Technological advancements and innovations continue to drive the automotive sector worldwide. The pursuit of the development of vehicles for the cities of the future has accelerated the pace at which technology is progressing, particularly in the automotive sector. Braking systems and components play an integral role in safeguarding the integrity of a vehicle. With significant technological developments, automotive manufacturers are allotting a substantial amount of resources toward the development of improved disk brakes, wherein automotive brake pads/blocks are an integral component of the standard braking equipment.

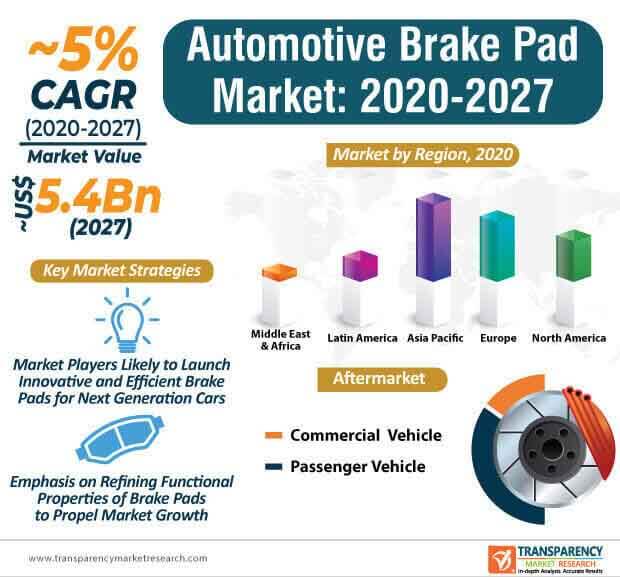

Stakeholders in the current automotive brake pad market are increasingly focusing on improving the design aspects of their products to enhance efficiency and prevent wear and tear. Apart from these key areas, participants in the current automotive brake pad market are also likely to improve the frictional properties of their automotive brake pads to gain a competitive edge over their competitors. Major companies in the current market landscape are exploring the potential of an array of materials to develop automotive brake pads for automotive vehicles of the future. Due to these factors, the global automotive brake pad market is expected to reach ~US$ 5.4 Bn by the end of the forecast period (2020-2027).

Operators involved in the current market landscape have identified the need to improve the efficiency of standard braking equipment in automotive vehicles worldwide. While the automotive brake pad is predominantly made of three main materials: organic, metallic, and ceramic, stakeholders are not ruling out the possibility of deploying other materials to manufacture automotive brake pads. Research and development activities are in full swing to find novel materials that address the issues put forward by the existing braking systems and braking pads.

For instance, in April 2019, a group of researchers at the University of Toronto, Sharif University of Technology, and University of British Columbia introduced a new breaking system design, which is self-lubricating. The newly designed brakes are expected to prevent wear and tear, and offer superior frictional properties than the existing braking systems in the automotive market. While braking pad designs made from different materials offer a range of benefits and drawbacks based on multiple parameters, including noise, response time, design, cost, durability, and temperature while usage. However, apart from these parameters, the recently conducted research also takes into account other factors, including composite breakdown at high temperature, wear testing, durability, and friction.

The cutting-edge carbon fiber polymer brakes designed by researchers is expected to be a groundbreaking discovery in the automotive brake pad market. The advent of this technology is expected to trigger the development of smaller, cost-effective, and efficient brake pads with improved ability to withstand high temperatures and friction. Stakeholders in the current automotive brake pad market are expected to develop nanomaterials and combine them with polymers to create multifunctional composites to address a host of problems, including heat distribution, molecular level, friction, and wear.

Due to the evolving requirements of the automotive sector, the development of new automotive braking pads and innovations are expected to gain significant momentum in the automotive brake pad market. As new braking technologies continue to be launched in the market, new, efficient, and cost-effective automotive brake pads are set to feature in the automobiles in the future.

For instance, in July 2019, Dove Technologies, Inc. launched a new self-cooling brake pad in which the heat is directed away from the brake and the rotor contact area, owing to the unique design. While some companies are expected to launch new variants of automotive brake pads, other companies are inclined toward expanding their market presence by introducing innovative and high-performing disc brake technologies wherein braking pads are critical. For instance, in January 2020, Brembo, a leading brake manufacturer revealed that the company aims to strengthen its market presence by focusing on innovations and refining their disc brake technology.

Analysts’ Viewpoint

The global automotive brake pad market is expected to grow at a moderate CAGR of ~5% during the forecast period. The growth can be primarily attributed to significant advancements in technology, emphasis on refining the functional properties of brake pads, significant rise in the number of automotive vehicles worldwide, and development of highly efficient and cost-effective brake pads. Stakeholders in the automotive brake pad market should leverage opportunities in Asia Pacific and Europe to expand their market presence, owing to the thriving automotive sector in these regions. Moreover, stakeholders should also focus on launching new products, mergers, and collaborating with regional market players to strengthen their foothold in the market.

