Analysts’ Viewpoint

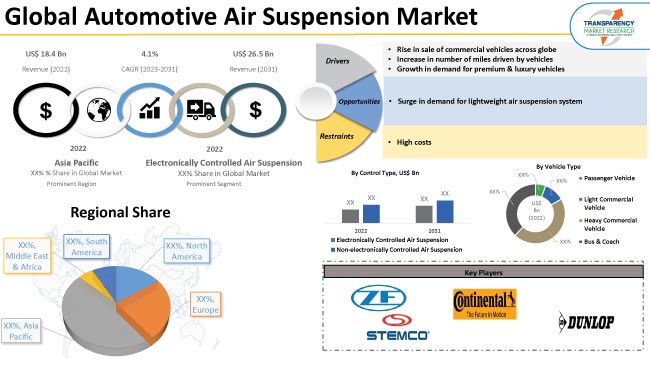

Rise in demand for high-end luxury automobiles and increase in sale of commercial vehicles are significant factors augmenting the global automotive air suspension industry growth. Surge in demand for vehicle comfort and safety and increase in adoption of air suspension systems in heavy commercial vehicles are also contributing to market growth.

Aftermarket demand for lightweight air suspension systems and related components is rising consistently across the globe, thus creating value-grab automotive air suspension business opportunities for manufacturers. Rise in sale of luxury vehicles due to increase in disposable income of consumers in emerging economies is also anticipated to fuel market statistics. Manufacturers are focusing on improving the reliability of air suspension systems. However, these systems are more expensive than traditional suspension systems. This is likely to hamper market trajectory in the near future.

Electric pump or compressor powers an air suspension system, a kind of vehicle suspension that pumps air into flexible bellows usually made of rubber with textile reinforcement. An axle is supported by the air spring suspension system, which uses air springs rather than steel springs or leaf springs. By leveling the suspension, air suspension system decreases noise and vibration, while increasing the capacity to move weights.

Height sensors and air springs are the two major parts of the air suspension system. Air springs offer additional benefits vis-à-vis traditional coil springs. Regardless of the load placed on it, vehicles with air suspension maintain stable levels. Widespread usage of air suspension systems in heavy commercial vehicles and rise in consumer demand for vehicle comfort and safety are the key growth prospects for automotive air suspension market.

Demand for vehicles with cutting-edge components, such as air suspension systems, is rising owing the increase in automation in automobiles. Better and more sophisticated air suspension systems are being installed in commercial trucks to increase driving comfort while lowering the risk of cargo damage.

The market for automotive air suspension is expected to grow in the near future, owing to the rise in demand for commercial vehicles across the globe. Many countries have enacted laws and regulations on automobiles to adopt cutting-edge comfort features such as air suspension systems. This has made it possible for manufacturers of commercial vehicles to equip their vehicles with air suspension systems, thus fueling market dynamics.

The number of vehicle miles traveled (VMT) is rising steadily across the globe. VMT per capita is also increasing. A vehicle is more prone to wear and tear due to the increase in miles driven and kilometers traveled. This necessitates the replacement of shock absorbers at regular intervals. Rise in replacement of air suspension components is expected to fuel market development during the forecast period.

Aftermarket demand for air springs, shock absorbers, compressors, electronic control units, height & pressure sensors, remote controls, solenoids, and other parts is rising due to the increase in the average age of vehicles. However, using a vehicle for an extended period increases maintenance work, thus augmenting the demand for air suspension parts.

The average age of vehicles in the EU is rising annually owing to better quality and consistent owner maintenance and service. Thus, growth in number of miles driven by vehicles is anticipated to fuel the automotive air suspension industry in the near future.

Based on control type, the global market has been classified into electronically controlled air suspension and non-electronically controlled air suspension. The electronically controlled air suspension control segment is projected to dominate in the near future.

Electronically controlled air suspension system is essentially a computer-controlled system that can modify the ride quality and driving dynamics of the car. In contrast to traditional air suspensions, electronic suspension automatically adjusts shocks and/or struts to provide a comfortable ride.

Electronically controlled air suspension system is now being used in several high-end passenger vehicles, including Audi A8, Mercedes-Benz S-Class, Porsche Cayenne, Land Rover Discovery, and Volkswagen Touareg.

Automakers need to obtain safety ratings from agencies such as IIHS, NCAP, and ICAT in order to sell cars. Thus, implementation of government-made safety standards and regulations is likely to boost market progress in the next few years.

Based on vehicle type, the heavy commercial vehicle segment held major share of 45.3% in 2022. The segment is likely to dominate during the forecast period.

Growth in demand for heavy commercial vehicles, including refrigerated trucks, for the transport of fragile and temperature-sensitive products is driving the global industry. Demand for heavy commercial vehicles is increasing significantly in Asia Pacific due to the rise in commercial activities. OEMs are introducing air suspension system in their vehicles due to the enactment of stringent environmental rules and increase in customer demand for smoother rides.

