Analysts’ Viewpoint

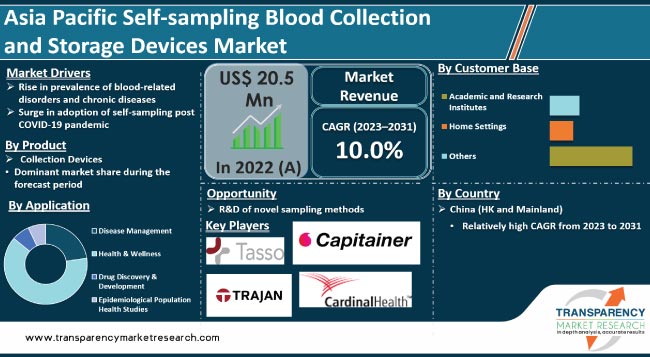

The Asia Pacific self-sampling blood collection and storage devices market size is expected to grow at a significant pace in the near future due to rise in prevalence of blood-related disorders and chronic diseases in the region. Advancements in self-sampling blood collection have revolutionized healthcare by enabling individuals to conveniently and safely collect their own blood samples for diagnostic testing at home.

Surge in adoption of self-sampling post COVID-19 pandemic is likely to offer lucrative opportunities to players in the Asia Pacific self-sampling blood collection and storage devices industry. Self-sampling blood collection and storage devices enable individuals to monitor their health regularly, thus leading to early detection of potential health issues and timely intervention.

Self-sampling blood collection and storage devices allow individuals to conveniently collect and store their blood samples for diagnostic purposes without the need for healthcare professionals.

Rise in emphasis on preventive healthcare and early disease detection is anticipated to spur the Asia Pacific self-sampling blood collection and storage devices market growth in the next few years.

Advancements in technology, such as the integration of smartphone applications and wearable devices, have improved the accessibility and ease of use of at-home blood collection and storage devices. Such technological innovations have made it possible for individuals to perform blood tests in the comfort of their homes and receive accurate results.

Self-sampling blood collection and storage devices are widely used in the diagnosis of various diseases such as chronic hepatitis B virus (HBV) infection, chronic viremic hepatitis C (HCV) infection, cancer, anemia, and sexually transmitted infections.

Blood disorders such as anemia; bleeding disorders including hemophilia and blood clots; and blood cancers such as leukemia, lymphoma, and myeloma are prevalent in Asia Pacific. Hence, surge in prevalence of blood-related disorders and chronic diseases is boosting market expansion.

Anemia, which is characterized by low hemoglobin concentration, affects a significant number of women and children in Southeast Asia, with iron deficiency being a major cause. The World Health Assembly has set a target to reduce anemia in women of reproductive age by 50% by 2025.

Chronic HBV and HCV infections are major public health concerns in Asia Pacific. The World Health Organization aims to eliminate these infections by 2030 through strategies such as timely and accurate diagnosis using self-testing and dried blood spots, which have been widely adopted in low- and middle-income countries.

Asia Pacific is also experiencing a significant burden of blood cancers, such as leukemia, with a substantial number of cases reported in the region. Demand for self-sampling blood collection and storage devices is projected to increase owing to the rise in prevalence of blood-related disorders in the region.

Emerging technologies in blood collection and storage are paving the way for more efficient and safer methods of preserving donated blood, thus ensuring its availability for life-saving transfusions when needed.

Health institutions and other organizations have been severely impacted by the COVID-19 epidemic, which has compelled them to restructure and reinvent their practices in a variety of ways. Blood collection for lab testing and patient monitoring has undergone modifications to keep employees and patients safe during and after the pandemic.

Healthcare providers are highlighting the need to adopt safer practices for blood collection in order to decrease unnecessary in-person visits and potential exposure to viruses and bacteria. Health organizations are utilizing telehealth tools and services to promote safer blood collection procedures. Thus, increase in adoption of self-sampling post COVID-19 pandemic is projected to fuel the market value in the near future.

