Analysts’ Viewpoint

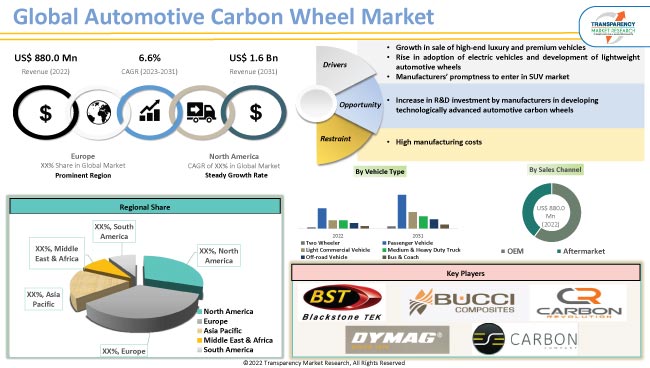

Growth in sale of high-end luxury and premium vehicles and rise in adoption of electric vehicles are significantly driving the global automotive carbon wheel market growth. Increase in demand for lightweight components to enhance the safety and efficiency of vehicles is also augmenting automotive carbon wheel market dynamics. Surge in capital investment and R&D spending by OEMs, particularly on passenger cars, is projected to drive the market during the forecast period.

Manufacturers of automotive carbon wheels are introducing innovative products that comply with rules, reduce carbon emissions, and boost efficiency. Technological advancements are expected to create ample opportunities for industry participants in the next few years. However, high manufacturing cost is projected to hamper market expansion in the near future.

Initially, steel and aluminum carbon fibers were used to manufacture automotive wheels. Nowadays, manufacturers are leaning toward carbon composite material-based wheels, which are superior in physical and chemical properties.

Steel and aluminum materials are also comparatively bulkier than carbon wheels. Hence, manufacturers catering to high-performance luxury, racing, or motorsports applications are preferring carbon wheels to obtain benefits such as weight reduction, enhanced ride comfort, and improved vehicle dynamics.

Rise in implementation of strict pollution standards worldwide is anticipated to bolster the demand for electric vehicles in the near future. This is likely to fuel automotive carbon wheel market development during the forecast period.

EV manufacturers are focusing on reducing vehicle mass and enhancing range and ride comfort. Furthermore, key carbon wheel vendors are expanding their manufacturing capabilities and developing wheels for a wider range of vehicles, including SUVs and EVs.

In March 2022, Carbon Revolution announced the development of its new 23-inch and 24-inch carbon fiber wheels to cater to the growing demand for EV SUV and trucks. This move is anticipated to help the company reduce the weight by 45% compared to aluminum wheels.

Automotive carbon wheels are gaining popularity in performance vehicles such as sports cars and SUVs owing to their strength, efficiency, strength-to-weight ratio, and vibration-curbing ability. Furthermore, rise in disposable income of people around the globe is augmenting the demand for high-end luxury and passenger vehicles.

Ford, a leading automaker, has introduced the world's first mass-produced carbon wheels for the Mustang Shelby GT350R. Ford has also fitted carbon wheels to its Ford GT and Mustang Shelby GT500.

Carbon fiber wheels are capturing the attention of SUV manufacturers, as they provide superior handling, better steering, and reduction in the vehicle's unsprung weight. SUV sales have been increasing significantly since the last five years. This is positively influencing the demand for carbon fiber wheels.

Consistent rise in global electric vehicle fleet is augmenting the market. EV weight minimization has been the key imperative for automakers. Players in the automobile carbon wheel market are increasing their research spending in order to come up with innovative carbon fiber wheels.

Auto manufacturers are also constantly striving to improve efficiency of modern cars. In March 2021, Bucci Composites completed the development of a 22-inch fully carbon fiber automotive wheel rim.

Developing countries such as India, China, Brazil, and Mexico are enacting emission standards that are comparable to Euro 6. Increase in trend of vehicle electrification and need to reduce curb weight and extend the range of EVs are key factors driving market growth.

