Analysts’ Viewpoint on Market Scenario

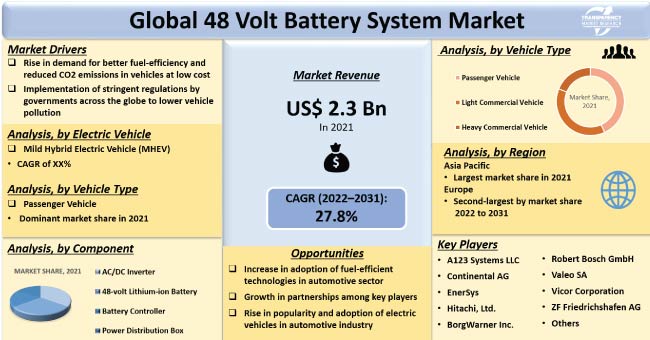

The automobile industry is promoting the electrification of the powertrain for vehicles to comply with the fuel economy regulations that are being enforced around the world. 48-volt battery systems help run internal combustion engines more efficiently and provide greater fuel economy and reduced emissions at a relatively low cost. This is augmenting the global 48 volt battery system market during the forecast period.

Furthermore, research & development initiatives can be taken up by market players to further upgrade the performance of battery systems. These 48V battery systems have the potential to reduce CO2 emissions over the next several years at a cost that is affordable to a wider section of customers. Major automotive manufacturers are integrating 48 volt battery systems in vehicles to improve performance and gain tremendous growth opportunities.

Demand for 48 volt battery management systems is increasing among automakers across the globe. The 48 volt technology enables the power management system of a vehicle to absorb more kinetic energy from braking and convert it into electricity, as well as to switch between using the electric motor as a generator. It uses a combination of an internal combustion engine and an electric motor to improve vehicle efficiency in several ways, including turning off the engine at idle, using the electric motor as a generator to recapture energy lost to braking, and replacing mechanical components with electrical components.

Moreover, the utilization of 48 volt battery backup systems enables the integration of numerous components into the powertrain, where the electrified powertrain components are integrated with a conventional internal combustion engine system. The intermediate technology can improve traditional powertrains by replacing the alternator with reversible 48V electric machine and adding 48V battery. This increases fuel efficiency in vehicles such as cars, trucks, and buses with an optimal balance of the powertrain components.

Governments across the globe are enacting stringent regulations to lower vehicle pollution and CO2 emissions, which is anticipated to offer significant opportunities for market players during the forecast period. Increase in adoption of 48 volt lithium battery packs that minimize resistive loss of energy, allows higher currents, and greater power delivery, is expected to increase the global 48 volt battery system market share in the near future.

Surge in demand for fuel efficiency and increased vehicle performance at a much lower cost among consumers is expected to assist the advancement of 48 volt systems in the automotive industry during the forecast period. Automakers in China, Europe, North America, and other nations are significantly focusing on reduction of CO2 emissions by lowering fuel consumption. The shift to 48 volt systems allows higher currents and enables greater power delivery, while offering excellent safety and durability. The primary advantage of these systems is that they are cost-efficient and help comply with the regulatory requirements for CO2 emissions.

Governments around the world are implementing stringent regulations to reduce pollution emitted from vehicles. Automakers are focused on the development of various electrified vehicles to improve fuel economy, in order to abide by emission standards. Several government bodies across the globe support the adoption and integration of EVs.

Moreover, 48 volt battery systems in modern vehicles are different from a conventional IC engine vehicle at the fundamental level in terms of design, performance, durability, and safety. Implementation of 48 volt battery systems is likely to offer lucrative opportunities for market players in the near future. Therefore, stringent government norms and favorable policies are expected to fuel global market progress during the forecast period.

In terms of electric vehicle, the mild hybrid electric vehicle (MHEV) segment is anticipated to dominate the global 48 volt battery system market during the forecast period. Rise in implementation of 48V battery system in mild hybrid vehicles is augmenting segment growth, as its components work in parallel with the combustion engine in MHEVs.

These improvements further enable the mild hybrid vehicle to have increased acceleration, quiet start-stop, near-silent electric take-off, and other improved driver experiences at less than half the cost and effort compared to the strong hybrids. Additionally, rise in stringent emission regulations is also expected to further promote the adoption of 48 volt battery systems in MHEVs in the next few years.

Based on vehicle type, the passenger vehicle segment is expected to hold dominant share of the global 48 volt battery system industry during the forecast period. It is the fastest-growing vehicle type in the automobile sector. Various initiatives by several governments to produce low-emission vehicles to meet the impending regulations and support the development of comprehensive charging infrastructure are likely to drive the passenger vehicle segment in the near future. Implementation of advanced technologies and rise in demand for fuel-efficient, safe, and reliable vehicles are estimated to augment the demand for passenger vehicles in the next few years.

The 48 volt battery system business in Asia Pacific is projected to grow at a rapid pace during the forecast period, as manufacturers in the region are introducing new materials and technologies to further increase their production capacity. Furthermore, rise in demand for 48 volt mild hybrid vehicles from consumers is projected to fuel market development in the region.

In terms of share, the market in Asia Pacific is likely to be followed by the market in North America and Europe. This is majorly due to the increase in demand for hybrid electric vehicles in these regions. Stringent emission norms, higher consumer affordability, introduction of tax benefits and subsidies from regulatory bodies in these regions are expected to prompt manufacturers to invest in R&D. This is estimated to enhance product design and quality of the 48 volt battery systems during the forecast period.

