Analysts’ Viewpoint on Asia Pacific Multilayer Pipes Market Scenario

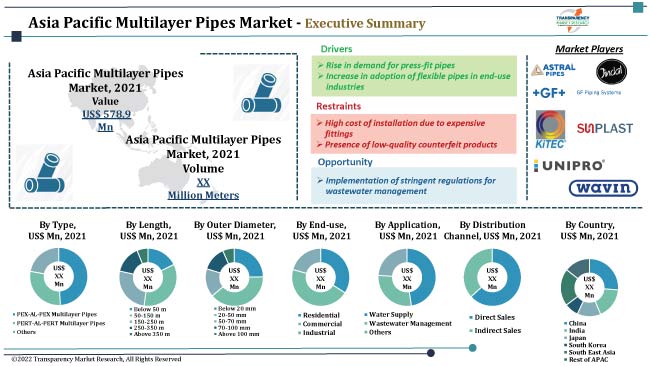

Rise in demand for efficient and lightweight plumbing systems is driving the Asia Pacific multilayer pipes market. Customers are increasingly preferring plumbing pipes and fittings that are durable and do not require high maintenance. The usage of metal between two polymer layers in multilayer pipes makes them stronger and more flexible. Rise in adoption of multilayer pipes in various sectors is fueling the market. Multilayer pipe fittings are used in residential, commercial, and industrial sectors due to their versatile properties. They are increasingly employed in water supply and wastewater management, owing to their corrosion-resistant nature. Companies in the market are offering sustainable products and expanding their network of dealers and distributors to enhance their share.

Multilayer pipes are made of an aluminum layer sandwiched between two layers of cross-linked polyethylene (PEX) or PERT. This metal layer acts as a barrier against oxygen, preventing its absorption into the water in the tube by preventing oxygen transport through a polymer pattern. Multilayer composite pipes were widely used for their radiant floor heating applications. Rise in application of these pipes has prompted manufacturers to produce multilayer polymer pipes made of an aluminum layer sandwiched between two polymers such as CPVC, PCV, and PE.

Insulated multilayer pipes are available in Nominal Pipe Sizes (NPS), which range from 3⁄8 to 2 1⁄4, and Nominal Diameter (DN), which ranges from 12 to 75 measurements. The pressure resistance of these pipes is 200 psi at 73°F or 1380 kPa at 23°C and 125 psi at 180°F or 860 kPa at 82°C. The two common forms of multilayer pipe deliveries are coils and straight lengths. Multilayer composite pipes offer the combined benefits of plastic and metal. They can handle a vast range of temperatures and pressures present in cold and hot water systems due to the flexibility of plastic and the strength of the metal. The multi-skin aluminum core layer enables the pipe to keep its shape when it is bent into shape. The interior and external PEX/PERT layers are more corrosion resistant compared to their metallic equivalents. This promotes their application in drinking water systems.

Adoption of multilayer pipe sliding sleeve systems and press-fitting pipes helps reduce various workplace risks. On-site press fitting has fewer health and safety concerns. Press fitting can reduce the possibility of damage to the surrounding areas and already-existing fixtures and fittings. These pipes may cool down without any delays as fire tools are not used. Multilayer pipes reduce installation time and costs as fewer workers are required for their installation. Multilayer pipe suppliers and manufacturers are providing protective caps on fittings and pipelines to enhance health and safety.

Increase in investment in public infrastructure and growth in the irrigation industry are expected to drive the Asia Pacific multilayer pipes market during the forecasted period. Additionally, rise in population, growth in residential and non-residential building projects, and increase in awareness about the advantages of multilayer pipes and fittings are fueling the market.

Rise in investment in wastewater treatment projects can be ascribed to the increase in environmental awareness and initiatives to improve the regulatory framework for the conservation of natural resources. Businesses in a variety of industry sectors are adopting innovative ways to reuse and dispose of wastewater due to restrictions at the national and state levels. These factors are boosting the demand for flexible pipes in end-use industries.

In terms of type, the Asia Pacific multilayer pipes market has been segmented into PEX-AL-PEX multilayer pipes, PERT-AL-PERT multilayer pipes, and others. The PEX-AL-PEX multilayer pipes segment dominates the market. End customers choose PEX-made multilayer pipes, as cross-linked polyethylene in internal and external layers of these pipes ensures the maximum level of safety, even at high temperatures. In comparison to other materials, PEX makes pipes stronger and more flexible, ensuring effective water and gas supply even during extreme weather conditions. PEX pipes freeze without any damage in cold temperatures. PEX-AL-PEX multilayer pipes are suitable for usage in all domestic, business, and industrial applications. PE, CPVC, and PVC pipes are less expensive options in PEX-AL-PEX multilayer pipes.

Based on application, the Asia Pacific multilayer pipes market has been classified into water supply, wastewater management, and others. The water supply segment dominates the market. A high-quality multilayer plumbing system is suitable for the transportation of hot and cold water. The combination of plastic and metal helps maintain water temperature. PEX and PERT materials do not change the temperature of water and the quality and condition of the inner walls of pipes are not impacted. Multilayer pipe is corrosion-resistant, which makes it a hygienic option for the transportation of drinking water. It is also not liable to oxygen diffusion through the pipe wall, which minimizes the risk of damage by oxygen corrosion elsewhere in the system. These features are augmenting the demand for multilayer pipes for long-lasting drinking water systems.

China dominates the Asia Pacific multilayer pipes market, followed by India. Multilayer pipes are used extensively in key sectors in the construction market in China such as commercial construction, industrial construction, infrastructure construction, energy and utility construction, institutional construction, and residential construction. Rise in population is expected to boost the construction sector in the country, thereby fueling the demand for multilayer pipes. China's design and construction sectors focus on local communities, younger residents, and culture-related projects. The young population in China prefers easy installation and low maintenance options. This is driving the multilayer pipes market in China.

