Healthcare Providers Increase Availability of Urinary Catheters During COVID-19 Outbreak

With the significant impact on the global economy and businesses, the coronavirus pandemic has put intense pressure on the healthcare system. The urinary catheters market in Asia Pacific is also negatively affected by the insufficient supply of devices, postponement of elective surgeries, shortage of hospital beds, medical staff, etc. However, the urinary catheters market in the region is booming after the significant efforts taken by healthcare providers and market stakeholders. The surging demand for urinary catheters due to rising incidence of urinary incontinence and increasing geriatric population who have a difficulty passing urine naturally drive the market in the region. Medical device manufacturers are now increasing the production of urinary catheters due to the increasing demand in the Asia Pacific.

Growing Prevalence of Urinary Incontinence and Surgical Procedures

Urinary incontinence or lack of control over urination is a commonly found health condition in the elderly population and the people suffering from diabetes. Excessive stress, chronic illnesses, kidney disorders, prostate cancers, dementia, and in some cases, neurological complications are some of the key factors responsible for the rising incidences of urinary incontinence, which, in turn, is boosting the Asia Pacific urinary catheters market. Urinary catheters are also used to empty the bladder before or after the surgical procedure. Innovative strategies adopted by manufacturers to increase the production of urinary catheters fuel market growth.

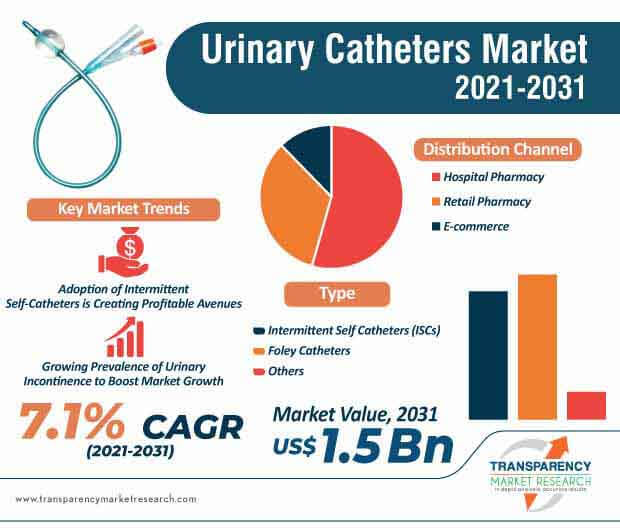

Adoption and Awareness of Intermittent Self-catheters (ISCs) Creating Profitable Avenues

The urinary catheters market in Asia Pacific is expected to expand at a CAGR of 7.1% during the forecast period of 2021-2031. The market in Asia Pacific is projected to reach US$ 1.5 Bn by 2031. Intermittent self-catheters (ISCs) are the effective product to manage urinary retention or incontinence problems in patients. Healthcare advancements, rise in the number of surgical procedures, and increase in awareness of urinary catheters drive the Asia Pacific urinary catheters market, creating profitable opportunities for market players. Embarrassment caused due to urine leakage and its impact on physical and mental health has led to the increasing adoption of such devices in the aging population. The growing health consciousness among people has encouraged them to follow healthier lifestyle, supported by the use of such devices.

Increasing Demand to Rise with Advanced Healthcare Infrastructure

The urinary catheters market in Asia Pacific is projected to witness lucrative growth opportunities during the forecast period, owing to rapid healthcare advancement, increasing geriatric population, and improving healthcare infrastructure. Favorable reimbursement policies in the healthcare sector supports market expansion. Bladder catheterization is the most commonly executed procedure in hospitals, which drives the growth of the urinary catheters market in Asia Pacific. Rising prevalence of prostate cancers and surging prostate operations in hospitals demand urinary catheters on a regular basis. Manufacturers operating in the Asia Pacific urinary catheters market are increasing the production of these devices to fulfill the demand from the healthcare industry. In order to increase the overall well-being of people, market players are introducing innovative urinary catheters to fulfill the surging demand.

The availability of advanced healthcare facilities, increasing healthcare expenditure, and growing prevalence of urinary disorders have positively influenced the demand for urinary catheters in Asia Pacific.

