Analysts’ Viewpoint on Global Asset and Wealth Management Scenario

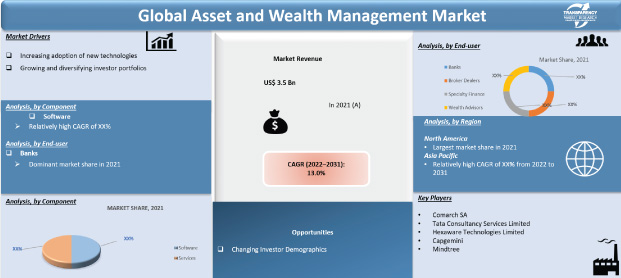

Asset and wealth management software providers are continuously innovating and developing new solutions backed by years of technical expertise, regulatory compliance, and cybersecurity solutions. Moreover, the growing scope of wealth management software, which includes applications from accounting and investment management to estate planning and retirement planning bodes well for the growth of the market. Furthermore, increasing demand for alternate investment methods; adoption of advanced technologies such as AI, Blockchain, and Big Data in wealth management; growing adoption of hybrid management services; and digital asset management are some of the factors that are likely to drive the asset and wealth management market.

Asset management refers to the management of assets such as stocks, fixed income instruments, real estate, and global investments, among others, whereas wealth management refers to overseeing all financial aspects which may include asset management, taxes, estate planning, cash flow management, and any other conceivable use of money. Thus, wealth management includes asset management and takes a comprehensive view of the client's finances. An asset and wealth management platform is specifically developed for financial planning and monitoring, as well as tax and legal advice, estate planning, personal retail banking services, online banking, retirement planning, and investment management.

Advancements and adoption of technology for wealth management are projected to increase and intensify the competition between traditional and non-traditional companies.

Technologies used in asset and wealth management comprise artificial intelligence (AI), machine learning (ML), robotic process automation (RPA), Blockchain, Big Data and data management, distribution platforms, cryptography/cybersecurity technology, crypto asset management, augmented and virtual reality (AR & VR), open platforms/application programming interfaces (APIs) architectures, and wearable technology, among others, provide users with a seamless user experience and security from cyber threats. Recent technological advancements and integration with asset and wealth management software are driving the adoption of asset and wealth management software. Several companies are embracing these advanced technologies as it impacts the overall system functionality.

Both small and large organizations are utilizing emerging technologies such as robotic process automation (RPA), web collaboration, AI, and Big Data and data management to automate routine tasks, and increase accuracy & productivity. For instance, according to research conducted by Oracle, progressive companies currently invest 16.8% of their turnover in technology and plan to increase it to 24% by the end of 2022. Likewise, over the last year, digitally advanced companies generated an 8.6% increase in revenue, a 11.3% increase in productivity, and a 6.3% increase in market share from their technological initiatives. Technologically advanced companies currently generate 32% of their revenue through digital channels, which is expected to rise to 48% by 2022.

Technological advancements allow organizations to democratize their assets and wealth management advice, reaching new clients who demand the convenience of digital solutions. Therefore, rapid technological advancements are projected to boost the demand for asset and wealth management.

The wealth management sector is currently undergoing transformation to meet the demands of changing investor demographics. Stakeholders continue to work to adapt across the wealth management industry, beginning with the way companies engage with clients, providing various forms of advice and service models, and the application of different regulations on firms. For instance, according to Accenture research report- "Enabling the Evolution of Advice in Canada," organizations are undergoing considerable transformation in response to the expectations of the millennial, a major rising investment demographic. Additionally, Canadian investors are more knowledgeable and confident, have access to expert knowledge and tools, and are actively planning for their finances. An increasing tendency toward self-sufficiency rather than relying on parents to support one's lifestyle demands is expected to generate opportunities for the market.

Moreover, shifting demographics, such as advisor aging and the projected transfer of wealth from baby boomers to their children, will disrupt many longstanding advisor/client relationships and create opportunities for new companies to grow in the asset and wealth management market.

The asset and wealth management market in North America is expected to hold a prominent share by the end of 2022, owing to the significant share of the U.S. and Canada, as well as increased demand for solutions by financial institutions in the region. In addition, the growth of the North American investment industry indicates a noticeable move toward high-tech asset and wealth management solutions, not only among key firms but also throughout the long tail of smaller companies.