The Asia Pacific multilayer pipes market is slightly fragmented in nature, with the presence of many regional players. Some large players dominate the market. Strategies followed by key players in the market include business expansion through mergers and acquisitions, product launches, collaborations, and alliances. Introduction of flexible and lightweight multilayer fittings is creating one of the largest opportunities for multilayer pipe manufacturers in the market. Astral Limited, GF Piping System, Jindal Composite Tubes Pvt. Ltd, KiTEC Industries (India) Pvt. Ltd., Ningbo Sunplast Pipe Co., Ltd., Unipro Piping Systems Private Limited, Wavin, Zhejiang Mingshi Xingxin HVAC Technology Co., Ltd., Aquatechnik, and Prince Pipes are key players operating in the multilayer pipes market.

Each of these players has been profiled in the Asia Pacific multilayer pipes market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 (Base Year) |

US$ 578.9 Mn |

|

Market Forecast Value in 2031 |

US$ 1.05 Bn |

|

Growth Rate (CAGR) |

6.4% |

|

Forecast Period |

2022-2031 |

|

Quantitative Units |

US$ Mn/Bn for Value Million Meters for Volume |

|

Market Analysis |

The qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, key market indicators, regulatory framework, COVID-19 impact analysis, and SWOT analysis. |

|

Competition Landscape |

|

|

Format |

|

|

Market Segmentation |

|

|

Regions Covered |

Asia Pacific |

|

Countries Covered |

China, India, Japan, South Korea, South East Asia (Malaysia, Singapore, Thailand, Indonesia, Philippines, Rest of South East Asia), and Rest of Asia |

|

Companies Profiled |

Astral Limited, GF Piping System, Jindal Composite Tubes Pvt Ltd, KiTEC Industries (India) Pvt. Ltd., Ningbo Sunplast Pipe Co., Ltd., Unipro Piping Systems Private Limited, Wavin, Zhejiang Mingshi Xingxin HVAC Technology Co., Ltd., Aquatechnik, and Prince Pipes |

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

The Asia Pacific multilayer pipes market stood at US$ 578.9 Mn in 2021

The Asia Pacific multilayer pipes market is estimated to grow at a CAGR of 6.4% during 2022-2031

The Asia Pacific multilayer pipes market is expected to reach US$ 1.05 Bn in 2031

Rise in demand for press-fit pipes and increase in adoption of flexible pipes in end-use industries

The PEX-AL-PEX multilayer pipes segment accounted for ~49% share of the Asia Pacific multilayer pipes market in 2021

Astral Limited, GF Piping System, Jindal Composite Tubes Pvt Ltd, KiTEC Industries (India) Pvt. Ltd., Ningbo Sunplast Pipe Co., Ltd., Unipro Piping Systems Private Limited, Wavin, Zhejiang Mingshi Xingxin HVAC Technology Co., Ltd., Aquatechnik, and Prince Pipes