Increase in production and sale of cars and rise in mass production initiatives are anticipated to fuel the demand for automobile carbon wheels in the near future.

Growth in sale of passenger vehicles across the globe is expected to drive the market during the forecast period. Premium passenger vehicles are gaining traction among customers. Increase in production of SUVs is fueling market statistics.

The passenger vehicle segment has been expanding since the last few years owing to the rise in purchasing power of people across the globe.

The OEM sales channels segment dominated the global market in 2022. It is anticipated to maintain its dominance throughout the forecast period.

Lucrative presence of luxury automakers across the globe is augmenting market progress. Major premium vehicle manufacturers are using carbon fiber wheels to enhance vehicle dynamics. This trend is gaining traction in premium cars as well as SUVs.

Europe accounted for major automotive carbon wheel market share in 2022. According to the automotive carbon wheel market research analysis, Europe is anticipated to hold significant share during the forecast period, owing to the large presence of OEMs as well as tier 1 and tier 2 manufacturers in the region.

Automotive carbon wheel market demand is likely to increase in the near future in Europe due to the growth in adoption of electric vehicles. High investment in research and development activities, rise in competition among luxury automakers, and significant presence of luxury automakers are fueling automotive carbon wheel market value in Europe.

The automotive carbon wheel market size in North America is projected to increase during the forecast period due to the rise in sale of high-end luxury vehicles. Furthermore, the region is the largest market for SUVs across the world. Growth in demand for automobiles with better fuel efficiency is projected to drive market development in the next few years.

As per the latest automotive carbon wheel market analysis, Blackstone Tek, Bucci Composites, Carbon Revolution, Dymag Group Limited, ESE Carbon Co., Geric, Hitachi Metals Ltd., HRE Wheels, LITESPEED RACING, Phoenix Wheel Company, Inc., Rotobox d.o.o., Rolko Kohlgrüber GmbH, Ronal Group, and Thyssenkrupp AG are some of the key players in the global landscape.

Each of these players has been profiled in the automotive carbon wheel market report based on parameters such as business segments, recent developments, financial overview, company overview, business strategies, and product portfolio.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 880.0 Mn |

|

Market Forecast Value in 2031 |

US$ 1.6 Bn |

|

Growth Rate (CAGR) |

6.6% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Mn/Bn for Value and Thousand Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 880.0 Mn in 2022.

It is anticipated to grow at a CAGR of 6.6% by 2031.

It would be worth US$ 1.6 Bn in 2031.

Increase in sale of high-end luxury and premium vehicles, rise in adoption of electric vehicles, and development of lightweight automotive wheels.

Based on vehicle type, the passenger vehicle segment accounted for major share in 2022.

Europe was the most lucrative region in 2022.

Blackstone Tek, Bucci Composites, Carbon Revolution, Dymag Group Limited, ESE Carbon, Geric, Hitachi Metals Ltd., HRE Wheels, LITESPEED RACING, Phoenix Wheel Company, Inc., Rotobox d.o.o., Rolko Kohlgrüber GmbH, Ronal Group, and Thyssenkrupp AG.

1. Preface

1.1. About TMR

1.2. Market Coverage / Taxonomy

1.3. Assumptions and Research Methodology

2. Executive Summary

2.1. Global Market Outlook

2.1.1. Market Size, Thousand Units, US$ Bn, 2017-2031

2.2. Demand & Supply Side Trends

2.3. TMR Analysis and Recommendations

2.4. Competitive Dashboard Analysis

3. Go to Market Strategy

3.1. Demand & Supply Side Trends

3.1.1. GAP Analysis

3.2. Identification of Potential Market Spaces

3.3. Understanding the Buying Process of the Customers

3.4. Preferred Sales & Marketing Strategy

4. Market Overview

4.1. Market Definition / Scope / Limitations

4.2. Macro-Economic Factors

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunity

4.4. Market Factor Analysis

4.4.1. Porter’s Five Force Analysis

4.4.2. SWOT Analysis

4.5. Regulatory Scenario

5. Key Trend Analysis

5.1. Higher Production Process

5.1.1. Growing Preference for higher Production Process in Automotive Carbon Wheel Industry, Sales Channel Approach, Vendor Approach, Business model for key players

