Analysts’ Viewpoint

Key players in the global automotive camera cleaning system industry are focusing on improving the efficiency of cleaning systems in order to provide their customers with a product portfolio that is cost-effective, diverse, and offers cutting-edge benefits. Rise in production and sales of vehicles equipped with camera-based systems is a key factor driving the automotive camera cleaning system market growth at a steady pace. Demand for camera cleaning systems is expected to increase at a substantial pace in the coming years due to increasing safety regulations, technological advancements, and the integration of cameras in various vehicle segments.

The market is also witnessing continuous technological advancements in camera cleaning systems. Manufacturers are developing innovative cleaning mechanisms, smart cleaning technologies, and self-cleaning solutions to improve the efficiency, effectiveness, and convenience of camera cleaning systems. This includes features such as intelligent sensors, automated cleaning cycles, and advanced cleaning fluid dispensing mechanisms.

An automotive camera cleaning system is a technology designed to keep cameras that are used in vehicles clean and free from dirt, dust, water, and other contaminants. These cameras are typically used for various purposes in modern automobiles, including advanced driver-assistance systems (ADAS), rearview cameras, parking assist systems, surround-view cameras, and autonomous driving features.

It typically involves a cleaning nozzle or sprayer that releases a cleaning solution, or air, to remove dirt or water droplets from the camera lens. The mechanism can be automated or manually activated by the driver. A specialized cleaning solution is used to effectively clean the camera lens. This fluid is designed to remove dirt, oil, and water residue without damaging the lens or other camera components.

Advanced driver assistance systems (ADAS) and autonomous driving technologies rely heavily on camera sensors for functions such as lane departure warning, adaptive cruise control, automatic emergency braking, and blind-spot detection. Therefore, it is crucial to keep the camera lenses clean for accurate and reliable operation.

Thus, growing consumer demand for enhanced safety features, improved visibility, and convenience during driving are likely to boost the automotive camera cleaning system market demand in the next few years.

ADAS relies heavily on camera-based sensors, as they provide crucial visual input for the ADAS algorithms to make informed decisions. Therefore, it is essential to keep the camera lenses clean and free from contaminants to ensure accurate and reliable performance. Camera cleaning systems help maintain clear vision, enabling the ADAS to function optimally.

Additionally, ADAS features are designed to improve vehicle safety and prevent accidents. However, the performance of these systems can be compromised if the camera lenses are obstructed by dirt, dust, or water droplets. Clear and unobstructed camera vision is vital for accurate object detection and tracking. Automotive camera cleaning systems play a critical role in ensuring consistent performance and meeting the safety requirements of ADAS. Consequently, rise in integration of ADAS in vehicles is projected to propel the automotive camera cleaning system market value during the forecast period.

Moreover, regulatory bodies are increasingly mandating the inclusion of ADAS features in vehicles to improve road safety. For instance, some countries have made certain features, such as automatic emergency braking and lane-keeping assist, mandatory. Automakers need to ensure the consistent performance of ADAS systems in order to meet these regulatory standards, which include maintaining the cleanliness of camera lenses.

Technological advancements have led to the development of automated cleaning mechanisms for automotive camera cleaning systems. These mechanisms can be integrated into the vehicle's overall control system, enabling automated cleaning cycles triggered by sensors or algorithms. Automated cleaning eliminates the need for manual intervention, ensuring convenience and timely maintenance of camera lenses. Therefore, advancements in technology is expected to be one of the key growth factors of the automotive camera cleaning system market in the next few years.

Furthermore, advanced sensor systems are being integrated into camera cleaning systems. These sensors can detect the presence of dirt, dust, or water droplets on the camera lens, triggering the cleaning process when necessary. Intelligent sensor systems improve the effectiveness and efficiency of the cleaning system by ensuring that cleaning is performed only when required, optimizing the use of cleaning fluids and resources.

Fixed nozzle camera cleaning systems are commonly used in vehicles equipped with camera-based systems. These systems feature a stationary nozzle positioned near the camera lens, which releases a cleaning solution, or air, to remove dirt and contaminants. The fixed nozzle design offers simplicity, reliability, and ease of integration into vehicle designs. Fixed nozzle camera cleaning systems are highly effective in providing targeted and precise cleaning. Moreover, the fixed nozzle design often enables automated cleaning cycles triggered by sensors or algorithms, enhancing convenience and timely maintenance.

Additionally, fixed nozzle camera cleaning systems are typically more cost-effective as compared to other complex designs. They are relatively simpler to manufacture, install, and maintain, making them a preferred choice for automotive manufacturers. These factors propel the nozzle systems segment and consequently augment the automotive camera cleaning system market statistics.

Based on vehicle type, passenger vehicle segment accounted for a prominent automotive camera cleaning system market share in 2022, owing to higher sales of passenger vehicles as compared to commercial vehicles, including trucks and buses. Manufacturers often prioritize integrating camera cleaning systems in passenger vehicles to cater to a broader market segment and meet consumer expectations for advanced safety features.

Additionally, passenger vehicles are witnessing a rapid increase in adoption of ADAS features. Clear and unobstructed camera vision is crucial for the accurate functioning of these systems. Consequently, passenger vehicles are more likely to be equipped with camera cleaning systems to ensure optimal performance and safety.

