Global Flexible Packaging Market: Snapshot

The global flexible packaging market is anticipated to showcase excellent growth during the forecast period owing to rising demand for innovative flexible packaging solutions across various end use industry verticals such as food and beverage, pharmaceutical, personal care, and cosmetics. Furthermore, development of the modern retailing sector, rapid adoption of e-commerce services among global population, particularly in developing economies, and rising consumer disposable income are also some of the major driving factors accelerating the growth of the global flexible packaging market in coming years. Furthermore, rising demand from various emerging economies, such as India and Brazil, is also expected to aid in the expansion of the global flexible packaging market in coming years.

The demand for daily staples as well as fresh food products rose tremendously during the COVID-19 pandemic and subsequent lockdowns. This resulted in the increased demand for the solutions in the global flexible packaging market. Furthermore, during the pandemic, pharmaceutical industry also contributed to the robust demand for innovative and safe solutions offered by the players and manufacturers in the global flexible packaging market. Rising demand for household essentials, medical goods, and healthcare products is also anticipated to foster the development trajectory of the global flexible packaging market in coming years. Moreover, increased demand for products in the global flexible packaging market for timely delivery of finished goods as well as raw materials is also expected to favor the industry growth in coming years.

Solutions in the global flexible packaging market require less energy for manufacturing, creates lesser greenhouse gas emissions, and utilizes fewer natural resources. This makes the products in the global flexible packaging market suitable for various end use industries. Furthermore, they also aid in prolonging the shelf life of various products, especially in the food and beverage industry. This, along with their cost effective nature are two of the major and key driving factors for the development of the global flexible packaging market during the forecast period. However, lack of proper infrastructure facilities for recycling the products in the global flexible packaging market made from plastic polymers may hinder the growth in the industry in coming years.

The use of flexible sheets and films in the packaging industry has been present for a substantial amount of time, but has seen commercial success only in the recent decades. Modern flexible packaging provide varying levels of flexibility while maintaining the highest level of durability possible, keeping their primary job of protecting the contents. These factors have strongly championed the use of flexible packaging in the ASEAN regions, where high population density, growing consumerism, increasing need for brand appeal, and the savings in size of package and space that they can achieve.

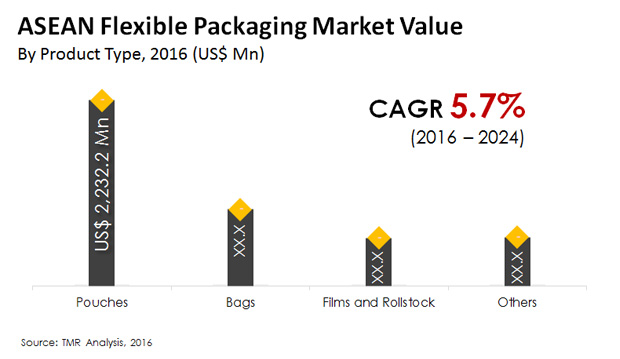

The ASEAN flexible packaging market is likely to show an optimistic CAGR of 5.7% within a forecast period from 2016 to 2024. It is expected to reach US$6.71 bn by the end of 2024, from its valuation of US$4.32 bn in 2015. The primary propellant for the market currently is the large scale consolidation efforts taken by the leading players in the market. The market also benefits substantially from factors such as economic advancements in the region, increasing rate of investments by multinational players, and dynamic characteristics of the population. Megatrends such as the flourishing modern retail industry and the increasing growth of food and beverages industries is also contributing to the growth of the ASEAN flexible packaging market. Food and beverages in the ASEAN region takes up a majority of the market for flexible packaging. Therefore, product development efforts initiated by manufacturers of flexible packaging in the ASEAN region are targeted towards key food and beverages clients.

Based on ASEAN nations, the flexible packaging market has been segmented into Indonesia, Thailand, Malaysia, Vietnam, Philippines, and Myanmar. Indonesia is currently estimated to constitute the leading share in the ASEAN flexible packaging market, with Thailand in second place. The markets in Philippines, Vietnam, and Myanmar are likely to show a relatively higher growth rate over the coming years. GDP growth and a rise in disposable income in the ASEAN region will play a key role in propelling the demand for flexible packaging over the coming years.