5.1.2. Business Case Study – Automotive Carbon Wheel

5.1.3. Introduction of One Piece Carbon Fiber Wheels

5.1.4. Introduction of EV Specific Carbon Wheels

6. Who Supplies Whom

6.1. Key Suppliers of Automotive Carbon Wheel

6.1.1. By Carbon Wheel Type

6.2. Customers of Automotive Carbon Wheel

7. Industry Ecosystem Analysis

7.1. Value Chain Analysis

7.1.1. Raw Rim Size Supplier

7.1.2. Component Manufacturer

7.1.3. System Suppliers

7.1.4. Tier 1 Players

7.1.5. Tier Players/ Technology Providers

7.1.6. OEMs/ End-users

8. Global Automotive Carbon Wheel Market Demand, Volume (Thousand Units) and Value (US$ Bn) Analysis and Forecast, 2017-2031

8.1. Current and Future Market Value (US$ Bn) Projections, 2017-2031

8.1.1. Y-o-Y Growth Trend Analysis

8.1.2. Absolute $ Opportunity Analysis

9. Pricing Analysis

9.1. Regional Automotive Carbon Wheel Sales Pricing (US$), 2017-2031

9.2. Cost Structure Analysis

9.3. Profit Margin Analysis

10. Impact Factors

10.1. Sustainability Related Trends – Growing Popularity of Composite Rim Sizes

10.2. Key Strategies Adopted by Carbon Wheel Manufacturers

10.3. Advent of 3D printing

10.4. Rising sales of premium and electric vehicles.

11. Global Automotive Carbon Wheel Market, By Production Process

11.1. Market Snapshot

11.1.1. Introduction, Definition, and Key Findings

11.1.2. Market Growth & Y-o-Y Projections

11.1.3. Base Point Share Analysis

11.2. Global Automotive Carbon Wheel Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Production Process

11.2.1. Up to 19”

11.2.2. 20”

11.2.3. 21”

11.2.4. 22” and above

12. Global Automotive Carbon Wheel Market, by Production Process

12.1. Market Snapshot

12.1.1. Introduction, Definition, and Key Findings

12.1.2. Market Growth & Y-o-Y Projections

12.1.3. Base Point Share Analysis

12.2. Global Automotive Carbon Wheel Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Production Process

12.2.1. Flow Forging

12.2.2. Dry Fiber

13. Global Automotive Carbon Wheel Market, by Vehicle Type

13.1. Global A Global Automotive Carbon Wheel Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Vehicle Type

13.1.1. Two Wheeler

13.1.2. Passenger Vehicle

13.1.2.1. Hatchback

13.1.2.2. Sedan

13.1.2.3. Utility Vehicle

13.1.3. Light Duty Vehicle

13.1.4. Medium & Heavy Commercial Duty Vehicle

13.1.5. Bus & Coach

13.1.6. Off-road Vehicle

14. Global Automotive Carbon Wheel Market, by Sales Channel

14.1. Market Snapshot

14.1.1. Introduction, Definition, and Key Findings

14.1.2. Market Growth & Y-o-Y Projections

14.1.3. Base Point Share Analysis

14.2. Global Automotive Carbon Wheel Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Sales Channel

14.2.1. OEM

14.2.2. Aftermarket

15. Global Automotive Carbon Wheel Market, by Region

15.1. Market Snapshot

15.1.1. Introduction, Definition, and Key Findings

15.1.2. Market Growth & Y-o-Y Projections

15.1.3. Base Point Share Analysis

15.2. Global Automotive Carbon Wheel Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Region

15.2.1. North America

15.2.2. Europe

15.2.3. Asia Pacific

15.2.4. Middle East & Africa

15.2.5. South America

16. North America Automotive Carbon Wheel Market

16.1. Market Snapshot

16.2. Automotive Carbon Wheel Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Production Process

16.2.1. Up to 19”

16.2.2. 20”

