Analysts’ Viewpoint

Demand for cleanroom equipment such as laminar airflow units is increasing in Asia Pacific due to their application in biological laboratories. The COVID-19 pandemic and the rise in co-morbidities as a result of the infection have considerably increased the number of microbiological tests, which has aided market progress.

Recent Asia Pacific cleanroom market trends include the highly versatile modular cleanroom equipment that is replacing traditional equipment. It provides businesses with an affordable option for modernization and improvement in hygiene standards. Quick installation and reconfiguration as needed are some benefits of modular cleanrooms.

Additionally, advancements in cleanroom design and the use of IoT-based HVAC systems are augmenting the cleanroom equipment market demand. The expanding pharmaceutical, biotech, and medical industries in Asia Pacific offers lucrative opportunities for market expansion.

Cleanroom equipment is meant to protect extremely delicate environments from contamination. They are specifically developed and designed to prevent contamination. The size and permitted particle count per air volume are the main factors used to categorize cleanrooms.

Different types of cleanrooms are categorized using regulatory standards including the Pharmaceutical Cleanroom Classifications, Federal Standard 209, British Standard 5295, and ISO Standard. Stricter laws, hastened by worldwide occurrences such as the COVID-19 pandemic encourage the use of cleanroom equipment.

Asia Pacific is a strategic location for investment in hi-tech applications. In 2021, investments in hi-tech clean spaces were recorded uniformly in Taiwan, South Korea, Singapore, and Hong Kong. Favorable healthcare guidelines and surge in healthcare expenditure are the primary factors driving the market in Asia Pacific.

In recent years, the incidence of healthcare-acquired infections (HAIs) has increased. According to the WHO, of every 100 patients in acute care hospitals, 15 patients in middle- and low-income countries and 7 patients in high-income countries are likely to be affected by at least one HAI during hospitalization, and on average 1 in every 10 affected patients will die from an HAI. Thus, the need to install clean rooms in hospitals has increased significantly to overcome the increasing incidence of HAIs. Cleanroom equipment market value is expected to increase in the future due to the rise in demand for cleanrooms.

Within hospitals, cleanrooms are integrated into burn units, surgical suits, isolation rooms, and in some cases corridors that are regularly exposed to biohazardous material. The COVID-19 pandemic has fueled cleanroom equipment market development due to increased demand for cleanroom technologies.

Continuous advances in the field of medicine and drugs have opened up a number of possibilities to treat different health problems and helped in developing patient-centered healthcare models. An increase in drug approvals by regulatory bodies is expected to boost drug-manufacturing practices. Additionally, a large number of ongoing clinical trials have created lucrative growth opportunities, which is expected to propel the Asia Pacific cleanroom equipment market size.

One of the main factors anticipated to drive the Asia Pacific cleanroom equipment industry during the forecast period is the surge in need for cleanroom technology in manufacturing facilities. The entire production cycle may be contaminated by a variety of sources, including workers, raw materials, machinery, and product flow. This could also contaminate the finished product.

Computer-aided engineering has made significant strides in cleanroom design in recent years, particularly in process mapping and positioning. This prolongs the life of a gadget and helps to maximize workflow and efficiency. It can also lessen worker weariness, cut down on mistakes, and boost yield, all of which raises productivity. Thus, technological advancements in cleanrooms are expected to boost the cleanroom equipment industry growth during the forecast period.

Demand is also being stimulated by continuous improvements in cleanroom technology, such as more effective HVAC systems and cutting-edge product offers. IoT offers remote monitoring solutions for HVAC cleanroom installations and maintenance, which is expected to drive cleanroom equipment market growth.

The industry's increasing realization of the value of controlled environments across a range of sectors is demonstrated by the growth of cleanroom applications in emerging markets, especially in Asia Pacific. Essentially, the future dynamics of the cleanroom equipment market are being driven by the convergence of product innovation and industry expansion.

