A supply/demand imbalance has caused the Asia and Middle East FCC catalyst market to tumble during the coronavirus (COVID-19) era. Hence, refiners are adopting unique operating strategies as a response to the low demand environment. Since fluid catalytic cracking (FCC) catalyst is at the heart of most refinery configurations, refiners are playing out operating adjustments in order to respond to the supply/demand imbalance. In order to achieve this, manufacturers have lowered their FCC catalyst products charge rates to cope in low demand environments.

FCC catalyst manufacturers are practicing limited shutdown in plants as a response to the supply/demand imbalance. Their technical service teams are adopting the low-severity mode of operation in their FCCs to reduce gasoline. Likewise, manufacturers are pushing higher severity of FCC operations to overcrack gasoline in the form of lighter products. As such, undercutting is being used in both the solutions to minimize the production of gasoline.

These factors are expected to drive the Asia and Middle East FCC catalyst market.

The demand for FCC catalyst products is surging as refiners aim to deliver superior butylene over propylene selectivity in gas oil feedstock. For instance, in March 2020, BASF— a leading chemical producer company announced the launch of Fourtune™, an FCC catalyst, which delivers better economic performance through butylene selectivity, owing to the company’s Multiple Framework Topology (MFT) technology. Thus, companies in the Asia and Middle East FCC catalyst market are taking cues from world leaders in chemicals to innovate in FCC catalysts.

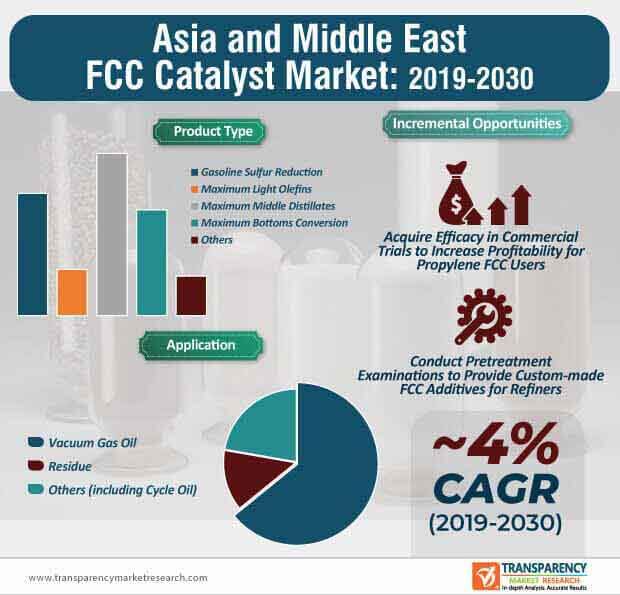

Superior butylene selectivity over propylene is important for achieving improved alkylate yield. Manufacturers in the Asia and Middle East FCC catalyst market are increasing their R&D capabilities to develop products that maintain superior catalyst activity and performance. They are conducting commercial trials to validate the efficacy of FCC catalysts that deploy high conversion and high distillate yields.

Companies in the Asia and Middle East FCC catalyst market are innovating in products that deploy superior propylene yields from resid or gas oil feedstocks. Such innovations are bolstering growth of the market, which is expected to reach a value of US$ 1.4 Bn by the end of 2027. New FCC products are enhancing the production of light olefins in processing units. Since refiners are focusing their shift toward petroleum feedstocks, manufacturers are increasing the availability of FCC catalysts that deliver superior propylene yields whilst maintaining the base catalyst performance.

The trend of conducting commercial trials is becoming increasingly commonplace in the Asia and Middle East FCC catalyst market. Companies are increasing the presence of zeolite active sites in propylene FCC additives, since refiners are increasingly shifting toward crude-to-chemical applications. They are committed to continuously innovate in propylene FCC additives that improve the refiner’s profitability.

Refiners are seeking more value from moderate and heavy metal applications with the help of the FCC catalyst. Hence, companies in the Asia and Middle East FCC catalyst market are deploying world class R&D and making processing advances in FCC additives. They are creating advanced matrix binding systems that deliver superior coke selectivity and bottoms cracking from a single particle. Processing of heavy feedstocks containing high contaminant metals is another key driver, which is triggering the demand for FCC catalysts.

With the help of new FCC additives, refiners can push operating constraints associated with high metal contamination and increase their volume gain. As such, manufacturers in the Asia and Middle East FCC catalyst market are increasing their product portfolio in FCC and hydroprocessing catalyst portfolios to serve specific needs of the refining industry.

