Analyst Viewpoint

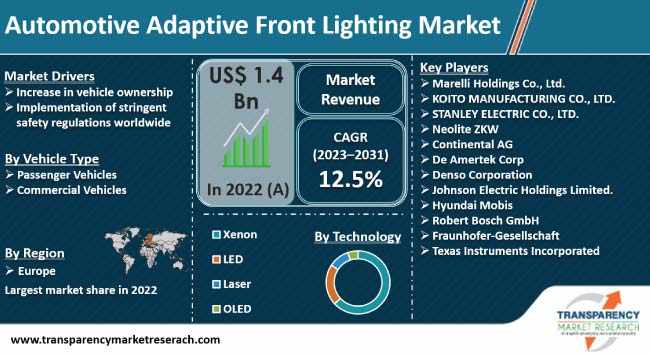

Rise in vehicle ownership is one of the prominent factors that is propelling the automotive adaptive front lighting market size. Demand for lightweight passenger and commercial vehicles is rising significantly in emerging economies such as India and China, while manufacturing hubs such as Germany and South Korea are producing millions of units of vehicles. Stringent government regulations around road and vehicle safety are also augmenting market statistics.

Key players in the global automotive adaptive front lighting market are investing substantially in intelligent front lighting systems while experimenting with novel materials and designs to cater to an evolving autonomous automobile sector. As more sophisticated road networks are constructed to accommodate the increasing number of vehicles on road, advanced safety and vision features are becoming vital components of transportation.

Adaptive Front Lighting System (AFS) is a technology that dynamically adjusts the distribution of light from the headlights to ensure optimum night vision for the driver without neglecting the safety of other drivers. The automotive system aids in keeping the vehicle secure and safe by guiding low-beam headlamp units in line with steering angle and vehicle speed.

Automotive adaptive front lighting also utilizes image sensors to detect the position of incoming traffic while automatically dimming the LEDs to avoid direct glare toward oncoming vehicles. This reduces the chances of automobile collisions.

Improvement in safety, enhancement of visibility, and decrease in driver fatigue are benefits of adopting adaptive front lighting in an automobile. A well-illuminated field of view and avoidance of glare assist in improving road collision statistics by a significant margin.

Rise in disposable income and growth in urbanization in developing countries have led to an increase in demand for vehicle ownership. Production of automobiles has increased significantly in manufacturing hubs such as Germany, China, and Japan. This, in turn, is boosting the demand for advanced automotive systems, including adaptive front lighting.

As per a survey conducted by Rakuten Insight, about 71.4% of Chinese respondents stated that they owned a vehicle. According to the World Bank, China can add up to 500 million more passenger vehicles to its national fleet if the country reaches the motorization rate of the European Union by 2050.

Increase in vehicle ownership is expected to result in heightened focus on automobile maintenance and passenger safety. This is anticipated to augment the demand for automobile safety features such as adaptive front lighting, including adaptive headlight systems.

Road safety, along with emission control, is a priority among governments worldwide and regulatory bodies related to transportation and automobile sectors. Stringent safety regulations are compelling automakers to integrate features such as dynamic front lighting solutions to meet compliance standards and elevate passenger safety.

As per the Governors Highway Safety Association, more than 7,508 people were struck and killed while walking by drivers in the U.S. in 2022. Rise in emphasis on pedestrian safety, growth in awareness regarding the benefits of adaptive lighting systems, and increase in trend of autonomous vehicles or electric vehicles are creating lucrative automotive adaptive front lighting market opportunities for companies operating in the sector.

According to a report published by the Government of India, road accidents took about 20 lives every hour in 2022. The government is constantly implementing stricter safety regulations to curb road accidents. As the number of road collisions rises, the need for nighttime safety features is set to increase, thus accelerating market development.

As per the recent automotive adaptive front lighting market analysis, Europe held the largest share in the global landscape in 2022. Expansion in the automobile sector and stringent safety standards enforced by the European Union are fueling the market statistics of the region.

