Analyst Viewpoint

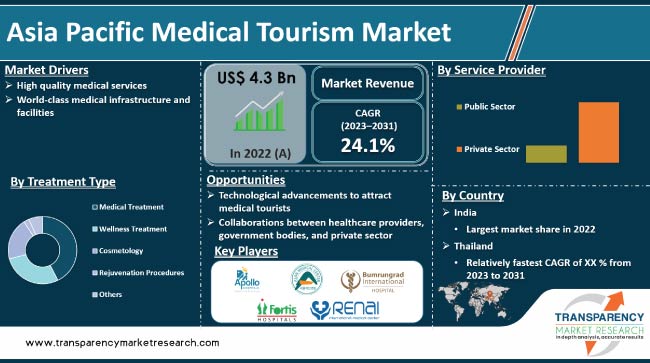

High quality medical services at affordable prices is driving Asia Pacific market. The region’s cost advantage compared to western counterparts continues to attract a global patient base. Quality healthcare services bolstered by cutting-edge technology and skilled medical professionals are the other factors driving market development. Furthermore, world-class medical infrastructure and facilities is expected to bolster Asia Pacific medical tourism market size during the forecast period.

Integration of healthcare with tourism and rise in demand for advanced medical interventions offer lucrative opportunities to market players. Companies are focusing on providing specialized treatments, ranging from cosmetic surgery to traditional medicine in order to increase market revenue.

Medical or health tourism in Asia has experienced significant growth in the last decade, establishing the region as a key player in the global healthcare industry. Several factors contribute to the region’s appeal as a preferred destination for medical tourists seeking healthcare services.

Governments in Asia actively promote medical tourism and have implemented policies to facilitate the entry of international patients. Investment in healthcare infrastructure and regulatory frameworks that support medical tourism have contributed to the growth of the industry.

Adoption of telemedicine and digital health solutions has enhanced accessibility to healthcare services. This innovation allows patients to consult with healthcare professionals remotely, facilitating pre- and post-operative care and follow-up consultations.

Countries in Asia Pacific have recognized the potential of offering comprehensive healthcare packages that include not only medical treatments but also travel, accommodation, and other related services.

This approach enables medical tourists to plan and budget for their entire medical journey more effectively. By bundling services into packages, Asia Pacific provides a transparent and cost-effective solution for patients, further enhancing its appeal as a medical tourism destination.

For instance, medical tourism hubs, such as Singapore, have positioned themselves as holistic healthcare destinations by offering packages that cover medical treatments, post-operative care, rehabilitation, and even wellness and preventive care services. This comprehensive approach not only simplifies the logistical aspects of medical travel in Asia Pacific, but also adds value for patients seeking a seamless healthcare experience.

In terms of type, the medical treatment segment accounted for largest Asia Pacific medical tourism market share in 2022. Several medical treatment segments are popular among international patients.

Procedures such as breast augmentation, rhinoplasty, facelifts, and liposuction are sought after by medical tourists in countries such as South Korea, Thailand, and Malaysia. Joint replacements, spinal surgeries, and orthopedic treatments are popular, with countries including India, Thailand, and Singapore offering advanced facilities and expertise in this field.

Asia Pacific countries, such as India, Thailand, and South Korea, have established cancer centers offering advanced treatments like chemotherapy, radiation therapy, and immunotherapy.

Cosmetic and plastic surgery have been prominent segments in the medical tourism market in Asia Pacific. Countries such as South Korea, Thailand, and India have gained a reputation for providing high-quality cosmetic procedures, including rhinoplasty, liposuction, and breast augmentation, often at more affordable prices than in several countries in the West.

Based on service provider, the private segment dominated Asia Pacific medical tourism market demand in 2022. Private service providers often invest significantly in state-of-the-art medical infrastructure, including advanced medical equipment and facilities. This commitment to technological advancement allows private sector players to offer cutting-edge medical treatments and procedures, attracting patients seeking access to the latest healthcare innovations.

Private hospitals frequently establish themselves as centers of excellence in specific medical specialties, such as cardiac care, orthopedics, fertility treatments, and cosmetic surgery. This specialization attracts patients seeking highly skilled medical professionals and specialized expertise for their particular healthcare needs.

