Global Automated Sample Storage Systems Market: Snapshot

Automated sample storage systems are computer controlled storage devices used for the preservation of samples such as chemical compounds and biological samples. These systems help laboratory facilities store and retrieve samples efficiently as and when required. The sample storage systems vary from manually controlled, relatively simple and small storage operating devices to large computer controlled automated storage devices. Automated sample storage systems help reduce labor costs and lower essential workforce requirements, improving workplace safety and taking personnel out from difficult working conditions such as cold storage environments.

These systems also help in improving space utilization and increasing storage density, both horizontally and vertically. Nowadays, long-term automated sample storage systems are a requirement for almost every research laboratory. Therefore, this sector has raised the opportunity for business investment. A large number of samples can be stored at individual biobanks with the help of automated sample storage systems, instead of installing devices in separate institutes at the regional and national levels. This is likely to drive demand from the automated sample storage systems market in the 2017-2025 forecast period.

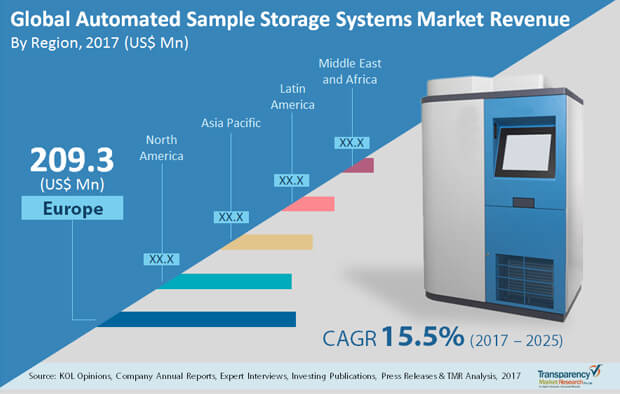

The global automated sample storage systems market is expected to rise from US$617 mn to close to US$2 bn over the 2017-2025 forecast period, exhibiting a robust 15.5% CAGR.

Pharma and Biotech Sector to Dominate Demand from Automated Storage Systems Market

The automated sample storage systems market is segmented by product type, application type, capacity, end user, and region. Based on product type, the automated sample storage systems market is segmented into systems units and reagents and consumables. The reagents and consumables segment dominates the global automated sample storage systems market, accounting for the largest market share in 2016. The segment is anticipated to dominate the automated sample storage system market during the forecast period owing to increasing demand and adoption of automated sample storage systems worldwide.

Based on application type, the automated sample storage systems market is segmented into biological sample storage and compound storage. The biological sample storage segment accounted for largest market share for automated sample storage systems in 2016 due to increasing adoption of automation by biobanks and research laboratories.

Based on capacity, the automated sample storage systems market is segmented into less than 100K samples, 100K - 500K samples, 500K - 2M samples, and more than 2M samples. The less than 100K samples segment accounts for the largest share in the automated sample storage systems market due to the high demand for small capacity storage systems from biobanks and research laboratories.

Based on end user, automated sample storage systems market is segmented into pharmaceutical and biotech companies, academic research labs, private biobanks, and others. Pharmaceutical and biotech companies accounted for the largest market share for automated sample storage systems in 2016 due to increasing demand for compound storage in drug discovery application from pharmaceutical and biotech companies. The growing government support to drug discovery programs in developed Western economies is thus likely to remain a key driver for the global automated sample storage systems market in the coming years.

Asia Pacific to Exhibit Rapid Rise in Automated Sample Storage Systems Market

The global automated sample storage systems market has been segmented into five major regions, namely, North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa., which are further categorized into various countries under each region. Europe dominated the global automated sample storage systems market in 2016 owing to high demand of automated sample storage systems in the region. The Europe automated sample storage systems market was valued at close to US$210 mn in 2017, and is likely to more than triple in valuation over the 2017-2025 forecast period at a steady 15.3% CAGR.

Asia Pacific is projected to constitute the highest growth rate over the forecast period owing to increasing adoption of automated sample storage systems among contract research organizations, research laboratories, and biobanks in the region. The regional market’s projected 19.4% CAGR is expected to propel the market from a 2017 valuation of US$119.5 mn to a 2025 valuation of US$493.5 mn.

Brooks Automation, Inc. dominated the global automated sample storage systems market in 2016. The major factors responsible for its dominance are widespread market presence, innovative product catalog, and huge investment in R&D. Other major players in the automated sample storage systems market include TTP LabTech, Thermo Fisher Scientific, Inc., Angelantoni Life Science, LiCONiC AG, Panasonic Healthcare Co., Ltd., Biotron Healthcare, Haier BioMedical (Haier Group), ASKION, and Tsubakimoto Chain Co.

