Analysts’ Viewpoint

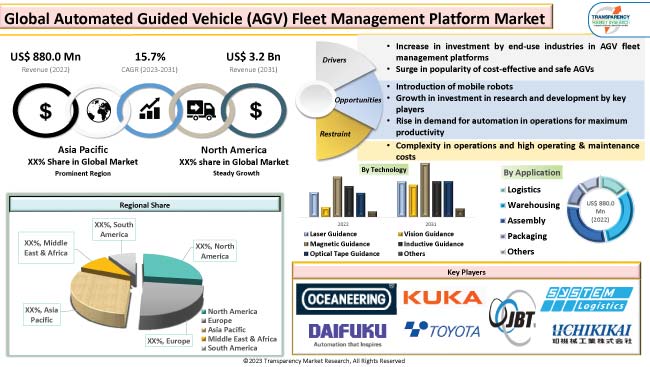

Rise in need for cost-effective and safe AGVs in material handling operations to promote productivity is one of the key automated guided vehicle (AGV) fleet management platform market drivers. Automated guided vehicle (AGV) fleet management platform market demand is increasing significantly due to surge in investment in this technology by several end-use industries. Other factors contributing to the automated guided vehicle (AGV) fleet management platform market growth are increase in Industry 4.0 acceptance among AGV manufacturers and rise in focus on worker safety in industries.

Many manufacturing plants and warehouses use material handling equipment for various purposes such as movement of products and raw materials. Hence, transportation and logistics companies need to boost the efficiency of their operations. Continuous innovations and investment in the technology by key players are creating value-grab automated guided vehicle (AGV) fleet management platform business opportunities.

Automated guided vehicles (AGVs) or computer-controlled vehicles are fitted with a range of collision avoidance and guidance algorithms. These self-guiding vehicles can transfer products straight to production lines or move raw materials from loading locations to warehouses.

Autonomous guided vehicle technology offers durability and dependability. It helps complete duplicate jobs more effectively. Additionally, it reduces operating costs and manufacturing time, while enhancing worker safety.

Many businesses are moving toward automated systems to maximize output. Data sharing has gathered momentum with the introduction of Industry 4.0. Hence, demand for various types of automated guided vehicles has increased over the past few years.

Automated guided vehicles (AGVs) are increasingly using software for steering, navigating, and managing traffic and transportation. Automated material handling processes are making use of big data and machine learning technologies. Thus, rise in in-house logistics and material handling requirements is driving market dynamics.

Growth in e-commerce and automotive industries is fueling the demand for AGVs. Businesses in the automotive sector are creating cutting-edge applications by investing in new technologies, including Internet of Things (IoT) and artificial intelligence (AI). This is contributing to the growth of the global automated guided vehicle (AGV) fleet management platform market.

Manufacturers are releasing mobile robots and vision-guided vehicles, thus opening up opportunities for market growth. Industries all over the world are placing a strong emphasis on reducing operational costs and boosting productivity with the help of AGVs.

AGVs enable businesses to implement cutting-edge manufacturing methods and reduce waste produced during production. Growth in penetration of safety sensors and devices to avoid and proactively prevent risks in AGVs and enhancements in AGV management platforms are augmenting market expansion. Increase in investment in the development of AGVs by major automakers is anticipated to propel market trajectory in the near future.

Automated workflow is becoming increasingly popular across all business verticals in an effort to reduce downtime and boost productivity. Several industries such as automotive, healthcare, and retail are investing in technologically advanced systems to boost operational effectiveness and enhance the production process.

The healthcare sector is investing significantly in AGV fleet management platforms to accelerate the timely delivery of medicines and other pharmaceutical products. E-commerce, electronics, and mining are some of the other industries investing in AGV fleet management platforms.

Growth in demand for automation and material handling equipment in distribution facilities is likely to drive automated guided vehicle (AGV) fleet management platform market statistics in the near future.

The magnetic guidance technology segment is projected to dominate the global automated guided vehicle (AGV) fleet management platform market during the forecast period.

It is easy to install and change magnetic guiding technology. No invasive installation is necessary. Furthermore, it provides precise location compared to other technologies. According to the AGV fleet management platform market analysis, demand for magnetic guidance technology is expected to increase significantly in the next few years.

Rise in adoption of camera vision systems owing to their effectiveness in applications and decrease in cost of camera sensors are estimated to boost market development in the near future.

Asia Pacific is anticipated to account for major automated guided vehicle (AGV) fleet management platform market share during the forecast period.

China and India are the key countries of the automated guided vehicle (AGV) fleet management platform market in Asia Pacific. Businesses in Japan are projected to grow significantly in the near future, as they offer both customized as well as entry-level AGVs.

