Analyst Viewpoint

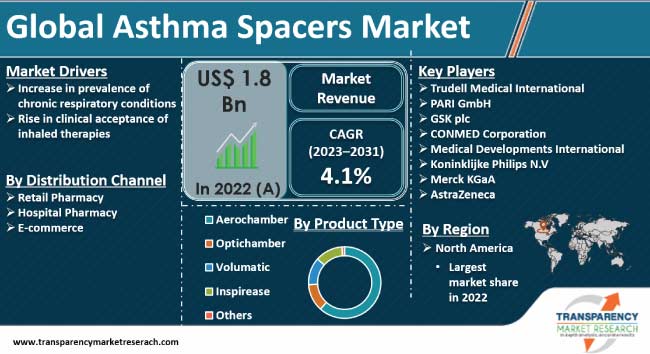

Increase in prevalence of chronic respiratory conditions is fueling the asthma spacers market share. Chronic respiratory diseases, such as asthma and bronchitis, are the most common non-communicable illnesses worldwide. Rise in air pollution, surge in geriatric population, and worsening lifestyle are key factors leading to growth in cases of asthma.

Rise in clinical acceptance of inhaled therapies is augmenting the asthma spacers market revenue. Enhanced awareness about the benefits of inhaled therapies increases the need for asthma spacers as they assist in improving treatment outcomes by efficiently administrating the right dosage of medication to the lungs.

Prominent players operating in the global landscape are investing substantially in the R&D of customized inhaler spacers for children and elderly patients suffering from asthma and other respiratory diseases.

Asthma is a common chronic respiratory illness that affects airways in the lungs. Common symptoms of the disease include wheezing, coughing, shortness of breath, and chest tightness. The difficulty in breathing is caused due to inflammation or narrowing of the airways in the lungs.

Asthma spacers are medical devices that are applied along with inhalers to deliver medicine more effectively to the lungs. A spacer is a tube-like equipment that coordinates the process of pressing the puffer and breathing in. It assists in administering the optimum dosage of medicine by slowing down the process and allowing the patient to take multiple breaths, without forceful deep breathing.

Surge in cases of asthma is boosting the global asthma spacers market landscape. Rise in awareness about respiratory conditions, their symptoms, and treatments is also augmenting the market progress.

Chronic respiratory illnesses are the most common non-communicable diseases globally. This is primarily due to the rise in air pollution, smoking, and sedentary lifestyle. An increase in the geriatric population worldwide is also a key factor in the increase in the prevalence of respiratory issues such as asthma, bronchitis, and pulmonary diseases.

According to a report by SingleCare, more than 339 million people globally suffer from asthma. As per the Asthma and Allergy Foundation of America, one in thirteen people in the U.S. have asthma and nearly 5 million children in the country suffer from the disease.

Surge in cases of chronic respiratory diseases is boosting the demand for therapeutic and management devices such as asthma spacers. Spacers allow for optimum wellness by ensuring efficient delivery of medication to the lungs. Their application reduces medication wastage, fosters better disease management, and improves drug deposition.

Healthcare professionals worldwide are accepting the benefits of inhaled therapies for the treatment and management of respiratory diseases. Inhaled therapies offer targeted delivery of medications directly to the lungs, ensuring rapid and efficient absorption, and thereby improving treatment outcomes.

Asthma spacers reduce the chances of improper breathing techniques, which might mitigate the efficiency of medication or lead to the administration of improper dosage. Growth in awareness about the benefits of inhalation therapeutics in both healthcare workers and patients is propelling the asthma spacers industry.

Spacer technologies in asthma management help reduce the risks of side effects from asthma drugs. Increase in investment in the R&D of advanced spacer technologies that cater to the specific needs of children and older adults is bolstering the asthma spacers market opportunities.

According to a recent asthma spacers market analysis, North America had the largest share in 2022. Presence of a well-established healthcare sector, rise in awareness about chronic respiratory illnesses, and R&D of inhaling solutions are augmenting the market dynamics of the region.

As per the National Center for Health Statistics, in 2022, 4.6% of adults in the U.S. were diagnosed with Chronic Obstructive Pulmonary Disease (COPD), emphysema, or chronic bronchitis. The report also states that the number of deaths due to chronic lower respiratory diseases (including asthma) in the country was 142,342 in 2021.

