Analysts’ Viewpoint

Increase in awareness about asthma treatment is expected to drive the global asthma treatment market size during the forecast period. Participation of several organizations such as the Centers for Disease Control and Prevention’s National Asthma Control Program to increase awareness about asthma and its treatment is estimated to boost market development. Furthermore, asthma camps conducted by the Asthma Society of India are anticipated to augment the industry during the forecast period.

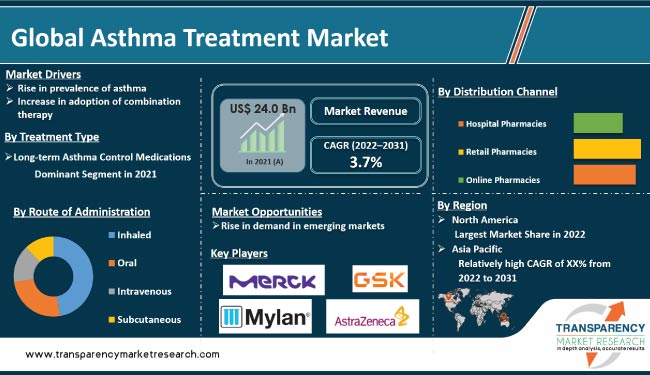

Rise in prevalence of asthma, increase in adoption of combination therapy, and surge in focus on development of smart/digital inhalers are propelling the demand for asthma treatment. Furthermore, several companies are engaging in collaborations and focusing on product innovation, which is likely to increase the demand for asthma medications. For instance, AstraZeneca partnered with the Avillion Company to develop ‘PT027,’ an asthma rescue inhaler.

Asthma is a condition, in which the airways narrow and swell, resulting in extra mucus formation. This can make breathing difficult and cause coughing, a whistling sound, and shortness of breath. Asthma is a minor annoyance for some people. For some, it can be a major issue that disrupts daily activities and could result in a life-threatening asthma attack, which is also called asthma exacerbation.

Symptoms in some people worsen in situations such as exercise-induced asthma, which could be exacerbated by cold and dry air. Irritants in the workplace such as chemical fumes, gases, or dust cause occupational asthma. Airborne allergens such as pollen, mold spores, cockroach waste, or skin and dried saliva shed by pets cause allergy-induced asthma.

Asthma medications include nebulizers and spacers. Nebulizer is preferred for asthma patients. It is a device that can deliver doses of medicines quickly and easily to asthma patients.

Asthma is a major public health issue that affects millions of people across the globe. Genetics or environmental factors, such as microbial exposure, passive smoking, and air pollution, are increasing the disease burden in both adults and children, thereby driving the need for asthma medications.

According to the WHO, asthma affected about 262 million people and 455,000 people succumbed to the disease in 2019. Majority of asthma-related deaths occur in low- and lower-middle-income countries, where underdiagnosis and undertreatment are common.

According to CDC, asthma affects nearly 26 million people in the U.S. The disease is estimated to cost more than US$ 56 Bn annually to the society. Thus, increase in number of asthma patients is projected to drive the demand for treatments for asthma during the forecast period.

Asthma is one of the common lifelong chronic diseases. People are increasingly becoming aware about asthma and its treatment. World Asthma Day is an annual event organized by the Global Initiative for Asthma (GINA) to improve awareness about asthma attack treatment across the world. The entire month of May is designated as National Asthma and Allergy Awareness Month to help manage asthma and educate people to raise awareness and improve lives for all. People are aware of common treatment options for asthma such as pressurized metered dose inhalers and dry powder inhalers.

CDC’s National Asthma Control Program aims to support the people in the U.S. in treating asthma in order to achieve better health and improve the quality of life. The program funds states, school programs, and non-government organizations to help them improve their surveillance of asthma, train healthcare professionals, educate individuals and their families about asthma, and explain asthma to the public.

In terms of treatment, the global asthma treatment market has been bifurcated into long-term asthma control medications and quick-relief (rescue) medications. The long-term asthma control medications segment dominated the industry in 2021. It is the most effective treatment choice for asthma. Inhaled corticosteroids (ICS) are the most potent and effective long-term asthma medications. GlaxoSmithKline plc's ADVAIR DISKUS and AstraZeneca's Symbicort are vital long-term asthma medications that hold major share in the business.

Based on route of administration, the global market has been classified into inhaled, oral, intravenous, and subcutaneous. The inhaled segment held major share in 2021. Inhaled drug therapy is the most preferred asthma attack treatment, as the drug is directly absorbed into the epithelium of the lung.

