Analysts’ Viewpoint

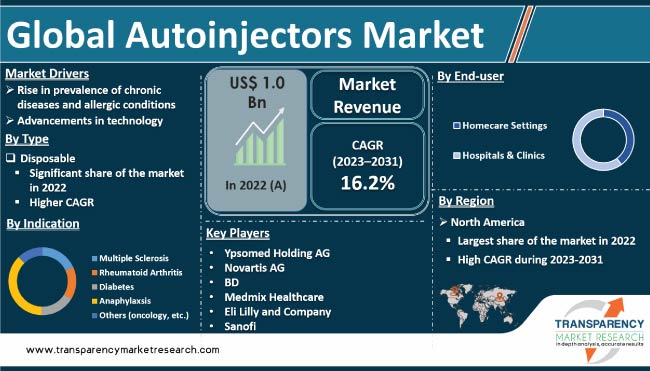

Increase in prevalence of chronic diseases is driving the global autoinjectors market. Conditions such as diabetes, rheumatoid arthritis, multiple sclerosis, and autoimmune diseases require frequent and precise administration of medications. Shift toward self-care and home healthcare has propelled demand for autoinjectors. Surge in incidence of anaphylaxis and severe allergic reactions has fueling demand for autoinjectors, particularly for epinephrine administration. Furthermore, ease of use and accuracy offered by autoinjectors are expected to propel market expansion during the forecast period.

Technological advancements in autoinjector devices offer lucrative opportunities to market players. Manufacturers are continually investing in research & development to improve the functionality, usability, and safety features of autoinjectors.

Autoinjectors are devices designed to deliver a specific dose of medication to patients with ease and precision. These are typically used for self-administration of medications, and offer advantages such as convenience, accuracy, and reduced needlestick injuries.

Autoinjectors have witnessed substantial developments, including integration of electronic features such as dose memory, connectivity, and audio-visual guidance, enhancing patient adherence and monitoring.

Manufacturers are focusing on user-friendly designs, ergonomic features, and improvements in needle safety mechanisms to ensure patient comfort and safety. Moreover, advancements in technology have led to the development of smart autoinjectors capable of wirelessly transmitting data to healthcare providers for monitoring and tracking purposes.

Rise in prevalence of chronic diseases has led to a shift toward self-care and increase in demand for home healthcare. These factors are likely to propel global autoinjectors market size during the forecast periods.

Rise in prevalence of chronic diseases such as diabetes, rheumatoid arthritis, multiple sclerosis, and autoimmune disorders necessitates regular medication administration. This has increased demand for autoinjectors as a convenient and user-friendly method for patients to self-administer their medications, reducing their reliance on healthcare professionals and improving their overall quality of life.

The portable nature and ease of use of autoinjectors make them particularly beneficial for individuals who require frequent injections, allowing them to administer their medication conveniently at home or while on the move.

Prevalence of allergic conditions, including severe allergies and anaphylaxis, has also contributed to the surge in global autoinjectors market demand. Anaphylaxis is a potentially life-threatening allergic reaction that requires immediate administration of epinephrine (adrenaline). Autoinjectors, such as EpiPens, are specifically designed to deliver precise dose of epinephrine during an anaphylactic emergency.

Increase in awareness about anaphylaxis and the importance of timely treatment has induced individuals with allergies and their caregivers to opt for autoinjectors as a crucial tool in managing and responding to allergic reactions.

Advancements in technology are expected to drive the global auto injectable market value by revolutionizing the way injectable medications are administered. These advancements encompass various aspects, including device design, connectivity, usability, and safety features These are aimed at improving patient experience and treatment outcomes.

Device design is one key area of advancement. Manufacturers are continuously innovating to create more user-friendly and intuitive autoinjectors. This involves optimizing the ergonomics of the device, simplifying the injection process, and ensuring accurate dosage delivery. For instance, autoinjectors now feature improved grip designs, ergonomic buttons, and clear visual indicators to facilitate easy and precise administration.

Connectivity is another crucial aspect driving market development. With the integration of digital technologies, autoinjectors can now connect to mobile applications and healthcare platforms, enabling remote monitoring, data collection, and personalized treatment management. Patients can receive reminders, track their injections, and share data with healthcare providers, leading to better treatment adherence and disease management.