Section 1 Preface

1.1 Report Scope and Market Segmentation

1.2 Research Highlights

Section 2 Assumptions and Research Methodology

2.1 Assumptions

2.2 Research Methodology

Section 3 Executive Summary

3.1 Global Automated Sample Storage Systems Market Snapshot, 2016

3.2 Global Automated Sample Storage Systems Market: Opportunity Map

Section 4 Market Overview

4.1 Overview

4.2 Global Automated Sample Storage Systems Market Size (US$ Mn) Forecast, 2015–2025

4.3 Global Automated Sample Storage Systems Market Outlook

4.4 Global Automated Sample Storage Systems Market: Key Industry Events

4.5 Global Automated Sample Storage Systems Market: Porter's Analysis

4.6 Decision Making Process for Purchase of Automated Sample Storage Systems

4.7 Automated Sample Storage Systems: Budgets & Return on Investment

4.8 Automated Sample Storage Systems: R&D Scenario

4.9 Automated Sample Storage Systems: Market Entry Challenges

Section 5 Market Dynamics

5.1 Drivers

5.1.1 Increased demand for high level of integrity for critical samples

5.1.2 Growth in drug discovery and clinical diagnostic processes

5.1.3 Increasing public-private relationships in biobanking

5.1.4 Cost cutting through reduced lab professionals

5.1.5 Strategic alliance by leading market players

5.1.6 Miniaturization of processes resulting in low reagent costs and high productivity

5.2 Restraints

5.2.1 High initial investment

5.2.2 Lack of planning for technology development

5.2.3 Low priority/limited adoption for lab automation among small & medium-sized laboratories

5.2.4 Compatibility and portability of existing system

5.3 Opportunity Analysis

5.4 Opportunities

5.4.1 Increasing use in biorepositories

5.4.2 Automation in microbiology & cancer research

5.5 Key Trends

5.5.1 Increasing number of private biobanks

5.5.2 Funding for biobanks

5.5.3 Introduction of new pricing models to make expensive drugs more affordable

Section 6 Automated Sample Storage Systems Market Analysis, by Product Type

6.1 Introduction

6.2 Global Automated Sample Storage Systems Market Value Share Analysis, by Product Type

6.3 Automated Sample Storage Systems Market Analysis, by Product Type

6.3.1 System Units

6.3.2 Reagents & Consumables

6.4 Automated Sample Storage Systems Market Attractiveness Analysis, by Product Type

6.5 Key Trends

Section 7 Automated Sample Storage Systems Market Analysis, by Application

7.1 Introduction

7.2 Global Automated Sample Storage Systems Market Value Share Analysis, by Application

7.3 Automated Sample Storage Systems Market Analysis, by Application

7.3.1 Biological Sample Storage

7.3.2 Compound Storage

7.4 Automated Sample Storage Systems Market Attractiveness Analysis, by Application

7.5 Key Trends

Section 8 Automated Sample Storage Systems Market Analysis, by Capacity

8.1 Introduction

8.2 Global Automated Sample Storage Systems Market Value Share Analysis, by Capacity

8.3 Automated Sample Storage Systems Market Analysis, by Capacity

8.3.1 Less Than 100K Samples

8.3.2 100K - 500K Samples

8.3.3 500K - 2M Samples

8.3.4 More Than 2M Samples

8.4 Automated Sample Storage Systems Market Attractiveness Analysis, by Capacity

8.5 Key Trends

Section 9 Automated Sample Storage Systems Market Analysis, by End User

9.1 Introduction

9.2 Global Automated Sample Storage Systems Market Value Share Analysis, by End User

9.3 Automated Sample Storage Systems Market Analysis, by End User

9.3.1 Pharma & Biotech Companies

9.3.2 Academic Research Labs

9.3.3 Private Biobanks

9.3.4 Others

9.4 Automated Sample Storage Systems Market Attractiveness Analysis, by End User

9.5 Key Trends

Section 10 Automated Sample Storage Systems Market Analysis, by Region

10.1 Global Automated Sample Storage Systems Market Snapshot, by Country

10.2 Global Automated Sample Storage Systems Market Value Share Analysis, by Region

10.3 Automated Sample Storage Systems Market Forecast, by Region

10.4 Automated Sample Storage Systems Market Attractiveness Analysis, by Region

Section 11 North America Automated Sample Storage Systems Market Analysis

11.1 Key Findings

11.2 North America Automated Sample Storage Systems Market Overview

11.3 North America Market Value Share Analysis, by Product Type

11.4 North America Market Forecast, by Product Type

11.4.1 System Units

11.4.2 Reagents & Consumables

11.5 North America Market Value Share Analysis, by Application

11.6 North America Market Forecast, by Application

11.6.1 Biological Sample Storage

11.6.2 Compound Storage

11.7 North America Market Value Share Analysis, by Capacity

11.8 North America Market Forecast, by Capacity

11.8.1 Less Than 100K Samples

11.8.2 100K - 500K Samples

11.8.3 500K - 2M Samples

11.8.4 More Than 2M Samples

11.8 North America Market Value Share Analysis, by End User

11.9 North America Market Forecast, by End User

11.9.1 Pharma & Biotech Companies

11.9.2 Academic Research Labs

11.9.3 Private Biobanks

11.9.4 Others

11.10 Market Analysis, by Country

11.11 Market Value Share Analysis, by Country

11.12 Market Size (US$ Mn) Forecast, by Country, 2017–2025

11.12.1 U.S.

11.12.2 Canada

11.13 Market Attractiveness Analysis

11.13.1 By Product Type

11.13.2 By Application

11.13.3 By Capacity

11.13.4 By End User

11.13.5 By Country

11.14 Market Trends

Section 12 Europe Automated Sample Storage Systems Market Analysis

12.1 Key Findings

12.2 Europe Automated Sample Storage Systems Market Overview

12.3 Europe Market Value Share Analysis, by Product Type

12.4 Europe Market Forecast, by Product Type

12.4.1 System Units

12.4.2 Reagents & Consumables

12.5 Europe Market Value Share Analysis, by Application

