Analysts’ Viewpoint on Market Scenario

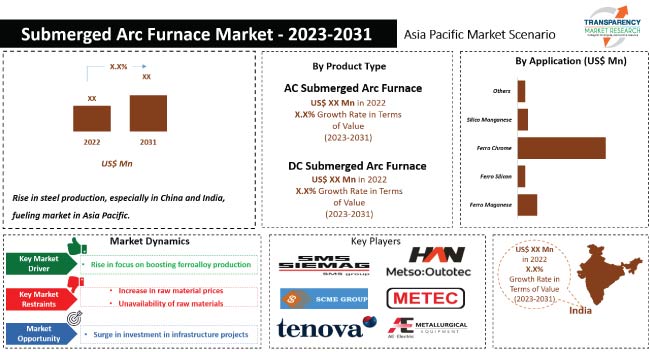

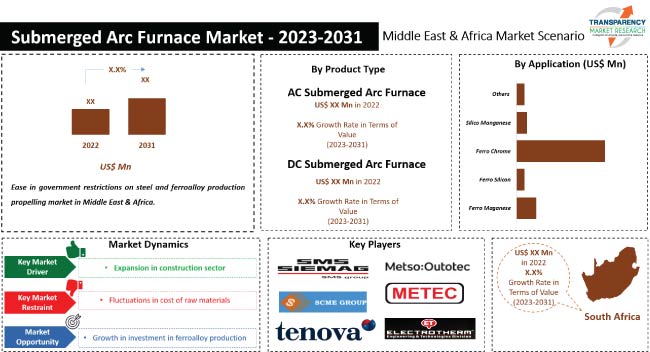

The Asia Pacific and Middle East & Africa submerged arc furnace market value is driven by rise in the production of steel, ferroalloys, silicon metal, and other non-ferrous metals. Growth in the urban population has led to significant investment in the construction sector. This is boosting the demand for steel and other construction materials.

Surge in emphasis on sustainable and energy-efficient production processes in the steel and metal industries is likely to fuel the demand for submerged arc furnaces in the near future. Submerged arc furnaces are capable of producing a wide range of ferroalloys, including ferro silicon, ferro manganese, and ferro chrome, which are essential in the steel and metal industries. Consequently, manufacturers are offering solutions that reduce energy consumption and emissions while maintaining high production levels to remain competitive in the industry.

Submerged arc furnaces use electrodes and a charge material to produce high temperatures and chemical reactions in a molten bath of metal or slag. Submerged arc furnace, or submerged electric arc furnace, is used to manufacture different types of ferroalloys and other commodities. Most of these furnaces are powered by alternate current (AC) and are employed in the steel and metal industries due to their reliability, efficiency, and versatility.

Direct current (DC) submerged arc furnaces use direct current instead of AC to generate heat and create a molten bath of metal or slag. DC furnaces have higher energy efficiency than AC furnaces due to the reduced power losses in the power supply system and better control of the arc. This leads to lower electricity consumption and reduced operating costs.

Submerged arc furnaces are commonly employed in the production of ferroalloys and specialty metals, which are essential components of steel production. Use of submerged arc furnaces in steel production offers numerous advantages, including higher energy efficiency, improved productivity, and better product quality. The global steelmaking capacity is projected to rise by 5.9% from 2023 to 2025. Thus, surge in steel production is estimated to spur the Asia Pacific and Middle East & Africa submerged arc furnace market growth in the near future.

Ferroalloys are essential components in the production of steel and other alloys. Demand for ferroalloys is increasing due to expansion in the steel industry and other end-use industries. Submerged arc furnaces are widely utilized in the production of ferroalloys due to their high energy efficiency, superior process control, and ability to handle a wide range of feed materials.

Therefore, stakeholders in the steel industry are enhancing ferroalloy production capabilities. This is projected to drive the Asia Pacific and Middle East & Africa submerged arc furnace market size in the next few years.