Usability enhancements have also played a significant role in propelling the market. Autoinjectors now incorporate features such as audio-visual prompts, systematic instructions, and feedback mechanisms to guide patients through the injection process. These user-friendly features improve patient confidence, especially for individuals who may have limited experience with self-administration.

Safety is a paramount concern, and technological advancements have addressed this by incorporating various safety features in autoinjectors. Needlestick injuries are minimized through mechanisms such as automatic needle retraction or needle shields, reducing the risk of accidental pricks. Some devices also include sensors to detect correct needle placement and prevent injection if not positioned correctly, ensuring precise and safe delivery of medication.

In terms of type, the disposable autoinjectors segment accounted for the largest global autoinjectors market share in 2022. This is ascribed to several key factors. Disposable autoinjectors offer convenience and simplicity to both patients and healthcare providers.

These devices are pre-filled with a specific dose of medication, eliminating the need for manual loading or measurement. Patients can easily self-administer their medication without the hassle of handling needles, drawing up doses, or dealing with vials and syringes. This simplicity makes disposable autoinjectors highly preferred, especially for individuals who may have limited experience or dexterity in medication administration.

Disposable autoinjectors provide enhanced safety features. These are designed to be single-use devices, ensuring sterility and minimizing the risk of contamination or needlestick injuries. Once the medication is administered, the autoinjector is discarded, eliminating the need for needle disposal or cleaning procedure.

Based on route of administration, the subcutaneous segment dominated the global market in 2022. Subcutaneous administration is widely used for the delivery of various medications, including biologics, hormones, and vaccines.

Several therapeutic agents are designed to be administered into the subcutaneous tissue layer, which allows for slower and more controlled absorption into the bloodstream. Autoinjectors specifically designed for subcutaneous injection provide a convenient and effective method for patients to self-administer these medications at home or in clinical settings.

The subcutaneous route offers advantages in terms of bioavailability and pharmacokinetics. Several medications are optimally absorbed and have predictable pharmacokinetic profiles when administered subcutaneously.

Autoinjectors provide consistent and accurate delivery of medication into the subcutaneous tissue, ensuring reliable absorption and maintaining therapeutic drug levels over a prolonged period.

In terms of application, the anaphylaxis segment accounted for the leading share of the global autoinjectors market. Anaphylaxis is a severe and potentially life-threatening allergic reaction that necessitates immediate administration of epinephrine.

Autoinjectors have become the established method for delivering epinephrine during an anaphylactic emergency, making them an indispensable tool in managing this condition.

Prevalence of anaphylaxis is a growing global health concern. Incidence of severe allergic reactions is increasing, with a growing number of individuals being diagnosed with allergies to various triggers such as foods, insect stings, medications, and more. Consequently, demand for autoinjectors to effectively treat anaphylaxis is witnessing significant rise in the market.

Based on end-user, the hospitals & clinics segment dominated the global market in 2022. Autoinjectors are extensively used in hospitals and clinics for various purposes, including the administration of medications for chronic diseases, emergency treatments, and vaccinations. Availability of skilled healthcare professionals in these settings ensures proper training and supervision for patients who require assistance in using autoinjectors.

Hospitals and clinics have well-established infrastructure and resources to support the utilization of autoinjectors. These facilities are equipped with medical professionals, including doctors, nurses, and pharmacists, who play a critical role in prescribing, dispensing, and administering medications via autoinjectors.

Hospitals and clinics have proper storage facilities and inventory management systems to handle the stock of autoinjectors and ensure their availability when needed.

North America benefits from a strong healthcare infrastructure and high prevalence of chronic diseases. Increase in incidence of conditions such as diabetes, rheumatoid arthritis, multiple sclerosis, and autoimmune disorders in the region has led to higher demand for self-administered injectable medications.

Europe has witnessed advancements in technology and innovation in the field of autoinjectors. Manufacturers in the region are continually investing in research and development to enhance product features, usability, and patient experience.