Over the coming years, the ASEAN flexible packaging market is forecast to swing from single layer packaging to multilayer variants. The latter segment can be divided further into two layers, three layers, five layers and seven layers. Five-layered flexible packaging and seven-layered flexible packaging are expected to take up the greater shares in the overall market for the given forecast period, with the market segment on the basis of layer types. However, the multi-layered packaging segment currently shows greater barriers to growth, such as high costs of manufacturing and overall reluctance of consumers to purchase the items with costlier packaging. The promotion of this segment as a highly hygienic and safe option for packaging of food products is likely to boost its demand over the coming years.

Based on products, the ASEAN flexible packaging market can be divided into pouches, bags, films and rollstocks, and other flexible packaging products. Pouches took up the leading share in the market in 2015, in terms of demand volume and growth rate. This segment is additionally expected to remain a highly attractive over the forecast period. The pouches segment is further divided into standup pouches, retort pouches, and vacuum pouches, among which standup and retort pouches are forecast to show a profitable future. The segment of bags is divided into wicketed bags and gusseted bags.

The leading players in the ASEAN flexible packaging market so far, have included Sonoco Products Company, Bemis Company, Inc., Amcor Limited, Constantia Flexibles GmbH, Mondi Group, Berry Plastics Group, Inc., and AR Packaging Group.

Rising Demand from Food and Beverage Sector will Boost ASEAN Flexible Packaging Market

The increasing adoption of advanced technologies with robust innovation and product development will help promote the growth of the ASEAN flexible packaging market in the coming years. Rising information on advantage and viability of bundling of the tidbits and refreshments with adaptable bundling is boosting interest for sacks, rollstocks, pockets, and movies. Besides, the market is likely to witness a significant growth in the coming years owing to the rising ramifications of the few guidelines for the protected bundling of food and refreshments.

The ASEAN flexible packaging materials market is classified on the basis of material type, layer type, product type, end use, and regions. The product type segment is further grouped into films and rollstocks, bags, and pouches. The increasing awareness about the benefits of beverage and snacks packaging is boosting the demand for rollstocks, films, and bags.

The adaptable bundling market is to a great extent recovering foothold owing to powerful improvement of the food and refreshments industry in the locale. Vigorous advancement of the items and prospering current retail industry in the ASEAN district are profiting the adaptable bundling market and is probably going to be a vital factor to drive market development in the coming years. Bundled and handled food industry in the ASEAN locale is blasting; in this manner, the vital participants in the adaptable bundling market are focusing in the business to help their deals.

From the local cutting edge, the adaptable bundling market in Indonesia saw appeal than different nations in the district. This is likely because of the high appropriation of adaptable bundling, for example, sacks, pockets, and movies in the area for spill-confirmation bundling of food and drinks. Also, the market in Thailand is remaining in the subsequent position. In any case, the market in Vietnam, Myanmar, and the Philippines are required to show the most rewarding developments.

Flexible Packaging Market is projected to reach US$6.71 bn by 2024

Flexible Packaging Market is expected to grow at a CAGR of 5.7% during 2016 - 2024

Flexible Packaging Market is studied from 2016 - 2024

Key vendors in the Flexible Packaging Market are Sonoco Products Company, Bemis Company, Inc., Amcor Limited, Constantia Flexibles GmbH, Mondi Group, Berry Plastics Group, Inc., and AR Packaging Group.