1. Preface

1.1. Market Definition and Scope

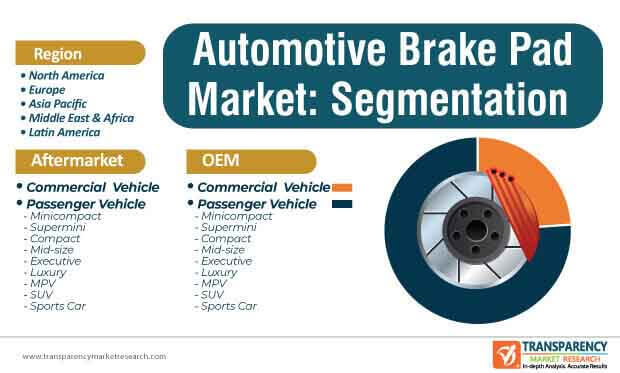

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Automotive Brake Pad Market

3.1. Global Automotive Brake Pad Market Size (Thousand Units) and Value (US$ Mn) and Forecast 2019?2027

4. Market Overview

4.1. Overview

4.2. Key Trend Analysis

4.3. Market Indicators

4.4. Market Dynamics

4.4.1. Drivers

4.4.2. Restraints

4.5. Opportunity

4.6. Porter’s Five Force Analysis

4.7. Value Chain Analysis

4.7.1. List of Key Manufacturers

4.7.2. List of Customers

4.7.3. Level of Integration

4.8. Regulatory Scenario

4.9. SWOT Analysis

5. Key Emerging Markets – Country and Sub-region/Region (Units, Revenue, Macroeconomic Indicators)

6. Market Trends: Connectivity, Autonomous, Shared Mobility, Electrification (CASE)

6.1. OEM POV (Future Automotive Programs)

6.2. Auto Fair Trends

6.3. Partnerships and Strategic Alliances (Digital Players: Apple, Google, etc.)

7. Global Automotive Brake Pad Market Analysis and Forecast, by OEM

7.1. Introduction & Definition

7.2. Key Findings

7.3. Global Automotive Brake Pad Market Volume (Thousand Units) and Value (US$ Mn) Forecast, by OEM, 2020?2027

7.3.1. Commercial Vehicle

7.3.2. Passenger Vehicle

7.3.2.1. Mini-compact (A segment)

7.3.2.2. Super-mini (B segment)

7.3.2.3. Compact (C segment)

7.3.2.4. Mid-size (D segment)

7.3.2.5. Executive (E segment)

7.3.2.6. Luxury (F segment)

7.3.2.7. MPV (Multi-purpose vehicle)

7.3.2.8. SUVs

7.3.2.9. Sport Cars

7.4. Global Automotive Brake Pad Market Attractiveness, by OEM

8. Global Automotive Brake Pad Market Analysis and Forecast, by Aftermarket

8.1. Introduction & Definition

8.2. Key Findings

8.3. Global Automotive Brake Pad Market Volume (Thousand Units) and Value (US$ Mn) Forecast, by Aftermarket, 2015?2020

8.3.1. Commercial Vehicle

8.3.2. Passenger Vehicle

8.3.2.1. Mini-compact (A segment)

8.3.2.2. Super-mini (B segment)

8.3.2.3. Compact (C segment)

8.3.2.4. Mid-size (D segment)

8.3.2.5. Executive (E segment)

8.3.2.6. Luxury (F segment)

8.3.2.7. MPV (Multi-purpose vehicle)

8.3.2.8. SUVs

8.3.2.9. Sport Cars

8.4. Global Automotive Brake Pad Market Attractiveness, by Aftermarket

9. Global Automotive Brake Pad Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Global Automotive Brake Pad Market Volume (Thousand Units) and Value (US$ Mn) Forecast by Region, 2020?2027

9.2.1. North America

9.2.2. Latin America

9.2.3. Europe

9.2.4. Asia Pacific

9.2.5. Middle East & Africa

9.3. Global Automotive Brake Pad Market Automotive Brake Pad Market Attractiveness Analysis, by Region

10. North America Automotive Brake Pad Market Volume (Thousand Units) and Value (US$ Mn) and Forecast 2020?2027

10.1. Key Findings

10.2. North America Automotive Brake Pad Market Volume (Thousand Units) and Value (US$ Mn), and Forecast, by OEM, 2020?2027

10.2.1. Commercial Vehicle

10.2.2. Passenger Vehicle

10.2.2.1. Mini-compact (A segment)

10.2.2.2. Super-mini (B segment)

10.2.2.3. Compact (C segment)

10.2.2.4. Mid-size (D segment)

10.2.2.5. Executive (E segment)

10.2.2.6. Luxury (F segment)

10.2.2.7. MPV (Multi-purpose vehicle)

10.2.2.8. SUVs

10.2.2.9. Sport Cars

10.3. North America Automotive Brake Pad Market Volume (Thousand Units) and Value (US$ Mn), and Forecast, by Aftermarket, 2015?2020

10.3.1. Commercial Vehicle

10.3.2. Passenger Vehicle

10.3.2.1. Mini-compact (A segment)

10.3.2.2. Super-mini (B segment)

10.3.2.3. Compact (C segment)

10.3.2.4. Mid-size (D segment)

10.3.2.5. Executive (E segment)

10.3.2.6. Luxury (F segment)

10.3.2.7. MPV (Multi-purpose vehicle)

10.3.2.8. SUVs

10.3.2.9. Sport Cars

10.4. North America Automotive Brake Pad Market Volume (Thousand Units) and Value (US$ Mn) and Forecast, by Country and Sub-region, 2020?2027