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Market Indicators

5.2.1. Overall Pipes & Tubing Industry Overview

5.3. Key Trend Analysis

5.3.1. Supplier Side

5.3.2. Demand Side

5.4. Industry SWOT Analysis

5.5. Porter’s Five Forces Analysis

5.6. Value Chain Analysis

5.7. COVID-19 Impact Analysis

5.8. Regulatory Framework & Guidelines

5.9. Technical Parameter Analysis

5.9.1. Nominal Pipe Size

5.9.2. Inner Diameter

5.9.3. Jointing Technology

5.9.3.1. Cone Grip Union

5.9.3.2. Press

5.9.3.3. Push-fit

5.10. Raw Material Analysis

5.11. Asia Pacific Multilayer Pipes Market Analysis and Forecast, 2017- 2031

5.11.1. Market Value Projections (US$ Mn)

5.11.2. Market Volume Projections (Million Meters)

6. Asia Pacific Multilayer Pipes Market Analysis and Forecast, by Type

6.1. Asia Pacific Multilayer Pipes Market Size (US$ Mn) (Million Meters), by Type, 2017- 2031

6.1.1. PEX-AL-PEX Multilayer Pipes

6.1.2. PERT-AL-PERT Multilayer Pipes

6.1.3. Others

6.2. Incremental Opportunity, by Type

7. Asia Pacific Multilayer Pipes Market Analysis and Forecast, by Outer Diameter

7.1. Asia Pacific Multilayer Pipes Market Size (US$ Mn) (Million Meters), by Outer Diameter, 2017- 2031

7.1.1. Below 20 mm

7.1.2. 20-50 mm

7.1.3. 50-70 mm

7.1.4. 70-100 mm

7.1.5. Above 100 mm

7.2. Incremental Opportunity, by Outer Diameter

8. Asia Pacific Multilayer Pipes Market Analysis and Forecast, by Length

8.1. Asia Pacific Multilayer Pipes Market Size (US$ Mn) (Million Meters), by Length, 2017- 2031

8.1.1. Below 50 m

8.1.2. 50-150 m

8.1.3. 150-250 m

8.1.4. 250-350 m

8.1.5. Above 50 m

8.2. Incremental Opportunity, by Length

9. Asia Pacific Multilayer Pipes Market Analysis and Forecast, by Application

9.1. Asia Pacific Multilayer Pipes Market Size (US$ Mn) (Million Meters), by Application, 2017- 2031

9.1.1. Water Supply

9.1.2. Wastewater Management

9.1.3. Others

9.2. Incremental Opportunity, Application

10. Asia Pacific Multilayer Pipes Market Analysis and Forecast, by End-use

10.1. Asia Pacific Multilayer Pipes Market Size (US$ Mn) (Million Meters), by End-use, 2017- 2031

10.1.1. Residential

10.1.2. Commercial

10.1.3. Industrial

10.1.3.1. Manufacturing & Processing

10.1.3.2. Agriculture

10.1.3.3. Wastewater Treatment

10.1.3.4. Oil & Gas

10.1.3.5. Others

10.2. Incremental Opportunity, by End-use

11. Asia Pacific Multilayer Pipes Market Analysis and Forecast, by Distribution Channel

11.1. Asia Pacific Multilayer Pipes Market Size (US$ Mn) (Million Meters), by Distribution Channel, 2017- 2031

11.1.1. Direct Sales

11.1.2. Indirect Sales

11.2. Incremental Opportunity, by Distribution Channel

12. Asia Pacific Multilayer Pipes Market Analysis and Forecast, by Country or Sub-Region

12.1. Asia Pacific Multilayer Pipes Market Size (US$ Mn) (Million Meters), by Country or Sub-Region, 2017- 2031

12.1.1. China

12.1.2. India

12.1.3. Japan

12.1.4. South Korea

12.1.5. South East Asia

12.1.6. Rest of Asia Pacific

12.2. Incremental Opportunity, by Country or Sub-Region

13. China Multilayer Pipes Market Analysis and Forecast

13.1. Country Snapshot

13.2. Key Supplier Analysis

13.3. COVID-19 Impact Analysis

13.4. Key Trends Analysis

13.4.1. Supply side

13.4.2. Demand Side

13.5. Price Trend Analysis

13.5.1. Weighted Average Selling Price (US$)

13.6. Multilayer Pipes Market Size (US$ Mn) (Million Meters), by Type, 2017- 2031

13.6.1. PEX-AL-PEX Multilayer Pipes

13.6.2. PERT-AL-PERT Multilayer Pipes

13.6.3. Others

13.7. Multilayer Pipes Market Size (US$ Mn) (Million Meters), by Outer Diameter, 2017- 2031

13.7.1. Below 20 mm

13.7.2. 20-50 mm

13.7.3. 50-70 mm

13.7.4. 70-100 mm

13.7.5. Above 100 mm

13.8. Multilayer Pipes Market Size (US$ Mn) (Million Meters), by Length, 2017- 2031

13.8.1. Below 50 m

13.8.2. 50-150 m

13.8.3. 150-250 m

13.8.4. 250-350 m

13.8.5. Above 50 m

13.9. Multilayer Pipes Market Size (US$ Mn) (Million Meters), by Application, 2017- 2031

13.9.1. Water Supply

13.9.2. Wastewater Management

13.9.3. Others

13.10. Multilayer Pipes Market Size (US$ Mn) (Million Meters), by End-use, 2017- 2031

13.10.1. Residential

13.10.2. Commercial

13.10.3. Industrial

13.10.3.1. Manufacturing & Processing

13.10.3.2. Agriculture

13.10.3.3. Wastewater Treatment

13.10.3.4. Oil & Gas

13.10.3.5. Others

13.11. Multilayer Pipes Market Size (US$ Mn) (Million Meters), by Distribution Channel, 2017- 2031

13.11.1. Direct Sales

13.11.2. Indirect Sales

13.12. Incremental Opportunity Analysis

14. India Multilayer Pipes Market Analysis and Forecast

14.1. Country Snapshot

14.2. Key Supplier Analysis

14.3. COVID-19 Impact Analysis

14.4. Key Trends Analysis

14.4.1. Supply side

14.4.2. Demand Side

14.5. Price Trend Analysis

14.5.1. Weighted Average Selling Price (US$)

14.6. Multilayer Pipes Market Size (US$ Mn) (Million Meters), by Type, 2017- 2031

14.6.1. PEX-AL-PEX Multilayer Pipes

14.6.2. PERT-AL-PERT Multilayer Pipes

14.6.3. Others

14.7. Multilayer Pipes Market Size (US$ Mn) (Million Meters), by Outer Diameter, 2017- 2031

14.7.1. Below 20 mm

14.7.2. 20-50 mm

14.7.3. 50-70 mm

14.7.4. 70-100 mm

14.7.5. Above 100 mm

14.8. Multilayer Pipes Market Size (US$ Mn) (Million Meters), by Length, 2017- 2031

14.8.1. Below 50 m

14.8.2. 50-150 m

14.8.3. 150-250 m

14.8.4. 250-350 m

14.8.5. Above 50 m

14.9. Multilayer Pipes Market Size (US$ Mn) (Million Meters), by Application, 2017- 2031

14.9.1. Water Supply