Meanwhile, the European market for asset and wealth management is expected to witness decent growth during the projected period. Europe's high net worth individual population and wealth have grown significantly in the recent years.

The Asia Pacific asset and wealth management market is predicated to advance at a high CAGR over the forecast period, mainly due to the rapid growth of the financial and banking sector in the region. Middle East & Africa is projected to develop steadily in the asset and wealth management market over the next few years, as a number of western banks with wealth management companies focus on making the region a global financial hub. This will encourage additional investors to come to the region, allowing the market to grow progressively.

The global asset and wealth management market is consolidated with a few large-scale vendors controlling majority of the market share. Most of the firms are spending significant sums of money on comprehensive research and development. Diversification of product portfolios and mergers & acquisitions are the key strategies adopted by market players. Comarch SA, Temenos, Avaloq Group AG (NEC Corporation), Profile Software, Tata Consultancy Services Limited, Salesforce, Inc., Hexaware Technologies Limited, Capgemini, Mindtree, FIS, Mphasis, and CACEIS, among others are the prominent entities operating in this market.

Each of these players have been profiled in the asset and wealth management market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments

|

Attribute |

Detail |

|

Market Size (Value) in 2021 |

US$ 3.5 Bn |

|

Market Forecast Value in 2031 |

US$ 11.8 Bn |

|

Growth Rate (CAGR) |

13.0% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross-segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The asset and wealth management market is expected to reach US$ 11.8 Bn by 2031

The asset and wealth management market is estimated to rise at a CAGR of 13.0% during the forecast period

Increasing adoption of new technologies is projected to drive the global asset and wealth management market

North America is more attractive for vendors in the asset and wealth management market

Comarch SA, Temenos, Avaloq Group AG (NEC Corporation), Profile Software, Tata Consultancy Services Limited, Salesforce, Inc., Hexaware Technologies Limited, Capgemini, Mindtree, FIS, Mphasis, and CACEIS

1. Preface

1.1. Market Introduction

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Research Methodology

2.1.1. List of Primary and Secondary Sources

2.2. Key Assumptions for Data Modeling

3. Executive Summary: Global Asset and Wealth Management Market

4. Market Overview

4.1. Market Definition

4.2. Technology/Product Roadmap

4.3. Market Factor Analysis

4.3.1. Forecast Factors

4.3.2. Ecosystem/ Value Chain Analysis

4.3.3. Market Dynamics (Growth Influencers)

4.3.3.1. Drivers

4.3.3.2. Restraints

4.3.3.3. Opportunities

4.3.3.4. Impact Analysis of Drivers and Restraints

4.4. COVID-19 Impact Analysis

4.4.1. Impact of COVID-19 on Asset and Wealth Management Market

4.4.2. End-user Sentiment Analysis: Comparative Analysis on Spending

4.4.2.1. Increase in Spending

4.4.2.2. Decrease in Spending

4.4.3. Short Term and Long Term Impact on the Market

4.5. Market Opportunity Assessment – by Region (North America/ Europe/ Asia Pacific/ Middle East & Africa/ South America)