Europe is anticipated to dominate the global automotive camera cleaning system business during forecast period. The region has a strong focus on vehicle safety, stringent regulations, and a well-established automotive industry. Future analysis of the automotive camera cleaning system market in Europe reveals that growth is driven by the demand for advanced driver-assistance features, increasing vehicle safety standards, and the presence of major automotive manufacturers emphasizing safety and innovation.

Asia Pacific is estimated to be an emerging market for automotive camera cleaning system. Increase in production and sales of vehicles, rise in disposable income, and growing awareness about safety technologies contribute are projected to offer significant automotive camera cleaning system market opportunities for key manufacturers in the region. China, Japan, South Korea, and India are major contributors to market growth in the region due to strong presence of automotive manufacturing hubs and a growing consumer base.

The global vehicle camera cleaning system market is highly consolidated with a few manufacturers controlling majority of market share and key companies possessing the potential to increase the pace of growth by the way of adoption of newer technologies. Prominent players are following the latest automotive camera cleaning system market trends and focusing on expansion of product offerings and merger and acquisitions. Some of the key players in the global market are Continental AG, Denso Corporation, dlhBOWLES, Ficosa International SA, KAUTEX TEXTRON GMBH & CO. KG, MAGNA ELECTRONICS INC., MS FOSTER & ASSOCIATES, INC., Panasonic Corp., Seeva Technologies, Shenzhen Mingshang Industrial Co., Ltd., Valeo SA, and Waymo.

Key players in the global automotive camera cleaning system market report have been profiled based on various parameters such as company overview, business strategies, financial overview, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Size Value in 2022 |

US$ 670.0 Mn |

|

Market Forecast Value in 2031 |

US$ 4.9 Bn |

|

Growth Rate (CAGR) |

24.8% |

|

Forecast Period |

2023-2031 |

|

Quantitative Units |

Thousand Units for Volume US$ Mn/Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, key trend analysis, Global Automotive Camera Cleaning System market size, Global Automotive Camera Cleaning System market share, and forecast of Global Automotive Camera Cleaning System market. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

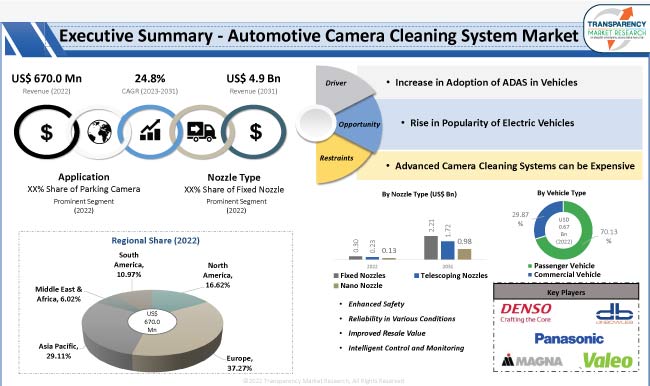

The global market was valued at US$ 670.0 Mn in 2022

It is expected to expand at a CAGR of 24.8% by 2031

The business is estimated to reach a value of US$ 4.9 Bn in 2031

Fixed nozzles are likely to witness highest demand during the forecast period

The passenger vehicle segment accounted for largest share in 2022

Europe was a highly lucrative region for automotive camera cleaning systems

Continental AG, Denso Corporation, dlhBOWLES, Ficosa International SA, KAUTEX TEXTRON GMBH & CO. KG, MAGNA ELECTRONICS INC., MS FOSTER & ASSOCIATES, INC., Panasonic Corp., Seeva Technologies, Shenzhen Mingshang Industrial Co., Ltd., Valeo SA, Waymo.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Automotive Camera Cleaning System Market