14.9.2. Wastewater Management

14.9.3. Others

14.10. Multilayer Pipes Market Size (US$ Mn) (Million Meters), by End-use, 2017- 2031

14.10.1. Residential

14.10.2. Commercial

14.10.3. Industrial

14.10.3.1. Manufacturing & Processing

14.10.3.2. Agriculture

14.10.3.3. Wastewater Treatment

14.10.3.4. Oil & Gas

14.10.3.5. Others

14.11. Multilayer Pipes Market Size (US$ Mn) (Million Meters), by Distribution Channel, 2017- 2031

14.11.1. Direct Sales

14.11.2. Indirect Sales

14.12. Incremental Opportunity Analysis

15. Japan Multilayer Pipes Market Analysis and Forecast

15.1. Country Snapshot

15.2. Key Supplier Analysis

15.3. COVID-19 Impact Analysis

15.4. Key Trends Analysis

15.4.1. Supply side

15.4.2. Demand Side

15.5. Price Trend Analysis

15.5.1. Weighted Average Selling Price (US$)

15.6. Multilayer Pipes Market Size (US$ Mn) (Million Meters), by Type, 2017- 2031

15.6.1. PEX-AL-PEX Multilayer Pipes

15.6.2. PERT-AL-PERT Multilayer Pipes

15.6.3. Others

15.7. Multilayer Pipes Market Size (US$ Mn) (Million Meters), by Outer Diameter, 2017- 2031

15.7.1. Below 20 mm

15.7.2. 20-50 mm

15.7.3. 50-70 mm

15.7.4. 70-100 mm

15.7.5. Above 100 mm

15.8. Multilayer Pipes Market Size (US$ Mn) (Million Meters), by Length, 2017- 2031

15.8.1. Below 50 m

15.8.2. 50-150 m

15.8.3. 150-250 m

15.8.4. 250-350 m

15.8.5. Above 50 m

15.9. Multilayer Pipes Market Size (US$ Mn) (Million Meters), by Application, 2017- 2031

15.9.1. Water Supply

15.9.2. Wastewater Management

15.9.3. Others

15.10. Multilayer Pipes Market Size (US$ Mn) (Million Meters), by End-use, 2017- 2031

15.10.1. Residential

15.10.2. Commercial

15.10.3. Industrial

15.10.3.1. Manufacturing & Processing

15.10.3.2. Agriculture

15.10.3.3. Wastewater Treatment

15.10.3.4. Oil & Gas

15.10.3.5. Others

15.11. Multilayer Pipes Market Size (US$ Mn) (Million Meters), by Distribution Channel, 2017- 2031

15.11.1. Direct Sales

15.11.2. Indirect Sales

15.12. Incremental Opportunity Analysis

16. South Korea Multilayer Pipes Market Analysis and Forecast

16.1. Country Snapshot

16.2. Key Supplier Analysis

16.3. COVID-19 Impact Analysis

16.4. Key Trends Analysis

16.4.1. Supply side

16.4.2. Demand Side

16.5. Price Trend Analysis

16.5.1. Weighted Average Selling Price (US$)

16.6. Multilayer Pipes Market Size (US$ Mn) (Million Meters), by Type, 2017- 2031

16.6.1. PEX-AL-PEX Multilayer Pipes

16.6.2. PERT-AL-PERT Multilayer Pipes

16.6.3. Others

16.7. Multilayer Pipes Market Size (US$ Mn) (Million Meters), by Outer Diameter, 2017- 2031

16.7.1. Below 20 mm

16.7.2. 20-50 mm

16.7.3. 50-70 mm

16.7.4. 70-100 mm

16.7.5. Above 100 mm

16.8. Multilayer Pipes Market Size (US$ Mn) (Million Meters), by Length, 2017- 2031

16.8.1. Below 50 m

16.8.2. 50-150 m

16.8.3. 150-250 m

16.8.4. 250-350 m

16.8.5. Above 50 m

16.9. Multilayer Pipes Market Size (US$ Mn) (Million Meters), by Application, 2017- 2031

16.9.1. Water Supply

16.9.2. Wastewater Management

16.9.3. Others

16.10. Multilayer Pipes Market Size (US$ Mn) (Million Meters), by End-use, 2017- 2031

16.10.1. Residential

16.10.2. Commercial

16.10.3. Industrial

16.10.3.1. Manufacturing & Processing

16.10.3.2. Agriculture

16.10.3.3. Wastewater Treatment

16.10.3.4. Oil & Gas

16.10.3.5. Others

16.11. Multilayer Pipes Market Size (US$ Mn) (Million Meters), by Distribution Channel, 2017- 2031

16.11.1. Direct Sales

16.11.2. Indirect Sales

16.12. Incremental Opportunity Analysis

17. South East Asia Multilayer Pipes Market Analysis and Forecast

17.1. Regional Snapshot

17.2. Key Supplier Analysis

17.3. COVID-19 Impact Analysis

17.4. Key Trends Analysis

17.4.1. Supply side

17.4.2. Demand Side

17.5. Price Trend Analysis

17.5.1. Weighted Average Selling Price (US$)

17.6. Multilayer Pipes Market Size (US$ Mn) (Million Meters), by Type, 2017- 2031

17.6.1. PEX-AL-PEX Multilayer Pipes

17.6.2. PERT-AL-PERT Multilayer Pipes

17.6.3. Others

17.7. Multilayer Pipes Market Size (US$ Mn) (Million Meters), by Outer Diameter, 2017- 2031

17.7.1. Below 20 mm

17.7.2. 20-50 mm

17.7.3. 50-70 mm

17.7.4. 70-100 mm

17.7.5. Above 100 mm

17.8. Multilayer Pipes Market Size (US$ Mn) (Million Meters), by Length, 2017- 2031

17.8.1. Below 50 m

17.8.2. 50-150 m

17.8.3. 150-250 m

17.8.4. 250-350 m

17.8.5. Above 50 m

17.9. Multilayer Pipes Market Size (US$ Mn) (Million Meters), by Application, 2017- 2031

17.9.1. Water Supply

17.9.2. Wastewater Management

17.9.3. Others

17.10. Multilayer Pipes Market Size (US$ Mn) (Million Meters), by End-use, 2017- 2031

17.10.1. Residential

17.10.2. Commercial

17.10.3. Industrial

17.10.3.1. Manufacturing & Processing

17.10.3.2. Agriculture

17.10.3.3. Wastewater Treatment

17.10.3.4. Oil & Gas

17.10.3.5. Others

17.11. Multilayer Pipes Market Size (US$ Mn) (Million Meters), by Country or Sub-Region, 2017- 2031

17.11.1. Malaysia

17.11.2. Singapore

17.11.3. Thailand

17.11.4. Indonesia

17.11.5. Philippines

17.11.6. Rest of South East Asia

17.12. Multilayer Pipes Market Size (US$ Mn) (Million Meters), by Distribution Channel, 2017- 2031

17.12.1. Direct Sales

17.12.2. Indirect Sales

17.13. Incremental Opportunity Analysis

18. Competition Landscape

18.1. Competition Dashboard

18.2. Market Share Analysis % (2021)

18.3. Company Profiles [Company Overview, Product Portfolio, Financial Information, (Subject to Data Availability), Business Strategies / Recent Developments]