4.5.1. By Component

4.5.2. By End-user

5. Global Asset and Wealth Management Market Analysis and Forecast

5.1. Market Revenue Analysis (US$ Mn), 2016-2031

5.1.1. Historic Growth Trends, 2016-2021

5.1.2. Forecast Trends, 2022-2031

6. Global Asset and Wealth Management Market Analysis, by Component

6.1. Overview and Definitions

6.2. Key Segment Analysis

6.3. Asset and Wealth Management Market Size (US$ Mn) Forecast, by Component, 2018 - 2031

6.3.1. Software

6.3.2. Services

7. Global Asset and Wealth Management Market Analysis, by End-user

7.1. Overview and Key Segment Analysis

7.2. Asset and Wealth Management Market Size (US$ Mn) Forecast, by End-user, 2018 - 2031

7.2.1. Banks

7.2.2. Broker Dealers

7.2.3. Specialty Finance

7.2.4. Wealth Advisors

8. Global Asset and Wealth Management Market Analysis and Forecasts, by Region

8.1. Key Findings

8.2. Market Size (US$ Mn) Forecast by Region, 2018-2031

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Middle East & Africa

8.2.5. South America

9. North America Asset and Wealth Management Market Analysis and Forecast

9.1. Regional Outlook

9.2. Asset and Wealth Management Market Size (US$ Mn) Analysis and Forecast (2018 - 2031)

9.2.1. By Component

9.2.2. By End-user

9.3. Asset and Wealth Management Market Size (US$ Mn) Forecast, by Country, 2018 - 2031

9.3.1. U.S.

9.3.2. Canada

9.3.3. Mexico

10. Europe Asset and Wealth Management Market Analysis and Forecast

10.1. Regional Outlook

10.2. Asset and Wealth Management Market Size (US$ Mn) Analysis and Forecast (2018 - 2031)

10.2.1. By Component

10.2.2. By End-user

10.3. Asset and Wealth Management Market Size (US$ Mn) Forecast, by Country & Sub-region, 2018 - 2031

10.3.1. Germany

10.3.2. UK

10.3.3. France

10.3.4. Italy

10.3.5. Spain

10.3.6. Rest of Europe

11. Asia Pacific Asset and Wealth Management Market Analysis and Forecast

11.1. Regional Outlook

11.2. Asset and Wealth Management Market Size (US$ Mn) Analysis and Forecast (2018 - 2031)

11.2.1. By Component

11.2.2. By End-user

11.3. Asset and Wealth Management Market Size (US$ Mn) Forecast, by Country & Sub-region, 2018 - 2031

11.3.1. China

11.3.2. India

11.3.3. Japan

11.3.4. ASEAN

11.3.5. Rest of Asia Pacific

12. Middle East & Africa Asset and Wealth Management Market Analysis and Forecast

12.1. Regional Outlook

12.2. Asset and Wealth Management Market Size (US$ Mn) Analysis and Forecast (2018 - 2031)

12.2.1. By Component

12.2.2. By End-user

12.3. Asset and Wealth Management Market Size (US$ Mn) Forecast, by Country & Sub-region, 2018 - 2031

12.3.1. Saudi Arabia

12.3.2. The United Arab Emirates

12.3.3. South Africa

12.3.4. Rest of Middle East & Africa

13. South America Asset and Wealth Management Market Analysis and Forecast

13.1. Regional Outlook

13.2. Asset and Wealth Management Market Size (US$ Mn) Analysis and Forecast (2018 - 2031)

13.2.1. By Component

13.2.2. By End-user

13.3. Asset and Wealth Management Market Size (US$ Mn) Forecast, by Country & Sub-region, 2018 - 2031

13.3.1. Brazil

13.3.2. Argentina

13.3.3. Rest of South America

14. Competition Landscape

14.1. Market Competition Matrix, by Leading Players

14.2. Market Revenue Share Analysis (%), by Leading Players (2021)

14.3. Competitive Scenario

14.3.1. List of Emerging, Prominent, and Leading Players

14.3.2. Major Mergers & Acquisitions, Expansions, Partnership, Contacts, Deals, etc.

15. Company Profiles

15.1. Comarch SA

15.1.1. Business Overview

15.1.2. Company Revenue

15.1.3. Product Portfolio

15.1.4. Geographic Footprint

15.1.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

15.2. Temenos

15.2.1. Business Overview

15.2.2. Company Revenue

15.2.3. Product Portfolio

15.2.4. Geographic Footprint

15.2.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

15.3. Avaloq Group AG (NEC Corporation)

15.3.1. Business Overview

15.3.2. Company Revenue

15.3.3. Product Portfolio

15.3.4. Geographic Footprint

15.3.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

15.4. Profile Software

15.4.1. Business Overview

15.4.2. Company Revenue

15.4.3. Product Portfolio

