Analyst Viewpoint

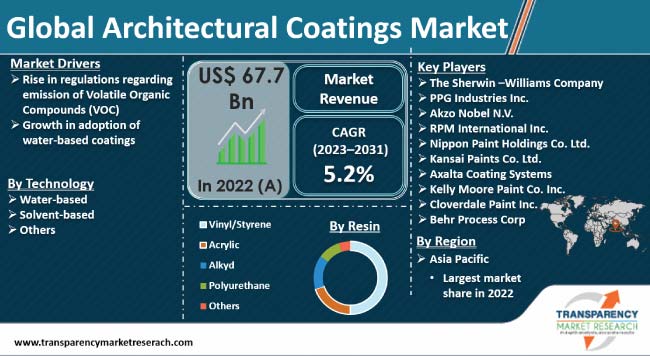

Rise in regulations regarding the emission of Volatile Organic Compounds (VOC) across the globe is a prominent factor that is driving the architectural coatings market value. Growth in adoption of water-based organic coatings is another factor augmenting market statistics. Surge in urbanization and rise in migration toward urban settlements are leading to a significant increase in construction activities for residential as well as commercial/industrial purposes. This is creating lucrative architectural coatings industry opportunities for companies operating in the sector.

Key manufacturers of architectural coatings are introducing specialized and sustainable coating solutions to expand their customer base. They are also investing in data-driven capabilities that simplify the formulation process and accelerate innovation in order to increase their architectural coatings market revenue.

Architectural coating is a type of coating that is prominently used in the building & construction sector. Architectural and industrial coatings are often employed for niche purposes such as roof coatings, wall paints, or deck finishes in the building & construction sector. These coatings are primarily used to provide ornamental, long-lasting, and protective functions.

Significant increase in the number of residential structures throughout the world, owing to the surge in population, is a prominent factor that is augmenting the worldwide architectural coatings market growth. Rapid urbanization, especially in developing countries, is boosting the demand for residential and commercial development. Governments of several countries are promoting schemes that provide affordable homes for citizens.

Rise in awareness regarding the need for environmental conservation has led to the introduction of eco-friendly architectural coatings. Safety requirements established by various governments are also providing further impetus to market expansion. Several countries have enacted stringent environmental laws to lower VOC emissions. As a result, the demand for water-based goods is rising across the globe.

Architectural coatings play a critical role in providing air barriers. They also ensure energy-efficient building enclosures. These beneficial qualities of architectural coatings are estimated to boost market dynamics.

Exterior architectural coatings must meet a variety of performance criteria. They are particularly designed to endure high moisture levels, while maintaining substrate adherence. They also offer excellent washing and stain resistance.

Various types of architectural coatings applied to the outside of structures tolerate recurrent environmental variations such as freeze/thaw cycles, rain resistance, and substrate dimensional instability.

Stringent laws, in tandem with growth in concerns about environmental sustainability, are leading to a significant increase in the usage of low-VOC architectural paints. Concerns regarding the usage of VOCs as well as consumer preference for ecologically responsible products are key factors that are bolstering the adoption of specialty architectural coatings.

Favorable certifications, such as LEED (Leadership in Energy and Environmental Design), generally mandate low- or zero-VOC paints, which contribute significantly to the rise in acceptance of low-VOC architectural coatings.

Implementation of green building standards, linked with good indoor air quality, has spread across numerous countries throughout the world. This is driving the usage of low-VOC architectural paints, thereby augmenting the growth of the architectural coatings industry.

Aside from their low-emission properties, low-VOC architectural coatings are especially sought after for their low-odor characteristics. As a result, smooth painting over inhabited rooms is possible with little or no disturbance to everyday operations.

Water-based paints account for more than 80% of residential paints sold in the U.S., according to the Paint Quality Institute, a paint consultancy and testing organization. Water-based architectural coatings are chosen over other forms of architectural coatings due to their eco-friendliness. These coatings are popular due to their sufficient adherence to North American and European regulations regarding acceptable levels of volatile organic compound (VOC) emissions.

Water-based architectural paints are less combustible due to their high water content. This eliminates the need for hazardous waste disposal. Architectural coatings based on solvents are petrochemical derivatives with strong curing qualities. However, the rate of volatile organic compound emission is significant in solvent-based technology. This is regarded as one of the key drawbacks of the solvent-based technology, which uses a high concentration of solid components distributed in organic solvents.