Custom-designed catalyst systems are some of the strategies that manufacturers are using to maximize the profitability of refiners. Manufacturers in the Asia and Middle East FCC catalyst market are appointing dynamic teams that work closely with customers and access FCC units (FCCU) to develop custom-designed catalyst products. As teams assess specific constraints in FCC complexes, manufacturers provide tailored solutions to refiners. Companies are focusing on providing FCC pretreatment solutions that help to maximize the profitability of refiners.

Industry-leading FCC pretreatment catalyst solutions help to meet specific performance goals of refiners. These solutions deploy innovations in custom-designed FCC additives that lie within the constraint set by the refiners. Thus, companies in the Asia and Middle East FCC catalyst market are realizing that a thorough study of the refiner’s integrated FCC complexes in important before designing FCC catalyst products.

The Asia and Middle East FCC catalyst market is projected to advance at a modest CAGR of ~4% during the forecast period. This is evident since the optimal control systems in FCC units are insufficiently treated, which later affect catalytic cracking processes. Hence, manufacturers are increasing efforts to establish an optimal hierarchical control system that improves the efficiency of catalytic cracking processes. They are improving the mechanical design of the reactor and regenerator of FCC units to increase the efficiency of catalytic cracking processes.

FCC units play an instrumental role in the petroleum industry. Hence, companies in the Asia and Middle East FCC catalyst market are ensuring maximum safety and stability in FCC units that help to produce new catalyst additives. They are constantly monitoring the cracking gas compressors of FCCUs to increase the catalytic cracking processes efficiency.

Analysts’ Viewpoint

Effective strategies that help to reduce gasoline production amidst the COVID-19 pandemic include the use of ZSM-5-based additives in FCCs to yield propylene and butylene in order to respond to the supply/demand imbalance. Manufacturers are entering joint development agreements to address the challenges faced by refinery industries. As such, stringent performance constraints of refiners act as a hurdle for companies in the Asia and Middle East FCC catalyst market. Hence, manufacturers are gaining efficacy in industry-leading FCC pretreatment catalyst solutions to provide custom-design additives. They are making improvements in the mechanical designs of FCC units to maintain optimum efficiency in catalytic cracking processes.

Asia and Middle East FCC Catalyst Market: Overview

Expansion of Refinery Capacity to Drive Asia and Middle East FCC Catalyst Market

Rise in Demand for Synthetic Zeolites to Boost FCC Catalyst Market in Asia and Middle East