According to the latest Asia Pacific cleanroom equipment market forecast, China is expected to hold largest share from 2023 to 2031. Strong industrial growth in China, especially in electronics, semiconductors, and pharmaceutical industries, has significantly increased the demand for cleanroom equipment. Strict cleanliness regulations are required due to the nation's status as a global center of manufacturing. China's regulatory agencies often revise their recommendations regarding the layout and functionality of cleanrooms. Businesses are eager to invest in cutting-edge cleanroom equipment in the country to ensure compliance.

India is a major provider of pharmaceuticals to the world. Cleanroom equipment market statistics in India are fueled by the pharmaceutical industry's emphasis on quality and compliance with regulations.

The Asia Pacific cleanroom equipment market is considerably consolidated with the presence of large-scale cleanroom equipment manufacturers. AccumaX India, ACMAS Technologies (P) Ltd, Aircare Projects Pvt. Ltd, Airomax Airborne LLP, Bionics Scientific Technologies (P) LTD., Brinda Pharma Technologies, K J Pharmatech, MRC Systems FZE, Pharma Air Modular Systems, and Stericox India Private Limited are the prominent players operating in this market.

Each of these players has been profiled in the Asia Pacific cleanroom equipment market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

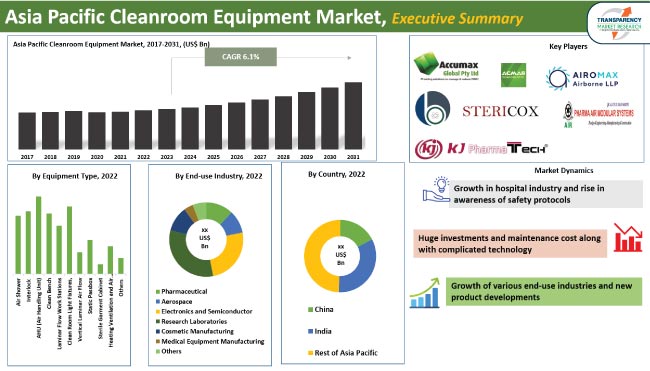

| Market Value in 2022 | US$ 4.6 Bn |

| Market Forecast Value in 2031 | US$ 7.8 Bn |

| Growth Rate (CAGR) | 6.1% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value & Thousand Units for Volume |

| Market Analysis | Includes cross-segment analysis at the Asia Pacific as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Region Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 4.6 Bn in 2022

The CAGR is projected to be 6.1% from 2023 to 2031

It is expected to reach US$ 7.8 Bn by the end of 2031

Increase in microbiological tests due to the COVID-19 pandemic, surge in occurrence of co-morbidities due to the infection, and their application in every laboratory involved in biological activities

AccumaX India, ACMAS Technologies (P) Ltd, Aircare Projects Pvt. Ltd, Airomax Airborne LLP, Bionics Scientific Technologies (P) LTD., Brinda Pharma Technologies, K J Pharmatech, MRC Systems FZE, Pharma Air Modular Systems, and Stericox India Private Limited

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.4. Porter’s Five Forces Analysis