In terms of distribution channel, the global asthma treatment market has been divided into hospital pharmacies, retail pharmacies, and online pharmacies. The retail pharmacies segment accounted for the largest share in 2021. This can be ascribed to the increase in number of asthma therapeutics being dispensed through retail pharmacies and rise in the number of retail pharmacies in developing countries.

North America accounted for major market share in 2021. This can be ascribed to recent FDA approvals, large number of drugs in pipeline, rise in focus on reducing the number of undiagnosed asthma cases, and availability of early treatment in the region. According to the CDC, in 2017, asthma caused an estimated 1.6 million emergency department (ED) visits and 183,000 hospitalizations in the U.S.

The market in Asia Pacific is expected to expand at a higher CAGR during the forecast period. This can be ascribed to high prevalence of asthma, increase in smoking, and rise in environmental pollution in China and India. According to a study published in the Lung India journal, with an estimated 1.5 crore to 2 crore asthma patients, at least one in every 10 asthma patients globally is from India. Increase in focus on respiratory disease management and rise in awareness about managing asthma are fueling market expansion in the region.

The global asthma treatment market is consolidated, with the presence of a small number of large companies. Expansion of product portfolio and mergers & acquisitions are the major strategies adopted by the key players. Leading players in the business are Mylan N.V, AstraZeneca plc., Boehringer Ingelheim, F. Hoffmann-La Roche Ltd., GlaxoSmithKline plc, Lupin Pharmaceuticals, Glenmark Pharmaceuticals, Merck & Co. Inc., Novartis International AG, Sanofi, Sunovion Pharmaceuticals, Inc., and Teva Pharmaceutical Industries.

Leading players have been profiled in the market report based on parameters such as company overview, financial overview, strategies, portfolio, segments, and recent developments.

|

Attribute |

Detail |

|

Size in 2021 |

US$ 24.0 Bn |

|

Forecast (Value) in 2031 |

More than US$ 34.5 Bn |

|

Growth Rate (CAGR) |

3.7% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 24.0 Bn in 2021

The industry is projected to reach more than US$ 34.5 Bn by 2031.

The CAGR stood at 3.2% from 2017 to 2021

The market is anticipated to grow at a CAGR of 3.7% from 2022 to 2031

Increase in adoption of combination therapy and rise in prevalence of asthma

North America is expected to account for the largest share

Mylan N.V, AstraZeneca plc., Boehringer Ingelheim, F. Hoffmann-La Roche Ltd., GlaxoSmithKline plc., Lupin Pharmaceuticals, Glenmark Pharmaceuticals, Merck & Co. Inc., Novartis International AG, Sanofi, Sunovion Pharmaceuticals, Inc., and Teva Pharmaceutical Industries

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Asthma Treatment Market

4. Market Overview

4.1. Introduction

4.1.1. Definition

4.1.2. Industry Evolution/Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Asthma Treatment Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Bn)

5. Key Insights

5.1. Key Industry Events (Mergers & Acquisitions, Treatment Type Launches, Partnerships, etc.)

5.2. Pipeline Analysis

5.3. Regulatory Scenario by Region/Globally

5.4. COVID-19 Pandemic Impact on the Industry

6. Global Asthma Treatment Market Analysis and Forecast, by Treatment Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Treatment Type, 2017–2031

6.3.1. Long-term Asthma Control Medications

6.3.2. Quick-relief (Rescue) Medications

6.4. Market Attractiveness Analysis, by Treatment Type

7. Global Asthma Treatment Market Analysis and Forecast, by Route of Administration

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Route of Administration, 2017–2031

7.3.1. Inhaled

7.3.2. Oral

7.3.3. Intravenous

7.3.4. Subcutaneous

7.4. Market Attractiveness Analysis, by Route of Administration

8. Global Asthma Treatment Market Analysis and Forecast, by Distribution Channel

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by Distribution Channel, 2017–2031

8.3.1. Retail Pharmacies

8.3.2. Hospital Pharmacies

8.3.3. Online Pharmacies

8.4. Market Attractiveness Analysis, by Distribution Channel

9. Global Asthma Treatment Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Asthma Treatment Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Treatment Type, 2017–2031