3.1. Global Automotive Camera Cleaning System Market Size, Thousand Units, US$ Bn, 2017-2031

4. Market Overview

4.1. Overview

4.2. Key Trend Analysis

4.3. Market Indicators

4.4. Market Dynamics

4.4.1. Drivers

4.4.2. Restraints

4.5. Opportunity

4.6. Porter’s Five Force Analysis

4.7. Value Chain Analysis

4.7.1. Mapping of Value Chain of Automotive Camera Cleaning System

4.7.2. List of Key Manufacturers

4.7.3. List of Customers

4.7.4. Level of Integration

4.8. Technological Development of Automotive Camera Cleaning System

4.9. Adoption of multiple, wide angle and high resolution Camera in Automotive

4.10. Adoption multiple Sensors for object detection on road in Automotive

4.11. Regulatory Scenario for Autonomous Vehicles and Semi - Autonomous Vehicles.

4.12. SWOT Analysis

5. Impact of Below Mentioned Factors on Automotive Camera Cleaning System:

5.1. Economic Impacts

5.2. Impact of ADAS (Advanced Driver Assistance Systems) on automobile industry

5.3. Government Policies On Vehicle Safety

6. Use of blower type in Automotive Camera Cleaning System

6.1. Estimated Market Share

6.1.1. Air Blower

6.1.2. Others

7. Coating used in Automotive Camera Cleaning System

7.1. Estimated Market Share

7.1.1. Silica Gel

7.1.2. Ceramics

7.1.3. Lens Pens

7.1.4. Others

8. Global Automotive Camera Cleaning System Market Sales Analysis and Forecast, by Application

8.1. Introduction & Definition

8.2. Key Findings

8.3. Automotive Camera Cleaning System Volume (Thousand Units), Value (US$ Bn) Forecast by Application, 2017-2031

8.3.1. Parking camera

8.3.2. Front camera

8.3.3. Interjection camera

8.3.4. Night vision camera

8.3.5. Camera in mirror

8.3.6. CMS (Central Monitoring System) camera

8.4. Market Attractiveness, by Application

9. Global Automotive Camera Cleaning System Market Sales Analysis and Forecast, by Nozzle Type

9.1. Introduction & Definition

9.2. Key Findings

9.3. Automotive Camera Cleaning System Volume (Thousand Units), Value (US$ Bn) Forecast by Nozzle Type, 2017-2031

9.3.1. Fixed Nozzles

9.3.2. Telescoping Nozzles

9.3.3. Nano Nozzle

9.4. Market Attractiveness, by Nozzle Type

10. Global Automotive Camera Cleaning System Market Sales Analysis and Forecast, by Sales Channel

10.1. Introduction & Definition

10.2. Key Findings

10.3. Automotive Camera Cleaning System Volume (Thousand Units), Value (US$ Bn) Forecast by Sales Channel, 2017-2031

10.3.1. OEM

10.3.2. Aftermarket

10.4. Market Attractiveness, by Sales Channel

11. Global Automotive Camera Cleaning System Market Sales Analysis and Forecast, by Vehicle Type

11.1. Introduction & Definition

11.2. Key Findings

11.3. Automotive Camera Cleaning System Volume (Thousand Units), Value (US$ Bn) Forecast by Vehicle Type, 2017-2031

11.3.1. Passenger Vehicle

11.3.1.1. Entry

11.3.1.2. Mid-Size

11.3.1.3. Premium/ Luxury

11.3.2. Commercial Vehicle

11.4. Market Attractiveness, by Vehicle Type

12. Global Automotive Camera Cleaning System Market Sales Analysis and Forecast, by Region

12.1. Key Findings

12.2. Automotive Camera Cleaning System Volume (Thousand Units), Value (US$ Bn) Forecast by Region, 2017-2031

12.2.1. North America

12.2.2. South America

12.2.3. Europe

12.2.4. Asia Pacific

12.2.5. Middle East & Africa

12.3. Automotive Camera Cleaning System Market Attractiveness Analysis By Region

13. North America Automotive Camera Cleaning System Market Size and Forecast (Thousand Units), (US$ Bn), 2017-2031

13.1. Key Findings

13.2. North America Market, by Application

13.2.1. Parking camera

13.2.2. Front camera

13.2.3. Interjection camera

13.2.4. Night vision camera

13.2.5. Camera in mirror

13.3. North America Market, by Nozzle Type

13.3.1. Fixed Nozzles

13.3.2. Telescoping Nozzles

13.3.3. Nano Nozzle

13.4. North America Market, by Sales Channel

13.4.1. OEM

13.4.2. Aftermarket

13.5. North America Market, by Vehicle Type

13.5.1. Passenger Vehicle

13.5.1.1. Entry

13.5.1.2. Mid-Size

13.5.1.3. Premium/ Luxury

13.5.2. Commercial Vehicle

13.6. North America Market Size & Forecast by Country

13.6.1. U.S.

13.6.2. Canada

13.7. U.S. Market, by Application