Rise in awareness about passenger safety and constant innovations in automobile lighting are playing a key role in bolstering the automotive adaptive front lighting industry across the globe.

According to a report by the European Commission, 20,600 people were killed in road accidents in 2022. This represents 2,000 fewer casualties when compared to pre-pandemic 2019 numbers. The United Nations and the European Union aim to halve the number of road deaths by 2050.

As per the latest automotive adaptive front lighting market research, the industry in Asia Pacific is projected to grow at a steady pace during the forecast period, led by expansion in the automobile manufacturing sector and surge in demand for passenger and commercial vehicles in the region.

Prominent companies operating in the global automotive adaptive front lighting market are investing significantly in advancements in adaptive headlight systems and intelligent front lighting to enhance the functionality and design features of their products.

Adoption of improved materials to meet the rising demand from the electric transportation sector is key automotive adaptive front lighting market growth strategy adopted by the leading players.

HELLA GmbH & Co. KGaA, Marelli Holdings Co., Ltd., KOITO MANUFACTURING CO., LTD., STANLEY ELECTRIC CO., LTD., Neolite ZKW, Continental AG, De Amertek Corp, Denso Corporation, Johnson Electric Holdings Limited., Hyundai Mobis, Robert Bosch GmbH, Fraunhofer-Gesellschaft, and Texas Instruments Incorporated are key players that account for large automotive adaptive front lighting market share.

These companies have been covered in the automotive adaptive front lighting market report in terms of parameters such as company overview, product portfolio, business strategies, financial overview, and business segments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 (Base Year) | US$ 1.4 Bn |

| Market Forecast Value in 2031 | US$ 4.1 Bn |

| Growth Rate (CAGR) | 12.5% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2021 |

| Quantitative Units | US$ Bn for Value and Million Units for Volume |

| Market Analysis | Qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, and SWOT analysis. Furthermore, at the regional level, the qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Regions Covered |

|

| Countries Covered |

|

| Market Segmentation |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

It was valued at US$ 1.4 Bn in 2022

It is projected to advance at a CAGR of 12.5% from 2023 to 2031

Increase in vehicle ownership and implementation of stringent safety regulations worldwide

The xenon segment accounted for the largest share in 2022

Europe was the leading region in 2022

HELLA GmbH & Co. KGaA, Marelli Holdings Co., Ltd., KOITO MANUFACTURING CO., LTD., STANLEY ELECTRIC CO., LTD., Neolite ZKW, Continental AG, De Amertek Corp, Denso Corporation, Johnson Electric Holdings Limited., Hyundai Mobis, Robert Bosch GmbH, Fraunhofer-Gesellschaft, and Texas Instruments Incorporated

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Size, Value US$ Mn, 2017-2031

1.2. Go to Market Strategy

1.2.1. Demand & Supply Side Trends

1.2.2. Identification of Potential Market Spaces

1.2.3. Understanding the Buying Process of Customers

1.2.4. Preferred Sales & Marketing Strategy

1.3. Competitive Dashboard Analysis

2. Market Overview

2.1. Market Definition / Scope / Limitations

2.2. TMR Analysis and Recommendations

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunities

2.4. Market Factor Analysis

2.4.1. Porter’s Five Forces Analysis

2.4.2. SWOT Analysis

2.5. Regulatory Scenario

2.6. Key Trend Analysis

2.7. Value Chain Analysis

2.8. Cost Structure Analysis

2.9. Profit Margin Analysis

3. Global Automotive Adaptive Front Lighting Market, By Vehicle Type

3.1. Market Snapshot

3.1.1. Introduction, Definition, and Key Findings

3.1.2. Market Growth & Y-o-Y Projections

3.1.3. Base Point Share Analysis

3.2. Global Automotive Adaptive Front Lighting Market Size & Forecast, 2017-2031, By Vehicle Type

3.2.1. Passenger Vehicles

3.2.2. Commercial Vehicles

4. Global Automotive Adaptive Front Lighting Market, By Technology

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Automotive Adaptive Front Lighting Market Size & Forecast, 2017-2031, By Technology