Introduction of user-friendly designs, needle safety mechanisms, and electronic monitoring systems has improved the overall functionality and acceptance of autoinjectors. These technological advancements are propelling the autoinjectors market in Europe.

Government initiatives and policies focused on improving healthcare infrastructure and access to medical technologies have contributed to the growth of the autoinjectors market in Asia Pacific. Governments in countries such as China and India are investing in healthcare reforms, which include the expansion of healthcare facilities and the promotion of self-care practices. Such initiatives create a conducive environment for the adoption of autoinjectors and drive market growth.

The global market is fragmented, with the presence of a number of players. Leading players have adopted strategies such new product development and merger & expansion in order to increase market presence. Ypsomed Holding AG, Novartis AG, BD, Medmix Healthcare, Eli Lilly and Company, Sanofi, Mylan N.V., Amgen, Inc., SHL Medical AG, and Recipharm AB are the prominent players in the market.

The autoinjectors market report profiles key players based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Size in 2022 |

US$ 1.0 Bn |

|

Forecast Value in 2031 |

More than US$ 3.8 Bn |

|

CAGR - 2022-2031 |

16.2% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

|

|

Pricing |

|

The global industry was valued at US$ 1.0 Bn in 2022

It is projected to reach more than US$ 3.8 Bn by 2031

The industry is likely to advance at a CAGR of 16.2% from 2023 to 2031

North America is expected to account for largest share from 2022 to 2031

Ypsomed Holding AG, Novartis AG, BD, Medmix Healthcare, Eli Lilly and Company, Sanofi, Mylan N.V., Amgen, Inc., SHL Medical AG, and Recipharm AB are the prominent players in the market

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Autoinjectors Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Autoinjectors Market Analysis and Forecast, 2017-2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Technological Advancement

5.2. Disease Incidence and Prevalence

5.3. Overview: Future of Autoinjectors

5.4. Regulatory Analysis

5.5. COVID-19 Impact Analysis

6. Global Autoinjectors Market Analysis and Forecast, by Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Type, 2017-2031

6.3.1. Disposable

6.3.2. Reusable

6.4. Market Attractiveness Analysis, by Type

7. Global Autoinjectors Market Analysis and Forecast, by Technology

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Technology, 2017-2031

7.3.1. Handheld

7.3.2. Wearable

7.4. Market Attractiveness Analysis, by Technology

8. Global Autoinjectors Market Analysis and Forecast, by Route of Administration

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Route of Administration, 2017-2031

