Analysts’ Viewpoint on Application Specific Integrated Circuit (ASIC) Market Scenario

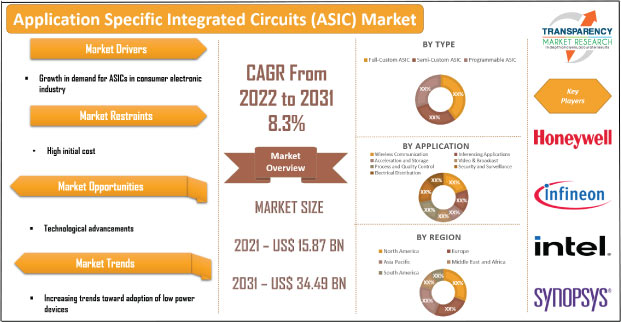

Manufacturers have been focusing on the current trends in the electronics sector, such as usage of advanced materials, development of low-power devices, organic electronics, and miniaturization, since the last few decades. Application specific integrated circuit (ASIC) has been gaining traction due to its flexible design, high speed, and requirement for low power. Companies in the application specific integrated circuit (ASIC) market are focusing on high-growth end-use industries such as aerospace, consumer electronics, and telecommunication to keep their businesses growing post the peak of the COVID-19 pandemic. The market is estimated to grow at a CAGR of 8.3% during the forecast period, owing to the rise in demand for application specific integrated circuit (ASIC) in the consumer electronics industry and increase in requirement for custom-made circuits.

Application specific integrated circuit (ASIC) is specially developed for a specific application or a particular industry. ASIC can enhance speed compared to a programmable logic device. It can also be made smaller and requires minimum energy or power. ASIC can provide better performance, higher voltage, minimize the footprint of materials, and enhance reliability. ASIC chip is used as IP (Intellectual Property) core for satellites and ROM (Read-only Memory) manufacturing. It is also used in a wide range of applications in the medical & research sector. Currently, Bitcoin mining is one of the emerging applications of ASIC.

The global application specific integrated circuit (ASIC) market is expected to grow significantly, owing to the rise in demand for application specific integrated circuit (ASIC) in several industries such as aerospace, industrial, automotive, and consumer electronics. Apart from product innovations in ASICs, semiconductor companies are diversifying their products and services in software defined networking, ASIC design services, and deep learning chipsets.

ASIC is extensively used in consumer electronics applications. It provides high bandwidth, which helps electronic devices operate efficiently for a longer time. Increase in adoption of advanced integrated circuits in smartphones, tablets, computers, and wearable devices is one of the significant factors that is estimated to drive the market in the next few years. ASIC is typically designed for a product with a large production run. It contains a significant portion of the electronics required on a single integrated circuit.

Demand for ASICs has been increasing since the last few decades due to their beneficial properties such as lower power consumption, higher integration, intellectual property protection, and higher functionality. Furthermore, rise in investment in development of advanced integrated circuits is boosting the application specific integrated circuit (ASIC) market.

ASICs can be highly cost-effective for many high-volume applications regardless of the cost of an ASIC design. It is possible to tailor the ASIC design to cater to the exact requirements of the product. Much of the overall design can be contained in one integrated circuit with the help of ASIC, thus reducing the number of additional components. Consequently, ASICs are widely used in high-volume products such as smartphones and business products.

ASICs are increasingly being used in various applications in aircraft such as cockpit lighting control that compensates for sunlight to night vision, onboard data handling protocols, and high-speed high accuracy accelerometer processing for inertial guidance. Thus, rise in usage of ASIC technology in aerospace applications is projected to propel the market during the forecast period.

The usage of field programmable gate array (FPGA) has some advantages for logic solutions in aerospace applications. It provides impressive performance capabilities, advanced IP-like microprocessors, and memory interfaces in programmable devices. It can make these programmable devices more attractive for aerospace applications. Furthermore, ASIC chips are used for aviation or maritime security identification to confirm that the bearer has passed the security check.

Some companies develop ASIC products especially for aerospace applications. For instance, Honeywell International Inc. offers radiation-hardened integrated circuits and technology for aerospace systems & electrical designers. This helps maximize performance, minimize risks, and ensure successful missions in space and other radiation-prone environments. Recently, the company developed custom application specific integrated circuits (ASICs) of up to 15M gates.

Favorable government regulations are boosting the adoption of advanced technologies, which is fueling the aerospace industry. In turn, this is propelling the demand for application specific integrated circuits. Furthermore, manufacturers are unlocking growth opportunities by increasing the production of military ASIC products.

In terms of type, the global application specific integrated circuit (ASIC) market has been segregated into full-custom ASIC, semi-custom ASIC, and programmable ASIC. The semi-custom ASIC segment has been further bifurcated into array based and cell based. The programmable ASIC segment has been further split into field-programmable gate array (FPGA) and programmable logic device (PLD). Semi-custom ASIC is projected to be the dominant segment of the market during the forecast period.