4.2.1. Xenon

4.2.2. LED

4.2.3. Laser

4.2.4. OLED

5. Global Automotive Adaptive Front Lighting Market, by Region

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Automotive Adaptive Front Lighting Market Size & Forecast, 2017-2031, By Region

5.2.1. North America

5.2.2. Europe

5.2.3. Asia Pacific

5.2.4. Middle East & Africa

5.2.5. South America

6. North America Automotive Adaptive Front Lighting Market

6.1. Market Snapshot

6.2. North America Automotive Adaptive Front Lighting Market Size & Forecast, 2017-2031, By Vehicle Type

6.2.1. Passenger Vehicles

6.2.2. Commercial Vehicles

6.3. North America Automotive Adaptive Front Lighting Market Size & Forecast, 2017-2031, By Technology

6.3.1. Xenon

6.3.2. LED

6.3.3. Laser

6.3.4. OLED

6.4. North America Automotive Adaptive Front Lighting Market Size & Forecast, 2017-2031, By Country

6.4.1. U.S.

6.4.2. Canada

6.4.3. Mexico

7. Europe Automotive Adaptive Front Lighting Market

7.1. Market Snapshot

7.2. Europe Automotive Adaptive Front Lighting Market Size & Forecast, 2017-2031, By Vehicle Type

7.2.1. Passenger Vehicles

7.2.2. Commercial Vehicles

7.3. Europe Automotive Adaptive Front Lighting Market Size & Forecast, 2017-2031, By Technology

7.3.1. Xenon

7.3.2. LED

7.3.3. Laser

7.3.4. OLED

7.4. Europe Automotive Adaptive Front Lighting Market Size & Forecast, 2017-2031, By Country

7.4.1. Germany

7.4.2. U.K.

7.4.3. France

7.4.4. Italy

7.4.5. Spain

7.4.6. Nordic Countries

7.4.7. Russia & CIS

7.4.8. Rest of Europe

8. Asia Pacific Automotive Adaptive Front Lighting Market

8.1. Market Snapshot

8.2. Asia Pacific Automotive Adaptive Front Lighting Market Size & Forecast, 2017-2031, By Vehicle Type

8.2.1. Passenger Vehicles

8.2.2. Commercial Vehicles

8.3. Asia Pacific Automotive Adaptive Front Lighting Market Size & Forecast, 2017-2031, By Technology

8.3.1. Xenon

8.3.2. LED

8.3.3. Laser

8.3.4. OLED

8.4. Asia Pacific Automotive Adaptive Front Lighting Market Size & Forecast, 2017-2031, By Country

8.4.1. China

8.4.2. India

8.4.3. Japan

8.4.4. ASEAN Countries

8.4.5. South Korea

8.4.6. ANZ

8.4.7. Rest of Asia Pacific

9. Middle East & Africa Automotive Adaptive Front Lighting Market

9.1. Market Snapshot

9.2. Middle East & Africa Automotive Adaptive Front Lighting Market Size & Forecast, 2017-2031, By Vehicle Type

9.2.1. Passenger Vehicles

9.2.2. Commercial Vehicles

9.3. Middle East & Africa Automotive Adaptive Front Lighting Market Size & Forecast, 2017-2031, By Technology

9.3.1. Xenon

9.3.2. LED

9.3.3. Laser

9.3.4. OLED

9.4. Middle East & Africa Automotive Adaptive Front Lighting Market Size & Forecast, 2017-2031, By Country

9.4.1. GCC

9.4.2. South Africa

9.4.3. Turkey

9.4.4. Rest of Middle East & Africa

10. South America Automotive Adaptive Front Lighting Market

10.1. Market Snapshot

10.2. South America Automotive Adaptive Front Lighting Market Size & Forecast, 2017-2031, By Vehicle Type

10.2.1. Passenger Vehicles

10.2.2. Commercial Vehicles

10.3. South America Automotive Adaptive Front Lighting Market Size & Forecast, 2017-2031, By Technology

10.3.1. Xenon

10.3.2. LED

10.3.3. Laser

10.3.4. OLED

10.4. South America Automotive Adaptive Front Lighting Market Size & Forecast, 2017-2031, By Country

10.4.1. Brazil

10.4.2. Argentina

10.4.3. Rest of South America

11. Competitive Landscape

11.1. Company Share Analysis/ Brand Share Analysis, 2022

11.2. Company Analysis for Each Player Company Overview, Company Footprint, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share