According to the latest Asia Pacific and Middle East & Africa submerged arc furnace market trends, the AC submerged arc furnace product type segment is anticipated to dominate the industry during the forecast period. AC submerged arc furnaces are widely employed in the production of ferroalloys. These furnaces are less expensive than their DC counterparts. They do not have any complicated rectification circuits and are relatively simple to operate. These advantages are augmenting the demand for AC submerged arc furnaces.

According to the latest Asia Pacific and Middle East & Africa submerged arc furnace market forecast, China is projected to hold major share from 2023 to 2031. Rise in the production of steel is fueling market dynamics in the country. China is one of the major producers of steel and ferroalloys worldwide.

The industry in India is estimated to grow at a significant pace in the near future. Increase in focus on boosting ferroalloy production and addressing the unavailability of raw materials is augmenting market statistics in the country. South Africa is poised to be a major growth engine of the industry in Middle East & Africa due to the abundance of mineral resources in the country.

The industry is fragmented and competitive due to the presence of several local and regional players including Electrotherm, Hani Tech, Metso Outotec, Eastern Metec Pvt. Ltd, Vaibh Metallurgical Solutions Private Limited, SCME Group, SMS Group, Tenova S.p.A., Xi'an Abundance Electric Technology Co., Ltd., and Shaanxi Heyuan Metallurgical Electromechanical Co., Ltd.

These vendors have been profiled in the Asia Pacific and Middle East & Africa submerged arc furnace market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments. Vendors are focusing on technological advancements in the industry to improve efficiency, reduce production costs, and enhance product quality. They are also expanding their operations to new regions to increase their Asia Pacific and Middle East & Africa submerged arc furnace market share.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 489.4 Mn |

|

Market Forecast Value in 2031 |

US$ 668.2 Mn |

|

Growth Rate (CAGR) |

3.4% |

|

Market Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Mn for Value |

|

Market Analysis |

Qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, Trade Analysis, SWOT analysis, etc. Furthermore, at the regional level and country level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The market was valued at US$ 489.4 Mn in 2022.

It is expected to reach US$ 668.2 Mn by the end of 2031.

It is estimated to grow at a CAGR of 3.4% from 2023 to 2031.

Increase in demand for steel and ferroalloys and rise in focus on boosting ferroalloy production.

The AC submerged arc furnace product type segment is expected to dominate the market from 2023 to 2031.

China and India are more attractive countries for vendors in the business.

Electrotherm, Hani Tech, Metso Outotec, Eastern Metec Pvt. Ltd, Vaibh Metallurgical Solutions Private Limited, SCME Group, SMS Group, Tenova S.p.A., Xi'an Abundance Electric Technology Co., Ltd., and Shaanxi Heyuan Metallurgical Electromechanical Co., Ltd.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Key Market Indicators