Operating in tight or poorly ventilated environments could make solvent evaporation uncomfortable or even dangerous to workers' health. As a result, many projects, such as those involving gasoline storage tanks and train tank wagons, employ water-based coatings. These coatings also help limit the concentration of combustible elements in an enclosed area. Thus, rise in adoption of water-based coatings is accelerating architectural coatings market demand.

As per architectural coatings market analysis, Asia Pacific accounted for significant share of the global landscape in 2022. China dominates the architectural coatings sector in the region owing to rapid urbanization in the country. Easy availability of resins, such as polyurethane and acrylic, and expansion in the furniture sector are prominent factors that are boosting market development in China.

According to the latest architectural coatings market research, Europe also commands key share of the global landscape. France, Italy, Spain, and the U.K hold large share of the architectural coatings industry in the region. Increase in adoption of architectural coatings in Europe can be ascribed to the rise in demand for specialized and eco-friendly coating solutions in the region.

In accordance with the recent architectural coatings market trends, companies operating in the sector are investing significantly in R&D operations to produce high-quality architectural coatings with unique compositions such as architectural metal coatings and architectural powder coatings.

Manufacturers of architectural coatings are also concentrating on organic growth strategies such as new launches and product approvals. Subsidiary acquisitions and partnerships are key examples of inorganic growth strategies adopted by the leading players.

The Sherwin-Williams Company, PPG Industries Inc., Akzo Nobel N.V., RPM International Inc., Nippon Paint Holdings Co. Ltd., Kansai Paints Co. Ltd., Axalta Coating Systems, Kelly Moore Paint Co. Inc., Cloverdale Paint Inc., and Behr Process Corp. are some of the prominent architectural coatings market manufacturers.

These players have been profiled in the architectural coatings market report based on parameters such as company overview, financial overview, business strategies, business segments, and product portfolio.

| Attribute | Detail |

|---|---|

| Market Value in 2022 (Base Year) | US$ 67.7 Bn |

| Market Forecast Value in 2031 | US$ 107.0 Bn |

| Growth Rate (CAGR) | 5.2% |

| Forecast Period | 2023 to 2031 |

| Historical Data Available for | 2021 |

| Quantitative Units | US$ Bn for Value and Tons for Volume |

| Market Analysis | Qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, and SWOT analysis. Furthermore, at the regional level, the qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

It was valued at US$ 67.7 Bn in 2022

It is likely to grow at a CAGR of 5.2% from 2023 to 2031

Rise in regulations regarding emission of Volatile Organic Compounds (VOC) and growth in demand for water-based coatings

The vinyl/styrene segment commands a bulk of the share

Asia Pacific was the leading region in 2022

The Sherwin-Williams Company, PPG Industries Inc., Akzo Nobel N.V., RPM International Inc., Nippon Paint Holdings Co. Ltd., Kansai Paints Co. Ltd., Axalta Coating Systems, Kelly Moore Paint Co. Inc., Cloverdale Paint Inc., and Behr Process Corp.

