Analysts’ Viewpoint

Rise in energy consumption, technological advancements, and regional economic expansion across Asia Pacific are projected to fuel the power distribution component industry growth in the region. Furthermore, growing in urbanization and industrialization across the region is also anticipated to propel power distribution component market growth in the next few years.

Governments across Asia Pacific are encouraging the use of new power distribution components that improve efficiency and resilience, with a strategic focus on advanced and sustainable energy solutions. Key power distribution component manufacturers are supporting this trend by focusing on environmentally friendly practices and the incorporation of renewable energy sources.

The Asia Pacific power distribution component industry is undergoing a transformation, owing to rapid economic expansion, urbanization, and ever-increasing need for a reliable and efficient energy supply across the region. Asia Pacific, which is home to some of the world's fastest-growing economies, is also witnessing a significant increase in power consumption, driven by rising prosperity and changing lifestyles of a growing population. Consequently, the region's power distribution component market has become critical in guaranteeing a stable and robust electricity infrastructure.

Power distribution components, which include transformers, switchgear, distribution boards, and cabling, are critical in the energy transmission chain. These components form the backbone of electrical infrastructure, ensuring the safe and continuous transmission of power from generation sources to end consumers. They are essential in powering a wide range of applications, from residential and commercial buildings to crucial infrastructure such as hospitals and data centers.

Growing emphasis on renewable energy sources, smart grid solutions, and energy-efficient practices is fueling the demand for innovative and sophisticated power distribution components. These components are intended to promote the smooth integration of renewable energy sources, improve grid resilience, and correspond with the region's environmental sustainability objective.

Manufacturers are leading the way with new solutions that focus on increased efficiency, safety, and sustainability. The market's progress is closely aligned with the region's goal of reliable and sustainable energy infrastructure.

Asia Pacific is witnessing an increase in number of construction projects, ranging from residential structures to commercial complexes and large-scale infrastructural improvements, due to exponential rise in urbanization, economic expansion, and growing population. This expansion fuels the demand for dependable and efficient power distribution systems, making power distribution components essential. Therefore, rise in building and infrastructure activity is a key factor augmenting the power distribution component market value.

A regular and steady power supply is critical in the all types of building and infrastructure. Smart technology usage in buildings and infrastructure projects involves the use of improved power distribution components. These components support energy-efficient solutions, real-time monitoring, and grid resilience, all of which are in line with the region's push for sustainable and intelligent construction practices. Manufacturers are focusing on the development of cutting-edge components to address the rising demands for efficiency, safety, and sustainability.

Rise in energy consumption and demand for power in Asia Pacific is due to significant growth of diverse industries, rapid urbanization, and the growing disposable income of an expanding population. Demand for dependable and efficient power distribution networks has never been greater, as several countries in Asia Pacific continue to expand and modernize

Power distribution components are critical to meeting the rising demand for uninterrupted supply of energy. Transformers, switchgear, distribution boards, and cables ensure the safe and effective transmission of energy, which powers residential and commercial buildings, industrial facilities, and crucial infrastructure.

Asia Pacific is also witnessing an increase in adoption of renewable energy sources and smart grid technology. This shift toward renewable resource energy involves the use of contemporary and sophisticated power distribution components to properly integrate and manage renewable energy sources, while improving grid stability and resilience.

Rising energy consumption in Asia Pacific is not only driving the power distribution component market statistics, but also fostering innovation. Accordingly, manufacturers are creating innovative components to address the region's wider aims of guaranteeing a dependable and sustainable energy supply to support its rapid growth and development.

China accounted for a notable distribution component market share in 2022. It is expected to maintain its dominant position during the forecast period due to significant expansion of the construction industry as well as extensive electrification activities across the country. India is estimated to be a major market, owing to implementation of government measures aimed at providing cheap homes to the lower middle class in the country. Notably, panel components emerged as a highly lucrative segment of the Australia power distribution component market in 2022. The segment is projected to grow considerably in the next few years, while the socket segment is also expected to rise during the forecast period.

