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 43: Europe Automotive Center Console Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 44: Europe Automotive Center Console Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 45: Europe Automotive Center Console Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 46: Asia Pacific Automotive Center Console Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Figure 47: Asia Pacific Automotive Center Console Market Value (US$ Bn) Forecast, by Type, 2017-2031

Figure 48: Asia Pacific Automotive Center Console Market, Incremental Opportunity, by Type, Value (US$ Bn), 2023-2031

Figure 49: Asia Pacific Automotive Center Console Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 50: Asia Pacific Automotive Center Console Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 51: Asia Pacific Automotive Center Console Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 52: Asia Pacific Automotive Center Console Market Volume (Thousand Units) Forecast, by Electric Vehicle Type, 2017-2031

Figure 53: Asia Pacific Automotive Center Console Market Value (US$ Bn) Forecast, by Electric Vehicle Type, 2017-2031

Figure 54: Asia Pacific Automotive Center Console Market, Incremental Opportunity, by Electric Vehicle Type, Value (US$ Bn), 2023-2031

Figure 55: Asia Pacific Automotive Center Console Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 56: Asia Pacific Automotive Center Console Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 57: Asia Pacific Automotive Center Console Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 58: Asia Pacific Automotive Center Console Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 59: Asia Pacific Automotive Center Console Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 60: Asia Pacific Automotive Center Console Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 61: Middle East & Africa Automotive Center Console Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Figure 62: Middle East & Africa Automotive Center Console Market Value (US$ Bn) Forecast, by Type, 2017-2031

Figure 63: Middle East & Africa Automotive Center Console Market, Incremental Opportunity, by Type, Value (US$ Bn), 2023-2031

Figure 64: Middle East & Africa Automotive Center Console Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 65: Middle East & Africa Automotive Center Console Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 66: Middle East & Africa Automotive Center Console Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 67: Middle East & Africa Automotive Center Console Market Volume (Thousand Units) Forecast, by Electric Vehicle Type, 2017-2031

Figure 68: Middle East & Africa Automotive Center Console Market Value (US$ Bn) Forecast, by Electric Vehicle Type, 2017-2031

Figure 69: Middle East & Africa Automotive Center Console Market, Incremental Opportunity, by Electric Vehicle Type, Value (US$ Bn), 2023-2031

Figure 70: Middle East & Africa Automotive Center Console Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 71: Middle East & Africa Automotive Center Console Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 72: Middle East & Africa Automotive Center Console Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 73: Middle East & Africa Automotive Center Console Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 74: Middle East & Africa Automotive Center Console Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 75: Middle East & Africa Automotive Center Console Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 76: South America Automotive Center Console Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Figure 77: South America Automotive Center Console Market Value (US$ Bn) Forecast, by Type, 2017-2031

Figure 78: South America Automotive Center Console Market, Incremental Opportunity, by Type, Value (US$ Bn), 2023-2031

Figure 79: South America Automotive Center Console Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 80: South America Automotive Center Console Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 81: South America Automotive Center Console Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 82: South America Automotive Center Console Market Volume (Thousand Units) Forecast, by Electric Vehicle Type, 2017-2031

Figure 83: South America Automotive Center Console Market Value (US$ Bn) Forecast, by Electric Vehicle Type, 2017-2031

Figure 84: South America Automotive Center Console Market, Incremental Opportunity, by Electric Vehicle Type, Value (US$ Bn), 2023-2031

Figure 85: South America Automotive Center Console Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 86: South America Automotive Center Console Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 87: South America Automotive Center Console Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 88: South America Automotive Center Console Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 89: South America Automotive Center Console Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 90: South America Automotive Center Console Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031