According to the global automotive air suspension market analysis, Asia Pacific is expected to dominate the global landscape during the forecast period. Growth in the automotive sector is fueling the automotive air suspension market value in the region. Increase in number of commercial vehicles in countries such as Japan, India, and China is also likely to augment automotive air suspension market demand in Asia Pacific in the near future.

Rise in vehicle production in Asia Pacific is driving the automotive air suspension business growth in the region. As per the automotive air suspension market sales analysis, infrastructure development and ease of obtaining vehicle financing in Asia Pacific are likely to boost car sales in the next few years. This is projected to positively impact the market for automotive air suspension in Asia Pacific.

The global business is fragmented, with the presence of a large number of manufacturers that control majority of the automotive air suspension market share. Key players are strengthening their market position by implementing innovative automotive air suspension marketing strategies such as partnerships, mergers, acquisitions, and development of product portfolios.

Some of the leading manufacturers identified in the global market are AccuAir Control Systems, L.L.C., Air Lift Company, BWI Group, Continental AG, Dunlop Systems and Components, DuPont de Nemours, Inc., Firestone Industrial Products, Hendrickson International Corporation, Hendrickson USA, L.L.C., Hitachi Ltd., Magneti Marelli S.p.A., Mando Corporation, Meklas Group, SAF-Holland, ThyssenKrupp AG, VB-Airsuspension, Wabco Holdings Inc., and ZF Friedrichshafen AG. These players are following the latest automotive air suspension industry trends to gain revenue benefits.

Each of these players has been profiled in the automotive air suspension market report based on parameters such as financial overview, business segments, product portfolio, business strategies, recent developments, and company overview.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 18.4 Bn |

|

Market Forecast Value in 2031 |

US$ 26.5 Bn |

|

Growth Rate (CAGR) |

4.1% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value and Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 18.4 Bn in 2022

It is likely to grow at a CAGR of 4.1% by 2031

It would be worth US$ 26.5 Bn in 2031

Rise in sale of commercial vehicles across the globe, increase in number of miles driven by vehicles, and growth in the automotive industry

The electronically controlled air suspension segment accounted for the largest share in 2022

Asia Pacific is a highly lucrative region for vendors

AccuAir Control Systems, L.L.C., Air Lift Company, BWI Group, Continental AG, Dunlop Systems and Components, DuPont de Nemours, Inc., Firestone Industrial Products, Hendrickson International Corporation, Hendrickson USA, L.L.C., Hitachi Ltd., Magneti Marelli S.p.A., Mando Corporation, Meklas Group, SAF-Holland, ThyssenKrupp AG, VB-Airsuspension, Wabco Holdings Inc., and ZF Friedrichshafen AG

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Volume (Units), Revenue US$ Bn, 2017-2031

1.2. Competitive Dashboard Analysis

2. Market Overview

2.1. TMR Analysis and Recommendations

2.2. Market Coverage / Taxonomy

2.3. Market Definition / Scope / Limitations

2.4. Macro-Economic Factors

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunity

2.6. Market Factor Analysis

2.6.1. Porter’s Five Force Analysis

2.6.2. SWOT Analysis

2.7. Regulatory Scenario

2.8. Key Trend Analysis

3. Industry Ecosystem Analysis

3.1. Value Chain Analysis

3.2. Gross Margin Analysis

4. Pricing Analysis

4.1. Cost Structure Analysis

4.2. Profit Margin Analysis

5. Impact Factors

5.1. Trend for Equipment Electrification

5.2. Expansion of Road Transportation Sector

5.3. Development of Automated Trucks

6. COVID-19 Impact Analysis – Automotive Air Suspension Market

7. Global Automotive Air Suspension Market, By Control Type

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Automotive Air Suspension Market Size Analysis & Forecast, 2017-2031, By Control Type

7.2.1. Electronically Controlled Air Suspension

7.2.2. Non-electronically Controlled Air Suspension

8. Global Automotive Air Suspension Market, By Component

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Automotive Air Suspension Market Size Analysis & Forecast, 2017-2031, By Component

8.2.1. Air Spring

8.2.2. Shock Absorber

8.2.3. Compressor

8.2.4. Electronic Control Unit

8.2.5. Air Reservoir

8.2.6. Height & Pressure Sensor

8.2.7. Remote Control

8.2.8. Solenoid Valve

8.2.9. Others

9. Global Automotive Air Suspension Market, By Vehicle Type

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global Automotive Air Suspension Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