The global 48 volt battery system market is fragmented with a large number of technology providers controlling the market share and major companies possessing the potential to increase the pace of growth by the way of adoption of innovative developments. Expansion of product portfolios and mergers and acquisitions are major strategies adopted by key players. Tier one suppliers and OEMs in the automotive industry are keen to adopt 48V systems in conventional vehicles.

Some of the key players operating in the market across the globe are A123 Systems LLC, Continental AG, Delphi technologies, East Penn Manufacturing Company, EnerSys, Furukawa Electric Co. Ltd., GS Yuasa Corporation, Hitachi, Ltd., Johnson Controls International Plc, BorgWarner Inc., Robert Bosch GmbH, Valeo SA, Vicor Corporation, and ZF Friedrichshafen AG.

Key players have been profiled in the market research report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

Global 48 Volt Battery System Market

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 2.3 Bn |

|

Market Forecast Value in 2031 |

US$ 27.0 Bn |

|

Growth Rate (CAGR) |

27.8% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value and Million Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The market was valued at US$ 2.3 Bn in 2021.

It is expected to advance at a CAGR of 27.8% by 2031.

The market would be worth US$ 27.0 Bn in 2031.

Implementation of stringent regulations by governments across the globe to lower vehicle pollution and rise in demand for better fuel-efficiency and reduced CO2 emissions in vehicles at low cost.

The passenger vehicle segment held largest share of the market in 2021.

Asia Pacific is the most lucrative region of the global market.

A123 Systems LLC, Continental AG, Delphi technologies, East Penn Manufacturing Company, EnerSys, Furukawa Electric Co. Ltd., GS Yuasa Corporation, Hitachi, Ltd., Johnson Controls International Plc, BorgWarner Inc., Robert Bosch GmbH, Valeo SA, Vicor Corporation, and ZF Friedrichshafen AG.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global 48 Volt Battery System Market

3.1. Global 48 Volt Battery System Market Size, Million Units, US$ Bn, 2017-2031

4. Market Overview

4.1. Overview

4.2. Technology Roadmap for 48V Battery System

4.3. Key Trend Analysis

4.4. Market Dynamics

4.4.1. Drivers

4.4.2. Restraints

4.5. Opportunity

4.6. Porter’s Five Force Analysis

4.7. Value Chain Analysis

4.7.1. List of Key Manufacturers

4.7.2. List of Customers

4.7.3. Level of Integration

4.8. Regulatory Scenario

4.9. SWOT Analysis

5. Global 48 Volt Battery System Market: Business Case Study

6. 48 Volt Battery System: Ecosystem Mapping

7. Global 48 Volt Battery System Market Analysis and Forecast, by Component

7.1. Introduction & Definition

7.2. Key Findings

7.3. 48 Volt Battery System Volume (Million Units) & Value (US$ Bn) Forecast, by Component, 2017-2031

7.3.1. AC/DC Inverter

7.3.2. 48-volt Lithium-ion Battery

7.3.3. Battery Controller

7.3.4. Power Distribution Box

8. Global 48 Volt Battery System Market Analysis and Forecast, by Electric Vehicle

8.1. Introduction & Definition

8.2. Key Findings

8.3. 48 Volt Battery System Volume (Million Units) & Value (US$ Bn) Forecast, by Electric Vehicle, 2017-2031

8.3.1. Battery Electric Vehicle (BEV)

8.3.2. Mild Hybrid Electric Vehicle (MHEV)

8.3.3. Plug-in Hybrid Vehicle (PHEV)

8.3.4. Hybrid Electric Vehicle (HEV)

8.4. 48 Volt Battery System Volume (Million Units) & Value (US$ Bn) Forecast, by Vehicle, 2017-2031

8.4.1. Passenger Vehicle

8.4.2. Light Commercial Vehicle

8.4.3. Heavy Commercial Vehicle

9. Global 48 Volt Battery System Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. 48 Volt Battery System Volume (Million Units) & Value (US$ Bn) Forecast, by Region, 2017-2031