Semi-custom design is a substitute for full-custom design. All logic cells are predesigned and some mask layers are customized in semi-custom ASIC development. Predesigning logic cells can make semi-custom ASIC chip designing easier.

Various design methods have been developed to reduce the design time and cost of full-custom ASICs. These are called semi-custom ASIC designs. Generally, logic level is the lowest level of hierarchy incorporated in semi-custom designs. This is in contrast to a full-custom job, where the development and layout of the individual transistor might be involved.

In terms of application, the global application specific integrated circuit (ASIC) market has been classified into wireless communication, inferencing applications, acceleration and storage, video and broadcast, process and quality control, security and surveillance, and electrical distribution. Wireless communication is a rapidly expanding segment of the global application specific integrated circuit (ASIC) market due to the increase in adoption of 5G networks in developing countries and enactment of supportive government regulations & policies.

Custom ASICs verify the seamless integration of analog and digital subsystems in wired or wireless communications systems. Shrinking communication boards onto a single custom chip and integrating them as much as possible onto that chip provides superior noise performance, reduces front-end power consumption, and significantly minimizes variability in radio performance in volume production.

Some of the key players in the market provide ASIC products, especially for wireless communications. For instance, Alle rechten voorbehouden provides ASIC products for industrial, medical, wireless, and automotive communications.

In terms of value, the application specific integrated circuit (ASIC) market in Asia Pacific is projected to grow at a rapid pace during the forecast period. This can be primarily ascribed to the significantly high demand for application specific integrated circuits in the consumer electronic industry, which held major share of the market in Asia Pacific in terms of volume in 2021. China accounted for significant revenue share of the application specific integrated circuit (ASIC) market in Asia Pacific in the same year.

North America and Europe are also prominent markets for application specific integrated circuits (ASIC). These regions held large share of the global market in 2021. Increase in demand for application specific integrated circuits (ASIC) in automotive and aerospace industries is driving the market in North America.

Middle East & Africa is a larger market for application specific integrated circuits (ASIC) than Latin America. However, the market in Latin America is estimated to grow at a faster pace, as manufacturers in the region are strengthening output capacities in programmable ASIC products, analog integrated circuits (ICs), and power management integrated circuits, among others.

The global application specific integrated circuit (ASIC) market is consolidated, with a small number of large-scale vendors controlling majority of the share. Most of the firms are spending significantly on comprehensive research and development activities and new product development. Diversification of product portfolios and mergers & acquisitions are important strategies adopted by key players. Alle rechten voorbehouden, Honeywell International Inc., Infineon Technologies AG, Intel Corporation, Marvell, Maxim Integrated, OMNIVISION, Qualcomm Technologies, Inc., Renesas Electronics Corporation, Semiconductor Components Industries, LLC, STMicroelectronics, Synopsys, Inc., and TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION are the prominent entities operating in the market.

Each of these players has been profiled in the application specific integrated circuit (ASIC) market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 15.87 Bn |

|

Market Forecast Value in 2031 |

US$ 34.49 Bn |

|

Growth Rate (CAGR) |

8.3% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The Application Specific Integrated Circuit (ASIC) market stood at US$ 15.87 Bn in 2021.

The Application Specific Integrated Circuit (ASIC) market is expected to grow at a CAGR of 8.3% by 2031

The Application Specific Integrated Circuit (ASIC) market is likely to reach US$ 34.49 Bn in 2031

Prominent players operating in the Application Specific Integrated Circuit (ASIC) market include Alle rechten voorbehouden, Honeywell International Inc., Infineon Technologies AG, Intel Corporation, Marvell, Maxim Integrated, OMNIVISION, Qualcomm Technologies, Inc., Renesas Electronics Corporation, Semiconductor Components Industries, LLC, STMicroelectronics, Synopsys, Inc., and TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION

The U.S. accounted for approximately 26% share of the global Application Specific Integrated Circuit (ASIC) market in 2021

The semi-custom ASIC segment held around 35% share of the Application Specific Integrated Circuit (ASIC) market in 2021

Growth in adoption of energy-efficient devices is a prominent trend in the Application Specific Integrated Circuit (ASIC) market

North America is a more lucrative region of the Application Specific Integrated Circuit (ASIC) market

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Application Specific Integrated Circuit (ASIC) Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Global Microelectronics Industry Overview