12.6 Europe Market Forecast, by Application

12.6.1 Biological Sample Storage

12.6.2 Compound Storage

12.7 Europe Market Value Share Analysis, by Capacity

12.8 Europe Market Forecast, by Capacity

12.8.1 Less Than 100K Samples

12.8.2 100K - 500K Samples

12.8.3 500K - 2M Samples

12.8.4 More Than 2M Samples

12.8 Europe Market Value Share Analysis, by End User

12.9 Europe Market Forecast, by End User

12.9.1 Pharma & Biotech Companies

12.9.2 Academic Research Labs

12.9.3 Private Biobanks

12.9.4 Others

12.10 Market Analysis, by Country

12.11 Market Value Share Analysis, by Country

12.12 Market Size (US$ Mn) Forecast, by Country, 2017–2025

12.12.1 Germany

12.12.2 France

12.12.3 U.K.

12.12.4 Rest of Europe

12.13 Market Attractiveness Analysis

12.13.1 By Product Type

12.13.2 By Application

12.13.3 By Capacity

12.13.4 By End User

12.13.5 By Country

12.14 Market Trends

Section 13 Asia Pacific Automated Sample Storage Systems Market Analysis

13.1 Key Findings

13.2 Asia Pacific Automated Sample Storage Systems Market Overview

13.3 Asia Pacific Market Value Share Analysis, by Product Type

13.4 Asia Pacific Market Forecast, by Product Type

13.4.1 System Units

13.4.2 Reagents & Consumables

13.5 Asia Pacific Market Value Share Analysis, by Application

13.6 Asia Pacific Market Forecast, by Application

13.6.1 Biological Sample Storage

13.6.2 Compound Storage

13.7 Asia Pacific Market Value Share Analysis, by Capacity

13.8 Asia Pacific Market Forecast, by Capacity

13.8.1 Less Than 100K Samples

13.8.2 100K - 500K Samples

13.8.3 500K - 2M Samples

13.8.4 More Than 2M Samples

13.8 Asia Pacific Market Value Share Analysis, by End User

13.9 Asia Pacific Market Forecast, by End User

13.9.1 Pharma & Biotech Companies

13.9.2 Academic Research Labs

13.9.3 Private Biobanks

13.9.4 Others

13.10 Market Analysis, by Country

13.11 Market Value Share Analysis, by Country

13.12 Market Size (US$ Mn) Forecast, by Country, 2017–2025

13.12.1 China

13.12.2 Japan

13.12.3 India

13.12.4 Australia & New Zealand

13.12.5 Rest of Asia Pacific

13.13 Market Attractiveness Analysis

13.13.1 By Product Type

13.13.2 By Application

13.13.3 By Capacity

13.13.4 By End User

13.13.5 By Country

13.14 Market Trends

Section 14 China Automated Sample Storage Systems Market Analysis

14.1 Key Findings

14.2 China Automated Sample Storage Systems Market Overview

14.3 China Market Value Share Analysis, by Product Type

14.4 China Market Forecast, by Product Type

14.4.1 System Units

14.4.2 Reagents & Consumables

14.5 China Market Value Share Analysis, by Application

14.6 China Market Forecast, by Application

14.6.1 Biological Sample Storage

14.6.2 Compound Storage

14.7 China Market Value Share Analysis, by Capacity

14.8 China Market Forecast, by Capacity

14.8.1 Less Than 100K Samples

14.8.2 100K - 500K Samples

14.8.3 500K - 2M Samples

14.8.4 More Than 2M Samples

14.8 China Market Value Share Analysis, by End User

14.9 China Market Forecast, by End User

14.9.1 Pharma & Biotech Companies

14.9.2 Academic Research Labs

14.9.3 Private Biobanks

14.9.4 Others

14.10 Market Analysis, by Country

14.11 Market Value Share Analysis, by Country

14.12 Market Attractiveness Analysis

14.12.1 By Product Type

14.12.2 By Application

14.12.3 By Capacity

14.12.4 By End User

14.13 Market Trends

Section 15 Japan Automated Sample Storage Systems Market Analysis

15.1 Key Findings

15.2 Japan Automated Sample Storage Systems Market Overview

15.3 Japan Market Value Share Analysis, by Product Type

15.4 Japan Market Forecast, by Product Type

15.4.1 System Units

15.4.2 Reagents & Consumables

15.5 Japan Market Value Share Analysis, by Application

15.6 Japan Market Forecast, by Application

15.6.1 Biological Sample Storage

15.6.2 Compound Storage

15.7 Japan Market Value Share Analysis, by Capacity

15.8 Japan Market Forecast, by Capacity

15.8.1 Less Than 100K Samples

15.8.2 100K - 500K Samples

15.8.3 500K - 2M Samples

15.8.4 More Than 2M Samples

15.8 Japan Market Value Share Analysis, by End User

15.9 Japan Market Forecast, by End User

15.9.1 Pharma & Biotech Companies

15.9.2 Academic Research Labs

15.9.3 Private Biobanks

15.9.4 Others

15.10 Market Analysis, by Country

15.11 Market Value Share Analysis, by Country

15.12 Market Attractiveness Analysis

15.12.1 By Product Type

15.12.2 By Application

15.12.3 By Capacity

15.12.4 By End User

15.13 Market Trends

Section 16 India Automated Sample Storage Systems Market Analysis

16.1 Key Findings

16.2 India Automated Sample Storage Systems Market Overview

16.3 India Market Value Share Analysis, by Product Type

16.4 India Market Forecast, by Product Type

16.4.1 System Units

16.4.2 Reagents & Consumables

16.5 India Market Value Share Analysis, by Application

16.6 India Market Forecast, by Application

16.6.1 Biological Sample Storage

16.6.2 Compound Storage

16.7 India Market Value Share Analysis, by Capacity

16.8 India Market Forecast, by Capacity

16.8.1 Less Than 100K Samples

16.8.2 100K - 500K Samples

16.8.3 500K - 2M Samples

16.8.4 More Than 2M Samples

16.8 India Market Value Share Analysis, by End User

16.9 India Market Forecast, by End User

16.9.1 Pharma & Biotech Companies

16.9.2 Academic Research Labs

16.9.3 Private Biobanks

16.9.4 Others

16.10 Market Analysis, by Country

16.11 Market Value Share Analysis, by Country

16.12 Market Attractiveness Analysis

16.12.1 By Product Type

16.12.2 By Application

16.12.3 By Capacity

16.12.4 By End User

16.13 Market Trends

Section 17 Australia & New Zealand Automated Sample Storage Systems Market Analysis