15.4.4. Geographic Footprint

15.4.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

15.5. Tata Consultancy Services Limited

15.5.1. Business Overview

15.5.2. Company Revenue

15.5.3. Product Portfolio

15.5.4. Geographic Footprint

15.5.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

15.6. Salesforce, Inc.

15.6.1. Business Overview

15.6.2. Company Revenue

15.6.3. Product Portfolio

15.6.4. Geographic Footprint

15.6.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

15.7. Hexaware Technologies Limited

15.7.1. Business Overview

15.7.2. Company Revenue

15.7.3. Product Portfolio

15.7.4. Geographic Footprint

15.7.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

15.8. Capgemini

15.8.1. Business Overview

15.8.2. Company Revenue

15.8.3. Product Portfolio

15.8.4. Geographic Footprint

15.8.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

15.9. Mindtree

15.9.1. Business Overview

15.9.2. Company Revenue

15.9.3. Product Portfolio

15.9.4. Geographic Footprint

15.9.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

15.10. FIS

15.10.1. Business Overview

15.10.2. Company Revenue

15.10.3. Product Portfolio

15.10.4. Geographic Footprint

15.10.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

15.11. Mphasis

15.11.1. Business Overview

15.11.2. Company Revenue

15.11.3. Product Portfolio

15.11.4. Geographic Footprint

15.11.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation, etc.

15.12. Others

16. Key Takeaways

List of Tables

Table 1: Acronyms Used in the Asset and Wealth Management Market

Table 2: North America Asset and Wealth Management Market Revenue Analysis, by Country, 2022 - 2031 (US$ Mn)

Table 3: Europe Asset and Wealth Management Market Revenue Analysis, by Country, 2022 - 2031 (US$ Mn)

Table 4: Asia Pacific Asset and Wealth Management Market Revenue Analysis, by Country, 2022 - 2031 (US$ Mn)

Table 5: Middle East & Africa Asset and Wealth Management Market Revenue Analysis, by Country, 2021 and 2031 (US$ Mn)

Table 6: South America Asset and Wealth Management Market Revenue Analysis, by Country, 2022 - 2031 (US$ Mn)

Table 7: Forecast Factors: Relevance and Impact (1/2)

Table 8: Forecast Factors: Relevance and Impact (2/2)

Table 9: Impact Analysis of Drivers & Restraints

Table 10: List of Companies, Visits Per Minute (VPM), Features, and Pricing

Table 11: List of Companies, Visits Per Minute (VPM), Features, and Pricing

Table 12: Global Asset and Wealth Management Market Value (US$ Mn) Forecast, by Component, 2018 – 2031

Table 13: Global Asset and Wealth Management Market Value (US$ Mn) Forecast, by End-user, 2018 – 2031

Table 14: Global Asset and Wealth Management Market Volume (US$ Mn) Forecast, by Region, 2018 - 2031

Table 15: North America Asset and Wealth Management Market Value (US$ Mn) Forecast, by Component, 2018 – 2031

Table 16: North America Asset and Wealth Management Market Value (US$ Mn) Forecast, by End-user, 2018 – 2031

Table 17: North America Asset and Wealth Management Market Value (US$ Mn) Forecast, by Country, 2018 - 2031

Table 18: U.S. Asset and Wealth Management Market Revenue CAGR Breakdown (%), by Growth Term

Table 19: Canada Asset and Wealth Management Market Revenue CAGR Breakdown (%), by Growth Term

Table 20: Mexico Asset and Wealth Management Market Revenue CAGR Breakdown (%), by Growth Term

Table 21: Europe Asset and Wealth Management Market Value (US$ Mn) Forecast, by Component, 2018 – 2031

Table 22: Europe Asset and Wealth Management Market Value (US$ Mn) Forecast, by End-user, 2018 – 2031

Table 23: Europe Asset and Wealth Management Market Value (US$ Mn) Forecast, by Country, 2018 - 2031

Table 24: Germany Asset and Wealth Management Market Revenue CAGR Breakdown (%), by Growth Term

Table 25: UK Asset and Wealth Management Market Revenue CAGR Breakdown (%), by Growth Term

Table 26: France Asset and Wealth Management Market Revenue CAGR Breakdown (%), by Growth Term

Table 27: Italy Asset and Wealth Management Market Revenue CAGR Breakdown (%), by Growth Term

Table 28: Spain Asset and Wealth Management Market Revenue CAGR Breakdown (%), by Growth Term