Asia Pacific region Takes Lead in the Flexible Packaging Market

1. Executive Summary: ASEAN Flexible Packaging Market

2. Research Methodology

3. Assumptions and Acronyms

4. Market Taxonomy

5. Market Dynamics

5.1 Drivers

5.2 Restraints

5.3 Opportunities

5.4 Trends

5.5 ASEAN Flexible Packaging Market: Value Chain

5.6 ASEAN Flexible Packaging Market – Value & Volume and Absolute $ Opportunity

6. ASEAN Flexible Packaging Market Analysis and Forecast, By Product Type

6.1. Introduction

6.1.1. Market share and Basis Points (BPS) Analysis by Product Type

6.1.2. Y-o-Y Growth Projections by Product Type

6.2. Market Size (US$ Mn) and Volume (Tons) Forecast, By Product Type

6.2.1. Pouches

6.2.1.1. Stand up pouches

6.2.1.2. Vacuum pouches & bags

6.2.1.3. Retort pouches

6.2.2. Bags

6.2.2.1. Gusseted bags

6.2.2.2. Wicketed bags

6.2.3. Films and Rollstocks

6.2.4. Others

6.3. Market Attractiveness Analysis by Product Type

7. ASAN Flexible Packaging Market Analysis and Forecast, By Layer Type

7.1. Introduction

7.1.1. Market share and Basis Points (BPS) Analysis by Layer Type

7.1.2. Y-o-Y Growth Projections by Layer Type

7.2. Market Size (US$ Mn) and Volume (Tons) Forecast, By Layer Type

7.2.1. Mono layer

7.2.2. Multi-layer

7.2.2.1. Two Layers

7.2.2.2. Three Layers

7.2.2.3. Five

7.2.2.4. Seven

7.2.2.5. Others

7.3. Market Attractiveness Analysis by Layer Type

8. ASEAN Flexible Packaging Market Analysis and Forecast, By Material Type

8.1. Introduction

8.1.1. Market share and Basis Points (BPS) Analysis by Material Type

8.1.2. Y-o-Y Growth Projections by Material Type

8.2. Market Value (US$ Mn) and Volume (Tons) Forecast By Material Type

8.2.1. Polyethylene (PE)

8.2.2. Polypropylene (PP)

8.2.2.1. BOPP

8.2.2.2. COPP

8.2.2.3. OOPP

8.2.3. Nylon

8.2.4. Polyethylene terephthalate (PET)

8.2.5. Polystyrene (PS)

8.2.6. Others

8.3. Market Attractiveness Analysis by Material Type

9. ASEAN Flexible Packaging Market Analysis and Forecast, By End Use

9.1. Introduction

9.1.1. Market share and Basis Points (BPS) Analysis by End Use

9.1.2. Y-o-Y Growth Projections by End Use

9.2. Market Size (US$ Mn) and Volume (Tons) Forecast By End Use

9.2.1. Food & Beverages

9.2.2. Pharmaceutical

9.2.3. Cosmetic & Personal care

9.2.4. Home care & Toiletries

9.2.5. Sports goods

9.2.6. Others

9.3. Market Attractiveness Analysis by End Use

10. ASEAN Flexible Packaging Market, Regional Analysis

10.1. Introduction & Section Summary

10.2. Market Share & Y-o-Y Growth Comparison

10.3. Market Value & Volume Forecast

10.3.1. Indonesia

10.3.2. Thailand

10.3.3. Malaysia

10.3.4. Philippines

10.3.5. Vietnam

10.3.6. Myanmar

10.4. ASEAN Flexible Packaging Market Attractiveness Analysis, Region Type

11. Competitive Landscape

11.1. Competition Dashboard

11.2. Company Market Share Analysis

11.3. Company Profiles

11.3.1. Amcor Limited

11.3.1.1. Overview

11.3.1.2. Financials

11.3.1.3. Strategy and SWOT

11.3.1.4. Recent Developments

11.3.2. Bemis Company

11.3.2.1. Overview

11.3.2.2. Financials

11.3.2.3. Strategy and SWOT

11.3.2.4. Recent Developments

11.3.3. Berry Plastics

11.3.3.1. Overview

11.3.3.2. Financials

11.3.3.3. Strategy and SWOT

11.3.3.4. Recent Developments

11.3.4. Mondi Group

11.3.4.1. Overview

11.3.4.2. Financials

11.3.4.3. Strategy and SWOT

11.3.4.4. Recent Developments

11.3.5. Sealed Air Corporation

11.3.5.1. Overview

11.3.5.2. Financials

11.3.5.3. Strategy and SWOT

11.3.5.4. Recent Developments

11.3.6. Sonoco Products Company

11.3.6.1. Overview

11.3.6.2. Financials

11.3.6.3. Strategy and SWOT

11.3.6.4. Recent Developments

11.3.7. Constantia Flexibles Gmbh

11.3.7.1. Overview

11.3.7.2. Financials

11.3.7.3. Strategy and SWOT

11.3.7.4. Recent Developments

11.3.8. AR Packaging Group

11.3.8.1. Overview

11.3.8.2. Financials

11.3.8.3. Strategy and SWOT

11.3.8.4. Recent Developments

List of Tables

Table 01: ASEAN Flexible Packaging Market Value (US$ Mn) and Volume (‘000 MT) Forecast, by Product Type 2016–2024