18.3.1. Aquatechnik

18.3.1.1. Company Overview

18.3.1.2. Product Portfolio

18.3.1.3. Financial Information, (Subject to Data Availability)

18.3.1.4. Business Strategies / Recent Developments

18.3.2. Astral Limited

18.3.2.1. Company Overview

18.3.2.2. Product Portfolio

18.3.2.3. Financial Information, (Subject to Data Availability)

18.3.2.4. Business Strategies / Recent Developments

18.3.3. GF Piping System

18.3.3.1. Company Overview

18.3.3.2. Product Portfolio

18.3.3.3. Financial Information, (Subject to Data Availability)

18.3.3.4. Business Strategies / Recent Developments

18.3.4. Jindal Composite Tubes Pvt. Ltd.

18.3.4.1. Company Overview

18.3.4.2. Product Portfolio

18.3.4.3. Financial Information, (Subject to Data Availability)

18.3.4.4. Business Strategies / Recent Developments

18.3.5. KiTEC Industries (India) Pvt. Ltd.

18.3.5.1. Company Overview

18.3.5.2. Product Portfolio

18.3.5.3. Financial Information, (Subject to Data Availability)

18.3.5.4. Business Strategies / Recent Developments

18.3.6. Ningbo Sunplast Pipe Co., Ltd.

18.3.6.1. Company Overview

18.3.6.2. Product Portfolio

18.3.6.3. Financial Information, (Subject to Data Availability)

18.3.6.4. Business Strategies / Recent Developments

18.3.7. Prince Pipes

18.3.7.1. Company Overview

18.3.7.2. Product Portfolio

18.3.7.3. Financial Information, (Subject to Data Availability)

18.3.7.4. Business Strategies / Recent Developments

18.3.8. Unipro Piping Systems Private Limited

18.3.8.1. Company Overview

18.3.8.2. Product Portfolio

18.3.8.3. Financial Information, (Subject to Data Availability)

18.3.8.4. Business Strategies / Recent Developments

18.3.9. Wavin

18.3.9.1. Company Overview

18.3.9.2. Product Portfolio

18.3.9.3. Financial Information, (Subject to Data Availability)

18.3.9.4. Business Strategies / Recent Developments

18.3.10. Zhejiang Mingshi Xingxin HVAC Technology Co., Ltd.

18.3.10.1. Company Overview

18.3.10.2. Product Portfolio

18.3.10.3. Financial Information, (Subject to Data Availability)

18.3.10.4. Business Strategies / Recent Developments

19. Key Takeaways

19.1. Identification of Potential Market Spaces

19.1.1. Type

19.1.2. Outer Diameter

19.1.3. Length

19.1.4. Application

19.1.5. End-use

19.1.6. Distribution Channel

19.1.7. Geography

19.2. Understanding the Procurement Process of the End-user

19.3. Prevailing Market Risks

19.4. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Asia Pacific Multilayer Pipes Market, by Type, Million Meters, 2017-2031

Table 2: Asia Pacific Multilayer Pipes Market, by Type, US$ Mn, 2017-2031

Table 3: Asia Pacific Multilayer Pipes Market, by Length, Million Meters, 2017-2031

Table 4: Asia Pacific Multilayer Pipes Market, by Length, US$ Mn, 2017-2031

Table 5: Asia Pacific Multilayer Pipes Market, by Outer Diameter, Million Meters, 2017-2031

Table 6: Asia Pacific Multilayer Pipes Market, by Outer Diameter, US$ Mn, 2017-2031

Table 7: Asia Pacific Multilayer Pipes Market, by End-use, Million Meters, 2017-2031

Table 8: Asia Pacific Multilayer Pipes Market, by End-use, US$ Mn, 2017-2031

Table 9: Asia Pacific Multilayer Pipes Market, by Application, Million Meters, 2017-2031

Table 10: Asia Pacific Multilayer Pipes Market, by Application, US$ Mn, 2017-2031

Table 11: Asia Pacific Multilayer Pipes Market, by Distribution Channel, Million Meters, 2017-2031

Table 12: Asia Pacific Multilayer Pipes Market, by Distribution Channel, US$ Mn, 2017-2031

Table 13: Asia Pacific Multilayer Pipes Market, by Country, Million Meters, 2017-2031

Table 14: Asia Pacific Multilayer Pipes Market, by Country, US$ Mn, 2017-2031

Table 15: China Multilayer Pipes Market, by Type, Million Meters, 2017-2031

Table 16: China Multilayer Pipes Market, by Type, US$ Mn, 2017-2031

Table 17: China Multilayer Pipes Market, by Length, Million Meters, 2017-2031

Table 18: China Multilayer Pipes Market, by Length, US$ Mn, 2017-2031

Table 19: China Multilayer Pipes Market, by Outer Diameter, Million Meters, 2017-2031

Table 20: China Multilayer Pipes Market, by Outer Diameter, US$ Mn, 2017-2031

Table 21: China Multilayer Pipes Market, by End-use, Million Meters, 2017-2031

Table 22: China Multilayer Pipes Market, by End-use, US$ Mn, 2017-2031

Table 23: China Multilayer Pipes Market, by Application, Million Meters, 2017-2031

Table 24: China Multilayer Pipes Market, by Application, US$ Mn, 2017-2031

Table 25: China Multilayer Pipes Market, by Distribution Channel, Million Meters, 2017-2031