9.2.1. Passenger Vehicle

9.2.1.1. Hatchback

9.2.1.2. Sedan

9.2.1.3. Utility Vehicle

9.2.2. Light Commercial Vehicle

9.2.3. Heavy Commercial Vehicle

9.2.4. Bus & Coach

10. Global Automotive Air Suspension Market, By Sales Channel

10.1. Market Snapshot

10.1.1. Introduction, Definition, and Key Findings

10.1.2. Market Growth & Y-o-Y Projections

10.1.3. Base Point Share Analysis

10.2. Global Automotive Air Suspension Market Size Analysis & Forecast, 2017-2031, By Sales Channel

10.2.1. OEM

10.2.2. Aftermarket

11. Global Automotive Air Suspension Market, By Region

11.1. Market Snapshot

11.1.1. Introduction, Definition, and Key Findings

11.1.2. Market Growth & Y-o-Y Projections

11.1.3. Base Point Share Analysis

11.2. Global Automotive Air Suspension Market Size Analysis & Forecast, 2017-2031, By Region

11.2.1. North America

11.2.2. Europe

11.2.3. Asia Pacific

11.2.4. Middle East & Africa

11.2.5. South America

12. North America Automotive Air Suspension Market

12.1. Market Snapshot

12.2. North America Automotive Air Suspension Market Size Analysis & Forecast, 2017-2031, By Control Type

12.2.1. Electronically Controlled Air Suspension

12.2.2. Non-electronically Controlled Air Suspension

12.3. North America Automotive Air Suspension Market Size Analysis & Forecast, 2017-2031, By Component

12.3.1. Air Spring

12.3.2. Shock Absorber

12.3.3. Compressor

12.3.4. Electronic Control Unit

12.3.5. Air Reservoir

12.3.6. Height & Pressure Sensor

12.3.7. Remote Control

12.3.8. Solenoid Valve

12.3.9. Others

12.4. North America Automotive Air Suspension Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

12.4.1. Passenger Vehicle

12.4.1.1. Hatchback

12.4.1.2. Sedan

12.4.1.3. Utility Vehicle

12.4.2. Light Commercial Vehicle

12.4.3. Heavy Commercial Vehicle

12.4.4. Bus & Coach

12.5. North America Automotive Air Suspension Market Size Analysis & Forecast, 2017-2031, By Sales Channel

12.5.1. OEM

12.5.2. Aftermarket

12.6. Key Country Analysis – North America Automotive Air Suspension Market Size Analysis & Forecast, 2017-2031

12.6.1. U.S.

12.6.2. Canada

12.6.3. Mexico

13. Europe Automotive Air Suspension Market

13.1. Market Snapshot

13.2. Europe Automotive Air Suspension Market Size Analysis & Forecast, 2017-2031, By Control Type

13.2.1. Electronically Controlled Air Suspension

13.2.2. Non-electronically Controlled Air Suspension

13.3. Europe Automotive Air Suspension Market Size Analysis & Forecast, 2017-2031, By Component

13.3.1. Air Spring

13.3.2. Shock Absorber

13.3.3. Compressor

13.3.4. Electronic Control Unit

13.3.5. Air Reservoir

13.3.6. Height & Pressure Sensor

13.3.7. Remote Control

13.3.8. Solenoid Valve

13.3.9. Others

13.4. Europe Automotive Air Suspension Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

13.4.1. Passenger Vehicle

13.4.1.1. Hatchback

13.4.1.2. Sedan

13.4.1.3. Utility Vehicle

13.4.2. Light Commercial Vehicle

13.4.3. Heavy Commercial Vehicle

13.4.4. Bus & Coach

13.5. Europe Automotive Air Suspension Market Size Analysis & Forecast, 2017-2031, By Sales Channel

13.5.1. OEM

13.5.2. Aftermarket

13.6. Key Country Analysis – Europe Automotive Air Suspension Market Size Analysis & Forecast, 2017-2031

13.6.1. Germany

13.6.2. U. K.

13.6.3. France

13.6.4. Italy

13.6.5. Spain

13.6.6. Nordic Countries

13.6.7. Russia & CIS

13.6.8. Rest of Europe

14. Asia Pacific Automotive Air Suspension Market

14.1. Market Snapshot

14.2. Asia Pacific Automotive Air Suspension Market Size Analysis & Forecast, 2017-2031, By Control Type

14.2.1. Electronically Controlled Air Suspension

14.2.2. Non-electronically Controlled Air Suspension

14.3. Asia Pacific Automotive Air Suspension Market Size Analysis & Forecast, 2017-2031, By Component

14.3.1. Air Spring

14.3.2. Shock Absorber

14.3.3. Compressor

14.3.4. Electronic Control Unit

14.3.5. Air Reservoir

14.3.6. Height & Pressure Sensor

14.3.7. Remote Control

14.3.8. Solenoid Valve

14.3.9. Others

14.4. Asia Pacific Automotive Air Suspension Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

14.4.1. Passenger Vehicle

14.4.1.1. Hatchback

14.4.1.2. Sedan

14.4.1.3. Utility Vehicle

14.4.2. Light Commercial Vehicle

14.4.3. Heavy Commercial Vehicle

14.4.4. Bus & Coach

14.5. Asia Pacific Automotive Air Suspension Market Size Analysis & Forecast, 2017-2031, By Sales Channel

14.5.1. OEM

14.5.2. Aftermarket