17.1 Key Findings

17.2 Australia & New Zealand Automated Sample Storage Systems Market Overview

17.3 Australia & New Zealand Market Value Share Analysis, by Product Type

17.4 Australia & New Zealand Market Forecast, by Product Type

17.4.1 System Units

17.4.2 Reagents & Consumables

17.5 Australia & New Zealand Market Value Share Analysis, by Application

17.6 Australia & New Zealand Market Forecast, by Application

17.6.1 Biological Sample Storage

17.6.2 Compound Storage

17.7 Australia & New Zealand Market Value Share Analysis, by Capacity

17.8 Australia & New Zealand Market Forecast, by Capacity

17.8.1 Less Than 100K Samples

17.8.2 100K - 500K Samples

17.8.3 500K - 2M Samples

17.8.4 More Than 2M Samples

17.8 Australia & New Zealand Market Value Share Analysis, by End User

17.9 Australia & New Zealand Market Forecast, by End User

17.9.1 Pharma & Biotech Companies

17.9.2 Academic Research Labs

17.9.3 Private Biobanks

17.9.4 Others

17.10 Market Analysis, by Country

17.11 Market Value Share Analysis, by Country

17.12 Market Attractiveness Analysis

17.12.1 By Product Type

17.12.2 By Application

17.12.3 By Capacity

17.12.4 By End User

17.13 Market Trends

Section 18 Rest of Asia Pacific Automated Sample Storage Systems Market Analysis

18.1 Key Findings

18.2 Rest of Asia Pacific Automated Sample Storage Systems Market Overview

18.3 Rest of Asia Pacific Market Value Share Analysis, by Product Type

18.4 Rest of Asia Pacific Market Forecast, by Product Type

18.4.1 System Units

18.4.2 Reagents & Consumables

18.5 Rest of Asia Pacific Market Value Share Analysis, by Application

18.6 Rest of Asia Pacific Market Forecast, by Application

18.6.1 Biological Sample Storage

18.6.2 Compound Storage

18.7 Rest of Asia Pacific Market Value Share Analysis, by Capacity

18.8 Rest of Asia Pacific Market Forecast, by Capacity

18.8.1 Less Than 100K Samples

18.8.2 100K - 500K Samples

18.8.3 500K - 2M Samples

18.8.4 More Than 2M Samples

18.8 Rest of Asia Pacific Market Value Share Analysis, by End User

18.9 Rest of Asia Pacific Market Forecast, by End User

18.9.1 Pharma & Biotech Companies

18.9.2 Academic Research Labs

18.9.3 Private Biobanks

18.9.4 Others

18.10 Market Analysis, by Country

18.11 Market Value Share Analysis, by Country

18.12 Market Attractiveness Analysis

18.12.1 By Product Type

18.12.2 By Application

18.12.3 By Capacity

18.12.4 By End User

18.13 Market Trends

Section 19 Latin America Automated Sample Storage Systems Market Analysis

19.1 Key Findings

19.2 Latin America Automated Sample Storage Systems Market Overview

19.3 Latin America Market Value Share Analysis, by Product Type

19.4 Latin America Market Forecast, by Product Type

19.4.1 System Units

19.4.2 Reagents & Consumables

19.5 Latin America Market Value Share Analysis, by Application

19.6 Latin America Market Forecast, by Application

19.6.1 Biological Sample Storage

19.6.2 Compound Storage

19.7 Latin America Market Value Share Analysis, by Capacity

19.8 Latin America Market Forecast, by Capacity

19.8.1 Less Than 100K Samples

19.8.2 100K - 500K Samples

19.8.3 500K - 2M Samples

19.8.4 More Than 2M Samples

19.8 Latin America Market Value Share Analysis, by End User

19.9 Latin America Market Forecast, by End User

19.9.1 Pharma & Biotech Companies

19.9.2 Academic Research Labs

19.9.3 Private Biobanks

19.9.4 Others

19.10 Market Analysis, by Country

19.11 Market Value Share Analysis, by Country

19.12 Market Size (US$ Mn) Forecast, by Country, 2017–2025

19.12.1 Brazil

19.12.2 Mexico

19.12.3 Rest of Latin America

19.13 Market Attractiveness Analysis

19.13.1 By Product Type

19.13.2 By Application

19.13.3 By Capacity

19.13.4 By End User

19.13.5 By Country

19.14 Market Trends

Section 20 Middle East & Africa Automated Sample Storage Systems Market Analysis

20.1 Key Findings

20.2 Middle East & Africa Automated Sample Storage Systems Market Overview

20.3 Middle East & Africa Market Value Share Analysis, by Product Type

20.4 Middle East & Africa Market Forecast, by Product Type

20.4.1 System Units

20.4.2 Reagents & Consumables

20.5 Middle East & Africa Market Value Share Analysis, by Application

20.6 Middle East & Africa Market Forecast, by Application