Analysts’ Viewpoint

Companies in the Asia Pacific urinary catheters market should accelerate their product development and unlock revenue opportunities to obtain competitive benefits. Market stakeholders are extending their services arms to gain competitive edge in the healthcare sector. Increasing incidences of neurological disorders, urinary incontinence, diabetes, rising surgical procedures are boosting the demand for catheterizations. The players in the Asia Pacific urinary catheters market should focus on the production of low-risk, pain-free, and comfortable products to avoid the risk of infection. Expanding online and offline distribution channels, hospitals pharmacies, etc. help manufacturers to mark their presence and generate revenue opportunities in the Asia Pacific market.

Read More:

Asia Pacific Urinary Catheters Market: Overview

Asia Pacific Urinary Catheters Market: Segmentation

Asia Pacific Urinary Catheters Market: Country/Sub-region Segmentation

Asia Pacific Urinary Catheters Market: Major Players

Asia Pacific Urinary Catheters Market Snapshot

|

Attribute |

Detail |

|

Market Size Value in 2020 (Base Year) |

US$ 685 Mn |

|

Market Forecast Value in 2031 |

US$ 1.5 Bn |

|

Growth Rate (CAGR) |

7.1% |

|

Forecast Period |

2021–2031 |

|

Quantitative Units |

US$ Mn for Value & ‘000 Units for Volume |

|

Market Analysis |

The report includes cross segment analysis at regional level. Qualitative analysis includes drivers, restraints, opportunities, key trends, etc. The report includes volume of various ACL reconstruction procedures across the region. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

Urinary catheters market in asia pacific to reach valuation of US$ 1.5 bn by 2031

Urinary catheters market in asia pacific is expected to expand at a CAGR of 7.1% during

Urinary catheters market in asia pacific is driven by increase in prevalence of urologic diseases

The intermittent self-catheters (iscs) segment dominated the asia pacific urinary catheters market

Key players in the urinary catheters market in asia pacific include medtronic, advin health care, b. braun melsungen ag, medline industries, inc., becton

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Asia Pacific Urinary Catheters Market

4. Market Overview

4.1. Introduction

4.1.1. Market Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Asia Pacific Urinary Catheters Market Analysis and Forecast, 2018–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Technological Advancements

5.2. Key Industry Events

5.3. Prevalence of Urinary Incontinence across region

5.4. COVID-19 pandemic impact on Asia Pacific Urinary Catheters Market

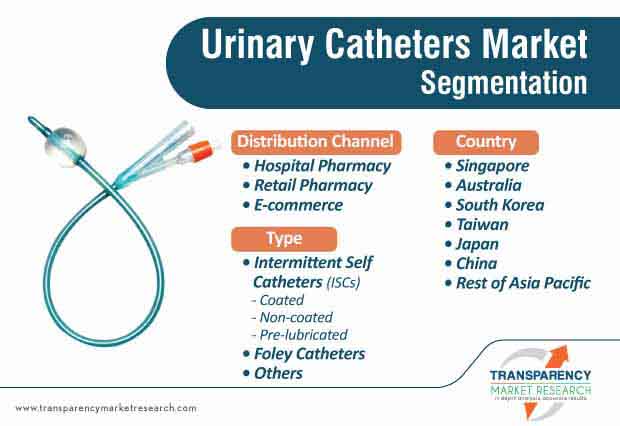

6. Asia Pacific Urinary Catheters Market Analysis and Forecast, by Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Asia Pacific Urinary Catheters Market Value (US$ Mn) Forecast, by Type, 2017–2031

6.3.1. Intermittent Self Catheters (ISCs)

6.3.1.1. Coated

6.3.1.2. Non-coated

6.3.1.3. Pre-lubricated

6.3.2. Foley Catheters

6.3.3. Others

6.4. Asia Pacific Urinary Catheters Market Attractiveness Analysis, by Type

7. Asia Pacific Urinary Catheters Market Analysis and Forecast, by Distribution Channel

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Asia Pacific Urinary Catheters Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