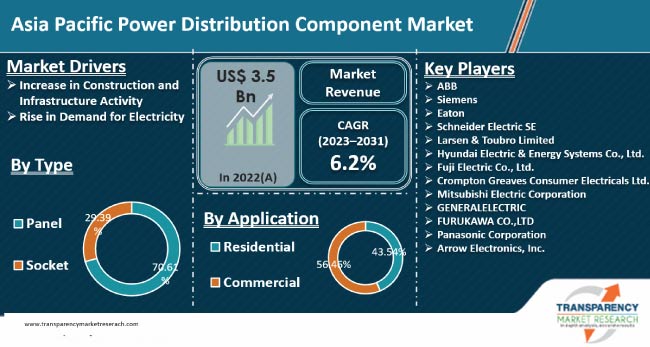

The Asia Pacific power distribution component market is consolidated, with multiple major companies having considerable presence in the region. These companies follow the latest power distribution component market trends and employ various strategies to boost their share. A few of the prominent players operating in the market are ABB, Siemens, Eaton, Schneider Electric SE, Larsen & Toubro Limited, Hyundai Electric & Energy Systems Co., Ltd., Fuji Electric Co., Ltd., Crompton Greaves Consumer Electricals Ltd., Mitsubishi Electric Corporation, GENERAL ELECTRIC, FURUKAWA CO.,LTD, Panasonic Corporation, Arrow Electronics, Inc.

Key players in the Asia Pacific power distribution component market report have been profiled based on various parameters such as company overview, financial state, business strategies, product portfolio, business sectors, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2022 | US$ 3.5 Bn |

| Forecast (Value) in 2031 | US$ 6.1 Bn |

| Growth Rate (CAGR) | 6.2% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2020-2022 |

| Quantitative Value | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces Analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Region Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The Asia Pacific market was valued at US$ 3.5 Bn in 2022

It is expected to grow at a CAGR of 6.2% from 2023 to 2031

Increase in construction and infrastructure activity and rise in demand for electricity

In terms of type, the panel segment held largest share in 2022

ABB, Siemens, Eaton, Schneider Electric SE, Larsen & Toubro Limited, Hyundai Electric & Energy Systems Co., Ltd., Fuji Electric Co., Ltd., Crompton Greaves Consumer Electricals Ltd., Mitsubishi Electric Corporation, GENERAL ELECTRIC, FURUKAWA CO.,LTD, Panasonic Corporation, Arrow Electronics, Inc.

1. Executive Summary

1.1. Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Power Distribution Component Market Analysis and Forecast, 2023-2031

2.6.1. Power Distribution Component Market Value (US$ Mn)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Component Providers