10.4.1. U. S.

10.4.2. Canada

10.5. U. S. Automotive Brake Pad Market Volume (Thousand Units) and Value (US$ Mn) Forecast, by OEM

10.5.1. Commercial Vehicle

10.5.2. Passenger Vehicle

10.5.2.1. Mini-compact (A segment)

10.5.2.2. Super-mini (B segment)

10.5.2.3. Compact (C segment)

10.5.2.4. Mid-size (D segment)

10.5.2.5. Executive (E segment)

10.5.2.6. Luxury (F segment)

10.5.2.7. MPV (Multi-purpose vehicle)

10.5.2.8. SUVs

10.5.2.9. Sport Cars

10.6. U. S. Automotive Brake Pad Market Volume (Thousand Units) and Value (US$ Mn) Forecast, by Aftermarket

10.6.1. Commercial Vehicle

10.6.2. Passenger Vehicle

10.6.2.1. Mini-compact (A segment)

10.6.2.2. Super-mini (B segment)

10.6.2.3. Compact (C segment)

10.6.2.4. Mid-size (D segment)

10.6.2.5. Executive (E segment)

10.6.2.6. Luxury (F segment)

10.6.2.7. MPV (Multi-purpose vehicle)

10.6.2.8. SUVs

10.6.2.9. Sport Cars

10.7. Canada Automotive Brake Pad Market Volume (Thousand Units) and Value (US$ Mn) Forecast, by OEM

10.7.1. Commercial Vehicle

10.7.2. Passenger Vehicle

10.7.2.1. Mini-compact (A segment)

10.7.2.2. Super-mini (B segment)

10.7.2.3. Compact (C segment)

10.7.2.4. Mid-size (D segment)

10.7.2.5. Executive (E segment)

10.7.2.6. Luxury (F segment)

10.7.2.7. MPV (Multi-purpose vehicle)

10.7.2.8. SUVs

10.7.2.9. Sport Cars

10.8. Canada Automotive Brake Pad Market Volume (Thousand Units) and Value (US$ Mn) Forecast, by Aftermarket

10.8.1. Commercial Vehicle

10.8.2. Passenger Vehicle

10.8.2.1. Mini-compact (A segment)

10.8.2.2. Super-mini (B segment)

10.8.2.3. Compact (C segment)

10.8.2.4. Mid-size (D segment)

10.8.2.5. Executive (E segment)

10.8.2.6. Luxury (F segment)

10.8.2.7. MPV (Multi-purpose vehicle)

10.8.2.8. SUVs

10.8.2.9. Sport Cars

10.9. North America Automotive Brake Pad Market : PEST Analysis

11. Europe Automotive Brake Pad Market Volume (Thousand Units) and Value (US$ Mn) and Forecast 2020?2027

11.1. Key Findings

11.2. Europe Automotive Brake Pad Market Volume (Thousand Units) and Value (US$ Mn) and Forecast, by OEM, 2020?2027

11.2.1. Commercial Vehicle

11.2.2. Passenger Vehicle

11.2.2.1. Mini-compact (A segment)

11.2.2.2. Super-mini (B segment)

11.2.2.3. Compact (C segment)

11.2.2.4. Mid-size (D segment)

11.2.2.5. Executive (E segment)

11.2.2.6. Luxury (F segment)

11.2.2.7. MPV (Multi-purpose vehicle)

11.2.2.8. SUVs

11.2.2.9. Sport Cars

11.3. Europe Automotive Brake Pad Market Volume (Thousand Units) and Value (US$ Mn) and Forecast, by Aftermarket, 2015?2020

11.3.1. Commercial Vehicle

11.3.2. Passenger Vehicle

11.3.2.1. Mini-compact (A segment)

11.3.2.2. Super-mini (B segment)

11.3.2.3. Compact (C segment)

11.3.2.4. Mid-size (D segment)

11.3.2.5. Executive (E segment)

11.3.2.6. Luxury (F segment)

11.3.2.7. MPV (Multi-purpose vehicle)

11.3.2.8. SUVs

11.3.2.9. Sport Cars

11.4. Europe Automotive Brake Pad Market Volume (Thousand Units) and Value (US$ Mn) and Forecast, by Country and Sub-region, 2020?2027

11.4.1. Germany

11.4.2. U. K.

11.4.3. Rest of Europe

11.5. Germany Automotive Brake Pad Market Volume (Thousand Units) and Value (US$ Mn) Forecast, by OEM

11.5.1. Commercial Vehicle

11.5.2. Passenger Vehicle

11.5.2.1. Mini-compact (A segment)

11.5.2.2. Super-mini (B segment)

11.5.2.3. Compact (C segment)

11.5.2.4. Mid-size (D segment)

11.5.2.5. Executive (E segment)

11.5.2.6. Luxury (F segment)

11.5.2.7. MPV (Multi-purpose vehicle)

11.5.2.8. SUVs

11.5.2.9. Sport Cars

11.6. Germany Automotive Brake Pad Market Volume (Thousand Units) and Value (US$ Mn) Forecast, by Aftermarket

11.6.1. Commercial Vehicle

11.6.2. Passenger Vehicle

11.6.2.1. Mini-compact (A segment)

11.6.2.2. Super-mini (B segment)

11.6.2.3. Compact (C segment)

11.6.2.4. Mid-size (D segment)

11.6.2.5. Executive (E segment)

11.6.2.6. Luxury (F segment)

11.6.2.7. MPV (Multi-purpose vehicle)

11.6.2.8. SUVs

11.6.2.9. Sport Cars

11.7. U. K. Automotive Brake Pad Market Volume (Thousand Units) and Value (US$ Mn) Forecast, by OEM

11.7.1. Commercial Vehicle

11.7.2. Passenger Vehicle

11.7.2.1. Mini-compact (A segment)

11.7.2.2. Super-mini (B segment)

11.7.2.3. Compact (C segment)

11.7.2.4. Mid-size (D segment)

11.7.2.5. Executive (E segment)

11.7.2.6. Luxury (F segment)

11.7.2.7. MPV (Multi-purpose vehicle)

11.7.2.8. SUVs

11.7.2.9. Sport Cars

11.8. U. K. Automotive Brake Pad Market Volume (Thousand Units) and Value (US$ Mn) Forecast, by Aftermarket

11.8.1. Commercial Vehicle

11.8.2. Passenger Vehicle

11.8.2.1. Mini-compact (A segment)

11.8.2.2. Super-mini (B segment)

11.8.2.3. Compact (C segment)

11.8.2.4. Mid-size (D segment)

11.8.2.5. Executive (E segment)

11.8.2.6. Luxury (F segment)

11.8.2.7. MPV (Multi-purpose vehicle)

11.8.2.8. SUVs

11.8.2.9. Sport Cars

11.9. Rest of Europe Automotive Brake Pad Market Volume (Thousand Units) and Value (US$ Mn) Forecast, by OEM

11.9.1. Commercial Vehicle

11.9.2. Passenger Vehicle

11.9.2.1. Mini-compact (A segment)

11.9.2.2. Super-mini (B segment)

11.9.2.3. Compact (C segment)

11.9.2.4. Mid-size (D segment)

11.9.2.5. Executive (E segment)

11.9.2.6. Luxury (F segment)

11.9.2.7. MPV (Multi-purpose vehicle)

11.9.2.8. SUVs

11.9.2.9. Sport Cars

11.10. Rest of Europe Automotive Brake Pad Market Volume (Thousand Units) and Value (US$ Mn) Forecast, by Aftermarket

11.10.1. Commercial Vehicle

11.10.2. Passenger Vehicle

11.10.2.1. Mini-compact (A segment)

11.10.2.2. Super-mini (B segment)

11.10.2.3. Compact (C segment)

11.10.2.4. Mid-size (D segment)

11.10.2.5. Executive (E segment)

11.10.2.6. Luxury (F segment)

11.10.2.7. MPV (Multi-purpose vehicle)

11.10.2.8. SUVs

11.10.2.9. Sport Cars

11.11. Europe Automotive Brake Pad Market : PEST Analysis

12. Asia Pacific Automotive Brake Pad Market Volume (Thousand Units) and Value (US$ Mn) and Forecast 2020?2027

12.1. Key Findings

12.2. Asia Pacific Automotive Brake Pad Market Volume (Thousand Units) and Value (US$ Mn) and Forecast, by OEM, 2020?2027

12.2.1. Commercial Vehicle

12.2.2. Passenger Vehicle

12.2.2.1. Mini-compact (A segment)

12.2.2.2. Super-mini (B segment)

12.2.2.3. Compact (C segment)

12.2.2.4. Mid-size (D segment)

12.2.2.5. Executive (E segment)

12.2.2.6. Luxury (F segment)

12.2.2.7. MPV (Multi-purpose vehicle)

12.2.2.8. SUVs

12.2.2.9. Sport Cars

12.3. Asia Pacific Automotive Brake Pad Market Volume (Thousand Units) and Value (US$ Mn), and Forecast, by Aftermarket, 2015?2020