Table 02: ASEAN Flexible Packaging Market Value (US$ Mn) and Volume (‘000 MT) Forecast, by Layer Type 2016–2024

Table 03: ASEAN Flexible Packaging Market Value (US$ Mn) and Volume (‘000 MT), by Material Type 2016–2024

Table 04: ASEAN Flexible Packaging Market Value (US$ Mn) and Volume (‘000 MT) Forecast, by End Use 2016–2024

Table 05: ASEAN Flexible Packaging Market Value (US$ Mn) and Volume (‘000 MT) Forecast, by Region, 2015–2024

Table 06: Indonesia Flexible Packaging Market Value (US$ Mn) and Volume (‘000 MT) Forecast, By Product Type

Table 07: Indonesia Flexible Packaging Market Value (US$ Mn) and Volume (‘000 MT) Forecast, By Layer Type

Table 08: Indonesia Flexible Packaging Market Value (US$ Mn) and Volume (‘000 MT) Forecast, By Material Type

Table 09: Indonesia Flexible Packaging Market Value (US$ Mn) and Volume (‘000 MT) Forecast, By End Use

Table 10: Thailand Flexible Packaging Market Value (US$ Mn) and Volume (‘000 MT) Forecast, By Product Type

Table 11: Thailand Flexible Packaging Market Value (US$ Mn) and Volume (‘000 MT) Forecast, By Layer Type

Table 12: Thailand Flexible Packaging Market Value (US$ Mn) and Volume (‘000 MT) Forecast, By Material Type

Table 13: Thailand Flexible Packaging Market Value (US$ Mn) and Volume (‘000 MT) Forecast, By End Use

Table 14: Malaysia Flexible Packaging Market Value (US$ Mn) and Volume (‘000 MT) Forecast, By Product Type

Table 15: Malaysia Flexible Packaging Market Value (US$ Mn) and Volume (‘000 MT) Forecast, By Layer Type

Table 16: Malaysia Flexible Packaging Market Value (US$ Mn) and Volume (‘000 MT) Forecast, By Material Type

Table 17: Malaysia Flexible Packaging Market Value (US$ Mn) and Volume (‘000 MT) Forecast, By End Use

Table 18: Philippines Flexible Packaging Market Value (US$ Mn) and Volume (‘000 MT) Forecast, By Product Type

Table 19: Philippines Flexible Packaging Market Value (US$ Mn) and Volume (‘000 MT) Forecast, By Layer Type

Table 20: Philippines Flexible Packaging Market Value (US$ Mn) and Volume (‘000 MT) Forecast, By Material Type

Table 21: Philippines Flexible Packaging Market Value (US$ Mn) and Volume (‘000 MT) Forecast, By End Use

Table 22: Vietnam Flexible Packaging Market Value (US$ Mn) and Volume (‘000 MT) Forecast, By Product Type

Table 23: Vietnam Flexible Packaging Market Value (US$ Mn) and Volume (‘000 MT) Forecast, By Layer Type

Table 24: Vietnam Flexible Packaging Market Value (US$ Mn) and Volume (‘000 MT) Forecast, By Material Type

Table 25: Vietnam Flexible Packaging Market Value (US$ Mn) and Volume (‘000 MT) Forecast, By End Use

Table 26: Myanmar Flexible Packaging Market Value (US$ Mn) and Volume (‘000 MT) Forecast, By Product Type

Table 27: Myanmar Flexible Packaging Market Value (US$ Mn) and Volume (‘000 MT) Forecast, By Layer Type

Table 28: Myanmar Flexible Packaging Market Value (US$ Mn) and Volume (‘000 MT) Forecast, By Material Type

Table 29: Myanmar Flexible Packaging Market Value (US$ Mn) and Volume (‘000 MT) Forecast, By End Use

List of Figures

Figure 01: ASEAN Flexible Packaging Market Value (US$ Mn) and Volume (‘000 MT), 2015–2024