Table 26: China Multilayer Pipes Market, by Distribution Channel, US$ Mn, 2017-2031

Table 27: India Multilayer Pipes Market, by Type, Million Meters, 2017-2031

Table 28: India Multilayer Pipes Market, by Type, US$ Mn, 2017-2031

Table 29: India Multilayer Pipes Market, by Length, Million Meters, 2017-2031

Table 30: India Multilayer Pipes Market, by Length, US$ Mn, 2017-2031

Table 31: India Multilayer Pipes Market, by Outer Diameter, Million Meters, 2017-2031

Table 32: India Multilayer Pipes Market, by Outer Diameter, US$ Mn, 2017-2031

Table 33: India Multilayer Pipes Market, by End-use, Million Meters, 2017-2031

Table 34: India Multilayer Pipes Market, by End-use, US$ Mn, 2017-2031

Table 35: India Multilayer Pipes Market, by Application, Million Meters, 2017-2031

Table 36: India Multilayer Pipes Market, by Application, US$ Mn, 2017-2031

Table 37: India Multilayer Pipes Market, by Distribution Channel, Million Meters, 2017-2031

Table 38: India Multilayer Pipes Market, by Distribution Channel, US$ Mn, 2017-2031

Table 39: Japan Multilayer Pipes Market, by Type, Million Meters, 2017-2031

Table 40: Japan Multilayer Pipes Market, by Type, US$ Mn, 2017-2031

Table 41: Japan Multilayer Pipes Market, by Length, Million Meters, 2017-2031

Table 42: Japan Multilayer Pipes Market, by Length, US$ Mn, 2017-2031

Table 43: Japan Multilayer Pipes Market, by Outer Diameter, Million Meters, 2017-2031

Table 44: Japan Multilayer Pipes Market, by Outer Diameter, US$ Mn, 2017-2031

Table 45: Japan Multilayer Pipes Market, by End-use, Million Meters, 2017-2031

Table 46: Japan Multilayer Pipes Market, by End-use, US$ Mn, 2017-2031

Table 47: Japan Multilayer Pipes Market, by Application, Million Meters, 2017-2031

Table 48: Japan Multilayer Pipes Market, by Application, US$ Mn, 2017-2031

Table 49: Japan Multilayer Pipes Market, by Distribution Channel, Million Meters, 2017-2031

Table 50: Japan Multilayer Pipes Market, by Distribution Channel, US$ Mn, 2017-2031

Table 51: South Korea Multilayer Pipes Market, by Type, Million Meters, 2017-2031

Table 52: South Korea Multilayer Pipes Market, by Type, US$ Mn, 2017-2031

Table 53: South Korea Multilayer Pipes Market, by Length, Million Meters, 2017-2031

Table 54: South Korea Multilayer Pipes Market, by Length, US$ Mn, 2017-2031

Table 55: South Korea Multilayer Pipes Market, by Outer Diameter, Million Meters, 2017-2031

Table 56: South Korea Multilayer Pipes Market, by Outer Diameter, US$ Mn, 2017-2031

Table 57: South Korea Multilayer Pipes Market, by End-use, Million Meters, 2017-2031

Table 58: South Korea Multilayer Pipes Market, by End-use, US$ Mn, 2017-2031

Table 59: South Korea Multilayer Pipes Market, by Application, Million Meters, 2017-2031

Table 60: South Korea Multilayer Pipes Market, by Application, US$ Mn, 2017-2031

Table 61: South Korea Multilayer Pipes Market, by Distribution Channel, Million Meters, 2017-2031

Table 62: South Korea Multilayer Pipes Market, by Distribution Channel, US$ Mn, 2017-2031

Table 63: South East Asia Multilayer Pipes Market, by Type, Million Meters, 2017-2031

Table 64: South East Asia Multilayer Pipes Market, by Type, US$ Mn, 2017-2031

Table 65: South East Asia Multilayer Pipes Market, by Length, Million Meters, 2017-2031

Table 66: South East Asia Multilayer Pipes Market, by Length, US$ Mn, 2017-2031

Table 67: South East Asia Multilayer Pipes Market, by Outer Diameter, Million Meters, 2017-2031

Table 68: South East Asia Multilayer Pipes Market, by Outer Diameter, US$ Mn, 2017-2031

Table 69: South East Asia Multilayer Pipes Market, by End-use, Million Meters, 2017-2031

Table 70: South East Asia Multilayer Pipes Market, by End-use, US$ Mn, 2017-2031

Table 71: South East Asia Multilayer Pipes Market, by Application, Million Meters, 2017-2031

Table 72: South East Asia Multilayer Pipes Market, by Application, US$ Mn, 2017-2031

Table 73: South East Asia Multilayer Pipes Market, by Distribution Channel, Million Meters, 2017-2031

Table 74: South East Asia Multilayer Pipes Market, by Distribution Channel, US$ Mn, 2017-2031

Table 75: South East Asia Multilayer Pipes Market, by Country, Million Meters, 2017-2031

Table 76: South East Asia Multilayer Pipes Market, by Country, US$ Mn, 2017-2031

List of Figures

Figure 1: Asia Pacific Multilayer Pipes Market, by Type, Million Meters, 2017-2031

Figure 2: Asia Pacific Multilayer Pipes Market, by Type, US$ Mn, 2017-2031

Figure 3: Asia Pacific Multilayer Pipes Market, by Type, Incremental Opportunity, 2017-2031

Figure 4: Asia Pacific Multilayer Pipes Market, by Length, Million Meters, 2017-2031

Figure 5: Asia Pacific Multilayer Pipes Market, by Length, US$ Mn, 2017-2031

Figure 6: Asia Pacific Multilayer Pipes Market, by Length, Incremental Opportunity, 2017-2031