10.2.1. Long-term Asthma Control Medications

10.2.2. Quick-relief (Rescue) Medications

10.3. Market Value Forecast, by Route of Administration, 2017–2031

10.3.1. Inhaled

10.3.2. Oral

10.3.3. Intravenous

10.3.4. Subcutaneous

10.4. Market Value Forecast, by Distribution Channel, 2017–2031

10.4.1. Retail Pharmacies

10.4.2. Hospital Pharmacies

10.4.3. Online Pharmacies

10.5. Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Treatment Type

10.6.2. By Route of Administration

10.6.3. By Distribution Channel

10.6.4. By Country

11. Europe Asthma Treatment Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Treatment Type, 2017–2031

11.2.1. Long-term Asthma Control Medications

11.2.2. Quick-relief (Rescue) Medications

11.3. Market Value Forecast, by Route of Administration, 2017–2031

11.3.1. Inhaled

11.3.2. Oral

11.3.3. Intravenous

11.3.4. Subcutaneous

11.4. Market Value Forecast, by Distribution Channel, 2017–2031

11.4.1. Retail Pharmacies

11.4.2. Hospital Pharmacies

11.4.3. Online Pharmacies

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Treatment Type

11.6.2. By Route of Administration

11.6.3. By Distribution Channel

11.6.4. By Country/Sub-region

12. Asia Pacific Asthma Treatment Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Treatment Type, 2017–2031

12.2.1. Long-term Asthma Control Medications

12.2.2. Quick-relief (Rescue) Medications

12.3. Market Value Forecast, by Route of Administration, 2017–2031

12.3.1. Inhaled

12.3.2. Oral

12.3.3. Intravenous

12.3.4. Subcutaneous

12.4. Market Value Forecast, by Distribution Channel, 2017–2031

12.4.1. Retail Pharmacies

12.4.2. Hospital Pharmacies

12.4.3. Online Pharmacies

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Treatment Type

12.6.2. By Route of Administration

12.6.3. By Distribution Channel

12.6.4. By Country/Sub-region

13. Latin America Asthma Treatment Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Treatment Type, 2017–2031

13.2.1. Long-term Asthma Control Medications

13.2.2. Quick-relief (Rescue) Medications

13.3. Market Value Forecast, by Route of Administration, 2017–2031

13.3.1. Inhaled

13.3.2. Oral

13.3.3. Intravenous

13.3.4. Subcutaneous

13.4. Market Value Forecast, by Distribution Channel, 2017–2031

13.4.1. Retail Pharmacies

13.4.2. Hospital Pharmacies

13.4.3. Online Pharmacies

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Treatment Type

13.6.2. By Route of Administration

13.6.3. By Distribution Channel

13.6.4. By Country/Sub-region

14. Middle East & Africa Asthma Treatment Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Treatment Type, 2017–2031

14.2.1. Long-term Asthma Control Medications

14.2.2. Quick-relief (Rescue) Medications

14.3. Market Value Forecast, by Route of Administration, 2017–2031

14.3.1. Inhaled

14.3.2. Oral

14.3.3. Intravenous

14.3.4. Subcutaneous

14.4. Market Value Forecast, by Distribution Channel, 2017–2031

14.4.1. Retail Pharmacies

14.4.2. Hospital Pharmacies

14.4.3. Online Pharmacies

14.5. Market Value Forecast, by Country/Sub-region, 2017–2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Treatment Type

14.6.2. By Route of Administration

14.6.3. By Distribution Channel

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (by tier and size of companies)