16.2.3. 21”

16.2.4. 22” and above

16.3. Automotive Carbon Wheel Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Production Process

16.3.1. Flow Forging

16.3.2. Dry Fiber

16.4. Global A Global Automotive Carbon Wheel Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Vehicle Type

16.4.1. Two Wheeler

16.4.2. Passenger Vehicle

16.4.2.1. Hatchback

16.4.2.2. Sedan

16.4.2.3. Utility Vehicle

16.4.3. Light Duty Vehicle

16.4.4. Medium & Heavy Commercial Duty Vehicle

16.4.5. Bus & Coach

16.4.6. Off-road Vehicle

16.5. Global Automotive Carbon Wheel Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Sales Channel

16.5.1. OEM

16.5.2. Aftermarket

16.6. Key Country Analysis – North America Automotive Carbon Wheel Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031

16.6.1. The U. S.

16.6.2. Canada

16.6.3. Mexico

17. Europe Automotive Carbon Wheel Market

17.1. Market Snapshot

17.2. Automotive Carbon Wheel Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Production Process

17.2.1. Up to 19”

17.2.2. 20”

17.2.3. 21”

17.2.4. 22” and above

17.3. Automotive Carbon Wheel Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Production Process

17.3.1. Flow Forging

17.3.2. Dry Fiber

17.4. Automotive Carbon Wheel Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Vehicle Type

17.4.1. Two Wheeler

17.4.2. Passenger Vehicle

17.4.2.1. Hatchback

17.4.2.2. Sedan

17.4.2.3. Utility Vehicle

17.4.3. Light Duty Vehicle

17.4.4. Medium & Heavy Commercial Duty Vehicle

17.4.5. Bus & Coach

17.4.6. Off-road Vehicle

17.5. Automotive Carbon Wheel Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Sales Channel

17.5.1. OEM

17.5.2. Aftermarket

17.6. Key Country Analysis – Europe Automotive Carbon Wheel Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031

17.6.1. Germany

17.6.2. U. K.

17.6.3. France

17.6.4. Italy

17.6.5. Spain

17.6.6. Nordic Countries

17.6.7. Russia & CIS

17.6.8. Rest of Europe

18. Asia Pacific Automotive Carbon Wheel Market

18.1. Market Snapshot

18.2. Automotive Carbon Wheel Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Production Process

18.2.1. Up to 19”

18.2.2. 20”

18.2.3. 21”

18.2.4. 22” and above

18.3. Automotive Carbon Wheel Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Production Process

18.3.1. Flow Forging

18.3.2. Dry Fiber

18.4. Automotive Carbon Wheel Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Vehicle Type

18.4.1. Two Wheeler

18.4.2. Passenger Vehicle

18.4.2.1. Hatchback

18.4.2.2. Sedan

18.4.2.3. Utility Vehicle

18.4.3. Light Duty Vehicle

18.4.4. Medium & Heavy Commercial Duty Vehicle

18.4.5. Bus & Coach

18.4.6. Off-road Vehicle

18.5. Automotive Carbon Wheel Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Sales Channel

18.5.1. OEM

18.5.2. Aftermarket

18.6. Key Country Analysis – Asia Pacific Automotive Carbon Wheel Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031

18.6.1. China

18.6.2. India

18.6.3. Japan

18.6.4. ASEAN Countries

18.6.5. South Korea

18.6.6. ANZ

18.6.7. Rest of Asia Pacific

19. Middle East & Africa Automotive Carbon Wheel Market

19.1. Market Snapshot

19.2. Automotive Carbon Wheel Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Production Process

19.2.1. Up to 19”

19.2.2. 20”