9.2.1. North America

9.2.2. Latin America

9.2.3. Europe

9.2.4. Asia Pacific

9.2.5. Middle East & Africa

9.3. 48 Volt Battery System Market Attractiveness Analysis By Region

10. North America 48 Volt Battery System Market Size and Forecast (US$ Bn), 2017-2031

10.1. Key Findings

10.2. North America Market, by Component

10.2.1. AC/DC Inverter

10.2.2. 48-volt Lithium-ion Battery

10.2.3. Battery Controller

10.2.4. Power Distribution Box

10.3. North America Market, by Electric Vehicle

10.3.1. Battery Electric Vehicle (BEV)

10.3.2. Mild Hybrid Electric Vehicle (MHEV)

10.3.3. Plug-in Hybrid Vehicle (PHEV)

10.3.4. Hybrid Electric Vehicle (HEV)

10.4. North America Market, by Vehicle

10.4.1. Passenger Vehicle

10.4.2. Light Commercial Vehicle

10.4.3. Heavy Commercial Vehicle

10.5. North America Market Size & Forecast, by Country

10.5.1. U.S.

10.5.2. Canada

10.6. U.S. Market, by Component

10.6.1. AC/DC Inverter

10.6.2. 48-volt Lithium-ion Battery

10.6.3. Battery Controller

10.6.4. Power Distribution Box

10.7. U.S. Market, by Electric Vehicle

10.7.1. Battery Electric Vehicle (BEV)

10.7.2. Mild Hybrid Electric Vehicle (MHEV)

10.7.3. Plug-in Hybrid Vehicle (PHEV)

10.7.4. Hybrid Electric Vehicle (HEV)

10.8. U.S. Market, by Vehicle

10.8.1. Passenger Vehicle

10.8.2. Light Commercial Vehicle

10.8.3. Heavy Commercial Vehicle

10.9. Canada Market, by Component

10.9.1. AC/DC Inverter

10.9.2. 48-volt Lithium-ion Battery

10.9.3. Battery Controller

10.9.4. Power Distribution Box

10.10. Canada Market, by Electric Vehicle

10.10.1. Battery Electric Vehicle (BEV)

10.10.2. Mild Hybrid Electric Vehicle (MHEV)

10.10.3. Plug-in Hybrid Vehicle (PHEV)

10.10.4. Hybrid Electric Vehicle (HEV)

10.11. Canada Market, by Vehicle

10.11.1. Passenger Vehicle

10.11.2. Light Commercial Vehicle

10.11.3. Heavy Commercial Vehicle

10.12. North America 48 Volt Battery System Market: PEST Analysis

11. Latin America 48 Volt Battery System Market Size and Forecast (US$ Bn), 2017-2031

11.1. Key Findings

11.2. Latin America Market, by Component

11.2.1. AC/DC Inverter

11.2.2. 48-volt Lithium-ion Battery

11.2.3. Battery Controller

11.2.4. Power Distribution Box

11.3. Latin America Market, by Electric Vehicle

11.3.1. Battery Electric Vehicle (BEV)

11.3.2. Mild Hybrid Electric Vehicle (MHEV)

11.3.3. Plug-in Hybrid Vehicle (PHEV)

11.3.4. Hybrid Electric Vehicle (HEV)

11.4. Latin America Market, by Vehicle

11.4.1. Passenger Vehicle

11.4.2. Light Commercial Vehicle

11.4.3. Heavy Commercial Vehicle

11.5. Latin America Market Size & Forecast, by Country

11.5.1. Brazil

11.5.2. Mexico

11.5.3. Rest of Latin America

11.6. Brazil Market, by Component

11.6.1. AC/DC Inverter

11.6.2. 48-volt Lithium-ion Battery

11.6.3. Battery Controller

11.6.4. Power Distribution Box

11.7. Brazil Market, by Electric Vehicle

11.7.1. Battery Electric Vehicle (BEV)

11.7.2. Mild Hybrid Electric Vehicle (MHEV)

11.7.3. Plug-in Hybrid Vehicle (PHEV)

11.7.4. Hybrid Electric Vehicle (HEV)

11.8. Brazil Market, by Vehicle

11.8.1. Passenger Vehicle

11.8.2. Light Commercial Vehicle

11.8.3. Heavy Commercial Vehicle

11.9. Mexico Market, by Component

11.9.1. AC/DC Inverter

11.9.2. 48-volt Lithium-ion Battery

11.9.3. Battery Controller

11.9.4. Power Distribution Box

11.10. Mexico Market, by Electric Vehicle

11.10.1. Battery Electric Vehicle (BEV)

11.10.2. Mild Hybrid Electric Vehicle (MHEV)

11.10.3. Plug-in Hybrid Vehicle (PHEV)

11.10.4. Hybrid Electric Vehicle (HEV)

11.11. Mexico Market, by Vehicle

11.11.1. Passenger Vehicle

11.11.2. Light Commercial Vehicle

11.11.3. Heavy Commercial Vehicle

11.12. Rest of Latin America Market, by Component

11.12.1. AC/DC Inverter

11.12.2. 48-volt Lithium-ion Battery

11.12.3. Battery Controller

11.12.4. Power Distribution Box

11.13. Rest of Latin America Market, by Electric Vehicle

11.13.1. Battery Electric Vehicle (BEV)

11.13.2. Mild Hybrid Electric Vehicle (MHEV)

11.13.3. Plug-in Hybrid Vehicle (PHEV)

11.13.4. Hybrid Electric Vehicle (HEV)

11.14. Rest of Latin America Market, by Vehicle

11.14.1. Passenger Vehicle

11.14.2. Light Commercial Vehicle

11.14.3. Heavy Commercial Vehicle

11.15. Latin America 48 Volt Battery System Market: PEST Analysis

12. Europe 48 Volt Battery System Market Size and Forecast (US$ Bn), 2017-2031