According to the latest asthma spacers market overview, Asia Pacific is a lucrative market due to the high prevalence of asthma, a surge in the elderly population, and worsening air pollution. According to the Global Asthma Report 2022, an estimated 35 million people in India suffer from asthma. The National Center for Biotechnology Information reports that nearly 45.7 million adults in China suffer from asthma.

According to recent asthma spacers market trends, prominent manufacturers are investing heavily in the development of inhaler chambers and inhaler spacers. They are developing advanced asthma inhaler spacers for elderly patients as the global geriatric population is rising significantly.

Trudell Medical International, PARI GmbH, GSK plc, CONMED Corporation, Medical Developments International, Koninklijke Philips N.V, Merck KGaA, and AstraZeneca are key manufacturers of asthma spacers.

These companies have been profiled in the asthma spacers market report based on various parameters such as company overview, business strategies, product portfolio, financial overview, and business segments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 (Base Year) | US$ 1.8 Bn |

| Market Forecast Value in 2031 | US$ 2.6 Bn |

| Growth Rate (CAGR) | 4.1% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | Qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, and SWOT analysis. Furthermore, at the regional level, the qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Regions Covered |

|

| Countries Covered |

|

| Market Segmentation |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

It was valued at US$ 1.8 Bn in 2022

It is projected to advance at a CAGR of 4.1% from 2023 to 2031

Increase in prevalence of chronic respiratory conditions and rise in clinical acceptance of inhaled therapies

The aerochamber product type segment held the largest share in 2022

North America was the leading region in 2022

Trudell Medical International, PARI GmbH, GSK plc, CONMED Corporation, Medical Developments International, Koninklijke Philips N.V, Merck KGaA, and AstraZeneca

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Asthma Spacers Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Evolution/Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Asthma Spacers Market Analysis and Forecast, 2017–2031

5. Key Insights

5.1. Pipeline Analysis

5.2. Key Product/Brand Analysis

5.3. Key Mergers & Acquisitions

5.4. COVID-19 Pandemic Impact on Industry

6. Global Asthma Spacers Market Analysis and Forecast, by Product Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Product Type, 2017–2031

6.3.1. Aerochamber

6.3.2. Optichamber

6.3.3. Volumatic

6.3.4. Inspirease

6.3.5. Others

6.4. Market Attractiveness Analysis, by Product Type

7. Global Asthma Spacers Market Analysis and Forecast, by Distribution Channel

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Distribution Channel, 2017–2031