13.7.1. Parking camera

13.7.2. Front camera

13.7.3. Interjection camera

13.7.4. Night vision camera

13.7.5. Camera in mirror

13.8. U.S. Market, by Nozzle Type

13.8.1. Fixed Nozzles

13.8.2. Telescoping Nozzles

13.8.3. Nano Nozzle

13.9. U.S. Market, by Sales Channel

13.9.1. OEM

13.9.2. Aftermarket

13.10. U.S. Market, by Vehicle Type

13.10.1. Passenger Vehicle

13.10.1.1. Entry

13.10.1.2. Mid-Size

13.10.1.3. Premium/ Luxury

13.10.2. Commercial Vehicle

13.11. Canada Market, by Application

13.11.1. Parking camera

13.11.2. Front camera

13.11.3. Interjection camera

13.11.4. Night vision camera

13.11.5. Camera in mirror

13.12. Canada Market, by Nozzle Type

13.12.1. Fixed Nozzles

13.12.2. Telescoping Nozzles

13.12.3. Nano Nozzle

13.13. Canada Market, by Sales Channel

13.13.1. OEM

13.13.2. Aftermarket

13.14. Canada Market, by Vehicle Type

13.14.1. Passenger Vehicle

13.14.1.1. Entry

13.14.1.2. Mid-Size

13.14.1.3. Premium/ Luxury

13.14.2. Commercial Vehicle

13.15. North America Automotive Camera Cleaning System Market : PEST Analysis

14. South America Automotive Camera Cleaning System Market Size and Forecast (Thousand Units), (US$ Bn), 2017-2031

14.1. Key Findings

14.2. South America Market, by Application

14.2.1. Parking camera

14.2.2. Front camera

14.2.3. Interjection camera

14.2.4. Night vision camera

14.2.5. Camera in mirror

14.3. South America Market, by Nozzle Type

14.3.1. Fixed Nozzles

14.3.2. Telescoping Nozzles

14.3.3. Nano Nozzle

14.4. South America Market, by Sales Channel

14.4.1. OEM

14.4.2. Aftermarket

14.5. South America Market, by Vehicle Type

14.5.1. Passenger Vehicle

14.5.1.1. Entry

14.5.1.2. Mid-Size

14.5.1.3. Premium/ Luxury

14.5.2. Commercial Vehicle

14.6. South America Market Size & Forecast by Country

14.6.1. Brazil

14.6.2. Mexico

14.6.3. Rest of South America

14.7. Brazil Market, by Application

14.7.1. Parking camera

14.7.2. Front camera

14.7.3. Interjection camera

14.7.4. Night vision camera

14.7.5. Camera in mirror

14.8. Brazil Market, by Nozzle Type

14.8.1. Fixed Nozzles

14.8.2. Telescoping Nozzles

14.8.3. Nano Nozzle

14.9. Brazil Market, by Sales Channel

14.9.1. OEM

14.9.2. Aftermarket

14.10. Brazil Market, by Vehicle Type

14.10.1. Passenger Vehicle

14.10.1.1. Entry

14.10.1.2. Mid-Size

14.10.1.3. Premium/ Luxury

14.10.2. Commercial Vehicle

14.11. Mexico Market, by Application

14.11.1. Parking camera

14.11.2. Front camera

14.11.3. Interjection camera

14.11.4. Night vision camera

14.11.5. Camera in mirror

14.12. Mexico Market, by Nozzle Type

14.12.1. Fixed Nozzles

14.12.2. Telescoping Nozzles

14.12.3. Nano Nozzle

14.13. Mexico Market, by Sales Channel

14.13.1. OEM

14.13.2. Aftermarket

14.14. Mexico Market, by Vehicle Type

14.14.1. Passenger Vehicle

14.14.1.1. Entry

14.14.1.2. Mid-Size

14.14.1.3. Premium/ Luxury

14.14.2. Commercial Vehicle

14.15. Rest of South America Market, by Application

14.15.1. Parking camera

14.15.2. Front camera

14.15.3. Interjection camera

14.15.4. Night vision camera

14.15.5. Camera in mirror

14.16. Rest of South America Market, by Nozzle Type

14.16.1. Fixed Nozzles

14.16.2. Telescoping Nozzles

14.16.3. Nano Nozzle

14.17. Rest of South America Market, by Sales Channel

14.17.1. OEM

14.17.2. Aftermarket

14.18. Rest of South America Market, by Vehicle Type

14.18.1. Passenger Vehicle

14.18.1.1. Entry

14.18.1.2. Mid-Size

14.18.1.3. Premium/ Luxury

14.18.2. Commercial Vehicle

14.19. South America Automotive Camera Cleaning System Market : PEST Analysis

15. Europe Automotive Camera Cleaning System Market Size and Forecast (Thousand Units), (US$ Bn), 2017-2031

15.1. Key Findings

15.2. Europe Market, by Application

15.2.1. Parking camera

15.2.2. Front camera

15.2.3. Interjection camera

15.2.4. Night vision camera

15.2.5. Camera in mirror

15.3. Europe Market, by Nozzle Type

15.3.1. Fixed Nozzles

15.3.2. Telescoping Nozzles

15.3.3. Nano Nozzle

15.4. Europe Market, by Sales Channel

15.4.1. OEM

15.4.2. Aftermarket

15.5. Europe Market, by Vehicle Type

15.5.1. Passenger Vehicle