2.9.2. List of Manufacturers

2.9.3. List of Dealer/Distributors

2.9.4. List of Potential Customers

2.10. Product Specification Analysis

2.11. Production Overview

2.12. Cost Structure Analysis

3. COVID-19 Impact Analysis

3.1. Impact on the Supply Chain of the Power Distribution Component

3.2. Impact on the Demand of Power Distribution Component – Pre & Post Crisis

4. Impact of Current Geopolitical Scenario on Market

5. Power Distribution Component Market Analysis and Forecast, by Type, 2023-2031

5.1. Introduction and Definitions

5.2. Power Distribution Component Market Value (US$ Mn) Forecast, by Type, 2023-2031

5.2.1. Panel

5.2.1.1. Distribution Panel

5.2.1.2. Motor Control Panel

5.2.1.3. Others

5.2.2. Socket

5.2.2.1. Plug Socket

5.2.2.2. Wall Socket

5.3. Power Distribution Component Market Attractiveness, by Type

6. Power Distribution Component Market Analysis and Forecast, by Application, 2023-2031

6.1. Introduction and Definitions

6.2. Power Distribution Component Market Value (US$ Mn) Forecast, by Application, 2023-2031

6.2.1. Residential

6.2.2. Commercial

6.3. Power Distribution Component Market Attractiveness, by Application

7. Asia Power Distribution Component Market Analysis and Forecast, by Country and Sub-Region, 2023-2031

7.1. Key Findings

7.2. Power Distribution Component Market Value (US$ Mn) Forecast, by Country and Sub-Region, 2023-2031

7.2.1. China

7.2.2. India

7.2.3. Japan

7.2.4. ASEAN

7.2.5. Rest of Asia

7.3. Asia Power Distribution Component Market Attractiveness, by Country and Sub-Region

8. Australia Power Distribution Component Market Analysis and Forecast, by Country and Sub-Region, 2023-2031

8.1. Key Findings

8.2. Australia Power Distribution Component Market Value (US$ Mn) Forecast, 2023-2031

8.3. Australia Power Distribution Component Market Attractiveness,

9. Asia Power Distribution Component Market Analysis and Forecast, 2023-2031

9.1. Key Findings

9.2. Asia Power Distribution Component Market Value (US$ Mn) Forecast, by Type , 2023-2031

9.3. Asia Power Distribution Component Market Value (US$ Mn) Forecast, by Application, 2023-2031

9.4. Asia Power Distribution Component Market Value (US$ Mn) Forecast, by Country, 2023-2031

9.4.1. China Power Distribution Component Market Value (US$ Mn) Forecast, by Type , 2023-2031

9.4.2. China Power Distribution Component Market Value (US$ Mn) Forecast, by Application, 2023-2031

9.4.3. INDIA Power Distribution Component Market Value (US$ Mn) Forecast, by Type , 2023-2031

9.4.4. INDIA Power Distribution Component Market Value (US$ Mn) Forecast, by Application, 2023-2031

9.4.5. Japan Power Distribution Component Market Value (US$ Mn) Forecast, by Type , 2023-2031

9.4.6. Japan Power Distribution Component Market Value (US$ Mn) Forecast, by Application, 2023-2031

9.4.7. ASEAN Power Distribution Component Market Value (US$ Mn) Forecast, by Type , 2023-2031

9.4.8. ASEAN Power Distribution Component Market Value (US$ Mn) Forecast, by Application, 2023-2031

9.4.9. Rest of Asia Power Distribution Component Market Value (US$ Mn) Forecast, by Type , 2023-2031

9.4.10. Rest of Asia Power Distribution Component Market Value (US$ Mn) Forecast, by Application, 2023-2031

9.5. Power Distribution Component Market Attractiveness Analysis

10. Australia Power Distribution Component Market Analysis and Forecast, 2023-2031

10.1. Key Findings

10.2. Australia Power Distribution Component Market Value (US$ Mn) Forecast, by Type , 2023-2031

10.3. Australia Power Distribution Component Market Value (US$ Mn) Forecast, by Application, 2023-2031

10.4. Australia Power Distribution Component Market Attractiveness Analysis

11. Competition Landscape

11.1. Market Players - Competition Matrix (by Tier and Size of Companies)

11.2. Market Share Analysis, 2021

11.3. Market Footprint Analysis

11.3.1. By Type

11.3.2. By Application

11.4. Company Profiles

11.4.1. ABB

11.4.1.1. Company Revenue

11.4.1.2. Business Overview

11.4.1.3. Product Segments

11.4.1.4. Geographic Footprint

11.4.1.5. Production Type/Plant Details, etc. (*As Applicable)

11.4.1.6. Strategic Partnership, Type Expansion, New Product Innovation, etc.

11.4.2. Siemens

11.4.2.1. Company Revenue

11.4.2.2. Business Overview

11.4.2.3. Product Segments

11.4.2.4. Geographic Footprint

11.4.2.5. Production Type/Plant Details, etc. (*As Applicable)

11.4.2.6. Strategic Partnership, Type Expansion, New Product Innovation, etc.

11.4.3. Eaton

11.4.3.1. Company Revenue

11.4.3.2. Business Overview

11.4.3.3. Product Segments

11.4.3.4. Geographic Footprint

11.4.3.5. Production Type/Plant Details, etc. (*As Applicable)

11.4.3.6. Strategic Partnership, Type Expansion, New Product Innovation, etc.

11.4.4. Schneider Electric SE

11.4.4.1. Company Revenue

11.4.4.2. Business Overview

11.4.4.3. Product Segments

11.4.4.4. Geographic Footprint

11.4.4.5. Production Type/Plant Details, etc. (*As Applicable)

11.4.4.6. Strategic Partnership, Type Expansion, New Product Innovation etc.

11.4.5. Larsen & Toubro Limited

11.4.5.1. Company Revenue

11.4.5.2. Business Overview

11.4.5.3. Product Segments

11.4.5.4. Geographic Footprint