14.6. Key Country Analysis – Asia Pacific Automotive Air Suspension Market Size Analysis & Forecast, 2017-2031

14.6.1. China

14.6.2. India

14.6.3. Japan

14.6.4. ASEAN Countries

14.6.5. South Korea

14.6.6. ANZ

14.6.7. Rest of Asia Pacific

15. Middle East & Africa Automotive Air Suspension Market

15.1. Market Snapshot

15.2. Middle East & Africa Automotive Air Suspension Market Size Analysis & Forecast, 2017-2031, By Control Type

15.2.1. Electronically Controlled Air Suspension

15.2.2. Non-electronically Controlled Air Suspension

15.3. Middle East & Africa Automotive Air Suspension Market Size Analysis & Forecast, 2017-2031, By Component

15.3.1. Air Spring

15.3.2. Shock Absorber

15.3.3. Compressor

15.3.4. Electronic Control Unit

15.3.5. Air Reservoir

15.3.6. Height & Pressure Sensor

15.3.7. Remote Control

15.3.8. Solenoid Valve

15.3.9. Others

15.4. Middle East & Africa Automotive Air Suspension Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

15.4.1. Passenger Vehicle

15.4.1.1. Hatchback

15.4.1.2. Sedan

15.4.1.3. Utility Vehicle

15.4.2. Light Commercial Vehicle

15.4.3. Heavy Commercial Vehicle

15.4.4. Bus & Coach

15.5. Middle East & Africa Automotive Air Suspension Market Size Analysis & Forecast, 2017-2031, By Sales Channel

15.5.1. OEM

15.5.2. Aftermarket

15.6. Key Country Analysis – Middle East & Africa Automotive Air Suspension Market Size Analysis & Forecast, 2017-2031

15.6.1. GCC

15.6.2. South Africa

15.6.3. Turkey

15.6.4. Rest of Middle East & Africa

16. South America Automotive Air Suspension Market

16.1. Market Snapshot

16.2. South America Automotive Air Suspension Market Size Analysis & Forecast, 2017-2031, By Control Type

16.2.1. Electronically Controlled Air Suspension

16.2.2. Non-electronically Controlled Air Suspension

16.3. South America Automotive Air Suspension Market Size Analysis & Forecast, 2017-2031, By Component

16.3.1. Air Spring

16.3.2. Shock Absorber

16.3.3. Compressor

16.3.4. Electronic Control Unit

16.3.5. Air Reservoir

16.3.6. Height & Pressure Sensor

16.3.7. Remote Control

16.3.8. Solenoid Valve

16.3.9. Others

16.4. South America Automotive Air Suspension Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

16.4.1. Passenger Vehicle

16.4.1.1. Hatchback

16.4.1.2. Sedan

16.4.1.3. Utility Vehicle

16.4.2. Light Commercial Vehicle

16.4.3. Heavy Commercial Vehicle

16.4.4. Bus & Coach

16.5. South America Automotive Air Suspension Market Size Analysis & Forecast, 2017-2031, By Sales Channel

16.5.1. OEM

16.5.2. Aftermarket

16.6. Key Country Analysis – South America Automotive Air Suspension Market Size Analysis & Forecast, 2017-2031

16.6.1. Brazil

16.6.2. Argentina

16.6.3. Rest of South America

17. Competitive Landscape

17.1. Company Share Analysis/ Brand Share Analysis, 2022

17.2. Pricing comparison among key players

17.3. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

18. Company Profile/ Key Players

18.1. AccuAir Control Systems, L.L.C.

18.1.1. Company Overview

18.1.2. Company Footprints

18.1.3. Production Locations

18.1.4. Product Portfolio

18.1.5. Competitors & Customers

18.1.6. Subsidiaries & Parent Organization

18.1.7. Recent Developments

18.1.8. Financial Analysis

18.1.9. Profitability

18.1.10. Revenue Share

18.2. Air Lift Company

18.2.1. Company Overview

18.2.2. Company Footprints

18.2.3. Production Locations

18.2.4. Product Portfolio

18.2.5. Competitors & Customers

18.2.6. Subsidiaries & Parent Organization

18.2.7. Recent Developments

18.2.8. Financial Analysis

18.2.9. Profitability

18.2.10. Revenue Share

18.3. BWI Group

18.3.1. Company Overview

18.3.2. Company Footprints

18.3.3. Production Locations

18.3.4. Product Portfolio

18.3.5. Competitors & Customers

18.3.6. Subsidiaries & Parent Organization

18.3.7. Recent Developments

18.3.8. Financial Analysis

18.3.9. Profitability

18.3.10. Revenue Share

18.4. Continental AG

18.4.1. Company Overview

18.4.2. Company Footprints

18.4.3. Production Locations

18.4.4. Product Portfolio

18.4.5. Competitors & Customers

18.4.6. Subsidiaries & Parent Organization

18.4.7. Recent Developments

18.4.8. Financial Analysis

18.4.9. Profitability

18.4.10. Revenue Share

18.5. Dunlop Systems and Components

18.5.1. Company Overview

18.5.2. Company Footprints

18.5.3. Production Locations

18.5.4. Product Portfolio

18.5.5. Competitors & Customers

18.5.6. Subsidiaries & Parent Organization