12. Company Profiles/Key Players

12.1. HELLA GmbH & Co. KGaA

12.1.1. Company Overview

12.1.2. Footprint

12.1.3. Production Locations

12.1.4. Competitors & Customers

12.1.5. Subsidiaries & Parent Organization

12.1.6. Recent Developments

12.1.7. Financial Analysis

12.1.8. Revenue Share

12.2. Marelli Holdings Co., Ltd.

12.2.1. Company Overview

12.2.2. Footprint

12.2.3. Production Locations

12.2.4. Competitors & Customers

12.2.5. Subsidiaries & Parent Organization

12.2.6. Recent Developments

12.2.7. Financial Analysis

12.2.8. Revenue Share

12.3. KOITO MANUFACTURING CO., LTD.

12.3.1. Company Overview

12.3.2. Footprint

12.3.3. Production Locations

12.3.4. Competitors & Customers

12.3.5. Subsidiaries & Parent Organization

12.3.6. Recent Developments

12.3.7. Financial Analysis

12.3.8. Revenue Share

12.4. STANLEY ELECTRIC CO., LTD.

12.4.1. Company Overview

12.4.2. Footprint

12.4.3. Production Locations

12.4.4. Competitors & Customers

12.4.5. Subsidiaries & Parent Organization

12.4.6. Recent Developments

12.4.7. Financial Analysis

12.4.8. Revenue Share

12.5. Neolite ZKW

12.5.1. Company Overview

12.5.2. Footprint

12.5.3. Production Locations

12.5.4. Competitors & Customers

12.5.5. Subsidiaries & Parent Organization

12.5.6. Recent Developments

12.5.7. Financial Analysis

12.5.8. Revenue Share

12.6. Continental AG

12.6.1. Company Overview

12.6.2. Footprint

12.6.3. Production Locations

12.6.4. Competitors & Customers

12.6.5. Subsidiaries & Parent Organization

12.6.6. Recent Developments

12.6.7. Financial Analysis

12.6.8. Revenue Share

12.7. De Amertek Corp

12.7.1. Company Overview

12.7.2. Footprint

12.7.3. Production Locations

12.7.4. Competitors & Customers

12.7.5. Subsidiaries & Parent Organization

12.7.6. Recent Developments

12.7.7. Financial Analysis

12.7.8. Revenue Share

12.8. Denso Corporation

12.8.1. Company Overview

12.8.2. Footprint

12.8.3. Production Locations

12.8.4. Competitors & Customers

12.8.5. Subsidiaries & Parent Organization

12.8.6. Recent Developments

12.8.7. Financial Analysis

12.8.8. Revenue Share

12.9. Johnson Electric Holdings Limited.

12.9.1. Company Overview

12.9.2. Footprint

12.9.3. Production Locations

12.9.4. Competitors & Customers

12.9.5. Subsidiaries & Parent Organization

12.9.6. Recent Developments

12.9.7. Financial Analysis

12.9.8. Revenue Share

12.10. Hyundai Mobis

12.10.1. Company Overview

12.10.2. Footprint

12.10.3. Production Locations

12.10.4. Competitors & Customers

12.10.5. Subsidiaries & Parent Organization

12.10.6. Recent Developments

12.10.7. Financial Analysis

12.10.8. Revenue Share

12.11. Robert Bosch GmbH

12.11.1. Company Overview

12.11.2. Footprint

12.11.3. Production Locations

12.11.4. Competitors & Customers

12.11.5. Subsidiaries & Parent Organization

12.11.6. Recent Developments

12.11.7. Financial Analysis

12.11.8. Revenue Share

12.12. Fraunhofer-Gesellschaft

12.12.1. Company Overview

12.12.2. Footprint

12.12.3. Production Locations

12.12.4. Competitors & Customers

12.12.5. Subsidiaries & Parent Organization

12.12.6. Recent Developments

12.12.7. Financial Analysis

12.12.8. Revenue Share

12.13. Texas Instruments Incorporated

12.13.1. Company Overview

12.13.2. Footprint