15.5.1.1. Entry

15.5.1.2. Mid-Size

15.5.1.3. Premium/ Luxury

15.5.2. Commercial Vehicle

15.6. Europe Market Size & Forecast by Country

15.6.1. Germany

15.6.2. U.K.

15.6.3. France

15.6.4. Italy

15.6.5. Spain

15.6.6. NORDIC

15.6.7. Rest of Europe

15.7. Germany Market, by Application

15.7.1. Parking camera

15.7.2. Front camera

15.7.3. Interjection camera

15.7.4. Night vision camera

15.7.5. Camera in mirror

15.8. Germany Market, by Nozzle Type

15.8.1. Fixed Nozzles

15.8.2. Telescoping Nozzles

15.8.3. Nano Nozzle

15.9. Germany Market, by Sales Channel

15.9.1. OEM

15.9.2. Aftermarket

15.10. Germany Market, by Vehicle Type

15.10.1. Passenger Vehicle

15.10.1.1. Entry

15.10.1.2. Mid-Size

15.10.1.3. Premium/ Luxury

15.10.2. Commercial Vehicle

15.11. U.K. Market, by Application

15.11.1. Parking camera

15.11.2. Front camera

15.11.3. Interjection camera

15.11.4. Night vision camera

15.11.5. Camera in mirror

15.12. U.K. Market, by Nozzle Type

15.12.1. Fixed Nozzles

15.12.2. Telescoping Nozzles

15.12.3. Nano Nozzle

15.13. U.K. Market, by Sales Channel

15.13.1. OEM

15.13.2. Aftermarket

15.14. U.K. Market, by Vehicle Type

15.14.1. Passenger Vehicle

15.14.1.1. Entry

15.14.1.2. Mid-Size

15.14.1.3. Premium/ Luxury

15.14.2. Commercial Vehicle

15.15. France Market, by Application

15.15.1. Parking camera

15.15.2. Front camera

15.15.3. Interjection camera

15.15.4. Night vision camera

15.15.5. Camera in mirror

15.16. France Market, by Nozzle Type

15.16.1. Fixed Nozzles

15.16.2. Telescoping Nozzles

15.16.3. Nano Nozzle

15.17. France Market, by Sales Channel

15.17.1. OEM

15.17.2. Aftermarket

15.18. France Market, by Vehicle Type

15.18.1. Passenger Vehicle

15.18.1.1. Entry

15.18.1.2. Mid-Size

15.18.1.3. Premium/ Luxury

15.18.2. Commercial Vehicle

15.19. Italy Market, by Application

15.19.1. Parking camera

15.19.2. Front camera

15.19.3. Interjection camera

15.19.4. Night vision camera

15.19.5. Camera in mirror

15.20. Italy Market, by Nozzle Type

15.20.1. Fixed Nozzles

15.20.2. Telescoping Nozzles

15.20.3. Nano Nozzle

15.21. Italy Market, by Sales Channel

15.21.1. OEM

15.21.2. Aftermarket

15.22. Italy Market, by Vehicle Type

15.22.1. Passenger Vehicle

15.22.1.1. Entry

15.22.1.2. Mid-Size

15.22.1.3. Premium/ Luxury

15.22.2. Commercial Vehicle

15.23. Spain Market, by Application

15.23.1. Parking camera

15.23.2. Front camera

15.23.3. Interjection camera

15.23.4. Night vision camera

15.23.5. Camera in mirror

15.24. Spain Market, by Nozzle Type

15.24.1. Fixed Nozzles

15.24.2. Telescoping Nozzles

15.24.3. Nano Nozzle

15.25. Spain Market, by Sales Channel

15.25.1. OEM

15.25.2. Aftermarket

15.26. Spain Market, by Vehicle Type

15.26.1. Passenger Vehicle

15.26.1.1. Entry

15.26.1.2. Mid-Size

15.26.1.3. Premium/ Luxury

15.26.2. Commercial Vehicle

15.27. NORDIC Market, by Application

15.27.1. Parking camera

15.27.2. Front camera

15.27.3. Interjection camera

15.27.4. Night vision camera

15.27.5. Camera in mirror

15.28. NORDIC Market, by Nozzle Type

15.28.1. Fixed Nozzles

15.28.2. Telescoping Nozzles

15.28.3. Nano Nozzle

15.29. NORDIC Market, by Sales Channel

15.29.1. OEM

15.29.2. Aftermarket

15.30. NORDIC Market, by Vehicle Type

15.30.1. Passenger Vehicle

15.30.1.1. Entry

15.30.1.2. Mid-Size

15.30.1.3. Premium/ Luxury

15.30.2. Commercial Vehicle

15.31. Rest of Europe Market, by Application

15.31.1. Parking camera

15.31.2. Front camera

15.31.3. Interjection camera

15.31.4. Night vision camera

15.31.5. Camera in mirror

15.32. Rest of Europe Market, by Nozzle Type

15.32.1. Fixed Nozzles

15.32.2. Telescoping Nozzles

15.32.3. Nano Nozzle

15.33. Rest of Europe Market, by Sales Channel

15.33.1. OEM

15.33.2. Aftermarket

15.34. Rest of Europe Market, by Vehicle Type

15.34.1. Passenger Vehicle

15.34.1.1. Entry

15.34.1.2. Mid-Size

15.34.1.3. Premium/ Luxury

15.34.2. Commercial Vehicle

15.35. Europe Automotive Camera Cleaning System Market : PEST Analysis

16. Asia Pacific Automotive Camera Cleaning System Market Size and Forecast (Thousand Units), (US$ Bn), 2017-2031