Healthcare institutions have started offering remote, patient-managed blood collection methods. VAMS is one of the most effective methods for patient-centric sampling. It involves the patient using a simple finger-stick method to collect a small drop. Blood drops are absorbed onto the tip of a Mitra device, which is designed with VAMS to absorb a scientifically precise volume of blood for lab analysis. This is a safer and easier blood collection technique to collect blood samples at home.

Dried blood collection using Dried Blood Spots (DBS) for the detection of HIV, HCV, and HBV antibodies, antigens, or nucleic acids has shown success in the diagnosis of these illnesses. Recently, DBS or other dried blood sample collection techniques have been studied for the detection of SARS-CoV-2 or influenza antibodies. Different techniques for SARS-CoV-2 antibody detection may be possible with other devices made for self-collection and storage of liquid blood.

According to the latest Asia Pacific Self-sampling blood collection and storage devices market trends, the collection devices product segment is anticipated to dominate the industry during the forecast period. The segment accounted for major share in 2022.

Self-sampling blood collection devices are designed for convenient and safe blood sample collection. Collection devices offer individuals the ability to collect blood samples in the comfort of their homes, thus providing convenience and reducing the need for healthcare professional intervention.

As per the latest Asia Pacific self-sampling blood collection and storage devices market analysis, the health & wellness application segment is projected to hold the largest share from 2023 to 2031.

Surge in emphasis on preventive healthcare and growth in awareness about self-monitoring for maintaining overall health and well-being are driving the demand for self-sampling devices in this segment.

These devices enable individuals to track their health parameters, monitor chronic conditions, and detect early signs of diseases. Additionally, advancements in technology, such as smartphone integration and wearable devices, have made self-sampling more accessible and user-friendly for health and wellness purposes.

According to the latest Asia Pacific Self-sampling blood collection and storage devices market forecast, the home settings customer base segment is estimated to account for the leading share from 2023 to 2031.

Convenience, privacy, and cost-effectiveness offered by portable blood collection and storage devices make them highly suitable for usage in home settings. Growth in the trend of personalized healthcare and surge in preference for remote monitoring and testing are fueling the adoption of self-sampling devices in home environments.

Individuals can easily collect and store their blood samples at home due to advancements in technology and the availability of user-friendly devices.

As per the latest Asia Pacific Self-sampling blood collection and storage devices market research, China (HK and Mainland) is likely to dominate during the forecast period. Rise in investment in healthcare infrastructure and surge in demand for self-testing and monitoring devices are fueling market dynamics of the country.

Increase in emphasis on preventive healthcare and self-monitoring is boosting the demand for self-sampling blood collection and storage devices in China. The Government of China is supporting healthcare reforms and promoting self-care practices. Additionally, the country has a strong manufacturing and export base for medical devices, allowing for efficient production and distribution.

Vendors in China are launching new self-testing blood collection tools to increase their Asia Pacific self-sampling blood collection and storage devices market share.

Presence of a well-developed healthcare system, strong emphasis on technological advancements, and proactive approach to preventive healthcare are key factors augmenting market statistics in Singapore. Surge in awareness about self-monitoring, increase in adoption of digital health solutions, presence of key players in the medical device sector, and implementation of favorable regulatory policies are also contributing to market development in Singapore.

Tasso Inc., Trajan Group Holdings Limited, Cardinal Health, Inc., LAMEDITECH, Prenetics Global Limited, Capitainer, Drawbridge Health, Seventh Sense Biosystems, Vital Science Industry, LifeCell International Pvt. Ltd., and Hebei Xinle Science & Technology Co., Ltd. are the leading players operating in this market.

