Analysts’ Viewpoint on Aseptic Transfer System Market Scenario

“A shift toward smaller and flexible drug manufacturing production lines during the ongoing COVID-19 situation is predicted to keep the economies running. Increasing advancements in product innovations in pouch filling equipment by manufacturers are contributing to the growth of the global aseptic transfer system market. However, it is necessary to ensure a safe and sterile transfer of active pharmaceutical ingredients (APIs). In order to make sure a contaminant-free production line, market players should adopt measures such as thorough disinfection and no open-door interventions. Manufacturers are increasing their production capabilities in single use aseptic fitments and bag-in-box filling equipment to facilitate hygienic and non-invasive product transfer.”

The rising adoption of aseptic transfer system to ensure safety and contamination-free drug transfer during COVID-19 has created tremendous opportunities for the market players. Companies in the aseptic transfer system market are taking the advantage of the situation to increase the availability of products. Aseptic transfer system is a process of preventing the risk of contamination of different pharmaceutical component. There is a growing awareness about sterile and particle-free manufacture of pharmaceutical drugs. Companies in the aseptic transfer system market are fulfilling the rising demand for sterile biopharmaceutical products from consumers. Vaccines manufacturers are making use of aseptic transfer method for effective packaging of vaccines in order to prevent contamination.

The increasing prevalence of chronic diseases, along with rising patient population is contributing to market expansion. It is challenging manufacturers to design filling lines that require minimal human intervention. This has led to increased awareness about training and education for personnel and other operators in order to achieve a clear understanding of hygiene and gowning. Companies in the aseptic transfer system market are increasing their efforts to provide training to respective operators to identify the risks associated with the non-sterile products. The growth of the pharmaceutical industry, along with the rapid development in drug discovery & development propels the market.

Technological innovations in the liquid transfer systems are helping to bolster market growth. Key market contributors in the global aseptic transfer system market are increasing their product portfolio by providing sustainable and flexible packaging solutions. Market players are focusing on providing sterile packaging solutions for medical liquids. This has led to the popularity of flexible packaging solutions to keep non-invasive pharmaceutical liquids safe and sterile for controlled use in labs and medical facilities. Consistent efforts of manufacturers working in the global aseptic transfer system market to fulfill the surging demand from healthcare and pharmaceutical industries are driving the global market. Increased awareness about the sterilized packaging solutions in consumers is contributing to the global market growth.

Ongoing research & development activities in aseptic transfer systems are fueling market growth. There is an increasing demand for an efficient and reliable transfer of powdered products. Companies in the aseptic transfer system market are investing in skilled workers who are proficient in aseptic powder handling. This is an important factor of drug development. Market contributors in the aseptic transfer system market are using barrier technologies such as restricted access barrier (RAB) systems and isolators to provide better levels of microbiological protection. Technological advancements in healthcare and pharmaceutical industries are also contributing to the growth of the global aseptic transfer system market. Manufacturers are focusing on finding out ways to prevent the harmful contamination during the drug development process.