Table 29: Asia Pacific Asset and Wealth Management Market Value (US$ Mn) Forecast, by Component, 2018 – 2031

Table 30: Asia Pacific Asset and Wealth Management Market Value (US$ Mn) Forecast, by End-user, 2018 – 2031

Table 31: Asia Pacific Asset and Wealth Management Market Value (US$ Mn) Forecast, by Country, 2018 - 2031

Table 32: China Asset and Wealth Management Market Revenue CAGR Breakdown (%), by Growth Term

Table 33: India Asset and Wealth Management Market Revenue CAGR Breakdown (%), by Growth Term

Table 34: Japan Asset and Wealth Management Market Revenue CAGR Breakdown (%), by Growth Term

Table 35: ASEAN Asset and Wealth Management Market Revenue CAGR Breakdown (%), by Growth Term

Table 36: Middle East & Africa Asset and Wealth Management Market Value (US$ Mn) Forecast, by Component, 2018 – 2031

Table 37: Middle East & Africa Asset and Wealth Management Market Value (US$ Mn) Forecast, by End-user, 2018 – 2031

Table 38: Middle East & Africa Asset and Wealth Management Market Value (US$ Mn) Forecast, by Country, 2018 - 2031

Table 39: Saudi Arabia Asset and Wealth Management Market Revenue CAGR Breakdown (%), by Growth Term

Table 40: The United Arab Emirates Asset and Wealth Management Market Revenue CAGR Breakdown (%), by Growth Term

Table 41: South Africa Asset and Wealth Management Market Revenue CAGR Breakdown (%), by Growth Term

Table 42: South America Asset and Wealth Management Market Value (US$ Mn) Forecast, by Component, 2018 – 2031

Table 43: South America Asset and Wealth Management Market Value (US$ Mn) Forecast, by End-user, 2018 – 2031

Table 44: South America Asset and Wealth Management Market Value (US$ Mn) Forecast, by Country, 2018 - 2031

Table 45: Brazil Asset and Wealth Management Market Revenue CAGR Breakdown (%), by Growth Term

Table 46: Argentina Asset and Wealth Management Market Revenue CAGR Breakdown (%), by Growth Term

Table 47: Mergers & Acquisitions, Partnerships (1/2)

Table 48: Mergers & Acquisitions, Partnership (2/2)

List of Figures

Figure 1: Global Asset and Wealth Management Market Size (US$ Mn) Forecast, 2018–2031

Figure 2: Global Asset and Wealth Management Market Revenue (US$ Mn) Opportunity Assessment, by Region, 2022E

Figure 3: Top Segment Analysis of Asset and Wealth Management Market

Figure 4: Global Asset and Wealth Management Market Revenue (US$ Mn) Opportunity Assessment, by Region, 2031F

Figure 5: Global Asset and Wealth Management Market Attractiveness Assessment, by Component

Figure 6: Global Asset and Wealth Management Market Attractiveness Assessment, by End-user

Figure 7: Global Asset and Wealth Management Market Attractiveness Assessment, by Region

Figure 8: Global Asset and Wealth Management Market Revenue (US$ Mn) Historic Trends, 2016 – 2021

Figure 9: Global Asset and Wealth Management Market Revenue Opportunity (US$ Mn) Historic Trends, 2016 – 2021

Figure 10: Global Asset and Wealth Management Market Value Share Analysis, by Component, 2022

Figure 11: Global Asset and Wealth Management Market Value Share Analysis, by Component, 2031

Figure 12: Global Asset and Wealth Management Market Absolute Opportunity (US$ Mn), by Software, 2022 – 2031

Figure 13: Global Asset and Wealth Management Market Absolute Opportunity (US$ Mn), by Services, 2022 – 2031

Figure 14: Global Asset and Wealth Management Market Value Share Analysis, by End-user, 2022

Figure 15: Global Asset and Wealth Management Market Value Share Analysis, by End-user, 2031

Figure 16: Global Asset and Wealth Management Market Absolute Opportunity (US$ Mn), by Banks, 2022 – 2031

Figure 17: Global Asset and Wealth Management Market Absolute Opportunity (US$ Mn), by Broker Dealers, 2022 – 2031