7.3.1. Hospital Pharmacy

7.3.2. Retail Pharmacy

7.3.3. E-commerce

7.4. Asia Pacific Urinary Catheters Market Attractiveness Analysis, by Distribution Channel

8. Asia Pacific Urinary Catheters Market Analysis and Forecast, by Country/Sub-region

8.1. Key Findings

8.2. Asia Pacific Urinary Catheters Market Value (US$ Mn) Forecast, by Country/Sub-region

8.2.1. Singapore

8.2.2. Australia

8.2.3. South Korea

8.2.4. Japan

8.2.5. Taiwan

8.2.6. China

8.2.7. Rest of Asia Pacific

8.3. Asia Pacific Urinary Catheters Market Attractiveness Analysis, by Country/Sub-region

9. Singapore Urinary Catheters Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Singapore Urinary Catheters Market Value (US$ Mn) Forecast, by Type, 2017–2031

9.2.1. Intermittent Self Catheters (ISCs)

9.2.1.1. Coated

9.2.1.2. Non-coated

9.2.1.3. Pre-lubricated

9.2.2. Foley Catheters

9.2.3. Others

9.3. Singapore Urinary Catheters Market Analysis, by Distribution Channel, 2017–2031

9.3.1. Hospital Pharmacy

9.3.2. Retail Pharmacy

9.3.3. E-commerce

10. Australia Urinary Catheters Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Australia Urinary Catheters Market Value (US$ Mn) Forecast, by Type, 2017–2031

10.2.1. Intermittent Self Catheters (ISCs)

10.2.1.1. Coated

10.2.1.2. Non-coated

10.2.1.3. Pre-lubricated

10.2.2. Foley Catheters

10.2.3. Others

10.3. Australia Urinary Catheters Market Analysis, by Distribution Channel, 2017–2031

10.3.1. Hospital Pharmacy

10.3.2. Retail Pharmacy

10.3.3. E-commerce

11. South Korea Urinary Catheters Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. South Korea Urinary Catheters Market Value (US$ Mn) Forecast, by Type, 2017–2031

11.2.1. Intermittent Self Catheters (ISCs)

11.2.1.1. Coated

11.2.1.2. Non-coated

11.2.1.3. Pre-lubricated

11.2.2. Foley Catheters

11.2.3. Others

11.3. South Korea Urinary Catheters Market Analysis, by Distribution Channel, 2017–2031

11.3.1. Hospital Pharmacy

11.3.2. Retail Pharmacy

11.3.3. E-commerce

12. Japan Urinary Catheters Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Japan Urinary Catheters Market Value (US$ Mn) Forecast, by Type, 2017–2031

12.2.1. Intermittent Self Catheters (ISCs)

12.2.1.1. Coated

12.2.1.2. Non-coated

12.2.1.3. Pre-lubricated

12.2.2. Foley Catheters

12.2.3. Others

12.3. Japan Urinary Catheters Market Analysis, by Distribution Channel, 2017–2031

12.3.1. Hospital Pharmacy

12.3.2. Retail Pharmacy

12.3.3. E-commerce

13. Taiwan Urinary Catheters Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Taiwan Urinary Catheters Market Value (US$ Mn) Forecast, by Type, 2017–2031

13.2.1. Intermittent Self Catheters (ISCs)

13.2.1.1. Coated

13.2.1.2. Non-coated

13.2.1.3. Pre-lubricated

13.2.2. Foley Catheters

13.2.3. Others

13.3. Taiwan Urinary Catheters Market Analysis, by Distribution Channel, 2017–2031

13.3.1. Hospital Pharmacy

13.3.2. Retail Pharmacy

13.3.3. E-commerce

14. China Urinary Catheters Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. China Urinary Catheters Market Value (US$ Mn) Forecast, by Type, 2017–2031