19.2.3. 21”

19.2.4. 22” and above

19.3. Automotive Carbon Wheel Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Production Process

19.3.1. Flow Forging

19.3.2. Dry Fiber

19.4. Automotive Carbon Wheel Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Vehicle Type

19.4.1. Two Wheeler

19.4.2. Passenger Vehicle

19.4.2.1. Hatchback

19.4.2.2. Sedan

19.4.2.3. Utility Vehicle

19.4.3. Light Duty Vehicle

19.4.4. Medium & Heavy Commercial Duty Vehicle

19.4.5. Bus & Coach

19.4.6. Off-road Vehicle

19.5. Automotive Carbon Wheel Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Sales Channel

19.5.1. OEM

19.5.2. Aftermarket

19.6. Key Country Analysis – Middle East & Africa Automotive Carbon Wheel Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031

19.6.1. GCC Countries

19.6.2. Turkey

19.6.3. South Africa

19.6.4. Rest of Middle East & Africa

20. South America Automotive Carbon Wheel Market

20.1. Market Snapshot

20.2. Automotive Carbon Wheel Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Production Process

20.2.1. Up to 19”

20.2.2. 20”

20.2.3. 21”

20.2.4. 22” and above

20.3. Automotive Carbon Wheel Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Production Process

20.3.1. Flow Forging

20.3.2. Dry Fiber

20.4. Automotive Carbon Wheel Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Vehicle Type

20.4.1. Two Wheeler

20.4.2. Passenger Vehicle

20.4.2.1. Hatchback

20.4.2.2. Sedan

20.4.2.3. Utility Vehicle

20.4.3. Light Duty Vehicle

20.4.4. Medium & Heavy Commercial Duty Vehicle

20.4.5. Bus & Coach

20.4.6. Off-road Vehicle

20.5. Automotive Carbon Wheel Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031, By Sales Channel

20.5.1. OEM

20.5.2. Aftermarket

20.6. Key Country Analysis – South America Automotive Carbon Wheel Market Size (Thousand Units) & Revenue (US$ Bn) Analysis & Forecast, 2017-2031