20.6.1 Biological Sample Storage

20.6.2 Compound Storage

20.7 Middle East & Africa Market Value Share Analysis, by Capacity

20.8 Middle East & Africa Market Forecast, by Capacity

20.8.1 Less Than 100K Samples

20.8.2 100K - 500K Samples

20.8.3 500K - 2M Samples

20.8.4 More Than 2M Samples

20.8 Middle East & Africa Market Value Share Analysis, by End User

20.9 Middle East & Africa Market Forecast, by End User

20.9.1 Pharma & Biotech Companies

20.9.2 Academic Research Labs

20.9.3 Private Biobanks

20.9.4 Others

20.10 Market Analysis, by Country

20.11 Market Value Share Analysis, by Country

20.12 Market Size (US$ Mn) Forecast, by Country, 2017–2025

20.12.1 Saudi Arabia

20.12.2 South Africa

20.12.3 Rest of Middle East & Africa

20.13 Market Attractiveness Analysis

20.13.1 By Product Type

20.13.2 By Application

20.13.3 By Capacity

20.13.4 By End User

20.13.5 By Country

20.14 Market Trends

Section 21 Competition Landscape

21.1 Global Automated Sample Storage Systems Market Share Analysis, by Company, 2016

21.2 Asia Pacific Automated Sample Storage Systems Market Share Ranking by Company, 2016

21.3 Competition Matrix

21.4 Company Profiles

21.4.1 Hamilton Company (Hamilton Storage Technologies, Inc.)

21.4.1.1. Company Overview (HQ, Business Segments, Employee Strength)

21.4.1.2. Financial Overview

21.4.1.3. Product Portfolio

21.4.1.4. SWOT Analysis

21.4.1.5. Strategic Overview

21.4.2 Brooks Automation, Inc.

21.4.2.1. Company Overview (HQ, Business Segments, Employee Strength)

21.4.2.2. Financial Overview

21.4.2.3. Product Portfolio

21.4.2.4. SWOT Analysis

21.4.2.5. Strategic Overview

21.4.3 TTP LabTech

21.4.3.1. Company Overview (HQ, Business Segments, Employee Strength)

21.4.3.2. Financial Overview

21.4.3.3. Product Portfolio

21.4.3.4. SWOT Analysis

21.4.3.5. Strategic Overview

21.4.4 Thermo Fisher Scientific, Inc.

21.4.4.1. Company Overview (HQ, Business Segments, Employee Strength)

21.4.4.2. Financial Overview

21.4.4.3. Product Portfolio

21.4.4.4. SWOT Analysis

21.4.4.5. Strategic Overview

21.4.5 Angelantoni Life Science

21.4.5.1. Company Overview (HQ, Business Segments, Employee Strength)

21.4.5.2. Financial Overview

21.4.5.3. Product Portfolio

21.4.5.4. SWOT Analysis

21.4.5.5. Strategic Overview

21.4.6 LiCONiC AG

21.4.6.1. Company Overview (HQ, Business Segments, Employee Strength)

21.4.6.2. Financial Overview

21.4.6.3. Product Portfolio

21.4.6.4. SWOT Analysis

21.4.6.5. Strategic Overview

21.4.7 Panasonic Healthcare Co., Ltd.

21.4.7.1. Company Overview (HQ, Business Segments, Employee Strength)

21.4.7.2. Financial Overview

21.4.7.3. Product Portfolio

21.4.7.4. SWOT Analysis

21.4.7.5. Strategic Overview

21.4.8 Biotron Healthcare

21.4.8.1. Company Overview (HQ, Business Segments, Employee Strength)

21.4.8.2. Financial Overview

21.4.8.3. Product Portfolio

21.4.8.4. SWOT Analysis

21.4.8.5. Strategic Overview

21.4.9 Haier BioMedical (Haier Group)

21.4.9.1. Company Overview (HQ, Business Segments, Employee Strength)

21.4.9.2. Financial Overview

21.4.9.3. Product Portfolio

21.4.9.4. SWOT Analysis

21.4.9.5. Strategic Overview

21.4.10 ASKION

21.4.10.1. Company Overview (HQ, Business Segments, Employee Strength)

21.4.10.2. Financial Overview

21.4.10.3. Product Portfolio

21.4.10.4. SWOT Analysis

21.4.10.5. Strategic Overview

21.4.11 Tsubakimoto Chain Co.

21.4.11.1. Company Overview (HQ, Business Segments, Employee Strength)

21.4.11.2. Financial Overview

21.4.11.3. Product Portfolio

21.4.11.4. SWOT Analysis

21.4.11.5. Strategic Overview

List of Tables

Table 01: Global Automated Sample Storage Systems Market Size (US$ Mn) Forecast, by Product Type, 2015–2025

Table 02: Global Automated Sample Storage Systems Market Size (US$ Mn) Forecast, by Application, 2015–2025

Table 03: Global Automated Sample Storage Systems Market Size (US$ Mn) Forecast, by Capacity, 2015–2025

Table 04: Global Automated Sample Storage Systems Market Size (US$ Mn) Forecast, by End User, 2015–2025

Table 05: Global Automated Sample Storage Systems Market Size (US$ Mn) Forecast, by Region, 2015–2025

Table 06: North America Automated Sample Storage Systems Market Size (US$ Mn) Forecast, by Country, 2015–2025