According to Asia Pacific medical tourism market forecast, India constituted significant industry share in 2022. The travel healthcare industry is expanding in the country. The travel healthcare sector in India was valued at US$ 9 Bn in 2022.

Around 2 million patients from 78 countries visit India each year for medical, wellness, and IVF treatments, generating US$ 6 Bn for the industry. This is expected to increase to US$ 13 Bn by 2026 under the government's Heal in India initiative.

According to the Federation of Indian Chambers of Commerce and Industry and Ernst & Young, majority of medical patients arriving in India in 2019 came from Southeast Asia, the Middle East, Africa, and the SAARC region. Australia, Canada, China, Russia, the U.K., and the U.S. send a significant number of medical patients to India.

Thailand has consistently demonstrated its prominence in the field of medical tourism, ranking among the top five markets in the Medical Tourism Index (MTI) 2020-2021 Global Destination ranking for Destination Attractiveness and Medical Tourism Cost factors. The country’s healthcare industry, known for its exceptional offerings, is on a strong growth trajectory, with projections indicating a significant post-pandemic rebound in 2023.

Leading players in Asia Pacific medical tourism industry are focusing on strategies such as mergers, partnerships, and collaborations to strengthen their position.

Bumrungrad International Hospital, Apollo Hospitals, Asan Medical Center, Gleneagles Hospital, Raffles Hospital, Samitivej Hospital, Parkway Pantai Limited, Fortis Healthcare, Shanghai Renai Hospital, and Anadolu Medical Center are prominent players in the region. These companies are following the latest medical tourism market trends to avail lucrative revenue opportunities.

Prominent players have been profiled in Asia Pacific medical tourism market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and latest developments.

| Attribute | Detail |

|---|---|

| Size in 2022 | US$ 4.3 Bn |

| Forecast (Value) in 2031 | More than US$ 38.9 Bn |

| Growth Rate (CAGR) | 24.1% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

| Competition Landscape | Company profiles section includes overview, product portfolio, sales footprint, key subsidiaries or distributors, strategy & recent developments, and key financials |

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 4.3 Bn in 2022

It is projected to reach more than US$ 38.9 Bn by 2031

The CAGR is anticipated to be 24.1% from 2023 to 2031

High quality medical services and world-class medical infrastructure & facilities

The medical treatment type segment accounted for major share in 2022

India is expected to account for major share during the forecast period

Bumrungrad International Hospital, Apollo Hospitals, Asan Medical Center, Gleneagles Hospital, Raffles Hospital, Samitivej Hospital, Parkway Pantai Limited, Fortis Healthcare, Shanghai Renai Hospital, and Anadolu Medical Center

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Asia Pacific Medical Tourism Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Asia Pacific Medical Tourism Market Analysis and Forecast, 2017–2031

5. Key Insights

5.1. Regulatory Scenario, by Asia Pacific Country/Sub-region

5.2. Medical Tourism and the Application of Technology

5.3. COVID-19 Pandemic Impact on Industry

6. Asia Pacific Medical Tourism Market Analysis and Forecast, by Treatment Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Treatment Type, 2017–2031