7.3.1. Retail Pharmacy

7.3.2. Hospital Pharmacy

7.3.3. E-commerce

7.4. Market Attractiveness Analysis, by Distribution Channel

8. Global Asthma Spacers Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region, 2017–2031

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness Analysis, by Region

9. North America Asthma Spacers Market Analysis and Forecast

9.1. Introduction

9.2. Key Findings

9.3. Market Value Forecast, by Product Type, 2017–2031

9.3.1. Aerochamber

9.3.2. Optichamber

9.3.3. Volumatic

9.3.4. Inspirease

9.3.5. Others

9.4. Market Value Forecast, by Distribution Channel, 2017–2031

9.4.1. Retail Pharmacy

9.4.2. Hospital Pharmacy

9.4.3. E-commerce

9.5. Market Value Forecast, by Country, 2017–2031

9.5.1. U.S.

9.5.2. Canada

9.6. Market Attractiveness Analysis

9.6.1. By Product Type

9.6.2. By Distribution Channel

9.6.3. By Country

10. Europe Asthma Spacers Market Analysis and Forecast

10.1. Introduction

10.2. Key Findings

10.3. Market Value Forecast, by Product Type, 2017–2031

10.3.1. Aerochamber

10.3.2. Optichamber

10.3.3. Volumatic

10.3.4. Inspirease

10.3.5. Others

10.4. Market Value Forecast, by Distribution Channel, 2017–2031

10.4.1. Retail Pharmacy

10.4.2. Hospital Pharmacy

10.4.3. E-commerce

10.5. Market Value Forecast, by Country/Sub-region, 2017–2031

10.5.1. Germany

10.5.2. U.K.

10.5.3. France

10.5.4. Italy

10.5.5. Spain

10.5.6. Rest of Europe

10.6. Market Attractiveness Analysis

10.6.1. By Product Type

10.6.2. By Distribution Channel

10.6.3. By Country/Sub-region

11. Asia Pacific Asthma Spacers Market Analysis and Forecast

11.1. Introduction

11.2. Key Findings

11.3. Market Value Forecast, by Product Type, 2017–2031

11.3.1. Aerochamber

11.3.2. Optichamber

11.3.3. Volumatic

11.3.4. Inspirease

11.3.5. Others

11.4. Market Value Forecast, by Distribution Channel, 2017–2031

11.4.1. Retail Pharmacy

11.4.2. Hospital Pharmacy

11.4.3. E-commerce

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. China

11.5.2. Japan

11.5.3. India

11.5.4. Australia & New Zealand

11.5.5. Rest of Asia Pacific

11.6. Market Attractiveness Analysis

11.6.1. By Product Type

11.6.2. By Distribution Channel

11.6.3. By Country/Sub-region

12. Latin America Asthma Spacers Market Analysis and Forecast

12.1. Introduction

12.2. Key Findings

12.3. Market Value Forecast, by Product Type, 2017–2031

12.3.1. Aerochamber

12.3.2. Optichamber

12.3.3. Volumatic

12.3.4. Inspirease

12.3.5. Others

12.4. Market Value Forecast, by Distribution Channel, 2017–2031

12.4.1. Retail Pharmacy

12.4.2. Hospital Pharmacy

12.4.3. E-commerce

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. Brazil

12.5.2. Mexico

12.5.3. Rest of Latin America

12.6. Market Attractiveness Analysis

12.6.1. By Product Type

12.6.2. By Distribution Channel

12.6.3. By Country/Sub-region

13. Middle East & Africa Asthma Spacers Market Analysis and Forecast

13.1. Introduction

13.2. Key Findings

13.3. Market Value Forecast, by Product Type, 2017–2031

13.3.1. Aerochamber

13.3.2. Optichamber

13.3.3. Volumatic

13.3.4. Inspirease

13.3.5. Others

13.4. Market Value Forecast, by Distribution Channel, 2017–2031

13.4.1. Retail Pharmacy

13.4.2. Hospital Pharmacy

13.4.3. E-commerce

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. GCC Countries

13.5.2. South Africa

13.5.3. Rest of Middle East & Africa

13.6. Market Attractiveness Analysis

13.6.1. By Product Type

13.6.2. By Distribution Channel

13.6.3. By Country/Sub-region

14. Competition Landscape

14.1. Market Player - Competitive Matrix (by Tier and Size of Companies)

14.2. Market Share Analysis, by Company (2022)

14.3. Company Profiles

14.3.1. Trudell Medical International

14.3.1.1. Company Overview

14.3.1.2. Product Portfolio

14.3.1.3. SWOT Analysis

14.3.1.4. Financial Overview

14.3.1.5. Strategic Overview

14.3.2. PARI GmbH

14.3.2.1. Company Overview

14.3.2.2. Product Portfolio

14.3.2.3. SWOT Analysis

14.3.2.4. Financial Overview

14.3.2.5. Strategic Overview

14.3.3. GSK plc

14.3.3.1. Company Overview

14.3.3.2. Product Portfolio

14.3.3.3. SWOT Analysis

14.3.3.4. Financial Overview

14.3.3.5. Strategic Overview

14.3.4. CONMED Corporation

14.3.4.1. Company Overview

14.3.4.2. Product Portfolio

14.3.4.3. SWOT Analysis

14.3.4.4. Financial Overview

14.3.4.5. Strategic Overview

14.3.5. Medical Developments International

14.3.5.1. Company Overview

14.3.5.2. Product Portfolio

14.3.5.3. SWOT Analysis

14.3.5.4. Financial Overview

14.3.5.5. Strategic Overview

14.3.6. Koninklijke Philips N.V

14.3.6.1. Company Overview

14.3.6.2. Product Portfolio

14.3.6.3. SWOT Analysis

14.3.6.4. Financial Overview

14.3.6.5. Strategic Overview

14.3.7. Merck KGaA

14.3.7.1. Company Overview

14.3.7.2. Product Portfolio

14.3.7.3. SWOT Analysis

14.3.7.4. Financial Overview

14.3.7.5. Strategic Overview

14.3.8. AstraZeneca

14.3.8.1. Company Overview

14.3.8.2. Product Portfolio

14.3.8.3. SWOT Analysis

14.3.8.4. Financial Overview

14.3.8.5. Strategic Overview

List of Tables

Table 01: Global Asthma Spacers Market Size (US$ Mn) Forecast, by Product Type, 2017–2031

Table 02: Global Asthma Spacers Market Size (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 03: Global Asthma Spacers Market Size (US$ Mn) Forecast, by Region, 2017–2031