15.2. Market Share/Ranking Analysis, by Company (2021)

15.3. Company Profiles

15.3.1. Mylan N.V.

15.3.1.1. Company Overview

15.3.1.2. Product Portfolio

15.3.1.3. SWOT Analysis

15.3.1.4. Strategic Overview

15.3.2. AstraZeneca plc

15.3.2.1. Company Overview

15.3.2.2. Product Portfolio

15.3.2.3. SWOT Analysis

15.3.2.4. Strategic Overview

15.3.3. Boehringer Ingelheim

15.3.3.1. Company Overview

15.3.3.2. Product Portfolio

15.3.3.3. SWOT Analysis

15.3.3.4. Strategic Overview

15.3.4. F. Hoffmann-La Roche Ltd.

15.3.4.1. Company Overview

15.3.4.2. Product Portfolio

15.3.4.3. SWOT Analysis

15.3.4.4. Strategic Overview

15.3.5. GlaxoSmithKline plc.

15.3.5.1. Company Overview

15.3.5.2. Product Portfolio

15.3.5.3. SWOT Analysis

15.3.5.4. Strategic Overview

15.3.6. Glenmark Pharmaceuticals

15.3.6.1. Company Overview

15.3.6.2. Product Portfolio

15.3.6.3. SWOT Analysis

15.3.6.4. Strategic Overview

15.3.7. Lupin Pharmaceuticals

15.3.7.1. Company Overview

15.3.7.2. Product Portfolio

15.3.7.3. SWOT Analysis

15.3.7.4. Strategic Overview

15.3.8. Merck & Co. Inc.

15.3.8.1. Company Overview

15.3.8.2. Product Portfolio

15.3.8.3. SWOT Analysis

15.3.8.4. Strategic Overview

15.3.9. Novartis International AG

15.3.9.1. Company Overview

15.3.9.2. Product Portfolio

15.3.9.3. SWOT Analysis

15.3.9.4. Strategic Overview

15.3.10. Sanofi

15.3.10.1. Company Overview

15.3.10.2. Product Portfolio

15.3.10.3. SWOT Analysis

15.3.10.4. Strategic Overview

15.3.11. Sunovion Pharmaceuticals, Inc.

15.3.11.1. Company Overview

15.3.11.2. Product Portfolio

15.3.11.3. SWOT Analysis

15.3.11.4. Strategic Overview

15.3.12. Teva Pharmaceutical Industries

15.3.12.1. Company Overview

15.3.12.2. Product Portfolio

15.3.12.3. SWOT Analysis

15.3.12.4. Strategic Overview

List of Tables

Table 01: Global Asthma Treatment Market Value (US$ Bn) Forecast, by Treatment Type, 2017‒2031

Table 02: Global Asthma Treatment Market Value (US$ Bn) Forecast, by 2017‒2031, by Route of Administration

Table 03: Global Asthma Treatment Market Value (US$ Bn) Forecast, by Distribution Channel, 2017–2031

Table 04: Global Asthma Treatment Market Value (US$ Bn) Forecast, by Region, 2017–2031

Table 05: North America Asthma Treatment Market Value (US$ Bn) Forecast, by Country, 2017–2031

Table 06: North America Asthma Treatment Market Value (US$ Bn) Forecast, by Treatment Type, 2017‒2031

Table 07: North America Asthma Treatment Market Value (US$ Bn) Forecast, by Route of Administration, 2017‒2031

Table 08: North America Asthma Treatment Market Value (US$ Bn) Forecast, by Distribution Channel, 2017–2031

Table 09: Europe Asthma Treatment Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017–2031

Table 10: Europe Asthma Treatment Market Value (US$ Bn) Forecast, by Treatment Type, 2017‒2031

Table 11: Europe Asthma Treatment Market Value (US$ Bn) Forecast, by Route of Administration, 2017‒2031

Table 12: Europe Asthma Treatment Market Value (US$ Bn) Forecast, by Distribution Channel, 2017–2031

Table 13: Asia Pacific Asthma Treatment Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Asia Pacific Asthma Treatment Market Value (US$ Bn) Forecast, by Treatment Type, 2017‒2031

Table 15: Asia Pacific Asthma Treatment Market Value (US$ Bn) Forecast, by Route of Administration, 2017‒2031

Table 16: Asia Pacific Asthma Treatment Market Value (US$ Bn) Forecast, by Distribution Channel, 2017–2031

Table 17: Latin America Asthma Treatment Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017-2031

Table 18: Latin America Asthma Treatment Market Value (US$ Bn) Forecast, by Treatment Type, 2017‒2031

Table 19: Latin America Asthma Treatment Market Value (US$ Bn) Forecast, by Route of Administration, 2017‒2031

Table 20: Latin America Asthma Treatment Market Value (US$ Bn) Forecast, by Distribution Channel, 2017–2031

Table 21: Middle East & Africa Asthma Treatment Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017-2031

Table 22: Middle East & Africa Asthma Treatment Market Value (US$ Bn) Forecast, by Treatment Type, 2017‒2031

Table 23: Middle East & Africa Asthma Treatment Market Value (US$ Bn) Forecast, by Route of Administration, 2017‒2031

Table 24: Middle East & Africa Asthma Treatment Market Value (US$ Bn) Forecast, by Distribution Channel, 2017–2031

List of Figures

Figure 01: Global Asthma Treatment Market Value (US$ Bn) Forecast, 2017–2031

Figure 02: Global Asthma Treatment Market Value Share, by Treatment Type, 2021

Figure 03: Global Asthma Treatment Market Value Share, by Route of Administration, 2021

Figure 04: Global Asthma Treatment Market Value Share, by Distribution Channel, 2021

Figure 05: Global Asthma Treatment Market Value Share Analysis, by Treatment Type, 2021 and 2031

Figure 06: Global Asthma Treatment Market Attractiveness Analysis, by Treatment Type, 2022–2031

