Analysts’ Viewpoint

Expansion of the automotive industry, increase in sale of passenger and commercial vehicles, and prominent development in LCV and SUV segments along with surge in awareness about vehicle safety requirement as per norms suggested by regulatory authorities are projected to boost the automotive bumper industry. Established players, tier I suppliers, and key manufacturers of automotive bumper are integrating their ideas and forming joint ventures and alliances in order to develop more sustainable business strategies.

Light trucks, including pickup trucks, have a robust market presence, particularly in North America. Demand for trucks, which often have heavy-duty bumpers, can significantly impact the bumper market development. Growing popularity of electric vehicles is also influencing the demand for bumpers. EV manufacturers often prioritize lightweight materials and aerodynamic designs, which can affect bumper materials and designs. Several plastic bumper materials are recyclable, aligning with the automotive industry's sustainability goals. Recycled plastics can be used in the production of new bumpers, reducing their environmental impact.

The automotive bumper market refers to the segment of the automotive industry focused on the design, manufacture, and distribution of bumpers for motor vehicles. Bumpers are essential safety and esthetic components that are installed on the front and rear of automobiles. They serve multiple functions. Bumpers are primarily designed to absorb and distribute impact energy in the event of a collision. This helps protect both the vehicle and its occupants by minimizing damage and reducing the risk of injury.

A significant factor driving the demand for automotive bumper in vehicles is the rising sales of passenger and commercial vehicles around the world. Vehicle bumpers play a role in pedestrian safety by providing a softer, more impact-absorbing surface in case a vehicle strikes a pedestrian. In addition to their safety functions, auto bumpers contribute to the overall appearance and design of a vehicle. Automakers often incorporate bumpers as key elements in the vehicle's exterior styling. Modern car front bumpers often integrate various sensors and components for advanced driver assistance systems (ADAS), such as radar sensors, parking sensors, and cameras.

Stringent safety regulations and standards imposed by governments and organizations worldwide are a major driver of the automotive bumper market. Regulatory bodies such as the National Highway Traffic Safety Administration (NHTSA) in the United States and the European New Car Assessment Programme (Euro NCAP) in Europe establish strict requirements for vehicle safety, including bumper performance in crash tests.

Automakers are compelled to design and manufacture bumpers that meet these standards to ensure the safety of their vehicles. Consistent improvements and increasing stringency in safety regulations drives innovation in bumper design and materials to enhance crashworthiness and pedestrian protection.

Increase in awareness among consumers regarding vehicle safety has propelled the demand for advanced safety features in automobiles. Vehicle front fascia is a critical component in the overall safety system of a vehicle. Consumers seek vehicles with robust bumpers that offer effective collision protection for both passengers and pedestrians. Additionally, the integration of bumpers with advanced driver assistance systems (ADAS), such as adaptive cruise control, automatic emergency braking, and parking sensors, has become a significant selling point.

Automakers respond to this demand by investing in the development of advanced bumper technologies that provide enhanced safety to consumers. Furthermore, rapid advancements in materials and manufacturing technologies have a significant impact on the automotive bumper market demand. Lightweight materials, such as high-strength plastics and composites, are increasingly being used to reduce vehicle weight, while maintaining or improving safety and performance. These materials also offer design flexibility and contribute to improved fuel efficiency.

In terms of material, the use of plastic materials in various types of automotive bumpers is a significant and prevalent trend due to the numerous advantages that plastic offer in terms of performance, cost, and design flexibility. Most plastic bumpers are made from thermoplastic polymers, which can be melted and molded into various shapes during manufacturing. This flexibility in shaping allows for innovative and aerodynamic bumper designs that can enhance a vehicle's aesthetics. Plastic allows for the design of intricate and complex bumpers that can enhance both esthetics and functionality.

Based on vehicle type, passenger cars, including sedans, hatchbacks, and SUVs, account for the largest automotive bumper market share. These vehicles make up a substantial portion of the global automotive market, and bumper demand is closely tied to their production and sales. The popularity of SUVs and crossovers has been on the rise in various regions, including North America, Europe, and Asia Pacific. These vehicles often have larger and more complex bumpers due to their size and design, which can drive the demand for specialized bumper systems further.

Asia Pacific dominates the global market for automobile bumpers due to the presence of prominent automotive industries in China, Japan, India, and South Korea. China has become the world's largest automotive market, and it is estimated to play a significant role in influencing the global bumper market forecast for the next few years.

Analysis of the latest automotive bumper market research reveals that the market in China is influenced by government incentives to promote EVs and improve safety standards. In India, small and compact cars are prevalent. Cost-effective bumpers are often a priority in this market; however, demand for safety features is also rising. Moreover, automakers in Japan are emphasizing on integration of technology and safety features in their vehicles, which can influence bumper designs. Japan also plays a key role in the global supply chain for bumper materials and components.

The U.S., in North America, has a significant automotive industry. The bumper market statistics in the U.S. are influenced by consumer demand for trucks, SUVs, and crossover vehicles. Bumper designs often prioritize esthetics and safety features. The market is also influenced by stringent safety regulations from agencies such as the NHTSA.