20.6.1. Brazil

20.6.2. Argentina

20.6.3. Rest of South America

21. Competitive Landscape

21.1. Company Share Analysis/ Brand Share Analysis, 2022

21.2. Key Strategy Analysis

21.2.1. Strategic Overview - Expansion, M&A, Partnership

21.2.2. Product & Marketing Strategy

21.3. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

22. Company Profile/ Key Players – Automotive Carbon Wheel Manufacturers

22.1. Blackstone Tek

22.1.1. Company Overview

22.1.2. Company Footprints

22.1.3. Production Locations

22.1.4. Product Portfolio

22.1.5. Competitors & Customers

22.1.6. Subsidiaries & Parent Organization

22.1.7. Recent Developments

22.1.8. Financial Analysis

22.1.9. Profitability

22.1.10. Revenue Share

22.2. Bucci Composites

22.2.1. Company Overview

22.2.2. Company Footprints

22.2.3. Production Locations

22.2.4. Product Portfolio

22.2.5. Competitors & Customers

22.2.6. Subsidiaries & Parent Organization

22.2.7. Recent Developments

22.2.8. Financial Analysis

22.2.9. Profitability

22.2.10. Revenue Share

22.3. Carbon Revolution

22.3.1. Company Overview

22.3.2. Company Footprints

22.3.3. Production Locations

22.3.4. Product Portfolio

22.3.5. Competitors & Customers

22.3.6. Subsidiaries & Parent Organization

22.3.7. Recent Developments

22.3.8. Financial Analysis

22.3.9. Profitability

22.3.10. Revenue Share

22.4. Dymag Group Limited

22.4.1. Company Overview

22.4.2. Company Footprints

22.4.3. Production Locations

22.4.4. Product Portfolio

22.4.5. Competitors & Customers

22.4.6. Subsidiaries & Parent Organization

22.4.7. Recent Developments

22.4.8. Financial Analysis

22.4.9. Profitability

22.4.10. Revenue Share

22.5. ESE Carbon

22.5.1. Company Overview

22.5.2. Company Footprints

22.5.3. Production Locations

22.5.4. Product Portfolio

22.5.5. Competitors & Customers

22.5.6. Subsidiaries & Parent Organization

22.5.7. Recent Developments

22.5.8. Financial Analysis

22.5.9. Profitability

22.5.10. Revenue Share

22.6. Geric

22.6.1. Company Overview

22.6.2. Company Footprints

22.6.3. Production Locations

22.6.4. Product Portfolio

22.6.5. Competitors & Customers

22.6.6. Subsidiaries & Parent Organization

22.6.7. Recent Developments

22.6.8. Financial Analysis

22.6.9. Profitability

22.6.10. Revenue Share

22.7. Hitachi Metals Ltd.

22.7.1. Company Overview

22.7.2. Company Footprints

22.7.3. Production Locations

22.7.4. Product Portfolio

22.7.5. Competitors & Customers

22.7.6. Subsidiaries & Parent Organization

22.7.7. Recent Developments

22.7.8. Financial Analysis

22.7.9. Profitability

22.7.10. Revenue Share

22.8. HRE Wheels

22.8.1. Company Overview

22.8.2. Company Footprints

22.8.3. Production Locations

22.8.4. Product Portfolio

22.8.5. Competitors & Customers

22.8.6. Subsidiaries & Parent Organization

22.8.7. Recent Developments

22.8.8. Financial Analysis

22.8.9. Profitability

22.8.10. Revenue Share

22.9. LITESPEED RACING

22.9.1. Company Overview

22.9.2. Company Footprints

22.9.3. Production Locations

22.9.4. Product Portfolio

22.9.5. Competitors & Customers

22.9.6. Subsidiaries & Parent Organization

22.9.7. Recent Developments

22.9.8. Financial Analysis

22.9.9. Profitability

22.9.10. Revenue Share

22.10. Phoenix Wheel Company, Inc.

22.10.1. Company Overview

22.10.2. Company Footprints

22.10.3. Production Locations

22.10.4. Product Portfolio

22.10.5. Competitors & Customers

22.10.6. Subsidiaries & Parent Organization

22.10.7. Recent Developments

22.10.8. Financial Analysis

22.10.9. Profitability

22.10.10. Revenue Share

22.11. Rotobox d.o.o.

22.11.1. Company Overview

22.11.2. Company Footprints

22.11.3. Production Locations

22.11.4. Product Portfolio

22.11.5. Competitors & Customers

22.11.6. Subsidiaries & Parent Organization

22.11.7. Recent Developments

22.11.8. Financial Analysis

22.11.9. Profitability

22.11.10. Revenue Share

22.12. Rolko Kohlgrüber GmbH

22.12.1. Company Overview

22.12.2. Company Footprints

22.12.3. Production Locations

22.12.4. Product Portfolio

22.12.5. Competitors & Customers

22.12.6. Subsidiaries & Parent Organization

22.12.7. Recent Developments

22.12.8. Financial Analysis

22.12.9. Profitability

22.12.10. Revenue Share

22.13. Ronal Group

22.13.1. Company Overview

22.13.2. Company Footprints

22.13.3. Production Locations

22.13.4. Product Portfolio

22.13.5. Competitors & Customers

22.13.6. Subsidiaries & Parent Organization

22.13.7. Recent Developments

22.13.8. Financial Analysis

22.13.9. Profitability

22.13.10. Revenue Share

22.14. Thyssenkrupp AG

22.14.1. Company Overview

22.14.2. Company Footprints

22.14.3. Production Locations

22.14.4. Product Portfolio

22.14.5. Competitors & Customers

22.14.6. Subsidiaries & Parent Organization

22.14.7. Recent Developments

22.14.8. Financial Analysis

22.14.9. Profitability

22.14.10. Revenue Share

22.15. Others

22.15.1. Company Overview

22.15.2. Company Footprints

22.15.3. Production Locations

22.15.4. Product Portfolio

22.15.5. Competitors & Customers

22.15.6. Subsidiaries & Parent Organization

22.15.7. Recent Developments

22.15.8. Financial Analysis

22.15.9. Profitability

22.15.10. Revenue Share

List of Tables

Table 1: Global Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Rim Size, 2017-2031

Table 2: Global Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Rim Size, 2017-2031

Table 3: Global Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Production Process, 2017-2031

Table 4: Global Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Production Process, 2017-2031

Table 5: Global Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 6: Global Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 7: Global Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 8: Global Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 9: Global Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Table 10: Global Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Region, 2017-2031