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Market Trends

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunities

2.4. Porter’s Five Forces Analysis

2.5. Regulatory Analysis

2.6. Value Chain Analysis

2.6.1. List of Raw Material Suppliers

2.6.2. List of Key Manufacturers

2.6.3. List of Suppliers/ Distributors

2.6.4. List of Potential Customers

2.7. Technology Specification Analysis

2.8. Overview of Manufacturing Process

2.9. Cost Structure Analysis

3. COVID-19 Impact Analysis

4. Production Output Analysis, 2022

5. Price Trend Analysis

6. Global Architectural Coatings Market Analysis and Forecast, by Resin, 2020–2031

6.1. Introduction and Definitions

6.2. Global Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

6.2.1. Vinyl/Styrene

6.2.2. Acrylic

6.2.3. Alkyd

6.2.4. Polyurethane

6.2.5. Others

6.3. Global Architectural Coatings Market Attractiveness, by Resin

7. Global Architectural Coatings Market Analysis and Forecast, by Technology, 2020–2031

7.1. Introduction and Definitions

7.2. Global Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

7.2.1. Water-based

7.2.2. Solvent-based

7.2.3. Others

7.3. Global Architectural Coatings Market Attractiveness, by Technology

8. Global Architectural Coatings Market Analysis and Forecast, by End-user, 2020–2031

8.1. Introduction and Definitions

8.2. Global Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

8.2.1. Residential

8.2.1.1. New Building

8.2.1.2. Reconstruction

8.2.2. Non-residential

8.2.2.1. New Building

8.2.2.2. Reconstruction

8.3. Global Architectural Coatings Market Attractiveness, by End-user

9. Global Architectural Coatings Market Analysis and Forecast, by Region, 2020–2031

9.1. Key Findings

9.2. Global Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Region, 2020–2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. Latin America