Europe has a strong focus on vehicle safety and emission reduction. The region often leads in implementation of stringent safety standards and promotion of sustainability for vehicle bumpers. Automakers in Europe follow the latest automotive bumper market trends and use lightweight materials in their bumpers to meet emissions targets. Additionally, design and esthetics are essential considerations in the Europe bumper market.

Key players operating in the global automotive bumper business are expected to benefit from the formation of strategic alliances with other global players. These players have strong global presence, firm establishments, and diverse product portfolios. Prominent players operating in the global automotive bumper market include: Plastic Omnium, Hyundai Mobis Co. Ltd., Magna International, Inc., SMP Deutschland GmbH, Toyoda Gosei Co. Ltd., Benteler Automotive, Samvardhana Motherson Group (SMG), Faurecia SA, NTF Group, Tong Yang Group, KIRCHHOFF Automotive, Yanfeng Automotive Interiors, Futaba Industrial Co. Ltd., Flex-N-Gate Corporation, and Toyota Boshoku Corporation.

Key players in the automotive bumper market report have been profiled based on various parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2022 | US$ 12.2 Bn |

| Market Forecast Value in 2031 | US$ 16.6 Bn |

| Growth Rate (CAGR) | 3.5% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

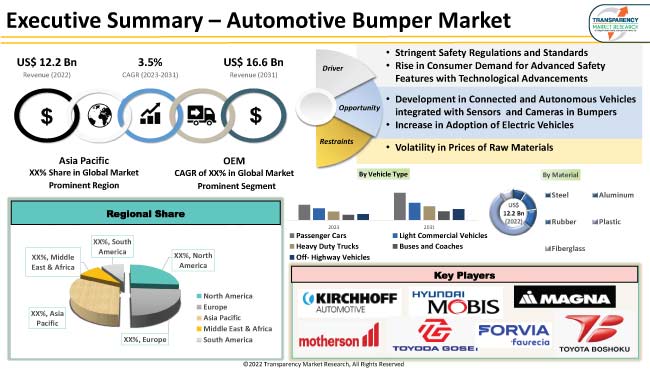

The global market was valued at US$ 12.2 Bn in 2022

It is expected to expand at a CAGR of 3.5% by 2031

It is estimated to be worth US$ 16.6 Bn in 2031

Stringent safety regulations and standards and rise in consumer demand for advanced safety features with technological advancements

In terms of Material, the plastic segment accounted for major share in 2022

Asia Pacific was the most lucrative region for automotive bumper vendors

Plastic Omnium, Hyundai Mobis Co. Ltd., Magna International, Inc., SMP Deutschland GmbH, Toyoda Gosei Co. Ltd., Benteler Automotive, Samvardhana Motherson Group (SMG), Faurecia SA, NTF Group, Tong Yang Group, KIRCHHOFF Automotive, Yanfeng Automotive Interiors, Futaba Industrial Co. Ltd., Flex-N-Gate Corporation, Toyota Boshoku Corporation

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Size in Volume (Thousand Units) & Value US$ Mn, 2017-2031

1.2. TMR Analysis and Recommendations

1.3. Competitive Dashboard Analysis

2. Go to Market Strategy

2.1. Demand & Supply Side Trends

2.1.1. Gap Analysis

2.2. Identification of Potential Market Spaces

2.3. Understanding the Buying Process of the Customers

2.4. Preferred Sales & Marketing Strategy

3. Market Overview

3.1. Market Definition / Scope / Limitations

3.2. Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunity

3.3. Market Factor Analysis

3.3.1. Porter’s Five Force Analysis

3.3.2. SWOT Analysis

3.4. Regulatory Scenario

3.5. Key Trend Analysis

3.6. Value Chain Analysis

3.7. Cost Structure Analysis

3.8. Profit Margin Analysis

4. Global Automotive Bumper Market, by Type

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Automotive Bumper Market Size & Forecast, 2017-2031, by Type

4.2.1. Standard Bumper

4.2.2. Deep Drop/Cowboy Bumper

4.2.3. Roll Pan Bumper

4.2.4. Step Bumper

4.2.5. Tube Bumper

5. Global Automotive Bumper Market, by Material

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Automotive Bumper Market Size & Forecast, 2017-2031, by Material

5.2.1. Steel

5.2.2. Aluminum

5.2.3. Rubber

5.2.4. Plastic

5.2.4.1. Polypropylene (PP)

5.2.4.2. HDPE (High-Density Polyethylene)

5.2.4.3. Polycarbonate

5.2.4.4. Thermoplastic Polyolefins (TPOs)

5.2.4.5. Carbon Fiber

5.2.5. Fiberglass

6. Global Automotive Bumper Market, by Positioning

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Automotive Bumper Market Size & Forecast, 2017-2031, by Positioning

6.2.1. Front Ends

6.2.2. Rear Ends

7. Global Automotive Bumper Market, by Vehicle Type

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Automotive Bumper Market Size & Forecast, 2017-2031, by Vehicle Type