Figure 18: Global Asset and Wealth Management Market Absolute Opportunity (US$ Mn), by Specialty Finance, 2022 – 2031

Figure 19: Global Asset and Wealth Management Market Absolute Opportunity (US$ Mn), by Wealth Advisors, 2022 – 2031

Figure 20: Global Asset and Wealth Management Market Opportunity (US$ Mn), by Region

Figure 21: Global Asset and Wealth Management Market Opportunity Share (%), by Region, 2022–2031

Figure 22: Global Asset and Wealth Management Market Size (US$ Mn), by Region, 2022 & 2031

Figure 23: Global Asset and Wealth Management Market Value Share Analysis, by Region, 2022

Figure 24: Global Asset and Wealth Management Market Value Share Analysis, by Region, 2031

Figure 25: North America Asset and Wealth Management Market Absolute Opportunity (US$ Mn), 2022 – 2031

Figure 26: Europe Asset and Wealth Management Market Absolute Opportunity (US$ Mn), 2022 – 2031

Figure 27: Asia Pacific Asset and Wealth Management Market Absolute Opportunity (US$ Mn), 2022 – 2031

Figure 28: Middle East & Africa Asset and Wealth Management Market Absolute Opportunity (US$ Mn), 2022 – 2031

Figure 29: South America Asset and Wealth Management Market Absolute Opportunity (US$ Mn), 2022 – 2031

Figure 30: North America Asset and Wealth Management Market Revenue Opportunity Share, by Component

Figure 31: North America Asset and Wealth Management Market Revenue Opportunity Share, by End-user

Figure 32: North America Asset and Wealth Management Market Revenue Opportunity Share, by Country

Figure 33: North America Asset and Wealth Management Market Value Share Analysis, by Component, 2022

Figure 34: North America Asset and Wealth Management Market Value Share Analysis, by Component, 2031

Figure 35: North America Asset and Wealth Management Market Absolute Opportunity (US$ Mn), by Software, 2022 – 2031

Figure 36: North America Asset and Wealth Management Market Absolute Opportunity (US$ Mn), by Services, 2022 – 2031

Figure 37: North America Asset and Wealth Management Market Value Share Analysis, by End-user, 2022

Figure 38: North America Asset and Wealth Management Market Value Share Analysis, by End-user, 2031

Figure 39: North America Asset and Wealth Management Market Absolute Opportunity (US$ Mn), by Banks, 2022 – 2031

Figure 40: North America Asset and Wealth Management Market Absolute Opportunity (US$ Mn), by Broker Dealers, 2022 – 2031

Figure 41: North America Asset and Wealth Management Market Absolute Opportunity (US$ Mn), by Specialty Finance, 2022 – 2031

Figure 42: North America Asset and Wealth Management Market Absolute Opportunity (US$ Mn), by Wealth Advisors, 2022 – 2031

Figure 43: North America Asset and Wealth Management Market Value Share Analysis, by Country, 2022

Figure 44: North America Asset and Wealth Management Market Value Share Analysis, by Country, 2031

Figure 45: U.S. Asset and Wealth Management Market Opportunity Growth Analysis (US$ Mn) Forecast, 2022 – 2031

Figure 46: Canada Asset and Wealth Management Market Opportunity Growth Analysis (US$ Mn) Forecast, 2022 – 2031

Figure 47: Mexico Asset and Wealth Management Market Opportunity Growth Analysis (US$ Mn) Forecast, 2022 – 2031

Figure 48: Europe Asset and Wealth Management Market Revenue Opportunity Share, by Component

Figure 49: Europe Asset and Wealth Management Market Revenue Opportunity Share, by End-user

Figure 50: Europe Asset and Wealth Management Market Revenue Opportunity Share, by Country

Figure 51: Europe Asset and Wealth Management Market Value Share Analysis, by Component, 2022

Figure 52: Europe Asset and Wealth Management Market Value Share Analysis, by Component, 2031

Figure 53: Europe Asset and Wealth Management Market Absolute Opportunity (US$ Mn), by Software, 2022 – 2031

Figure 54: Europe Asset and Wealth Management Market Absolute Opportunity (US$ Mn), by Services, 2022 – 2031