4.2. Supply Chain Analysis

4.3. Technology Roadmap Analysis

4.4. Industry SWOT Analysis

4.5. Porter Five Forces Analysis

4.6. Covid-19 Impact and Recovery Analysis

5. Application Specific Integrated Circuit (ASIC) Market Analysis, by Type

5.1. Application Specific Integrated Circuit (ASIC) Market Value (US$ Mn) Analysis & Forecast, by Type, 2017–2031

5.1.1. Full-Custom ASIC

5.1.2. Semi-Custom ASIC

5.1.2.1. Array Based

5.1.2.2. Cell Based

5.1.3. Programmable ASIC

5.1.3.1. Field-Programmable Gate Array (FPGA)

5.1.3.2. Programmable Logic Device (PLD)

5.2. Market Attractiveness Analysis, by Type

6. Application Specific Integrated Circuit (ASIC) Market Analysis, by Application

6.1. Application Specific Integrated Circuit (ASIC) Market Value (US$ Mn) Analysis & Forecast, by Application, 2017–2031

6.1.1. Wireless Communication

6.1.2. Inferencing Applications

6.1.3. Acceleration and Storage

6.1.4. Video & Broadcast

6.1.5. Process and Quality Control

6.1.6. Security and Surveillance

6.1.7. Electrical Distribution

6.2. Market Attractiveness Analysis, by Application

7. Application Specific Integrated Circuit (ASIC) Market Analysis, by End-use Industry

7.1. Application Specific Integrated Circuit (ASIC) Market Value (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

7.1.1. IT & Telecommunication

7.1.2. Industrial

7.1.3. Media & Entertainment

7.1.4. Automotive

7.1.5. Healthcare

7.1.6. Aerospace

7.1.7. Consumer Electronics

7.1.8. Others (Power and Energy, Semiconductor, etc.)

7.2. Market Attractiveness Analysis, by End-use Industry

8. Application Specific Integrated Circuit (ASIC) Market Analysis and Forecast, by Region

8.1. Application Specific Integrated Circuit (ASIC) Market Value (US$ Mn) Analysis & Forecast, by Region, 2017–2031

8.1.1. North America

8.1.2. Europe

8.1.3. Asia Pacific

8.1.4. Middle East & Africa

8.1.5. South America

8.2. Market Attractiveness Analysis, by Region

9. North America Application Specific Integrated Circuit (ASIC) Market Analysis and Forecast

9.1. Market Snapshot

9.2. Drivers and Restraints: Impact Analysis

9.3. Application Specific Integrated Circuit (ASIC) Market Value (US$ Mn) Analysis & Forecast, by Type, 2017–2031

9.3.1. Full-Custom ASIC

9.3.2. Semi-Custom ASIC

9.3.2.1. Array Based

9.3.2.2. Cell Based

9.3.3. Programmable ASIC

9.3.3.1. Field-Programmable Gate Array (FPGA)

9.3.4. Programmable Logic Device (PLD)

9.4. Application Specific Integrated Circuit (ASIC) Market Value (US$ Mn) Analysis & Forecast, by Application, 2017–2031

9.4.1. Wireless Communication

9.4.2. Inferencing Applications

9.4.3. Acceleration and Storage

9.4.4. Video & Broadcast

9.4.5. Process and Quality Control

9.4.6. Security and Surveillance

9.4.7. Electrical Distribution

9.5. Application Specific Integrated Circuit (ASIC) Market Value (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

9.5.1. IT & Telecommunication

9.5.2. Industrial

9.5.3. Media & Entertainment

9.5.4. Automotive

9.5.5. Healthcare

9.5.6. Aerospace

9.5.7. Consumer Electronics

9.5.8. Others (Power and Energy, Semiconductor, etc.)

9.6. Application Specific Integrated Circuit (ASIC) Value (US$ Mn) Analysis & Forecast, by Country and Sub-region, 2017–2031

9.6.1. The U.S.

9.6.2. Canada

9.6.3. Rest of North America

9.7. Market Attractiveness Analysis

9.7.1. By Type

9.7.2. By Application

9.7.3. By End-use Industry

9.7.4. By Country & Sub-region

10. Europe Application Specific Integrated Circuit (ASIC) Market Analysis and Forecast

10.1. Market Snapshot

10.2. Drivers and Restraints: Impact Analysis

10.3. Application Specific Integrated Circuit (ASIC) Market Value (US$ Mn) Analysis & Forecast, by Type, 2017–2031

10.3.1. Full-Custom ASIC

10.3.2. Semi-Custom ASIC

10.3.2.1. Array Based

10.3.2.2. Cell Based

10.3.3. Programmable ASIC

10.3.3.1. Field-Programmable Gate Array (FPGA)

10.3.4. Programmable Logic Device (PLD)

10.4. Application Specific Integrated Circuit (ASIC) Market Value (US$ Mn) Analysis & Forecast, by Application, 2017–2031