7.2.1. Passenger Cars

7.2.1.1. Hatchbacks

7.2.1.2. Sedans

7.2.1.3. Utility Vehicles (SUVs & MPVs)

7.2.2. Light Commercial Vehicles

7.2.3. Heavy Duty Trucks

7.2.4. Buses and Coaches

7.2.5. Off - Highway Vehicles

7.2.5.1. Agriculture Tractors & Equipment

7.2.5.2. Construction & Mining Equipment

7.2.5.3. Industrial Vehicles (Forklift, AGV, Etc.)

8. Global Automotive Bumper Market, by Sales Channel

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Automotive Bumper Market Size & Forecast, 2017-2031, by Sales Channel

8.2.1. OEM

8.2.2. Aftermarket

9. Global Automotive Bumper Market, by Region

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global Automotive Bumper Market Size & Forecast, 2017-2031, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. South America

10. North America Automotive Bumper Market

10.1. Market Snapshot

10.2. Automotive Bumper Market Size & Forecast, 2017-2031, by Type

10.2.1. Standard Bumper

10.2.2. Deep Drop/Cowboy Bumper

10.2.3. Roll Pan Bumper

10.2.4. Step Bumper

10.2.5. Tube Bumper

10.3. Automotive Bumper Market Size & Forecast, 2017-2031, by Material

10.3.1. Steel

10.3.2. Aluminum

10.3.3. Rubber

10.3.4. Plastic

10.3.4.1. Polypropylene (PP)

10.3.4.2. HDPE (High-Density Polyethylene)

10.3.4.3. Polycarbonate

10.3.4.4. Thermoplastic Polyolefins (TPOs)

10.3.4.5. Carbon Fiber

10.3.5. Fiberglass

10.4. Automotive Bumper Market Size & Forecast, 2017-2031, by Positioning

10.4.1. Front Ends

10.4.2. Rear Ends

10.5. Automotive Bumper Market Size & Forecast, 2017-2031, by Vehicle Type

10.5.1. Passenger Cars

10.5.1.1. Hatchbacks

10.5.1.2. Sedans

10.5.1.3. Utility Vehicles (SUVs & MPVs)

10.5.2. Light Commercial Vehicles

10.5.3. Heavy Duty Trucks

10.5.4. Buses and Coaches

10.5.5. Off - Highway Vehicles

10.5.5.1. Agriculture Tractors & Equipment

10.5.5.2. Construction & Mining Equipment

10.5.5.3. Industrial Vehicles (Forklift, AGV, Etc.)

10.6. Automotive Bumper Market Size & Forecast, 2017-2031, by Sales Channel

10.6.1. OEM

10.6.2. Aftermarket

10.7. Key Country Analysis - North America Automotive Bumper Market Size & Forecast, 2017-2031

10.7.1. U. S.

10.7.2. Canada

10.7.3. Mexico

11. Europe Automotive Bumper Market

11.1. Market Snapshot

11.2. Automotive Bumper Market Size & Forecast, 2017-2031, by Type

11.2.1. Standard Bumper

11.2.2. Deep Drop/Cowboy Bumper

11.2.3. Roll Pan Bumper

11.2.4. Step Bumper

11.2.5. Tube Bumper

11.3. Automotive Bumper Market Size & Forecast, 2017-2031, by Material

11.3.1. Steel

11.3.2. Aluminum

11.3.3. Rubber

11.3.4. Plastic

11.3.4.1. Polypropylene (PP)

11.3.4.2. HDPE (High-Density Polyethylene)

11.3.4.3. Polycarbonate

11.3.4.4. Thermoplastic Polyolefins (TPOs)

11.3.4.5. Carbon Fiber

11.3.5. Fiberglass

11.4. Automotive Bumper Market Size & Forecast, 2017-2031, by Positioning

11.4.1. Front Ends

11.4.2. Rear Ends

11.5. Automotive Bumper Market Size & Forecast, 2017-2031, by Vehicle Type

11.5.1. Passenger Cars

11.5.1.1. Hatchbacks

11.5.1.2. Sedans

11.5.1.3. Utility Vehicles (SUVs & MPVs)

11.5.2. Light Commercial Vehicles

11.5.3. Heavy Duty Trucks

11.5.4. Buses and Coaches

11.5.5. Off - Highway Vehicles

11.5.5.1. Agriculture Tractors & Equipment

11.5.5.2. Construction & Mining Equipment

11.5.5.3. Industrial Vehicles (Forklift, AGV, Etc.)

11.6. Automotive Bumper Market Size & Forecast, 2017-2031, by Sales Channel

11.6.1. OEM

11.6.2. Aftermarket

11.7. Key Country Analysis - Europe Automotive Bumper Market Size & Forecast, 2017-2031

11.7.1. Germany

11.7.2. U. K.

11.7.3. France

11.7.4. Italy

11.7.5. Spain

11.7.6. Nordic Countries

11.7.7. Russia & CIS

11.7.8. Rest of Europe

12. Asia Pacific Automotive Bumper Market

12.1. Market Snapshot

12.2. Automotive Bumper Market Size & Forecast, 2017-2031, by Type

12.2.1. Standard Bumper

12.2.2. Deep Drop/Cowboy Bumper

12.2.3. Roll Pan Bumper

12.2.4. Step Bumper

12.2.5. Tube Bumper

12.3. Automotive Bumper Market Size & Forecast, 2017-2031, by Material

12.3.1. Steel

12.3.2. Aluminum

12.3.3. Rubber

12.3.4. Plastic

12.3.4.1. Polypropylene (PP)

12.3.4.2. HDPE (High-Density Polyethylene)

12.3.4.3. Polycarbonate

12.3.4.4. Thermoplastic Polyolefins (TPOs)

12.3.4.5. Carbon Fiber

12.3.5. Fiberglass

12.4. Automotive Bumper Market Size & Forecast, 2017-2031, by Positioning

12.4.1. Front Ends

12.4.2. Rear Ends

12.5. Automotive Bumper Market Size & Forecast, 2017-2031, by Vehicle Type

12.5.1. Passenger Cars

12.5.1.1. Hatchbacks