5.5. Industry SWOT Analysis

5.6. Value Chain Analysis

5.7. COVID-19 Impact Analysis

5.8. Import/Export Analysis

5.9. Key Suppliers Analysis

5.10. Price Trend Analysis

5.10.1. Weighted Average Selling Price (US$)

6. Asia Pacific Cleanroom Equipment Market Analysis and Forecast, By Equipment Type

6.1. Cleanroom Equipment Market Size (US$ Mn and Thousand Units ), By Equipment Type, 2017 - 2031

6.1.1. Air Shower

6.1.2. Interlock

6.1.3. AHU (Air Handling Unit)

6.1.4. Clean Bench

6.1.5. Laminar Flow Work Stations

6.1.6. Cleanroom Light Fixtures

6.1.7. Vertical Laminar Air Flow

6.1.8. Static Passbox

6.1.9. Sterile Garment Cabinet

6.1.10. Heating Ventilation and Air Conditioning Equipment (HVAC)

6.1.11. Others

6.2. Incremental Opportunity, By Equipment Type

7. Asia Pacific Cleanroom Equipment Market Analysis and Forecast, By End-use Industry

7.1. Cleanroom Equipment Market Size (US$ Mn and Thousand Units ), By End-use Industry, 2017 - 2031

7.1.1. Pharmaceutical

7.1.2. Aerospace

7.1.3. Electronics and Semiconductor

7.1.4. Research Laboratories

7.1.5. Cosmetic Manufacturing

7.1.6. Medical Equipment Manufacturing

7.1.7. Others

7.2. Incremental Opportunity, By End Use Industry

8. Asia Pacific Cleanroom Equipment Market Analysis and Forecast, By Region

8.1. Cleanroom Equipment Market Size (US$ Mn and Thousand Units), By Region, 2017 - 2031

8.1.1. China

8.1.2. India

8.1.3. Rest of Asia Pacific

8.2. Incremental Opportunity, By Region

9. India Cleanroom Equipment Market Analysis and Forecast

9.1. Country Snapshot

9.2. Key Supplier Analysis

9.3. Key Trends Analysis

9.3.1. Supply side

9.3.2. Demand Side

9.4. Price Trend Analysis

9.4.1. Weighted Average Selling Price (US$)

9.5. Cleanroom Equipment Market Size (US$ Mn and Thousand Units ), By Equipment Type, 2017 - 2031

9.5.1. Air Shower

9.5.2. Interlock

9.5.3. AHU (Air Handling Unit)

9.5.4. Clean Bench

9.5.5. Laminar Flow Work Stations

9.5.6. Cleanroom Light Fixtures

9.5.7. Vertical Laminar Air Flow

9.5.8. Static Passbox

9.5.9. Sterile Garment Cabinet

9.5.10. Heating Ventilation and Air Conditioning Equipment (HVAC)

9.5.11. Others

9.6. Cleanroom Equipment Market Size (US$ Mn and Thousand Units ), By End-use Industry, 2017 - 2031

9.6.1. Pharmaceutical

9.6.2. Aerospace

9.6.3. Electronics and Semiconductor

9.6.4. Research Laboratories

9.6.5. Cosmetic Manufacturing,

9.6.6. Medical Equipment Manufacturing

9.6.7. Others

9.7. Incremental Opportunity Analysis

10. China Cleanroom Equipment Market Analysis and Forecast

10.1. Country Snapshot

10.2. Key Supplier Analysis

10.3. Key Trends Analysis

10.3.1. Supply side

10.3.2. Demand Side

10.4. Price Trend Analysis

10.4.1. Weighted Average Selling Price (US$)

10.5. Cleanroom Equipment Market Size (US$ Mn and Thousand Units ), By Equipment Type, 2017 - 2031

10.5.1. Air Shower

10.5.2. Interlock

10.5.3. AHU (Air Handling Unit)

10.5.4. Clean Bench

10.5.5. Laminar Flow Work Stations

10.5.6. Cleanroom Light Fixtures

10.5.7. Vertical Laminar Air Flow

10.5.8. Static Passbox

10.5.9. Sterile Garment Cabinet

10.5.10. Heating Ventilation and Air Conditioning Equipment (HVAC)

10.5.11. Others

10.6. Cleanroom Equipment Market Size (US$ Mn and Thousand Units ), By End-use Industry, 2017 - 2031

10.6.1. Pharmaceutical

10.6.2. Aerospace

10.6.3. Electronics and semiconductor

10.6.4. Research Laboratories

10.6.5. Cosmetic Manufacturing

10.6.6. Medical Equipment Manufacturing

10.6.7. Others

10.7. Incremental Opportunity Analysis

11. Rest of Asia Pacific Cleanroom Equipment Market Analysis and Forecast

11.1. Country Snapshot

11.2. Key Supplier Analysis

11.3. Key Trends Analysis

11.3.1. Supply side

11.3.2. Demand Side

11.4. Price Trend Analysis

11.4.1. Weighted Average Selling Price (US$)

11.5. Cleanroom Equipment Market Size (US$ Mn and Thousand Units ), By Equipment Type, 2017 - 2031

11.5.1. Air Shower

11.5.2. Interlock

11.5.3. AHU (Air Handling Unit)

11.5.4. Clean Bench

11.5.5. Laminar Flow Work Stations

11.5.6. Cleanroom Light Fixtures

11.5.7. Vertical Laminar Air Flow

11.5.8. Static Passbox

11.5.9. Sterile Garment Cabinet

11.5.10. Heating Ventilation and Air Conditioning Equipment (HVAC)

11.5.11. Others

11.6. Cleanroom Equipment Market Size (US$ Mn and Thousand Units ), By End-use Industry, 2017 - 2031

11.6.1. Pharmaceutical

11.6.2. Aerospace

11.6.3. Electronics and Semiconductor

11.6.4. Research Laboratories

11.6.5. Cosmetic Manufacturing,

11.6.6. Medical Equipment Manufacturing

11.6.7. Others

11.7. Incremental Opportunity Analysis

12. Competition Landscape

12.1. Market Player – Competition Dashboard

12.2. Market Share Analysis (%), 2022

12.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview, Go-To-Market Strategy)