Expansion in the manufacturing sector is fueling automated guided vehicle (AGV) fleet management platform industry growth. Development of e-commerce and retail industries is also driving the demand for high-quality material handling equipment in Asia Pacific.

Established firms are striving to differentiate themselves by expediting the in-house logistic operations and gaining more productivity in terms of time and cost. This is positively impacting market expansion.

Addverb Technologies, Aichi Machine Industry Co., Ltd., China SME Group Co., Ltd., DAIFUKU GROUP, Egemin Automation Inc., Fori Automation, GreyOrange, GRIDBOTS, Hi-tech Robotic Systemz Limited, JBT Corporation, KOLEC, Kinexon, Konecranes, KUKA AG, Hikrobot, MHP Management- und IT-Beratung GmbH, Murata Machinery, Ltd., Oceaneering International Inc., Shenzhen Mircolomay Technology Co., Ltd, Simplex Robotics Pvt Ltd., System Logistics S.p.A., and Toyota Industries Corporation are the leading automated guided vehicle (AGV) fleet management platform market players.

As per the latest AGV fleet management platform market report, these key players are following the latest trends to gain incremental opportunities.

Key players have been profiled in the AGV fleet management platform market report based on parameters including business segments, latest developments, company overview, product portfolio, business strategies, and financial overview.

|

Attribute |

Detail |

|

Market Value in 2022 |

US$ 880.0 Mn |

|

Market Forecast Value in 2031 |

US$ 3.2 Bn |

|

Growth Rate (CAGR) |

15.7% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Mn/Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 880.0 Mn in 2022

It is likely to advance at a CAGR of 15.7% by 2031

It would be worth US$ 3.2 Bn in 2031

Increase in investment in AGV fleet management platforms by end-use industries, rise in demand for automation in operations for maximum productivity, surge in popularity of cost-effective and safe AGVs, and introduction of mobile robots

The magnetic guidance technology segment held major share in 2022

Asia Pacific is anticipated to be a highly lucrative region in the near future

Addverb Technologies, Aichi Machine Industry Co., Ltd., China SME Group Co., Ltd., DAIFUKU GROUP, Egemin Automation Inc., Fori Automation, GreyOrange, GRIDBOTS, Hi-tech Robotic Systemz Limited, JBT Corporation, KOLEC, Kinexon, Konecranes, KUKA AG, Hikrobot, MHP Management- und IT-Beratung GmbH, Murata Machinery, Ltd., Oceaneering International Inc., Shenzhen Mircolomay Technology Co., Ltd, Simplex Robotics Pvt Ltd., System Logistics S.p.A., and Toyota Industries Corporation

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Size, Value US$ Bn, 2017-2031

1.2. Go to Market Strategy

1.2.1. Demand & Supply Side Trends

1.2.2. Identification of Potential Market Spaces

1.2.3. Understanding the Buying Process of the Customers

1.2.4. Preferred Sales & Marketing Strategy

1.3. TMR Analysis and Recommendations

2. Market Overview

2.1. Market Coverage / Taxonomy

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Opportunity

2.3. Market Factor Analysis

2.3.1. Porter’s Five Force Analysis

2.3.2. SWOT Analysis

2.3.3. Value Chain Analysis

2.4. Regulatory Scenario

3. Key Industry Trends and Developments

3.1. Product Trends

3.2. Industry/ Application Trends

3.3. Technology Trends

3.3.1. IOT

3.3.2. 5G

3.3.3. Machine Learning

3.4. Emerging Technology Trends

3.4.1. LiDAR Sensors

3.4.2. Camera Vision

3.4.3. Dual Mode AGVs

4. Pricing (US$) for AGVs, by key Vendors, by Region

4.1. Cost Structure Analysis

4.2. Profit Margin Analysis

5. Supplier and Customer Analysis of AGVs

5.1. Key Suppliers of AGVs

5.2. Key Customer of AGVs, by Industry

5.3. For instance, Customers of Gridbots Technologies Pvt. Ltd. in India are Adani Group for Ports/ Terminal and TATA group for Chemical/Energy

6. Global Automated Guided Vehicle (AGV) Fleet Management Platform Market, By Type

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Automated Guided Vehicle (AGV) Fleet Management Platform Market Size Analysis & Forecast, 2017-2031, By Type