12.1. Key Findings

12.2. Europe Market, by Component

12.2.1. AC/DC Inverter

12.2.2. 48-volt Lithium-ion Battery

12.2.3. Battery Controller

12.2.4. Power Distribution Box

12.3. Europe Market, by Electric Vehicle

12.3.1. Battery Electric Vehicle (BEV)

12.3.2. Mild Hybrid Electric Vehicle (MHEV)

12.3.3. Plug-in Hybrid Vehicle (PHEV)

12.3.4. Hybrid Electric Vehicle (HEV)

12.4. Europe Market, by Vehicle

12.4.1. Passenger Vehicle

12.4.2. Light Commercial Vehicle

12.4.3. Heavy Commercial Vehicle

12.5. Europe Market Size & Forecast, by Country

12.5.1. Germany

12.5.2. U.K.

12.5.3. France

12.5.4. Italy

12.5.5. Spain

12.5.6. Rest of Europe

12.6. Germany Market, by Component

12.6.1. AC/DC Inverter

12.6.2. 48-volt Lithium-ion Battery

12.6.3. Battery Controller

12.6.4. Power Distribution Box

12.7. Germany Market, by Electric Vehicle

12.7.1. Battery Electric Vehicle (BEV)

12.7.2. Mild Hybrid Electric Vehicle (MHEV)

12.7.3. Plug-in Hybrid Vehicle (PHEV)

12.7.4. Hybrid Electric Vehicle (HEV)

12.8. Germany Market, by Vehicle

12.8.1. Passenger Vehicle

12.8.2. Light Commercial Vehicle

12.8.3. Heavy Commercial Vehicle

12.9. U.K. Market, by Component

12.9.1. AC/DC Inverter

12.9.2. 48-volt Lithium-ion Battery

12.9.3. Battery Controller

12.9.4. Power Distribution Box

12.10. U.K. Market, by Electric Vehicle

12.10.1. Battery Electric Vehicle (BEV)

12.10.2. Mild Hybrid Electric Vehicle (MHEV)

12.10.3. Plug-in Hybrid Vehicle (PHEV)

12.10.4. Hybrid Electric Vehicle (HEV)

12.11. U.K. Market, by Vehicle

12.11.1. Passenger Vehicle

12.11.2. Light Commercial Vehicle

12.11.3. Heavy Commercial Vehicle

12.12. France Market, by Component

12.12.1. AC/DC Inverter

12.12.2. 48-volt Lithium-ion Battery

12.12.3. Battery Controller

12.12.4. Power Distribution Box

12.13. France Market, by Electric Vehicle

12.13.1. Battery Electric Vehicle (BEV)

12.13.2. Mild Hybrid Electric Vehicle (MHEV)

12.13.3. Plug-in Hybrid Vehicle (PHEV)

12.13.4. Hybrid Electric Vehicle (HEV)

12.14. France Market, by Vehicle

12.14.1. Passenger Vehicle

12.14.2. Light Commercial Vehicle

12.14.3. Heavy Commercial Vehicle

12.15. Italy Market, by Component

12.15.1. AC/DC Inverter

12.15.2. 48-volt Lithium-ion Battery

12.15.3. Battery Controller

12.15.4. Power Distribution Box

12.16. Italy Market, by Electric Vehicle

12.16.1. Battery Electric Vehicle (BEV)

12.16.2. Mild Hybrid Electric Vehicle (MHEV)

12.16.3. Plug-in Hybrid Vehicle (PHEV)

12.16.4. Hybrid Electric Vehicle (HEV)

12.17. Italy Market, by Vehicle

12.17.1. Passenger Vehicle

12.17.2. Light Commercial Vehicle

12.17.3. Heavy Commercial Vehicle

12.18. Spain Market, by Component

12.18.1. AC/DC Inverter

12.18.2. 48-volt Lithium-ion Battery

12.18.3. Battery Controller

12.18.4. Power Distribution Box

12.19. Spain Market, by Electric Vehicle

12.19.1. Battery Electric Vehicle (BEV)

12.19.2. Mild Hybrid Electric Vehicle (MHEV)

12.19.3. Plug-in Hybrid Vehicle (PHEV)

12.19.4. Hybrid Electric Vehicle (HEV)

12.20. Spain Market, by Vehicle

12.20.1. Passenger Vehicle

12.20.2. Light Commercial Vehicle

12.20.3. Heavy Commercial Vehicle

12.21. Rest of Europe Market, by Component

12.21.1. AC/DC Inverter

12.21.2. 48-volt Lithium-ion Battery

12.21.3. Battery Controller

12.21.4. Power Distribution Box

12.22. Rest of Europe Market, by Electric Vehicle

12.22.1. Battery Electric Vehicle (BEV)

12.22.2. Mild Hybrid Electric Vehicle (MHEV)

12.22.3. Plug-in Hybrid Vehicle (PHEV)

12.22.4. Hybrid Electric Vehicle (HEV)

12.23. Rest of Europe Market, by Vehicle

12.23.1. Passenger Vehicle

12.23.2. Light Commercial Vehicle

12.23.3. Heavy Commercial Vehicle

12.24. Europe 48 Volt Battery System Market: PEST Analysis

13. Asia Pacific 48 Volt Battery System Market Size and Forecast (US$ Bn), 2017-2031

13.1. Key Findings

13.2. Asia Pacific Market, by Component

13.2.1. AC/DC Inverter

13.2.2. 48-volt Lithium-ion Battery

13.2.3. Battery Controller

13.2.4. Power Distribution Box

13.3. Asia Pacific Market, by Electric Vehicle

13.3.1. Battery Electric Vehicle (BEV)

13.3.2. Mild Hybrid Electric Vehicle (MHEV)

13.3.3. Plug-in Hybrid Vehicle (PHEV)

13.3.4. Hybrid Electric Vehicle (HEV)

13.4. Asia Pacific Market, by Vehicle

13.4.1. Passenger Vehicle

13.4.2. Light Commercial Vehicle