|

Attribute |

Detail |

|

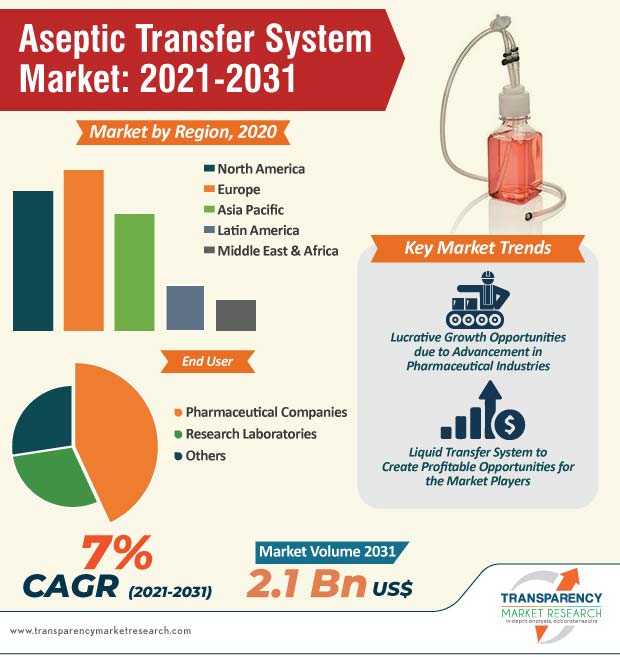

Market Size Value in 2020 |

US$ 0.97 Bn |

|

Market Forecast Value in 2031 |

US$ 2.1 Bn |

|

Growth Rate (CAGR) |

7% |

|

Forecast Period |

2021–2031 |

|

Historical Data Available for |

2017–2019 |

|

Quantitative Units |

US$ Mn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

Aseptic transfer system market is expected to cross the value of US$ 2.1 Bn by the end of 2031

Aseptic transfer system market is estimated to expand at a CAGR of 7% from 2021 to 2031

Aseptic transfer system market is driven by increasing demand for sterile pharmaceutical products

The end-use segments in aseptic transfer system market are hospitals and diagnostic laboratories

Key players operating in the global aseptic Transfer System market include ABC Transfer SAS, Aseptic Technologies, Atec Pharmatechnik GmbH, Cape Europe AE Ltd, Castus GmbH & Co. KG

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Aseptic Transfer System Market

4. Market Overview

4.1. Introduction

4.1.1. Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Aseptic Transfer System Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

4.4.2. Market Volume/Unit Shipments Projections

5. Key Insights

5.1. Key Industry Events

5.2. COVID-19 Pandemic Impact on Industry (value chain and short / mid /long term impact)

5.3. Technological Advancement

5.4. List of Distributors

5.5. Role of Aseptic Transfer System

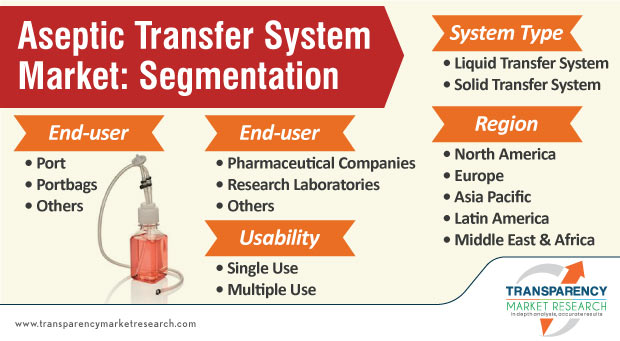

6. Global Aseptic Transfer System Market Analysis and Forecast, by System Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by System Type, 2017–2031

6.3.1. Liquid Transfer System

6.3.2. Solid Transfer System

6.4. Market Attractiveness Analysis, by System Type

7. Global Aseptic Transfer System Market Analysis and Forecast, by Usability

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Usability, 2017–2031

7.3.1. Single Use

7.3.2. Multiple Use

7.4. Market Attractiveness Analysis, by Usability

8. Global Aseptic Transfer System Market Analysis and Forecast, by Transfer Type

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value & Volume Forecast, by Transfer Type, 2017–2031

8.3.1. Port

8.3.2. Portbags

8.3.3. Others

8.4. Market Attractiveness Analysis, by Transfer Type

9. Global Aseptic Transfer System Market Analysis and Forecast, by End-user

9.1. Introduction & Definition

9.2. Key Findings / Developments

9.3. Market Value Forecast, by End-user, 2017–2031

9.3.1. Pharmaceutical Companies

9.3.2. Research Laboratories

9.3.3. Others

9.4. Market Attractiveness Analysis, by End-user

10. Global Aseptic Transfer System Market Analysis and Forecast, by Region

10.1. Key Findings

10.2. Market Value Forecast, by Region

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Market Attractiveness Analysis, by Country/Region