8.3.1. Subcutaneous

8.3.2. Intramuscular

8.4. Market Attractiveness Analysis, by Route of Administration

9. Global Autoinjectors Market Analysis and Forecast, by Indication

9.1. Introduction & Definition

9.2. Key Findings / Developments

9.3. Market Value Forecast, by Indication, 2017-2031

9.3.1. Multiple Sclerosis

9.3.2. Rheumatoid Arthritis

9.3.3. Diabetes

9.3.4. Anaphylaxsis

9.3.5. Others

9.4. Market Attractiveness Analysis, by Indication

10. Global Autoinjectors Market Analysis and Forecast, by End-user

10.1. Introduction & Definition

10.2. Key Findings / Developments

10.3. Market Value Forecast, by End-user, 2017-2031

10.3.1. Homecare Settings

10.3.2. Hospitals & Clinics

10.4. Market Attractiveness Analysis, by End-user

11. Global Autoinjectors Market Analysis and Forecast, by Region

11.1. Key Findings

11.2. Market Value Forecast, by Region

11.2.1. North America

11.2.2. Europe

11.2.3. Asia Pacific

11.2.4. Latin America

11.2.5. Middle East & Africa

11.3. Market Attractiveness Analysis, by Region

12. North America Autoinjectors Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Type, 2017-2031

12.2.1. Disposable

12.2.2. Reusable

12.3. Market Value Forecast, by Technology, 2017-2031

12.3.1. Handheld

12.3.2. Wearable

12.4. Market Value Forecast, by Route of Administration, 2017-2031

12.4.1. Subcutaneous

12.4.2. Intramuscular

12.5. Market Value Forecast, by Indication, 2017-2031

12.5.1. Multiple Sclerosis

12.5.2. Rheumatoid Arthritis

12.5.3. Diabetes

12.5.4. Anaphylaxsis

12.5.5. Others

12.6. Market Value Forecast, by End-user, 2017-2031

12.6.1. Homecare Settings

12.6.2. Hospitals & Clinics

12.7. Market Value Forecast, by Country, 2017-2031

12.7.1. U.S.

12.7.2. Canada

12.8. Market Attractiveness Analysis

12.8.1. By Type

12.8.2. By Technology

12.8.3. By Route of Administration

12.8.4. By Indication

12.8.5. By End-user

12.8.6. By Country

13. Europe Autoinjectors Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Type, 2017-2031

13.2.1. Disposable

13.2.2. Reusable

13.3. Market Value Forecast, by Technology, 2017-2031

13.3.1. Handheld

13.3.2. Wearable

13.4. Market Value Forecast, by Route of Administration, 2017-2031

13.4.1. Subcutaneous

13.4.2. Intramuscular

13.5. Market Value Forecast, by Indication, 2017-2031

13.5.1. Multiple Sclerosis

13.5.2. Rheumatoid Arthritis

13.5.3. Diabetes

13.5.4. Anaphylaxsis

13.5.5. Others

13.6. Market Value Forecast, by End-user, 2017-2031

13.6.1. Homecare Settings

13.6.2. Hospitals & Clinics

13.7. Market Value Forecast, by Country/Sub-region, 2017-2031

13.7.1. Germany

13.7.2. U.K.

13.7.3. France

13.7.4. Italy

13.7.5. Spain

13.7.6. Rest of Europe

13.8. Market Attractiveness Analysis

13.8.1. By Type

13.8.2. By Technology

13.8.3. By Route of Administration

13.8.4. By Indication

13.8.5. By End-user

13.8.6. By Country/Sub-region

14. Asia Pacific Autoinjectors Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Type, 2017-2031

14.2.1. Disposable

14.2.2. Reusable

14.3. Market Value Forecast, by Technology, 2017-2031

14.3.1. Handheld

14.3.2. Wearable

14.4. Market Value Forecast, by Route of Administration, 2017-2031

14.4.1. Subcutaneous

14.4.2. Intramuscular

14.5. Market Value Forecast, by Indication, 2017-2031

14.5.1. Multiple Sclerosis

14.5.2. Rheumatoid Arthritis

14.5.3. Diabetes

14.5.4. Anaphylaxsis

14.5.5. Others

14.6. Market Value Forecast, by End-user, 2017-2031

14.6.1. Homecare Settings

14.6.2. Hospitals & Clinics

14.7. Market Value Forecast, by Country/Sub-region, 2017-2031

14.7.1. China

14.7.2. Japan

14.7.3. India

14.7.4. Australia & New Zealand

14.7.5. Rest of Asia Pacific

14.8. Market Attractiveness Analysis

14.8.1. By Type

14.8.2. By Route of Administration

14.8.3. By Technology

14.8.4. By Indication

14.8.5. By End-user

14.8.6. By Country/Sub-region

15. Latin America Autoinjectors Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast, by Type, 2017-2031