12.3.1. AccumaX Asia Pacific

12.3.1.1. Company Overview

12.3.1.2. Sales Area/Geographical Presence

12.3.1.3. Revenue

12.3.1.4. Strategy & Business Overview

12.3.1.5. Go-To-Market Strategy

12.3.2. ACMAS Technologies (P) Ltd

12.3.2.1. Company Overview

12.3.2.2. Sales Area/Geographical Presence

12.3.2.3. Revenue

12.3.2.4. Strategy & Business Overview

12.3.2.5. Go-To-Market Strategy

12.3.3. AIRCARE PROJECTS PVT. LTD

12.3.3.1. Company Overview

12.3.3.2. Sales Area/Geographical Presence

12.3.3.3. Revenue

12.3.3.4. Strategy & Business Overview

12.3.3.5. Go-To-Market Strategy

12.3.4. Airomax Airborne LLP

12.3.4.1. Company Overview

12.3.4.2. Sales Area/Geographical Presence

12.3.4.3. Revenue

12.3.4.4. Strategy & Business Overview

12.3.4.5. Go-To-Market Strategy

12.3.5. Bionics Scientific Technologies (P) Ltd.

12.3.5.1. Company Overview

12.3.5.2. Sales Area/Geographical Presence

12.3.5.3. Revenue

12.3.5.4. Strategy & Business Overview

12.3.5.5. Go-To-Market Strategy

12.3.6. Brinda Pharma Technologies

12.3.6.1. Company Overview

12.3.6.2. Sales Area/Geographical Presence

12.3.6.3. Revenue

12.3.6.4. Strategy & Business Overview

12.3.6.5. Go-To-Market Strategy

12.3.7. K J Pharmatech

12.3.7.1. Company Overview

12.3.7.2. Sales Area/Geographical Presence

12.3.7.3. Revenue

12.3.7.4. Strategy & Business Overview

12.3.7.5. Go-To-Market Strategy

12.3.8. MRC Systems FZE

12.3.8.1. Company Overview

12.3.8.2. Sales Area/Geographical Presence

12.3.8.3. Revenue

12.3.8.4. Strategy & Business Overview

12.3.8.5. Go-To-Market Strategy

12.3.9. Pharma Air Modular Systems

12.3.9.1. Company Overview

12.3.9.2. Sales Area/Geographical Presence

12.3.9.3. Revenue

12.3.9.4. Strategy & Business Overview

12.3.9.5. Go-To-Market Strategy

12.3.10. Stericox Asia Pacific Private Limited

12.3.10.1. Company Overview

12.3.10.2. Sales Area/Geographical Presence

12.3.10.3. Revenue

12.3.10.4. Strategy & Business Overview

12.3.10.5. Go-To-Market Strategy

12.3.11. Other Key Players

12.3.11.1. Company Overview

12.3.11.2. Sales Area/Geographical Presence

12.3.11.3. Revenue

12.3.11.4. Strategy & Business Overview

12.3.11.5. Go-To-Market Strategy

13. Go To Market Strategy

13.1. Identification of Potential Market Spaces

13.2. Understanding the Buying Process of Customers

List of Tables

Table 1: Asia Pacific Cleanroom Equipment Market Volume(Thousand Units) Share, By Equipment Type 2017-2031