6.3.1. Medical Treatment

6.3.1.1. Dentistry

6.3.1.2. Cardiology

6.3.1.3. Orthopedic Surgery

6.3.1.4. Neurology

6.3.1.5. Oncology

6.3.1.6. Ophthalmology treatment

6.3.1.7. Bariatric Treatment

6.3.1.8. Others

6.3.2. Wellness Treatment

6.3.3. Cosmetology

6.3.3.1. Hair Transplant

6.3.3.2. Breast augmentation

6.3.3.3. Others

6.3.4. Rejuvenation Procedures

6.3.5. Others

6.4. Market Attractiveness Analysis, by Treatment Type

7. Asia Pacific Medical Tourism Market Analysis and Forecast, by Service Provider

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Service Provider, 2017–2031

7.3.1. Public

7.3.2. Private

7.4. Market Attractiveness Analysis, by Service Provider

8. Asia Pacific Medical Tourism Market Analysis and Forecast, by Country/Sub-region

8.1. Key Findings

8.2. Market Value Forecast, by Country, 2017–2031

8.2.1. India

8.2.2. Thailand

8.2.3. Singapore

8.2.4. Malaysia

8.2.5. South Korea

8.2.6. Rest of Asia Pacific

8.3. Market Attractiveness Analysis, by Country/Sub-region

9. India Medical Tourism Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Treatment Type, 2017–2031

9.2.1. Medical Treatment

9.2.1.1. Dentistry

9.2.1.2. Cardiology

9.2.1.3. Orthopedic Surgery

9.2.1.4. Neurology

9.2.1.5. Oncology

9.2.1.6. Ophthalmology treatment

9.2.1.7. Bariatric Treatment

9.2.1.8. Others

9.2.2. Wellness Treatment

9.2.3. Cosmetology

9.2.3.1. Hair Transplant

9.2.3.2. Breast augmentation

9.2.3.3. Others

9.2.4. Rejuvenation Procedures

9.2.5. Others

9.3. Market Value Forecast, by Service Provider, 2017–2031

9.3.1. Public

9.3.2. Private

9.4. Market Value Forecast, 2017–2031

9.5. Market Attractiveness Analysis

9.5.1. By Treatment Type

9.5.2. By Service Provider

10. Thailand Medical Tourism Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Treatment Type, 2017–2031

10.2.1. Medical Treatment

10.2.1.1. Dentistry

10.2.1.2. Cardiology

10.2.1.3. Orthopedic Surgery

10.2.1.4. Neurology

10.2.1.5. Oncology

10.2.1.6. Ophthalmology treatment

10.2.1.7. Bariatric Treatment

10.2.1.8. Others

10.2.2. Wellness Treatment

10.2.3. Cosmetology

10.2.3.1. Hair Transplant

10.2.3.2. Breast augmentation

10.2.3.3. Others

10.2.4. Rejuvenation Procedures

10.2.5. Others

10.3. Market Value Forecast, by Technology, 2017–2031

10.3.1. Pharmaceuticals Industry

10.3.2. Nutraceutical Industry

10.4. Market Value Forecast, 2017–2031

10.5. Market Attractiveness Analysis

10.5.1. By Treatment Type

10.5.2. By Service Provider

11. Singapore Medical Tourism Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Treatment Type, 2017–2031

11.2.1. Medical Treatment

11.2.1.1. Dentistry

11.2.1.2. Cardiology

11.2.1.3. Orthopedic Surgery

11.2.1.4. Neurology

11.2.1.5. Oncology

11.2.1.6. Ophthalmology treatment

11.2.1.7. Bariatric Treatment

11.2.1.8. Others

11.2.2. Wellness Treatment

11.2.3. Cosmetology

11.2.3.1. Hair Transplant

11.2.3.2. Breast augmentation

11.2.3.3. Others

11.2.4. Rejuvenation Procedures

11.2.5. Others

11.3. Market Value Forecast, by Technology, 2017–2031

11.3.1. Pharmaceuticals Industry

11.3.2. Nutraceutical Industry

11.4. Market Value Forecast, 2017–2031

11.5. Market Attractiveness Analysis

11.5.1. By Treatment Type

11.5.2. By Service Provider

12. Malaysia Medical Tourism Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Treatment Type, 2017–2031

12.2.1. Medical Treatment

12.2.1.1. Dentistry

12.2.1.2. Cardiology

12.2.1.3. Orthopedic Surgery

12.2.1.4. Neurology

12.2.1.5. Oncology

12.2.1.6. Ophthalmology treatment

12.2.1.7. Bariatric Treatment

12.2.1.8. Others

12.2.2. Wellness Treatment

12.2.3. Cosmetology

12.2.3.1. Hair Transplant

12.2.3.2. Breast augmentation

12.2.3.3. Others

12.2.4. Rejuvenation Procedures