6.2.1. Forklift Vehicle

6.2.2. Assembly Line Vehicle

6.2.3. Automatic Guided Cart (AGC)

6.2.4. Towing Vehicle

6.2.5. Unit Load Carrier

6.2.6. Pallet Truck

6.2.7. Autonomous Mobile Robot

6.2.8. Others

7. Global Automated Guided Vehicle (AGV) Fleet Management Platform Market, By Technology

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Automated Guided Vehicle (AGV) Fleet Management Platform Market Size Analysis & Forecast, 2017-2031, By Technology

7.2.1. Laser Guidance

7.2.2. Vision Guidance

7.2.3. Magnetic Guidance

7.2.4. Inductive Guidance

7.2.5. Optical Tape Guidance

7.2.6. Others

8. Global Automated Guided Vehicle (AGV) Fleet Management Platform Market, By Application

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Automated Guided Vehicle (AGV) Fleet Management Platform Market Size Analysis & Forecast, 2017-2031, By Application

8.2.1. Logistics

8.2.2. Warehousing

8.2.3. Assembly

8.2.4. Packaging

8.2.5. Others

9. Global Automated Guided Vehicle (AGV) Fleet Management Platform Market, By End-use Industry

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global Automated Guided Vehicle (AGV) Fleet Management Platform Market Size Analysis & Forecast, 2017-2031, By End-use Industry

9.2.1. Retail/Wholesale

9.2.2. Food/Pharma

9.2.3. Transport/Logistics

9.2.4. Manufacturing

9.2.5. Automotive

9.2.6. Ports/Terminal

9.2.7. Mining & Construction

9.2.8. Chemical/Energy

9.2.9. Forestry/Wood

9.2.10. Others

10. Global Automated Guided Vehicle (AGV) Fleet Management Platform Market, By Region

10.1. Market Snapshot

10.1.1. Introduction, Definition, and Key Findings

10.1.2. Market Growth & Y-o-Y Projections

10.1.3. Base Point Share Analysis

10.2. Global Automated Guided Vehicle (AGV) Fleet Management Platform Market Size Analysis & Forecast, 2017-2031, By Region

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Middle East & Africa

10.2.5. South America

11. North America Automated Guided Vehicle (AGV) Fleet Management Platform Market

11.1. Market Snapshot

11.2. Automated Guided Vehicle (AGV) Fleet Management Platform Market Size Analysis & Forecast, 2017-2031, By Type

11.2.1. Forklift Vehicle

11.2.2. Assembly Line Vehicle

11.2.3. Automatic Guided Cart (AGC)

11.2.4. Towing Vehicle

11.2.5. Unit Load Carrier

11.2.6. Pallet Truck

11.2.7. Autonomous Mobile Robot

11.2.8. Others

11.3. Automated Guided Vehicle (AGV) Fleet Management Platform Market Size Analysis & Forecast, 2017-2031, By Technology

11.3.1. Laser Guidance

11.3.2. Vision Guidance

11.3.3. Magnetic Guidance

11.3.4. Inductive Guidance

11.3.5. Optical Tape Guidance

11.3.6. Others

11.4. Automated Guided Vehicle (AGV) Fleet Management Platform Market Size Analysis & Forecast, 2017-2031, By Application

11.4.1. Logistics

11.4.2. Warehousing

11.4.3. Assembly

11.4.4. Packaging

11.4.5. Others

11.5. Automated Guided Vehicle (AGV) Fleet Management Platform Market Size Analysis & Forecast, 2017-2031, By End-use Industry

11.5.1. Retail/Wholesale

11.5.2. Food/Pharma

11.5.3. Transport/Logistics

11.5.4. Manufacturing

11.5.5. Automotive

11.5.6. Ports/Terminal

11.5.7. Mining & Construction

11.5.8. Chemical/Energy

11.5.9. Forestry/Wood

11.5.10. Others

11.6. Automated Guided Vehicle (AGV) Fleet Management Platform Market Size & Forecast, 2017-2031, By Country

11.6.1. The U. S.

11.6.2. Canada

11.6.3. Mexico

12. Europe Automated Guided Vehicle (AGV) Fleet Management Platform Market

12.1. Market Snapshot

12.2. Automated Guided Vehicle (AGV) Fleet Management Platform Market Size Analysis & Forecast, 2017-2031, By Type

12.2.1. Forklift Vehicle

12.2.2. Assembly Line Vehicle

12.2.3. Automatic Guided Cart (AGC)

12.2.4. Towing Vehicle

12.2.5. Unit Load Carrier

12.2.6. Pallet Truck

12.2.7. Autonomous Mobile Robot

12.2.8. Others

12.3. Automated Guided Vehicle (AGV) Fleet Management Platform Market Size Analysis & Forecast, 2017-2031, By Technology

12.3.1. Laser Guidance

12.3.2. Vision Guidance

12.3.3. Magnetic Guidance

12.3.4. Inductive Guidance

12.3.5. Optical Tape Guidance

12.3.6. Others

12.4. Automated Guided Vehicle (AGV) Fleet Management Platform Market Size Analysis & Forecast, 2017-2031, By Application