11. North America Aseptic Transfer System Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by System Type, 2017–2031

11.2.1. Liquid Transfer System

11.2.2. Solid Transfer System

11.3. Market Value Forecast, by Usability, 2017–2031

11.3.1. Single Use

11.3.2. Multiple Use

11.4. Market Value & Volume Forecast, by Transfer Type, 2017–2031

11.4.1. Port

11.4.2. Portbags

11.4.3. Others

11.5. Market Value Forecast, by End-user, 2017–2031

11.5.1. Pharmaceutical Companies

11.5.2. Research Laboratories

11.5.3. Others

11.6. Market Value Forecast, by Country, 2017–2031

11.6.1. U.S.

11.6.2. Canada

11.7. Market Attractiveness Analysis

11.7.1. By System Type

11.7.2. By Usability

11.7.3. By Transfer Type

11.7.4. By End-user

11.7.5. By Country

12. Europe Aseptic Transfer System Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by System Type, 2017–2031

12.2.1. Liquid Transfer System

12.2.2. Solid Transfer System

12.3. Market Value Forecast, by Usability, 2017–2031

12.3.1. Single Use

12.3.2. Multiple Use

12.4. Market Value & Volume Forecast, by Transfer Type, 2017–2031

12.4.1. Port

12.4.2. Portbags

12.4.3. Others

12.5. Market Value Forecast, by End-user, 2017–2031

12.5.1. Pharmaceutical Companies

12.5.2. Research Laboratories

12.5.3. Others

12.6. Market Value Forecast, by Country/Sub-region, 2017–2031

12.6.1. Germany

12.6.2. U.K.

12.6.3. France

12.6.4. Italy

12.6.5. Spain

12.6.6. Rest of Europe

12.7. Market Attractiveness Analysis

12.7.1. By System Type

12.7.2. By Usability

12.7.3. By Transfer Type

12.7.4. By End-user

12.7.5. By Country/Sub-region

13. Asia Pacific Aseptic Transfer System Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by System Type, 2017–2031

13.2.1. Liquid Transfer System

13.2.2. Solid Transfer System

13.3. Market Value Forecast, by Usability, 2017–2031

13.3.1. Single Use

13.3.2. Multiple Use

13.4. Market Value & Volume Forecast, by Transfer Type, 2017–2031

13.4.1. Port

13.4.2. Portbags

13.4.3. Others

13.5. Market Value Forecast, by End-user, 2017–2031

13.5.1. Pharmaceutical Companies

13.5.2. Research Laboratories

13.5.3. Others

13.6. Market Value Forecast, by Country/Sub-region, 2017–2031

13.6.1. Japan

13.6.2. China

13.6.3. India

13.6.4. Australia & New Zealand

13.6.5. Rest of Asia Pacific

13.7. Market Attractiveness Analysis

13.7.1. By System Type

13.7.2. By Usability

13.7.3. By Transfer Type

13.7.4. By End-user

13.7.5. By Country/Sub-region

14. Latin America Aseptic Transfer System Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by System Type, 2017–2031

14.2.1. Liquid Transfer System

14.2.2. Solid Transfer System

14.3. Market Value Forecast, by Usability, 2017–2031

14.3.1. Single Use

14.3.2. Multiple Use

14.4. Market Value & Volume Forecast, by Transfer Type, 2017–2031

14.4.1. Port

14.4.2. Portbags

14.4.3. Others

14.5. Market Value Forecast, by End-user, 2017–2031

14.5.1. Pharmaceutical Companies

14.5.2. Research Laboratories

14.5.3. Others

14.6. Market Value Forecast, by Country/Sub-region, 2017–2031

14.6.1. Brazil

14.6.2. Mexico

14.6.3. Rest of Latin America

14.7. Market Attractiveness Analysis

14.7.1. By System Type

14.7.2. By Usability

14.7.3. By Transfer Type

14.7.4. By End-user

14.7.5. By Country/Sub-region

15. Middle East & Africa Aseptic Transfer System Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast, by System Type, 2017–2031