13.4.3. Heavy Commercial Vehicle

13.5. Asia Pacific Market Size & Forecast, by Country

13.5.1. China

13.5.2. India

13.5.3. Japan

13.5.4. South Korea

13.5.5. ASEAN

13.5.6. Rest of Asia Pacific

13.6. China Market, by Component

13.6.1. AC/DC Inverter

13.6.2. 48-volt Lithium-ion Battery

13.6.3. Battery Controller

13.6.4. Power Distribution Box

13.7. China Market, by Electric Vehicle

13.7.1. Battery Electric Vehicle (BEV)

13.7.2. Mild Hybrid Electric Vehicle (MHEV)

13.7.3. Plug-in Hybrid Vehicle (PHEV)

13.7.4. Hybrid Electric Vehicle (HEV)

13.8. China Market, by Vehicle

13.8.1. Passenger Vehicle

13.8.2. Light Commercial Vehicle

13.8.3. Heavy Commercial Vehicle

13.9. India Market, by Component

13.9.1. AC/DC Inverter

13.9.2. 48-volt Lithium-ion Battery

13.9.3. Battery Controller

13.9.4. Power Distribution Box

13.10. India Market, by Electric Vehicle

13.10.1. Battery Electric Vehicle (BEV)

13.10.2. Mild Hybrid Electric Vehicle (MHEV)

13.10.3. Plug-in Hybrid Vehicle (PHEV)

13.10.4. Hybrid Electric Vehicle (HEV)

13.11. India Market, by Vehicle

13.11.1. Passenger Vehicle

13.11.2. Light Commercial Vehicle

13.11.3. Heavy Commercial Vehicle

13.12. Japan Market, by Component

13.12.1. AC/DC Inverter

13.12.2. 48-volt Lithium-ion Battery

13.12.3. Battery Controller

13.12.4. Power Distribution Box

13.13. Japan Market, by Electric Vehicle

13.13.1. Battery Electric Vehicle (BEV)

13.13.2. Mild Hybrid Electric Vehicle (MHEV)

13.13.3. Plug-in Hybrid Vehicle (PHEV)

13.13.4. Hybrid Electric Vehicle (HEV)

13.14. Japan Market, by Vehicle

13.14.1. Passenger Vehicle

13.14.2. Light Commercial Vehicle

13.14.3. Heavy Commercial Vehicle

13.15. South Korea Market, by Component

13.15.1. AC/DC Inverter

13.15.2. 48-volt Lithium-ion Battery

13.15.3. Battery Controller

13.15.4. Power Distribution Box

13.16. South Korea Market, by Electric Vehicle

13.16.1. Battery Electric Vehicle (BEV)

13.16.2. Mild Hybrid Electric Vehicle (MHEV)

13.16.3. Plug-in Hybrid Vehicle (PHEV)

13.16.4. Hybrid Electric Vehicle (HEV)

13.17. South Korea Market, by Vehicle

13.17.1. Passenger Vehicle

13.17.2. Light Commercial Vehicle

13.17.3. Heavy Commercial Vehicle

13.18. ASEAN Market, by Component

13.18.1. AC/DC Inverter

13.18.2. 48-volt Lithium-ion Battery

13.18.3. Battery Controller

13.18.4. Power Distribution Box

13.19. ASEAN Market, by Electric Vehicle

13.19.1. Battery Electric Vehicle (BEV)

13.19.2. Mild Hybrid Electric Vehicle (MHEV)

13.19.3. Plug-in Hybrid Vehicle (PHEV)

13.19.4. Hybrid Electric Vehicle (HEV)

13.20. ASEAN Market, by Vehicle

13.20.1. Passenger Vehicle

13.20.2. Light Commercial Vehicle

13.20.3. Heavy Commercial Vehicle

13.21. Rest of Asia Pacific Market, by Component

13.21.1. AC/DC Inverter

13.21.2. 48-volt Lithium-ion Battery

13.21.3. Battery Controller

13.21.4. Power Distribution Box

13.22. Rest of Asia Pacific Market, by Electric Vehicle

13.22.1. Battery Electric Vehicle (BEV)

13.22.2. Mild Hybrid Electric Vehicle (MHEV)

13.22.3. Plug-in Hybrid Vehicle (PHEV)

13.22.4. Hybrid Electric Vehicle (HEV)

13.23. Rest of Asia Pacific Market, by Vehicle

13.23.1. Passenger Vehicle

13.23.2. Light Commercial Vehicle

13.23.3. Heavy Commercial Vehicle

13.23.4. Buses & Coaches

13.24. Asia Pacific 48 Volt Battery System Market: PEST Analysis

14. Middle East & Africa 48 Volt Battery System Market Size and Forecast (US$ Bn), 2017-2031

14.1. Key Findings

14.2. Middle East & Africa Market, by Component

14.2.1. AC/DC Inverter

14.2.2. 48-volt Lithium-ion Battery

14.2.3. Battery Controller

14.2.4. Power Distribution Box

14.3. Middle East & Africa Market, by Electric Vehicle

14.3.1. Battery Electric Vehicle (BEV)

14.3.2. Mild Hybrid Electric Vehicle (MHEV)

14.3.3. Plug-in Hybrid Vehicle (PHEV)

14.3.4. Hybrid Electric Vehicle (HEV)

14.4. Middle East & Africa Market, by Vehicle

14.4.1. Passenger Vehicle

14.4.2. Light Commercial Vehicle

14.4.3. Heavy Commercial Vehicle

14.5. Middle East & Africa Market Size & Forecast, by Country

14.5.1. GCC

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. GCC Market, by Component

14.6.1. AC/DC Inverter

14.6.2. 48-volt Lithium-ion Battery

14.6.3. Battery Controller

14.6.4. Power Distribution Box

14.7. GCC Market, by Electric Vehicle

14.7.1. Battery Electric Vehicle (BEV)