Each of these players has been profiled in the Asia Pacific self-sampling blood collection and storage devices market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

Prominent players are investing in R&D activities to introduce innovative home blood collection devices and expand their market presence. They are also focusing on strategic collaborations and partnerships to enhance their distribution networks and cater to the increase in demand for self-sampling blood collection and storage devices in Asia Pacific.

| Attribute | Detail |

|---|---|

|

Market Size in 2022 |

US 20.5 Mn |

|

Forecast Value in 2031 |

US$ 48.1 Mn |

|

Growth Rate (CAGR) |

10.0% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Mn for Value |

|

Market Analysis |

It includes segment analysis as well as country level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

Asia Pacific |

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 20.5 Mn in 2022

It is projected to reach US$ 48.1 Mn by the end of 2031

It is projected to advance at a CAGR of 10.0% from 2023 to 2031

Rise in prevalence of blood-related disorders and chronic diseases and surge in adoption of self-sampling post COVID-19 pandemic

Collection devices was the largest product segment with more than 80.0% share in 2022

China (HK and Mainland) is expected to record the highest demand from 2023 to 2031

Tasso Inc., Trajan Group Holdings Limited, Cardinal Health, Inc., LAMEDITECH, Prenetics Global Limited, Capitainer, Drawbridge Health, Seventh Sense Biosystems, Vital Science Industry, LifeCell International Pvt. Ltd., and Hebei Xinle Science & Technology Co., Ltd.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Asia Pacific Self-sampling Blood Collection and Storage Devices Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Evolution / Development

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Asia Pacific Self-sampling Blood Collection and Storage Devices Market Analysis and Forecast, 2017-2031

5. Key Insights

5.1. Technological Advancements

5.2. Regulatory Scenario by Country

5.3. Overview of Blood Collection Devices Market

5.4. Pricing Trends, by Product

5.5. COVID-19 Pandemic Impact on Industry (Value Chain and Short/Mid/Long-term Impact)

6. China (HK and Mainland) Self-sampling Blood Collection and Storage Devices Market Analysis and Forecast

6.1. Introduction

6.1.1. Key Findings

6.2. Market Value Forecast, by Product, 2017-2031

6.2.1. Collection Devices

6.2.2. Others

6.3. Market Value Forecast, by Application, 2017-2031

6.3.1. Disease Management

6.3.2. Health & Wellness

6.3.3. Drug Discovery & Development

6.3.4. Epidemiological Population Health Studies

6.4. Market Value Forecast, by Customer Base, 2017-2031

6.4.1. Academic and Research Institutes

6.4.2. Home Settings

6.4.3. Others

6.5. Market Attractiveness Analysis

6.5.1. By Product

6.5.2. By Application

6.5.3. By Customer Base

7. Japan Self-sampling Blood Collection and Storage Devices Market Analysis and Forecast

7.1. Introduction

7.1.1. Key Findings

7.2. Market Value Forecast, by Product, 2017-2031

7.2.1. Collection Devices

7.2.2. Others

7.3. Market Value Forecast, by Application, 2017-2031

7.3.1. Disease Management

7.3.2. Health & Wellness

7.3.3. Drug Discovery & Development

7.3.4. Epidemiological Population Health Studies

7.4. Market Value Forecast, by Customer Base, 2017-2031

7.4.1. Academic and Research Institutes

7.4.2. Home Settings

7.4.3. Others

7.5. Market Attractiveness Analysis

7.5.1. By Product

7.5.2. By Application

7.5.3. By Customer Base

8. Taiwan Self-sampling Blood Collection and Storage Devices Market Analysis and Forecast

8.1. Introduction

8.1.1. Key Findings

8.2. Market Value Forecast, by Product, 2017-2031

8.2.1. Collection Devices

8.2.2. Others

8.3. Market Value Forecast, by Application, 2017-2031

8.3.1. Disease Management

8.3.2. Health & Wellness

8.3.3. Drug Discovery & Development

8.3.4. Epidemiological Population Health Studies

8.4. Market Value Forecast, by Customer Base, 2017-2031

8.4.1. Academic and Research Institutes

8.4.2. Home Settings

8.4.3. Others

8.5. Market Attractiveness Analysis

8.5.1. By Product

8.5.2. By Application

8.5.3. By Customer Base

9. Singapore Self-sampling Blood Collection and Storage Devices Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Product, 2017-2031