14.2.1. Intermittent Self Catheters (ISCs)

14.2.1.1. Coated

14.2.1.2. Non-coated

14.2.1.3. Pre-lubricated

14.2.2. Foley Catheters

14.2.3. Others

14.3. China Urinary Catheters Market Analysis, by Distribution Channel, 2017–2031

14.3.1. Hospital Pharmacy

14.3.2. Retail Pharmacy

14.3.3. E-commerce

15. Rest of Asia Pacific Urinary Catheters Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Rest of Asia Pacific Urinary Catheters Market Value (US$ Mn) Forecast, by Type, 2017–2031

15.2.1. Intermittent Self Catheters (ISCs)

15.2.1.1. Coated

15.2.1.2. Non-coated

15.2.1.3. Pre-lubricated

15.2.2. Foley Catheters

15.2.3. Others

15.3. Rest of Asia Pacific Urinary Catheters Market Analysis, by Distribution Channel, 2017–2031

15.3.1. Hospital Pharmacy

15.3.2. Retail Pharmacy

15.3.3. E-commerce

16. Competitive Landscape

16.1. Company Profiles (2020)

16.1.1. Medtronic

16.1.1.1. Company Overview (HQ, Business Segments, Employee Strength)

16.1.1.2. Product Portfolio

16.1.1.3. Financial Overview

16.1.1.4. Strategic Overview

16.1.1.5. SWOT Analysis

16.1.2. Advin Health Care

16.1.2.1. Company Overview (HQ, Business Segments, Employee Strength)

16.1.2.2. Product Portfolio

16.1.2.3. Strategic Overview

16.1.2.4. SWOT Analysis

16.1.3. B. Braun Melsungen AG

16.1.3.1. Company Overview (HQ, Business Segments, Employee Strength)

16.1.3.2. Product Portfolio

16.1.3.3. Financial Overview

16.1.3.4. Strategic Overview

16.1.3.5. SWOT Analysis

16.1.4. Medline Industries, Inc.

16.1.4.1. Company Overview (HQ, Business Segments, Employee Strength)

16.1.4.2. Product Portfolio

16.1.4.3. Strategic Overview

16.1.4.4. SWOT Analysis

16.1.5. Becton, Dickinson & Company

16.1.5.1. Company Overview (HQ, Business Segments, Employee Strength)

16.1.5.2. Product Portfolio

16.1.5.3. Financial Overview

16.1.5.4. Strategic Overview

16.1.5.5. SWOT Analysis

16.1.6. Boston Scientific Corporation or its affiliates

16.1.6.1. Company Overview (HQ, Business Segments, Employee Strength)

16.1.6.2. Product Portfolio

16.1.6.3. Financial Overview

16.1.6.4. Strategic Overview

16.1.6.5. SWOT Analysis

16.1.7. Coloplast Group

16.1.7.1. Company Overview (HQ, Business Segments, Employee Strength)

16.1.7.2. Product Portfolio

16.1.7.3. Financial Overview

16.1.7.4. Strategic Overview

16.1.7.5. SWOT Analysis

16.1.8. ConvaTec, Inc.

16.1.8.1. Company Overview (HQ, Business Segments, Employee Strength)

16.1.8.2. Product Portfolio

16.1.8.3. Strategic Overview

16.1.8.4. SWOT Analysis

16.1.9. Flexicare (Group) Limited

16.1.9.1. Company Overview (HQ, Business Segments, Employee Strength)

16.1.9.2. Product Portfolio

16.1.9.3. Strategic Overview

16.1.9.4. SWOT Analysis

16.1.10. Hollister Incorporated

16.1.10.1. Company Overview (HQ, Business Segments, Employee Strength)

16.1.10.2. Product Portfolio

16.1.10.3. Strategic Overview

16.1.10.4. SWOT Analysis

16.1.11. Teleflex Incorporated

16.1.11.1. Company Overview (HQ, Business Segments, Employee Strength)

16.1.11.2. Product Portfolio

16.1.11.3. Financial Overview

16.1.11.4. Strategic Overview

16.1.11.5. SWOT Analysis

16.1.12. Well Lead Medical Co., Ltd.

16.1.12.1. Company Overview (HQ, Business Segments, Employee Strength)

16.1.12.2. Product Portfolio

16.1.12.3. Strategic Overview

16.1.12.4. SWOT Analysis

List of Tables

Table 01: Singapore Urinary Catheters Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 02: Singapore Urinary Catheters Market Volume (Units) Forecast, by Type, 2017–2031