Figure 55: Europe Asset and Wealth Management Market Value Share Analysis, by End-user, 2022

Figure 56: Europe Asset and Wealth Management Market Value Share Analysis, by End-user, 2031

Figure 57: Europe Asset and Wealth Management Market Absolute Opportunity (US$ Mn), by Banks, 2022 – 2031

Figure 58: Europe Asset and Wealth Management Market Absolute Opportunity (US$ Mn), by Broker Dealers, 2022 – 2031

Figure 59: Europe Asset and Wealth Management Market Absolute Opportunity (US$ Mn), by Specialty Finance, 2022 – 2031

Figure 60: Europe Asset and Wealth Management Market Absolute Opportunity (US$ Mn), by Wealth Advisors, 2022 – 2031

Figure 61: Europe Asset and Wealth Management Market Value Share Analysis, by Country, 2022

Figure 62: Europe Asset and Wealth Management Market Value Share Analysis, by Country, 2031

Figure 63: Germany Asset and Wealth Management Market Opportunity Growth Analysis (US$ Mn) Forecast, 2022 – 2031

Figure 64: U.K. Asset and Wealth Management Market Opportunity Growth Analysis (US$ Mn) Forecast, 2022 – 2031

Figure 65: France Asset and Wealth Management Market Opportunity Growth Analysis (US$ Mn) Forecast, 2022 – 2031

Figure 66: Italy Asset and Wealth Management Market Opportunity Growth Analysis (US$ Mn) Forecast, 2022 – 2031

Figure 67: Spain Asset and Wealth Management Market Opportunity Growth Analysis (US$ Mn) Forecast, 2022 – 2031

Figure 68: Asia Pacific Asset and Wealth Management Market Revenue Opportunity Share, by Component

Figure 69: Asia Pacific Asset and Wealth Management Market Revenue Opportunity Share, by End-user

Figure 70: Asia Pacific Asset and Wealth Management Market Revenue Opportunity Share, by Country

Figure 71: Asia Pacific Asset and Wealth Management Market Value Share Analysis, by Component, 2022

Figure 72: Asia Pacific Asset and Wealth Management Market Value Share Analysis, by Component, 2031

Figure 73: Asia Pacific Asset and Wealth Management Market Absolute Opportunity (US$ Mn), by Software, 2022 – 2031

Figure 74: Asia Pacific Asset and Wealth Management Market Absolute Opportunity (US$ Mn), by Services, 2022 – 2031

Figure 75: Asia Pacific Asset and Wealth Management Market Value Share Analysis, by End-user, 2022

Figure 76: Asia Pacific Asset and Wealth Management Market Value Share Analysis, by End-user, 2031

Figure 77: Asia Pacific Asset and Wealth Management Market Absolute Opportunity (US$ Mn), by Banks, 2022 – 2031

Figure 78: Asia Pacific Asset and Wealth Management Market Absolute Opportunity (US$ Mn), by Broker Dealers, 2022 – 2031

Figure 79: Asia Pacific Asset and Wealth Management Market Absolute Opportunity (US$ Mn), by Specialty Finance, 2022 – 2031

Figure 80: Asia Pacific Asset and Wealth Management Market Absolute Opportunity (US$ Mn), by Wealth Advisors, 2022 – 2031

Figure 81: Asia Pacific Asset and Wealth Management Market Value Share Analysis, by Country, 2022

Figure 82: Asia Pacific Asset and Wealth Management Market Value Share Analysis, by Country, 2031

Figure 83: China Asset and Wealth Management Market Opportunity Growth Analysis (US$ Mn) Forecast, 2022 – 2031

Figure 84: India Asset and Wealth Management Market Opportunity Growth Analysis (US$ Mn) Forecast, 2022 – 2031

Figure 85: Japan Asset and Wealth Management Market Opportunity Growth Analysis (US$ Mn) Forecast, 2022 – 2031

Figure 86: ASEAN Asset and Wealth Management Market Opportunity Growth Analysis (US$ Mn) Forecast, 2022 – 2031

Figure 87: Middle East & Africa Asset and Wealth Management Market Revenue Opportunity Share, by Component