12.5.1.2. Sedans

12.5.1.3. Utility Vehicles (SUVs & MPVs)

12.5.2. Light Commercial Vehicles

12.5.3. Heavy Duty Trucks

12.5.4. Buses and Coaches

12.5.5. Off - Highway Vehicles

12.5.5.1. Agriculture Tractors & Equipment

12.5.5.2. Construction & Mining Equipment

12.5.5.3. Industrial Vehicles (Forklift, AGV, Etc.)

12.6. Automotive Bumper Market Size & Forecast, 2017-2031, by Sales Channel

12.6.1. OEM

12.6.2. Aftermarket

12.7. Key Country Analysis - Asia Pacific Automotive Bumper Market Size & Forecast, 2017-2031

12.7.1. China

12.7.2. India

12.7.3. Japan

12.7.4. ASEAN Countries

12.7.5. South Korea

12.7.6. ANZ

12.7.7. Rest of Asia Pacific

13. Middle East & Africa Automotive Bumper Market

13.1. Market Snapshot

13.2. Automotive Bumper Market Size & Forecast, 2017-2031, by Type

13.2.1. Standard Bumper

13.2.2. Deep Drop/Cowboy Bumper

13.2.3. Roll Pan Bumper

13.2.4. Step Bumper

13.2.5. Tube Bumper

13.3. Automotive Bumper Market Size & Forecast, 2017-2031, by Material

13.3.1. Steel

13.3.2. Aluminum

13.3.3. Rubber

13.3.4. Plastic

13.3.4.1. Polypropylene (PP)

13.3.4.2. HDPE (High-Density Polyethylene)

13.3.4.3. Polycarbonate

13.3.4.4. Thermoplastic Polyolefins (TPOs)

13.3.4.5. Carbon Fiber

13.3.5. Fiberglass

13.4. Automotive Bumper Market Size & Forecast, 2017-2031, by Positioning

13.4.1. Front Ends

13.4.2. Rear Ends

13.5. Automotive Bumper Market Size & Forecast, 2017-2031, by Vehicle Type

13.5.1. Passenger Cars

13.5.1.1. Hatchbacks

13.5.1.2. Sedans

13.5.1.3. Utility Vehicles (SUVs & MPVs)

13.5.2. Light Commercial Vehicles

13.5.3. Heavy Duty Trucks

13.5.4. Buses and Coaches

13.5.5. Off - Highway Vehicles

13.5.5.1. Agriculture Tractors & Equipment

13.5.5.2. Construction & Mining Equipment

13.5.5.3. Industrial Vehicles (Forklift, AGV, Etc.)

13.6. Automotive Bumper Market Size & Forecast, 2017-2031, by Sales Channel

13.6.1. OEM

13.6.2. Aftermarket

13.7. Key Country Analysis - Middle East & Africa Automotive Bumper Market Size & Forecast, 2017-2031

13.7.1. GCC

13.7.2. South Africa

13.7.3. Turkey

13.7.4. Rest of Middle East & Africa

14. South America Automotive Bumper Market

14.1. Market Snapshot

14.2. Automotive Bumper Market Size & Forecast, 2017-2031, by Type

14.2.1. Standard Bumper

14.2.2. Deep Drop/Cowboy Bumper

14.2.3. Roll Pan Bumper

14.2.4. Step Bumper

14.2.5. Tube Bumper

14.3. Automotive Bumper Market Size & Forecast, 2017-2031, by Material

14.3.1. Steel

14.3.2. Aluminum

14.3.3. Rubber

14.3.4. Plastic

14.3.4.1. Polypropylene (PP)

14.3.4.2. HDPE (High-Density Polyethylene)

14.3.4.3. Polycarbonate

14.3.4.4. Thermoplastic Polyolefins (TPOs)

14.3.4.5. Carbon Fiber

14.3.5. Fiberglass

14.4. Automotive Bumper Market Size & Forecast, 2017-2031, by Positioning

14.4.1. Front Ends

14.4.2. Rear Ends

14.5. Automotive Bumper Market Size & Forecast, 2017-2031, by Vehicle Type

14.5.1. Passenger Cars

14.5.1.1. Hatchbacks

14.5.1.2. Sedans

14.5.1.3. Utility Vehicles (SUVs & MPVs)

14.5.2. Light Commercial Vehicles

14.5.3. Heavy Duty Trucks

14.5.4. Buses and Coaches

14.5.5. Off - Highway Vehicles

14.5.5.1. Agriculture Tractors & Equipment

14.5.5.2. Construction & Mining Equipment

14.5.5.3. Industrial Vehicles (Forklift, AGV, Etc.)

14.6. Automotive Bumper Market Size & Forecast, 2017-2031, by Sales Channel

14.6.1. OEM

14.6.2. Aftermarket

14.7. Key Country Analysis - South America Automotive Bumper Market Size & Forecast, 2017-2031

14.7.1. Brazil

14.7.2. Argentina

14.7.3. Rest of South America

15. Competitive Landscape

15.1. Company Share Analysis/ Brand Share Analysis, 2022

15.2. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

16. Company Profile/ Key Players

16.1. Plastic Omnium

16.1.1. Company Overview

16.1.2. Company Footprints

16.1.3. Production Locations

16.1.4. Product Portfolio

16.1.5. Competitors & Customers

16.1.6. Subsidiaries & Parent Organization

16.1.7. Recent Developments

16.1.8. Financial Analysis

16.1.9. Profitability

16.1.10. Revenue Share

16.2. Hyundai Mobis Co. Ltd.

16.2.1. Company Overview

16.2.2. Company Footprints

16.2.3. Production Locations

16.2.4. Product Portfolio

16.2.5. Competitors & Customers

16.2.6. Subsidiaries & Parent Organization

16.2.7. Recent Developments

16.2.8. Financial Analysis

16.2.9. Profitability

16.2.10. Revenue Share

16.3. Magna International, Inc.

16.3.1. Company Overview

16.3.2. Company Footprints

16.3.3. Production Locations

16.3.4. Product Portfolio

16.3.5. Competitors & Customers