16.1. Key Findings

16.2. Asia Pacific Market, by Application

16.2.1. Parking camera

16.2.2. Front camera

16.2.3. Interjection camera

16.2.4. Night vision camera

16.2.5. Camera in mirror

16.3. Asia Pacific Market, by Nozzle Type

16.3.1. Fixed Nozzles

16.3.2. Telescoping Nozzles

16.3.3. Nano Nozzle

16.4. Asia Pacific Market, by Sales Channel

16.4.1. OEM

16.4.2. Aftermarket

16.5. Asia Pacific Market, by Vehicle Type

16.5.1. Passenger Vehicle

16.5.1.1. Entry

16.5.1.2. Mid-Size

16.5.1.3. Premium/ Luxury

16.5.2. Commercial Vehicle

16.6. Asia Pacific Market Size & Forecast by Country

16.6.1. China

16.6.2. India

16.6.3. Japan

16.6.4. ASEAN

16.6.5. ANZ

16.6.6. Rest of Asia Pacific

16.7. China Market, by Application

16.7.1. Parking camera

16.7.2. Front camera

16.7.3. Interjection camera

16.7.4. Night vision camera

16.7.5. Camera in mirror

16.8. China Market, by Nozzle Type

16.8.1. Fixed Nozzles

16.8.2. Telescoping Nozzles

16.8.3. Nano Nozzle

16.9. China Market, by Sales Channel

16.9.1. OEM

16.9.2. Aftermarket

16.10. China Market, by Vehicle Type

16.10.1. Passenger Vehicle

16.10.1.1. Entry

16.10.1.2. Mid-Size

16.10.1.3. Premium/ Luxury

16.10.2. Commercial Vehicle

16.10.3. Semi - Autonomous and Autonomous Vehicles

16.11. India Market, by Application

16.11.1. Parking camera

16.11.2. Front camera

16.11.3. Interjection camera

16.11.4. Night vision camera

16.11.5. Camera in mirror

16.12. India Market, by Nozzle Type

16.12.1. Fixed Nozzles

16.12.2. Telescoping Nozzles

16.12.3. Nano Nozzle

16.13. India Market, by Sales Channel

16.13.1. OEM

16.13.2. Aftermarket

16.14. India Market, by Vehicle Type

16.14.1. Passenger Vehicle

16.14.1.1. Entry

16.14.1.2. Mid-Size

16.14.1.3. Premium/ Luxury

16.14.2. Commercial Vehicle

16.15. Japan Market, by Application

16.15.1. Parking camera

16.15.2. Front camera

16.15.3. Interjection camera

16.15.4. Night vision camera

16.15.5. Camera in mirror

16.16. Japan Market, by Nozzle Type

16.16.1. Fixed Nozzles

16.16.2. Telescoping Nozzles

16.16.3. Nano Nozzle

16.17. Japan Market, by Sales Channel

16.17.1. OEM

16.17.2. Aftermarket

16.18. Japan Market, by Vehicle Type

16.18.1. Passenger Vehicle

16.18.1.1. Entry

16.18.1.2. Mid-Size

16.18.1.3. Premium/ Luxury

16.18.2. Commercial Vehicle

16.19. ASEAN Market, by Application

16.19.1. Parking camera

16.19.2. Front camera

16.19.3. Interjection camera

16.19.4. Night vision camera

16.19.5. Camera in mirror

16.20. ASEAN Market, by Nozzle Type

16.20.1. Fixed Nozzles

16.20.2. Telescoping Nozzles

16.20.3. Nano Nozzle

16.21. ASEAN Market, by Sales Channel

16.21.1. OEM

16.21.2. Aftermarket

16.22. ASEAN Market, by Vehicle Type

16.22.1. Passenger Vehicle

16.22.1.1. Entry

16.22.1.2. Mid-Size

16.22.1.3. Premium/ Luxury

16.22.2. Commercial Vehicle

16.23. ANZ Market, by Application

16.23.1. Parking camera

16.23.2. Front camera

16.23.3. Interjection camera

16.23.4. Night vision camera

16.23.5. Camera in mirror

16.24. ANZ Market, by Nozzle Type

16.24.1. Fixed Nozzles

16.24.2. Telescoping Nozzles

16.24.3. Nano Nozzle

16.25. ANZ Market, by Sales Channel

16.25.1. OEM

16.25.2. Aftermarket

16.26. ANZ Market, by Vehicle Type

16.26.1. Passenger Vehicle

16.26.1.1. Entry

16.26.1.2. Mid-Size

16.26.1.3. Premium/ Luxury

16.26.2. Commercial Vehicle

16.27. Rest of Asia Pacific Market, by Application

16.27.1. Parking camera

16.27.2. Front camera

16.27.3. Interjection camera

16.27.4. Night vision camera

16.27.5. Camera in mirror

16.28. Rest of Asia Pacific Market, by Nozzle Type

16.28.1. Fixed Nozzles

16.28.2. Telescoping Nozzles

16.28.3. Nano Nozzle

16.29. Rest of Asia Pacific Market, by Sales Channel

16.29.1. OEM

16.29.2. Aftermarket

16.30. Rest of Asia Pacific Market, by Vehicle Type

16.30.1. Passenger Vehicle

16.30.1.1. Entry

16.30.1.2. Mid-Size

16.30.1.3. Premium/ Luxury

16.30.2. Commercial Vehicle

16.31. Asia Pacific Automotive Camera Cleaning System Market : PEST Analysis

17. Middle East & Africa Automotive Camera Cleaning System Market Size and Forecast (Thousand Units), (US$ Bn), 2017-2031