18.5.7. Recent Developments

18.5.8. Financial Analysis

18.5.9. Profitability

18.5.10. Revenue Share

18.6. DuPont de Nemours, Inc.

18.6.1. Company Overview

18.6.2. Company Footprints

18.6.3. Production Locations

18.6.4. Product Portfolio

18.6.5. Competitors & Customers

18.6.6. Subsidiaries & Parent Organization

18.6.7. Recent Developments

18.6.8. Financial Analysis

18.6.9. Profitability

18.6.10. Revenue Share

18.7. Firestone Industrial Products

18.7.1. Company Overview

18.7.2. Company Footprints

18.7.3. Production Locations

18.7.4. Product Portfolio

18.7.5. Competitors & Customers

18.7.6. Subsidiaries & Parent Organization

18.7.7. Recent Developments

18.7.8. Financial Analysis

18.7.9. Profitability

18.7.10. Revenue Share

18.8. Hendrickson International Corporation

18.8.1. Company Overview

18.8.2. Company Footprints

18.8.3. Production Locations

18.8.4. Product Portfolio

18.8.5. Competitors & Customers

18.8.6. Subsidiaries & Parent Organization

18.8.7. Recent Developments

18.8.8. Financial Analysis

18.8.9. Profitability

18.8.10. Revenue Share

18.9. Hendrickson USA, L.L.C.

18.9.1. Company Overview

18.9.2. Company Footprints

18.9.3. Production Locations

18.9.4. Product Portfolio

18.9.5. Competitors & Customers

18.9.6. Subsidiaries & Parent Organization

18.9.7. Recent Developments

18.9.8. Financial Analysis

18.9.9. Profitability

18.9.10. Revenue Share

18.10. Hitachi Ltd.

18.10.1. Company Overview

18.10.2. Company Footprints

18.10.3. Production Locations

18.10.4. Product Portfolio

18.10.5. Competitors & Customers

18.10.6. Subsidiaries & Parent Organization

18.10.7. Recent Developments

18.10.8. Financial Analysis

18.10.9. Profitability

18.10.10. Revenue Share

18.11. Magneti Marelli S.p.A.

18.11.1. Company Overview

18.11.2. Company Footprints

18.11.3. Production Locations

18.11.4. Product Portfolio

18.11.5. Competitors & Customers

18.11.6. Subsidiaries & Parent Organization

18.11.7. Recent Developments

18.11.8. Financial Analysis

18.11.9. Profitability

18.11.10. Revenue Share

18.12. Mando Corporation

18.12.1. Company Overview

18.12.2. Company Footprints

18.12.3. Production Locations

18.12.4. Product Portfolio

18.12.5. Competitors & Customers

18.12.6. Subsidiaries & Parent Organization

18.12.7. Recent Developments

18.12.8. Financial Analysis

18.12.9. Profitability

18.12.10. Revenue Share

18.13. Meklas Group

18.13.1. Company Overview

18.13.2. Company Footprints

18.13.3. Production Locations

18.13.4. Product Portfolio

18.13.5. Competitors & Customers

18.13.6. Subsidiaries & Parent Organization

18.13.7. Recent Developments

18.13.8. Financial Analysis

18.13.9. Profitability

18.13.10. Revenue Share

18.14. SAF-Holland

18.14.1. Company Overview

18.14.2. Company Footprints

18.14.3. Production Locations

18.14.4. Product Portfolio

18.14.5. Competitors & Customers

18.14.6. Subsidiaries & Parent Organization

18.14.7. Recent Developments

18.14.8. Financial Analysis

18.14.9. Profitability

18.14.10. Revenue Share

18.15. ThyssenKrupp AG

18.15.1. Company Overview

18.15.2. Company Footprints

18.15.3. Production Locations

18.15.4. Product Portfolio

18.15.5. Competitors & Customers

18.15.6. Subsidiaries & Parent Organization

18.15.7. Recent Developments

18.15.8. Financial Analysis

18.15.9. Profitability

18.15.10. Revenue Share

18.16. VB-Airsuspension

18.16.1. Company Overview

18.16.2. Company Footprints

18.16.3. Production Locations

18.16.4. Product Portfolio

18.16.5. Competitors & Customers

18.16.6. Subsidiaries & Parent Organization

18.16.7. Recent Developments

18.16.8. Financial Analysis

18.16.9. Profitability

18.16.10. Revenue Share

18.17. Wabco Holdings Inc.

18.17.1. Company Overview

18.17.2. Company Footprints

18.17.3. Production Locations

18.17.4. Product Portfolio

18.17.5. Competitors & Customers

18.17.6. Subsidiaries & Parent Organization

18.17.7. Recent Developments

18.17.8. Financial Analysis

18.17.9. Profitability

18.17.10. Revenue Share

18.18. ZF Friedrichshafen AG

18.18.1. Company Overview

18.18.2. Company Footprints

18.18.3. Production Locations

18.18.4. Product Portfolio

18.18.5. Competitors & Customers

18.18.6. Subsidiaries & Parent Organization

18.18.7. Recent Developments

18.18.8. Financial Analysis

18.18.9. Profitability

18.18.10. Revenue Share

18.19. Other Key Players

18.19.1. Company Overview