12.2.5. Others

12.3. Market Value Forecast, by Service Provider, 2017–2031

12.3.1. Public

12.3.2. Private

12.4. Market Value Forecast, 2017–2031

12.5. Market Attractiveness Analysis

12.5.1. By Treatment Type

12.5.2. By Service Provider

13. South Korea Medical Tourism Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast By Treatment Type, 2017 - 2031

13.2.1. Medical Treatment

13.2.1.1. Dentistry

13.2.1.2. Cardiology

13.2.1.3. Orthopedic Surgery

13.2.1.4. Neurology

13.2.1.5. Oncology

13.2.1.6. Ophthalmology treatment

13.2.1.7. Bariatric Treatment

13.2.1.8. Others

13.2.2. Wellness Treatment

13.2.3. Cosmetology

13.2.3.1. Hair Transplant

13.2.3.2. Breast augmentation

13.2.3.3. Others

13.2.4. Rejuvenation Procedures

13.2.5. Others

13.3. Market Value Forecast By Service Provider, 2017 - 2031

13.3.1. Public

13.3.2. Private

13.4. Market Attractiveness Analysis

13.4.1. By Treatment Type

13.4.2. By Service Provider

14. Rest of Asia Pacific Medical Tourism Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast By Treatment Type, 2017 - 2031

14.2.1. Medical Treatment

14.2.1.1. Dentistry

14.2.1.2. Cardiology

14.2.1.3. Orthopedic Surgery

14.2.1.4. Neurology

14.2.1.5. Oncology

14.2.1.6. Ophthalmology treatment

14.2.1.7. Bariatric Treatment

14.2.1.8. Others

14.2.2. Wellness Treatment

14.2.3. Cosmetology

14.2.3.1. Hair Transplant

14.2.3.2. Breast augmentation

14.2.3.3. Others

14.2.4. Rejuvenation Procedures

14.2.5. Others

14.3. Market Value Forecast By Service Provider, 2017 - 2031

14.3.1. Public

14.3.2. Private

14.4. Market Value Forecast, 2017 - 2031

14.5. Market Attractiveness Analysis

14.5.1. By Treatment Type

14.5.2. By Service Provider

15. Competition Landscape

15.1. Market Player – Competition Matrix (By Tier and Size of Companies)

15.2. Market Share Analysis, by Company (2022)

15.3. Company Profiles

15.3.1. Bumrungrad International Hospital

15.3.1.1. Company Overview

15.3.1.2. Product Portfolio

15.3.1.3. Financial Overview

15.3.1.4. SWOT Analysis

15.3.1.5. Strategic Overview

15.3.2. Apollo Hospitals

15.3.2.1. Company Overview

15.3.2.2. Product Portfolio

15.3.2.3. Financial Overview

15.3.2.4. SWOT Analysis

15.3.2.5. Strategic Overview

15.3.3. Asan Medical Center

15.3.3.1. Company Overview

15.3.3.2. Product Portfolio

15.3.3.3. Financial Overview

15.3.3.4. SWOT Analysis

15.3.3.5. Strategic Overview

15.3.4. Gleneagles Hospital

15.3.4.1. Company Overview

15.3.4.2. Product Portfolio

15.3.4.3. Financial Overview

15.3.4.4. SWOT Analysis

15.3.4.5. Strategic Overview

15.3.5. Raffles Hospital

15.3.5.1. Company Overview

15.3.5.2. Product Portfolio

15.3.5.3. Financial Overview

15.3.5.4. SWOT Analysis

15.3.5.5. Strategic Overview

15.3.6. Samitivej Hospital

15.3.6.1. Company Overview

15.3.6.2. Product Portfolio

15.3.6.3. Financial Overview

15.3.6.4. SWOT Analysis

15.3.6.5. Strategic Overview

15.3.7. Parkway Pantai Limited

15.3.7.1. Company Overview

15.3.7.2. Product Portfolio

15.3.7.3. Financial Overview

15.3.7.4. SWOT Analysis

15.3.7.5. Strategic Overview

15.3.8. Fortis Healthcare

15.3.8.1. Company Overview

15.3.8.2. Product Portfolio

15.3.8.3. Financial Overview

15.3.8.4. SWOT Analysis

15.3.8.5. Strategic Overview

15.3.9. Shanghai Renai Hospital

15.3.9.1. Company Overview

15.3.9.2. Product Portfolio

15.3.9.3. Financial Overview

15.3.9.4. SWOT Analysis

15.3.9.5. Strategic Overview

15.3.10. Anadolu Medical

15.3.10.1. Company Overview

15.3.10.2. Product Portfolio

15.3.10.3. Financial Overview

15.3.10.4. SWOT Analysis

15.3.10.5. Strategic Overview

List of Tables

Table 01: Asia Pacific Medical Tourism Market Value (US$ Mn) Forecast, by Treatment Type, 2023-2031