5.5. COVID-19 Impact Analysis

5.6. Trade Analysis

5.7. Standard and Regulations

5.8. Porter’s Five Forces Analysis

5.9. Industry SWOT Analysis

6. Asia Pacific Submerged Arc Furnace Market Analysis and Forecast

6.1. Regional Snapshot

6.2. Key Supplier Analysis

6.3. Key Trend Analysis

6.4. Price Trend Analysis

6.5. Submerged Arc Furnace Market Size (US$ Mn) Forecast, by Product Type, 2017 - 2031

6.5.1. AC Submerged Arc Furnace

6.5.2. DC Submerged Arc Furnace

6.6. Submerged Arc Furnace Market Size (US$ Mn) Forecast, by Application, 2017 - 2031

6.6.1. Ferro Chrome

6.6.2. Ferro Silicon

6.6.3. Ferro Manganese

6.6.4. Silico Manganese

6.6.5. Others

6.7. Submerged Arc Furnace Market Size (US$ Mn), by Country, 2017 - 2031

6.7.1. India

6.7.2. Southeast Asia

6.7.3. Rest of Asia Pacific

6.8. Incremental Opportunity Analysis

7. India Submerged Arc Furnace Market Analysis and Forecast

7.1. Country Snapshot

7.2. Key Supplier Analysis

7.3. Key Trend Analysis

7.4. Price Trend Analysis

7.4.1. Weighted Average Price

7.5. Submerged Arc Furnace Market Size (US$ Mn) Forecast, by Product Type, 2017 - 2031

7.5.1. AC Submerged Arc Furnace

7.5.2. DC Submerged Arc Furnace

7.6. Submerged Arc Furnace Market Size (US$ Mn) Forecast, by Application, 2017 - 2031

7.6.1. Ferro Chrome

7.6.2. Ferro Silicon

7.6.3. Ferro Manganese

7.6.4. Silico Manganese

7.6.5. Others

8. Middle East & Africa Submerged Arc Furnace Market Analysis and Forecast

8.1. Regional Snapshot

8.2. Key Supplier Analysis

8.3. Key Trend Analysis

8.4. Price Trend Analysis

8.5. Submerged Arc Furnace Market Size (US$ Mn) Forecast, by Product Type, 2017 - 2031

8.5.1. AC Submerged Arc Furnace

8.5.2. DC Submerged Arc Furnace

8.6. Submerged Arc Furnace Market Size (US$ Mn) Forecast, by Application, 2017 - 2031

8.6.1. Ferro Chrome

8.6.2. Ferro Silicon

8.6.3. Ferro Manganese

8.6.4. Silico Manganese

8.6.5. Others

8.7. Submerged Arc Furnace Market Size (US$ Mn) Forecast, by Country, 2017 – 2031

8.7.1. GCC

8.7.2. South Africa

8.7.3. North Africa

8.7.4. Rest of Middle East & Africa

8.8. Incremental Opportunity Analysis

9. Competition Landscape

9.1. Market Player – Competition Dashboard

9.2. Market Share Analysis (%)-2022

9.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Manufacturing Location, Revenue, Strategy & Business Process Overview)