Asia and Middle East FCC Catalyst Market Outlook

Recent Developments, Expansions, Acquisitions, and New Contracts

Highly Competitive Asia and Middle East FCC Catalyst Market

1. Executive Summary

1.1. Market Outlook

1.2. Key Facts and Figures

1.3. Key Trends

1.4. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Market Indicators

3. Market Dynamics

3.1. Drivers and Restraints Snapshot Analysis

3.1.1.1. Drivers

3.1.1.2. Restraints

3.1.1.3. Opportunities

3.2. Porter’s Five Forces Analysis

3.2.1. Threat of Substitutes

3.2.2. Bargaining Power of Buyers

3.2.3. Bargaining Power of Suppliers

3.2.4. Threat of New Entrants

3.2.5. Degree of Competition

3.3. Regulatory Scenario

3.4. Value Chain Analysis

4. Asia and Middle East FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Mn) Analysis, by Product Type

4.1. Key Findings and Introduction

4.2. Asia and Middle East FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2018-2027

4.2.1. Asia and Middle East FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Gasoline Sulfur Reduction, 2018-2027

4.2.2. Asia and Middle East FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Maximum Light Olefins, 2018-2027

4.2.3. Asia and Middle East FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Maximum Middle Distillates, 2018-2027

4.2.4. Asia and Middle East FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Maximum Bottoms Conversion, 2018-2027

4.2.5. Asia and Middle East FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Others, 2018-2027

4.3. Asia and Middle East FCC Catalyst Market Attractiveness Analysis, by Product Type

5. Asia and Middle East FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Mn) Analysis, by Application

5.1. Key Findings and Introduction

5.2. Asia and Middle East FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018-2027

5.2.1. Asia and Middle East FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Vacuum Gas Oil, 2018-2027

5.2.2. Asia and Middle East FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Residue, 2018-2027

5.2.3. Asia and Middle East FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Others, 2018-2027

5.3. Asia and Middle East FCC Catalyst Market Attractiveness Analysis, by Application

6. Asia and Middle East FCC Catalyst Market Analysis, by Region

6.1. Key Findings

6.2. Asia and Middle East FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Region

6.2.1. Asia

6.2.2. Middle East

6.3. FCC Catalyst Market Attractiveness Analysis, by Region

7. Asia FCC Catalyst Market Overview

7.1. Key Findings

7.2. Asia FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2018-2027

7.3. Asia FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018-2027

7.4. Asia FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region

7.4.1. China FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2018-2027

7.4.2. China FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018-2027

7.4.3. India FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2018-2027

7.4.4. India FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018-2027

7.4.5. Japan FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2018-2027

7.4.6. Japan FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018-2027

7.4.7. South Korea FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2018-2027

7.4.8. South Korea FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018-2027

7.4.9. Malaysia FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2018-2027

7.4.10. Malaysia FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018-2027

7.4.11. Singapore FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2018-2027

7.4.12. Singapore FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018-2027

7.4.13. Rest of Asia FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2018-2027

7.4.14. Rest of Asia FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018-2027

7.5. Asia FCC Catalyst Market Attractiveness Analysis, by Product Type

7.6. Asia FCC Catalyst Market Attractiveness Analysis, by Application

7.7. Asia FCC Catalyst Market Attractiveness Analysis, by Country and Sub-region

8. Middle East FCC Catalyst Market Overview

8.1. Key Findings

8.2. Middle East FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2018-2027

8.3. Middle East FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018-2027

8.4. Middle East FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region

8.4.1. Saudi Arabia FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2018-2027

8.4.2. Saudi Arabia FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018-2027

8.4.3. Iran FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2018-2027

8.4.4. Iran FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018-2027

8.4.5. UAE FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2018-2027

8.4.6. UAE FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018-2027

8.4.7. Kuwait FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2018-2027

8.4.8. Kuwait FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018-2027

8.4.9. Rest of Middle East FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2018-2027

8.4.10. Rest of Middle East FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018-2027

8.5. Middle East FCC Catalyst Market Attractiveness Analysis, by Product Type

8.6. Middle East FCC Catalyst Market Attractiveness Analysis, by Application

8.7. Middle East FCC Catalyst Market Attractiveness Analysis, by Country and Sub-region

9. Competition Landscape

9.1. Competition Matrix

9.2. Asia and Middle East FCC Catalyst Market Share Analysis, by Company (2018)

9.3. Market Footprint Analysis

9.4. Company Profiles

9.4.1. W. R. Grace & Co.-Conn

9.4.1.1. Company Details

9.4.1.2. Company Description

9.4.1.3. Business Overview

9.4.1.4. Financial Details

9.4.1.5. Strategic Overview/Recent Developments

9.4.2. Albemarle Corporation

9.4.2.1. Company Details

9.4.2.2. Company Description

9.4.2.3. Business Overview

9.4.2.4. Financial Details

9.4.2.5. Strategic Overview/Recent Developments

9.4.3. BASF SE

9.4.3.1. Company Details

9.4.3.2. Company Description

9.4.3.3. Business Overview

9.4.3.4. Financial Details

9.4.3.5. Strategic Overview/Recent Developments

9.4.4. Haldor Topsoe A/S

9.4.4.1. Company Details

9.4.4.2. Company Description

9.4.4.3. Business Overview

9.4.4.4. Financial Details

9.4.4.5. Strategic Overview/Recent Developments

9.4.5. JGC Catalysts & Chemicals Co

9.4.5.1. Company Details

9.4.5.2. Company Description

9.4.5.3. Business Overview

9.4.5.4. Financial Details

9.4.5.5. Strategic Overview/Recent Developments

9.4.6. China Petroleum & Chemical Corporation

9.4.6.1. Company Details

9.4.6.2. Company Description

9.4.6.3. Business Overview

9.4.6.4. Financial Details

9.4.6.5. Strategic Overview/Recent Developments

9.4.7. Clariant International Ltd.,

9.4.7.1. Company Details

9.4.7.2. Company Description

9.4.7.3. Business Overview

9.4.7.4. Financial Details

9.4.7.5. Strategic Overview/Recent Developments

9.4.8. ReZel Catalysts

9.4.8.1. Company Details

9.4.8.2. Company Description

9.4.8.3. Business Overview

9.4.8.4. Financial Details

9.4.8.5. Strategic Overview/Recent Developments

9.4.9. Anten Chemical Co.,Ltd.

9.4.9.1. Company Details

9.4.9.2. Company Description

9.4.9.3. Business Overview

9.4.9.4. Financial Details

9.4.9.5. Strategic Overview/Recent Developments

9.4.10. SINOCATA

9.4.10.1. Company Details

9.4.10.2. Company Description

9.4.10.3. Business Overview

9.4.10.4. Financial Details

9.4.10.5. Strategic Overview/Recent Developments

9.4.11. Yueyang Sciensun Chemical Co., Ltd

9.4.11.1. Company Details

9.4.11.2. Company Description

9.4.11.3. Business Overview

9.4.11.4. Financial Details

9.4.11.5. Strategic Overview/Recent Developments

10. Primary Research – Key Insights

11. Appendix

11.1. Research Methodology and Assumptions

List of Tables

Table 01: Production Cost Analysis, FCC Catalyst Plant (2,000 Tons/year)