14.7.2. Mild Hybrid Electric Vehicle (MHEV)

14.7.3. Plug-in Hybrid Vehicle (PHEV)

14.7.4. Hybrid Electric Vehicle (HEV)

14.8. GCC Market, by Vehicle

14.8.1. Passenger Vehicle

14.8.2. Light Commercial Vehicle

14.8.3. Heavy Commercial Vehicle

14.9. South Africa Market, by Component

14.9.1. AC/DC Inverter

14.9.2. 48-volt Lithium-ion Battery

14.9.3. Battery Controller

14.9.4. Power Distribution Box

14.10. South Africa Market, by Electric Vehicle

14.10.1. Battery Electric Vehicle (BEV)

14.10.2. Mild Hybrid Electric Vehicle (MHEV)

14.10.3. Plug-in Hybrid Vehicle (PHEV)

14.10.4. Hybrid Electric Vehicle (HEV)

14.11. South Africa Market, by Vehicle

14.11.1. Passenger Vehicle

14.11.2. Light Commercial Vehicle

14.11.3. Heavy Commercial Vehicle

14.12. Rest of Middle East & Africa Market, by Component

14.12.1. AC/DC Inverter

14.12.2. 48-volt Lithium-ion Battery

14.12.3. Battery Controller

14.12.4. Power Distribution Box

14.13. Rest of Middle East & Africa Market, by Electric Vehicle

14.13.1. Battery Electric Vehicle (BEV)

14.13.2. Mild Hybrid Electric Vehicle (MHEV)

14.13.3. Plug-in Hybrid Vehicle (PHEV)

14.13.4. Hybrid Electric Vehicle (HEV)

14.14. Rest of Middle East & Africa Market, by Vehicle

14.14.1. Passenger Vehicle

14.14.2. Light Commercial Vehicle

14.14.3. Heavy Commercial Vehicle

14.15. Middle East & Africa 48 Volt Battery System Market: PEST Analysis

15. Competition Landscape

15.1. Market Share Analysis By Company (2017)

15.2. Market Player – Competition Matrix (By Tier and Size of companies)

15.3. Company Financials

15.4. Executive Bios/ Key Executive Changes

15.5. Key Market Players (Details – Overview, Overall Volume (Million Units) & Revenue, Recent Developments, Strategy)

15.5.1. A123 Systems LLC

15.5.1.1. Overview

15.5.1.2. Overall Volume (Million Units) & Revenue

15.5.1.3. Recent Developments

15.5.1.4. Strategy

15.5.2. Continental AG

15.5.2.1. Overview

15.5.2.2. Overall Volume (Million Units) & Revenue

15.5.2.3. Recent Developments

15.5.2.4. Strategy

15.5.3. Delphi technologies

15.5.3.1. Overview

15.5.3.2. Overall Volume (Million Units) & Revenue

15.5.3.3. Recent Developments

15.5.3.4. Strategy

15.5.4. East Penn Manufacturing Company

15.5.4.1. Overview

15.5.4.2. Overall Volume (Million Units) & Revenue

15.5.4.3. Recent Developments

15.5.4.4. Strategy

15.5.5. EnerSys

15.5.5.1. Overview

15.5.5.2. Overall Volume (Million Units) & Revenue

15.5.5.3. Recent Developments

15.5.5.4. Strategy

15.5.6. Furukawa Electric Co. Ltd.

15.5.6.1. Overview

15.5.6.2. Overall Volume (Million Units) & Revenue

15.5.6.3. Recent Developments

15.5.6.4. Strategy

15.5.7. GS Yuasa Corporation

15.5.7.1. Overview

15.5.7.2. Overall Volume (Million Units) & Revenue

15.5.7.3. Recent Developments

15.5.7.4. Strategy

15.5.8. Hitachi, Ltd.

15.5.8.1. Overview

15.5.8.2. Overall Volume (Million Units) & Revenue

15.5.8.3. Recent Developments

15.5.8.4. Strategy

15.5.9. Johnson Controls International Plc

15.5.9.1. Overview

15.5.9.2. Overall Volume (Million Units) & Revenue

15.5.9.3. Recent Developments

15.5.9.4. Strategy

15.5.10. BorgWarner Inc.

15.5.10.1. Overview

15.5.10.2. Overall Volume (Million Units) & Revenue

15.5.10.3. Recent Developments

15.5.10.4. Strategy

15.5.11. Robert Bosch GmbH

15.5.11.1. Overview

15.5.11.2. Overall Volume (Million Units) & Revenue

15.5.11.3. Recent Developments

15.5.11.4. Strategy

15.5.12. Valeo SA

15.5.12.1. Overview

15.5.12.2. Overall Volume (Million Units) & Revenue

15.5.12.3. Recent Developments

15.5.12.4. Strategy

15.5.13. Vicor Corporation

15.5.13.1. Overview

15.5.13.2. Overall Volume (Million Units) & Revenue

15.5.13.3. Recent Developments

15.5.13.4. Strategy

15.5.14. ZF Friedrichshafen AG

15.5.14.1. Overview

15.5.14.2. Overall Volume (Million Units) & Revenue

15.5.14.3. Recent Developments

15.5.14.4. Strategy

List of Tables

Table 1: Global 48 Volt Battery System Market Volume (Million Units) Forecast, by Component, 2017-2031

Table 2: Global 48 Volt Battery System Market Value (US$ Bn) Forecast, by Component, 2017-2031

Table 3: Global 48 Volt Battery System Market Volume (Million Units) Forecast, by Electric Vehicle, 2017-2031

Table 4: Global 48 Volt Battery System Market Value (US$ Bn) Forecast, by Electric Vehicle, 2017-2031