9.3. Global Architectural Coatings Market Attractiveness, by Region

10. North America Architectural Coatings Market Analysis and Forecast, 2020–2031

10.1. Key Findings

10.2. North America Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

10.3. North America Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

10.4. North America Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

10.5. North America Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Country, 2020–2031

10.5.1. U.S. Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

10.5.2. U.S. Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

10.5.3. U.S. Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

10.5.4. Canada Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

10.5.5. Canada Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

10.5.6. Canada Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

10.6. North America Architectural Coatings Market Attractiveness Analysis

11. Europe Architectural Coatings Market Analysis and Forecast, 2020–2031

11.1. Key Findings

11.2. Europe Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

11.3. Europe Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

11.4. Europe Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

11.5. Europe Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

11.5.1. Germany Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

11.5.2. Germany Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

11.5.3. Germany Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

11.5.4. France Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

11.5.5. France Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

11.5.6. France Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

11.5.7. U.K. Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

11.5.8. U.K. Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

11.5.9. U.K. Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

11.5.10. Italy Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

11.5.11. Italy. Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

11.5.12. Italy Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

11.5.13. Russia & CIS Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

11.5.14. Russia & CIS Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

11.5.15. Russia & CIS Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

11.5.16. Rest of Europe Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

11.5.17. Rest of Europe Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

11.5.18. Rest of Europe Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

11.6. Europe Architectural Coatings Market Attractiveness Analysis

12. Asia Pacific Architectural Coatings Market Analysis and Forecast, 2020–2031

12.1. Key Findings

12.2. Asia Pacific Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Resin

12.3. Asia Pacific Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

12.4. Asia Pacific Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

12.5. Asia Pacific Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

12.5.1. China Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

12.5.2. China Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

12.5.3. China Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

12.5.4. Japan Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

12.5.5. Japan Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

12.5.6. Japan Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

12.5.7. India Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

12.5.8. India Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

12.5.9. India Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

12.5.10. ASEAN Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

12.5.11. ASEAN Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

12.5.12. ASEAN Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

12.5.13. Rest of Asia Pacific Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

12.5.14. Rest of Asia Pacific Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

12.5.15. Rest of Asia Pacific Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

12.6. Asia Pacific Architectural Coatings Market Attractiveness Analysis

13. Latin America Architectural Coatings Market Analysis and Forecast, 2020–2031

13.1. Key Findings

13.2. Latin America Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

13.3. Latin America Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

13.4. Latin America Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

13.5. Latin America Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

13.5.1. Brazil Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

13.5.2. Brazil Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

13.5.3. Brazil Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

13.5.4. Mexico Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

13.5.5. Mexico Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

13.5.6. Mexico Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

13.5.7. Rest of Latin America Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

13.5.8. Rest of Latin America Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

13.5.9. Rest of Latin America Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

13.6. Latin America Architectural Coatings Market Attractiveness Analysis

14. Middle East & Africa Architectural Coatings Market Analysis and Forecast, 2020–2031

14.1. Key Findings

14.2. Middle East & Africa Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

14.3. Middle East & Africa Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

14.4. Middle East & Africa Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

14.5. Middle East & Africa Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

14.5.1. GCC Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

14.5.2. GCC Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

14.5.3. GCC Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

14.5.4. South Africa Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

14.5.5. South Africa Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

14.5.6. South Africa Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

14.5.7. Rest of Middle East & Africa Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

14.5.8. Rest of Middle East & Africa Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

14.5.9. Rest of Middle East & Africa Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

14.6. Middle East & Africa Architectural Coatings Market Attractiveness Analysis

15. Competition Landscape

15.1. Global Architectural Coatings Market Company Share Analysis, 2022

15.2. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

15.2.1. Akzo Nobel N.V.

15.2.1.1. Company Description

15.2.1.2. Business Overview

15.2.1.3. Financial Overview

15.2.1.4. Strategic Overview

15.2.2. Nippon Paint Holdings Co., Ltd.

15.2.2.1. Company Description

15.2.2.2. Business Overview

15.2.2.3. Financial Overview

15.2.2.4. Strategic Overview

15.2.3. PPG Industries, Inc.

15.2.3.1. Company Description

15.2.3.2. Business Overview

15.2.3.3. Financial Overview

15.2.3.4. Strategic Overview

15.2.4. The Sherwin-Williams Company

15.2.4.1. Company Description

15.2.4.2. Business Overview

15.2.4.3. Financial Overview

15.2.4.4. Strategic Overview

15.2.5. RPM International Inc.

15.2.5.1. Company Description

15.2.5.2. Business Overview

15.2.5.3. Financial Overview

15.2.5.4. Strategic Overview

15.2.6. Kansai Paints Co. Ltd.

15.2.6.1. Company Description

15.2.6.2. Business Overview

15.2.6.3. Financial Overview

15.2.6.4. Strategic Overview

15.2.7. Axalta Coating Systems

15.2.7.1. Company Description

15.2.7.2. Business Overview

15.2.7.3. Financial Overview

15.2.7.4. Strategic Overview

15.2.8. Kelly Moore Paint Co. Inc.

15.2.8.1. Company Description

15.2.8.2. Business Overview

15.2.8.3. Financial Overview

15.2.8.4. Strategic Overview

15.2.9. Cloverdale Paint Inc.

15.2.9.1. Company Description

15.2.9.2. Business Overview

15.2.9.3. Financial Overview

15.2.9.4. Strategic Overview

15.2.10. Behr Process Corp.

15.2.10.1. Company Description

15.2.10.2. Business Overview

15.2.10.3. Financial Overview

15.2.10.4. Strategic Overview

16. Primary Research: Key Insights

17. Appendix

List of Tables

Table 1: Global Architectural Coatings Market Forecast, by Resin, 2020–2031

Table 2: Global Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 3: Global Architectural Coatings Market Forecast, by Technology, 2020–2031

Table 4: Global Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

Table 5: Global Architectural Coatings Market Forecast, by End-user, 2020–2031

Table 6: Global Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 7: Global Architectural Coatings Market Forecast, by Region, 2020–2031

Table 8: Global Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Region, 2020–2031

Table 9: North America Architectural Coatings Market Forecast, by Resin, 2020–2031

Table 10: North America Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 11: North America Architectural Coatings Market Forecast, by Technology, 2020–2031

Table 12: North America Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

Table 13: North America Architectural Coatings Market Forecast, by End-user, 2020–2031

Table 14: North America Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 15: North America Architectural Coatings Market Forecast, by Country, 2020–2031

Table 16: North America Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Country, 2020–2031

Table 17: U.S. Architectural Coatings Market Forecast, by Resin, 2020–2031

Table 18: U.S. Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 19: U.S. Architectural Coatings Market Forecast, by Technology, 2020–2031

Table 20: U.S. Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

Table 21: U.S. Architectural Coatings Market Forecast, by End-user, 2020–2031

Table 22: U.S. Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 23: Canada Architectural Coatings Market Forecast, by Resin, 2020–2031

Table 24: Canada Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 25: Canada Architectural Coatings Market Forecast, by Technology, 2020–2031

Table 26: Canada Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

Table 27: Canada Architectural Coatings Market Forecast, by End-user, 2020–2031

Table 28: Canada Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 29: Europe Architectural Coatings Market Forecast, by Resin, 2020–2031

Table 30: Europe Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 31: Europe Architectural Coatings Market Forecast, by Technology, 2020–2031

Table 32: Europe Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

Table 33: Europe Architectural Coatings Market Forecast, by End-user, 2020–2031

Table 34: Europe Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 35: Europe Architectural Coatings Market Forecast, by Country and Sub-region, 2020–2031

Table 36: Europe Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 37: Germany Architectural Coatings Market Forecast, by Resin, 2020–2031

Table 38: Germany Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 39: Germany Architectural Coatings Market Forecast, by Technology, 2020–2031