10.4.1. Wireless Communication

10.4.2. Inferencing Applications

10.4.3. Acceleration and Storage

10.4.4. Video & Broadcast

10.4.5. Process and Quality Control

10.4.6. Security and Surveillance

10.4.7. Electrical Distribution

10.5. Application Specific Integrated Circuit (ASIC) Market Value (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

10.5.1. IT & Telecommunication

10.5.2. Industrial

10.5.3. Media & Entertainment

10.5.4. Automotive

10.5.5. Healthcare

10.5.6. Aerospace

10.5.7. Consumer Electronics

10.5.8. Others (Power and Energy, Semiconductor, etc.)

10.6. Application Specific Integrated Circuit (ASIC) Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

10.6.1. The U.K.

10.6.2. Germany

10.6.3. France

10.6.4. Rest of Europe

10.7. Market Attractiveness Analysis

10.7.1. By Type

10.7.2. By Application

10.7.3. By End-use Industry

10.7.4. By Country & Sub-region

11. Asia Pacific Application Specific Integrated Circuit (ASIC) Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. Application Specific Integrated Circuit (ASIC) Market Value (US$ Mn) Analysis & Forecast, by Type, 2017–2031

11.3.1. Full-Custom ASIC

11.3.2. Semi-Custom ASIC

11.3.2.1. Array Based

11.3.2.2. Cell Based

11.3.3. Programmable ASIC

11.3.3.1. Field-Programmable Gate Array (FPGA)

11.3.4. Programmable Logic Device (PLD)

11.4. Application Specific Integrated Circuit (ASIC) Market Value (US$ Mn) Analysis & Forecast, by Application, 2017–2031

11.4.1. Wireless Communication

11.4.2. Inferencing Applications

11.4.3. Acceleration and Storage

11.4.4. Video & Broadcast

11.4.5. Process and Quality Control

11.4.6. Security and Surveillance

11.4.7. Electrical Distribution

11.5. Application Specific Integrated Circuit (ASIC) Market Value (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

11.5.1. IT & Telecommunication

11.5.2. Industrial

11.5.3. Media & Entertainment

11.5.4. Automotive

11.5.5. Healthcare

11.5.6. Aerospace

11.5.7. Consumer Electronics

11.5.8. Others (Power and Energy, Semiconductor, etc.)

11.6. Application Specific Integrated Circuit (ASIC) Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

11.6.1. China

11.6.2. India

11.6.3. Japan

11.6.4. South Korea

11.6.5. ASEAN

11.6.6. Rest of Asia Pacific

11.7. Market Attractiveness Analysis

11.7.1. By Type

11.7.2. By Application

11.7.3. By End-use Industry

11.7.4. By Country & Sub-region

12. Middle East & Africa Application Specific Integrated Circuit (ASIC) Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. Application Specific Integrated Circuit (ASIC) Market Value (US$ Mn) Analysis & Forecast, by Type, 2017–2031

12.3.1. Full-Custom ASIC

12.3.2. Semi-Custom ASIC

12.3.2.1. Array Based

12.3.2.2. Cell Based

12.3.3. Programmable ASIC

12.3.3.1. Field-Programmable Gate Array (FPGA)

12.3.4. Programmable Logic Device (PLD)

12.4. Application Specific Integrated Circuit (ASIC) Market Value (US$ Mn) Analysis & Forecast, by Application, 2017–2031

12.4.1. Wireless Communication

12.4.2. Inferencing Applications

12.4.3. Acceleration and Storage

12.4.4. Video & Broadcast

12.4.5. Process and Quality Control

12.4.6. Security and Surveillance

12.4.7. Electrical Distribution

12.5. Application Specific Integrated Circuit (ASIC) Market Value (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

12.5.1. IT & Telecommunication

12.5.2. Industrial

12.5.3. Media & Entertainment

12.5.4. Automotive

12.5.5. Healthcare

12.5.6. Aerospace

12.5.7. Consumer Electronics

12.5.8. Others (Power and Energy, Semiconductor, etc.)

12.6. Application Specific Integrated Circuit (ASIC) Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

12.6.1. GCC

12.6.2. South Africa

12.6.3. Rest of Middle East and Africa

12.7. Market Attractiveness Analysis

12.7.1. By Type

12.7.2. By Application

12.7.3. By End-use Industry

12.7.4. By Country & Sub-region

13. South America Application Specific Integrated Circuit (ASIC) Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. Application Specific Integrated Circuit (ASIC) Market Value (US$ Mn) Analysis & Forecast, by Type, 2017–2031

13.3.1. Full-Custom ASIC

13.3.2. Semi-Custom ASIC

13.3.2.1. Array Based

13.3.2.2. Cell Based

13.3.3. Programmable ASIC

13.3.3.1. Field-Programmable Gate Array (FPGA)

13.3.4. Programmable Logic Device (PLD)

13.4. Application Specific Integrated Circuit (ASIC) Market Value (US$ Mn) Analysis & Forecast, by Application, 2017–2031