Table 5: Global 48 Volt Battery System Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Table 6: Global 48 Volt Battery System Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 7: Global 48 Volt Battery System Market Volume (Million Units) Forecast, by Region, 2017-2031

Table 8: Global 48 Volt Battery System Market Value (US$ Bn) Forecast, by Region, 2017-2031

Table 9: North America 48 Volt Battery System Market Volume (Million Units) Forecast, by Component, 2017-2031

Table 10: North America 48 Volt Battery System Market Value (US$ Bn) Forecast, by Component, 2017-2031

Table 11: North America 48 Volt Battery System Market Volume (Million Units) Forecast, by Electric Vehicle, 2017-2031

Table 12: North America 48 Volt Battery System Market Value (US$ Bn) Forecast, by Electric Vehicle, 2017-2031

Table 13: North America 48 Volt Battery System Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Table 14: North America 48 Volt Battery System Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 15: North America 48 Volt Battery System Market Volume (Million Units) Forecast, by Country, 2017-2031

Table 16: North America 48 Volt Battery System Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 17: Latin America 48 Volt Battery System Market Volume (Million Units) Forecast, by Component, 2017-2031

Table 18: Latin America 48 Volt Battery System Market Value (US$ Bn) Forecast, by Component, 2017-2031

Table 19: Latin America 48 Volt Battery System Market Volume (Million Units) Forecast, by Electric Vehicle, 2017-2031

Table 20: Latin America 48 Volt Battery System Market Value (US$ Bn) Forecast, by Electric Vehicle, 2017-2031

Table 21: Latin America 48 Volt Battery System Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Table 22: Latin America 48 Volt Battery System Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 23: Latin America 48 Volt Battery System Market Volume (Million Units) Forecast, by Country, 2017-2031

Table 24: Latin America 48 Volt Battery System Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 25: Europe 48 Volt Battery System Market Volume (Million Units) Forecast, by Component, 2017-2031

Table 26: Europe 48 Volt Battery System Market Value (US$ Bn) Forecast, by Component, 2017-2031

Table 27: Europe 48 Volt Battery System Market Volume (Million Units) Forecast, by Electric Vehicle, 2017-2031

Table 28: Europe 48 Volt Battery System Market Value (US$ Bn) Forecast, by Electric Vehicle, 2017-2031

Table 29: Europe 48 Volt Battery System Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Table 30: Europe 48 Volt Battery System Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 31: Europe 48 Volt Battery System Market Volume (Million Units) Forecast, by Country, 2017-2031

Table 32: Europe 48 Volt Battery System Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 33: Asia Pacific 48 Volt Battery System Market Volume (Million Units) Forecast, by Component, 2017-2031

Table 34: Asia Pacific 48 Volt Battery System Market Value (US$ Bn) Forecast, by Component, 2017-2031

Table 35: Asia Pacific 48 Volt Battery System Market Volume (Million Units) Forecast, by Electric Vehicle, 2017-2031

Table 36: Asia Pacific 48 Volt Battery System Market Value (US$ Bn) Forecast, by Electric Vehicle, 2017-2031

Table 37: Asia Pacific 48 Volt Battery System Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Table 38: Asia Pacific 48 Volt Battery System Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 39: Asia Pacific 48 Volt Battery System Market Volume (Million Units) Forecast, by Country, 2017-2031

Table 40: Asia Pacific 48 Volt Battery System Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 41: Middle East & Africa 48 Volt Battery System Market Volume (Million Units) Forecast, by Component, 2017-2031

Table 42: Middle East & Africa 48 Volt Battery System Market Value (US$ Bn) Forecast, by Component, 2017-2031

Table 43: Middle East & Africa 48 Volt Battery System Market Volume (Million Units) Forecast, by Electric Vehicle, 2017-2031

Table 44: Middle East & Africa 48 Volt Battery System Market Value (US$ Bn) Forecast, by Electric Vehicle, 2017-2031

Table 45: Middle East & Africa 48 Volt Battery System Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Table 46: Middle East & Africa 48 Volt Battery System Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 47: Middle East & Africa 48 Volt Battery System Market Volume (Million Units) Forecast, by Country, 2017-2031

Table 48: Middle East & Africa 48 Volt Battery System Market Value (US$ Bn) Forecast, by Country, 2017-2031

List of Figures

Figure 1: Global 48 Volt Battery System Market Volume (Million Units) Forecast, by Component, 2017-2031

Figure 2: Global 48 Volt Battery System Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 3: Global 48 Volt Battery System Market, Incremental Opportunity, by Component, Value (US$ Bn), 2022-2031

Figure 4: Global 48 Volt Battery System Market Volume (Million Units) Forecast, by Electric Vehicle, 2017-2031

Figure 5: Global 48 Volt Battery System Market Value (US$ Bn) Forecast, by Electric Vehicle, 2017-2031

Figure 6: Global 48 Volt Battery System Market, Incremental Opportunity, by Electric Vehicle, Value (US$ Bn), 2022-2031

Figure 7: Global 48 Volt Battery System Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Figure 8: Global 48 Volt Battery System Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 9: Global 48 Volt Battery System Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 10: Global 48 Volt Battery System Market Volume (Million Units) Forecast, by Region, 2017-2031

Figure 11: Global 48 Volt Battery System Market Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 12: Global 48 Volt Battery System Market, Incremental Opportunity, by Region, Value (US$ Bn), 2022-2031

Figure 13: North America 48 Volt Battery System Market Volume (Million Units) Forecast, by Component, 2017-2031