Table 02: Asia Pacific Medical Tourism Market Value (US$ Mn) Forecast, by Service Provider, 2023-2031

Table 03: Asia Pacific Medical Tourism Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023-2031

Table 04: India Medical Tourism Market Value (US$ Mn) Forecast, 2023-2031

Table 05: India Medical Tourism Market Value (US$ Mn) Forecast, by Treatment Type, 2023-2031

Table 06: India Medical Tourism Market Value (US$ Mn) Forecast, by Service Provider, 2023-2031

Table 07: Thailand Medical Tourism Market Value (US$ Mn) Forecast, 2023-2031

Table 08: Thailand Medical Tourism Market Value (US$ Mn) Forecast, by Treatment Type, 2023-2031

Table 09: Thailand Medical Tourism Market Value (US$ Mn) Forecast, by Service Provider, 2023-2031

Table 10: Singapore Medical Tourism Market Value (US$ Mn) Forecast, 2023-2031

Table 11: Singapore Medical Tourism Market Value (US$ Mn) Forecast, by Treatment Type, 2023-2031

Table 12: Singapore Medical Tourism Market Value (US$ Mn) Forecast, by Service Provider, 2023-2031

Table 13: Malaysia Medical Tourism Market Value (US$ Mn) Forecast, 2023-2031

Table 14: Malaysia Medical Tourism Market Value (US$ Mn) Forecast, by Treatment Type, 2023-2031

Table 15: Malaysia Medical Tourism Market Value (US$ Mn) Forecast, by Service Provider, 2023-2031

Table 16: South Korea Medical Tourism Market Value (US$ Mn) Forecast, 2023-2031

Table 17: South Korea Medical Tourism Market Value (US$ Mn) Forecast, by Treatment Type, 2023-2031

Table 18: South Korea Medical Tourism Market Value (US$ Mn) Forecast, by Service Provider, 2023-2031

Table 19: Rest of Asia Pacific Medical Tourism Market Value (US$ Mn) Forecast, 2023-2031

Table 20: Rest of Asia Pacific Medical Tourism Market Value (US$ Mn) Forecast, by Treatment Type, 2023-2031

Table 21: Rest of Asia Pacific Medical Tourism Market Value (US$ Mn) Forecast, by Service Provider, 2023-2031

List of Figures

Figure 01: Asia Pacific Medical Tourism Market Size, by Treatment Type, 2022

Figure 02: Asia Pacific Medical Tourism Market Share (%), by Treatment Type, 2022

Figure 03: Asia Pacific Medical Tourism Market Size, by Service Provider, 2022

Figure 04: Asia Pacific Medical Tourism Market Share (%), by Service Provider, 2022

Figure 05: Asia Pacific Medical Tourism Market, by Country/Sub-region (2022 and 2031)

Figure 06: Asia Pacific Medical Tourism Market Value (US$ Mn) Forecast, 2017–2031

Figure 07: Asia Pacific Medical Tourism Market Value (US$ Mn) Share Analysis, by Treatment Type, 2022 and 2031

Figure 08: Asia Pacific Medical Tourism Market Value (US$ Mn) Share Analysis, by Treatment Type, 2022

Figure 09: Asia Pacific Medical Tourism Market Value (US$ Mn) Share Analysis, by Treatment Type, 2031

Figure 10: Asia Pacific Medical Tourism Market Attractiveness Analysis, by Treatment Type, 2023–2031

Figure 11: Asia Pacific Medical Tourism Market Value (US$ Mn) Share Analysis, by Service Provider, 2022 and 2031

Figure 12: Asia Pacific Medical Tourism Market Value (US$ Mn) Share Analysis, by Service Provider, 2022

Figure 13: Asia Pacific Medical Tourism Market Value (US$ Mn) Share Analysis, by Service Provider, 2031

Figure 14: Asia Pacific Medical Tourism Market Attractiveness Analysis, by Service Provider, 2023–2031

Figure 15: Asia Pacific Medical Tourism Market Value (US$ Mn) Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 16: Asia Pacific Medical Tourism Market Value (US$ Mn) Share Analysis, by Country/Sub-region, 2022