Table 07: North America Automated Sample Storage Systems Market Size (US$ Mn) Forecast, by Product Type, 2015–2025

Table 08: North America Automated Sample Storage Systems Market Size (US$ Mn) Forecast, by Application, 2015–2025

Table 09: North America Automated Sample Storage Systems Market Size (US$ Mn) Forecast, by Capacity, 2015–2025

Table 10: North America Automated Sample Storage Systems Market Size (US$ Mn) Forecast, by End-user, 2015–2025

Table 11: Europe Automated Sample Storage Systems Market Size (US$ Mn) Forecast, by Country, 2015–2025

Table 12: Europe Automated Sample Storage Systems Market Size (US$ Mn) Forecast, by Product Type, 2015–2025

Table 13: Europe Automated Sample Storage Systems Market Size (US$ Mn) Forecast, by Application, 2015–2025

Table 14: Europe Automated Sample Storage Systems Market Size (US$ Mn) Forecast, by Capacity, 2015–2025

Table 15: Europe Automated Sample Storage Systems Market Size (US$ Mn) Forecast, by End User, 2015–2025

Table 16: Asia Pacific Automated Sample Storage Systems Market Size (US$ Mn) Forecast, by Country, 2015–2025

Table 17: Asia Pacific Automated Sample Storage Systems Market Size (US$ Mn) Forecast, by Product Type, 2015–2025

Table 18: Asia Pacific Automated Sample Storage Systems Market Size (US$ Mn) Forecast, by Application, 2015–2025

Table 19: Asia Pacific Automated Sample Storage Systems Market Size (US$ Mn) Forecast, by Capacity, 2015–2025

Table 20: Asia Pacific Automated Sample Storage Systems Market Size (US$ Mn) Forecast, by End-user, 2015–2025

Table 21: China Automated Sample Storage Systems Market Size (US$ Mn) Forecast, by Product Type, 2015–2025

Table 22: China Automated Sample Storage Systems Market Size (US$ Mn) Forecast, by Application, 2015–2025

Table 23: China Automated Sample Storage Systems Market Size (US$ Mn) Forecast, by Capacity, 2015–2025

Table 24: China Automated Sample Storage Systems Market Size (US$ Mn) Forecast, by End-user, 2015–2025

Table 25: Japan Automated Sample Storage Systems Market Size (US$ Mn) Forecast, by Product Type, 2015–2025

Table 26: Japan Automated Sample Storage Systems Market Size (US$ Mn) Forecast, by Application, 2015–2025

Table 27: Japan Automated Sample Storage Systems Market Size (US$ Mn) Forecast, by Capacity, 2015–2025

Table 28: Japan Automated Sample Storage Systems Market Size (US$ Mn) Forecast, by End-user, 2015–2025

Table 29: India Automated Sample Storage Systems Market Size (US$ Mn) Forecast, by Product, 2015–2025

Table 30: India Automated Sample Storage Systems Market Size (US$ Mn) Forecast, by Application, 2015–2025

Table 31: India Automated Sample Storage Systems Market Size (US$ Mn) Forecast, by Capacity, 2015–2025

Table 32: India Automated Sample Storage Systems Market Size (US$ Mn) Forecast, by End-user, 2015–2025

Table 33: Australia & New Zealand Automated Sample Storage Systems Market Size (US$ Mn) Forecast, by Product, 2015–2025

Table 34: Australia & New Zealand Automated Sample Storage Systems Market Size (US$ Mn) Forecast, by Application,2015 2025

Table 35: Australia & New Zealand Automated Sample Storage Systems Market Size (US$ Mn) Forecast, by Capacity, 2015–2025

Table 36: Australia & New Zealand Automated Sample Storage Systems Market Size (US$ Mn) Forecast, by End-user, 2015–2025

Table 37: Rest of Asia Pacific Automated Sample Storage Systems Market Size (US$ Mn) Forecast, by Product,

Table 38: Rest of Asia Pacific Automated Sample Storage Systems Market Size (US$ Mn) Forecast, by Application,

Table 39: Rest of Asia Pacific Automated Sample Storage Systems Market Size (US$ Mn) Forecast, by Capacity,

Table 40: Rest of Asia Pacific Automated Sample Storage Systems Market Size (US$ Mn) Forecast, by End-user, 2015–2025

Table 41: Latin America Automated Sample Storage Systems Market Size (US$ Mn) Forecast, by Country, 2015–2025

Table 42: Latin America Automated Sample Storage Systems Market Size (US$ Mn) Forecast, by Product Type, 2015–2025

Table 43: Latin America Automated Sample Storage Systems Market Size (US$ Mn) Forecast, by Application, 2015–2025

Table 44: Latin America Automated Sample Storage Systems Market Size (US$ Mn) Forecast, by Capacity, 2015–2025

Table 45: Latin America Automated Sample Storage Systems Market Size (US$ Mn) Forecast, by End User, 2015–2025

Table 46: Middle East & Africa Automated Sample Storage Systems Market Size (US$ Mn) Forecast, by Country,

Table 47: Middle East & Africa Automated Sample Storage Systems Market Size (US$ Mn) Forecast, by Product Type, 2015–2025

Table 48: Middle East & Africa Automated Sample Storage Systems Market Size (US$ Mn) Forecast, by Application, 2015–2025

Table 49: Middle East & Africa Automated Sample Storage Systems Market Size (US$ Mn) Forecast, by Capacity, 2015–2025

Table 50: Middle East & Africa Automated Sample Storage Systems Market Size (US$ Mn) Forecast, by End-user, 2015–2025