Table 03: Singapore Urinary Catheters Market Value (US$ Mn) Forecast, by Intermittent Self Catheters (ISCs) Type, 2017–2031

Table 04: Singapore Urinary Catheters Market Volume (Units) Forecast, by Intermittent Self Catheters (ISCs) Type, 2017–2031

Table 05: Singapore Urinary Catheters Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 06: Singapore Urinary Catheters Market Volume (Units) Forecast, by Distribution Channel, 2017–2031

Table 07: Singapore Intermittent Self Catheters Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 08: Singapore Intermittent Self Catheters Market Volume (Units) Forecast, by Distribution Channel, 2017–2031

Table 09: Australia Urinary Catheters Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 10: Australia Urinary Catheters Market Volume (Units) Forecast, by Type, 2017–2031

Table 11: Australia Urinary Catheters Market Value (US$ Mn) Forecast, by Intermittent Self Catheters (ISCs), 2017–2031

Table 12: Australia Urinary Catheters Market Volume (Units) Forecast, by Intermittent Self Catheters (ISCs), 2017–2031

Table 13: Australia Urinary Catheters Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 14: Australia Urinary Catheters Market Volume (Units) Forecast, by Distribution Channel, 2017–2031

Table 15: Australia Intermittent Self Catheters Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 16: Australia Intermittent Self Catheters Market Volume (Units) Forecast, by Distribution Channel, 2017–2031

Table 17: South Korea Urinary Catheters Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 18: South Korea Urinary Catheters Market Volume (Units) Forecast, by Type, 2017–2031

Table 19: South Korea Urinary Catheters Market Value (US$ Mn) Forecast, by Intermittent Self Catheters (ISCs), 2017–2031

Table 20: South Korea Urinary Catheters Market Volume (Units) Forecast, by Intermittent Self Catheters (ISCs), 2017–2031

Table 21: South Korea Urinary Catheters Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 22: South Korea Urinary Catheters Market Volume (Units) Forecast, by Distribution Channel, 2017–2031

Table 23: South Korea Intermittent Self Catheters Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 24: South Korea Intermittent Self Catheters Market Volume (Units) Forecast, by Distribution Channel, 2017–2031

Table 25: Japan Urinary Catheters Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 26: Japan Urinary Catheters Market Volume (Units) Forecast, by Type, 2017–2031

Table 27: Japan Urinary Catheters Market Value (US$ Mn) Forecast, by Intermittent Self Catheters (ISCs), 2017–2031

Table 28: Japan Urinary Catheters Market Volume (Units) Forecast, by Intermittent Self Catheters (ISCs), 2017–2031

Table 29: Japan Urinary Catheters Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 30: Japan Urinary Catheters Market Volume (Units) Forecast, by Distribution Channel, 2017–2031

Table 31: Japan Intermittent Self Catheters Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 32: Japan Intermittent Self Catheters Market Volume (Units) Forecast, by Distribution Channel, 2017–2031

Table 33: Taiwan Urinary Catheters Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 34: Taiwan Urinary Catheters Market Volume (Units) Forecast, by Type, 2017–2031

Table 35: Taiwan Urinary Catheters Market Value (US$ Mn) Forecast, by Intermittent Self Catheters (ISCs), 2017–2031

Table 36: Taiwan Urinary Catheters Market Volume (Units) Forecast, by Intermittent Self Catheters (ISCs), 2017–2031

Table 37: Taiwan Urinary Catheters Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 38: Taiwan Urinary Catheters Market Volume (Units) Forecast, by Distribution Channel, 2017–2031

Table 39: Taiwan Intermittent Self Catheters Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 40: Taiwan Intermittent Self Catheters Market Volume (Units) Forecast, by Distribution Channel, 2017–2031

List of Figures

Figure 01: Singapore Urinary Catheters Market Value Share, by Type, 2020

Figure 02: Singapore Urinary Catheters Market Value Share, by Distribution Channel, 2020