Table 40: Germany Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

Table 41: Germany Architectural Coatings Market Forecast, by End-user, 2020–2031

Table 42: Germany Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 43: France Architectural Coatings Market Forecast, by Resin, 2020–2031

Table 44: France Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 45: France Architectural Coatings Market Forecast, by Technology, 2020–2031

Table 46: France Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

Table 47: France Architectural Coatings Market Forecast, by End-user, 2020–2031

Table 48: France Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 49: U.K. Architectural Coatings Market Forecast, by Resin, 2020–2031

Table 50: U.K. Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 51: U.K. Architectural Coatings Market Forecast, by Technology, 2020–2031

Table 52: U.K. Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

Table 53: U.K. Architectural Coatings Market Forecast, by End-user, 2020–2031

Table 54: U.K. Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 55: Italy Architectural Coatings Market Forecast, by Resin, 2020–2031

Table 56: Italy Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 57: Italy Architectural Coatings Market Forecast, by Technology, 2020–2031

Table 58: Italy Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

Table 59: Italy Architectural Coatings Market Forecast, by End-user, 2020–2031

Table 60: Italy Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 61: Spain Architectural Coatings Market Forecast, by Resin, 2020–2031

Table 62: Spain Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 63: Spain Architectural Coatings Market Forecast, by Technology, 2020–2031

Table 64: Spain Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

Table 65: Spain Architectural Coatings Market Forecast, by End-user, 2020–2031

Table 66: Spain Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 67: Russia & CIS Architectural Coatings Market Forecast, by Resin, 2020–2031

Table 68: Russia & CIS Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 69: Russia & CIS Architectural Coatings Market Forecast, by Technology, 2020–2031

Table 70: Russia & CIS Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

Table 71: Russia & CIS Architectural Coatings Market Forecast, by End-user, 2020–2031

Table 72: Russia & CIS Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 73: Rest of Europe Architectural Coatings Market Forecast, by Resin, 2020–2031

Table 74: Rest of Europe Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 75: Rest of Europe Architectural Coatings Market Forecast, by Technology, 2020–2031

Table 76: Rest of Europe Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

Table 77: Rest of Europe Architectural Coatings Market Forecast, by End-user, 2020–2031

Table 78: Rest of Europe Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 79: Asia Pacific Architectural Coatings Market Forecast, by Resin, 2020–2031

Table 80: Asia Pacific Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 81: Asia Pacific Architectural Coatings Market Forecast, by Technology, 2020–2031

Table 82: Asia Pacific Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

Table 83: Asia Pacific Architectural Coatings Market Forecast, by End-user, 2020–2031

Table 84: Asia Pacific Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 85: Asia Pacific Architectural Coatings Market Forecast, by Country and Sub-region, 2020–2031

Table 86: Asia Pacific Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 87: China Architectural Coatings Market Forecast, by Resin, 2020–2031

Table 88: China Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Resin 2020–2031

Table 89: China Architectural Coatings Market Forecast, by Technology, 2020–2031

Table 90: China Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

Table 91: China Architectural Coatings Market Forecast, by End-user, 2020–2031

Table 92: China Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 93: Japan Architectural Coatings Market Forecast, by Resin, 2020–2031

Table 94: Japan Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 95: Japan Architectural Coatings Market Forecast, by Technology, 2020–2031

Table 96: Japan Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

Table 97: Japan Architectural Coatings Market Forecast, by End-user, 2020–2031

Table 98: Japan Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 99: India Architectural Coatings Market Forecast, by Resin, 2020–2031

Table 100: India Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 101: India Architectural Coatings Market Forecast, by Technology, 2020–2031

Table 102: India Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

Table 103: India Architectural Coatings Market Forecast, by End-user, 2020–2031

Table 104: India Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 105: India Architectural Coatings Market Forecast, by End-user, 2020–2031

Table 106: India Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by End-user 2020–2031

Table 107: ASEAN Architectural Coatings Market Forecast, by Resin, 2020–2031

Table 108: ASEAN Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 109: ASEAN Architectural Coatings Market Forecast, by Technology, 2020–2031

Table 110: ASEAN Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

Table 111: ASEAN Architectural Coatings Market Forecast, by End-user, 2020–2031

Table 112: ASEAN Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 113: Rest of Asia Pacific Architectural Coatings Market Forecast, by Resin, 2020–2031

Table 114: Rest of Asia Pacific Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 115: Rest of Asia Pacific Architectural Coatings Market Forecast, by Technology, 2020–2031