Table 2: Asia Pacific Cleanroom Equipment Market Value(US$ Mn) Share, By Equipment Type 2017-2031

Table 3: Asia Pacific Cleanroom Equipment Market Volume(Thousand Units) Share, By End-use Industry 2017-2031

Table 4: Asia Pacific Cleanroom Equipment Market Value(US$ Mn) Share, By End-use Industry 2017-2031

Table 5: Asia Pacific Cleanroom Equipment Market Volume(Thousand Units) Share, By Region 2017-2031

Table 6: Asia Pacific Cleanroom Equipment Market Value(US$ Mn) Share, By Region 2017-2031

Table 7: China Cleanroom Equipment Market Volume(Thousand Units) Share, By Equipment Type 2017-2031

Table 8: China Cleanroom Equipment Market Value(US$ Mn) Share, By Equipment Type 2017-2031

Table 9: China Cleanroom Equipment Market Volume(Thousand Units) Share, By End-use Industry 2017-2031

Table 10: China Cleanroom Equipment Market Value(US$ Mn) Share, By End-use Industry 2017-2031

Table 11: China Cleanroom Equipment Market Volume(Thousand Units) Share, By Country 2017-2031

Table 12: China Cleanroom Equipment Market Value(US$ Mn) Share, By Country 2017-2031

Table 13: India Cleanroom Equipment Market Volume(Thousand Units) Share, By Equipment Type 2017-2031

Table 14: India Cleanroom Equipment Market Value(US$ Mn) Share, By Equipment Type 2017-2031

Table 15: India Cleanroom Equipment Market Volume(Thousand Units) Share, By End-use Industry 2017-2031

Table 16: India Cleanroom Equipment Market Value(US$ Mn) Share, By End-use Industry 2017-2031

Table 17: India Cleanroom Equipment Market Volume(Thousand Units) Share, By Country 2017-2031

Table 18: India Cleanroom Equipment Market Value(US$ Mn) Share, By Country 2017-2031

Table 19: Rest of Asia Pacific Cleanroom Equipment Market Volume(Thousand Units) Share, By Equipment Type 2017-2031

Table 20: Rest of Asia Pacific Cleanroom Equipment Market Value(US$ Mn) Share, By Equipment Type 2017-2031

Table 21: Rest of Asia Pacific Cleanroom Equipment Market Volume (Thousand Units) Share, By End-use Industry 2017-2031

Table 22: Rest of Asia Pacific Cleanroom Equipment Market Value (US$ Mn) Share, By End-use Industry 2017-2031

Table 23: Rest of Asia Pacific Cleanroom Equipment Market Volume (Thousand Units) Share, By Country 2017-2031

Table 24: Rest of Asia Pacific Cleanroom Equipment Market Value (US$ Mn) Share, By Country 2017-2031

List of Figures

Figure 1: Asia Pacific Cleanroom Equipment Market Volume(Thousand Units) Share, By Equipment Type 2017-2031

Figure 2: Asia Pacific Cleanroom Equipment Market Value(US$ Mn) Share, By Equipment Type 2017-2031