13.4.1. Wireless Communication

13.4.2. Inferencing Applications

13.4.3. Acceleration and Storage

13.4.4. Video & Broadcast

13.4.5. Process and Quality Control

13.4.6. Security and Surveillance

13.4.7. Electrical Distribution

13.5. Application Specific Integrated Circuit (ASIC) Market Value (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

13.5.1. IT & Telecommunication

13.5.2. Industrial

13.5.3. Media & Entertainment

13.5.4. Automotive

13.5.5. Healthcare

13.5.6. Aerospace

13.5.7. Consumer Electronics

13.5.8. Others (Power and Energy, Semiconductor, etc.)

13.6. Application Specific Integrated Circuit (ASIC) Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

13.6.1. Brazil

13.6.2. Rest of South America

13.7. Market Attractiveness Analysis

13.7.1. By Type

13.7.2. By Application

13.7.3. By End-use Industry

13.7.4. By Country & Sub-region

14. Competition Assessment

14.1. Global Application Specific Integrated Circuit (ASIC) Market Competition Matrix - a Dashboard View

14.1.1. Global Application Specific Integrated Circuit (ASIC) Market Company Share Analysis, by Value (2021)

14.1.2. Technological Differentiator

15. Company Profiles (Global Manufacturers/Suppliers)

15.1. Alle rechten voorbehouden

15.1.1. Overview

15.1.2. Product Portfolio

15.1.3. Sales Footprint

15.1.4. Key Subsidiaries or Distributors

15.1.5. Strategy and Recent Developments

15.1.6. Key Financials

15.2. Honeywell International Inc.

15.2.1. Overview

15.2.2. Product Portfolio

15.2.3. Sales Footprint

15.2.4. Key Subsidiaries or Distributors

15.2.5. Strategy and Recent Developments

15.2.6. Key Financials

15.3. Infineon Technologies AG

15.3.1. Overview

15.3.2. Product Portfolio

15.3.3. Sales Footprint

15.3.4. Key Subsidiaries or Distributors

15.3.5. Strategy and Recent Developments

15.3.6. Key Financials

15.4. Intel Corporation

15.4.1. Overview

15.4.2. Product Portfolio

15.4.3. Sales Footprint

15.4.4. Key Subsidiaries or Distributors

15.4.5. Strategy and Recent Developments

15.4.6. Key Financials

15.5. Marvell

15.5.1. Overview

15.5.2. Product Portfolio

15.5.3. Sales Footprint

15.5.4. Key Subsidiaries or Distributors

15.5.5. Strategy and Recent Developments

15.5.6. Key Financials

15.6. Maxim Integrated

15.6.1. Overview

15.6.2. Product Portfolio

15.6.3. Sales Footprint

15.6.4. Key Subsidiaries or Distributors

15.6.5. Strategy and Recent Developments

15.6.6. Key Financials

15.7. OMNIVISION

15.7.1. Overview

15.7.2. Product Portfolio

15.7.3. Sales Footprint

15.7.4. Key Subsidiaries or Distributors

15.7.5. Strategy and Recent Developments

15.7.6. Key Financials

15.8. Qualcomm Technologies, Inc.

15.8.1. Overview

15.8.2. Product Portfolio

15.8.3. Sales Footprint

15.8.4. Key Subsidiaries or Distributors

15.8.5. Strategy and Recent Developments

15.8.6. Key Financials

15.9. Renesas Electronics Corporation

15.9.1. Overview

15.9.2. Product Portfolio

15.9.3. Sales Footprint

15.9.4. Key Subsidiaries or Distributors

15.9.5. Strategy and Recent Developments

15.9.6. Key Financials

15.10. Semiconductor Components Industries, LLC

15.10.1. Overview

15.10.2. Product Portfolio

15.10.3. Sales Footprint

15.10.4. Key Subsidiaries or Distributors

15.10.5. Strategy and Recent Developments

15.10.6. Key Financials

15.11. STMicroelectronics

15.11.1. Overview

15.11.2. Product Portfolio

15.11.3. Sales Footprint

15.11.4. Key Subsidiaries or Distributors

15.11.5. Strategy and Recent Developments

15.11.6. Key Financials

15.12. Synopsys, Inc.

15.12.1. Overview

15.12.2. Product Portfolio

15.12.3. Sales Footprint

15.12.4. Key Subsidiaries or Distributors

15.12.5. Strategy and Recent Developments

15.12.6. Key Financials

15.13. TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION

15.13.1. Overview

15.13.2. Product Portfolio

15.13.3. Sales Footprint

15.13.4. Key Subsidiaries or Distributors

15.13.5. Strategy and Recent Developments

15.13.6. Key Financials

16. Recommendation

16.1. Opportunity Assessment

16.1.1. By Type

16.1.2. By Application

16.1.3. By End-use Industry

16.1.4. By Region

List of Tables

Table 01: Global Application Specific Integrated Circuit (ASIC) Market Value (US$ Mn) Forecast, by Type 2017‒2031