17.1. Key Findings

17.2. Middle East & Africa Market, by Application

17.2.1. Parking camera

17.2.2. Front camera

17.2.3. Interjection camera

17.2.4. Night vision camera

17.2.5. Camera in mirror

17.3. Middle East & Africa Market, by Nozzle Type

17.3.1. Fixed Nozzles

17.3.2. Telescoping Nozzles

17.3.3. Nano Nozzle

17.4. Middle East & Africa Market, by Sales Channel

17.4.1. OEM

17.4.2. Aftermarket

17.5. Middle East & Africa Market, by Vehicle Type

17.5.1. Passenger Vehicle

17.5.1.1. Entry

17.5.1.2. Mid-Size

17.5.1.3. Premium/ Luxury

17.5.2. Commercial Vehicle

17.6. Middle East & Africa Market Size & Forecast by Country

17.6.1. GCC

17.6.2. South Africa

17.6.3. Rest of Middle East & Africa

17.7. GCC Market, by Application

17.7.1. Parking camera

17.7.2. Front camera

17.7.3. Interjection camera

17.7.4. Night vision camera

17.7.5. Camera in mirror

17.8. GCC Market, by Nozzle Type

17.8.1. Fixed Nozzles

17.8.2. Telescoping Nozzles

17.8.3. Nano Nozzle

17.9. GCC Market, by Sales Channel

17.9.1. OEM

17.9.2. Aftermarket

17.10. GCC Market, by Vehicle Type

17.10.1. Passenger Vehicle

17.10.1.1. Entry

17.10.1.2. Mid-Size

17.10.1.3. Premium/ Luxury

17.10.2. Commercial Vehicle

17.11. South Africa Market, by Application

17.11.1. Parking camera

17.11.2. Front camera

17.11.3. Interjection camera

17.11.4. Night vision camera

17.11.5. Camera in mirror

17.12. South Africa Market, by Nozzle Type

17.12.1. Fixed Nozzles

17.12.2. Telescoping Nozzles

17.12.3. Nano Nozzle

17.13. South Africa Market, by Sales Channel

17.13.1. OEM

17.13.2. Aftermarket

17.14. South Africa Market, by Vehicle Type

17.14.1. Passenger Vehicle

17.14.1.1. Entry

17.14.1.2. Mid-Size

17.14.1.3. Premium/ Luxury

17.14.2. Commercial Vehicle

17.15. Rest of Middle East & Africa Market, by Application

17.15.1. Parking camera

17.15.2. Front camera

17.15.3. Interjection camera

17.15.4. Night vision camera

17.15.5. Camera in mirror

17.16. Rest of Middle East & Africa Market, by Nozzle Type

17.16.1. Fixed Nozzles

17.16.2. Telescoping Nozzles

17.16.3. Nano Nozzle

17.17. Rest of Middle East & Africa Market, by Sales Channel

17.17.1. OEM

17.17.2. Aftermarket

17.18. Rest of Middle East & Africa Market, by Vehicle Type

17.18.1. Passenger Vehicle

17.18.1.1. Entry

17.18.1.2. Mid-Size

17.18.1.3. Premium/ Luxury

17.18.2. Commercial Vehicle

17.19. Middle East & Africa Automotive Camera Cleaning System Market : PEST Analysis

18. Competition Landscape

18.1. Market Share Analysis By Company (2022)

18.2. Market Player - Competition Matrix

18.3. Company Financials

18.4. Executive Bios/ Key Executive Changes

18.5. Key Market Players (Details - Overview, Overall Revenue, Recent Developments, Strategy)

18.5.1. Continental AG

18.5.1.1. Overview

18.5.1.2. Overall Revenue

18.5.1.3. Recent Developments

18.5.1.4. Strategy

18.5.2. Denso Corporation

18.5.2.1. Overview

18.5.2.2. Overall Revenue

18.5.2.3. Recent Developments

18.5.2.4. Strategy

18.5.3. dlhBOWLES

18.5.3.1. Overview

18.5.3.2. Overall Revenue

18.5.3.3. Recent Developments

18.5.3.4. Strategy

18.5.4. Ficosa International SA

18.5.4.1. Overview

18.5.4.2. Overall Revenue

18.5.4.3. Recent Developments

18.5.4.4. Strategy

18.5.5. KAUTEX TEXTRON GMBH & CO. KG

18.5.5.1. Overview

18.5.5.2. Overall Revenue

18.5.5.3. Recent Developments

18.5.5.4. Strategy

18.5.6. MAGNA ELECTRONICS INC.

18.5.6.1. Overview

18.5.6.2. Overall Revenue

18.5.6.3. Recent Developments

18.5.6.4. Strategy

18.5.7. MS FOSTER & ASSOCIATES, INC.

18.5.7.1. Overview

18.5.7.2. Overall Revenue

18.5.7.3. Recent Developments

18.5.7.4. Strategy

18.5.8. Panasonic Corp.

18.5.8.1. Overview

18.5.8.2. Overall Revenue

18.5.8.3. Recent Developments

18.5.8.4. Strategy

18.5.9. Seeva Technologies

18.5.9.1. Overview

18.5.9.2. Overall Revenue

18.5.9.3. Recent Developments

18.5.9.4. Strategy

18.5.10. Shenzhen Mingshang Industrial Co., Ltd.

18.5.10.1. Overview

18.5.10.2. Overall Revenue

18.5.10.3. Recent Developments

18.5.10.4. Strategy

18.5.11. Valeo SA

18.5.11.1. Overview

18.5.11.2. Overall Revenue

18.5.11.3. Recent Developments

18.5.11.4. Strategy

18.5.12. Waymo

18.5.12.1. Overview

18.5.12.2. Overall Revenue

18.5.12.3. Recent Developments

18.5.12.4. Strategy

List of Tables

Table 1: Global Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 2: Global Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 3: Global Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Nozzle Type, 2017-2031

Table 4: Global Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Nozzle Type, 2017‒2031

Table 5: Global Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 6: Global Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 7: Global Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 8: Global Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 9: Global Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Table 10: Global Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Region, 2017‒2031

Table 11: North America Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 12: North America Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 13: North America Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Nozzle Type, 2017-2031

Table 14: North America Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Nozzle Type, 2017‒2031

Table 15: North America Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 16: North America Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 17: North America Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 18: North America Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 19: North America Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 20: North America Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 21: South America Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 22: South America Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 23: South America Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Nozzle Type, 2017-2031

Table 24: South America Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Nozzle Type, 2017‒2031