Table 11: North America Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Rim Size, 2017-2031

Table 12: North America Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Rim Size, 2017-2031

Table 13: North America Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Production Process, 2017-2031

Table 14: North America Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Production Process, 2017-2031

Table 15: North America Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 16: North America Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 17: North America Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 18: North America Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 19: North America Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 20: North America Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 21: Europe Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Rim Size, 2017-2031

Table 22: Europe Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Rim Size, 2017-2031

Table 23: Europe Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Production Process, 2017-2031

Table 24: Europe Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Production Process, 2017-2031

Table 25: Europe Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 26: Europe Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 27: Europe Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 28: Europe Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 29: Europe Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 30: Europe Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 31: Asia Pacific Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Rim Size, 2017-2031

Table 32: Asia Pacific Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Rim Size, 2017-2031

Table 33: Asia Pacific Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Production Process, 2017-2031

Table 34: Asia Pacific Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Production Process, 2017-2031

Table 35: Asia Pacific Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 36: Asia Pacific Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 37: Asia Pacific Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 38: Asia Pacific Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 39: Asia Pacific Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 40: Asia Pacific Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 41: Middle East & Africa Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Rim Size, 2017-2031

Table 42: Middle East & Africa Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Rim Size, 2017-2031

Table 43: Middle East & Africa Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Production Process, 2017-2031

Table 44: Middle East & Africa Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Production Process, 2017-2031

Table 45: Middle East & Africa Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 46: Middle East & Africa Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 47: Middle East & Africa Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 48: Middle East & Africa Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 49: Middle East & Africa Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 50: Middle East & Africa Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 51: South America Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Rim Size, 2017-2031

Table 52: South America Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Rim Size, 2017-2031

Table 53: South America Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Production Process, 2017-2031

Table 54: South America Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Production Process, 2017-2031

Table 55: South America Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 56: South America Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 57: South America Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 58: South America Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 59: South America Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 60: South America Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

List of Figures

Figure 1: Global Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Rim Size, 2017-2031

Figure 2: Global Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Rim Size, 2017-2031

Figure 3: Global Automotive Carbon Wheel Market, Incremental Opportunity, by Rim Size, Value (US$ Bn), 2023-2031

Figure 4: Global Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Production Process, 2017-2031

Figure 5: Global Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Production Process, 2017-2031

Figure 6: Global Automotive Carbon Wheel Market, Incremental Opportunity, by Production Process, Value (US$ Bn), 2023-2031

Figure 7: Global Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 8: Global Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 9: Global Automotive Carbon Wheel Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 10: Global Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 11: Global Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 12: Global Automotive Carbon Wheel Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 13: Global Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Figure 14: Global Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Region, 2017-2031

Figure 15: Global Automotive Carbon Wheel Market, Incremental Opportunity, by Region, Value (US$ Bn), 2022-2031

Figure 16: North America Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Rim Size, 2017-2031

Figure 17: North America Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Rim Size, 2017-2031

Figure 18: North America Automotive Carbon Wheel Market, Incremental Opportunity, by Rim Size, Value (US$ Bn), 2023-2031

Figure 19: North America Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Production Process, 2017-2031