Table 116: Rest of Asia Pacific Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

Table 117: Rest of Asia Pacific Architectural Coatings Market Forecast, by End-user, 2020–2031

Table 118: Rest of Asia Pacific Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 119: Latin America Architectural Coatings Market Forecast, by Resin, 2020–2031

Table 120: Latin America Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 121: Latin America Architectural Coatings Market Forecast, by Technology, 2020–2031

Table 122: Latin America Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

Table 123: Latin America Architectural Coatings Market Forecast, by End-user, 2020–2031

Table 124: Latin America Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 125: Latin America Architectural Coatings Market Forecast, by Country and Sub-region, 2020–2031

Table 126: Latin America Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 127: Brazil Architectural Coatings Market Forecast, by Resin, 2020–2031

Table 128: Brazil Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 129: Brazil Architectural Coatings Market Forecast, by Technology, 2020–2031

Table 130: Brazil Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

Table 131: Brazil Architectural Coatings Market Forecast, by End-user, 2020–2031

Table 132: Brazil Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 133: Mexico Architectural Coatings Market Forecast, by Resin, 2020–2031

Table 134: Mexico Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 135: Mexico Architectural Coatings Market Forecast, by Technology, 2020–2031

Table 136: Mexico Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

Table 137: Mexico Architectural Coatings Market Forecast, by End-user, 2020–2031

Table 138: Mexico Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 139: Rest of Latin America Architectural Coatings Market Forecast, by Resin, 2020–2031

Table 140: Rest of Latin America Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 141: Rest of Latin America Architectural Coatings Market Forecast, by Technology, 2020–2031

Table 142: Rest of Latin America Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

Table 143: Rest of Latin America Architectural Coatings Market Forecast, by End-user, 2020–2031

Table 144: Rest of Latin America Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 145: Middle East & Africa Architectural Coatings Market Forecast, by Resin, 2020–2031

Table 146: Middle East & Africa Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 147: Middle East & Africa Architectural Coatings Market Forecast, by Technology, 2020–2031

Table 148: Middle East & Africa Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

Table 149: Middle East & Africa Architectural Coatings Market Forecast, by End-user, 2020–2031

Table 150: Middle East & Africa Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 151: Middle East & Africa Architectural Coatings Market Forecast, by Country and Sub-region, 2020–2031

Table 152: Middle East & Africa Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 153: GCC Architectural Coatings Market Forecast, by Resin, 2020–2031

Table 154: GCC Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 155: GCC Architectural Coatings Market Forecast, by Technology, 2020–2031

Table 156: GCC Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

Table 157: GCC Architectural Coatings Market Forecast, by End-user, 2020–2031

Table 158: GCC Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 159: South Africa Architectural Coatings Market Forecast, by Resin, 2020–2031

Table 160: South Africa Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 161: South Africa Architectural Coatings Market Forecast, by Technology, 2020–2031

Table 162: South Africa Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

Table 163: South Africa Architectural Coatings Market Forecast, by End-user, 2020–2031

Table 164: South Africa Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 165: Rest of Middle East & Africa Architectural Coatings Market Forecast, by Resin, 2020–2031

Table 166: Rest of Middle East & Africa Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 167: Rest of Middle East & Africa Architectural Coatings Market Forecast, by Technology, 2020–2031

Table 168: Rest of Middle East & Africa Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

Table 169: Rest of Middle East & Africa Architectural Coatings Market Forecast, by End-user, 2020–2031

Table 170: Rest of Middle East & Africa Architectural Coatings Market Volume (Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

List of Figures

Figure 1: Global Architectural Coatings Market Volume Share Analysis, by Resin, 2022, 2025, and 2031

Figure 2: Global Architectural Coatings Market Attractiveness, by Resin

Figure 3: Global Architectural Coatings Market Volume Share Analysis, by Technology, 2022, 2025, and 2031

Figure 4: Global Architectural Coatings Market Attractiveness, by Technology

Figure 5: Global Architectural Coatings Market Volume Share Analysis, by End-user, 2022, 2025, and 2031

Figure 6: Global Architectural Coatings Market Attractiveness, by End-user

Figure 7: Global Architectural Coatings Market Volume Share Analysis, by Region, 2022, 2025, and 2031