18.19.2. Company Footprints

18.19.3. Production Locations

18.19.4. Product Portfolio

18.19.5. Competitors & Customers

18.19.6. Subsidiaries & Parent Organization

18.19.7. Recent Developments

18.19.8. Financial Analysis

18.19.9. Profitability

18.19.10. Revenue Share

List of Tables

Table 1: Global Automotive Air Suspension Market Volume (Units) Forecast, by Control Type, 2017-2031

Table 2: Global Automotive Air Suspension Market Value (US$ Bn) Forecast, by Control Type, 2017‒2031

Table 3: Global Automotive Air Suspension Market Volume (Units) Forecast, By Component, 2017-2031

Table 4: Global Automotive Air Suspension Market Value (US$ Bn) Forecast, By Component, 2017‒2031

Table 5: Global Automotive Air Suspension Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Table 6: Global Automotive Air Suspension Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 7: Global Automotive Air Suspension Market Volume (Units) Forecast, by Sales Channel, 2017-2031

Table 8: Global Automotive Air Suspension Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 9: Global Automotive Air Suspension Market Volume (Units) Forecast, by Region, 2017-2031

Table 10: Global Automotive Air Suspension Market Value (US$ Bn) Forecast, by Region, 2017‒2031

Table 11: North America Automotive Air Suspension Market Volume (Units) Forecast, by Control Type, 2017-2031

Table 12: North America Automotive Air Suspension Market Value (US$ Bn) Forecast, by Control Type, 2017‒2031

Table 13: North America Automotive Air Suspension Market Volume (Units) Forecast, By Component, 2017-2031

Table 14: North America Automotive Air Suspension Market Value (US$ Bn) Forecast, By Component, 2017‒2031

Table 15: North America Automotive Air Suspension Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Table 16: North America Automotive Air Suspension Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 17: North America Automotive Air Suspension Market Volume (Units) Forecast, by Sales Channel, 2017-2031

Table 18: North America Automotive Air Suspension Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 19: North America Automotive Air Suspension Market Volume (Units) Forecast, by Country, 2017-2031

Table 20: North America Automotive Air Suspension Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 21: Europe Automotive Air Suspension Market Volume (Units) Forecast, by Control Type, 2017-2031

Table 22: Europe Automotive Air Suspension Market Value (US$ Bn) Forecast, by Control Type, 2017‒2031

Table 23: Europe Automotive Air Suspension Market Volume (Units) Forecast, By Component, 2017-2031

Table 24: Europe Automotive Air Suspension Market Value (US$ Bn) Forecast, By Component, 2017‒2031

Table 25: Europe Automotive Air Suspension Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Table 26: Europe Automotive Air Suspension Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 27: Europe Automotive Air Suspension Market Volume (Units) Forecast, by Sales Channel, 2017-2031

Table 28: Europe Automotive Air Suspension Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 29: Europe Automotive Air Suspension Market Volume (Units) Forecast, by Country, 2017-2031

Table 30: Europe Automotive Air Suspension Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 31: Asia Pacific Automotive Air Suspension Market Volume (Units) Forecast, by Control Type, 2017-2031

Table 32: Asia Pacific Automotive Air Suspension Market Value (US$ Bn) Forecast, by Control Type, 2017‒2031

Table 33: Asia Pacific Automotive Air Suspension Market Volume (Units) Forecast, By Component, 2017-2031

Table 34: Asia Pacific Automotive Air Suspension Market Value (US$ Bn) Forecast, By Component, 2017‒2031

Table 35: Asia Pacific Automotive Air Suspension Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Table 36: Asia Pacific Automotive Air Suspension Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 37: Asia Pacific Automotive Air Suspension Market Volume (Units) Forecast, by Sales Channel, 2017-2031

Table 38: Asia Pacific Automotive Air Suspension Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 39: Asia Pacific Automotive Air Suspension Market Volume (Units) Forecast, by Country, 2017-2031

Table 40: Asia Pacific Automotive Air Suspension Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 41: Middle East & Africa Automotive Air Suspension Market Volume (Units) Forecast, by Control Type, 2017-2031