12.13.3. Production Locations

12.13.4. Competitors & Customers

12.13.5. Subsidiaries & Parent Organization

12.13.6. Recent Developments

12.13.7. Financial Analysis

12.13.8. Revenue Share

List of Tables

Table 1: Global Automotive Adaptive Front Lighting Market Volume (Million Units) Forecast, by Vehicle Type, 2017‒2031

Table 2: Global Automotive Adaptive Front Lighting Market Value (US$ Mn) Forecast, by Vehicle Type, 2017‒2031

Table 3: Global Automotive Adaptive Front Lighting Market Volume (Million Units) Forecast, by Technology, 2017‒2031

Table 4: Global Automotive Adaptive Front Lighting Market Value (US$ Mn) Forecast, by Technology, 2017‒2031

Table 5: Global Automotive Adaptive Front Lighting Market Volume (Million Units) Forecast, by Region, 2017‒2031

Table 6: Global Automotive Adaptive Front Lighting Market Value (US$ Mn) Forecast, by Region, 2017‒2031

Table 7: North America Automotive Adaptive Front Lighting Market Volume (Million Units) Forecast, by Vehicle Type, 2017‒2031

Table 8: North America Automotive Adaptive Front Lighting Market Value (US$ Mn) Forecast, by Vehicle Type, 2017‒2031

Table 9: North America Automotive Adaptive Front Lighting Market Volume (Million Units) Forecast, by Technology, 2017‒2031

Table 10: North America Automotive Adaptive Front Lighting Market Value (US$ Mn) Forecast, by Technology, 2017‒2031

Table 11: North America Automotive Adaptive Front Lighting Market Volume (Million Units) Forecast, by Country, 2017‒2031

Table 12: North America Automotive Adaptive Front Lighting Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Table 13: Europe Automotive Adaptive Front Lighting Market Volume (Million Units) Forecast, by Vehicle Type, 2017‒2031

Table 14: Europe Automotive Adaptive Front Lighting Market Value (US$ Mn) Forecast, by Vehicle Type, 2017‒2031

Table 15: Europe Automotive Adaptive Front Lighting Market Volume (Million Units) Forecast, by Technology, 2017‒2031

Table 16: Europe Automotive Adaptive Front Lighting Market Value (US$ Mn) Forecast, by Technology, 2017‒2031

Table 17: Europe Automotive Adaptive Front Lighting Market Volume (Million Units) Forecast, by Country, 2017‒2031

Table 18: Europe Automotive Adaptive Front Lighting Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Table 19: Asia Pacific Automotive Adaptive Front Lighting Market Volume (Million Units) Forecast, by Vehicle Type, 2017‒2031

Table 20: Asia Pacific Automotive Adaptive Front Lighting Market Value (US$ Mn) Forecast, by Vehicle Type, 2017‒2031

Table 21: Asia Pacific Automotive Adaptive Front Lighting Market Volume (Million Units) Forecast, by Technology, 2017‒2031

Table 22: Asia Pacific Automotive Adaptive Front Lighting Market Value (US$ Mn) Forecast, by Technology, 2017‒2031

Table 23: Asia Pacific Automotive Adaptive Front Lighting Market Volume (Million Units) Forecast, by Country, 2017‒2031

Table 24: Asia Pacific Automotive Adaptive Front Lighting Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Table 25: Middle East & Africa Automotive Adaptive Front Lighting Market Volume (Million Units) Forecast, by Vehicle Type, 2017‒2031

Table 26: Middle East & Africa Automotive Adaptive Front Lighting Market Value (US$ Mn) Forecast, by Vehicle Type, 2017‒2031