16.3.6. Subsidiaries & Parent Organization

16.3.7. Recent Developments

16.3.8. Financial Analysis

16.3.9. Profitability

16.3.10. Revenue Share

16.4. SMP Deutschland GmbH

16.4.1. Company Overview

16.4.2. Company Footprints

16.4.3. Production Locations

16.4.4. Product Portfolio

16.4.5. Competitors & Customers

16.4.6. Subsidiaries & Parent Organization

16.4.7. Recent Developments

16.4.8. Financial Analysis

16.4.9. Profitability

16.4.10. Revenue Share

16.5. Toyoda Gosei Co. Ltd.

16.5.1. Company Overview

16.5.2. Company Footprints

16.5.3. Production Locations

16.5.4. Product Portfolio

16.5.5. Competitors & Customers

16.5.6. Subsidiaries & Parent Organization

16.5.7. Recent Developments

16.5.8. Financial Analysis

16.5.9. Profitability

16.5.10. Revenue Share

16.6. Benteler Automotive

16.6.1. Company Overview

16.6.2. Company Footprints

16.6.3. Production Locations

16.6.4. Product Portfolio

16.6.5. Competitors & Customers

16.6.6. Subsidiaries & Parent Organization

16.6.7. Recent Developments

16.6.8. Financial Analysis

16.6.9. Profitability

16.6.10. Revenue Share

16.7. Samvardhana Motherson Group (SMG)

16.7.1. Company Overview

16.7.2. Company Footprints

16.7.3. Production Locations

16.7.4. Product Portfolio

16.7.5. Competitors & Customers

16.7.6. Subsidiaries & Parent Organization

16.7.7. Recent Developments

16.7.8. Financial Analysis

16.7.9. Profitability

16.7.10. Revenue Share

16.8. Faurecia SA

16.8.1. Company Overview

16.8.2. Company Footprints

16.8.3. Production Locations

16.8.4. Product Portfolio

16.8.5. Competitors & Customers

16.8.6. Subsidiaries & Parent Organization

16.8.7. Recent Developments

16.8.8. Financial Analysis

16.8.9. Profitability

16.8.10. Revenue Share

16.9. NTF Group

16.9.1. Company Overview

16.9.2. Company Footprints

16.9.3. Production Locations

16.9.4. Product Portfolio

16.9.5. Competitors & Customers

16.9.6. Subsidiaries & Parent Organization

16.9.7. Recent Developments

16.9.8. Financial Analysis

16.9.9. Profitability

16.9.10. Revenue Share

16.10. Tong Yang Group

16.10.1. Company Overview

16.10.2. Company Footprints

16.10.3. Production Locations

16.10.4. Product Portfolio

16.10.5. Competitors & Customers

16.10.6. Subsidiaries & Parent Organization

16.10.7. Recent Developments

16.10.8. Financial Analysis

16.10.9. Profitability

16.10.10. Revenue Share

16.11. KIRCHHOFF Automotive

16.11.1. Company Overview

16.11.2. Company Footprints

16.11.3. Production Locations

16.11.4. Product Portfolio

16.11.5. Competitors & Customers

16.11.6. Subsidiaries & Parent Organization

16.11.7. Recent Developments

16.11.8. Financial Analysis

16.11.9. Profitability

16.11.10. Revenue Share

16.12. Yanfeng Automotive Interiors

16.12.1. Company Overview

16.12.2. Company Footprints

16.12.3. Production Locations

16.12.4. Product Portfolio

16.12.5. Competitors & Customers

16.12.6. Subsidiaries & Parent Organization

16.12.7. Recent Developments

16.12.8. Financial Analysis

16.12.9. Profitability

16.12.10. Revenue Share

16.13. Futaba Industrial Co. Ltd.

16.13.1. Company Overview

16.13.2. Company Footprints

16.13.3. Production Locations

16.13.4. Product Portfolio

16.13.5. Competitors & Customers

16.13.6. Subsidiaries & Parent Organization

16.13.7. Recent Developments

16.13.8. Financial Analysis

16.13.9. Profitability

16.13.10. Revenue Share

16.14. Flex-N-Gate Corporation

16.14.1. Company Overview

16.14.2. Company Footprints

16.14.3. Production Locations

16.14.4. Product Portfolio

16.14.5. Competitors & Customers

16.14.6. Subsidiaries & Parent Organization

16.14.7. Recent Developments

16.14.8. Financial Analysis

16.14.9. Profitability

16.14.10. Revenue Share

16.15. Toyota Boshoku Corporation

16.15.1. Company Overview

16.15.2. Company Footprints

16.15.3. Production Locations

16.15.4. Product Portfolio

16.15.5. Competitors & Customers

16.15.6. Subsidiaries & Parent Organization

16.15.7. Recent Developments

16.15.8. Financial Analysis

16.15.9. Profitability

16.15.10. Revenue Share

16.16. Other Key Players

16.16.1. Company Overview

16.16.2. Company Footprints

16.16.3. Production Locations

16.16.4. Product Portfolio

16.16.5. Competitors & Customers

16.16.6. Subsidiaries & Parent Organization

16.16.7. Recent Developments

16.16.8. Financial Analysis

16.16.9. Profitability

16.16.10. Revenue Share

List of Tables