Table 42: Middle East & Africa Automotive Air Suspension Market Value (US$ Bn) Forecast, by Control Type, 2017‒2031

Table 43: Middle East & Africa Automotive Air Suspension Market Volume (Units) Forecast, By Component, 2017-2031

Table 44: Middle East & Africa Automotive Air Suspension Market Value (US$ Bn) Forecast, By Component, 2017‒2031

Table 45: Middle East & Africa Automotive Air Suspension Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Table 46: Middle East & Africa Automotive Air Suspension Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 47: Middle East & Africa Automotive Air Suspension Market Volume (Units) Forecast, by Sales Channel, 2017-2031

Table 48: Middle East & Africa Automotive Air Suspension Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 49: Middle East & Africa Automotive Air Suspension Market Volume (Units) Forecast, by Country, 2017-2031

Table 50: Middle East & Africa Automotive Air Suspension Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 51: South America Automotive Air Suspension Market Volume (Units) Forecast, by Control Type, 2017-2031

Table 52: South America Automotive Air Suspension Market Value (US$ Bn) Forecast, by Control Type, 2017‒2031

Table 53: South America Automotive Air Suspension Market Volume (Units) Forecast, By Component, 2017-2031

Table 54: South America Automotive Air Suspension Market Value (US$ Bn) Forecast, By Component, 2017‒2031

Table 55: South America Automotive Air Suspension Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Table 56: South America Automotive Air Suspension Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 57: South America Automotive Air Suspension Market Volume (Units) Forecast, by Sales Channel, 2017-2031

Table 58: South America Automotive Air Suspension Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 59: South America Automotive Air Suspension Market Volume (Units) Forecast, by Country, 2017-2031

Table 60: South America Automotive Air Suspension Market Value (US$ Bn) Forecast, by Country, 2017‒2031

List of Figures

Figure 1: Global Automotive Air Suspension Market Volume (Units) Forecast, by Control Type, 2017-2031

Figure 2: Global Automotive Air Suspension Market Value (US$ Bn) Forecast, by Control Type, 2017-2031

Figure 3: Global Automotive Air Suspension Market, Incremental Opportunity, by Control Type, Value (US$ Bn), 2023-2031

Figure 4: Global Automotive Air Suspension Market Volume (Units) Forecast, By Component, 2017-2031

Figure 5: Global Automotive Air Suspension Market Value (US$ Bn) Forecast, By Component, 2017-2031

Figure 6: Global Automotive Air Suspension Market, Incremental Opportunity, By Component, Value (US$ Bn), 2023-2031

Figure 7: Global Automotive Air Suspension Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Figure 8: Global Automotive Air Suspension Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 9: Global Automotive Air Suspension Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 10: Global Automotive Air Suspension Market Volume (Units) Forecast, by Sales Channel, 2017-2031

Figure 11: Global Automotive Air Suspension Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 12: Global Automotive Air Suspension Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 13: Global Automotive Air Suspension Market Volume (Units) Forecast, by Region, 2017-2031

Figure 14: Global Automotive Air Suspension Market Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 15: Global Automotive Air Suspension Market, Incremental Opportunity, by Region, Value (US$ Bn), 2023-2031

Figure 16: North America Automotive Air Suspension Market Volume (Units) Forecast, by Control Type, 2017-2031

Figure 17: North America Automotive Air Suspension Market Value (US$ Bn) Forecast, by Control Type, 2017-2031

Figure 18: North America Automotive Air Suspension Market, Incremental Opportunity, by Control Type, Value (US$ Bn), 2023-2031

Figure 19: North America Automotive Air Suspension Market Volume (Units) Forecast, By Component, 2017-2031

Figure 20: North America Automotive Air Suspension Market Value (US$ Bn) Forecast, By Component, 2017-2031

Figure 21: North America Automotive Air Suspension Market, Incremental Opportunity, By Component, Value (US$ Bn), 2023-2031

Figure 22: North America Automotive Air Suspension Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Figure 23: North America Automotive Air Suspension Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 24: North America Automotive Air Suspension Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 25: North America Automotive Air Suspension Market Volume (Units) Forecast, by Sales Channel, 2017-2031

Figure 26: North America Automotive Air Suspension Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 27: North America Automotive Air Suspension Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 28: North America Automotive Air Suspension Market Volume (Units) Forecast, by Country, 2017-2031

Figure 29: North America Automotive Air Suspension Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 30: North America Automotive Air Suspension Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 31: Europe Automotive Air Suspension Market Volume (Units) Forecast, by Control Type, 2017-2031

Figure 32: Europe Automotive Air Suspension Market Value (US$ Bn) Forecast, by Control Type, 2017-2031

Figure 33: Europe Automotive Air Suspension Market, Incremental Opportunity, by Control Type, Value (US$ Bn), 2023-2031

Figure 34: Europe Automotive Air Suspension Market Volume (Units) Forecast, By Component, 2017-2031