9.2.1. Collection Devices

9.2.2. Others

9.3. Market Value Forecast, by Application, 2017-2031

9.3.1. Disease Management

9.3.2. Health & Wellness

9.3.3. Drug Discovery & Development

9.3.4. Epidemiological Population Health Studies

9.4. Market Value Forecast, by Customer Base, 2017-2031

9.4.1. Academic and Research Institutes

9.4.2. Home Settings

9.4.3. Others

9.5. Market Attractiveness Analysis

9.5.1. By Product

9.5.2. By Application

9.5.3. By Customer Base

10. Rest of Asia Pacific Self-sampling Blood Collection and Storage Devices Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product, 2017-2031

10.2.1. Collection Devices

10.2.2. Others

10.3. Market Value Forecast, by Application, 2017-2031

10.3.1. Disease Management

10.3.2. Health & Wellness

10.3.3. Drug Discovery & Development

10.3.4. Epidemiological Population Health Studies

10.4. Market Value Forecast, by Customer Base, 2017-2031

10.4.1. Academic and Research Institutes

10.4.2. Home Settings

10.5. Market Attractiveness Analysis

10.5.1. By Product

10.5.2. By Application

10.5.3. By Customer Base

11. Competition Landscape

11.1. Market Player - Competition Matrix (By Tier and Size of Companies)

11.2. Market Share Analysis, by Company (2021)

11.3. Company Profiles

11.3.1. Tasso Inc.

11.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.1.2. Product Portfolio

11.3.1.3. Financial Overview

11.3.1.4. SWOT Analysis

11.3.1.5. Strategic Overview

11.3.2. Trajan Group Holdings Limited

11.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.2.2. Product Portfolio

11.3.2.3. Financial Overview

11.3.2.4. SWOT Analysis

11.3.2.5. Strategic Overview

11.3.3. Cardinal Health, Inc.

11.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.3.2. Product Portfolio

11.3.3.3. Financial Overview

11.3.3.4. SWOT Analysis

11.3.3.5. Strategic Overview

11.3.4. LAMEDITECH

11.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.4.2. Product Portfolio

11.3.4.3. Financial Overview

11.3.4.4. SWOT Analysis

11.3.4.5. Strategic Overview

11.3.5. Prenetics Global Limited

11.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.5.2. Product Portfolio

11.3.5.3. Financial Overview

11.3.5.4. SWOT Analysis

11.3.5.5. Strategic Overview

11.3.6. Capitainer

11.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.6.2. Product Portfolio

11.3.6.3. Financial Overview

11.3.6.4. SWOT Analysis

11.3.6.5. Strategic Overview

11.3.7. Drawbridge Health

11.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.7.2. Product Portfolio

11.3.7.3. Financial Overview

11.3.7.4. SWOT Analysis

11.3.7.5. Strategic Overview

11.3.8. Seventh Sense Biosystems

11.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.8.2. Product Portfolio

11.3.8.3. Financial Overview

11.3.8.4. SWOT Analysis

11.3.8.5. Strategic Overview

11.3.9. Vital Science Industry

11.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.9.2. Product Portfolio

11.3.9.3. Financial Overview

11.3.9.4. SWOT Analysis

11.3.9.5. Strategic Overview

11.3.10. LifeCell International Pvt. Ltd.

11.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.10.2. Product Portfolio

11.3.10.3. Financial Overview

11.3.10.4. SWOT Analysis

11.3.10.5. Strategic Overview

11.3.11. Hebei Xinle Science & Technology Co., Ltd.

11.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.11.2. Product Portfolio

11.3.11.3. Financial Overview

11.3.11.4. SWOT Analysis

11.3.11.5. Strategic Overview

List of Tables

Table 1: Asia Pacific Self-sampling Blood Collection and Storage Devices Market Value (US$ Mn) Forecast, 2017-2031

Table 2: China (HK and Mainland) Self-sampling Blood Collection and Storage Devices Market Value (US$ Mn) Forecast, 2017-2031