Figure 07: Global Asthma Treatment Market Value Share Analysis, by Route of Administration, 2021 and 2031

Figure 08: Global Asthma Treatment Market Attractiveness Analysis, by Route of Administration, 2022–2031

Figure 09: Global Asthma Treatment Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 10: Global Asthma Treatment Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 11: Global Asthma Treatment Market Value Share Analysis, by Region, 2021 and 2031

Figure 12: Global Asthma Treatment Market Attractiveness Analysis, by Region, 2022–2031

Figure 13: North America Asthma Treatment Market Value (US$ Bn) Forecast, 2017–2031

Figure 14: North America Asthma Treatment Market Value Share Analysis, by Country, 2021 and 2031

Figure 15: North America Asthma Treatment Market Attractiveness Analysis, by Country, 2022–2031

Figure 16: North America Asthma Treatment Market Value Share Analysis, by Treatment Type, 2021 and 2031

Figure 17: North America Asthma Treatment Market Attractiveness Analysis, by Treatment Type, 2022–2031

Figure 18: North America Asthma Treatment Market Value Share Analysis, by Route of Administration, 2021 and 2031

Figure 19: North America Asthma Treatment Market Attractiveness Analysis, by Route of Administration, 2022–2031

Figure 20: North America Asthma Treatment Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 21: North America Asthma Treatment Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 22: Europe Asthma Treatment Market Value (US$ Bn) Forecast, 2017–2031

Figure 23: Europe Asthma Treatment Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 24: Europe Asthma Treatment Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 25: Europe Asthma Treatment Market Value Share Analysis, by Treatment Type, 2021 and 2031

Figure 26: Europe Asthma Treatment Market Attractiveness Analysis, by Treatment Type, 2022–2031

Figure 27: Europe Asthma Treatment Market Value Share Analysis, by Route of Administration, 2021 and 2031

Figure 28: Europe Asthma Treatment Market Attractiveness Analysis, by Route of Administration, 2022–2031

Figure 29: Europe Asthma Treatment Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 30: Europe Asthma Treatment Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 31: Asia Pacific Asthma Treatment Market Value (US$ Bn) Forecast, 2017–2031

Figure 32: Asia Pacific Asthma Treatment Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 33: Asia Pacific Asthma Treatment Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 34: Asia Pacific Asthma Treatment Market Value Share Analysis, by Treatment Type, 2021 and 2031

Figure 35: Asia Pacific Asthma Treatment Market Attractiveness Analysis, by Treatment Type, 2022–2031

Figure 36: Asia Pacific Asthma Treatment Market Value Share Analysis, by Route of Administration, 2021 and 2031

Figure 37: Asia Pacific Asthma Treatment Market Attractiveness Analysis, by Route of Administration, 2022–2031

Figure 38: Asia Pacific Asthma Treatment Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 39: Asia Pacific Asthma Treatment Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 40: Latin America Asthma Treatment Market Value (US$ Bn) Forecast, 2017–2031

Figure 41: Latin America Asthma Treatment Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 42: Latin America Asthma Treatment Market Attractiveness Analysis, by Country/Sub-region, 2021-2031

Figure 43: Latin America Asthma Treatment Market Value Share Analysis, by Treatment Type, 2021 and 2031

Figure 44: Latin America Asthma Treatment Market Attractiveness Analysis, by Treatment Type, 2022–2031

Figure 45: Latin America Asthma Treatment Market Value Share Analysis, by Route of Administration, 2021 and 2031

Figure 46: Latin America Asthma Treatment Market Attractiveness Analysis, by Route of Administration, 2022–2031

Figure 47: Latin America Asthma Treatment Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 48: Latin America Asthma Treatment Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 49: Middle East & Africa Asthma Treatment Market Value (US$ Bn) Forecast, 2017–2031

Figure 50: Middle East & Africa Asthma Treatment Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 51: Middle East & Africa Asthma Treatment Market Attractiveness Analysis, by Country/Sub-region, 2021-2031

Figure 52: Middle East & Africa Asthma Treatment Market Value Share Analysis, by Treatment Type, 2021 and 2031

Figure 53: Middle East & Africa Asthma Treatment Market Attractiveness Analysis, by Treatment Type, 2022–2031

Figure 54: Middle East & Africa Asthma Treatment Market Value Share Analysis, by Route of Administration, 2021 and 2031

Figure 55: Middle East & Africa Asthma Treatment Market Attractiveness Analysis, by Route of Administration, 2022–2031

Figure 56: Middle East & Africa Asthma Treatment Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 57: Middle East & Africa Asthma Treatment Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 58: Company Share Analysis, 2021