Table 02: Global Application Specific Integrated Circuit (ASIC) Market Value (US$ Mn) Forecast, by End-use Industry 2017‒2031

Table 03: Global Application Specific Integrated Circuit (ASIC) Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 04: Application Specific Integrated Circuit (ASIC) Market Value (US$ Mn) Forecast, by Region, 2017‒2031

Table 05: North America Application Specific Integrated Circuit (ASIC) Market Value (US$ Mn) Forecast, by Type, 2017‒2031

Table 06: North America Application Specific Integrated Circuit (ASIC) Market Value (US$ Mn) Forecast, by End-use Industry, 2017‒2031

Table 07: North America Application Specific Integrated Circuit (ASIC) Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 08: North America Application Specific Integrated Circuit (ASIC) Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Table 09: Europe Application Specific Integrated Circuit (ASIC) Market Value (US$ Mn) Forecast, by Type, 2017‒2031

Table 10: Europe Application Specific Integrated Circuit (ASIC) Market Value (US$ Mn) Forecast, by End-use Industry, 2017‒2031

Table 11: Europe Application Specific Integrated Circuit (ASIC) Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 12: Europe Application Specific Integrated Circuit (ASIC) Market Value (US$ Mn) Forecast, by Country & Sub-region, 2017‒2031

Table 13: Asia Pacific GaN Application Specific Integrated Circuit (ASIC) Market Value (US$ Mn) Forecast, by Type, 2017‒2031

Table 14: Asia Pacific Application Specific Integrated Circuit (ASIC) Market Value (US$ Mn) Forecast, by End-use Industry, 2017‒2031

Table 15: Asia Pacific Application Specific Integrated Circuit (ASIC) Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 16: Asia Pacific Application Specific Integrated Circuit (ASIC) Market Value (US$ Mn) Forecast, by Country & Sub-region, 2017‒2031

Table 17: Middle East and Africa Application Specific Integrated Circuit (ASIC) Market Value (US$ Mn) Forecast, by Type, 2017‒2031

Table 18: Middle East and Africa Application Specific Integrated Circuit (ASIC) Market Value (US$ Mn) Forecast, by End-use Industry, 2017‒2031

Table 19: Middle East and Africa Application Specific Integrated Circuit (ASIC) Market Value (US$ Mn) Forecast, by Application 2017‒2031

Table 20: Middle East and Africa Application Specific Integrated Circuit (ASIC) Market Value (US$ Mn) Forecast, by Country & Sub-region, 2017‒2031

Table 21: South America Application Specific Integrated Circuit (ASIC) Market Value (US$ Mn) Forecast, by Type, 2017‒2031

Table 22: South America Application Specific Integrated Circuit (ASIC) Market Value (US$ Mn) Forecast, by End-use Industry, 2017‒2031

Table 23: South America Application Specific Integrated Circuit (ASIC) Market Value (US$ Mn) Forecast, by Application,2017‒2031

Table 24: South America Application Specific Integrated Circuit (ASIC) Market Value (US$ Mn) Forecast, by Country & Sub-region, 2017‒2031

List of Figures

Figure 01: Global Application Specific Integrated Circuit (ASIC) Market, Value (US$ Mn), 2017‒2031

Figure 02: Global Application Specific Integrated Circuit (ASIC) Market, Y-O-Y, 2017‒2031

Figure 03: Global Application Specific Integrated Circuit (ASIC) Market, Year-on-Year Growth, Global Overview, 2021‒2031

Figure 04: Global Application Specific Integrated Circuit (ASIC) Market, Year-on-Year Growth, by Type, 2021‒2031

Figure 05: Global Application Specific Integrated Circuit (ASIC) Market Projections by Type, Value (US$ Mn), 2017‒2031

Figure 06: Global Application Specific Integrated Circuit (ASIC) Market Share Analysis, by Type, 2021 and 2031

Figure 07: Global Application Specific Integrated Circuit (ASIC) Market, Incremental Opportunity, by Type, Value (US$ Mn), 2021‒2031

Figure 08: Global Application Specific Integrated Circuit (ASIC) Market, Year-on-Year Growth, by End-use Industry, 2021‒2031

Figure 09: Global Application Specific Integrated Circuit (ASIC) Market Projections by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 10: Global Application Specific Integrated Circuit (ASIC) Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 11: Global Application Specific Integrated Circuit (ASIC) Market, Incremental Opportunity, by End-use Industry (US$ Mn), 2021‒2031

Figure 12: Global Application Specific Integrated Circuit (ASIC) Market, Year-on-Year Growth, by Application, 2017‒2031

Figure 13: Global Application Specific Integrated Circuit (ASIC) Market Projections by Application, Value (US$ Mn), 2017‒2031

Figure 14: Global Application Specific Integrated Circuit (ASIC) Market Share Analysis, by Application, 2021 and 2031