Figure 02: ASEAN Flexible Packaging Market Absolute $ Opportunity (US$ Mn), 2016?2024

Figure 03: ASEAN Flexible Packaging Market Share & BPS Analysis by Product Type, 2016 & 2024

Figure 04: ASEAN Flexible Packaging Market Revenue Y-o-Y Growth by Product Type, 2015–2024

Figure 05: ASEAN Flexible Packaging Market Value (US$ Mn) and Volume (‘000 MT), By Product Type – Pouches, 2015–2024

Figure 06: ASEAN Flexible Packaging Market Absolute $ Opportunity (US$ Mn), By Product Type – Pouches, 2016?2024

Figure 07: Market Value (US$ Mn) and Volume (‘000 MT), by Standup Pouches, 2015–2024

Figure 08: Absolute $ Opportunity by Standup Pouches, 2016–2024

Figure 09: Market Value (US$ Mn) and Volume (‘000 MT), by Vacuum Pouches, 2015–2024

Figure 10: Absolute $ Opportunity by Standup Pouches, 2016–2024

Figure 11: Market Value (US$ Mn) and Volume (‘000 MT), by Retort Pouches 2015–2024

Figure 12: Absolute $ Opportunity by Standup Pouches, 2016–2024

Figure 13: ASEAN Flexible Packaging Market Value (US$ Mn) and Volume (‘000 MT), By Product Type – Bags, 2015–2024

Figure 14: ASEAN Flexible Packaging Market Absolute $ Opportunity (US$ Mn), By Product Type – Bags, 2016?2024

Figure 15: Market Value (US$ Mn) and Volume (‘000 MT), by Gusseted Bags, 2015–2024

Figure 16: Absolute $ Opportunity by Gusseted Bags, 2016–2024

Figure 17: Market Value (US$ Mn) and Volume (‘000 MT), by Wicketed Bags, 2015–2024

Figure 18: Absolute $ Opportunity by Wicketed Bags, 2016–2024

Figure 19: : ASEAN Flexible Packaging Market Value (US$ Mn) and Volume (‘000 MT), By Product Type – Films and Rollstocks, 2015–2024

Figure 20: ASEAN Flexible Packaging Market Absolute $ Opportunity (US$ Mn), By Product Type – Films and Rollstocks, 2016?2024

Figure 21: ASEAN Flexible Packaging Market Value (US$ Mn) and Volume (‘000 MT), By Product Type – Others, 2015–2024

Figure 22: ASEAN Flexible Packaging Market Absolute $ Opportunity (US$ Mn), By Product Type – Others, 2016?2024

Figure 23: ASEAN Flexible Packaging Market Attractiveness by Product Type, 2016–2024

Figure 24: ASEAN Flexible Packaging Market Share & BPS Analysis by Layer Type, 2016 & 2024

Figure 25: ASEAN Flexible Packaging Market Revenue Y-o-Y Growth by Layer Type, 2015–2024

Figure 26: ASEAN Flexible Packaging Market Value (US$ Mn) and Volume (‘000 MT), By Layer Type Mono Layer, 2015–2024

Figure 27: ASEAN Flexible Packaging Market Absolute $ Opportunity (US$ Mn), By Layer Type Mono Layer, 2016?2024

Figure 28: ASEAN Flexible Packaging Market Value (US$ Mn) and Volume (‘000 MT), By Layer Type Multi-Layer, 2015–2024

Figure 29: ASEAN Flexible Packaging Market Absolute $ Opportunity (US$ Mn), By Layer Type Multi-Layer, 2016?2024

Figure 30: Market Value (US$ Mn) and Volume (‘000 MT), by Two Layers, 2015–2024

Figure 31: Absolute $ Opportunity by Two Layers, 2016–2024

Figure 32: Market Value (US$ Mn) and Volume (‘000 MT), by Three Layers, 2015–2024

Figure 33: Absolute $ Opportunity by Three Layers, 2016–2024

Figure 34: Market Value (US$ Mn) and Volume (‘000 MT), by Five Layers, 2015–2024

Figure 35: Absolute $ Opportunity by Five Layers, 2016–2024

Figure 36: Market Value (US$ Mn) and Volume (‘000 MT), by Seven Layers, 2015–2024