Figure 14: North America 48 Volt Battery System Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 15: North America 48 Volt Battery System Market, Incremental Opportunity, by Component, Value (US$ Bn), 2022-2031

Figure 16: North America 48 Volt Battery System Market Volume (Million Units) Forecast, by Electric Vehicle, 2017-2031

Figure 17: North America 48 Volt Battery System Market Value (US$ Bn) Forecast, by Electric Vehicle, 2017-2031

Figure 18: North America 48 Volt Battery System Market, Incremental Opportunity, by Electric Vehicle, Value (US$ Bn), 2022-2031

Figure 19: North America 48 Volt Battery System Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Figure 20: North America 48 Volt Battery System Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 21: North America 48 Volt Battery System Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 22: North America 48 Volt Battery System Market Volume (Million Units) Forecast, by Country, 2017-2031

Figure 23: North America 48 Volt Battery System Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 24: North America 48 Volt Battery System Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 25: Latin America 48 Volt Battery System Market Volume (Million Units) Forecast, by Component, 2017-2031

Figure 26: Latin America 48 Volt Battery System Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 27: Latin America 48 Volt Battery System Market, Incremental Opportunity, by Component, Value (US$ Bn), 2022-2031

Figure 28: Latin America 48 Volt Battery System Market Volume (Million Units) Forecast, by Electric Vehicle, 2017-2031

Figure 29: Latin America 48 Volt Battery System Market Value (US$ Bn) Forecast, by Electric Vehicle, 2017-2031

Figure 30: Latin America 48 Volt Battery System Market, Incremental Opportunity, by Electric Vehicle, Value (US$ Bn), 2022-2031

Figure 31: Latin America 48 Volt Battery System Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Figure 32: Latin America 48 Volt Battery System Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 33: Latin America 48 Volt Battery System Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 34: Latin America 48 Volt Battery System Market Volume (Million Units) Forecast, by Country, 2017-2031

Figure 35: Latin America 48 Volt Battery System Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 36: Latin America 48 Volt Battery System Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 37: Europe 48 Volt Battery System Market Volume (Million Units) Forecast, by Component, 2017-2031

Figure 38: Europe 48 Volt Battery System Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 39: Europe 48 Volt Battery System Market, Incremental Opportunity, by Component, Value (US$ Bn), 2022-2031

Figure 40: Europe 48 Volt Battery System Market Volume (Million Units) Forecast, by Electric Vehicle, 2017-2031

Figure 41: Europe 48 Volt Battery System Market Value (US$ Bn) Forecast, by Electric Vehicle, 2017-2031

Figure 42: Europe 48 Volt Battery System Market, Incremental Opportunity, by Electric Vehicle, Value (US$ Bn), 2022-2031

Figure 43: Europe 48 Volt Battery System Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Figure 44: Europe 48 Volt Battery System Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 45: Europe 48 Volt Battery System Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 46: Europe 48 Volt Battery System Market Volume (Million Units) Forecast, by Country, 2017-2031

Figure 47: Europe 48 Volt Battery System Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 48: Europe 48 Volt Battery System Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 49: Asia Pacific 48 Volt Battery System Market Volume (Million Units) Forecast, by Component, 2017-2031

Figure 50: Asia Pacific 48 Volt Battery System Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 51: Asia Pacific 48 Volt Battery System Market, Incremental Opportunity, by Component, Value (US$ Bn), 2022-2031

Figure 52: Asia Pacific 48 Volt Battery System Market Volume (Million Units) Forecast, by Electric Vehicle, 2017-2031

Figure 53: Asia Pacific 48 Volt Battery System Market Value (US$ Bn) Forecast, by Electric Vehicle, 2017-2031

Figure 54: Asia Pacific 48 Volt Battery System Market, Incremental Opportunity, by Electric Vehicle, Value (US$ Bn), 2022-2031

Figure 55: Asia Pacific 48 Volt Battery System Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Figure 56: Asia Pacific 48 Volt Battery System Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 57: Asia Pacific 48 Volt Battery System Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 58: Asia Pacific 48 Volt Battery System Market Volume (Million Units) Forecast, by Country, 2017-2031

Figure 59: Asia Pacific 48 Volt Battery System Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 60: Asia Pacific 48 Volt Battery System Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 61: Middle East & Africa 48 Volt Battery System Market Volume (Million Units) Forecast, by Component, 2017-2031

Figure 62: Middle East & Africa 48 Volt Battery System Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 63: Middle East & Africa 48 Volt Battery System Market, Incremental Opportunity, by Component, Value (US$ Bn), 2022-2031

Figure 64: Middle East & Africa 48 Volt Battery System Market Volume (Million Units) Forecast, by Electric Vehicle, 2017-2031

Figure 65: Middle East & Africa 48 Volt Battery System Market Value (US$ Bn) Forecast, by Electric Vehicle, 2017-2031

Figure 66: Middle East & Africa 48 Volt Battery System Market, Incremental Opportunity, by Electric Vehicle, Value (US$ Bn), 2022-2031

Figure 67: Middle East & Africa 48 Volt Battery System Market Volume (Million Units) Forecast, by Vehicle Type, 2017-2031

Figure 68: Middle East & Africa 48 Volt Battery System Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 69: Middle East & Africa 48 Volt Battery System Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 70: Middle East & Africa 48 Volt Battery System Market Volume (Million Units) Forecast, by Country, 2017-2031

Figure 71: Middle East & Africa 48 Volt Battery System Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 72: Middle East & Africa 48 Volt Battery System Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031