Table 3: China (HK and Mainland) Self-sampling Blood Collection and Storage Devices Market Value (US$ Mn) Forecast, by Product, 2017-2031

Table 4: China (HK and Mainland) Self-sampling Blood Collection and Storage Devices Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 5: China (HK and Mainland) Self-sampling Blood Collection and Storage Devices Market Value (US$ Mn) Forecast, by Customer Base, 2017-2031

Table 6: Japan Self-sampling Blood Collection and Storage Devices Market Value (US$ Mn) Forecast, 2017-2031

Table 7: Japan Self-sampling Blood Collection and Storage Devices Market Value (US$ Mn) Forecast, by Product, 2017-2031

Table 8: Japan Self-sampling Blood Collection and Storage Devices Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 9: Japan Self-sampling Blood Collection and Storage Devices Market Value (US$ Mn) Forecast, by Customer Base, 2017-2031

Table 10: Taiwan Self-sampling Blood Collection and Storage Devices Market Value (US$ Mn) Forecast, 2017-2031

Table 11: Taiwan Self-sampling Blood Collection and Storage Devices Market Value (US$ Mn) Forecast, by Product, 2017-2031

Table 12: Taiwan Self-sampling Blood Collection and Storage Devices Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 13: Taiwan Self-sampling Blood Collection and Storage Devices Market Value (US$ Mn) Forecast, by Customer Base, 2017-2031

Table 14: Singapore Self-sampling Blood Collection and Storage Devices Market Value (US$ Mn) Forecast, 2017-2031

Table 15: Singapore Self-sampling Blood Collection and Storage Devices Market Value (US$ Mn) Forecast, by Product, 2017-2031

Table 16: Singapore Self-sampling Blood Collection and Storage Devices Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 17: Singapore Self-sampling Blood Collection and Storage Devices Market Value (US$ Mn) Forecast, by Customer Base, 2017-2031

Table 18: Rest of Asia Pacific Self-sampling Blood Collection and Storage Devices Market Value (US$ Mn) Forecast, 2017-2031

Table 19: Rest of Asia Pacific Self-sampling Blood Collection and Storage Devices Market Value (US$ Mn) Forecast, by Product, 2017-2031

Table 20: Rest of Asia Pacific Self-sampling Blood Collection and Storage Devices Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 21: Rest of Asia Pacific Self-sampling Blood Collection and Storage Devices Market Value (US$ Mn) Forecast, by Customer Base, 2017-2031

List of Figures

Figure 1: Asia Pacific Self-sampling Blood Collection and Storage Devices Market Value Share, by Product, 2022

Figure 2: China (HK and Mainland) Self-sampling Blood Collection and Storage Devices Market Value Share Analysis, by Product 2022 and 2031

Figure 3: China (HK and Mainland) Self-sampling Blood Collection and Storage Devices Market Attractiveness Analysis, by Product, 2023-2031

Figure 4: China (HK and Mainland) Self-sampling Blood Collection and Storage Devices Market Value Share Analysis, by Application 2022 and 2031

Figure 5: China (HK and Mainland) Self-sampling Blood Collection and Storage Devices Market Attractiveness Analysis, by Application, 2023-2031

Figure 6: China (HK and Mainland) Self-sampling Blood Collection and Storage Devices Market Value Share Analysis, by Customer Base 2022 and 2031

Figure 7: China (HK and Mainland) Self-sampling Blood Collection and Storage Devices Market Attractiveness Analysis, by Customer Base, 2023-2031

Figure 8: Japan Self-sampling Blood Collection and Storage Devices Market Value Share Analysis, by Product 2022 and 2031

Figure 9: Japan Self-sampling Blood Collection and Storage Devices Market Attractiveness Analysis, by Product, 2023-2031

Figure 10: Japan Self-sampling Blood Collection and Storage Devices Market Value Share Analysis, by Application 2022 and 2031

Figure 11: Japan Self-sampling Blood Collection and Storage Devices Market Attractiveness Analysis, by Application, 2023-2031