Figure 8: Global Architectural Coatings Market Attractiveness, by Region

Figure 9: North America Architectural Coatings Market Volume Share Analysis, by Resin, 2022, 2025, and 2031

Figure 10: North America Architectural Coatings Market Attractiveness, by Resin

Figure 11: North America Architectural Coatings Market Volume Share Analysis, by Technology, 2022, 2025, and 2031

Figure 12: North America Architectural Coatings Market Attractiveness, by Technology

Figure 13: North America Architectural Coatings Market Volume Share Analysis, by End-user, 2022, 2025, and 2031

Figure 14: North America Architectural Coatings Market Attractiveness, by End-user

Figure 15: North America Architectural Coatings Market Volume Share Analysis, by Country, 2022, 2025, and 2031

Figure 16: North America Architectural Coatings Market Attractiveness, by Country

Figure 17: Europe Architectural Coatings Market Volume Share Analysis, by Resin, 2022, 2025, and 2031

Figure 18: Europe Architectural Coatings Market Attractiveness, by Resin

Figure 19: Europe Architectural Coatings Market Volume Share Analysis, by Technology, 2022, 2025, and 2031

Figure 20: Europe Architectural Coatings Market Attractiveness, by Technology

Figure 21: Europe Architectural Coatings Market Volume Share Analysis, by End-user, 2022, 2025, and 2031

Figure 22: Europe Architectural Coatings Market Attractiveness, by End-user

Figure 23: Europe Architectural Coatings Market Volume Share Analysis, by Country and Sub-region, 2022, 2025, and 2031

Figure 24: Europe Architectural Coatings Market Attractiveness, by Country and Sub-region

Figure 25: Asia Pacific Architectural Coatings Market Volume Share Analysis, by Resin, 2022, 2025, and 2031

Figure 26: Asia Pacific Architectural Coatings Market Attractiveness, by Resin

Figure 27: Asia Pacific Architectural Coatings Market Volume Share Analysis, by Technology, 2022, 2025, and 2031

Figure 28: Asia Pacific Architectural Coatings Market Attractiveness, by Technology

Figure 29: Asia Pacific Architectural Coatings Market Volume Share Analysis, by End-user, 2022, 2025, and 2031

Figure 30: Asia Pacific Architectural Coatings Market Attractiveness, by End-user

Figure 31: Asia Pacific Architectural Coatings Market Volume Share Analysis, by Country and Sub-region, 2022, 2025, and 2031

Figure 32: Asia Pacific Architectural Coatings Market Attractiveness, by Country and Sub-region

Figure 33: Latin America Architectural Coatings Market Volume Share Analysis, by Resin, 2022, 2025, and 2031

Figure 34: Latin America Architectural Coatings Market Attractiveness, by Resin

Figure 35: Latin America Architectural Coatings Market Volume Share Analysis, by Technology, 2022, 2025, and 2031

Figure 36: Latin America Architectural Coatings Market Attractiveness, by Technology

Figure 37: Latin America Architectural Coatings Market Volume Share Analysis, by End-user, 2022, 2025, and 2031

Figure 38: Latin America Architectural Coatings Market Attractiveness, by End-user

Figure 39: Latin America Architectural Coatings Market Volume Share Analysis, by Country and Sub-region, 2022, 2025, and 2031

Figure 40: Latin America Architectural Coatings Market Attractiveness, by Country and Sub-region

Figure 41: Middle East & Africa Architectural Coatings Market Volume Share Analysis, by Resin, 2022, 2025, and 2031

Figure 42: Middle East & Africa Architectural Coatings Market Attractiveness, by Resin

Figure 43: Middle East & Africa Architectural Coatings Market Volume Share Analysis, by Technology, 2022, 2025, and 2031

Figure 44: Middle East & Africa Architectural Coatings Market Attractiveness, by Technology

Figure 45: Middle East & Africa Architectural Coatings Market Volume Share Analysis, by End-user, 2022, 2025, and 2031

Figure 46: Middle East & Africa Architectural Coatings Market Attractiveness, by End-user

Figure 47: Middle East & Africa Architectural Coatings Market Volume Share Analysis, by Country and Sub-region, 2022, 2025, and 2031

Figure 48: Middle East & Africa Architectural Coatings Market Attractiveness, by Country and Sub-region