12.3.1. Commercial Vehicle

12.3.2. Passenger Vehicle

12.3.2.1. Mini-compact (A segment)

12.3.2.2. Super-mini (B segment)

12.3.2.3. Compact (C segment)

12.3.2.4. Mid-size (D segment)

12.3.2.5. Executive (E segment)

12.3.2.6. Luxury (F segment)

12.3.2.7. MPV (Multi-purpose vehicle)

12.3.2.8. SUVs

12.3.2.9. Sport Cars

12.4. Asia Pacific Automotive Brake Pad Market Volume (Thousand Units) and Value (US$ Mn), and Forecast, by Country and Sub-region, 2020?2027

12.4.1. China

12.4.2. India

12.4.3. Japan

12.4.4. Rest of Asia Pacific

12.5. China Automotive Brake Pad Market Volume (Thousand Units) and Value (US$ Mn) Forecast, by OEM

12.5.1. Commercial Vehicle

12.5.2. Passenger Vehicle

12.5.2.1. Mini-compact (A segment)

12.5.2.2. Super-mini (B segment)

12.5.2.3. Compact (C segment)

12.5.2.4. Mid-size (D segment)

12.5.2.5. Executive (E segment)

12.5.2.6. Luxury (F segment)

12.5.2.7. MPV (Multi-purpose vehicle)

12.5.2.8. SUVs

12.5.2.9. Sport Cars

12.6. China Automotive Brake Pad Market Volume (Thousand Units) and Value (US$ Mn) Forecast, by Aftermarket

12.6.1. Commercial Vehicle

12.6.2. Passenger Vehicle

12.6.2.1. Mini-compact (A segment)

12.6.2.2. Super-mini (B segment)

12.6.2.3. Compact (C segment)

12.6.2.4. Mid-size (D segment)

12.6.2.5. Executive (E segment)

12.6.2.6. Luxury (F segment)

12.6.2.7. MPV (Multi-purpose vehicle)

12.6.2.8. SUVs

12.6.2.9. Sport Cars

12.7. India Automotive Brake Pad Market Volume (Thousand Units) and Value (US$ Mn) Forecast, by OEM

12.7.1. Commercial Vehicle

12.7.2. Passenger Vehicle

12.7.2.1. Mini-compact (A segment)

12.7.2.2. Super-mini (B segment)

12.7.2.3. Compact (C segment)

12.7.2.4. Mid-size (D segment)

12.7.2.5. Executive (E segment)

12.7.2.6. Luxury (F segment)

12.7.2.7. MPV (Multi-purpose vehicle)

12.7.2.8. SUVs

12.7.2.9. Sport Cars

12.8. India Automotive Brake Pad Market Volume (Thousand Units) and Value (US$ Mn) Forecast, by Aftermarket

12.8.1. Commercial Vehicle

12.8.2. Passenger Vehicle

12.8.2.1. Mini-compact (A segment)

12.8.2.2. Super-mini (B segment)

12.8.2.3. Compact (C segment)

12.8.2.4. Mid-size (D segment)

12.8.2.5. Executive (E segment)

12.8.2.6. Luxury (F segment)

12.8.2.7. MPV (Multi-purpose vehicle)

12.8.2.8. SUVs

12.8.2.9. Sport Cars

12.9. Japan Automotive Brake Pad Market Volume (Thousand Units) and Value (US$ Mn) Forecast, by OEM

12.9.1. Commercial Vehicle

12.9.2. Passenger Vehicle

12.9.2.1. Mini-compact (A segment)

12.9.2.2. Super-mini (B segment)

12.9.2.3. Compact (C segment)

12.9.2.4. Mid-size (D segment)

12.9.2.5. Executive (E segment)

12.9.2.6. Luxury (F segment)

12.9.2.7. MPV (Multi-purpose vehicle)

12.9.2.8. SUVs

12.9.2.9. Sport Cars

12.10. Japan Automotive Brake Pad Market Volume (Thousand Units) and Value (US$ Mn) Forecast, by Aftermarket

12.10.1. Commercial Vehicle

12.10.2. Passenger Vehicle

12.10.2.1. Mini-compact (A segment)

12.10.2.2. Super-mini (B segment)

12.10.2.3. Compact (C segment)

12.10.2.4. Mid-size (D segment)

12.10.2.5. Executive (E segment)

12.10.2.6. Luxury (F segment)

12.10.2.7. MPV (Multi-purpose vehicle)

12.10.2.8. SUVs

12.10.2.9. Sport Cars

12.11. Rest of Asia Pacific Automotive Brake Pad Market Volume (Thousand Units) and Value (US$ Mn) Forecast, by OEM

12.11.1. Commercial Vehicle

12.11.2. Passenger Vehicle

12.11.2.1. Mini-compact (A segment)

12.11.2.2. Super-mini (B segment)

12.11.2.3. Compact (C segment)

12.11.2.4. Mid-size (D segment)

12.11.2.5. Executive (E segment)

12.11.2.6. Luxury (F segment)

12.11.2.7. MPV (Multi-purpose vehicle)

12.11.2.8. SUVs

12.11.2.9. Sport Cars

12.12. Rest of Asia Pacific Automotive Brake Pad Market Volume (Thousand Units) and Value (US$ Mn) Forecast, by Aftermarket

12.12.1. Commercial Vehicle

12.12.2. Passenger Vehicle

12.12.2.1. Mini-compact (A segment)

12.12.2.2. Super-mini (B segment)

12.12.2.3. Compact (C segment)

12.12.2.4. Mid-size (D segment)

12.12.2.5. Executive (E segment)

12.12.2.6. Luxury (F segment)

12.12.2.7. MPV (Multi-purpose vehicle)

12.12.2.8. SUVs

12.12.2.9. Sport Cars

12.13. Asia Pacific Automotive Brake Pad Market : PEST Analysis

13. Middle East & Africa Automotive Brake Pad Market Volume (Thousand Units) and Value (US$ Mn) and Forecast, 2020?2027

13.1. Key Findings

13.2. Middle East & Africa Automotive Brake Pad Market Volume (Thousand Units) and Value (US$ Mn) and Forecast, by OEM, 2020?2027