9.3.1. Electrotherm

9.3.1.1. Company Overview

9.3.1.2. Sales Area/Geographical Presence

9.3.1.3. Manufacturing Location

9.3.1.4. Revenue

9.3.1.5. Strategy & Business Process Overview

9.3.2. HANI Metallurgy

9.3.2.1. Company Overview

9.3.2.2. Sales Area/Geographical Presence

9.3.2.3. Manufacturing Location

9.3.2.4. Revenue

9.3.2.5. Strategy & Business Process Overview

9.3.3. Metso Outotec

9.3.3.1. Company Overview

9.3.3.2. Sales Area/Geographical Presence

9.3.3.3. Manufacturing Location

9.3.3.4. Revenue

9.3.3.5. Strategy & Business Process Overview

9.3.4. Eastern Metec Pvt. Ltd.

9.3.4.1. Company Overview

9.3.4.2. Sales Area/Geographical Presence

9.3.4.3. Manufacturing Location

9.3.4.4. Revenue

9.3.4.5. Strategy & Business Process Overview

9.3.5. Vaibh Metallurgical Solutions Private Limited

9.3.5.1. Company Overview

9.3.5.2. Sales Area/Geographical Presence

9.3.5.3. Manufacturing Location

9.3.5.4. Revenue

9.3.5.5. Strategy & Business Process Overview

9.3.6. SCME Group

9.3.6.1. Company Overview

9.3.6.2. Sales Area/Geographical Presence

9.3.6.3. Manufacturing Location

9.3.6.4. Revenue

9.3.6.5. Strategy & Business Process Overview

9.3.7. SMS Group

9.3.7.1. Company Overview

9.3.7.2. Sales Area/Geographical Presence

9.3.7.3. Manufacturing Location

9.3.7.4. Revenue

9.3.7.5. Strategy & Business Process Overview

9.3.8. Tenova S.p.A.

9.3.8.1. Company Overview

9.3.8.2. Sales Area/Geographical Presence

9.3.8.3. Manufacturing Location

9.3.8.4. Revenue

9.3.8.5. Strategy & Business Process Overview

9.3.9. Xi'an Abundance Electric Technology Co., Ltd.

9.3.9.1. Company Overview

9.3.9.2. Sales Area/Geographical Presence

9.3.9.3. Manufacturing Location

9.3.9.4. Revenue

9.3.9.5. Strategy & Business Process Overview

9.3.10. Shaanxi Heyuan Metallurgical Electromechanical Co., Ltd.

9.3.10.1. Company Overview

9.3.10.2. Sales Area/Geographical Presence

9.3.10.3. Manufacturing Location

9.3.10.4. Revenue

9.3.10.5. Strategy & Business Process Overview

10. Key Takeaway

10.1. Identification of Potential Market Spaces

10.1.1. By Product Type

10.1.2. By Application

10.1.3. By Region

10.2. Understanding Procurement Process of End-users

10.3. Prevailing Market Risks

10.4. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Asia Pacific Submerged Arc Furnace Market, by Product Type, US$ Mn 2017-2031

Table 2: Asia Pacific Submerged Arc Furnace Market, by Application, US$ Mn 2017-2031

Table 3: Asia Pacific Submerged Arc Furnace Market, by Country, US$ Mn 2017-2031

Table 4: India Submerged Arc Furnace Market, by Product Type, US$ Mn 2017-2031

Table 5: India Submerged Arc Furnace Market, by Application, US$ Mn 2017-2031

Table 6: Middle East & Africa Submerged Arc Furnace Market, by Product Type, US$ Mn 2017-2031

Table 7: Middle East & Africa Submerged Arc Furnace Market, by Application, US$ Mn 2017-2031

Table 8: Middle East & Africa Submerged Arc Furnace Market, by Country, US$ Mn 2017-2031

List of Figures

Figure 1: Asia Pacific Submerged Arc Furnace Market Projections, by Product Type, US$ Mn 2017-2031

Figure 2: Asia Pacific Submerged Arc Furnace Market, Incremental Opportunity, by Product Type, US$ Mn 2023 -2031

Figure 3: Asia Pacific Submerged Arc Furnace Market Projections, by Application, US$ Mn 2017-2031

Figure 4: Asia Pacific Submerged Arc Furnace Market, Incremental Opportunity, by Application, US$ Mn 2023 -2031

Figure 5: Asia Pacific Submerged Arc Furnace Market Projections, by Country, US$ Mn 2017-2031

Figure 6: Asia Pacific Submerged Arc Furnace Market, Incremental Opportunity, by Country, US$ Mn 2023 -2031

Figure 7: India Submerged Arc Furnace Market Projections, by Product Type, US$ Mn 2017-2031

Figure 8: India Submerged Arc Furnace Market, Incremental Opportunity, by Product Type, US$ Mn 2023 -2031

Figure 9: India Submerged Arc Furnace Market Projections, by Application, US$ Mn 2017-2031

Figure 10: India Submerged Arc Furnace Market, Incremental Opportunity, by Application, US$ Mn 2023 -2031

Figure 11: Middle East & Africa Submerged Arc Furnace Market Projections, by Product Type, US$ Mn 2017-2031

Figure 12: Middle East & Africa Submerged Arc Furnace Market, Incremental Opportunity, by Product Type, US$ Mn 2023 -2031

Figure 13: Middle East & Africa Submerged Arc Furnace Market Projections, by Application, US$ Mn 2017-2031

Figure 14: Middle East & Africa Submerged Arc Furnace Market, Incremental Opportunity, by Application, US$ Mn 2023 -2031

Figure 15: Middle East & Africa Submerged Arc Furnace Market Projections, by Country, US$ Mn 2017-2031

Figure 16: Middle East & Africa Submerged Arc Furnace Market, Incremental Opportunity, by Country, US$ Mn 2023 -2031