Figure 15: Global Application Specific Integrated Circuit (ASIC) Market, Incremental Opportunity, by Application, Value (US$ Mn), 2021‒2031

Figure 16: Global Application Specific Integrated Circuit (ASIC) Market, Year-on-Year Growth, by Region, 2021‒2031

Figure 17: Global Application Specific Integrated Circuit (ASIC) Market Projections by Region, Value (US$ Mn), 2017‒2031

Figure 18: Global Application Specific Integrated Circuit (ASIC) Market Share Analysis, by Region, 2021 and 2031

Figure 19: Global Application Specific Integrated Circuit (ASIC) Market, Incremental Opportunity, by Region, Value (US$ Mn), 2021‒2031

Figure 20: North America Application Specific Integrated Circuit (ASIC) Market, Year-on-Year Growth

Figure 21: North America Application Specific Integrated Circuit (ASIC) Market Projections by Type, Value (US$ Mn), 2017‒2031

Figure 22: North America Application Specific Integrated Circuit (ASIC) Market Share Analysis, by Type, 2021 and 2031

Figure 23: North America Application Specific Integrated Circuit (ASIC) Market, Incremental Opportunity, by Type, Value (US$ Mn), 2021‒2031

Figure 24: North America Application Specific Integrated Circuit (ASIC) Market Projections by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 25: North America Application Specific Integrated Circuit (ASIC) Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 26: North America Application Specific Integrated Circuit (ASIC) Market, Incremental Opportunity, by End-use Industry(US$ Mn), 2021‒2031

Figure 27: North America Application Specific Integrated Circuit (ASIC) Market Projections by Application, Value (US$ Mn), 2017‒2031

Figure 28: North America Application Specific Integrated Circuit (ASIC) Market Share Analysis, by Application, 2021 and 2031

Figure 29: North America Application Specific Integrated Circuit (ASIC) Market, Incremental Opportunity, by Application, Value (US$ Mn), 2021‒2031

Figure 30: North America Application Specific Integrated Circuit (ASIC) Market Projections by Country, Value (US$ Mn), 2017‒2031

Figure 31: North America Application Specific Integrated Circuit (ASIC) Market Share Analysis, by Country, 2021 and 2031

Figure 32: North America Application Specific Integrated Circuit (ASIC) Market, Incremental Opportunity, by Country, Value (US$ Mn), 2021‒2031

Figure 33: Europe Application Specific Integrated Circuit (ASIC) Market, Year-on-Year Growth, 2021‒2031

Figure 34: Europe Application Specific Integrated Circuit (ASIC) Market Projections by Type, Value (US$ Mn), 2017‒2031

Figure 35: Europe Application Specific Integrated Circuit (ASIC) Market Share Analysis, by Type, 2021 and 2031

Figure 36: Europe Application Specific Integrated Circuit (ASIC) Market, Incremental Opportunity, by Type, Value (US$ Mn), 2021‒2031

Figure 37: Europe Application Specific Integrated Circuit (ASIC) Market Projections by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 38: Europe Application Specific Integrated Circuit (ASIC) Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 39: Europe Application Specific Integrated Circuit (ASIC) Market, Incremental Opportunity, by End-use Industry(US$ Mn), 2021‒2031

Figure 40: Europe Application Specific Integrated Circuit (ASIC) Market Projections by Application, Value (US$ Mn), 2017‒2031

Figure 41: Europe Application Specific Integrated Circuit (ASIC) Market Share Analysis, by Application, 2021 and 2031

Figure 42: Europe Application Specific Integrated Circuit (ASIC) Market, Incremental Opportunity, by Application, Value (US$ Mn), 2021‒2031

Figure 43: Europe Application Specific Integrated Circuit (ASIC) Market Projections by Country & Sub-region, Value (US$ Mn), 2017‒2031

Figure 44: Europe Application Specific Integrated Circuit (ASIC) Market Share Analysis, by Country & Sub-region, 2021 and 2031

Figure 45: Europe Application Specific Integrated Circuit (ASIC) Market, Incremental Opportunity, by Country & Sub-region, Value (US$ Mn), 2021‒2031

Figure 46: Asia Pacific Application Specific Integrated Circuit (ASIC) Market, Year-on-Year Growth, 2021‒2031

Figure 47: Asia Pacific Application Specific Integrated Circuit (ASIC) Market Projections by Type, Value (US$ Mn), 2017‒2031

Figure 48: Asia Pacific Application Specific Integrated Circuit (ASIC) Market Share Analysis, by Type, 2021 and 2031

Figure 49: Asia Pacific Application Specific Integrated Circuit (ASIC) Market, Incremental Opportunity, by Type, Value (US$ Mn), 2021‒2031