13.2.1. Commercial Vehicle

13.2.2. Passenger Vehicle

13.2.2.1. Mini-compact (A segment)

13.2.2.2. Super-mini (B segment)

13.2.2.3. Compact (C segment)

13.2.2.4. Mid-size (D segment)

13.2.2.5. Executive (E segment)

13.2.2.6. Luxury (F segment)

13.2.2.7. MPV (Multi-purpose vehicle)

13.2.2.8. SUVs

13.2.2.9. Sport Cars

13.3. Middle East & Africa Automotive Brake Pad Market Volume (Thousand Units) and Value (US$ Mn) and Forecast, by Aftermarket, 2015?2020

13.3.1. Commercial Vehicle

13.3.2. Passenger Vehicle

13.3.2.1. Mini-compact (A segment)

13.3.2.2. Super-mini (B segment)

13.3.2.3. Compact (C segment)

13.3.2.4. Mid-size (D segment)

13.3.2.5. Executive (E segment)

13.3.2.6. Luxury (F segment)

13.3.2.7. MPV (Multi-purpose vehicle)

13.3.2.8. SUVs

13.3.2.9. Sport Cars

13.4. Middle East & Africa Automotive Brake Pad Market Volume (Thousand Units) and Value (US$ Mn) and Forecast, by Country and Sub-region, 2020?2027

13.4.1. GCC

13.4.2. South Africa

13.4.3. Rest of Middle East and Africa

13.5. GCC Automotive Brake Pad Market Volume (Thousand Units) and Value (US$ Mn) Forecast, by OEM

13.5.1. Commercial Vehicle

13.5.2. Passenger Vehicle

13.5.2.1. Mini-compact (A segment)

13.5.2.2. Super-mini (B segment)

13.5.2.3. Compact (C segment)

13.5.2.4. Mid-size (D segment)

13.5.2.5. Executive (E segment)

13.5.2.6. Luxury (F segment)

13.5.2.7. MPV (Multi-purpose vehicle)

13.5.2.8. SUVs

13.5.2.9. Sport Cars

13.6. GCC Automotive Brake Pad Market Volume (Thousand Units) and Value (US$ Mn) Forecast, by Aftermarket

13.6.1. Commercial Vehicle

13.6.2. Passenger Vehicle

13.6.2.1. Mini-compact (A segment)

13.6.2.2. Super-mini (B segment)

13.6.2.3. Compact (C segment)

13.6.2.4. Mid-size (D segment)

13.6.2.5. Executive (E segment)

13.6.2.6. Luxury (F segment)

13.6.2.7. MPV (Multi-purpose vehicle)

13.6.2.8. SUVs

13.6.2.9. Sport Cars

13.7. South Africa Automotive Brake Pad Market Volume (Thousand Units) and Value (US$ Mn) Forecast, by OEM

13.7.1. Commercial Vehicle

13.7.2. Passenger Vehicle

13.7.2.1. Mini-compact (A segment)

13.7.2.2. Super-mini (B segment)

13.7.2.3. Compact (C segment)

13.7.2.4. Mid-size (D segment)

13.7.2.5. Executive (E segment)

13.7.2.6. Luxury (F segment)

13.7.2.7. MPV (Multi-purpose vehicle)

13.7.2.8. SUVs

13.7.2.9. Sport Cars

13.8. South Africa Automotive Brake Pad Market Volume (Thousand Units) and Value (US$ Mn) Forecast, by Aftermarket

13.8.1. Commercial Vehicle

13.8.2. Passenger Vehicle

13.8.2.1. Mini-compact (A segment)

13.8.2.2. Super-mini (B segment)

13.8.2.3. Compact (C segment)

13.8.2.4. Mid-size (D segment)

13.8.2.5. Executive (E segment)

13.8.2.6. Luxury (F segment)

13.8.2.7. MPV (Multi-purpose vehicle)

13.8.2.8. SUVs

13.8.2.9. Sport Cars

13.9. Rest of Middle East & Africa Automotive Brake Pad Market Volume (Thousand Units) and Value (US$ Mn) Forecast, by OEM

13.9.1. Commercial Vehicle

13.9.2. Passenger Vehicle

13.9.2.1. Mini-compact (A segment)

13.9.2.2. Super-mini (B segment)

13.9.2.3. Compact (C segment)

13.9.2.4. Mid-size (D segment)

13.9.2.5. Executive (E segment)

13.9.2.6. Luxury (F segment)

13.9.2.7. MPV (Multi-purpose vehicle)

13.9.2.8. SUVs

13.9.2.9. Sport Cars

13.10. Rest of Middle East & Africa Automotive Brake Pad Market Volume (Thousand Units) and Value (US$ Mn) Forecast, by Aftermarket

13.10.1. Commercial Vehicle

13.10.2. Passenger Vehicle

13.10.2.1. Mini-compact (A segment)

13.10.2.2. Super-mini (B segment)

13.10.2.3. Compact (C segment)

13.10.2.4. Mid-size (D segment)

13.10.2.5. Executive (E segment)

13.10.2.6. Luxury (F segment)

13.10.2.7. MPV (Multi-purpose vehicle)

13.10.2.8. SUVs

13.10.2.9. Sport Cars

13.11. Middle East & Africa Automotive Brake Pad Market : PEST Analysis

14. Latin America Automotive Brake Pad Market Volume (Thousand Units) and Value (US$ Mn), and Forecast 2020?2027

14.1. Key Findings

14.2. Latin America Automotive Brake Pad Market Volume (Thousand Units) and Value (US$ Mn) and Forecast, by OEM, 2020?2027

14.2.1. Commercial Vehicle

14.2.2. Passenger Vehicle

14.2.2.1. Mini-compact (A segment)

14.2.2.2. Super-mini (B segment)

14.2.2.3. Compact (C segment)

14.2.2.4. Mid-size (D segment)

14.2.2.5. Executive (E segment)

14.2.2.6. Luxury (F segment)

14.2.2.7. MPV (Multi-purpose vehicle)

14.2.2.8. SUVs

14.2.2.9. Sport Cars

14.3. Latin America Automotive Brake Pad Market Volume (Thousand Units) and Value (US$ Mn), and Forecast, by Aftermarket, 2015?2020

14.3.1. Commercial Vehicle

14.3.2. Passenger Vehicle

14.3.2.1. Mini-compact (A segment)

14.3.2.2. Super-mini (B segment)

14.3.2.3. Compact (C segment)

14.3.2.4. Mid-size (D segment)

14.3.2.5. Executive (E segment)

14.3.2.6. Luxury (F segment)

14.3.2.7. MPV (Multi-purpose vehicle)

14.3.2.8. SUVs

14.3.2.9. Sport Cars

14.4. Latin America Automotive Brake Pad Market Volume (Thousand Units) and Value (US$ Mn), and Forecast, by Country and Sub-region 2020?2027