12.4.1. Logistics

12.4.2. Warehousing

12.4.3. Assembly

12.4.4. Packaging

12.4.5. Others

12.5. Automated Guided Vehicle (AGV) Fleet Management Platform Market Size Analysis & Forecast, 2017-2031, By End-use Industry

12.5.1. Retail/Wholesale

12.5.2. Food/Pharma

12.5.3. Transport/Logistics

12.5.4. Manufacturing

12.5.5. Automotive

12.5.6. Ports/Terminal

12.5.7. Mining & Construction

12.5.8. Chemical/Energy

12.5.9. Forestry/Wood

12.5.10. Others

12.6. Automated Guided Vehicle (AGV) Fleet Management Platform Market Size & Forecast, 2017-2031, By Country

12.6.1. Germany

12.6.2. U. K.

12.6.3. France

12.6.4. Italy

12.6.5. Spain

12.6.6. Nordic Countries

12.6.7. Russia & CIS

12.6.8. Rest of Europe

13. Asia Pacific Automated Guided Vehicle (AGV) Fleet Management Platform Market

13.1. Market Snapshot

13.2. Automated Guided Vehicle (AGV) Fleet Management Platform Market Size Analysis & Forecast, 2017-2031, By Type

13.2.1. Forklift Vehicle

13.2.2. Assembly Line Vehicle

13.2.3. Automatic Guided Cart (AGC)

13.2.4. Towing Vehicle

13.2.5. Unit Load Carrier

13.2.6. Pallet Truck

13.2.7. Autonomous Mobile Robot

13.2.8. Others

13.3. Automated Guided Vehicle (AGV) Fleet Management Platform Market Size Analysis & Forecast, 2017-2031, By Technology

13.3.1. Laser Guidance

13.3.2. Vision Guidance

13.3.3. Magnetic Guidance

13.3.4. Inductive Guidance

13.3.5. Optical Tape Guidance

13.3.6. Others

13.4. Automated Guided Vehicle (AGV) Fleet Management Platform Market Size Analysis & Forecast, 2017-2031, By Application

13.4.1. Logistics

13.4.2. Warehousing

13.4.3. Assembly

13.4.4. Packaging

13.4.5. Others

13.5. Automated Guided Vehicle (AGV) Fleet Management Platform Market Size Analysis & Forecast, 2017-2031, By End-use Industry

13.5.1. Retail/Wholesale

13.5.2. Food/Pharma

13.5.3. Transport/Logistics

13.5.4. Manufacturing

13.5.5. Automotive

13.5.6. Ports/Terminal

13.5.7. Mining & Construction

13.5.8. Chemical/Energy

13.5.9. Forestry/Wood

13.5.10. Others

13.6. Automated Guided Vehicle (AGV) Fleet Management Platform Market Size & Forecast, 2017-2031, By Country

13.6.1. China

13.6.2. India

13.6.3. Japan

13.6.4. ASEAN Countries

13.6.5. South Korea

13.6.6. ANZ

13.6.7. Rest of Asia Pacific

14. Middle East & Africa Automated Guided Vehicle (AGV) Fleet Management Platform Market

14.1. Market Snapshot

14.2. Automated Guided Vehicle (AGV) Fleet Management Platform Market Size Analysis & Forecast, 2017-2031, By Type

14.2.1. Forklift Vehicle

14.2.2. Assembly Line Vehicle

14.2.3. Automatic Guided Cart (AGC)

14.2.4. Towing Vehicle

14.2.5. Unit Load Carrier

14.2.6. Pallet Truck

14.2.7. Autonomous Mobile Robot

14.2.8. Others

14.3. Automated Guided Vehicle (AGV) Fleet Management Platform Market Size Analysis & Forecast, 2017-2031, By Technology

14.3.1. Laser Guidance

14.3.2. Vision Guidance

14.3.3. Magnetic Guidance

14.3.4. Inductive Guidance

14.3.5. Optical Tape Guidance

14.3.6. Others

14.4. Automated Guided Vehicle (AGV) Fleet Management Platform Market Size Analysis & Forecast, 2017-2031, By Application

14.4.1. Logistics

14.4.2. Warehousing

14.4.3. Assembly

14.4.4. Packaging

14.4.5. Others

14.5. Automated Guided Vehicle (AGV) Fleet Management Platform Market Size Analysis & Forecast, 2017-2031, By End-use Industry