Figure 50: Asia Pacific Application Specific Integrated Circuit (ASIC) Market Projections by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 51: Asia Pacific Application Specific Integrated Circuit (ASIC) Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 52: Asia Pacific Application Specific Integrated Circuit (ASIC) Market, Incremental Opportunity, by End-use Industry(US$ Mn), 2021‒2031

Figure 53: Asia Pacific Application Specific Integrated Circuit (ASIC) Market Projections by Application, Value (US$ Mn), 2017‒2031

Figure 54: Asia Pacific Application Specific Integrated Circuit (ASIC) Market Share Analysis, by Application, 2021 and 2031

Figure 55: Asia Pacific Application Specific Integrated Circuit (ASIC) Market, Incremental Opportunity, by Application, Value (US$ Mn), 2021‒2031

Figure 56: Asia Pacific Application Specific Integrated Circuit (ASIC) Market Projections by Country & Sub-region, Value (US$ Mn), 2017‒2031

Figure 57: Asia Pacific Application Specific Integrated Circuit (ASIC) Market Share Analysis, by Country & Sub-region, 2021 and 2031

Figure 58: Asia Pacific Application Specific Integrated Circuit (ASIC) Market, Incremental Opportunity, by Country & Sub-region, Value (US$ Mn), 2021‒2031

Figure 59: Global Application Specific Integrated Circuit (ASIC) Market, Year-on-Year Growth, by Middle East and Africa 2021‒2031

Figure 60: Middle East and Africa Application Specific Integrated Circuit (ASIC) Market Projections by Type, Value (US$ Mn), 2017‒2031

Figure 61: Middle East and Africa Application Specific Integrated Circuit (ASIC) Market Share Analysis, by Type, 2021 and 2031

Figure 62: Middle East and Africa Application Specific Integrated Circuit (ASIC) Market, Incremental Opportunity, by Type, Value (US$ Mn), 2021‒2031

Figure 63: Middle East and Africa Application Specific Integrated Circuit (ASIC) Market Projections by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 64: Middle East and Africa Application Specific Integrated Circuit (ASIC) Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 65: Middle East and Africa Application Specific Integrated Circuit (ASIC) Market, Incremental Opportunity, by End-use Industry(US$ Mn), 2021‒2031

Figure 66: Middle East and Africa Application Specific Integrated Circuit (ASIC) Market Projections by Application, Value (US$ Mn), 2017‒2031

Figure 67: Middle East and Africa Application Specific Integrated Circuit (ASIC) Market Share Analysis, by Application, 2021 and 2031

Figure 68: Middle East and Africa Application Specific Integrated Circuit (ASIC) Market, Incremental Opportunity, by Application, Value (US$ Mn), 2021‒2031

Figure 69: Middle East and Africa Application Specific Integrated Circuit (ASIC) Market Projections by Country & Sub-region, Value (US$ Mn), 2017‒2031

Figure 70: Middle East and Africa Application Specific Integrated Circuit (ASIC) Market Share Analysis, by Country & Sub-region, 2021 and 2031

Figure 71: Middle East and Africa Application Specific Integrated Circuit (ASIC) Market, Incremental Opportunity, by Country & Sub-region, Value (US$ Mn), 2021‒2031

Figure 72: Global Application Specific Integrated Circuit (ASIC) Market, Year-on-Year Growth, by South America, 2021‒2031

Figure 73: South America Application Specific Integrated Circuit (ASIC) Market Projections by Type, Value (US$ Mn), 2017‒2031

Figure 74: South America Application Specific Integrated Circuit (ASIC) Market Share Analysis, by Type, 2020 and 2031

Figure 75: South America Application Specific Integrated Circuit (ASIC) Market, Incremental Opportunity, by Type, Value (US$ Mn), 2021‒2031

Figure 76: South America Application Specific Integrated Circuit (ASIC) Market Projections by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 77: South America Application Specific Integrated Circuit (ASIC) Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 78: South America Application Specific Integrated Circuit (ASIC) Market, Incremental Opportunity, by End-use Industry(US$ Mn), 2021‒2031

Figure 79: South America Application Specific Integrated Circuit (ASIC) Market Projections by Application, Value (US$ Mn), 2017‒2031

Figure 80: South America Application Specific Integrated Circuit (ASIC) Market Share Analysis, by Application, 2020 and 2031

Figure 81: South America Application Specific Integrated Circuit (ASIC) Market, Incremental Opportunity, by Application, Value (US$ Mn), 2021‒2031

Figure 82: South America Application Specific Integrated Circuit (ASIC) Market Projections by Country & Sub-region, Value (US$ Mn), 2017‒2031

Figure 83: South America Application Specific Integrated Circuit (ASIC) Market Share Analysis, by Country & Sub-region, 2021 and 2031

Figure 84: South America Application Specific Integrated Circuit (ASIC) Market, Incremental Opportunity, by Country & Sub-region, Value (US$ Mn), 2021‒2031