Table 25: South America Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 26: South America Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 27: South America Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 28: South America Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 29: South America Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 30: South America Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 31: Europe Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 32: Europe Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 33: Europe Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Nozzle Type, 2017-2031

Table 34: Europe Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Nozzle Type, 2017‒2031

Table 35: Europe Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 36: Europe Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 37: Europe Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 38: Europe Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 39: Europe Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 40: Europe Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 41: Asia Pacific Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 42: Asia Pacific Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 43: Asia Pacific Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Nozzle Type, 2017-2031

Table 44: Asia Pacific Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Nozzle Type, 2017‒2031

Table 45: Asia Pacific Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 46: Asia Pacific Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 47: Asia Pacific Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 48: Asia Pacific Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 49: Asia Pacific Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 50: Asia Pacific Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 51: Middle East & Africa Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 52: Middle East & Africa Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 53: Middle East & Africa Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Nozzle Type, 2017-2031

Table 54: Middle East & Africa Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Nozzle Type, 2017‒2031

Table 55: Middle East & Africa Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 56: Middle East & Africa Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 57: Middle East & Africa Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 58: Middle East & Africa Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 59: Middle East & Africa Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 60: Middle East & Africa Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Country, 2017‒2031

List of Figures

Figure 1: Global Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 2: Global Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 3: Global Automotive Camera Cleaning System Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 4: Global Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Nozzle Type, 2017-2031

Figure 5: Global Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Nozzle Type, 2017-2031

Figure 6: Global Automotive Camera Cleaning System Market, Incremental Opportunity, by Nozzle Type, Value (US$ Bn), 2023-2031

Figure 7: Global Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 8: Global Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 9: Global Automotive Camera Cleaning System Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 10: Global Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 11: Global Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 12: Global Automotive Camera Cleaning System Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 13: Global Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Figure 14: Global Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 15: Global Automotive Camera Cleaning System Market, Incremental Opportunity, by Region, Value (US$ Bn), 2023-2031

Figure 16: North America Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 17: North America Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 18: North America Automotive Camera Cleaning System Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 19: North America Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Nozzle Type, 2017-2031

Figure 20: North America Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Nozzle Type, 2017-2031

Figure 21: North America Automotive Camera Cleaning System Market, Incremental Opportunity, by Nozzle Type, Value (US$ Bn), 2023-2031

Figure 22: North America Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 23: North America Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 24: North America Automotive Camera Cleaning System Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 25: North America Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 26: North America Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 27: North America Automotive Camera Cleaning System Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 28: North America Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 29: North America Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 30: North America Automotive Camera Cleaning System Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 31: South America Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 32: South America Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 33: South America Automotive Camera Cleaning System Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 34: South America Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Nozzle Type, 2017-2031

Figure 35: South America Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Nozzle Type, 2017-2031

Figure 36: South America Automotive Camera Cleaning System Market, Incremental Opportunity, by Nozzle Type, Value (US$ Bn), 2023-2031

Figure 37: South America Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 38: South America Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 39: South America Automotive Camera Cleaning System Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 40: South America Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 41: South America Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 42: South America Automotive Camera Cleaning System Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 43: South America Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 44: South America Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 45: South America Automotive Camera Cleaning System Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 46: Europe Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 47: Europe Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 48: Europe Automotive Camera Cleaning System Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 49: Europe Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Nozzle Type, 2017-2031

Figure 50: Europe Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Nozzle Type, 2017-2031

Figure 51: Europe Automotive Camera Cleaning System Market, Incremental Opportunity, by Nozzle Type, Value (US$ Bn), 2023-2031

Figure 52: Europe Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 53: Europe Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 54: Europe Automotive Camera Cleaning System Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 55: Europe Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 56: Europe Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 57: Europe Automotive Camera Cleaning System Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 58: Europe Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 59: Europe Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 60: Europe Automotive Camera Cleaning System Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 61: Asia Pacific Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 62: Asia Pacific Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 63: Asia Pacific Automotive Camera Cleaning System Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 64: Asia Pacific Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Nozzle Type, 2017-2031

Figure 65: Asia Pacific Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Nozzle Type, 2017-2031

Figure 66: Asia Pacific Automotive Camera Cleaning System Market, Incremental Opportunity, by Nozzle Type, Value (US$ Bn), 2023-2031

Figure 67: Asia Pacific Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 68: Asia Pacific Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 69: Asia Pacific Automotive Camera Cleaning System Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 70: Asia Pacific Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 71: Asia Pacific Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 72: Asia Pacific Automotive Camera Cleaning System Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 73: Asia Pacific Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 74: Asia Pacific Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 75: Asia Pacific Automotive Camera Cleaning System Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 76: Middle East & Africa Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 77: Middle East & Africa Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 78: Middle East & Africa Automotive Camera Cleaning System Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 79: Middle East & Africa Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Nozzle Type, 2017-2031

Figure 80: Middle East & Africa Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Nozzle Type, 2017-2031

Figure 81: Middle East & Africa Automotive Camera Cleaning System Market, Incremental Opportunity, by Nozzle Type, Value (US$ Bn), 2023-2031

Figure 82: Middle East & Africa Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 83: Middle East & Africa Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 84: Middle East & Africa Automotive Camera Cleaning System Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 85: Middle East & Africa Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 86: Middle East & Africa Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 87: Middle East & Africa Automotive Camera Cleaning System Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 88: Middle East & Africa Automotive Camera Cleaning System Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 89: Middle East & Africa Automotive Camera Cleaning System Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 90: Middle East & Africa Automotive Camera Cleaning System Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031