14.5.1. Retail/Wholesale

14.5.2. Food/Pharma

14.5.3. Transport/Logistics

14.5.4. Manufacturing

14.5.5. Automotive

14.5.6. Ports/Terminal

14.5.7. Mining & Construction

14.5.8. Chemical/Energy

14.5.9. Forestry/Wood

14.5.10. Others

14.6. Automated Guided Vehicle (AGV) Fleet Management Platform Market Size & Forecast, 2017-2031, By Country

14.6.1. GCC

14.6.2. South Africa

14.6.3. Turkey

14.6.4. Rest of Middle East & Africa

15. South America Automated Guided Vehicle (AGV) Fleet Management Platform Market

15.1. Market Snapshot

15.2. Automated Guided Vehicle (AGV) Fleet Management Platform Market Size Analysis & Forecast, 2017-2031, By Type

15.2.1. Forklift Vehicle

15.2.2. Assembly Line Vehicle

15.2.3. Automatic Guided Cart (AGC)

15.2.4. Towing Vehicle

15.2.5. Unit Load Carrier

15.2.6. Pallet Truck

15.2.7. Autonomous Mobile Robot

15.2.8. Others

15.3. Automated Guided Vehicle (AGV) Fleet Management Platform Market Size Analysis & Forecast, 2017-2031, By Technology

15.3.1. Laser Guidance

15.3.2. Vision Guidance

15.3.3. Magnetic Guidance

15.3.4. Inductive Guidance

15.3.5. Optical Tape Guidance

15.3.6. Others

15.4. Automated Guided Vehicle (AGV) Fleet Management Platform Market Size Analysis & Forecast, 2017-2031, By Application

15.4.1. Logistics

15.4.2. Warehousing

15.4.3. Assembly

15.4.4. Packaging

15.4.5. Others

15.5. Automated Guided Vehicle (AGV) Fleet Management Platform Market Size Analysis & Forecast, 2017-2031, By End-use Industry