14.4.1. Brazil

14.4.2. Mexico

14.4.3. Rest of Latin America

14.5. Brazil Automotive Brake Pad Market Volume (Thousand Units) and Value (US$ Mn) Forecast, by OEM

14.5.1. Commercial Vehicle

14.5.2. Passenger Vehicle

14.5.2.1. Mini-compact (A segment)

14.5.2.2. Super-mini (B segment)

14.5.2.3. Compact (C segment)

14.5.2.4. Mid-size (D segment)

14.5.2.5. Executive (E segment)

14.5.2.6. Luxury (F segment)

14.5.2.7. MPV (Multi-purpose vehicle)

14.5.2.8. SUVs

14.5.2.9. Sport Cars

14.6. Brazil Automotive Brake Pad Market Volume (Thousand Units) and Value (US$ Mn) Forecast, by Aftermarket

14.6.1. Commercial Vehicle

14.6.2. Passenger Vehicle

14.6.2.1. Mini-compact (A segment)

14.6.2.2. Super-mini (B segment)

14.6.2.3. Compact (C segment)

14.6.2.4. Mid-size (D segment)

14.6.2.5. Executive (E segment)

14.6.2.6. Luxury (F segment)

14.6.2.7. MPV (Multi-purpose vehicle)

14.6.2.8. SUVs

14.6.2.9. Sport Cars

14.7. Mexico Automotive Brake Pad Market Volume (Thousand Units) and Value (US$ Mn) Forecast, by OEM

14.7.1. Commercial Vehicle

14.7.2. Passenger Vehicle

14.7.2.1. Mini-compact (A segment)

14.7.2.2. Super-mini (B segment)

14.7.2.3. Compact (C segment)

14.7.2.4. Mid-size (D segment)

14.7.2.5. Executive (E segment)

14.7.2.6. Luxury (F segment)

14.7.2.7. MPV (Multi-purpose vehicle)

14.7.2.8. SUVs

14.7.2.9. Sport Cars

14.8. Mexico Automotive Brake Pad Market Volume (Thousand Units) and Value (US$ Mn) Forecast, by Aftermarket

14.8.1. Commercial Vehicle

14.8.2. Passenger Vehicle

14.8.2.1. Mini-compact (A segment)

14.8.2.2. Super-mini (B segment)

14.8.2.3. Compact (C segment)

14.8.2.4. Mid-size (D segment)

14.8.2.5. Executive (E segment)

14.8.2.6. Luxury (F segment)

14.8.2.7. MPV (Multi-purpose vehicle)

14.8.2.8. SUVs

14.8.2.9. Sport Cars

14.9. Rest of Latin Automotive Brake Pad Market Volume (Thousand Units) and Value (US$ Mn) Forecast, by OEM

14.9.1. Commercial Vehicle

14.9.2. Passenger Vehicle

14.9.2.1. Mini-compact (A segment)

14.9.2.2. Super-mini (B segment)

14.9.2.3. Compact (C segment)

14.9.2.4. Mid-size (D segment)

14.9.2.5. Executive (E segment)

14.9.2.6. Luxury (F segment)

14.9.2.7. MPV (Multi-purpose vehicle)

14.9.2.8. SUVs

14.9.2.9. Sport Cars

14.10. Rest of Latin Automotive Brake Pad Market Volume (Thousand Units) and Value (US$ Mn) Forecast, by Aftermarket

14.10.1. Commercial Vehicle

14.10.2. Passenger Vehicle

14.10.2.1. Mini-compact (A segment)

14.10.2.2. Super-mini (B segment)

14.10.2.3. Compact (C segment)

14.10.2.4. Mid-size (D segment)

14.10.2.5. Executive (E segment)

14.10.2.6. Luxury (F segment)

14.10.2.7. MPV (Multi-purpose vehicle)

14.10.2.8. SUVs

14.10.2.9. Sport Cars

14.11. Latin America Automotive Brake Pad Market: PEST Analysis

15. Competition Landscape

15.1. Market Share Analysis, by Company (2019)

15.2. Market Player Competition Matrix (by Tier and Size of the Company)

15.2.1. ACDelco

15.2.2. Robert Bosch GmbH

15.2.3. Delphi Technologies

15.2.4. Federal-Mogul LLC

15.2.5. Akebono Brake Corporation

15.2.6. ASK Automotive Pvt. Ltd.

15.2.7. Brembo S.p.A.

15.2.8. Delphi Technologies

15.2.9. Fras-le

15.2.10. Nisshinbo Brake Inc.

15.2.11. Super Circle Auto Limited.

15.2.12. ZF Friedrichshafen AG

15.2.13. Masu Brake

15.2.14. Federal-Mogul LLC

15.2.15. EBC Brakes

15.2.16. MACAS AUTOMOTIVE

15.2.17. Japan Brake Industrial Co., Ltd.

15.2.18. Brake Parts Inc. LLC.

15.2.19. Toughla Brakelinings

List of Tables

Table 1. Global Automotive Brake Pad Market Volume (Thousand Units), by OEM, 2019?2027

Table 2. Global Automotive Brake Pad Market Value (US$ Mn), by OEM, 2019?2027

Table 3. Global Automotive Brake Pad Market Volume (Thousand Units), by Aftermarket, 2015?2020

Table 4. Global Automotive Brake Pad Market Value (US$ Mn), by Aftermarket, 2015?2020

Table 5. Global Automotive Brake Pad Market Volume (Thousand Units), by Region, by OEM, 2019?2027

Table 6. Global Automotive Brake Pad Market Value (US$ Mn), by Region, by OEM, 2019?2027

Table 7. Global Automotive Brake Pad Market Volume (Thousand Units), by Region, by Aftermarket, 2015?2020

Table 8. Global Automotive Brake Pad Market Value (US$ Mn), by Region, by Aftermarket, 2015?2020

Table 9. North America Automotive Brake Pad Market Volume (Thousand Units), by OEM, 2019?2027

Table 10. North America Automotive Brake Pad Market Value (US$ Mn), by OEM, 2019?2027

Table 11. North America Automotive Brake Pad Market Volume (Thousand Units), by Aftermarket, 2015?2020

Table 12. North America Automotive Brake Pad Market Value (US$ Mn), by Aftermarket, 2015?2020

Table 13. U. S. Automotive Brake Pad Market Volume (Thousand Units), by OEM, 2019?2027