Table 27: Middle East & Africa Automotive Adaptive Front Lighting Market Volume (Million Units) Forecast, by Technology, 2017‒2031

Table 28: Middle East & Africa Automotive Adaptive Front Lighting Market Value (US$ Mn) Forecast, by Technology, 2017‒2031

Table 29: Middle East & Africa Automotive Adaptive Front Lighting Market Volume (Million Units) Forecast, by Country, 2017‒2031

Table 30: Middle East & Africa Automotive Adaptive Front Lighting Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Table 31: South America Automotive Adaptive Front Lighting Market Volume (Million Units) Forecast, by Vehicle Type, 2017‒2031

Table 32: South America Automotive Adaptive Front Lighting Market Value (US$ Mn) Forecast, by Vehicle Type, 2017‒2031

Table 33: South America Automotive Adaptive Front Lighting Market Volume (Million Units) Forecast, by Technology, 2017‒2031

Table 34: South America Automotive Adaptive Front Lighting Market Value (US$ Mn) Forecast, by Technology, 2017‒2031

Table 35: South America Automotive Adaptive Front Lighting Market Volume (Million Units) Forecast, by Country, 2017‒2031

Table 36: South America Automotive Adaptive Front Lighting Market Volume (Million Units) Forecast, by Country, 2017‒2031

List of Figures

Figure 1: Global Automotive Adaptive Front Lighting Market Volume (Million Units) Forecast, by Vehicle Type, 2017‒2031

Figure 2: Global Automotive Adaptive Front Lighting Market Value (US$ Mn) Forecast, by Vehicle Type, 2017‒2031

Figure 3: Global Automotive Adaptive Front Lighting Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2023‒2031

Figure 4: Global Automotive Adaptive Front Lighting Market Volume (Million Units) Forecast, by Technology, 2017‒2031

Figure 5: Global Automotive Adaptive Front Lighting Market Value (US$ Mn) Forecast, by Technology, 2017‒2031

Figure 6: Global Automotive Adaptive Front Lighting Market, Incremental Opportunity, by Technology, Value (US$ Mn), 2023‒2031

Figure 7: Global Automotive Adaptive Front Lighting Market Volume (Million Units) Forecast, by Region, 2017‒2031

Figure 8: Global Automotive Adaptive Front Lighting Market Value (US$ Mn) Forecast, by Region, 2017‒2031

Figure 9: Global Automotive Adaptive Front Lighting Market, Incremental Opportunity, by Region, Value (US$ Mn), 2023‒2031

Figure 10: North America Automotive Adaptive Front Lighting Market Volume (Million Units) Forecast, by Vehicle Type, 2017‒2031

Figure 11: North America Automotive Adaptive Front Lighting Market Value (US$ Mn) Forecast, by Vehicle Type, 2017‒2031

Figure 12: North America Automotive Adaptive Front Lighting Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2023‒2031

Figure 13: North America Automotive Adaptive Front Lighting Market Volume (Million Units) Forecast, by Technology, 2017‒2031

Figure 14: North America Automotive Adaptive Front Lighting Market Value (US$ Mn) Forecast, by Technology, 2017‒2031

Figure 15: North America Automotive Adaptive Front Lighting Market, Incremental Opportunity, by Technology, Value (US$ Mn), 2023‒2031

Figure 16: North America Automotive Adaptive Front Lighting Market Volume (Million Units) Forecast, by Country, 2017‒2031

Figure 17: North America Automotive Adaptive Front Lighting Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Figure 18: North America Automotive Adaptive Front Lighting Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023‒2031

Figure 19: Europe Automotive Adaptive Front Lighting Market Volume (Million Units) Forecast, by Vehicle Type, 2017‒2031

Figure 20: Europe Automotive Adaptive Front Lighting Market Value (US$ Mn) Forecast, by Vehicle Type, 2017‒2031

Figure 21: Europe Automotive Adaptive Front Lighting Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2023‒2031