Table 02: Capital Investment Analysis, FCC Catalyst Plant

Table 03: Production Cost Analysis, FCC Catalyst Plant (2,000 Tons/year)

Table 04: Sensitivity Analysis for FCC Catalyst Plant

Table 05: Asia and Middle East FCC Catalysts Market Volume (Kilo Tons) Forecast, by Product Type, 2018–2027

Table 06: Asia and Middle East FCC Catalysts Market Value (US$ Mn) Forecast, by Product Type, 2018–2027

Table 07: Asia and Middle East FCC Catalysts Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 08: Asia and Middle East FCC Catalysts Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 09: Asia FCC Catalyst Market Volume (Kilo Tons) Forecast, by Product Type, 2018 –2027

Table 10: Asia FCC Catalyst Market Value (US$ Mn) Forecast, by Product Type, 2018–2027

Table 11: Asia FCC Catalyst Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 12: Asia FCC Catalyst Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 13: Asia FCC Catalyst Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2018–2027

Table 14: Asia FCC Catalyst Market Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

Table 15: China FCC Catalyst Market Volume (Kilo Tons) Forecast, by Product Type, 2018–2027

Table 16: China FCC Catalyst Market Value (US$ Mn) Forecast, by Product Type, 2018–2027

Table 17: China FCC Catalyst Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 18: China FCC Catalyst Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 19: India FCC Catalyst Market Volume (Kilo Tons) Forecast, by Product Type, 2018–2027

Table 20: India FCC Catalyst Market Value (US$ Mn) Forecast, by Product Type, 2018–2027

Table 21: India FCC Catalyst Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 22: India FCC Catalyst Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 23: Japan FCC Catalyst Market Volume (Kilo Tons) Forecast, by Product Type, 2018–2027

Table 24: Japan FCC Catalyst Market Value (US$ Mn) Forecast, by Product Type, 2018–2027

Table 25: Japan FCC Catalyst Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 26: Japan FCC Catalyst Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 27: South Korea FCC Catalyst Market Volume (Kilo Tons) Forecast, by Product Type, 2018–2027

Table 28: South Korea FCC Catalyst Market Value (US$ Mn) Forecast, by Product Type, 2018–2027

Table 29: South Korea FCC Catalyst Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 30: South Korea FCC Catalyst Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 31: Malaysia FCC Catalyst Market Volume (Kilo Tons) Forecast, by Product Type, 2018–2027

Table 32: Malaysia FCC Catalyst Market Value (US$ Mn) Forecast, by Product Type, 2018–2027

Table 33: Malaysia FCC Catalyst Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 34: Malaysia FCC Catalyst Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 35: Singapore FCC Catalyst Market Volume (Kilo Tons) Forecast, by Product Type, 2018–2027

Table 36: Singapore FCC Catalyst Market Value (US$ Mn) Forecast, by Product Type, 2018–2027

Table 37: Singapore FCC Catalyst Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 38: Singapore FCC Catalyst Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 39: Rest of Asia FCC Catalyst Market Volume (Kilo Tons) Forecast, by Product Type, 2018–2027

Table 40: Rest of Asia FCC Catalyst Market Value (US$ Mn) Forecast, by Product Type, 2018–2027

Table 41: Rest of Asia FCC Catalyst Market Volume (Kilo Tons) Forecast, by Application, 2018–2027

Table 42: Rest of Asia FCC Catalyst Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 43: Middle East FCC Catalyst Market Volume (Kilo Tons) Forecast, by Product Type, 2018-2027

Table 44: Middle East FCC Catalyst Market Value (US$ Mn) Forecast, by Product Type, 2018-2027

Table 45: Middle East FCC Catalyst Market Volume (Kilo Tons) Forecast, by Application, 2018-2027

Table 46: Middle East FCC Catalyst Market Value (US$ Mn) Forecast, by Application, 2018-2027

Table 47: Middle East FCC Catalyst Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2018-2027