Figure 35: Europe Automotive Air Suspension Market Value (US$ Bn) Forecast, By Component, 2017-2031

Figure 36: Europe Automotive Air Suspension Market, Incremental Opportunity, By Component, Value (US$ Bn), 2023-2031

Figure 37: Europe Automotive Air Suspension Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Figure 38: Europe Automotive Air Suspension Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 39: Europe Automotive Air Suspension Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 40: Europe Automotive Air Suspension Market Volume (Units) Forecast, by Sales Channel, 2017-2031

Figure 41: Europe Automotive Air Suspension Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 42: Europe Automotive Air Suspension Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 43: Europe Automotive Air Suspension Market Volume (Units) Forecast, by Country, 2017-2031

Figure 44: Europe Automotive Air Suspension Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 45: Europe Automotive Air Suspension Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 46: Asia Pacific Automotive Air Suspension Market Volume (Units) Forecast, by Control Type, 2017-2031

Figure 47: Asia Pacific Automotive Air Suspension Market Value (US$ Bn) Forecast, by Control Type, 2017-2031

Figure 48: Asia Pacific Automotive Air Suspension Market, Incremental Opportunity, by Control Type, Value (US$ Bn), 2023-2031

Figure 49: Asia Pacific Automotive Air Suspension Market Volume (Units) Forecast, By Component, 2017-2031

Figure 50: Asia Pacific Automotive Air Suspension Market Value (US$ Bn) Forecast, By Component, 2017-2031

Figure 51: Asia Pacific Automotive Air Suspension Market, Incremental Opportunity, By Component, Value (US$ Bn), 2023-2031

Figure 52: Asia Pacific Automotive Air Suspension Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Figure 53: Asia Pacific Automotive Air Suspension Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 54: Asia Pacific Automotive Air Suspension Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 55: Asia Pacific Automotive Air Suspension Market Volume (Units) Forecast, by Sales Channel, 2017-2031

Figure 56: Asia Pacific Automotive Air Suspension Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 57: Asia Pacific Automotive Air Suspension Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 58: Asia Pacific Automotive Air Suspension Market Volume (Units) Forecast, by Country, 2017-2031

Figure 59: Asia Pacific Automotive Air Suspension Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 60: Asia Pacific Automotive Air Suspension Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 61: Middle East & Africa Automotive Air Suspension Market Volume (Units) Forecast, by Control Type, 2017-2031

Figure 62: Middle East & Africa Automotive Air Suspension Market Value (US$ Bn) Forecast, by Control Type, 2017-2031

Figure 63: Middle East & Africa Automotive Air Suspension Market, Incremental Opportunity, by Control Type, Value (US$ Bn), 2023-2031

Figure 64: Middle East & Africa Automotive Air Suspension Market Volume (Units) Forecast, By Component, 2017-2031

Figure 65: Middle East & Africa Automotive Air Suspension Market Value (US$ Bn) Forecast, By Component, 2017-2031

Figure 66: Middle East & Africa Automotive Air Suspension Market, Incremental Opportunity, By Component, Value (US$ Bn), 2023-2031

Figure 67: Middle East & Africa Automotive Air Suspension Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Figure 68: Middle East & Africa Automotive Air Suspension Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 69: Middle East & Africa Automotive Air Suspension Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 70: Middle East & Africa Automotive Air Suspension Market Volume (Units) Forecast, by Sales Channel, 2017-2031

Figure 71: Middle East & Africa Automotive Air Suspension Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 72: Middle East & Africa Automotive Air Suspension Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 73: Middle East & Africa Automotive Air Suspension Market Volume (Units) Forecast, by Country, 2017-2031

Figure 74: Middle East & Africa Automotive Air Suspension Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 75: Middle East & Africa Automotive Air Suspension Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 76: South America Automotive Air Suspension Market Volume (Units) Forecast, by Control Type, 2017-2031

Figure 77: South America Automotive Air Suspension Market Value (US$ Bn) Forecast, by Control Type, 2017-2031

Figure 78: South America Automotive Air Suspension Market, Incremental Opportunity, by Control Type, Value (US$ Bn), 2023-2031

Figure 79: South America Automotive Air Suspension Market Volume (Units) Forecast, By Component, 2017-2031

Figure 80: South America Automotive Air Suspension Market Value (US$ Bn) Forecast, By Component, 2017-2031

Figure 81: South America Automotive Air Suspension Market, Incremental Opportunity, By Component, Value (US$ Bn), 2023-2031

Figure 82: South America Automotive Air Suspension Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Figure 83: South America Automotive Air Suspension Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 84: South America Automotive Air Suspension Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 85: South America Automotive Air Suspension Market Volume (Units) Forecast, by Sales Channel, 2017-2031

Figure 86: South America Automotive Air Suspension Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 87: South America Automotive Air Suspension Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 88: South America Automotive Air Suspension Market Volume (Units) Forecast, by Country, 2017-2031

Figure 89: South America Automotive Air Suspension Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 90: South America Automotive Air Suspension Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031