Figure 37: Absolute $ Opportunity by Seven Layers, 2016–2024

Figure 38: Market Value (US$ Mn) and Volume (‘000 MT), by Others Multi-Layer Type, 2015–2024

Figure 39: Absolute $ Opportunity by Others Multi-Layer Type, 2016–2024

Figure 40: ASEAN Flexible Packaging Market Attractiveness by Layer Type, 2016–2024

Figure 41: ASEAN Flexible Packaging Market Share & BPS Analysis by Material Type, 2016 & 2024

Figure 42: ASEAN Flexible Packaging Market Revenue Y-o-Y Growth by Material Type, 2015–2024

Figure 43: ASEAN Flexible Packaging Market Value (US$ Mn) and Volume (‘000 MT), By Material Type PE, 2015–2024

Figure 44: ASEAN Flexible Packaging Market Absolute $ Opportunity (US$ Mn), By Material Type PE, 2016?2024

Figure 45: ASEAN Flexible Packaging Market Value (US$ Mn) and Volume (‘000 MT), By Material Type PP, 2015–2024

Figure 46: ASEAN Flexible Packaging Market Absolute $ Opportunity (US$ Mn), By Material Type PP, 2016?2024

Figure 47: Market Value (US$ Mn) and Volume (‘000 MT), By Material Type BOPP, 2015–2024

Figure 48: Figure 39: Absolute $ Opportunity by Material Type BOPP, 2016–2024

Figure 49: Market Value (US$ Mn) and Volume (‘000 MT), By Material Type COPP, 2015–2024

Figure 50: Absolute $ Opportunity by Material Type COPP, 2016–2024

Figure 51: Market Value (US$ Mn) and Volume (‘000 MT), By Material Type OPP, 2015–2024

Figure 52: Absolute $ Opportunity by Material Type OPP, 2016–2024

Figure 53: ASEAN Flexible Packaging Market Value (US$ Mn) and Volume (‘000 MT), By Material Type Nylon, 2015–2024

Figure 54: ASEAN Flexible Packaging Market Absolute $ Opportunity (US$ Mn), By Material Type Nylon, 2016?2024

Figure 55: ASEAN Flexible Packaging Market Value (US$ Mn) and Volume (‘000 MT), By Material Type PET, 2015–2024

Figure 56: ASEAN Flexible Packaging Market Absolute $ Opportunity (US$ Mn), By Material Type PET, 2016?2024

Figure 57: ASEAN Flexible Packaging Market Value (US$ Mn) and Volume (‘000 MT), By Material Type Polystyrene, 2015–2024

Figure 58: ASEAN Flexible Packaging Market Absolute $ Opportunity (US$ Mn), By Material Type Polystyrene, 2016?2024

Figure 59: ASEAN Flexible Packaging Market Value (US$ Mn) and Volume (‘000 MT), By Material Type Others, 2015–2024

Figure 60: ASEAN Flexible Packaging Market Absolute $ Opportunity (US$ Mn), By Material Type Others, 2016?2024

Figure 61: ASEAN Flexible Packaging Market Attractiveness by Material Type, 2015–2024

Figure 62: ASEAN Flexible Packaging Market Share & BPS Analysis by End Use, 2016 & 2024

Figure 63: ASEAN Flexible Packaging Market Revenue Y-o-Y Growth by End Use, 2015–2024

Figure 64: ASEAN Flexible Packaging Market Value (US$ Mn) and Volume (‘000 MT), By End Use Food and Beverages, 2015–2024

Figure 65: ASEAN Flexible Packaging Market Absolute $ Opportunity (US$ Mn), By End Use Food and Beverages, 2016?2024

Figure 66: ASEAN Flexible Packaging Market Value (US$ Mn) and Volume (‘000 MT), By End Use Pharmaceuticals, 2015–2024

Figure 67: ASEAN Flexible Packaging Market Absolute $ Opportunity (US$ Mn), By End Use Pharmaceuticals, 2016?2024

Figure 68: ASEAN Flexible Packaging Market Value (US$ Mn) and Volume (‘000 MT), By End Use Cosmetics and Personal Care, 2015–2024