Figure 88: Middle East & Africa Asset and Wealth Management Market Revenue Opportunity Share, by End-user

Figure 89: Middle East & Africa Asset and Wealth Management Market Revenue Opportunity Share, by Country

Figure 90: Middle East & Africa Asset and Wealth Management Market Value Share Analysis, by Component, 2022

Figure 91: Middle East & Africa Asset and Wealth Management Market Value Share Analysis, by Component, 2031

Figure 92: Middle East & Africa Asset and Wealth Management Market Absolute Opportunity (US$ Mn), by Software, 2022 – 2031

Figure 93: Middle East & Africa Asset and Wealth Management Market Absolute Opportunity (US$ Mn), by Services, 2022 – 2031

Figure 94: Middle East & Africa Asset and Wealth Management Market Value Share Analysis, by End-user, 2022

Figure 95: Middle East & Africa Asset and Wealth Management Market Value Share Analysis, by End-user, 2031

Figure 96: Middle East & Africa Asset and Wealth Management Market Absolute Opportunity (US$ Mn), by Banks, 2022 – 2031

Figure 97: Middle East & Africa Asset and Wealth Management Market Absolute Opportunity (US$ Mn), by Broker Dealers, 2022 – 2031

Figure 98: Middle East & Africa Asset and Wealth Management Market Absolute Opportunity (US$ Mn), by Specialty Finance, 2022 – 2031

Figure 99: Middle East & Africa Asset and Wealth Management Market Absolute Opportunity (US$ Mn), by Wealth Advisors, 2022 – 2031

Figure 100: Middle East & Africa Asset and Wealth Management Market Value Share Analysis, by Country, 2022

Figure 101: Middle East & Africa Asset and Wealth Management Market Value Share Analysis, by Country, 2031

Figure 102: Saudi Arabia Asset and Wealth Management Market Opportunity Growth Analysis (US$ Mn) Forecast, 2022 – 2031

Figure 103: The United Arab Emirates Asset and Wealth Management Market Opportunity Growth Analysis (US$ Mn) Forecast, 2022 – 2031

Figure 104: South Africa Asset and Wealth Management Market Opportunity Growth Analysis (US$ Mn) Forecast, 2022 – 2031

Figure 105: South America Asset and Wealth Management Market Revenue Opportunity Share, by Component

Figure 106: South America Asset and Wealth Management Market Revenue Opportunity Share, by End-user

Figure 107: South America Asset and Wealth Management Market Revenue Opportunity Share, by Country

Figure 108: South America Asset and Wealth Management Market Value Share Analysis, by Component, 2022

Figure 109: South America Asset and Wealth Management Market Value Share Analysis, by Component, 2031

Figure 110: South America Asset and Wealth Management Market Absolute Opportunity (US$ Mn), by Software, 2022 – 2031

Figure 111: South America Asset and Wealth Management Market Absolute Opportunity (US$ Mn), by Services, 2022 – 2031

Figure 112: South America Asset and Wealth Management Market Value Share Analysis, by End-user, 2022

Figure 113: South America Asset and Wealth Management Market Value Share Analysis, by End-user, 2031

Figure 114: South America Asset and Wealth Management Market Absolute Opportunity (US$ Mn), by Banks, 2022 – 2031

Figure 115: South America Asset and Wealth Management Market Absolute Opportunity (US$ Mn), by Broker Dealers, 2022 – 2031

Figure 116: South America Asset and Wealth Management Market Absolute Opportunity (US$ Mn), by Specialty Finance, 2022 – 2031

Figure 117: South America Asset and Wealth Management Market Absolute Opportunity (US$ Mn), by Wealth Advisors, 2022 – 2031

Figure 118: South America Asset and Wealth Management Market Value Share Analysis, by Country, 2022

Figure 119: South America Asset and Wealth Management Market Value Share Analysis, by Country, 2031

Figure 120: Brazil Asset and Wealth Management Market Opportunity Growth Analysis (US$ Mn) Forecast, 2022 – 2031

Figure 121: Argentina Asset and Wealth Management Market Opportunity Growth Analysis (US$ Mn) Forecast, 2022 – 2031