15.5.1. Retail/Wholesale

15.5.2. Food/Pharma

15.5.3. Transport/Logistics

15.5.4. Manufacturing

15.5.5. Automotive

15.5.6. Ports/Terminal

15.5.7. Mining & Construction

15.5.8. Chemical/Energy

15.5.9. Forestry/Wood

15.5.10. Others

15.6. Automated Guided Vehicle (AGV) Fleet Management Platform Market Size & Forecast, 2017-2031, By Country

15.6.1. Brazil

15.6.2. Argentina

15.6.3. Rest of South America

16. Competitive Landscape

16.1. Company Share Analysis/ Brand Share Analysis, 2022

16.2. Pricing comparison among key players

16.3. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

17. Company Profile/ Key Players

17.1. Addverb Technologies

17.1.1. Company Overview

17.1.2. Company Footprints

17.1.3. Production Locations

17.1.4. Product Portfolio

17.1.5. Competitors & Customers

17.1.6. Subsidiaries & Parent Organization

17.1.7. Recent Developments

17.1.8. Financial Analysis

17.1.9. Profitability

17.1.10. Revenue Share

17.2. Aichi Machine Industry Co., Ltd.

17.2.1. Company Overview

17.2.2. Company Footprints

17.2.3. Production Locations

17.2.4. Product Portfolio

17.2.5. Competitors & Customers

17.2.6. Subsidiaries & Parent Organization

17.2.7. Recent Developments

17.2.8. Financial Analysis

17.2.9. Profitability

17.2.10. Revenue Share

17.3. China SME Group Co., Ltd

17.3.1. Company Overview

17.3.2. Company Footprints

17.3.3. Production Locations

17.3.4. Product Portfolio

17.3.5. Competitors & Customers

17.3.6. Subsidiaries & Parent Organization

17.3.7. Recent Developments

17.3.8. Financial Analysis

17.3.9. Profitability

17.3.10. Revenue Share

17.4. DAIFUKU GROUP

17.4.1. Company Overview

17.4.2. Company Footprints

17.4.3. Production Locations

17.4.4. Product Portfolio

17.4.5. Competitors & Customers

17.4.6. Subsidiaries & Parent Organization

17.4.7. Recent Developments

17.4.8. Financial Analysis

17.4.9. Profitability

17.4.10. Revenue Share

17.5. Egemin Automation Inc.

17.5.1. Company Overview

17.5.2. Company Footprints

17.5.3. Production Locations

17.5.4. Product Portfolio

17.5.5. Competitors & Customers

17.5.6. Subsidiaries & Parent Organization

17.5.7. Recent Developments

17.5.8. Financial Analysis

17.5.9. Profitability

17.5.10. Revenue Share

17.6. Fori Automation

17.6.1. Company Overview

17.6.2. Company Footprints

17.6.3. Production Locations

17.6.4. Product Portfolio

17.6.5. Competitors & Customers

17.6.6. Subsidiaries & Parent Organization

17.6.7. Recent Developments

17.6.8. Financial Analysis

17.6.9. Profitability

17.6.10. Revenue Share

17.7. GreyOrange

17.7.1. Company Overview

17.7.2. Company Footprints

17.7.3. Production Locations

17.7.4. Product Portfolio

17.7.5. Competitors & Customers

17.7.6. Subsidiaries & Parent Organization

17.7.7. Recent Developments

17.7.8. Financial Analysis

17.7.9. Profitability

17.7.10. Revenue Share

17.8. GRIDBOTS

17.8.1. Company Overview

17.8.2. Company Footprints

17.8.3. Production Locations

17.8.4. Product Portfolio

17.8.5. Competitors & Customers

17.8.6. Subsidiaries & Parent Organization

17.8.7. Recent Developments

17.8.8. Financial Analysis

17.8.9. Profitability

17.8.10. Revenue Share

17.9. Hi-tech Robotic Systemz Limited

17.9.1. Company Overview

17.9.2. Company Footprints

17.9.3. Production Locations

17.9.4. Product Portfolio

17.9.5. Competitors & Customers

17.9.6. Subsidiaries & Parent Organization

17.9.7. Recent Developments

17.9.8. Financial Analysis

17.9.9. Profitability

17.9.10. Revenue Share

17.10. JBT Corporation

17.10.1. Company Overview

17.10.2. Company Footprints

17.10.3. Production Locations

17.10.4. Product Portfolio

17.10.5. Competitors & Customers

17.10.6. Subsidiaries & Parent Organization

17.10.7. Recent Developments

17.10.8. Financial Analysis

17.10.9. Profitability

17.10.10. Revenue Share

17.11. KOLEC

17.11.1. Company Overview

17.11.2. Company Footprints

17.11.3. Production Locations

17.11.4. Product Portfolio

17.11.5. Competitors & Customers

17.11.6. Subsidiaries & Parent Organization

17.11.7. Recent Developments

17.11.8. Financial Analysis

17.11.9. Profitability

17.11.10. Revenue Share

17.12. Kinexon

17.12.1. Company Overview

17.12.2. Company Footprints

17.12.3. Production Locations

17.12.4. Product Portfolio

17.12.5. Competitors & Customers

17.12.6. Subsidiaries & Parent Organization

17.12.7. Recent Developments

17.12.8. Financial Analysis

17.12.9. Profitability

17.12.10. Revenue Share

17.13. Konecranes

17.13.1. Company Overview

17.13.2. Company Footprints

17.13.3. Production Locations

17.13.4. Product Portfolio

17.13.5. Competitors & Customers

17.13.6. Subsidiaries & Parent Organization

17.13.7. Recent Developments

17.13.8. Financial Analysis

17.13.9. Profitability

17.13.10. Revenue Share

17.14. KUKA AG

17.14.1. Company Overview

17.14.2. Company Footprints

17.14.3. Production Locations

17.14.4. Product Portfolio

17.14.5. Competitors & Customers

17.14.6. Subsidiaries & Parent Organization

17.14.7. Recent Developments

17.14.8. Financial Analysis

17.14.9. Profitability

17.14.10. Revenue Share

17.15. Hikrobot

17.15.1. Company Overview

17.15.2. Company Footprints

17.15.3. Production Locations

17.15.4. Product Portfolio

17.15.5. Competitors & Customers

17.15.6. Subsidiaries & Parent Organization

17.15.7. Recent Developments

17.15.8. Financial Analysis

17.15.9. Profitability

17.15.10. Revenue Share

17.16. MHP Management- und IT-Beratung GmbH

17.16.1. Company Overview

17.16.2. Company Footprints

17.16.3. Production Locations

17.16.4. Product Portfolio

17.16.5. Competitors & Customers

17.16.6. Subsidiaries & Parent Organization

17.16.7. Recent Developments

17.16.8. Financial Analysis

17.16.9. Profitability

17.16.10. Revenue Share

17.17. Murata Machinery, Ltd.

17.17.1. Company Overview

17.17.2. Company Footprints

17.17.3. Production Locations

17.17.4. Product Portfolio