Figure 69: ASEAN Flexible Packaging Market Absolute $ Opportunity (US$ Mn), By End Use Cosmetics and Personal Care, 2016?2024

Figure 70: ASEAN Flexible Packaging Market Value (US$ Mn) and Volume (‘000 MT), By End Use Homecare and Toiletries, 2015–2024

Figure 71: ASEAN Flexible Packaging Market Absolute $ Opportunity (US$ Mn), By End Use Homecare and Toiletries, 2016?2024

Figure 72: ASEAN Flexible Packaging Market Value (US$ Mn) and Volume (‘000 MT), By End Use Sports Goods, 2015–2024

Figure 73: ASEAN Flexible Packaging Market Absolute $ Opportunity (US$ Mn), By End Use Sports Goods, 2016?2024

Figure 74: ASEAN Flexible Packaging Market Value (US$ Mn) and Volume (‘000 MT), By End Use Others, 2015–2024

Figure 75: ASEAN Flexible Packaging Market Absolute $ Opportunity (US$ Mn), By End Use Others, 2016?2024

Figure 76: ASEAN Flexible Packaging Market Attractiveness by End Use, 2015–2024

Figure 77: ASEAN Flexible Packaging Market Share & BPS Analysis by Region, 2016 & 2024

Figure 78: ASEAN Flexible Packaging Market Revenue Y-o-Y Growth by Region, 2015–2024

Figure 79: Indonesia Flexible Packaging Market – Value (US$ Mn), By Product Type, 2015-2024

Figure 80: Indonesia Flexible Packaging Market – Value (US$ Mn), By Layer Type, 2015-2024

Figure 81: Indonesia Flexible Packaging Market – Value (US$ Mn), By Material Type, 2015-2024

Figure 82: Indonesia Flexible Packaging Market – Value (US$ Mn), By End Use, 2015-2024

Figure 83: Thailand Flexible Packaging Market – Value (US$ Mn), By Product Type, 2015-2024

Figure 84: Thailand Flexible Packaging Market – Value (US$ Mn), By Layer Type, 2015-2024

Figure 85: Thailand Flexible Packaging Market – Value (US$ Mn), By Material Type, 2015-2024

Figure 86: Thailand Flexible Packaging Market – Value (US$ Mn), By End Use, 2015-2024

Figure 87: Malaysia Flexible Packaging Market – Value (US$ Mn), By Product Type, 2015-2024

Figure 88: Malaysia Flexible Packaging Market – Value (US$ Mn), By Layer Type, 2015-2024

Figure 89: Malaysia Flexible Packaging Market – Value (US$ Mn), By Material Type, 2015-2024

Figure 90: Malaysia Flexible Packaging Market – Value (US$ Mn), By End Use, 2015-2024

Figure 91: Philippines Flexible Packaging Market – Value (US$ Mn), By Product Type, 2015-2024

Figure 92: Philippines Flexible Packaging Market – Value (US$ Mn), By Layer Type, 2015-2024

Figure 93: Philippines Flexible Packaging Market – Value (US$ Mn), By Material Type, 2015-2024

Figure 94: Philippines Flexible Packaging Market – Value (US$ Mn), By End Use, 2015-2024

Figure 95: Vietnam Flexible Packaging Market – Value (US$ Mn), By Product Type, 2015-2024

Figure 96: Vietnam Flexible Packaging Market – Value (US$ Mn), By Layer Type, 2015-2024

Figure 97: Vietnam Flexible Packaging Market – Value (US$ Mn), By Material Type, 2015-2024

Figure 98: Vietnam Flexible Packaging Market – Value (US$ Mn), By End Use, 2015-2024

Figure 99: Myanmar Flexible Packaging Market – Value (US$ Mn), By Product Type, 2015-2024

Figure 100: Myanmar Flexible Packaging Market – Value (US$ Mn), By Layer Type, 2015-2024

Figure 101: Myanmar Flexible Packaging Market – Value (US$ Mn), By Material Type, 2015-2024

Figure 102: Myanmar Flexible Packaging Market – Value (US$ Mn), By End Use, 2015-2024

Figure 103: ASEAN Flexible Packaging Market Attractiveness by Region, 2016–2024

Figure 104: ASEAN Flexible Packaging Market, Market Share Analysis