List of Figures

Figure 01: Global Automated Sample Storage Systems Market Size (US$ Mn) and Y-o-Y Growth (%) Projection, 2015–2025

Figure 02: Global Automated Sample Storage Systems Market Value Share, by Product Type, 2017 and 2025

Figure 03: Global Automated Sample Storage Systems Market Attractiveness Analysis, by Product Type, 2017–2025

Figure 04: Global System Unit Market Revenue (US$ Mn) and Y-o-Y Growth (%) Projection, 2015–2025

Figure 05: Global Reagent & Consumables Market Revenue (US$ Mn) and Y-o-Y Growth (%) Projection, 2015–2025

Figure 06: Global Automated Sample Storage Systems Market Value Share, by Application, 2017 and 2025

Figure 07: Global Automated Sample Storage Systems Market Attractiveness Analysis, by Application, 2017–2025

Figure 08: Global Biological Sample Storage Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2015–2025

Figure 09: Global Compound Storage Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2015–2025

Figure 10: Global Automated Sample Storage Systems Market Value Share, by Capacity, 2017 and 2025

Figure 11: Global Automated Sample Storage Systems Market Attractiveness Analysis, by Capacity, 2017–2025

Figure 12: Global Automated Sample Storage Systems Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Less Than 100K Samples, 2015–2025

Figure 13: Global Automated Sample Storage Systems Market Revenue (US$ Mn) and Y-o-Y Growth (%), by 100K - 500K Samples, 2015–2025

Figure 14: Global Automated Sample Storage Systems Market Revenue (US$ Mn) and Y-o-Y Growth (%), by 500K - 2M Samples, 2015–2025

Figure 42: Europe Automated Sample Storage Systems Market Value Share, by Capacity, 2017 and 2025

Figure 43: Europe Automated Sample Storage Systems Market Attractiveness Analysis, by Capacity, 2017–2025

Figure 44: Europe Automated Sample Storage Systems Market Value Share, by End User, 2017 and 2025

Figure 45: Europe Automated Sample Storage Systems Market Attractiveness Analysis, by End User, 2017–2025

Figure 46: Asia Pacific Automated Sample Storage Systems Market Size (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2015–2025

Figure 47: Asia Pacific Automated Sample Storage Systems Market Value Share, by Country, 2017 and 2025

Figure 48: Asia Pacific Automated Sample Storage Systems Market Attractiveness, by Country, 2017–2025

Figure 49: Asia Pacific Automated Sample Storage Systems Market Value Share, by Product Type, 2017 and 2025

Figure 50: Asia Pacific Automated Sample Storage Systems Market Attractiveness, by Product Type, 2017–2025

Figure 51: Asia Pacific Automated Sample Storage Systems Market Value Share, by Application, 2017 and 2025

Figure 52: Asia Pacific Automated Sample Storage Systems Market Attractiveness Analysis, by Application, 2017–2025

Figure 53: Asia Pacific Automated Sample Storage Systems Market Value Share, by Capacity, 2017 and 2025

Figure 54: Asia Pacific Automated Sample Storage Systems Market Attractiveness Analysis, by Capacity, 2017–2025

Figure 55: Asia Pacific Automated Sample Storage Systems Market Value Share, by End-user, 2017 and 2025

Figure 56: Asia Pacific Automated Sample Storage Systems Market Attractiveness Analysis, by End-user, 2017–2025

Figure 57: China Automated Sample Storage Systems Market Size (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2015–2025

Figure 58: China Automated Sample Storage Systems Market Value Share, by Product Type, 2017 and 2025

Figure 59: China Automated Sample Storage Systems Market Value Share, by Capacity, 2017 and 2025

Figure 60: China Automated Sample Storage Systems Market Value Share, by Application, 2017 and 2025

Figure 61: China Automated Sample Storage Systems Market Value Share, by End-user, 2017 and 2025

Figure 62: China Automated Sample Storage Systems Market Attractiveness Analysis, by Product Type, 2017–2025

Figure 63: China Automated Sample Storage Systems Market Attractiveness Analysis, by Capacity, 2017–2025

Figure 64: China Automated Sample Storage Systems Market Attractiveness Analysis, by Application, 2017–2025

Figure 65: China Automated Sample Storage Systems Market Attractiveness Analysis, by End-user, 2017–2025

Figure 66: Japan Automated Sample Storage Systems Market Size (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2015–2025

Figure 67: Japan Automated Sample Storage Systems Market Value Share, by Product Type, 2017 and 2025

Figure 68: Japan Automated Sample Storage Systems Market Value Share, by Capacity, 2017 and 2025

Figure 69: Japan Automated Sample Storage Systems Market Value Share, by Application, 2017 and 2025

Figure 70: Japan Automated Sample Storage Systems Market Value Share, by End-user, 2017 and 2025

Figure 71: Japan Automated Sample Storage Systems Market Attractiveness Analysis, by Product Type, 2017–2025

Figure 72: Japan Automated Sample Storage Systems Market Attractiveness Analysis, by Capacity, 2017–2025

Figure 73: Japan Automated Sample Storage Systems Market Attractiveness Analysis, by Application, 2017–2025

Figure 74: Japan Automated Sample Storage Systems Market Attractiveness Analysis, by End-user, 2017–2025

Figure 75: India Automated Sample Storage Systems Market Size (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2015–2025

Figure 76: India Automated Sample Storage Systems Market Value Share, by Product, 2017 and 2025

Figure 77: India Automated Sample Storage Systems Market Value Share, by Capacity, 2017 and 2025