15.2.1. Disposable

15.2.2. Reusable

15.3. Market Value Forecast, by Technology, 2017-2031

15.3.1. Handheld

15.3.2. Wearable

15.4. Market Value Forecast, by Route of Administration, 2017-2031

15.4.1. Subcutaneous

15.4.2. Intramuscular

15.5. Market Value Forecast, by Indication, 2017-2031

15.5.1. Multiple Sclerosis

15.5.2. Rheumatoid Arthritis

15.5.3. Diabetes

15.5.4. Anaphylaxsis

15.5.5. Others

15.6. Market Value Forecast, by End-user, 2017-2031

15.6.1. Homecare Settings

15.6.2. Hospitals & Clinics

15.7. Market Value Forecast, by Country/Sub-region, 2017-2031

15.7.1. Brazil

15.7.2. Mexico

15.7.3. Rest of Latin America

15.8. Market Attractiveness Analysis

15.8.1. By Type

15.8.2. By Technology

15.8.3. By Route of Administration

15.8.4. By Indication

15.8.5. By End-user

15.8.6. By Country/Sub-region

16. Middle East & Africa Autoinjectors Market Analysis and Forecast

16.1. Introduction

16.1.1. Key Findings

16.2. Market Value Forecast, by Type, 2017-2031

16.2.1. Disposable

16.2.2. Reusable

16.3. Market Value Forecast, by Technology, 2017-2031

16.3.1. Handheld

16.3.2. Wearable

16.4. Market Value Forecast, by Route of Administration, 2017-2031

16.4.1. Subcutaneous

16.4.2. Intramuscular

16.5. Market Value Forecast, by Indication, 2017-2031

16.5.1. Multiple Sclerosis

16.5.2. Rheumatoid Arthritis

16.5.3. Diabetes

16.5.4. Anaphylaxsis

16.5.5. Others

16.6. Market Value Forecast, by End-user, 2017-2031

16.6.1. Homecare Settings

16.6.2. Hospitals & Clinics

16.7. Market Value Forecast, by Country/Sub-region, 2017-2031

16.7.1. GCC Countries

16.7.2. South Africa

16.7.3. Rest of Middle East & Africa

16.8. Market Attractiveness Analysis

16.8.1. By Type

16.8.2. By Technology

16.8.3. By Route of Administration

16.8.4. By Indication

16.8.5. By End-user

16.8.6. By Country/Sub-region

17. Competition Landscape

17.1. Market Player - Competition Matrix (By Tier and Size of companies)

17.2. Market Share Analysis By Company (2022)

17.3. Company Profiles

17.3.1. Ypsomed Holding AG

17.3.1.1. Company Overview

17.3.1.2. Financial Overview

17.3.1.3. Product Portfolio

17.3.1.4. Business Strategies

17.3.1.5. Recent Developments

17.3.2. Novartis AG

17.3.2.1. Company Overview

17.3.2.2. Financial Overview

17.3.2.3. Product Portfolio

17.3.2.4. Business Strategies

17.3.2.4. Recent Developments

17.3.3. BD

17.3.3.1. Company Overview

17.3.3.2. Financial Overview

17.3.3.3. Product Portfolio

17.3.3.4. Business Strategies

17.3.3.5. Recent Developments

17.3.4. Medmix Healthcare

17.3.4.1. Company Overview

17.3.4.2. Financial Overview

17.3.4.3. Product Portfolio

17.3.4.4. Business Strategies

17.3.4.5. Recent Developments

17.3.5. Eli Lilly and Company

17.3.5.1. Company Overview

17.3.5.2. Financial Overview

17.3.5.3. Product Portfolio

17.3.5.4. Business Strategies

17.3.5.5. Recent Developments

17.3.6. Sanofi

17.3.6.1. Company Overview

17.3.6.2. Financial Overview

17.3.6.3. Product Portfolio

17.3.6.4. Business Strategies

17.3.6.5. Recent Developments

17.3.7. Mylan N.V.

17.3.7.1. Company Overview

17.3.7.2. Financial Overview

17.3.7.3. Product Portfolio

17.3.7.4. Business Strategies

17.3.7.5. Recent Developments

17.3.8. Amgen Inc.

17.3.8.1. Company Overview

17.3.8.2. Financial Overview

17.3.8.3. Product Portfolio

17.3.8.4. Business Strategies

17.3.8.5. Recent Developments

17.3.9. SHL Medical AG

17.3.9.1. Company Overview

17.3.9.2. Financial Overview

17.3.9.3. Product Portfolio

17.3.9.4. Business Strategies

17.3.9.5. Recent Developments

17.3.10. Recipharm AB

17.3.10.1. Company Overview

17.3.10.2. Financial Overview

17.3.10.3. Product Portfolio

17.3.10.4. Business Strategies

17.3.10.5. Recent Developments

List of Tables

Table 01: Global Autoinjectors Market Size (US$ Mn) Forecast, by Type, 2017-2031

Table 02: Global Autoinjectors Market Size (US$ Mn) Forecast, by Technology, 2017-2031