Figure 3: Asia Pacific Cleanroom Equipment Market Incremental Opportunity (US$ Mn),By Equipment Type 2017-2031

Figure 4: Asia Pacific Cleanroom Equipment Market Volume(Thousand Units) Share, By End-use Industry 2017-2031

Figure 5: Asia Pacific Cleanroom Equipment Market Value(US$ Mn) Share, By End-use Industry 2017-2031

Figure 6: Asia Pacific Cleanroom Equipment Market Incremental Opportunity (US$ Mn),By End-use Industry, 2017-2031

Figure 7: Asia Pacific Cleanroom Equipment Market Volume(Thousand Units) Share, By Country 2017-2031

Figure 8: Asia Pacific Cleanroom Equipment Market Value(US$ Mn) Share, By Country 2017-2031

Figure 9: Asia Pacific Cleanroom Equipment Market Incremental Opportunity (US$ Mn),By Country 2017-2031

Figure 10: China Cleanroom Equipment Market Volume(Thousand Units) Share, By Equipment Type 2017-2031

Figure 11: China Cleanroom Equipment Market Value(US$ Mn) Share, By Equipment Type 2017-2031

Figure 12: China Cleanroom Equipment Market Incremental Opportunity (US$ Mn),By Equipment Type 2017-2031

Figure 13: China Cleanroom Equipment Market Volume(Thousand Units) Share, By End-use Industry 2017-2031

Figure 14: China Cleanroom Equipment Market Value(US$ Mn) Share, By End-use Industry 2017-2031

Figure 15: China Cleanroom Equipment Market Incremental Opportunity (US$ Mn),By End-use Industry 2017-2031

Figure 16: India Cleanroom Equipment Market Volume(Thousand Units) Share, By Equipment Type 2017-2031

Figure 17: India Cleanroom Equipment Market Value(US$ Mn) Share, By Equipment Type 2017-2031

Figure 18: India Cleanroom Equipment Market Incremental Opportunity (US$ Mn),By Equipment Type 2017-2031

Figure 19: India Cleanroom Equipment Market Volume(Thousand Units) Share, By End-use Industry 2017-2031

Figure 20: India Cleanroom Equipment Market Value(US$ Mn) Share, By End-use Industry 2017-2031

Figure 21: India Cleanroom Equipment Market Incremental Opportunity (US$ Mn),By End-use Industry 2017-2031

Figure 22: India Cleanroom Equipment Market Volume(Thousand Units) Share, By Country 2017-2031

Figure 23: India Cleanroom Equipment Market Value(US$ Mn) Share, By Country 2017-2031

Figure 24: India Cleanroom Equipment Market Incremental Opportunity (US$ Mn),By Country 2017-2031

Figure 25: Rest of Asia Pacific Cleanroom Equipment Market Volume(Thousand Units) Share, By Equipment Type 2017-2031

Figure 26: Rest of Asia Pacific Cleanroom Equipment Market Value(US$ Mn) Share, By Equipment Type 2017-2031

Figure 27: Rest of Asia Pacific Cleanroom Equipment Market Incremental Opportunity (US$ Mn),By Equipment Type 2017-2031

Figure 28: Rest of Asia Pacific Cleanroom Equipment Market Volume(Thousand Units) Share, By End-use Industry 2017-2031

Figure 29: Rest of Asia Pacific Cleanroom Equipment Market Value(US$ Mn) Share, By End-use Industry 2017-2031

Figure 30: Rest of Asia Pacific Cleanroom Equipment Market Incremental Opportunity (US$ Mn),By End-use Industry 2017-2031

Figure 31: Rest of Asia Pacific Cleanroom Equipment Market Volume(Thousand Units) Share, By Country 2017-2031

Figure 32: Rest of Asia Pacific Cleanroom Equipment Market Value(US$ Mn) Share, By Country 2017-2031

Figure 33: Rest of Asia Pacific Cleanroom Equipment Market Incremental Opportunity (US$ Mn),By Country 2017-2031