Figure 7: Asia Pacific Multilayer Pipes Market, by Outer Diameter, Million Meters, 2017-2031

Figure 8: Asia Pacific Multilayer Pipes Market, by Outer Diameter, US$ Mn, 2017-2031

Figure 9: Asia Pacific Multilayer Pipes Market, by Outer Diameter, Incremental Opportunity, 2017-2031

Figure 10: Asia Pacific Multilayer Pipes Market, by End-use, Million Meters, 2017-2031

Figure 11: Asia Pacific Multilayer Pipes Market, by End-use, US$ Mn, 2017-2031

Figure 12: Asia Pacific Multilayer Pipes Market, by End-use, Incremental Opportunity, 2017-2031

Figure 13: Asia Pacific Multilayer Pipes Market, by Application, Million Meters, 2017-2031

Figure 14: Asia Pacific Multilayer Pipes Market, by Application, US$ Mn, 2017-2031

Figure 15: Asia Pacific Multilayer Pipes Market, by Application, Incremental Opportunity, 2017-2031

Figure 16: Asia Pacific Multilayer Pipes Market, by Distribution Channel, Million Meters, 2017-2031

Figure 17: Asia Pacific Multilayer Pipes Market, by Distribution Channel, US$ Mn, 2017-2031

Figure 18: Asia Pacific Multilayer Pipes Market, by Distribution Channel, Incremental Opportunity, 2017-2031

Figure 19: Asia Pacific Multilayer Pipes Market, by Country, Million Meters, 2017-2031

Figure 20: Asia Pacific Multilayer Pipes Market, by Country, US$ Mn, 2017-2031

Figure 21: Asia Pacific Multilayer Pipes Market, by Country, Incremental Opportunity, 2017-2031

Figure 22: China Multilayer Pipes Market, by Type, Million Meters, 2017-2031

Figure 23: China Multilayer Pipes Market, by Type, US$ Mn, 2017-2031

Figure 24: China Multilayer Pipes Market, by Type, Incremental Opportunity, 2017-2031

Figure 25: China Multilayer Pipes Market, by Length, Million Meters, 2017-2031

Figure 26: China Multilayer Pipes Market, by Length, US$ Mn, 2017-2031

Figure 27: China Multilayer Pipes Market, by Length, Incremental Opportunity, 2017-2031

Figure 28: China Multilayer Pipes Market, by Outer Diameter, Million Meters, 2017-2031

Figure 29: China Multilayer Pipes Market, by Outer Diameter, US$ Mn, 2017-2031

Figure 30: China Multilayer Pipes Market, by Outer Diameter, Incremental Opportunity, 2017-2031

Figure 31: China Multilayer Pipes Market, by End-use, Million Meters, 2017-2031

Figure 32: China Multilayer Pipes Market, by End-use, US$ Mn, 2017-2031

Figure 33: China Multilayer Pipes Market, by End-use, Incremental Opportunity, 2017-2031

Figure 34: China Multilayer Pipes Market, by Application, Million Meters, 2017-2031

Figure 35: China Multilayer Pipes Market, by Application, US$ Mn, 2017-2031

Figure 36: China Multilayer Pipes Market, by Application, Incremental Opportunity, 2017-2031

Figure 37: China Multilayer Pipes Market, by Distribution Channel, Million Meters, 2017-2031

Figure 38: China Multilayer Pipes Market, by Distribution Channel, US$ Mn, 2017-2031

Figure 39: China Multilayer Pipes Market, by Distribution Channel, Incremental Opportunity, 2017-2031

Figure 40: India Multilayer Pipes Market, by Type, Million Meters, 2017-2031

Figure 41: India Multilayer Pipes Market, by Type, US$ Mn, 2017-2031

Figure 42: India Multilayer Pipes Market, by Type, Incremental Opportunity, 2017-2031

Figure 43: India Multilayer Pipes Market, by Length, Million Meters, 2017-2031

Figure 44: India Multilayer Pipes Market, by Length, US$ Mn, 2017-2031

Figure 45: India Multilayer Pipes Market, by Length, Incremental Opportunity, 2017-2031

Figure 46: India Multilayer Pipes Market, by Outer Diameter, Million Meters, 2017-2031

Figure 47: India Multilayer Pipes Market, by Outer Diameter, US$ Mn, 2017-2031

Figure 48: India Multilayer Pipes Market, by Outer Diameter, Incremental Opportunity, 2017-2031

Figure 49: India Multilayer Pipes Market, by End-use, Million Meters, 2017-2031

Figure 50: India Multilayer Pipes Market, by End-use, US$ Mn, 2017-2031

Figure 51: India Multilayer Pipes Market, by End-use, Incremental Opportunity, 2017-2031

Figure 52: India Multilayer Pipes Market, by Application, Million Meters, 2017-2031

Figure 53: India Multilayer Pipes Market, by Application, US$ Mn, 2017-2031

Figure 54: India Multilayer Pipes Market, by Application, Incremental Opportunity, 2017-2031

Figure 55: India Multilayer Pipes Market, by Distribution Channel, Million Meters, 2017-2031

Figure 56: India Multilayer Pipes Market, by Distribution Channel, US$ Mn, 2017-2031

Figure 57: India Multilayer Pipes Market, by Distribution Channel, Incremental Opportunity, 2017-2031

Figure 58: Japan Multilayer Pipes Market, by Type, Million Meters, 2017-2031

Figure 59: Japan Multilayer Pipes Market, by Type, US$ Mn, 2017-2031

Figure 60: Japan Multilayer Pipes Market, by Type, Incremental Opportunity, 2017-2031