Table 1: Global Automotive Bumper Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Table 2: Global Automotive Bumper Market Value (US$ Bn) Forecast, by Type, 2017-2031

Table 3: Global Automotive Bumper Market Volume (Thousand Units) Forecast, by Material, 2017-2031

Table 4: Global Automotive Bumper Market Value (US$ Bn) Forecast, by Material, 2017-2031

Table 5: Global Automotive Bumper Market Volume (Thousand Units) Forecast, by Positioning, 2017-2031

Table 6: Global Automotive Bumper Market Value (US$ Bn) Forecast, by Positioning, 2017-2031

Table 7: Global Automotive Bumper Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 8: Global Automotive Bumper Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 9: Global Automotive Bumper Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 10: Global Automotive Bumper Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 11: Global Automotive Bumper Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Table 12: Global Automotive Bumper Market Value (US$ Bn) Forecast, by Region, 2017-2031

Table 13: North America Automotive Bumper Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Table 14: North America Automotive Bumper Market Value (US$ Bn) Forecast, by Type, 2017-2031

Table 15: North America Automotive Bumper Market Volume (Thousand Units) Forecast, by Material, 2017-2031

Table 16: North America Automotive Bumper Market Value (US$ Bn) Forecast, by Material, 2017-2031

Table 17: North America Automotive Bumper Market Volume (Thousand Units) Forecast, by Positioning, 2017-2031

Table 18: North America Automotive Bumper Market Value (US$ Bn) Forecast, by Positioning, 2017-2031

Table 19: North America Automotive Bumper Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 20: North America Automotive Bumper Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 21: North America Automotive Bumper Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 22: North America Automotive Bumper Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 23: North America Automotive Bumper Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 24: North America Automotive Bumper Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 25: Europe Automotive Bumper Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Table 26: Europe Automotive Bumper Market Value (US$ Bn) Forecast, by Type, 2017-2031

Table 27: Europe Automotive Bumper Market Volume (Thousand Units) Forecast, by Material, 2017-2031

Table 28: Europe Automotive Bumper Market Value (US$ Bn) Forecast, by Material, 2017-2031

Table 29: Europe Automotive Bumper Market Volume (Thousand Units) Forecast, by Positioning, 2017-2031

Table 30: Europe Automotive Bumper Market Value (US$ Bn) Forecast, by Positioning, 2017-2031

Table 31: Europe Automotive Bumper Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 32: Europe Automotive Bumper Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 33: Europe Automotive Bumper Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 34: Europe Automotive Bumper Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 35: Europe Automotive Bumper Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 36: Europe Automotive Bumper Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 37: Asia Pacific Automotive Bumper Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Table 38: Asia Pacific Automotive Bumper Market Value (US$ Bn) Forecast, by Type, 2017-2031

Table 39: Asia Pacific Automotive Bumper Market Volume (Thousand Units) Forecast, by Material, 2017-2031

Table 40: Asia Pacific Automotive Bumper Market Value (US$ Bn) Forecast, by Material, 2017-2031

Table 41: Asia Pacific Automotive Bumper Market Volume (Thousand Units) Forecast, by Positioning, 2017-2031

Table 42: Asia Pacific Automotive Bumper Market Value (US$ Bn) Forecast, by Positioning, 2017-2031

Table 43: Asia Pacific Automotive Bumper Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 44: Asia Pacific Automotive Bumper Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 45: Asia Pacific Automotive Bumper Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 46: Asia Pacific Automotive Bumper Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 47: Asia Pacific Automotive Bumper Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 48: Asia Pacific Automotive Bumper Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 49: Middle East & Africa Automotive Bumper Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Table 50: Middle East & Africa Automotive Bumper Market Value (US$ Bn) Forecast, by Type, 2017-2031