11.4.5.5. Production Type/Plant Details, etc. (*As Applicable)

11.4.5.6. Strategic Partnership, Type Expansion, New Product Innovation, etc.

11.4.6. Hyundai Electric & Energy Systems Co., Ltd.

11.4.6.1. Company Revenue

11.4.6.2. Business Overview

11.4.6.3. Product Segments

11.4.6.4. Geographic Footprint

11.4.6.5. Production Type/Plant Details, etc. (*As Applicable)

11.4.6.6. Strategic Partnership, Type Expansion, New Product Innovation, etc.

11.4.7. Fuji Electric Co., Ltd.

11.4.7.1. Company Revenue

11.4.7.2. Business Overview

11.4.7.3. Product Segments

11.4.7.4. Geographic Footprint

11.4.7.5. Production Type/Plant Details, etc. (*As Applicable)

11.4.7.6. Strategic Partnership, Type Expansion, New Product Innovation, etc.

11.4.8. Crompton Greaves Consumer Electricals Ltd.

11.4.8.1. Company Revenue

11.4.8.2. Business Overview

11.4.8.3. Product Segments

11.4.8.4. Geographic Footprint

11.4.8.5. Production Type/Plant Details, etc. (*As Applicable)

11.4.8.6. Strategic Partnership, Type Expansion, New Product Innovation, etc.

11.4.9. Mitsubishi Electric Corporation

11.4.9.1. Company Revenue

11.4.9.2. Business Overview

11.4.9.3. Product Segments

11.4.9.4. Geographic Footprint

11.4.9.5. Production Type/Plant Details, etc. (*As Applicable)

11.4.9.6. Strategic Partnership, Type Expansion, New Product Innovation, etc.

11.4.10. GENERALELECTRIC

11.4.10.1. Company Revenue

11.4.10.2. Business Overview

11.4.10.3. Product Segments

11.4.10.4. Geographic Footprint

11.4.10.5. Production Type/Plant Details, etc. (*As Applicable)

11.4.10.6. Strategic Partnership, Type Expansion, New Product Innovation, etc.

11.4.11. FURUKAWA CO.,LTD

11.4.11.1. Company Revenue

11.4.11.2. Business Overview

11.4.11.3. Product Segments

11.4.11.4. Geographic Footprint

11.4.11.5. Production Type/Plant Details, etc. (*As Applicable)

11.4.11.6. Strategic Partnership, Type Expansion, New Product Innovation, etc.

11.4.12. Panasonic Corporation

11.4.12.1. Company Revenue

11.4.12.2. Business Overview

11.4.12.3. Product Segments

11.4.12.4. Geographic Footprint

11.4.12.5. Production Type/Plant Details, etc. (*As Applicable)

11.4.12.6. Strategic Partnership, Type Expansion, New Product Innovation, etc.

11.4.13. Arrow Electronics, Inc.

11.4.13.1. Company Revenue

11.4.13.2. Business Overview

11.4.13.3. Product Segments

11.4.13.4. Geographic Footprint

11.4.13.5. Production Type/Plant Details, etc. (*As Applicable)

11.4.13.6. Strategic Partnership, Type Expansion, New Product Innovation, etc.

12. Primary Research: Key Insights

13. Appendix

List of Tables

Table 1: Asia Power Distribution Component Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023–2031

Table 2: Asia Power Distribution Component Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 3: Asia Power Distribution Component Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 4: China Power Distribution Component Market Value (US$ Mn) Forecast, by Type , 2023–2031

Table 5: China Power Distribution Component Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 6: India Power Distribution Component Market Value (US$ Mn) Forecast, by Type , 2023–2031

Table 7: India Power Distribution Component Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 8: Japan Power Distribution Component Market Value (US$ Mn) Forecast, by Type , 2023–2031

Table 9: Japan Power Distribution Component Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 10: ASEAN Power Distribution Component Market Value (US$ Mn) Forecast, by Type , 2023–2031

Table 11: ASEAN Power Distribution Component Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 12: Rest of Asia Power Distribution Component Market Value (US$ Mn) Forecast, by Type , 2023–2031

Table 13: Rest of Asia Power Distribution Component Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 14: Australia Power Distribution Component Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 15: Australia Power Distribution Component Market Value (US$ Mn) Forecast, by Application, 2023–2031

List of Figures

Figure 1: Asia Power Distribution Component Market Value, 2022- 2031

Figure 2: Asia Power Distribution Component Market Value Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 3: Asia Power Distribution Component Market Attractiveness Analysis, by Country and Sub-region

Figure 4: Asia Power Distribution Component Market Value Share Analysis, by Type, 2022, 2027, and 2031

Figure 5: Asia Power Distribution Component Market Attractiveness Analysis, by Type

Figure 6: Asia Power Distribution Component Market Value Share Analysis, by Application, 2022,2027, and 2031

Figure 7: Asia Power Distribution Component Market Attractiveness Analysis, by Application, 2023-2031

Figure 8: Australia Power Distribution Component Market Value Share Analysis, by Type, 2022, 2027, and 2031

Figure 9: Australia Power Distribution Component Market Attractiveness Analysis, by Type

Figure 10: Australia Power Distribution Component Market Value Share Analysis, by Application, 2022,2027, and 2031

Figure 11: Australia Power Distribution Component Market Attractiveness Analysis, by Application, 2023-2031