Figure 61: Japan Multilayer Pipes Market, by Length, Million Meters, 2017-2031

Figure 62: Japan Multilayer Pipes Market, by Length, US$ Mn, 2017-2031

Figure 63: Japan Multilayer Pipes Market, by Length, Incremental Opportunity, 2017-2031

Figure 64: Japan Multilayer Pipes Market, by Outer Diameter, Million Meters, 2017-2031

Figure 65: Japan Multilayer Pipes Market, by Outer Diameter, US$ Mn, 2017-2031

Figure 66: Japan Multilayer Pipes Market, by Outer Diameter, Incremental Opportunity, 2017-2031

Figure 67: Japan Multilayer Pipes Market, by End-use, Million Meters, 2017-2031

Figure 68: Japan Multilayer Pipes Market, by End-use, US$ Mn, 2017-2031

Figure 69: Japan Multilayer Pipes Market, by End-use, Incremental Opportunity, 2017-2031

Figure 70: Japan Multilayer Pipes Market, by Application, Million Meters, 2017-2031

Figure 71: Japan Multilayer Pipes Market, by Application, US$ Mn, 2017-2031

Figure 72: Japan Multilayer Pipes Market, by Application, Incremental Opportunity, 2017-2031

Figure 73: Japan Multilayer Pipes Market, by Distribution Channel, Million Meters, 2017-2031

Figure 74: Japan Multilayer Pipes Market, by Distribution Channel, US$ Mn, 2017-2031

Figure 75: Japan Multilayer Pipes Market, by Distribution Channel, Incremental Opportunity, 2017-2031

Figure 76: South Korea Multilayer Pipes Market, by Type, Million Meters, 2017-2031

Figure 77: South Korea Multilayer Pipes Market, by Type, US$ Mn, 2017-2031

Figure 78: South Korea Multilayer Pipes Market, by Type, Incremental Opportunity, 2017-2031

Figure 79: South Korea Multilayer Pipes Market, by Length, Million Meters, 2017-2031

Figure 80: South Korea Multilayer Pipes Market, by Length, US$ Mn, 2017-2031

Figure 81: South Korea Multilayer Pipes Market, by Length, Incremental Opportunity, 2017-2031

Figure 82: South Korea Multilayer Pipes Market, by Outer Diameter, Million Meters, 2017-2031

Figure 83: South Korea Multilayer Pipes Market, by Outer Diameter, US$ Mn, 2017-2031

Figure 84: South Korea Multilayer Pipes Market, by Outer Diameter, Incremental Opportunity, 2017-2031

Figure 85: South Korea Multilayer Pipes Market, by End-use, Million Meters, 2017-2031

Figure 86: South Korea Multilayer Pipes Market, by End-use, US$ Mn, 2017-2031

Figure 87: South Korea Multilayer Pipes Market, by End-use, Incremental Opportunity, 2017-2031

Figure 88: South Korea Multilayer Pipes Market, by Application, Million Meters, 2017-2031

Figure 89: South Korea Multilayer Pipes Market, by Application, US$ Mn, 2017-2031

Figure 90: South Korea Multilayer Pipes Market, by Application, Incremental Opportunity, 2017-2031

Figure 91: South Korea Multilayer Pipes Market, by Distribution Channel, Million Meters, 2017-2031

Figure 92: South Korea Multilayer Pipes Market, by Distribution Channel, US$ Mn, 2017-2031

Figure 93: South Korea Multilayer Pipes Market, by Distribution Channel, Incremental Opportunity, 2017-2031

Figure 94: South East Asia Multilayer Pipes Market, by Type, Million Meters, 2017-2031

Figure 95: South East Asia Multilayer Pipes Market, by Type, US$ Mn, 2017-2031

Figure 96: South East Asia Multilayer Pipes Market, by Type, Incremental Opportunity, 2017-2031

Figure 97: South East Asia Multilayer Pipes Market, by Length, Million Meters, 2017-2031

Figure 98: South East Asia Multilayer Pipes Market, by Length, US$ Mn, 2017-2031

Figure 99: South East Asia Multilayer Pipes Market, by Length, Incremental Opportunity, 2017-2031

Figure 100: South East Asia Multilayer Pipes Market, by Outer Diameter, Million Meters, 2017-2031

Figure 101: South East Asia Multilayer Pipes Market, by Outer Diameter, US$ Mn, 2017-2031

Figure 102: South East Asia Multilayer Pipes Market, by Outer Diameter, Incremental Opportunity, 2017-2031

Figure 103: South East Asia Multilayer Pipes Market, by End-use, Million Meters, 2017-2031

Figure 104: South East Asia Multilayer Pipes Market, by End-use, US$ Mn, 2017-2031

Figure 105: South East Asia Multilayer Pipes Market, by End-use, Incremental Opportunity, 2017-2031

Figure 106: South East Asia Multilayer Pipes Market, by Application, Million Meters, 2017-2031

Figure 107: South East Asia Multilayer Pipes Market, by Application, US$ Mn, 2017-2031

Figure 108: South East Asia Multilayer Pipes Market, by Application, Incremental Opportunity, 2017-2031

Figure 109: South East Asia Multilayer Pipes Market, by Distribution Channel, Million Meters, 2017-2031

Figure 110: South East Asia Multilayer Pipes Market, by Distribution Channel, US$ Mn, 2017-2031

Figure 111: South East Asia Multilayer Pipes Market, by Distribution Channel, Incremental Opportunity, 2017-2031

Figure 112: South East Asia Multilayer Pipes Market, by Country, Million Meters, 2017-2031

Figure 113: South East Asia Multilayer Pipes Market, by Country, US$ Mn, 2017-2031

Figure 114: South East Asia Multilayer Pipes Market, by Country, Incremental Opportunity, 2017-2031