Table 51: Middle East & Africa Automotive Bumper Market Volume (Thousand Units) Forecast, by Material, 2017-2031

Table 52: Middle East & Africa Automotive Bumper Market Value (US$ Bn) Forecast, by Material, 2017-2031

Table 53: Middle East & Africa Automotive Bumper Market Volume (Thousand Units) Forecast, by Positioning, 2017-2031

Table 54: Middle East & Africa Automotive Bumper Market Value (US$ Bn) Forecast, by Positioning, 2017-2031

Table 55: Middle East & Africa Automotive Bumper Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 56: Middle East & Africa Automotive Bumper Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 57: Middle East & Africa Automotive Bumper Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 58: Middle East & Africa Automotive Bumper Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 59: Middle East & Africa Automotive Bumper Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 60: Middle East & Africa Automotive Bumper Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 61: South America Automotive Bumper Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Table 62: South America Automotive Bumper Market Value (US$ Bn) Forecast, by Type, 2017-2031

Table 63: South America Automotive Bumper Market Volume (Thousand Units) Forecast, by Material, 2017-2031

Table 64: South America Automotive Bumper Market Value (US$ Bn) Forecast, by Material, 2017-2031

Table 65: South America Automotive Bumper Market Volume (Thousand Units) Forecast, by Positioning, 2017-2031

Table 66: South America Automotive Bumper Market Value (US$ Bn) Forecast, by Positioning, 2017-2031

Table 67: South America Automotive Bumper Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 68: South America Automotive Bumper Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 69: South America Automotive Bumper Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 70: South America Automotive Bumper Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 71: South America Automotive Bumper Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 72: South America Automotive Bumper Market Value (US$ Bn) Forecast, by Country, 2017-2031

List of Figures

Figure 1: Global Automotive Bumper Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Figure 2: Global Automotive Bumper Market Value (US$ Bn) Forecast, by Type, 2017-2031

Figure 3: Global Automotive Bumper Market, Incremental Opportunity, by Type, Value (US$ Bn), 2023-2031

Figure 4: Global Automotive Bumper Market Volume (Thousand Units) Forecast, by Material, 2017-2031

Figure 5: Global Automotive Bumper Market Value (US$ Bn) Forecast, by Material, 2017-2031

Figure 6: Global Automotive Bumper Market, Incremental Opportunity, by Material, Value (US$ Bn), 2023-2031

Figure 7: Global Automotive Bumper Market Volume (Thousand Units) Forecast, by Positioning, 2017-2031

Figure 8: Global Automotive Bumper Market Value (US$ Bn) Forecast, by Positioning, 2017-2031

Figure 9: Global Automotive Bumper Market, Incremental Opportunity, by Positioning, Value (US$ Bn), 2023-2031

Figure 10: Global Automotive Bumper Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 11: Global Automotive Bumper Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 12: Global Automotive Bumper Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 13: Global Automotive Bumper Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 14: Global Automotive Bumper Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 15: Global Automotive Bumper Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 16: Global Automotive Bumper Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Figure 17: Global Automotive Bumper Market Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 18: Global Automotive Bumper Market, Incremental Opportunity, by Region, Value (US$ Bn), 2023-2031

Figure 19: North America Automotive Bumper Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Figure 20: North America Automotive Bumper Market Value (US$ Bn) Forecast, by Type, 2017-2031

Figure 21: North America Automotive Bumper Market, Incremental Opportunity, by Type, Value (US$ Bn), 2023-2031

Figure 22: North America Automotive Bumper Market Volume (Thousand Units) Forecast, by Material, 2017-2031

Figure 23: North America Automotive Bumper Market Value (US$ Bn) Forecast, by Material, 2017-2031

Figure 24: North America Automotive Bumper Market, Incremental Opportunity, by Material, Value (US$ Bn), 2023-2031

Figure 25: North America Automotive Bumper Market Volume (Thousand Units) Forecast, by Positioning, 2017-2031

Figure 26: North America Automotive Bumper Market Value (US$ Bn) Forecast, by Positioning, 2017-2031

Figure 27: North America Automotive Bumper Market, Incremental Opportunity, by Positioning, Value (US$ Bn), 2023-2031

Figure 28: North America Automotive Bumper Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 29: North America Automotive Bumper Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 30: North America Automotive Bumper Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 31: North America Automotive Bumper Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 32: North America Automotive Bumper Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 33: North America Automotive Bumper Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 34: North America Automotive Bumper Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 35: North America Automotive Bumper Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 36: North America Automotive Bumper Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 37: Europe Automotive Bumper Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Figure 38: Europe Automotive Bumper Market Value (US$ Bn) Forecast, by Type, 2017-2031

Figure 39: Europe Automotive Bumper Market, Incremental Opportunity, by Type, Value (US$ Bn), 2023-2031

Figure 40: Europe Automotive Bumper Market Volume (Thousand Units) Forecast, by Material, 2017-2031

Figure 41: Europe Automotive Bumper Market Value (US$ Bn) Forecast, by Material, 2017-2031

Figure 42: Europe Automotive Bumper Market, Incremental Opportunity, by Material, Value (US$ Bn), 2023-2031