Table 14. U. S. Automotive Brake Pad Market Value (US$ Mn), by OEM, 2019?2027

Table 15. U. S. Automotive Brake Pad Market Volume (Thousand Units), by Aftermarket, 2015?2020

Table 16. U. S. Automotive Brake Pad Market Value (US$ Mn), by Aftermarket, 2015?2020

Table 17. Canada Automotive Brake Pad Market Volume (Thousand Units), by OEM, 2019?2027

Table 18. Canada Automotive Brake Pad Market Value (US$ Mn), by OEM, 2019?2027

Table 19. Canada Automotive Brake Pad Market Volume (Thousand Units), by Aftermarket, 2015?2020

Table 20. Canada Automotive Brake Pad Market Value (US$ Mn), by Aftermarket, 2015?2020

Table 21. Europe Automotive Brake Pad Market Volume (Thousand Units), by OEM, 2019?2027

Table 22. Europe Automotive Brake Pad Market Value (US$ Mn), by OEM, 2019?2027

Table 23. Europe Automotive Brake Pad Market Volume (Thousand Units), by Aftermarket, 2015?2020

Table 24. Europe Automotive Brake Pad Market Value (US$ Mn), by Aftermarket, 2015?2020

Table 25. Germany Automotive Brake Pad Market Volume (Thousand Units), by OEM, 2019?2027

Table 26. Germany Automotive Brake Pad Market Value (US$ Mn), by OEM, 2019?2027

Table 27. Germany Automotive Brake Pad Market Volume (Thousand Units), by Aftermarket, 2015?2020

Table 28. Germany Automotive Brake Pad Market Value (US$ Mn), by Aftermarket, 2015?2020

Table 29. U. K. Automotive Brake Pad Market Volume (Thousand Units), by OEM, 2019?2027

Table 30. U. K. Automotive Brake Pad Market Value (US$ Mn), by OEM, 2019?2027

Table 31. U. K. Automotive Brake Pad Market Volume (Thousand Units), by Aftermarket, 2015?2020

Table 32. U. K. Automotive Brake Pad Market Value (US$ Mn), by Aftermarket, 2015?2020

Table 33. Rest of Europe Automotive Brake Pad Market Volume (Thousand Units), by OEM, 2019?2027

Table 34. Rest of Europe Automotive Brake Pad Market Value (US$ Mn), by OEM, 2019?2027

Table 35. Rest of Europe Automotive Brake Pad Market Volume (Thousand Units), by Aftermarket, 2015?2020

Table 36. Rest of Europe Automotive Brake Pad Market Value (US$ Mn), by Aftermarket, 2015?2020

Table 37. Asia Pacific Automotive Brake Pad Market Volume (Thousand Units), by OEM, 2019?2027

Table 38. Asia Pacific Automotive Brake Pad Market Value (US$ Mn), by OEM, 2019?2027

Table 39. Asia Pacific Automotive Brake Pad Market Volume (Thousand Units), by Aftermarket, 2015?2020

Table 40. Asia Pacific Automotive Brake Pad Market Value (US$ Mn), by Aftermarket, 2015?2020

Table 41. China Automotive Brake Pad Market Volume (Thousand Units), by OEM, 2019?2027

Table 42. China Automotive Brake Pad Market Value (US$ Mn), by OEM, 2019?2027

Table 43. China Automotive Brake Pad Market Volume (Thousand Units), by Aftermarket, 2015?2020

Table 44. China Automotive Brake Pad Market Value (US$ Mn), by Aftermarket, 2015?2020

Table 45. India Automotive Brake Pad Market Volume (Thousand Units), by OEM, 2019?2027

Table 46. India Automotive Brake Pad Market Value (US$ Mn), by OEM, 2019?2027

Table 47. India Automotive Brake Pad Market Volume (Thousand Units), by Aftermarket, 2015?2020

Table 48. India Automotive Brake Pad Market Value (US$ Mn), by Aftermarket, 2015?2020

Table 49. Japan Automotive Brake Pad Market Volume (Thousand Units), by OEM, 2019?2027

Table 50. Japan Automotive Brake Pad Market Value (US$ Mn), by OEM, 2019?2027

Table 51. Japan Automotive Brake Pad Market Volume (Thousand Units), by Aftermarket, 2015?2020

Table 52. Japan Automotive Brake Pad Market Value (US$ Mn), by Aftermarket, 2015?2020

Table 53. Rest of Asia Pacific Automotive Brake Pad Market Volume (Thousand Units), by OEM, 2019?2027

Table 54. Rest of Asia Pacific Automotive Brake Pad Market Value (US$ Mn), by OEM, 2019?2027

Table 55. Rest of Asia Pacific Automotive Brake Pad Market Volume (Thousand Units), by Aftermarket, 2015?2020

Table 56. Rest of Asia Pacific Automotive Brake Pad Market Value (US$ Mn), by Aftermarket, 2015?2020

Table 57. Middle East & Africa Automotive Brake Pad Market Volume (Thousand Units), by OEM, 2019?2027

Table 58. Middle East & Africa Automotive Brake Pad Market Value (US$ Mn), by OEM, 2019?2027

Table 59. Middle East & Africa Automotive Brake Pad Market Volume (Thousand Units), by Aftermarket, 2015?2020

Table 60. Middle East & Africa Automotive Brake Pad Market Value (US$ Mn), by Aftermarket, 2015?2020

Table 61. GCC Automotive Brake Pad Market Volume (Thousand Units), by OEM, 2019?2027

Table 62. GCC Automotive Brake Pad Market Value (US$ Mn), by OEM, 2019?2027

Table 63. GCC Automotive Brake Pad Market Volume (Thousand Units), by Aftermarket, 2015?2020

Table 64. GCC Automotive Brake Pad Market Value (US$ Mn), by Aftermarket, 2015?2020

Table 65. South Africa Automotive Brake Pad Market Volume (Thousand Units), by OEM, 2019?2027

Table 66. South Africa Automotive Brake Pad Market Value (US$ Mn), by OEM, 2019?2027

Table 67. South Africa Automotive Brake Pad Market Volume (Thousand Units), by Aftermarket, 2015?2020

Table 68. South Africa Automotive Brake Pad Market Value (US$ Mn), by Aftermarket, 2015?2020

Table 69. Rest of Middle East & Africa Automotive Brake Pad Market Volume (Thousand Units), by OEM, 2019?2027

Table 70. Rest of Middle East & Africa Automotive Brake Pad Market Value (US$ Mn), by OEM, 2019?2027