Figure 17: Asia Pacific Medical Tourism Market Value (US$ Mn) Share Analysis, by Country/Sub-region, 2031

Figure 18: Asia Pacific Medical Tourism Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 19: India Medical Tourism Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2023-2031

Figure 20: India Medical Tourism Market Value Share Analysis, 2022 and 2031

Figure 21: India Medical Tourism Market Attractiveness Analysis, 2023–2031

Figure 22: India Medical Tourism Market Value Share Analysis, by Treatment Type, 2022 and 2031

Figure 23: India Medical Tourism Market Attractiveness Analysis, by Treatment Type, 2023–2031

Figure 24: India Medical Tourism Market Value Share Analysis, by Service Provider, 2022 and 2031

Figure 25: India Medical Tourism Market Attractiveness Analysis, by Service Provider, 2023–2031

Figure 26: Thailand Medical Tourism Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2023-2031

Figure 27: Thailand Medical Tourism Market Value Share Analysis, 2022 and 2031

Figure 28: Thailand Medical Tourism Market Attractiveness Analysis, 2023–2031

Figure 29: Thailand Medical Tourism Market Value Share Analysis, by Treatment Type, 2022 and 2031

Figure 30: Thailand Medical Tourism Market Attractiveness Analysis, by Treatment Type, 2023–2031

Figure 31: Thailand Medical Tourism Market Value Share Analysis, by Service Provider, 2022 and 2031

Figure 32: Thailand Medical Tourism Market Attractiveness Analysis, by Service Provider, 2023–2031

Figure 33: Singapore Medical Tourism Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2023-2031

Figure 34: Singapore Medical Tourism Market Value Share Analysis, 2022 and 2031

Figure 35: Singapore Medical Tourism Market Attractiveness Analysis, 2023–2031

Figure 36: Singapore Medical Tourism Market Value Share Analysis, by Treatment Type, 2022 and 2031

Figure 37: Singapore Medical Tourism Market Attractiveness Analysis, by Treatment Type, 2023–2031

Figure 38: Singapore Medical Tourism Market Value Share Analysis, by Service Provider, 2022 and 2031

Figure 39: Singapore Medical Tourism Market Attractiveness Analysis, by Service Provider, 2023–2031

Figure 40: Malaysia Medical Tourism Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2023-2031

Figure 41: Malaysia Medical Tourism Market Value Share Analysis, 2022 and 2031

Figure 42: Malaysia Medical Tourism Market Attractiveness Analysis, 2023–2031

Figure 43: Malaysia Medical Tourism Market Value Share Analysis, by Treatment Type, 2022 and 2031

Figure 44: Malaysia Medical Tourism Market Attractiveness Analysis, by Treatment Type, 2023–2031

Figure 45: Malaysia Medical Tourism Market Value Share Analysis, by Service Provider, 2022 and 2031

Figure 46: Malaysia Medical Tourism Market Attractiveness Analysis, by Service Provider, 2023–2031

Figure 47: South Korea Medical Tourism Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2023-2031

Figure 48: South Korea Medical Tourism Market Value Share Analysis, 2022 and 2031

Figure 49: South Korea Medical Tourism Market Attractiveness Analysis, 2023–2031

Figure 50: South Korea Medical Tourism Market Value Share Analysis, by Treatment Type, 2022 and 2031

Figure 51: South Korea Medical Tourism Market Attractiveness Analysis, by Treatment Type, 2023–2031

Figure 52: Rest of Asia Pacific Medical Tourism Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2023-2031

Figure 53: Rest of Asia Pacific Medical Tourism Market Value Share Analysis, 2022 and 2031

Figure 54: Rest of Asia Pacific Medical Tourism Market Attractiveness Analysis, 2023–2031

Figure 55: Rest of Asia Pacific Medical Tourism Market Value Share Analysis, by Treatment Type, 2022 and 2031

Figure 56: Rest of Asia Pacific Medical Tourism Market Attractiveness Analysis, by Treatment Type, 2023–2031

Figure 57: Rest of Asia Pacific a Medical Tourism Market Value Share Analysis, by Service Provider, 2022 and 2031

Figure 58: Rest of Asia Pacific Medical Tourism Market Attractiveness Analysis, by Service Provider, 2023–2031