Figure 43: Europe Automotive Bumper Market Volume (Thousand Units) Forecast, by Positioning, 2017-2031

Figure 44: Europe Automotive Bumper Market Value (US$ Bn) Forecast, by Positioning, 2017-2031

Figure 45: Europe Automotive Bumper Market, Incremental Opportunity, by Positioning, Value (US$ Bn), 2023-2031

Figure 46: Europe Automotive Bumper Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 47: Europe Automotive Bumper Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 48: Europe Automotive Bumper Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 49: Europe Automotive Bumper Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 50: Europe Automotive Bumper Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 51: Europe Automotive Bumper Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 52: Europe Automotive Bumper Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 53: Europe Automotive Bumper Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 54: Europe Automotive Bumper Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 55: Asia Pacific Automotive Bumper Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Figure 56: Asia Pacific Automotive Bumper Market Value (US$ Bn) Forecast, by Type, 2017-2031

Figure 57: Asia Pacific Automotive Bumper Market, Incremental Opportunity, by Type, Value (US$ Bn), 2023-2031

Figure 58: Asia Pacific Automotive Bumper Market Volume (Thousand Units) Forecast, by Material, 2017-2031

Figure 59: Asia Pacific Automotive Bumper Market Value (US$ Bn) Forecast, by Material, 2017-2031

Figure 60: Asia Pacific Automotive Bumper Market, Incremental Opportunity, by Material, Value (US$ Bn), 2023-2031

Figure 61: Asia Pacific Automotive Bumper Market Volume (Thousand Units) Forecast, by Positioning, 2017-2031

Figure 62: Asia Pacific Automotive Bumper Market Value (US$ Bn) Forecast, by Positioning, 2017-2031

Figure 63: Asia Pacific Automotive Bumper Market, Incremental Opportunity, by Positioning, Value (US$ Bn), 2023-2031

Figure 64: Asia Pacific Automotive Bumper Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 65: Asia Pacific Automotive Bumper Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 66: Asia Pacific Automotive Bumper Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 67: Asia Pacific Automotive Bumper Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 68: Asia Pacific Automotive Bumper Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 69: Asia Pacific Automotive Bumper Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 70: Asia Pacific Automotive Bumper Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 71: Asia Pacific Automotive Bumper Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 72: Asia Pacific Automotive Bumper Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 73: Middle East & Africa Automotive Bumper Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Figure 74: Middle East & Africa Automotive Bumper Market Value (US$ Bn) Forecast, by Type, 2017-2031

Figure 75: Middle East & Africa Automotive Bumper Market, Incremental Opportunity, by Type, Value (US$ Bn), 2023-2031

Figure 76: Middle East & Africa Automotive Bumper Market Volume (Thousand Units) Forecast, by Material, 2017-2031

Figure 77: Middle East & Africa Automotive Bumper Market Value (US$ Bn) Forecast, by Material, 2017-2031

Figure 78: Middle East & Africa Automotive Bumper Market, Incremental Opportunity, by Material, Value (US$ Bn), 2023-2031

Figure 79: Middle East & Africa Automotive Bumper Market Volume (Thousand Units) Forecast, by Positioning, 2017-2031

Figure 80: Middle East & Africa Automotive Bumper Market Value (US$ Bn) Forecast, by Positioning, 2017-2031

Figure 81: Middle East & Africa Automotive Bumper Market, Incremental Opportunity, by Positioning, Value (US$ Bn), 2023-2031

Figure 82: Middle East & Africa Automotive Bumper Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 83: Middle East & Africa Automotive Bumper Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 84: Middle East & Africa Automotive Bumper Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 85: Middle East & Africa Automotive Bumper Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 86: Middle East & Africa Automotive Bumper Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 87: Middle East & Africa Automotive Bumper Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 88: Middle East & Africa Automotive Bumper Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 89: Middle East & Africa Automotive Bumper Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 90: Middle East & Africa Automotive Bumper Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 91: South America Automotive Bumper Market Volume (Thousand Units) Forecast, by Type, 2017-2031

Figure 92: South America Automotive Bumper Market Value (US$ Bn) Forecast, by Type, 2017-2031

Figure 93: South America Automotive Bumper Market, Incremental Opportunity, by Type, Value (US$ Bn), 2023-2031

Figure 94: South America Automotive Bumper Market Volume (Thousand Units) Forecast, by Material, 2017-2031

Figure 95: South America Automotive Bumper Market Value (US$ Bn) Forecast, by Material, 2017-2031

Figure 96: South America Automotive Bumper Market, Incremental Opportunity, by Material, Value (US$ Bn), 2023-2031

Figure 97: South America Automotive Bumper Market Volume (Thousand Units) Forecast, by Positioning, 2017-2031

Figure 98: South America Automotive Bumper Market Value (US$ Bn) Forecast, by Positioning, 2017-2031

Figure 99: South America Automotive Bumper Market, Incremental Opportunity, by Positioning, Value (US$ Bn), 2023-2031

Figure 100: South America Automotive Bumper Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 101: South America Automotive Bumper Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 102: South America Automotive Bumper Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 103: South America Automotive Bumper Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 104: South America Automotive Bumper Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 105: South America Automotive Bumper Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 106: South America Automotive Bumper Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 107: South America Automotive Bumper Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 108: South America Automotive Bumper Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031