Figure 20: North America Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Production Process, 2017-2031

Figure 21: North America Automotive Carbon Wheel Market, Incremental Opportunity, by Production Process, Value (US$ Bn), 2023-2031

Figure 22: North America Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 23: North America Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 24: North America Automotive Carbon Wheel Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 25: North America Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 26: North America Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 27: North America Automotive Carbon Wheel Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 28: North America Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 29: North America Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 30: North America Automotive Carbon Wheel Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 31: Europe Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Rim Size, 2017-2031

Figure 32: Europe Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Rim Size, 2017-2031

Figure 33: Europe Automotive Carbon Wheel Market, Incremental Opportunity, by Rim Size, Value (US$ Bn), 2023-2031

Figure 34: Europe Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Production Process, 2017-2031

Figure 35: Europe Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Production Process, 2017-2031

Figure 36: Europe Automotive Carbon Wheel Market, Incremental Opportunity, by Production Process, Value (US$ Bn), 2023-2031

Figure 37: Europe Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 38: Europe Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 39: Europe Automotive Carbon Wheel Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 40: Europe Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 41: Europe Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 42: Europe Automotive Carbon Wheel Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 43: Europe Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 44: Europe Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 45: Europe Automotive Carbon Wheel Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 46: Asia Pacific Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Rim Size, 2017-2031

Figure 47: Asia Pacific Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Rim Size, 2017-2031

Figure 48: Asia Pacific Automotive Carbon Wheel Market, Incremental Opportunity, by Rim Size, Value (US$ Bn), 2023-2031

Figure 49: Asia Pacific Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Production Process, 2017-2031

Figure 50: Asia Pacific Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Production Process, 2017-2031

Figure 51: Asia Pacific Automotive Carbon Wheel Market, Incremental Opportunity, by Production Process, Value (US$ Bn), 2023-2031

Figure 52: Asia Pacific Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 53: Asia Pacific Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 54: Asia Pacific Automotive Carbon Wheel Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 55: Asia Pacific Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 56: Asia Pacific Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 57: Asia Pacific Automotive Carbon Wheel Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 58: Asia Pacific Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 59: Asia Pacific Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 60: Asia Pacific Automotive Carbon Wheel Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 61: Middle East & Africa Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Rim Size, 2017-2031

Figure 62: Middle East & Africa Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Rim Size, 2017-2031

Figure 63: Middle East & Africa Automotive Carbon Wheel Market, Incremental Opportunity, by Rim Size, Value (US$ Bn), 2023-2031

Figure 64: Middle East & Africa Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Production Process, 2017-2031

Figure 65: Middle East & Africa Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Production Process, 2017-2031

Figure 66: Middle East & Africa Automotive Carbon Wheel Market, Incremental Opportunity, by Production Process, Value (US$ Bn), 2023-2031

Figure 67: Middle East & Africa Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 68: Middle East & Africa Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 69: Middle East & Africa Automotive Carbon Wheel Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 70: Middle East & Africa Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 71: Middle East & Africa Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 72: Middle East & Africa Automotive Carbon Wheel Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 73: Middle East & Africa Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 74: Middle East & Africa Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 75: Middle East & Africa Automotive Carbon Wheel Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 76: South America Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Rim Size, 2017-2031

Figure 77: South America Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Rim Size, 2017-2031

Figure 78: South America Automotive Carbon Wheel Market, Incremental Opportunity, by Rim Size, Value (US$ Bn), 2023-2031

Figure 79: South America Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Production Process, 2017-2031

Figure 80: South America Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Production Process, 2017-2031

Figure 81: South America Automotive Carbon Wheel Market, Incremental Opportunity, by Production Process, Value (US$ Bn), 2023-2031

Figure 82: South America Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 83: South America Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 84: South America Automotive Carbon Wheel Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 85: South America Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 86: South America Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 87: South America Automotive Carbon Wheel Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 88: South America Automotive Carbon Wheel Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 89: South America Automotive Carbon Wheel Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 90: South America Automotive Carbon Wheel Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031