Table 48: Middle East FCC Catalyst Market Value (US$ Mn) Forecast, by Country and Sub-region, 2018-2027

Table 49: Saudi Arabia FCC Catalyst Market Volume (Kilo Tons) Forecast, by Product Type, 2018-2027

Table 50: Saudi Arabia FCC Catalyst Market Value (US$ Mn) Forecast, by Product Type, 2018-2027

Table 51: Saudi Arabia FCC Catalyst Market Volume (Kilo Tons) Forecast, by Application, 2018-2027

Table 52: Saudi Arabia FCC Catalyst Market Value (US$ Mn) Forecast, by Application, 2018-2027

Table 53: Iran FCC Catalyst Market Volume (Kilo Tons) Forecast, by Product Type, 2018-2027

Table 54: Iran FCC Catalyst Market Value (US$ Mn) Forecast, by Product Type, 2018-2027

Table 55: Iran FCC Catalyst Market Volume (Kilo Tons) Forecast, by Application, 2018-2027

Table 56: Iran FCC Catalyst Market Value (US$ Mn) Forecast, by Application, 2018-2027

Table 57: UAE FCC Catalyst Market Volume (Kilo Tons) Forecast, by Product Type, 2018-2027

Table 58: UAE FCC Catalyst Market Value (US$ Mn) Forecast, by Product Type, 2018-2027

Table 59: UAE FCC Catalyst Market Volume (Kilo Tons) Forecast, by Application, 2018-2027

Table 60: UAE FCC Catalyst Market Value (US$ Mn) Forecast, by Application, 2018-2027

Table 61: Kuwait FCC Catalyst Market Volume (Kilo Tons) Forecast, by Product Type, 2018-2027

Table 62: Kuwait FCC Catalyst Market Value (US$ Mn) Forecast, by Product Type, 2018-2027

Table 63: Kuwait FCC Catalyst Market Volume (Kilo Tons) Forecast, by Application, 2018-2027

Table 64: Kuwait FCC Catalyst Market Value (US$ Mn) Forecast, by Application, 2018-2027

Table 65: Rest of Middle East FCC Catalyst Market Volume (Kilo Tons) Forecast, by Product Type, 2018-2027

Table 66: Rest of Middle East FCC Catalyst Market Value (US$ Mn) Forecast, by Product Type, 2018-2027

Table 67: Rest of Middle East FCC Catalyst Market Volume (Kilo Tons) Forecast, by Application, 2018-2027

Table 68: Rest of Middle East FCC Catalyst Market Value (US$ Mn) Forecast, by Application, 2018-2027

List of Figures

Figure 01: Pricing Analysis, 2018-2027

Figure 02: Historical Trend (Volume), 2013-2017

Figure 03: Historical Trend (Value), 2013-2017

Figure 05: Asia and Middle East FCC Catalysts Market Value Share Analysis, by Product Type, 2018 and 2027

Figure 06: Asia and Middle East FCC Catalysts Market Attractiveness Analysis, by Product Type

Figure 07: Asia and Middle East FCC Catalysts Market Value Share Analysis, by Application, 2018 and 2027

Figure 08: Asia and Middle East FCC Catalysts Market Attractiveness Analysis, by Application

Figure 09: Asia FCC Catalyst Market Value Share Analysis, by Product Type, 2018 and 2027

Figure 10: Asia FCC Catalyst Market Value Share Analysis, by Application, 2018 and 2027

Figure 11: Asia FCC Catalyst Market Value Share Analysis, by Country and Sub-region, 2018 and 2027

Figure 12: Asia FCC Catalyst Market Value Share Analysis, by Product Type, 2018

Figure 13: Asia FCC Catalyst Market Value Share Analysis, by Application, 2018

Figure 14: Asia FCC Catalyst Market Attractiveness Analysis, by Country and Sub-region

Figure 15: Middle East FCC Catalyst Market Value Share Analysis, by Product Type, 2018 and 2027

Figure 16: Middle East FCC Catalyst Market Value Share Analysis, by Application, 2018 and 2027

Figure 17: Middle East FCC Catalyst Market Value Share Analysis, by Country and Sub-region, 2018 and 2027

Figure 18: Middle East FCC Catalyst Market Value Share Analysis, by Product Type, 2018

Figure 19: Middle East FCC Catalyst Market Value Share Analysis, by Application, 2018

Figure 20: Middle East FCC Catalyst Market Attractiveness Analysis, by Country and Sub-region

Figure 21: Market Footprint Analysis, by Region

Figure 22: Global FCC Catalysts Market Share Analysis, by Company (2018)