15.2.1. Liquid Transfer System

15.2.2. Solid Transfer System

15.3. Market Value Forecast, by Usability, 2017–2031

15.3.1. Single Use

15.3.2. Multiple Use

15.4. Market Value & Volume Forecast, by Transfer Type, 2017–2031

15.4.1. Port

15.4.2. Portbags

15.4.3. Others

15.5. Market Value Forecast, by End-user, 2017–2031

15.5.1. Pharmaceutical Companies

15.5.2. Research Laboratories

15.5.3. Others

15.6. Market Value Forecast, by Country/Sub-region, 2017–2031

15.6.1. GCC Countries

15.6.2. South Africa

15.6.3. Rest of Middle East & Africa

15.7. Market Attractiveness Analysis

15.7.1. By System Type

15.7.2. By Usability

15.7.3. By Transfer Type

15.7.4. By End-user

15.7.5. By Country/Sub-region

16. Competition Landscape

16.1. Market Player - Competition Matrix (By Tier and Size of companies)

16.2. Market Share Analysis By Company (2020)

16.3. Company Profiles

16.3.1. ABC Transfer SAS

16.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.1.2. Product Portfolio

16.3.1.3. SWOT Analysis

16.3.1.4. Strategic Overview

16.3.2. Aseptic Technologies

16.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.2.2. Product Portfolio

16.3.2.3. SWOT Analysis

16.3.2.4. Strategic Overview

16.3.3. Atec Pharmatechnik GmbH.

16.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.3.2. Product Portfolio

16.3.3.3. SWOT Analysis

16.3.3.4. Strategic Overview

16.3.4. Cape Europe AE Ltd

16.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.4.2. Product Portfolio

16.3.4.3. SWOT Analysis

16.3.4.4. Strategic Overview

16.3.5. Castus GmbH & Co. KG

16.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.5.2. Product Portfolio

16.3.5.3. SWOT Analysis

16.3.5.4. Strategic Overview

16.3.6. Central Research Laboratories

16.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.6.2. Product Portfolio

16.3.6.3. SWOT Analysis

16.3.6.4. Strategic Overview

16.3.7. Getinge AB

16.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.7.2. Product Portfolio

16.3.7.3. SWOT Analysis

16.3.7.4. Strategic Overview

16.3.8. JCE BIOTECHNOLOGY

16.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.8.2. Product Portfolio

16.3.8.3. SWOT Analysis

16.3.8.4. Strategic Overview

16.3.9. Sartorius AG

16.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.9.2. Product Portfolio

16.3.9.3. SWOT Analysis

16.3.9.4. Strategic Overview

16.3.10. STERIS plc

16.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.10.2. Product Portfolio

16.3.10.3. SWOT Analysis

16.3.10.4. Strategic Overview

List of Tables

Table 01: Global Aseptic Transfer System Market Value (US$ Mn) Forecast, by System Type, 2017–2031

Table 02: Global Aseptic Transfer System Market Value (US$ Mn) Forecast, by Usability, 2017–2031

Table 03: Global Aseptic Transfer System Market Value (US$ Mn) Forecast, by Transfer Type, 2017–2031

Table 04: Global Aseptic Transfer System Market Volume (No. of Units) Forecast, by Transfer Type, 2017–2031

Table 05: Global Aseptic Transfer System Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 06: Global Aseptic Transfer System Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 07: North America Aseptic Transfer System Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 08: North America Aseptic Transfer System Market Value (US$ Mn) Forecast, by System Type, 2017–2031

Table 09: North America Aseptic Transfer System Market Value (US$ Mn) Forecast, by Usability, 2017–2031

Table 10: North America Aseptic Transfer System Market Value (US$ Mn) Forecast, by Transfer Type, 2017–2031

Table 11: North America Aseptic Transfer System Market Volume (US$ Mn) Forecast, by Transfer Type, 2017–2031

Table 12: North America Aseptic Transfer System Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 13: Asia Pacific Aseptic Transfer System Market Value (US$ Mn) Forecast, by Country/Sub-Region, 2017–2031

Table 14: Asia Pacific Aseptic Transfer System Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 15: Asia Pacific Aseptic Transfer System Market Value (US$ Mn) Forecast, by Usability, 2017–2031

Table 16: Asia Pacific Aseptic Transfer System Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 17: Latin America Aseptic Transfer System Market Value (US$ Mn) Forecast, by Country/Sub-Region, 2017–2031

List of Figures

Figure 01: Global Aseptic Transfer System Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Aseptic Transfer System Market Value Share, by System Type, 2020

Figure 03: Global Aseptic Transfer System Market Value Share, by Usability, 2020

Figure 04: Global Aseptic Transfer System Market Value Share, by Transfer Type, 2020