Figure 22: Europe Automotive Adaptive Front Lighting Market Volume (Million Units) Forecast, by Technology, 2017‒2031

Figure 23: Europe Automotive Adaptive Front Lighting Market Value (US$ Mn) Forecast, by Technology, 2017‒2031

Figure 24: Europe Automotive Adaptive Front Lighting Market, Incremental Opportunity, by Technology, Value (US$ Mn), 2023‒2031

Figure 25: Europe Automotive Adaptive Front Lighting Market Volume (Million Units) Forecast, by Country, 2017‒2031

Figure 26: Europe Automotive Adaptive Front Lighting Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Figure 27: Europe Automotive Adaptive Front Lighting Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023‒2031

Figure 28: Asia Pacific Automotive Adaptive Front Lighting Market Volume (Million Units) Forecast, by Vehicle Type, 2017‒2031

Figure 29: Asia Pacific Automotive Adaptive Front Lighting Market Value (US$ Mn) Forecast, by Vehicle Type, 2017‒2031

Figure 30: Asia Pacific Automotive Adaptive Front Lighting Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2023‒2031

Figure 31: Asia Pacific Automotive Adaptive Front Lighting Market Volume (Million Units) Forecast, by Technology, 2017‒2031

Figure 32: Asia Pacific Automotive Adaptive Front Lighting Market Value (US$ Mn) Forecast, by Technology, 2017‒2031

Figure 33: Asia Pacific Automotive Adaptive Front Lighting Market, Incremental Opportunity, by Technology, Value (US$ Mn), 2023‒2031

Figure 34: Asia Pacific Automotive Adaptive Front Lighting Market Volume (Million Units) Forecast, by Country, 2017‒2031

Figure 35: Asia Pacific Automotive Adaptive Front Lighting Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Figure 36: Asia Pacific Automotive Adaptive Front Lighting Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023‒2031

Figure 37: Middle East & Africa Automotive Adaptive Front Lighting Market Volume (Million Units) Forecast, by Vehicle Type, 2017‒2031

Figure 38: Middle East & Africa Automotive Adaptive Front Lighting Market Value (US$ Mn) Forecast, by Vehicle Type, 2017‒2031

Figure 39: Middle East & Africa Automotive Adaptive Front Lighting Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2023‒2031

Figure 40: Middle East & Africa Automotive Adaptive Front Lighting Market Volume (Million Units) Forecast, by Technology, 2017‒2031

Figure 41: Middle East & Africa Automotive Adaptive Front Lighting Market Value (US$ Mn) Forecast, by Technology, 2017‒2031

Figure 42: Middle East & Africa Automotive Adaptive Front Lighting Market, Incremental Opportunity, by Technology, Value (US$ Mn), 2023‒2031

Figure 43: Middle East & Africa Automotive Adaptive Front Lighting Market Volume (Million Units) Forecast, by Country, 2017‒2031

Figure 44: Middle East & Africa Automotive Adaptive Front Lighting Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Figure 45: Middle East & Africa Automotive Adaptive Front Lighting Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023‒2031

Figure 46: South America Automotive Adaptive Front Lighting Market Volume (Million Units) Forecast, by Vehicle Type, 2017‒2031

Figure 47: South America Automotive Adaptive Front Lighting Market Value (US$ Mn) Forecast, by Vehicle Type, 2017‒2031

Figure 48: South America Automotive Adaptive Front Lighting Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2023‒2031

Figure 49: South America Automotive Adaptive Front Lighting Market Volume (Million Units) Forecast, by Technology, 2017‒2031

Figure 50: South America Automotive Adaptive Front Lighting Market Value (US$ Mn) Forecast, by Technology, 2017‒2031

Figure 51: South America Automotive Adaptive Front Lighting Market, Incremental Opportunity, by Technology, Value (US$ Mn), 2023‒2031

Figure 52: South America Automotive Adaptive Front Lighting Market Volume (Million Units) Forecast, by Country, 2017‒2031

Figure 53: South America Automotive Adaptive Front Lighting Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Figure 54: South America Automotive Adaptive Front Lighting Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023‒2031