Table 03: Global Autoinjectors Market Size (US$ Mn) Forecast, by Route of Administration, 2017-2031

Table 04: Global Autoinjectors Market Size (US$ Mn) Forecast, by Indication, 2017-2031

Table 05: Global Autoinjectors Market Size (US$ Mn) Forecast, by End-user, 2017-2031

Table 06: Global Autoinjectors Market Value (US$ Mn) Forecast, by Region, 2017-2031

Table 07: North America Autoinjectors Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 08: North America Autoinjectors Market Size (US$ Mn) Forecast, by Type, 2017-2031

Table 09: North America Autoinjectors Market (US$ Mn) Forecast, by Technology, 2017-2031

Table 10: North America Autoinjectors Market Size (US$ Mn) Forecast, by Route of Administration, 2017-2031

Table 11: North America Autoinjectors Market Size (US$ Mn) Forecast, by Indication, 2017-2031

Table 12: North America Autoinjectors Market Size (US$ Mn) Forecast, by End-user, 2017-2031

Table 13: Europe Autoinjectors Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 14: Europe Autoinjectors Market Size (US$ Mn) Forecast, by Type, 2017-2031

Table 15: Europe Autoinjectors Market Size (US$ Mn) Forecast, by Technology, 2017-2031

Table 16: Europe Autoinjectors Market Size (US$ Mn) Forecast, by Route of Administration, 2017-2031

Table 17: Europe Autoinjectors Market Size (US$ Mn) Forecast, by Indication, 2017-2031

Table 18: Europe Autoinjectors Market Size (US$ Mn) Forecast, by End-user, 2017-2031

Table 19: Asia Pacific Autoinjectors Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 20: Asia Pacific Autoinjectors Market Size (US$ Mn) Forecast, by Type, 2017-2031

Table 21: Asia Pacific Autoinjectors Market Size (US$ Mn) Forecast, by Technology, 2017-2031

Table 22: Asia Pacific Autoinjectors Market Size (US$ Mn) Forecast, by Route of Administration, 2017-2031

Table 23: Asia Pacific Autoinjectors Market Size (US$ Mn) Forecast, by Indication, 2017-2031

Table 24: Asia Pacific Autoinjectors Market Size (US$ Mn) Forecast, by End-user, 2017-2031

Table 25: Latin America Autoinjectors Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 26: Latin America Autoinjectors Market Size (US$ Mn) Forecast, by Type, 2017-2031

Table 27: Latin America Autoinjectors Market Size (US$ Mn) Forecast, by Technology 2017-2031

Table 28: Latin America Autoinjectors Market Size (US$ Mn) Forecast, by Route of Administration, 2017-2031

Table 29: Latin America Autoinjectors Market Size (US$ Mn) Forecast, by Indication, 2017-2031

Table 30: Latin America Autoinjectors Market Size (US$ Mn) Forecast, by End-user, 2017-2031

Table 31: Middle East and Africa Autoinjectors Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 32: Middle East and Africa Autoinjectors Market Size (US$ Mn) Forecast, by Type, 2017-2031

Table 33: Middle East and Africa Autoinjectors Market Size (US$ Mn) Forecast, by Technology, 2017-2031

Table 34: Middle East and Africa Autoinjectors Market Size (US$ Mn) Forecast, by Route of Administration, 2017-2031

Table 35: Middle East and Africa Autoinjectors Market Size (US$ Mn) Forecast, by Indication, 2017-2031

Table 36: Middle East and Africa Autoinjectors Market Size (US$ Mn) Forecast, by End-user, 2017-2031

List of Figures

Figure 01: Global Autoinjectors Market Value (US$ Mn) Forecast, 2017-2031

Figure 02: Global Autoinjectors Market Value Share, by Type, 2022

Figure 03: Global Autoinjectors Market Value Share, by Technology, 2022

Figure 04: Global Autoinjectors Market Value Share, by Indication, 2022

Figure 05: Global Autoinjectors Market Value Share, by Route of Administration, 2022

Figure 06: Global Autoinjectors Market Value Share, by End-user, 2022

Figure 07: Global Autoinjectors Market Value Share Analysis, by Type, 2022 and 2031