Figure 12: Japan Self-sampling Blood Collection and Storage Devices Market Value Share Analysis, by Customer Base 2022 and 2031

Figure 13: Japan Self-sampling Blood Collection and Storage Devices Market Attractiveness Analysis, by Customer Base, 2023-2031

Figure 14: Taiwan Self-sampling Blood Collection and Storage Devices Market Value Share Analysis, by Product 2022 and 2031

Figure 15: Taiwan Self-sampling Blood Collection and Storage Devices Market Attractiveness Analysis, by Product, 2023-2031

Figure 16: Taiwan Self-sampling Blood Collection and Storage Devices Market Value Share Analysis, by Application 2022 and 2031

Figure 17: Taiwan Self-sampling Blood Collection and Storage Devices Market Attractiveness Analysis, by Application, 2023-2031

Figure 18: Global Self-sampling Blood Collection and Storage Devices Market Value Share, by Application, 2022

Figure 19: Taiwan Self-sampling Blood Collection and Storage Devices Market Value Share Analysis, by Customer Base 2022 and 2031

Figure 20: Taiwan Self-sampling Blood Collection and Storage Devices Market Attractiveness Analysis, by Customer Base, 2023-2031

Figure 21: Singapore Self-sampling Blood Collection and Storage Devices Market Value Share Analysis, by Product 2022 and 2031

Figure 22: Singapore Self-sampling Blood Collection and Storage Devices Market Attractiveness Analysis, by Product, 2023-2031

Figure 23: Singapore Self-sampling Blood Collection and Storage Devices Market Value Share Analysis, by Application 2022 and 2031

Figure 24: Singapore Self-sampling Blood Collection and Storage Devices Market Attractiveness Analysis, by Application, 2023-2031

Figure 25: Singapore Self-sampling Blood Collection and Storage Devices Market Value Share Analysis, by Customer Base 2022 and 2031

Figure 26: Singapore Self-sampling Blood Collection and Storage Devices Market Attractiveness Analysis, by Customer Base, 2023-2031

Figure 27: Rest of Asia Pacific Self-sampling Blood Collection and Storage Devices Market Value Share Analysis, by Product 2022 and 2031

Figure 28: Rest of Asia Pacific Self-sampling Blood Collection and Storage Devices Market Attractiveness Analysis, by Product, 2023-2031

Figure 29: Global Self-sampling Blood Collection and Storage Devices Market Value Share, by Customer Base, 2022

Figure 30: Rest of Asia Pacific Self-sampling Blood Collection and Storage Devices Market Value Share Analysis, by Application 2022 and 2031

Figure 31: Rest of Asia Pacific Self-sampling Blood Collection and Storage Devices Market Attractiveness Analysis, by Application, 2023-2031

Figure 32: Rest of Asia Pacific Self-sampling Blood Collection and Storage Devices Market Value Share Analysis, by Customer Base 2022 and 2031

Figure 33: Rest of Asia Pacific Self-sampling Blood Collection and Storage Devices Market Attractiveness Analysis, by Customer Base, 2023-2031

Figure 34: China (HK and Mainland) Self-sampling Blood Collection and Storage Devices Market Value Share Analysis, by Product 2022 and 2031

Figure 35: China (HK and Mainland) Self-sampling Blood Collection and Storage Devices Market Attractiveness Analysis, by Product, 2023-2031

Figure 36: China (HK and Mainland) Self-sampling Blood Collection and Storage Devices Market Value Share Analysis, by Application 2022 and 2031

Figure 37: China (HK and Mainland) Self-sampling Blood Collection and Storage Devices Market Attractiveness Analysis, by Application, 2023-2031

Figure 38: China (HK and Mainland) Self-sampling Blood Collection and Storage Devices Market Value Share Analysis, by Customer Base 2022 and 2031

Figure 39: China (HK and Mainland) Self-sampling Blood Collection and Storage Devices Market Attractiveness Analysis, by Customer Base, 2023-2031