Figure 03: Singapore Urinary Catheters Value Share, by ISCs Type, 2020

Figure 04: Singapore Urinary Catheters Volume Share, by Type, 2020

Figure 05: Australia Urinary Catheters Market Value Share, by Type, 2020

Figure 06: Australia Urinary Catheters Market Value Share, by Distribution Channel, 2020

Figure 07: Australia Urinary Catheters Value Share, by ISCs Type, 2020

Figure 08: Australia Urinary Catheters Volume Share, by Type, 2020

Figure 09: South Korea Urinary Catheters Market Value Share, by Type, 2020

Figure 10: South Korea Urinary Catheters Market Value Share, by Distribution Channel, 2020

Figure 11: South Korea Urinary Catheters Value Share, by ISCs Type, 2020

Figure 12: South Korea Urinary Catheters Volume Share, by Type, 2020

Figure 13: Japan Urinary Catheters Market Value Share, by Type, 2020

Figure 14: Japan Urinary Catheters Market Value Share, by Distribution Channel, 2020

Figure 15: Japan Urinary Catheters Value Share, by ISCs Type, 2020

Figure 16: Japan Urinary Catheters Volume Share, by Type, 2020

Figure 17: Taiwan Urinary Catheters Market Value Share, by Type, 2020

Figure 18: Taiwan Urinary Catheters Market Value Share, by Distribution Channel, 2020

Figure 19: Taiwan Urinary Catheters Value Share, by ISCs Type, 2020

Figure 20: Taiwan Urinary Catheters Volume Share, by Type, 2020

Figure 21: Singapore Urinary Catheters Market Value (US$ Mn) Forecast, 2017–2031

Figure 22: Singapore Urinary Catheters Market Value Share Analysis, by Type, 2020 and 2031

Figure 23: Singapore Urinary Catheters Market Attractiveness Analysis, by Type, 2021–2031

Figure 24: Singapore Urinary Catheters Market Revenue (US$ Mn), by Intermittent Self Catheters (ISCs), 2017–2031

Figure 25: Singapore Urinary Catheters Market Revenue (US$ Mn), by Foley Catheters, 2017–2031

Figure 26: Singapore Urinary Catheters Market Revenue (US$ Mn), by Others (External Catheters), 2017–2031

Figure 27: Singapore Urinary Catheters Market Value Share Analysis, by Distribution Channel, 2020 and 2031

Figure 28: Singapore Urinary Catheters Market Attractiveness Analysis, by Distribution Channel, 2021–2031

Figure 29: Singapore Urinary Catheters Market Revenue (US$ Mn), by Hospital Pharmacy, 2017–2031

Figure 30: Singapore Urinary Catheters Market Revenue (US$ Mn), by Retail Pharmacy, 2017–2031

Figure 31: Singapore Urinary Catheters Market Revenue (US$ Mn), by E-commerce, 2017–2031

Figure 34: Singapore Intermittent Self Catheters (ISCs), by Coated Type Market Share, 2020 (Approx. Share)

Figure 32: Singapore Intermittent Self Catheters (ISCs), by Uncoated Type Market Share, 2020 (Approx. Share)

Figure 33: Singapore Intermittent Self Catheters (ISCs), by Pre-lubricated Type Market Share, 2020 (Approx. Share)

Figure 35: Australia Urinary Catheters Market Value (US$ Mn) Forecast, 2017–2031

Figure 36: Australia Urinary Catheters Market Value Share Analysis, by Type, 2020 and 2031

Figure 37: Australia Urinary Catheters Market Attractiveness Analysis, by Type, 2021–2031

Figure 38: Australia Urinary Catheters Market Revenue (US$ Mn), by Intermittent Self Catheters (ISCs), 2017–2031

Figure 39: Australia Urinary Catheters Market Revenue (US$ Mn), by Foley Catheters, 2017–2031

Figure 40: Australia Urinary Catheters Market Revenue (US$ Mn), by Others, 2017–2031

Figure 41: Australia Urinary Catheters Market Value Share Analysis, by Distribution Channel, 2020 and 2031