Table 71. Rest of Asia Pacific Automotive Brake Pad Market Volume (Thousand Units), by Aftermarket, 2015?2020

Table 72. Rest of Middle East & Africa Automotive Brake Pad Market Value (US$ Mn), by Aftermarket, 2015?2020

Table 73. Latin America Automotive Brake Pad Market Volume (Thousand Units), by OEM, 2019?2027

Table 74. Latin America Automotive Brake Pad Market Value (US$ Mn), by OEM, 2019?2027

Table 75. Latin America Automotive Brake Pad Market Volume (Thousand Units), by Aftermarket, 2015?2020

Table 76. Latin America Automotive Brake Pad Market Value (US$ Mn), by Aftermarket, 2015?2020

Table 77. Brazil Automotive Brake Pad Market Volume (Thousand Units), by OEM, 2019?2027

Table 78. Brazil Automotive Brake Pad Market Value (US$ Mn), by OEM, 2019?2027

Table 79. Brazil Automotive Brake Pad Market Volume (Thousand Units), by Aftermarket, 2015?2020

Table 80. Brazil Automotive Brake Pad Market Value (US$ Mn), by Aftermarket, 2015?2020

Table 81. Mexico Automotive Brake Pad Market Volume (Thousand Units), by OEM, 2019?2027

Table 82. Mexico Automotive Brake Pad Market Value (US$ Mn), by OEM, 2019?2027

Table 83. Mexico Automotive Brake Pad Market Volume (Thousand Units), by Aftermarket, 2015?2020

Table 84. Mexico Automotive Brake Pad Market Value (US$ Mn), by Aftermarket, 2015?2020

Table 85. Rest of Latin America Automotive Brake Pad Market Volume (Thousand Units), by OEM, 2019?2027

Table 86. Rest of Latin America Automotive Brake Pad Market Value (US$ Mn), by OEM, 2019?2027

Table 87. Rest of Latin America Automotive Brake Pad Market Volume (Thousand Units), by Aftermarket, 2015?2020

Table 88. Rest of Latin America Automotive Brake Pad Market Value (US$ Mn), by Aftermarket, 2015?2020

List of Figures

Figure 1. Global Automotive Brake Pad Market Volume (Thousand Units) and Value (US$ Mn), 2019?2027

Figure 2. Global Automotive Brake Pad Market Share, by OEM, 2019

Figure 3. Global Automotive Brake Pad Market Share, by OEM, 2027

Figure 4. Global Automotive Brake Pad Market Attractiveness, by OEM, 2027

Figure 5. Global Automotive Brake Pad Market Share, by Aftermarket, 2015

Figure 6. Global Automotive Brake Pad Market Share, by Aftermarket, 2020

Figure 7. Global Automotive Brake Pad Market Attractiveness, by Aftermarket, 2015

Figure 8. Global Automotive Brake Pad Market Share, by Region, 2019

Figure 9. Global Automotive Brake Pad Market Share, by Region, 2027

Figure 10. Global Automotive Brake Pad Market Attractiveness, by Region, 2019

Figure 11. North America Automotive Brake Pad Market Volume (Thousand Units) and Value (US$ Mn), 2019?2027

Figure 12. North America Automotive Brake Pad Market Share, by OEM, 2019

Figure 13. North America Automotive Brake Pad Market Share, by OEM, 2027

Figure 14. North America Automotive Brake Pad Market Share, by Aftermarket, 2015

Figure 15. North America Automotive Brake Pad Market Share, by Aftermarket, 2020

Figure 16. North America Automotive Brake Pad Market Share, by Country and Sub-region, 2019

Figure 17. North America Automotive Brake Pad Market Share, by Country and Sub-region, 2027

Figure 18. Europe Automotive Brake Pad Market Volume (Thousand Units) and Value (US$ Mn), 2019?2027

Figure 19. Europe Automotive Brake Pad Market Share, by OEM, 2019

Figure 20. Europe Automotive Brake Pad Market Share, by OEM, 2027

Figure 21. Europe Automotive Brake Pad Market Share, by Aftermarket, 2015

Figure 22. Europe Automotive Brake Pad Market Share, by Aftermarket, 2020

Figure 23. Europe Automotive Brake Pad Market Share, by Country and Sub-region, 2019

Figure 24. Europe America Automotive Brake Pad Market Share, by Country and Sub-region, 2027

Figure 25. Asia Pacific Automotive Brake Pad Market Volume (Thousand Units) and Value (US$ Mn), 2019?2027

Figure 26. Asia Pacific Automotive Brake Pad Market Share, by OEM, 2019

Figure 27. Asia Pacific Automotive Brake Pad Market Share, by OEM, 2027

Figure 28. Asia Pacific Automotive Brake Pad Market Share, by Aftermarket, 2015

Figure 29. Asia Pacific Automotive Brake Pad Market Share, by Aftermarket, 2020

Figure 30. Asia Pacific Automotive Brake Pad Market Share, by Country and Sub-region, 2019

Figure 31. Asia Pacific America Automotive Brake Pad Market Share, by Country and Sub-region, 2027

Figure 32. Middle East & Africa Automotive Brake Pad Market Volume (Thousand Units) and Value (US$ Mn), 2019?2027

Figure 33. Middle East & Africa Automotive Brake Pad Market Share, by OEM, 2019

Figure 34. Middle East & Africa Automotive Brake Pad Market Share, by OEM, 2027

Figure 35. Middle East & Africa Automotive Brake Pad Market Share, by Aftermarket, 2015

Figure 36. Middle East & Africa Automotive Brake Pad Market Share, by Aftermarket, 2020

Figure 37. Middle East & Africa Automotive Brake Pad Market Share, by Country and Sub-region, 2019

Figure 38. Middle East & Africa Automotive Brake Pad Market Share, by Country and Sub-region, 2027

Figure 39. Latin America Automotive Brake Pad Market Volume (Thousand Units) and Value (US$ Mn), 2019?2027

Figure 40. Latin America Automotive Brake Pad Market Share, by OEM, 2019

Figure 41. Latin America Automotive Brake Pad Market Share, by OEM, 2027

Figure 42. Latin America Automotive Brake Pad Market Share, by Aftermarket, 2015

Figure 43. Latin America Automotive Brake Pad Market Share, by Aftermarket, 2020

Figure 44. Middle East & Africa Automotive Brake Pad Market Share, by Country and Sub-region, 2019

Figure 45. Middle East & Africa Automotive Brake Pad Market Share, by Country and Sub-region, 2027