Table 04: North America Asthma Spacers Market Size (US$ Mn) Forecast, by Country, 2017–2031

Table 05: North America Asthma Spacers Market Size (US$ Mn) Forecast, by Product Type, 2017–2031

Table 06: North America Asthma Spacers Market Size (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 07: Europe Asthma Spacers Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 08: Europe Asthma Spacers Market Size (US$ Mn) Forecast, by Product Type, 2017–2031

Table 09: Europe Asthma Spacers Market Size (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 10: Asia Pacific Asthma Spacers Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 11: Asia Pacific Asthma Spacers Market Size (US$ Mn) Forecast, by Product Type, 2017–2031

Table 12: Asia Pacific Asthma Spacers Market Size (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 13: Latin America Asthma Spacers Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Latin America Asthma Spacers Market Size (US$ Mn) Forecast, by Product Type, 2017–2031

Table 15: Latin America Asthma Spacers Market Size (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 16: Middle East & Africa Asthma Spacers Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 17: Middle East & Africa Asthma Spacers Market Size (US$ Mn) Forecast, by Product Type, 2017–2031

Table 18: Middle East & Africa Asthma Spacers Market Size (US$ Mn) Forecast, by Distribution Channel, 2017–2031

List of Figures

Figure 01: Global Asthma Spacers Market Size (US$ Mn) and Distribution (%), by Region, 2022 and 2031

Figure 02: Global Asthma Spacers Market Revenue (US$ Mn), by Product Type, 2022

Figure 03: Global Asthma Spacers Market Value Share, by Product Type, 2022

Figure 04: Global Asthma Spacers Market Revenue (US$ Mn), by Distribution Channel, 2022

Figure 05: Global Asthma Spacers Market Value Share, by Distribution Channel, 2022

Figure 06: Global Asthma Spacers Market Value Share, by Region, 2022

Figure 07: Global Asthma Spacers Market Value (US$ Mn) Forecast, 2023–2031

Figure 08: Global Asthma Spacers Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 09: Global Asthma Spacers Market Attractiveness Analysis, by Product Type, 2023-2031

Figure 10: Global Asthma Spacers Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 11: Global Asthma Spacers Market Attractiveness Analysis, by Distribution Channel, 2023-2031

Figure 12: Global Asthma Spacers Market Value Share Analysis, by Region, 2022 and 2031

Figure 13: Global Asthma Spacers Market Attractiveness Analysis, by Region, 2023-2031

Figure 14: North America Asthma Spacers Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 15: North America Asthma Spacers Market Attractiveness Analysis, by Country, 2023–2031

Figure 16: North America Asthma Spacers Market Value Share Analysis, by Country, 2022 and 2031

Figure 17: North America Asthma Spacers Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 18: North America Asthma Spacers Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 19: North America Asthma Spacers Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 20: North America Asthma Spacers Market Attractiveness Analysis, by Distribution Channel, 2023–2031

Figure 21: Europe Asthma Spacers Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 22: Europe Asthma Spacers Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 23: Europe Asthma Spacers Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 24: Europe Asthma Spacers Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 25: Europe Asthma Spacers Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 26: Europe Asthma Spacers Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 27: Europe Asthma Spacers Market Attractiveness Analysis, by Distribution Channel, 2023–2031

Figure 28: Asia Pacific Asthma Spacers Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 29: Asia Pacific Asthma Spacers Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 30: Asia Pacific Asthma Spacers Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 31: Asia Pacific Asthma Spacers Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 32: Asia Pacific Asthma Spacers Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 33: Asia Pacific Asthma Spacers Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 34: Asia Pacific Asthma Spacers Market Attractiveness Analysis, by Distribution Channel, 2023–2031

Figure 35: Latin America Asthma Spacers Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 36: Latin America Asthma Spacers Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 37: Latin America Asthma Spacers Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 38: Latin America Asthma Spacers Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 39: Latin America Asthma Spacers Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 40: Latin America Asthma Spacers Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 41: Latin America Asthma Spacers Market Attractiveness Analysis, by Distribution Channel, 2023–2031

Figure 42: Middle East & Africa Asthma Spacers Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 43: Middle East & Africa Asthma Spacers Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 44: Middle East & Africa Asthma Spacers Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 45: Middle East & Africa Asthma Spacers Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 46: Middle East & Africa Asthma Spacers Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 47: Middle East & Africa Asthma Spacers Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 48: Middle East & Africa Asthma Spacers Market Attractiveness Analysis, by Distribution Channel, 2023–2031