Figure 05: Global Aseptic Transfer System Market Value Share, by End-user, 2020

Figure 06: Global Aseptic Transfer System Market Value Share, by Region, 2020

Figure 07: Global Aseptic Transfer System Market Value Share Analysis, by System Type, 2020 and 2031

Figure 08: Global Aseptic Transfer System Market Attractiveness Analysis, by System Type, 2021–2031

Figure 09: Global Aseptic Transfer System Market Value (US$ Mn), by Liquid Transfer System, 2017–2031

Figure 10: Global Aseptic Transfer System Market Value (US$ Mn), by Solid Transfer System, 2017–2031

Figure 11: Global Aseptic Transfer System Market Value Share Analysis, by Usability, 2020 and 2031

Figure 12: Global Aseptic Transfer System Market Attractiveness Analysis, by Usability, 2021–2031

Figure 13: Global Aseptic Transfer System Market Value (US$ Mn), by Single Use, 2017–2031

Figure 14: Global Aseptic Transfer System Market Value (US$ Mn), by Multiple Use, 2017–2031

Figure 15: Global Aseptic Transfer System Market Value Share Analysis, by Transfer Type, 2020 and 2031

Figure 16: Global Aseptic Transfer System Market Attractiveness Analysis, by Transfer Type 2021–2031

Figure 17: Global Aseptic Transfer System Market Value (US$ Mn), by Port, 2017–2031

Figure 18: Global Aseptic Transfer System Market Value (US$ Mn), by Research Laboratories, 2017–2031

Figure 19: Global Aseptic Transfer System Market Value (US$ Mn), by Others, 2017–2031

Figure 20: Global Aseptic Transfer System Market Value Share Analysis, by End-user, 2020 and 2030

Figure 21: Global Aseptic Transfer System Market Attractiveness Analysis, by End-user, 2021–2031

Figure 22: Global Aseptic Transfer System Market Value (US$ Mn), by Pharmaceutical Companies, 2017–2031

Figure 23: Global Aseptic Transfer System Market Value (US$ Mn), by Research Laboratories, 2017–2031

Figure 24: Global Aseptic Transfer System Market Value (US$ Mn), by Others, 2017–2031

Figure 25: Global Aseptic Transfer System Market Attractiveness Analysis, by Region, 2020 and 2031

Figure 26: Global Aseptic Transfer System Market Value Share Analysis, by Region, 2021–2031

Figure 27: North America Aseptic Transfer System Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 28: North America Aseptic Transfer System Market Value Share Analysis, by Country, 2020 and 2031

Figure 29: North America Aseptic Transfer System Market Attractiveness Analysis, by Country, 2021–2031

Figure 30: North America Aseptic Transfer System Market Value Share Analysis, by System Type, 2020 and 2031

Figure 31: North America Aseptic Transfer System Market Attractiveness Analysis, by System Type, 2021–2031

Figure 32: North America Aseptic Transfer System Market Value Share Analysis, by Usability, 2020 and 2031

Figure 33: North America Aseptic Transfer System Market Attractiveness Analysis, by Usability, 2021–2031

Figure 34: North America Aseptic Transfer System Market Value Share Analysis, by Transfer Type, 2020 and 2031

Figure 35: North America Aseptic Transfer System Market Attractiveness Analysis, by Transfer Type, 2019–2031

Figure 36: North America Aseptic Transfer System Market Value Share Analysis, by End-user, 2020 and 2031

Figure 37: North America Aseptic Transfer System Market Attractiveness Analysis, by End-user, 2021–2031

Figure 38: Europe Aseptic Transfer System Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 39: Europe Aseptic Transfer System Market Value Share Analysis, by Country/Sub-region, 2020 and 2031

Figure 40: Europe Aseptic Transfer System Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 41: Europe Aseptic Transfer System Market Value Share Analysis, by System Type, 2020 and 2030

Figure 42: Europe Aseptic Transfer System Market Attractiveness Analysis, by System Type, 2021–2031

Figure 43: Europe Aseptic Transfer System Market Value Share Analysis, by Usability, 2020 and 2031

Figure 44: Europe Aseptic Transfer System Market Attractiveness Analysis, by Usability, 2021–2031

Figure 45: Europe Aseptic Transfer System Market Value Share Analysis, by Transfer Type, 2020 and 2031