17.17.5. Competitors & Customers

17.17.6. Subsidiaries & Parent Organization

17.17.7. Recent Developments

17.17.8. Financial Analysis

17.17.9. Profitability

17.17.10. Revenue Share

17.18. Oceaneering International, Inc.

17.18.1. Company Overview

17.18.2. Company Footprints

17.18.3. Production Locations

17.18.4. Product Portfolio

17.18.5. Competitors & Customers

17.18.6. Subsidiaries & Parent Organization

17.18.7. Recent Developments

17.18.8. Financial Analysis

17.18.9. Profitability

17.18.10. Revenue Share

17.19. SHENZHEN MIRCOLOMAY TECHNOLOGY CO., LTD

17.19.1. Company Overview

17.19.2. Company Footprints

17.19.3. Production Locations

17.19.4. Product Portfolio

17.19.5. Competitors & Customers

17.19.6. Subsidiaries & Parent Organization

17.19.7. Recent Developments

17.19.8. Financial Analysis

17.19.9. Profitability

17.19.10. Revenue Share

17.20. Simplex Robotics Pvt Ltd

17.20.1. Company Overview

17.20.2. Company Footprints

17.20.3. Production Locations

17.20.4. Product Portfolio

17.20.5. Competitors & Customers

17.20.6. Subsidiaries & Parent Organization

17.20.7. Recent Developments

17.20.8. Financial Analysis

17.20.9. Profitability

17.20.10. Revenue Share

17.21. System Logistics S.p.A.

17.21.1. Company Overview

17.21.2. Company Footprints

17.21.3. Production Locations

17.21.4. Product Portfolio

17.21.5. Competitors & Customers

17.21.6. Subsidiaries & Parent Organization

17.21.7. Recent Developments

17.21.8. Financial Analysis

17.21.9. Profitability

17.21.10. Revenue Share

17.22. TOYOTA INDUSTRIES CORPORATION

17.22.1. Company Overview

17.22.2. Company Footprints

17.22.3. Production Locations

17.22.4. Product Portfolio

17.22.5. Competitors & Customers

17.22.6. Subsidiaries & Parent Organization

17.22.7. Recent Developments

17.22.8. Financial Analysis

17.22.9. Profitability

17.22.10. Revenue Share

17.23. Other Key Players

17.23.1. Company Overview

17.23.2. Company Footprints

17.23.3. Production Locations

17.23.4. Product Portfolio

17.23.5. Competitors & Customers

17.23.6. Subsidiaries & Parent Organization

17.23.7. Recent Developments

17.23.8. Financial Analysis

17.23.9. Profitability

17.23.10. Revenue Share

List of Tables

Table 1: Global Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by Type, 2017-2031

Table 2: Global Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by Technology, 2017-2031

Table 3: Global Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Table 4: Global Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by End-use Industry, 2017-2031

Table 5: Global Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by Region, 2017-2031

Table 6: North America Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by Type, 2017-2031

Table 7: North America Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by Technology, 2017-2031

Table 8: North America Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Table 9: North America Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by End-use Industry, 2017-2031

Table 10: North America Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 11: Europe Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by Type, 2017-2031

Table 12: Europe Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by Technology, 2017-2031

Table 13: Europe Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Table 14: Europe Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by End-use Industry, 2017-2031

Table 15: Europe Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 16: Asia Pacific Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by Type, 2017-2031

Table 17: Asia Pacific Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by Technology, 2017-2031

Table 18: Asia Pacific Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Table 19: Asia Pacific Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by End-use Industry, 2017-2031

Table 20: Asia Pacific Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 21: Middle East & Africa Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by Type, 2017-2031

Table 22: Middle East & Africa Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by Technology, 2017-2031

Table 23: Middle East & Africa Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Table 24: Middle East & Africa Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by End-use Industry, 2017-2031

Table 25: Middle East & Africa Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 26: South America Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by Type, 2017-2031

Table 27: South America Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by Technology, 2017-2031

Table 28: South America Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Table 29: South America Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by End-use Industry, 2017-2031

Table 30: South America Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

List of Figures

Figure 1: Global Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by Type, 2017-2031

Figure 2: Global Automated Guided Vehicle (AGV) Fleet Management Platform Market, Incremental Opportunity, by Type, Value (US$ Bn), 2023-2031

Figure 3: Global Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by Technology, 2017-2031

Figure 4: Global Automated Guided Vehicle (AGV) Fleet Management Platform Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2023-2031

Figure 5: Global Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Figure 6: Global Automated Guided Vehicle (AGV) Fleet Management Platform Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 7: Global Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by End-use Industry, 2017-2031

Figure 8: Global Automated Guided Vehicle (AGV) Fleet Management Platform Market, Incremental Opportunity, by End-use Industry, Value (US$ Bn), 2023-2031

Figure 9: Global Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by Region, 2017-2031