Figure 78: India Automated Sample Storage Systems Market Value Share, by Application, 2017 and 2025

Figure 79: India Automated Sample Storage Systems Market Value Share, by End-user, 2017 and 2025

Figure 80: India Automated Sample Storage Systems Market Attractiveness Analysis, by Product, 2017–2025

Figure 81: India Automated Sample Storage Systems Market Attractiveness Analysis, by Capacity, 2017–2025

Figure 82: India Automated Sample Storage Systems Market Attractiveness Analysis, by Application, 2017–2025

Figure 83: India Automated Sample Storage Systems Market Attractiveness Analysis, by End-user, 2017–2025

Figure 84: Australia & New Zealand Automated Sample Storage Systems Market Size (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2015–2025

Figure 85: Australia & New Zealand Automated Sample Storage Systems Market Value Share, by Product, 2017 and 2025

Figure 86: Australia & New Zealand Automated Sample Storage Systems Market Value Share, by Capacity, 2017 and 2025

Figure 87: Australia & New Zealand Automated Sample Storage Systems Market Value Share, by Application, 2017 and 2025

Figure 88: Australia & New Zealand Automated Sample Storage Systems Market Value Share, by End-user, 2017 and 2025

Figure 89: Australia & New Zealand Automated Sample Storage Systems Market Attractiveness Analysis, by Product, 2017–2025

Figure 90: Australia & New Zealand Automated Sample Storage Systems Market Attractiveness Analysis, by Capacity, 2017–2025

Figure 91: Australia & New Zealand Automated Sample Storage Systems Market Attractiveness Analysis, by Application, 2017–2025

Figure 92: Australia & New Zealand Automated Sample Storage Systems Market Attractiveness Analysis, by End-user, 2017–2025

Figure 93: Rest of Asia Pacific Automated Sample Storage Systems Market Size (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2015–2025

Figure 94: Rest of Asia Pacific Automated Sample Storage Systems Market Value Share, by Product, 2017 and 2025

Figure 95: Rest of Asia Pacific Automated Sample Storage Systems Market Value Share, by Capacity, 2017 and 2025

Figure 96: Rest of Asia Pacific Automated Sample Storage Systems Market Value Share, by Application, 2017 and 2025

Figure 97: Rest of Asia Pacific Automated Sample Storage Systems Market Value Share, by End-user, 2017 and 2025

Figure 98: Rest of Asia Pacific Automated Sample Storage Systems Market Attractiveness Analysis, by Product, 2017–2025

Figure 99: Rest of Asia Pacific Automated Sample Storage Systems Market Attractiveness Analysis, by Capacity, 2017–2025

Figure 100: Rest of Asia Pacific Automated Sample Storage Systems Market Attractiveness Analysis, by Application, 2017–2025

Figure 101: Rest of Asia Pacific Automated Sample Storage Systems Market Attractiveness Analysis, by End-user, 2017–2025

Figure 102: Latin America Automated Sample Storage Systems Market Size (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2015–2025

Figure 103: Latin America Automated Sample Storage Systems Market Value Share, by Country, 2017 and 2025

Figure 104: Latin America Automated Sample Storage Systems Market Attractiveness, by Country, 2017–2025

Figure 105: Latin America Automated Sample Storage Systems Market Value Share, by Product Type, 2017 and 2025

Figure 106: Latin America Automated Sample Storage Systems Market Attractiveness, by Product Type, 2017–2025

Figure 107: Latin America Automated Sample Storage Systems Market Value Share, by Application Type, 2017 and 2025

Figure 108: Latin America Automated Sample Storage Systems Market Attractiveness Analysis, by Application Type, 2017–2025

Figure 109: Latin America Automated Sample Storage Systems Market Value Share, by Capacity, 2017 and 2025

Figure 110: Latin America Automated Sample Storage Systems Market Attractiveness Analysis, by Capacity, 2017–2025

Figure 111: Latin America Automated Sample Storage Systems Market Value Share, by End User, 2017 and 2025

Figure 112: Latin America Automated Sample Storage Systems Market Attractiveness Analysis, by End User, 2017–2025

Figure 113: Middle East & Africa Automated Sample Storage Systems Market Size (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2015–2025

Figure 114: Middle East & Africa Automated Sample Storage Systems Market Value Share, by Country, 2017 and 2025

Figure 115: Middle East & Africa Automated Sample Storage Systems Market Attractiveness, by Country, 2017–2025

Figure 116: Middle East & Africa Automated Sample Storage Systems Market Value Share, by Product Type, 2017 and 2025

Figure 117: Middle East & Africa Automated Sample Storage Systems Market Attractiveness, by Product Type, 2017–2025

Figure 118: Middle East & Africa Automated Sample Storage Systems Market Value Share, by Application, 2017 and 2025

Figure 119: Middle East & Africa Automated Sample Storage Systems Market Attractiveness Analysis, by Application, 2017–2025

Figure 120: Middle East & Africa Automated Sample Storage Systems Market Value Share, by Capacity, 2017 and 2025

Figure 121: Middle East & Africa Automated Sample Storage Systems Market Attractiveness Analysis, by Capacity, 2017–2025

Figure 122: Middle East & Africa Automated Sample Storage Systems Market Value Share, by End-user, 2017 and 2025

Figure 123: Middle East & Africa Automated Sample Storage Systems Market Attractiveness Analysis, by End-user, 2017–2025

Figure 124: Global Automated Sample Storage Systems Market Share Analysis, by Company, 2016