Figure 42: Australia Urinary Catheters Market Attractiveness Analysis, by Distribution Channel, 2021–2031

Figure 43: Australia Urinary Catheters Market Revenue (US$ Mn), by Hospital Pharmacy, 2017–2031

Figure 44: Australia Urinary Catheters Market Revenue (US$ Mn), by Retail Pharmacy, 2017–2031

Figure 45: Australia Urinary Catheters Market Revenue (US$ Mn), by E-commerce, 2017–2031

Figure 48: Australia Intermittent Self Catheters (ISCs), by Coated Type Market Share, 2020 (Approx. Share)

Figure 46: Australia Intermittent Self Catheters (ISCs), by Uncoated Type Market Share, 2020 (Approx. Share)

Figure 47: Australia Intermittent Self Catheters (ISCs), by Pre-lubricated Type Market Share, 2020 (Approx. Share)

Figure 49: South Korea Urinary Catheters Market Value (US$ Mn) Forecast, 2017–2031

Figure 50: South Korea Urinary Catheters Market Value Share Analysis, by Type, 2020 and 2031

Figure 51: South Korea Urinary Catheters Market Attractiveness Analysis, by Type, 2021–2031

Figure 52: South Korea Urinary Catheters Market Revenue (US$ Mn), by Intermittent Self Catheters (ISCs), 2017–2031

Figure 53: South Korea Urinary Catheters Market Revenue (US$ Mn), by Foley Catheters, 2017–2031

Figure 54: South Korea Urinary Catheters Market Revenue (US$ Mn), by Others, 2017–2031

Figure 55: South Korea Urinary Catheters Market Value Share Analysis, by Distribution Channel, 2020 and 2031

Figure 56: South Korea Urinary Catheters Market Attractiveness Analysis, by Distribution Channel, 2021–2031

Figure 57: South Korea Urinary Catheters Market Revenue (US$ Mn), by Hospital Pharmacy, 2017–2031

Figure 58: South Korea Urinary Catheters Market Revenue (US$ Mn), by Retail Pharmacy, 2017–2031

Figure 59: South Korea Urinary Catheters Market Revenue (US$ Mn), by E-commerce, 2017–2031

Figure 60: South Korea Intermittent Self Catheters (ISCs), by Uncoated Type Market Share, 2020 (Approx. Share)

Figure 61: South Korea Intermittent Self Catheters (ISCs), by Pre-lubricated Type Market Share, 2020 (Approx. Share)

Figure 62: South Korea Intermittent Self Catheters (ISCs), by Coated Type Market Share, 2020 (Approx. Share)

Figure 63: Japan Urinary Catheters Market Value (US$ Mn) Forecast, 2017–2031

Figure 64: Japan Urinary Catheters Market Value Share Analysis, by Type, 2020 and 2031

Figure 65: Japan Urinary Catheters Market Attractiveness Analysis, by Type, 2021–2031

Figure 66: Japan Urinary Catheters Market Revenue (US$ Mn), by Intermittent Self Catheters (ISCs), 2017–2031

Figure 67: Japan Urinary Catheters Market Revenue (US$ Mn), by Foley Catheters, 2017–2031

Figure 68: Japan Urinary Catheters Market Revenue (US$ Mn), by Others, 2017–2031

Figure 69: Japan Urinary Catheters Market Value Share Analysis, by Distribution Channel, 2020 and 2031

Figure 70: Japan Urinary Catheters Market Attractiveness Analysis, by Distribution Channel, 2021–2031

Figure 71: Japan Urinary Catheters Market Revenue (US$ Mn), by Hospital Pharmacy, 2017–2031

Figure 72: Japan Urinary Catheters Market Revenue (US$ Mn), by Retail Pharmacy, 2017–2031

Figure 73: Japan Urinary Catheters Market Revenue (US$ Mn), by e-commerce, 2017–2031

Figure 74: Japan Intermittent Self Catheters (ISCs), by Uncoated Type Market Share, 2020 (Approx. Share)

Figure 75: Japan Intermittent Self Catheters (ISCs), by Coated Type Market Share, 2020 (Approx. Share)