Figure 08: Global Autoinjectors Market Revenue (US$ Mn), by Disposable, 2017-2031

Figure 09: Global Autoinjectors Market Revenue (US$ Mn), by Reusable, 2017-2031

Figure 10: Global Autoinjectors Market Attractiveness Analysis, by Type, 2023-2031

Figure 11: Global Autoinjectors Market Value Share Analysis, by Technology, 2022 and 2031

Figure 12: Global Autoinjectors Market Revenue (US$ Mn), by Handheld, 2017-2031

Figure 13: Global Autoinjectors Market Revenue (US$ Mn), by Wearable, 2017-2031

Figure 14: Global Autoinjectors Market Attractiveness Analysis, by Technology, 2023-2031

Figure 15: Global Autoinjectors Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 16: Global Autoinjectors Market Revenue (US$ Mn), by Subcutaneous, 2017-2031

Figure 17: Global Autoinjectors Market Revenue (US$ Mn), by Intramuscular, 2017-2031

Figure 18: Global Autoinjectors Market Attractiveness Analysis, by Route of Administration, 2023-2031

Figure 19: Global Autoinjectors Market Value Share Analysis, by Indication, 2022 and 2031

Figure 20: Global Autoinjectors Market Revenue (US$ Mn), by Multiple Sclerosis, 2017-2031

Figure 21: Global Autoinjectors Market Revenue (US$ Mn), by Rheumatoid Arthritis, 2017-2031

Figure 22: Global Autoinjectors Market Revenue (US$ Mn), by Diabetes, 2017-2031

Figure 23: Global Autoinjectors Market Revenue (US$ Mn), by Anaphylaxsis, 2017-2031

Figure 24: Global Autoinjectors Market Attractiveness Analysis, by Indication, 2023-2031

Figure 25: Global Autoinjectors Market Value Share Analysis, by End-user, 2022 and 2031

Figure 26: Global Autoinjectors Market Value Share Analysis, by Homecare Settings, 2022 and 2031

Figure 27: Global Autoinjectors Market Value Share Analysis, by Hospitals & Clinics, 2022 and 2031

Figure 28: Global Autoinjectors Market Attractiveness Analysis, by End-user, 2023-2031

Figure 29: North America Autoinjectors Market Value Share Analysis, by Country, 2022 and 2031

Figure 30: North America Autoinjectors Market Attractiveness Analysis, by Country, 2023-2031

Figure 31: North America Autoinjectors Market Value Share Analysis, by Type, 2022 and 2031

Figure 32: North America Autoinjectors Market Attractiveness Analysis, by Type, 2023-2031

Figure 33: North America Autoinjectors Market Value Share Analysis, by Technology, 2022 and 2031

Figure 34: North America Autoinjectors Market Attractiveness Analysis, by Technology, 2023-2031

Figure 35: North America Autoinjectors Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 36: North America Autoinjectors Market Attractiveness Analysis, by Route of Administration, 2023-2031

Figure 37: North America Autoinjectors Market Value Share Analysis, by Indication, 2022 and 2031

Figure 38: North America Autoinjectors Market Attractiveness Analysis, by Indication, 2023-2031

Figure 39: North America Autoinjectors Market Value Share Analysis, by End-user, 2022 and 2031

Figure 40: North America Autoinjectors Market Attractiveness Analysis, by End-user, 2023-2031

Figure 41: Europe Autoinjectors Market Value (US$ Mn) Forecast, 2017-2031

Figure 42: Europe Autoinjectors Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 43: Europe Autoinjectors Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 44: Europe Autoinjectors Market Value Share Analysis, by Type, 2022 and 2031

Figure 45: Europe Autoinjectors Market Attractiveness Analysis, by Type, 2023-2031

Figure 46: Europe Autoinjectors Market Value Share Analysis, by Technology, 2022 and 2031

Figure 47: Europe Autoinjectors Market Attractiveness Analysis, by Technology, 2023-2031

Figure 48: Europe Autoinjectors Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 49: Europe Autoinjectors Market Attractiveness Analysis, by Route of Administration, 2023-2031

Figure 50: Europe Autoinjectors Market Value Share Analysis, by Indication, 2022 and 2031