Figure 10: Global Automated Guided Vehicle (AGV) Fleet Management Platform Market, Incremental Opportunity, by Region, Value (US$ Bn), 2023-2031

Figure 11: North America Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by Type, 2017-2031

Figure 12: North America Automated Guided Vehicle (AGV) Fleet Management Platform Market, Incremental Opportunity, by Type, Value (US$ Bn), 2017-2031

Figure 13: North America Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by Technology, 2017-2031

Figure 14: North America Automated Guided Vehicle (AGV) Fleet Management Platform Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2023-2031

Figure 15: North America Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Figure 16: North America Automated Guided Vehicle (AGV) Fleet Management Platform Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 17: North America Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by End-use Industry, 2017-2031

Figure 18: North America Automated Guided Vehicle (AGV) Fleet Management Platform Market, Incremental Opportunity, by End-use Industry, Value (US$ Bn), 2023-2031

Figure 19: North America Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 20: North America Automated Guided Vehicle (AGV) Fleet Management Platform Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 21: Europe Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by Type, 2017-2031

Figure 22: Europe Automated Guided Vehicle (AGV) Fleet Management Platform Market, Incremental Opportunity, by Type, Value (US$ Bn), 2017-2031

Figure 23: Europe Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by Technology, 2017-2031

Figure 24: Europe Automated Guided Vehicle (AGV) Fleet Management Platform Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2023-2031

Figure 25: Europe Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Figure 26: Europe Automated Guided Vehicle (AGV) Fleet Management Platform Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 27: Europe Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by End-use Industry, 2017-2031

Figure 28: Europe Automated Guided Vehicle (AGV) Fleet Management Platform Market, Incremental Opportunity, by End-use Industry, Value (US$ Bn), 2023-2031

Figure 29: Europe Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 30: Europe Automated Guided Vehicle (AGV) Fleet Management Platform Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 31: Asia Pacific Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by Type, 2017-2031

Figure 32: Asia Pacific Automated Guided Vehicle (AGV) Fleet Management Platform Market, Incremental Opportunity, by Type, Value (US$ Bn), 2017-2031

Figure 33: Asia Pacific Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by Technology, 2017-2031

Figure 34: Asia Pacific Automated Guided Vehicle (AGV) Fleet Management Platform Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2023-2031

Figure 35: Asia Pacific Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Figure 36: Asia Pacific Automated Guided Vehicle (AGV) Fleet Management Platform Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 37: Asia Pacific Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by End-use Industry, 2017-2031

Figure 38: Asia Pacific Automated Guided Vehicle (AGV) Fleet Management Platform Market, Incremental Opportunity, by End-use Industry, Value (US$ Bn), 2023-2031

Figure 39: Asia Pacific Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 40: Asia Pacific Automated Guided Vehicle (AGV) Fleet Management Platform Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 41: Middle East & Africa Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by Type, 2017-2031

Figure 42: Middle East & Africa Automated Guided Vehicle (AGV) Fleet Management Platform Market, Incremental Opportunity, by Type, Value (US$ Bn), 2017-2031

Figure 43: Middle East & Africa Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by Technology, 2017-2031

Figure 44: Middle East & Africa Automated Guided Vehicle (AGV) Fleet Management Platform Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2023-2031

Figure 45: Middle East & Africa Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Figure 46: Middle East & Africa Automated Guided Vehicle (AGV) Fleet Management Platform Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 47: Middle East & Africa Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by End-use Industry, 2017-2031

Figure 48: Middle East & Africa Automated Guided Vehicle (AGV) Fleet Management Platform Market, Incremental Opportunity, by End-use Industry, Value (US$ Bn), 2023-2031

Figure 49: Middle East & Africa Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 50: Middle East & Africa Automated Guided Vehicle (AGV) Fleet Management Platform Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 51: South America Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by Type, 2017-2031

Figure 52: South America Automated Guided Vehicle (AGV) Fleet Management Platform Market, Incremental Opportunity, by Type, Value (US$ Bn), 2017-2031

Figure 53: South America Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by Technology, 2017-2031

Figure 54: South America Automated Guided Vehicle (AGV) Fleet Management Platform Market, Incremental Opportunity, by Technology, Value (US$ Bn), 2023-2031

Figure 55: South America Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Figure 56: South America Automated Guided Vehicle (AGV) Fleet Management Platform Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 57: South America Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by End-use Industry, 2017-2031

Figure 58: South America Automated Guided Vehicle (AGV) Fleet Management Platform Market, Incremental Opportunity, by End-use Industry, Value (US$ Bn), 2023-2031

Figure 59: South America Automated Guided Vehicle (AGV) Fleet Management Platform Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 60: South America Automated Guided Vehicle (AGV) Fleet Management Platform Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031