Figure 51: Europe Autoinjectors Market Attractiveness Analysis, by Indication, 2023-2031

Figure 52: Europe Autoinjectors Market Value Share Analysis, by End-user, 2022 and 2031

Figure 53: Europe Autoinjectors Market Attractiveness Analysis, by End-user, 2023-2031

Figure 54: Asia Pacific Autoinjectors Market Value (US$ Mn) Forecast, 2017-2031

Figure 55: Asia Pacific Autoinjectors Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 56: Asia Pacific Autoinjectors Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 57: Asia Pacific Autoinjectors Market Value Share Analysis, by Type, 2022 and 2031

Figure 58: Asia Pacific Autoinjectors Market Attractiveness Analysis, by Type, 2023-2031

Figure 59: Asia Pacific Autoinjectors Market Value Share Analysis, by Technology, 2022 and 2031

Figure 60: Asia Pacific Autoinjectors Market Attractiveness Analysis, by Technology, 2023-2031

Figure 61: Asia Pacific Autoinjectors Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 62: Asia Pacific Autoinjectors Market Attractiveness Analysis, by Route of Administration, 2023-2031

Figure 63: Asia Pacific Autoinjectors Market Value Share Analysis, by Indication, 2022 and 2031

Figure 64: Asia Pacific Autoinjectors Market Attractiveness Analysis, by Indication, 2023-2031

Figure 65: Asia Pacific Autoinjectors Market Value Share Analysis, by End-user, 2022 and 2031

Figure 66: Asia Pacific Autoinjectors Market Attractiveness Analysis, by End-user, 2023-2031

Figure 67: Latin America Autoinjectors Market Value (US$ Mn) Forecast, 2017-2031

Figure 68: Latin America Autoinjectors Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 69: Latin America Autoinjectors Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 70: Latin America Autoinjectors Market Value Share Analysis, by Type, 2022 and 2031

Figure 71: Latin America Autoinjectors Market Attractiveness Analysis, by Type, 2023-2031

Figure 72: Latin America Autoinjectors Market Value Share Analysis, by Technology, 2022 and 2031

Figure 73: Latin America Autoinjectors Market Attractiveness Analysis, by Technology, 2023-2031

Figure 74: Latin America Autoinjectors Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 75: Latin America Autoinjectors Market Attractiveness Analysis, by Route of Administration, 2023-2031

Figure 76: Latin America Autoinjectors Market Value Share Analysis, by Indication, 2022 and 2031

Figure 77: Latin America Autoinjectors Market Attractiveness Analysis, by Indication, 2023-2031

Figure 78: Latin America Autoinjectors Market Value Share Analysis, by End-user, 2022 and 2031

Figure 79: Latin America Autoinjectors Market Attractiveness Analysis, by End-user, 2023-2031

Figure 80: Middle East and Africa Autoinjectors Market Value (US$ Mn) Forecast, 2017-2031

Figure 81: Middle East and Africa Autoinjectors Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 82: Middle East and Africa Autoinjectors Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 83: Middle East and Africa Autoinjectors Market Value Share Analysis, by Type, 2022 and 2031

Figure 84: Middle East and Africa Autoinjectors Market Attractiveness Analysis, by Type, 2023-2031

Figure 85: Middle East and Africa Autoinjectors Market Value Share Analysis, by Technology, 2022 and 2031

Figure 86: Middle East and Africa Autoinjectors Market Attractiveness Analysis, by Technology, 2023-2031

Figure 87: Middle East and Africa Autoinjectors Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 88: Middle East and Africa Autoinjectors Market Attractiveness Analysis, by Route of Administration, 2023-2031

Figure 89: Middle East and Africa Autoinjectors Market Value Share Analysis, by Indication, 2022 and 2031

Figure 90: Middle East and Africa Autoinjectors Market Attractiveness Analysis, by Indication, 2023-2031

Figure 91: Middle East and Africa Autoinjectors Market Value Share Analysis, by End-user, 2022 and 2031

Figure 92: Middle East and Africa Autoinjectors Market Attractiveness Analysis, by End-user, 2023-2031

Figure 93: Company Share Analysis, 2022